UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to

Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

ANIKA THERAPEUTICS, INC.

| (Name of Registrant as Specified in Its Charter) |

| Payment of Filing Fee (Check the appropriate box): | |||

| ☒ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) |

Title of each class of securities to which transaction applies:

|

||

| (2) |

Aggregate number of securities to which transaction applies:

| ||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| ||

| (4) |

Proposed maximum aggregate value of transaction:

| ||

| (5) |

Total fee paid:

| ||

| ☐ | Fee paid previously with preliminary materials. | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) |

Amount Previously Paid:

| ||

| (2) |

Form, Schedule or Registration Statement No.:

| ||

| (3) |

Filing Party:

| ||

| (4) |

Date Filed:

| ||

April 27, 2022

Dear Fellow Stockholder:

It is my pleasure to invite you to attend the Annual Meeting of Stockholders of Anika Therapeutics, Inc. to be held on June 8, 2022, at 9:00 a.m., Eastern time. This year’s Annual Meeting will be a “virtual meeting” conducted via live audio webcast, consistent with our recent practice. Each holder of common stock as of 5:00 p.m., Eastern time, on the record date of April 13, 2022 will be able to participate in the Annual Meeting by accessing a live webcast at virtualshareholdermeeting.com/ANIK2022 and entering the control number included on the holder’s Notice of Internet Availability of Proxy Materials or proxy card. Stockholders will also be able to vote their shares and submit questions via the internet during the meeting by participating in the webcast.

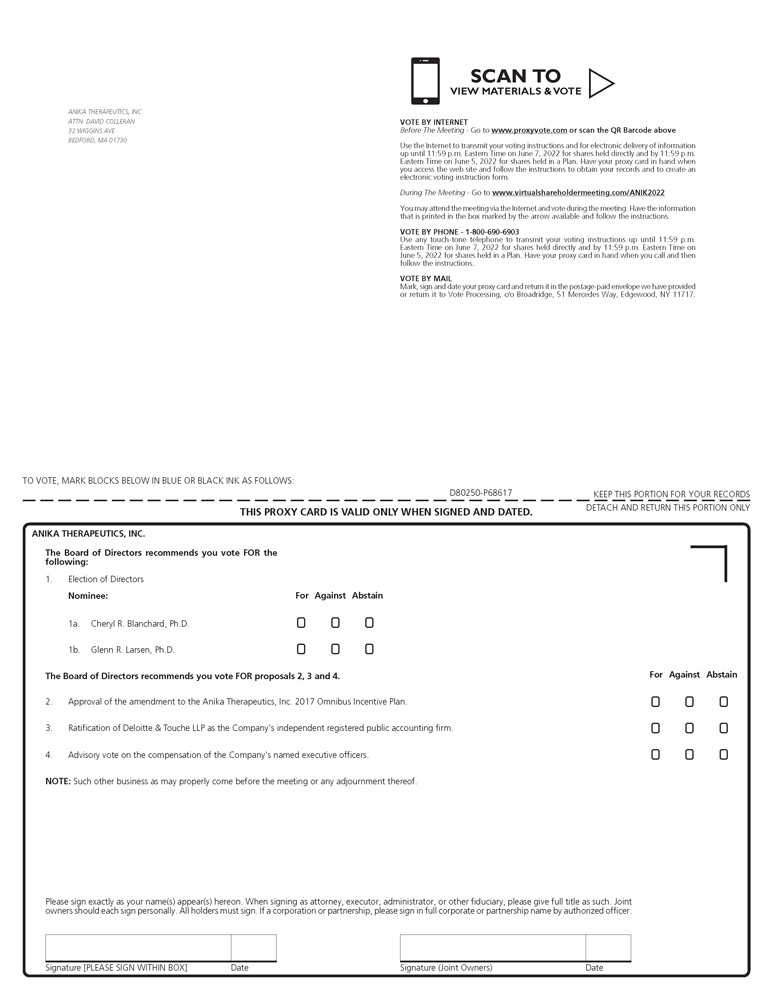

During the Annual Meeting stockholders will be asked to elect two Class II Directors, to approve an amendment to our 2017 Omnibus Incentive Plan, and to ratify the appointment of Deloitte & Touche LLP as our independent auditor for 2022. We will also be asking stockholders to approve, by an advisory vote, our 2021 executive compensation as disclosed in the Proxy Statement for the Annual Meeting (a “say-on-pay” vote). Each of these matters is important, and we urge you to vote in favor of the election of each of the director nominees, the approval of our 2017 Omnibus Incentive Plan amendment, the ratification of the appointment of our independent auditor, and the approval, on an advisory basis, of our 2021 executive compensation.

We are furnishing proxy materials to our stockholders over the internet. This process expedites the delivery of proxy materials to our stockholders, lowers our costs, and reduces the environmental impact of the Annual Meeting. Today, we are sending to each of our stockholders of record as of April 13, 2022, a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement for the Annual Meeting and our 2021 Annual Report to Stockholders, as well as instructions on how to vote via proxy either by telephone or over the internet. Some stockholders will receive copies of the Proxy Statement, a proxy card and the 2021 Annual Report by mail or e-mail. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, you may request those materials by following the instructions included in your Notice of Internet Availability of Proxy Materials.

It is important that you vote your shares of common stock virtually or by proxy, regardless of the number of shares you own. You will find the instructions for voting on your Notice of Internet Availability of Proxy Materials and proxy card. We appreciate your prompt attention.

The Board of Directors invites you to participate in the Annual Meeting where Anika will address appropriate general questions about the business as time allows. Thank you for your support, and we look forward to joining you at the Annual Meeting.

Sincerely,

Cheryl R. Blanchard, Ph.D.

President and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The Board of Directors of Anika Therapeutics, Inc., a Delaware corporation (“Anika"), is soliciting proxies for use at Anika’s 2022 Annual Meeting of Stockholders being held on Wednesday, June 8, 2022, at 9:00 a.m., Eastern time (the “Annual Meeting”). You are receiving the enclosed Proxy Statement because you were a holder of Anika’s common stock as of 5:00 p.m., Eastern time, on the record date of April 13, 2022, and therefore are entitled to vote at the Annual Meeting. You may participate in the Annual Meeting, including casting votes and asking questions, by accessing a live webcast at virtualshareholdermeeting.com/ANIK2022 and entering the control number included on the Notice of Internet Availability of Proxy Materials or proxy card. Online check-in to the Annual Meeting will begin at 8:45 a.m., Eastern time, and stockholders are encouraged to allow ample time to log in to the meeting webcast and test their computer and audio system. There will be no physical location for the Annual Meeting.

At the Annual Meeting the following matters will be considered:

| 1. | Election of two Class II Directors; |

| 2. | Amendment of Anika Therapeutics, Inc. 2017 Omnibus Incentive Plan; |

| 3. | Ratification of appointment of Deloitte & Touche LLP as Anika’s independent auditor for 2022; |

| 4. | Advisory “say-on-pay” vote on executive compensation; and |

| 5. | Any other matters that properly come before the Annual Meeting. |

Each share of common stock is entitled to one vote for each director position and other proposal. In accordance with rules of the Securities and Exchange Commission, or SEC, we are providing stockholders with access to proxy materials on the internet, instead of mailing printed copies. We are mailing to stockholders of record as of April 13, 2022, commencing on or about April 27, 2022, a Notice of Internet Availability of Proxy Materials to provide:

| · | Directions for accessing and reviewing the proxy materials on the internet and submitting a proxy over the internet or by telephone; |

| · | Instructions for requesting copies of proxy materials in printed form or by email at no charge; and |

| · | A control number for use in submitting proxies and accessing the Annual Meeting webcast. |

Some stockholders will receive copies of the Proxy Statement, a proxy card and the 2021 Annual Report by mail or e-mail. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, you may request those materials by following the instructions included in the Notice of Internet Availability of Proxy Materials.

Your vote is important. Whether or not you plan to participate in the Annual Meeting, please complete and return your proxy card or vote by telephone or via the internet by following the instructions on the Notice of Internet Availability of Proxy Materials. Returning a proxy card or otherwise submitting your proxy does not deprive you of your right to access the Annual Meeting and vote during the webcast at that time.

