UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-07460 |

| Exact name of registrant as specified in charter: | Delaware Investments® Dividend and Income Fund, Inc. |

| Address of principal executive offices: |

610 Market Street Philadelphia, PA 19106 |

| Name and address of agent for service: |

David F. Connor, Esq. 610 Market Street Philadelphia, PA 19106 |

| Registrant’s telephone number, including area code: | (800) 523-1918 |

| Date of fiscal year end: | November 30 |

| Date of reporting period: | November 30, 2022 |

Item 1. Reports to Stockholders

|

| |

| Annual report |

Closed-end fund

Delaware Investments® Dividend and Income Fund, Inc.

November 30, 2022

The figures in the annual report for Delaware Investments Dividend and Income Fund, Inc. represent past results, which are not a guarantee of future results. A rise or fall in interest rates can have a significant impact on bond prices. Funds that invest in bonds can lose their value as interest rates rise.

Delaware Investments® Dividend and Income Fund, Inc. (“DDF” or the “Fund”), acting pursuant to a Securities and Exchange Commission (“SEC”) exemptive order and with the approval of the Fund’s Board of Directors (the “Board”), has adopted a managed distribution policy (the “Plan”). The Fund currently makes monthly distributions to common shareholders at a targeted annual distribution rate of 7.5% of the Fund’s average net asset value (“NAV”) per share. The Fund will calculate the average NAV per share from the previous three full months immediately prior to the distribution based on the number of business days in those three months on which the NAV is calculated. The distribution will be calculated as 7.5% of the prior three months’ average NAV per share, divided by 12. This distribution methodology is intended to provide shareholders with a consistent, but not guaranteed, income stream and a targeted annual distribution rate and is intended to narrow any discount between the market price and the NAV of the Fund’s common shares, but there is no assurance that the policy will be successful in doing so.

Under the Plan, the Fund is managed with a goal of generating as much of the distribution as possible from net investment income and short-term capital gains. The balance of the distribution will then come from long-term capital gains to the extent permitted, and if necessary, a return of capital. The Fund will generally distribute amounts necessary to satisfy the terms of the Fund’s Plan and the requirements prescribed by excise tax rules and Subchapter M of the Internal Revenue Code (the “Code”). Each monthly distribution to shareholders is expected to be at the fixed percentage described above, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Fund to comply with the distribution requirements imposed by the Code.

The Board may amend, suspend, or terminate the Fund’s Plan at any time without prior notice if it deems such action to be in the best interest of the Fund or its shareholders. The methodology for determining monthly distributions under the Plan will be reviewed at least annually by the Fund’s Board, and the Fund will continue to evaluate its distribution in light of ongoing market conditions. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Fund’s stock is trading at or above NAV) or widening an existing trading discount. The Fund is subject to risks that could have an adverse impact on its ability to maintain distributions under the Plan. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, increased market volatility, portfolio companies suspending or decreasing corporate dividend distributions, and changes in the Code.

Shareholders should not draw any conclusions about the Fund’s investment performance from the amounts of these distributions or from the terms of the Plan. The Fund’s total investment return on NAV is presented in its financial highlights table.

A cumulative summary of the Section 19(a) notices for the Fund’s current fiscal period, if applicable, is included in Other Fund Information. Section 19(a) notices for the Fund, as applicable, are available on the Fund’s website at delawarefunds.com/about/press-releases-closed-end.

Macquarie Asset Management (MAM) is the asset management division of Macquarie Group. MAM is a full-service asset manager offering a diverse range of products across public and private markets including fixed income, equities, multi-asset solutions, private credit, infrastructure, renewables, natural assets, real estate, and asset finance. The Public Investments business is a part of MAM and includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A. For more information, including press releases, please visit delawarefunds.com/closed-end.

Unless otherwise noted, views expressed herein are current as of November 30, 2022, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

Other than Macquarie Bank Limited ABN 46 008 583 542 ("Macquarie Bank"), any Macquarie Group entity noted in this document is not an authorised deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these other Macquarie Group entities do not represent deposits or other liabilities of Macquarie Bank. Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these other Macquarie Group entities. In addition, if this document relates to an investment, (a) the investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group entity guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

The Fund is governed by US laws and regulations.

All third-party marks cited are the property of their respective owners.

© 2023 Macquarie Management Holdings, Inc.

Delaware Investments® Dividend and Income Fund, Inc.

November 30, 2022 (Unaudited)

Performance preview (for the year ended November 30, 2022)

| Delaware Investments Dividend and Income Fund, Inc. @ market price | 1-year return | -12.49% |

| Delaware Investments Dividend and Income Fund, Inc. @ NAV | 1-year return | -0.47% |

| Lipper Closed-end Income and Preferred Stock Funds Average @ market price | 1-year return | -16.94% |

| Lipper Closed-end Income and Preferred Stock Funds Average @ NAV | 1-year return | -9.85% |

Past performance does not guarantee future results.

Performance at market price will differ from performance at net asset value (NAV). Although market price returns tend to reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s distribution rate.

For complete, annualized performance for Delaware Investments Dividend and Income Fund, Inc., please see the table on page 3.

Economic backdrop

At the start of the Fund’s fiscal year in December 2021, equity markets continued to advance, and some US stock indices reached new highs. Globally, inflation also increased to long-term highs, and central banks responded by tightening monetary policy. The US Federal Reserve stepped sharply on the brakes, scaling back its bond purchases and hinting at several interest rate hikes in 2022. Bond yields were relatively stable in the fourth quarter of 2021 despite continuous increases in short-term US yields. The US dollar appreciated against major currencies. Oil prices also rose further, while gas markets eased somewhat at the end of 2021, following dramatic increases in Europe.

In January 2022, persistently high inflation led to frequent and serious discussions at the Fed about implementing interest rate hikes. Investors reacted by selling bonds, which pushed yields higher and equity prices lower. Financial markets also reacted negatively as Russia built up its troops along the Ukraine border. Russia’s invasion in February 2022 prompted unprecedented sanctions – including a freeze on Russian central bank reserves, an oil embargo, and a trading ban on Russian financial stocks. Equities sold off globally while commodity prices soared. Government bonds were briefly in demand as a short-term safe haven, but quickly resumed their downward trend.

Tighter central bank monetary policy characterized the rest of the fiscal year, with the Fed leading the way. From March through September 2022, the Fed raised the federal funds rate five times, including three 0.75-percentage-point increases – at the June, July, and September meetings of the Federal Open Market Committee (FOMC). As a result, the target short-term interest rate rose from a range of zero to 0.25% in January 2022 to 3.00% to 3.25% by the end of the fiscal year. This increase in rates was the Fed’s aggressive attempt to try to bring inflation under control.

Other central banks, including the Bank of England and the European Central Bank, also took repeated steps to tighten monetary policy in their jurisdictions. Meanwhile, equities and bonds posted historically poor performance throughout the measurement period in the face of brutal headwinds and unrelenting negative news. This included soaring inflation, consequent aggressive monetary tightening, ongoing supply chain problems, China’s zero-COVID policy-related lockdowns, the Russia-Ukraine war, and soaring energy prices. The higher prices and disruptions within the oil and gas supply hit Europe hardest as Russia cut off gas to several European Union (EU) countries. In turn, the Group of Seven (G7) nations and later the EU implemented an oil embargo.

Among major central banks, only the Bank of Japan maintained ultra-loose monetary policy as it attempted to keep Japanese yields stable by buying bonds. However, that led to a weakening of the Japanese yen, which fell to a 20-year low.

Markets rallied briefly in July 2022, when a near-term turnaround in inflation seemed possible. Despite investors’ concerns about economic growth slowing, stocks appreciated along with other risk asset classes, including corporate, high yield, convertible, and emerging market bonds. A key reason for this appreciation was the decline in yields on US and euro-zone government bonds, leading to significant price gains. However, the tide turned again in mid-August and the bear market returned for most asset classes as hopes for a slowdown of inflation were dashed. Central banks reaffirmed their intentions to continue aggressively tightening monetary policy. Recession fears mounted and the energy crisis worsened as Russia announced it was shutting down a gas pipeline for maintenance. German bond yields rose sharply, and the euro fell below parity with the US dollar for the first time in 20 years.

The picture worsened even further in September 2022, with heavy losses among virtually all asset classes. Energy prices continued to fall while the European inflation rate reached double-digit levels and central banks planned further interest rate hikes. As the fiscal period ended, the market showed its friendlier side. Although inflation remained high and central banks continued to raise interest rates, increasing data indicating an economic slowdown gave rise to hopes of a turnaround in monetary policy.

Markets were in recovery mode in November. After the Fed’s expected interest rate hike of 0.75 percentage points at the beginning of the month, poorer economic data during the month and slightly declining inflation rates fueled hopes of slower rate hikes in the near

1

Portfolio management review

Delaware Investments® Dividend and Income Fund, Inc.

future. Against this backdrop, both equities and bonds rose strongly. Thanks to sharply falling risk premiums, investment grade corporate and emerging market government bonds performed particularly well. The US dollar weakened, and the price of oil fell due to weaker demand. China relaxed its zero-COVID policy somewhat, but record-high infections led to new restrictions, resulting in protests and somewhat deteriorating market sentiment towards the month’s end.

