SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

|

o

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

or

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2012

or

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from __________ to __________

or

| o |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Date of event requiring this shell company report _________

Commission file number: 0-21218

GILAT SATELLITE NETWORKS LTD.

(Exact name of Registrant as specified in its charter)

ISRAEL

(Jurisdiction of incorporation or organization)

Gilat House, 21 Yegia Kapayim Street, Kiryat Arye, Petah Tikva, 49130 Israel

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

Ordinary Shares, NIS 0.20 nominal value

|

Name of each exchange on which registered

NASDAQ Global Select Market

|

Securities registered or to be registered pursuant of Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock at the close of the period covered by the annual report:

41,700,100 Ordinary Shares, NIS 0.20 nominal value per share

(as of December 31, 2012)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer x

|

Non-accelerated filer o

|

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

x U.S. GAAP

|

o International Financial Reporting Standards as issued

by the International Accounting Standards Board

|

o Other

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 o Item 18 o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

This report on Form 20-F is being incorporated by reference into our Registration Statements on Form F-3 (Registration Nos. 333-160683 and No. 333-174142) and the Registration Statements on Form S-8 (Registration Nos. 333-96630, 333-113932, 333-123410, 333-132649, 333-158476, 333-180552 and 333-187021.

INTRODUCTION

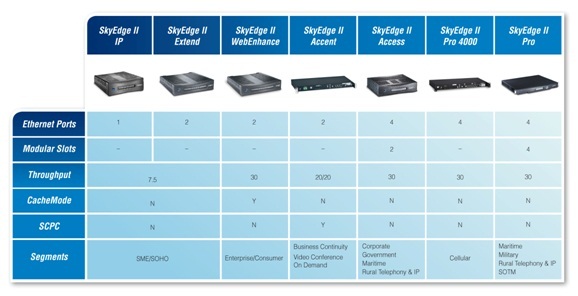

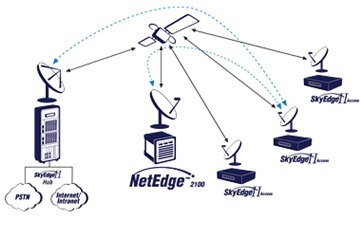

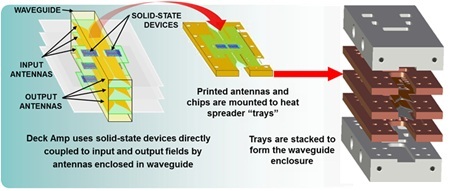

We are a leading global provider of broadband satellite communication and networking products and services. We design, produce and market very small aperture terminals, or VSATs, solid-state power amplifiers, or SSPAs and low-profile antennas. VSATs are earth-based terminals that transmit and receive broadband Internet, voice, data and video via satellite. VSAT networks have significant advantages over wireline and wireless networks, as VSATs can provide highly reliable, cost-effective, end-to-end communications regardless of the number of sites or their geographic locations.

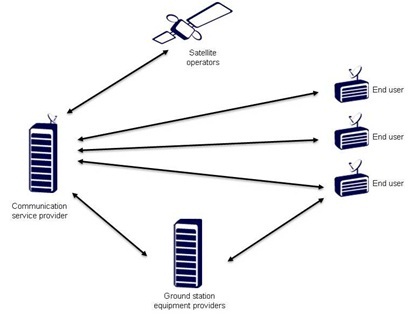

We have a large installed customer base and have shipped more than one million VSAT units to customers in around 90 countries on six continents since 1989. We have 21 sales and support offices worldwide, six network operations centers, or NOCs, and five R&D centers. Our products are primarily sold to communication service providers and operators that use VSATs to serve enterprise, government and residential users or to system integrators that use our technology. We also provide services directly to end-users in various market segments in the U.S. and certain countries in Latin America.

Starting in 2012, in accordance with the organizational changes within our company, we operate three business divisions, comprised of our Commercial, Defense and Services divisions:

• Commercial Division - provides VSAT networks, satellite communication products and associated professional services to service providers and operators worldwide, including consumer Ka-band initiatives worldwide.

• Defense Division - provides satellite communication products and solutions to defense and homeland security organizations worldwide and also includes the operations of Wavestream Corporation, or Wavestream, our subsidiary, whose sales are primarily to defense and homeland security organizations.

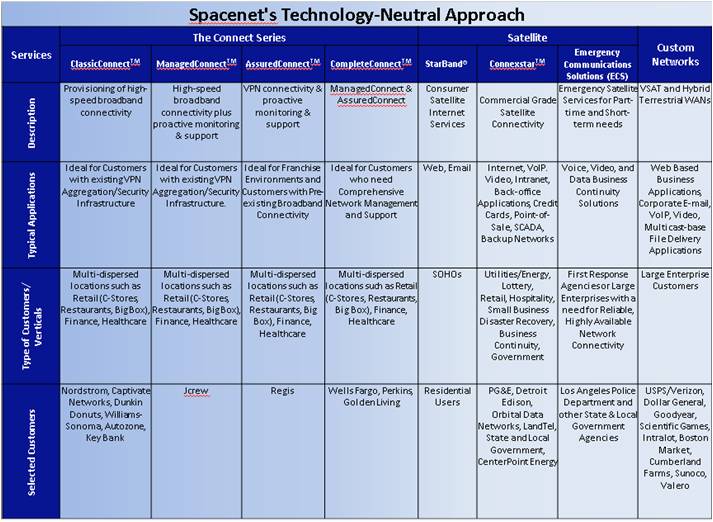

• Service Division - provides managed network services for business, government and residential customers in North America through Spacenet Inc., or Spacenet, as well as our service businesses in Peru and Colombia, which offer rural telephony and Internet access solutions.

Our ordinary shares are traded on the NASDAQ Global Select Market and on the Tel Aviv Stock Exchange, or the TASE, under the symbol “GILT”. As used in this annual report, the terms “we”, “us”, “Gilat” and “our” mean Gilat Satellite Networks Ltd. and its subsidiaries, unless otherwise indicated.

The name "Gilat®" and the names "Connexstar™," "SkyAbis™," "SkyEdge™," "Spacenet™," Wavestream®, "StarBand®" and "Raysat™" and other names appearing in this annual report on Form 20-F marked with “™” are trademarks of our company and its subsidiaries . Other trademarks appearing in this annual report on Form 20-F are owned by their respective holders.

This Annual Report on Form 20-F contains various “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and within the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements reflect our current view with respect to future events and, financial results of operations. Forward-looking statements usually include the verbs, “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “understands" and other verbs suggesting uncertainty. We remind readers that forward-looking statements are merely predictions and therefore inherently subject to uncertainties and other factors and involve known and unknown risks that could cause the actual` results, performance, levels of activity, or our achievements, or industry results to be materially different from any future results, performance, levels of activity, or our achievements expressed or implied by such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements which speak only as of the date hereof. We undertake no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. We have attempted to identify additional significant uncertainties and other factors affecting forward-looking statements in the Risk Factors section which appears in Item 3D: “Key Information–Risk Factors”.