Anika will maintain a list of stockholders of record as of the record date at Anika’s corporate headquarters, 32 Wiggins Avenue, Bedford, Massachusetts, for a period beginning ten days prior to the Annual Meeting and ending at the close of the Annual Meeting.

By Order of the Board of Directors,

David B. Colleran

Executive Vice President, General Counsel and Secretary

Bedford, Massachusetts

April 27, 2022

|

Important Notice Regarding Availability of Proxy Materials for Annual Meeting on June 8, 2022:

The Notice of Annual Meeting of Stockholders, Proxy Statement and 2021 Annual Report to Stockholders are available at https://ir.anika.com/annual-meeting. |

32 Wiggins Avenue

Bedford, Massachusetts 01730

Proxy Statement dated April 27, 2022

2022 Annual Meeting of Stockholders

Anika Therapeutics, Inc., a Delaware corporation, is furnishing this Proxy Statement and the related proxy materials in connection with the solicitation by its Board of Directors of proxies to be voted at its 2022 Annual Meeting of Stockholders and any postponements or adjournments thereof. Anika Therapeutics, Inc. is providing these materials to the holders of record of its common stock as of the close of business on April 13, 2022 and is first making available or mailing the materials on or about April 27, 2022.

The Annual Meeting is scheduled to be held as follows:

| Date: | Wednesday, June 8, 2022 | |

| Time: | 9:00 a.m., Eastern time | |

| Meeting Webcast Address: | virtualshareholdermeeting.com/ANIK2022 |

Your vote is important.

Please see the detailed information that follows.

| i |

Table of Contents

References in this Proxy Statement to “Anika,” “we,” “us,” “our,” “our company” and similar references refer to Anika Therapeutics, Inc. and its subsidiaries, unless the context requires otherwise.

Anika, Anika Therapeutics, Arthrosurface, Parcus Medical, WristMotion, Tactoset, and Cingal are our registered trademarks. For convenience, these registered trademarks appear in this Proxy Statement without ® symbols, but that practice does not mean we will not assert, to the fullest extent under applicable law, our rights to the registered trademarks. This Proxy Statement also contains trademarks and service marks that are the property of other companies, including certain trademarks licensed to us.

| ii |

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Annual Meeting of Stockholders

| Time and Date | 9:00 a.m., Eastern time, on June 8, 2022 | |

| Meeting Webcast Address | virtualshareholdermeeting.com/ANIK2022 —To join, a stockholder will need the control number located on the stockholder’s Notice of Internet Availability of Proxy Materials or proxy card | |

| Record Date | 5:00 p.m., Eastern time, on April 13, 2022 | |

| Voting | Stockholders will be entitled to one vote at the Annual Meeting for each outstanding share of common stock they hold of record as of the record date | |

| Outstanding Common Stock | 14,519,284 shares as of the record date |

Annual Meeting Agenda

| Proposal | Board Recommendation | |||

| 1 | Election of two Class II Directors | FOR each nominee | ||

| 2 | Amendment of 2017 Omnibus Incentive Plan | FOR | ||

| 3 | Ratification of independent auditor for 2022 | FOR | ||

| 4 | Advisory “say-on-pay” vote | FOR |

How to Vote Prior to the Annual Meeting

|

By mailing your proxy card |

By telephone |

By Internet | ||

|

|

| ||

|

Cast your ballot,

sign your proxy card and |

Dial toll-free 24/7

|

Visit 24/7 | ||

| Mark, sign and date your proxy card and return it in the postage-paid envelope included in your proxy materials. Your proxy card must arrive by June 7, 2022. |

Use a touch-tone telephone to transmit your voting instructions at any time up to 11:59 p.m., ET, on June 7, 2022. Follow the instructions on your Notice of Internet Delivery of Proxy Materials or proxy card. |

Use the Internet to transmit your voting instructions at any time up to 11:59 p.m., ET, on June 7, 2022. Follow the instructions on your Notice of Internet Delivery of Proxy Materials or proxy card. |

| 1 |

Proposal 1: Election of Two Class II Directors

Cheryl R. Blanchard, Ph.D. and Glenn R. Larsen, Ph.D. serve as Class II Directors, with terms of office expiring at this year’s Annual Meeting. Drs. Blanchard and Larsen are the Board’s nominees for election to the Board at the Annual Meeting. Each Class II Director will be elected to hold office until the 2025 Annual Meeting and until their successors are duly elected and qualified. Raymond J. Land, who also is currently a Class II Director, notified us that he has decided not to stand for re-election. Anika is very thankful to Mr. Land for his 16 years of thoughtful leadership and service to Anika.

| Director Nominees | Age | Director Since |

Occupation | Experience / Qualifications |

Independent | Board Roles |

| Cheryl R. Blanchard, Ph.D. | 57 | 2018 | President and Chief Executive Officer of Anika Therapeutics, Inc. |

• Executive Leadership • Industry Experience • Research and Development • Commercialization |

No | None |

| Glenn R. Larsen, Ph.D. | 67 | 2015 | Chairman, President, Chief Executive Officer and Co-Founder of Aquinnah Pharmaceuticals, Inc. |

• Board and Executive Leadership • Industry Experience • Research and Development • Operations |

Yes | Member of Compensation Committee and Governance and Nominating Committee |

| Board Recommendation: | The Board of Directors recommends a vote “FOR” the reelection of each of Drs. Blanchard and Larsen. | |

| Vote Required for Approval: | Affirmative vote of a majority of the shares of common stock that are voting in the election of directors, meaning that, to be elected, the shares voted “FOR” a nominee must exceed the number of shares voted “AGAINST” that nominee. | |

| Under our Majority Voting in Uncontested Director Elections Policy, if a director receives a greater number of votes “AGAINST” than “FOR” election, the director must promptly offer to resign, which resignation will be considered by the Governance and Nominating Committee. Please see the section captioned “Majority Voting in Uncontested Director Elections Policy” for more details on this policy and its impact on the election of director nominees. | ||

| Abstentions and broker non-votes will have no effect on the outcome of this proposal because they are not counted as “votes cast.” |

Board Representation

| DIVERSITY | INDEPENDENCE | TENURE | ||

| 4 of our 7 continuing directors and director nominees voluntarily self-identify as having a diverse identity (gender, race/ethnicity, or LGBTQ+). | 6 of our 7 continuing directors and director nominees qualify as independent under NASDAQ standards and SEC regulations. | The tenure of our continuing director nominees (average 4.1 years) reflects experience and fresh perspective. | ||

|

|

|

| 2 |

Director Skills and Diversity

The Board of Directors is committed to maintaining a diverse and inclusive membership with varying experience, characteristics, and expertise that complement our business strategy. The matrices below provide a summary of certain key skills, experience, and diversity disclosures of our continuing directors and director nominees. Our directors, individually and as a group, possess a wide range of skills and experiences that are highly relevant as we transform our company, expand our business into new treatment areas and develop, manufacture, and launch new products. Our directors are strategic thinkers with high expectations for our performance and are attuned to the value and importance of diversity in all of its forms and the demands of proper Board oversight and good governance practices.

