United States Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||

| FOR THE FISCAL YEAR ENDED DECEMBER 31, 2012 | ||||

OR |

||||

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 1-11846

![]()

AptarGroup, Inc.

| DELAWARE | 36-3853103 |

475 WEST TERRA COTTA AVENUE, SUITE E, CRYSTAL LAKE, ILLINOIS 60014

815-477-0424

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class

|

Name of each exchange on which registered

|

|

| Common Stock $.01 par value Preferred Stock Purchase Rights |

New York Stock Exchange New York Stock Exchange |

Securities Registered Pursuant to Section 12 (g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Yes ý | No o |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Yes o | No ý |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes ý | No o |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Yes ý | No o |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Yes o | No ý |

The aggregate market value of the common stock held by non-affiliates as of June 30, 2012 was $3,275,207,521.

The number of shares outstanding of common stock, as of February 21, 2013, was 66,213,433 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement to be delivered to stockholders in connection with the Annual Meeting of Stockholders to be held May 8, 2013 are incorporated by reference into Part III of this report.

AptarGroup, Inc.

FORM 10-K

For the Year Ended December 31, 2012

INDEX

i /ATR

2012 Form 10-K

We are a leading global solution provider of a broad range of innovative packaging delivery solutions primarily for the beauty, personal care, home care, pharmaceutical, food and beverage markets. Our creative packaging solutions enhance the convenience, safety and security of consumers around the globe and allow our customers to differentiate their products in the market.

Our business was started in the late 1940's, manufacturing and selling aerosol valves in the United States, and has grown primarily through the acquisition of relatively small companies and internal expansion. We were incorporated in Delaware in 1992. In this report, we may refer to AptarGroup, Inc. and its subsidiaries as "AptarGroup" or the "Company".

We have manufacturing facilities located throughout the world including North America, Europe, Asia and South America. We have over 5,000 customers with no single customer accounting for greater than 6% of our 2012 net sales.

Sales of our dispensing systems have traditionally grown at a faster rate than the overall packaging industry as consumers' preference for convenience has increased and product differentiation through packaging design has become more important to our customers. Consumer product marketers have converted many of their products to packages with dispensing systems that offer the benefit of enhanced shelf appeal, convenience, cleanliness or accuracy of dosage. We expect this trend to continue.

Pumps are finger-actuated dispensing systems that dispense a spray or lotion from non-pressurized containers. The style of pump used depends largely on the nature of the product being dispensed, from small, fine mist pumps used with perfume and pharmaceutical products to lotion pumps for more viscous formulas.

Closures are primarily dispensing closures but to a lesser degree can include non-dispensing closures. Dispensing closures are plastic caps, primarily for plastic containers such as bottles and tubes, which allow a product to be dispensed without removing the cap.

Aerosol valves dispense product from pressurized containers. The majority of the aerosol valves that we sell are continuous spray valves, with the balance being metered dose inhaler valves.

Our periodic and current reports are available, free of charge, through a link on the Investors page of our website (www.aptar.com), as soon as reasonably practicable after the material is electronically filed with, or furnished to, the SEC. Also posted on our website are the charters for our Audit, Compensation, Governance and Executive Committees, our Governance Principles, our Code of Business Conduct & Ethics and our Director Independence Standards. Within the time period required by the SEC and the New York Stock Exchange ("NYSE"), we will post on our website any amendment to or waiver to the Code of Business Conduct & Ethics applicable to any executive officer or director. The information provided on our website is not part of this report and is therefore not incorporated herein by reference.

DESCRIPTION OF APTARGROUP'S REPORTING SEGMENTS

FINANCIAL INFORMATION ABOUT SEGMENTS

The Company operates in the packaging components industry, which includes the development, manufacture and sale of consumer product dispensing systems. AptarGroup's organizational structure consists of three market-focused business segments which are Beauty + Home, Pharma and Food + Beverage. This is a strategic structure which allows us to be more closely aligned with our customers and the markets in which they operate. Operations that sell dispensing systems primarily to the beauty, personal care and home care markets form the Beauty + Home segment. Operations that sell dispensing systems or primary packaging components to the prescription drug and consumer health care markets form the Pharma segment. Operations that sell dispensing systems to the food and beverage markets form the Food + Beverage segment. Each of these three business segments is described more fully below. A summary of revenue, by segment, from external customers, profitability and total assets based upon this reporting structure for each of the last three years is shown in Note 15 to the Consolidated Financial Statements in Item 8 (which is incorporated by reference herein).

BEAUTY + HOME

The Beauty + Home segment is our largest segment in terms of net sales and total assets representing 63% and 53% of AptarGroup's Net Sales and Total Assets, respectively. The Beauty + Home segment primarily sells pumps, closures, aerosol valves and accessories to the personal care and home care markets and pumps and decorative components to the beauty market. We believe we are the leading supplier of beauty and personal care fine mist spray pumps worldwide and the second largest supplier of personal care lotion pumps worldwide. We believe we are also one of the largest continuous spray aerosol

1 /ATR

2012 Form 10-K

valve suppliers worldwide. We believe we are the largest supplier of dispensing closures in the United States, and the second largest supplier in Europe.

Beauty. Sales to the beauty market accounted for approximately 46% of the segment's total net sales in 2012. The beauty market requires a broad range of spray pumps and sampling dispensing systems to meet functional as well as aesthetic requirements. A considerable amount of research, time and coordination with our customers is required to qualify a pump for use with their products. Within the market, we expect the use of pumps to continue to increase, particularly in the cosmetics and sampling sectors of this market. In the cosmetic sector, packaging for certain products such as natural and organic cosmetics and anti-aging lotions continue to provide us with growth opportunities. Our cosmetic lotion pumps, airless dispensing systems and lotion sampling devices, and decorative capabilities will also provide growth opportunities. We have experienced significant growth in recent years in South America particularly in the sales of our products to the fragrance market and we believe there are significant opportunities for growth in the sale of our products for cosmetic applications in Asia.

Personal Care. Sales to the personal care market accounted for approximately 44% of the segment's total net sales in 2012. Personal care products include fine mist spray pumps, lotion pumps, closures and continuous spray aerosol valves. Typical personal care spray pump applications include hair care, body care and sun care products. Typical lotion pump applications include skin moisturizers, hand sanitizers and soap. Typical personal care closures applications include shampoos and conditioners. Typical personal care continuous aerosol valve applications include hair care products, deodorants, shaving creams and sun care products. Our research and development teams continue to design unique accessories that increase the value of our continuous aerosol valve offerings.

Home Care. Sales to the home care market accounted for approximately 8% of the segment's total net sales in 2012. Home care products primarily use continuous or metered dose spray aerosol valves, closures and to a lesser degree spray and lotion pumps. Applications for continuous spray valves include disinfectants, spray paints, insecticides and automotive products. Metered dose valves are used for air fresheners. Closure applications include liquid detergents and household cleansers. Spray and lotion pump applications primarily include household and industrial cleaners.

PHARMA

The Pharma segment is our second largest segment in terms of net sales and total assets, accounting for 25% and 29% of AptarGroup's Net Sales and Total Assets, respectively, and is our most profitable segment. We believe we are the leading supplier of pumps and metered dose inhaler valves ("MDI's") to the pharmaceutical market worldwide and we believe we are the number three supplier of elastomer primary packaging components worldwide. Characteristics of this market include (i) governmental regulation of our pharmaceutical customers, (ii) contaminant-controlled manufacturing environments, and (iii) a significant amount of time and research from initially working with pharmaceutical companies at the molecular development stage of a medication through the eventual distribution to the market. We have clean-room manufacturing facilities in Argentina, China, France, Germany, India, Switzerland and the United States. We believe that the conversion from traditional medication forms such as pills to value-added, convenient dispensing systems will continue to offer opportunities for our business.

