UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-7440

DIMENSIONAL EMERGING MARKETS VALUE FUND

(Exact name of registrant as specified in charter)

6300 Bee Cave Road, Building One, Austin, TX 78746

(Address of principal executive offices) (Zip code)

Catherine L. Newell, Esquire, President and General Counsel

Dimensional Emerging Markets Value Fund,

6300 Bee Cave Road, Building One, Austin, TX 78746

(Name and address of agent for service)

Registrant’s telephone number, including area code: 512-306-7400

Date of fiscal year end: October 31

Date of reporting period: October 31, 2020

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Annual Report

Year Ended: October 31, 2020

DFA INVESTMENT DIMENSIONS GROUP INC. / DIMENSIONAL INVESTMENT GROUP INC. / THE DFA INVESTMENT TRUST COMPANY / DIMENSIONAL EMERGING MARKETS VALUE FUND

DFA Investment Dimensions Group Inc.

| Large Cap International Portfolio | DFA International Real Estate Securities Portfolio | World Core Equity Portfolio | ||

| International Core Equity Portfolio | DFA Global Real Estate Securities Portfolio |

Selectively Hedged Global Equity Portfolio | ||

| Global Small Company Portfolio | DFA International Small Cap Value Portfolio |

Emerging Markets Portfolio | ||

| International Small Company Portfolio | International Vector Equity Portfolio | Emerging Markets Small Cap Portfolio | ||

| Japanese Small Company Portfolio | International High Relative Profitability Portfolio | Emerging Markets Value Portfolio | ||

| Asia Pacific Small Company Portfolio | World ex U.S. Value Portfolio | Emerging Markets Core Equity Portfolio | ||

| United Kingdom Small Company Portfolio |

World ex U.S. Core Equity Portfolio | Emerging Markets Targeted Value Portfolio | ||

| Continental Small Company Portfolio | ||||

Dimensional Investment Group Inc.

DFA International Value Portfolio

The DFA Investment Trust Company

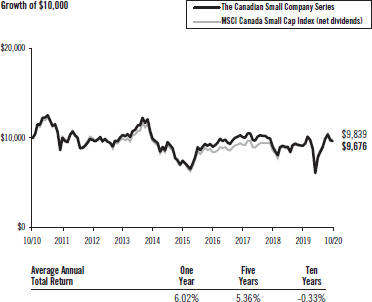

| The DFA International Value Series | The Continental Small Company Series | |

| The Japanese Small Company Series | The Canadian Small Company Series | |

| The Asia Pacific Small Company Series | The Emerging Markets Series | |

| The United Kingdom Small Company Series | The Emerging Markets Small Cap Series | |

Dimensional Emerging Markets Value Fund

See the inside front cover for important information about access to your fund’s annual and semi-annual shareholder reports.

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Portfolio’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Portfolio or from your financial intermediary. Instead, the reports will be made available on a Portfolio’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically from a Portfolio anytime by contacting the Portfolio’s transfer agent at (888) 576-1167 or by contacting your financial intermediary.

You may elect to receive all future shareholder reports in paper free of charge. You can inform a Portfolio that you wish to continue receiving paper copies of your shareholder reports by contacting your financial intermediary or, if you invest directly with the Portfolio, by calling (888) 576-1167, to let the Portfolio know of your request. Your election to receive reports in paper will apply to all DFA Funds held directly or to all funds held through your financial intermediary.

[THIS PAGE INTENTIONALLY LEFT BLANK]

December 2020

Dear Fellow Shareholder,

As we come to the end of a year that saw an array of challenges, we want to thank you for the honor of serving you. We recognize that your financial assets play a vital role in your future, and we have tremendous gratitude for the faith you place in us by entrusting those assets with Dimensional.

Since the day our firm was founded nearly 40 years ago, we have focused on bringing the great ideas in finance to life for investors. We believe that a sensible, financial science-based approach offers people the best chance at a successful investment experience. With that as a guiding principle, we continue to innovate in the strategies we offer and how they are executed. We look forward to further work on these efforts—if there’s a better way to do something, we want to pursue it.

We also place great value on helping our clients understand what they can expect from us. We strive to be transparent about what we can deliver, and to then excel in our execution.