Board of Directors Skills Matrix

| Skills and Experience | Blanchard | Conley | Henneman | Larsen | Richard | Thompson | Vogt |

| CEO/CFO Experience | • | • | • | • | • | • | • |

| Medical Devices/Pharmaceutical | • | • | • | • | • | • | • |

| Manufacturing | • | • | • | • | • | ||

| R&D/Innovation | • | • | • | • | • | ||

| Regulatory | • | • | • | • | • | • | |

| Financial Oversight/Accounting | • | • | • | • | • | ||

| Human Capital Management | • | • | • | • | • | • | • |

| Commercialization/Marketing | • | • | • | • | • | ||

| Public Company Governance/Corporate Responsibility | • | • | • | • | • | • | • |

| M&A/Business Development | • | • | • | • | • | ||

| International/Global Business | • | • | • | • | • | • | • |

| Other Public Company Experience | • | • | • | • | • | • | • |

Board of Directors Diversity Matrix

| Demographics | Blanchard | Conley | Henneman | Larsen | Richard | Thompson | Vogt |

| Age | 57 | 61 | 60 | 67 | 59 | 56 | 68 |

| Gender Identity | F | F | M | M | M | M | F |

| African American or Black | • | ||||||

| White | • | • | • | • | • | • |

| 3 |

Additional Board Governance Practices

| Elections: | Voting Standard | Majority (1) |

| Resignation Policy | Yes | |

| Mandatory Retirement Age or Tenure | No | |

| Chair: | Separate Chair of the Board and Chief Executive Officer | Yes |

| Independent Chair of the Board | Yes | |

| Robust Responsibilities and Duties Assigned to Independent Chair | Yes | |

| Meetings: | Number of Board Meetings Held in 2021 | 8 |

| Each of the Directors Attended all of the Board Meetings in 2021 | Yes | |

| Independent Directors Meet without Management Present | Yes | |

| Number of Standing Committee Meetings Held in 2021 | 13 | |

| Each of the Members Attended all of the Committee Meetings in 2021 | Yes | |

| Director Status: | All Directors in Compliance with our Overboarding Guidelines | Yes |

| Material Related-Party Transactions with Directors | None | |

| Standing Board Committee Membership Independence | 100% | |

| Board Oversight of Company Strategy and Risk | Yes | |

| All Directors in Compliance with Hedging and Pledging Prohibitions | Yes | |

| All Directors in Compliance with Stock Ownership Guidelines | Yes | |

| Stockholder Rights: | Dual Class Common Stock | No |

| Poison Pill | No | |

| Cumulative Voting | No |

| (1) | Plurality carve out for contested elections |

| 4 |

Proposal 2: Amendment of 2017 Omnibus Incentive Plan

The Board of Directors has approved the amendment, subject to stockholder approval, of our 2017 Omnibus Incentive Plan (as amended June 16, 2021) to increase the number of shares of common stock reserved by 950,000, from 4,600,000 to 5,550,000. As of April 13, 2022, a total of 934,089 shares of common stock remained available for grant under the plan. Additionally, the Board approved an amendment, subject to stockholder approval, to allow all shares authorized under the plan to be granted as incentive stock options. Please see the complete amendment attached hereto as Appendix A. No other provisions of the plan are proposed to be amended.

In order to capitalize on the transformation our company has undertaken over the past two years, including transformation in such key areas as leadership, technology, product portfolio expansion, commercial infrastructure enhancements, and the expansion of our addressable market, it is crucial that we are able to remain competitive in our compensation offerings. Our ability to grant equity awards to key employees is a fundamental part of our compensation program and integral to the success of our transformation. We believe the request for 950,000 additional shares will be sufficient for us to grant equity awards to attract and incent newly hired employees and to compensate existing employees and directors for approximately one year, based on our compensation philosophy and policies. Our actual share usage will vary depending on a number of factors, including the number of employees receiving equity awards, the prevailing price per share of our common stock, the methodology used to value and determine the size of equity awards, and the mix of award types provided to participants.

Without the ability to grant equity at a competitive level, our alternatives would be limited and would likely include the need to increase the cash compensation of our employees to attract, motivate and retain the people with the skills and experiences that we need to execute our long-term strategy. We believe equity-based compensation is an important feature of our compensation program because it aligns the interests of our management team with those of our stockholders.

The following table recaps key provisions of the plan, after giving effect to the proposed amendment.

| Key Provision | Summary Description | |

| New share request | The 950,000 shares of common stock requested represents 6.5% of the fully diluted common stock outstanding as of April 13, 2022 and would increase the total shares of common stock available for grant under the plan from 934,089 to 1,884,089. | |

| Shares reserved | Up to 1,884,089 shares of common stock, representing 13% of the fully diluted common stock outstanding as of April 13, 2022, would be available for grant, subject to adjustment by the plan administrator as set forth in the plan. | |

| Multiple award types | Various types of awards may be granted as compensation tools to attract new employees and motivate our workforce, including incentive stock options, non-qualified stock options, stock appreciation rights, restricted stock units, restricted stock awards, and other types of share and cash-based awards. | |

| Minimum vesting requirements | Awards must have a vesting period of at least 1 year, except that: |

| • | Up to 5% of the share pool can be granted without such minimum vesting period; and | |

| • | Awards may be accelerated due to a participant’s retirement, death, disability or a change in control of Anika, if such term was included in the award agreement. | |

| Maximum award terms | Awards may have terms of up to 10 years. | |

| Board of Director limits | The plan specifies the following annual limits on the value of awards that may be granted to non-employee directors: |

| • | $500,000 limit for the non-employee Chair or Lead Director of the Board; and | |

| • | $425,000 limit for each non-employee director other than the Chair or Lead Director of the Board (not including awards to non-employee directors upon initial election to the Board) | |

| No repricing | Awards may not be repriced without stockholder approval. | |

| No transferability | Awards generally may not be transferred, except by will or laws of descent and distribution. |

| Board Recommendation: | The Board recommends a vote “FOR” the amendment of our 2017 Omnibus Incentive Plan. | |

| Vote Required for Approval: | Affirmative vote of the holders of a majority of the shares of common stock that are voting on the matter. Abstentions and broker non-votes will not be treated as votes cast and will have no impact on the proposal. |

| 5 |

Proposal 3: Ratification of Independent Auditor for 2022

The Audit Committee has approved the retention of Deloitte & Touche LLP as our independent auditor with respect to our consolidated financial statements as of, and for the year ending, December 31, 2022.

| Board Recommendation: | The Board of Directors recommends a vote “FOR” the ratification of Deloitte & Touche LLP as our independent auditor for 2022. | |

| Vote Required for Approval: | Affirmative vote of the holders of a majority of the shares of common stock that are voting on the matter. Abstentions will not count as votes cast and will have no effect on the vote. Because this proposal is considered a routine matter, discretionary votes by brokers will be counted. |

Proposal 4: Advisory “Say-on-Pay” Vote

The overall objective of our executive compensation policy is to attract and retain highly qualified executive officers and to incentivize them to provide superior performance for the benefit of our company and stockholders.

2021 Executive Total Compensation Mix

The charts below show the annual total direct compensation (actual base salary, grant date fair value of equity incentive compensation granted in 2021, and actual cash bonuses received for the 2021 fiscal year) for our Chief Executive Officer and our other named executive officers, or NEOs, for 2021. Of total direct compensation, 84% of our Chief Executive Officer’s compensation, and on average 66% of our other NEOs’ compensation, was variable, either because it was subject to performance goals, the fluctuations of our stock price, or both.

| 6 |

| Compensation Element | Description | Objectives | ||||

| Base salary | • | Fixed cash compensation | • | Provide appropriate level of fixed compensation based on role, responsibility, performance and competitive market practices | ||

| Cash bonuses | • | Annual cash award based on the performance of our company and the individual | • | Reward the achievement of financial results, organizational development, business and technical development, individual goals and contributions to building long-term stockholder value | ||

| • | Overall cash bonus capped at 200% of the target payout | |||||

| Equity-based grants | • | Grants of equity awards, including restricted stock unit awards and stock options, under our equity plan | • | Align interests of our executive officers with those of our stockholders in terms of long-term value generation | ||

| • | Includes performance-based and time-vesting equity awards | • | Provide executive officers with opportunity to be compensated based on meaningful and continued stock price appreciation over time | |||

| • | Encourage employee retention through long-term value creation | |||||

Additional detailed information regarding our compensation philosophy and process and the compensation awarded to our named executive officers in 2021 is included in the Compensation Discussion and Analysis beginning on page 29, the Executive and Director Compensation Tables beginning on page 41, and other related disclosures throughout this Proxy Statement.

| Board Recommendation: | The Board of Directors recommends a vote “FOR” the approval of NEO compensation for the 2021 fiscal year as set forth in this Proxy Statement. | |

| Vote Required for Approval: | Affirmative vote of the holders of a majority of the shares of common stock that are voting on the matter. Abstentions and broker non-votes will not be treated as votes cast and will have no impact on the proposal. This vote is not binding on us, but will be given due consideration by the Compensation Committee and the Board. |

| 7 |

Proposal 1: Election of Directors

Our company is managed under the oversight of the Board of Directors, which is led by an independent chair. The directors utilize their deep experience in business and science, including biotech, pharmaceuticals, and medical devices, as well as their diverse backgrounds to provide management with guidance and oversight in delivering innovative products to meet the needs of clinicians and the patients that they treat, and in executing on our strategy for long-term value creation.

