EX-99.2

Amedisys First Quarter 2020 Earnings

Call Supplemental Slides May 7th, 2020 Exhibit 99.2

This presentation may include

forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon current expectations and assumptions about our business that are subject to a variety of risks and

uncertainties that could cause actual results to differ materially from those described in this presentation. You should not rely on forward-looking statements as a prediction of future events. Additional information regarding factors that could

cause actual results to differ materially from those discussed in any forward-looking statements are described in reports and registration statements we file with the SEC, including our Annual Report on Form 10-K and subsequent Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K, copies of which are available on the Amedisys internet website http://www.amedisys.com or by contacting the Amedisys Investor Relations department at (225) 292-2031. We disclaim any obligation to update any

forward-looking statements or any changes in events, conditions or circumstances upon which any forward-looking statement may be based except as required by law. www.amedisys.com NASDAQ: AMED We encourage everyone to visit the Investors Section of

our website at www.amedisys.com, where we have posted additional important information such as press releases, profiles concerning our business and clinical operations and control processes, and SEC filings. Forward-looking statements

Q1 2020 Results

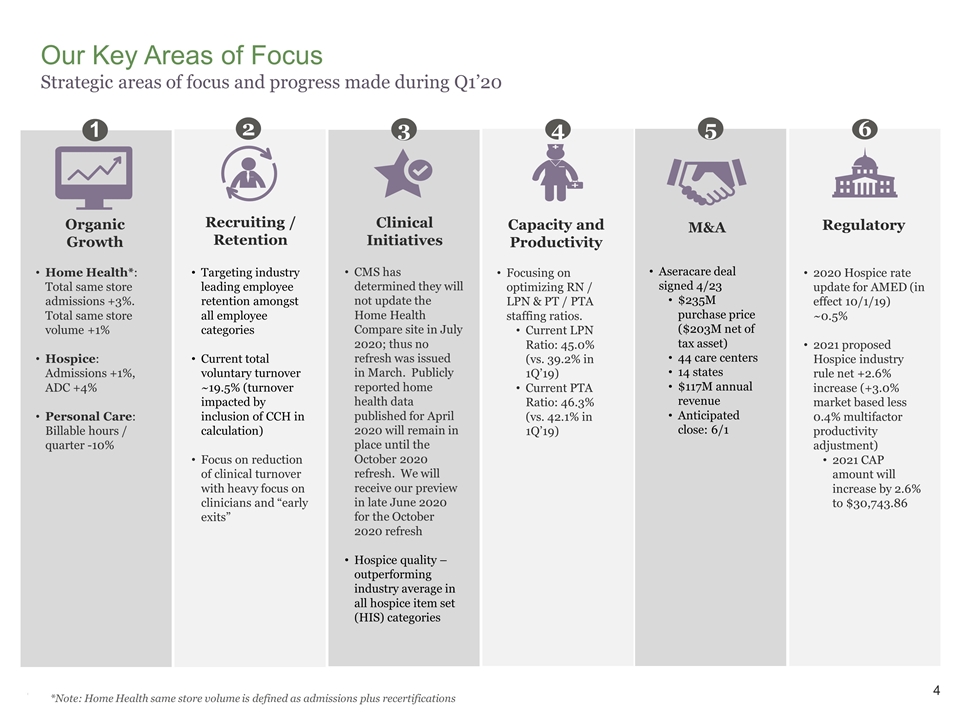

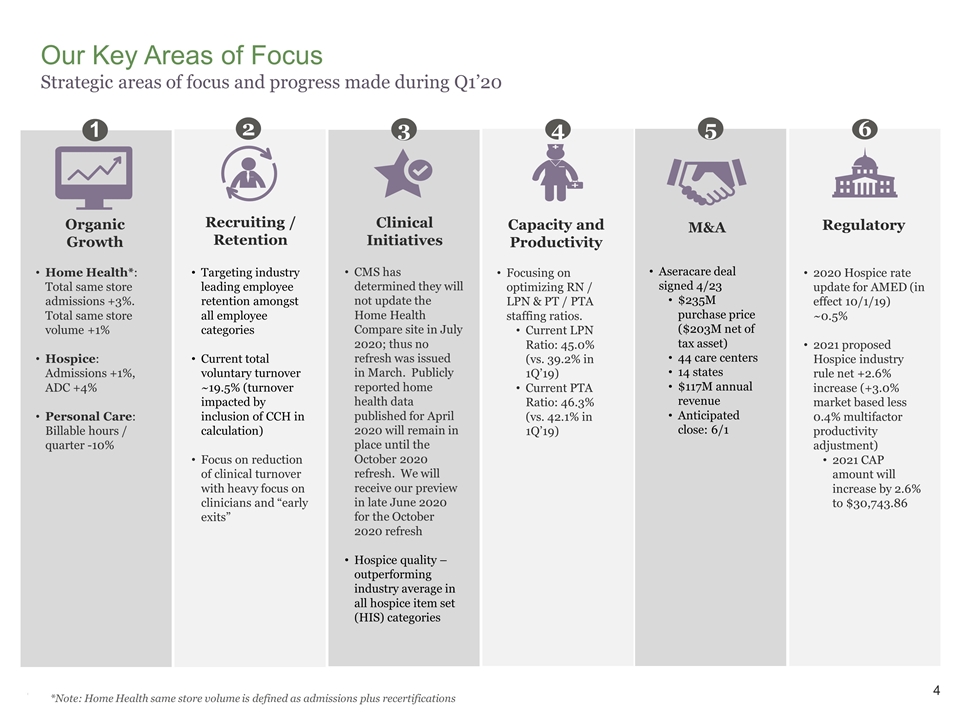

Our Key Areas of Focus Strategic areas

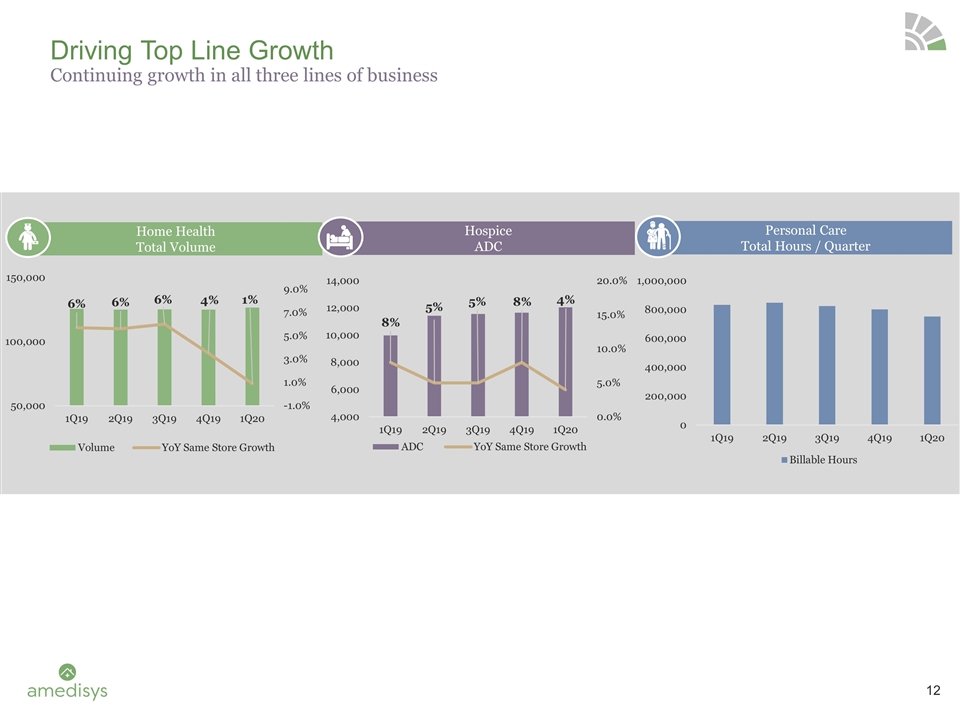

of focus and progress made during Q1’20 Home Health*: Total same store admissions +3%. Total same store volume +1% Hospice: Admissions +1%, ADC +4% Personal Care: Billable hours / quarter -10% 1 Organic Growth CMS has determined they will not

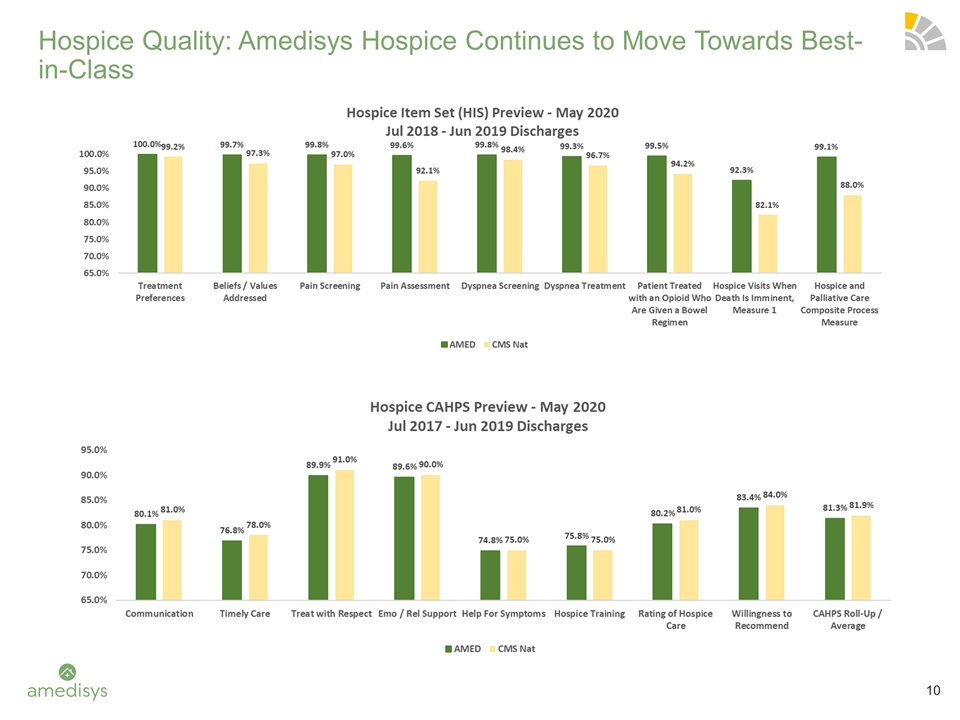

update the Home Health Compare site in July 2020; thus no refresh was issued in March. Publicly reported home health data published for April 2020 will remain in place until the October 2020 refresh. We will receive our preview in late June 2020 for

the October 2020 refresh Hospice quality – outperforming industry average in all hospice item set (HIS) categories 3 Clinical Initiatives Focusing on optimizing RN / LPN & PT / PTA staffing ratios. Current LPN Ratio: 45.0% (vs. 39.2% in

