UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2021

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from ______________ to ______________

Commission File Number: 1-36254

_______________________

(Exact Name of Registrant as Specified in Its Charter)

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |||||||||||||

| (Address of Principal Executive Offices, Including Zip Code) | ||||||||||||||

(978 ) 640-6789

(Registrant’s Telephone Number, Including Area Code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||||||||

Securities Registered Pursuant to Section 12(g) of the Act: None

_______________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, an emerging growth company or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer”, “emerging growth company” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

x | Accelerated Filer | ☐ | |||||||||

| Non-accelerated Filer | o | Smaller Reporting Company | |||||||||

| Emerging Growth Company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $1,667,368,942 based on the closing price of the Common Stock on the Nasdaq Global Select Market on June 30, 2021. The number of shares outstanding of the registrant’s Common Stock as of February 25, 2022 was 44,679,990 .

DOCUMENTS INCORPORATED BY REFERENCE | ||||||||||||||

| Document Description | 10-K Part | |||||||||||||

| Portions of the Registrant’s Proxy Statement for the 2022 Annual Meeting of Stockholders | III | |||||||||||||

AVID TECHNOLOGY, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2021

TABLE OF CONTENTS

| Page | ||||||||

| Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | ||||||||

ii

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or Form 10-K, filed by Avid Technology, Inc. together with its consolidated subsidiaries, “Avid” or the “Company”, or “we”, “us,” or “our” unless the context indicates otherwise, includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements contained in this Form 10-K that relate to future results or events are forward-looking statements. Forward-looking statements may be identified by use of forward-looking words, such as “anticipate,” “believe,” “confidence,” “could,” “estimate,” “expect,” “feel,” “intend,” “may,” “plan,” “should,” “seek,” “will,” and “would,” or similar expressions.

Forward-looking statements may involve subjects relating to, among others, the following:

•the effects that the COVID-19 pandemic, including variants, and its related consequences may have on the national and global economy and on our business and operations, revenues, cash flows and profitability, and capital resources;

•our ability to successfully implement our strategy, including our cost saving measures and other actions implemented in response to the COVID-19 pandemic;

•the anticipated trends and developments in our markets and the success of our products in these markets;

•our ability to develop, market, and sell new products and services;

•our business strategies and market positioning;

•our ability to achieve our goal of expanding our market positions;

•our ability to accelerate growth of our cloud-enabled platform;

•anticipated trends relating to our sales, financial condition or results of operations, including our ongoing shift to a recurring revenue model and complex enterprise sales with long sales cycles;

•the expected timing of recognition of revenue backlog as revenue, and the timing of recognition of revenues from subscription offerings;

•our ability to successfully consummate acquisitions, and investment transactions and to successfully integrate acquired businesses;

•the anticipated performance of our products;

•our ability to maintain adequate supplies of products and components, including through sole-source supply arrangements;

•our plans regarding repatriation of foreign earnings;

•the outcome, impact, costs, and expenses of pending litigation or any new litigation or government inquiries to which we may become subject;

•our compliance with covenants contained in the agreements governing our indebtedness;

•our ability to service our debt and meet the obligations thereunder;

•the effect of seasonal changes in demand for our products and services;

•fluctuations in foreign exchange and interest rates;

•estimated asset and liability values;

•our ability to protect and enforce our intellectual property rights; and

•the expected availability of cash to fund our business and our ability to maintain adequate liquidity and capital resources, generally and in the wake of the COVID-19 pandemic

Actual results and events in future periods may differ materially from those expressed or implied by the forward-looking statements in this Form 10-K. There are a number of factors that could cause actual events or results to differ materially from those indicated or implied by forward-looking statements, many of which are beyond our control, including the risk factors

iii

discussed in Item 1A of this Form 10-K. The forward-looking statements contained in this Form 10-K represent our estimates only as of the date of this filing and should not be relied upon as representing our estimates as of any subsequent date. While we may elect to update these forward-looking statements in the future, we specifically disclaim any obligation to do so, whether to reflect actual results, changes in assumptions, changes in other factors affecting such forward-looking statements, or otherwise.

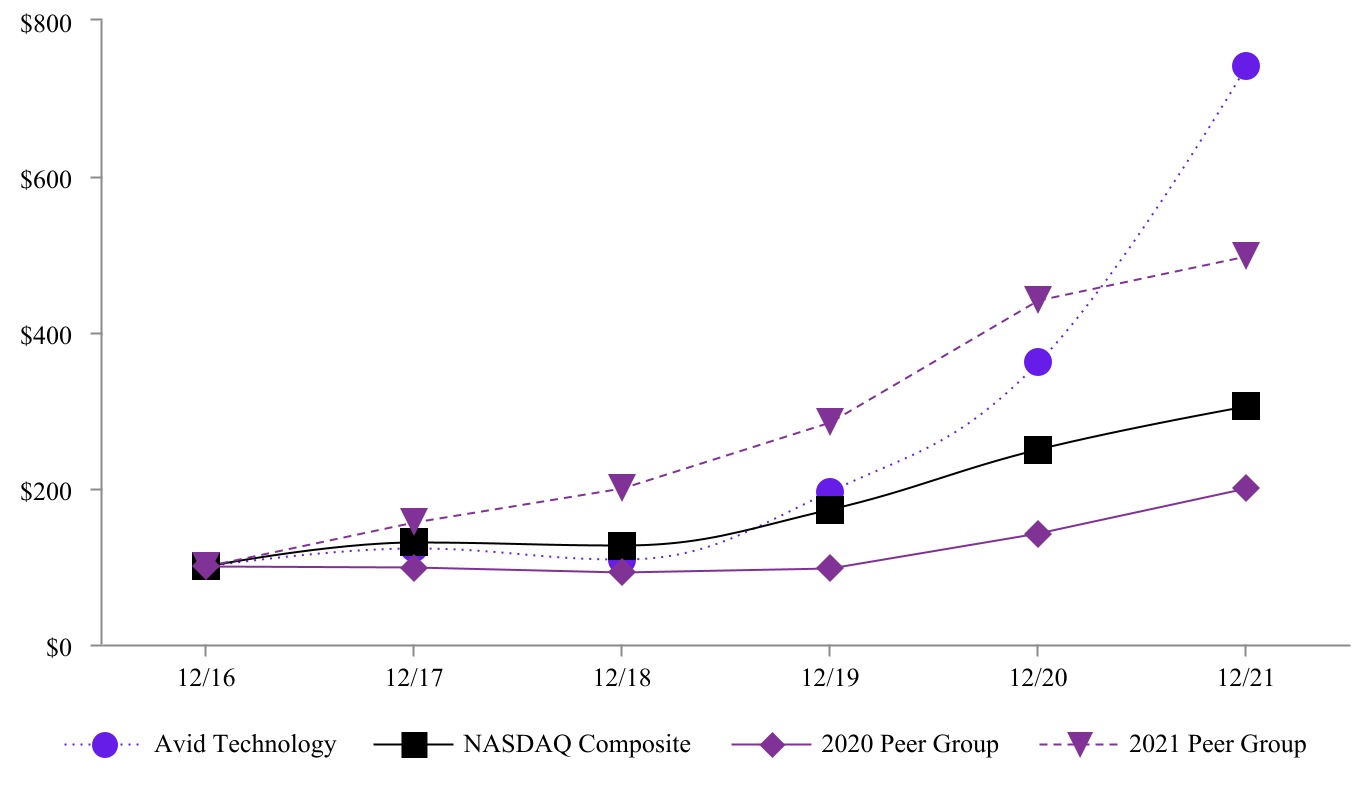

The information included under the heading “Stock Performance Graph” in Item 5 of this Form 10-K is “furnished” and not “filed” and shall not be deemed to be “soliciting material” or subject to Regulation 14A, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, or the Securities Act, except to the extent that we specifically incorporate it by reference.