Within the Fund

For the fiscal year ended November 30, 2022, Delaware Investments Dividend and Income Fund, Inc. returned -0.47% at net asset value (NAV) and -12.49% at market price (both figures reflect all distributions reinvested). For the Fund’s complete, annualized performance, please see the table on page 3.

Individual contributors and detractors

During the fiscal year, equities made the largest contribution to performance, while fixed income was the largest detractor from performance. Within equities, the Fund’s US large-cap value equity allocation was the largest contributor to performance. Among the individual positions, ConocoPhillips and Cigna Corp. were the largest contributors to the Fund’s performance. Each position accounted for approximately a 2.0% average weight of gross assets. In contrast, The Walt Disney Co. (average weight of approximately 1.8% of gross assets) and Fidelity National Information Services Inc. (average weight of roughly 1.8% of gross assets) detracted the most from the Fund’s performance.

Portfolio positioning

We regularly invest across multiple asset classes, searching for securities that offer a competitive yield and the opportunity for dividend growth. We also prioritize managing downside risk while seeking to limit any capital losses. Our asset shifts throughout the fiscal year reflected these priorities.

The Fund’s largest allocation remained in large-cap value equities. During the fiscal year, we slightly reduced the Fund’s allocation to US large-cap value equities and allocated the proceeds to US convertibles.

Within fixed income, we believe high yield bonds may continue to deliver income opportunities.

The Fund’s use of leverage – a portfolio management tool designed to obtain a potentially higher return on the Fund’s investments – detracted from performance. Leverage magnifies the effect of gains and losses.

The economic outlook is still challenging, with recession probabilities for 2023 now elevated. We don’t believe equity valuations fully reflect this economic backdrop, as historically recessions have typically been accompanied by declining corporate earnings as well. At the same time, bond yields – while somewhat down from their October and November 2022 highs – have risen, which might provide more downside protection in fixed income. We continue to expect a restrictive central bank policy and think this might be a headwind for many riskier asset classes as well.

In our view, a thoughtful active management approach is needed given the increased uncertainty. We believe vigilant and continuous assessment of the current market environment offers opportunities to take advantage of market dislocations and may help us achieve what we consider to be attractive risk-adjusted returns through an active focus on portfolio risk and diversification.

2

Delaware Investments® Dividend and Income Fund, Inc.

November 30, 2022 (Unaudited)

The performance quoted represents past performance and does not guarantee future results. Investment return, principal value, and market value of an investment will fluctuate so that shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Please obtain the most recent performance data by calling 866 437-0252 or visiting our website at delawarefunds.com/closed-end.

Fund performance

| Average annual total returns through November 30, 2022 | 1 year | 5 year | 10 year | ||||

| At market price (inception date March 26, 1993) | -12.49% | +4.43% | +8.77% | ||||

| At net asset value (inception date March 26, 1993) | -0.47% | +4.31% | +8.91% |

Diversification may not protect against market risk.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt. This includes prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult to obtain precise valuations of the high yield securities.

Narrowly focused investments may exhibit higher volatility than investments in multiple industry sectors.

Real estate investment trust (REIT) investments are subject to many of the risks associated with direct real estate ownership, including changes in economic conditions, credit risk, and interest rate fluctuations.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

The Fund borrows through a line of credit for purposes of leveraging. Leveraging may result in higher degrees of volatility because the Fund’s net asset value could be subject to fluctuations in short-term interest rates and changes in market value of portfolio securities attributable to leverage. Leverage magnifies the potential for gain and the risk of loss. As a result, a relatively small decline in the value of the underlying investments could result in a relatively large loss. In addition, the leverage through the line of credit is dependent on the credit provider’s ability to fulfill its contractual obligations.

IBOR risk is the risk that changes related to the use of the London interbank offered rate (LIBOR) or similar rates (such as EONIA) could have adverse impacts on financial instruments that reference these rates. The abandonment of these rates and transition to alternative rates could affect the value and liquidity of instruments that reference them and could affect investment strategy performance.

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

Closed-end fund shares do not represent

a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not

federally insured by the Federal Deposit Insurance Corporation or any other government agency.

3

Performance summary

Delaware Investments® Dividend and Income Fund, Inc.

Closed-end funds, unlike open-end funds, are not continuously offered. After being issued during a one-time-only public offering, shares of closed-end funds are sold in the open market through a securities exchange. Net asset value (NAV) is calculated by subtracting total liabilities from total assets, then dividing by the number of shares outstanding. At the time of sale, your shares may have a market price that is above or below NAV, and may be worth more or less than your original investment.

The Fund may make distributions of ordinary income and capital gains at calendar year end. Those distributions may temporarily cause extraordinarily high yields. There is no assurance that a Fund will repeat that yield in the future. Subsequent monthly distributions that do not include ordinary income or capital gains in the form of dividends will likely be lower.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Returns reflect the reinvestment of all distributions. Dividends and distributions, if any, are assumed, for the purpose of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment policy. Shares of the Fund were initially offered with a sales charge of 6%. Performance since inception does not include the sales charge or any other brokerage commission for purchases made since inception.

Past performance does not guarantee future results.

| Fund

basics As of November 30, 2022 | ||

| Fund objectives | Fund start date | |

| The Fund’s primary investment objective is to seek high current income with capital appreciation as a secondary objective. | March 26, 1993 | |

| Total net assets | NYSE symbol | |

| $71.9 million | DDF | |

| Number of holdings | ||

| 291 | ||

4

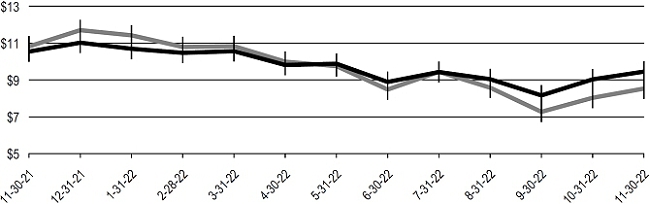

Market price versus net asset value (see notes below and on next page)

For the period November 30, 2021 through November 30, 2022

| Starting value | Ending value | ||||

|

Delaware Investments Dividend and Income Fund, Inc. @ NAV | $10.54 | $9.45 | ||

|

Delaware Investments Dividend and Income Fund, Inc. @ market price | $10.82 | $8.53 |

Past performance does not guarantee future results.

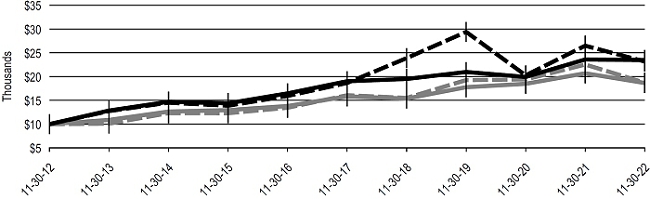

Performance of a $10,000 investment

For the period November 30, 2012 through November 30, 2022

| Starting value | Ending value | ||||

|

Delaware Investments Dividend and Income Fund, Inc. @ NAV | $10,000 | $23,484 | ||

|

Delaware Investments Dividend and Income Fund, Inc. @ market price | $10,000 | $23,178 | ||

|

Lipper Closed-end Income and Preferred Stock Funds Average @ market price | $10,000 | $18,718 | ||

|

Lipper Closed-end Income and Preferred Stock Funds Average @ NAV | $10,000 | $18,654 |

The “Performance of a $10,000 investment” graph assumes $10,000 invested in the Fund on November 30, 2012, and includes the reinvestment of all distributions at market value. The graph assumes $10,000 in the Lipper Closed-end Income and Preferred Stock Funds Average at market price and at NAV.

Performance of the Fund and the Lipper peer group at market value is based on market performance during the period. Performance of the Fund and the Lipper peer group at NAV is based on the fluctuations in NAV during the period. Delaware Investments Dividend and Income Fund, Inc. was initially offered with a sales charge of 6%. For market price, performance shown in both graphs above does not include fees, the

5

Performance summary

Delaware Investments® Dividend and Income Fund, Inc.

initial sales charge, or any brokerage commissions on purchases. For NAV, performance shown in both graphs above includes fees, but does not include the initial sales charge or any brokerage commissions for purchases. Investments in the Fund are not available at NAV.

The Lipper Closed-end Income and Preferred Stock Funds Average represents the average return of closed-end funds that normally seek a high level of current income through investing in income-producing stocks, bonds, and money market instruments, or funds that invest primarily in preferred securities, often considering tax code implications (source: Lipper).

Market price is the price an investor would pay for shares of the Fund on the secondary market.

NAV is the total value of one fund share, generally equal to a fund’s net assets divided by the number of shares outstanding.

Past performance does not guarantee future results.

6

Security type / sector allocations and top 10 equity holdings

Delaware Investments® Dividend and Income Fund, Inc.

