AVID-12.31.2014-10K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 10-K

|

| | | |

| (Mark One) | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014 | |

| OR | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| FOR THE TRANSITION PERIOD FROM __________ TO __________ | |

Commission File Number: 1-36254

_______________________

Avid Technology, Inc.

(Exact Name of Registrant as Specified in Its Charter) |

| | | | |

| Delaware (State or Other Jurisdiction of Incorporation or Organization) | | 04-2977748 (I.R.S. Employer Identification No.) | |

75 Network Drive

Burlington, Massachusetts 01803

(Address of Principal Executive Offices, Including Zip Code)

(978) 640-6789

(Registrant’s Telephone Number, Including Area Code)

Securities Registered Pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act:

|

|

Title of Each Class |

Common Stock, $.01 Par Value |

_______________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

| | | | |

| Large Accelerated Filer ¨ Non-accelerated Filer ¨ (Do not check if smaller reporting company) | | Accelerated Filer x Smaller Reporting Company ¨ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No S

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $287,833,000 based on the closing price of the Common Stock as quoted on the OTC Pink Tier on June 30, 2014. The number of shares outstanding of the registrant’s Common Stock as of March 13, 2015 was 39,466,054.

|

| | | | |

| DOCUMENTS INCORPORATED BY REFERENCE | |

| Document Description | | 10-K Part | |

| Portions of the Registrant’s Proxy Statement for the 2015 Annual Meeting of Stockholders | | III | |

AVID TECHNOLOGY, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

TABLE OF CONTENTS

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or Form 10-K, filed by Avid Technology, Inc. (together with its consolidated subsidiaries, “Avid” or the “Company”, or “we”, “us” or “our” unless the context indicates otherwise includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements contained in this Form 10-K that relate to future results or events are forward-looking statements. Forward-looking statements may be identified by use of forward-looking words, such as “anticipate,” “believe,” “confidence,” “could,” “estimate,” “expect,” “feel,” “intend,” “may,” “plan,” “should,” “seek,” “will” and “would,” or similar expressions.

Forward-looking statements may involve subjects relating to the following:

| |

• | the development, marketing and selling of new products and services; |

| |

• | our ability to successfully implement our Avid Everywhere strategic plan and other strategic initiatives, including our cost saving strategies; |

| |

• | anticipated trends relating to our sales, financial condition or results of operations; |

| |

• | our goal of expanding our market positions; |

| |

• | the anticipated performance of our products; |

| |

• | our business strategies and market positioning; |

| |

• | our ability to successfully consummate any potential acquisitions or investment transactions and successfully integrate acquired business into our operations; |

| |

• | the anticipated trends and development of our markets and the success of our products in these markets; |

| |

• | our ability to mitigate and remediate effectively the material weaknesses in our internal control over financial reporting; |

| |

• | the risk of restatement of our financial statements; |

| |

• | our capital resources and the adequacy thereof; |

| |

• | the impact, costs and expenses of any litigation or government inquiries we may be subject to now or in the future; |

| |

• | the effect of the continuing worldwide macroeconomic uncertainty on our business and results of operation; |

| |

• | the expected timing of recognition of revenue backlog as revenue; |

| |

• | estimated asset and liability values and amortization of our intangible assets; |

| |

• | our compliance with covenants contained in our indebtedness; |

| |

• | changes in inventory levels; |

| |

• | plans regarding repatriation of foreign earnings; |

| |

• | transactions in and valuations of investments and derivative instruments; and |

| |

• | fluctuations in foreign exchange and interest rates. |

Actual results and events in future periods may differ materially from those expressed or implied by these forward-looking statements in this report. There are a number of factors that could cause actual events or results to differ materially from those indicated or implied by forward-looking statements, many of which are beyond our control, including the risk factors discussed in Item 1A of this Form 10-K. In addition, the forward-looking statements contained in this Form 10-K represent our estimates only as of the date of this filing and should not be relied upon as representing our estimates as of any subsequent date. While we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, whether to reflect actual results, changes in assumptions, changes in other factors affecting such forward-looking statements or otherwise.

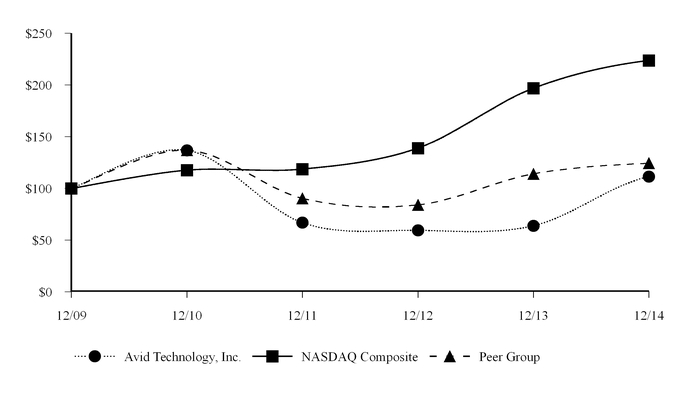

The information included under the heading “Stock Performance Graph” in Item 5 of this Form 10-K is “furnished” and not “filed” and shall not be deemed to be “soliciting material” or subject to Regulation 14A, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, or the Securities Act, except to the extent that we specifically incorporate it by reference.

We own or have rights to trademarks and service marks that we use in connection with the operation of our business. Avid is a trademark of Avid Technology, Inc. Other trademarks, logos, and slogans registered or used by us and our subsidiaries in the United States and other countries include, but are not limited to, the following: Avid Everywhere, Avid Motion Graphics, AirSpeed, EUCON, Fast Track, iNEWS, Interplay, ISIS, Avid MediaCentral Platform, Mbox, Media Composer, NewsCutter, Nitris, Pro Tools, Sibelius and Symphony. Other trademarks appearing in this Form 10-K are the property of their respective owners.

PART I

OVERVIEW

We provide an open, integrated, and comprehensive technology platform, along with applications and services that enable the creation, distribution, and monetization of audio and video content. Specifically, we develop, market, sell, and support software and hardware for digital media content production, management, secured content storage and distribution. Digital media are video, audio or graphic elements in which the image, sound or picture is recorded and stored as digital values, as opposed to analog or tape-based signals. Our products are used in production and post-production facilities; film studios; network, affiliate, independent and cable television stations; recording studios; live-sound performance venues; advertising agencies; government and educational institutions; corporate communication departments; and by independent video and audio creative professionals, as well as aspiring professionals and enthusiasts. Projects produced using our products include feature films, television programs, live events, news programs, commercials, music, video and other recordings.

Our mission is to create the most powerful and collaborative media network that enables the creation, distribution and monetization of the most inspiring content in the world. Guided by our Avid Everywhere strategic vision, we strive to deliver the industry’s most open, innovative and comprehensive media platform connecting content creation with collaboration, asset protection, distribution and consumption for the media in the world – from the most prestigious and award-winning feature films, music recordings, and television shows, to live concerts and news broadcasts. We have been honored over time for our technological innovation with 14 Emmy Awards, one Grammy Award, two Oscar statuettes and the first ever America Cinema Editors Technical Excellence Award. Our solutions were used in all 2015 Oscar nominated films for Best Picture, Best Editing, Best Sound Editing and Best Sound Mixing.

