false--07-31FY20200000896878P5M0.050.0561000000P7YP3M300000012000000P3Y0.010.017500000007500000002601800002617400000.006500.009500.013500.01650P2YP3Y00000us:gaap_OtherLiabilitiesCurrent0.010.01134500014500025000013450001450002500000000P30YP5YP16YP6YP2YP5YP3YP2YP2YP3YP5YP3YP3Y0.01100.00870.00950.00850.00730.00670.00950.00740.250.200.330.270.210.260.720.230.01960.01050.02440.02920.01940.01840.02230.0024

0000896878

2019-08-01

2020-07-31

0000896878

2019-01-31

0000896878

2020-08-24

0000896878

2017-08-01

2018-07-31

0000896878

2018-08-01

2019-07-31

0000896878

us-gaap:ProductMember

2017-08-01

2018-07-31

0000896878

us-gaap:ProductMember

2018-08-01

2019-07-31

0000896878

us-gaap:ProductMember

2019-08-01

2020-07-31

0000896878

us-gaap:ServiceMember

2018-08-01

2019-07-31

0000896878

us-gaap:ServiceMember

2017-08-01

2018-07-31

0000896878

us-gaap:ServiceMember

2019-08-01

2020-07-31

0000896878

2020-07-31

0000896878

2019-07-31

0000896878

us-gaap:SeriesAPreferredStockMember

2020-07-31

0000896878

us-gaap:SeriesBPreferredStockMember

2020-07-31

0000896878

us-gaap:SeriesBPreferredStockMember

2019-07-31

0000896878

us-gaap:SeriesAPreferredStockMember

2019-07-31

0000896878

us-gaap:RetainedEarningsMember

2018-07-31

0000896878

us-gaap:CommonStockMember

2019-08-01

2020-07-31

0000896878

us-gaap:CommonStockMember

2020-07-31

0000896878

us-gaap:RetainedEarningsMember

2017-08-01

2018-07-31

0000896878

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-07-31

0000896878

us-gaap:CommonStockMember

2019-07-31

0000896878

us-gaap:AdditionalPaidInCapitalMember

2018-08-01

2019-07-31

0000896878

us-gaap:CommonStockMember

2018-07-31

0000896878

us-gaap:AdditionalPaidInCapitalMember

2018-07-31

0000896878

us-gaap:TreasuryStockMember

2017-07-31

0000896878

us-gaap:RetainedEarningsMember

2019-07-31

0000896878

us-gaap:CommonStockMember

2017-07-31

0000896878

us-gaap:AdditionalPaidInCapitalMember

2019-08-01

2020-07-31

0000896878

us-gaap:RetainedEarningsMember

2018-08-01

2019-07-31

0000896878

us-gaap:RetainedEarningsMember

2017-07-31

0000896878

us-gaap:TreasuryStockMember

2019-08-01

2020-07-31

0000896878

us-gaap:TreasuryStockMember

2017-08-01

2018-07-31

0000896878

us-gaap:CommonStockMember

2017-08-01

2018-07-31

0000896878

us-gaap:TreasuryStockMember

2019-07-31

0000896878

2017-07-31

0000896878

us-gaap:RetainedEarningsMember

2019-08-01

2020-07-31

0000896878

us-gaap:TreasuryStockMember

2018-08-01

2019-07-31

0000896878

us-gaap:AdditionalPaidInCapitalMember

2017-08-01

2018-07-31

0000896878

us-gaap:AdditionalPaidInCapitalMember

2020-07-31

0000896878

us-gaap:AdditionalPaidInCapitalMember

2019-07-31

0000896878

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-07-31

0000896878

us-gaap:TreasuryStockMember

2020-07-31

0000896878

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-07-31

0000896878

us-gaap:CommonStockMember

2018-08-01

2019-07-31

0000896878

us-gaap:AdditionalPaidInCapitalMember

2017-07-31

0000896878

2018-07-31

0000896878

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-08-01

2018-07-31

0000896878

us-gaap:RetainedEarningsMember

2020-07-31

0000896878

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-08-01

2020-07-31

0000896878

us-gaap:TreasuryStockMember

2018-07-31

0000896878

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2017-07-31

0000896878

srt:RestatementAdjustmentMember

2017-08-01

2018-07-31

0000896878

srt:RestatementAdjustmentMember

2018-08-01

2019-07-31

0000896878

srt:MaximumMember

2019-08-01

2020-07-31

0000896878

intu:SmallBusinessAdministrationSBACARESActPaycheckProtectionProgramMember

2020-07-31

0000896878

us-gaap:AccountingStandardsUpdate201602Member

2019-08-01

0000896878

srt:MaximumMember

us-gaap:SoftwareDevelopmentMember

2019-08-01

2020-07-31

0000896878

srt:MaximumMember

2020-07-31

0000896878

srt:MinimumMember

2019-08-01

2020-07-31

0000896878

srt:MinimumMember

us-gaap:SoftwareDevelopmentMember

2019-08-01

2020-07-31

0000896878

srt:MinimumMember

2020-07-31

0000896878

us-gaap:CashAndCashEquivalentsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:CashAndCashEquivalentsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

intu:AvailableForSaleDebtSecuritiesInInvestmentsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:CashAndCashEquivalentsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

intu:AvailableForSaleDebtSecuritiesInInvestmentsMember

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

intu:AvailableForSaleDebtSecuritiesInFundsHeldForCustomersMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

intu:AvailableForSaleDebtSecuritiesInInvestmentsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

intu:AvailableForSaleDebtSecuritiesInFundsHeldForCustomersMember

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

intu:AvailableForSaleDebtSecuritiesInInvestmentsMember

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

intu:AvailableForSaleDebtSecuritiesInFundsHeldForCustomersMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

intu:AvailableForSaleDebtSecuritiesInFundsHeldForCustomersMember

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:CashAndCashEquivalentsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

us-gaap:CashAndCashEquivalentsMember

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

intu:AvailableForSaleDebtSecuritiesInFundsHeldForCustomersMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

intu:AvailableForSaleDebtSecuritiesInInvestmentsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

intu:AvailableForSaleDebtSecuritiesInFundsHeldForCustomersMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

intu:AvailableForSaleDebtSecuritiesInInvestmentsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:CashAndCashEquivalentsMember

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

intu:SeniorUnsecuredNotesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

us-gaap:CorporateNoteSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:CorporateNoteSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

us-gaap:MunicipalBondsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

intu:SeniorUnsecuredNotesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:MunicipalBondsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:MunicipalBondsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

intu:SeniorUnsecuredNotesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:MunicipalBondsMember

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

intu:SeniorUnsecuredNotesMember

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

us-gaap:MunicipalBondsMember

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:CorporateNoteSecuritiesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

intu:SeniorUnsecuredNotesMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

intu:SeniorUnsecuredNotesMember

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

us-gaap:CorporateNoteSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

us-gaap:CorporateNoteSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:MunicipalBondsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2019-07-31

0000896878

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:CorporateNoteSecuritiesMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2020-07-31