Prescription. Sales to the prescription market accounted for approximately 72% of the segment's total net sales in 2012. Pumps sold to the prescription market deliver medications nasally, orally or topically. Currently the majority of our pumps sold are for nasal allergy treatments. Recently, our nasal dispensing pumps were also sold on pain management products primarily for post-operative pain management. Potential opportunities for conversion from pills to pump dispensing systems include treatment for vaccines, additional cold and flu treatments and hormone replacement therapies.

MDI's are used for dispensing precise amounts of medication. This aerosol technology allows medication to be broken up into very fine particles, which enables the drug to be delivered typically via the pulmonary system. Currently the majority of our MDI's sold are used for respiratory ailments.

We continue to develop new dispensing systems and accessories in this segment. Our innovative dose indicator for use with MDI's lets patients know how many doses are left in a container. This dose indicator recently launched in the market on two different products—a European asthma medication and a U.S. allergy treatment. We also developed new delivery device technologies featuring lock-out capabilities. We are also entering new categories such as sleep aids and hormone replacement therapies. While we expect that these new products will come to market in the future, it is difficult to estimate when, as the rigors of pharmaceutical regulations affect the timing of product introductions by our pharmaceutical customers which use our dispensing systems.

On July 3, 2012, the Company completed its acquisition of Rumpler—Technologies S.A., together with its direct and indirect subsidiaries ("Stelmi") for approximately $188 million. Stelmi is a producer of elastomer primary packaging components for injectable drug delivery and operates two manufacturing plants located in the Normandy region of France and also has a research and development facility located near Paris.

During 2011, we acquired a minority investment in Oval Medical Technologies Limited (Oval Medical) for approximately $3.2 million. Oval Medical has broad expertise in the design and development of injectable drug delivery devices. This

2 /ATR

2012 Form 10-K

acquisition represents a significant opportunity for the Pharma segment to enter a new category and broaden our product portfolio and customer reach.

Consumer Health Care. Sales to the consumer health care market accounted for approximately 28% of the segment's total net sales in 2012. Applications for this market are similar to the pharmaceutical market; however these applications are sold over the counter without a prescription. Typical consumer health care spray pump applications include nasal decongestants, nasal salines and cough and cold applications. Typical consumer health care valve applications include nasal saline using our bag-on valve technology. Other products sold to this market include dispensing closures primarily for ophthalmic liquid products and lotion and airless systems for dermal applications.

FOOD + BEVERAGE

The Food + Beverage segment is our smallest segment in terms of net sales and total assets representing 12% and 10% of AptarGroup's Net Sales and Total Assets, respectively, but is our fastest growing segment. We primarily sell dispensing closures and to a lesser degree, non-dispensing closures, spray pumps and aerosol valves to the food and beverage markets.

Sales of dispensing closures have grown as consumers worldwide have demonstrated a preference for a package utilizing the convenience of a dispensing closure. At the same time, consumer marketers are trying to differentiate their products by incorporating performance enhancing features such as no-drip dispensing, inverted packaging and directional flow to make packages simpler to use, cleaner and more appealing to consumers.

Food. Sales to the food market accounted for approximately 56% of the segment's total net sales in 2012. Food products primarily use dispensing closures and to a lesser degree, non-dispensing closures, spray pumps and aerosol valves. Applications for dispensing closures include sauces, condiment and powdered infant formula closures while non-dispensing closures include granular and powder additives. Applications for continuous spray valves include cooking sprays. Spray pump applications primarily include butter or salad dressing sprays.

Beverage. Sales to the beverage market accounted for approximately 41% of the segment's total net sales in 2012. Beverage products primarily utilize dispensing closure technologies. Sales of dispensing closures to the beverage market have increased significantly over the last several years as we continue to see an increase of interest from marketers using dispensing closures for their products. Examples of beverage products currently utilizing dispensing closures include bottled water, sport and energy drinks, juices and recently concentrated water flavorings.

We believe there are good growth opportunities in the food and beverage markets reflecting the continued and growing acceptance in this market of our dispensing technology, and additional conversion from traditional packages to packages using dispensing closure systems, in particular for the single and multi-serve non-carbonated beverage industry. We expanded our North American presence in 2011 by investing in a facility in Lincolnton, North Carolina which primarily serves our Food + Beverage customers. During 2010, we acquired assets related to a licensed technology that bonds aluminum to plastic (BAPTM). This technology allows for a liner with a pull ring to be bonded directly to the container providing added convenience for the consumer in the removal of the liner and is being used in certain powdered infant formula and fruit preservative closures.

GROWTH STRATEGY

We seek to enhance our position as a leading global solution provider of innovative packaging delivery solutions by (i) expanding geographically, (ii) converting non-convenient, non-dispensing applications to convenient dispensing systems, (iii) replacing current dispensing applications with more value-added dispensing products and (iv) developing or acquiring new dispensing, safety or security technologies.

We are committed to expanding geographically to serve local and multinational customers in existing and emerging areas. Targeted areas include Asia, South America, and Eastern Europe. During 2011, we acquired a producer of dispensing closures and added a separate pharmaceutical manufacturing facility, both in India, to expand our geographic presence in the country. We continue to invest increasing amounts of our capital expenditures in these areas to be able to produce locally and increase our product offerings.

We believe significant opportunities exist to introduce our dispensing systems to replace non-dispensing applications. Examples of these opportunities include potential conversion in the food and beverage markets for single and multi-serve non-carbonated beverages, condiments, cooking oils and infant formula. In the beauty market, potential conversion includes creams and lotions currently packaged in jars or tubes using removable non-dispensing closures, converting to lotion pumps or dispensing closures. We have developed and patented a thin sprayable dispensing system that can be inserted into magazines to replace the traditional scent strips. We believe this innovative system offers growth opportunities, particularly for fragrance samples. We have also developed a similar miniature flat sample for viscous creams as well as a small pump for use on vials for cosmetic lotions.

3 /ATR

2012 Form 10-K

In addition to introducing new dispensing applications, we believe there are significant growth opportunities in converting existing pharmaceutical delivery systems to our more convenient dispensing pump or MDI systems. Examples of opportunities in the pharmaceutical market include ways to dispense vaccines, cold and flu treatments, hormone replacement therapies, breakthrough pain medication, sleep aids and ophthalmic applications. Examples of opportunities in the beauty and home care markets include replacing closures on sun care applications with our bag-on valve technology and replacing finger actuators on fragrance applications with bulb atomizers.

We are committed to developing or acquiring new dispensing technologies that can lead to the development of completely new dispensing systems or can complement our existing product offerings. In 2012, we acquired Stelmi which produces elastomer primary packaging components for injectable drug delivery. We also manufacture decorative packaging components primarily for the high end of the beauty market. This technology includes advanced molding capabilities as well as decoration (vacuum metallization and varnishing) of plastic components. We have also acquired assets related to the BAPTM technology that provides opportunities for additional product applications requiring a liner. In 2011, we acquired a minority investment in Oval Medical for their broad expertise in the design and development of injectable drug delivery devices. This investment along with the acquisition of Stelmi, represents a significant opportunity for the Pharma segment to enter a new category and broaden our product portfolio and customer reach.

RESEARCH AND DEVELOPMENT

One of our competitive strengths is our commitment to innovation. Our commitment to innovation has resulted in an emphasis on research and development. Our research and development activities are directed toward developing affordable new innovative packaging delivery solutions and adapting existing products for new markets or customer requirements. Our research and development personnel are primarily located in the United States, France, Germany and Italy. In certain cases, our customers share in the research and development expenses of customer initiated projects. Occasionally, we acquire or license from third parties technologies or products that are in various stages of development. Expenditures for research and development activities, net of certain research and development credits, were $65.4 million, $67.0 million and $51.4 million in 2012, 2011 and 2010, respectively.

PATENTS AND TRADEMARKS

We customarily seek patent and trademark protection for our products and brands. We own and currently have numerous applications pending for patents and trademarks in many regions of the world. In addition, certain of our products are produced under patent licenses granted by third parties. We believe that we possess certain technical capabilities in making our products that make it difficult for a competitor to duplicate.