That’s how we help clients achieve their financial goals. And at Dimensional, we believe that when investors win, we all win. On behalf of over 1,400 employees, we send our deepest appreciation for letting us serve as the investment manager of your assets.

| Sincerely, | ||||

|

| |||

| David P. Butler | Gerard O’Reilly | |||

| CO-CHIEF EXECUTIVE OFFICER | CO-CHIEF EXECUTIVE OFFICER and | |||

| CHIEF INVESTMENT OFFICER | ||||

[THIS PAGE INTENTIONALLY LEFT BLANK]

Table of Contents

| Page | ||||

| Letter to Shareholders |

||||

| 1 | ||||

| DFA Investment Dimensions Group Inc. |

||||

| 3 | ||||

| 15 | ||||

| 28 | ||||

| 32 | ||||

| Schedules of Investments/Summary Schedules of Portfolio Holdings |

||||

| 34 | ||||

| 38 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 53 | ||||

| 55 | ||||

| 60 | ||||

| 64 | ||||

| 68 | ||||

| 69 | ||||

| 76 | ||||

| 77 | ||||

| 79 | ||||

| 80 | ||||

| 81 | ||||

| 82 | ||||

| 87 | ||||

| 91 | ||||

| 97 | ||||

| 103 | ||||

| 111 | ||||

| 124 | ||||

| 153 | ||||

| 155 | ||||

| Dimensional Investment Group Inc. |

||||

| 156 | ||||

| 157 | ||||

| 160 | ||||

| 162 | ||||

| Schedule of Investments |

||||

| 163 | ||||

| 164 | ||||

| 165 | ||||

| 166 | ||||

| 167 | ||||

| 169 | ||||

| 175 | ||||

| The DFA Investment Trust Company |

||||

| 176 | ||||

| 180 | ||||

i

TABLE OF CONTENTS

CONTINUED

| Page | ||||

| 185 | ||||

| 187 | ||||

| Summary Schedules of Portfolio Holdings |

||||

| 189 | ||||

| 193 | ||||

| 196 | ||||

| 198 | ||||

| 201 | ||||

| 205 | ||||

| 208 | ||||

| 213 | ||||

| 218 | ||||

| 220 | ||||

| 222 | ||||

| 225 | ||||

| 229 | ||||

| 242 | ||||

| Dimensional Emerging Markets Value Fund |

||||

| 243 | ||||

| 244 | ||||

| 247 | ||||

| 249 | ||||

| Summary Schedule of Portfolio Holdings |

||||

| 250 | ||||

| 255 | ||||

| 256 | ||||

| 257 | ||||

| 258 | ||||

| 259 | ||||

| 268 | ||||

| 269 | ||||

| 270 | ||||

| 277 | ||||

| 278 | ||||

This report is submitted for the information of the Portfolio’s shareholders. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

ii

DFA INVESTMENT DIMENSIONS GROUP INC.

DIMENSIONAL INVESTMENT GROUP INC.

THE DFA INVESTMENT TRUST COMPANY

DIMENSIONAL EMERGING MARKETS VALUE FUND

DEFINITIONS OF ABBREVIATIONS AND FOOTNOTES

Schedules of Investments/Summary Schedules of Portfolio Holdings

| Investment Abbreviations | ||

| ADR |

American Depositary Receipt | |

| P.L.C. |

Public Limited Company | |

| SA |

Special Assessment | |

| REIT |

Real Estate Investment Trust | |

| GDR |

Global Depositary Receipt | |

| AUD |

Australian Dollars | |

| CAD |

Canadian Dollars | |

| CHF |

Swiss Franc | |

| DKK |

Danish Krone | |

| EUR |

Euro | |

| GBP |

British Pounds | |

| ILS |

Israeli New Shekel | |

| JPY |

Japanese Yen | |

| NOK |

Norwegian Krone | |

| SEK |

Swedish Krona | |

| Investment Footnotes | ||

| » |

Securities that have generally been fair value factored. See Note B to Financial Statements. | |

| ‡ |

Calculated as a percentage of total net assets. Percentages shown parenthetically next to the category headings have been calculated as a percentage of total investments. “Other Securities” are those securities that are not among the top 50 holdings in unaffiliated issuers of the Fund or do not represent more than 1.0% of the net assets of the Fund. Some of the individual securities within this category may include Total or Partial Securities on Loan and/or Non-Income Producing Securities. | |

| # |

Total or Partial Securities on Loan. | |

| * |

Non-Income Producing Securities. | |

| † |

See Note B to Financial Statements. | |

| @ |

Security purchased with cash collateral received from Securities on Loan. | |

| § |

Affiliated Fund. | |

| W |

Rule 144A, Section 4(2), or other security that is restricted as to resale to institutional investors. This security has been deemed liquid based upon the Fund’s Liquidity Guidelines. The liquidity determination is unaudited. | |