Our consolidated financial statements appearing in this annual report are prepared in U.S. dollars and in accordance with U.S. generally accepted accounting principles, or U.S. GAAP. All references in this annual report to “dollars” or “$” are to U.S. dollars and all references in this annual report to “NIS” are to New Israeli Shekels. The representative exchange rate between the NIS and the dollar as published by the Bank of Israel on April 5, 2013 was NIS 3.627 per $1.00.

Statements made in this Annual Report concerning the contents of any contract, agreement or other document are summaries of such contracts, agreements or documents and are not complete descriptions of all of their terms. If we filed any of these documents as an exhibit to this Annual Report or to any registration statement or annual report that we previously filed, you may read the document itself for a complete description of its terms.

TABLE OF CONTENTS

|

1

|

||

|

1

|

||

|

1

|

||

|

1

|

||

|

A.

|

Selected Consolidated Financial Data

|

1

|

|

B.

|

Capitalization and Indebtedness

|

2

|

|

C.

|

Reasons for the Offer and Use of Proceeds

|

2

|

|

D.

|

Risk Factors

|

2

|

|

21

|

||

|

A.

|

History and Development of the Company

|

21

|

|

B.

|

Business Overview

|

22

|

|

C.

|

Organizational Structure

|

41

|

|

D.

|

Property, Plants and Equipment

|

42

|

|

42

|

||

|

42

|

||

|

A.

|

Operating Results

|

42

|

|

B.

|

Liquidity and Capital Resources

|

60

|

|

C.

|

Research and Development

|

62

|

|

D.

|

Trend Information

|

63

|

|

E.

|

Off-Balance Sheet Arrangements

|

63

|

|

F.

|

Tabular Disclosure of Contractual Obligations

|

64

|

|

64

|

||

|

A.

|

Directors and Senior Management

|

65

|

|

B.

|

Compensation of Directors and Officers

|

69

|

|

C.

|

Board Practices

|

72

|

|

D.

|

Employees

|

80

|

|

E.

|

Share Ownership

|

81

|

|

82

|

||

|

A.

|

Major Shareholders

|

82

|

|

B.

|

Related Party Transactions.

|

85

|

|

C.

|

Interests of Experts and Counsel.

|

85

|

|

85

|

||

|

87

|

||

|

A.

|

Offer and Listing Details

|

87

|

|

B.

|

Plan of Distribution

|

88

|

|

C.

|

Markets

|

88

|

|

D.

|

Selling Shareholders

|

88

|

|

E.

|

Dilution

|

88

|

|

F.

|

Expense of the Issue

|

88

|

|

88

|

||

|

A.

|

Share Capital

|

88

|

|

B.

|

Memorandum and Articles of Association

|

89

|

|

C.

|

Material Contracts

|

93

|

|

D.

|

Exchange Controls

|

94

|

|

E.

|

Taxation

|

94

|

|

F.

|

Dividend and Paying Agents

|

101

|

|

G.

|

Statement by Experts

|

102

|

|

H.

|

Documents on Display

|

102

|

|

I.

|

Subsidiary Information

|

102

|

|

102

|

||

|

104

|

||

|

104

|

||

|

104

|

||

|

104

|

||

|

104

|

||

|

106

|

||

|

106

|

||

|

106

|

||

| PRINCIPAL ACCOUNTANT FEES AND SERVICES |

106

|

|

|

107

|

||

|

107

|

||

|

107

|

||

|

107

|

||

|

108

|

||

|

108

|

||

|

108

|

||

|

108

|

||

|

109

|

||

|

110

|

||

|

ITEM 1:

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

|

|

|

Not Applicable.

|

|

ITEM 2:

|

OFFER STATISTICS AND EXPECTED TIMETABLE

|

|

|

Not Applicable.

|

|

ITEM 3:

|

KEY INFORMATION

|

|

A.

|

Selected Consolidated Financial Data

|

The selected consolidated statement of operations data set forth below for the years ended December 31, 2012, 2011 and 2010, and the selected consolidated balance sheet data as of December 31, 2012 and 2011 are derived from our audited consolidated financial statements that are included elsewhere in this Annual Report. These financial statements have been prepared in accordance with U.S. GAAP. The selected consolidated statement of operations data set forth below for the years ended December 31, 2009 and 2008 and the selected consolidated balance sheet data as of December 31, 2010, 2009, and 2008 are derived from our audited consolidated financial statements that are not included in this Annual Report.

The selected consolidated financial data set forth below should be read in conjunction with and is qualified entirely by reference to Item 5: “Operating and Financial Review and Prospects” and the Consolidated Financial Statements and Notes thereto included in Item 18 in this Annual Report on Form 20-F.

|

Year ended December 31,

|

||||||||||||||||||||

|

2012

|

2011

|

2010

|

2009

|

2008

|

||||||||||||||||

|

U.S. Dollars in thousands, except for share data

|

||||||||||||||||||||

|

Statement of Operations Data:

|

||||||||||||||||||||

|

Revenues:

|

||||||||||||||||||||

|

Products

|

169,603 | 201,697 | 120,255 | 91,407 | 150,351 | |||||||||||||||

|

Services

|

178,760 | 137,504 | 112,730 | 136,652 | 117,175 | |||||||||||||||

|

Total

|

348,363 | 339,201 | 232,985 | 228,059 | 267,526 | |||||||||||||||

|

Cost of revenues:

|

||||||||||||||||||||

|

Products

|

106,207 | 114,510 | 61,975 | 56,672 | 80,424 | |||||||||||||||

|

Services

|

129,156 | 103,064 | 91,156 | 100,956 | 101,150 | |||||||||||||||

|

Total

|

235,363 | 217,574 | 153,131 | 157,628 | 181,574 | |||||||||||||||

|

Gross profit

|

113,000 | 121,627 | 79,854 | 70,431 | 85,952 | |||||||||||||||

|

Operating expenses:

|

||||||||||||||||||||

|

Research and development, net

|

29,241 | 31,701 | 18,945 | 13,970 | 16,942 | |||||||||||||||

|

Selling and marketing

|

42,631 | 46,523 | 33,396 | 29,138 | 35,783 | |||||||||||||||

|

General and administrative

|

34,075 | 36,005 | 29,844 | 27,987 | 29,819 | |||||||||||||||

|

Costs related to acquisition transactions

|

— | 256 | 3,842 | — | — | |||||||||||||||

|

Impairment of long lived assets, goodwill and intangible assets, restructuring costs and other charges

|

32,194 | 19,478 | — | — | 5,020 | |||||||||||||||

|

Operating (loss)

|

(25,141 | ) | (12,336 | ) | (6,173 | ) | (664 | ) | (1,612 | ) | ||||||||||

|

Financial income (expenses), net

|

(2,642 | ) | (1,931 | ) | (557 | ) | 1,050 | 1,300 | ||||||||||||

|

Expenses related to aborted merger transaction

|

— | — | — | — | (2,350 | ) | ||||||||||||||

|

Other income

|

2,729 | 8,074 | 37,360 | 2,396 | 2,983 | |||||||||||||||

|

Income (loss) before taxes on income

|

(25,054 | ) | (6,193 | ) | 30,630 | 2,782 | 321 | |||||||||||||

|

Taxes on income (tax benefit)

