As filed with the U.S. Securities and Exchange Commission on July 30, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Ault Alliance, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

3679 (Primary Standard Industrial Classification Code Number) |

94-1721931 (I.R.S. Employer Identification No.) |

| 11411 Southern Highlands Parkway, Suite 240 Las Vegas, Nevada 89141 Telephone: (949) 444-5464 |

||

| (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | ||

|

Henry Nisser President and General Counsel Ault Alliance, Inc. 122 East 42nd Street, 50th Floor New York, NY 10168 |

||

| (Name, address, including zip code, and telephone number, including area code, of agent for service) | ||

|

Copies to:

Spencer G. Feldman, Esq. Kenneth A. Schlesinger, Esq. |

||

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | x | Smaller reporting company | x |

| Emerging growth company | ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a) of the Securities Act, may determine.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED JULY 30, 2024

Ault Alliance, Inc.

1,500,000 Shares of 13.00% Series D Cumulative Redeemable Perpetual Preferred Stock

This prospectus relates to the offer and resale of up to 1,500,000 shares of Ault Alliance, Inc.’s (“we,” “us,” “our company” or the “Company”) 13.00% Series D Cumulative Redeemable Perpetual Preferred Stock, par value $0.001 per share (“Series D Preferred Stock” or the “Shares”), by Orion Equity Partners LLC (the “Selling Stockholder” or “Orion”). The shares included in this prospectus consist of (i) shares of our Series D Preferred Stock that we may, in our discretion, elect to issue and sell to the Selling Stockholder, from time to time after the date of this prospectus, pursuant to a Purchase Agreement we entered into with the Selling Stockholder on June 20, 2024 (the “Purchase Agreement”), in which the Selling Stockholder has committed to purchase from us, at our direction, up to an aggregate of $25 million of shares of Series D Preferred Stock (the “Commitment Amount”) and (ii) an aggregate of $500,000 of shares of our Series D Preferred Stock to be issued to the Selling Stockholder as consideration for its irrevocable commitment to purchase shares of our Series D Preferred Stock at our election in our sole discretion, from time to time after the date of this prospectus (the “Commitment Fee Shares”). See the section titled “Committed Equity Financing” for a description of the Purchase Agreement and the section titled “Selling Stockholder” for additional information regarding the Selling Stockholder.

We are not selling any shares of Series D Preferred Stock being offered by this prospectus and will not receive any of the proceeds from the sale of such shares by the Selling Stockholder. However, we may receive up to $25 million in aggregate gross proceeds from sales of our Series D Preferred Stock to the Selling Stockholder, in our sole and absolute discretion, that we elect to make, from time to time over the approximately 36-month period commencing on the date of the Purchase Agreement, provided that this registration statement, of which this prospectus forms a part, and any other registration statement the Company may file from time to time, covering the resale by the Selling Stockholder of the shares of our Series D Preferred Stock purchased from us by the Selling Stockholder pursuant to the Purchase Agreement is declared effective by the U.S. Securities and Exchange Commission (“SEC”) and remains effective, and the other conditions set forth in the Purchase Agreement are satisfied (the “Commencement Date”).

The Selling Stockholder may sell or otherwise dispose of the shares of our Series D Preferred Stock included in this prospectus in a number of different ways and at varying prices. See the section titled “Plan of Distribution (Conflict of Interest)” for more information about how the Selling Stockholder may sell or otherwise dispose of the Series D Preferred Stock being offered in this prospectus. The Selling Stockholder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”).

The Company’s Series D Preferred Stock trades on the NYSE American LLC (“NYSE American”) under the symbol “AULT PRD.” On July 29, 2024, the last reported sales price of the Company’s Series D Preferred Stock, as reported by NYSE American, was $27.70 per share.

We are a “smaller reporting company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and may elect to do so in future filings.

Investing in the Series D Preferred Stock is highly speculative and involves a high degree of risk. You should review carefully the risks and uncertainties described in the section titled “Risk Factors” beginning on page 15 of this prospectus, and under similar headings in any amendments or supplements to this prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of the Series D Preferred Stock or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

| i |

This prospectus is part of a Registration Statement on Form S-1 that we filed with the SEC. The Selling Stockholder may, from time to time, sell up to 1,500,000 shares of our Series D Preferred Stock, as described in this prospectus. We will not receive any proceeds from the sale by the Selling Stockholder of the securities described in this prospectus.

You should rely only on the information contained in this prospectus, any supplement to this prospectus or in any free writing prospectus, filed with the SEC. Neither we nor the Selling Stockholder have authorized anyone to provide you with additional information or information different from that contained in this prospectus, or any applicable prospectus supplement or any free writing prospectuses prepared by us or on our behalf and filed with the SEC. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The Selling Stockholder is offering to sell our securities only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment, as the case may be, may add, update or change information contained in this prospectus with respect to such offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any shares of our Series D Preferred Stock, you should carefully read this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, together with the additional information described under “Where You Can Find More Information.”

For investors outside of the United States: Neither we nor the Selling Stockholder have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus outside the United States.

This document includes trademarks, tradenames and service marks, certain of which belong to the Company and others that are the property of other organizations. Solely for convenience, trademarks, tradenames and service marks referred to in this document appear without the ®, TM and SM symbols, but the absence of those symbols is not intended to indicate, in any way, that the Company will not assert its rights or that the applicable owner will not assert its rights to these trademarks, tradenames and service marks to the fullest extent under applicable law. The Company does not intend its use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of the Company by, these other parties.

Unless the context indicates otherwise, references in this prospectus to the “Company,” “we,” “us,” “our company” and similar terms refer to Ault Alliance, Inc. and its consolidated subsidiaries.

| ii |

This prospectus contains estimates, projections, and other information concerning our industry and business, as well as data regarding market research, estimates, and forecasts prepared by our management. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” Unless otherwise expressly stated, we obtained this industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by market research firms and other third parties, industry and general publications, government data, and similar sources. In some cases, we do not expressly refer to the sources from which this data is derived. In that regard, when we refer to one or more sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived from sources which we paid for, sponsored, or conducted, unless otherwise expressly stated or the context otherwise requires. While we have compiled, extracted, and reproduced industry data from these sources, we have not independently verified the data. Forecasts and other forward-looking information with respect to industry, business, market, and other data are subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this document. See “Cautionary Note Regarding Forward-Looking Statements.”