As of November 30, 2022 (Unaudited)

Sector designations may be different from the sector designations presented in other Fund materials.

| Security type / sector | Percentage of net assets | ||||

| Convertible Bonds | 8.97 | % | |||

| Corporate Bonds | 31.15 | % | |||

| Automotive | 1.50 | % | |||

| Basic Industry | 2.94 | % | |||

| Capital Goods | 1.45 | % | |||

| Consumer Goods | 0.50 | % | |||

| Energy | 4.44 | % | |||

| Financial Services | 1.40 | % | |||

| Healthcare | 2.94 | % | |||

| Insurance | 0.93 | % | |||

| Leisure | 2.73 | % | |||

| Media | 2.83 | % | |||

| Real Estate Investment Trusts | 0.17 | % | |||

| Retail | 1.85 | % | |||

| Services | 2.16 | % | |||

| Technology & Electronics | 0.93 | % | |||

| Telecommunications | 2.26 | % | |||

| Transportation | 1.19 | % | |||

| Utilities | 0.93 | % | |||

| Common Stocks | 89.59 | % | |||

| Communication Services | 6.39 | % | |||

| Consumer Discretionary | 7.52 | % | |||

| Consumer Staples | 5.41 | % | |||

| Energy | 2.57 | % | |||

| Financials | 13.07 | % | |||

| Healthcare | 15.39 | % | |||

| Industrials | 10.59 | % | |||

| Information Technology | 14.74 | % | |||

| Materials | 2.74 | % | |||

| REIT Diversified | 0.08 | % | |||

| REIT Healthcare | 0.68 | % | |||

| REIT Hotel | 0.28 | % | |||

| REIT Industrial | 0.98 | % | |||

| REIT Information Technology | 0.66 | % | |||

| REIT Lodging | 0.23 | % | |||

| REIT Mall | 0.20 | % | |||

| REIT Manufactured Housing | 0.26 | % | |||

| REIT Multifamily | 2.91 | % | |||

| REIT Office | 0.24 | % | |||

| REIT Self-Storage | 0.80 | % | |||

| REIT Shopping Center | 0.61 | % | |||

| REIT Single Tenant | 0.49 | % | |||

| REIT Specialty | 0.38 | % | |||

| Utilities | 2.37 | % | |||

| Convertible Preferred Stock | 1.29 | % | |||

| Short-Term Investments | 1.73 | % | |||

| Total Value of Securities | 132.73 | % | |||

| Borrowings Under Line of Credit | (33.37 | %) | |||

| Receivables and Other Assets Net of Liabilities | 0.64 | % | |||

| Total Net Assets | 100.00 | % | |||

Holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| Top 10 equity holdings | Percentage of net assets | ||||

| Oracle | 2.83 | % | |||

| Merck & Co. | 2.78 | % | |||

| American International Group | 2.76 | % | |||

| MetLife | 2.76 | % | |||

| DuPont de Nemours | 2.74 | % | |||

| Conagra Brands | 2.73 | % | |||

| Honeywell International | 2.72 | % | |||

| Raytheon Technologies | 2.72 | % | |||

| Motorola Solutions | 2.69 | % | |||

| Archer-Daniels-Midland | 2.68 | % | |||

7

Delaware Investments® Dividend and Income Fund, Inc.

November 30, 2022

| Principal amount° | Value (US $) | ||||

| Convertible Bonds — 8.97% | |||||

| Basic Industry — 0.15% | |||||

| Ivanhoe Mines 144A 2.50% exercise price $9.31, maturity date 4/15/26 # | 81,000 | $ | 109,875 | ||

| 109,875 | |||||

| Brokerage — 0.08% | |||||

| New Mountain Finance 144A 7.50% exercise price $14.20, maturity date 10/15/25 # | 57,000 | 57,963 | |||

| 57,963 | |||||

| Capital Goods — 0.26% | |||||

| Kaman 3.25% exercise price $65.26, maturity date 5/1/24 | 200,000 | 186,100 | |||

| 186,100 | |||||

| Communications — 1.00% | |||||

| Cable One 1.125% exercise price $2,275.83, maturity date 3/15/28 | 266,000 | 191,254 | |||

| DISH Network 3.375% exercise price $65.17, maturity date 8/15/26 | 241,000 | 156,650 | |||

| Liberty Broadband 144A 1.25% exercise price $900.01, maturity date 9/30/50 # | 316,000 | 302,965 | |||

| Liberty Latin America 2.00% exercise price $20.65, maturity date 7/15/24 | 76,000 | 67,688 | |||

| 718,557 | |||||

| Consumer Cyclical — 0.60% | |||||

| Cheesecake Factory 0.375% exercise price $77.09, maturity date 6/15/26 | 311,000 | 259,879 | |||

| Ford Motor 3.177% exercise price $16.85, maturity date 3/15/26 ^ | 163,000 | 169,194 | |||

| 429,073 | |||||

| Consumer Non-Cyclical — 2.48% | |||||

| BioMarin Pharmaceutical 0.599% exercise price $124.67, maturity date 8/1/24 | 89,000 | 94,058 | |||

| Chefs' Warehouse 1.875% exercise price $44.20, maturity date 12/1/24 | 261,000 | 291,145 | |||

| Chegg 4.124% exercise price $107.55, maturity date 9/1/26 ^ | 253,000 | 201,606 | |||

| Coherus Biosciences 1.50% exercise price $19.26, maturity date 4/15/26 | 163,000 | 112,486 | |||

| Collegium Pharmaceutical 2.625% exercise price $29.19, maturity date 2/15/26 | 150,000 | 148,656 | |||

| CONMED 144A 2.25%

exercise price $145.33, maturity date 6/15/27 # | 228,000 | 203,262 | |||

| Integra LifeSciences Holdings 0.50% exercise price $73.67, maturity date 8/15/25 | 210,000 | 203,385 | |||

| Ionis Pharmaceuticals 0.125% exercise price $83.28, maturity date 12/15/24 | 151,000 | 137,861 | |||

| Jazz Investments I 2.00% exercise price $155.81, maturity date 6/15/26 | 93,000 | 110,496 | |||

| Paratek Pharmaceuticals 4.75% exercise price $15.90, maturity date 5/1/24 | 319,000 | 282,921 | |||

| 1,785,876 | |||||

| Electric — 0.69% | |||||

| NextEra Energy Partners 144A 1.411% exercise price $75.33, maturity date 11/15/25 #, ^ | 74,000 | 81,511 | |||

| NRG Energy 2.75% exercise price $43.46, maturity date 6/1/48 | 208,000 | 237,536 | |||

| Ormat Technologies 144A 2.50% exercise price $90.27, maturity date 7/15/27 # | 149,000 | 177,459 | |||

| 496,506 | |||||

| Energy — 0.46% | |||||

| Helix Energy Solutions Group 6.75% exercise price $6.97, maturity date 2/15/26 | 259,000 | 329,914 | |||

| 329,914 | |||||

| Financials — 0.66% | |||||

| FTI Consulting 2.00% exercise price $101.38, maturity date 8/15/23 | 149,000 | 255,461 | |||

| Repay Holdings 144A 2.497% exercise price $33.60, maturity date 2/1/26 #, ^ | 292,000 | 217,715 | |||

| 473,176 | |||||

| Industrials — 0.32% | |||||

| Chart Industries 144A 1.00% exercise price $58.72, maturity date 11/15/24 # | 83,000 | 204,055 | |||

8

| Principal amount° | Value (US $) | ||||

| Convertible Bonds (continued) | |||||

| Industrials (continued) | |||||

| Danimer Scientific 144A 3.25% exercise price $10.79, maturity date 12/15/26 # | 53,000 | $ | 23,379 | ||

| 227,434 | |||||

| Real Estate Investment Trusts — 0.39% | |||||

| Blackstone Mortgage Trust 4.75% exercise price $36.23, maturity date 3/15/23 | 211,000 | 212,055 | |||

| Summit Hotel Properties 1.50% exercise price $11.88, maturity date 2/15/26 | 76,000 | 69,806 | |||

| 281,861 | |||||

| Technology — 1.64% | |||||

| Block 0.125% exercise price $121.01, maturity date 3/1/25 | 126,000 | 123,638 | |||

| InterDigital 144A 3.50% exercise price $77.49, maturity date 6/1/27 # | 278,000 | 263,266 | |||

| ON Semiconductor 1.625% exercise price $20.72, maturity date 10/15/23 | 71,000 | 257,410 | |||

| Palo Alto Networks 0.75% exercise price $88.78, maturity date 7/1/23 | 120,000 | 230,760 | |||

| Quotient Technology 1.75% exercise price $17.36, maturity date 12/1/22 | 116,000 | 116,572 | |||

| Semtech 144A 1.625% exercise price $37.27, maturity date 11/1/27 # | 94,000 | 98,606 | |||

| Wolfspeed 144A 0.25% exercise price $127.22, maturity date 2/15/28 # | 94,000 | 90,945 | |||

| 1,181,197 | |||||

| Transportation — 0.24% | |||||

| Spirit Airlines 1.00% exercise price $49.07, maturity date 5/15/26 | 210,000 | 173,670 | |||