1Q’19) Current PTA Ratio: 46.3% (vs. 42.1% in 1Q’19) 4 Capacity and Productivity Aseracare deal signed 4/23 $235M purchase price ($203M net of tax asset) 44 care centers 14 states $117M annual revenue Anticipated close: 6/1 5 M&A 2

Recruiting / Retention Targeting industry leading employee retention amongst all employee categories Current total voluntary turnover ~19.5% (turnover impacted by inclusion of CCH in calculation) Focus on reduction of clinical turnover with heavy

focus on clinicians and “early exits” *Note: Home Health same store volume is defined as admissions plus recertifications 2020 Hospice rate update for AMED (in effect 10/1/19) ~0.5% 2021 proposed Hospice industry rule net +2.6% increase

(+3.0% market based less 0.4% multifactor productivity adjustment) 2021 CAP amount will increase by 2.6% to $30,743.86 6 Regulatory

Highlights and Summary Financial

Results (Adjusted): 1Q 2020(1) Home Health total same store volume +1%, total same store admissions +3%. Hospice same store admissions +1% Amedisys Consolidated Revenue Growth: +5% EBITDA: $53M (-3%) EBITDA Margin: 11% (-90 bps) EPS: $1.05 (-5%)

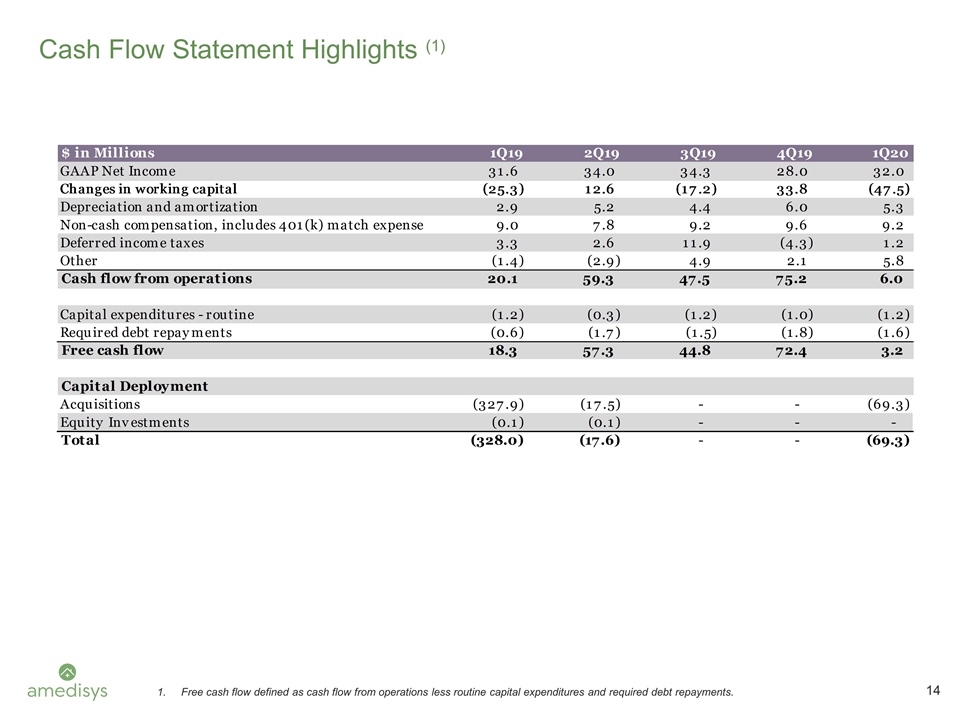

1Q’20 Net debt: $216.5M Net Leverage ratio: 1.0x CFFO: $6.0M Free cash flow (4): $3.2M DSO: 46.6 (vs. Q4’19 of 40.9) Balance Sheet & Cash Flow 1Q’20 Same Store (2)(3): Total Volume: +1% Total Admissions: +3% Other Statistics:

Revenue per Episode: $2,734 (-3.7%) Total Cost per Visit: $92.53 (+3.9%) Medicare Recert Rate: 33.6% (-230 bps) Home Health Growth Metrics (5): Billable hours/quarter: -10% Clients served: -8% Personal Care Same Store Volume (3): Admissions: +1%

ADC: +4% Other Statistics: Revenue per Day: $154.55 (+0.9%) Cost per day: $83.64 (+2.6%) Hospice 1Q’20 1Q’20 1Q’20 Adjusted Financial Results(1) 1Q’20 The financial results for the three-month periods ended March 31, 2019 and

March 31, 2020 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting

period. Same Store volume – Includes admissions and recertifications. Effective July 1, 2019, same store is defined as care centers that we have operated for at least the last 12 months and startups that are an expansion of a same store care

center. Free cash flow defined as cash flow from operations less routine capital expenditures and required debt repayments. Includes acquisitions.

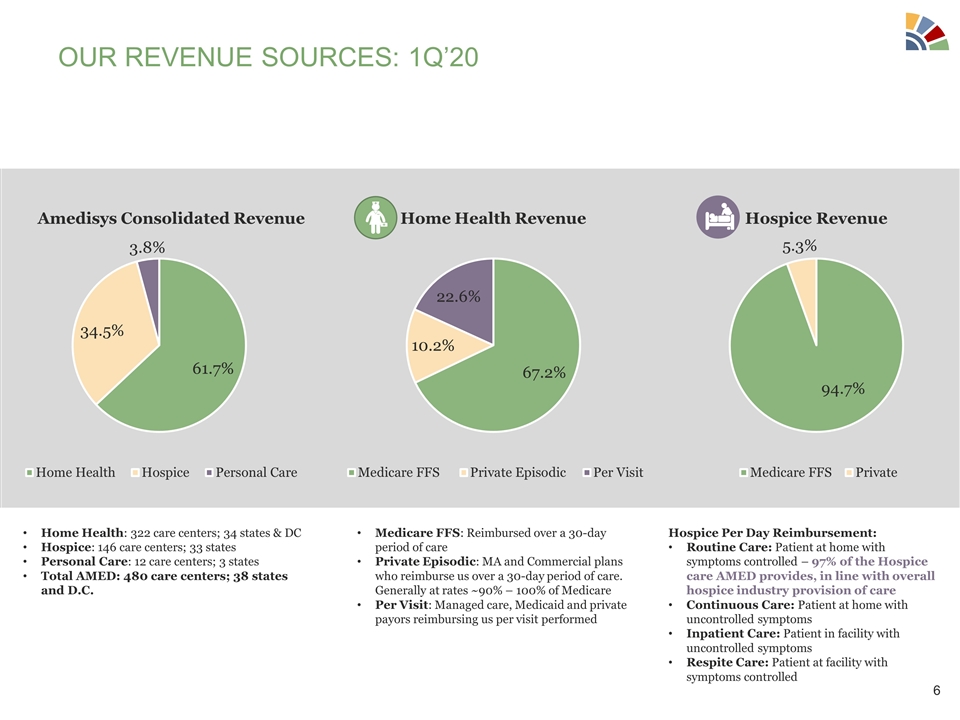

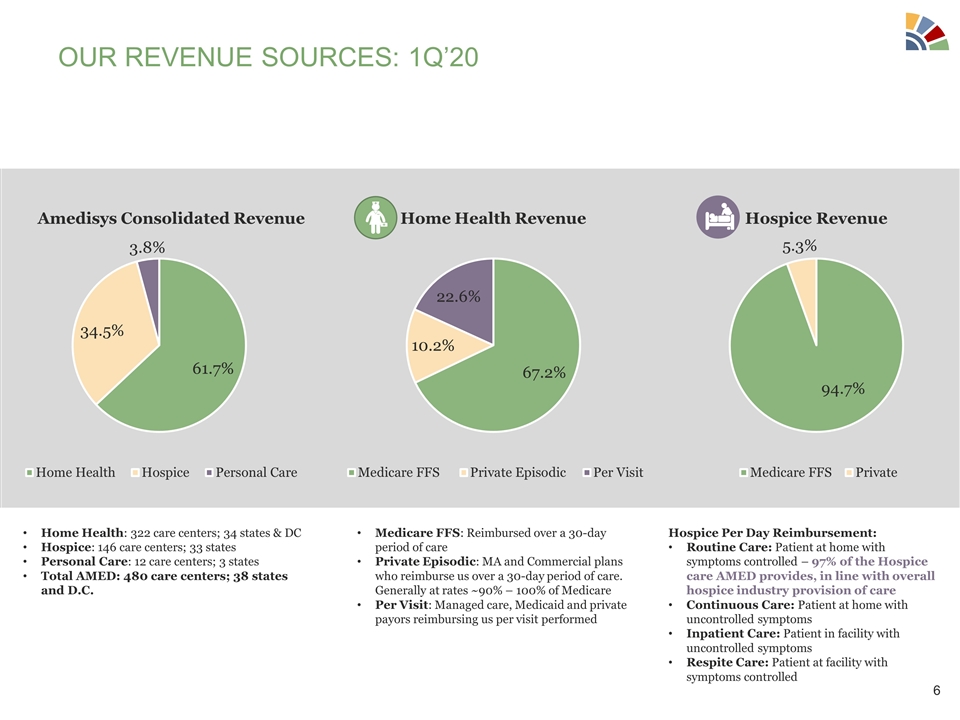

Our revenue sources: 1Q’20

Medicare FFS: Reimbursed over a 30-day period of care Private Episodic: MA and Commercial plans who reimburse us over a 30-day period of care. Generally at rates ~90% – 100% of Medicare Per Visit: Managed care, Medicaid and private payors

