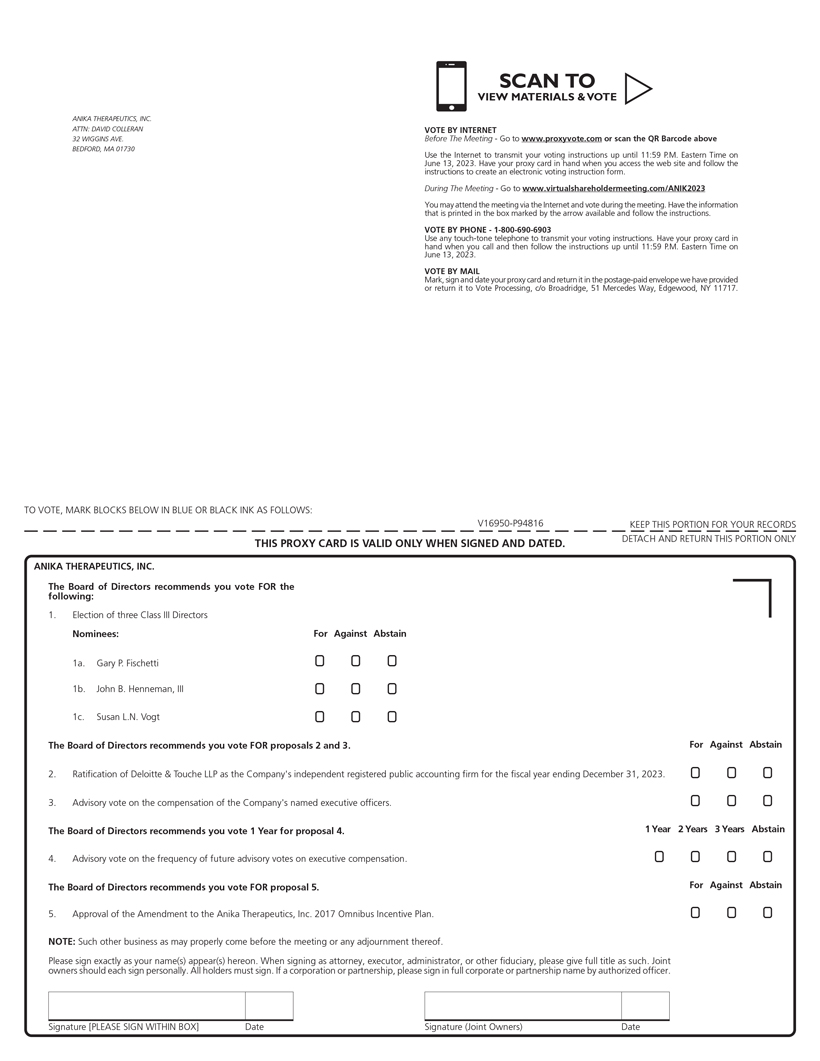

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION DATED APRIL 25, 2023

| Cheryl R. Blanchard, Ph.D. | ||

|

|

, 2023

Dear Fellow Anika Stockholder,

Over the last year, we made significant progress strengthening our already market-leading hyaluronic acid-based Osteoarthritis, or OA, Pain Management business, while at the same time positioning Anika to be a global leader in joint preservation with a focus on early intervention orthopedics, now with the most robust product | |

portfolio and pipeline in Anika’s over 30 year history. Through this transformation, we have expanded Anika’s market opportunity from $1 billion to more than $8 billion today across OA Pain Management, Regenerative Solutions, Sports Medicine, and Arthrosurface Joint Solutions and created a powerful growth engine for years to come. Anika is now at an important inflection point, with growth in joint preservation set to significantly accelerate in 2023 and beyond.

We have been executing a focused strategy to develop and commercialize products in the largest and fastest growing segments of the joint preservation market, with multiple successful product launches including Tactoset® with bone marrow aspirate, the X-Twist™ Fixation System, and the RevoMotion™ Reverse Shoulder Arthroplasty System over the last year alone. These products along with our differentiated OVOMotion anatomic shoulder system and regenerative rotator cuff patch system, to be launched in 2024, give Anika the right to win across the shoulder continuum of care representing an over $2 billion market opportunity. Importantly, we are hearing direct feedback from surgeons that our innovative and differentiated products and delivery systems provide them with both cutting edge technology to help restore active living to their patients and the ability to work more efficiently, which is all the more important as the world emerges from the global pandemic.

In addition to the significant joint preservation product launches, this year we successfully completed our third Phase III clinical trial for Cingal®, our next generation non-opioid, HA-based OA pain management product, which has unparalleled clinical data, is sold in over 35 countries internationally, and represents an additional $1 billion market opportunity once approved in the U.S. We also significantly advanced our Phase III pivotal trial for our highly differentiated, cartilage repair product, Hyalofast™, now approaching full enrollment. With the ongoing strength of our OA Pain Management business and key joint preservation product launches in 2023 and 2024, we are diligently driving execution to realize Anika’s significant multi-year growth prospects.

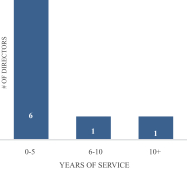

Our management team is supported by an outstanding Board of Directors that comprises leaders with the expertise to usher in our next chapter of growth. We recently welcomed a new Board member, Gary Fischetti, who represents our fourth new independent director in the past three years. As a result of our active Board refreshment focus, 75% of our Board has joined since 2018. Over the last several years, especially when elective surgeries were prevented or significantly delayed due to the pandemic, this Board has been instrumental in helping to transform Anika and to ensure that the company has a broad and differentiated product portfolio, exciting pipeline and experienced leadership team focused on high opportunity spaces within the large and growing joint preservation continuum of care. Today, we are well-positioned operationally and financially and pleased to return capital to shareholders in the form of a new share repurchase program.

Anika is just starting to realize the significant potential of our comprehensive and expanding portfolio. With a strong balance sheet, robust cash flows to self-fund continued targeted investments and improving market