| iii |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This registration statement, of which this prospectus forms a part, contains forward-looking statements. All statements other than statements of historical fact contained herein, including statements regarding our business plans or strategies, projected or anticipated benefits or other consequences of our plans or strategies are forward-looking statements. Words such as “anticipates,” “assumes,” “believes,” “can,” “could,” “estimates,” “expects,” “forecasts,” “guides,” “intends,” “is confident that,” “may,” “plans,” “seeks,” “projects,” “targets,” and “would,” and their opposites and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will actually be achieved. Forward-looking statements are based on information we have when those statements are made or our management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| · | we will need to raise additional capital to fund our operations in furtherance of our business plan; |

| · | we have an evolving business model, which increases the complexity of our business; |

| · | our Bitcoin mining operations present a number of risks; |

| · | we are highly reliant on the price of Bitcoin and the level of demand for, and financial performance of, the crypto-currency industry; |

| · | our holding company model presents certain additional risks; |

| · | our growth strategy is subject to a significant degree of risk; |

| · | we are heavily dependent on our senior management, and a loss of a member of our senior management team could cause our stock price to suffer; |

| · | if we fail to anticipate and adequately respond to rapid technological changes in our industry, including evolving industry-wide standards, in a timely and cost-effective manner, our business, financial condition and results of operations would be materially and adversely affected; |

| · | we are subject to risks related to governmental regulation and enforcement with respect to Bitcoin mining, including: |

| o | regulatory changes or actions may restrict the use of bitcoins or the operation of the Bitcoin network in a manner that adversely affects an investment in our securities; |

| o | due to the unregulated nature and lack of transparency surrounding the operations of many bitcoin trading venues, they may experience fraud, security failures or operational problems, which may adversely affect the value of our bitcoin; |

| iv |

| o | if regulatory changes or interpretations require the regulation of bitcoins under the Securities Act and the Investment Company Act of 1940, as amended (the “Investment Act”) by the SEC, we may be required to register and comply with such regulations. To the extent we decide to continue operations, the required registrations and regulatory compliance steps may result in extraordinary, non-recurring expenses to us. We may also decide to cease certain operations. Any disruption of our operations in response to the changed regulatory circumstances may be at a time that is disadvantageous to investors. This would likely have a material adverse effect on us and investors may lose their investment; and |

| o | changing environmental regulation and public energy policy may expose our business to new risks; |

| · | we may be significantly impacted by developments and changes in laws and regulations, including increased regulation of the cryptocurrency industry through legislative action and revised rules and standards applied by The Financial Crimes Enforcement Network under the authority of the U.S. Bank Secrecy Act and the Investment Act; |

| · | if we do not continue to satisfy the NYSE American continued listing requirements, our securities could be delisted from NYSE American; |

| · | our Series D Preferred Stock price is volatile; and |

| · | other risks and uncertainties described in this prospectus, including those under the section entitled “Risk Factors.” |

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of the Company prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

Except to the extent required by applicable law or regulation, the Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

| v |

This summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our securities and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our Series D Preferred Stock, you should read the entire prospectus carefully, including the section titled “Risk Factors” and our financial statements and related notes thereto included elsewhere in this prospectus.

Company Overview

Ault Alliance, Inc., a Delaware corporation, was incorporated in September 2017. Through our wholly and majority owned subsidiaries and strategic investments, we own and/or operate data centers at which we mine Bitcoin and offer colocation and hosting services for the emerging artificial intelligence (“AI”) ecosystems and other industries, and provide mission-critical products that support a diverse range of industries, including a metaverse platform, oil exploration, crane services, defense/aerospace, industrial, automotive, medical/biopharma and textiles. Our direct and indirect wholly owned subsidiaries include (i) Sentinum, Inc. (“Sentinum”), (ii) Alliance Cloud Services, LLC (“ACS”), (iii) BNI Montana, LLC (“BNI Montana”), (iv) Ault Capital Group, Inc. (“Ault Capital”), (v) Ault Lending, LLC (“Ault Lending”), (vii) Ault Global Real Estate Equities, Inc. (“AGREE”), (viii) Ault Disruptive Technologies Company, LLC (“ADTC”), which is the sponsor, Manager and the majority owner of Ault Disruptive Technologies Corporation (“Ault Disruptive”), (ix) Eco Pack Technologies, Inc. (“Eco Pack”), which has a controlling interest in Eco Pack Technologies Limited, (x) Ault Aviation, LLC (“Ault Aviation”) and (xi) Third Avenue Apartments, LLC (“Third Avenue”).

We also have a direct controlling interest in (i) Circle 8 Holdco LLC (“Circle 8 Holdco”), which wholly owns Circle 8 Crane Services, LLC (“Circle 8”), (ii) TurnOnGreen, Inc., formerly known as Imperalis Holding Corp. (“TurnOnGreen”), which wholly owns TOG Technologies, Inc. (“TOG Technologies”) and Digital Power Corporation (“Digital Power”), (iii) Gresham Worldwide, Inc., formerly known as Giga-tronics Incorporated (“GIGA”), which wholly owns Gresham Holdings, Inc., formerly Gresham Worldwide, Inc. (“GWW”), which in turn wholly owns Gresham Power Electronics Ltd. (“Gresham Power”), Enertec Systems 2001 Ltd. (“Enertec”), Relec Electronics Ltd. (“Relec”) and has a controlling interest in Microphase Corporation (“Microphase”), (iv) Avalanche International Corp. (“Avalanche” or “AVLP”), which does business as MTIX International (“MTIX”), and (v) RiskOn International, Inc., formerly known as BitNile Metaverse, Inc. (“ROI”), which wholly owns BitNile.com, Inc. (“BNC”), RiskOn360, Inc., formerly known as Ault Iconic, Inc. (“RiskOn360”), RiskOn Learning, Inc. and GuyCare, Inc. (“GuyCare”).

We were founded by Milton C. (Todd) Ault, III, our Executive Chairman, and are led by Mr. Ault, William B. Horne, our Chief Executive Officer and Vice Chairman, and Henry Nisser, our President and General Counsel. Together, they constitute the Executive Committee, which manages the day-to-day operations of the holding company. The Company’s long-term objective is to maximize per share intrinsic value. All major investment and capital allocation decisions are made for us by Mr. Ault and the Executive Committee.

We have the following reportable segments:

| · | Technology and Finance (“Fintech”) – commercial lending, activist investing, and stock trading through Ault Lending; |

| 1 |

| · | Sentinum: digital assets mining operations and colocation and hosting services for the emerging artificial intelligence ecosystems and other industries through Sentinum; |

| · | Ault Global Real Estate Equities, Inc. (“AGREE”): hotel operations and other commercial real estate holdings; |

| · | Circle 8: crane rental and lifting solutions provider for oilfield, construction, commercial and infrastructure markets; |

| · | ROI: operates a software-as-a-service platform called askROI.com, which is a unique, generative AI-driven platform engineered to provide pertinent and unique data insights through integration with business specific data that pushes beyond the conventional uses of existing large language models. ROI also owns 100% of BNC, which operates a metaverse platform and 100% of GuyCare, which develops products designed to improve men’s health; |

| · | GIGA: defense solutions with operations conducted by GWW’s subsidiaries Microphase, Enertec, Gresham Power and Relec; |

| · | TurnOnGreen: commercial electronics solutions with operations conducted by Digital Power, and electric vehicle (“EV”) charging solutions through TOG Technologies; and |

| · | Ault Disruptive: a special purpose acquisition company. |

We operate as a holding company with operations conducted primarily through our subsidiaries, which are described below.

Recent Events and Developments

On December 14, 2023, we, along with our wholly owned subsidiaries Sentinum, Third Avenue, ACS, BNI Montana, Ault Lending, Ault Aviation and AGREE (collectively with our company, Sentinum, Third Avenue, ACS, BNI Montana, Ault Lending and Ault Aviation, the “Guarantors”) entered into a Loan and Guaranty Agreement (the “2023 Loan Agreement”) with institutional lenders, pursuant to which Ault & Company, Inc. (“Ault & Company”), a related party, borrowed $36 million and issued secured promissory notes to the lenders in the aggregate amount of $38.9 million (collectively, the “Secured Notes”; and the transaction, the “Loan”). The 2023 Loan Agreement was amended as of April 15, 2024.