1

DEFINITIONS OF ABBREVIATIONS AND FOOTNOTES

CONTINUED

Financial Highlights

| ** |

The Net Investment Income (Loss) per share and the ratio of Net Investment Income to Average Net Assets includes the current year effect of an estimation related to a one time distribution from a real estate investment trust. Net Investment Income (Loss) per share, Net Gain (Loss) per share and the ratio of Net Investment Income to Average Net Assets would have been $0.39, $2.11 and 3.39%, respectively had the current year effect of this estimation not been considered. | |

| (A) |

Computed using average shares outstanding. | |

| (B) |

Non-Annualized | |

| (C) |

Represents the combined ratios for the respective Portfolio and its respective pro-rata share of its Master Fund(s) and/or Underlying Fund(s). | |

| (D) |

Annualized | |

| (E) |

Because of commencement of operations and related preliminary transaction costs, these ratios are not necessarily indicative of future ratios. | |

| (F) |

Represents the combined ratios for the respective Portfolio and its respective pro-rata share of its Master Fund(s). |

All Statements, Schedules and Notes to Financial Statements

| — |

Amounts designated as — are either zero or rounded to zero. | |

| SEC |

Securities and Exchange Commission | |

| u |

Commencement of Operations. |

2

DFA INVESTMENT DIMENSIONS GROUP INC.

(Unaudited)

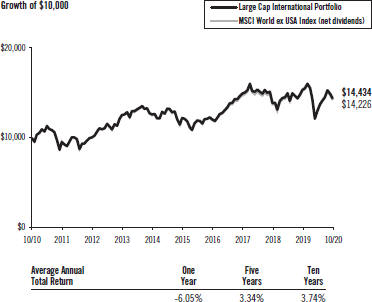

Large Cap International Portfolio vs.

MSCI World ex USA Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

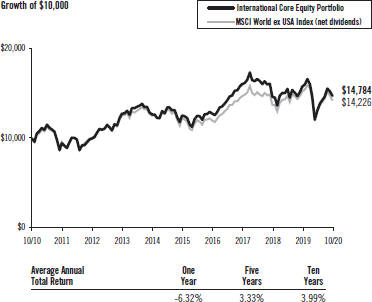

International Core Equity Portfolio vs.

MSCI World ex USA Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

3

DFA INVESTMENT DIMENSIONS GROUP INC.

PERFORMANCE CHARTS

(Unaudited)

Global Small Company Portfolio vs.

MSCI All Country World Small Cap Index (net dividends)

January 18, 2017-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

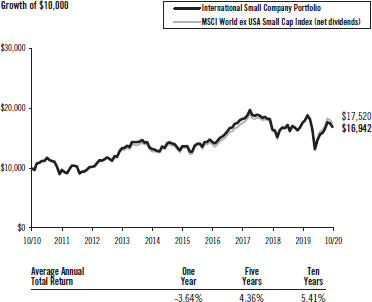

International Small Company Portfolio vs.

MSCI World ex USA Small Cap Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

4

DFA INVESTMENT DIMENSIONS GROUP INC.

PERFORMANCE CHARTS

(Unaudited)

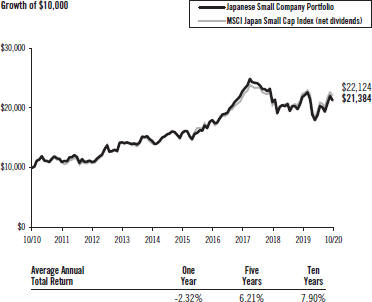

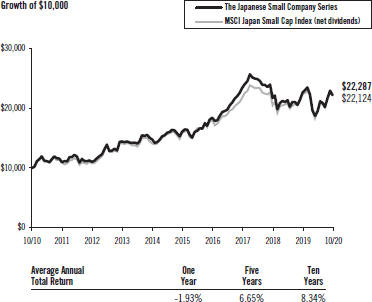

Japanese Small Company Portfolio vs.

MSCI Japan Small Cap Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

Asia Pacific Small Company Portfolio vs.

MSCI Pacific ex Japan Small Cap Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

5

DFA INVESTMENT DIMENSIONS GROUP INC.