We own or have rights to trademarks and service marks that we use in connection with the operation of our business. “Avid” is a trademark of Avid Technology, Inc. Other trademarks, logos, and slogans registered or used by us and our subsidiaries in the United States and other countries include, but are not limited to, the following: Avid, Avid NEXIS, AirSpeed, FastServe, MediaCentral, Media Composer, Pro Tools, and Sibelius. Other trademarks appearing in this Form 10-K are the property of their respective owners.

iv

PART I

1

ITEM 1.BUSINESS

OVERVIEW

We develop, market, sell, and support software and integrated solutions for video and audio content creation, management, and distribution. We are a leading technology provider that powers the media and entertainment industry. We do this by providing an open and efficient platform for digital media, along with a comprehensive set of creative software tools and workflow solutions. Our solutions are used in production and post-production facilities; film studios; network, affiliate, independent and cable television stations; recording studios; live-sound performance venues; advertising agencies; government and educational institutions; corporate communications departments; and by independent video and audio creative professionals, as well as aspiring professionals. Projects produced using our tools, platform, and ecosystem include feature films, television programming, live events, news broadcasts, sports productions, commercials, music, video, and other digital media content. With over one million creative users and thousands of enterprise clients relying on our technology platforms and solutions around the world, Avid enables the industry to thrive in today’s connected media and entertainment world.

Our mission is to empower media creators with innovative technology and collaborative tools to entertain, inform, educate, and enlighten the world. Our clients rely on Avid to create prestigious and award-winning feature films, music recordings, television shows, live concerts, sporting events, and news broadcasts. Avid has been honored for technological innovation with 18 Emmy Awards, one Grammy Award, two Oscars, and the first ever America Cinema Editors Technical Excellence Award.

For a discussion of the impact of the COVID-19 pandemic on our business, see "Management's Discussion and Analysis of Financial Condition and Results of Operations - Executive Overview - Impact of COVID-19 on Our Business" in Item 7 of this Form 10-K.

Avid was incorporated in Delaware in 1987. We are headquartered in Burlington, Massachusetts, with operations in North America, South America, Europe, the Middle East, Asia and Australia.

CORPORATE STRATEGY

Acceleration of digitization is having a tremendous impact on the media industry and altering the industry value chain. Today’s consumers are empowered to create and consume content on-demand, anywhere, anytime. Organizations in the media industry are under pressure to connect and automate the entire creation-to-consumption workflow, and are facing a number of challenges, including:

•Increasing rate of content creation and digitization of media assets - Many organizations are feeling intense pressure to create more and more content, increasingly tailored for audience niches, while also facing greater competition from nimble players. At the same time, access to creative software tools is wider today than ever before, giving more people the ability to tell their stories.

•Exponential growth of distribution platforms - The number of distribution platforms continues to expand, and the economic models of new distribution platforms are still evolving. To satisfy their customers, organizations need to develop or license content for their distribution platforms. Many organizations need to embrace new opportunities while also maximizing heritage business.

•Continued increase in content consumption - There has been a tremendous increase in viewership in the last decade, but it is spread across many outlets and channels. This increase in viewership is dwarfed by an increase in competitive content. In addition, with growing audience fragmentation, compelling content, brand equity, and relevance are even more critical today.

•Disparate mix of tools, skills, and workflows - Lack of commonality and a fragmented supplier landscape creates incompatibilities, inhibiting agility, collaboration, sharing, and efficiency.

2

•Media technology budgets - Today’s economic realities are placing pressure on media technology budgets, while content output must increase exponentially to deliver on the market requirements. Many content creators and distributors have to work with essentially flat budgets, which demands more efficient workflows and solutions.

We believe we are well positioned in the media technology industry because we have a set of differentiated creative software tools (including ProTools for audio and Media Composer for video), a differentiated platform strategy (Avid MediaCentral platform described below) and a well-established market position. Our products and solutions allow our customers to (i) create high-quality, engaging, and immersive content, (ii) distribute to more outlets and devices, (iii) maximize and protect the value of media assets, and (iv) create operational and capital efficiency. As a result of our market position across the media industry, we believe we can take advantage of the following opportunities and trends:

•Large and growing market poised for transition - Our customers are facing significant disruption and need to make major changes and investments in their business and operational approaches to address the challenges described above. Our product offerings help them address those challenges.

•Deeply entrenched with a market leadership position - We can strategically leverage a significant global customer base that is loyal to our brand across TV, film, music, and media.

•Positioned to help the industry navigate disruption - Our unique approach encompasses a common technology platform, leading software applications and integrated solutions with a large and open ecosystem, which we believe differentiates us from our competitors.

•Ready to intercept the next emerging opportunity - By leveraging our partnership with Microsoft and our MediaCentral platform, we believe we can lead the media and entertainment industry into the cloud with market-leading Software as a Service, or SaaS, offerings.

Our strategy for connecting creative professionals and media enterprises with audiences in a powerful, efficient, collaborative, and profitable way leverages our creative software tools, including Pro Tools for audio and Media Composer for video, and our MediaCentral Platform - the open, extensible, and customizable foundation that streamlines and simplifies content workflows by integrating all Avid or third-party products and services that run on top of it. The platform provides secure and protected access, and enables fast and easy creation, delivery, and monetization of content.

We work to ensure that we are meeting customer needs, staying ahead of industry trends, and investing in the right areas through a close and interactive relationship with our customer base. The Avid Community Association was established to be an innovative and influential media technology community. It represents thousands of organizations and over 30,000 professionals from all levels of the industry including inspirational and award-winning thought leaders, innovators, and storytellers. The Avid Community Association fosters collaboration between Avid, its customers, and other industry colleagues to help shape our product offerings and provide a means to shape our industry together.

A key element of our strategy is our transition to a recurring revenue-based model through a combination of subscription offerings, maintenance contracts, and long-term agreements. We started offering subscription licensing options for some of our products and solutions in 2014 and by the end of 2021 had approximately 410,000 paid subscriptions. Starting in the third quarter of 2021, subscription count includes all paid and active seats under multi-seat licenses. These licensing options offer choices in pricing and deployment to suit our customers’ needs. We expect to increase subscription sales to media enterprises going forward as we expand offerings and move through customer upgrade cycles, which we expect will further increase recurring revenue on a longer-term basis. Our long-term agreements are comprised of multi-year agreements with large media enterprise customers to provide specified products and services, including SaaS offerings, and agreements with channel partners and resellers to purchase minimum amounts of products and service over a specified period of time.

During the third quarter of 2021, Avid began implementing a digital transformation which focuses on optimizing systems, processes, and back-office functions with the objective of improving our operations related to our digital and subscription

business. Over the next four years, we plan to significantly invest in transforming our enterprise-wide infrastructure and technologies to benefit customers and drive enhanced performance across the company.