|

(1,862 | ) | (343 | ) | 11 | 904 | 1,445 | |||||||||||||

|

Net income (loss)

|

(23,192 | ) | (5,850 | ) | 30,619 | 1,878 | (1,124 | ) | ||||||||||||

|

Net earnings (loss) per share

|

||||||||||||||||||||

|

Basic

|

(0.56 | ) | (0.14 | ) | 0.76 | 0.05 | (0.03 | ) | ||||||||||||

|

Diluted

|

(0.56 | ) | (0.14 | ) | 0.73 | 0.04 | (0.03 | ) | ||||||||||||

|

Weighted average number of shares used in computing net earnings (loss) per share:

|

||||||||||||||||||||

|

Basic

|

41,410 | 40,929 | 40,467 | 40,159 | 39,901 | |||||||||||||||

|

Diluted

|

41,410 | 40,929 | 41,985 | 41,474 | 39,901 | |||||||||||||||

1

|

As of December 31,

|

||||||||||||||||||||

|

2012

|

2011

|

2010

|

2009

|

2008

|

||||||||||||||||

|

U.S. dollars in thousands

|

||||||||||||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Working capital

|

83,673 | 62,704 | 78,808 | 164,280 | 152,806 | |||||||||||||||

|

Total assets..

|

414,643 | 446,678 | 455,378 | 357,228 | 410,639 | |||||||||||||||

|

Short-term bank credit and current maturities

|

11,480 | 22,063 | 4,315 | 5,220 | 10,846 | |||||||||||||||

|

Convertible subordinated notes, net of current maturities

|

— | — | 14,379 | 15,220 | 16,315 | |||||||||||||||

|

Long term loan, net of current maturities

|

40,747 | 40,353 | 45,202 | — | — | |||||||||||||||

|

Other long-term liabilities

|

28,082 | 34,786 | 43,832 | 37,297 | 45,414 | |||||||||||||||

|

Shareholders’ equity

|

241,957 | 260,075 | 264,113 | 232,295 | 230,224 | |||||||||||||||

|

B.

|

Capitalization and Indebtedness

|

Not applicable.

|

C.

|

Reasons for the Offer and Use of Proceeds

|

Not applicable.

|

D.

|

Risk Factors

|

Investing in our ordinary shares involves a high degree of risk and uncertainty. You should carefully consider the risks and uncertainties described below before investing in our ordinary shares. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be materially harmed. In that case, the value of our ordinary shares could decline substantially, and you could lose all or part of your investment.

Risks Relating to Our Business

We have incurred major losses in past years and may not operate profitably in the future.

We reported an operating loss of $25 million and a net loss of approximately $23.2 million in the year ended December 31, 2012, compared to an operating loss of $12.3 million and a net loss of $5.9 million in 2011. Our 2012 net loss is primarily attributable to $31.9 million of goodwill and other intangible assets impairment charges related to our 2010 acquisition of Wavestream, as well as to certain restructuring costs. We incurred major losses in prior years and currently have an accumulated deficit of $633 million. We cannot assure you that we can operate profitably in the future. If we do not achieve profitable operations, the viability of our company will be in question and our share price will decline.

2

Our available cash balance may decrease in the future if we cannot generate cash from operations.

Our total cash, including cash equivalents and restricted cash (short term and long term) net of short term bank credit, as of December 31, 2012 was $70.1 million. Our positive cash flow from operating activities was approximately $21.6 million and $8.6 million in years ended December 31, 2012 and 2011, respectively. If we do not generate sufficient cash from operations in the future, our cash balance will decline and the unavailability of cash could have a material adverse effect on our business, operating results and financial condition.

If the commercial satellite communications markets fail to grow, our business could be materially harmed.

A number of the commercial markets for our products and services in the satellite communications area, including our broadband products, have emerged in recent years. Because these markets are relatively new, it is difficult to predict the rate at which these markets will grow, if at all. If the markets for commercial satellite communications products fail to grow, our business could be materially harmed. Conversely, growth in these markets could result in satellite capacity limitations which in turn could materially harm our business and impair the value of our shares. Specifically, we derive virtually all of our revenues from sales of satellite based communications networks and related equipment and provision of services related to these networks and products. A significant decline in this market or the replacement of VSAT and other satellite based technologies by an alternative technology could materially harm our business and impair the value of our shares.

Because we compete for large-scale contracts in competitive bidding processes, losing a small number of bids or a decrease in the revenues generated from our large scale projects could have a significant adverse impact on our operating results.

A significant portion of our revenues is derived from acting as the supplier of networks based on VSATs and other satellite-based communication equipment, under large scale contracts that we are awarded from time to time in competitive bidding processes. These large-scale contracts sometimes involve the installation of thousands of VSATs. The number of major bids for these large-scale contracts for satellite-based networks in any given year is limited and the competition is intense. Losing or defaulting on a relatively small number of bids each year could have a significant adverse impact on our operating results.

In 2012, 14% and 12% of our revenues were generated from one Commercial Division customer and one Services Division customer, respectively. If we default on any such large scale contract or if such contract is terminated or reduced for any other reason, this could have an adverse impact on our operating results.

We operate in the highly competitive network communications industry. We may be unsuccessful in competing effectively against competitors who have substantially greater financial resources.

We operate in a highly competitive industry of network communications, both in the sales of our products and our services. As a result of the rapid technological changes that characterize our industry, we face intense worldwide competition to capitalize on new opportunities, to introduce new products and to obtain proprietary and standard technologies that are perceived by the market as being superior to those of our competitors. Some of our competitors have greater financial resources, providing them with greater research and development and marketing capabilities. Our competitors may also be more experienced in obtaining regulatory approvals for their products and services and in marketing them. Our relative position in the network communications industry may place us at a disadvantage in responding to our competitors' pricing strategies, technological advances and other initiatives. Our principal competitors in the supply of VSAT networks are Hughes Network Systems, LLC, or HNS, ViaSat Inc. or Viasat, and iDirect Technologies, or iDirect. Most of our competitors have developed or adopted different technology standards for their VSAT products.

3

Our low-profile in-motion antennas target a market that has not yet matured and we compete with products from competitors such as General Dynamics, Cobham, Orbit Communication Systems and Thinkom Solutions. Wavestream’s competitors include Comtech Xicom Technology, Inc., CPI Satcom (which acquired Codan Satcom in 2012), General Dynamics SATCOM Technologies, and Paradise Datacom.

In the U.S. market, where we operate as a managed network service provider via Spacenet, Spacenet competes mainly in the enterprise managed wide area network, or WAN market and the VSAT services market. These markets are extremely competitive, with a few established VSAT service providers and numerous terrestrial providers competing for nearly all contracts. The U.S. enterprise VSAT market is primarily served by HNS and Spacenet. Spacenet's primary competitors in the enterprise managed WAN market are large terrestrial carriers such as AT&T, Verizon, CenturyLink, Megapath/Covad, and numerous other smaller managed WAN providers.