CORPORATE STRATEGY

Technology has enabled almost every aspect of how we live to become increasingly digitized, and acceleration of digitization is having a tremendous impact on the media industry and altering the industry value chain. Today’s consumers are empowered to create and consume content on-demand-anywhere, anytime. Organizations are under pressure to connect and automate the entire creation-to-consumption workflow. This consumerization has increased the cost and complexity of monetizing assets, which in turn leads to demand for new platforms for distribution and consumption. Organizations need to rely on partners with the strategic understanding and technological expertise to help navigate the challenges they are facing. We believe we are uniquely positioned as a proven and trusted leader to effectively help the media industry navigate through this period of unprecedented changes.

Our strategy is built on three pillars, Avid Everywhere, The Avid Advantage and the Avid Customer Association. Avid Everywhere, introduced in April 2013, is our strategic vision for connecting creative professionals and media organizations with their audiences in a more powerful, efficient, collaborative, and profitable way. Central to the Avid Everywhere vision is the Avid MediaCentral Platform, an open, extensible, and customizable foundation that streamlines and simplifies workflows by tightly integrating all Avid or third party products and services that run on top of it. The platform provides secure and protected access, which enables the creation and delivery of content faster and easier through a set of modular application suites that together represent an open, integrated, and flexible media production and distribution environment for the media industry. The Avid Advantage complements Avid Everywhere by offering a new standard in service, support and education to enable our customers to derive more efficiency from their Avid investment. Finally, the Avid Customer Association, or ACA, created in September 2013, is an association run for and by a dedicated group of media community visionaries, thought leaders and users. The ACA is designed to provide essential strategic leadership to the media industry, facilitate collaboration between Avid and key industry leaders and visionaries, and deepen relationships between our customers and us. With a 51% increase in members in the past year, the ACA is fast becoming a powerful platform for the media industry.

We have organized our existing hardware and software products and introduced new solutions in three suites, all built upon the MediaCentral Platform. These three suites encompass both audio and video products and solutions and are summarized below:

| |

• | Artist Suite encompasses all of our products and tools used to create content, including video editing solutions, digital audio workstations (DAW), music notation software, control surfaces and live sound systems. Products and tools in the |

Artist Suite can be deployed on premise, cloud-enabled, or through a hybrid approach. Users can collaborate to access, edit, and share the same media; and collaborate with others as if they were all in the same facility.

| |

• | Media Suite includes all of our tools and services used to manage, protect, distribute, and monetize media, including solutions for newsroom management, asset management, and multiplatform distribution. We are also expanding the Media Suite to include metadata tagging, protection and encryption, and analytics. |

| |

• | Storage Suite refers to all of our products and tools used to capture, store, and deliver media, including online storage, nearline storage, and ingest/playout servers. These products and tools work in close concert with the Media Suite’s tagging and asset management. |

CUSTOMER MARKETS

We provide digital media content-creation, management and distribution products and solutions to customers in the following markets:

| |

• | Broadcast and Media. This market consists of broadcast, government, sports and other organizations that acquire, create, process, and/or distribute audio and video content to a large audience for communication, entertainment, analysis, and/or forensic purposes. Customers in this industry rely on workflows that span content acquisition, creation, editing, distribution, sales and redistribution and utilize all content distribution platforms, including web, mobile, internet protocol television, cable, satellite, on-air and various other proprietary platforms. For this market, we offer a range of open products and solutions including hardware- and software-based video- and audio-editing tools, collaborative workflow and asset management solutions, and automation tools, as well as scalable media storage options. Our domain expertise also allows us to provide customers in this market with a range of professional and consulting services. We sell into this market through our direct sales force and resellers. |

| |

• | Video and Audio Post and Professional. This market is made up of individual artists and entities that create audio and video media as a paid service, but do not currently distribute media to end consumers on a large scale. This industry spans a wide-ranging target audience that includes: independent video editors, facilities and filmmakers that produce video media as a business but are not broadcasters; professional sound designers, editors and mixers and facilities that specialize in the creation of audio for picture; songwriters, musicians, producers, film composers and engineers who compose and record music professionally; technicians, engineers, rental companies and facilities that present, record and broadcast audio and video for live performances; and students and teachers in career technical education programs in high schools, colleges and universities, as well as in post-secondary vocational schools, that prepare students for professional media production careers in the digital workplace. For this market, we offer a range of products and solutions based on the Avid MediaCentral Platform, including hardware- and software-based creative production tools, scalable media storage options and collaborative workflows. Our domain expertise also allows us to provide customers in this market with a broad range of professional services. We sell into this market through storefront and on-line retailers, as well as through our direct sales force and resellers. |

PRODUCTS AND SERVICES

Overview

In April 2014, guided by Avid Everywhere, our strategic vision for the media and entertainment industry, we launched the Avid MediaCentral Platform, a set of modular application suites, and new private and public marketplaces that together will represent an open, integrated and flexible media production and distribution environment in the industry. With on-premises and cloud-enabled deployment options, as well as subscription, floating and perpetual licensing options, customers have more choice over how they use Avid solutions.

In July 2012, as a result of a strategic review of our business and the markets we serve, we divested our consumer-focused product lines. The divestiture has enabled us to focus on our core business as a provider of video and audio content creation, distribution and monetization solutions for the professional markets.

The following table presents our net revenues from continuing operations, which includes the amortization of deferred revenues but excludes the revenues from our consumer business divested in 2012, for the periods indicated (in thousands):

|

| | | | | | | | | | | |

| Year Ended December 31, |

| 2014 | | 2013 | | 2012 |

Video products and solutions | $ | 233,464 |

| | $ | 243,173 |

| | $ | 276,909 |

|

Audio products and solutions | 145,163 |

| | 152,358 |

| | 201,921 |

|

Total products and solutions | 378,627 |

| | 395,531 |

| | 478,830 |

|

Services | 151,624 |

| | 167,881 |

| | 156,873 |

|

Total net revenues | $ | 530,251 |

| | $ | 563,412 |

| | $ | 635,703 |

|

The following table presents our net revenues from continuing operations, which includes the amortization of deferred revenues but excludes the revenues from our consumer business divested in 2012, by type as a percentage of total net revenues from continuing operations for the periods indicated:

