UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| (Mark One) | |

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended | |

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to | |

Commission File Number

Anika Therapeutics, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| (State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) |

(Address of Principal Executive Offices) (Zip Code)

(

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | | Non-accelerated filer ☐ | Smaller reporting company | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of voting common stock held by non-affiliates of the registrant as of June 30, 2022, the last day of the registrant’s most recently completed second fiscal quarter, was $

At March 8, 2023, there were

Documents Incorporated By Reference

Portions of the registrant’s proxy statement for its 2023 annual meeting of stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K.

ANIKA THERAPEUTICS, INC.

TABLE OF CONTENTS

References in this Annual Report on Form 10-K to “we,” “us,” “our,” “our company,” and other similar references refer to Anika Therapeutics, Inc. and its subsidiaries unless the context otherwise indicates.

ANIKA, ANIKA THERAPEUTICS, ANIKAVISC, ARTHROSURFACE, CINGAL, HYAFF, HYVISC, MONOVISC, ORTHOVISC, OVOMOTION, PARCUS MEDICAL, REVOMOTION, TACTOSET, WRISTMOTION, and X-TWIST are trademarks or registered trademarks of Anika Therapeutics, Inc. or its subsidiaries that appear in this Annual Report on Form 10-K. For convenience, these trademarks appear in this Annual Report on Form 10-K without ® and ™ symbols, but that practice does not mean that we will not assert, to the fullest extent under applicable law, our rights to the trademarks. This Annual Report on Form 10-K may also contain trademarks and trade names that are the property of other companies, including certain trademarks licensed to us. The use of third-party trademarks does not constitute an endorsement or imply a relationship or other affiliation.

FORM 10-K

ANIKA THERAPEUTICS, INC.

For Fiscal Year Ended December 31, 2022

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 concerning our business, consolidated financial condition, and results of operations. The Securities and Exchange Commission, or SEC, encourages companies to disclose forward-looking statements so that investors can better understand a company’s future prospects and make informed investment decisions. Forward-looking statements are subject to risks and uncertainties, many of which are outside our control, which could cause actual results to differ materially from these statements. Therefore, you should not rely on any of these forward-looking statements. Forward-looking statements can be identified by such words as "will," "likely," "may," "believe," "expect," "anticipate," "intend," "seek," "designed," "develop," "would," "future," "can," "could," and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters. All statements other than statements of historical facts included in this Annual Report regarding our strategies, prospects, financial condition, operations, costs, plans, and objectives are forward-looking statements. Examples of forward-looking statements include, among others, statements regarding expected future operating results, expectations regarding the timing and receipt of regulatory results, anticipated levels of capital expenditures, and expectations of the effect on our financial condition of claims, litigation, and governmental and regulatory proceedings.

Please refer to "Item 1A. Risk Factors" for important factors that we believe could cause actual results to differ materially from those in our forward-looking statements. Any forward-looking statement made by us in this Annual Report on Form 10-K is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments, or otherwise.

RISK FACTOR SUMMARY

The risk factors detailed in Item 1A entitled “Risk Factors” in this Annual Report on Form 10-K are the risks that we believe are material to our investors and a reader should carefully consider them. Those risks are not all of the risks we face and other factors not presently known to us or that we currently believe are immaterial may also affect our business if they occur. The following is a summary of the risk factors detailed in Item 1A:

| ● |

Our financial performance depends on sales growth and increasing demand for our legacy and acquired product portfolios, and we may not be able to successfully manage the recent, and future, expansion of our operations. |

| ● |

Substantial competition could materially affect our financial performance. |

| ● |

Our business may be adversely affected if consolidation in the healthcare industry leads to demand for price concessions or if we are excluded from being a supplier by a group purchasing organization or similar entity. |

| ● |

A significant portion of our OA Pain Management revenues are derived from a small number of customers, the loss of which could materially adversely affect our business, financial condition and results of operations. |

| ● |

We experience quarterly sales volume variation, which makes our future results difficult to predict and makes period-to-period comparisons potentially not meaningful. |

| ● |

We rely on a small number of suppliers for certain key raw materials and a small number of suppliers for a number of other materials required for the manufacturing and delivery of our products, and disruption could materially adversely affect our business, financial condition, and results of operations. |

| ● |

Our manufacturing processes involve inherent risks, and disruption could materially adversely affect our business, financial condition, and results of operations. |

| ● |

Failure to comply with current or future national, international, federal or state laws and regulations, regulatory guidance and industry standards relating to data protection, privacy and information security, including restrictive European regulations, could lead to government enforcement actions (which could include civil or criminal penalties), private litigation, and/or adverse publicity and could negatively affect our operating results and business. |

| ● |

We are increasingly dependent on sophisticated information technology and if we fail to effectively maintain or protect our information systems or data, including from data breaches, our business could be adversely affected. |

| ● |

We may require additional capital in the future. We cannot give any assurance that such capital will be available at all or on terms acceptable to us, and if it is available, additional capital raised by us could dilute your ownership interest or the value of your shares. |

| ● |

Our license agreements with Mitek provide substantial control of Monovisc and Orthovisc in the United States to Mitek, and Mitek’s actions could have a material impact on our business, financial condition and results of operations. |

| ● |

We may not succeed in our integration and buildout of our direct sales channel in the United States, and our failure to do so could negatively impact our business and financial results. |

| ● |

We are dependent upon marketing and distribution partners and the failure to maintain strategic alliances on acceptable terms will have a material adverse effect on our business, financial condition, and results of operations. |

| ● |

Sales of our products are largely dependent upon third-party health insurance coverage and reimbursement and our performance may be harmed by health care cost containment initiatives or decisions of individual third-party payers. |

| ● |

We are facing a longer than expected pathway to commercialize our Cingal product in the United States, and we may face other unforeseen difficulties in achieving regulatory approval for Cingal, which could affect our business and financial results. |

| ● |

Failure to obtain, or any delay in obtaining, FDA or other U.S. and foreign governmental clearances or approvals for our products may have a material adverse effect on our business, financial condition and results of operations. |

| ● |

Once obtained, we cannot guarantee that the FDA or international product clearances or approvals will not be withdrawn or that relevant agencies will not require other corrective action, and any withdrawal or corrective action could materially affect our business and financial results. |

| ● |

Our operations and products are subject to extensive regulation, compliance with which is costly and time consuming, and our failure to comply may result in substantial penalties, including recalls of our products. |

| ● |

Any changes in the FDA or international regulations related to product approval or approval renewal, including those currently under consideration by the FDA or those that apply retroactively, could adversely affect our competitive position and materially affect our business and financial results. |

| ● |

Notices of inspectional observations or deficiencies from the FDA or other regulatory bodies require us to undertake corrective and preventive actions or other actions to address the FDA’s or other regulatory bodies' concerns. These actions could be expensive and time-consuming to complete and could impose an additional burden on us. |

| ● |

We may rely on third parties to support certain aspects of our clinical trials. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may not be able to obtain regulatory clearance or approval or commercialize our products, and our business could be substantially harmed. |