3

CUSTOMER MARKETS

We provide our solutions to the following markets:

•Media Enterprises. This market consists of broadcast, government, sports, and other organizations that acquire, create, process, and/or distribute audio and video content to a large audience for communication, entertainment, analysis, and/or forensic purposes. Customers in this market rely on workflows that span content acquisition, creation, editing, distribution, sales, and redistribution and utilize all content distribution platforms, including web, mobile, internet protocol television, cable, satellite, on-air, and various other proprietary platforms. Our expertise also allows us to provide customers in this market with a range of professional and learning services. We sell into this market through our direct sales force and resellers.

•Creative Professionals. This market is made up of individual artists and small entities that create audio and video media as a paid service but do not currently distribute media to end consumers on a large scale. This market spans a wide-ranging target audience that includes: independent video editors; facilities and filmmakers that produce video media as a business but are not broadcasters; professional sound designers, editors, and mixers and facilities that specialize in the creation of audio for picture; songwriters, musicians, producers, film composers, and engineers who compose and record music professionally; technicians, engineers, rental companies, and facilities that present, record, and broadcast audio and video for live performances; and students and teachers in career technical education programs in high schools, colleges, universities, and post-secondary vocational schools that prepare students for professional media production careers in the digital workplace. Our expertise also allows us to provide customers in this market with a broad range of professional services. We sell into this market through our webstore, resellers (including storefront and online retailers) and our direct sales force.

PRODUCTS AND SERVICES

Overview

Avid’s growing product portfolio is rooted in providing open and extensible products that ensure our long-term position with customers. Our software and integrated solutions, as well as our services offerings, address the diverse needs, skills, and sophistication levels of our customers. In addition, we provide flexible deployment models, licensing options, and commercial structures so our customers can choose how, when, and where to deploy and use our tools.

The standalone software portion of our product portfolio consists of our Creative Software Solutions and our Enterprise Software Solutions, representing a large high-margin software and maintenance business.

Creative Software Solutions

Our Creative Software Solutions includes our Media Composer, Pro Tools, and Sibelius tools, as well as Avid Link, all of which are key components of our cloud-enabled software subscription strategy.

Media Composer

Our award-winning Media Composer product line is used to edit video content, including television programming, commercials, and films. Our cloud-enabled solutions that include Media Composer enable broadcast news, sports, reality television, and film professionals to acquire, access, edit, and finish stories anytime and from everywhere. Leveraging an integrated, yet open, end-to-end architecture, this solution gives contributors the ability to craft stories where and while they are happening and speed them to delivery, while maintaining connectivity with the central production operation. Media Composer also offers resolution flexibility and independence, accelerating high-res, HDR, and 4K workflows. We offer Media Composer through both subscription and perpetual license offerings.

Pro Tools

4

Our Pro Tools digital audio workstation software facilitates the audio production process, including music and sound creation, recording, editing, signal processing, integrated surround mixing, and mastering and reference video playback. The Pro Tools platform supports a wide variety of internally developed and third-party software plug-ins and integrated hardware. Pro Tools solutions are offered at a range of price points and are used by professionals in music, film, television, radio, gaming, internet, and other media production environments. We offer Pro Tools software through both subscription and perpetual license offerings.

Sibelius

Our Sibelius product allows users to create, edit, and publish musical scores. It is used by composers, arrangers, and other music professionals. Student versions are also available to assist in the teaching of music composition and score writing. Sibelius music notation software offers sophisticated, yet easy-to-use tools that are proven and trusted by composers, arrangers, publishers, educators, and students alike. We also offer Sibelius | Cloud Sharing, which allows users to view and play scores anywhere from the cloud through a web browser and on mobile devices. We offer Sibelius through both subscription and perpetual license offerings.

Avid Link

Avid Link is a free desktop and mobile application that offers a creative community a variety of benefits and value along their journey to achieve their goals. It’s for anyone wanting to find, network, connect and engage in collaboration with other artists, producers, mixers, composers, editors, videographers, movie makers, and graphic designers, as well as explore the Avid Marketplace populated with third party applications and services to use within their workflow. Through Avid Link, users can subscribe to Avid Play and distribute their music to streaming services worldwide like Apple Music, Spotify, and TIDAL. Available for macOS, Windows, iOS, and Android OS users, Avid Link is intended to make it easy for users to find, connect, message, and collaborate with audio and video creators, promote their work and skills to a vast network of media professionals, manage and keep their software up to date, and purchase new tools. We believe Avid Link will increase interest and demand for Avid’s suite of product offerings.

Enterprise Software Solutions

Avid’s Enterprise Software Solutions are built on the MediaCentral platform along with a suite of applications, modules, and services and is also the foundation of our cloud and SaaS offerings.

MediaCentral

MediaCentral | Cloud UX is Avid’s next-generation media production suite that further extends the Avid MediaCentral platform into the cloud. The MediaCentral platform scales from the simplest to the most sophisticated solutions. Built on a customizable cloud native microservices architecture, MediaCentral platform features a cloud-based user experience that runs on any device, as well as workflow modules for editorial, production, news, graphics, and asset management. It also features applications to enhance and scale any of those modules, and a wide array of media services and partner connectors. Every user is connected in a completely integrated workflow environment with a user-friendly interface, and gains a unified view into all their media with flexible deployment options for on premises, hybrid, or cloud (public/private) environments.

As part of the Avid MediaCentral platform, we also offer Avid Nexis| Edge, (formally known as Editorial Management) a module for smaller creative teams that provides the same robust media management capabilities used by the largest media enterprises in the industry. Integrated within Media Composer via a panel, Nexis| Edge connects directly to Avid NEXIS storage to provide easy access to media with hyper-search functionality. Avid Nexis| Edge also extends collaboration capabilities for the assistant editor in an easy to use web interface by allowing Media Composer bin creation, logging, and search capabilities, greatly expanding the efficiency of creative teams.

SaaS Solutions

We have a strategic partnership with Microsoft to deliver Azure-certified solutions to support end-to-end hybrid and cloud deployments of news workflows. Our partnership includes developing virtualized versions of many of our product offerings, allowing them to run in a private cloud, public cloud, or in hybrid deployments. This enables customers to migrate to more traditional IT infrastructures leveraging IP technology to integrate disparate systems within a post production and broadcast environment. We believe our new SaaS and cloud offerings will allow our customers to (i) scale production while lowering

5

costs, (ii) enable anytime access, boosting efficiency and collaboration, and (iii) deliver content quickly and securely to any device, from anywhere. Our first enterprise SaaS offering, Edit on Demand, has been deployed in post production and news environments.

Integrated Solutions

The Integrated Solutions part of our portfolio mainly consists of four common, best-in-class hardware platforms that are combined with tightly integrated software elements to create powerful and differentiated solutions, all of which complement and enhance our overall software strategy.