Pursuant to the 2023 Loan Agreement, the Guarantors, as well as Milton C. Ault, III, our Executive Chairman and the Chief Executive Officer of Ault & Company, agreed to act as guarantors for repayment of the Secured Notes. In addition, certain Guarantors entered into various agreements as collateral in support of the guarantee of the Secured Notes, including (i) a security agreement by Sentinum, pursuant to which Sentinum granted to the Lenders a security interest in (a) 19,226 Antminers (the “Miners”), (b) all of the digital currency mined or otherwise generated from the Miners and (c) the membership interests of ACS, (ii) a security agreement by the Company, Ault Lending, BNI Montana and AGREE, pursuant to which those entities granted to the lenders a security interest in substantially all of their assets, as well as a pledge of equity interests in Ault Aviation, AGREE, Sentinum, Third Avenue, Ault Energy, LLC, our wholly owned subsidiary (“Ault Energy”), ADTC, Eco Pack, and Circle 8 Holdco, (iii) a mortgage and security agreement by Third Avenue on the real estate property owned by Third Avenue in St. Petersburg, Florida (the “Florida Property”), (iv) a future advance mortgage by ACS on the real estate property owned by ACS in Dowagiac, Michigan (the “Michigan Property”), (v) an aircraft mortgage and security agreement by Ault Aviation on a private aircraft owned by Ault Aviation (the “Aircraft”), and (vi) deposit account control agreements over certain bank accounts held by certain of our subsidiaries.

| 2 |

In addition, pursuant to the 2023 Loan Agreement, we agreed to establish a segregated deposit account (the “Segregated Account”), which would be used as a further guarantee of repayment of the Secured Notes. $3.5 million of cash was paid into the Segregated Account on the closing date. We are required to have the minimum balance in the Segregated Account be not less than $7 million, $15 million, $20 million and $27.5 million on the five-month, nine-month, one-year and two-year anniversaries of the closing date, respectively. In addition, starting on March 31, 2024, we were required to deposit $0.3 million monthly into the Segregated Account, which increases to $0.4 million monthly starting March 31, 2025. Further, we agreed to deposit into the Segregated Account, (i) up to the first $7 million of net proceeds, if any, from the sale of the Hilton Garden Inn in Madison West, the Residence Inn in Madison West, the Courtyard in Madison West, and the Hilton Garden Inn in Rockford; (ii) 50% of cash dividends (on a per dividend basis) received from Circle 8 on or after June 30, 2024; (iii) 30% of the net proceeds from any bond offerings we conduct, which shall not exceed $9 million in the aggregate; and (iv) 25% of the net proceeds from cash flows, collections and revenues from loans or other investments made by Ault Lending (including but not limited to sales of loans or investments, dividends, interest payments and amortization payments), which shall not exceed $5 million in the aggregate. In addition, if we decide to sell certain assets, we further agreed to deposit funds into the Segregated Account from the sale of those assets, including, (i) $15 million from the sale of the Florida Property, (ii) $11 million from the sale of the Aircraft, (iii) $17 million from the sale of the Michigan Property, (iv) $350 per Miner, subject to a de minimis threshold of $1 million, and (v) $10 million from the sale of Circle 8.

On May 15, 2024, the 2023 Loan Agreement was amended to extend the date by which we were required to have a specified minimum balance in the Segregated Account from May 15, 2024 to July 22, 2024 and the specified minimum balance to be in the account as of such date was increased from $7 million to $7.4 million. On July 25, 2024, the 2023 Loan Agreement was further amended to extend the date by which we were required to have a specified minimum balance in the Segregated Account from July 22, 2024 to July 31, 2024.

On January 12, 2024, pursuant to the approval provided by our stockholders at the annual meeting of stockholders, we filed an Amendment to our Certificate of Incorporation with the State of Delaware to effectuate a reverse stock split of our common stock affecting both the authorized and issued and outstanding number of such shares by a ratio of one-for-twenty-five. The reverse stock split became effective on January 16, 2024. All share amounts in this registration statement have been updated to reflect the reverse stock split.

On January 31, 2024, Ault Lending entered into a securities purchase agreement (the “January 2024 SPA”) with Alzamend Neuro, Inc. (“Alzamend”), pursuant to which Alzamend agreed to sell, in one or more closings, to Ault Lending up to 6,000 shares of Series B convertible preferred stock (the “ALZN Series B Preferred”) and warrants to purchase up to 6.0 million shares of Alzamend common stock (the “ALZN Series B Warrants”) for a total purchase price of up to $6.0 million. On January 31, 2024, Ault Lending purchased 1,220 shares of ALZN Series B Preferred and warrants to purchase 122,000 shares for a total purchase price of $1.22 million. The purchase price was paid by the cancellation of $1.22 million of cash advances made by Ault Lending to Alzamend between November 9, 2023 and January 31, 2023. Each share of ALZN Series B Preferred has a stated value of $1.00 per share and is convertible into a number of shares of Alzamend’s common stock determined by dividing the stated value by $10.00, subject to adjustment in the event of an issuance of Alzamend common stock at a price per share lower than the conversion price, as well as upon customary stock splits, stock dividends, combinations or similar events. The ALZN Series B Warrants are exercisable on the first business day after the six-month anniversary of issuance and have a five-year term, expiring on the fifth anniversary of the initial exercise date. The exercise price of the ALZN Series B Warrants is $12.00, subject to adjustment in the event of an issuance of Alzamend common stock at a price per share lower than the conversion price, as well as upon customary stock splits, stock dividends, combinations or similar events.

| 3 |

On each of March 7, 2024, March 8, 2024, March 18, 2024, March 19, 2024 and April 17, 2024 pursuant to the securities purchase agreement we entered into with Ault & Company, dated as of November 6, 2023 (the “November 2023 SPA”), we sold to Ault & Company 500 shares of Series C Convertible Preferred Stock and warrants to purchase 147,820 shares of common stock to the Purchaser, for a purchase price of $500,000. As of the date of this prospectus, Ault & Company has purchased an aggregate of 44,000 shares of Series C Convertible Preferred Stock and warrants to purchase an aggregate of 13,008,131 shares of common stock, for an aggregate purchase price of $44.0 million.

On March 11, 2024, we entered into a note purchase agreement with two institutional investors (the “Buyers”) pursuant to which the Buyers purchased from the Company, on March 12, 2024 in a registered direct offering to the Buyers an aggregate of $2,000,000 principal face amount convertible promissory notes (the “Notes”). The Notes were sold to the Buyers for an aggregate purchase price of $1,800,000, which reflects an original issue discount of $200,000. The Notes accrue interest at the rate of 6% per annum, unless an event of default (as defined in the Notes) occurs, at which time the Notes would accrue interest at 12% per annum. The Notes were subsequently converted in full into shares of common stock at a conversion price of $0.35 per share.

On March 26, 2024, pursuant to the January 2024 SPA, Ault Lending purchased 780 shares of ALZN Series B Preferred Stock and ALZN Series B Warrants to purchase 78,000 shares of Alzamend common, for a purchase price of $780,000. As of the date of this prospectus, Ault Lending has purchased an aggregate of 2,000 shares of ALZN Series B Preferred and ALZN Series B Warrants to purchase an aggregate of 200,000 shares of Alzamend common stock, for an aggregate purchase price of $2.0 million.