0000896878

us-gaap:FairValueInputsLevel3Member

2020-07-31

0000896878

intu:SeniorUnsecuredNotesMember

2020-07-31

0000896878

us-gaap:ShortTermInvestmentsMember

2019-07-31

0000896878

intu:FundsHeldForCustomersMember

2020-07-31

0000896878

intu:FundsHeldForCustomersMember

2019-07-31

0000896878

intu:LongTermInvestmentMember

2020-07-31

0000896878

intu:LongTermInvestmentMember

2019-07-31

0000896878

us-gaap:ShortTermInvestmentsMember

2020-07-31

0000896878

us-gaap:CashAndCashEquivalentsMember

2019-07-31

0000896878

us-gaap:CashAndCashEquivalentsMember

2020-07-31

0000896878

intu:CashAndCashEquivalentsIncludingFundsHeldForCustomersMember

2019-07-31

0000896878

us-gaap:CorporateNoteSecuritiesMember

2020-07-31

0000896878

us-gaap:AvailableforsaleSecuritiesMember

2019-07-31

0000896878

us-gaap:MunicipalBondsMember

2019-07-31

0000896878

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2019-07-31

0000896878

us-gaap:OtherLongTermInvestmentsMember

2020-07-31

0000896878

us-gaap:AvailableforsaleSecuritiesMember

2020-07-31

0000896878

intu:CashAndCashEquivalentsIncludingFundsHeldForCustomersMember

2020-07-31

0000896878

us-gaap:OtherLongTermInvestmentsMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2020-07-31