In addition, the launch of the Wild Blue 1 and ViaSat-1 satellites by ViaSat and of the SPACEWAY-3 and EchoStar XVII by HNS, enable ViaSat and HNS to offer vertically integrated solutions to their customers, which may further change the competitive environment in which we operate and could have an adverse effect on our business.

In Peru and Colombia, where we primarily operate public rural telecom services (voice, data and Internet), we typically encounter competition on government subsidized bids from various service providers, system integrators and consortiums. Some of these competitors offer solutions based on VSAT technology and some on terrestrial technologies (typically, fiber, DSL, wireless local loop and worldwide interoperability for microwave access, or WiMAX). In addition, as competing technologies such as cellular telephones in Peru and fiber optics in Colombia become available in rural areas where not previously available, our business can be adversely affected.

Our lengthy sales cycles could harm our results of operations if forecasted sales are delayed or do not occur.

The length of time between the date of initial contact with a potential customer or sponsor and the execution of a contract with the potential customer or sponsor may be lengthy and vary significantly depending on the nature of the arrangement. During any given sales cycle, we may expend substantial funds and management resources and not obtain significant revenue, resulting in a negative impact on our operating results. In the past, we have seen longer sales cycles in all of the regions in which we do business. In addition, we have seen projects delayed or even canceled, which would also have an adverse impact on our sales cycles. In our defense business, in particular, sales cycles may be longer and it may be difficult to accurately forecast sales due to the uncertainty around defense projects and their award and starting periods.

We may engage in acquisitions that could harm our business, results of operations and financial condition, and dilute our shareholders' equity.

We generally seek to acquire businesses that enhance our capabilities and add new technologies, products, services and customers to our existing businesses. We may not be able to continue to identify acquisition candidates on commercially reasonable terms or at all. If we make additional business acquisitions, we may not realize the benefits anticipated from these acquisitions, including sales growth, cost synergies and improving margins. Furthermore, we may not be able to obtain additional financing for business acquisitions, since such additional financing could be restricted or limited by the terms of our debt agreements or due to unfavorable capital market conditions.

4

Further, once integrated, acquisitions may not achieve comparable levels of revenues, profitability or productivity as our existing business or otherwise perform as expected. The occurrence of any of these events could harm our business, financial condition or results of operations.

In 2010, we completed the acquisition of RaySat Antenna Systems, or RAS, a leading provider of satcom-on-the-move antenna solutions, of RaySat BG, a Bulgarian research and development center, and of Wavestream, a provider of SSPAs and block up converters, or BUCs, with high performance solutions designed for mobile and fixed satellite communication, or Satcom, systems worldwide. In April 2011, Spacenet completed the acquisition of CICAT Networks Inc., a provider of terrestrial access and network services to enterprises with multi-site locations. We may not be able to successfully integrate the businesses or exploit the solutions that we acquired. Future acquisitions may require substantial capital resources, which may not be available to us or may require us to seek additional debt or equity financing.

The risks associated with acquisitions by us include the following, any of which could seriously harm our results of operations or the price of our shares:

|

|

·

|

issuance of equity securities as consideration for acquisitions that would dilute our current shareholders' percentages of ownership;

|

|

|

·

|

significant acquisition costs;

|

|

|

·

|

decrease of our cash balance;

|

|

|

·

|

the incurrence of debt and contingent liabilities;

|

|

|

·

|

difficulties in the assimilation and integration of operations, personnel, technologies, products and information systems of the acquired companies;

|

|

|

·

|

diversion of management's attention from other business concerns;

|

|

|

·

|

contractual disputes;

|

|

|

·

|

risks of entering geographic and business markets in which we have no or only limited prior experience;

|

|

|

·

|

potential loss of key employees of acquired organizations.

|

|

|

·

|

the possibility that business cultures will not be compatible;

|

|

|

·

|

the difficulty of incorporating acquired technology and rights into our products and services;

|

|

|

·

|

unanticipated expenses related to integration of the acquired companies;

|

|

|

·

|

difficulties in implementing and maintaining uniform standards, controls and policies;

|

|

|

·

|

the impairment of relationships with employees and customers as a result of integration of new personnel;

|

|

|

·

|

potential inability to retain, integrate and motivate key management, marketing, technical sales and customer support personnel;

|

|

|

·

|

loss of significant customers or markets;

|

|

|

·

|

potential unknown liabilities associated with acquired businesses; and

|

|

|

·

|

impairment of goodwill and other assets acquired.

|

In 2012 and in 2011, we recorded impairment of goodwill and intangible assets charges of $31.9 million and $17.8 million, respectively, in connection with our 2010 acquisition of Wavestream.

5

A decline in or a redirection of the U.S. defense budget could result in a material decrease in our sales, results of operations and cash flows.

Our contracts and sales with and to systems integrators in connection with government contracts in the U.S. are subject to the congressional budget authorization and appropriations process. Congress appropriates funds for a given program on a fiscal year basis, even though contract periods of performance may extend over many years. Consequently, at the beginning of a major program, the contract is partially funded, and additional monies are normally committed to the contract by the procuring agency only as appropriations are made by Congress in future fiscal years. Department of Defense, or DoD, budgets are a function of factors beyond our control, including, but not limited to, changes in U.S. procurement policies, budget considerations, current and future economic conditions, presidential administration priorities, changing national security and defense requirements, geopolitical developments and actual fiscal year congressional appropriations for defense budgets. Any of these factors could result in a significant decline in, or redirection of, current and future DoD budgets and impact our future results of operations.

Concerns about increased deficit spending, along with continued economic challenges, continue to place pressure on the DoD budget and international customer budgets. The DoD budget cuts, added by additional cuts from the sequestration in effect since March 2013, have and may continue to result in reduced demand for our products, resulting in a reduction in our revenues, and an adverse effect on our business and results of operations. The national security spending cuts from sequestration are expected to mostly reduce DoD budgets by equally cutting funding for all DoD budget line items. If the sequestration cuts to the DoD budget are not revised, we expect that they will negatively impact our results of operations and cash flows, and could potentially trigger further goodwill impairment charges.

In 2012, Wavestream’s revenues from the sales of SSPAs derived through systems integrators from government agencies decreased compared to our 2012 forecast and to 2011 revenues. The continuing pressure on the DoD budget along with ongoing uncertainties surrounding future spending by the DoD, as well as other elements, reflected in the reduction of Wavestream’s revenues and operational results in 2012 and in 2011 compared to our forecast and the decrease in actual revenues in 2012 compared to 2011 and 2011 compared to 2010, led us to record impairment charges related to our investment in Wavestream of $31.9 million in 2012 and $17.9 million in 2011. See Item 5 – “Operating and Financial Review and Prospects– Operating Results”.

Uncertainties in governmental spending may also adversely affect our efforts to further penetrate the defense market with our defense-related products. We expect that RAS will become increasingly dependent on DoD spending for related contracts with system integrators. If such business is not realized and we fail to obtain other business, we would likely record an impairment of goodwill associated with RAS. Any of these events would likely result in a material adverse effect on our financial position, results of operations and cash flows.