|

| | | | | | | | |

| Year Ended December 31, |

| 2014 | | 2013 | | 2012 |

Video products and solutions | 44 | % | | 43 | % | | 43 | % |

Audio products and solutions | 27 | % | | 27 | % | | 32 | % |

Total products and solutions | 71 | % | | 70 | % | | 75 | % |

Services | 29 | % | | 30 | % | | 25 | % |

Total net revenues | 100 | % | | 100 | % | | 100 | % |

Video Products and Solutions

Professional Video Creative Tools

We offer a range of software and hardware video-editing tools for the professional. Our award-winning Media Composer product line is used to edit video content, including television programming, commercials and films, while our NewsCutter option and iNews systems are designed for the fast-paced world of news production. Our Avid Symphony option is used during the “online” or “finishing” stage of post-production, during which the final program is assembled in high resolution with finished graphics, visual effects, color grading and audio tracks. Our Media Composer | Cloud solution (formerly Interplay Sphere) enables broadcast news professionals to acquire, access, edit and finish stories anytime, from everywhere. Leveraging a cloud-based architecture, this solution gives contributors the ability to craft stories where they are happening and speed them to air while maintaining connectivity with the newsroom operation. In May 2014, we released Media Composer version 8 with subscription offerings and updates, and in December 2014 we released a new version with resolution flexibility and independence, which allows users to manage and edit high-resolution media content with ease. These new versions are designed to extend the production capabilities of these solutions and demonstrates our continuing commitment to provide tools that allow for improved creativity and productivity of the professional editor, delivered in a way most attractive to the user.

Revenues from our professional video creative tools accounted for approximately 8%, 10% and 12% of our net revenues from continuing operations for 2014, 2013 and 2012, respectively.

Media Management Solutions

Our Avid MediaCentral | UX (formerly Interplay Central) web and mobile-based apps extend the capability of our Avid Interplay | MAM and Avid Interplay | Production asset management solutions by providing real-time access to media assets for the on-the-go media professional. Avid Interplay | MAM allows users to focus on managing content and workflows by giving them the tools to connect their media operations and business intelligence, control movement of media between various storage systems, configure metadata, and leverage a service-oriented architecture structure to integrate in-house and third-party applications. Avid Interplay | Production enhances production team collaboration by coordinating the collaborative editorial workflow of team members at each site, many of whom may be working on the same projects at the same time. Avid Interplay | Production also manages the detailed composition of a project and provides the ability to track media, production file formats, and a project’s history.

Revenues from media management solutions accounted for approximately 9%, 8% and 8% of our net revenues from continuing operations in 2014, 2013 and 2012, respectively.

Video Storage and Server Solutions

Our Avid ISIS 5500 and ISIS 7500 shared storage systems are real-time, open solutions that bring the power of shared storage to local, regional, national and multinational broadcasters and post-production facilities at competitive prices. Customers can improve allocation of creative resources and support changing project needs with an open shared storage platform that includes the ISIS file system technology on lower cost hardware, support for third-party applications and streamlined administration to create more content more affordably. In April 2014, we introduced ISIS 2500 as a near-line storage solution with common off-the-shelf storage with an application layer that provides secure storage and allows customers to extend their library of accessible media assets. Our on-air server solutions include AirSpeed 5000 and AirSpeed 5500, which enable broadcasters to automate the ingest and playout of television and news programming. The AirSpeed 5000 and 5500 video servers work with a wide range of applications to improve workflow and provide cost-efficient ingest and play to air capabilities for broadcasters of any size.

Revenues from video storage and server solutions accounted for approximately 25%, 24% and 24% of our net revenues from continuing operations in 2014, 2013 and 2012, respectively.

Audio Products and Solutions

Digital Audio Software and Workstation Solutions

Our Pro Tools digital audio software and workstation solutions facilitate the audio production process, including music and sound creation, recording, editing, signal processing, integrated surround mixing and mastering, and reference video playback. The Pro Tools platform supports a wide variety of internally developed and third-party software plug-ins and integrated hardware. Pro Tools solutions are offered at a range of price points and are used by professionals and aspiring professionals in music, film, television, radio, game, Internet and other media production environments. In June 2013, we released Pro Tools version 11 featuring a fully redesigned audio engine and 64-bit architecture. In January 2015, we announced Pro Tools version 12 with subscription offerings and new features and updates, including the ability to collaborate over the cloud, as well as Pro Tools | First, which will allow beginners to access the same music creation tools used by professionals.

Our Pro Tools HD family of digital audio workstations, designed to provide high performance, low latency, and great sound quality, provides music production professionals with two powerful solutions, the Pro Tools | HD Native system and the Pro Tools | HDX system. Our Pro Tools | HDX workstation represents a new generation of Pro Tools HD solutions by providing more power, higher audio quality, and easier ways to record, edit and mix demanding audio productions. The most recent addition to our Pro Tools | HD workstation family, the Pro Tools | HD Native Thunderbolt, uses a high-speed Thunderbolt interface to connect to a laptop or desktop computer to eliminate monitor latency while recording.

Our audio recording interfaces are designed to deliver high audio quality plus hands-on controls giving musicians the tools to produce quality recordings in less time. In September 2014, Avid partnered with US based Apogee Electronics Corp. and introduced two new audio recording interfaces: The Pro Tools | Duet and Pro Tools | Quartet, comprised of Apogee audio interfaces and Pro Tools software to provide fully EUCON integrated solutions for musicians and audio engineers.

Revenues from digital audio software and workstation solutions accounted for approximately 16%, 16% and 20% of our net revenues from continuing operations in 2014, 2013 and 2012, respectively.

Control Surfaces, Consoles and Live-Sound Systems

We offer a range of complementary control surfaces and consoles, leveraging the open industry standard protocol EUCON (Extended User Control) to provide open solutions that meet the needs of customers ranging from the independent professional to the high-end broadcaster. Our System 5 digital audio console is a large-format, scalable console with power on demand to mix large feature films or album projects. The addition of our EUCON Hybrid option extends the control capabilities of a System 5 console, enabling the user to bring audio tracks from multiple digital audio workstations onto the console surface for mixing. In September 2013, we introduced our Pro Tools | S6 control surface for sound recording, mixing and editing, which was designed as a state-of-the-art modular solution that scales to meet both current and future customer requirements. S6 is designed for audio professionals in demanding production environments, delivering the performance needed to complete projects faster while

producing high quality mixes. Our Artist Series control surfaces offer integrated, hands-on control for price-sensitive applications. Compact and portable, all control surfaces in the Artist line feature EUCON, allowing hands-on control of the user’s applications.

Our VENUE product family includes console systems for mixing audio for live sound reinforcement for concerts, theater performances and other public address events. We offer a range of VENUE systems designed for large performance settings, such as stadium concerts, as well as medium-sized theaters and houses of worship. VENUE systems allow the direct integration of Pro Tools solutions to create and playback live recordings. The VENUE | SC48 Remote System features the VENUE | SC48 digital console paired with the VENUE Stage 48 remote box, enabling the user to place input/output devices away from the console and closer to the sources, eliminating cable clutter.