On March 25, 2024 we entered into an amendment to the (i) November 2023 SPA, (ii) the related Certificate of Designation of Preferences, Rights and Limitations of the Series C Preferred Convertible Stock and (iii) the number of Series C Warrants, to provide for (A) an increase in the dollar amount of the Series C Convertible Preferred Stock that Ault & Company may purchase from us from $50,000,000.00 to $75,000,000.00 and (B) extended the date of on which the final closing may occur to June 30, 2024, subject to Ault & Company’s ability to further extended such date for ninety days.

Effective April 29, 2024, we issued to an accredited investor a term note with a principal face amount of $1,705,000. The note bears interest at the rate of 15% per annum and the note was issued with an original issuance discount. The maturity date of the note was May 17, 2024. The note contained a standard and customary event of default for failure to make payments when due under the note. The purchase price for the note was $1,550,000. The term note was amended on May 16, 2024 to extend the maturity date to June 15, 2024 and further amended on June 18, 2024 to extend the maturity date to July 31, 2024.

On June 4, 2024, we entered into a Loan Agreement (the “2024 Credit Agreement”) with OREE Lending Company, LLC and Helios Funds LLC, as lenders. The 2024 Credit Agreement provides for an unsecured, non-revolving credit facility in an aggregate principal amount of up to $20,000,000, provided, however, that at no point will we be allowed to have outstanding loans under the 2024 Credit Agreement in a principal amount received of more than $2,000,000. The lenders made a loan to the Company of $1,500,000 on June 4, 2024. The loans under the 2024 Credit Agreement are due December 4, 2024, provided, however, that if on such date, we have executed an equity line of credit agreement relating to the sale of shares of the Series D Preferred Stock, which was executed on June 20, 2024, have an effective registration statement relating thereto and are not currently in default under such agreement, then the maturity date shall be automatically extended until June 4, 2025. The lenders are not obligated to make any further loans under the 2024 Credit Agreement after the maturity date described above. Loans under the 2024 Credit Agreement will be evidenced by promissory notes (the “Promissory Notes”) and will include the addition of an original issuance discount of 20% to the amount of each loan and all loans will bear interest at the rate of 15.0% per annum and may be repaid at any time without penalty or premium.

| 4 |

On June 23, 2024, our subsidiaries, Ault Disruptive and GIGA, entered into to an Agreement and Plan of Merger with ADRT Merger Sub, Inc., a direct and wholly owned subsidiary of Ault Disruptive, whereby ADRT Merger Sub, Inc. will merge with and into GIGA, with GIGA being the surviving corporation and thereby becoming a wholly owned subsidiary of Ault Disruptive. Upon the closing of the merger, it is expected that Ault Disruptive will be renamed Gresham Worldwide, Inc., and thereafter remain listed on the NYSE American under a new ticker symbol, “GWWI.”

On July 18, 2024, we entered into a note purchase agreement with an institutional investor pursuant to which the institutional investor agreed to acquire, and we agreed to issue and sell in a registered direct offering to the institutional investor, a $5,390,000 10% OID Convertible Promissory Note (the “OID Note”). The OID Note was sold to the institutional investor for a purchase price of $4,900,000, an original issue discount of $490,000. The OID Note will accrue interest at the rate of 15% per annum, unless an event of default occurs, at which time the OID Note would accrue interest at 18% per annum. The OID Note will mature on October 19, 2024. In addition, the OID Note is convertible at any time after NYSE American approval of a Supplemental Listing Application into shares of our common stock at a conversion price of $0.22 per share (the “OID Conversion Price”), subject to adjustment. However, we may not issue shares of common stock upon conversion of the OID Note to the extent such issuance would result in an aggregate number of shares of common stock exceeding 19.99% of the total shares of common stock issued and outstanding as of July 18, 2024, in accordance with the rules and regulations of the New York Stock Exchange (the “NYSE Limit”) unless we first obtain stockholder approval (“Stockholder Approval”).

If, on September 2, 2024 (the “Adjustment Date”), the closing bid price of our common stock is lower than the OID Conversion Price, then the OID Conversion Price will be reduced to 85% of the closing bid price of the common stock on September 2, 2024. However, if after July 19, 2024, and prior to the date on which Stockholder Approval is obtained, the holder of the OID Note has converted a portion of the outstanding amount under the OID Note into shares of our common stock in an aggregate amount equal to the NYSE Limit, then the Adjustment Date will be extended by such number of days between such date and the date on which we obtain Stockholder Approval.

Our Corporate Structure

On January 3, 2023, we changed our name from BitNile Holdings, Inc. to Ault Alliance, Inc. (the “Name Change”). The Name Change was effected through a parent/subsidiary short form merger pursuant to an Agreement and Plan of Merger dated December 20, 2022. Neither the merger nor the Name Change affected the rights of our security holders. Our common stock is traded on the NYSE American under the symbol “AULT.” Existing stock certificates that reflect a prior corporate name continue to be valid. Certificates reflecting the new corporate name are issued as old stock certificates are tendered for exchange or transfer to our transfer agent.

| 5 |

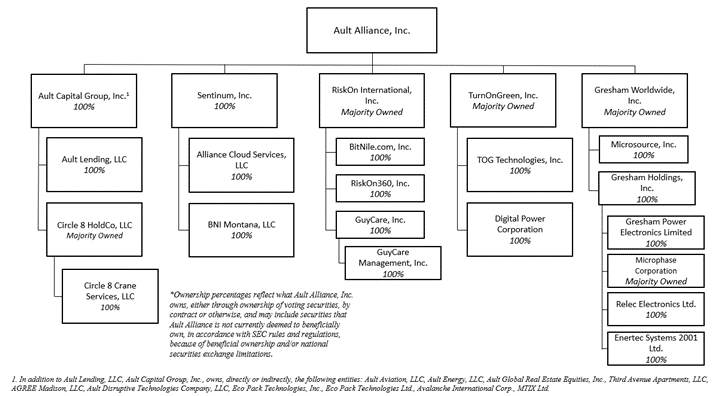

In March 2024, we reorganized our corporate structure pursuant to a series of transactions by and among the Company and its directly and indirectly owned subsidiaries as well as third parties. The purpose of the reorganization was to simplify our organizational and reporting structure to more accurately reflect our business operations. As a result of the foregoing transactions, our corporate structure is currently as follows:

Committed Equity Financing

On June 20, 2024, we entered into the Purchase Agreement with the Selling Stockholder. The Purchase Agreement provides that, upon the terms and subject to the conditions and limitations set forth therein, we have the right to direct the Selling Stockholder to purchase up to an aggregate of $25 million of shares of our Series D Preferred Stock over the 36-month term of the Purchase Agreement. Under the Purchase Agreement, after the satisfaction of certain commencement conditions, including, without limitation, the effectiveness of a registration statement, we have the right to submit to the Selling Stockholder an advance notice (each, an “Advance Notice”) directing the Selling Stockholder to purchase any amount up to the Maximum Advance Amount (as described below).

The Maximum Advance Amount means an amount equal to 40% of the average of the Daily Value Traded (as defined below) of our Series D Preferred Stock during the ten trading days immediately preceding an Advance Notice, provided that we must send the Advance Notice to the Selling Stockholder by 8:30 a.m., Eastern time, unless otherwise agreed to in writing by us and the Selling Stockholder. For these purposes, “Daily Value Traded” is the product obtained by multiplying the daily trading volume of our Series D Preferred Stock on NYSE American during regular trading hours, as reported by Bloomberg L.P., by the VWAP (as defined in the Purchase Agreement) for that trading day.