Many of our large scale contracts are with governments or large governmental agencies in Latin America and other parts of the world, so that any volatility in the political or economic situation or any unexpected unilateral termination or suspension of payments could have a significant adverse impact on our business.

In recent years, a significant portion of our revenues has been derived from large scale contracts with foreign governments and agencies, either directly or through contractors and system integrators, including those in Peru, Colombia, and Australia. Agreements with the governments in these countries typically include unilateral early termination clauses and involve other risks such as the imposition of new government regulations and taxation that could pose additional financial burdens on us. Changes in the political or economic situation in these countries can result in the early termination of our business there. Any termination of our business in any of the aforementioned countries could have a significant adverse impact on our business.

6

In December 2011, Gilat Colombia was awarded the Compartel Schools project, which is expected to end in August 2013. Additionally, in October 2012, the Ministry of Information Technologies and Communications in Colombia amended and extended our agreements for the provision of Communitarian telecomm services for an additional six-month period ending March 31, 2013. We have not participated in the most recent bid for communitarian telecom services published by the Ministry of Information Technologies and Communications in Colombia in December 2012 since we considered the terms of the bid to be unfavorable. In 2012, our revenues from these projects in Colombia generated 10% of our total consolidated revenues. Following completion of the Schools project, if we are unable to obtain new business, our revenues in Colombia are expected to materially decrease or terminate and we may not be able to operate our business in Colombia at a profit.

If we are unable to develop, introduce and market new innovative products, applications and services on a cost effective and timely basis, our business could be adversely affected.

The network communications market, which our products and services target, is characterized by rapid technological changes, new product introductions and evolving industry standards. If we fail to stay abreast of significant technological changes, our existing products and technology could be rendered obsolete. Historically, we have endeavored to enhance the applications of our existing products to meet the technological changes and industry standards. Our success is dependent upon our ability to continue to develop new innovative products, applications and services and meet developing market needs.

To remain competitive in the network communications market, we must continue to be able to anticipate changes in technology, market demands and industry standards and to develop and introduce new products, applications and services, as well as enhancements to our existing products, applications and services. Competitors in satellite ground equipment market and low-profile antenna market are introducing new and improved products and our ability to remain competitive in this field will depend in part on our ability to advance our own technology. New products and technologies for power amplifiers, such as Gallium Nitride, or GaN, may compete with our current Wavestream SSPA offerings and may reduce the market prices and success of Wavestream’s products. If we are unable to respond to technological advances on a cost-effective and timely basis, or if our new products or applications are not accepted by the market, our business, financial condition and operating results could be adversely affected.

A decrease in the selling prices of our products and services could materially harm our business.

The average selling prices of wireless communications products historically decline over product life cycles. In particular, we expect the average selling prices of our products to decline as a result of competitive pricing pressures and customers who negotiate discounts based on large unit volumes. A decrease in the selling prices of our products and services could have a material adverse effect on our business.

If we are unable to competitively operate within the Ka-Band satellite environment, our business could be adversely affected.

In the U.S. market, some of our competitors have launched Ka-band satellites. These actions may affect our competitiveness due to the relative lower cost of Ka-band space segment per user as well as the increased integration of the VSAT technology in the satellite solution. Due to the current nature of the Ka-band solution where the initial investment in ground segment gateway equipment is relatively high, ground segment equipment effectively becomes tightly coupled to the specific satellite technology. As such, there may be circumstances where it is difficult for competitors to compete with the incumbent VSAT vendor using the particular Ka-band satellite. If this occurs, the market dynamics may change to favor a VSAT vendor partnering with the satellite service provider, which may decrease the number of vendors who may be able to succeed. If we are unable to forge such a partnership our business could be adversely affected.

7

Although we have entered the Ka-band market with responsive Ka-band VSAT technology, we expect that our penetration into that market will be gradual and our success is not assured. In addition, our competitors, who are producing large numbers of Ka-band VSATs, may benefit from cost advantages. If we are unable to reduce our Ka-band VSAT costs sufficiently, we may not be competitive in the international market. We also expect that competition in this industry will continue to increase.

If we lose existing contracts or orders for our products are not renewed, our ability to generate revenues will be harmed.

A significant part of our business in previous years, including 2012, was generated from recurring customers. As a result, the termination or non-renewal of our contracts could have a material adverse effect on our business, financial condition and operating results. Some of our existing contracts could be terminated due to any of the following reasons, among others:

|

·

|

dissatisfaction of our customers with our products and/or the services we provide or our inability to provide or install additional products or requested new applications on a timely basis;

|

|

·

|

customers' default on payments due;

|

|

·

|

our failure to comply with financial covenants in our contracts;

|

|

·

|

the cancellation of the underlying project by the sponsoring government body; or

|

|

·

|

the loss of existing contracts or a decrease in the number of renewals of orders or a decrease in the number of new large orders.

|

If we are not able to gain new customers and retain our present customer base, our revenues will decline significantly. In addition, if Spacenet experiences a higher than anticipated subscriber churn rate, or if our service businesses in Peru and Colombia does not win new government related contracts, this could materially adversely affect our financial position.

Our business focused on defense and related defense markets is dependent on defense spending and may be adversely affected if the pace of spending by government and security organizations internationally including the U.S. Departments of Defense and Homeland Security is slower than anticipated.

The market for our VSAT, Satellite-On-The-Move antennas and SSPAs for defense, public safety and law enforcement, carried out mainly through contractors and system integrators in the defense sector, is highly dependent on the spending cycle and spending scope of local, state and municipal governments and security organizations in international markets, including the DoD, and U.S. Department of Homeland Security. The funding of programs for which our products are being marketed through contractors and systems integrators is subject to government budgeting decisions affected by numerous factors that are beyond our control, including geo-political events, macro-economic conditions and other factors dictating cuts in budgets. These customers are heavily dependent on the DoD budget, and when the DoD budget is, or may potentially be, reduced and programs are cancelled or may be potentially reduced in scope, our customers may reduce or hold their new purchase orders as we partially experienced in 2011 and 2012. We cannot be sure that the spending cycles will materialize as we expect or that we will be positioned to benefit from the potential opportunities, especially in light of the current economic, political and market conditions. Reduced government spending in the U.S. and other countries may negatively affect demand for our defense-related products, which could materially adversely affect our business and operating results.

8

If we fail to penetrate new markets and expand our business in markets other than the defense market in the U.S., our business in the U.S. will remain dependent on the defense market, a reduction of which could have a material adverse effect on our overall business.

A substantial portion of our product revenues from North America are dependent on business from the defense market, being derived directly or indirectly through contractors and system integrators from sales to government agencies, mainly the DoD, pursuant to contracts awarded under defense-related programs. Government spending under such contracts may cease or may be reduced, which would cause a negative effect on our revenues, results of operations, cash flow and financial condition. We experienced a reduction in revenues from such customers in 2012 and 2011, which has continued into 2013 and there is no assurance that there will not be a further reduction in the future. Although we have begun to move into the avionics and international markets, we may not be successful in our plans to penetrate these markets, which are relatively new and untried for our SSPA product line and will require additional expenditures for research and development and sales and marketing. We may also not be able to develop new technologies for those markets on a timely basis. Barriers to entry into those markets or delays in our development programs could have a material adverse effect on our business and operating results.