In May of 2013, we introduced Avid S3L, which delivers the sound quality, performance, and features of Avid live systems in a modular, networked design. In October 2014, we released a newer version, Avid Venue | S3L-X, which was built on the merits of Avid S3L and enhances every facet of live sound production. The open and flexible system is comprised of a high-performance HDX-powered mix engine running VENUE software and AAX DSP plug-ins, scalable remote I/O, a compact EUCON-enabled control surface, and Pro Tools software for integrated live sound mixing and recording. The streamlined networked design simplifies system set-up and configuration with drag-and-drop functionality, while direct Pro Tools recording and mixing capabilities open opportunities for live album releases. The compact S3L-X System can be taken on tour or installed in clubs, theaters, houses of worship, or other performance venues to meet a broad range of demands. The S3 control surface from the S3L-X system was made available in December 2014 as a standalone product allowing users to control Pro Tools or other EUCON-enabled EUCON digital audio workstations in a studio or home environment.

Revenues from control surfaces and live systems accounted for approximately 10%, 9% and 10% of our net revenues from continuing operations in 2014, 2013 and 2012, respectively.

Notation Software

Our Sibelius-branded software allows users to create, edit and publish musical scores. Sibelius software is used by composers, arrangers and other music professionals. Student versions are also available to assist in the teaching of music composition and score writing. The newest version of our musical notation software, Sibelius 7.5, features a task-oriented user interface and native 64-bit performance. We recently introduced Sibelius | Cloud Publishing, which will allow users to view, play, transpose, print and purchase scores using current web browsers and mobile device. We also offer Avid Scorch, an application for the Apple iPad mobile device that turns an iPad into an interactive score library with access to sheet music through an in-app store with more than 150,000 premium titles.

Professional Services and Customer Care

Our Professional Services team delivers workflow design and consulting; program and project management; system installation and commissioning; custom development and role-based product level training. The Professional Services team facilitates the engagement with our customers to maximize their investment in technology; increase their operational efficiency; and enable them to reduce deployment risk and implement our solutions.

Our Education team delivers public and private training to our customers and alliance partners to ensure that they have the necessary skills and technical competencies to deploy, use, administer and create Avid solutions. The Education team develops and licenses curriculum content for use by third party Avid Learning partners to deliver training to customers, users and alliance partners. The Education team includes the Avid Certification program which validates the skills and competency of Avid users, administrators, instructors, support representatives and developers.

Our Customer Care team provides customers with a partner committed to giving them help and support when they need it. We offer a variety of services contracts and support plans, allowing each customer to select the level of technical and operational support that they need to maintain their operational effectiveness. Our global Customer Care team of more than 300 in-house and third-party industry professionals offers a blend of technology expertise and real-world experience from throughout the audio, visual, and entertainment industries. The team’s mission is to provide timely, informed responses to our customers’ issues and proactive maintenance for our solutions to help our customers maintain high standards of operational effectiveness.

COMPETITION

Our customer markets are highly competitive and subject to rapid change and declining average selling prices. The competitive landscape is fragmented with a large number of companies providing various types of products and services in different markets and geographic areas. We provide integrated solutions that compete based on total value workflow, features, quality, service and price. Companies with which we compete in some contexts may also act as our partners in other contexts, such as large enterprise customer environments.

Companies that compete with us across certain of our products and solutions are listed below by the market in which they compete:

| |

• | Broadcast and Media: The Associated Press Inc., Belden Inc., Bitcentral Inc., Dalet S.A., EVS Corporation, Harmonic Inc., Imagine Communications Corp, Ross Video Limited and Vizrt Ltd., among others. |

| |

• | Audio and Video Post and Professional: Ableton AG, Autodesk Inc., Blackmagic Design Pty Ltd, Harman International Industries Inc., Steinberg Media Technologies GmbH, Universal Audio Inc. and Yamaha Corporation, among others. |

In addition, we compete across both previously mentioned markets with companies such as Adobe Systems Incorporated, Apple Inc., Editshare LLC, Quantel Limited, Sony Corporation and EMC Corporation.

Some of our principal competitors are substantially larger than we are and have greater financial, technical, marketing and other resources than we have. For a discussion of these and other risks associated with our competitors, see Item 1A, “Risk Factors.”

OPERATIONS

Sales and Services Channels

We market and sell our products and solutions through a combination of direct, indirect and digital sales channels. Our direct sales channel consists of internal sales representatives serving select customers and markets. Our indirect sales channels include global networks of independent distributors, value-added resellers, dealers and retailers. Our digital sales channel is represented by the online Avid Marketplace.

We have significant international operations with offices in 22 countries and the ability to reach over 130 countries through a combination of our direct sales force and resellers. Sales to customers outside the United States accounted for 64%, 61% and 61%, respectively, of our net revenues from continuing operations in 2014, 2013 and 2012. Additional information about the geographic breakdown of our revenues and long-lived assets can be found in Note P to our Consolidated Financial Statements in Item 8 of this Form 10-K. For additional information about risks associated with our international operations, see Item 1A, “Risk Factors” in Item 1A of this Form 10-K.

We generally ship our products shortly after the receipt of an order. However, a high percentage of our revenues has historically been generated in the third month of each fiscal quarter and concentrated in the latter part of that month. Orders that may exist at the end of a quarter and have not been shipped are not recognized as revenues and are included in revenue backlog.

Certain orders included in revenue backlog may be reduced, canceled or deferred by our customers. Our revenue backlog, as we define it, consists of firm orders received and includes both (i) orders where the customer has paid in advance of our performance obligations being fulfilled, and (ii) orders for future product deliveries or services that have not yet been invoiced by us. The expected timing of the recognition of revenue backlog into revenue is based on current estimates and could change based on a number of factors, including (i) the timing of delivery of products and services, (ii) customer cancellations or change orders, (iii) changes in the estimated period of time Implied Maintenance Release PCS is provided to customers or (iv) changes in accounting standards or policies. Implied Maintenance Release PCS, as we define it, is the implicit obligation to make such software updates available to customers over a period of time which represents implied post-contract customer support and is deemed to be a deliverable in each arrangement and accounted for as a separate element. As there is no industry standard definition of revenue backlog, our reported revenue backlog may not be comparable with other companies. Additional information on our revenue backlog can be found in “Management’s Discussion and Analysis of Financial Condition and Results of Operation.”

We provide customer care services directly through regional in-house and contracted support centers and major-market field service representatives and indirectly through dealers, value-added resellers and authorized third-party service providers. Depending on the solution, customers may choose from a variety of support offerings, including telephone and online technical support, on-site assistance, hardware replacement and extended warranty, and software upgrades. In addition to customer care

services, we offer a broad array of professional services, including installation, integration, planning and consulting services, and customer training.