| ● |

We may have difficulty managing our growth. |

| ● |

We may not generate the expected benefits of our acquisitions, and the ongoing integration of those acquisitions could disrupt our ongoing business, distract our management and increase our expenses. |

| ● |

We expect to continue to actively explore inorganic growth as a part of our future growth strategy, which exposes us to a variety of risks that could adversely affect our business operations. |

| ● |

As our international sales and operations grow, we could become increasingly subject to additional economic, political, and other risks that could harm our business. |

| ● |

We may be unable to adequately protect our intellectual property rights, which could have a material impact on our business and future financial results. |

| ● |

Our operations are located in areas impacted by the COVID-19 pandemic, and those operations have been, and may continue to be, adversely affected by the COVID-19 pandemic. |

| ● |

The COVID-19 pandemic resulted in a significant reduction in the number of elective surgeries being performed since 2020 and the lingering impact of the pandemic has slowed the pace of new product approvals by current and potential customers, which has decreased the usage of, and revenue from, certain of our products. |

| ● |

Our stock price may be highly volatile, and we cannot assure you that market making in our common stock will continue. |

| ● |

Our charter documents contain anti-takeover provisions that may prevent or delay an acquisition of our company. |

| ● |

We have been, and may continue to be, subject to the actions of activist stockholders, which could cause us to incur substantial costs, divert management’s and the board’s attention and resources, and have an adverse effect on our business and stock price. |

This section contains forward-looking statements. You should refer to the explanation of the qualifications and limitations on forward-looking statements beginning on page 4.

Overview

Founded in 1992, Anika Therapeutics, Inc. is a global joint preservation company that creates and delivers meaningful advancements in early intervention orthopedic care. Based on our collaborations with clinicians to understand what they need most to treat their patients, we develop minimally invasive products that restore active living for people around the world. We are committed to leading in high opportunity spaces within orthopedics, including osteoarthritis, or OA pain management, regenerative solutions, sports medicine and Arthrosurface joint solutions (previously Bone Preserving Joint Solutions).

We have over thirty years of global expertise developing, manufacturing and commercializing products based on our hyaluronic acid, or HA, technology platform. HA is a naturally occurring polymer found throughout the body that is vital for proper joint health and tissue function. Our proprietary technologies for modifying the HA molecule allow product properties to be tailored specifically to multiple uses, including enabling longer residence time to support OA pain management and creating a solid form of HA called Hyaff, which is the platform for some of our regenerative solutions portfolio.

In early 2020, we expanded our overall technology platform, product portfolio, and significantly expanded our commercial infrastructure, especially in the United States, through our strategic acquisitions of Parcus Medical, LLC, or Parcus Medical, a sports medicine and instrumentation solutions provider, and Arthrosurface, Inc., or Arthrosurface, a company specializing in bone preserving partial and total joint replacement solutions. These acquisitions have ignited the transformation of our company by augmenting our HA-based OA pain management and regenerative products with a broad suite of products and capabilities focused on early intervention joint preservation primarily in upper and lower extremities such as shoulder, foot/ankle, knee and hand/wrist.

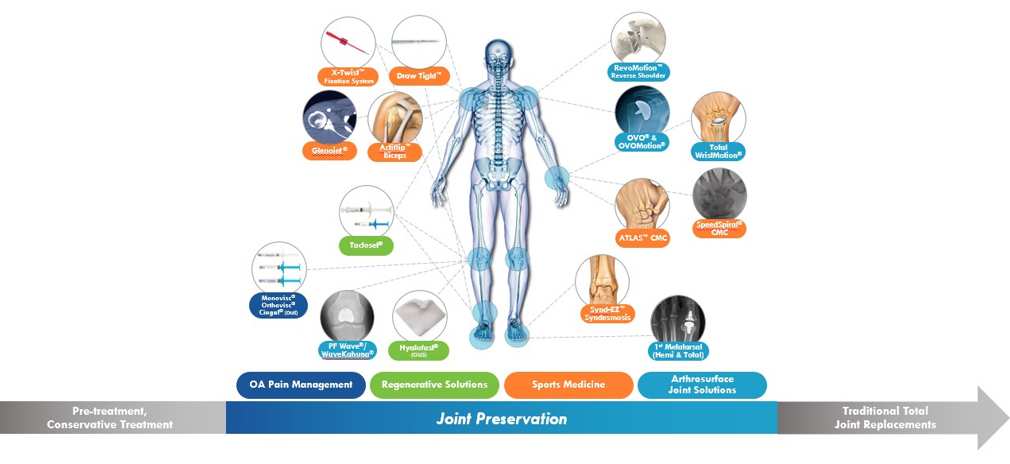

Note: Illustration of available treatments does not reflect Anika’s full product portfolio

Strategy

Beginning in 2020, we launched our transformational strategy to diversify our revenue in the global joint preservation markets, expanding our addressable global market from the over $1 billion global OA pain management market to the over $8 billion global joint preservation market (which includes faster growing regenerative medicine, sports medicine and extremities segments). This multi-year journey, which accelerated with the acquisitions of Arthrosurface and Parcus Medical, through which we entered into the sports medicine and bone preserving joint technology markets with a hybrid direct sales model that also expanded the commercial capabilities for our regenerative solutions portfolio, leverages our existing leadership position and expertise in the HA-based OA pain management market, and has included strengthening our team and infrastructure with investments in people, systems and processes. The combination of Anika with Arthrosurface and Parcus Medical enhances the value to the clinician and their patient through a unique product portfolio suited to early intervention orthopedics that leverages HA’s regenerative attributes for natural, faster healing. In the upcoming years, we will continue to invest in our research and development pipeline and strengthen our commercial capabilities to position our product portfolio for the needs of clinicians that practice in ambulatory surgical centers, or ASCs, and hospitals, as well as expand into new geographic areas to drive accelerated growth and profitability. As our pipeline evolves, we intend to expand our HA expertise by selectively developing and offering solutions for joint preservation and regenerative solutions targeted at procedures that are performed in the ASCs and to focus on completing clinical development for key products we sell outside the United States, (i.e. Cingal and Hyalofast), to gain approval for entry into the large U.S. market.

As we look forward, our business is positioned to capture value within our target markets in joint preservation. We believe our future success will be driven by our:

| ● |

Decades of experience in HA-based regenerative solutions and early intervention orthopedics combined under new seasoned leadership with a strong financial foundation for future investment in meaningful solutions for our customers and their patients; |

|

| ● |

Utilizing HA-based technology and manufacturing expertise to provide new and differentiated solutions for the faster growing joint preservation and regenerative medicine markets; |

|

| ● |

Robust network of stakeholders in our target markets that will allow us to identify evolving unmet patient treatment needs; |

|

| ● |

Prioritized investment in a differentiated pipeline of regenerative solutions, bone preserving implants and sports medicine solutions; |

|

| ● |

Global commercial expertise, which we will leverage to drive growth across our product portfolio, including an intentional site of care focus in ASCs in the United States and continued international expansion; |

|

| ● |

Pursuit of strategic inorganic growth opportunities, including potential partnerships and smaller acquisitions and technology licensing, by leveraging our strong financial foundation and operational capabilities; and |