Avid NEXIS

Our Avid NEXIS family of shared storage systems are real-time, open solutions that bring the power of shared storage to local, regional, national and multinational broadcasters, and post-production facilities at competitive prices. Customers can improve allocation of creative resources and support changing project needs with an open, shared storage platform that includes file system technology on lower cost hardware, support for third-party applications, and streamlined administration to create more content at an affordable price. Avid NEXIS is the industry’s first and only software-defined storage platform specifically designed for storing and managing media. Avid NEXIS enables fully virtualized storage so media organizations can adjust storage capacity mid-project, without disrupting workflows. Powered by our MediaCentral Platform, Avid NEXIS delivers media storage flexibility, scalability, and control for both Avid-based and third-party workflows. It has been designed to serve small production teams as powerfully as large media enterprises and is built with flexibility to grow with customers through their business stages. In addition to on-premises Avid NEXIS workflows, Avid NEXIS Cloud provides on-line, nearline and archive storage tiers in the cloud, and is a key component of our SaaS offerings.

Avid S6

Our Avid S6 product line offers customers a range of complementary control surfaces for sound recording, mixing and editing, leveraging the open industry standard protocol EUCON (Extended User Control) to provide open solutions that meet the needs of customers ranging from the independent professional to the high-end broadcaster. The Avid S6 was designed as a modular solution that scales to meet both current and future customer requirements. The Avid S6 is designed for audio professionals in demanding production environments, delivering the performance needed to complete projects faster while producing high quality mixes. Compact and portable, all control surfaces in the Artist line feature EUCON, allowing hands-on control of the user’s applications. Finally, the free Pro Tools | Control iOS application enables customers to record and mix faster and easier than working with a mouse and keyboard alone.

Avid S1 and Avid S4

The Avid S4 and Avid S1 audio control surfaces are for professionals at smaller facilities and project studios. Avid S4 brings the power and workflows of the Avid S6 control surface to budget-conscious audio professionals and small- to mid-size music and audio post facilities in an ergonomic and more compact package. The Avid S1 delivers the speed, rich visual feedback, and software integration of Avid’s high-end consoles in a portable, slimline surface that’s an easy fit for any space or budget.

Live Sound

Our VENUE product family and our VENUE | S6L live sound system includes console systems for mixing audio for live sound reinforcement for concerts, theater performances, and other public address events. We offer a range of VENUE systems designed for large performance settings, such as stadium concerts, as well as medium-sized theaters and houses of worship. VENUE systems allow the direct integration of Pro Tools solutions to mix and record live productions of any size.

Maestro

Our Maestro product line offers customers comprehensive production graphics solutions, ideal for any type of production needs in news, sports, and entertainment, creating greater accessibility, efficiency at scale to enable the delivery of content with graphics faster. Maestro features a core platform that includes a powerful render engine and featured design tool called

6

Maestro | Designer that drives a line-up of applications that are designed to address the specific challenges broadcasters face when automating the integration of statistics and graphics for the creation of an engaging broadcast. By tightly integrating Maestro with MediaCentral we enable journalists and producers to add graphics remotely to news stories or enhance any story with innovative stats to drive augmented reality graphics for presenting data in new and compelling ways.

FastServe

Our FastServe video server product line assists broadcasters in making the move to UHD and IP based workflows with a new, modular architecture. The Avid FastServe family integrates with the MediaCentral platform, empowering creative teams to deliver content fast for news, sports, entertainment, and other media productions. Its 10GbE interface offers direct connection to Avid NEXIS storage, enabling real-time ingest, editing, and playout, even while media is being captured. Its modular architecture improves efficiency and provides a smooth transition from HD to UHD, and from SDI workflows to video over IP. We also continue to sell and support our on-air server solutions, including AirSpeed 5000 and AirSpeed 5500, which enable broadcasters to automate the ingest and playout of television and news programming. The AirSpeed 5000 and 5500 video servers work with a wide range of applications to improve workflow and provide cost-efficient ingest and play to air capabilities for broadcasters of any size.

I/O and Processing

We offer a number of hardware products that complement our Media Composer and Pro Tools creative solutions, which include I/O devices, interfaces, and audio and video processing equipment. We have recently updated our Pro Tools Hardware portfolio with new offerings including, Avid MTRX Studio and Avid Pro Tools| Carbon. Pro Tools| Carbon is our next generation music creation hardware platform.

Maintenance

We offer a variety of maintenance contracts for our software and integrated solutions, allowing each customer to select the level of technical and operational support that they need to maintain their operational effectiveness. Maintenance contracts typically include the right to the latest software updates, call support, and, in some cases, hardware maintenance. Maintenance contracts for individual products are sold bundled with initial product offerings or as renewals once initial contracts have lapsed. Maintenance contracts are also sold on an enterprise basis where a customer purchases maintenance for all Avid products owned. Our Customer Care team provides customers with a partner committed to giving them help and support when they need it. Our global Customer Care team of industry professionals offers a blend of technology expertise and real-world experience throughout the audio, visual, and entertainment industries. The team’s mission is to provide timely, informed responses to our customers’ issues and proactive maintenance for our solutions to help our customers maintain high standards of operational effectiveness.

Professional Services

Our Professional Services team delivers workflow design and consulting, program, and project management, system installation and commissioning, custom development, and role-based product level training. The Professional Services team facilitates the engagement with our customers to maximize their investment in technology, increase their operational efficiency, and enable them to reduce deployment risk and implement our solutions.

Learning Services

Our Learning Services team delivers public and private training classes as well as self-paced eLearning content to our customers and alliance partners to ensure that they have the necessary skills and technical competencies to deploy, use, administer, and create Avid solutions. The Learning Services team develops and licenses curriculum content for use by third-party Avid Learning partners to deliver training to customers, users, and alliance partners. The Learning Services team includes the Avid Certification program which validates the skills and competency of Avid users, administrators, instructors, support representatives, and developers.

7

COMPETITION

The markets in which we serve our customers are highly competitive and subject to rapid change. The competitive landscape is fragmented with a large number of companies providing various types of products and services in different markets and geographic areas. We provide integrated solutions that compete based on total workflow value, features, quality, service, and flexibility of pricing and deployment options. Companies with which we compete in some contexts may also act as our partners in other contexts, such as large enterprise customer environments.

Certain companies that compete with us across some of our products and solutions are listed below by the market relevant to Avid in which they compete predominantly:

•Broadcast and Media: ChyronHego Corporation, Dalet S.A., Dell Technologies Inc. (EMC Isilon), EVS Corporation, Grass Valley, Harmonic Inc., Quantum Corporation, Ross Video Limited, and Vizrt Ltd., among others.

•Audio and Video Post and Professional: Ableton AG, Adobe Systems Incorporated, Apple Inc., AudioTonix Limited, Blackmagic Design Pty Ltd, PreSonus Audio Electronics, Inc., and Yamaha Corporation, among others.

For additional information about risks associated with our competitors, see “Risk Factors” in Item 1A of this Form 10-K.

OPERATIONS

Sales and Services Channels

We market and sell our products and solutions through a combination of direct, indirect, and digital sales channels. Our direct sales channel consists of internal sales representatives serving select customers and markets. Our indirect sales channels include global networks of independent distributors, value-added resellers, system integrators, and retailers. Our digital sales channel is represented by the online Avid Marketplace, and also through the Xchange Market Platform, or XMP, with some of our key partners and distributors.

We have significant international operations with offices in 16 countries and the ability to reach approximately 171 countries through a combination of our direct sales force and resellers. Sales to customers outside the United States accounted for 58%, 60% and 63% of our total net revenues in 2021, 2020 and 2019, respectively. Additional information about the geographic breakdown of our revenues and long-lived assets can be found in Note P to our Consolidated Financial Statements in Item 8 of this Form 10-K. For additional information about risks associated with our international operations, see “Risk Factors” in Item 1A of this Form 10-K.