Manufacturing and Suppliers

Our internal manufacturing operations consist primarily of the testing of subassemblies and components purchased from third parties, the duplication of software, and the configuration, final assembly and testing of board sets, software, related hardware components and complete systems. In addition to our internal manufacturing operations, we rely on a network of contractors around the globe to manufacture many of our products, components and subassemblies. Our products undergo testing and quality assurance at the final assembly stage. We depend on sole-source suppliers for certain key hardware product components and finished goods, including some critical items. Although we have procedures in place to mitigate the risks associated with our sole-sourced suppliers, we cannot be certain that we will be able to obtain sole-sourced components or finished goods from alternative suppliers or that we will be able to do so on commercially reasonable terms without a material impact on our results of operations or financial position. For the risks associated with our use of contractors and sole-source vendors, see “Risk Factors” in Item 1A of this Form 10-K.

Our company-operated manufacturing facilities, primarily for final assembly and testing of certain products, are located in: Dublin, Ireland and Mountain View, California. Our Dublin facility is ISO 14001, Environmental Management System, certified.

We and our contract manufacturers manufacture our products at a relatively limited number of different facilities located throughout the world, and, in most cases, the manufacturing of each of our products is concentrated in one or a few locations. An interruption in manufacturing capabilities at any of these facilities, as a result of equipment failure or other reasons, could reduce, delay or prevent the production of our products. Because some of our manufacturing or our contract manufacturer’s operations are located outside of the United States, including in Ireland, China and Thailand, those manufacturing operations are also subject to additional challenges and risks associated with international operations. For these and other risks associated with our manufacturing operations, see “Risk Factors” in Item 1A of this Form 10-K.

Research and Development

We are committed to delivering best-in-class digital media content-creation solutions that are designed for the unique needs, skills and sophistication levels of our target customer markets. Having helped establish the digital media technology industry, we are building on a 25+ year heritage of innovation and leadership in developing content-creation solutions. We have research and development, or R&D, operations around the globe. Our R&D efforts are focused on the development of digital media content-creation, distribution, and monetization tools that operate primarily on the Mac and Windows platforms. Our R&D efforts also include networking and storage initiatives intended to deliver standards-based media transfer and media asset management tools, as well as stand-alone and network-attached media storage systems for workgroups. In addition to our internal R&D efforts, we outsource a significant portion of certain R&D projects to internationally based partners in Kiev, Ukraine and, to a lesser extent, Thailand. Our R&D expenditures for 2014, 2013 and 2012 were $90.4 million, $95.2 million and $98.9 million, respectively, which represented approximately 17%, 17% and 16%, respectively, of our net revenues from continuing operations. For the risks associated with our use of partners for R&D projects, see “Risk Factors” in Item 1A of this Form 10-K.

Our company-operated R&D operations are located in: Burlington, Massachusetts; Mountain View, California; Berkeley, California; Santa Cruz, California; Munich, Germany; Kaiserslautern, Germany; and Montreal, Canada. We also partner with a vendor in Ukraine for outsourced R&D services and a vendor in Thailand for hardware R&D services. We are in the process of expanding our own development activities to Taiwan.

Intellectual Property

We regard our software and hardware as proprietary and protect our proprietary interests under the laws of patents, copyrights, trademarks and trade secrets, as well as through contractual provisions.

We have obtained patents and have registered copyrights, trademarks and service marks in the United States and in many foreign countries. At December 31, 2014, we held 175 U.S. patents, with expiration dates through 2033, and had 32 patent applications pending with the U.S. Patent and Trademark Office. We have also registered or applied to register various trademarks and service marks in the United States and a number of foreign countries, including Avid, Avid Everywhere, Media Composer, Pro Tools and Sibelius. As a technology company, we regard our patents, copyrights, trademarks, service marks and trade secrets as being

among our most valuable assets, together with the innovative skills, technical competence and marketing abilities of our personnel.

Our software is licensed to end users pursuant to shrink-wrap, embedded, click-through or signed license agreements. Our products generally contain features to guard against unauthorized use. Policing unauthorized use of computer software is difficult, and software piracy is a persistent problem for us, as it is for the software industry in general. This problem is particularly acute in some of the international markets in which we operate. Although we attempt to protect our intellectual property rights through patents, trademarks, copyrights, licensing arrangements, maintaining certain technology as trade secrets and other measures, we cannot assure you that any patent, trademark, copyright or other intellectual property rights owned by us will not be invalidated, circumvented or challenged, that such intellectual property rights will provide competitive advantages to us, or that any of our pending or future patent applications will be issued with the claims, or the scope of the claims, sought by us, if at all. We cannot assure you that others will not develop technologies that are similar or superior to our technology, duplicate our technology or design around the patents that we own. In addition, effective patent, copyright and trade secret protection may be unavailable or limited in countries in which we do business or may do business in the future. For these and other risks associated with the protection of our intellectual property, see “Risk Factors” in Item 1A of this Form 10-K.

HISTORY AND EMPLOYEES

Avid was incorporated in Delaware in 1987. We are headquartered in Burlington, Massachusetts, with operations in North America, South America, Europe, Asia and Australia. At December 31, 2014, our worldwide workforce consisted of 1,413 employees and 391 external contractors.

AVAILABLE INFORMATION

We make available free of charge on our website, www.avid.com, copies of our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K and all amendments to those reports as soon as practicable after filing with the Securities and Exchange Commission, or SEC. Additionally, we will provide paper copies of all of these filings free of charge upon request. Alternatively, these reports can be accessed at the SEC’s Internet website at www.sec.gov. The information contained on our web site shall not be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act.

You should carefully consider the risks and uncertainties described below in addition to the other information included or incorporated by reference in this Form 10-K before making an investment decision regarding our common stock. If any of the following risks were to actually occur, our business, financial condition or operating results would likely suffer, possibly materially, the trading price of our common stock could decline, and you could lose part or all of your investment. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business.

Risks Related to Our Business and Industry

If we are unable to successfully execute on our strategy, our business, financial condition, and results of operations could be adversely affected.

We are in the process of transforming our business based on a strategy built on three pillars, Avid Everywhere, The Avid Advantage and the Avid Customer Association. As part of our corporate strategy we have organized our products in three suites, all built upon our MediaCentral Platform. The ongoing implementation of some of our strategy may require additional capital that we may not have access to on reasonable terms or at all. Additionally, our strategy is requiring us to develop expertise in new areas and establish new competencies either through talent acquisition or internal development, which we may not be able to successfully achieve. Moreover, the pace and scope of the transformation contemplated in our strategy increases the risk that not all of our strategic plans will deliver the expected benefits within the anticipated time frames, or at all. Furthermore, as a part of our strategy we are also identifying and executing on opportunities to reduce operating costs. If we are unable successfully to execute on our strategy, our business, financial condition, and results of operations could be adversely affected.

We operate in highly competitive markets, and our competitors may be able to draw upon a greater depth and breadth of resources than those that are available to us.