PERFORMANCE CHARTS

(Unaudited)

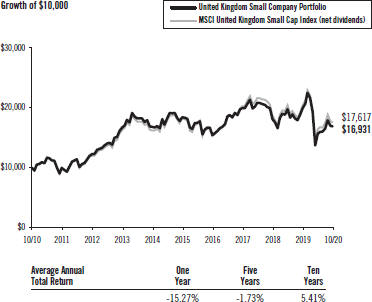

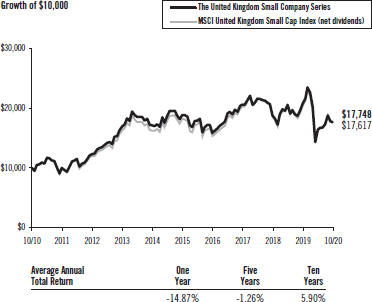

United Kingdom Small Company Portfolio vs.

MSCI United Kingdom Small Cap Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

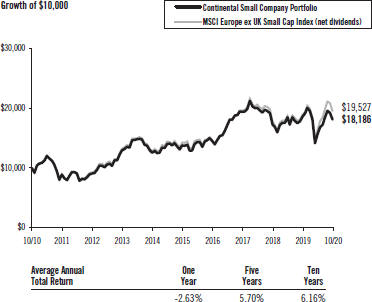

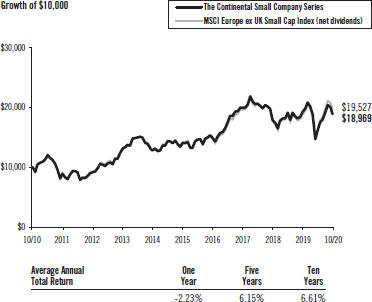

Continental Small Company Portfolio vs.

MSCI Europe ex UK Small Cap Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

6

DFA INVESTMENT DIMENSIONS GROUP INC.

PERFORMANCE CHARTS

(Unaudited)

DFA International Real Estate Securities Portfolio vs.

S&P Global ex U.S. REIT Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Copyright 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. |

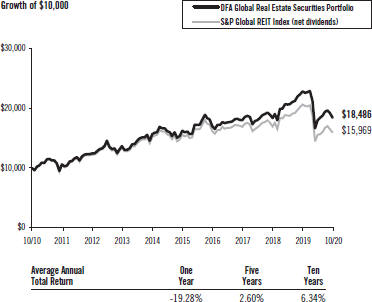

DFA Global Real Estate Securities Portfolio vs.

S&P Global REIT Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Copyright 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. |

7

DFA INVESTMENT DIMENSIONS GROUP INC.

PERFORMANCE CHARTS

(Unaudited)

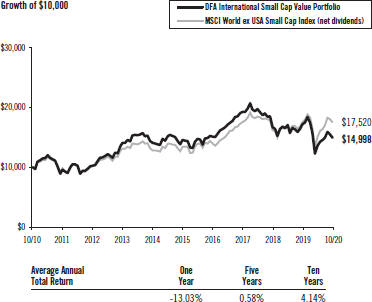

DFA International Small Cap Value Portfolio vs.

MSCI World ex USA Small Cap Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

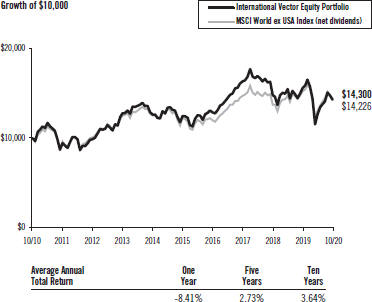

International Vector Equity Portfolio vs.

MSCI World ex USA Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

8

DFA INVESTMENT DIMENSIONS GROUP INC.

PERFORMANCE CHARTS

(Unaudited)

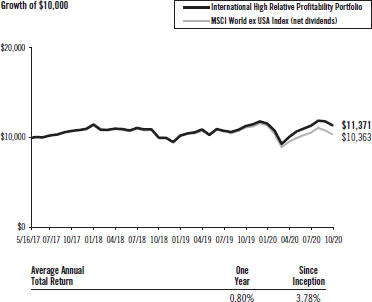

International High Relative Profitability Portfolio vs.