| 173,670 | |||||

| Total Convertible

Bonds (cost $6,327,864) | 6,451,202 | ||||

| Corporate Bonds — 31.15% | |||||

| Automotive — 1.50% | |||||

| Allison Transmission 144A 5.875% 6/1/29 # | 330,000 | 312,287 | |||

| Ford Motor 4.75% 1/15/43 | 80,000 | 59,295 | |||

| Ford Motor Credit | |||||

| 3.375% 11/13/25 | 310,000 | 286,362 | |||

| 4.542% 8/1/26 | 305,000 | 287,420 | |||

| Goodyear Tire & Rubber 5.25% 7/15/31 | 155,000 | 133,056 | |||

| 1,078,420 | |||||

| Basic Industry — 2.94% | |||||

| ATI 5.125% 10/1/31 | 100,000 | 84,626 | |||

| Avient 144A 5.75% 5/15/25 # | 88,000 | 85,905 | |||

| Chemours 144A 5.75% 11/15/28 # | 155,000 | 136,322 | |||

| First Quantum Minerals 144A 7.50% 4/1/25 # | 200,000 | 197,348 | |||

| FMG Resources August

2006 144A 5.875% 4/15/30 # | 150,000 | 140,764 | |||

| Freeport-McMoRan 5.45% 3/15/43 | 185,000 | 166,098 | |||

| INEOS Quattro Finance 2 144A 3.375% 1/15/26 # | 200,000 | 178,036 | |||

| Koppers 144A 6.00% 2/15/25 # | 215,000 | 200,568 | |||

| Novelis 144A 4.75% 1/30/30 # | 195,000 | 173,617 | |||

| Olin | |||||

| 5.00% 2/1/30 | 175,000 | 159,032 | |||

| 5.125% 9/15/27 | 195,000 | 183,022 | |||

| Standard Industries 144A 4.75% 1/15/28 # | 145,000 | 131,631 | |||

| Steel Dynamics 5.00% 12/15/26 | 280,000 | 276,131 | |||

| 2,113,100 | |||||

| Capital Goods — 1.45% | |||||

| Ardagh Packaging Finance 144A 5.25% 8/15/27 # | 300,000 | 227,445 | |||

| Madison IAQ 144A 5.875% 6/30/29 # | 160,000 | 118,558 | |||

| Sealed Air 144A 5.00% 4/15/29 # | 150,000 | 139,652 | |||

| Terex 144A 5.00% 5/15/29 # | 180,000 | 163,078 | |||

| TK Elevator US Newco 144A 5.25% 7/15/27 # | 300,000 | 272,698 | |||

| TransDigm 144A 6.25% 3/15/26 # | 125,000 | 124,544 | |||

| 1,045,975 | |||||

| Consumer Goods — 0.50% | |||||

| Pilgrim's Pride 144A 4.25% 4/15/31 # | 150,000 | 130,187 | |||

| Post Holdings | |||||

| 144A 5.625% 1/15/28 # | 180,000 | 171,996 | |||

| 144A 5.75% 3/1/27 # | 60,000 | 58,565 | |||

| 360,748 | |||||

9

Schedule of investments

Delaware Investments® Dividend and Income Fund, Inc.