We operate in highly competitive markets characterized by pressure to innovate, expand feature sets and functionality, accelerate new product releases and reduce prices. Markets for certain of our products also have limited barriers to entry. There is an additional risk of consolidation among our competitors, which could result in fewer, more effective competitors. Customers consider many factors when evaluating our products relative to those of our competitors, including innovation, ease of use, price, feature sets, functionality, reliability, performance, reputation, and training and support, and we may not compare favorably against our competitors in all respects. Our restatement process may have had a negative impact on our reputation among our customers. Some of our current and potential competitors have longer operating histories, greater brand recognition and substantially greater financial, technical, marketing, distribution and support resources than we do. As a result, they may be able to deliver greater innovation, respond more quickly to new or emerging technologies and changes in market demand, devote more resources to the development, marketing and sale of their products, successfully expand into emerging and other international markets, or price their products more aggressively than we can.

If our competitors are more successful than we are in developing products or in attracting and retaining customers, our financial condition and operating results could be adversely affected.

The rapid evolution of the media industry is changing our customers’ needs, businesses and revenue models, and if we cannot anticipate or adapt quickly, our business will be harmed.

The media industry has rapidly and dramatically transformed over the past few years and is continuing to do so as free content, minimal entry costs for creation and distribution, and the expansion of mobile devices have become prevalent. As a result, our traditional customers’ needs, businesses and revenue models are changing, often in ways that deviate from our core strengths and traditional bases. If we cannot anticipate these changes or adapt to them quickly, our business will be harmed. For example, our customers have to address the increasing digitization of the media industry, which requires the creation of a more seamless value chain between content creation and monetization. Furthermore, because of the consumerization of the media industry, there is more pressure to create media that can be repurposed in a variety of ways in an efficient manner. As a result of these industry changes, traditional advertising channels are also facing competition from web and mobile platforms and diminished revenues from traditional advertising will cause some customers’ budgets for the purchase of our solutions to decline; this may be particularly true among local television stations, which in the past have been an important customer industry for us. Additionally,

our customers may also seek to pool or share facilities and resources with others in their industry and engage with providers of software as a service.

We continually assess new products and solutions for our customers and we continue to implement our Avid Everywhere strategy and platform designed to address changes in the industry by offering an open platform that will enable people to connect, collaborate, store, manage, distribute, share and monetize media assets; however, the changes in the industry may reduce demand for some of our existing products and services. Our competitive landscape continues to evolve as the media industry rapidly evolves. New or non-traditional competitors may arise or adapt in response to this evolution of the media industry, which could create downward price pressure on our products and solutions and reduce our market share and revenue opportunities.

Our success depends in significant part on our ability to provide innovative products and solutions in response to dynamic and rapidly evolving market demand.

To succeed in our market, we must deliver innovative products and solutions. Innovation requires both that we accurately predict future market trends and customer expectations and that we quickly adapt our development efforts in response. We also have the challenge of protecting our product roadmap and new product initiatives from leaks to competitors that might reduce or eliminate any innovative edge that we seek to gain. Predicting market trends is difficult, as our market is dynamic and rapidly evolving. Additionally, given the complex, sophisticated nature of our solutions and our typically lengthy product development cycles, we may not be able to rapidly change our product direction or strategic course. If we are unable to accurately predict market trends or adapt to evolving market conditions, our ability to capture customer demand will suffer and our market reputation and financial performance will be negatively affected. Even to the extent we make accurate predictions and possess the requisite flexibility to adapt, we may be able to pursue only a handful of possible innovations as a result of limited resources. Our success, therefore, further depends on our ability to identify and focus on the most promising innovations.

When we do introduce new products, our success depends on our ability to manage a number of risks associated with new products including but not limited to timely and successful product launch, market acceptance, and the availability of products in appropriate locations, quantities and costs to meet demand. For example, we have focused a significant part of our development efforts on developing our Avid Everywhere Platform, discussed in the preceding risk factor. There can be no assurance that these efforts will be successful in the near future, or at all, or that our competitors will not take significant market share in similar efforts. If we fail to develop new products and to manage new product introductions and transitions properly, our financial condition and operating results could be harmed.

Our international operations expose us to legal, regulatory and other risks that we may not face in the United States.

We derive more than half of our revenues from customers outside of the United States, and we rely on foreign contractors for the supply and manufacture of many of our products. We also conduct significant research and development activities overseas, including through third-party development vendors. For example, a significant part of our research and development is outsourced to contractors operating in Kiev, Ukraine and Thailand and we are in the process of expanding our own development activities to Taiwan and the Philippines. Our international operations are subject to a variety of risks that we may not face in the United States, including:

| |

• | the financial and administrative burdens associated with compliance with a myriad of environmental, tax and export laws, as well as other business regulations in foreign jurisdictions, including high compliance costs, inconsistencies among jurisdictions, and a lack of administrative or judicial interpretative guidance; |

| |

• | reduced or varied protection for intellectual property rights in some countries; |

| |

• | regional economic downturns; |

| |

• | economic, social and political instability abroad and international security concerns in general; |

| |

• | fluctuations in foreign currency exchange rates; |

| |

• | longer collection cycles for accounts receivable payment cycles and difficulties in enforcing contracts; |

| |

• | difficulties in managing and staffing international implementations and operations, and executing our business strategy internationally; |

| |

• | potentially adverse tax consequences, including the complexities of foreign value added or other tax systems and restrictions on the repatriation of earnings; |

| |

• | increased financial accounting and reporting burdens and complexities; |

| |

• | compliance with the applicable laws and regulations, including, for example, the EU Data Protection Directive, the U.S. Foreign Corrupt Practices Act, or FCPA, and the U.K. Bribery Act, particularly in emerging market countries; |

| |

• | difficulties in maintaining effective internal controls over financial reporting and disclosure controls; |

| |

• | costs and delays associated with developing products in multiple languages; and |

| |

• | foreign exchange controls that may prevent or limit our ability to repatriate income earned in foreign markets. |

Our overall success in international markets depends, in part, on our ability to succeed in differing legal, regulatory, economic, social and political conditions. We may not be successful in developing, implementing or maintaining policies and strategies that will be effective in managing these risks in each country where we do business. Our failure to manage these risks successfully, including developing appropriate contingency plans for our outsourced research and development work, could harm our international operations, reduce our international sales and increase our costs, thus adversely affecting our business, operating results and financial condition.

We have a significant relationship with a development vendor operating in Kiev, Ukraine and manufacturing vendors operating in China and Thailand, and changes to those relationships may result in delays or disruptions that could harm our business.

We rely on an offshore software development vendor for developing and servicing our products primarily from its offices in Kiev, Ukraine and manufacturing vendors for manufacturing certain of our products and developing hardware primarily in China and Thailand. If one of those vendors were, for any reason, to cease or experience significant disruptions in its operations, among others as a result of political unrest, we might be unable to replace it on a timely basis with a comparably priced provider. We would also have to expend time and resources to train any new development or manufacturing vendor. If any of the vendors were to suffer an interruption in its business, or experience delays, disruptions or quality control problems in development or manufacturing operations, or if we had to change development or manufacturing vendors, our ability to provide services to our customers would be delayed and our business, operating results and financial condition would be adversely affected.