The Board sets high standards for management and employees tied to our core values of principled and ethical behavior, and the Board applies those same standards to itself, undertaking regular and rigorous reviews of each committee’s and each director’s performance, both collectively and individually. This is evidenced in our ongoing approach to Board refreshment, having added three of our current eight directors in the past three years. The current mix of longer-serving and recently added directors provides an appropriate balance of perspectives as the Board holds management accountable for delivering long-term value and keeping the interests of our stockholders and stakeholders, including clinicians and their patients, employees and business partners, at the center of our priorities.

The Board is currently comprised of eight directors and is divided into three classes: Class I, Class II and Class III. Each class of directors serves for a three-year term, with one class of directors being elected by our stockholders at each annual meeting. Cheryl R. Blanchard, Ph.D. and Glenn R. Larsen, Ph.D. serve as Class II Directors, with terms of office expiring at the Annual Meeting. Raymond J. Land, who currently serves as a Class II Director, will not stand for re-election at the Annual Meeting. John B. Henneman, III and Susan L. N. Vogt serve as Class III Directors, with terms of office expiring at the 2023 Annual Meeting. Sheryl L. Conley, Stephen O. Richard and Jeffery S. Thompson serve as Class I Directors, with terms of office expiring at the 2024 Annual Meeting.

Drs. Blanchard and Larsen are the Board’s nominees for election as Class II Directors at the Annual Meeting. Each Class II Director will be elected to hold office until the 2025 Annual Meeting and until a successor is duly elected and qualified. Unless otherwise instructed, the persons named in the accompanying proxy will vote, as permitted by our bylaws, to elect Drs. Blanchard and Larsen as Class II Directors. The Board has no reason to believe that either Dr. Blanchard or Dr. Larsen will be unable or unwilling to serve if elected.

There are no arrangements or understandings between any nominee and any other person pursuant to which the nominee was selected.

Vote Required

At the Annual Meeting, the election of a director requires the affirmative vote of a majority of the shares of common stock that are voting in the election of directors, meaning that, to be elected, the shares voted “FOR” a nominee must exceed the number of shares voted “AGAINST” that nominee. Abstentions and broker non-votes will not be treated as votes cast and will have no impact on the proposal. Under our Majority Voting in Uncontested Director Elections Policy, if a director receives a greater number of votes “AGAINST” than “FOR” election, the director must promptly offer the director’s resignation for consideration by the Governance and Nominating Committee. Please see the section captioned “Majority Voting in Uncontested Director Elections Policy” for more details on this policy and its impact on the election of director nominees.

Board Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF CHERYL R. BLANCHARD, PH.D. AND GLENN R. LARSEN, PH.D., THE DIRECTOR NOMINEES.

| 8 |

Information Regarding Directors

The following table sets forth the name of our current directors and includes the nominees for re-election as directors at the Annual Meeting, together with their ages (as of the record date) and the years in which they became a director. As noted elsewhere, Raymond J. Land, who currently is a Class II Director, is not standing for re-election at the Annual Meeting.

| Director Name | Age | Director Since | Term Expires |

| Class I Directors | |||

| Sheryl L. Conley | 61 | 2021 | 2024 |

| Stephen O. Richard | 59 | 2020 | 2024 |

| Jeffery S. Thompson | 56 | 2011 | 2024 |

| Class II Directors | |||

| Cheryl R. Blanchard Ph.D. | 57 | 2018 | 2022 |

| Glenn R. Larsen, Ph.D. | 67 | 2015 | 2022 |

| Class III Directors | |||

| John B. Henneman, III | 60 | 2020 | 2023 |

| Susan L. N. Vogt | 68 | 2018 | 2023 |

| 9 |

| Cheryl R. Blanchard, Ph.D. |

|

Anika Board Service: · Tenure: 3.5 years |

|

PRESIDENT and CHIEF EXECUTIVE OFFICER |

Age: 57 |

| Sheryl L. Conley |

|

Anika Board Service: · Tenure: 0.5 years · Committees: ○ Audit | |

|

INDEPENDENT |

Age: 61 |

Professional Experience

| · | Director since August 2018 |

| · | President and Chief Executive Officer of Anika since April 2020, and Interim Chief Executive Officer of Anika from February 2020 through April 2020 |

| · | Principal at Blanchard Consulting, LLC, a provider of scientific, regulatory, and business strategy consulting services to medical device companies and private equity clients, from 2012 to 2020 |

| · | President and Chief Executive Officer of Microchips Biotech, Inc., a venture-backed biotechnology company developing regenerative medicine and drug delivery products, from 2014 until its sale to Daré Bioscience, Inc. in November 2019 |

| · | Various offices, including Senior Vice President, Chief Scientific Officer, and general manager of Zimmer Biologics, of Zimmer, Inc., a medical device company focused on musculoskeletal products, from 2000 to 2012 |

Professional Experience

| · | Director since October 2021 |

| · | President and Board Member of AcceLINX, Inc., a musculoskeletal health business accelerator, from March 2017 - present |

| · | President and Chief Executive Officer of OrthoWorx, Inc., a community-based initiative that works strategically and collaboratively with the orthopedic industry, from September 2012 to May 2017 |

| · | Various management roles at Zimmer, Inc., a medical device company focused on musculoskeletal products, including Group President, Americas and Global Brand Management, and Chief Marketing Officer from December 2005 to May 2008 |

Other Current Public Company Board Service

| · | Daré Bioscience, Inc. (NASDAQ: DARE), a clinical-stage biopharmaceutical company committed to the advancement of innovative products for women's health, from November 2019 – present |

| · | Vigil Neuroscience, Inc. (NASDAQ: VIGL), a clinical-stage biotechnology company that went public in January 2022, committed to harnessing the power of microglia for the treatment of neurodegenerative diseases, from November 2020 – present |

Other Public Company Board Service

| · | Neuronetics, Inc. (NASDAQ: STIM), a medical technology company focused on developing products that improve the quality of life for patients suffering from psychiatric disorders, from October 2019 - present |

| · | Surgalign Holdings, Inc. (NASDAQ: SRGA), a global medical technology company focused on elevating the standard of care by driving the evolution of digital surgery, from May 2021 - present |

Former Recent Public Company Board Service

| · | Neuronetics, Inc. (NASDAQ: STIM), a commercial stage medical technology company focused on products for psychiatric disorders, from February 2019 to June 2020 |

| · | SeaSpine Holdings Corporation (NASDAQ: SPNE), a global medical technology company focused on surgical solutions for the treatment of spinal disorders, from June 2015 – May 2019 |

Education

| · | Ph.D. and M.S. in Materials Science and Engineering from the University of Texas-Austin |

| · | B.S. in Ceramic Engineering from Alfred University |

Education

| · | M.B.A. from Ball State University |

| · | B.S. in Biology and Chemistry from Ball State University |

Relevant Skills

| · | Strong scientific and business background in biologics and regenerative medicine industry |

| · | Extensive experience in management, including as a Chief Executive Officer, business development and developing and commercializing medical device and regenerative medicine and drug delivery products at multiple companies in the life science industry |

| · | Significant experience in innovative research and product development and commercial development |