TECHNOLOGY

We have technical expertise regarding injection molding and high-speed assembly. We also have expertise regarding the formulation and finish of elastomer and silicone components. In addition, we offer a variety of sterilization options for elastomer components for the pharmaceutical industry. Pumps and aerosol valves require the assembly of several different plastic, metal and rubber components using high-speed equipment. When molding dispensing closures, or plastic components to be used in pump or aerosol valve products, we use advanced plastic injection molding technology, including large cavitation plastic injection molds. We are able to mold within tolerances as small as one one-thousandth of an inch and we assemble products in a high-speed, cost-effective manner. Our injection molding capabilities include recent advances such as spin-stack and cube molding which utilize high-efficiency rotating molds. We are also utilizing In-Molding Assembly Technology (IMAT) which allows us to assemble products within the molding process. We are experts in molding liquid silicone rubber that is used in certain dispensing closures and certain pumps as well as rubber gasket formulation and production primarily for the pharmaceutical markets. We also have technology to decorate plastic and metal components sold primarily to the beauty and personal care markets.

MANUFACTURING AND SOURCING

More than half of our worldwide production is located outside of the United States. In order to augment capacity and to maximize internal capacity utilization (particularly for plastic injection molding), we use subcontractors to supply certain plastic, metal and rubber components. Certain suppliers of these components have unique technical abilities that make us dependent on them, particularly for aerosol valve and pump production. The principal raw materials used in our production are plastic resins, rubber and certain metal products. We believe an adequate supply of such raw materials is available from existing and alternative sources. We attempt to offset cost increases through improving productivity and increasing selling prices over time, as allowed by market conditions or contractual commitments. Our pharmaceutical products often use resin and rubber components specifically approved by our customers. Significant delays in receiving components from these suppliers or discontinuance of an approved raw material would require us to seek alternative sources, which could result in higher costs as well as impact our ability to supply products in the short term.

4 /ATR

2012 Form 10-K

SALES AND DISTRIBUTION

Sales of products are primarily through our own sales force. To a limited extent, we also use the services of independent representatives and distributors who sell our products as independent contractors to certain smaller customers and export markets.

BACKLOG

Our sales are primarily made pursuant to standard purchase orders for delivery of products. While most orders placed with us are ready for delivery within 120 days, we continue to experience a trend towards shorter lead times requested by our customers. Some customers place blanket orders, which extend beyond this delivery period. However, deliveries against purchase orders are subject to change, and only a small portion of the order backlog is noncancelable. The dollar amount associated with the noncancelable portion is not material. Therefore, we do not believe that backlog as of any particular date is an accurate indicator of future results.

CUSTOMERS

The demand for our products is influenced by the demand for our customers' products. Demand for our customers' products may be affected by general economic conditions and liquidity, government regulations, tariffs and other trade barriers. Our customers include many of the largest beauty, personal care, pharmaceutical, home care, food and beverage marketers in the world. We have over 5,000 customers with no single customer accounting for greater than 6% of 2012 net sales. A consolidation of our customer base has occurred and this trend is expected to continue. A concentration of customers presents opportunities for increasing sales due to the breadth of our product line, our international presence and our long-term relationships with certain customers. However, this situation also may result in pricing pressures or a loss of volume.

INTERNATIONAL BUSINESS

Typically, we produce our products close to where our customers fill their finished product. Sales in Europe for the years ended December 31, 2012, 2011 and 2010 were approximately 54%, 57% and 57%, respectively, of net sales. We manufacture the majority of units sold in Europe at facilities in the Czech Republic, England, France, Germany, Ireland, Italy, Russia, Spain and Switzerland. Other countries in which we operate include Argentina, Brazil, China, India, Indonesia, Japan, Mexico and Thailand which when aggregated represented approximately 18%, 16% and 14% of our consolidated sales for the years ended December 31, 2012, 2011 and 2010, respectively. Export sales from the United States were $152.9 million, $150.4 million and $143.4 million in 2012, 2011 and 2010, respectively. For additional financial information about geographic areas, please refer to Note 15 in the Notes to the Consolidated Financial Statements in Item 8 (which is incorporated by reference herein).

FOREIGN CURRENCY

Because of our international presence, movements in exchange rates may have a significant impact on the translation of the financial statements of our foreign entities. Our primary foreign exchange exposure is to the Euro, but we have foreign exchange exposure to the Brazilian Real, British Pound, Swiss Franc and South American and Asian currencies, among others. We manage our exposures to foreign exchange principally with forward exchange contracts to economically hedge recorded transactions and firm purchase and sales commitments denominated in foreign currencies. A strengthening U.S. dollar relative to foreign currencies has a dilutive translation effect on our financial statements. Conversely, a weakening U.S. dollar has an additive effect. In some cases, we sell products denominated in a currency different from the currency in which the related costs are incurred. Changes in exchange rates on such inter-country sales could materially impact our results of operations.

WORKING CAPITAL PRACTICES

Collection and payment periods tend to be longer for our operations located outside the United States due to local business practices. We have also seen an increasing trend in pressure from certain customers to lengthen their payment terms. As the majority of our products are made to order, we have not needed to keep significant amounts of finished goods inventory to meet customer requirements.

EMPLOYEE AND LABOR RELATIONS

AptarGroup has approximately 12,000 full-time employees. Of the full-time employees, approximately 6,700 are located in Europe, 3,100 are located in Asia and South America and the remaining 2,200 are located in North America. The majority of our European employees are covered by collective bargaining arrangements made at either the local or national level in their respective countries and approximately 200 of the North American employees are covered by a collective bargaining agreement. Termination of employees at certain of our international operations could be costly due to local regulations regarding severance benefits. There were no material work stoppages in 2012 and management considers our employee relations to be satisfactory.

5 /ATR

2012 Form 10-K

COMPETITION

All of the markets in which we operate are highly competitive and we continue to experience price competition in all product lines and markets. Competitors include privately and publicly held entities. Our competitors range from regional to international companies. We expect the market for our products to remain competitive. We believe our competitive advantages are consistent high levels of innovation, quality and service, geographic diversity and breadth of products. Our manufacturing strength lies in the ability to mold complex plastic components and formulate and finish elastomer and silicone components in a cost-effective manner and to assemble products at high speeds. Our business is capital intensive and it is becoming more important to our customers to have global manufacturing capabilities. Both of these serve as barriers to entry for new competitors wanting to enter our business.

While we have experienced some competition from low cost Asian suppliers particularly in the low-end beauty and personal care market, this has not been significant. Indirectly, some fragrance marketers are sourcing their manufacturing requirements, including filling of their product in Asia and importing the finished product back into the United States or Europe. However, some customers who had bought dispensing packaging products from low cost Asian suppliers in the past have reverted to purchasing our dispensing products, citing the higher quality offered by our products and the logistical advantage of being closer to the customer.

ENVIRONMENT

Our manufacturing operations primarily involve plastic injection molding, automated assembly processes, elastomer and silicone formulation and finishing and, to a limited degree, metal anodization and vacuum metallization of plastic components. Historically, the environmental impact of these processes has been minimal, and we believe we meet current environmental standards in all material respects. To date, our manufacturing operations have not been significantly affected by environmental laws and regulations relating to the environment.

Recently there is increased interest and awareness from the public and our customers in sustainability or producing sustainable products and measuring carbon footprints. We are focused on becoming more energy efficient and improving our carbon footprint. We are also designing products that improve recyclability and use less material. Future regulations on environmental matters regarding recycling or sustainability policies could impact our business.

GOVERNMENT REGULATION

Certain of our products are indirectly affected by government regulation. Demand for aerosol and pump packaging is affected by government regulations regarding the release of volatile organic compounds ("VOCs") into the atmosphere. Certain states within the United States have regulations that require the reduction in the amount of VOCs that can be released into the atmosphere and the potential exists for this type of regulation to expand worldwide. These regulations required our customers to reformulate certain aerosol and pump products, which may have affected the demand for such products. We own patents and have developed systems to function with alternative propellant and product formulations.