MSCI World ex USA Index (net dividends)

May 16, 2017-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

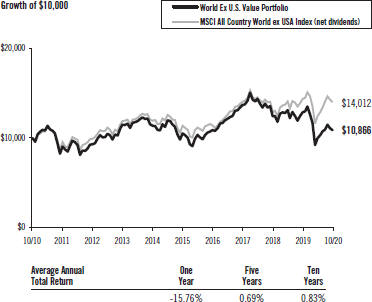

World Ex U.S. Value Portfolio vs.

MSCI All Country World ex USA Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

9

DFA INVESTMENT DIMENSIONS GROUP INC.

PERFORMANCE CHARTS

(Unaudited)

World Ex U.S. Core Equity Portfolio vs.

MSCI All Country World ex USA Index (net dividends)

April 9, 2013-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

World Core Equity Portfolio vs.

MSCI All Country World Index (net dividends)

March 7, 2012-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

10

DFA INVESTMENT DIMENSIONS GROUP INC.

PERFORMANCE CHARTS

(Unaudited)

Selectively Hedged Global Equity Portfolio vs.

MSCI All Country World Index (net dividends)

November 14, 2011-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

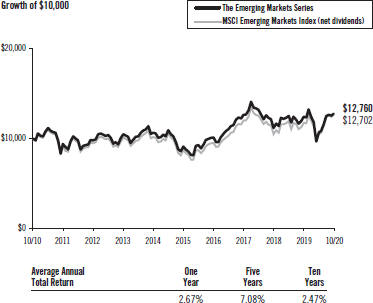

Emerging Markets Portfolio vs.

MSCI Emerging Markets Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

11

DFA INVESTMENT DIMENSIONS GROUP INC.

PERFORMANCE CHARTS

(Unaudited)

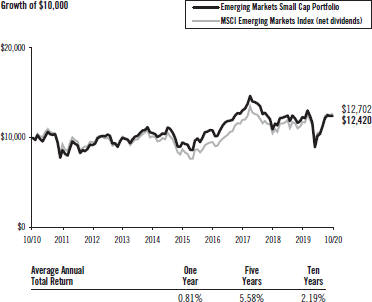

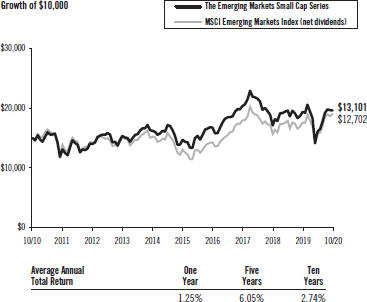

Emerging Markets Small Cap Portfolio vs.

MSCI Emerging Markets Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

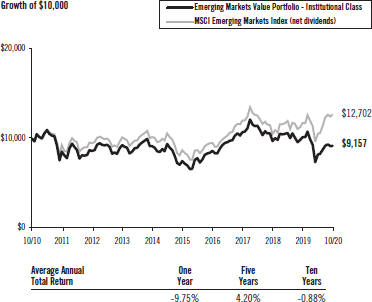

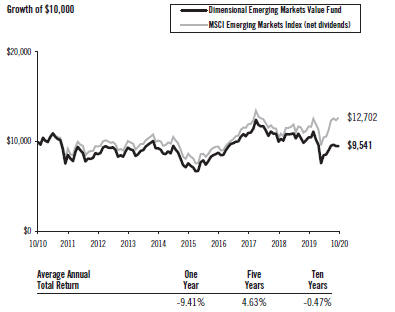

Emerging Markets Value Portfolio — Institutional Class vs.

MSCI Emerging Markets Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

12

DFA INVESTMENT DIMENSIONS GROUP INC.

PERFORMANCE CHARTS

(Unaudited)

Emerging Markets Value Portfolio — Class R2 vs.

MSCI Emerging Markets Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

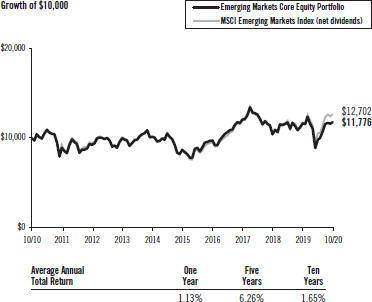

Emerging Markets Core Equity Portfolio vs.

MSCI Emerging Markets Index (net dividends)

October 31, 2010-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

13

DFA INVESTMENT DIMENSIONS GROUP INC.

PERFORMANCE CHARTS

(Unaudited)

Emerging Markets Targeted Value Portfolio vs.