| Principal amount° | Value (US $) | ||||

| Corporate Bonds (continued) | |||||

| Energy — 4.44% | |||||

| Ascent Resources Utica Holdings | |||||

| 144A 5.875% 6/30/29 # | 170,000 | $ | 153,501 | ||

| 144A 7.00% 11/1/26 # | 80,000 | 78,530 | |||

| Callon Petroleum 144A 8.00% 8/1/28 # | 200,000 | 197,827 | |||

| Cheniere Corpus Christi Holdings | |||||

| 5.125% 6/30/27 | 40,000 | 40,082 | |||

| 5.875% 3/31/25 | 80,000 | 80,414 | |||

| CNX Midstream Partners 144A 4.75% 4/15/30 # | 85,000 | 70,990 | |||

| CNX Resources 144A 6.00% 1/15/29 # | 155,000 | 146,671 | |||

| Crestwood Midstream Partners 144A 6.00% 2/1/29 # | 188,000 | 173,625 | |||

| Energy Transfer 5.50% 6/1/27 | 115,000 | 114,902 | |||

| EQM Midstream Partners 144A 4.75% 1/15/31 # | 275,000 | 231,840 | |||

| Genesis Energy | |||||

| 7.75% 2/1/28 | 210,000 | 200,756 | |||

| 8.00% 1/15/27 | 160,000 | 152,919 | |||

| Hilcorp Energy I | |||||

| 144A 6.00% 4/15/30 # | 170,000 | 156,527 | |||

| 144A 6.00% 2/1/31 # | 15,000 | 13,839 | |||

| 144A 6.25% 4/15/32 # | 77,000 | 70,739 | |||

| Murphy Oil 6.375% 7/15/28 | 265,000 | 261,812 | |||

| NuStar Logistics | |||||

| 5.625% 4/28/27 | 160,000 | 150,719 | |||

| 6.00% 6/1/26 | 113,000 | 109,702 | |||

| Occidental Petroleum | |||||

| 6.45% 9/15/36 | 70,000 | 70,260 | |||

| 6.60% 3/15/46 | 180,000 | 183,838 | |||

| 6.625% 9/1/30 | 80,000 | 83,560 | |||

| PDC Energy 5.75% 5/15/26 | 175,000 | 167,373 | |||

| Southwestern Energy | |||||

| 5.375% 2/1/29 | 25,000 | 23,625 | |||

| 5.375% 3/15/30 | 110,000 | 103,555 | |||

| 7.75% 10/1/27 | 40,000 | 41,199 | |||

| USA Compression Partners | |||||

| 6.875% 4/1/26 | 20,000 | 19,181 | |||

| 6.875% 9/1/27 | 98,000 | 93,724 | |||

| 3,191,710 | |||||

| Financial Services — 1.40% | |||||

| Ally Financial 5.75% 11/20/25 | 435,000 | 429,457 | |||

| Castlelake Aviation Finance DAC 144A 5.00% 4/15/27 # | 230,000 | 195,883 | |||

| Hightower Holding 144A 6.75% 4/15/29 # | 100,000 | 83,344 | |||

| Midcap Financial Issuer Trust 144A 6.50% 5/1/28 # | 200,000 | 174,747 | |||

| MSCI 144A 3.625% 11/1/31 # | 145,000 | 122,291 | |||

| 1,005,722 | |||||

| Healthcare — 2.94% | |||||

| 1375209 BC 144A 9.00% 1/30/28 # | 52,000 | 51,350 | |||

| Bausch Health | |||||

| 144A 11.00% 9/30/28 # | 92,000 | 71,070 | |||

| 144A 14.00% 10/15/30 # | 18,000 | 10,076 | |||

| Centene 3.375% 2/15/30 | 245,000 | 209,008 | |||

| Cheplapharm Arzneimittel 144A 5.50% 1/15/28 # | 200,000 | 166,551 | |||

| CHS 144A 4.75% 2/15/31 # | 90,000 | 66,055 | |||

| DaVita 144A 4.625% 6/1/30 # | 135,000 | 109,483 | |||

| Encompass Health 5.75% 9/15/25 | 120,000 | 118,885 | |||

| HCA | |||||

| 5.375% 2/1/25 | 405,000 | 404,523 | |||

| 5.875% 2/15/26 | 165,000 | 166,432 | |||

| 7.58% 9/15/25 | 80,000 | 83,347 | |||

| ModivCare Escrow Issuer 144A 5.00% 10/1/29 # | 150,000 | 126,414 | |||

| Service Corp International 4.00% 5/15/31 | 285,000 | 244,527 | |||

| Tenet Healthcare | |||||

| 144A 4.25% 6/1/29 # | 160,000 | 139,009 | |||

| 144A 6.125% 10/1/28 # | 170,000 | 150,293 | |||

| 2,117,023 | |||||

| Insurance — 0.93% | |||||

| HUB International 144A 5.625% 12/1/29 # | 215,000 | 188,648 | |||

| NFP | |||||

| 144A 6.875% 8/15/28 # | 160,000 | 135,553 | |||

| 144A 7.50% 10/1/30 # | 60,000 | 57,927 | |||

| USI 144A 6.875% 5/1/25 # | 295,000 | 289,518 | |||

| 671,646 | |||||

| Leisure — 2.73% | |||||

| Boyd Gaming 4.75% 12/1/27 | 289,000 | 269,263 | |||

| Caesars Entertainment 144A 6.25% 7/1/25 # | 295,000 | 291,953 | |||

| Carnival | |||||

| 144A 5.75% 3/1/27 # | 300,000 | 223,500 | |||

| 144A 7.625% 3/1/26 # | 215,000 | 181,558 | |||

| GLP Capital 5.375% 4/15/26 | 110,000 | 106,775 | |||

| Hilton Domestic

Operating 144A 4.00% 5/1/31 # | 475,000 | 400,169 | |||

| Royal Caribbean Cruises 144A 5.50% 4/1/28 # | 448,000 | 366,200 | |||

| Scientific

Games International 144A 7.25% 11/15/29 # | 130,000 | 127,515 | |||

| 1,966,933 | |||||

10

| Principal amount° | Value (US $) | ||||

| Corporate Bonds (continued) | |||||

| Media — 2.83% | |||||

| AMC Networks 4.25% 2/15/29 | 370,000 | $ | 276,227 | ||

| CCO Holdings | |||||

| 144A 4.50% 8/15/30 # | 175,000 | 147,655 | |||

| 4.50% 5/1/32 | 40,000 | 33,053 | |||

| 144A 5.125% 5/1/27 # | 120,000 | 113,714 | |||

| 144A 5.375% 6/1/29 # | 130,000 | 118,129 | |||

| CMG Media 144A 8.875% 12/15/27 # | 145,000 | 110,473 | |||

| CSC Holdings | |||||

| 144A 3.375% 2/15/31 # | 250,000 | 180,778 | |||

| 144A 5.00% 11/15/31 # | 200,000 | 126,712 | |||

| Cumulus Media New Holdings 144A 6.75% 7/1/26 # | 135,000 | 113,346 | |||

| Directv Financing 144A 5.875% 8/15/27 # | 160,000 | 146,999 | |||

| Gray Television 144A 4.75% 10/15/30 # | 290,000 | 215,049 | |||

| Sirius XM Radio 144A 4.00%

7/15/28 # | 325,000 | 287,566 | |||

| VZ

Secured Financing 144A 5.00% 1/15/32 # | 200,000 | 165,752 | |||

| 2,035,453 | |||||

| Real Estate Investment Trusts — 0.17% | |||||

| VICI Properties | |||||

| 144A 3.875% 2/15/29 # | 45,000 | 39,550 | |||

| 144A 5.75% 2/1/27 # | 85,000 | 82,474 | |||

| 122,024 | |||||

| Retail — 1.85% | |||||

| Asbury Automotive Group | |||||

| 144A 4.625% 11/15/29 # | 200,000 | 174,788 | |||

| 4.75% 3/1/30 | 95,000 | 81,386 | |||

| Bath & Body Works | |||||

| 6.875% 11/1/35 | 160,000 | 145,019 | |||

| 6.95% 3/1/33 | 104,000 | 90,376 | |||

| Bloomin' Brands 144A 5.125% 4/15/29 # | 150,000 | 129,782 | |||

| CP Atlas Buyer 144A 7.00% 12/1/28 # | 80,000 | 58,664 | |||

| Levi Strauss & Co. 144A 3.50% 3/1/31 # | 143,000 | 117,576 | |||

| LSF9 Atlantis Holdings 144A 7.75% 2/15/26 # | 195,000 | 180,228 | |||

| Murphy Oil USA 144A 3.75% 2/15/31 # | 145,000 | 118,915 | |||

| PetSmart 144A 7.75% 2/15/29 # | 250,000 | 231,559 | |||

| 1,328,293 | |||||

| Services — 2.16% | |||||

| Aramark Services 144A 5.00% 2/1/28 # | 345,000 | 323,129 | |||

| GFL Environmental 144A 3.75% 8/1/25 # | 59,000 | 55,311 | |||

| Iron Mountain 144A 4.50% 2/15/31 # | 305,000 | 255,758 | |||

| NESCO Holdings II 144A 5.50% 4/15/29 # | 145,000 | 127,740 | |||

| Prime Security Services Borrower 144A 5.75% 4/15/26 # | 220,000 | 218,063 | |||

| Sotheby's 144A 5.875% 6/1/29 # | 200,000 | 166,771 | |||

| United Rentals North America

3.875% 2/15/31 | 149,000 | 128,369 | |||

| Univar Solutions USA 144A 5.125% 12/1/27 # | 140,000 | 134,891 | |||

| White Cap Buyer 144A 6.875% 10/15/28 # | 168,000 | 145,036 | |||

| White Cap Parent 144A PIK 8.25% 3/15/26 #, « | 2,000 | 1,705 | |||

| 1,556,773 | |||||

| Technology & Electronics — 0.93% | |||||

| Entegris Escrow 144A 4.75% 4/15/29 # | 63,000 | 57,099 | |||

| 144A 5.95% 6/15/30 # | 180,000 | 168,363 | |||

| Go Daddy Operating 144A 3.50% 3/1/29 # | 160,000 | 135,413 | |||

| Sensata Technologies 144A

4.00% 4/15/29 # | 60,000 | 52,297 | |||

| SS&C Technologies 144A 5.50% 9/30/27 # | 270,000 | 258,473 | |||

| 671,645 | |||||

| Telecommunications — 2.26% | |||||

| Altice France 144A 5.50% 10/15/29 # | 240,000 | 192,754 | |||

| Altice France Holding 144A 6.00% 2/15/28 # | 305,000 | 205,093 | |||

| Connect Finco 144A 6.75% 10/1/26 # | 200,000 | 189,327 | |||

| Consolidated Communications 144A 5.00% 10/1/28 # | 70,000 | 52,982 | |||

| 144A 6.50% 10/1/28 # | 165,000 | 136,174 | |||

| Digicel International

Finance 144A 8.75% 5/25/24 # | 200,000 | 175,276 | |||

| Frontier Communications Holdings 144A 5.00% 5/1/28 # | 25,000 | 22,276 | |||

| 144A 5.875% 10/15/27 # | 260,000 | 247,728 | |||

| 144A 6.75% 5/1/29 # | 100,000 | 84,138 | |||

| Sprint 7.875% 9/15/23 | 103,000 | 105,363 | |||

11

Schedule of investments

Delaware Investments® Dividend and Income Fund, Inc.