Future government regulations could include medical cost containment policies. For example, reviews by various governments to determine the number of drugs, or prices thereof, that will be paid by their insurance systems could affect future sales to the pharmaceutical industry. Such regulation could adversely affect prices of and demand for our pharmaceutical products. We believe that the focus on the cost effectiveness of the use of medications as compared to surgery and hospitalization provides us with an opportunity to expand sales to the pharmaceutical market. In general, government regulation of our customers' products could impact our sales to them of our dispensing systems.

6 /ATR

2012 Form 10-K

EXECUTIVE OFFICERS

Our executive officers as of February 28, 2013:

| Name |

Age |

Position with the Company |

|||

|---|---|---|---|---|---|

| |

|||||

| Stephen Hagge | 61 | President and Chief Executive Officer, AptarGroup, Inc. | |||

| Mr. Hagge has been President and Chief Executive Officer since January 2012. Prior to this, Mr. Hagge was Chief Operating Officer from 2008 to 2011, Executive Vice President from 1993 through 2011, Secretary from 1993 to June 2011 and Chief Financial Officer of AptarGroup from 1993 to 2007. | |||||

Robert Kuhn |

50 |

Executive Vice President, Chief Financial Officer and Secretary, AptarGroup, Inc. |

|||

| Mr. Kuhn has been Executive Vice President and Chief Financial Officer since September 2008. Mr. Kuhn has been Secretary since June 2011. Prior to this, Mr. Kuhn was Vice President Financial Reporting from 2000 to 2008. | |||||

Patrick Doherty |

57 |

President, Aptar Beauty + Home |

|||

| Mr. Doherty has been President of Aptar Beauty + Home since October 2010. Prior to this, Mr. Doherty was Co-President of Aptar Beauty + Home since January 2010 and served as President of SeaquistPerfect Dispensing Group from 2000 to 2009. | |||||

Olivier Fourment |

55 |

President, Aptar Pharma |

|||

| Mr. Fourment has been President of Aptar Pharma since January 2008. Prior to this, Mr. Fourment was Co-President of Valois Group from 2000 to 2007. | |||||

Eldon Schaffer |

47 |

President, Aptar Food + Beverage |

|||

| Mr. Schaffer has been President of Aptar Food + Beverage since January 2012. Prior to this, Mr. Schaffer was President of Aptar Beauty + Home North America from 2010 to 2011 and was Seaquist Closures' General Manager of North America from 2004 to 2009. | |||||

Ursula Saint-Léger |

49 |

Vice President of Human Resources |

|||

| Ms. Saint-Léger has been Vice President of Human Resources since October 2010. Prior to joining AptarGroup in 2010, Ms. Saint-Léger was Sr. Group Vice President Human Resources at TAQA (industrialization and energy services) from 2009 to 2010 and was Senior Vice President Human Resources at Umicore (materials technology) from 2004 to 2009. | |||||

There were no arrangements or understandings between any of the executive officers and any other person(s) pursuant to which such officers were elected.

7 /ATR

2012 Form 10-K

Set forth below and elsewhere in this report and in other documents we file with the Securities and Exchange Commission are risks and uncertainties that could cause our actual results to materially differ from the results contemplated by the forward-looking statements contained in this report and in other documents we file with the Securities and Exchange Commission. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also impair our business operations. You should carefully consider the following factors in addition to other information contained in this report on Form 10-K before purchasing any shares of our common stock.

FACTORS AFFECTING OPERATIONS OR OPERATING RESULTS

If there is a deterioration in economic conditions in one of our significant regions such as Europe or the U.S., our business and operating results could be materially adversely impacted. Due to our strong balance sheet, diverse product offerings, various end-markets served, and our broad geographic presence, we are well positioned to withstand slowness in any one particular region or market. However, economic uncertainties affect businesses such as ours in a number of ways, making it difficult to accurately forecast and plan our future business activities. A tightening of credit in financial markets or other factors may lead consumers and businesses to postpone spending, which may cause our customers to cancel, decrease or delay their existing and future orders with us. In addition, financial difficulties experienced by our suppliers, customers or distributors could result in product delays, increased accounts receivable defaults and inventory or supply challenges. An interruption in supply may also impact our ability to meet customer demands. Consumer demand for our customers' products and shifting consumer preferences are unpredictable and could have a negative impact on our customers and our customers' demand for our products. A disruption in the credit markets could also restrict our access to capital.

If our expansion initiatives are unsuccessful, our operating results and reputation may suffer. We are expanding our operations in a number of new and existing markets and jurisdictions, including facilities expansions in the U.S., India, Russia and Latin America. Expansion of our operations will continue to require a significant amount of time and attention from our senior management and capital investment. Our expansion activities present considerable challenges and risks, including the general economic and political conditions existing in new markets and jurisdictions that we enter, attracting, training and retaining qualified and talented employees, infrastructure and labor disruptions, fluctuations in currency exchange rates, the imposition of restrictions by governmental authorities, compliance with current, new and changing governmental laws and regulations and the cost of such compliance activities. We may have limited or no prior experience in certain of these new markets and there is no assurance any of our expansion efforts will be successful. If any of our expansion efforts are unsuccessful, our operating results and reputation may suffer.

Higher raw material costs and other inputs and an inability to increase our selling prices may materially adversely affect our operating results and financial condition. The cost of raw materials and other inputs (particularly resin, rubber, metal, anodization costs and transportation and energy costs) are volatile and susceptible to rapid and substantial changes due to factors beyond our control, such as changing economic conditions, currency fluctuations, weather conditions, political unrest and instability in energy-producing nations, and supply and demand pressures. Raw material costs are expected to increase in the coming years and we have generally been able to increase selling prices to cover increased costs. In the future, market conditions may prevent us from passing these increased costs on to our customers through timely price increases. In addition, we may not be able to improve productivity or realize savings from our cost reduction programs sufficiently enough to offset the impact of increased raw material costs. As a result, higher raw material costs could result in declining margins and operating results.

The timing and completion of our European Operations Optimization ("EOO") plan may negatively impact our results. On November 1, 2012, the Company announced a plan to optimize certain capacity in Europe. Due to increased production efficiencies and to better position the Company for future growth in Europe, AptarGroup will transfer and consolidate production capacity involving twelve facilities. Two facilities, one in Italy and one in Switzerland, are expected to close and will impact approximately 170 employees. If we fail to execute the established plan as intended, we risk creating longer lead times to our customers and our results could be negatively impacted.

In difficult market conditions, our high fixed costs combined with potentially lower revenues may negatively impact our results. Our business is characterized by high fixed costs and, notwithstanding our utilization of third-party manufacturing capacity, most of our production requirements are met by our own manufacturing facilities. In difficult environments, we are generally faced with a decline in the utilization rates of our manufacturing facilities due to decreases in product demand. During such periods, our plants do not operate at full capacity and the costs associated with this excess capacity are charged directly to cost of sales. Difficult market conditions in the future may adversely affect our utilization rates and consequently our future gross margins, and this, in turn, could have a material negative impact on our business, financial condition and results of operations.

8 /ATR

2012 Form 10-K

We face strong global competition and our market share could decline. All of the markets in which we operate are highly competitive and we continue to experience price competition in all product lines and segments. Competitors include privately and publicly held entities. Our competitors range from regional to international companies. While we have experienced some competition from low cost Asian suppliers in some of our markets, particularly in the low-end beauty and personal care market, this has not been significant. Indirectly, some fragrance marketers are sourcing their manufacturing requirements including filling of their product in Asia and importing the finished product back into the United States or Europe. If we are unable to compete successfully, our market share may decline, which could materially adversely affect our results of operations and financial condition.

