PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION DATED MARCH 27, 2023

, 2023

Dear Fellow Stockholder:

It is my pleasure to invite you to attend the Annual Meeting of Stockholders of Anika Therapeutics, Inc. to be held on , 2023, at , Eastern time. This year’s Annual Meeting will be a “virtual meeting” conducted via live audio webcast, consistent with our recent practice. Each holder of common stock as of 5:00 p.m., Eastern time, on the record date of , 2023 will be able to participate in the Annual Meeting by accessing a live webcast at www.cesonlineservices.com/anik23_vm. To participate in the Annual Meeting, you must pre-register at www.cesonlineservices.com/anik23_vm by , Eastern Time, on , 2023. Stockholders will also be able to vote their shares and submit questions via the internet during the meeting by participating in the webcast.

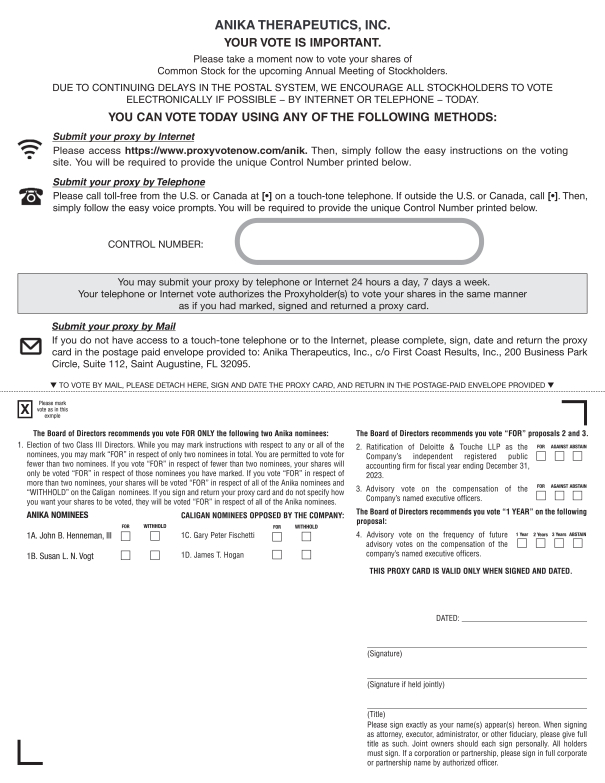

During the Annual Meeting stockholders will be asked to elect two Class III Directors and to ratify the appointment of Deloitte & Touche LLP as our independent auditor for 2023. We will also be asking stockholders to approve, by an advisory vote, both our 2022 executive compensation as disclosed in the Proxy Statement for the Annual Meeting (a “say-on-pay” vote) and the frequency of future advisory votes on executive compensation. Each of these matters is important, and we urge you to vote in favor of the election of each of the Company’s director nominees, the ratification of the appointment of our independent auditor, the approval, on an advisory basis, of our 2022 executive compensation and the approval, on an advisory basis, of the frequency of future advisory votes on executive compensation.

Our 2022 Annual Report to stockholders, containing financial statements for the fiscal year ended December 31, 2022, as well as instructions on how to vote via proxy either by telephone, over the internet or by mail, is being provided together with this Proxy Statement to all stockholders entitled to vote at the Annual Meeting. It is anticipated that this proxy statement and the accompanying proxy will be first sent or given to stockholders on or about , 2023.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please vote electronically via the Internet or by telephone by following the instructions on the enclosed WHITE proxy card, or by signing, marking, dating and returning your enclosed WHITE proxy card by mail in the postage-paid envelope provided. We appreciate your prompt attention.

The Board of Directors invites you to participate in the Annual Meeting. Thank you for your support, and we look forward to joining you at the Annual Meeting.

| Sincerely, |

| Cheryl R. Blanchard, Ph.D. |

| President and Chief Executive Officer |