|

| ● |

Energized and experienced team focused on strong values, talent, and culture. |

Products

OA Pain Management

Our OA Pain Management product family consists of:

| ● |

Monovisc and Orthovisc, our single- and multi-injection, HA-based viscosupplement product offerings indicated to provide pain relief from OA conditions solely for use in the knee. Our OA Pain Management products are generally administered to patients in an office setting. In the United States, Monovisc and Orthovisc are marketed exclusively by DePuy Synthes Mitek Sports Medicine, part of the Johnson & Johnson Medical Companies, or Mitek. In December 2011, we entered into a fifteen-year licensing agreement with Mitek to exclusively market Monovisc in the United States through December 2026. In December 2003, we entered into a ten-year licensing agreement to exclusively market Orthovisc in the United States. Mitek extended this agreement for additional five-year terms in 2007, 2012, 2017 and most recently in August 2022. The current agreement expires in December 2028 unless extended at the option of Mitek. The Monovisc and Orthovisc products have been the market leaders, based on combined overall revenue in the viscosupplement market, since 2018. Internationally, we market our OA Pain Management products directly through a worldwide network of commercial distributors. |

|

| ● |

Cingal, our novel, next-generation, single-injection OA Pain Management product consisting of our proprietary cross-linked HA material combined with a fast-acting steroid, designed to provide both short- and long-term pain relief. Cingal is CE marked and for several years has been sold outside the United States directly in over 35 countries through our network of distributors. In the United States, Cingal is a pipeline product not yet approved for commercial sale; for additional information please see the section captioned “Item 1. Business—Research and Development.” |

|

| ● |

Hyvisc, our high molecular weight injectable HA veterinary product for the treatment of joint dysfunction in horses due to non-infectious synovitis associated with equine OA. |

Joint Preservation and Restoration

Our Joint Preservation and Restoration product family, consists of:

| ● |

Regenerative Solutions. Our portfolio of orthopedic regenerative solutions leveraging our proprietary technologies based on HA and Hyaff, which is a solid form of HA. These products include Tactoset Injectable Bone Substitute, an HA-enhanced injectable bone repair therapy designed to treat insufficiency fractures and for augmenting hardware fixation, such as suture anchors, and Hyalofast, a biodegradable support for human bone marrow mesenchymal stem cells used for cartilage regeneration and as an adjunct for microfracture surgery. Tactoset is commercialized principally in the United States, whereas Hyalofast is currently available outside the United States in over 30 countries within Europe, South America, Asia, and certain other international markets. In the United States, Hyalofast is a pipeline product under a pivotal Investigational Device Exemption, or IDE, clinical trial and is not available for commercial sale. For additional information, please see the section captioned “Item 1. Business—Research and Development.” |

|

| ● |

Sports Medicine. Our line of soft tissue repair solutions is used by surgeons to repair and reconstruct damaged ligaments and tendons resulting from sports injuries, trauma and disease. These more traditional sports medicine solutions include screws, sutures, suture anchors, grafts and other surgical systems that facilitate surgical procedures on the shoulder, knee, hip, upper and lower extremities, and other soft tissues. Our X-Twist Fixation System, launched in September of 2022 for limited use and fully launched in early 2023 for broad market use in the United States and certain international markets, is a platform of knotless and knotted suture anchors designed for soft tissue repairs in the shoulder and other extremities. |

|

| ● |

Arthrosurface Joint Solutions. Our portfolio of more than 150 bone preserving joint solutions, including partial joint replacement, joint resurfacing, and minimally invasive and bone sparing implants, is designed to treat upper and lower extremity orthopedic conditions as well as knee and hip conditions caused by arthritic disease, trauma and injury. These products span multiple joints including OVOMotion with Inlay Glenoid for the shoulder, WristMotion wrist arthroplasty system, as well as foot and ankle, and knee products generally intended to restore a patient’s natural anatomy and movement. Our recently launched RevoMotion Reverse Shoulder Arthroplasty System (limited launch beginning early 2023), is a differentiated reverse shoulder implant system addressing the largest portion of the shoulder replacement market. These products often are used to treat patients with OA progression beyond where our OA Pain Management products can allow the patients to retain an active lifestyle when early surgical intervention becomes preferable. |

We currently commercialize our Joint Preservation and Restoration products principally by selling to hospitals and ASCs, through an independent network of sales representatives and distributors.

Non-Orthopedic

Our Non-Orthopedic product family consists of legacy HA-based products that are marketed principally for non-orthopedic applications. These products include Hyalobarrier, an anti-adhesion barrier indicated for use after abdominal-pelvic surgeries, Hyalomatrix, used for the treatment of complex wounds such as burns and ulcers, as well as products used in connection with the treatment of ears, nose and throat disorders, and ophthalmic products, including injectable, high molecular weight HA products such as Anikavisc and Nuvisc, used as viscoelastic agents in ophthalmic surgical procedures such as cataract extraction and intraocular lens implantation. These Non-Orthopedic products are sold through commercial sales and marketing partners around the world.

Sales Channels

A majority of our products are used by clinicians and surgeons in one of three environments: office-based procedures usually focused on injections, hospital operating rooms and ASCs, which are clinics outside of a normal hospital setting that are often at least partially physician-owned. These medical care delivery environments typically require different commercial approaches and have distinct call points, which requires diversity in our sales approach. For instance, our OA Pain Management product family and certain products in our Non-Orthopedic category are almost entirely utilized in an office-based setting while our Joint Preservation and Restoration and certain of our Non-Orthopedic products are almost exclusively consumed in hospital operating rooms or ASCs.

As a result of these distinctions, we employ multiple sales models in the United States to ensure that we are meeting the needs of our customers and other healthcare system stakeholders. For many years, we have maintained a mutually beneficial commercial partnership with Mitek, which sells Monovisc and Orthovisc in the United States. For this arrangement with Mitek, we sell the Monovisc and Orthovisc products that we manufacture to Mitek, and we also receive from Mitek a royalty on their end user sales of these products in the United States. We have U.S. commercial partnerships for other products in our OA Pain Management and Non-Orthopedic product families. Under these commercial partnerships, we sell our products directly to our partners, who perform downstream sales and marketing activities to customers and end-users. In addition to a transfer price, we may also structure our arrangements to receive a royalty on end user sales.

With our expanded commercial infrastructure as a result of the Parcus Medical and Arthrosurface acquisitions, we sell our Joint Preservation and Restoration family directly to clinicians, including hospitals and ASCs, through our Anika sales team and large network of independent third-party distributors. Since the acquisitions, we integrated our U.S. commercial organization, including cross training our sales team to sell the consolidated Joint Preservation and Restoration product portfolio. Within this framework, we employ selling models that seek to maximize the benefit for our company and customers, including in certain instances, contracts with group purchasing organizations and certain fixed-price delivery models.

Outside of the United States, we principally market and sell our products using a worldwide network of commercial partners, along with a small number of direct sales representatives, to provide a solid foundation for future revenue growth and territorial expansion. Our relationships with these partners are generally structured such that we sell our products to these partners directly while they, with global support from our team, perform the in-country sales and marketing activities to drive growth and adoption of our products locally. We expect to generally maintain this model for the foreseeable future, while also selectively evaluating other options and being opportunistic about adopting other sales models, including direct sales, in certain jurisdictions.