We have foreign currency translation and transaction risks that may materially adversely affect our operating results. A significant number of our operations are located outside of the United States. Because of this, movements in exchange rates may have a significant impact on the translation of the financial statements of our foreign entities. Our primary foreign exchange exposure is to the Euro, but we have foreign exchange exposure to Swiss, South American and Asian currencies, among others. We manage our exposures to foreign exchange principally with forward exchange contracts to economically hedge certain transactions and firm purchase and sales commitments denominated in foreign currencies. A strengthening U.S. dollar relative to foreign currencies has a dilutive translation effect on our financial statements. Conversely, a weakening U.S. dollar has an additive translation effect. In some cases, we sell products denominated in a currency different from the currency in which the related costs are incurred. The volatility of currency exchange rates may materially affect our operating results.

If our unionized employees were to engage in a strike or other work stoppage, our business and operating results and financial condition could be materially adversely affected. The majority of our European employees are covered by collective bargaining arrangements made either at the local or national level in their respective countries and approximately 200 of our North American employees are covered by a collective bargaining agreement. Although we believe that our relations with our employees are satisfactory, no assurance can be given that this will continue. If disputes with our unions arise, or if our unionized workers engage in a strike or other work stoppage, we could incur higher labor costs or experience a significant disruption of operations, which could have a material adverse effect on our business, financial position and results of operations.

If we were to incur a significant product liability claim above our current insurance coverage, our operating results and financial condition could be materially adversely affected. Approximately 25% of our net sales are made to customers in the pharmaceutical industry. If our devices fail to operate as intended, medication prescribed for patients may be under administered, or may be over administered. The failure of our devices to operate as intended may result in a product liability claim against us. We believe we maintain adequate levels of product liability insurance coverage. A product liability claim or claims in our Pharma segment or our other segments in excess of our insurance coverage may materially adversely affect our business, financial position and results of operations.

The success or failure of our customers' products, particularly in the pharmaceutical market, may materially affect our operating results and financial condition. In the pharmaceutical market, the proprietary nature of our customers' products and the success or failure of their products in the market using our dispensing systems may have a material impact on our operating results and financial condition. We may potentially work for years on modifying our dispensing device to work in conjunction with a customer's drug formulation. If the customer's pharmaceutical product is not approved by regulatory bodies or it is not successful on the market, the associated costs may not be recovered.

Single sourced materials and manufacturing sites could risk our ability to deliver product. The Company sources certain materials, especially some resins and rubber components for our pharmaceutical segment, from a single source. Any disruption in the supply of these materials could adversely impact our ability to deliver product to our customers. Similarly, we have certain components and / or products that are manufactured at a single location or from a single machine or mold. Any disruption to the manufacturing process could also impact our ability to deliver product to our customers.

We have approximately $352 million in recorded goodwill and changes in future business conditions could cause this asset to become impaired, requiring write-downs that would reduce our operating income. We evaluate the recoverability of goodwill amounts annually, or more frequently when evidence of potential impairment exists. The impairment test is based on several factors requiring judgment. A decrease in expected reporting unit cash flows or changes in market conditions may indicate potential impairment of recorded goodwill and, as a result, our operating results could be materially adversely affected. See "Critical Accounting Estimates" in Part II, Item 7 (which is incorporated by reference herein).

Government regulation on environmental matters regarding recycling or sustainability policies could impact our business. Future government regulations mandating the use of certain materials could impact our manufacturing processes or the technologies we use forcing us to reinvest in alternative materials or assets used in the production of our products.

9 /ATR

2012 Form 10-K

FACTORS AFFECTING APTARGROUP STOCK

Ownership by Certain Significant Shareholders. Currently, Aptar has five shareholders who each own between 5% and 10% of our outstanding common stock. If one of these significant shareholders decides to sell significant volumes of our stock, this could put downward pressure on the price of the stock.

Certain Anti-takeover Factors. Our preferred stock purchase rights plan and certain provisions of our Certificate of Incorporation and Bylaws may inhibit changes in control of AptarGroup not approved by the Board of Directors. These provisions include (i) special voting requirements for business combinations, (ii) a classified board of directors, (iii) a prohibition on stockholder action through written consents, (iv) a requirement that special meetings of stockholders be called only by the board of directors, (v) advance notice requirements for stockholder proposals and nominations, (vi) limitations on the ability of stockholders to amend, alter or repeal our bylaws and (vii) provisions that require the vote of 70% of the whole Board of Directors in order to take certain actions. The Board of Directors of Aptar intends to let the preferred stock purchase rights plan expire on April 7, 2013.

ITEM 1B. UNRESOLVED STAFF COMMENTS

The Company has no unresolved comments from the SEC.

We lease or own our principal offices and manufacturing facilities. None of the owned principal properties is subject to a lien or other encumbrance material to our operations. We believe that existing operating leases will be renegotiated as they expire, will be acquired through purchase options or that suitable alternative properties will be leased on acceptable terms. We consider the condition and extent of utilization of our manufacturing facilities and other properties to be generally good, and the capacity of our plants to be adequate for the needs of our business. The locations of our principal manufacturing facilities, by country, are set forth below:

| ARGENTINA Florencio Varela (1 & 2) Tortuguitas (1 & 3) BRAZIL Sao Paulo (1 & 3) Maringá Paraná (1 & 3) CHINA Suzhou (1, 2 & 3) CZECH REPUBLIC Ckyne (1 & 3) FRANCE Annecy (1) Brecey (2) Charleval (1) Granville (2) Le Neubourg (1) Le Vaudreuil (2) Oyonnax (1) Poincy (1 & 3) Verneuil Sur Avre (1) |

GERMANY Böhringen (1) Dortmund (1) Eigeltingen (2) Freyung (1 & 3) Menden (1) INDIA Himachal Pradesh (1 & 2) Hyderabad (1 & 3) Mumbai (2) INDONESIA Cikarang, Bekasi (1) IRELAND Ballinasloe, County Galway (1) ITALY Manoppello (1) San Giovanni Teatino (Chieti) (1) MEXICO Queretaro (1 & 3) RUSSIA Vladimir (1 & 3) |

SPAIN Madrid (1) Torello (1 & 3) SWITZERLAND Messovico (2) Neuchâtel (1 & 2) THAILAND Chonburi (1) UNITED KINGDOM Leeds, England (1 & 3) UNITED STATES Cary, Illinois (1, 2 & 3) Congers, New York (2) Libertyville, Illinois (1, 2 & 3) Lincolnton, North Carolina (3) McHenry, Illinois (1 & 2) Midland, Michigan (3) Mukwonago, Wisconsin (1, 2 & 3) Stratford, Connecticut (1 & 3) Torrington, Connecticut (1 & 3) Watertown, Connecticut (1 & 3) |

- (1)

- Locations of facilities manufacturing for the Beauty + Home segment.

- (2)

- Locations of facilities manufacturing for the Pharma segment.

- (3)

- Locations of facilities manufacturing for the Food + Beverage segment.

We also have sales personnel in Canada and Japan. Our corporate office is located in Crystal Lake, Illinois.

10 /ATR

2012 Form 10-K

Claims in the product liability and patent infringement areas, even if without merit, could result in the significant expenditure of our financial and managerial resources. It is possible that future results of operations or cash flows for any particular quarterly or annual period could be materially affected by an unfavorable resolution of such a claim.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, ISSUER PURCHASES OF EQUITY SECURITIES AND SHARE PERFORMANCE

MARKET FOR REGISTRANT'S COMMON EQUITY

Information regarding market prices of our Common Stock and dividends declared may be found in Note 17 to the Consolidated Financial Statements in Item 8 (which is incorporated by reference herein). Our Common Stock is traded on the New York Stock Exchange under the symbol ATR. As of February 15, 2013, there were approximately 300 registered holders of record.