reimbursing us per visit performed Hospice Per Day Reimbursement: Routine Care: Patient at home with symptoms controlled – 97% of the Hospice care AMED provides, in line with overall hospice industry provision of care Continuous Care: Patient

at home with uncontrolled symptoms Inpatient Care: Patient in facility with uncontrolled symptoms Respite Care: Patient at facility with symptoms controlled Home Health: 322 care centers; 34 states & DC Hospice: 146 care centers; 33 states

Personal Care: 12 care centers; 3 states Total AMED: 480 care centers; 38 states and D.C.

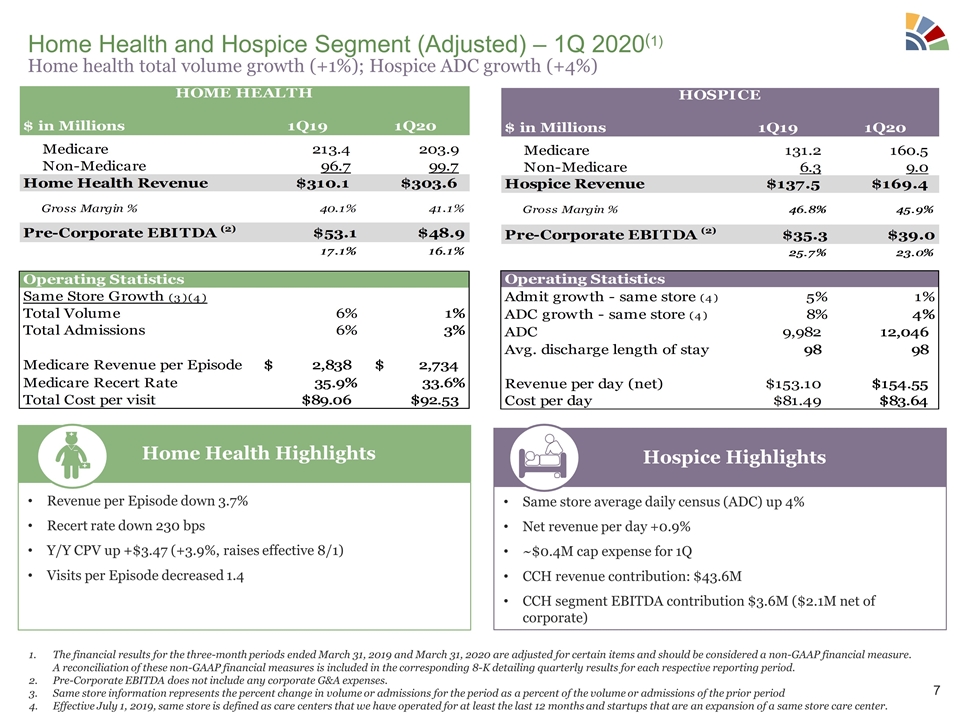

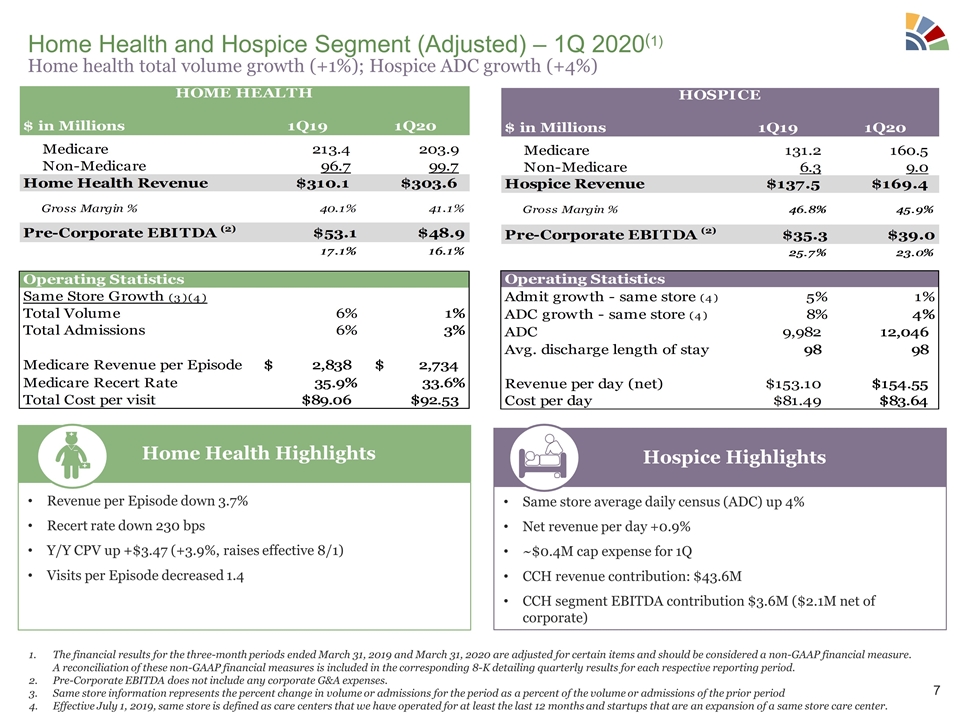

Home Health and Hospice Segment

(Adjusted) – 1Q 2020(1) Revenue per Episode down 3.7% Recert rate down 230 bps Y/Y CPV up +$3.47 (+3.9%, raises effective 8/1) Visits per Episode decreased 1.4 Home Health Highlights Same store average daily census (ADC) up 4% Net revenue per

day +0.9% ~$0.4M cap expense for 1Q CCH revenue contribution: $43.6M CCH segment EBITDA contribution $3.6M ($2.1M net of corporate) Hospice Highlights The financial results for the three-month periods ended March 31, 2019 and March 31, 2020 are

adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period.

Pre-Corporate EBITDA does not include any corporate G&A expenses. Same store information represents the percent change in volume or admissions for the period as a percent of the volume or admissions of the prior period Effective July 1, 2019,

same store is defined as care centers that we have operated for at least the last 12 months and startups that are an expansion of a same store care center. Home health total volume growth (+1%); Hospice ADC growth (+4%)