We believe that our overall sales approach provides our business with a strong base to drive revenue growth as we continue to grow and scale our commercial infrastructure. We will continue to focus on expanding our own commercial capabilities, including with respect to market access, innovative sales and delivery models, and improved logistics management.

Manufacturing

We manufacture all of our HA-based products, including all our OA Pain Management products and certain additional products, at our facility in Bedford, Massachusetts, where we have developed significant manufacturing expertise around procedures such as homogenized mixing and filling of highly viscous liquids and manipulation of solid HA into scaffolds or other presentations. We manufacture much of our sports medicine soft tissue repair products at our facility in Sarasota, Florida and we manufacture our bone preserving joint products and certain elements of our soft tissue repair portfolio utilizing third-party contract manufacturing organizations.

The raw materials necessary to manufacture our products are generally available from multiple sources. However, we rely on a small number of suppliers for certain key raw materials and a small number of suppliers for certain other materials, components, parts and disposables required for the manufacturing and delivery of these products. The downstream effects of the COVID-19 pandemic has impacted our supply chain as the companies that produce our products, product components or otherwise support our manufacturing processes, the distribution centers where we manage our inventory, or the operations of our logistics and other service providers, including third parties that sterilize and store our products, are disrupted, temporarily close or experience worker shortages or expanded lead-times for deliveries for a sustained period of time. Any prolonged interruption of operations or significant reduction in the capacity or performance capability of any of our manufacturing facilities, or with any of our key suppliers, could have a material adverse effect on our operations. For additional information on the impact of the COVID-19 pandemic on our manufacturing operations, please refer to the section captioned “Item 1A. Risk Factors—Risks related to the COVID-19 Pandemic. “Our operations are located in areas impacted by the COVID-19 pandemic, and those operations have been, and may continue to be, adversely affected by the COVID-19 pandemic”, and “Our global supply chain may be materially adversely impacted due to the COVID-19 pandemic.”

Research and Development

Our research and development efforts consist of the development of new medical applications for our technology platforms, including new implant designs, the development of intellectual property with respect to our technology platforms and new products, the management of clinical trials for certain product candidates, the preparation and processing of applications for regulatory clearances and approvals, and process development and scale-up manufacturing activities for our existing and new product development initiatives. For 2022, 2021, and 2020, research and development expenses were $28.2 million, $27.3 million and $23.4 million, respectively. The increase in 2022 was primarily due to costs to ensure compliance with growing regulatory requirements globally and new product development in our research and development pipeline. We anticipate that we will continue to commit significant resources to research and development activities, primarily for new product development, regulatory compliance, scale-up manufacturing activities, and pre-clinical and clinical activities.

Our new product development efforts focus on products in four large and growing orthopedic markets to drive long-term growth: OA pain management, regenerative solutions, sports medicine soft tissue repair and Arthrosurface joint solutions. In order to better inform and target our research and development investment, we routinely interact with key external stakeholders, including clinicians, to encompass customer and patient insights in our development process that help ensure we bring needed solutions to the market. As we move forward, we plan to continue to invest in novel and meaningful new products for our target markets based on our core capabilities, including further expanding our regenerative HA technology platform.

Our development focus for OA Pain Management will continue to be on bringing Cingal, our next-generation, single-injection HA-based viscosupplement product combined with a fast-acting steroid, to the U.S. market. In 2022, we completed a third Phase III clinical trial for Cingal, which achieved its primary endpoint. We will engage with the U.S. Food and Drug Administration, or the FDA, in 2023 on next steps for U.S. regulatory approval. In parallel, we are exploring the potential to advance Cingal through commercial partnerships in the U.S. and select Asian markets. These efforts will inform next steps, including if and how to proceed with another clinical trial in the United States.

Development for our Joint Preservation and Restoration product family is focused in several key areas. We are developing novel solutions and line extensions across our regenerative solutions, sports medicine soft tissue repair and Arthrosurface joint solutions product families, largely targeting the faster-growing extremities segments such as the shoulder. These include enhancements to existing regenerative solutions such as our fast-growing Tactoset Injectable Bone Substitute, which received an additional 510(k) clearance in 2021 for hardware augmentation, along with new soft tissue fixation and extremities products like our X-Twist Fixation System that achieved 510(k) clearance from the FDA in 2022 (with a limited market launch that began in September 2022) and our RevoMotion Reverse Shoulder Arthroplasty System, which received 510(k) clearance in 2021 (with a limited market launch that began in early 2023), as well as continued progress on a regenerative solution product targeted at rotator cuff repair utilizing our proprietary solid HA technology. We also made significant progress in 2022 on our clinical trial to support approval in the United States for Hyalofast, our single stage, off the shelf, cartilage repair therapy, currently sold only outside the United States. To date, we have enrolled 199 of the 200 patients targeted in the trial. This pivotal trial has a two-year follow-up protocol before regulatory submission.

Intellectual Property

We seek patent and trademark protection for our key technologies, products and product improvements, both in the U.S. and in select foreign countries. When determined appropriate, we enforce and plan to enforce and defend our patent and trademark rights. While we rely on our patent and trademark portfolio to provide us with competitive advantages as it relates to our existing and future product lines, it is not our sole source of protection in the development and manufacture of our products. We also rely upon trade secrets and continuing technological innovations to develop and maintain our competitive position.

Competition

We compete with many companies including large pharmaceutical firms and large and specialized medical device companies across our product lines. For our OA Pain Management products, our principal competitors include Sanofi Genzyme, Zimmer Biomet, Inc., Bioventus Inc., Avanos Medical, Inc., and Ferring Pharmaceuticals, as well as other companies that are commercializing or developing competitive products. Our key competitors for our Joint Preservation and Restoration products include Arthrex, Inc., the DePuy Synthes Companies of Johnson & Johnson, Smith & Nephew PLC., Stryker Corporation, and Zimmer Biomet, Inc., as well as certain smaller organizations that focus on subsets of the larger industry, such as Catalyst OrthoScience, Enovis Corporation and Shoulder Innovations. Many of the larger companies have substantially greater financial resources, larger research and development staffs, more extensive marketing and manufacturing organizations, and more experience in regulatory processes than we have. We also compete with academic institutions, government agencies, and other research organizations that may be involved in the research and development and commercialization of products. Many of our competitors also compete against us in securing relationships with collaborators for their research and development, manufacturing and supply, and distribution and commercialization programs.