RECENT SALES OF UNREGISTERED SECURITIES

The employees of AptarGroup S.A.S. and Aptar France S.A.S., our subsidiaries, are eligible to participate in the FCP Aptar Savings Plan (the "Plan"). All eligible participants are located outside of the United States. An independent agent purchases shares of Common Stock available under the Plan for cash on the open market and we do not issue shares. We do not receive any proceeds from the purchase of Common Stock under the Plan. The agent under the Plan is Banque Nationale de Paris Paribas Fund Services. No underwriters are used under the Plan. All shares are sold in reliance upon the exemption from registration under the Securities Act of 1933 provided by Regulation S promulgated under that Act. During the quarter ended December 31, 2012, the Plan purchased 7,152 shares of our common stock on behalf of the participants at an average price of $48.27 per share, for an aggregate amount of $345 thousand, and sold 2,318 shares of our Common Stock on behalf of the participants at an average price of $49.10 per share, for an aggregate amount of $114 thousand. At December 31, 2012, the Plan owned 34,888 shares of our Common Stock.

ISSUER PURCHASES OF EQUITY SECURITIES

The following table summarizes the Company's purchases of its securities for the quarter ended December 31, 2012:

| |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Period |

Total Number Of Shares Purchased |

Average Price Paid Per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number of Shares that May Yet be Purchased Under the Plans or Programs |

|||||||||

| |

|||||||||||||

| 10/1 - 10/31/12 | — | $ | — | — | 2,790,691 | ||||||||

| 11/1 - 11/30/12 | 519,452 | 47.64 | 519,452 | 2,271,239 | |||||||||

12/1 - 12/31/12

|

297,548

|

47.55

|

297,548

|

1,973,691

|

|||||||||

| Total | 817,000 | $ | 47.61 | 817,000 | 1,973,691 | ||||||||

The Company announced the existing repurchase program on July 19, 2011. There is no expiration date for this repurchase program.

11 /ATR

2012 Form 10-K

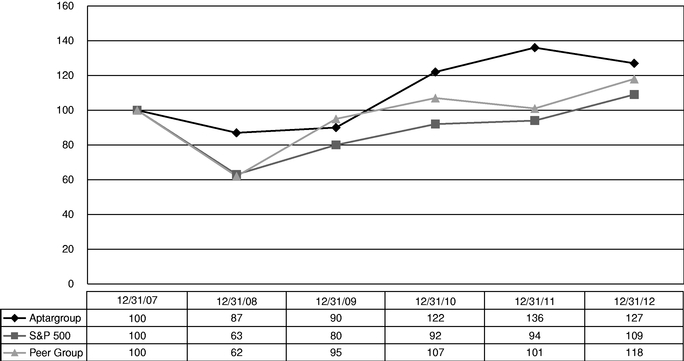

The following graph shows a five year comparison of the cumulative total stockholder return on AptarGroup's common stock as compared to the cumulative total return of the Standard & Poor's 500 Composite Stock Price Index and to an index of peer group companies we selected. The companies included in the peer group are: AEP Industries Inc., Bemis Company, Inc., Boise Inc., Buckeye Technologies Inc., Crown Holdings, Inc., Graphic Packaging Holding Company, Greif Inc., MeadWestvaco Corporation, Owen's-Illinois, Inc., Packaging Corporation of America, Rock-Tenn Company, Sealed Air Corporation, Silgan Holdings, Inc., Sonoco Products Company, and West Pharmaceutical Services Inc.

Comparison of 5 Year Cumulative Stockholder Returns

The graph and other information furnished in the section titled "Share Performance" under this Part II, Item 5 of this Form 10-K shall not be deemed to be "soliciting" material or to be "filed" with the Securities and Exchange Commission or subject to Regulation 14A or 14C, or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended.

12 /ATR

2012 Form 10-K

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA

FIVE YEAR SUMMARY OF SELECTED FINANCIAL DATA

| In millions of dollars, except per share data | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

||||||||||||||||

| Years Ended December 31, |

2012 |

2011 |

2010 |

2009 |

2008 |

|||||||||||

| |

||||||||||||||||

Statement of Income Data: |

||||||||||||||||

Net Sales |

$ | 2,331.0 | $ | 2,337.2 | $ | 2,076.7 | $ | 1,841.6 | $ | 2,071.7 | ||||||

Cost of sales (exclusive of depreciation and amortization shown below) |

1,590.4 | 1,568.3 | 1,378.8 | 1,225.7 | 1,411.3 | |||||||||||

% of Net Sales |

68.2 | % | 67.1 | % | 66.4 | % | 66.6 | % | 68.1 | % | ||||||

Selling, research & development and administrative |

341.6 | 347.6 | 296.9 | 276.9 | 295.1 | |||||||||||

% of Net Sales |

14.7 | % | 14.9 | % | 14.3 | % | 15.0 | % | 14.2 | % | ||||||

Depreciation and amortization (1) |

137.0 | 134.2 | 133.0 | 133.0 | 131.1 | |||||||||||

% of Net Sales |

5.9 | % | 5.7 | % | 6.4 | % | 7.2 | % | 6.3 | % | ||||||

Restructuring initiatives |

3.1 | (0.1 | ) | 0.1 | 7.6 | — | ||||||||||

% of Net Sales |

0.1 | % | — | — | 0.4 | % | — | |||||||||

Operating Income |

258.9 | 287.1 | 268.0 | 198.4 | 234.2 | |||||||||||

% of Net Sales |

11.1 | % | 12.3 | % | 12.9 | % | 10.8 | % | 11.3 | % | ||||||

Net Income |

162.4 | 183.6 | 173.6 | 124.6 | 153.5 | |||||||||||

% of Net Sales |

7.0 | % | 7.9 | % | 8.4 | % | 6.8 | % | 7.4 | % | ||||||

Net Income Attributable to AptarGroup, Inc. |

162.6 | 183.7 | 173.5 | 124.6 | 153.5 | |||||||||||

% of Net Sales |

7.0 | % | 7.9 | % | 8.4 | % | 6.8 | % | 7.4 | % | ||||||

Net Income Attributable to AptarGroup, Inc. per Common Share: |

||||||||||||||||

Basic |

2.45 | 2.76 | 2.58 | 1.84 | 2.26 | |||||||||||

Diluted |

2.38 | 2.65 | 2.48 | 1.79 | 2.18 | |||||||||||

Balance Sheet and Other Data: |

||||||||||||||||

Capital Expenditures |

$ | 174.1 | $ | 179.7 | $ | 118.8 | $ | 144.9 | $ | 203.6 | ||||||

Total Assets |

2,324.4 | 2,159.3 | 2,032.7 | 1,956.2 | 1,831.8 | |||||||||||

Long-Term Obligations |

352.9 | 254.9 | 258.8 | 209.6 | 226.9 | |||||||||||

Net Debt (2) |

197.8 | 61.0 | (22.1 | ) | 5.0 | 99.4 | ||||||||||

AptarGroup, Inc. Stockholders' Equity |

1,379.9 | 1,289.8 | 1,278.9 | 1,252.8 | 1,131.0 | |||||||||||

Capital Expenditures % of Net Sales |

7.5 | % | 7.7 | % | 5.7 | % | 7.9 | % | 9.8 | % | ||||||

Interest Bearing Debt to Total Capitalization (3) |

23.7 | % | 25.4 | % | 21.7 | % | 21.2 | % | 20.4 | % | ||||||

Net Debt to Net Capitalization (4) |

12.5 | % | 4.5 | % | (1.8 | %) | 0.4 | % | 8.1 | % | ||||||

Cash Dividends Declared per Common Share |

.8 | 8 | .8 | 0 | .6 | 6 | .6 | 0 | .5 | 6 | ||||||

- (1)

- Depreciation and amortization includes $1.6 million of accelerated depreciation related to the EOO plan.

- (2)

- Net Debt is interest bearing debt less cash and cash equivalents.

- (3)

- Total Capitalization is AptarGroup, Inc. Stockholders' Equity plus Interest Bearing Debt.

- (4)

- Net Capitalization is AptarGroup, Inc. Stockholders' Equity plus Net Debt.