0000896878

us-gaap:OtherLongTermInvestmentsMember

2019-07-31

0000896878

us-gaap:USGovernmentAgenciesDebtSecuritiesMember

2020-07-31

0000896878

us-gaap:CorporateNoteSecuritiesMember

2019-07-31

0000896878

us-gaap:MunicipalBondsMember

2020-07-31

0000896878

us-gaap:OtherLongTermInvestmentsMember

us-gaap:EstimateOfFairValueFairValueDisclosureMember

2019-07-31

0000896878

srt:MaximumMember

us-gaap:EquipmentMember

2019-08-01

2020-07-31

0000896878

srt:MaximumMember

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2019-08-01

2020-07-31

0000896878

srt:MaximumMember

us-gaap:LeaseholdImprovementsMember

2019-08-01

2020-07-31

0000896878

srt:MaximumMember

us-gaap:BuildingMember

2019-08-01

2020-07-31

0000896878

srt:MinimumMember

us-gaap:EquipmentMember

2019-08-01

2020-07-31

0000896878

srt:MinimumMember

us-gaap:LeaseholdImprovementsMember

2019-08-01

2020-07-31

0000896878

srt:MinimumMember

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2019-08-01

2020-07-31

0000896878

us-gaap:FurnitureAndFixturesMember

2019-08-01

2020-07-31

0000896878

srt:MinimumMember

us-gaap:BuildingMember

2019-08-01

2020-07-31

0000896878

us-gaap:CustomerListsMember

2018-08-01

2019-07-31

0000896878

us-gaap:TradeNamesMember

2019-07-31

0000896878

us-gaap:NoncompeteAgreementsMember

2020-07-31

0000896878

us-gaap:NoncompeteAgreementsMember

2019-08-01

2020-07-31

0000896878

us-gaap:CustomerListsMember

2020-07-31

0000896878

us-gaap:CustomerListsMember

2019-07-31

0000896878

us-gaap:NoncompeteAgreementsMember

2019-07-31

0000896878

us-gaap:TradeNamesMember

2020-07-31

0000896878

intu:PurchasedTechnologyMember

2018-08-01

2019-07-31

0000896878

intu:PurchasedTechnologyMember

2019-07-31

0000896878

us-gaap:NoncompeteAgreementsMember

2018-08-01

2019-07-31

0000896878

us-gaap:TradeNamesMember

2018-08-01

2019-07-31

0000896878

intu:PurchasedTechnologyMember

2020-07-31

0000896878

intu:PurchasedTechnologyMember

2019-08-01

2020-07-31

0000896878

us-gaap:CustomerListsMember

2019-08-01

2020-07-31

0000896878

intu:SmallBusinessSelfEmployedSegmentMember

2018-07-31

0000896878

intu:ConsumerSegmentMember

2020-07-31

0000896878

intu:ConsumerSegmentMember

2019-08-01

2020-07-31

0000896878

intu:ConsumerSegmentMember

2019-07-31

0000896878

intu:SmallBusinessSelfEmployedSegmentMember

2019-08-01

2020-07-31

0000896878

intu:StrategicPartnerSegmentMember

2020-07-31

0000896878

intu:StrategicPartnerSegmentMember

2019-08-01

2020-07-31

0000896878

intu:StrategicPartnerSegmentMember

2018-07-31

0000896878

intu:ConsumerSegmentMember

2018-07-31

0000896878

intu:SmallBusinessSelfEmployedSegmentMember

2019-07-31

0000896878

intu:StrategicPartnerSegmentMember

2019-07-31

0000896878

intu:SmallBusinessSelfEmployedSegmentMember

2020-07-31

0000896878

intu:StrategicPartnerSegmentMember

2018-08-01

2019-07-31

0000896878

intu:SmallBusinessSelfEmployedSegmentMember

2018-08-01

2019-07-31

0000896878

intu:ConsumerSegmentMember

2018-08-01

2019-07-31

0000896878

intu:CreditKarmaIncMember

2020-02-24

0000896878

us-gaap:RestrictedStockUnitsRSUMember

intu:CreditKarmaIncMember

2020-02-24

2020-02-24

0000896878

intu:ExactorInc.TSheetsInc.andApplatixMember

2017-08-01

2018-07-31

0000896878

intu:ExactorInc.TSheetsInc.andApplatixMember

2018-07-31

0000896878

intu:CreditKarmaIncMember

2020-02-24

2020-02-24

0000896878

intu:ExactorInc.TSheetsInc.andApplatixMember

us-gaap:CustomerListsMember

2018-07-31

0000896878

intu:EquityAwardMember

intu:CreditKarmaIncMember

2020-02-24

2020-02-24

0000896878

intu:ExactorInc.TSheetsInc.andApplatixMember

us-gaap:TechnologyBasedIntangibleAssetsMember

2018-07-31

0000896878

intu:ExactorInc.TSheetsInc.andApplatixMember

us-gaap:NoncompeteAgreementsMember

2018-07-31

0000896878

srt:MinimumMember

intu:TermLoanMember

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

us-gaap:BaseRateMember

2019-05-02

2019-05-02

0000896878

intu:TermLoanMember

intu:May22019CreditAgreementMember

2017-08-01

2018-07-31

0000896878

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

us-gaap:SubsequentEventMember

2020-08-01

2020-08-31

0000896878

intu:TermLoanMember

intu:May22019CreditAgreementMember

us-gaap:UnsecuredDebtMember

2019-05-02

0000896878

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

2019-05-02

0000896878

us-gaap:RevolvingCreditFacilityMember

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

2019-05-02

0000896878

intu:TermLoanMember

intu:May22019CreditAgreementMember

2019-08-01

2020-07-31

0000896878

us-gaap:RevolvingCreditFacilityMember

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

2019-05-02

2019-05-02

0000896878

intu:TermLoanMember

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

2020-07-31

0000896878

intu:TermLoanMember

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

2019-05-02

2019-05-02

0000896878

srt:MaximumMember

us-gaap:RevolvingCreditFacilityMember

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

us-gaap:BaseRateMember

2019-05-02

2019-05-02

0000896878

srt:MinimumMember

intu:TermLoanMember

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-05-02

2019-05-02

0000896878

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2019-08-01

2020-07-31

0000896878

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2017-08-01

2018-07-31

0000896878

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2018-08-01

2019-07-31

0000896878

intu:TermLoanMember

intu:May22019CreditAgreementMember

2018-08-01

2019-07-31

0000896878

srt:MaximumMember

intu:TermLoanMember

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

us-gaap:BaseRateMember

2019-05-02

2019-05-02

0000896878

srt:MinimumMember

us-gaap:RevolvingCreditFacilityMember

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-05-02

2019-05-02

0000896878

srt:MaximumMember

us-gaap:RevolvingCreditFacilityMember

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-05-02

2019-05-02

0000896878

srt:MinimumMember

us-gaap:RevolvingCreditFacilityMember

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

us-gaap:BaseRateMember

2019-05-02

2019-05-02

0000896878

srt:MaximumMember

intu:TermLoanMember

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-05-02

2019-05-02

0000896878

intu:TermLoanMember

intu:May22019CreditAgreementMember

us-gaap:LineOfCreditMember

2019-05-02

0000896878

intu:TheSeniorUnsecuredNotesMember

intu:SeniorUnsecuredNotesMember

2020-06-01

2020-06-30

0000896878

intu:TheSeniorUnsecuredNotesMember

intu:SeniorUnsecuredNotesMember

2020-06-30

0000896878

intu:SubsidiaryMember

us-gaap:RevolvingCreditFacilityMember

intu:SecuredRevolvingCreditFacility2019Member

us-gaap:LineOfCreditMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-02-19

2019-02-19

0000896878

intu:SubsidiaryMember

us-gaap:RevolvingCreditFacilityMember

intu:SecuredRevolvingCreditFacility2019Member

us-gaap:LineOfCreditMember

2019-08-01

2020-07-31

0000896878

intu:SubsidiaryMember

us-gaap:RevolvingCreditFacilityMember

intu:SecuredRevolvingCreditFacility2019Member

us-gaap:LineOfCreditMember

2020-07-31

0000896878

intu:SubsidiaryMember

us-gaap:RevolvingCreditFacilityMember

intu:SecuredRevolvingCreditFacility2019Member

us-gaap:LineOfCreditMember

2019-02-19

0000896878

intu:SubsidiaryMember

us-gaap:RevolvingCreditFacilityMember

intu:SecuredRevolvingCreditFacility2019Member

us-gaap:LineOfCreditMember

2019-02-19

2019-02-19

0000896878

intu:SubsidiaryMember

us-gaap:RevolvingCreditFacilityMember

intu:SecuredRevolvingCreditFacility2019Member

us-gaap:LineOfCreditMember

2018-08-01

2019-07-31

0000896878

intu:A0.650NotesDueJuly2023Member

intu:SeniorUnsecuredNotesMember

2020-07-31

0000896878

intu:TheSeniorUnsecuredNotesMember

intu:SeniorUnsecuredNotesMember

2020-07-31

0000896878

intu:A0.950NotesDueJuly2025Member

intu:SeniorUnsecuredNotesMember

2020-07-31

0000896878

intu:A1.650notesdueJuly2030Member

intu:SeniorUnsecuredNotesMember

2020-07-31

0000896878

intu:A1.350notesdueJuly2027Member

intu:SeniorUnsecuredNotesMember

2020-07-31

0000896878

2020-03-01

2020-03-31

0000896878

us-gaap:DomesticCountryMember

2019-08-01

2020-07-31

0000896878

us-gaap:DomesticCountryMember

2017-08-01

2018-07-31

0000896878

us-gaap:DomesticCountryMember

2018-08-01

2019-07-31

0000896878

us-gaap:StateAndLocalJurisdictionMember

2020-07-31

0000896878

us-gaap:StateAndLocalJurisdictionMember

us-gaap:ResearchMember

2020-07-31

0000896878

us-gaap:StateAndLocalJurisdictionMember

2017-08-01

2018-07-31

0000896878

us-gaap:StateAndLocalJurisdictionMember

2018-08-01

2019-07-31

0000896878

us-gaap:ForeignCountryMember

us-gaap:SecretariatOfTheFederalRevenueBureauOfBrazilMember

2020-07-31

0000896878

us-gaap:DomesticCountryMember

2020-07-31

0000896878

us-gaap:ForeignCountryMember

us-gaap:InlandRevenueSingaporeIRASMember

2020-07-31

0000896878

us-gaap:StateAndLocalJurisdictionMember