The number of shares that we can issue to the Selling Stockholder from time to time under the Purchase Agreement is subject to the Ownership Limitation (as defined below in the prospectus). We control the timing and number of sales of our Series D Preferred Stock to the Selling Stockholder. The Selling Stockholder has no right to require any sales by us, and is obligated to make purchases from us as directed solely by us in accordance with the Purchase Agreement. The Selling Stockholder has agreed that neither it nor any of its agents, representatives and affiliates will engage in any direct or indirect short-selling or hedging our Series D Preferred Stock during any time prior to the termination of the Purchase Agreement.

| 6 |

Pursuant to the Purchase Agreement, we agreed to prepare and file with the SEC a registration statement for the resale by the Selling Stockholder of Registrable Securities (as defined in the Purchase Agreement) within 30 calendar days from the date of the Purchase Agreement.

In consideration for the Selling Stockholder’s execution of the Purchase Agreement, we are required to issue to the Selling Stockholder, as a commitment fee, the Commitment Fee Shares, which constitute the number of shares of Series D Preferred Stock having an aggregate dollar value equal to $500,000. Within one business day of the effectiveness of this registration statement, we will deliver irrevocable instructions to our transfer agent to electronically transfer to the Selling Stockholder that number of shares of Series D Preferred Stock having an aggregate dollar value equal to $100,000 based on the Series D Preferred Stock price equal to the simple average of the closing prices of the Series D Preferred Stock during the five trading days immediately preceding the effectiveness of this registration statement (the “Initial Issuance”). We will deliver irrevocable instructions to our transfer agent to electronically transfer to the Selling Stockholder that number of shares of Series D Preferred Stock having an aggregate dollar value equal to $400,000 based on the Series D Preferred Stock price as follows: (i) $100,000 worth of the Commitment Fee Shares on the two month anniversary of the Initial Issuance based on the Series D Preferred Stock price equal to the simple average of the closing prices of the Series D Preferred Stock during the seven trading days immediately preceding the two month anniversary, (ii) $100,000 worth of the Commitment Fee Shares on the four month anniversary of the Initial Issuance based on the Series D Preferred Stock price equal to the simple average of the closing prices of the Series D Preferred Stock during the seven trading days immediately preceding the four month anniversary, (iii) $100,000 worth of the Commitment Fee Shares on the six month anniversary of the Initial Issuance based on the Series D Preferred Stock price equal to the simple average of the closing prices of the Series D Preferred Stock during the seven trading days immediately preceding the six month anniversary, and (iv) $100,000 worth of the Commitment Fee Shares on the eight month anniversary of the Initial Issuance based on the Series D Preferred Stock price equal to the simple average of the closing prices of the Series D Preferred Stock during the seven trading days immediately preceding the eight month anniversary.

The Purchase Agreement may be terminated by us at any time after commencement, at our discretion; provided that upon early termination we are required to issue the outstanding Commitment Fee Shares to the Selling Stockholder. The Purchase Agreement will automatically terminate on the date that we sell, and the Selling Stockholder purchases, the full $25 million amount under the agreement or, if the full amount has not been purchased, on the expiration of the 36-month term of the Purchase Agreement.

Corporate Information

We are a Delaware corporation, initially formed in California in 1969 and reincorporated in Delaware in 2017. We are located at 11411 Southern Highlands Parkway, Suite 240, Las Vegas, NV 89141. Our phone number is (949) 444-5464 and our website address is www.ault.com. We make our periodic and current reports that are filed with the SEC available, free of charge, on our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. Information contained on, or accessible through, our website is not a part of, and is not incorporated by reference into, this prospectus.

| 7 |

| Issuer | Ault Alliance, Inc. | |

| Shares of our Series D Preferred Stock offered by the Selling Stockholder | Up to 1,500,000 shares of our Series D Preferred Stock, consisting of (i) an indeterminable number of shares of our Series D Preferred Stock that may be issued as Commitment Fee Shares to the Selling Stockholder, pursuant to the terms of the Purchase Agreement, if any, and (ii) an indeterminable number of shares of our Series D Preferred Stock we may elect, in our sole discretion, to issue and sell to the Selling Stockholder under the Purchase Agreement from time to time after the Commencement Date, if any. | |

| Shares of our Series D Preferred Stock outstanding as of July 29, 2024 | 323,835 shares of Series D Preferred Stock | |

| Shares of our Series D Preferred Stock outstanding after giving effect to the issuance of the shares registered hereunder | 1,823,835 shares of Series D Preferred Stock | |

| Dividends |

Holders of the Series D Preferred Stock are entitled to receive cumulative cash dividends at a rate of 13.00% per annum of the $25.00 per share liquidation preference (equivalent to $3.25 per annum per share or $0.2708333 per month per share).

Dividends are payable monthly within eight business days of the last day of each month, commencing on June 30, 2022 when, as and if declared by our board of directors (each, a “dividend payment date”). Dividends are payable to holders of record as they appear in our stock records for the Series D Preferred Stock at the close of business on the corresponding record date, which is the last day of the month, whether or not a business day, in which the applicable dividend payment date falls (each, a “dividend record date”). As a result, holders of shares of Series D Preferred Stock are not entitled to receive dividends on a dividend payment date if such shares were not issued and outstanding on the applicable dividend record date. In the event we do not pay dividends on the Series D Preferred Stock for 18 or more monthly dividend periods (whether or not consecutive), the holders of Series D Preferred Stock will have certain voting rights. See the sections entitled “Description of the Series D Preferred Stock—Series D Preferred Stock—Dividends” and “—Voting Rights.” |

| 8 |

As of July 29, 2024, we have timely made every monthly dividend payment since the first dividend record date of June 30, 2022, in which we have paid an aggregate of $1,971,212 in dividends to the holders of Series D Preferred Stock. For further information, see the section entitled “Description of the Series D Preferred Stock—Series D Preferred Stock—Dividends. ” | ||

| No Maturity, Sinking Fund or Mandatory Redemption | The Series D Preferred Stock is perpetual and has no stated maturity date and will not be subject to any sinking fund or mandatory redemption. Shares of the Series D Preferred Stock will remain outstanding indefinitely unless we decide to redeem or otherwise repurchase them. We are not required to set aside funds to redeem the Series D Preferred Stock. | |

| Optional Redemption | Prior to June 3, 2025, the date that is three years following the initial issuance of the Series D Preferred Stock, we may, at our option, redeem the Series D Preferred Stock, in whole or in part, at any time or from time to time, at a redemption price equal to $25.50 per share of Series D Preferred Stock, plus any accumulated and unpaid dividends (whether or not declared) on the Series D Preferred Stock up to, but not including, the date of such redemption, upon written notice, as described in the section entitled “Description of the Series D Preferred Stock—Series D Preferred Stock—Redemption—Redemption Procedures.” On and after June 3, 2025, the redemption price decreases to $25.00 per share. See the section entitled “Description of the Series D Preferred Stock—Series D Preferred Stock—Redemption—Optional Redemption.” | |