We compete with other market participants primarily on the efficacy of our products, our products’ reputation for safety, and the breadth of our overall product portfolio. Other factors that impact competition in our industry are the timing and scope of regulatory approvals, the availability of manufacturing supplies, raw materials and finished product supply, marketing and sales capability, reimbursement coverage, product pricing, and patent protection. Some of the principal factors that may affect our ability to compete in our target markets include:

| ● |

The quality and breadth of our continued development of our product portfolio; |

|

| ● |

Our ability to complete successful clinical studies and obtain FDA marketing and foreign regulatory clearances/approvals; |

|

| ● |

Our ability to successfully source raw materials and components from suppliers at price points that are in-line with our financial objectives, as well as deliver them on schedule to meet the needs of our operational and commercial organizations; |

|

| ● |

Our ability to continue to build our commercial infrastructure, integrate our sales channels and execute our sales strategies; |

|

| ● |

The execution by our key partners of their commercial strategies for our products and our ability to manage our relationships with those key partners; |

|

| ● |

Our ability to recruit and retain skilled employees; and |

|

| ● |

The availability of capital resources to fund strategic activities related to the significant expansion of our business or product portfolio, including through acquisitions of third parties or certain assets. |

We are aware of several companies that are developing and/or marketing competitive products. In some cases, competitors have already obtained product approvals, submitted applications for approval, or commenced human clinical studies, either in the United States or in certain foreign countries. All our products face substantial competition. There is a risk that we will be unable to compete effectively against our current or future competitors. Additionally, legislation and regulation aimed at curbing rising healthcare costs has resulted in a consolidation trend in the healthcare industry to create larger companies, including hospitals, with greater market power. In turn, this has led to greater and more intense competition in the provision of products and services to market participants. Important market makers, like group purchasing organizations and integrated delivery networks, have increased their negotiating leverage, and if these market makers demand significant price concessions or if we are excluded as a supplier by these market makers, our product revenue could be adversely impacted.

Governmental Regulation

The clinical development, manufacturing, and marketing of our products are subject to governmental regulation in the United States, the European Union, and other territories worldwide, including pursuant to the Federal Food, Drug, and Cosmetic Act, or FDCA, in the United States. Medical products regulated by the FDA and other regulatory authorities are generally classified as drugs, biologics, or medical devices, and the current classification standards for our current or future products may be altered over time due to new regulations or augmented interpretation of data or current regulations.

Regulation of Medical Devices

Medical devices intended for human use are classified into three categories (Class I, II or III) based on the controls deemed reasonably necessary by the FDA to assure their safety and effectiveness. Class I and II devices are subject to the 510(k) premarket notification process in order to be commercially distributed, unless exempt Class III devices must obtain FDA approval of their premarket approval applications, or PMAs, in order to be commercially distributed.

Some of our current products are subject to premarket notification and clearance under section 510(k) of the FDCA. To obtain 510(k) clearance, a company must submit to the FDA a premarket notification, or 510(k), demonstrating that the proposed device is “substantially equivalent” to a legally marketed device, known as a “predicate device.” A device is substantially equivalent if, with respect to the predicate device, it has the same intended use and has either (i) the same technological characteristics, or (ii) different technological characteristics, but the information provided in the 510(k) submission demonstrates that the device does not raise new questions of safety and effectiveness and is at least as safe and effective as the predicate device.

The FDA aims to review and issue a determination on a 510(k) submission within 90 calendar days. As a practical matter, 510(k) clearance often takes longer. The FDA may require additional information, including clinical data, to make a determination regarding substantial equivalence.

If the FDA agrees that the device is substantially equivalent, it will grant 510(k) clearance to commercially market the device. If the FDA determines that the device is ‘‘not substantially equivalent’’ to a predicate device, the device is automatically designated as a Class III device. The device sponsor must then fulfill more rigorous PMA requirements or may be able to request a risk-based classification determination for the device in accordance with the ‘‘de novo’’ process, which is a route to market for novel medical devices that are low to moderate risk and are not substantially equivalent to a predicate device.

After a device receives 510(k) clearance, any modification that could significantly affect its safety or effectiveness, or that would constitute a major change or modification in its intended use, will require a new 510(k) clearance or, depending on the modification, PMA approval. The determination as to whether a modification could significantly affect the device’s safety or effectiveness is initially left to the manufacturer using available FDA guidance. Many minor modifications are accomplished by a ‘‘letter to file’’, in which the manufacturer documents the rationale for the change and why a new 510(k) submission is not required. However, the FDA may review such letters to file to evaluate the regulatory status of the modified device at any time and may require the manufacturer to cease marketing and recall the modified device until 510(k) clearance or PMA approval is obtained.

Some of our devices are Class III devices that require PMA approval before they can be marketed. In a PMA, the manufacturer must demonstrate that the device is reasonably safe and effective, and the PMA must be supported by extensive data, including data from preclinical studies and clinical trials. The PMA must also contain a full description of the device and its components, a full description of the methods, facilities and controls used for manufacturing, and proposed labeling. If the FDA accepts the application for review, it has 180 days under the FDCA to complete its review of a PMA, although in practice, the FDA’s review often takes significantly longer, and can take up to several years. An advisory committee of experts from outside the FDA may be convened to review and evaluate the application and provide recommendations to the FDA as to the approvability of the device. The FDA may or may not accept the advisory committee’s recommendation. In addition, the FDA will generally conduct a pre-approval inspection of the applicant or its third-party manufacturers’ or suppliers’ manufacturing facility or facilities to ensure compliance with the QSR.

The FDA will approve the new device for commercial distribution if it determines that the data and information in the PMA constitute valid scientific evidence and that there is reasonable assurance that the device is safe and effective for its intended use(s). Certain changes to an approved device that affect the safety or effectiveness of the device, require submission of a PMA supplement or in some cases a new PMA.

Regulation of a Drug

In order to be marketed, new drugs require FDA approval of a New Drug Application, or NDA. Satisfaction of the FDA approval requirements for drugs typically takes several years and the actual time required may vary substantially based on the type, complexity and novelty of the product. None of our products are currently approved under an NDA.

The steps for obtaining FDA approval of an NDA to market a drug in the United States include:

| ● |

completion of preclinical laboratory tests, animal studies and formulation studies under the FDA’s Good Laboratory Practices regulations; |

| ● |

submission to the FDA of an Investigational New Drug Application, or IND, for human clinical testing, which must become effective before human clinical trials may begin and Institutional Review Board, or IRB, approval at each clinical site before the trials may be initiated; |

| ● |

performance of adequate and well-controlled clinical trials in accordance with Good Clinical Practices to establish the safety and efficacy of the product for each indication; |

| ● |

submission to the FDA of a user fee (unless a fee waiver applies) and an NDA, which contains detailed information about the Chemistry, Manufacturing and Control, or CMC, for the product, reports of the outcomes and full data sets of the preclinical testing and clinical trials, and proposed labeling and packaging for the product; |

| ● |

satisfactory review of the contents of the NDA by the FDA, including the satisfactory resolution of any questions raised during the review; |

| ● |

satisfactory completion of an FDA advisory committee review, if applicable; |

| ● |

satisfactory completion of an FDA inspection of the manufacturing facility or facilities at which the product is produced to assess compliance with current Good Manufacturing Practices, or cGMP, regulations, to assure that the facilities, methods and controls are adequate to ensure the product’s identity, strength, quality and purity; and |

| ● |

FDA approval of the NDA including agreement on post-marketing commitments, if applicable. |

After the NDA submission is accepted for filing, the FDA reviews the NDA to determine, among other things, whether the proposed product is safe and effective for its intended use, and has an acceptable purity profile. A drug-drug combination product must meet the FDA’s fixed combination rule and thus demonstrate the contribution of each component to the therapeutic effect.