2019-08-01

2020-07-31

0000896878

us-gaap:ForeignCountryMember

us-gaap:HerMajestysRevenueAndCustomsHMRCMember

2020-07-31

0000896878

2018-05-01

2018-07-31

0000896878

us-gaap:SalesRevenueProductLineMember

2018-08-01

2019-07-31

0000896878

us-gaap:SalesRevenueProductLineMember

2017-08-01

2018-07-31

0000896878

us-gaap:GeneralAndAdministrativeExpenseMember

2018-08-01

2019-07-31

0000896878

us-gaap:ResearchAndDevelopmentExpenseMember

2017-08-01

2018-07-31

0000896878

us-gaap:SellingAndMarketingExpenseMember

2017-08-01

2018-07-31

0000896878

intu:ShareBasedCompensationExpenseMember

2017-08-01

2018-07-31

0000896878

intu:ShareBasedCompensationExpenseMember

2018-08-01

2019-07-31

0000896878

us-gaap:SegmentContinuingOperationsMember

2018-08-01

2019-07-31

0000896878

intu:ShareBasedCompensationExpenseMember

2019-08-01

2020-07-31

0000896878

us-gaap:SegmentContinuingOperationsMember

2017-08-01

2018-07-31

0000896878

us-gaap:SegmentContinuingOperationsMember

2019-08-01

2020-07-31

0000896878

us-gaap:CostOfSalesMember

2017-08-01

2018-07-31

0000896878

us-gaap:ResearchAndDevelopmentExpenseMember

2019-08-01

2020-07-31

0000896878

us-gaap:CostOfSalesMember

2019-08-01

2020-07-31

0000896878

us-gaap:CostOfSalesMember

2018-08-01

2019-07-31

0000896878

us-gaap:ResearchAndDevelopmentExpenseMember

2018-08-01

2019-07-31

0000896878

us-gaap:SellingAndMarketingExpenseMember

2019-08-01

2020-07-31

0000896878

us-gaap:GeneralAndAdministrativeExpenseMember

2019-08-01

2020-07-31

0000896878

us-gaap:SalesRevenueProductLineMember

2019-08-01

2020-07-31

0000896878

us-gaap:SellingAndMarketingExpenseMember

2018-08-01

2019-07-31

0000896878

us-gaap:GeneralAndAdministrativeExpenseMember

2017-08-01

2018-07-31

0000896878

us-gaap:EmployeeStockOptionMember

2019-08-01

2020-07-31

0000896878

us-gaap:EmployeeStockOptionMember

2017-08-01

2018-07-31

0000896878

us-gaap:EmployeeStockMember

2019-08-01

2020-07-31

0000896878

us-gaap:EmployeeStockMember

2018-08-01

2019-07-31

0000896878

us-gaap:EmployeeStockMember

2017-08-01

2018-07-31

0000896878

us-gaap:EmployeeStockOptionMember

2018-08-01

2019-07-31

0000896878

us-gaap:RestrictedStockUnitsRSUMember

2019-08-01

2020-07-31

0000896878

us-gaap:RestrictedStockUnitsRSUMember

2017-08-01

2018-07-31

0000896878

us-gaap:RestrictedStockUnitsRSUMember

2018-08-01

2019-07-31

0000896878

srt:MaximumMember

us-gaap:EmployeeStockOptionMember

2019-08-01

2020-07-31

0000896878

us-gaap:EmployeeStockOptionMember

intu:Restated2005PlanMember

2019-08-01

2020-07-31

0000896878

intu:CurrentProgramMember

2020-07-31

0000896878

us-gaap:EmployeeStockMember

2020-07-31

0000896878

srt:MaximumMember

us-gaap:RestrictedStockUnitsRSUMember

2019-08-01

2020-07-31

0000896878

us-gaap:EmployeeStockOptionMember

2020-07-31

0000896878

us-gaap:RestrictedStockUnitsRSUMember

2020-07-31

0000896878

us-gaap:SubsequentEventMember

2020-08-31

0000896878

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2019-08-01

2020-07-31

0000896878

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2018-08-01

2019-07-31

0000896878

intu:Restated2005PlanMember

2020-07-31

0000896878

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2017-08-01

2018-07-31

0000896878

intu:StockOptionsAndEsppMember

2019-08-01

2020-07-31

0000896878

intu:StockOptionsAndEsppMember

2017-08-01

2018-07-31

0000896878

intu:StockOptionsAndEsppMember

2018-08-01

2019-07-31

0000896878

us-gaap:AccumulatedTranslationAdjustmentMember

2020-07-31

0000896878

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2019-07-31

0000896878

us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember

2020-07-31

0000896878

us-gaap:AccumulatedTranslationAdjustmentMember

2019-07-31

0000896878

srt:MaximumMember

us-gaap:EmployeeStockMember

2017-08-01

2018-07-31

0000896878

srt:MinimumMember

us-gaap:EmployeeStockMember

2018-08-01

2019-07-31

0000896878

srt:MaximumMember

us-gaap:EmployeeStockMember

2018-08-01

2019-07-31

0000896878

srt:MinimumMember

us-gaap:EmployeeStockMember

2019-08-01

2020-07-31

0000896878

srt:MinimumMember

us-gaap:EmployeeStockOptionMember

2018-08-01

2019-07-31

0000896878

srt:MaximumMember

us-gaap:EmployeeStockOptionMember

2018-08-01

2019-07-31

0000896878

srt:MaximumMember

us-gaap:EmployeeStockMember

2019-08-01

2020-07-31

0000896878

srt:MinimumMember

us-gaap:EmployeeStockMember

2017-08-01

2018-07-31

0000896878

srt:MinimumMember

us-gaap:RestrictedStockUnitsRSUMember

2019-08-01

2020-07-31

0000896878

srt:MinimumMember

us-gaap:EmployeeStockOptionMember

2019-08-01

2020-07-31

0000896878

intu:QuickBooksDesktopPackagedSoftwareProductsMember

2019-08-01

2020-07-31

0000896878

intu:QuickBooksDesktopPackagedSoftwareProductsMember

2017-08-01

2018-07-31

0000896878

srt:MaximumMember

intu:CountriesOutsideoftheUnitedStatesMember

2019-08-01

2020-07-31

0000896878

intu:QuickBooksDesktopPackagedSoftwareProductsMember

2018-08-01

2019-07-31

0000896878

intu:QuickBooksOnlineAccountingMember

2019-08-01

2020-07-31

0000896878

intu:OnlineEcosystemMember

2017-08-01

2018-07-31

0000896878

intu:QuickBooksDesktopAccountingMember

2019-08-01

2020-07-31

0000896878

intu:QuickBooksDesktopAccountingMember

2018-08-01

2019-07-31

0000896878

intu:DesktopServicesandSuppliesMember

2018-08-01

2019-07-31

0000896878

intu:OnlineEcosystemMember

2018-08-01

2019-07-31

0000896878

intu:SmallBusinessSelfEmployedSegmentMember

2017-08-01

2018-07-31

0000896878

intu:DesktopServicesandSuppliesMember

2019-08-01

2020-07-31

0000896878

intu:OnlineServicesMember

2017-08-01

2018-07-31

0000896878

intu:QuickBooksOnlineAccountingMember

2017-08-01

2018-07-31

0000896878

intu:OnlineServicesMember

2019-08-01

2020-07-31

0000896878

intu:QuickBooksDesktopAccountingMember

2017-08-01

2018-07-31

0000896878

intu:OnlineServicesMember

2018-08-01

2019-07-31

0000896878

intu:StrategicPartnerSegmentMember

2017-08-01

2018-07-31

0000896878

intu:DesktopServicesandSuppliesMember

2017-08-01

2018-07-31

0000896878

intu:DesktopEcosystemMember

2018-08-01

2019-07-31

0000896878

intu:QuickBooksOnlineAccountingMember

2018-08-01

2019-07-31

0000896878

intu:OnlineEcosystemMember

2019-08-01

2020-07-31

0000896878

intu:DesktopEcosystemMember

2019-08-01

2020-07-31

0000896878

intu:ConsumerSegmentMember

2017-08-01

2018-07-31

0000896878

intu:DesktopEcosystemMember

2017-08-01

2018-07-31

0000896878

us-gaap:MaterialReconcilingItemsMember

2018-08-01

2019-07-31

0000896878

us-gaap:OperatingSegmentsMember

intu:StrategicPartnerSegmentMember

2019-08-01

2020-07-31

0000896878

us-gaap:MaterialReconcilingItemsMember

2019-08-01

2020-07-31

0000896878

us-gaap:OperatingSegmentsMember

intu:StrategicPartnerSegmentMember

2017-08-01

2018-07-31

0000896878

us-gaap:OperatingSegmentsMember

intu:SmallBusinessSelfEmployedSegmentMember

2019-08-01

2020-07-31

0000896878

us-gaap:OperatingSegmentsMember

2019-08-01

2020-07-31

0000896878

us-gaap:MaterialReconcilingItemsMember

2017-08-01

2018-07-31

0000896878

us-gaap:OperatingSegmentsMember

2018-08-01

2019-07-31

0000896878

us-gaap:OperatingSegmentsMember

intu:SmallBusinessSelfEmployedSegmentMember

2018-08-01

2019-07-31

0000896878

us-gaap:OperatingSegmentsMember

intu:ConsumerSegmentMember

2018-08-01

2019-07-31

0000896878

us-gaap:OperatingSegmentsMember

intu:ConsumerSegmentMember

2019-08-01

2020-07-31

0000896878

us-gaap:OperatingSegmentsMember

intu:StrategicPartnerSegmentMember

2018-08-01

2019-07-31

0000896878

us-gaap:OperatingSegmentsMember

2017-08-01

2018-07-31

0000896878

us-gaap:OperatingSegmentsMember

intu:ConsumerSegmentMember

2017-08-01

2018-07-31

0000896878

us-gaap:OperatingSegmentsMember

intu:SmallBusinessSelfEmployedSegmentMember

2017-08-01

2018-07-31

0000896878

srt:MaximumMember

intu:CountriesOutsideoftheUnitedStatesMember

2017-08-01

2018-07-31

0000896878

srt:MaximumMember

intu:CountriesOutsideoftheUnitedStatesMember

2018-08-01

2019-07-31

0000896878

2019-11-01

2020-01-31

0000896878

2020-05-01

2020-07-31

0000896878

2019-08-01

2019-10-31

0000896878

2020-02-01

2020-04-30

0000896878

2018-11-01

2019-01-31

0000896878

2018-08-01

2018-10-31

0000896878

2019-02-01

2019-04-30

0000896878

2019-05-01

2019-07-31

0000896878

intu:SECSchedule1209AllowanceDoubtfulAccountsMember

2019-07-31

0000896878

intu:SECSchedule1209AllowanceDoubtfulAccountsMember

2018-07-31

0000896878

intu:SECSchedule1209AllowanceDoubtfulAccountsMember

2019-08-01

2020-07-31

0000896878

intu:ReserveForRebatesMemberMember

2018-08-01

2019-07-31

0000896878

intu:SECSchedule1209ReserveSalesReturnsMember

2018-07-31

0000896878

intu:SECSchedule1209AllowanceDoubtfulAccountsMember

2020-07-31

0000896878

intu:ReserveForRebatesMemberMember

2019-07-31

0000896878

intu:SECSchedule1209ReserveSalesReturnsMember

2019-08-01

2020-07-31