Our failure to obtain or maintain authorizations under the U.S. export control and trade sanctions laws and regulations could have a material adverse effect on our business.

The export of some of our satellite communication products, related technical information and services is subject to U.S. State Department, Commerce Department and Treasury Department regulations, including International Traffic in Arms Regulations, or ITAR. If we do not maintain our existing authorizations or obtain necessary future authorizations under the export control laws and regulations of the U.S., including by entering into technical assistance agreements to disclose technical data or provide services to foreign persons, we may be unable to export technical information or equipment to non-U.S. persons and companies, including to our own non-U.S. employees, as may be required to fulfill contracts we may enter into. In addition, to participate in classified U.S. government programs, we would have to obtain security clearances from the DoD, for one or more of our subsidiaries that would want to participate. Such clearance may require that we enter into a proxy agreement with the U.S. government, which would limit our ability to control the operations of the subsidiary and which may impose on us substantial administrative burdens in order to comply. Further, if we materially violate the terms of any proxy agreement, the subsidiary holding the security clearances may be suspended or debarred from performing any government contracts, whether classified or unclassified. If we fail to maintain or obtain the necessary authorizations under the U.S. export control laws and regulations, we may not be able to realize our market focus and our business could be materially adversely affected.

If we are unable to comply with Israel’s enhanced export control regulations our ability to export our products from Israel could be negatively impacted.

Our export of military products and related technical information is also subject to enhanced Israeli Ministry of Defense regulations regarding defense export controls and the export of “dual use” items (items that are typically sold in the commercial market but that may also be used in the defense market). If we do not maintain our existing authorizations or obtain necessary future authorizations under the export control laws and regulations of Israel, including export licenses for the sale of our equipment, we may be unable to export technical information or equipment outside of Israel, we may not be able to realize our market focus and our business could be materially adversely affected.

If demand for our Satcom-On-The-Move products declines or if we are unable to develop products to meet demand, our business could be adversely affected.

Our low-profile in-motion antenna systems and a portion of our SSPA product lines are intended for mobile Satcom-On-The-Move applications. If the demand for such products declines, or if we are unable to develop products that are competitive in technology and pricing, we may not be able to realize our market focus and our Satcom-On-The-Move business could be materially adversely affected.

9

We are dependent on contracts with governments around the world for a significant portion of our revenue. These contracts may expose us to additional business risks and compliance obligations.

We have focused on expanding our business to include contracts with or for various governments and governmental agencies around the world, including U.S. federal, state, and local government agencies through contractors or systems integrators. Our business generated from government contracts may be materially adversely affected if:

|

|

·

|

our reputation or relationship with government agencies is impaired;

|

|

|

·

|

we are suspended or otherwise prohibited from contracting with a domestic or foreign government or any significant law enforcement agency;

|

|

|

·

|

levels of government expenditures and authorizations for law enforcement and security related programs decrease or shift to programs in areas where we do not provide products and services;

|

|

|

·

|

we are prevented from entering into new government contracts or extending existing government contracts based on violations or suspected violations of laws or regulations, including those related to procurement;

|

|

|

·

|

we are not granted security clearances that are required to sell our products to domestic or foreign governments or such security clearances are deactivated;

|

|

|

·

|

there is a change in government procurement procedures or conditions of remuneration; or

|

|

|

·

|

there is a change in the political climate that adversely affects our existing or prospective relationships.

|

We depend on our main facility in Israel and are susceptible to any event that could adversely affect its condition as well as the condition of our facilities elsewhere.

A material portion of our laboratory capacity, our principal offices and principal research and development facilities are concentrated in a single location in Israel. We also have significant facilities for research and development and manufacturing of components for our low profile antennas at a single location in Bulgaria as well as a research and development center in Moldova. Wavestream’s principal offices, research and development and engineering and manufacturing facilities are located at a single location in California and its additional research and development and engineering facility is located in Singapore. Fire, natural disaster or any other cause of material disruption in our operation in any of these locations could have a material adverse effect on our business, financial condition and operating results.

We are dependent upon a limited number of suppliers for key components that are incorporated in our products, including those used to build our hubs and VSATs, and may be significantly harmed if we are unable to obtain such components on favorable terms or on a timely basis. We are also dependent upon a limited number of suppliers of space segment, or transponder capacity, and may be significantly harmed if we are unable to obtain the space segment for the provision of services on favorable terms or on a timely basis.

Several of the components required to build our VSATs and hubs are manufactured by a limited number of suppliers. We have not experienced any difficulties with our suppliers with respect to availability of components. However, we cannot assure you of the continuous availability of key components or our ability to forecast our component requirements sufficiently in advance. Our research and development and operations groups are continuously working with our suppliers and subcontractors to obtain components for our products on favorable terms in order to reduce the overall price of our products. If we are unable to obtain the necessary volume of components at sufficiently favorable terms or prices, we may be unable to produce our products at competitive prices. As a result, sales of our products may be lower than expected, which could have a material adverse effect on our business, financial condition and operating results. In addition, our suppliers are not always able to meet our requested lead times. If we are unable to satisfy customers' needs on time, we could lose their business.

10

In 2007, we entered into an outsourcing manufacturing agreement with a single source manufacturer for almost all of our VSAT indoor units. This agreement exposes us to certain risks related to our dependence on a single manufacturer which could include failure in meeting time tables and quantities, or material price increases which may affect our ability to provide competitive prices. We estimate that the replacement of the outsourcing manufacturer would, if necessary, take a period of between six to nine months.

There are only a limited number of suppliers of satellite transponder capacity and a limited amount of space segment available. We are dependent on these suppliers for our provision of services in Peru, Colombia and the U.S. While we do secure long term agreements with our satellite transponder providers, we cannot assure the continuous availability of space segment, the pricing upon renewals of space segment and the continuous availability and coverage in the regions where we supply services. If we are unable to secure contracts with satellite transponder providers with reliable service at competitive prices, our services business could be adversely affected.

Breaches of network or information technology security, natural disasters or terrorist attacks could have an adverse effect on our business.

Cyber attacks or other breaches of network or information technology (IT) security, natural disasters, terrorist acts or acts of war may cause equipment failures or disrupt our systems and operations. In particular, both unsuccessful and successful cyber attacks on companies have increased in frequency, scope and potential harm in recent years. Any such event result in our inability to operate our facilities, which, even if the event is for a limited period of time, may result in significant expenses and/or loss of market share to other competitors in the market for telemanagement products and invoice management solutions. While we maintain insurance coverage for some of these events, the potential liabilities associated with these events could exceed the insurance coverage we maintain. A failure to protect the privacy of customer and employee confidential data against breaches of network or IT security could result in damage to our reputation. Any of these occurrences could result in a material adverse effect on our results of operations and financial condition.

We have been subject, and will likely continue to be subject, to attempts to breach the security of our networks and IT infrastructure through cyber attack, malware, computer viruses and other means of unauthorized access. However, to date, we have not been subject to cyber attacks or other cyber incidents which, individually or in the aggregate, resulted in a material impact to our operations or financial condition.