Relevant Skills

| · | More than 35 years in the orthopedic medical device and healthcare industries |

| · | Significant executive leadership experience running full profit-and-loss business segments, global brand management, marketing, sales, product development, and operations |

| · | Extensive experience in global medical device development and commercialization |

| 10 |

| John B. Henneman, III |

|

Anika Board Service: · Tenure: 1.5 years · Committees: ○ Compensation (Chair) ○ Governance and Nominating | |

|

INDEPENDENT |

Age: 60 |

| Glenn R. Larsen, Ph.D. |

|

Anika Board Service: · Tenure: 7 years · Committees: ○ Compensation ○ Governance and Nominating | |

|

INDEPENDENT |

Age: 67 |

Professional Experience

| · | Director since September 2020 |

| · | Senior Advisor to Prettybrook Partners, a private equity firm investing in medical technology and healthcare services companies, from May 2018 - present |

| · | Consultant to SparkMed Advisors LLC, a provider of consulting and other services to start-up medical device and biotechnology companies, from January 2019 - present |

| · | Executive Vice President and Chief Financial Officer of NewLink Genetics Corporation, a public biotechnology company, from October 2014 to July 2018 and Chief Administrative Officer of NewLink from July 2018 through his retirement in November 2018 |

| · | Various offices of Integra LifeSciences Holdings Corp., a medical devices company, from 1998 to 2014, including Chief Financial Officer from 2007 to 2014 and earlier as General Counsel and Chief Administrative Officer |

Other Public Company Board Service

| · | Aprea Therapeutics Inc. (NASDAQ: APRE), a biotechnology company focused on novel cancer therapeutics, from August 2019 – present (lead independent director from September 2020 - present) |

| · | R1 RCM, Inc. (NASDAQ: RCM), a provider of revenue cycle management services to healthcare providers, from February 2016 – present (lead independent director from February 2022 – present) |

| · | SeaSpine Holdings Corporation (NASDAQ: SPNE), a spinal implant and orthobiologics company, from July 2015 - present |

Professional Experience

| · | Director since February 2015 |

| · | Chairman, President, Chief Executive Officer and cofounder of Aquinnah Pharmaceuticals, Inc., a pharmaceutical company focused on the development of treatments for ALS, Alzheimer’s and other neurodegenerative diseases, from February 2014 - present |

| · | Chairman, President, and Chief Executive Officer of 180 Therapeutics L.P., a clinical stage musculoskeletal drug development company, from 2013 until its merger with NASDAQ-listed 180 LifeSciences in 2020 |

| · | Chief Scientific Officer and Executive Vice President of Research and Development of SpringLeaf Therapeutics, Inc., a producer of combination drug delivery devices, from 2010 to 2013 |

| · | Chief Operating Officer, Executive Vice President of Research and Development and director of Hydra Biosciences, Inc., a biopharmaceutical company focused on developing pain therapeutic drugs, from 2003 to 2010 |

| · | Series of drug discovery and development leadership positions, including Vice President Musculoskeletal Sciences, at Wyeth (now Pfizer)/Genetics Institute, where he directed Wyeth’s second-largest therapeutic area with responsibility for Enbrel, an anti-TNF therapeutic for arthritic pain with multi-billion dollar annual sales, and the development of Infuse Bone Graft, the 1st regenerative biologic medicine approved for numerous orthopedic bone regeneration indications |

Education

| · | J.D. from University of Michigan Law School |

| · | A.B. in Politics from Princeton University |

Education

| · | Ph.D. in Biochemistry from Stony Brook University |

| · | P.M.D. from Harvard University |

Relevant Skills

| · | More than 25 years of senior management experience in the medical technology and biotechnology industries |

| · | Significant experience in serving on boards of directors, including boards of publicly held life science companies |

| · | Extensive experience in the areas of finance, financial accounting, business transactions, law, and mergers and acquisitions |

Relevant Skills

| · | Strong scientific background in pharmaceuticals, biotech, orthopedics, pain management and regenerative medicine |

| · | Extensive experience in management, product development and business development at multiple companies in the life science industry |

| · | Significant experience in innovative research and product development and commercial development |

| 11 |

| Stephen O. Richard |

|

Anika Board Service: · Tenure: 1.5 years · Committees: ○ Audit (Financial Expert) | |

|

INDEPENDENT |

Age: 59 |

| Jeffery S. Thompson |

|

Anika Board Service: · Tenure: 11 years · Chair of the Board | |

|

INDEPENDENT |

Age: 56 |

Professional Experience

| · | Director since September 2020 |

| · | Senior Vice President, Chief Risk Officer from May 2019 - present and Chief Audit Executive from 2016 to present of Becton, Dickinson and Company, a medical technology company |

| · | Various offices in the areas of finance, operations and business development of the National Basketball Association organization from 1998 to 2016, including Senior Vice President, Business Development and Global Operations of NBA Properties, Inc. from 2013 to 2016, Chief Financial Officer of NBA China from 2010 to 2013 and Interim Chief Executive Officer of NBA China from 2010 to 2011 |

| · | Earlier in his career, Mr. Richard served as, among other positions, Regional Audit Director, U.S. Consumer Businesses at Citigroup Inc., District Manager, Financial Planning and Analysis at AT&T Corporation, and Senior Manager at Deloitte & Touche LLP |

Professional Experience

| · | Director since January 2011 |

| · | Partner with HealthEdge Investment Partners, LLC, or HealthEdge, a private equity firm providing strategic capital exclusively to the healthcare industry, where he sits on the investment team and serves as a director for numerous HealthEdge affiliated companies, including ITRACs, Legacy Xspire Holdings, LifeSync and Westone, from 2008 - present |

| · | Previously, Chairman, Chief Executive Officer and President of Advanced Bio-Technologies, Inc. and Enaltus LLC, both HealthEdge portfolio company specializing in skincare solutions sold to consumers and direct to physicians from 2008 to 2017 |

| · | Non-executive director of Sinclair Pharma, plc, a publicly traded international aesthetic dermatology company from September 2014 until its acquisition by China Grand in November 2018 |

| · | Director of Stiefel Laboratories, Inc., an independent pharmaceutical company specializing in dermatology, and President of Glades Pharmaceuticals, both of which were sold to GlaxoSmithKline in 2008 |

| · | Earlier in his career, Mr. Thompson held sales and business management positions at Bausch & Lomb Pharmaceuticals and SmithKline Beecham |

Education

| · | M.B.A. in Finance from Columbia Business School. |

| · | B.S. in Accounting from Northeastern University |

Education

| · | B.S. in General Science from University of Pittsburgh |

Relevant Skills

| · | Education, training and experience in accounting and finance, reflected in status as a Certified Public Accountant, multiple senior accounting roles and the Chairman of the Committee on Governance, Risk and Compliance of Financial Executives International, an association of financial executives serving public and private companies |

| · | Significant senior management experience, including in the medical technology industry |

Relevant Skills

| · | Extensive experience serving on boards of directors of numerous life sciences, biotechnology, and healthcare services companies |

| · | Significant experience as chief executive officer of life sciences and healthcare services companies |

| · | More than a decade of experience advising HealthEdge portfolio and other life science companies on business development strategies and transactions |

| 12 |

| Susan L. N. Vogt |

|

Anika Board Service: · Tenure: 3.5 years · Committees: ○ Audit (Financial Expert) ○ Governance and Nominating (Chair) | |

|

INDEPENDENT |

Age: 68 |

Professional Experience

| · | Director since October 2018 |

| · | Chief Executive Officer and President of Aushon Biosystems, Inc., a developer of a multiplex immunoassay platform, from 2013 until its acquisition in January 2018 |

| · | Chief Executive Officer, President, and a director of SeraCare Life Sciences, Inc., a NASDAQ-listed life sciences developer of products facilitating human diagnostics and therapeutics, from 2006 to 2011 |

| · | Former director of Andor Technology (LSE:AND) from 2010 to 2013 |

| · | From 1981 to 2005, various management and officer positions at Millipore Corporation (now part of MilliporeSigma, the life science business of Merck KGaA), an NYSE-listed developer of technologies for life science research, drug development and manufacturing for the biotechnology and pharmaceutical industries, including, among other leadership roles, President of the Biopharmaceutical Division, Vice President and General Manager of the Laboratory Water Division, Vice President and General Manager of the Analytical Products Division. |

Other Public Company Board Service

| · | Sharps Compliance, Inc. (NASDAQ: SMED) a leading full-service national provider of comprehensive waste management services, including medical, pharmaceutical, and hazardous, from October 2019 - present |

| · | Charlotte’s Web Holdings, Inc. (TSX: CWEB) a leading provider of CBD wellness products, from September 2020 - present |

Education

| · | M.B.A. from Boston University, concentration in Finance |

| · | A.B. in Art History from Brown University |

Relevant Skills

| · | More than thirty-five years of experience in the global life science research, pharmaceutical, biotech and clinical diagnostics industries |

| · | Proven record of driving operational efficiency and productivity, successfully scaling commercial operations, enhancing profitability by streamlining, restructuring and consolidating operations, and delivering sustained revenue and cash flow growth at multiple companies |

| · | Deep understanding of finance and accounting as a result of her education, financial-based roles during her career and serving on audit committees of several companies |

| 13 |

Corporate Governance and Board Matters

The Board of Directors annually reviews the independence of all non-employee directors. In April 2020, the Board established categorical standards consistent with the corporate governance standards of NASDAQ to assist the Board in making determinations of the independence of Board members. A copy of our Standards for Director Independence, which was adopted by the Board in April 2020, is available on the investor relations portion of our website at https://ir.anika.com/governance-documents. These categorical standards require that, to be independent, a director may not have a material relationship with our company. Even if a director meets all categorical standards for independence, the Board reviews other relationships with Anika in order to conclude that each independent director has no material relationship with Anika either directly or indirectly.