0000896878

intu:ReserveForRebatesMemberMember

2019-08-01

2020-07-31

0000896878

intu:ReserveForRebatesMemberMember

2017-07-31

0000896878

intu:ReserveForRebatesMemberMember

2020-07-31

0000896878

intu:SECSchedule1209ReserveSalesReturnsMember

2017-08-01

2018-07-31

0000896878

intu:SECSchedule1209AllowanceDoubtfulAccountsMember

2017-08-01

2018-07-31

0000896878

intu:SECSchedule1209AllowanceDoubtfulAccountsMember

2018-08-01

2019-07-31

0000896878

intu:ReserveForRebatesMemberMember

2017-08-01

2018-07-31

0000896878

intu:ReserveForRebatesMemberMember

2018-07-31

0000896878

intu:SECSchedule1209AllowanceDoubtfulAccountsMember

2017-07-31

0000896878

intu:SECSchedule1209ReserveSalesReturnsMember

2020-07-31

0000896878

intu:SECSchedule1209ReserveSalesReturnsMember

2019-07-31

0000896878

intu:SECSchedule1209ReserveSalesReturnsMember

2017-07-31

0000896878

intu:SECSchedule1209ReserveSalesReturnsMember

2018-08-01

2019-07-31

intu:business

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

intu:Period_of_time

intu:extension

intu:claim

intu:segment

intu:option_to_extend

xbrli:pure

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

FORM 10-K

|

| | |

☑ | | Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended July 31, 2020

OR

|

| | |

☐ | | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number 0-21180

INTUIT INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 77-0034661 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

2700 Coast Avenue, Mountain View, CA 94043

(Address of principal executive offices, including zip code)

(650) 944-6000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Stock, $0.01 par value | | INTU | | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

|

| | | | | | | | | |

Large accelerated filer | ☑ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of Intuit Inc. outstanding common stock held by non-affiliates of Intuit as of January 31, 2020, the last business day of our most recently completed second fiscal quarter, based on the closing price of $280.38 reported by the Nasdaq Global Select Market on that date, was $70.6 billion.

There were 261,807,204 shares of Intuit voting common stock outstanding as of August 24, 2020.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its Annual Meeting of Stockholders to be held on January 21, 2021 are incorporated by reference in Part III of this Annual Report on Form 10-K.

INTUIT INC.

FISCAL 2020 FORM 10-K

INDEX

Intuit, the Intuit logo, QuickBooks, TurboTax, Mint, Lacerte, ProSeries, and Intuit ProConnect, among others, are registered trademarks and/or registered service marks of Intuit Inc., or one of its subsidiaries, in the United States and other countries. Other parties’ marks are the property of their respective owners.

|

| | | |

| | | |

| Intuit Fiscal 2020 Form 10-K | 2 | |

| | | |

| | | |

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties. These risks and uncertainties may be amplified by the coronavirus (“COVID-19”) pandemic, which has caused significant global economic instability and uncertainty. The extent to which the COVID-19 pandemic impacts Intuit’s business, operations, financial results, and financial condition, including the duration and magnitude of such effects, will depend on numerous evolving factors, which are highly uncertain and cannot be predicted, including, but not limited to, the duration and spread of the pandemic, its severity, the actions to contain the virus or respond to its impact, and how quickly and to what extent normal economic and operating conditions can resume. Please also see the section entitled “Risk Factors” in Item 1A of Part I of this Annual Report for important information to consider when evaluating these statements. All statements in this report, other than statements that are purely historical, are forward-looking statements. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “forecast,” “estimate,” “seek,” and similar expressions also identify forward-looking statements. In this report, forward-looking statements include, without limitation, the following:

| |

• | our expectations and beliefs regarding future conduct and growth of the business; |

| |

• | statements regarding the impact of the COVID-19 pandemic on our business; |

| |

• | the timing of when individuals will file their tax returns; |

| |

• | our beliefs and expectations regarding seasonality, competition and other trends that affect our business; |

| |

• | our expectation that we will continue to invest significant resources in our product development, marketing and sales capabilities; |

| |

• | our expectation that we will continue to invest significant management attention and resources in our information technology infrastructure and in our privacy and security capabilities; |

| |

• | our expectation that we will work with the broader industry and government to protect our customers from fraud; |

| |

• | our expectation that we will generate significant cash from operations; |

| |

• | our expectation that total service and other revenue as a percentage of our total revenue will continue to grow; |

| |

• | our expectations regarding the development of future products, services, business models and technology platforms and our research and development efforts; |

| |

• | our assumptions underlying our critical accounting policies and estimates, including our judgments and estimates regarding revenue recognition; stock volatility and other assumptions used to estimate the fair value of share-based compensation; the fair value of goodwill; and expected future amortization of acquired intangible assets; |

| |

• | our intention not to sell our investments and our belief that it is more likely than not that we will not be required to sell them before recovery at par; |

| |

• | our belief that the investments we hold are not other-than-temporarily impaired; |

| |

• | our belief that we take prudent measures to mitigate investment related risks; |

| |

• | our belief that our exposure to currency exchange fluctuation risk will not be significant in the future; |

| |

• | our assessments and estimates that determine our effective tax rate; |

| |

• | our belief that our income tax valuation allowance is sufficient; |

| |

• | our belief that it is not reasonably possible that there will be a significant increase or decrease in our unrecognized tax benefits over the next 12 months; |

| |

• | our belief that our cash and cash equivalents, investments and cash generated from operations will be sufficient to meet our seasonal working capital needs, capital expenditure requirements, contractual obligations (including the pending acquisition of Credit Karma, Inc. (Credit Karma)), debt service requirements and other liquidity requirements associated with our operations for at least the next 12 months; |

| |

• | our expectation that we will return excess cash generated by operations to our stockholders through repurchases of our common stock and the payment of cash dividends, after taking into account our operating and strategic cash needs; |

| |

• | our plan to continue to provide ongoing enhancements and certain connected services for all future versions of our QuickBooks Desktop software products; |

| |

• | our judgments and assumptions relating to our loan portfolio; |

| |

• | our belief that the credit facilities will be available to us should we choose to borrow under them; |

| |

• | our assessments and beliefs regarding the future outcome of pending legal proceedings and inquiries by regulatory authorities, the liability, if any, that Intuit may incur as a result of those proceedings and inquiries, and the impact of any potential losses associated with such proceedings or inquiries on our financial statements; and |

| |

• | our expectations and beliefs regarding the pending acquisition of Credit Karma. |

|

| | | |

| | | |

| Intuit Fiscal 2020 Form 10-K | 3 | |

| | | |

| | | |

We caution investors that forward-looking statements are only predictions based on our current expectations about future events and are not guarantees of future performance. We encourage you to read carefully all information provided in this report and in our other filings with the Securities and Exchange Commission before deciding to invest in our stock or to maintain or change your investment. These forward-looking statements are based on information as of the filing date of this Annual Report, and we undertake no obligation to revise or update any forward-looking statement for any reason.

|

| | | |

| | | |

| Intuit Fiscal 2020 Form 10-K | 4 | |

| | | |

| | | |

PART I

General

Intuit helps consumers, small businesses, and the self-employed prosper by delivering financial management and compliance products and services. We also provide specialized tax products to accounting professionals, who are key partners that help us serve small business customers.