| Principal amount° | Value (US $) | ||||

| Corporate Bonds (continued) | |||||

| Telecommunications (continued) | |||||

| T-Mobile USA | |||||

| 2.625% 4/15/26 | 85,000 | $ | 78,049 | ||

| 3.375% 4/15/29 | 85,000 | 75,255 | |||

| 3.50% 4/15/31 | 66,000 | 57,588 | |||

| 1,622,003 | |||||

| Transportation — 1.19% | |||||

| American Airlines 144A 5.75% 4/20/29 # | 89,108 | 83,050 | |||

| Delta Air Lines 7.375% 1/15/26 | 206,000 | 213,092 | |||

| Laredo Petroleum 144A 7.75% 7/31/29 # | 135,000 | 128,925 | |||

| Mileage Plus Holdings 144A 6.50% 6/20/27 # | 142,500 | 141,965 | |||

| Seaspan 144A 5.50% 8/1/29 # | 225,000 | 173,624 | |||

| United Airlines | |||||

| 144A 4.375% 4/15/26 # | 55,000 | 51,261 | |||

| 144A 4.625% 4/15/29 # | 70,000 | 62,388 | |||

| 854,305 | |||||

| Utilities — 0.93% | |||||

| Calpine | |||||

| 144A 5.00% 2/1/31 # | 285,000 | 246,826 | |||

| 144A 5.25% 6/1/26 # | 48,000 | 46,045 | |||

| PG&E 5.25% 7/1/30 | 90,000 | 81,639 | |||

| Vistra | |||||

| 144A 7.00% 12/15/26 #, µ, ψ | 200,000 | 179,152 | |||

| 144A 8.00% 10/15/26 #, µ, ψ | 120,000 | 114,221 | |||

| 667,883 | |||||

| Total Corporate Bonds (cost $25,197,452) | 22,409,656 | ||||

| Number of shares | |||||

| Common Stocks — 89.59% | |||||

| Communication Services — 6.39% | |||||

| Century Communications =, † | 500,000 | 0 | |||

| Comcast Class A | 44,948 | 1,646,894 | |||

| Verizon Communications | 37,300 | 1,453,954 | |||

| Walt Disney † | 15,279 | 1,495,356 | |||

| 4,596,204 | |||||

| Consumer Discretionary — 7.52% | |||||

| Dollar General | 7,175 | 1,834,504 | |||

| Dollar Tree † | 11,600 | 1,743,364 | |||

| TJX | 22,900 | 1,833,145 | |||

| 5,411,013 | |||||

| Consumer Staples — 5.41% | |||||

| Archer-Daniels-Midland | 19,800 | 1,930,500 | |||

| Conagra Brands | 51,663 | 1,962,161 | |||

| 3,892,661 | |||||

| Energy — 2.57% | |||||

| ConocoPhillips | 14,979 | 1,850,056 | |||

| 1,850,056 | |||||

| Financials — 13.07% | |||||

| American International Group | 31,500 | 1,987,965 | |||

| Discover Financial Services | 17,600 | 1,907,136 | |||

| MetLife | 25,864 | 1,983,769 | |||

| Truist Financial | 38,200 | 1,788,142 | |||

| US Bancorp | 38,200 | 1,733,898 | |||

| 9,400,910 | |||||

| Healthcare — 15.39% | |||||

| Baxter International | 31,900 | 1,803,307 | |||

| Cigna | 5,208 | 1,712,859 | |||

| CVS Health | 17,500 | 1,782,900 | |||

| Healthcare Realty Trust | 2,740 | 56,252 | |||

| Hologic † | 24,459 | 1,862,798 | |||

| Johnson & Johnson | 10,400 | 1,851,200 | |||

| Merck & Co. | 18,200 | 2,004,184 | |||

| 11,073,500 | |||||

| Industrials — 10.59% | |||||

| Dover | 13,295 | 1,887,226 | |||

| Honeywell International | 8,924 | 1,959,264 | |||

| Northrop Grumman | 3,400 | 1,813,186 | |||

| Raytheon Technologies | 19,814 | 1,956,038 | |||

| 7,615,714 | |||||

| Information Technology — 14.74% | |||||

| Broadcom | 3,300 | 1,818,399 | |||

| Cisco Systems | 38,000 | 1,889,360 | |||

| Cognizant Technology Solutions Class A | 24,782 | 1,541,688 | |||

| Fidelity National Information Services | 19,139 | 1,389,109 | |||

| Motorola Solutions | 7,100 | 1,932,620 | |||

| Oracle | 24,500 | 2,034,235 | |||

| 10,605,411 | |||||

| Materials — 2.74% | |||||

| DuPont de Nemours | 27,932 | 1,969,485 | |||

| 1,969,485 | |||||

| REIT Diversified — 0.08% | |||||

| LXP Industrial Trust | 5,276 | 56,770 | |||

| 56,770 | |||||

| REIT Healthcare — 0.68% | |||||

| Alexandria Real Estate Equities | 840 | 130,712 | |||

| CareTrust REIT | 2,570 | 50,886 | |||

12

| Number of shares | Value (US $) | ||||

| Common Stocks (continued) | |||||

| REIT Healthcare (continued) | |||||

| Healthpeak Properties | 2,300 | $ | 60,398 | ||

| Medical Properties Trust | 4,020 | 52,742 | |||

| Ventas | 741 | 34,479 | |||

| Welltower | 2,254 | 160,102 | |||

| 489,319 | |||||

| REIT Hotel — 0.28% | |||||

| Gaming and Leisure Properties | 1,140 | 59,975 | |||

| VICI Properties | 4,068 | 139,126 | |||

| 199,101 | |||||

| REIT Industrial — 0.98% | |||||

| Plymouth Industrial REIT | 860 | 17,802 | |||

| Prologis | 5,520 | 650,201 | |||

| Terreno Realty | 610 | 35,770 | |||

| 703,773 | |||||

| REIT Information Technology — 0.66% | |||||

| Digital Realty Trust | 1,338 | 150,471 | |||

| Equinix | 466 | 321,843 | |||

| 472,314 | |||||

| REIT Lodging — 0.23% | |||||

| Apple Hospitality REIT | 6,429 | 109,679 | |||

| Chatham Lodging Trust † | 3,288 | 43,960 | |||

| Host Hotels & Resorts | 720 | 13,637 | |||

| 167,276 | |||||

| REIT Mall — 0.20% | |||||

| Simon Property Group | 1,196 | 142,850 | |||

| 142,850 | |||||

| REIT Manufactured Housing — 0.26% | |||||

| Equity LifeStyle Properties | 1,300 | 86,346 | |||

| Sun Communities | 700 | 102,830 | |||

| 189,176 | |||||

| REIT Multifamily — 2.91% | |||||

| American Homes 4 Rent Class A | 1,505 | 49,770 | |||

| AvalonBay Communities | 742 | 129,776 | |||

| Camden Property Trust | 583 | 70,153 | |||

| Equity Residential | 24,963 | 1,619,100 | |||

| Essex Property Trust | 500 | 110,190 | |||

| Mid-America Apartment Communities | 499 | 82,275 | |||

| UDR | 775 | 32,139 | |||

| 2,093,403 | |||||

| REIT Office — 0.24% | |||||

| Cousins Properties | 1,866 | 49,225 | |||

| Douglas Emmett | 870 | 15,069 | |||

| Highwoods Properties | 1,693 | 50,452 | |||

| Kilroy Realty | 665 | 28,741 | |||

| Piedmont Office Realty Trust Class A | 2,491 | 25,931 | |||

| 169,418 | |||||

| REIT Self-Storage — 0.80% | |||||

| CubeSmart | 778 | 32,201 | |||

| Extra Space Storage | 931 | 149,602 | |||

| Life Storage | 937 | 100,718 | |||

| National Storage Affiliates Trust | 880 | 35,033 | |||

| Public Storage | 860 | 256,246 | |||

| 573,800 | |||||

| REIT Shopping Center — 0.61% | |||||

| Agree Realty | 500 | 34,975 | |||

| Brixmor Property Group | 3,795 | 87,968 | |||

| Kimco Realty | 3,094 | 70,914 | |||

| Kite Realty Group Trust | 2,542 | 57,958 | |||

| Regency Centers | 1,065 | 70,748 | |||

| Retail Opportunity Investments | 3,914 | 59,688 | |||

| SITE Centers | 3,096 | 42,075 | |||

| Urban Edge Properties | 831 | 13,072 | |||

| 437,398 | |||||

| REIT Single Tenant — 0.49% | |||||

| Four Corners Property Trust | 1,611 | 43,723 | |||

| National Retail Properties | 755 | 35,002 | |||

| Realty Income | 2,330 | 146,953 | |||

| Spirit Realty Capital | 1,358 | 56,248 | |||

| STORE Capital | 2,229 | 71,105 | |||

| 353,031 | |||||

| REIT Specialty — 0.38% | |||||

| EPR Properties | 225 | 9,362 | |||

| Essential Properties Realty Trust | 1,905 | 44,215 | |||

| Invitation Homes | 4,276 | 139,526 | |||

| Lamar Advertising Class A | 240 | 24,034 | |||

| Outfront Media | 570 | 10,425 | |||

| WP Carey | 610 | 48,068 | |||

| 275,630 | |||||

| Utilities — 2.37% | |||||

| Edison International | 25,600 | 1,706,496 | |||

| 1,706,496 | |||||

| Total Common Stocks (cost $52,624,710) | 64,444,709 | ||||

| Convertible Preferred Stock — 1.29% | |||||

| 2020 Mandatory Exchangeable Trust 144A 6.50% exercise price $47.09, maturity date 5/16/23 # | 95 | 96,709 | |||

| Algonquin Power & Utilities 7.75% exercise price $18.00, maturity date 6/15/24 | 3,449 | 90,364 | |||

13

Schedule of investments

Delaware Investments® Dividend and Income Fund, Inc.

| Number of shares | Value (US $) | ||||

| Convertible Preferred Stock (continued) | |||||

| AMG Capital Trust II 5.15% exercise price $195.47, maturity date 10/15/37 | 1,374 | $ | 71,063 | ||

| Bank of America 7.25% exercise price $50.00 ω | 96 | 116,973 | |||

| El Paso Energy Capital Trust I 4.75% exercise price $34.49, maturity date 3/31/28 | 3,327 | 152,543 | |||

| Elanco Animal Health 5.00% exercise price $38.40, maturity date 2/1/23 | 2,890 | 59,939 | |||

| Lyondellbasell Advanced Polymers 6.00% exercise price $52.33 ω | 133 | 113,050 | |||

| RBC Bearings 5.00% exercise price $226.60, maturity date 10/15/24 | 623 | 72,137 | |||

| UGI 7.25% exercise price $52.57, maturity date 6/1/24 | 1,715 | 151,349 | |||

| Total Convertible Preferred Stock (cost $1,051,746) | 924,127 | ||||

| Short-Term Investments — 1.73% | |||||

| Money Market Mutual Funds — 1.73% | |||||

| BlackRock Liquidity FedFund - Institutional Shares (seven-day effective yield 3.55%) | 310,963 | 310,963 | |||

| Fidelity Investments Money Market Government Portfolio - Class I (seven-day effective yield 3.56%) | 310,963 | 310,963 | |||

| Goldman Sachs Financial Square Government Fund - Institutional Shares (seven-day effective yield 3.80%) | 310,963 | 310,963 | |||

| Morgan Stanley Institutional Liquidity Funds Government Portfolio - Institutional Class (seven-day effective yield 3.62%) | 310,963 | 310,963 | |||

| Total Short-Term

Investments (cost $1,243,852) | 1,243,852 | ||||

| Total Value of Securities—132.73%

(cost $86,445,624) | $95,473,546 | ||||

| ° | Principal amount shown is stated in USD unless noted that the security is denominated in another currency. |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At November 30, 2022, the aggregate value of Rule 144A securities was $17,407,070, which represents 24.20% of the Fund's net assets. See Note 9 in “Notes to financial statements." |

| ^ | Zero-coupon security. The rate shown is the effective yield at the time of purchase. |

| « | PIK. The first payment of cash and/or principal will be made after November 30, 2022. |

| µ | Fixed to variable rate investment. The rate shown reflects the fixed rate in effect at November 30, 2022. Rate will reset at a future date. |

| ψ | Perpetual security. Maturity date represents next call date. |

| = | The value of this security was determined using significant unobservable inputs and is reported as a Level 3 security in the disclosure table located in Note 3 in “Notes to financial statements.” |

| † | Non-income producing security. |

| ω | Perpetual security with no stated maturity date. |

Summary of abbreviations:

DAC - Designated Activity Company

MSCI - Morgan Stanley Capital International

PIK - Payment-in-kind

REIT - Real Estate Investment Trust

USD - US Dollar

See accompanying notes, which are an integral part of the financial statements.

14

Statement of assets and liabilities

Delaware Investments® Dividend and Income Fund, Inc.