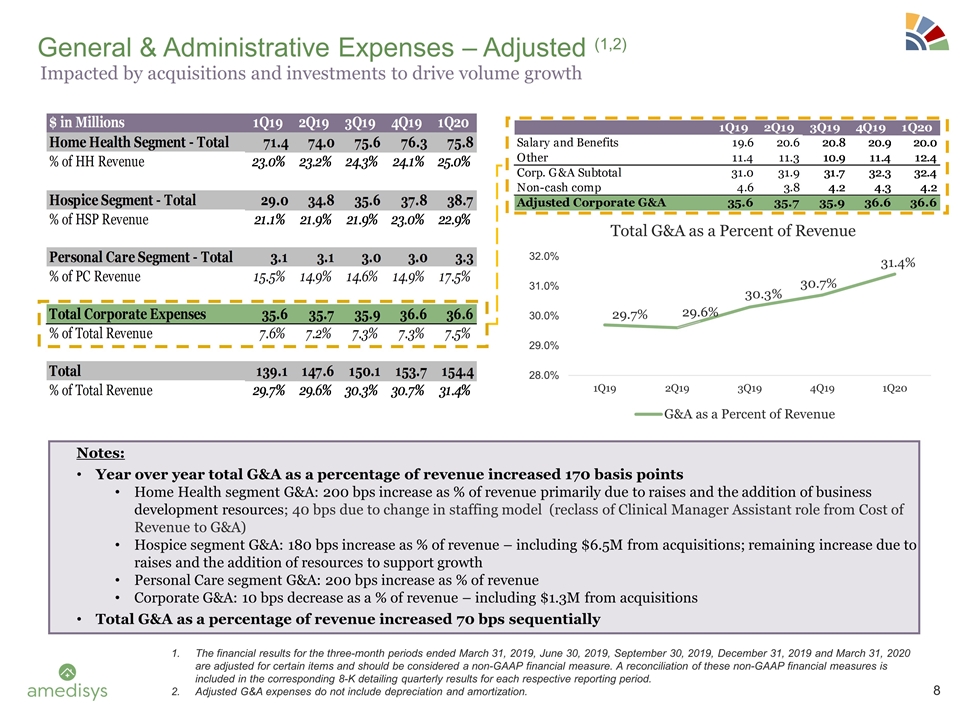

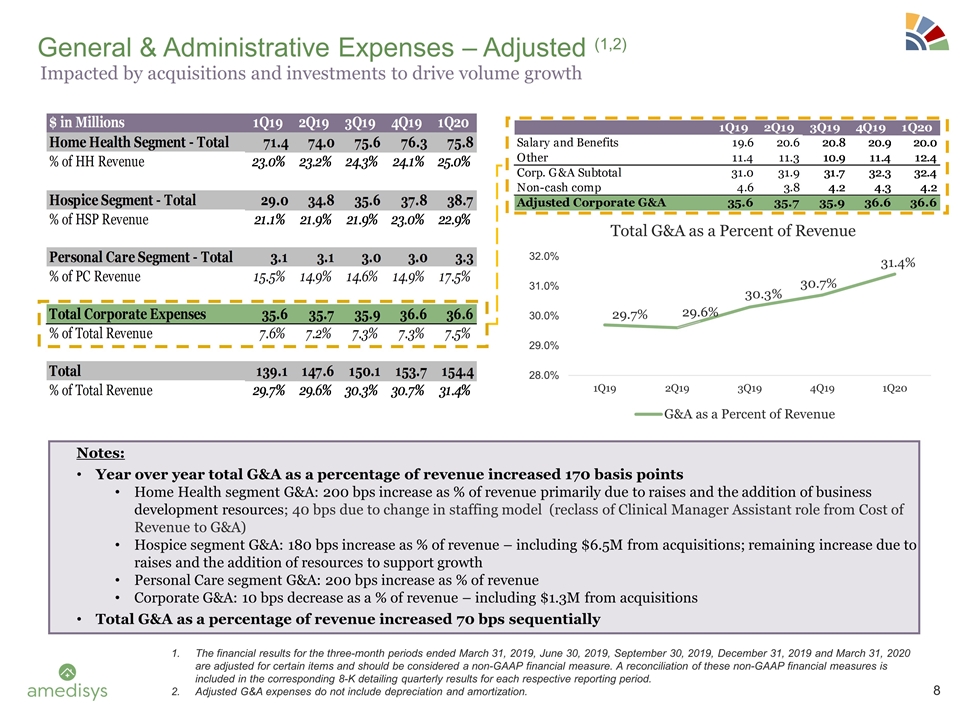

General & Administrative Expenses

– Adjusted (1,2) Notes: Year over year total G&A as a percentage of revenue increased 170 basis points Home Health segment G&A: 200 bps increase as % of revenue primarily due to raises and the addition of business development

resources; 40 bps due to change in staffing model (reclass of Clinical Manager Assistant role from Cost of Revenue to G&A) Hospice segment G&A: 180 bps increase as % of revenue – including $6.5M from acquisitions; remaining increase

due to raises and the addition of resources to support growth Personal Care segment G&A: 200 bps increase as % of revenue Corporate G&A: 10 bps decrease as a % of revenue – including $1.3M from acquisitions Total G&A as a

percentage of revenue increased 70 bps sequentially The financial results for the three-month periods ended March 31, 2019, June 30, 2019, September 30, 2019, December 31, 2019 and March 31, 2020 are adjusted for certain items and should be

considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. Adjusted G&A expenses do not include

depreciation and amortization. Impacted by acquisitions and investments to drive volume growth

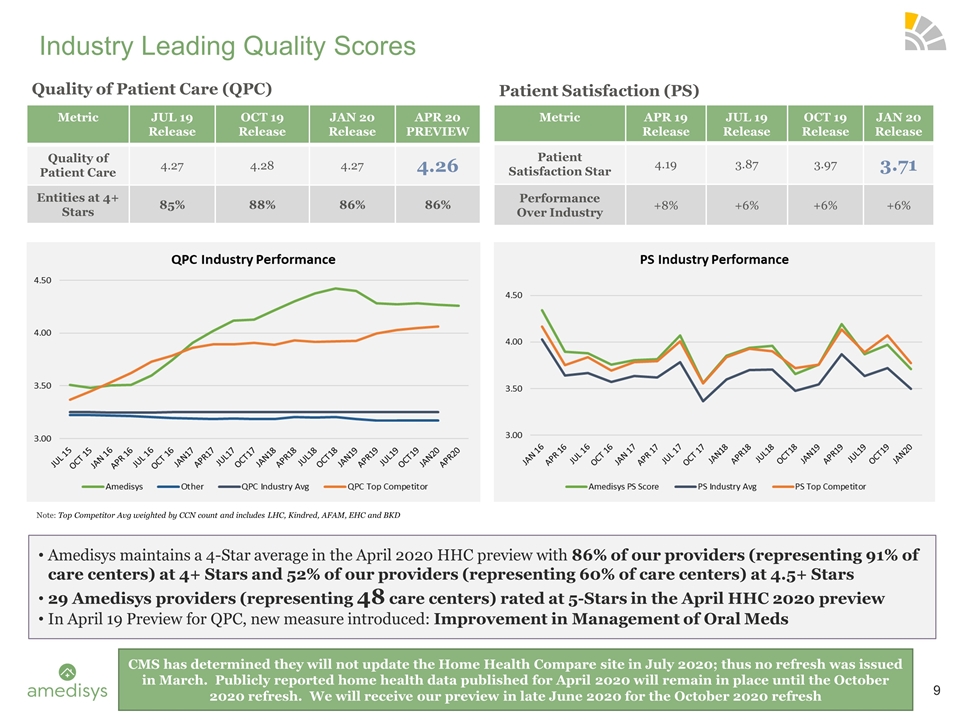

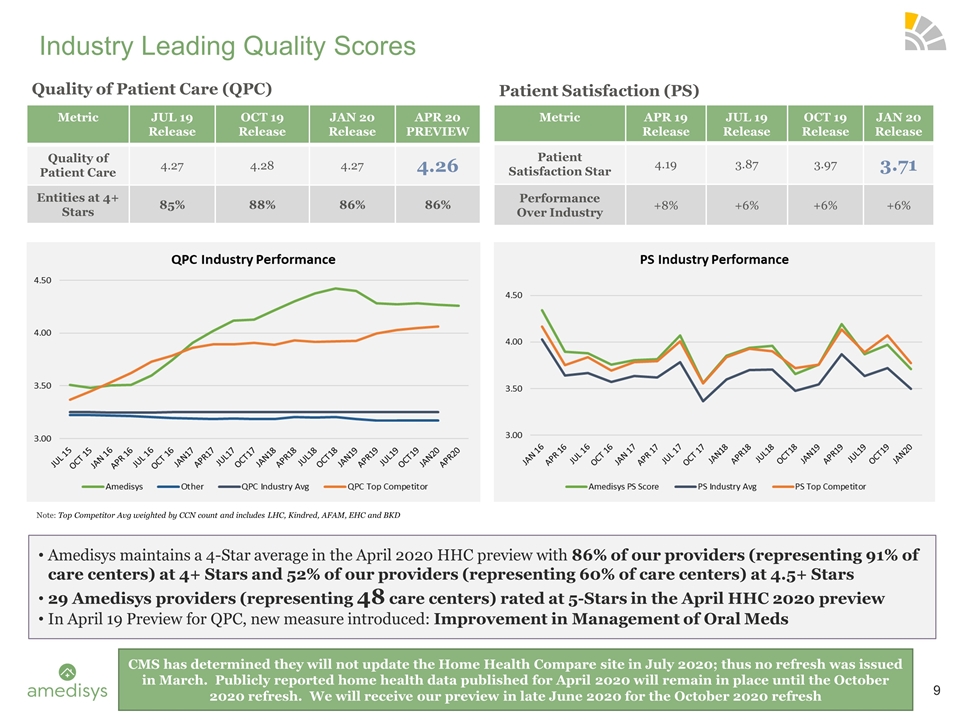

Industry Leading Quality Scores Note:

Top Competitor Avg weighted by CCN count and includes LHC, Kindred, AFAM, EHC and BKD Metric JUL 19 Release OCT 19 Release JAN 20 Release APR 20 PREVIEW Quality of Patient Care 4.27 4.28 4.27 4.26 Entities at 4+ Stars 85% 88% 86% 86% Metric APR 19

Release JUL 19 Release OCT 19 Release JAN 20 Release Patient Satisfaction Star 4.19 3.87 3.97 3.71 Performance Over Industry +8% +6% +6% +6% Quality of Patient Care (QPC) Patient Satisfaction (PS) Amedisys maintains a 4-Star average in the April

2020 HHC preview with 86% of our providers (representing 91% of care centers) at 4+ Stars and 52% of our providers (representing 60% of care centers) at 4.5+ Stars 29 Amedisys providers (representing 48 care centers) rated at 5-Stars in the April

HHC 2020 preview In April 19 Preview for QPC, new measure introduced: Improvement in Management of Oral Meds CMS has determined they will not update the Home Health Compare site in July 2020; thus no refresh was issued in March. Publicly reported

home health data published for April 2020 will remain in place until the October 2020 refresh. We will receive our preview in late June 2020 for the October 2020 refresh