MSCI Emerging Markets Index (net dividends)

November 14, 2018-October 31, 2020

|

Past performance is not predictive of future performance.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

MSCI data © MSCI 2020, all rights reserved. |

14

MANAGEMENT’S DISCUSSION AND ANALYSIS

| International Equity Market Review | 12 Months Ended October 31, 2020 |

Performance of non-U.S. developed markets was mostly negative for the period. As measured by the MSCI World ex USA indices, small-cap stocks outperformed large-cap stocks, and mid-cap stocks, a subset of the large-cap universe, outperformed large-cap stocks but underperformed small-cap stocks. Value stocks underperformed growth stocks as measured by the MSCI World ex USA indices.

12 Months Ended October 31, 2020

| Return in U.S. Dollars | ||||

| MSCI World ex USA Index |

-6.79 | % | ||

| MSCI World ex USA Mid Cap Index |

-3.83 | % | ||

| MSCI World ex USA Small Cap Index |

-0.65 | % | ||

| MSCI World ex USA Value Index |

-18.72 | % | ||

| MSCI World ex USA Growth Index |

5.65 | % | ||

For the 12 Months Ended October 31, 2020, the U.S. dollar depreciated against most non-U.S. developed markets currencies. Overall, currency movements had a positive impact on the U.S. dollar-denominated returns of developed markets.

12 Months Ended October 31, 2020

| Ten Largest Foreign Developed Markets by Market Cap |

Local Return | Return in U.S. Dollars | ||||||

| Japan |

-2.97 | % | 0.33 | % | ||||

| United Kingdom |

-22.19 | % | -22.25 | % | ||||

| France |

-17.43 | % | -13.79 | % | ||||

| Switzerland |

-4.37 | % | 2.95 | % | ||||

| Canada |

-4.70 | % | -6.05 | % | ||||

| Germany |

-10.77 | % | -6.84 | % | ||||

| Australia |

-11.01 | % | -9.29 | % | ||||

| Netherlands |

4.14 | % | 8.62 | % | ||||

| Hong Kong |

-8.06 | % | -7.15 | % | ||||

| Sweden |

0.79 | % | 9.10 | % | ||||

Source: Returns are of MSCI standard indices net of foreign withholding taxes on dividends. Copyright MSCI 2020, all rights reserved.

Emerging markets had mostly positive performance for the period, outperforming non-U.S. developed markets but underperforming the U.S. As measured by the MSCI Emerging Markets indices, small-cap stocks underperformed large-cap stocks, and mid-cap stocks, a subset of the large-cap universe, underperformed large-cap stocks and small-cap stocks. Value stocks underperformed growth stocks as measured by the MSCI Emerging Markets indices.

15

12 Months Ended October 31, 2020

| Return in U.S. Dollars | ||||

| MSCI Emerging Markets Index |

8.25 | % | ||

| MSCI Emerging Markets Mid Cap Index |

-3.22 | % | ||

| MSCI Emerging Markets Small Cap Index |

2.39 | % | ||

| MSCI Emerging Markets Value Index |

-8.47 | % | ||

| MSCI Emerging Markets Growth Index |

25.97 | % | ||

For the 12 Months Ended October 31, 2020, the U.S. dollar depreciated against some emerging markets currencies and appreciated against others. Overall, currency movements had a negative impact on the U.S. dollar denominated returns of emerging markets.

12 Months Ended October 31, 2020

| Ten Largest Emerging Markets by Market Cap |

Local Return | Return in U.S. | ||||||

| Dollars |

||||||||

| China |

33.57 | % | 35.19 | % | ||||

| Taiwan |

18.86 | % | 26.49 | % | ||||

| Korea |

11.33 | % | 14.15 | % | ||||

| India |

1.83 | % | -2.54 | % | ||||

| Brazil |

-11.13 | % | -38.13 | % | ||||

| South Africa |

-6.49 | % | -13.31 | % | ||||

| Saudi Arabia |

-0.90 | % | -0.90 | % | ||||

| Russia |

-14.17 | % | -29.27 | % | ||||

| Thailand |

-28.54 | % | -30.77 | % | ||||

| Malaysia |

-6.02 | % | -5.49 | % | ||||

Source: Returns are of MSCI standard indices net of foreign withholding taxes on dividends. Copyright MSCI 2020, all rights reserved.