If the FDA determines the application, the manufacturing process or manufacturing facilities are not acceptable, it will either not approve the NDA or issue a complete response letter in which it will outline the deficiencies in the NDA. If a complete response letter is issued, the applicant may either resubmit the NDA to address all deficiencies identified in the letter, withdraw the application, or request a hearing. Notwithstanding the submission of any requested additional information, the FDA ultimately may decide that the NDA does not satisfy the regulatory criteria for approval.

The FDA seeks to review standard NDAs in 10 months and priority NDAs in six months, whereupon a review decision is to be made. The FDA does not always meet its goal dates for standard and priority NDAs and its review goals are subject to change from time to time.

Clinical Trials

Clinical trials are typically required to support a PMA and an NDA and are sometimes required to support a 510(k) submission. All clinical trials must be approved by, and conducted under the oversight of an IRB for each clinical site. Clinical investigators must obtain informed consent from all study subjects. After a trial begins, we, the FDA or the IRB could suspend or terminate a clinical trial at any time for various reasons, including a belief that the risks to study subjects outweigh the anticipated benefits. Information about certain clinical studies must be submitted with specific timeframes to the National Institutes of Health for public dissemination at www.clinicaltrials.gov. All clinical investigations of devices to determine safety and effectiveness must be conducted in accordance with the FDA’s investigational device exemption, or IDE, regulations which govern investigational device labeling, prohibit promotion of the investigational device, and specify an array of recordkeeping, reporting and monitoring responsibilities of study sponsors and study investigators. If the device presents a ‘‘significant risk’’ as defined by the FDA, to human health, the FDA requires the device sponsor to submit an IDE application to the FDA, which must be approved prior to commencing human clinical trials. A significant risk device is one that presents a potential for serious risk to the health, safety or welfare of a patient and either is implanted, purported or represented to be used in supporting or sustaining human life, is for a use that is substantially important in diagnosing, curing, mitigating or treating disease or otherwise preventing impairment of human health, or otherwise presents a potential for serious risk to a subject. A clinical trial may begin 30 days after receipt of the IDE by the FDA unless the FDA notifies the company that the investigation may not begin.

If an IDE application is approved by the FDA and one or more IRBs, human clinical trials may begin at a specific number of investigational sites with a specific number of patients, as approved by the FDA. If the device is considered a ‘‘non-significant risk’’ IDE submission to the FDA is not required. Instead, only approval from the IRB overseeing the investigation at each clinical trial site is required.

For a new drug, an IND application must be submitted prior to the initiation of the clinical study and contain information on animal pharmacology and toxicology studies, manufacturing, and clinical protocols and investigator information.

Some preclinical testing may continue after the IND application is submitted. The IND must become effective before human clinical trials may begin. An IND will automatically become effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions about issues such as the conduct of the trials and/or supporting preclinical data as outlined in the IND application and places the trial on clinical hold. In that case, the IND sponsor and the FDA must resolve any outstanding FDA concerns or questions before clinical trials can proceed.

For purposes of NDA approval, human clinical trials are typically conducted in three sequential phases that may overlap:

| ● |

Phase 1—The investigational product is initially introduced into healthy human subjects and tested for safety. In the case of some products for severe or life-threatening diseases, especially when the product may be too inherently toxic to ethically administer to healthy volunteers, the initial human testing is often conducted in patients. These trials may also provide early evidence of their effectiveness. |

| ● |

Phase 2—These trials are conducted in a limited number of patients in the target population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage. |

| ● |

Phase 3—Phase 3 trials are undertaken to provide statistically significant evidence of clinical efficacy and to further evaluate dosage, potency, and safety in an expanded patient population at multiple clinical trial sites. They are performed after preliminary evidence suggesting effectiveness of the product has been obtained and are intended to establish the overall benefit-risk relationship of the investigational product, and to provide an adequate basis for product approval and physician labeling. |

Typically, if a product is intended to treat a chronic disease, safety and efficacy data must be gathered over an extended period, which can range from six months to three years or more.

During all phases of clinical development, the FDA requires extensive monitoring and auditing of all clinical activities, clinical data, and clinical trial investigators. Annual progress reports detailing the results of the clinical trials and reports of serious adverse events must be submitted to the FDA.

Post-Approval Requirements

Products manufactured or distributed pursuant to FDA clearances or approvals are subject to continuing regulation by the FDA, including, among other things, requirements relating to monitoring, record-keeping, advertising and promotion, reporting of adverse experiences, and limitations on industry-sponsored scientific and educational activities.

FDA regulations require that PMA and NDA approved products be manufactured in specific facilities and all devices and drugs must be manufactured in accordance with the QSR and cGMP regulations, respectively. Manufacturers and other entities involved in the manufacture and distribution of cleared or approved devices or drugs are required to register their establishments and list their products with the FDA and certain state agencies. Manufacturers are subject to periodic announced and unannounced inspections by the FDA and certain state agencies for compliance with regulatory requirements. The discovery of violative conditions, including failure to conform to the QSR and cGMP regulations, could result in enforcement actions.

Products may be promoted only for the cleared or approved indications and in accordance with the provisions of the label. The FDA does not regulate behavior of physicians in their choice of treatments and physicians may legally prescribe available products for uses that are not described in the product’s labeling and that differ from those approved or cleared by the FDA. However, the FDA does restrict an applicant’s communications about off-label use of its products. The FDA and other agencies actively enforce the laws prohibiting the marketing and promotion of off-label uses, and a company that is found to have improperly marketed or promoted off-label use may be subject to significant liability, including criminal and civil penalties under the FDCA and False Claims Act, exclusion from participation in federal healthcare programs, and mandatory compliance programs.

The FDA also may require post-marketing testing and surveillance to monitor the effects of a marketed product. Discovery of previously unknown problems with a product or the failure to comply with applicable FDA requirements can have negative consequences, including adverse publicity, restrictions on a product, and judicial or administrative enforcement. The FDA has broad regulatory compliance and enforcement powers. If the FDA determines that we failed to comply with applicable regulatory requirements, it can take a variety of compliance or enforcement actions, including, without limitation, issuing a Form FDA 483 notice of inspectional observations or a warning letter or untitled letter, imposing civil money penalties, suspending or delaying issuance of clearances or approvals or refusing to grant clearances or approve pending premarket applications, requiring or requesting product recall, imposing a total or partial shutdown of production, withdrawal of approvals or clearances already granted, pursuing product seizures, consent decrees or other injunctive relief, or criminal prosecution through the Department of Justice. The FDA can also require us to repair, replace, or refund the cost of devices that we manufactured or distributed. Outside the United States, regulatory agencies may exert a range of similar powers.

EU Regulation

In the European Union, medical devices must be CE marked in order to be marketed. CE marking a device involves working with a Notified Body (or in some cases, for the lowest risk class devices, the manufacturer can self-certify) to demonstrate that the device meets all applicable requirements of the EU medical devices legislation and that the Quality Management System is compliant. The EU’s Medical Device Directive, or MDD, has been replaced by the EU Medical Device Regulation, or EU MDR, enacted in 2017, and which became effective on May 26, 2021. EU MDR requirements will phase in on a product-by-product basis as certifications issued under the MDD lapse and will require all products to undergo review and approval under these new regulations. The timing for this transition has been extended from no later than May 26, 2024 to December 2027 or December 2028, depending on device classification, provided certain conditions are met with regard to the new regulation, one of which being that all submissions are filed by May 26, 2024. The EU MDR will generally require increased levels of clinical data as compared to MDD requirements, and all product technical data must comply to the latest standards regardless of when the product was initially developed.