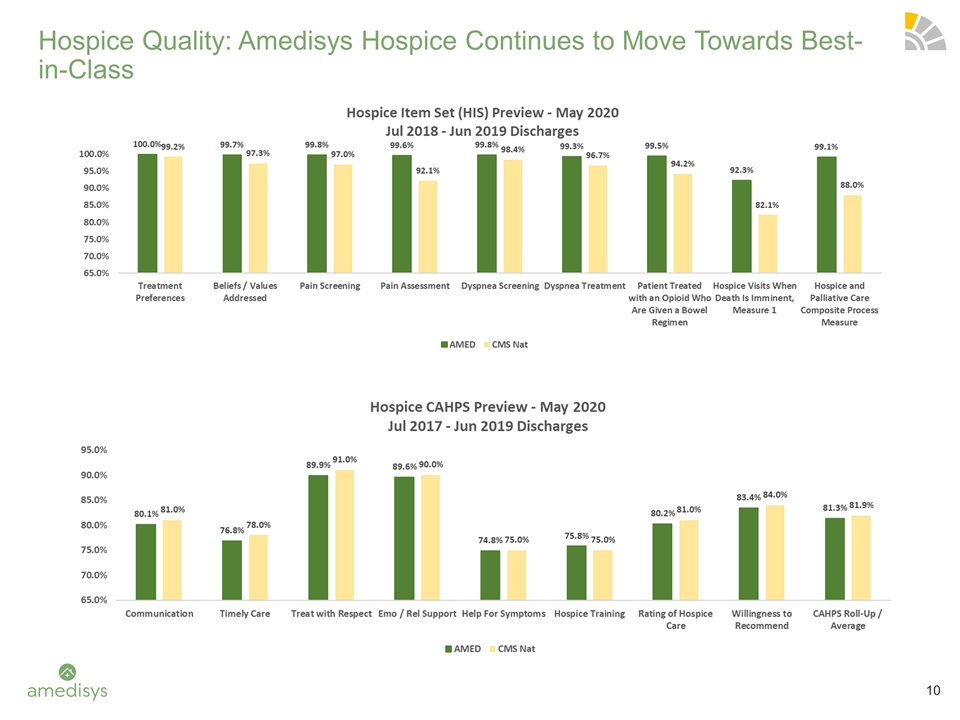

Hospice Quality: Amedisys Hospice

Continues to Move Towards Best-in-Class Hospice Quality

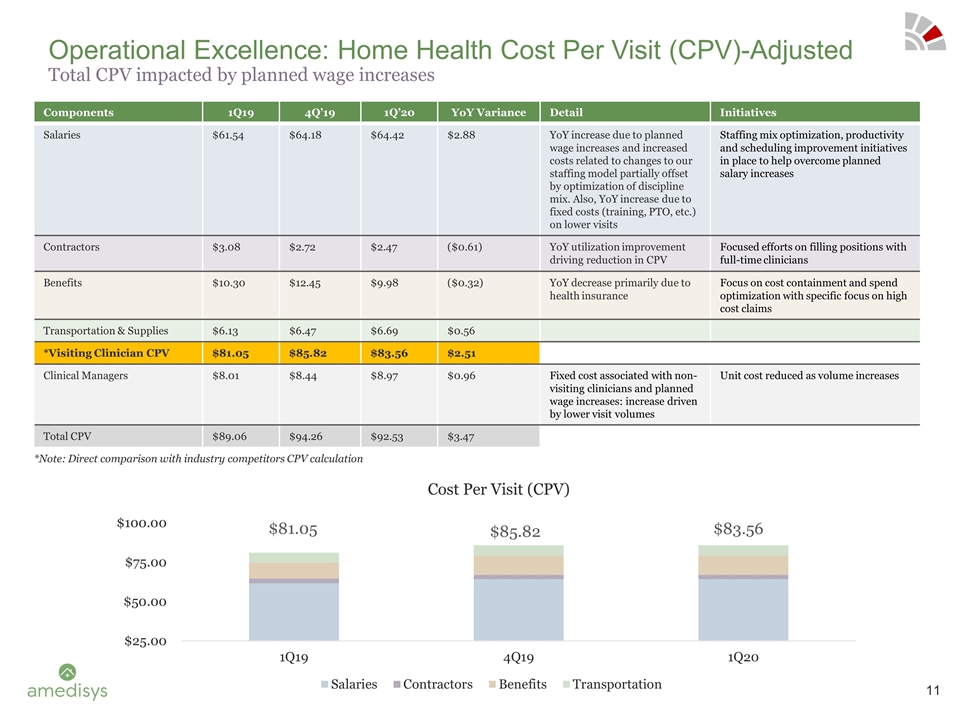

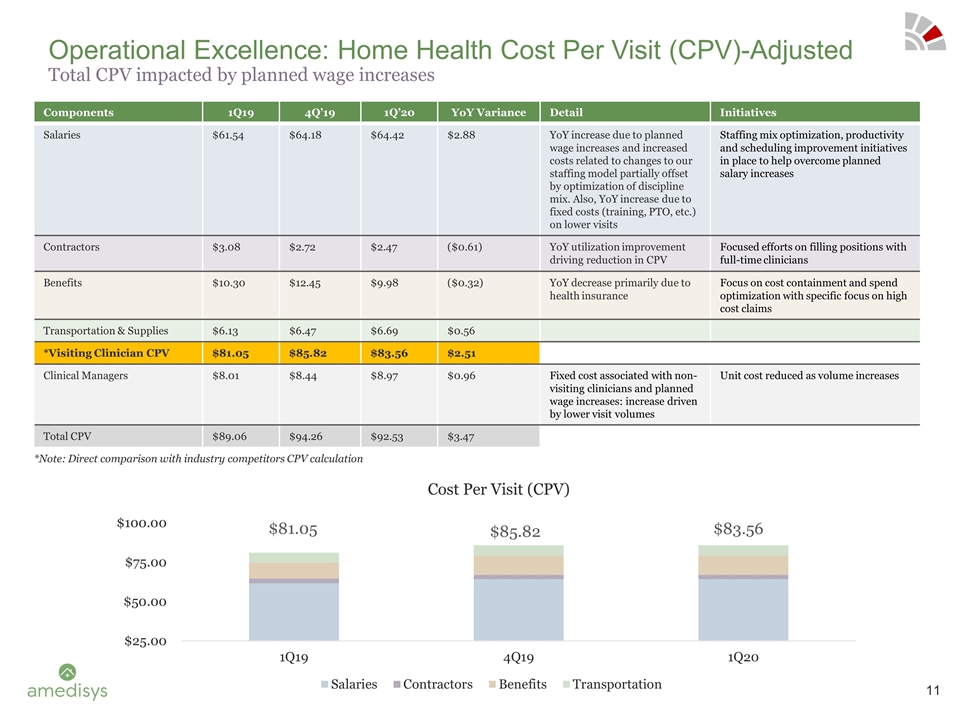

Components 1Q19 4Q’19

1Q’20 YoY Variance Detail Initiatives Salaries $61.54 $64.18 $64.42 $2.88 YoY increase due to planned wage increases and increased costs related to changes to our staffing model partially offset by optimization of discipline mix. Also, YoY

increase due to fixed costs (training, PTO, etc.) on lower visits Staffing mix optimization, productivity and scheduling improvement initiatives in place to help overcome planned salary increases Contractors $3.08 $2.72 $2.47 ($0.61) YoY utilization

improvement driving reduction in CPV Focused efforts on filling positions with full-time clinicians Benefits $10.30 $12.45 $9.98 ($0.32) YoY decrease primarily due to health insurance Focus on cost containment and spend optimization with specific

focus on high cost claims Transportation & Supplies $6.13 $6.47 $6.69 $0.56 *Visiting Clinician CPV $81.05 $85.82 $83.56 $2.51 Clinical Managers $8.01 $8.44 $8.97 $0.96 Fixed cost associated with non-visiting clinicians and planned wage

increases: increase driven by lower visit volumes Unit cost reduced as volume increases Total CPV $89.06 $94.26 $92.53 $3.47 Operational Excellence: Home Health Cost Per Visit (CPV)-Adjusted Total CPV impacted by planned wage increases *Note: Direct

comparison with industry competitors CPV calculation $81.05 $85.82 $83.56

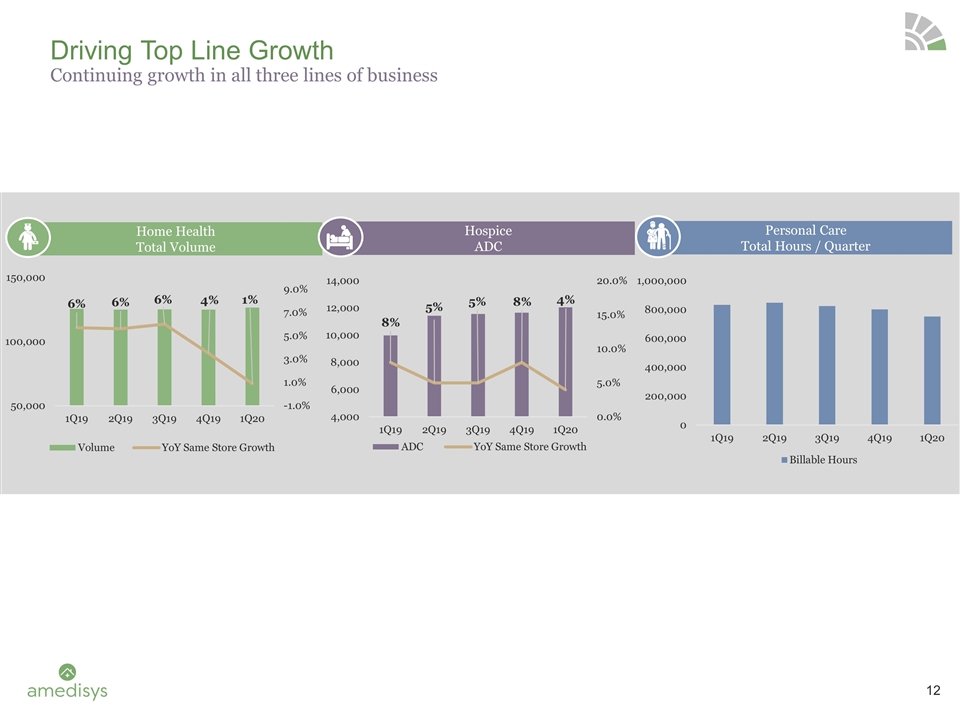

Driving Top Line Growth Continuing

growth in all three lines of business Home Health Total Volume Hospice ADC Personal Care Total Hours / Quarter