We generally ship our products shortly after the receipt of an order. However, a high percentage of our revenues has historically been generated in the third month of each fiscal quarter and concentrated in the latter part of that month. Orders that may exist at the end of a quarter and have not been shipped are not recognized as revenues in that quarter and are included in revenue backlog.

We provide customer care services directly through regional in-house and contracted support centers and major-market field service representatives. We also provide customer care services indirectly through dealers, value-added resellers, and authorized third-party service providers. Depending on the solution, customers may choose from a variety of support offerings, including telephone and online technical support, on-site assistance, hardware replacement and extended warranty, and software upgrades. In addition to customer care services, we offer a broad array of professional services, including installation, integration, planning and consulting services, and customer training.

Manufacturing and Suppliers

Our manufacturing operations consist primarily of a network of contract manufacturers around the globe to manufacture many of our products, components and subassemblies, and original equipment manufacturers, or OEMs, from whom we

8

purchase finished assemblies. Our products undergo testing and quality assurance at the final assembly stage. We depend on sole-source suppliers for many key hardware product components and finished goods, including some critical items.

Our contract manufacturers and OEMs manufacture our products at a relatively limited number of facilities located throughout the world and, in most cases, the manufacturing of each of our products is concentrated in one or a few locations. For additional information about risks associated with our sole source suppliers and and manufacturing operations, see “Risk Factors” in Item 1A of this Form 10-K.

Research and Development

We are committed to delivering best-in-class digital media content-creation solutions that are designed for the unique needs, skills and sophistication levels of our target customer markets as well as a standardized media platform for the media industry. Having helped establish the digital media technology industry, we are building on a 30-year heritage of innovation and leadership in developing content-creation solutions and platforms. We have research and development, or R&D, operations in six facilities located in five countries. Our R&D efforts are focused on the development of digital media content-creation, distribution, and monetization tools as well as the media platform. These tools operate primarily on the Mac and on Windows platforms, whereas the media platform primarily operates on Linux platforms. Our R&D efforts also include highly optimized media storage solutions, standards-based media transfer and media asset management tools, and ingest and playout solutions to cover the entire workflow. Our R&D expenditures for 2021, 2020 and 2019 were $65.6 million, $57.0 million and $62.3 million, respectively, which represented 16%, 16% and 15% of our total net revenues, respectively.

Our philosophy is to prioritize research and development investments to take advantage of market opportunities based on the following short-term, medium-term, and long-term horizons:

•Here & Now - Improve performance, solidify core portfolio, improve margins, and ignite growth.

•Emerging - Expand opportunities by pursuing growth areas, extending our product portfolio, and expanding market opportunities.

•Transformational - Build for the future, creating unique defensible differentiation in our products and solutions with disruptive and visionary innovation.

Our company-operated R&D operations are located in: Burlington, Massachusetts; Berkeley, California; Munich, Germany; Kfar Saba, Israel; Szczecin, Poland; and Montreal, Canada. We also partner with a vendor in Kiev, Ukraine for outsourced R&D services. For additional information about risks associated with our R&D efforts, see “Risk Factors” in Item 1A of this Form 10-K.

Intellectual Property

We regard our software and hardware as proprietary and protect our proprietary interests under the laws of patents, copyrights, trademarks, and trade secrets, as well as through contractual provisions.

We have obtained patents and have registered copyrights, trademarks and service marks in the United States and in many foreign countries. At February 1, 2022, we held 111 U.S. patents, with expiration dates through 2040, and had 13 patent applications pending with the U.S. Patent and Trademark Office. We have also registered or applied to register various trademarks and service marks in the United States and a number of foreign countries, including Avid, Avid Nexis, AirSpeed, FastServe, MediaCentral, Media Composer, Pro Tools, and Sibelius. As a technology company, we regard our patents, copyrights, trademarks, service marks, and trade secrets as being among our most valuable assets, together with the innovative skills, technical competence, and marketing abilities of our personnel.

Our software is licensed to end users pursuant to shrink-wrap, embedded, click-through, or signed license agreements. Our products generally contain features to guard against unauthorized use. Policing unauthorized use of computer software is difficult, and software piracy is a persistent problem for us, as it is for the software industry in general. For additional information about risks associated with the protection of our intellectual property, see “Risk Factors” in Item 1A of this Form 10-K.

9

HUMAN CAPITAL

We view our employees and our culture as key to our success. As of December 31, 2021, we had approximately 1,405 full-time employees and 333 external contractors located globally in 33 countries. Of these, 35% were located in the United States, Canada, and Latin America, 45% in Europe, Middle East, and Africa, and 20% in Asia-Pacific.

The COVID-19 pandemic continues to impact lives and businesses around the world. We have taken proactive steps to help protect the health and safety of our employees and maintain business continuity. A vast majority of our office workers continue to telecommute as we have implemented a work from anywhere policy. This allows our employees to choose their workstyle whether it be fully remote, fully onsite, or a mix of the two. Within our office areas we have established a number of safety protocols, including face covering and physical distance requirements when necessary, enhanced cleaning, encouraging daily self-health checks, and access to virtual primary care physicians. All of the actions above are overseen by Avid’s Crisis Management Team, a multi-functional, multi-discipline team tasked with integrating all aspects of Avid’s COVID-19 response. In addition, we have created a TeamAvid Community, where employees can virtually share communications, collaborate, and engage with each other from their remote locations. This was implemented as a way to keep employees connected throughout the pandemic.

We believe in fostering great leaders. Through our Avid University platform, we have built the opportunity for employees to power their performance with continuous learning and development courses to provide skills and coaching to employees on a variety of topics, such as leading and inspiring teams. We believe this focus helps our employees grow as leaders and well-rounded individuals, and better positions Avid to operate our global business of empowering media creators with innovative technology and collaborative tools to entertain, inform, educate, and enlighten the world. We also offer tuition reimbursement for eligible classes at external education organizations that may not be covered under Avid University.

We believe a critical component of our success is our company culture. We are focused on creating a company culture of integrity and respect, with the goal of working together to drive our business to be creative, innovative and competitive. To achieve these objectives, we have adopted and regularly communicate to our employees our core values of Trusted, Empowered, Passionate, and Inclusive. We believe in the power of an increasingly diverse, inclusive, and collaborative team and we embrace and leverage the global community of TeamAvid. We believe that diverse and inclusive companies are more productive and deliver better performance than their counterparts, and we seek to better mirror our diverse customer and user base to best serve them.

To further that focus, Avid has implemented the Global Leadership Team, or GLT. The GLT is comprised of a group of global leaders throughout the organization who are either key stakeholders in our business or an important beacon of our culture. The GLT meets with the Executive Team and Senior Management Teams to align on corporate strategy, culture and development. Avid has taken many steps to expand diversity, equity and inclusion (“DEI”) within the company. At the governance level, Avid now has a Steering Committee for DEI; Mission, Vision and Goals statements for DEI; and a DEI Policy. In terms of recruitment, three women are on the executive leadership team, and in 2021 Avid recruited 58 percent women globally. Avid considers DEI training as an essential part of creating an inclusive culture with self-paced online learning topics addressing inclusion, LGBTQIA+ issues, and inclusive retention and career direction. Avid is enhancing its global onboarding process to include DEI training for all employees.