The Board has determined that each of the continuing directors and director nominees, other than our President and Chief Executive Officer, Cheryl R. Blanchard, Ph.D., is “independent” within the meaning of the director independence standards of NASDAQ and the SEC. The Board based these determinations primarily on a review of the responses of each director and director nominee to questions regarding employment and compensation history, affiliations, and family and other relationships, and on other relevant discussions with the directors and director nominees.

Independent directors meet regularly in executive sessions without management participation. The executive sessions generally occur in connection with regularly scheduled meetings of the Board and committees of the Board, and at other times the independent directors deem appropriate. The executive sessions are chaired either by the Chair of the Board or by the chair of the Board committee, as applicable.

The Board and its committees review matters related to our corporate governance annually at regularly scheduled meetings. The Board’s review process includes an evaluation of our bylaws, committee charters, diversity programs, corporate social and environmental responsibility initiatives, and other matters related to our governance. During this review, the Board assesses input from management and outside consultants to discern whether any actions should be taken on any of these topics. Furthermore, the Board conducts periodic evaluations that focus on the effectiveness of the Board as a whole and of its committees. Board members complete a detailed questionnaire that provides for quantitative rankings in key areas and seeks subjective comments in each of those areas. In addition, members of each Board committee complete a detailed questionnaire to evaluate how well their committee is operating and to make suggestions for improvement. The evaluation process is managed by the Chair of the Governance and Nominating Committee, with advice and assistance from outside counsel. Outside counsel may conduct separate, confidential interviews with some or all of the directors to follow-up on responses and comments reflected in the questionnaires to the extent it is determined helpful or necessary. An anonymized summary of the principal findings from the evaluation process is prepared by outside counsel and is used as the basis for self-assessment discussions by the Board and its committees.

The Board met 8 times during 2021. Each of the directors attended all of the Board meetings in 2021 during the director’s term. The Board continued to make it a priority to oversee and support the senior management team in addressing the challenges presented by the COVID-19 pandemic and its impact on the company’s short and long-term strategic plans. The Board discussions included continued focus on items such as key business updates, financial updates, including monitoring our liquidity and cash position, recruitment and retention of employees, and support provided to the management team to ensure an appropriate and well-measured response to the effects of the COVID-19 pandemic. The key goal, which we believe was achieved again in 2021, was to support employee health and safety, while avoiding significant operational disruptions to the business.

Our annual meetings of stockholders are generally held to coincide with one of the Board’s regular quarterly meetings. Although we have no formal policy requiring attendance, directors are encouraged to attend annual meetings of stockholders and each of the then-serving or nominated directors attended the 2021 Annual Meeting.

The Board’s Leadership Structure

Jeffery S. Thompson has served as the Chair of the Board since September 2020. Separating the roles of Chair of the Board and Chief Executive Officer allows our Chief Executive Officer to focus on the strategic management of our day-to-day business, while allowing the Chair of the Board to focus on leading the Board of Directors in its fundamental role of providing advice to, and independently overseeing, management. The Board recognizes the time, effort, and energy that the Chief Executive Officer is required to devote to the position in the current business environment, as well as the commitment required to serve as Chair of the Board, particularly as the Board’s oversight responsibilities continue to grow. The Board believes that having separate positions, with an independent, non-executive director serving as Chair of the Board, is the appropriate leadership structure for our company at this time and allows the Board to fulfill its role with appropriate independence.

| 14 |

The Board’s Role in Environmental, Social and Governance (ESG) Oversight

The Board of Directors believes that our company has a broad responsibility that takes into account the positive effect we seek to have on the people we employ, serve and support, and the environment and the communities where we live and work. The full Board has oversight of our Environmental, Social and Governance, or ESG, initiatives, which are the direct responsibility of a cross-functional group comprised of members of our senior management team under the leadership of our Vice President, Investor Relations, ESG and Corporate Communications. For additional detailed information regarding our ESG initiatives, please see the section captioned “Our Commitment to Corporate Social Responsibility – Focus on Environmental, Social, and Governance (ESG)” below.

The Board’s Role in Risk Oversight

The role of the Board of Directors in our risk oversight process includes receiving reports from management and the Chairs of Board committees on areas of material risk to our company, including operational, financial, commercial, legal, regulatory, strategic, cyber security and reputational risks. The Board has delegated primary responsibility to the Audit Committee to review these reports and discuss with management the process by which management assesses and manages our risk exposure, risk management, and risk mitigation strategies. The Audit Committee also works with other committees to assess areas of risk under the particular purview of those committees. When the Audit Committee receives a report from management or another committee, the Chair of the Audit Committee reviews the report and then summarizes the review results in a presentation to the full Board. This enables the Board and its committees to coordinate the risk oversight role to ensure that all directors receive all significant risk-related information. The Board also administers its risk oversight function through the required approval by the Board (or a committee of the Board) of significant transactions and other material decisions and through regular periodic reports from our independent registered public accounting firm and other outside consultants regarding various areas of potential risk, including, among others, those relating to our internal controls and financial reporting. In addition, as part of its charter, the Audit Committee discusses with management significant financial and operational risks and exposures, as well as the steps management has taken to minimize those risks.

The Board of Directors currently has three standing committees:

| • | Audit Committee; |

| • | Compensation Committee; and |

| • | Governance and Nominating Committee. |

The membership of each standing committees was as follows as of April 13, 2022:

| Director | Audit | Committee Compensation |

Governance and Nominating |

Independent Under SEC Rules |

Financial Expert Under SEC Rules |

| Sheryl L. Conley | ✓ | ✓ | |||

| John B. Henneman III | Chair | ✓ | ✓ | ||

| Raymond J. Land | Chair | ✓ | ✓ | ✓ | |

| Glenn R. Larsen, Ph.D. | ✓ | ✓ | ✓ | ||

| Stephen O. Richard | ✓ | ✓ | ✓ | ||

| Jeffery S. Thompson(1) | ✓ | ||||

| Susan L. N. Vogt | ✓ | Chair | ✓ | ✓ |

| (1) | Mr. Thompson serves as our Chair of the Board of Directors and does not serve on any standing committees. |

The Board has adopted a written charter for each standing committee, which is reviewed yearly by that committee. You can find these charters on the investor relations portion of our website at https://ir.anika.com/board-committees. The information contained on the website is not incorporated by reference in, or considered to be a part of, this Proxy Statement.

| 15 |

Audit Committee

| Role and Key Responsibilities |

| ü | Overseeing accounting and financial reporting processes |

| ü | Overseeing audits of our financial statements and internal controls |

| ü | Taking, or recommending that the Board of Directors take, appropriate action to oversee the qualifications, independence and performance of our independent registered public accounting firm |

| ü | Leading the review of our risk management processes and exposure to financial and operational risks |

| ü | Preparing an Audit Committee report, as required by the SEC, for inclusion in our annual Proxy Statement |

| ü | Selecting, retaining, overseeing, and, when appropriate, terminating our independent registered public accounting firm |

| ü | Conferring with the independent registered public accounting firm and reporting to the Board regarding the scope, method, and result of the audit of our books and records |

| ü | Reviewing and discussing proposed earnings press releases and financial information and guidance proposed to be provided to investors |

| ü | Establishing, overseeing and periodically reviewing procedures for complaints regarding accounting or auditing matters |

| ü | Establishing and monitoring a policy relative to non-audit services provided by the independent registered public accounting firm in order to ensure the firm’s independence |

The Audit Committee held 4 meetings in 2021. Each of the members attended all of the Audit Committee meetings held in 2021 while the member served on the Audit Committee. The Audit Committee holds separate sessions of its meetings, outside the presence of management, with our independent auditor in conjunction with each regularly scheduled Audit Committee meeting in which the independent auditor participates. During 2021, the Audit Committee regularly met privately with our management and held executive sessions with only non-employee directors in attendance as appropriate. No director is eligible to serve on the Audit Committee if that director simultaneously serves on the audit committees of four or more other public companies.