November 30, 2022

| Assets: | |||

| Investments, at value* | $ | 95,473,546 | |

| Foreign currencies, at value∆ | 3,221 | ||

| Dividends and interest receivable | 544,709 | ||

| Receivable for securities sold | 121,330 | ||

| Foreign tax reclaims receivable | 3,680 | ||

| Other assets | 569 | ||

| Total Assets | 96,147,055 | ||

| Liabilities: | |||

| Due to custodian | 23,685 | ||

| Borrowing under line of credit | 24,000,000 | ||

| Other accrued expenses | 134,773 | ||

| Investment management fees payable to affiliates | 42,155 | ||

| Administration expenses payable to affiliates | 9,838 | ||

| Interest expense payable on line of credit | 3,340 | ||

| Total Liabilities | 24,213,791 | ||

| Total Net Assets | $ | 71,933,264 | |

| Net Assets Consist of: | |||

| Common stock, $0.01 par value, 500,000,000 shares authorized to the Fund | $ | 61,270,461 | |

| Total distributable earnings (loss) | 10,662,803 | ||

| Total Net Assets | $ | 71,933,264 | |

| Common Shares: | |||

| Net assets | $ | 71,933,264 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | 7,611,158 | ||

| Net asset value per share | $ | 9.45 | |

| * Investments, at cost | $ | 86,445,624 | |

| ∆ Foreign currencies, at cost | 3,018 | ||

See accompanying notes, which are an integral part of the financial statements.

15

Delaware Investments® Dividend and Income Fund, Inc.

Year ended November 30, 2022

| Investment Income: | |||

| Dividends | $ | 1,687,083 | |

| Interest | 1,388,984 | ||

| Foreign tax withheld | (1,258 | ) | |

| 3,074,809 | |||

| Expenses: | |||

| Management fees | 560,327 | ||

| Interest expense | 607,831 | ||

| Dividend disbursing and transfer agent fees and expenses | 103,286 | ||

| Reports and statements to shareholders expenses | 101,473 | ||

| Accounting and administration expenses | 59,849 | ||

| Legal fees | 48,815 | ||

| Audit and tax fees | 41,767 | ||

| Directors' fees and expenses | 7,846 | ||

| Custodian fees | 6,725 | ||

| Registration fees | 134 | ||

| Other | 115,436 | ||

| Total operating expenses | 1,653,489 | ||

| Net Investment Income (Loss) | 1,421,320 | ||

| Net Realized and Unrealized Gain (Loss): | |||

| Net realized gain (loss) on: | |||

| Investments | 5,631,994 | ||

| Foreign currencies | (42 | ) | |

| Net realized gain (loss) | 5,631,952 | ||

| Net change in unrealized appreciation (depreciation) on: | |||

| Investments | (7,314,173 | ) | |

| Foreign currencies | (80 | ) | |

| Net change in unrealized appreciation (depreciation) | (7,314,253 | ) | |

| Net Realized and Unrealized Gain (Loss) | (1,682,301 | ) | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | (260,981 | ) |

See accompanying notes, which are an integral part of the financial statements.

16

Statements of changes in net assets

Delaware Investments® Dividend and Income Fund, Inc.

| Year ended | |||||||

| 11/30/22 | 11/30/21 | ||||||

| Increase (Decrease) in Net Assets from Operations: | |||||||

| Net investment income (loss) | $ | 1,421,320 | $ | 1,899,995 | |||

| Net realized gain (loss) | 5,631,952 | 6,753,905 | |||||

| Net change in unrealized appreciation (depreciation) | (7,314,253 | ) | 4,627,757 | ||||

| Net increase (decrease) in net assets resulting from operations | (260,981 | ) | 13,281,657 | ||||

| Dividends and Distributions to Shareholders from: | |||||||

| Distributable earnings | (8,038,905 | ) | (5,886,470 | ) | |||

| Total distributions to shareholders | (8,038,905 | ) | (5,886,470 | ) | |||

| Net Increase (Decrease) in Net Assets | (8,299,886 | ) | 7,395,187 | ||||

| Net Assets: | |||||||

| Beginning of year | 80,233,150 | 72,837,963 | |||||

| End of year | $ | 71,933,264 | $ | 80,233,150 | |||

See accompanying notes, which are an integral part of the financial statements.

17

Delaware Investments® Dividend and Income Fund, Inc.

Year ended November 30, 2022

| Cash flows provided by (used for) operating activities: | |||

| Net increase (decrease) in net assets resulting from operations | $ | (260,981 | ) |

| Adjustments to reconcile net increase (decrease) in net assets from operations to net cash provided by (used for) operating activities: |

|||

| Amortization of premium and accretion of discount on investments, net | 106,218 | ||

| Proceeds from disposition of investment securities | 28,385,731 | ||

| Purchase of investment securities | (20,581,754 | ) | |

| Proceeds (purchase) from disposition of short-term investment securities, net | 3,586,324 | ||

| Net realized (gain) loss on investments | (5,631,994 | ) | |

| Net change in unrealized (appreciation) depreciation of investments | 7,314,173 | ||

| Net change in unrealized (appreciation) depreciation of foreign currencies | 80 | ||

| Return of capital distributions on investments | 108,094 | ||

| (Increase) decrease in receivable for securities sold | 586,280 | ||

| (Increase) decrease in dividends and interest receivable | 18,435 | ||

| Increase (decrease) in foreign tax reclaims receivable | 45 | ||

| Increase (decrease) in other assets | (569 | ) | |

| Increase (decrease) in payable for securities purchased | (75,805 | ) | |

| Increase (decrease) in administration expenses payable to affiliates | 9,175 | ||

| Increase (decrease) in investment management fees payable to affiliates | (9,079 | ) | |

| Increase (decrease) in reports and statements to shareholders expenses payable to affiliates | (84 | ) | |

| Increase (decrease) in directors' fees and expense payable to affiliates | (251 | ) | |

| Increase (decrease) in legal fees payable to affiliates | (925 | ) | |

| Increase (decrease) in other accrued expenses | 23,281 | ||

| (Increase) decrease in interest expense payable on line of credit | 3,340 | ||

| Total adjustments | 13,840,715 | ||

| Net cash provided by (used for) operating activities | 13,579,734 | ||

| Cash provided by (used for) financing activities: | |||

| Cash received from borrowings under line of credit | 2,500,000 | ||

| Cash payments to reduce borrowing under line of credit | (8,000,000 | ) | |

| Cash dividends and distributions paid to shareholders | (8,038,905 | ) | |

| Increase (decrease) in bank overdraft | (37,528 | ) | |

| Net cash provided by (used for) financing activities | (13,576,433 | ) | |

| Effect of exchange rates on cash | (80 | ) | |

| Net increase (decrease) in cash | 3,221 | ||

| Cash and foreign currencies at beginning of year | — | ||

| Cash and foreign currencies at end of year | $ | 3,221 | |

| Cash paid during the period for interest expense from borrowings | $ | 604,491 | |

See accompanying notes, which are an integral part of the financial statements.

18

Delaware Investments® Dividend and Income Fund, Inc.

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Year ended | ||||||||||||||||||||

| 11/30/22 | 11/30/21 | 11/30/20 | 11/30/19 | 11/30/18 | ||||||||||||||||

| Net asset value, beginning of period | $ | 10.54 | $ | 9.57 | $ | 10.99 | $ | 11.09 | $ | 12.09 | ||||||||||

| Income (loss) from investment operations | ||||||||||||||||||||

| Net investment income1 | 0.19 | 0.25 | 0.26 | 0.31 | 0.28 | |||||||||||||||

| Net realized and unrealized gain (loss) | (0.23 | ) | 1.49 | (0.83 | ) | 0.68 | 0.01 | |||||||||||||

| Total from investment operations | (0.04 | ) | 1.74 | (0.57 | ) | 0.99 | 0.29 | |||||||||||||

| Less dividends and distributions from: | ||||||||||||||||||||

| Net investment income | (1.05 | ) | (0.77 | ) | (0.44 | ) | (1.09 | ) | (0.95 | ) | ||||||||||

| Net realized gain | — | — | — | — | (0.34 | ) | ||||||||||||||

| Return of capital | — | — | (0.41 | ) | — | — | ||||||||||||||

| Total dividends and distributions | (1.05 | ) | (0.77 | ) | (0.85 | ) | (1.09 | ) | (1.29 | ) | ||||||||||

| Net asset value, end of period | $ | 9.45 | $ | 10.54 | $ | 9.57 | $ | 10.99 | $ | 11.09 | ||||||||||

| Market value, end of period | $ | 8.53 | $ | 10.82 | $ | 8.90 | $ | 14.09 | $ | 12.42 | ||||||||||

| Total return based on:2 | ||||||||||||||||||||

| Net asset value | (0.47% | ) | 18.39% | (4.95% | ) | 7.51% | 3 | 2.55% | ||||||||||||

| Market value | (12.49% | ) | 30.69% | (31.05% | ) | 23.07% | 27.97% | |||||||||||||

| Ratios and supplemental data: | ||||||||||||||||||||

| Net assets, end of period (000 omitted) | $ | 71,933 | $ | 80,233 | $ | 72,838 | $ | 84,481 | $ | 85,244 | ||||||||||

| Ratio of expenses to average net assets4, 5, 6, 7 | 2.23% | 1.75% | 2.12% | 3.15% | 2.48% | |||||||||||||||

| Ratio of net investment income to average net assets8 | 1.91% | 2.35% | 2.78% | 2.88% | 2.37% | |||||||||||||||