We would be adversely affected if we are unable to retain key employees.

Our success depends in part on key management, sales, marketing and development personnel and our continuing ability to attract and retain highly qualified personnel. There is competition for the services of such personnel. The loss of the services of key personnel, and the failure to attract highly qualified personnel in the future, may have a negative impact on our business. Moreover, our competitors may hire and gain access to the expertise of our former employees.

Trends and factors affecting the telecommunications industry are beyond our control and may result in reduced demand and pricing pressure on our products.

We operate in the telecommunication industry and are influenced by trends of that industry, which are beyond our control and may affect our operations. These trends include:

|

|

·

|

adverse changes in the public and private equity and debt markets and our ability, as well as the ability of our customers and suppliers, to obtain financing or to fund working capital and capital expenditures;

|

|

|

·

|

adverse changes in the credit ratings of our customers and suppliers;

|

11

|

|

·

|

adverse changes in the market conditions in our industry and the specific markets for our products;

|

|

|

·

|

access to, and the actual size and timing of, capital expenditures by our customers;

|

|

|

·

|

inventory practices, including the timing of product and service deployment, of our customers;

|

|

|

·

|

the amount of network capacity and the network capacity utilization rates of our customers, and the amount of sharing and/or acquisition of new and/or existing network capacity by our customers;

|

|

|

·

|

the overall trend toward industry consolidation and rationalization among our customers, competitors, and suppliers;

|

|

|

·

|

price reductions by our direct competitors and by competing technologies including, for example, the introduction of Ka-band satellite systems by our direct competitors which could significantly drive down market prices or limit the availability of satellite capacity for use with our VSAT systems;

|

|

|

·

|

conditions in the broader market for communications products, including data networking products and computerized information access equipment and services;

|

|

|

·

|

governmental regulation or intervention affecting communications or data networking;

|

|

|

·

|

monetary stability in the countries where we operate; and

|

|

|

·

|

the effects of war and acts of terrorism, such as disruptions in general global economic activity, changes in logistics and security arrangements, and reduced customer demand for our products and services.

|

These trends and factors may reduce the demand for our products and services or require us to increase our research and development expenses and may harm our financial results.

Unfavorable global economic conditions could have a material adverse effect on our business, operating results and financial condition

The financial and economic downturn in the U.S. and European countries may cause revenues of our customers to decrease. This may result in reductions in sales of our products and services in some markets, longer sales cycles, slower adoption of new technologies and increased price competition. In addition, weakness in the end-user market could negatively affect the cash flow of our customers who could, in turn, delay paying their obligations to us or ask us for vendor financing. This could increase our credit risk exposure and cause delays in our recognition of revenues on future sales to these customers. Specific economic trends, such as declines in the demand for telecommunications products and services, the tightening of credit markets, or weakness in corporate spending, could have a direct impact on our business. Any of these events would likely harm our business, operating results and financial condition. If global economic and market conditions do not improve, or weaken further, it may have a material adverse effect on our business, operating results and financial condition.

Our international sales expose us to changes in foreign regulations and tariffs, tax exposures, political instability and other risks inherent to international business, any of which could adversely affect our operations.

We sell and distribute our products and provide our services internationally, particularly in the U.S., Latin America, Asia, Asia Pacific, Africa and Europe. A component of our strategy is to continue to expand into new international markets, including China. Our operations can be limited or disrupted by various factors known to affect international trade. These factors include the following:

|

|

·

|

imposition of governmental controls, regulations and taxation which might include a government's decision to raise import tariffs or license fees in countries in which we do business;

|

12

|

|

·

|

government regulations that may prevent us from choosing our business partners or restrict our activities. For example, a particular country may decide that high-speed data networks used to provide access to the Internet should be made available generally to Internet service providers and may require us to provide our wholesale service to any Internet service provider that request it, including entities that compete with us. If we become subject to any additional obligations such as these, we would be forced to comply with potentially costly requirements and limitations on our business activities, which could result in a substantial reduction in our revenue;

|

|

|

·

|

the U.S. Foreign Corrupt Practices Act, or the FCPA, and similar anti-corruption laws in other jurisdictions, which include anti-bribery provisions. We have adopted internal policies mandating compliance with these laws. Nevertheless, we may not always be protected in cases of violation of the FCPA or other anti-corruption laws by our employees or third-parties acting on our behalf. A violation of anti-corruption laws by our employees or third-parties during the performance of their obligations for us may have a material adverse effect on our reputation operating results and financial condition;

|

|

|

·

|

tax exposures in various jurisdictions relating to our activities throughout the world;

|

|

|

·

|

political and/or economic instability in countries in which we do or desire to do business. Such unexpected changes have had an adverse effect on the gross margin of some of our projects. We also face similar risks from potential or current political and economic instability as well as volatility of foreign currencies in countries such as Colombia, Brazil, Venezuela and certain countries in East Asia;

|

|

|

·

|

difficulties in staffing and managing foreign operations that might mandate employing staff in various countries to manage foreign operations. This requirement could have an adverse effect on the profitability of certain projects;

|

|

|

·

|

longer payment cycles and difficulties in collecting accounts receivable;

|

|

|

·

|

foreign exchange risks due to fluctuations in local currencies relative to the dollar; and

|

|

|

·

|

relevant zoning ordinances that may restrict the installation of satellite antennas and might also reduce market demand for our service. Additionally, authorities may increase regulation regarding the potential radiation hazard posed by transmitting earth station satellite antennas' emissions of radio frequency energy that may negatively impact our business plan and revenues.

|

Any decline in commercial business in any country may have an adverse effect on our business as these trends often lead to a decline in technology purchases or upgrades by private companies. We expect that in difficult economic periods, countries in which we do business will find it more difficult to raise financing from investors for the further development of the telecommunications industry and private companies will find it more difficult to finance the purchase or upgrade of our technology. Any such changes could adversely affect our business in these and other countries.

We may face difficulties in obtaining regulatory approvals for our telecommunication services and products, which could adversely affect our operations.

Our telecommunication services require licenses and approvals by the Federal Communications Commission, or FCC, in the U.S. and by regulatory bodies in other countries. In the U.S., the operation of satellite earth station facilities and VSAT systems such as ours are prohibited except under licenses issued by the FCC. Our airborne products require licenses and approvals by the Federal Aviation Agency, or FAA. We must also obtain approval of the regulatory authority in each country in which we propose to provide network services or operate VSATs. The approval process in Latin America and elsewhere can often take a substantial amount of time and require substantial resources.

13

In addition, any licenses and approvals that are granted may be subject to conditions that may restrict our activities or otherwise adversely affect our operations. Also, after obtaining the required licenses and approvals, the regulating agencies may, at any time, impose additional requirements on our operations. We cannot assure you that we will be able to comply with any new requirements or conditions imposed by such regulating agencies on a timely or economically efficient basis.

Our products are also subject to certain homologation requirements – certification of compliance with local regulatory standards. Delays in receiving such certification could adversely affect our operations.