The current members of the Audit Committee are Raymond J. Land, who serves as Chair, Sheryl L. Conley, Stephen O. Richard and Susan L. N. Vogt. The Board has determined that each member is independent, as defined for purposes of the SEC and NASDAQ, is financially literate, and has the requisite financial sophistication to serve on the Audit Committee. The Board has also determined that each of Messrs. Land and Richard and Ms. Vogt qualifies under SEC rules as an “audit committee financial expert,” which designation is an SEC disclosure requirement related to their experience and understanding of certain accounting and auditing matters. The designation does not impose upon any of the three members any duties, obligations, or liabilities that are greater than those otherwise imposed on them as members of the Audit Committee and the Board.

| 16 |

Compensation Committee

| Role and Key Responsibilities |

| ü | Managing our overall compensation philosophy, structure, policies, processes, procedures, and programs |

| ü | Reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other executive officers |

| ü | Reviewing the performance of and determining the compensation of the Chief Executive Officer |

| ü | Reviewing the performance of and determining, with the advice and assistance of the Chief Executive Officer, the compensation of our executive officers other than the Chief Executive Officer |

| ü | Annually reviewing and recommending to the Board of Directors compensation for non-employee directors |

| ü | Overseeing our overall compensation programs, including the granting of awards under our omnibus incentive plan |

| ü | Preparing a report on executive compensation for inclusion in our annual Proxy Statement |

| ü | Reviewing, discussing with management and any compensation consultant, and recommending the inclusion of disclosures under “Compensation Discussion and Analysis” in our Proxy Statement |

| ü | Periodically conducting a risk assessment to evaluate whether forms of pay encourage unnecessary or excessive risk taking and assisting the Audit Committee in assessing and managing potential risks created by our compensation practices, policies and programs |

| ü | Reviewing, approving, recommending to the Board for approval, and considering the results of stockholder advisory “say-on-pay” and “say-on-frequency” votes and reviewing and recommending to the Board whether to submit a stockholder advisory vote on certain acquisition-related compensation arrangements |

| ü | Appointing, retaining, compensating, terminating, and overseeing the work of any compensation consultant or other compensation adviser, as well as considering the independence of any compensation consultant or other compensation adviser |

The Compensation Committee held 4 meetings in 2021. Each of the members attended all of the Compensation Committee meetings held in 2021 while the member served on the Compensation Committee. During 2021, the Compensation Committee regularly held executive sessions with only non-employee directors in attendance as appropriate, including when evaluating the performance of Dr. Cheryl R. Blanchard. The Compensation Committee continued to monitor and discuss the impact of the COVID-19 pandemic and its impact on our organization in 2021, especially in light of the continued cancellation or delay of many clinical procedures as the pandemic cases rose and fell unpredictably throughout the year, to ensure that there continued to be strong engagement and appropriate motivation for our executives and other employees.

The current members of the Compensation Committee are John B. Henneman, III, who serves as Chair, Raymond J. Land, and Glenn R. Larsen, Ph.D. The Board has determined that each current member of the Compensation Committee is independent, as defined in the listing standards of NASDAQ.

| 17 |

Governance and Nominating Committee

| Role and Key Responsibilities |

| ü | Recommending to the Board of Directors the criteria for Board and committee membership |

| ü | Identifying, evaluating, and recommending nominees to stand for election as directors at each Annual Meeting of Stockholders, including incumbent directors and candidates recommended by stockholders |

| ü | Developing succession plans for the Board, the Chief Executive Officer and other executives |

| ü | Coordinating performance evaluations of the Board and its standing committees |

| ü | Recommending to the Board assignments of directors to each Board committee and monitoring compliance with Board and committee membership criteria |

| ü | Overseeing and administering Board education programs |

| ü | Overseeing corporate governance affairs of the Board and our company |

The Governance and Nominating Committee held 5 meetings in 2021. Each of the members attended all of the of the Governance and Nominating Committee meetings held in 2021 while the member served on the Governance and Nominating Committee. During 2021, the Governance and Nominating Committee regularly held executive sessions with only non-employee directors in attendance as appropriate. In 2021, the Governance and Nominating committee focused on the activities required to identify, recruit, and onboard our new director, Sheryl L. Conley, and reviewing the skill set of the Board members as a whole to ensure that the Board represents a balanced skill set enabling appropriate Board oversight of our company in relation to our industry, strategic plan and stockholder alignment.

The current members of the Governance and Nominating Committee are Susan L. N. Vogt, who serves as Chair, John B. Henneman, III, and Glenn R. Larsen, Ph.D. The Board has determined that each current member of the Governance and Nominating Committee is independent, as defined in the listing standards of NASDAQ.

Board Membership Qualifications and Procedures

When considering candidates for director, the Governance and Nominating Committee takes into account a number of factors, including the following minimum qualifications: the nominee (a) shall have the highest personal and professional integrity, (b) shall have demonstrated exceptional ability and judgment, and (c) shall be most effective, in conjunction with the other members of the Board of Directors, in collectively serving the long-term interests of the stockholders. In addition, the Governance and Nominating Committee takes into consideration such other factors as it deems appropriate, including any direct experience in the biotechnology, pharmaceutical, medical device, and/or life sciences industries, or in the markets in which we operate. The Governance and Nominating Committee may also consider, among other things, the skills of the candidate, his or her availability, the candidate’s depth and breadth of experience or other background characteristics, and his or her independence.

In addition to the considerations above, the Board strongly believes that diversity is an important component of a successful and effective board of directors and good corporate governance, including diversity of background, skills, experience, gender, race, and ethnicity. The Governance and Nominating Committee, guided by its charter, assesses and considers the diversity of the Board prior to nominating candidates and seeks to identify director candidates who will enhance the Board’s overall diversity. The Governance and Nominating Committee and the Board select candidates on the basis of qualifications and experience without discriminating on the basis of race, color, national origin, gender, sex, sexual preference, or religion. Accordingly, it is the practice of the Governance and Nominating Committee to include, and we request that the search firms we engage include, candidates with diversity in gender and demographic backgrounds in any pool from which the Governance and Nominating Committee selects director candidates. We believe that our current Board members collectively reflect a broad range of knowledge, expertise, and experience in the disciplines that impact our business.

| 18 |

Our bylaws include a procedure that stockholders must follow to nominate a person for election as a director at an annual meeting of stockholders. The bylaws require that timely notice of the nomination in proper written form, including all required information as specified in the bylaws, be mailed to the Governance and Nominating Committee in care of our Chief Executive Officer, Anika Therapeutics, Inc., 32 Wiggins Avenue, Bedford, Massachusetts 01730. A copy of our bylaws can be viewed on the investor relations portion of our website at https://ir.anika.com/governance-documents. The Governance and Nominating Committee will consider director nominees recommended by stockholders in accordance with the Anika Therapeutics, Inc. Policy and Procedures for Stockholder Nominations to the Board adopted by the Governance and Nominating Committee and approved by the Board in April 2020, a copy of which is available on the investor relations portion of our website at https://ir.anika.com/governance-documents. Recommendations should be submitted to our Secretary in writing at Anika Therapeutics, Inc., 32 Wiggins Avenue, Bedford, Massachusetts 01730, along with additional required information about the nominee and the stockholder making the recommendation. Information on qualifications for nominations to the Board and procedures for stockholder nominations to the Board is included below under “Proposal 1. Election of Directors—Board Membership Qualifications and Procedures” and “Stockholder Proposals.” The Governance and Nominating Committee may solicit recommendations for candidates for directors from non-management directors, the Chief Executive Officer, other executive officers, third-party search firms, and such other sources as it deems appropriate, including stockholders. The Governance and Nominating Committee will review and evaluate the qualifications of all such proposed candidates in the same manner and without regard to the source of the recommendation.