| Special Optional Redemption |

Upon the occurrence of a Change of Control, we may, at our option, redeem the Series D Preferred Stock, in whole or in part, within 120 days after the first date on which such Change of Control occurred, for cash at a redemption price of $25.00 per share, plus any accumulated and unpaid dividends (whether or not declared) to, but not including, the redemption date. |

| 9 |

| A “Change of Control” is deemed to occur when the following have occurred and are continuing: (i) the acquisition by any person, including any syndicate or group deemed to be a “person” under Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (other than Ault & Company, which is a majority stockholder of our Company and affiliates of Milton C. (Todd) Ault III, our Executive Chairman, and any “person” or “group” under Section 13(d)(3) of the Exchange Act that is an affiliate of Ault & Company or any trust, partnership, corporate or other entity affiliated with any of the foregoing), of beneficial ownership, directly or indirectly, through a purchase, merger or other acquisition transaction or series of purchases, mergers or other acquisition transactions of our stock entitling that person to exercise more than 50% of the total voting power of all our stock entitled to vote generally in the election of our directors (except that such person will be deemed to have beneficial ownership of all securities that such person has the right to acquire, whether such right is currently exercisable or is exercisable only upon the occurrence of a subsequent condition); and (ii) following the closing of any transaction referred to above, neither we nor the acquiring or surviving entity has a class of common securities (or American Depositary Receipts representing such securities) listed on the NYSE, the NYSE American or the NASDAQ Stock Market (“NASDAQ”), or listed or quoted on an exchange or quotation system that is a successor to the NYSE, the NYSE American or NASDAQ. | ||

| Liquidation Preference | If we liquidate, dissolve or wind up, holders of the Series D Preferred Stock will have the right to receive $25.00 per share, plus any accumulated and unpaid dividends to, but not including, the date of payment, before any payment is made to the holders of our common stock or any capital stock ranking junior to the Series D Preferred Stock. See the section entitled “Description of the Series D Preferred Stock—Series D Preferred Stock—Liquidation Preference.” |

| 10 |

| Ranking | The Series D Preferred Stock will rank, with respect to rights to the payment of dividends and the distribution of assets upon our liquidation, dissolution or winding up, (1) senior to all classes or series of our common stock and to all other equity securities issued by us other than equity securities referred to in clauses (2) and (3); (2) in parity with all equity securities issued by us with terms specifically providing that those equity securities rank in parity with the Series D Preferred Stock with respect to rights to the payment of dividends and the distribution of assets upon our liquidation, dissolution or winding up, including our Series A Preferred Stock and Series C Preferred Stock; (3) junior to all equity securities issued by us with terms specifically providing that those equity securities rank senior to the Series D Preferred Stock with respect to rights to the payment of dividends and the distribution of assets upon our liquidation, dissolution or winding up; and (4) effectively junior to all of our existing and future indebtedness (including indebtedness convertible into our common stock or preferred stock) and to the indebtedness and other liabilities of (as well as any preferred equity interests held by others in) our existing subsidiaries and any future subsidiaries. See the section entitled “Description of the Series D Preferred Stock—Series D Preferred Stock—Ranking.” | |

| Limited Voting Rights |

Holders of Series D Preferred Stock will generally have no voting rights. However, if we do not pay dividends on the Series D Preferred Stock for 18 or more monthly dividend periods (whether or not consecutive), the holders of the Series D Preferred Stock (voting separately as a class with the holders of all other classes or series of our preferred stock we may issue upon which like voting rights have been conferred and are exercisable and which are entitled to vote as a class with the Series D Preferred Stock in the election referred to below) will be entitled to vote for the election of two additional directors to serve on our board of directors until we pay, or declare and set aside funds for the payment of, all dividends that we owe on the Series D Preferred Stock, subject to certain limitations described in the section entitled “Description of the Series D Preferred Stock—Series D Preferred Stock—Voting Rights.” In addition, the affirmative vote of the holders of at least two-thirds of the outstanding shares of Series D Preferred Stock is required at any time for us to authorize or issue any class or series of our capital stock ranking senior to the Series D Preferred Stock with respect to the payment of dividends or the distribution of assets on liquidation, dissolution or winding up, to amend any provision of our certificate of incorporation so as to materially and adversely affect any rights of the Series D Preferred Stock. If any such amendments to our certificate of incorporation would be material and adverse to holders of the Series D Preferred Stock and any other series of parity preferred stock upon which similar voting rights have been conferred and are exercisable, a vote of at least two-thirds of the outstanding shares of Series D Preferred Stock and the shares of the other applicable series materially and adversely affected, voting together as a class, would be required. See the section entitled “Description of the Series D Preferred Stock—Series D Preferred Stock—Voting Rights.” |

| 11 |

| Further, unless we have received the approval of two thirds of the votes entitled to be cast by the holders of Series D Preferred Stock, we will not effect any consummation of a binding share exchange or reclassification of the Series D Preferred Stock or a merger or consolidation with another entity, unless (a) the shares of Series D Preferred Stock remain outstanding or, in the case of a merger or consolidation with respect to which we are not the surviving entity, the shares of Series D Preferred Stock are converted into or exchanged for preference securities, or (b) such shares remain outstanding or such preference securities are not materially less favorable than the Series D Preferred Stock immediately prior to such consummation. See the section entitled “Description of the Series D Preferred Stock—Series D Preferred Stock—Voting Rights.” | ||

| Information Rights | During any period in which we are not subject to Section 13 or 15(d) of the Exchange Act, and any shares of Series D Preferred Stock are outstanding, we will use our best efforts to (i) transmit by mail (or other permissible means under the Exchange Act) to all holders of Series D Preferred Stock, as their names and addresses appear on our record books and without cost to such holders, copies of the Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q that we would have been required to file with the SEC pursuant to Section 13 or 15(d) of the Exchange Act if we were subject thereto (other than any exhibits that would not have been required) and (ii) promptly, upon request, supply copies of such reports to any holders or prospective holder of Series D Preferred Stock, subject to certain exceptions described in this prospectus. We will use our best efforts to mail (or otherwise provide) the information to the holders of the Series D Preferred Stock within 15 days after the respective dates by which a periodic report on Form 10-K or Form 10-Q, as the case may be, in respect of such information would have been required to be filed with the SEC, as if we were subject to Section 13 or 15(d) of the Exchange Act, in each case, based on the dates on which we would be required to file such periodic reports as if we were a “non-accelerated filer” within the meaning of the Exchange Act. |

| 12 |

| Use of proceeds | We will not receive any proceeds from the resale of our shares of Series D Preferred Stock included in this prospectus by the Selling Stockholder. However, we may receive up to $25 million in aggregate gross proceeds under the Purchase Agreement from sales of our shares of Series D Preferred Stock that we may elect to make to the Selling Stockholder pursuant to the Purchase Agreement, if any, from time to time in our sole discretion, from and after the Commencement Date. Any such proceeds will be used solely for repayment of debt under the 2024 Credit Agreement for so long as any Promissory Notes under the 2024 Credit Agreement remain outstanding; thereafter, for working capital purposes. The precise amount and timing of the application of such proceeds will depend upon our liquidity needs and the availability and cost of other capital over which we have little or no control. As of the date hereof, we cannot specify with certainty the particular uses for the net proceeds. For more information see the section herein titled “Use of Proceeds.” | |