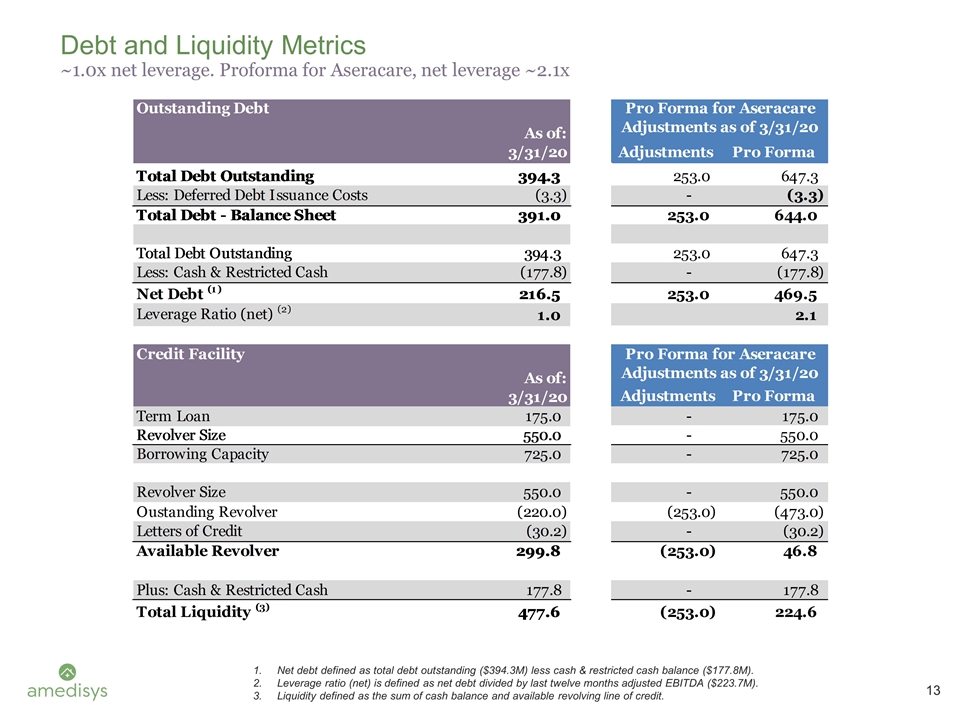

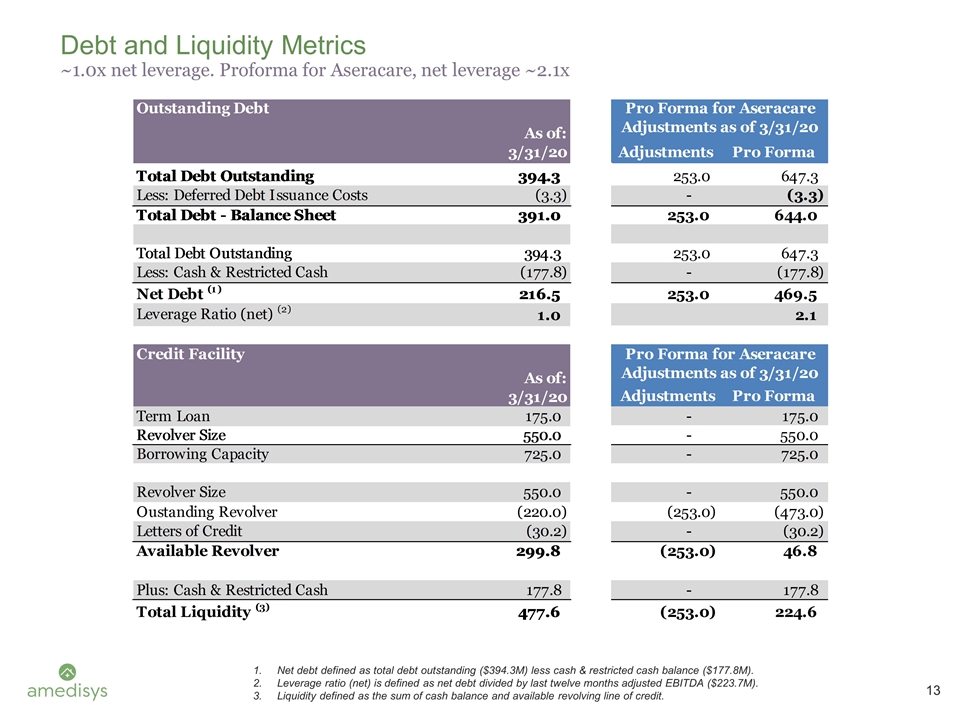

Debt and Liquidity Metrics ~1.0x net

leverage. Proforma for Aseracare, net leverage ~2.1x Net debt defined as total debt outstanding ($394.3M) less cash & restricted cash balance ($177.8M). Leverage ratio (net) is defined as net debt divided by last twelve months adjusted EBITDA

($223.7M). Liquidity defined as the sum of cash balance and available revolving line of credit. Outstanding Debt As of: 3/31/20 Pro Forma for Aseracare Adjustments as of 3/31/20 42460 Adjustments Pro Forma #REF! Total Debt Outstanding 394.3 253

647.29999999999995 #REF! Less: Deferred Debt Issuance Costs -3.3 0 -3.3 Total Debt - Balance Sheet 391 253 644 #REF! #REF! Total Debt Outstanding 394.3 253 647.29999999999995 #REF! Less: Cash & Restricted Cash -,177.8 0 -,177.8 Net Debt (1)

216.5 253 469.49999999999994 Leverage Ratio (net) (2) 0.96781403665623611 2.0987930263746088 #REF! #REF! Credit Facility As of: 3/31/20 Pro Forma for Aseracare Adjustments as of 3/31/20 #REF! Adjustments Pro Forma Term Loan 175 0 175 #REF! Revolver

Size 550 0 550 #REF! Borrowing Capacity 725 0 725 #REF! Revolver Size 550 0 550 Oustanding Revolver -,220 -,253 -,473 #REF! Letters of Credit -30.2 0 -30.2 #REF! Available Revolver 299.8 -,253 46.8 38.9 Plus: Cash & Restricted Cash 177.8 0 177.8

1.0x Total Liquidity (3) 477.6 -,253 224.60000000000002 216.5 223.7 0.96781403665623611

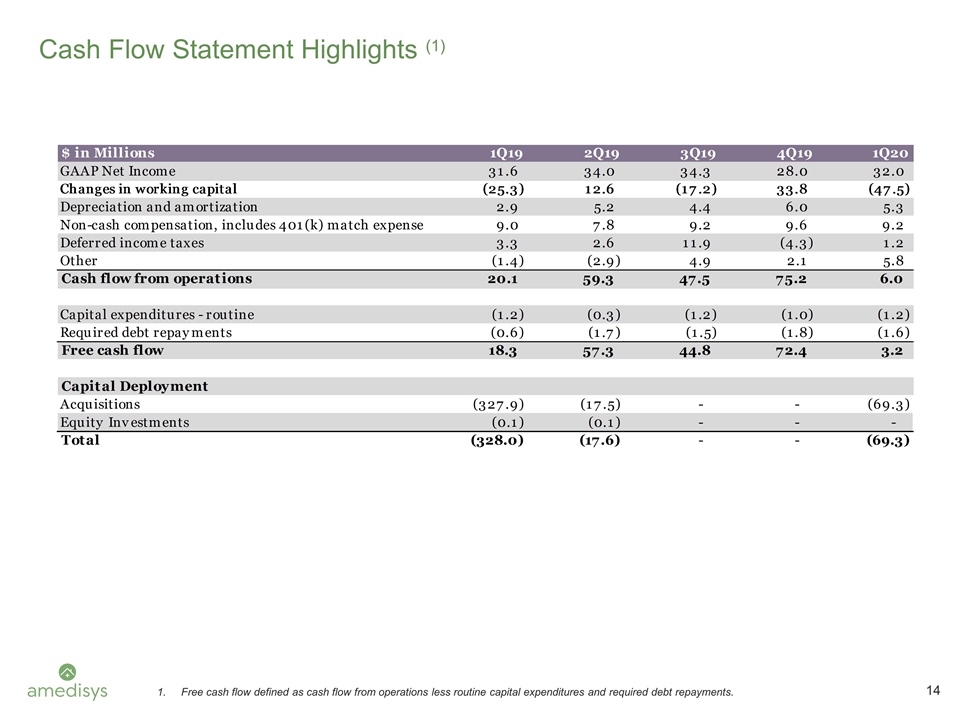

Cash Flow Statement Highlights (1)

Free cash flow defined as cash flow from operations less routine capital expenditures and required debt repayments.