AVAILABLE INFORMATION

We make available free of charge on our website, www.avid.com, copies of our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K, and all amendments to those reports as soon as practicable after filing with the Securities and Exchange Commission, or SEC. Additionally, we will provide paper copies of all of these filings free of charge upon request. Alternatively, these reports can be accessed at the SEC’s Internet website at www.sec.gov. The information contained on our web site shall not be deemed incorporated by reference in any filing under the Exchange Act.

10

ITEM 1A.RISK FACTORS

You should carefully consider the risks and uncertainties described below, in addition to the other information included or incorporated by reference in this Form 10-K, before making an investment decision regarding our common stock. If any of the following risks were to actually occur, our business, financial condition or operating results would likely suffer, possibly materially, the trading price of our common stock could decline, and you could lose part or all of your investment. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business.

Risks Related to Our Business and Industry

The novel coronavirus, or COVID-19, and actions taken in response to it have adversely affected our business and are likely to continue to adversely affect our business, financial condition and results of operations.

The COVID-19 pandemic has been the source of economic disruption, and has led to federal, state and local governments enacting various restrictions in an attempt to limit the spread of the virus. This has included declarations of states of emergency and school and business closings affecting a large number of countries. It has also prompted limitations on social or public gatherings and other social distancing measures, such as office closures, shelter in place orders, working remotely, travel restrictions and quarantines, some of which continue in effect in many cities and countries.

In these challenging and dynamic circumstances, Avid is working to protect its employees and the public, maintain business continuity and sustain its operations. We have taken, and may take in the future, actions as required by government authorities or that we determine are in the best interests of our employees, customers, manufacturers, and suppliers that diminish our ability to promote our products and services, and deliver required on-site professional services, including on-site support to our customers and users, and that could negatively impact our business and results of operations.

The COVID-19 pandemic has significantly increased economic and demand uncertainty, which has caused a decline in the media, entertainment, and sports industries and, in turn, reduced demand for our products and services. These factors are expected to continue to reduce demand for our products and services, possibly significantly, including causing delays in purchasing and projects by our enterprise customers and channel partners. Additionally, the provision of on-site professional service may be impacted for a prolonged period of time due to site restrictions and related costs and delays, further impacting our business.

The COVID-19 pandemic and the response to it has and continues to adversely impact our operations and supply chain. If such impacts continue as a result of the ongoing pandemic, we could experience further interruptions in our supply chain, along with limitations in our and our manufacturers’ ability to timely procure products or their components and our ability to perform critical functions. Supply chain disruptions could also be exacerbated by and compounded with disruptions and limitations related to geopolitical instability, armed conflict and insurrection or the threat thereof, and other related conflict. The current conflict in Ukraine, including indirect impacts as a result of sanctions and economic disruption, may further complicate such supply chain disruptions. These limitations could significantly hamper our ability to supply our products to our customers. If we encounter delays or difficulties in the manufacturing process that disrupt our ability to supply our products, we may not be able to satisfy customer demand or we may experience a product stock-out, which would likely have a material adverse effect on our business.

If the pandemic continues and economic conditions worsen, we expect to experience additional adverse impacts on our operations and revenues and our collections of accounts receivable, which adverse impacts may be material.

Further, the continued spread of COVID-19 has led to disruption and volatility in the global capital markets, which may increase the cost of capital and adversely impact access to capital. If we experience further deterioration in demand and our cash flows from operations decrease, we may require additional funding and may not be able to obtain such funding on favorable terms, or at all.

The degree to which COVID-19 impacts our results going forward will depend on future developments, which remain uncertain and cannot be predicted, including, but not limited to, the duration and spread of COVID-19, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. Any of the foregoing factors, or other cascading effects of the COVID-19 pandemic that are not currently foreseeable, could materially increase our costs, negatively impact our business and damage our results of operations and our liquidity position, possibly to a significant degree.

11

Our success depends in significant part on our ability to offer innovative products and solutions in response to dynamic and rapidly evolving market demand.

To succeed in our market, we must offer innovative products and solutions. Innovation requires that we accurately predict future market trends and customer expectations, and that we quickly adapt our development efforts in response. We must also protect our product roadmap and new product initiatives from leaks that might reduce or eliminate any innovative edge that we seek. Predicting market trends is difficult because our market is dynamic and rapidly evolving. Additionally, given the complex, sophisticated nature of our solutions and our typically lengthy product development cycles, we may not be able to rapidly change our product direction or strategic course. If we are unable to accurately predict market trends or adapt to evolving market conditions, we may be unable to capture customer demand and our market reputation and financial performance will be negatively affected. Even to the extent we make accurate predictions and possess the requisite flexibility to adapt, we may be able to pursue only some of the possible innovations due to limited resources. Our success, therefore, further depends on our ability to identify and focus on the most promising innovations.

Our success also depends on our ability to manage a number of risks associated with new products that we introduce, including timely and successful product launch, market acceptance, and the availability of products in appropriate locations, quantities, and costs to meet demand. Our efforts may not be successful in the near future, or at all, and our competitors may take significant market share in similar efforts. If we fail to develop new products and to manage new product introductions and transitions properly, our financial condition and operating results could be harmed.

Our increased emphasis on a cloud strategy may give rise to risks that could harm our business.

Our cloud strategy requires continued investment in product development and cloud operations, where we have a limited operating history. Our cloud strategy has also led to changes in the way we price and deliver our products. Many of our competitors may have advantages over us due to their larger market presence, larger developer network, deeper experience in the cloud-based computing market, and greater sales and marketing resources. It is uncertain whether our cloud strategy will prove successful, or whether we will be able to develop the necessary infrastructure and business models more quickly than our competitors. Our cloud strategy may give rise to a number of risks, including the following:

•Our customers may prefer perpetual licenses, and we may not be as successful as we anticipate in selling subscriptions;

•although we intend to support our perpetual license business, the increased emphasis on a cloud strategy may raise concerns among our installed customer base;

•we may be unsuccessful in achieving our target pricing;

•our revenues might decline over the short or long term as a result of this strategy;

•our relationships with existing partners that resell perpetual licenses may be damaged; and

•we may incur costs at a higher than forecasted rate as we enhance and expand our cloud operations.

Certain of our enterprise offerings have long and complex sales cycles, which could result in a loss of customers and lower revenues.

With our transition to leveraging the Avid MediaCentral platform in our sales process, we have experienced longer and more complex sales cycles for some of our enterprise offerings. The length and complexity in these sales cycles are due to a number of factors, including, among other things, the need for our sales representatives to educate customers about the uses and benefits of our products and services, the desire of large and medium size organizations to undertake significant evaluation processes to determine their technology requirements prior to making information technology expenditures, and the need to negotiate large, complex, enterprise-wide contracts. These longer and more complex sales cycles could result in a loss of customers and lower revenues.

We spend substantial time and money on our sales efforts without any assurance that potential customers will ultimately purchase our solutions. As we target our sales efforts at larger enterprise customers, these trends are expected to continue. Our long and complex sales cycle for these products makes it difficult to predict when a given sales cycle will close.

There are a number of financial and accounting risks in our subscription model.