| Portfolio turnover | 21% | 38% | 56% | 52% | 29% | |||||||||||||||

| Leverage analysis: | ||||||||||||||||||||

| Debt outstanding at end of period at par (000 omitted) | $ | 24,000 | $ | 29,500 | $ | 25,900 | $ | 35,000 | $ | 40,000 | ||||||||||

| Asset coverage per $1,000 of debt outstanding at end of period | $ | 3,997 | $ | 3,720 | $ | 3,812 | $ | 3,414 | $ | 3,131 | ||||||||||

| 1 | Calculated using average shares outstanding. |

| 2 | Total return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for the purpose of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Generally, total investment return based on net asset value will be higher than total investment return based on market value in periods where there is an increase in the discount or decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total return based on net asset value will be lower than total return based on market value in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods. |

| 3 | General Motors term loan litigation were included in total return. If excluded, the impact on the total return would be 0.18% lower. |

| 4 | Expense ratios do not include expenses of any investment companies in which the Fund invests. |

| 5 | The ratio of expenses before interest expense to adjusted average net assets (excluding debt outstanding) for the years ended November 30, 2022, 2021, 2020, 2019, and 2018 were 1.03%, 1.02%, 1.08%, 1.26%, and 0.86%, respectively. |

| 6 | The ratio of interest expense to average net assets for the years ended November 30, 2022, 2021, 2020, 2019, and 2018 were 0.82%, 0.36%, 0.61%, 1.35%, and 1.23% respectively. |

| 7 | The ratio of interest expense to adjusted average net assets (excluding debt outstanding) for the years ended November 30, 2022, 2021, 2020, 2019, and 2018 were 0.60%, 0.27%, 0.43%, 0.95%, and 0.85%, respectively. |

| 8 | The ratio of net investment income to adjusted average net assets (excluding debt outstanding) for the years ended November 30, 2022, 2021, 2020, 2019, and 2018 were 1.40%, 1.73%, 1.99%, 2.03%, and 1.64%, respectively. |

See accompanying notes, which are an integral part of the financial statements.

19

Delaware Investments® Dividend and Income Fund, Inc.

November 30, 2022

Delaware Investments® Dividend and Income Fund, Inc. (Fund) is organized as a Maryland corporation and is a diversified closed-end management investment company under the Investment Company Act of 1940, as amended (1940 Act). The Fund’s shares trade on the New York Stock Exchange (NYSE) under the symbol DDF.

1. Significant Accounting Policies

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services — Investment Companies. The following accounting policies are in accordance with US generally accepted accounting principles (US GAAP) and are consistently followed by the Fund.

Security Valuation — Equity securities and exchange-traded funds (ETFs), except those traded on the Nasdaq Stock Market LLC (Nasdaq), are valued at the last quoted sales price as of the time of the regular close of the NYSE on the valuation date. Equity securities and ETFs traded on the Nasdaq are valued in accordance with the Nasdaq Official Closing Price, which may not be the last sales price. If, on a particular day, an equity security or ETF does not trade, the mean between the bid and the ask prices will be used, which approximates fair value. Equity securities listed on a foreign exchange are normally valued at the last quoted sales price on the valuation date. US government and agency securities are valued at the mean between the bid and the ask prices, which approximates fair value. Other debt securities are valued based upon valuations provided by an independent pricing service or broker and reviewed by management. To the extent current market prices are not available, the pricing service may take into account developments related to the specific security, as well as transactions in comparable securities. Valuations for fixed income securities utilize matrix systems, which reflect such factors as security prices, yields, maturities, and ratings, and are supplemented by dealer and exchange quotations. Open-end investment companies, other than ETFs, are valued at their published net asset value (NAV). Foreign currency exchange contracts are valued at the mean between the bid and the ask prices, which approximates fair value. Interpolated values are derived when the settlement date of the contract is an interim date for which quotations are not available. Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith by the Fund’s valuation designee, Delaware Management Company (DMC). Subject to the oversight of the Fund’s Board of Trustees (Board), DMC, as valuation designee, has adopted policies and procedures to fair value securities for which market quotations are not readily available consistent with the requirements of Rule 2a-5 under the 1940 Act. In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. Restricted securities and private placements are valued at fair value.

Federal and Foreign Income Taxes — No provision for federal income taxes has been made as the Fund intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to shareholders. The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the “more-likely-than-not” threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken or expected to be taken on the Fund’s federal income tax returns through the year ended November 30, 2022 and for all open tax years (years ended November 30, 2019-November 30, 2021), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. In regard to foreign taxes only, the Fund has open tax years in certain foreign countries in which it invests that may date back to the inception of the Fund. If applicable, the Fund recognizes interest accrued on unrecognized tax benefits in interest expense and penalties in “Other” on the “Statement of operations.” During the year ended November 30, 2022, the Fund did not incur any interest or tax penalties.

Distributions — The Fund has implemented a managed distribution policy. Under the policy, the Fund is managed with a goal of generating as much of the distribution as possible from net investment income and short-term capital gains. The balance of the distribution will then come from long-term capital gains to the extent permitted, and if necessary, a return of capital. A return of capital may occur for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.” Even though the Fund may realize current year capital gains, such gains may be offset, in whole or in part, by the Fund’s capital loss carryovers from prior years. The Fund’s managed distribution policy is described in more detail on the inside front cover of this report.

Cash and Cash Equivalents — Cash and cash equivalents include deposits held at financial institutions, which are available for the Fund’s use with no restrictions, with original maturities of 90 days or less.

20

Foreign Currency Transactions — Transactions denominated in foreign currencies are recorded at the prevailing exchange rates on the valuation date in accordance with the Fund’s prospectus. The value of all assets and liabilities denominated in foreign currencies is translated daily into US dollars at the exchange rate of such currencies against the US dollar. Transaction gains or losses resulting from changes in exchange rates during the reporting period or upon settlement of the foreign currency transaction are reported in operations for the current period. The Fund generally does not bifurcate that portion of realized gains and losses on investments which is due to changes in foreign exchange rates from that which is due to changes in market prices. These gains and losses are included on the “Statement of operations” under “Net realized gain (loss) on investments.” The Fund reports certain foreign currency related transactions as components of realized gains (losses) for financial reporting purposes, whereas such components are treated as ordinary income (loss) for federal income tax purposes.

Use of Estimates — The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the fair value of investments, the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material.

Other — Expenses directly attributable to the Fund are charged directly to the Fund. Other expenses common to various funds within the Delaware Funds by Macquarie® (Delaware Funds) are generally allocated among such funds on the basis of average net assets. Management fees and certain other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Income and capital gain distributions from any investment companies (Underlying Funds) in which the Fund invests are recorded on the ex-dividend date. Discounts and premiums on debt securities are accreted or amortized to interest income, respectively, over the lives of the respective securities using the effective interest method. Distributions received from investments in real estate investment trusts (REITs) are recorded as dividend income on the ex-dividend date, subject to reclassification upon notice of the character of such distributions by the issuer. The financial statements reflect an estimate of the reclassification of the distribution character. Distributions received from investments in master limited partnerships are recorded as return of capital on the ex-dividend date. Foreign dividends are also recorded on the ex-dividend date or as soon after the ex-dividend date that the Fund is aware of such dividends, net of all tax withholdings, a portion of which may be reclaimable. Withholding taxes and reclaims on foreign dividends have been recorded in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Fund pays DMC, a series of Macquarie Investment Management Business Trust, and the investment manager, an annual fee of 0.55%, calculated daily and paid monthly, of the adjusted average daily net assets of the Fund. For purposes of the calculation of investment management fees, adjusted average daily net assets excludes the line of credit liability.

DMC’s affiliate, Macquarie Investment Management Austria Kapitalanlage AG (MIMAK), acts as sub-advisor to the Manager and provides asset allocation services to the Fund. MIMAK has primary day-to-day responsibility for managing the Fund and may allocate assets to its affiliate, Macquarie Investment Management Global Limited (MIMGL), to invest in real estate investment trust securities and other equity asset classes to which MIMAK may allocate assets. MIMAK may also allocate assets to the Manager.

DMC, and as applicable, MIMAK, may seek investment advice and recommendations from its affiliates: Macquarie Investment Management Europe Limited, MIMAK, and MIMGL (together, the “Affiliated Fixed Income Sub-Advisors”). The Manager may also permit these Affiliated Fixed Income Sub-Advisors to execute Fund fixed income security trades on behalf of the Manager and exercise investment discretion for securities in certain markets where DMC believes it will be beneficial to utilize an Affiliated Fixed Income Sub-Advisor’s specialized market knowledge. DMC may permit its affiliates, MIMGL and Macquarie Funds Management Hong Kong Limited (together, the “Affiliated Equity Sub-Advisors”), to execute Fund equity security trades on behalf of the Manager. The Manager may also seek quantitative support from MIMGL. Although the Affiliated Equity Sub-Advisors serve as sub-advisors, DMC has ultimate responsibility for all investment advisory services. For these services, DMC, not the Fund, may pay each Affiliated Fixed Income Sub-Advisor and Affiliated Equity Sub-Advisor a portion of its investment management fee.

21

Notes to financial statements

Delaware Investments® Dividend and Income Fund, Inc.

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates (continued)