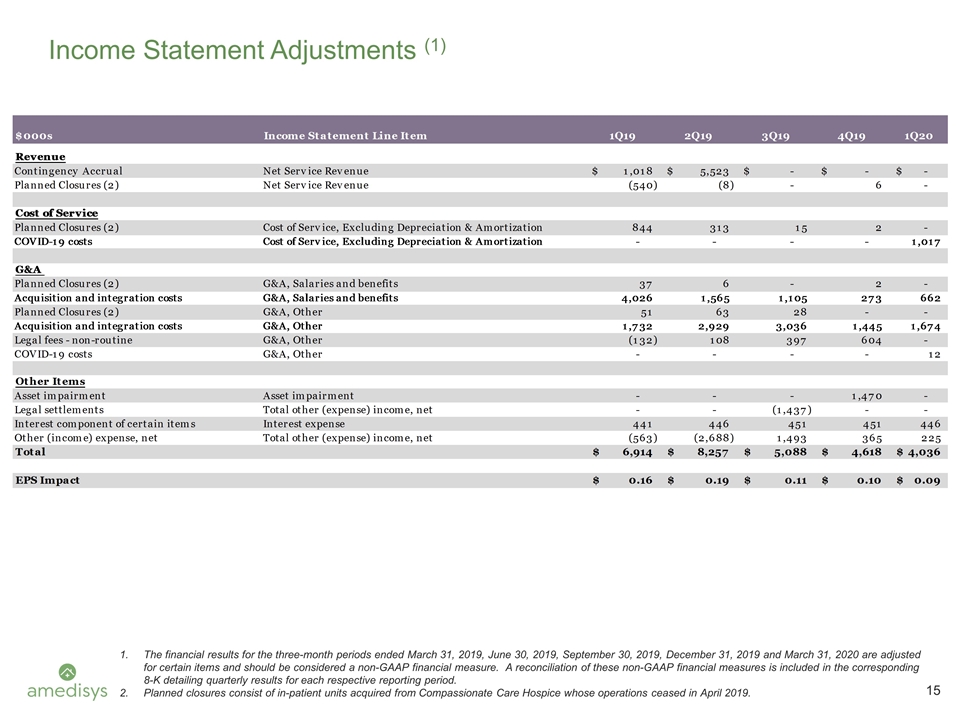

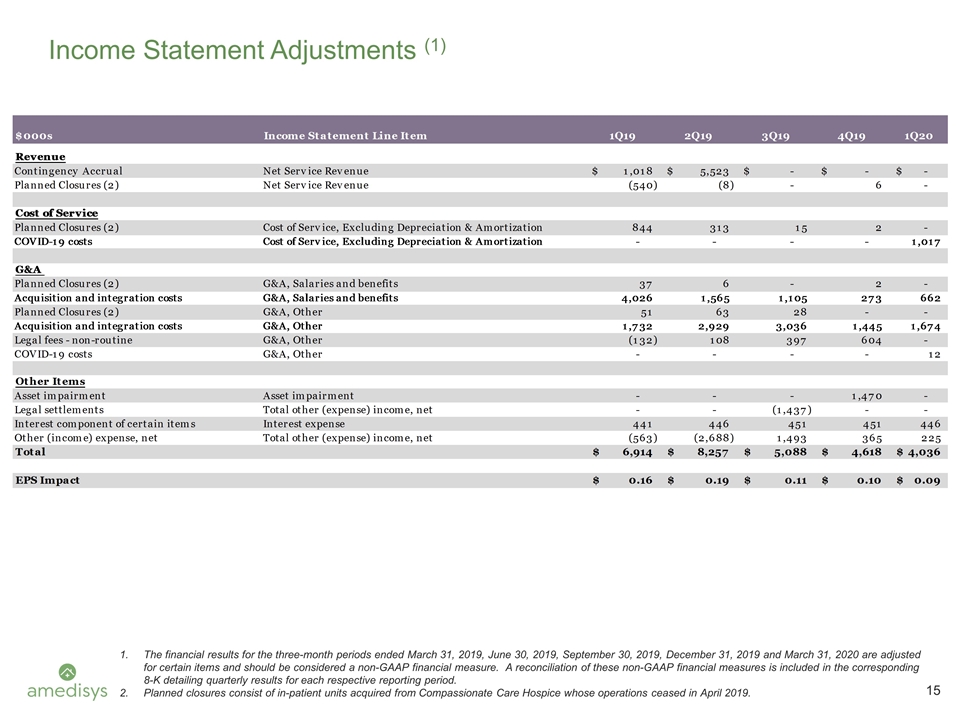

Income Statement Adjustments (1) The

financial results for the three-month periods ended March 31, 2019, June 30, 2019, September 30, 2019, December 31, 2019 and March 31, 2020 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of

these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. Planned closures consist of in-patient units acquired from Compassionate Care Hospice whose operations ceased in

April 2019. $000s Income Statement Line Item Q414 2Q15 3Q15 4Q15 1Q16 2Q16 2Q17 3Q17 2Q18 1Q19 2Q19 3Q19 4Q19 1Q20 Revenue Contingency Accrual Net Service Revenue $1,018 $5,523 $0 $0 $0 Planned Closures (2) Net Service Revenue -540 -8 0 6 0 Cost of

Service Planned Closures (2) Cost of Service, Excluding Depreciation & Amortization -1059 844 313 15 2 0 COVID-19 costs Cost of Service, Excluding Depreciation & Amortization 0 0 0 0 1017 G&A Planned Closures (2) G&A, Salaries and

benefits 37 6 0 2 0 Acquisition and integration costs G&A, Salaries and benefits 4026 1565 1105 273 662 Planned Closures (2) G&A, Other 51 63 28 0 0 Acquisition and integration costs G&A, Other 1046 1202 183 294 440 1732 2929 3036 1445

1674 Legal fees - non-routine G&A, Other 8000 286 2824 616 459 1111 176 543 -132 108 397 604 0 COVID-19 costs G&A, Other 0 0 0 0 12 Other Items Asset impairment Asset impairment 0 0 0 1470 0 Legal settlements Total other (expense) income,

net -1,113 -307 -1014 -5314 -541 -265 -693 -647 0 0 -1437 0 0 Interest component of certain items Interest expense 441 446 451 451 446 Other (income) expense, net Total other (expense) income, net -3945 -1563 436 70 -1692 -115 -1635 -563 -2688 1493

365 225 Total -214 3748 2996 -3562 2614 447 27732 -586 1035 $6,914 $8,257 $5,088 $4,618 $4,036 EPS Impact -0.01 0.12 9.1387688013335661E-2 0.02 0.14000000000000001 0.1 0.49 0.13 $0.02 $0.16 $0.19 $0.11 $0.1 $0.09