We operate in many different jurisdictions and we could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and similar foreign anti-corruption laws.

The FCPA, and similar foreign anti-corruption laws generally prohibit companies and their intermediaries from offering, promising, authorizing, or making payments to foreign officials for the purpose of influencing any act or decision of such official in his or her official capacity, inducing the official to do any act in violation of his or her lawful duty, or to secure any improper advantage in obtaining or retaining business. Recent years have seen a substantial increase in the global enforcement of anti-corruption laws, with more frequent voluntary self-disclosures by companies, aggressive investigations and enforcement proceedings by both the DOJ and the SEC resulting in record fines and penalties, increased enforcement activity by non-U.S. regulators, and increases in criminal and civil proceedings brought against companies and individuals.

Our internal policies mandate compliance with these anti-corruption laws. We operate in many parts of the world that are recognized as having governmental corruption problems to some degree and where local customs and practices may not foster strict compliance with anti-corruption laws. Our continued operation and expansion outside the United States could increase the risk of such violations in the future. Despite our training and compliance programs, we cannot assure you that our internal control policies and procedures will protect us from unauthorized reckless or criminal acts committed by our employees or agents. In the event that we believe or have reason to believe that our employees or agents have or may have violated applicable anti-corruption laws, including the FCPA, we may be required to investigate or have outside counsel investigate the relevant facts and circumstances, which can be expensive and require significant time and attention from senior management. Violations of these laws may result in severe criminal or civil sanctions, which could disrupt our business and result in a material adverse effect on our reputation, business, results of operations or financial condition.

Failure of our information systems or breaches of data security could impact our business.

Our systems and processes involve the storage and transmission of proprietary information and sensitive or confidential data, including personal information of employees, customers and others. In addition, we rely on information systems controlled by third parties. Information system failures, network disruptions and system and data security breaches, manipulation, destruction or leakage, whether intentional or accidental, could harm our ability to conduct our business, impede development, manufacture or shipment of products, interrupt or delay processing of transactions and reporting financial results or result in the unintentional disclosure of proprietary, sensitive or confidential information. With our development of Avid Everywhere with its public and private marketplaces and cloud based offerings, our and our customer’s data and financial and proprietary information could

become more susceptible to such failures and data breaches. Additionally, significant or repeated reductions in the performance, reliability, security or availability of our information systems and network infrastructure could significantly harm our brand and reputation and ability to attract and retain existing and potential users, customers, advertisers and content providers.

Such information system failures or unauthorized access could be caused by our failure to adequately maintain and enhance these systems and networks, external theft or attack, misconduct by our employees, contractors, or vendors, or many other causes such as power failures, earthquake, fire or other natural disasters. Such information system failures or unauthorized access could expose us, our customers or the individuals affected to a risk of loss or misuse of this information, resulting in litigation and potential liability for us. In addition, the cost and operational consequences of implementing further data protection measures could be significant.

Additionally, the Avid Everywhere cloud based offerings depend on the availability and proper functioning of certain third-party services, including but not limited to cloud provider, database management, backup, monitoring and logging services. The failure or improper functioning of these third party services could lead to outages, security breaches and data losses, including loss of customer creative assets. If third-party services become unavailable, we may need to expend considerable resources identifying and integrating alternate providers.

Our engagement of contractors for product development and manufacturing may reduce our control over those activities, provide uncertain cost savings and expose our proprietary assets to greater risk of misappropriation.

We outsource a portion of our software development and our hardware design and manufacturing to contractors, both domestic and offshore. These relationships provide us with more flexible resource capabilities, access to global talent and cost savings, but also expose us to risks that may not exist or may be less pronounced with respect to our internal operations. We are able to exercise only limited oversight of our contractors, including with respect to their engineering and manufacturing processes, resource allocations, delivery schedules, security procedures and quality control. Language, cultural and time zone differences complicate effective management of contractors that are located abroad. Additionally, competition for talent in certain locations may lead to high turnover rates that disrupt development or manufacturing continuity. The manufacturers we use also manufacture products for other companies, including our competitors. Our contractors could choose to prioritize capacity for other users, increase the prices they charge us or reduce or eliminate deliveries to us, which could have a material adverse effect on our business. Moreover, if any of our third-party manufacturing suppliers suffer any damage to facilities, lose benefits under material agreements, experience power outages, lack sufficient capacity to manufacture our products, encounter financial difficulties or are unable to secure necessary raw materials from their suppliers, or suffer any other disruption or reduction in efficiency, we may encounter supply delays or disruptions. Pricing terms offered by contractors may be highly variable over time reflecting, among other things, order volume, local inflation and exchange rates. For example, during the past few years, including in 2014, most of our outsourced manufacturers have been in China, where the cost of manufacturing has been increasing and labor unrest and turn-over rates at manufacturers have been on the rise. Some of our contractor relationships are based on contract, while others operate on a purchase order basis, where we do not have the benefit of written protections with respect to pricing or other critical terms.

Many of our contractors require access to our intellectual property and our confidential and proprietary information to perform their services. Protection of these assets in relevant offshore locations may be less robust than in the United States. We must rely on policies and procedures we have instituted with our contractors and certain confidentiality and contractual provisions in our written agreements, to the extent they exist, for protection. These safeguards may be inadequate to prevent breaches. If a breach were to occur, available legal or other remedies may be limited or otherwise insufficient to compensate us for any resulting damages.

Certain of our contractor relationships involve complex and mission-critical dependencies. If any of the preceding risks were to occur, we might not be able to rapidly wind down these relationships or quickly transition to alternative providers.

Our success depends in part on our ability to hire and retain competent and skilled management and technical, sales and other personnel.

We are highly dependent on the continued service and performance of our management team and key technical, sales and other personnel and our success will depend in part on our ability to retain these employees in a competitive job market. If we fail to appropriately match the skill sets of our employees to our needs we may incur increased costs or experience challenges with execution of our strategic plan. We rely on cash bonuses and equity awards as significant compensation and retention tools for key personnel. In addition to compensation, we seek to foster an innovative work culture to retain employees. We also rely on the attractiveness of developing technology for the film, television and music industries as a means of retention. We continue to take actions to transform strategically, operationally and culturally and to achieve cost savings, all with the intent to drive improved operating performance both in the U.S and internationally. The uncertainty inherent in our transformational strategy and the resulting workload and stress may make it difficult to attract and retain key personnel and increase turnover of key officers and employees.

Our competitors may in some instances be able to offer a more established or more dynamic work environment, higher compensation or more opportunities to work with cutting-edge technology than we can. If we are unable to retain our key personnel or appropriately match skill sets with our needs, we would be required to expend significant time and financial resources to identify and hire new qualified personnel and to transfer significant internal historical knowledge, which might significantly delay or prevent the achievement of our business objectives.

Potential acquisitions could be difficult to consummate and integrate into our operations, and they and investment transactions could disrupt our business, dilute stockholder value or impair our financial results.

As part of our business strategy, from time to time we may acquire companies, technologies and products that we believe can improve our ability to compete in our existing customer markets or allow us to enter new markets. We may also pursue strategic investments. The potential risks associated with acquisitions and investment transactions include, but are not limited to:

| |

• | failure to realize anticipated returns on investment, cost savings and synergies; |

| |

• | difficulty in assimilating the operations, policies and personnel of the acquired company; |

| |

• | challenges in combining product offerings and entering into new markets in which we may not have experience; |

| |

• | distraction of management’s attention from normal business operations; |

| |

• | potential loss of key employees of the acquired company; |

| |

• | difficulty implementing effective internal controls over financial reporting and disclosure controls and procedures; |

| |

• | impairment of relationships with customers or suppliers; |

| |

• | possibility of incurring impairment losses related to goodwill and intangible assets; and |

| |

• | unidentified issues not discovered in due diligence, which may include product quality issues or legal or other contingencies. |

In order to complete an acquisition or investment transaction, we may need to obtain financing, including through the incurrence of borrowings or the issuance of debt or equity securities. This could potentially dilute stockholder value for existing stockholders. We may borrow to finance an acquisition, and the amount and terms of any potential future acquisition-related borrowings, as well as other factors, could affect our liquidity and financial condition and potentially our credit ratings. We may not be able to consummate such financings on commercially reasonable terms, or at all, in which case our ability to complete desired acquisitions or investments and to implement our business strategy, and as a result our financial results, may be materially impaired. In addition, our effective tax rate on an ongoing basis is uncertain, and business combinations and investment transactions could impact our effective tax rate. We may experience risks relating to the challenges and costs of closing a business combination or investment transaction and the risk that an announced business combination or investment transaction may not close. As a result, any completed, pending or future transactions may contribute to financial results that differ from the investment community’s expectations in a given quarter.

We obtain hardware product components and finished goods under sole-source supply arrangements, and any disruptions to these arrangements could jeopardize the manufacturing or distribution of certain of our hardware products.

Although we generally prefer to establish multi-source supply arrangements for our hardware product components and finished goods, multi-source arrangements are not always possible or cost-effective. We consequently depend on sole-source suppliers for certain hardware product components and finished goods, including some critical items. We do not generally carry significant inventories of, and may not in all cases have guaranteed supply arrangements for, these sole-sourced items. If any of our sole-source suppliers were to cease, suspend or otherwise limit production or shipment (due to, among other things, macroeconomic events, political crises or natural or environmental disasters or other occurrences), or adversely modify supply terms or pricing,

our ability to manufacture, distribute and service our products may be impaired and our business could be harmed. We cannot be certain that we will be able to obtain sole-sourced components or finished goods, or acceptable substitutes, from alternative suppliers or that we will be able to do so on commercially reasonable terms. We may also be required to expend significant development resources to redesign our products to work around the exclusion of any sole-sourced component or accommodate the inclusion of any substitute component.

We depend on the availability and proper functioning of certain third-party technology that we incorporate into or bundle with our products. Third-party technology may include defects or errors that could adversely affect the performance of our products. If third-party technology becomes unavailable, we may need to expend considerable resources integrating alternative third-party technology or developing our own substitute technology.

We license third-party technology for incorporation into or bundling with our products. This technology may provide us with critical or strategic feature sets or functionality. The profit margin for each of our products depends in part on the royalty, license and purchase fees we pay in connection with third-party technology. To the extent we add additional third-party technology to our products and we are unable to offset associated costs, our profit margins may decline and our operating results may suffer. In addition to cost implications, third-party technology may include defects or errors that could adversely affect the performance of our products, which may harm our market reputation or adversely affect our product sales. Third-party technology may also include certain open source software code that if used in combination with our own software may jeopardize our intellectual property rights or limit our ability to sell through certain sales channels. If any third-party technology license expires, is terminated or ceases to be available on commercially reasonable terms, we may be required to expend considerable resources integrating alternative third-party technology or developing our own substitute technology. In the interim, sales of our products may be delayed or suspended or we may be forced to distribute our products with reduced feature sets or functionality.

Lengthy procurement lead times and unpredictable life cycles and customer demand for some of our products may result in significant inventory risks.

With respect to many of our products, particularly our audio products, we must procure component parts and build finished inventory far in advance of product shipments. Certain of these products may have unpredictable life cycles and encounter rapid technological obsolescence as a result of dynamic market conditions. We procure product components and build inventory based upon our forecasts of product life cycle and customer demand. If we are unable to accurately forecast product life cycle and customer demand or unable to manage our inventory levels in response to shifts in customer demand, the result may be insufficient, excess or obsolete product inventory. Insufficient product inventory may impair our ability to fulfill product orders and negatively affect our revenues, while excess or obsolete inventory may require a write-down on products and components to their net realizable value, which would negatively affect our results of operations.

Our revenues and operating results depend significantly on our third-party reseller and distribution channels. Our failure to adequately manage the delivery model for our products and services could adversely affect our revenues and gross margins and therefore our profitability.

We distribute many of our products indirectly through third-party resellers and distributors. We also distribute products directly to end-user customers. Successfully managing the interaction of our direct and indirect channel efforts to reach various potential customer industries for our products and services is a complex process. For example, in response to our direct sales strategies or for other business reasons, our current resellers and distributors may from time to time choose to resell our competitors’ products in addition to, or in place of, ours. Moreover, since each distribution method has distinct risks and gross margins, our failure to identify and implement the most advantageous balance in the delivery model for our products and services could adversely affect our revenues and gross margins and therefore our profitability.

In addition, some of our resellers and distributors have rights of return, as well as inventory stock rotation and price protection. Accordingly, reserves for estimated returns and exchanges, and credits for price protection, are recorded as a reduction of revenues upon applicable product shipment, and are based upon our historical experience. Our reliance upon indirect distribution methods may reduce visibility to demand and pricing issues, and therefore make forecasting more difficult and, to the extent that returns exceed estimates, our revenues and operating results may be adversely affected.

We may not be able to achieve the efficiencies, savings and other benefits anticipated from our cost reduction, margin improvement and other business optimization initiatives.

We are continually reviewing and implementing programs throughout the company to reduce costs, increase efficiencies and enhance our business. We have in the past undertaken and expect to continue to undertake various restructuring activities and cost reduction initiatives in an effort to better align our organizational structure and costs with our strategy. In connection with these activities, we may experience a disruption in our ability to perform functions important to our strategy. Unexpected delays, increased costs, challenges with adapting our internal control environment to a new organizational structure, inability to retain and motivate employees or other challenges arising from these initiatives could adversely affect our ability to realize the anticipated savings or other intended benefits of these activities and could have a material adverse impact on our financial condition and operating results.

Our products may experience quality issues that could negatively impact our customer relationships, our market reputation and our operating results.