Our global products and platforms, including QuickBooks, TurboTax, Mint and Turbo, are designed to help our customers better manage their money, reduce their debt and file their taxes with ease so they can receive the maximum refund they deserve. For those customers who run small businesses, we are focused on helping them get paid faster, pay their employees, access capital, ensure their books are done right and find and keep customers. We serve more than 50 million customers across our product offerings and platforms. We had revenue of $7.7 billion in our fiscal year which ended July 31, 2020, with approximately 10,600 employees in offices in the United States, India, Canada, the United Kingdom, Israel, Australia, and other locations.

Intuit Inc. was incorporated in California in March 1984. We reincorporated in Delaware and completed our initial public offering in March 1993. Our principal executive offices are located at 2700 Coast Avenue, Mountain View, California, 94043, and our main telephone number is 650-944-6000. When we refer to “we,” “our” or “Intuit” in this Annual Report on Form 10-K, we mean the current Delaware corporation (Intuit Inc.) and its California predecessor, as well as all of our consolidated subsidiaries.

Available Information

Our corporate website, www.intuit.com, provides materials for investors and information relating to Intuit’s corporate governance. The content on any website referred to in this filing is not incorporated by reference into this filing unless expressly noted otherwise.

We file reports required of public companies with the Securities and Exchange Commission (SEC). These include annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other reports, and amendments to these reports. The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. We make available free of charge on the Investor Relations section of our corporate website all of the reports we file with or furnish to the SEC as soon as reasonably practicable after the reports are filed or furnished. Copies of this Annual Report on Form 10-K may also be obtained without charge by contacting Investor Relations, Intuit Inc., P.O. Box 7850, Mountain View, California 94039-7850 or by calling 650-944-6000 or by emailing investor_relations@intuit.com.

Intuit’s Mission

At Intuit, our mission is to power prosperity around the world. All of our customers have a common set of needs. They are trying to make ends meet, maximize their tax refunds, save money and pay off debt. And those who have made the bold decision to become entrepreneurs, and go into business for themselves, have an additional set of needs. They want to find and keep customers, get paid for their hard work, access capital to grow and ensure their books are right.

Across our platform, we use the power of technology to deliver three core benefits to our customers: helping put more money in their pockets, eliminating work and drudgery so they can focus on what matters to them, and ensuring that they have complete confidence in every financial decision they make.

The rise of Artificial Intelligence (AI) is fundamentally reshaping our world — and Intuit is taking advantage of this technological revolution to find new ways to deliver on our mission. We are focused on capitalizing on this opportunity to improve prosperity globally and inspire our workforce, while investing in our company’s reputation and durable growth in the future.

|

| | | |

| | | |

| Intuit Fiscal 2020 Form 10-K | 5 | |

| | | |

| | | |

Our Business Portfolio

We organize our businesses into three reportable segments: |

|

Small Business & Self-Employed: This segment serves small businesses and the self-employed around the world, and the accounting professionals who assist and advise them. Our offerings include QuickBooks financial and business management online services and desktop software, payroll solutions, merchant payment processing solutions, and financing for small businesses. Consumer: This segment serves consumers and includes do-it-yourself and assisted TurboTax income tax preparation products and services sold in the U.S. and Canada. Our Mint and Turbo offerings serve consumers and help them understand and improve their financial lives by offering a view of their financial health. Strategic Partner: This segment serves professional accountants in the U.S. and Canada, who are essential to both small business success and tax preparation and filing. Our professional tax offerings include Lacerte, ProSeries, ProFile, and ProConnect Tax Online. |

Our Growth Strategy

At Intuit, our strategy starts with customer obsession. We listen to and observe our customers, understand their challenges, and then use advanced technology, including AI, to develop innovative solutions designed to solve their problems and help them grow and prosper. For more than three decades, our values have inspired us to innovate and reimagine ways to save people time and money, eliminate drudgery and inspire confidence. We have reinvented and disrupted ourselves to better serve our customers along the way.

Our strategy for delivering on our bold goals is to become an AI-driven expert platform where we and others can solve our customers’ most important problems. We plan to accelerate the development of the platform by applying AI in three key areas:

| |

• | Machine Learning - Building algorithms which progressively learn from data to automate tasks for our customers. |

| |

• | Knowledge Engineering - Turning rules, such as IRS regulations, and relationships about data into code to eliminate work and provide tailored experiences. |

| |

• | Natural Language Processing - Processing, analyzing and understanding human language to create interactions with customers and automate repetitive tasks. |

As we build our AI-driven expert platform, we are prioritizing our resources on five strategic priorities across the company. These priorities focus on solving the problems that matter most to customers and include:

| |

• | Revolutionizing speed to benefit: When customers use our products and services, we aim to deliver value instantly by making the interactions with our offerings frictionless, without the need for customers to manually enter data. We are accelerating the application of AI with a goal to revolutionize the customer experience. This priority is foundational across our business, and execution against it positions us to succeed with our other four strategic priorities. |

| |

• | Connecting people to experts: The largest problem our customers face is lack of confidence to file their own taxes or to manage their books. To build their confidence, we are connecting our customers to experts. We offer customers access to experts to help them make important decisions – and experts, such as accountants, gain access to new customers so they can grow their businesses. |

| |

• | Unlocking smart money decisions: Crippling high-cost debt and lack of savings are at unprecedented levels across the U.S. With the insights generated through our ecosystem, we strive to offer the right financial opportunities based on a customer’s unique situation. We expect that our proposed acquisition of Credit Karma will help us tackle these problems. |

| |

• | Be the center of small business growth: We are focused on helping customers grow their businesses by offering a broad, seamless set of tools that are designed to help them get paid faster, manage and get access to capital, pay employees with confidence, and use third-party apps to help run their businesses. At the same time, we want to position ourselves to better serve product-based businesses to benefit customers who sell products through multiple channels. |

| |

• | Disrupt the small business mid-market: We aim to disrupt the mid-market with QuickBooks Online Advanced, our online offering designed to address the needs of small business customers with 10 to 100 employees. This offering enables us to increase retention of these larger customers, and attract new mid-market customers who are over-served by available offerings. |

As the external environment evolves, we continue to innovate and adapt our strategy and anticipate our customers’ needs. For more than 35 years, we have been dedicated to developing innovative financial and compliance products and services that are easy to use and are available where and when customers need them. As a result, our customers actively recommend our products and solutions to others, which is one important way that we measure the success of our strategy.

|

| | | |

| | | |

| Intuit Fiscal 2020 Form 10-K | 6 | |

| | | |

| | | |

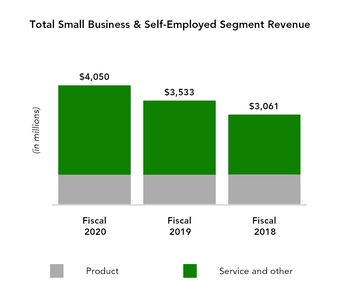

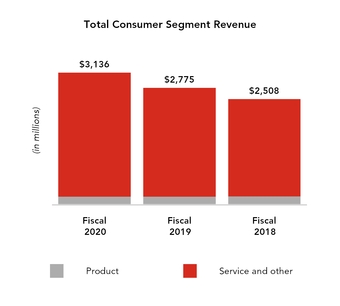

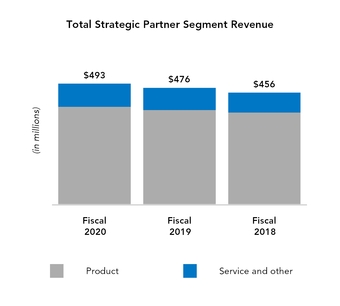

During fiscal 2020 we offered our products and services in the three segments described in “Business Overview” above. The following table shows the revenue for each of these segments over the last three fiscal years.

|

| | | | | | | | |

| Fiscal 2020 | | Fiscal 2019 | | Fiscal 2018 |

| | | | | |

Small Business & Self-Employed | 53 | % | | 52 | % | | 51 | % |

Consumer | 41 | % | | 41 | % | | 42 | % |

Strategic Partner | 6 | % | | 7 | % | | 7 | % |

Total international net revenue was less than 5% of consolidated total net revenue for fiscal 2020, fiscal 2019, and fiscal 2018.

For financial information about our reportable segments, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 and Note 14 to the financial statements in Item 8 of this Annual Report.

Small Business & Self-Employed

Our Small Business & Self-Employed segment serves small businesses and the self-employed around the world, and the accounting professionals who assist and advise them. Our offerings include QuickBooks financial and business management online services and desktop software, payroll and payment processing solutions, financial supplies, and financing for small businesses.

QuickBooks Online and Desktop Software. Our QuickBooks financial management solutions help small businesses, the self-employed, and accountants solve financial and compliance problems, make more money and reduce unnecessary work, while giving them complete confidence in their actions and decisions. Users can track income and expenses, create and send invoices and estimates, manage and pay bills, and review a variety of financial reports. QuickBooks Live enables our customers to obtain live bookkeeping advice from professionals. Our QuickBooks offerings are available either online or as desktop versions. Our online offerings can be accessed on mobile devices.

QuickBooks is built on an open platform, allowing third-party developers to create online and mobile applications that integrate with our offering. A growing number of companies offer applications built for our QuickBooks platform, including PayPal, Shopify, Square, and Bill.com.

In addition to our core QuickBooks offering, we also offer specific solutions for the following customer segments:

| |

• | Mid-Market Small Businesses. Our QuickBooks Online Advanced and QuickBooks Enterprise offerings are designed for small businesses with 10 to 100 employees that have more complex needs. QuickBooks Online Advanced, Intuit’s cloud-based offering specifically designed for high-growth, mid-market small businesses, leverages AI, automation and data insights to deliver more ways for them to grow and scale. QuickBooks Enterprise is available for download or on a disk and can also be provided as a hosted solution. This offering provides industry-specific reports and features for a range of industries, including Contractor, Manufacturing and Wholesale, Nonprofit, and Retail. |

| |

• | Self-Employed. QuickBooks Self-Employed is designed specifically for self-employed customers whose needs are different than small businesses that use QuickBooks. Features include categorizing business and personal transactions, identifying and classifying tax deductible expenses, tracking mileage, calculating estimated quarterly taxes and sending invoices. QuickBooks Self-Employed can be combined with TurboTax to export and pay year-end taxes. QuickBooks Self-Employed is available both online and via a mobile application. |

| |

• | Accountants. QuickBooks Online Accountant and QuickBooks Accountant Desktop Plus are available to accounting professionals who use QuickBooks offerings and recommend them to their small business clients. These offerings provide the tools and file-sharing capabilities that accounting professionals need to efficiently complete bookkeeping and financial reporting tasks and to manage their practices. We also offer memberships to the QuickBooks ProAdvisor program, which provides access to QuickBooks Online Accountant, QuickBooks Accountant Desktop Plus, QuickBooks Desktop Enterprise Accountant, QuickBooks Point of Sale Desktop, technical support, training, product certification, marketing tools, and discounts on Intuit products and services purchased on behalf of clients. |

Employer Solutions (Payroll and Time Tracking). Our payroll solutions are sold on a subscription basis and integrate with our QuickBooks Online and QuickBooks Desktop offerings. All of our payroll offerings allow customers to perform payroll processing, direct deposit of employee paychecks, payroll reports, electronic payment of federal and state payroll taxes, and electronic filing of federal and state payroll tax forms. Our QuickBooks Online payroll offerings include automated tax payments and filings, as well as access to employee benefits offerings like health insurance. Certain online offerings also include same day direct deposit, access to human resource advice, and access to additional expert-powered services like Tax Penalty Protection. QuickBooks Desktop payroll is available in both a self-service and an assisted version, depending on whether customers want to do their own taxes or leverage automated tax payments and filings. We also offer TSheets by QuickBooks which seamlessly integrates with QuickBooks Payroll and third-party payroll products to help businesses easily and

|

| | | |

| | | |

| Intuit Fiscal 2020 Form 10-K | 7 | |

| | | |

| | | |

accurately track time across a mobile workforce, including tools for project planning, job costing, and tracking per-client billable hours.

Payment Processing Solutions. Our full range of merchant services for small businesses includes credit card, debit card, and ACH payment services. In addition to transaction processing services, our broad support for our clients includes customer service, merchant and consumer collections, chargeback and retrieval support, and fraud and loss prevention screening. We also offer e-invoicing, which allows small businesses to email invoices directly from QuickBooks with a link that enables customers to instantly pay online or from their mobile device.

Capital for Small Businesses. We offer financing options for small businesses to help them get the capital they need to succeed. The financing process provides small businesses the ability to use their QuickBooks data to qualify to borrow capital.

Financial Supplies. We offer a range of financial supplies designed for individuals and small businesses that use our QuickBooks offerings. These include standard paper checks and Secure Plus checks with CheckLock fraud protection features, a variety of stationery, tax forms and related supplies.

Consumer

Our TurboTax products and services are designed to enable customers to prepare and file their federal and state income tax returns quickly and accurately. They are designed to be easy to use, yet sophisticated enough for complex tax returns. For customers looking for additional advice or guidance along the way, we have experts standing by to offer tax review and advice all year round. These offerings are available either online or as desktop versions. Our online offerings can be accessed on mobile devices.

Tax Return Preparation Offerings. For the 2019 tax season, we offered a variety of commercial software products and filing services to meet the different needs of our customers, including those filing simple returns, those who itemize deductions, own investments or rental property, and small business owners. Customers can electronically file their federal and state income tax returns through our electronic filing service. We also offered TurboTax Live for customers seeking to obtain tax advice from professionals, as well as audit defense and audit support services. Our online tax preparation and filing services were offered through the websites of thousands of financial institutions, electronic retailers, and other online merchants. Financial institutions can offer our online tax preparation and filing services to their customers through a link to TurboTax Online. Our TurboTax U.S. and Canada offerings consist of desktop, online, and mobile offerings. In addition to our commercial product offerings, we are a member of the Free File Alliance, a consortium of private sector companies that has entered into an agreement with the federal government to provide free online federal tax preparation and filing services to eligible taxpayers, which the IRS then markets to consumers on an IRS website. See also “Competition – Consumer Segment” later in this Item 1 for more information on the Free File Alliance.

Personal Finance Offerings. Our consumer platform, including our Mint and Turbo offerings, is aimed at helping customers unlock smart money decisions by connecting them to financial products to help make ends meet. These offerings help customers understand and improve their financial lives by offering a view of their financial health, as well as access to credit scores and monitoring.

Strategic Partner

Our Strategic Partner segment includes our professional tax offerings and serves professional accountants in the U.S. and Canada, who are essential to both small business success and tax preparation and filing. Our professional tax offerings consist of Lacerte, ProSeries, ProFile and ProConnect Tax Online and enable accountants to accurately and efficiently complete and electronically file a full range of consumer, small business, and commercial federal and state tax returns. Lacerte is designed for full-service year-round accounting firms who handle more complex returns. ProSeries is designed for year-round tax practices handling moderately complex tax returns. ProConnect Tax Online is our cloud-based solution, which is designed for full-service year-round practices who prepare all forms of consumer and small business returns and integrates with our QuickBooks Online offerings. ProFile is our Canadian tax offering, which serves year-round full-service accounting firms for both consumer and business tax returns. We also offer a variety of tax-related services that complement the tax return preparation process including year-round document storage, collaboration services, e-signature, and bank products.

The markets for software and related services are characterized by rapid technological change, shifting customer needs and frequent new product introductions and enhancements. Continuous investment is required to innovate and develop new products and services as well as enhance existing offerings to be successful in these markets. Our product development efforts are more important than ever as we pursue our growth strategy.

We develop many of our products and services internally, and we have a number of United States and foreign patents and pending applications that relate to various aspects of our products and technology. We also supplement our internal development efforts by acquiring or licensing products and technology from third parties, and establishing other relationships

|

| | | |

| | | |

| Intuit Fiscal 2020 Form 10-K | 8 | |

| | | |

| | | |

that enable us to enhance or expand our offerings more rapidly. We expect to expand our third-party technology relationships as we continue to pursue our growth strategy.

Our online offerings and mobile applications have rapid development cycles, while our traditional desktop software products tend to have predictable annual development and product release cycles. In addition, developing consumer and professional tax software and services presents unique challenges because of the demanding development cycle required to accurately incorporate federal and state tax law and tax form changes within a rigid timetable. The development timing for our small business payroll and merchant payment processing services offerings varies with business needs and regulatory requirements, and the length of the development cycle depends on the scope and complexity of each project.

We continue to make substantial investments in research and development, and we expect to focus our future research and development efforts on enhancing existing products and services with financial recommendations, personalization, and ease of use enabled by AI and other advanced technologies. We continue to focus on developing new products and services, including new mobile and global offerings, and significant research and development efforts for ongoing projects to update the technology platforms for several of our offerings.

Historically, our Consumer and Strategic Partner offerings have had a significant and distinct seasonal pattern as sales and revenue from our income tax preparation products and services are heavily concentrated in the period from November through April. This seasonal pattern has historically resulted in higher net revenues during our second and third quarters ending January 31 and April 30, respectively. In March 2020, as a relief measure in response to the COVID-19 pandemic, the IRS extended the filing deadline for the 2019 tax year from April 15, 2020 to July 15, 2020. Additionally, all states with a personal income tax have also extended their due dates, predominantly to July. As a result, we experienced a shift in sales and revenue from our third fiscal quarter to our fourth fiscal quarter during fiscal 2020. We expect the seasonality of our Consumer and Strategic Partner businesses to continue to have a significant impact on our quarterly financial results in the future.

|

|

MARKETING, SALES AND DISTRIBUTION CHANNELS |

Markets

Our primary customers are consumers, small businesses, and the self-employed. We also provide specialized tax and accounting products to professional accountants, who are key partners to help us reach small business customers. The markets in which we compete have always been characterized by rapid technological change, shifting customer needs, and frequent new product introductions and enhancements by competitors. Over the past several years, the widespread usage of mobile devices and the explosion of social media have accelerated the pace of change and revolutionized the way that customers learn about, evaluate, and purchase products and services.

Real-time, personalized online and mobile shopping experiences are the standard. In addition, many customers now begin shopping in one channel and ultimately purchase in another. This has created a need for integrated, multi-channel, shop-and-buy experiences. Market and industry changes quickly make existing products and services obsolete. Our success depends on our ability to respond rapidly to these changes with new business models, updated competitive strategies, new or enhanced products and services, alternative distribution methods, and other changes in the way we do business.

Marketing Programs

We use a variety of marketing programs to generate direct sales, develop leads, increase general awareness of our product portfolio, and drive sales in retail. These programs include digital marketing such as display and pay-per-click advertising, search engine optimization, and social and affiliate marketing; mobile marketing through online app stores; email marketing; offline marketing such as TV, radio, billboard, magazine and newspaper advertising; retail marketing; public relations; and in product marketing to drive awareness of related products and services. Our campaigns are designed to attract new users, retain existing users, and cross sell additional offerings.

Sales and Distribution Channels

Multi-Channel Shop-and-Buy Experiences. Our customers use the web and mobile devices to research products and services. Some customers buy and use our products and services entirely online or through their mobile devices. Others research online but make their purchase at a retail location. Because many customers shop across multiple channels, we continue to coordinate our online, offline, and retail presence and promotions to support an integrated, multi-channel, shop-and-buy model. We also focus on cross-selling complementary Intuit and third-party offerings online and in-product.

Direct Sales Channel. We sell many of our products and services directly through our websites and call centers. Direct, online sales are an effective channel for customers who can make purchase decisions based on content provided on our websites, via other online content or word of mouth recommendations. Telesales continues to be an effective channel for serving customers that want live help to select the products and services that are right for their needs. We also have a direct sales force that calls

|

| | | |

| | | |

| Intuit Fiscal 2020 Form 10-K | 9 | |

| | | |

| | | |

on U.S. and international accounting firms and seeks to increase their awareness, usage, and recommendation of our small business and professional tax solutions.

Mobile Application Stores. We distribute many of our offerings for mobile devices through proprietary online stores that provide applications for specific devices. These include the Apple App Store and Google’s Play Store.

Partner and Other Channels. We sell our products and services through partners including value-added resellers, system integrators (including accountants), and managed service providers who help us reach new customers at the point of need and drive growth and market share by extending our online reach. These partners combine our products and services with marketing, sales, and technical expertise to deliver a complete solution at the local level. We also sell our QuickBooks and TurboTax desktop software as well as payroll services at retail locations across the United States and Canada and on retailer websites. In Canada, we also rely on distributors who sell products into the retail channel.

Overview

We face intense competition in all of our businesses, both domestically and internationally. Competitive interest and expertise in many of the markets we serve have grown markedly over the past few years and we expect this trend to continue. Some of our existing competitors have significantly greater financial, technical and marketing resources than we do. In addition, the competitive landscape can shift rapidly as new companies enter and existing companies expand their businesses to include the markets in which we compete. This is particularly true for online and mobile products and services, where the barriers to entry are lower than they are for desktop software products and services. To attract customers, many online and mobile competitors are offering free or low-priced products which we must take into account in our pricing strategies.