COVID-19

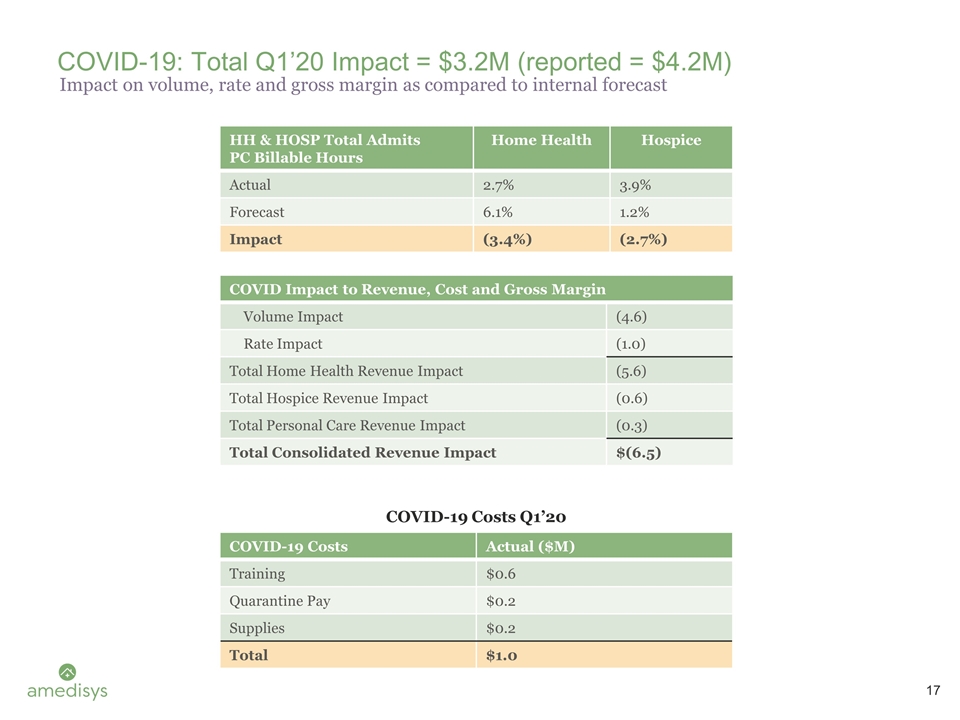

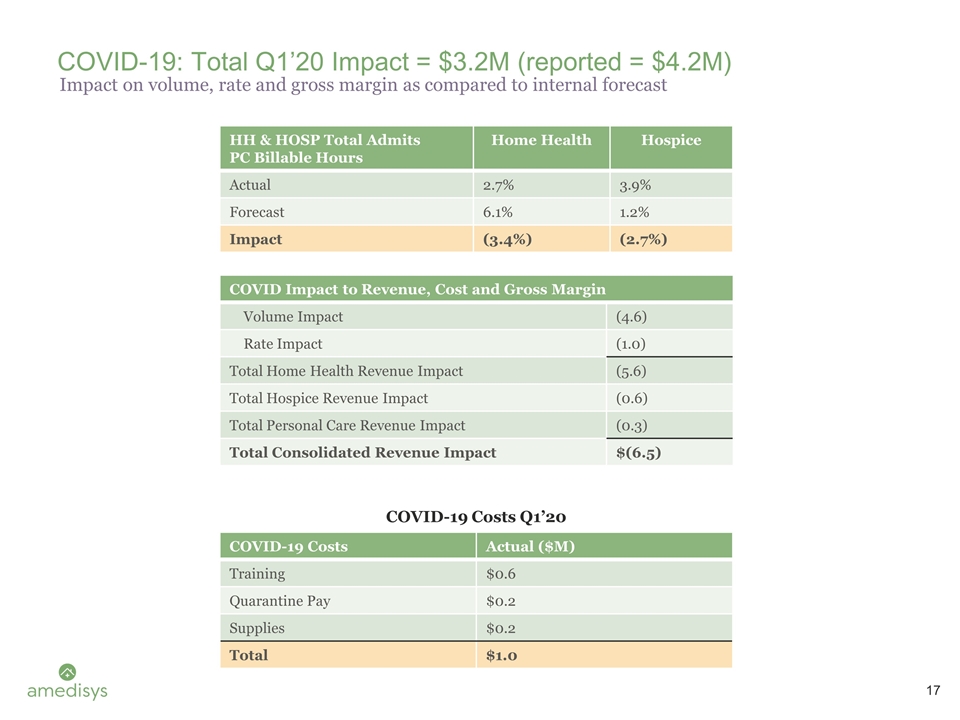

COVID-19: Total Q1’20 Impact =

$3.2M (reported = $4.2M) Impact on volume, rate and gross margin as compared to internal forecast HH & HOSP Total Admits PC Billable Hours Home Health Hospice Actual 2.7% 3.9% Forecast 6.1% 1.2% Impact (3.4%) (2.7%) COVID Impact to Revenue, Cost

and Gross Margin Volume Impact (4.6) Rate Impact (1.0) Total Home Health Revenue Impact (5.6) Total Hospice Revenue Impact (0.6) Total Personal Care Revenue Impact (0.3) Total Consolidated Revenue Impact $(6.5) COVID-19 Costs Actual ($M) Training

$0.6 Quarantine Pay $0.2 Supplies $0.2 Total $1.0 COVID-19 Costs Q1’20

COVID-19 Impact on March and

Q1’20 Home health referrals and admissions hit their low point the week of 4/5 and have begun to recover. Hospice referrals hit their low point week of 3/22 and have begun to recover *Baseline defined as referrals and admits from pre-Covid-19

timeframe of 1/5/20 – 3/14/20 PPE Item Units Cost ($M) Avg. Per Unit Normalized Avg. Per Unit Months on Hand N95 418,200 $2.3 $5.56 $0.60 6 Earloop Surgical Mask 1,460,200 $1.5 $1.02 $0.06 4 Isolation Gown 165,406 $0.8 $4.75 $0.48 3 Exam Glove

2,394,200 $0.2 $0.08 $0.04 2 Goggles / Face Shield 40,630 $0.2 $5.45 $2.52 6 Paper Bag 1,225,000 $0.1 $0.06 $0.06 2 Total - ~$5.1 - - - PPE Received & On Order HH: Consolidated Same Store HOSP: AMED + CCH (ex. Asana) *Baseline defined as

referrals and admits from pre-Covid-19 timeframe of 1/5/20 – 3/14/20

PPE Graphs PPE inventory at care

centers – not including centralized PPE supply. We have made significant progress providing our care centers with all critical PPE needed to care for COVID-19 symptomatic and COVID-19 positive patients

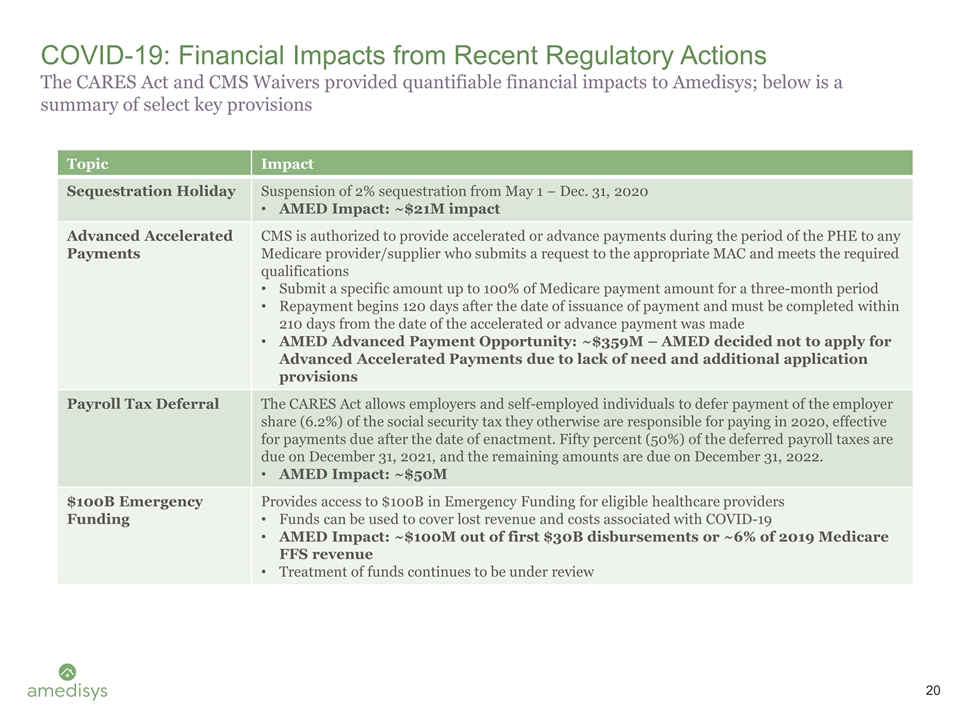

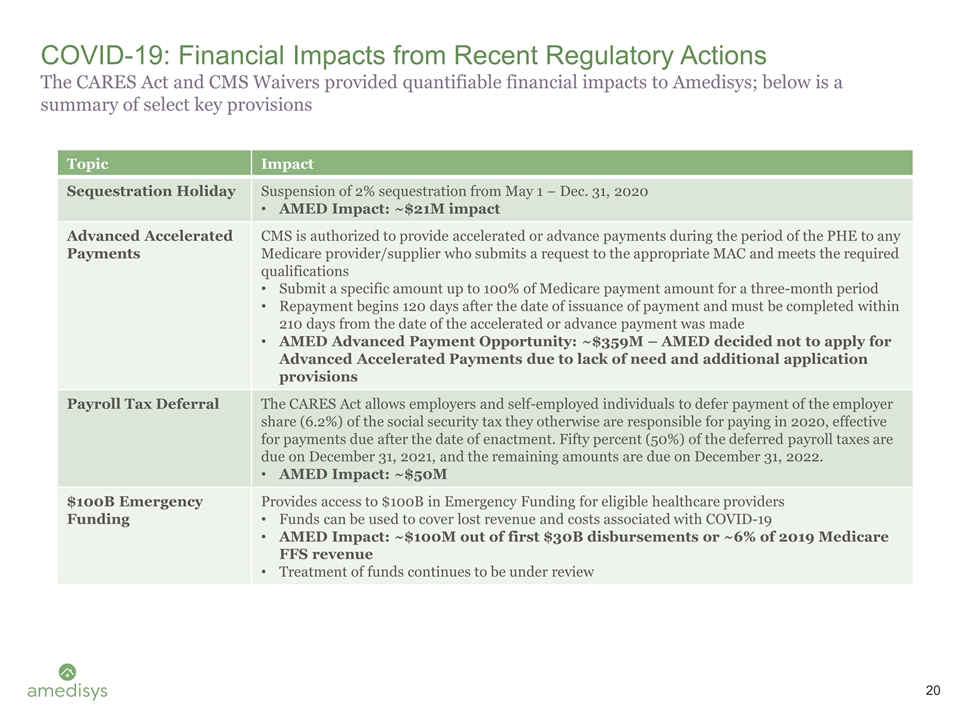

COVID-19: Financial Impacts from

Recent Regulatory Actions The CARES Act and CMS Waivers provided quantifiable financial impacts to Amedisys; below is a summary of select key provisions Topic Impact Sequestration Holiday Suspension of 2% sequestration from May 1 – Dec. 31,

2020 AMED Impact: ~$21M impact Advanced Accelerated Payments CMS is authorized to provide accelerated or advance payments during the period of the PHE to any Medicare provider/supplier who submits a request to the appropriate MAC and meets the

required qualifications Submit a specific amount up to 100% of Medicare payment amount for a three-month period Repayment begins 120 days after the date of issuance of payment and must be completed within 210 days from the date of the accelerated or

advance payment was made AMED Advanced Payment Opportunity: ~$359M – AMED decided not to apply for Advanced Accelerated Payments due to lack of need and additional application provisions Payroll Tax Deferral The CARES Act allows employers and

self-employed individuals to defer payment of the employer share (6.2%) of the social security tax they otherwise are responsible for paying in 2020, effective for payments due after the date of enactment. Fifty percent (50%) of the deferred payroll

taxes are due on December 31, 2021, and the remaining amounts are due on December 31, 2022. AMED Impact: ~$50M $100B Emergency Funding Provides access to $100B in Emergency Funding for eligible healthcare providers Funds can be used to cover lost

revenue and costs associated with COVID-19 AMED Impact: ~$100M out of first $30B disbursements or ~6% of 2019 Medicare FFS revenue Treatment of funds continues to be under review