Drug approval in the European Union follows one of several possible processes: (i) a centralized procedure involving members of the European Medicines Agency’s Committee for Medicinal Products for Human Use; (ii) a “mutual recognition procedure” in which an individual country's regulatory agency approves the product followed by “mutual recognition” of this approval by regulatory agencies of other countries; (iii) a decentralized procedure in which the approval is sought through the regulatory agencies of multiple countries at the same time; or (iv) a national procedure in which the approval is sought through the regulatory agency of one country.

UK Regulation

The UK formally left the EU on January 31, 2020. The EU and the UK have concluded a trade and cooperation agreement, or TCA, which was provisionally applicable since January 1, 2021 and has been formally applicable since May 1, 2021. The TCA includes specific provisions concerning pharmaceuticals, which include the mutual recognition of GMP, inspections of manufacturing facilities for medicinal products and GMP documents issued, but does not foresee wholesale mutual recognition of UK and EU pharmaceutical regulations. At present, Great Britain has implemented EU legislation on the marketing, promotion and sale of medicinal products through the Human Medicines Regulations 2012 (as amended) (under the Northern Ireland Protocol, the EU regulatory framework will continue to apply in Northern Ireland). The regulatory regime in Great Britain therefore currently aligns with EU regulations in many ways, however it is possible that these regimes will diverge more significantly in the future now that Great Britain’s regulatory system is independent from the EU.

In respect of medical devices, since the end of the Brexit transitional period on January 1, 2021, new regulations require medical devices to be registered with the Medicines and Healthcare products Regulatory Agency, or MHRA (the UK medicines and medical devices regulator) before being placed on the Great Britain market. The MHRA will only register devices where the manufacturer or their United Kingdom Responsible Person has a registered place of business in the United Kingdom. By July 1, 2023, in Great Britain, all medical devices will require a UKCA (UK Conformity Assessed) mark but CE marks issued by EU notified bodies will remain valid until December 2024. Manufacturers may choose to use the UKCA mark on a voluntary basis until June 30, 2023. UCKA marking will, however, not be recognized in the EU. The rules for placing medical devices on the market in Northern Ireland, which is part of the United Kingdom, differ from those in the rest of the United Kingdom.

Other Health Care Laws

The delivery of our products is subject to regulation by the U.S. Department of Health and Human services and other state and non-U.S. government agencies responsible for reimbursement and regulation of health care items and services. U.S. laws and regulations are imposed primarily in connection with government-funded health care programs, such as Medicare and Medicaid, as well as the government’s interest in regulating the quality and cost of health care. Other governments also impose regulations in connection with their health care reimbursement programs and the delivery of health care items and services.

We are subject to various U.S. federal and state laws pertaining to health care fraud and abuse, including anti-kickback, false claims, self-referrals, and other health care fraud. In addition, we are subject to U.S. federal and state transparency laws, such as the U.S. Physician Payments Sunshine Act, which require us to annually disclose certain payments and other transfers of value we make to U.S.-licensed health care practitioners (like physicians, nurse practitioners, advanced practice registered nurses, and others) and others. Similar laws and regulations pertaining to sales, marketing and advertising practices exist in the other geographic areas where we operate.

Coverage and Reimbursement

Sales of any medical product depend, in part, on the extent to which such product (or procedures using such product) will be covered by third-party payers, such as federal, state, and foreign government healthcare programs, commercial insurance and managed healthcare organizations, and the level of reimbursement for such product or procedure by third-party payers. Decisions regarding the extent of coverage and amount of reimbursement to be provided are made on a plan-by-plan basis. These third-party payers are increasingly reducing reimbursements for medical products and related procedures.

Factors that payers consider in determining reimbursement are based on whether the product or procedure is:

| ● |

a covered benefit under its health plan; |

| ● |

safe, effective and medically necessary; |

| ● |

appropriate for the specific patient; |

| ● |

cost-effective; and |

| ● |

neither experimental nor investigational. |

No uniform policy for coverage and reimbursement for medical products or procedures that use medical products exists among third-party payers in the U.S. Therefore, coverage and reimbursement for products or their procedures can differ significantly from payer to payer. As a result, the coverage determination process is often a time-consuming and costly process that will require us to provide scientific and clinical support for the use of our products to each payer separately, with no assurance that coverage and adequate reimbursement will be applied consistently or obtained in the first instance. Furthermore, rules and regulations regarding reimbursement change frequently, in some cases on short notice, and we believe that changes in these rules and regulations are likely.

In addition, the U.S. government, state legislatures and foreign governments have continued implementing cost-containment programs, including price controls, restrictions on coverage and reimbursement and requirements for substitution of generic products. Adoption of price controls and cost-containment measures, and adoption of more restrictive policies in jurisdictions with existing controls and measures, could further limit sales of any product. Decreases in third-party reimbursement for any product or procedure that uses our products or a decision by a third-party payer not to cover a product or related procedure could reduce physician usage and patient demand for the product or procedure and also have a material adverse effect on sales.

Health Care Reform

The Affordable Care Act of 2010, or the ACA, substantially changed the way healthcare is financed by both governmental and private insurers, and significantly affected the pharmaceutical and medical device industry. The ACA contained a number of provisions, including those governing enrollment in federal healthcare programs, reimbursement adjustments and changes to fraud and abuse laws as well as Medicare provisions aimed at decreasing costs, comparative effectiveness research, an independent payment advisory board and pilot programs to evaluate alternative payment methodologies. Since its enactment, there have been ongoing judicial and Congressional efforts to modify or repeal certain aspects of the ACA. For example, the Further Consolidated Appropriations Act, 2020, repealed the Cadillac tax, the health insurance provider tax, and the medical device excise tax. It is impossible to determine whether similar taxes could be instated in the future or how future healthcare reform measures or other efforts, if any, to challenge repeal or replace the ACA, will impact our business.

Data Privacy and Security Laws

We are also subject to various laws and regulations concerning data privacy in the United States, Europe, and elsewhere, including the General Data Protection Regulation, or GDPR, in the European Union and the United Kingdom. These legal requirements impose stringent requirements on the processing, administration, security, and confidentiality of personal data and empower enforcement agencies to impose large penalties for noncompliance. In addition, various jurisdictions around the world continue to propose new laws that regulate the privacy and/or security of certain types of personal data. Complying with these laws, if enacted, would require significant resources and leave us vulnerable to possible fines, penalties, litigation, and reputational harm if we are unable to comply.

Environmental Laws

We believe that we are in compliance with all foreign, federal, state, and local environmental regulations with respect to our manufacturing facilities. The cost of ongoing compliance with such environmental regulations does not have a material effect on our operations.