Our operating results may vary significantly from quarter to quarter and these quarterly variations in operating results, as well as other factors, may contribute to the volatility of the market price of our shares.

Our operating results have and may continue to vary significantly from quarter to quarter. The causes of fluctuations include, among other things:

|

|

·

|

the timing, size and composition of orders from customers;

|

|

|

·

|

the timing of introducing new products and product enhancements by us and the level of their market acceptance;

|

|

|

·

|

the mix of products and services we offer; and

|

|

|

·

|

the changes in the competitive environment in which we operate.

|

The quarterly variation of our operating results, may, in turn, create volatility in the market price for our shares. Other factors that may contribute to wide fluctuations in our market price, many of which are beyond our control, include, but are not limited to:

|

|

·

|

economic instability;

|

|

|

·

|

announcements of technological innovations;

|

|

|

·

|

customer orders or new products or contracts;

|

|

|

·

|

competitors' positions in the market;

|

|

|

·

|

changes in financial estimates by securities analysts;

|

|

|

·

|

conditions and trends in the VSAT and other technology industries relevant to our businesses;

|

|

|

·

|

our earnings releases and the earnings releases of our competitors; and

|

|

|

·

|

the general state of the securities markets (with particular emphasis on the technology and Israeli sectors thereof).

|

In addition to the volatility of the market price of our shares, the stock market in general and the market for technology companies in particular have been highly volatile and at times thinly traded. Investors may not be able to resell their shares during and following periods of volatility.

14

We may be unable to adequately protect our proprietary rights, which may limit our ability to compete effectively.

Our business is based mainly on our proprietary technology and related products and services. We establish and protect proprietary rights and technology used in our products by the use of patents, trade secrets, copyrights and trademarks. We also utilize non-disclosure and intellectual property assignment agreements. Because of the rapid technological changes and innovation that characterize the network communications industry, our success will depend in large part on our ability to protect and defend our intellectual property rights. Our actions to protect our proprietary rights in our VSAT technology and other products may be insufficient to prevent others from developing products similar to our products. In addition, the laws of many foreign countries do not protect our intellectual property rights to the same extent as the laws of the U.S. If we are unable to protect our intellectual property, our ability to operate our business and generate expected revenues may be harmed.

We may be subject to claims by third parties alleging that we infringe intellectual property owned by them. We may be required to commence litigation to protect our intellectual property rights. Any intellectual property litigation may continue for an extended period and may materially adversely affect our business, financial condition and operating results.

There are numerous patents, both pending and issued, in the network communications industry. We may unknowingly infringe on a patent. We may from time to time be notified of claims that we are infringing on patents, copyrights or other intellectual property rights owned by third parties. While we do not believe that we have infringed in the past or are infringing at present on any intellectual property rights of third parties, we cannot assure you that we will not be subject to such claims or that damages for any such claim will not be awarded against us by court. In November 2012, a claim was filed against our U.S. subsidiary for alleged patent infringement. Although we believe that the claim is without merits, there is no assurance as to the ultimate resolution of this matter. See Item 8 – “Financial Information – Legal proceedings”.

In addition, we may be required to commence litigation to protect our intellectual property rights and trade secrets, to determine the validity and scope of the proprietary rights of others or to defend against third-party claims of invalidity or infringement. An adverse result in the pending litigation or any litigation could force us to pay substantial damages, stop designing, manufacturing, using or selling related products, spend significant resources to develop alternative technologies, discontinue using certain processes or obtain licenses. In addition, we may not be able to develop alternative technology, and we may not be able to find appropriate licenses on reasonably satisfactory terms. Any such litigation, including the pending litigation in which we are currently involved, could result in substantial costs and diversion of resources and could have a material adverse effect on our business, financial condition and operating results.

Potential product liability claims relating to our products could have a material adverse effect on our business.

We may be subject to product liability claims relating to the products we sell. Potential product liability claims could include, among other things, those for exposure to electromagnetic radiation from the antennas we provide. We endeavor to include in our agreements with our business customers provisions designed to limit our exposure to potential claims. We also maintain a product liability insurance policy. However, our contractual limitation of liability may be rejected or limited in certain jurisdiction and our insurance may not cover all relevant claims or may not provide sufficient coverage. To date, we have not experienced any material product liability claim. Our business, financial condition and operating results could be materially adversely affected if costs resulting from future claims are not covered by our insurance or exceed our coverage.

Our insurance coverage may not be sufficient for every aspect or risk related to our business.

Our business includes risks, only some of which are covered by our insurance. For example, in many of our satellite capacity agreements, we do not have a backup for satellite capacity, and we do not have indemnification or insurance in the event that our supplier's satellite malfunctions or data is lost. In addition, we are not covered by our insurance for acts of fraud or theft. Our business, financial condition and operating results could be materially adversely affected if we incur significant costs resulting from these exposures.

15

Risks Related to Ownership of Our Ordinary Shares

Our share price has been highly volatile and may continue to be volatile and decline.

The trading price of our shares has fluctuated widely in the past and may continue to do so in the future as a result of a number of factors, many of which are outside our control. In addition, the stock market has experienced extreme price and volume fluctuations that have affected the market prices of many technology companies, particularly telecommunication and Internet-related companies, and that have often been unrelated or disproportionate to the operating performance of these companies. These broad market fluctuations could adversely affect the market price of our shares. In the past, following periods of volatility in the market price of a particular company's securities, securities class action litigation has often been brought against that company. Securities class action litigation against us could result in substantial costs and a diversion of our management's attention and resources.

We may in the future be classified as a passive foreign investment company, or PFIC, which will subject our U.S. investors to adverse tax rules.

Holders of our ordinary shares who are U.S. residents may face income tax risks. There is a risk that we will be treated as a “passive foreign investment company” or PFIC. Our treatment as a PFIC could result in a reduction in the after-tax return to the holders of our ordinary shares and would likely cause a reduction in the value of such shares. A foreign corporation will be treated as a PFIC for U.S. federal income tax purposes if either (1) at least 75% of its gross income for any taxable year consists of certain types of “passive income,” or (2) at least 50% of the average value of the corporation’s gross assets produce, or are held for the production of, such types of “passive income.” For purposes of these tests, “passive income” includes dividends, interest, gains from the sale or exchange of investment property and rents and royalties other than rents and royalties that are received from unrelated parties in connection with the active conduct of trade or business. For purposes of these tests, income derived from the performance of services does not constitute “passive income”. Those holders of shares in a PFIC who are citizens or residents of the U.S. or domestic entities would alternatively be subject to a special adverse U.S. federal income tax regime with respect to the income derived by the PFIC, the distributions they receive from the PFIC and the gain, if any, they derive from the sale or other disposition of their shares in the PFIC. In particular, any dividends paid by us, if any, would not be treated as “qualified dividend income” eligible for preferential tax rates in the hands of non-corporate U.S. shareholders. U.S. residents should carefully read Item 10E. “Additional Information – Taxation”, of this annual report on Form 20-F for a more complete discussion of the U.S. federal income tax risks related to owning and disposing of our ordinary shares.

The concentration of our ordinary share ownership may limit our shareholders’ ability to influence corporate matters.