| Liquidity | This offering involves the potential sale of up to the $25 million Commitment Amount. Once this registration statement is effective and during such time as it remains effective, the Selling Stockholder will be permitted to sell the shares, if any. The resale, or expected or potential resale, of a substantial number of shares of our Series D Preferred Stock in the public market could adversely affect the market price for our Series D Preferred Stock and make it more difficult for our stockholders to sell their shares of our Series D Preferred Stock at times and prices that they feel are appropriate. |

| 13 |

| Risk Factors | See the section herein titled “Risk Factors” and the other information included in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our securities. | |

| NYSE American trading symbol | “AULT PRD” | |

| Conflict of Interest | An affiliate of Orion (an entity under common control with Orion) is a Financial Industry Regulatory Authority, Inc. (“FINRA”) member which will act as an executing broker for the sale of the Shares sold by Orion pursuant to the Purchase Agreement. Because Orion will receive all the net proceeds from sales of the shares made to the public, Orion is deemed to have a “conflict of interest” within the meaning of Rule 5121 of FINRA. Accordingly, this offering is being made in compliance with the requirements of Rule 5121. In accordance with Rule 5121, the Company and Orion have engaged Ascendiant Capital Markets, LLC, and it has agreed to serve as a Qualified Independent Underwriter for future purchases made under the Purchase Agreement, where required. In exchange for its services as a Qualified Independent Underwriter, Ascendiant Capital Markets, LLC shall receive a cash fee equal to 11.12% of the discount received by Orion for each such purchase. See “Plan of Distribution (Conflict of Interest)”. |

| 14 |

Investing in our securities involves a high degree of risk. You should carefully consider the following risk factors, as well as those set forth in our most recent Annual Report on Form 10-K filed with the SEC and subsequent Quarterly Reports on Form 10-Q which are incorporated by reference into this prospectus, as well as the other information set forth in this prospectus and the documents incorporated by reference herein, before deciding whether to invest in our securities. Additional risks and uncertainties that we are unaware of may become important factors that affect us. If any of these risks actually occurs, our business, financial condition and operating results may suffer, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to the Offering

It is not possible to predict the actual number of shares of Series D Preferred Stock we will sell under the Purchase Agreement to the Selling Stockholder, or the actual gross proceeds resulting from those sales. Further, we may not have access to the full amount available under the Purchase Agreement with the Selling Stockholder.

On June 20, 2024, we entered into the Purchase Agreement with the Selling Stockholder, pursuant to which the Selling Stockholder has committed to purchase up to the $25 million Commitment Amount of our Series D Preferred Stock, subject to certain limitations and conditions set forth in the Purchase Agreement. The shares of our Series D Preferred Stock that may be issued under the Purchase Agreement may be sold by us to the Selling Stockholder at our discretion from time to time beginning on the Commencement Date and during the term of the Purchase Agreement.

We generally have the right to control the timing and amount of any sales of shares of our Series D Preferred Stock to the Selling Stockholder under the Purchase Agreement. Sales of our Series D Preferred Stock, if any, to the Selling Stockholder under the Purchase Agreement will depend upon market conditions and other factors to be determined by us. We may ultimately decide to sell to the Selling Stockholder all, some or none of the shares of our Series D Preferred Stock that may be available for us to sell to the Selling Stockholder pursuant to the Purchase Agreement. Depending on market liquidity at the time, resales of those shares by the Selling Stockholder may cause the public trading price of our Series D Preferred Stock to decrease.

Because the purchase price per share to be paid by the Selling Stockholder for the shares of our Series D Preferred Stock that we may elect to sell to the Selling Stockholder under the Purchase Agreement, if any, will fluctuate based on the market prices of our Series D Preferred Stock during the applicable pricing period when an Advance Notice is delivered for each sale made pursuant to the Purchase Agreement, if any, it is not possible for us to predict, as of the date of this prospectus and prior to any such sales, the number of shares of our Series D Preferred Stock that we will sell to the Selling Stockholder under the Purchase Agreement, the purchase price per share that the Selling Stockholder will pay for shares purchased from us under the Purchase Agreement, or the aggregate gross proceeds that we will receive from those purchases by the Selling Stockholder under the Purchase Agreement, if any.

| 15 |

Moreover, although the Purchase Agreement provides that we may, in our discretion, from time to time beginning on the Commencement Date and during the term of the Purchase Agreement, direct the Selling Stockholder to purchase shares of Series D Preferred Stock from us in one or more purchases under the Purchase Agreement, up to the Commitment Amount, if any, only 1,500,000 shares of our Series D Preferred Stock are being registered for resale under this registration statement, of which this prospectus forms a part. Additionally, because the price per share at which the Commitment Fee Shares is based will fluctuate based on market prices of our Series D Preferred Stock during the applicable time periods during which the closing price for such issuable shares is calculated, it is not possible for us to predict the number of Commitment Fee Shares or the number of Commitment Fee Shares issuable to the Selling Stockholder pursuant to the Purchase Agreement. Accordingly, the number of shares of our Series D Preferred Stock we may elect, in our sole discretion, to issue and sell to the Selling Stockholder, from time to time from and after the Commencement Date under the Purchase Agreement cannot be determined at this time. Even assuming the 1,500,000 shares of Series D Preferred Stock offered for resale by the Selling Stockholder under this prospectus were sold by us to the Selling Stockholder for a per share price of $12.34 (which represents the lowest reported sales price of our Series D Preferred Stock during the 12 months immediately prior to the date of this prospectus, as reported by NYSE American), less a 9% discount (the same fixed percentage discount that will be used to calculate the applicable per share purchase price for shares of Series D Preferred Stock that we may elect to sell to the Selling Stockholder under the Purchase Agreement), we would only receive aggregate gross proceeds of approximately $16,844,100, which is less than the $25 million Commitment Amount available to us under the Purchase Agreement. Therefore, because the market prices of our Series D Preferred Stock may fluctuate from time to time after the date of this prospectus and, as a result, the actual purchase prices to be paid by the Selling Stockholder for shares of our Series D Preferred Stock that we direct it to purchase under the Purchase Agreement, if any, also may fluctuate because they will be based on such fluctuating market prices of our Series D Preferred Stock, it is possible that we may need to issue and sell more than the number of shares being registered for resale under this prospectus to the Selling Stockholder under the Purchase Agreement in order to receive aggregate gross proceeds equal to the Selling Stockholder’s $25 million Commitment Amount under the Purchase Agreement.

If it becomes necessary for us to issue and sell to the Selling Stockholder under the Purchase Agreement more shares of our Series D Preferred Stock than are being registered for resale under this prospectus in order to receive aggregate gross proceeds equal to $25 million from sales of our Series D Preferred Stock to the Selling Stockholder under the Purchase Agreement, we must first file with the SEC one or more additional registration statements to register under the Securities Act the resale by the Selling Stockholder of any such additional shares of our Series D Preferred Stock we wish to sell to the Selling Stockholder from time to time under the Purchase Agreement, and the SEC must declare such additional registration statements effective before we may elect to sell any additional shares of our Series D Preferred Stock to the Selling Stockholder under the Purchase Agreement. The number of shares of our Series D Preferred Stock ultimately offered for resale by the Selling Stockholder is dependent upon the number of shares of our Series D Preferred Stock, if any, we ultimately sell to the Selling Stockholder under the Purchase Agreement.

Our inability to access a portion or the full amount available under the Purchase Agreement, in the absence of any other financing sources, could have a material adverse effect on our business.