Seasonality

Our OA Pain Management and Non-Orthopedic product families are generally less seasonal in nature due to the nature of our product mix and sales channels and strategies. In Joint Preservation and Restoration, procedure volumes are normally higher in the fourth quarter due to several factors including the satisfaction by patients of insurance deductible limits and the time of year patients prefer to have elective procedures. The ongoing effects of the COVID-19 pandemic have also somewhat changed the historic seasonality of our Joint Preservation and Restoration business. These effects have included periodic restrictions on the performance of elective surgical procedures throughout the U.S. and global markets, the unavailability of physicians and/or changes to their treatment prioritizations, reductions in the levels of healthcare facility staffing and, in certain instances, the willingness or ability of patients to seek treatment. The impact of seasonality on our business could continue to evolve based on factors such as patient behavior and attitudes towards vacations, the emergence of COVID-19 variants, and supply chain and staffing challenges.

Environmental, Social and Governance

In 2021, we began a process to develop a foundational Environmental, Social and Governance, or ESG, framework for our organization. This framework integrates our six key corporate values: People, Quality, Integrity, Accountability, Innovation and Teamwork. The initial step in our ESG journey included the completion of a “materiality assessment” based on the Sustainability Accounting Standards Board, or SASB, framework. Our materiality assessment was a research-intensive and stakeholder-inclusive process and included guidance and insight from external advisors, and crucial feedback from key internal and external stakeholders, including investors, customers, suppliers, employees and our board of directors.

As a result of the materiality assessment, we identified the themes that are most important to our stakeholders and our business within traditional environmental, social and governance pillars. Most immediately, our materiality assessment enabled us to select our six key focus areas, with a goal to be aligned with SASB standards for the medical device industry. We will continue to assess and update our ESG initiatives as our business grows and as we implement processes and improvements over time.

Human Capital Management

We believe that creating a diverse, talented, and inclusive workplace is a central aspect to our culture, employee recruitment, retention and engagement, innovation, operational excellence and overall performance. In turn, this culture and drive for performance is an important factor in our ability to attract and retain key talent. Our culture is centered around our fundamental values of:

| ● |

People: We engage and invest in each other in a community that values diversity and inclusion. |

|

| ● |

Innovation: We are agile and entrepreneurial in developing and delivering meaningful solutions to our healthcare stakeholders within our target markets. |

|

| ● |

Quality: We strive for the highest quality and compliance in everything we do. |

|

| ● |

Teamwork: We operate with mutual respect and trust and are collaborative as we grow together. |

|

| ● |

Integrity: We live up to our promises and do the right thing, every day. |

|

| ● |

Accountability: We are empowered and accountable to deliver results and value to all of our stakeholders. |

Talent Acquisition and Management

Our industry requires complex processes for product development and commercialization, each of which requires deep expertise and experience across a broad array of disciplines. Medical device companies therefore compete for a limited number of qualified applicants to fill specialized positions. This requires competitive compensation and benefits packages and an attractive culture in order to attract and retain skilled employees to support the growth and success of the company.

As of December 31, 2022, we employed 345 full-time employees in the United States and Europe. We expect to continue to add employees in 2023 and beyond as we grow our business.

We believe that our employees’ understanding of how their work contributes to our overall strategy and performance is key to our success. In order to communicate with respect to these important topics in a manner that is engaging to our team, we utilize a variety of channels. These include all-employee town hall meetings with senior management, regular email updates from our chief executive officer and other key members of the executive team, as well as presentations to our employees by invited clinicians, who use our products, participate and share their experiences from a customer’s perspective. In addition, to assess employee perceptions in areas such as inclusion, professional development/training, reward/recognition, equity, engagement and overall organizational satisfaction, we conduct company-wide employee engagement surveys using an external survey platform. Our management team evaluates the results and identifies potential opportunities for improvement. As a result of employee feedback, we have established an employee communications taskforce chartered with improving communications and employee engagement across the business and introduced new e-learning programs to expand employee development.

Diversity, Equity and Inclusion

We are committed to a diverse, equitable and inclusive workplace where all employees, regardless of their gender, race, ethnicity, national origin, age, sexual orientation or identity, education or disability are valued, respected and supported. Beginning in 2021, we made a commitment to comply with key elements of the MassBio CEO Pledge for a More Equitable and Inclusive Life Science Industry. We are working on a multi-year approach at providing the key deliverables to meet our commitment. This included the development and communication of a corporate Diversity, Equity and Inclusion Policy Statement as well as the creation of a Diversity Dashboard. The Diversity Dashboard tracks the current diversity within the organization and is shared with the board of directors to provide engagement and oversight at the highest levels of the organization. We have also conducted employee surveys and employee focus groups to discuss diversity and inclusion. We will continue to enhance the diversity of our workforce through focused talent acquisition goals and development plans.

Employee Development

The ongoing development of our employees continues to be a catalyst for our growth and success as a company. Many of our employees have obtained advanced degrees in their professions. We support our employees’ further development with individualized development plans, mentoring, coaching, group training, conference attendance. We also provide financial support, including tuition reimbursement for qualified programs, as well as access to a broad-based learning management platform for self-directed learning and improvement.

Competitive Pay and Benefits

To attract and retain qualified employees and key talent, we offer our employees total rewards packages consisting of base salary, a cash bonus, and a comprehensive benefit package. We also provide equity compensation for certain employees based on various criteria, including their level within our company. All employees globally are eligible to participate in the annual incentive cash bonus plan or a sales incentive plan which are aligned to both corporate and individual performance. Bonus opportunity and equity compensation increase as a percentage of total compensation based on level of responsibility. Our Employee Stock Purchase Plan, introduced in 2021, gives eligible employees the opportunity to purchase shares in Anika at a discounted rate. Bravo, our global online employee recognition program, provides the opportunity for both peer to peer and manager to employee recognition, and has been well received by our employees.

Health and Safety

We remain focused on promoting the total wellness of our employees including resources, programs and services to support their physical, mental and financial wellness. As a result of the COVID-19 pandemic, we augmented certain of our normal business practices to ensure that we promote health and safety for our employees. A cross functional COVID-19 Pandemic Task Force was put in place since the start of the pandemic. We established safety policies and protocols, and we regularly update our employees with respect to any changes. We adjusted attendance policies to encourage those who may be ill to stay home. To further protect our on-site employees, we have provided personal protective equipment and cleaning supplies. Additionally, we engaged a third-party firm to conduct a proactive facility assessment and upgraded our air filtration systems to be more effective against COVID-19 transmission, thus enhancing the safety of our workforce while on the job. We have also provided general information updates and support for our employees to ensure that they have resources and information to protect their health and that of those around them, including their families and co-workers.

Product Liability

The testing, marketing, and sale of human health care products entail an inherent risk of allegations of product liability, and we cannot assure that substantial product liability claims will not be asserted against us. Although we have not received any material product liability claims to date, we cannot assure that if material claims arise in the future, our insurance will be adequate to cover all situations. Moreover, we cannot assure that such insurance, or additional insurance, if required, will be available in the future or, if available, will be available on commercially reasonable terms. Any product liability claim, if successful, could have a material adverse effect on our business, financial condition, and results of operations.

Available Information