12

A growing portion of our revenue is subscription-based pursuant to service and subscription agreements that are generally month-to-month or one year in length, and we intend to continue to expand our subscription-based offerings. Although the subscription model is designed to increase the number of customers who purchase our products and services on a recurring basis and create a more predictable revenue stream, there are certain risks inherent in a subscription-based model. These risks include the risk that customers will not renew their subscriptions, risks related to the timing of revenue recognition, and the risk of potential reductions in cash flows. Although many of our service and subscription agreements contain automatic renewal terms, generally, our customers have no obligation to renew their subscriptions for our services after the expiration of their initial subscription period. If customers do renew their subscriptions, these subscriptions may not be renewed on the same terms. Moreover, under certain circumstances, some of our customers have the right to cancel their service agreements prior to the expiration of the terms of their agreements. If our customers do not renew their subscriptions for our services or if they renew on terms less favorable to us, our revenues may decline. Our future growth is also affected by our ability to sell additional features and services to our current customers, which depends on a number of factors, including customers' satisfaction with our products and services, the prices of our offerings, and general economic conditions. If our efforts to cross-sell and upsell to our customers are unsuccessful, the rate at which our business grows may decline.

A portion of the subscription-based revenue we report each quarter results from the recognition of deferred revenue relating to subscription agreements entered into during previous quarters. A decline in new or renewed subscriptions in any period may not be immediately reflected in our reported financial results for that period but may result in a decline in our revenue in future quarters. If we were to experience significant downturns in subscription sales and renewal rates, our reported financial results might not reflect such downturns until future periods. Our subscription model could also make it difficult for us to rapidly increase our revenues from subscription-based services through additional sales in any period, as revenue from new customers will be recognized over the applicable subscription term. Further, any increases in sales under our subscription sales model could result in decreased revenues over the short term if these sales are offset by a decline in sales from perpetual license customers. If any of our assumptions about revenue from our new businesses or our addition of a subscription-based model prove incorrect, our actual results may differ materially from those anticipated, estimated, or projected. We may be unable accurately to predict subscription renewal rates and the impact these rates may have on our future revenue and operating results.

We operate in highly fragmented and competitive markets, and our competitors may be able to draw upon a greater depth and breadth of resources than those available to us.

We operate in highly fragmented and competitive markets characterized by pressure to innovate, expand feature sets and functionality, accelerate new product releases, and reduce prices. Markets for certain of our products have limited barriers to entry. Also, the fragmentation in our markets creates an additional risk of consolidation among our competitors, which would result in fewer, more effective competitors. Customers consider many factors when evaluating our products relative to those of our competitors, including innovation, ease of use, price, feature sets, functionality, reliability, performance, reputation, and training and support, and we may not compare favorably against our competitors in all respects. Some of our current and potential competitors have longer operating histories, greater brand recognition, and substantially greater financial, technical, marketing, distribution, and support resources than we do. As a result, our competitors may be able to deliver greater innovation, respond more quickly to new or emerging technologies and changes in market demand, devote more resources to the development, marketing and sale of their products, successfully expand into emerging and other international markets, or price their products more aggressively than we can. If our competitors are more successful than we are in developing products, or in attracting and retaining customers, our financial condition and operating results could be adversely affected.

We obtain certain hardware product components and finished goods under sole-source supplier arrangements. Disruptions to these arrangements and other supply chain interruptions could jeopardize the manufacturing or distribution of certain of our hardware products.

Although we generally prefer to establish multi-source supply arrangements for our hardware product components and finished goods, multi-source arrangements are not always possible or cost-effective, and therefore we rely on sole-source suppliers for some of our hardware product components and finished goods. Reliance on sole source suppliers increases our susceptibility to supply chain limitations and interruptions. We do not generally carry significant inventories of, and may not in all cases have guaranteed supply arrangements for, these sole-sourced items. Our sole-source suppliers may cease, suspend, or otherwise limit production or shipment of our product components, or they may terminate our agreements or adversely modify supply terms or pricing, due to, among other things, macroeconomic events, political crises, natural or environmental disasters, labor shortages, or

13

other unforeseen occurrences outside the control of us or our suppliers. Supply chain disruptions due to the conflict in Ukraine and any indirect effects may further complicate existing supply chain constraints. If any of these events occur, our ability to manufacture, distribute, and service our products would be impaired, and our business could be significantly harmed. We may not be able to obtain sole-sourced components or finished goods, or acceptable substitutes, from alternative suppliers or on commercially reasonable terms. If we are forced to change sole-source suppliers due to a contract termination or other production cessation, it may take a significant amount of time and expenses to obtain substitute suppliers, during which time our inventory may be significantly reduced, which may adversely impact our business, financial condition and results of operations. We may also be required to expend significant development resources to redesign our products to work around the exclusion of any sole-sourced component or accommodate the inclusion of any substitute component. Although we have procedures in place to mitigate the risks associated with our sole-sourced suppliers, we cannot be certain that we will be able to obtain sole-sourced components or finished goods from alternative suppliers or that we will be able to do so on commercially reasonable terms without a material impact on our results of operations or financial position.

A natural disaster or catastrophic event may significantly limit our ability to conduct business as normal and harm our business.

Our operations, and the operations of our customers, are vulnerable to interruptions by natural disasters and catastrophic events, including pandemics such as the COVID-19 pandemic, as well as political unrest including armed conflicts such as the Russian invasion of Ukraine. We operate a complex, geographically dispersed business, which includes significant personnel, customers and facilities in California near major earthquake fault lines and in Manila which is subject to sever weather from typhoons and volcanic activity. We may not be able to protect our company from, and we are predominantly uninsured for, business continuity losses and disruptions caused by such catastrophic events. Disruption or failure of our or our customers’ networks or systems, or injury or damage to either parties’ personnel or physical infrastructure, caused by a natural disaster, public health crisis, terrorism, cyber-attack, political unrest, acts of war or armed conflict, or other catastrophic event may significantly limit our or our customers’ ability to conduct business as normal, including our ability to communicate and transact with customers, suppliers, distributors, and resellers, which may negatively affect our revenues and operating results. Additionally, a natural disaster or catastrophic event could cause us or our customers to suspend all or a portion of operations for a significant period of time, result in a permanent loss of resources, and require the relocation of personnel and material to alternate facilities that may not be available or adequate. Such an event could also cause an indirect economic impact on our customers, which could affect our customers’ purchasing decisions and reduce demand for our products and services. There could also be disruptions to our supply chain as a result of such events. We may also experience disruption to our internal operations if we are forced to restrict employee travel, cancel events with customers or partners, or even close office facilities as a result of such events. Any significant disruption resulting from such events on a large scale or over a prolonged period of time could cause significant delays and disruption to our business until the Company would be able to resume normal business operations or shift to other third-party vendors, negatively affecting our revenue and other financial results. A prolonged disruption of our business could also damage our reputation, particularly among our global news organization customers who are likely to require our solutions and support during such time. Any of these factors could cause a material adverse impact on our financial condition and operating results.

Our products may experience defects that could negatively impact our customer relationships, market reputation, and operating results.