13 /ATR

2012 Form 10-K

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF CONSOLIDATED RESULTS OF OPERATIONS AND FINANCIAL CONDITION

(In thousands, except per share amounts or otherwise

indicated)

The objective of the following Management's Discussion and Analysis of Consolidated Results of Operations and Financial Condition ("MD&A") is to help the reader understand the financial performance of AptarGroup, Inc. MD&A is presented in eight sections: Overview, Results of Operations, Liquidity and Capital Resources, Off-Balance Sheet Arrangements, Overview of Contractual Obligations, Recently Issued Accounting Pronouncements, Critical Accounting Estimates, Operations Outlook and Forward-Looking Statements. MD&A should be read in conjunction with our consolidated financial statements and accompanying Notes to Consolidated Financial Statements contained elsewhere in this Report on Form 10-K.

In MD&A, "we," "our," "us," "AptarGroup," "AptarGroup, Inc." and "the Company" refer to AptarGroup, Inc. and its subsidiaries.

GENERAL

We are a leading global provider of a broad range of innovative packaging delivery systems primarily for the beauty, personal care, home care, pharmaceutical, food and beverage markets. Our creative packaging solutions enhance the convenience, safety and security of consumers around the globe and allow our customers to differentiate their products in the market.

We consider sales excluding acquisitions and changes in foreign currency rates as core sales. Our diverse product offering, broad global reach and deep penetration in multiple markets drove core growth in 2012. In spite of difficult conditions in certain markets, we were able to grow core sales by 3% over last year's very strong performance. It was particularly challenging most of the year for our largest segment Beauty + Home primarily due to the economic situation in Europe causing customers to reduce orders. We also experienced a slowdown in our most profitable segment, Pharma, in the second half of 2012. Our Food + Beverage segment had a good year driven by the strength of our beverage closure business which more than offset a flat performance in the food market. On a geographic basis excluding currency effects and the Aptar Stelmi acquisition, Europe was softer than the prior year, primarily due to softness in the beauty and personal care markets. While our business in the U.S. was up slightly from the prior year, we continued to grow at a strong rate in Latin America and Asia.

2012 HIGHLIGHTS

- •

- Core sales excluding acquisitions and changes in foreign currency rates increased 3%.

- •

- In spite of difficult market conditions in certain markets, each segment reported core sales growth over the prior year.

- •

- We reported strong sales growth in Latin America and Asia.

- •

- We acquired Rumpler—Technologies S.A., together with its direct and indirect subsidiaries ("Stelmi"). Stelmi is a producer of elastomer primary packaging components for injectable drug delivery and operates two manufacturing plants located in the Normandy region of France and also has a research and development facility located near Paris.

- •

- We opened two new production facilities, one in Lincolnton, North Carolina to initially serve our Food + Beverage segment's customers in the U.S., and one in Mumbai, India to initially serve our Pharma segment's customers in India.

- •

- Due to increased production efficiencies and to better position the Company for future growth in Europe, the Company initiated a plan to optimize certain operations in Europe (EOO).

- •

- We spent approximately $79.8 million to repurchase 1.6 million shares of our common stock.

- •

- We made dividend payments to our shareholders totaling approximately $58.4 million.

14 /ATR

2012 Form 10-K

The following table sets forth the consolidated statements of income and the related percentages of net sales for the periods indicated:

| |

|||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Years Ended December 31, |

2012 | 2011 | 2010 | ||||||||||||||||

| |

Amount in $ Thousands |

% of Net Sales |

Amount in $ Thousands |

% of Net Sales |

Amount in $ Thousands |

% of Net Sales |

|||||||||||||

| |

|||||||||||||||||||

Net sales |

$ | 2,331,036 | 100.0 | % | $ | 2,337,183 | 100.0 | % | $ | 2,076,719 | 100.0 | % | |||||||

Cost of sales (exclusive of depreciation shown below) |

1,590,365 | 68.2 | 1,568,286 | 67.1 | 1,378,792 | 66.4 | |||||||||||||

Selling, research & development and administrative |

341,634 | 14.7 | 347,629 | 14.9 | 296,861 | 14.3 | |||||||||||||

Depreciation and amortization |

137,022 | 5.9 | 134,243 | 5.7 | 132,959 | 6.4 | |||||||||||||

Restructuring initiatives |

3,102 | 0.1 | (71 | ) | — | 93 | — | ||||||||||||

Operating income |

258,913 | 11.1 | 287,096 | 12.3 | 268,014 | 12.9 | |||||||||||||

Other expense |

(17,540 | ) | (0.8 | ) | (12,154 | ) | (0.5 | ) | (13,629 | ) | (0.7 | ) | |||||||

Income before income taxes |

241,373 | 10.3 | 274,942 | 11.8 | 254,385 | 12.2 | |||||||||||||

Net Income |

162,420 | 7.0 | 183,630 | 7.9 | 173,589 | 8.4 | |||||||||||||

Effective tax rate |

32.7%

|

33.2%

|

31.8%

|

||||||||||||||||

NET SALES

Reported net sales of $2.3 billion were basically unchanged compared to $2.3 billion recorded in 2011. Stelmi sales contributed $56.8 million and represented a positive impact of 2% on our reported sales growth. The average U.S. dollar exchange rate strengthened relative to the Euro and other foreign currencies, such as the Brazilian Real and Swiss Franc, in 2012 compared to 2011, and as a result, changes in exchange rates had a negative impact of 5% on our reported sales growth. The 3% core sales growth was due to increased demand for our innovative dispensing systems across each of our business segments.

In 2011, reported net sales increased approximately 13% to $2.3 billion compared to $2.1 billion recorded in 2010. The U.S. dollar weakened against several currencies including the Euro (our primary foreign currency exposure) in 2011 compared to 2010, and as a result, changes in exchange rates positively impacted sales by approximately 4%. Core sales growth was 9% due to strong demand for our innovative dispensing systems across each of our business segments.

For further discussion on net sales by reporting segment, please refer to the segment analysis of net sales and operating income on the following pages.

The following table sets forth, for the periods indicated, net sales by geographic location:

| |

|||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Years Ended December 31, |

2012 |

% of Total |

2011 |

% of Total |

2010 |

% of Total |

|||||||||||||

| |

|||||||||||||||||||

Domestic |

$ | 650,637 | 28% | $ | 636,060 | 27% | $ | 594,467 | 29% | ||||||||||

Europe |

1,269,289 | 54% | 1,340,036 | 57% | 1,191,039 | 57% | |||||||||||||

Other Foreign |

411,110 | 18% | 361,087 | 16% | 291,213 | 14% | |||||||||||||

COST OF SALES (EXCLUSIVE OF DEPRECIATION SHOWN BELOW)

Our cost of sales as a percentage of net sales increased in 2012 to 68.2% compared to 67.1% in 2011. Excluding Stelmi, 2012 cost of sales represented 68.1% of net sales:

The following factors negatively impacted our cost of sales percentage in 2012:

Increased Raw Material Costs. Raw material costs, primarily the cost of plastic resin, increased in 2012 compared to 2011. While the majority of resin cost increases are passed along to our customers in our selling prices, we typically experience a lag in the timing of passing on these cost increases. Other material costs also increased such as the cost of aluminum, steel and rubber.

Mix of Products Sold. Excluding acquisitions and foreign currency, our Pharma segment sales represented a slightly lower percentage of our overall sales. This negatively impacts our cost of sales percentage as margins on our pharmaceutical products typically are higher than the overall company average.

Lincolnton Start-up Costs. Start-up activities associated with our new facility in Lincolnton, North Carolina have led to under-absorption of costs. For the year, we have recognized $3.5 million of under-absorption in our results.

15 /ATR

2012 Form 10-K

The following factor positively impacted our cost of sales percentage in 2012:

Strengthening of the U.S. Dollar. We are a net importer from Europe into the U.S. of products produced in Europe with costs denominated in Euros. As a result, when the U.S. dollar or other currencies strengthen against the Euro, products produced in Europe (with costs denominated in Euros) and sold in currencies that are stronger compared to the Euro, have a positive impact on cost of sales as a percentage of net sales.