The sale and issuance of our Series D Preferred Stock to the Selling Stockholder will cause dilution to our existing stockholders of Series D Preferred Stock, and the sale of the shares of our Series D Preferred Stock acquired by the Selling Stockholder, or the perception that such sales may occur, could cause the price of our Series D Preferred Stock to fall.

The purchase price for the shares that we may sell to the Selling Stockholder under the Purchase Agreement will fluctuate based on the price of the shares of our Series D Preferred Stock. Depending on market liquidity at the time, sales of such shares may cause the trading price of our Series D Preferred Stock to fall.

| 16 |

If and when we do sell shares to the Selling Stockholder, after the Selling Stockholder has acquired the shares, the Selling Stockholder may resell all, some, or none of those shares at any time or from time to time in its discretion. Therefore, sales to the Selling Stockholder by us could result in substantial dilution to the interests of other holders of our Series D Preferred Stock. Additionally, the sale of a substantial number of shares of our Series D Preferred Stock to the Selling Stockholder, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales.

Investors who buy shares at different times will likely pay different prices.

Pursuant to the Purchase Agreement and subject to market demand, we will have discretion to vary the timing, prices, and numbers of shares sold to the Selling Stockholder. If and when we do elect to sell shares of our Series D Preferred Stock to the Selling Stockholder pursuant to the Purchase Agreement, after the Selling Stockholder has acquired such shares, the Selling Stockholder may resell all, some or none of such shares at any time or from time to time in its discretion and at different prices. As a result, investors who purchase shares from the Selling Stockholder in this offering at different times will likely pay different prices for those shares, and so may experience different levels of dilution and in some cases substantial dilution and different outcomes in their investment results. Investors may experience a decline in the value of the shares they purchase from the Selling Stockholder in this offering as a result of future sales made by us to the Selling Stockholder at prices lower than the prices such investors paid for their shares in this offering. In addition, if we sell a substantial number of shares to the Selling Stockholder under the Purchase Agreement, or if investors expect that we will do so, the actual sales of shares or the mere existence of our arrangement with the Selling Stockholder may make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect such sales.

The Selling Stockholder will pay less than the then-prevailing market price for our Series D Preferred Stock, which could cause the price of our Series D Preferred Stock to decline.

The purchase price of our Series D Preferred Stock to be sold to the Selling Stockholder under the Purchase Agreement is derived from the market price of our Series D Preferred Stock on the NYSE American. Shares to be sold to the Selling Stockholder pursuant to the Purchase Agreement will be purchased at a discounted price. We may effect sales at a price equal to 91% of the arithmetic seven-day average of the closing prices of the Series D Preferred Stock during the seven (7) consecutive trading days ending on the trading day immediately preceding such Advance Notice Date (as defined in the Purchase Agreement) (see “Committed Equity Financing—Purchase of Shares under the Purchase Agreement”). As a result of this pricing structure, the Selling Stockholder may sell the shares it receives immediately after receipt of the shares, which could cause the price of our Series D Preferred Stock to decrease.

Our management team may have broad discretion over the use of the net proceeds from our sale of shares of Series D Preferred Stock to the Selling Stockholder, if any, and you may not agree with how we use the proceeds and the proceeds may not be invested successfully.

Any proceeds from the sale of our shares of Series D Preferred Stock to the Selling Stockholder must be used solely for repayment of debt under the 2024 Credit Agreement for so long as any Promissory Notes under the 2024 Credit Agreement remain outstanding, however, if no Promissory Note is currently outstanding, we may use any remaining proceeds for working capital purposes. Our management team would then have broad discretion as to the use of the net proceeds from the sale of our shares of Series D Preferred Stock to the Selling Stockholder, if any, and we could use such proceeds for purposes other than those contemplated at the time of commencement of this offering. Accordingly, you will be relying on the judgment of our management team with regard to the use of those net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that, pending their use, we may invest those net proceeds in a way that does not yield a favorable, or any, return for us. The failure of our management team to use such funds effectively could have a material adverse effect on our business, financial condition, operating results and cash flows.

| 17 |

Risks Related to the Series D Preferred Stock

The Series D Preferred Stock ranks junior to all of our indebtedness and other liabilities.

In the event of our bankruptcy, liquidation, dissolution or winding-up of our affairs, our assets will be available to pay obligations on the Series D Preferred Stock only after all of our indebtedness and other liabilities have been paid. The rights of holders of the Series D Preferred Stock to participate in the distribution of our assets will rank junior to the prior claims of our current and future creditors, the holders of our existing series of preferred stock and any future series or class of preferred stock we may issue that ranks senior to the Series D Preferred Stock. Also, the Series D Preferred Stock effectively ranks junior to all existing and future indebtedness and to the indebtedness and other liabilities of our existing subsidiaries and any future subsidiaries. Our existing subsidiaries are, and future subsidiaries would be, separate legal entities and have no legal obligation to pay any amounts to us in respect of dividends due on the Series D Preferred Stock. If we are forced to liquidate our assets to pay our creditors, we may not have sufficient assets to pay amounts due on any or all of the Series D Preferred Stock then outstanding. We have incurred and may in the future incur substantial amounts of debt and other obligations that will rank senior to the Series D Preferred Stock. At March 31, 2024, our total liabilities equaled approximately $233.9 million.

Certain of our existing or future debt instruments may restrict the authorization, payment or setting apart of dividends on the Series D Preferred Stock. There can be no assurance that we will always remain in compliance with any credit agreement we may enter into in the future, and if we default, we may be contractually prohibited from paying dividends on the Series D Preferred Stock. Also, future offerings of debt or senior equity securities may adversely affect the market price of the Series D Preferred Stock. If we decide to issue debt or senior equity securities in the future, it is possible that these securities will be governed by an indenture or other instruments containing covenants restricting our operating flexibility. Additionally, any convertible or exchangeable securities that we issue in the future may have rights, preferences and privileges more favorable than those of the Series D Preferred Stock and may result in dilution to owners of the Series D Preferred Stock. We and, indirectly, our stockholders, will bear the cost of issuing and servicing such securities. Because our decision to issue debt or equity securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings. The holders of the Series D Preferred Stock will bear the risk of our future offerings, which may reduce the market price of the Series D Preferred Stock and may dilute the value of their holdings in us.

Future offerings of debt or senior equity securities may adversely affect the market price of the Series D Preferred Stock.

If we decide to issue debt or senior equity securities in the future, it is possible that these securities will be governed by an indenture or other instrument containing covenants restricting our operating flexibility. Additionally, any convertible or exchangeable securities that we issue in the future may have rights, preferences and privileges more favorable to the holders of those securities than the Series D Preferred Stock with respect to the owners of the Series D Preferred Stock and may result in dilution to owners of the Series D Preferred Stock. We and, indirectly, our stockholders, will bear the cost of issuing and servicing such securities. Because our decision to issue debt or equity securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings. Thus, holders of the Series D Preferred Stock will bear the risk of our future offerings reducing the market price of the Series D Preferred Stock and the common stock into which the Series D Preferred Stock, in certain limited circumstances, is convertible and diluting the value of their holdings in us.

| 18 |

We may issue additional shares of Series D Preferred Stock and additional series of preferred stock that rank senior to or on a parity with the Series D Preferred Stock as to dividend rights, rights upon liquidation, voting rights and other rights.