Our software products occasionally include coding defects (commonly referred to as “bugs”), which in some cases may interfere with or impair a customer’s ability to operate or use the software. Similarly, our hardware products could include design or manufacturing defects that could cause them to malfunction. The quality control measures we use are not designed or intended to detect and remedy all defects. Any product defects could result in loss of customers or revenues, delays in revenue recognition, increased product returns, damage to our market reputation, and significant warranty or other expense and could have a material adverse impact on our financial condition and operating results.

Lengthy procurement lead times and unpredictable life cycles and customer demand for some of our products may result in significant inventory risks.

With respect to many of our products, particularly our audio products, we must procure component parts and build finished inventory far in advance of product shipments. Certain of these products may have unpredictable life cycles and encounter rapid technological obsolescence as a result of dynamic market conditions. We procure product components and build inventory based upon our forecasts of product life cycle and customer demand. If we are unable to accurately forecast product life cycle and customer demand or unable to manage our inventory levels in response to shifts in customer demand, the result may be

14

insufficient, excess, or obsolete product inventory. Insufficient product inventory may impair our ability to fulfill product orders and negatively affect our revenues, while excess or obsolete inventory may require a write-down on products and components to their net realizable value, which would negatively affect our results of operations.

Our revenues and operating results depend significantly on our third-party reseller and distribution channels. Our failure to effectively manage our distribution channels for our products and services could adversely affect our revenues and gross margins and therefore our profitability.

We distribute many of our products indirectly through third-party resellers and distributors. We also distribute products directly to end-user customers. Successfully managing the interaction of our direct and indirect channel efforts to reach various potential customer industries for our products and services is a complex process. For example, in response to our direct sales strategies or for other business reasons, our current resellers and distributors may from time to time choose to resell our competitors’ products in addition to, or in place of, our products. Moreover, since each distribution method has distinct risks and gross margins, our failure to identify and implement the most advantageous balance in the delivery model for our products and services could adversely affect our revenues and gross margins and therefore our profitability.

Potential acquisitions could be difficult to consummate and integrate into our operations, and they could disrupt our business, dilute stockholder value, or impair our financial results.

As part of our business strategy, from time to time we may seek to grow our business through acquisitions of or investments in new or complementary businesses, technologies, or products that we believe can improve our ability to compete in our existing customer markets or allow us to enter new markets. There are numerous risks associated with acquisitions and investment transactions including, but not limited to, failing to realize anticipated returns on investment, unanticipated costs and liabilities associated with the acquisition, and difficulty assimilating the operations, policies and personnel of the acquired business.

Our revenues and operating results are difficult to predict and may fluctuate from period to period.

Our results of operations have been, and may continue to, be subject to significant quarterly variation. Our revenues and operating results for any particular quarter may also vary due to a number of factors, including, but not limited to, those enumerated under the section “Cautionary Note on Forward-Looking Statements,” appearing elsewhere in this Form 10-K and:

•the timing of large or enterprise-wide sales and our ability to recognize revenues from such sales;

•demand planning and logistics;

•renewal rates under subscription contracts;

•reliance on third-party reseller and distribution channels;

•disruptions in our supply chain;

•changes in operating expenses;

•price protections and provisions for inventory obsolescence extended to resellers and distributors;

•seasonal factors, such as higher consumer demand at year-end; and

•complex accounting rules for revenue recognition.

The occurrence and interaction of these variables may cause our revenues and operating results to fluctuate from period to period. As a result, period-to-period comparisons of our revenues and operating results may not provide an adequate indication of our future performance. We cannot be certain when, or if, our operations will be profitable in future periods.

Our revenue backlog estimates are based on certain assumptions and are subject to unexpected adjustments and cancellations, and backlog orders may not be timely converted to revenues in any particular fiscal period, if at all, or be indicative of our actual operating results for any future period.

Our revenue backlog, as we define it, consists of firm orders received and includes both (i) orders where the customer has paid in advance of our performance obligations being fulfilled, which are reflected as deferred revenues on our balance sheet, and (ii) orders for future product deliveries or services that have not yet been invoiced by us. To the extent that our customers cancel their orders with us, or reduce their requirements during a particular period for any reason, we will not realize revenue or profit from

15

the associated revenue backlog. Even where a project proceeds as scheduled, it is possible that the customer may default and fail to pay amounts owed to us. Material delays, payment defaults, or cancellations could reduce the amount of revenue backlog currently reported, and consequently, could inhibit the conversion of that backlog into revenues. Furthermore, orders included in our revenue backlog may not be profitable. We may experience variances in the realization of our revenue backlog because of project delays or cancellations resulting from external market factors and economic factors beyond our control. In addition, even if we realize all of the revenue from the projects in our revenue backlog, if our expenses associated with these projects are higher than expected, our results of operations and financial condition would be adversely affected.

Risks Related to Intellectual Property

Our intellectual property and trade secrets are valuable assets that may be subject to third-party infringement and misappropriation.

As a technology company, our intellectual property and trade secrets are among our most valuable assets. Infringement or misappropriation of these assets can result in lost revenues, and thereby ultimately reduce their value. We rely on a combination of patent, copyright, trademark, and trade secret laws, as well as confidentiality procedures, contractual provisions, and anti-piracy technology in certain of our products to protect our intellectual property and trade secrets. Most of these tools require vigilant monitoring of competitor and other third-party activities and of end-user usage of our products to be effective. These tools may not provide adequate protection in all instances, may be subject to circumvention, or may require a vigilance that in some cases exceeds our capabilities or resources. Additionally, our business model is increasingly focused on software products and, as we offer more software products, our revenues may be more vulnerable to loss through piracy. The legal regimes of certain foreign jurisdictions in which we operate may not protect our intellectual property or trade secrets to the same extent as do the laws of the United States. These concerns may be heightened in areas of geopolitical conflict, such as Russian occupied areas of Ukraine, where law enforcement may not provide physical security sufficient to protect hard assets containing our IP. If our intellectual property or trade secrets are misappropriated in foreign jurisdictions, we may be without adequate remedies to address these issues. Regardless of jurisdiction, assuming legal protection exists, and infringement or misappropriation is detected, any enforcement action that we may pursue could be costly and time-consuming, the outcome will be uncertain, and the alleged offender in some cases may seek to have our intellectual property rights invalidated. If we are unable to protect our intellectual property and trade secrets, our business could be harmed.

Our results could be materially adversely affected if we are accused of, or found to be, infringing third parties’ intellectual property rights.

Because of technological change in our industry, extensive and sometimes uncertain patent coverage, and the rapid issuance of new patents, it is possible that certain of our products or business methods may infringe the patents or other intellectual property rights of third parties. Companies in the technology industry own large numbers of patents, copyrights, trademarks, and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. Our technologies may not be able to withstand any third-party claims or rights against their use. We have received claims and have been subject to litigation alleging that we infringe patents owned by third parties, and we may in the future be subject to such claims and litigation. Regardless of the scope or validity of such patents, or the merits of any patent claims by potential or actual litigants, we could incur substantial costs in defending intellectual property claims and litigation, and such claims and litigation could distract management’s attention from normal business operations. In addition, we provide indemnification provisions in agreements with certain customers covering potential claims by third parties of intellectual property infringement. These agreements generally provide that we will indemnify customers for losses incurred in connection with an infringement claim brought by a third party with respect to our products, and we have received claims for such indemnification. The results of any intellectual property litigation to which we are, or may become, a party, or for which we are required to provide indemnification, may require us to: