Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07454

Pacific Capital Funds

(Exact name of registrant as specified in charter)

3435 Stelzer Rd

Columbus, OH 43219

(Address of principal executive offices) (Zip code)

Citi Fund Services

3435 Stelzer Road

Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 614-470-8000

Date of fiscal year end:

7/31

Date of reporting period:

7/31/09

Table of Contents

Item 1. Reports to Stockholders.

Table of Contents

Table of Contents

Page 1

Page 3

Statements of Assets and Liabilities

Page 29

Page 32

Statements of Changes in Net Assets

Page 35

Schedules of Portfolio Investments

Page 43

Page 75

Page 89

Report of Independent Registered Public Accounting Firm

Page 101

Page 102

Page 104

Page 107

Table of Contents

Dear Shareholders:

Thank you for investing with Pacific Capital Funds. We value the trust you place in us, and we seek to provide world-class investment management to help you meet your financial goals.

Pacific Capital Funds draw upon the investment expertise of the Asset Management Group of Bank of Hawaii (AMG), which has approximately $3.5 billion in mutual fund assets under management. AMG has partnered with a select list of sub-advisors to provide Pacific Capital Funds’ shareholders with greater investment opportunities, broader diversification and access to an elite group of institutional money managers:

| • | Chicago Equity Partners, LLC, which specializes in domestic equity markets, serves as Sub-Adviser to the Pacific Capital Mid-Cap Fund, Pacific Capital Growth Stock Fund, Pacific Capital Growth and Income Fund and Pacific Capital Value Fund. |

| • | First State Investments International, Limited, a specialist in single-country, regional and sector-specific investments, serves as Sub-Adviser to the Pacific Capital New Asia Growth Fund. |

| • | Hansberger Global Investors, Inc., a specialist in international equity investments, serves as Sub-Adviser to the Pacific Capital International Stock Fund. |

| • | Nicholas-Applegate Capital Management, which specializes in global, international and domestic equity and special strategy management acts as one of three Sub-Advisers to the Pacific Capital Small Cap Fund, managing the U.S. systematic small cap core portion of the portfolio. |

| • | Wellington Management Company, LLP, one of the largest independent investment management firms in the world with more than $550 billion in assets, also serves as a Sub-Adviser to the Pacific Capital Small Cap Fund, managing the small cap growth portion of the portfolio. |

| • | Mellon Capital Management Corporation, with more than $200 billion in assets, manages the small cap value portion of the portfolio as the third Sub-Adviser for the Pacific Capital Small Cap Fund. |

Annual Review

The 12-month period between August 2008 and July 2009 coincided with one of the most difficult economic and market environments in U.S. history. A recession that began in December 2007 deepened, exacerbated by a widening credit crisis and accelerated by the failure of several large financial institutions. Spending by consumers and corporations fell, resulting in economic contraction and rising unemployment. The declining economic environment and the prospect of further failures in the financial markets caused investors to shun securities they perceived to be risky, and instead to seek safety in bonds backed by the U.S. government.

The federal government attempted to repair the damaged financial system through several measures, including a dramatic lowering of the Federal Reserve’s target short-term interest rate, the federal funds rate, from 2% to a range between 0% and 0.25%. In addition, a government stimulus package enacted in February aimed to pump money into the economy through a mixture of tax credits and new spending on infrastructure, health care and other items. Government intervention also helped prop up mortgage lenders such as Fannie Mae and Freddie Mac, as well as damaged financial firms such as insurance company AIG.

Meanwhile, investors spooked by companies’ shaky balance sheets and difficult outlooks avoided corporate securities, including stocks and corporate bonds. The financial crisis even affected the normally stable money markets, forcing one prominent money market fund to “break the buck”—that is, to guarantee investors less than one dollar per fund share. That uncertainty in the markets led investors to retreat to Treasury securities, which offered the safety of backing by the U.S. government. The rapid influx of investment money into Treasury securities pushed down the bonds’ yields, to the extent that at one point three-month Treasury bills briefly offered negative yields.

The efforts by the federal government to resuscitate the financial system appeared to take hold in the early part of 2009. The credit markets began to thaw, opening up much-needed funding for corporations and consumers. Gross domestic product1 fell precipitously in the fourth quarter of 2008 and the first quarter of 2009, but declined only modestly in the second quarter. Investors, gaining confidence that the worst of the economic and financial downturn had passed, moved beyond the shelter of U.S. government bonds and back into higher-risk areas of the market, including equities and high-yield and corporate bonds.

The financial markets continued to improve as the period wore on. The housing market appeared to stabilize, while investors’ fear of credit risk dissipated. By the end of the 12-month period, corporate earnings were exceeding expectations and investors continued to seek higher-risk securities that offered greater return potential.

Investors return to equities

Stocks across all sectors and investment styles fell sharply early in the period. But investors re-entered the equity market in the early part of 2009, sparking a significant rally that has continued through the end of the period. During the 12-month period, the S&P 5002 fell -19.96%, while small-cap stocks as measured by the Russell 20002 fell -20.72%. The MSCI EAFE Index2 of foreign stocks in 21 developed countries lost -22.60%.

| 1 | The Gross Domestic Product (“GDP”) is the measure of the market value of the goods and services produced by labor and property in the United States |

| 2 | The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Standard & Poor’s 500 Index (“S&P 500”) is an index of 500 selected common stocks, most of which are listed on the New York Stock Exchange, and is considered a measure of the U.S. stock market as a whole. The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. As of June 2007 the MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. Investors cannot invest directly in an index. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232, or visit the Funds’ website at pacificcapitalfunds.com. |

1

Table of Contents

The credit crisis and recession led to the collapse or sale of Wall Street firms such as Lehman Brothers and Merrill Lynch, while the balance sheets of many companies suffered tremendously. Defensive stocks, such as shares of consumer staples firms, held up best early in the period. Economically cyclical sectors such as consumer discretionary, energy, materials, industrials and information technology suffered during the first months of this fiscal year, but gained back some of those losses later in the period.

Mid-cap stocks led both small- and large-cap stocks in 2009, though large-cap stocks were the top performers for the 12-month period as equity investors earlier in the period sought shares of large and relatively stable firms with strong balance sheets. Small-cap stocks posted significant early losses due in part to their reliance on the credit markets, which were virtually frozen in late 2008. Small caps surged during the market’s rebound, however.

Outside of the U.S., emerging markets performed very poorly early in the period. However, emerging markets—particularly the BRIC countries of Brazil, Russia, India and China—rebounded earlier than domestic equities and rallied strongly through the end of the period. These countries experienced relatively strong economic growth during a period where much of the developed world’s economies were shrinking.

Bond investors seek higher yields

Treasury bonds led the fixed-income markets in 2008. Investors abandoned those securities that carried even a hint of risk in favor of the safety and liquidity of Treasuries. As a result, corporate, agency, mortgage-backed and municipal bonds all underperformed Treasuries early in the period.

Spreads between yields on Treasuries and other types of fixed-income securities widened to historic levels during 2008. Investors in 2009 sought yield by moving out of Treasuries and into other sectors of the fixed-income markets.

Lower-quality bonds significantly underperformed Treasuries early in the period, but then posted very strong gains. High-yield bonds and municipal bonds were the strongest performers during the last seven months of the period, and ended the fiscal year with positive performance for the 12-month period as a whole. Corporate bonds also rallied after a slow start to post positive returns for the period.

Our perspective

We are cautiously optimistic about the current economic environment. We believe we will continue to see better corporate earnings, and expect investors to be more willing to take on investment risk. We believe those factors may potentially drive better performance in both the equity and fixed-income markets.

We would like to take this opportunity to remind investors of the importance of appropriate diversification among asset classes. The markets’ turbulence during the past twelve months underscores the danger of holding all of a portfolio in one type of investment. Proper diversification, based on your particular financial goals and your time frame for reaching them, can help you achieve long-term objectives despite difficult market environments.

Thank you for your confidence in the Pacific Capital Funds. If you have any questions or would like a Fund prospectus, we encourage you to contact your registered investment professional, call Pacific Capital Funds at (800) 258-9232 or visit our website at www.pacificcapitalfunds.com.

Sincerely,

Tobias M. Martyn

Senior Executive Vice President & Chief Investment Officer

Asset Management Group of Bank of Hawaii

The foregoing information and opinions and following management discussions and analysis are for general information only. The Asset Management Group of Bank of Hawaii does not guarantee the accuracy or completeness, nor assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or offering of individual or personalized investment advice.

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232, or visit the Funds’ website at pacificcapitalfunds.com. |

| * | For additional information regarding Fund performance, please refer to the Funds’ commentary section. |

NOTICE ABOUT DUPLICATE MAILINGS

In order to reduce expenses incurred in connection with the mailing of prospectuses, prospectus supplements, semi-annual reports and annual reports to multiple shareholders at the same address, Pacific Capital Funds may in the future deliver one copy of a prospectus, prospectus supplement, semi-annual report or annual report to a single investor sharing a street address or post office box with other investors, provided that all such investors have the same last name or are believed to be members of the same family. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you share an address with another investor and wish to receive your own prospectus, prospectus supplements, semi-annual reports and annual reports, please call the Trust toll-free at 1-800-258-9232.

2

Table of Contents

Investment Style

Regional, multi-cap, growth

Investment Objective

Long-term capital appreciation by investing in a broadly diversified portfolio of companies located in Asia’s developing regions, excluding Japan. Investments are not limited to any particular size or sector.

Investment Considerations

An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. The Fund’s share price is expected to be more volatile than that of a U.S.-only fund. Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Process

| • | Follow active bottom-up investment approach |

| • | Invest for absolute versus relative return |

| • | Look outside benchmark representation for fresh opportunities |

| • | Identify sensibly priced, high-quality companies that exhibit long-term growth potential |

Investment Management

Advised by Asset Management Group of Bank of Hawaii

Sub-Advised by First State Investments International Limited (since June 29, 2006)

| • | First State Investments is part of Colonial First State Global Asset Management (CFS GAM), the consolidated asset management business of the Commonwealth Bank of Australia (CBA) |

| • | CFS GAM’S combined investment businesses manage approximately US$111.7 billion globally |

| • | CFS GAM has offices in London, Edinburgh, Sydney, Hong Kong, Singapore and Jakarta |

| • | Specialist in single country, regional, global and sector specific investments |

How did the Fund perform compared to its benchmark?

For the 12-month period ended July 31, 2009, the Fund returned -6.91% (Class A Shares without sales charge), underforming its benchmark, the MSCI AC Far East Free Index1 (excluding Japan), which returned -6.49%.

What were the major factors in the market that influenced the Fund’s performance?

The MSCI Far East ex-Japan Index outperformed global indices for the year ended July 31, 2009. The MSCI World Index declined 21.07% and the MSCI Emerging Markets Index fell by 16.57% in U.S. dollar terms.

Asian markets were weak during the second half of 2008 and at the start of 2009 due to continuing concerns about the impact of the credit crunch, with some falling to valuation levels not seen since the 1970s. However, markets saw a recovery from March 2009 as credit conditions improved and risk appetite returned.

At the sector level, Information Technology, Utilities, Consumer Discretionary, and Financials outperformed. Information Technology benefitted as investors expected an improved outlook for demand. The Energy and Materials sectors underperformed as the price of oil and gold declined from the record highs seen in the previous period.

What helped the Fund’s performance?

Positions in the Financial sector outperformed as companies rebounded from oversold levels as credit conditions eased, in particular Kasikornbank (Thailand), Oversea-Chinese Banking Corp (Singapore), Hang Lung Group and Swire Pacific (Hong Kong).†

Information Technology stocks Infosys Technologies (India), Taiwan Semiconductor and Samsung Electronics (South Korea) all contributed positively as investors were attracted by low valuations and expectations of a demand recovery.†

What hurt the Fund’s performance?

On the negative side, several positions in Malaysia lagged. Tenaga Nasional (Utilities) underperformed on concerns that the government was not serious about state reform, Genting (Consumer Discretionary) lagged due to concerns about its corporate governance and IOI Corp (Consumer Staples) underperformed as the price of palm oil declined during the period.†

Performance was also hurt by Keppel Corp (Singapore), which declined with the oil price and Chunghwa Telecom (Taiwan), which underperformed as markets recovered due to its defensive nature.†

What major changes have occurred in the portfolio during the period covered by this report?

Over the year, we added to our positions in the Consumer Staples sector purchasing Chinese stocks Hengan International, which offers visible long-term growth and Tingyi, a dominant producer of noodles and beverages that is increasing market share.†

In the Information Technology sector, we bought AU Optronics (Taiwan) and Lenovo Group (China) as they were trading at compelling valuations. We also purchased Telekomunikasi (Indonesia: Telecom Services) for its defensive earnings stream and good cash flow.†

We sold Hong Kong Financial stocks Wing Hang Bank on valuation concerns and Kerry Properties on the deteriorating outlook for the Hong Kong property market. E.Sun Financial Holdings (Taiwan) was sold on concerns about management strategy.†

Past performance does not guarantee future results.

| 1 | The Morgan Stanley Capital International (MSCI) All Country (AC) Far East Free Index (excluding Japan) is a free float-adjusted market capitalization index that is designed to measure equity market performance in the Far East, excluding Japan. Investors cannot invest directly in an index. |

| † | The composition of the Fund’s portfolio is subject to change. |

3

Table of Contents

In the Industrials sector, we sold Keppel Corp (Singapore) which rebounded sharply with the oil price as well as benefitting from increased optimism towards the Singapore property sector and China Merchants Holdings on worries about a further slowdown in Chinese exports. We sold Consumer Discretionary stocks Li & Fung (Hong Kong), following a period of strong performance, and Genting (Malaysia) on worries about corporate governance.†

What is your outlook for the Fund?

We continue to retain a very conservative stance seeing little upside at current valuations.

Markets are discounting a rapid return to the favourable conditions of strong global economic growth that was prevalent before the recent financial crisis.

However, they are not discounting the possibility of inflation returning because of ‘quantitative easing’.

We believe the extent and pace of the rebound since March has been astonishing and a further correction over the coming months seems likely.

Past performance does not guarantee future results.

| † | The composition of the Fund’s portfolio is subject to change. |

4

Table of Contents

Country Weightings as of July 31, 2009 (as a percentage of total investments)

The composition of the Fund’s portfolio is subject to change.

Growth of a $10,000 Investment

The hypothetical $10,000 investment graph above represents a comparison of the performance of the indicated share class versus a similar investment in the Fund’s benchmark.

Average Annual Total Returns as of July 31, 2009

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||

| Class A Shares* |

-11.78 | % | 6.83 | % | 13.90 | % | 7.66 | % | ||||

| Class B Shares** |

-10.27 | % | 7.34 | % | 14.12 | % | 7.65 | % | ||||

| Class C Shares** |

-8.30 | % | 7.93 | % | 14.25 | % | 7.49 | % | ||||

| Class Y Shares |

-6.74 | % | 8.99 | % | 15.39 | % | 8.51 | % | ||||

| MSCI AC Far East Free Index (excluding Japan) |

-6.49 | % | 8.17 | % | 15.19 | % | 6.28 | % | ||||

| Expense Ratios |

Class A | Class B | Class C | Class Y | ||||||||

| Gross |

1.74 | % | 2.34 | % | 2.34 | % | 1.34 | % | ||||

| With Contractual Waivers |

1.59 | % | 2.34 | % | 2.34 | % | 1.34 | % | ||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232 or visit the Funds’ website at pacificcapitalfunds.com.

The above expense ratios are from the Funds’ prospectus dated November 28, 2008. Additional information pertaining to the Funds’ expense ratios for the year ended July 31, 2009 can be found in the financial highlights.

| * | Reflects 5.25% maximum front-end sales charge. |

| ** | Reflects maximum contingent deferred sales charge (CDSC) of up to 5.00% for the Class B Shares and a maximum CDSC of 1.00% for the Class C Shares (applicable only to redemptions within one year of purchase). |

The hypothetical $10,000 graph and above performance table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Total returns reflect the waiver of various operational fees. Had these waivers not been in effect, performance quoted would have been lower.

The Class C Shares of the Fund commenced operations on April 30, 2004. Performance information for Class C Shares prior to April 30, 2004 is based on the performance of Class B Shares.

The performance of the Pacific Capital New Asia Growth Fund is measured against the MSCI AC Far East Free ex Japan Index, a free float-adjusted market capitalization index that is designed to measure equity market performance in the Far East, excluding Japan. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Effective May 1, 2009, the offering of the Class C Shares was suspended, and will remain in effect until further notice.

The Pacific Capital Funds are distributed by Foreside Distribution Services, L.P. The Asset Management Group of Bank of Hawaii is investment adviser to the Fund and receives a fee for its services. First State Investments International Limited is sub-adviser to the Fund and is paid a fee for its services.

5

Table of Contents

Investment Style

International, multi-cap, blend

Investment Objective

Long-term capital appreciation by investing in a broadly diversified portfolio of companies domiciled outside the United States. Investments are not limited to any particular type or size of company or to any region of the world, including emerging markets countries.

Investment Considerations

An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. The Fund’s share price is expected to be more volatile than that of a U.S.-only fund. Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Process

| • | Style neutral growth and value discipline |

| • | Disciplined bottom-up stock selection |

Investment Management

Advised by Asset Management Group of Bank of Hawaii

Sub-Advised by Hansberger Global Investors, Inc. (since June 1, 2004)

| • | Founded in 1994. |

| • | Headquartered in Ft. Lauderdale, Florida, with satellite offices in Hong Kong, Moscow, Toronto and Mumbai |

| • | 23 investment professionals, 18 nationalities |

| • | $6.6 billion in assets under advisement, includes $0.8 billion in Advised Managed Accounts of other firms based on HGI models |

| • | HGI is an affiliated investment manager of Natixis Asset Management Group (Natixis). Natixis has an ownership position of 86%. HGI management and employees own the remaining 14%. |

How did the Fund perform compared to its benchmark?

For the 12-month period ended July 31, 2009, the Fund underperformed its benchmark, the MSCI ACWI ex US Index1. The Fund (Class A shares without sales charge) returned -22.32%, while the MSCI ACWI ex US Index returned -20.90%.

What were the major factors in the market that influenced the Fund’s performance?

Japanese stocks held within the portfolio performed worse than the MSCI Japan Index falling -23.9% compared to -16.9%. Orix Corporation (down -70.1%) and Nintendo (down -42.6%) were the major detractors to performance. Pacific ex Japan holdings also underperformed the MSCI Pacific ex Japan Index falling -25.9% compared to -14.5%. Australia’s Woodside Petroleum (down -40.0%) and Hong Kong’s Foxconn International (down -63.8%) were the main detractors in the year. Emerging Markets stocks held by the Fund performed better than the MSCI EM Index, falling -12.5% compared to -16.6%. Chinese companies Agile Property Holdings (up 63.2%) and Tencent Holdings (up 281.5%) were the main contributors to outperformance.†

Currency: Holding a different basket of currencies than the MSCI ACWI ex U.S. had a positive net effect on the relative return.†

What major changes have occurred in the portfolio during the period covered by this report?

Change in absolute weights: On an absolute basis, the largest changes in the regional weights were a -2.8% decrease to Europe and a 1.9% increase to Emerging Markets.†

From a sector perspective, the Fund’s largest absolute weighting changes were a 2.4% increase to Consumer Discretionary, a 1.8% increase to Financials, and a -1.0% decrease to Information Technology. †

Change in benchmark-relative weights: Relative to the benchmark, the Funds North American (Canada) weight increased by 0.9% and its Japan weight decreased by -0.8%.†

From a sector perspective the largest changes were a 1.5% increase to Financials, a 1.1% increase to Industrials, and a -1.2% decrease to Consumer Discretionary.†

What is your outlook for the Fund?

While the pace of economic growth has slowed dramatically, the long-term outlook for many economies—especially the Emerging Markets—is still very much alive. Maintaining a well-diversified portfolio of international companies should prove beneficial as investors return to equities and risk aversion subsides. Many of the names that will recover first are the liquid, large-cap companies that we hold in the portfolio.†

Past performance does not guarantee future results.

| 1 | The Morgan Stanley Capital International (MSCI) All Country World (ACWI) ex US Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets outside the U.S. Investors cannot invest directly in an index. |

| † | The composition of the Fund’s portfolio is subject to change. |

6

Table of Contents

Country Weightings as of July 31, 2009 (as a percentage of total investments)

The composition of the Fund’s portfolio is subject to change.

Growth of a $10,000 Investment

The hypothetical $10,000 investment graph above represents a comparison of the performance of the indicated share class versus a similar investment in the Fund’s benchmark.

Average Annual Total Returns as of July 31, 2009

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||

| Class A Shares* |

-26.37 | % | -5.34 | % | 4.57 | % | 0.01 | % | ||||

| Class B Shares** |

-25.09 | % | -4.99 | % | 4.78 | % | -0.01 | % | ||||

| Class C Shares** |

-23.48 | % | -4.39 | % | 4.89 | % | -0.17 | % | ||||

| Class Y Shares |

-22.21 | % | -3.44 | % | 5.95 | % | 0.82 | % | ||||

| MSCI ACWI ex US Index |

-20.90 | % | -2.68 | % | 7.57 | % | 3.66 | % | ||||

| Expense Ratios |

Class A | Class B | Class C | Class Y | ||||||||

| Gross |

1.60 | % | 2.20 | % | 2.20 | % | 1.20 | % | ||||

| With Contractual Waivers |

1.45 | % | 2.20 | % | 2.20 | % | 1.20 | % | ||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232 or visit the Funds’ website at pacificcapitalfunds.com.

The above expense ratios are from the Funds’ prospectus dated November 28, 2008. Additional information pertaining to the Funds’ expense ratios for the year ended July 31, 2009 can be found in the financial highlights.

| * | Reflects 5.25% maximum front-end sales charge. |

| ** | Reflects maximum contingent deferred sales charge (CDSC) of up to 5.00% for the Class B Shares and a maximum CDSC of 1.00% for the Class C Shares (applicable only to redemptions within one year of purchase). |

The above hypothetical $10,000 graph and performance table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Total returns reflect the waiver of various operational fees. Had these waivers not been in effect, performance quoted would have been lower.

The Class C Shares of the Fund commenced operations on April 30, 2004. Performance information for Class C Shares prior to April 30, 2004 is based on the performance of Class B Shares.

The performance of the Pacific Capital International Stock Fund is measured against the MSCI ACWI ex US Index, which is unmanaged and designed to measure equity market performance in the global developed and emerging markets outside the U.S. The index does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Effective May 1, 2009, the offering of the Class C Shares was suspended, and will remain in effect until further notice.

The Pacific Capital Funds are distributed by Foreside Distribution Services, L.P. The Asset Management Group of Bank of Hawaii is investment adviser to the Fund and receives a fee for its services. Hansberger Global Investors, Inc. is sub-adviser to the Fund and is paid a fee for its services.

7

Table of Contents

Investment Style

Domestic, small-cap, blend

Investment Objective

Long-term capital appreciation by investing in a diversified portfolio of small-capitalization companies.

Investment Considerations

Small-capitalization stocks typically carry additional risk, since smaller companies generally have a higher risk of failure and experience a greater degree of volatility than larger companies. Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Process

Nicholas-Applegate Capital Management

| • | Systematic small cap strategy: Emphasizes a quantitative stock-selection approach to identify companies with sustainable growth characteristics and timely market recognition |

Wellington Management Company, LLP

| • | Small cap growth intersection strategy: Combines fundamental research with quantitative valuation techniques in a disciplined framework to assess investment attractiveness |

Mellon Capital Management Corporation

| • | Small cap value strategy: Utilizes a disciplined process that combines computer modeling techniques, fundamental analysis, and risk management to select undervalued stocks for the Fund |

How did the Fund perform compared to its benchmark?

For the 12-month period ended July 31, 2009, the Fund returned -26.16% (Class A Shares without sales charge), underperforming the Fund’s benchmark, the Russell 2000® Index1, which returned -20.72%.

What were the major factors in the market that influenced the Fund’s performance?

During the fiscal year, large caps (represented by the S&P 5002 ) returned -19.96%, outperforming small caps (represented by the Russell 2000®) which returned -20.72%. Within the small cap universe, growth and value stocks experienced equal declines (the Russell 2000® Value3 returned -20.67% while the Russell 2000® Growth4 returned -20.86%). Within the Russell 2000® Growth Index, the Consumer Staples and Information Technology sectors were the strongest performers, while Energy, Industrials, and Telecommunication Services suffered the largest declines.

After registering its sixth straight quarterly decline in the first quarter of 2009, the broad U.S. equity market (as measured by the S&P 500) rose sharply during the second quarter, recouping losses from earlier in the year to finish slightly ahead at the end of June. Investors shook off fears created by the volatility in the markets earlier in the period and interpreted a slowdown in the pace of economic decline as a sign that a bottoming process for the global economy had begun, reacting positively to the responsiveness of many companies in trimming cost structures and realigning operations to meet a softer demand outlook. Many larger banks, brokerage firms, and real estate companies successfully launched capital raises, shoring up balance sheets and in turn, investor confidence.

Stock selection was the primary driver of performance during the year. Selection within Information Technology, Telecommunication Services, and Financials contributed most to performance, and more than offset weaker selection in Energy and Materials. The top relative contributors to Fund performance were CV Therapeutics (Health Care), Atlantic Tele-Network (Telecommunication Services), and WMS Industries (Consumer Discretionary), while top relative detractors included Human Genome Science (Health Care), and Energy holdings Complete Production and ATP Oil & Gas.†

What major changes have occurred in the portfolio during the period covered by the report?

Since June 2006, the Fund employed a “multi-manager” approach whereby portions of the Fund’s assets were allocated among three different investment sub-advisers: small cap value strategy managed by Mellon Capital Management (“MCM”), systematic small cap core strategy managed by Nicholas-Applegate Capital Management (“NACM”), and small cap growth strategy managed by Wellington Management Company (“WMC”). Each sub-adviser utilizes distinct investment styles intended to complement one another, applying its own methodology for selecting investments.

Past performance does not guarantee future results.

| 1 | The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. Investors cannot invest directly in an index. |

| 2 | The Standard & Poor’s 500 Index (“S&P 500”) is an index of 500 selected common stocks, most of which are listed on the New York Stock Exchange, and is considered a measure of the U.S. stock market as a whole. Investors cannot invest directly in an index. |

| 3 | The Russell 2000® Value Index measures the performance of small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. Investors cannot invest directly in an index. |

| 4 | The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-value ratios and higher forecasted growth values. |

| † | The composition of the Fund’s portfolio is subject to change. |

8

Table of Contents

Investment Management

Advised by Asset Management Group of Bank of Hawaii

Sub-Advised by Nicholas-Applegate Capital Management (since January 31, 2001)

| • | Founded in 1984, Nicholas-Applegate is a diversified global investment firm with more than twenty years of experience delivering value to clients |

| • | Nicholas-Applegate offers a broad array of investment solutions built on a consistent investment philosophy |

| • | Income & Growth |

| • | Systematic Equity |

| • | Traditional Global, U.S. and non-U.S. |

| • | $8.7 billion in assets under management |

Sub-Advised by Wellington Management Company, LLP (since June 14, 2006)

| • | Tracing its roots to 1928, Wellington Management is one of the largest independent investment management firms in the world |

| • | Serves as investment manager for clients in over 40 countries |

| • | $448.0 billion in assets under management |

Sub-Advised by Mellon Capital Management (since January 1, 2008)

| • | Founded in 1983, Mellon Capital is headquartered in San Francisco with offices in Pittsburgh, Philadelphia, Boston and Jersey City |

| • | Specializes in domestic and global asset allocation strategies, active and passive equity and fixed income strategies, alternative investments, currency strategies, and overlay strategies |

| • | Over $153.0 billion in assets under management (including $9.7 billion in overlay assets) |

MCM—Small Cap Value

There have been no major changes in this portion of the portfolio during the period. The portfolio remains diversified across many industry groups. Given the continued volatility in the financial markets, a strategy emphasizing strong fundamentals and sector diversification has served clients well over the long run.†

NACM—Systematic Small Cap

All buys and sells in this portion of the portfolio are driven by NACM’s quantitative stock selection model based on each position’s relative attractiveness and contribution to risk in relation to existing portfolio holdings. During the period, there were minor changes in sector weights in this sleeve of the portfolio relative to the benchmark driven by stock selection model. Sector weightings in Consumer Discretion and Information Technology were increased, while the weightings in Energy, Financials and Health Care were reduced.†

WMC—Small Cap Growth Intersection

Changes in this portion of the portfolio are driven by bottom-up fundamental and quantitative research rather than sector-level, top-down views. During the 12-month period, the largest new purchases in this portion of the portfolio included Manpower, an employment services company, and Arbitron, a leading provider of media audience rating services for the radio industry. Our largest eliminations included U.S.-based pharmaceutical company CV Therapeutics, and medical and surgical supply distributor Owens & Minor.†

What is your outlook for the Fund?

We believe it is increasingly clear that the U.S. is in a deep recession, notwithstanding the second quarter’s stock market rally. Unemployment is rising sharply, the housing slowdown continues, and the consumer is contracting. The government is reshaping the financial playing field through actions ranging from stimulus packages to massive loans to impaired private sector companies, all taken with an eye towards thawing frozen credit markets and expanding purchasing power. We believe these moves could help mitigate some of the negative economic pressures, and while the outlook remains uncertain, markets have begun to anticipate a recovery.

We will continue to employ a combination of fundamental and quantitative research rather than sector-level top-down views to identify the most attractive stocks, while maintaining appropriate risk controls relative to the benchmark. Over the long-run, security selection should drive the Fund’s results as the portfolio will be close to neutral relative to the benchmark on most metrics.†

| † | The composition of the Fund’s portfolio is subject to change. |

9

Table of Contents

Sector Weightings as of July 31, 2009 (as a percentage of total investments)

The composition of the Fund’s portfolio is subject to change.

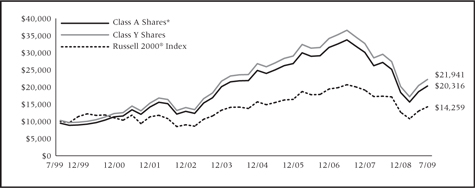

Growth of a $10,000 Investment

The hypothetical $10,000 investment graph above represents a comparison of the performance of the indicated share class versus a similar investment in the Fund’s benchmark.

Average Annual Total Returns as of July 31, 2009

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||

| Class A Shares* |

-30.05 | % | -11.77 | % | -1.60 | % | 7.35 | % | ||||

| Class B Shares** |

-28.98 | % | -11.23 | % | -1.20 | % | 7.27 | % | ||||

| Class C Shares** |

-27.50 | % | -10.87 | % | -1.29 | % | 7.10 | % | ||||

| Class Y Shares |

-25.99 | % | -9.95 | % | -0.28 | % | 8.17 | % | ||||

| Russell 2000® Index |

-20.72 | % | -6.05 | % | 1.52 | % | 3.61 | % | ||||

| Expense Ratios |

Class A | Class B | Class C | Class Y | ||||||||

| Gross |

1.88 | % | 2.48 | % | 2.48 | % | 1.48 | % | ||||

| With Contractual Waivers |

1.73 | % | 2.48 | % | 2.48 | % | 1.48 | % | ||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232 or visit the Funds’ website at pacificcapitalfunds.com.

The above expense ratios are from the Funds’ prospectus dated November 28, 2008. Additional information pertaining to the Funds’ expense ratios for the year ended July 31, 2009 can be found in the financial highlights.

| * | Reflects 5.25% maximum front-end sales charge. |

| ** | Reflects maximum contingent deferred sales charge (CDSC) of up to 5.00% for the Class B Shares and a maximum CDSC of 1.00% for the Class C Shares (applicable only to redemptions within one year of purchase). |

The above hypothetical $10,000 graph and performance table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Total returns reflect the waiver of various operational fees. Had these waivers not been in effect, performance quoted would have been lower.

The Class C Shares of the Fund commenced operations on April 30, 2004. Performance information for Class C Shares prior to April 30, 2004 is based on the performance of Class B Shares.

The performance of the Pacific Capital Small Cap Fund is measured against the Russell 2000® Index, which measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Effective May 1, 2009, the offering of the Class C Shares was suspended, and will remain in effect until further notice.

The Pacific Capital Funds are distributed by Foreside Distribution Services, L.P. The Asset Management Group of Bank of Hawaii is investment adviser to the Fund and receives a fee for its services. Nicholas-Applegate Capital Management, Wellington Management Company, LLP and Mellon Capital Management Corporation are each sub-advisers for a portion of the Fund’s assets and are paid a fee for their services.

10

Table of Contents

Investment Style

Domestic, mid-cap, blend

Investment Objective

Long-term capital appreciation by investing in a diversified portfolio of mid-capitalization companies the sub-adviser believes are reasonably priced, fundamentally strong and exhibit better growth expectations relative to peers.

Investment Considerations

Mid-capitalization stocks typically carry additional risk, since smaller companies generally have a higher risk of failure and a greater degree of volatility than larger companies. Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Process

| • | Quantitative research analysis with fundamental research overlay |

| • | Quantitative analysts use proprietary screen to evaluate expectations, valuation and quality of 3,000 stocks |

| • | Fundamental analysts identify factors not included in the screen to determine most attractive stocks |

| • | Portfolio construction emphasizes stock selection and seeks to neutralize risk elements that are not consistently rewarded |

Investment Management

Advised by Asset Management Group of Bank of Hawaii

Sub-Advised by Chicago Equity Partners, LLC (CEP) (since October 10, 2006)

| • | Founded in 1989, CEP specializes in core domestic equity and fixed income markets |

| • | CEP investment management team averages 21 years experience |

| • | $6.6 billion in assets under management |

How did the Fund perform compared to its benchmark?

For the 12-month period ended July 31, 2009, the Fund underperformed its benchmark, the S&P MidCap 400 Index1. The Fund produced a total return of -25.62% (Class A Shares without sales charge), compared to the S&P MidCap 400 Index, which returned -20.25% for the same period.

What were the major factors in the market that influenced the Fund’s performance?

After declining significantly in 2008 and early 2009, several economic metrics began to stabilize or improve slightly during the second quarter. Although the global economy remained mired in recession, the fear of imminent economic collapse appeared to be lessening substantially. According to the National Bureau of Economic Research, the current recession is the longest since the Great Depression. On a more uplifting note, GDP2 estimates are now positive for the fourth quarter of 2009, after growth plunged 6.3% and 5.7% in the fourth quarter 2008 and first quarter 2009, respectively. Nevertheless, questions remain as to whether the stimulus-driven improvement can become self-sustaining.

The equity market rally that began in March has been led by low-quality, low-priced stocks. As a result, our model was inverted in the second quarter, with the lowest-ranked stocks outperforming and the highest-ranked stocks underperforming. Of the four factor groups, only the Value group performed well. We increased our exposure to the value factor group, which provided a benefit. These changes allowed the portfolio to participate in the recent market rally even though our model was not providing the full potential.†

Over the last twelve months, the Fund underperformed the benchmark. Over the long term, our proprietary quantitative model shows strong discrimination between the lowest- and highest-rated stocks. The stocks in the highest deciles have an “intersection” of the following qualities:

| • | They are trading at a reasonable price versus peer companies; |

| • | They are growing at a faster rate; |

| • | They have strong balance sheets and have a higher quality aspect to them; and |

| • | They are responsible with their capital. |

An intersection of these factor groups was heavily punished over the last twelve months. Stocks that had a combination of lower valuations, sustainable earnings growth and higher-quality financials underperformed in this market environment. The Fund holds a majority of its weight in these types of stocks; these stocks generally underperformed their peers during this time. However, we have begun to see performance in this product rebound, as the Fund has outperformed during the first quarter of 2009.†

Overall, our philosophy will not change based on short-term trends or conditions in the market. Our goal is to add value through security selection, while attempting to neutralize other risk factors, such as market timing and sector rotation, for which there is not adequate compensation by the market. We will continue to use our disciplined approach to provide added value at controlled levels of risk.†

What major changes have occurred in the portfolio during the period covered by the report?

Other than typical re-balancing, no major changes occurred during the period. We are maintaining our disciplined process that has delivered competitive returns.†

What is your outlook for the Fund?

We believe that as investors gain confidence the economy should avoid a depression, the smallest, hardest-hit, most vulnerable stocks have bounced back most so far in this stage. As we move forward, and the economy begins to recover, which most economists predict GDP will grow in the third quarter, we believe there will be a premium on investing in really well-run companies with strong balance sheets and favorable growth prospects. We believe the portfolio is positioned to continue to do well as our strongest performance tends to follow periods of underperformance.†

Past performance does not guarantee future results.

| 1 | The S&P MidCap 400 Index is a market capitalization-weighted index of 400 medium capitalization stocks. Investors cannot invest directly in an index. |

| 2 | The Gross Domestic Product (“GDP”) is the measure of the market value of the goods and services produced by labor and property in the United States. |

| † | The composition of the Fund’s portfolio is subject to change. |

11

Table of Contents

Sector Weightings as of July 31, 2009 (as a percentage of total investments)

The composition of the Fund’s portfolio is subject to change.

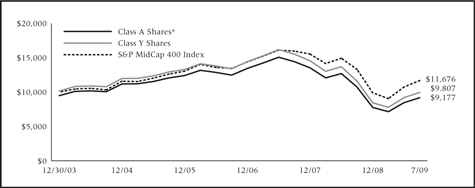

Growth of a $10,000 Investment

The hypothetical $10,000 investment graph above represents a comparison of the performance of the indicated share class versus a similar investment in the Fund’s benchmark.

Average Annual Total Returns as of July 31, 2009

| 1 Year | 3 Year | 5 Year | Since Inception (12/30/03) |

|||||||||

| Class A Shares* |

-29.54 | % | -11.05 | % | -2.38 | % | -1.52 | % | ||||

| Class C Shares** |

-27.00 | % | -10.14 | % | -2.06 | % | -1.27 | % | ||||

| Class Y Shares |

-25.51 | % | -9.23 | % | -1.11 | % | -0.35 | % | ||||

| S&P MidCap 400 Index |

-20.25 | % | -4.00 | % | 3.04 | % | 2.93 | % | ||||

| Expense Ratios |

Class A | Class C | Class Y | |||||||||

| Gross |

1.55 | % | 2.15 | % | 1.15 | % | ||||||

| With Contractual Waivers |

1.40 | % | 2.15 | % | 1.15 | % | ||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232 or visit the Funds’ website at pacificcapitalfunds.com.

The above expense ratios are from the Funds’ prospectus dated November 28, 2008. Additional information pertaining to the Funds’ expense ratios for the year ended July 31, 2009 can be found in the financial highlights.

| * | Reflects 5.25% maximum front-end sales charge. |

| ** | Reflects maximum contingent deferred sales charge (CDSC) of up to 1.00% (applicable only to redemptions within one year of purchase). |

The above hypothetical $10,000 graph and performance table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Total returns reflect the waiver of various operational fees. Had these waivers not been in effect, performance quoted would have been lower.

The Pacific Capital Mid-Cap Fund’s inception date was December 30, 2003. The Class C Shares were not in existence prior to April 30, 2004. Performance information for the Class C Shares prior to April 30, 2004 is based on the performance of Class A Shares, which does not reflect the higher 12b-1 fees charged to Class C Shares. Had the higher 12b-1 fees been reflected, total return figures may have been adversely affected.

The performance of the Pacific Capital Mid-Cap Fund is measured against the S&P MidCap 400 Index, a market capitalization-weighted index of 400 medium capitalization stocks. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Effective May 1, 2009, the offering of the Class C Shares was suspended, and will remain in effect until further notice.

The Pacific Capital Funds are distributed by Foreside Distribution Services, L.P. The Asset Management Group of Bank of Hawaii is investment adviser to the Fund and receives a fee for its services. Chicago Equity Partners, LLC, is sub-adviser to the Fund and is paid a fee for its services.

12

Table of Contents

Investment Style

Domestic, large-cap, growth

Investment Objective

Long-term capital appreciation and dividend income by investing in a diversified portfolio of large-capitalization companies whose earnings are expected to grow faster than the average of other companies in their industries.

Investment Considerations

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Process

| • | Utilizes a dynamic multi-factor quantitative stock model to evaluate the expected returns of a large universe of stocks |

| • | Fundamental analysts identify factors not included in the stock model to choose the best risk-adjusted stocks within their sector |

| • | Follows a disciplined portfolio construction process that seeks to neutralize risk elements that are not consistently rewarded |

Investment Management

Advised by Asset Management Group of Bank of Hawaii

Sub-Advised by Chicago Equity Partners, LLC (CEP) (since June 29, 2007)

| • | Founded in 1989, CEP specializes in core domestic equity and fixed income markets |

| • | CEP investment management team averages 21 years experience |

| • | $6.6 billion in assets under management |

How did the Fund perform compared to its benchmark?

For the 12-month period ended July 31, 2009, the Fund produced a -18.22% total return (Class A Shares without sales charge), underperforming its benchmark, the S&P 500/Citigroup Growth Index1, which returned -16.44%.

What were the major factors in the market that influenced the Fund’s performance?

After declining significantly in 2008 and early 2009, several economic metrics began to stabilize or improve slightly during the second quarter. Although the global economy remained mired in recession, the fear of imminent economic collapse appeared to be lessening substantially. According to the National Bureau of Economic Research, the current recession is the longest since the Great Depression. On a more uplifting note, GDP2 estimates are now positive for the fourth quarter of 2009, after growth plunged 6.3% and 5.7% in the fourth quarter 2008 and first quarter 2009, respectively. Nevertheless, questions remain as to whether the stimulus-driven improvement can become self-sustaining.

The equity market rally that began in March has been led by low-quality, low-priced stocks. As a result, our model was inverted in the second quarter, with the lowest-ranked stocks outperforming and the highest-ranked stocks underperforming. Of the four factor groups, only the Value group performed well. We increased our exposure to the value factor group, which provided a benefit. These changes allowed the portfolio to participate in the recent market rally, although we still underperformed.†

Over the last twelve months, the Fund underperformed the benchmark. Over the long term, our proprietary quantitative model shows strong discrimination between the lowest- and highest-rated stocks. The stocks in the highest deciles have an “intersection” of the following qualities:

| • | They are trading at a reasonable price versus peer companies; |

| • | They are growing at a faster rate; |

| • | They have strong balance sheets and have a higher quality aspect to them; and |

| • | They are responsible with their capital. |

An intersection of these factor groups was heavily punished over the last twelve months. Stocks that had a combination of lower valuations, sustainable earnings growth and higher-quality financials underperformed in this market environment. The Fund holds a majority of its weight in these types of stocks; these stocks generally underperformed their peers during this time.†

Overall, our philosophy will not change based on short-term trends or conditions in the market. Our goal is to add value through security selection, while attempting to neutralize other risk factors, such as market timing and sector rotation, for which there is not adequate compensation by the market. We will continue to use our disciplined approach to provide added value at controlled levels of risk.†

What major changes have occurred in the portfolio during the period covered by the report?

Other than typical re-balancing, no major changes occurred during the period. We are maintaining our disciplined process that has historically helped the Fund to deliver competitive returns.†

What is your outlook for the Fund?

We believe as investors gain confidence the economy should avoid a depression, the smallest, hardest-hit, most vulnerable stocks have bounced back most so far in this stage. As we move forward, and the economy does begin to recover, which most economists predict GDP will grow in the third quarter, we believe there will be a premium on investing in really well-run companies with strong balance sheets and favorable growth prospects. We believe the portfolio is positioned to do well as our strongest performance tends to follow periods of underperformance.†

Past performance does not guarantee future results.

| 1 | The S&P 500/Citigroup Growth Index measures the performance of all stocks in the S&P 500 Index (the 500 largest U.S. companies based on total market capitalization) that are classified as growth stocks. Investors cannot invest directly in an index. |

| 2 | The Gross Domestic Product (“GDP”) is the measure of the market value of the goods and services produced by labor and property in the United States. |

| † | The composition of the Fund’s portfolio is subject to change. |

13

Table of Contents

Sector Weightings as of July 31, 2009 (as a percentage of total investments)

The composition of the Fund’s portfolio is subject to change.

Growth of a $10,000 Investment

The hypothetical $10,000 investment graph above represents a comparison of the performance of the indicated share class versus a similar investment in the Fund’s benchmarks.

Average Annual Total Returns as of July 31, 2009

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||

| Class A Shares* |

-22.53 | % | -6.57 | % | -2.71 | % | -3.78 | % | ||||

| Class B Shares** |

-22.13 | % | -6.54 | % | -2.60 | % | -3.82 | % | ||||

| Class C Shares** |

-19.59 | % | -5.59 | % | -2.37 | % | -3.96 | % | ||||

| Class Y Shares |

-18.03 | % | -4.62 | % | -1.43 | % | -3.01 | % | ||||

| S&P 500/Citigroup Growth Index |

-16.44 | % | -3.03 | % | 0.42 | % | -2.47 | % | ||||

| Expense Ratios |

Class A | Class B | Class C | Class Y | ||||||||

| Gross |

1.51 | % | 2.11 | % | 2.11 | % | 1.11 | % | ||||

| With Contractual Waivers |

1.36 | % | 2.11 | % | 2.11 | % | 1.11 | % | ||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232 or visit the Funds’ website at pacificcapitalfunds.com.

The above expense ratios are from the Funds’ prospectus dated November 28, 2008 and excludes the impact of underlying fund fees and expenses. Additional information pertaining to the Funds’ expense ratios for the year ended July 31, 2009 can be found in the financial highlights.

| * | Reflects 5.25% maximum front-end sales charge. |

| ** | Reflects maximum contingent deferred sales charge (CDSC) of up to 5.00% for the Class B Shares and a maximum CDSC of 1.00% for the Class C Shares (applicable only to redemptions within one year of purchase). |

The above hypothetical $10,000 graph and performance table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Total returns reflect the waiver of various operational fees. Had these waivers not been in effect, performance quoted would have been lower.

The Class C Shares of the Fund commenced operations on April 30, 2004. Performance information for Class C Shares prior to April 30, 2004 is based on the performance of Class B Shares.

The performance of the Pacific Capital Growth Stock Fund is measured against the S&P 500/Citigroup Growth Index, which measures the performance of all stocks in the S&P 500 Index (the 500 largest U.S. companies based on total market capitalization) that are classified as growth stocks. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Effective May 1, 2009, the offering of the Class C Shares was suspended, and will remain in effect until further notice.

The Pacific Capital Funds are distributed by Foreside Distribution Services, L.P. The Asset Management Group of Bank of Hawaii is investment adviser to the Fund and receives a fee for its services. Chicago Equity Partners, LLC, is sub-adviser to the Fund and is paid a fee for its services.

14

Table of Contents

Investment Style

Domestic, large-cap, blend

Investment Objective

Long-term capital appreciation and current income by investing in a diversified portfolio of large-capitalization dividend-paying companies (currently greater than $1 billion) whose earnings are expected to grow at above-average rates in relation to other companies in their industries.

Investment Considerations

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Process

| • | Utilizes a dynamic multi-factor quantitative stock model to evaluate the expected returns of a large universe of stocks |

| • | Fundamental analysts identify factors not included in the stock model to choose the best risk-adjusted stocks within their sector |

| • | Follows a disciplined portfolio construction process that seeks to neutralize risk elements that are not consistently rewarded |

Investment Management

Advised by Asset Management Group of Bank of Hawaii

Sub-Advised by Chicago Equity Partners, LLC (CEP) (since June 29, 2007)

| • | Founded in 1989, CEP specializes in core domestic equity and fixed income markets |

| • | CEP investment management team averages 21 years experience |

| • | $6.6 billion in assets under management |

How did the Fund perform compared to its benchmark?

For the 12-month period ended July 31, 2009, the Fund returned -22.98% (Class A Shares without sales charge), underperforming its benchmark, the S&P 500 Index1, which returned -19.96%.

What were the major factors in the market that influenced the Fund’s performance?

After declining significantly in 2008 and early 2009, several economic metrics began to stabilize or improve slightly during the second quarter. Although the global economy remained mired in recession, the fear of imminent economic collapse appeared to be lessening substantially. According to the National Bureau of Economic Research, the current recession is the longest since the Great Depression. On a more uplifting note, GDP2 estimates are now positive for the fourth quarter of 2009, after growth plunged 6.3% and 5.7% in the fourth quarter 2008 and first quarter 2009, respectively. Nevertheless, questions remain as to whether the stimulus-driven improvement can become self-sustaining.

The equity market rally that began in March has been led by low-quality, low-priced stocks. As a result, our model was inverted in the second quarter, with the lowest-ranked stocks outperforming and the highest-ranked stocks underperforming. Of the four factor groups, only the Value group performed well. We increased our exposure to the value factor group, which provided a benefit. These changes allowed the portfolio to participate in the recent market rally, although we still underperformed.†

Over the last twelve months, the Fund underperformed the benchmark. Over the long term, our proprietary quantitative model shows strong discrimination between the lowest- and highest-rated stocks. The stocks in the highest deciles have an “intersection” of the following qualities:

| • | They are trading at a reasonable price versus peer companies; |

| • | They are growing at a faster rate; |

| • | They have strong balance sheets and have a higher quality aspect to them; and |

| • | They are responsible with their capital. |

An intersection of these factor groups was heavily punished over the last twelve months. Stocks that had a combination of lower valuations, sustainable earnings growth and higher quality financials underperformed in this market environment. The Fund holds a majority of its weight in these types of stocks; these stocks generally underperformed their peers during this time.†

Overall, our philosophy will not change based on short-term trends or conditions in the market. Our goal is to add value through security selection, while attempting to neutralize other risk factors, such as market timing and sector rotation, for which there is not adequate compensation by the market. We will continue to use our disciplined approach to provide added value at controlled levels of risk.†

What major changes have occurred in the portfolio during the period covered by the report?

Other than typical re-balancing, no major changes occurred during the period. We are maintaining our disciplined process that has historically helped the Fund to deliver competitive returns.†

What is your outlook for the Fund?

We believe as investors gain confidence the economy should avoid a depression, the smallest, hardest-hit, most vulnerable stocks have bounced back most so far in this stage. As we move forward, and the economy does begin to recover, which most economists predict GDP will grow in the third quarter, we believe there will be a premium on investing in really well-run companies with strong balance sheets and favorable growth prospects. We believe the portfolio is positioned to do well as our strongest performance tends to follow periods of underperformance.†

Past performance does not guarantee future results.

| 1 | The Standard & Poor’s 500 Index (“S&P 500”) is an index of 500 selected common stocks, most of which are listed on the New York Stock Exchange, and is considered a measure of the U.S. stock market as a whole. Investors cannot invest directly in an index. |

| 2 | The Gross Domestic Product (“GDP”) is the measure of the market value of the goods and services produced by labor and property in the United States. |

| † | The composition of the Fund’s portfolio is subject to change. |

15

Table of Contents

Sector Weightings as of July 31, 2009 (as a percentage of total investments)

The composition of the Fund’s portfolio is subject to change.

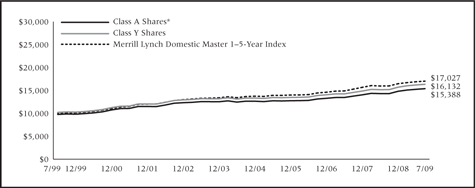

Growth of a $10,000 Investment

The hypothetical $10,000 investment graph above represents a comparison of the performance of the indicated share class versus a similar investment in the Fund’s benchmark.

Average Annual Total Returns as of July 31, 2009

| 1 Year | 3 Year | 5 Year | 10 Year | |||||||||

| Class A Shares* |

-27.03 | % | -10.47 | % | -3.75 | % | -3.82 | % | ||||

| Class B Shares** |

-26.57 | % | -10.39 | % | -3.62 | % | -3.88 | % | ||||

| Class C Shares** |

-24.33 | % | -9.55 | % | -3.44 | % | -4.02 | % | ||||

| Class Y Shares |

-22.77 | % | -8.62 | % | -2.45 | % | -3.06 | % | ||||

| S&P 500 Index |

-19.96 | % | -6.16 | % | -0.14 | % | -1.19 | % | ||||

| Expense Ratios |

Class A | Class B | Class C | Class Y | ||||||||

| Gross |

1.50 | % | 2.10 | % | 2.10 | % | 1.10 | % | ||||

| With Contractual Waivers |

1.35 | % | 2.10 | % | 2.10 | % | 1.10 | % | ||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please call 1-800-258-9232 or visit the Funds’ website at pacificcapitalfunds.com.

The above expense ratios are from the Funds’ prospectus dated November 28, 2008 and excludes the impact of underlying fund fees and expenses. Additional information pertaining to the Funds’ expense ratios for the year ended July 31, 2009 can be found in the financial highlights.

| * | Reflects 5.25% maximum front-end sales charge. |

| ** | Reflects maximum contingent deferred sales charge (CDSC) of up to 5.00% for the Class B Shares and a maximum CDSC of 1.00% for the Class C Shares (applicable only to redemptions within one year of purchase). |

The above hypothetical $10,000 graph and performance table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Total returns reflect the waiver of various operational fees. Had these waivers not been in effect, performance quoted would have been lower.

The Class C Shares of the Fund commenced operations on April 30, 2004. Performance information for Class C Shares prior to April 30, 2004 is based on the performance of Class B Shares.

The performance of the Pacific Capital Growth and Income Fund is measured against the S&P 500 Index, which measures the performance of 500 selected common stocks, most of which are listed on the New York Stock Exchange, and is considered a measure of the U.S. stock market as a whole. The index is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index.

Effective May 1, 2009, the offering of the Class C Shares was suspended, and will remain in effect until further notice.

The Pacific Capital Funds are distributed by Foreside Distribution Services, L.P. The Asset Management Group of Bank of Hawaii is investment adviser to the Fund and receives a fee for its services. Chicago Equity Partners, LLC, is sub-adviser to the Fund and is paid a fee for its services.

16

Table of Contents

Investment Style

Domestic, large-cap, value

Investment Objective

Long-term capital appreciation and current income by investing in a diversified portfolio of large-capitalization companies (currently greater than $1 billion) whose stock prices, the Fund’s sub-adviser believes are undervalued.

Investment Considerations

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value. Equity securities (stocks) are more volatile and carry more risk than other forms of investments, such as investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Investment Process

| • | Utilizes a dynamic multi-factor quantitative stock model to evaluate the expected returns of a large universe of stocks |

| • | Fundamental analysts identify factors not included in the stock model to choose the best risk-adjusted stocks within their sector |

| • | Follows a disciplined portfolio construction process that seeks to neutralize risk elements that are not consistently rewarded |

Investment Management

Advised by Asset Management Group of Bank of Hawaii

Sub-Advised by Chicago Equity Partners, LLC (CEP) (since June 29, 2007)

| • | Founded in 1989, CEP specializes in core domestic equity and fixed income markets |

| • | CEP investment management team averages 21 years experience |

| • | $6.6 billion in assets under management |

How did the Fund perform compared to its benchmark?

For the 12-month period ended July 31, 2009, the Fund returned -21.08% (Class A Shares without sales charge), outperforming its benchmark, the Russell 1000® Value Index1, which returned -22.94%.

What were the major factors in the market that influenced the Fund’s performance?

After declining significantly in 2008 and early 2009, several economic metrics began to stabilize or improve slightly during the second quarter. Although the global economy remained mired in recession, the fear of imminent economic collapse appeared to be lessening substantially. According to the National Bureau of Economic Research, the current recession is the longest since the Great Depression. On a more uplifting note, GDP2 estimates are now positive for the fourth quarter of 2009, after growth plunged 6.3% and 5.7% in the fourth quarter 2008 and first quarter 2009, respectively. Nevertheless, questions remain as to whether the stimulus-driven improvement can become self-sustaining.

The national unemployment rate (9.5%) and the average unemployment duration (14.9 weeks) recently hit multi-year highs and are likely to continue rising. With industrial production falling, the business economy remains weak, but there are signs of life in new orders. Additionally, the Index of Leading Economic Indicators, an amalgamation of 10 individual financial and economic variables, and the broader Chicago Federal Reserve National Activity Index3 recently posted modest improvements. Housing prices continue to fall, albeit at a slower pace. Valuations, down 18.7% on a year-over-year basis through May, stood at late-2002 levels, according to the S&P/Case-Schiller Home Price Index4. Although home inventories remained high, housing starts jumped 17% on a year-over-year basis through May.