The Board of Directors seeks input from a wide variety of sources to inform their work, including from stockholders. The Board welcomes stockholder input via voting, via participating in our annual meetings of stockholders, via our stockholder engagement program, and, more formally, via mail. If you wish to communicate with any of our directors, or the Board as a group, you may do so by writing to the individual director or to the Board, in care of our Chief Executive Officer, Anika Therapeutics, Inc., 32 Wiggins Avenue, Bedford, Massachusetts 01730. We recommend that all correspondence be sent via certified U.S. mail, return receipt requested. All correspondence received by the Chief Executive Officer will be forwarded to the appropriate addressee. Communications involving substantive accounting or auditing matters will be forwarded to the Chair of the Audit Committee. Communications that pertain to non-financial matters will be forwarded to the relevant director.

Our Code of Business Conduct and Ethics

The Board of Directors has adopted the Anika Therapeutics, Inc. Code of Business Conduct and Ethics to clarify, disseminate, and enforce the requirement and expectation that all of our officers, directors, and employees worldwide conduct our business in an honest and ethical manner and in compliance with all applicable laws and regulations. The Code of Business Conduct and Ethics applies to all of our officers, directors, and employees worldwide, including our Chief Executive Officer and Chief Financial Officer. It is our goal to aid our employees and Board members in making ethical and legal decisions when conducting company business and performing daily duties. We cannot anticipate every situation an employee or Board member may face when conducting business on behalf of our company, and we therefore encourage our employees and Board members to speak with any one of several company representatives when he or she encounters situations giving rise to a question or concern regarding compliance with our Code of Business Conduct and Ethics. The Code of Business Conduct and Ethics can be viewed on the investor relations portion of our website at https://ir.anika.com/governance-documents. Please note that the information contained on the website is not incorporated by reference in, or considered to be part of, this Proxy Statement.

We are committed to maintaining a strong culture of compliance across our entire organization. We believe that a workplace with a culture of “do the right thing,” guided by high standards and comprehensive policies, is the bedrock of our success as a healthcare company and our ability to deliver life-changing solutions to the customers we serve and all of the patients they treat around the world. As part of setting this culture and maintaining a strong tone at the top, the following quote from our President and Chief Executive Officer, Dr. Blanchard, is included in our strategic plan as presented to the Board and at the beginning of each individual and annual compliance training session:

“At Anika, a commitment to ethics and quality, as realized and demonstrated through personal integrity and accountability, forms the basis for everything we do and forges the path to all that we can achieve. These foundational tenets of our company are non-negotiable and do not take a day off.”

In addition, in 2021, we continued to build upon our previously expanded company-wide Compliance Program focused on healthcare fraud and abuse, anti-kickback, and foreign corrupt practices act regulations, among others, and reinforced and updated processes to ensure that appropriate controls are in place for compliance with these laws and regulations.

| 19 |

Our Commitment to Corporate Social Responsibility – Focus on Environmental, Social, and Governance (ESG)

Introduction

The Board of Directors and our senior management team believe that our company has a broad responsibility to take into account the people we employ, serve and support, and the environment and the communities where we live and work. The full Board has oversight of our environmental, social and governance, or ESG, initiatives.

In 2021, we embarked on a process to develop a foundational ESG framework for our company. This framework integrates our six key values:

| · | People: We engage and invest in each other in a community that values diversity and inclusion. | |

| · | Innovation: We are agile and entrepreneurial in developing and delivering meaningful solutions to our healthcare stakeholders within our target markets. | |

| · | Quality: We strive for the highest quality and compliance in everything we do. | |

| · | Teamwork: We operate with mutual respect and trust and are collaborative as we grow together. | |

| · | Integrity: We live up to our promises and do the right thing, every day. | |

| · | Accountability: We are empowered and accountable to deliver results and value to all of our stakeholders. |

The initial step in our ESG journey included the completion of a “materiality assessment” based on the Sustainability Accounting Standards Board, or SASB, framework. Our materiality assessment was a research-intensive and stakeholder-inclusive process and included guidance and insight from external advisors, while soliciting crucial feedback from key internal and external stakeholders, including investors, customers, suppliers, employees and members of our Board. The materiality assessment, and the initiatives that have resulted from it, have been undertaken with full support and oversight of the Board. Our senior management team owns, implements, and tracks our ESG strategy and efforts in collaboration with every major business function, all under the leadership of our Vice President, Investor Relations, ESG and Corporate Communications.

| 20 |

As a result of the materiality assessment, we identified the themes that are most important to our stakeholders and our business within traditional environmental, social and governance pillars. Most immediately, our materiality assessment enabled us to select our current focus areas within ESG initiatives:

Environmental

| · | Climate, Energy Use and Emissions |

Social

| · | Diversity and Inclusion |

| · | Safe and Healthy Workplace |

| · | Product Quality and Safety |

Governance

| · | Business Ethics and Integrity |

| · | Supply Chain Management |

Each of our ESG focus areas will continue to have management team sponsorship and engagement with ongoing oversight by the Board. We will continue to assess and update our ESG initiatives as our business grows and as we implement processes and improvements over time.

Our Environmental Focus

Environmental Climate: Climate, Energy Use and Emissions

As a global company, we recognize the importance of reducing the impact of our operations on the environment. Water is a precious resource, which we conserve and protect in a number of ways. We employ deionization in our primary manufacturing facility in Bedford, Massachusetts to remove impurities in wastewater, allowing it to be reused during the manufacturing process. In addition, because our Bedford facility is adjacent to wetlands, we take measures to protect the wetlands through the use of state-of-the-art technology to trap sediment and other materials, maintain storm water pollution plans, and ensure that harmful chemicals are not used on our company’s grounds.

Though we are not a significant generator of greenhouse gases, we continually work to reduce energy consumption and evaluate ways to minimize greenhouse gases in our atmosphere. In recent years, we have taken proactive steps to increase energy efficiency at our facilities. For example, we completed a full transition to LED lighting at our Bedford facility in 2020, resulting in an energy reduction of 373,500 kilowatts over the prior year.

In 2018, we began recycling packaging used in the manufacture of our products, as well as paper goods used across our company. As a result of this program, in 2021 we diverted more than 6,000 pounds of recyclable materials from landfills, saving the equivalent of 54 trees, nine cubic yards of landfill, six barrels of oil and 21,000 gallons of water.

Our Social Focus

Human Capital: Diversity and Inclusion

Promoting diversity throughout our company, including within the Board of Directors and our management team, has been a focal point of the Board, starting with the appointment of Cheryl R. Blanchard, Ph.D. as our President and Chief Executive Officer in early 2020, and the additions to the Board of Stephen O. Richard and Sheryl L. Conley in 2020 and 2021, respectively. As of April 27, 2022, women accounted for 36% of our senior management team and 37.5% of our Board. As detailed under the “Board Representation” section on page 2 and our Board of Directors Diversity Matrix on page 3 above, our eight-member Board currently includes three women and one person of color.

In 2020, Dr. Blanchard, with the support of the Board, joined other chief executive officers in signing the Massachusetts Biotechnology Council “CEO Pledge for a More Equitable and Inclusive Life Sciences Industry.” The signers of this pledge “recognize that racial inequity exists in [the life sciences] industry and in [life sciences] companies, and [they] must take responsibility to fix that injustice through comprehensive equity, diversity, and inclusion initiatives that are broad in scope, specific in action, and measurable in results.” The full text of the pledge can be found at: https://www.massbio.org/initiatives/equity-diversity-and-inclusion/open-letter/.