In 2011, our cost of sales as a percentage of net sales increased to 67.1% compared to 66.4% in 2010.

The following factor positively impacted our cost of sales percentage in 2011:

Mix of Products Sold. Compared to the prior year, our Pharma segment sales represented a higher percentage of our overall sales. This positively impacts our cost of sales percentage as margins on our pharmaceutical products typically are higher than the overall company average.

The following factors negatively impacted our cost of sales percentage in 2011:

Increased Raw Material Costs. Raw material costs, primarily the cost of plastic resin, increased in 2011 compared to 2010. While the majority of resin cost increases are passed along to our customers in our selling prices, we typically experience a lag in the timing of passing on these cost increases. Other material costs also increased such as the cost of aluminum, steel and rubber.

Increased Sales of Custom Tooling. Sales of custom tooling increased $12.9 million in 2011 compared to 2010. Traditionally, sales of custom tooling generate lower margins than our regular product sales and thus, an increase in sales of custom tooling negatively impacted cost of sales as a percentage of sales.

Weakening of the U.S. Dollar. We are a net importer from Europe into the U.S. of products produced in Europe with costs denominated in Euros. As a result, when the U.S. dollar or other currencies weaken against the Euro, products produced in Europe (with costs denominated in Euros) and sold in currencies that are weaker compared to the Euro, have a negative impact on cost of sales as a percentage of net sales.

Last in First Out ("LIFO") Inventory Valuation. Some of our U.S. operations use LIFO as their inventory valuation method. As some material costs, mainly resins, increased during the year, the increase to the LIFO reserve in 2011 was approximately $1.7 million, thus negatively impacting our cost of sales percentage in 2011.

SELLING, RESEARCH & DEVELOPMENT AND ADMINISTRATIVE

Our Selling, Research & Development and Administrative expenses ("SG&A") decreased approximately 2% or $6.0 million in 2012. Excluding changes in foreign currency rates, SG&A increased by approximately $11.8 million for the year. Increases due to Stelmi operational costs of $7.7 million and transaction costs of $5.9 million were offset by lower professional fees as higher legal costs were incurred in 2011. For 2012, SG&A as a percentage of net sales decreased to 14.7% compared to 14.9% of net sales in the same period of the prior year.

In 2011, our SG&A increased approximately 17% or $50.8 million in 2011. Excluding changes in foreign currency rates, the increase was approximately $39.6 million for the year. The increase was primarily due to higher compensation expenses (including salary and wage inflation and additional personnel associated with our realigned market-focused organization) and higher professional fees. SG&A as a percentage of net sales increased to 14.9% compared to 14.3% of net sales in 2010 primarily due to the items noted above.

DEPRECIATION AND AMORTIZATION

Depreciation and amortization expense increased approximately 2% or $2.8 million in 2012. Excluding changes in foreign currency rates, depreciation and amortization increased $10.0 million. Stelmi represented $5.6 million and accelerated depreciation related to our EOO plan represented $1.6 million of the increase in 2012. The remaining increase is related to the additional investments in our new facilities in Lincolnton, North Carolina and Mumbai, India, and general capital investment increases across all three business segments. Depreciation and amortization expense increased to 5.9% of net sales in 2012 compared to 5.7% in 2011 primarily due to the items mentioned above.

In 2011, depreciation and amortization expense increased approximately 1% or $1.3 million in 2011. Excluding changes in foreign currency rates, depreciation and amortization decreased $3.7 million primarily due to lapsing of certain software and patent related costs. Depreciation and amortization expense decreased to 5.7% of net sales in 2011 compared to 6.4% in 2010 primarily due to the strong increase in sales in 2011.

16 /ATR

2012 Form 10-K

RESTRUCTURING INITIATIVES

On November 1, 2012, the Company announced a plan to optimize certain capacity in Europe (EOO). Due to increased production efficiencies and to better position the Company for future growth in Europe, AptarGroup will transfer and consolidate production capacity involving twelve facilities. Two facilities, one in Italy and one in Switzerland, are expected to close and will impact approximately 170 employees. During 2012, we recognized $3.3 million of restructuring expenses along with the accelerated depreciation of assets mentioned above. Using current exchange rates, we expect to recognize approximately $14 million in additional costs, most of which will be incurred in 2013. Annual savings are estimated to be approximately €9 million (approximately $12 million using current exchange rates) beginning in late 2013.

During 2009, the Company announced a plan to consolidate two French dispensing closure manufacturing facilities and several sales offices in North America and Europe and has subsequently expanded the program to include additional headcount reductions. During 2012, 2011 and 2010, we recognized ($0.2) million, ($0.1) million and $0.1 million, respectively, of restructuring expenses due to the settlement of several reserve balances. The total costs associated with this consolidation/severance programs were $7.4 million. The plan has been substantially completed, subject to the settlement of remaining immaterial reserve balances.

OPERATING INCOME

Operating income decreased approximately $28.2 million or 10% to $258.9 million in 2012. Excluding changes in foreign currency rates, operating income decreased by approximately $10.8 million in 2012 compared to the same period a year ago. Stelmi contributed a $4.6 million operating loss in 2012 and costs related to our EOO plan contributed $4.9 million. Excluding Stelmi, the EOO plan and the changes in foreign currency rates, operating income decreased by approximately $1.4 million in 2012 compared to the same period a year ago due to the higher cost of sales percentage and the incremental depreciation related to our capital investments. Operating income as a percentage of sales decreased to 11.1% in 2012 compared to 12.3% in 2011 also due to the higher percentage of cost of sales and depreciation cost compared to prior year as discussed above.

In 2011, operating income increased approximately $19.1 million or 7% to a record $287.1 million in 2011 on the strong increases in sales volumes at each segment. Operating income as a percentage of sales decreased to 12.3% in 2011 compared to 12.9% in 2010 mainly due to the higher percentage of cost of sales and SG&A cost compared to prior year as discussed above.

NET OTHER EXPENSES

Net other expenses in 2012 increased to $17.5 million compared to $12.2 million in 2011. This increase is mainly due to $2.7 million of lower interest income and $1.7 million higher interest expense related to converting part of our short-term borrowing to long-term in order to lock in the historically low interest rates.

In 2011, net other expenses decreased to $12.2 million compared to $13.6 million in 2010 due primarily to lower foreign currency losses of $2.1 million. A $2.9 million increase in interest expense was mostly offset by an increase in interest income of $2.5 million.

EFFECTIVE TAX RATE

The reported effective tax rate on net income for 2012 and 2011 was 32.7% and 33.2%, respectively. The lower tax rate for 2012 is primarily the mix of earnings and lower tax expense associated with earnings repatriated to the U.S. during 2012. These benefits were partially offset by tax increases resulting from law changes enacted in 2012 in France.

The reported effective tax rate on net income for 2011 and 2010 was 33.2% and 31.8%, respectively. The higher tax rate for 2011 is primarily due to a 5% income tax surcharge enacted in France.

NET INCOME ATTRIBUTABLE TO APTARGROUP, INC.

We reported net income of $162.6 million in 2012 compared to $183.7 million reported in 2011 and $173.5 million reported in 2010.

BEAUTY + HOME SEGMENT

| |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Years Ended December 31, |

2012 |

2011 |

2010 |

% Change 2012 vs. 2011 |

% Change 2011 vs. 2010 |

|||||||||||

| |

||||||||||||||||

Net Sales |

$ | 1,453,940 | $ | 1,516,305 | $ | 1,380,065 | (4.1 | )% | 9.9 | % | ||||||

Segment Income (1) |

123,527 | 130,818 | 132,218 | (5.6 | ) | (1.1 | ) | |||||||||

Segment Income as a percentage of Net Sales |

8.5%

|

8.6%

|

9.6%

|

|||||||||||||

- (1)