For Portfolios investing in non-U.S. equities traded outside of the U.S. market time zone, differences in the valuation timing and methodology between a Portfolio and its benchmark index may impact relative performance over the referenced period. The Portfolios price foreign exchange rates at the closing of the U.S. market, while their benchmark indices use rates at 4 p.m. London time. The Portfolios also may use fair value pricing to price certain portfolio securities at the closing of the U.S. market, while benchmark indices may use local market closing prices. For the one-year period ended October 31, 2020, these differences generally contributed positively to the Portfolios’ relative performance.

16

Large Cap International Portfolio

The Large Cap International Portfolio invests in developed ex U.S. large company stocks. The investment strategy is process driven, emphasizing broad diversification. with increased exposure to stocks with smaller total market capitalizations, lower relative price (value) stocks, and higher-profitability stocks within the large-cap segment of developed ex U.S. markets. As of October 31, 2020, the Portfolio held approximately 1,330 securities in 22 eligible developed markets. Average cash exposure throughout the year was less than 1% of the Portfolio’s assets.

For the 12 months ended October 31, 2020, total returns were -6.05% for the Portfolio and -6.79% for the MSCI World ex USA Index (net dividends), the Portfolio’s benchmark. The Portfolio’s greater emphasis on higher-profitability stocks contributed positively to performance relative to the benchmark, as these stocks generally outperformed lower-profitability stocks. Additionally, the Portfolio’s exclusion of real estate investment trusts (REITs) had a positive impact on relative performance, as REITs generally underperformed in developed ex U.S. markets.

International Core Equity Portfolio

The International Core Equity Portfolio invests in a broadly diversified group of stocks in developed ex U.S. markets, with increased exposure to stocks with smaller market capitalization, lower relative price (value), and higher profitability. The investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Portfolio held approximately 5,040 securities in 22 eligible developed markets. Average cash exposure throughout the year was less than 1% of the Portfolio’s assets.

For the 12 months ended October 31, 2020, total returns were -6.32% for the Portfolio and -6.79% for the MSCI World ex USA Index (net dividends), the Portfolio’s benchmark. With small-cap stocks outperforming large-cap stocks in developed ex U.S. markets for the period, the Portfolio’s inclusion of and emphasis on small-caps had a positive impact on performance relative to the benchmark, which is composed primarily of large- and mid-cap stocks. The Portfolio’s greater emphasis on higher-profitability stocks contributed positively to relative performance, as higher-profitability stocks generally outperformed lower-profitability stocks. Additionally, the Portfolio’s exclusion of real estate investment trusts (REITs) had a positive impact on relative performance, as REITs generally underperformed in developed ex U.S. markets.

Global Small Company Portfolio

The Global Small Company Portfolio is designed to capture the returns of global small company stocks by purchasing shares of seven funds (which shall be collectively referred to below as the “Underlying Funds”) managed by Dimensional that individually invest in Canada, the United States, the United Kingdom, Europe (including Israel and excluding the U.K.), Japan, the Asia Pacific region (ex Japan), and emerging markets. The Underlying Funds generally exclude stocks with the lowest profitability and highest relative price. The investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Underlying Funds collectively held approximately 10,730 securities in 44 eligible developed and emerging markets.

For the 12 months ended October 31, 2020, total returns were -3.75% for the Portfolio and 0.27% for the MSCI All Country World Small Cap Index (net dividends), the Portfolio’s benchmark. The Underlying Funds’ greater emphasis on stocks with smaller market capitalizations had a negative impact on performance relative to the benchmark, as these stocks underperformed. The Underlying Fund’s

17

exclusion of stocks with the lowest profitability and highest relative price also detracted from relative performance, as those stocks outperformed. Conversely, the Underlying Funds’ exclusion of real estate investment trusts (REITs) contributed positively to relative performance, as REITs generally underperformed globally.

International Small Company Portfolio

The International Small Company Portfolio invests in developed ex U.S. small company stocks by purchasing shares of five Master Funds managed by Dimensional that invest individually in Canada, the United Kingdom, Europe (including Israel and excluding the U.K.), Japan, and the Asia Pacific region (ex Japan). The Portfolio generally excluded stocks with the lowest profitability and highest relative price. The investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Master Funds collectively held approximately 4,200 securities in 22 eligible developed markets. Average cash exposure throughout the year was less than 1% of the Portfolio’s assets.

For the 12 months ended October 31, 2020, total returns were -3.64% for the Portfolio and -0.65% for the MSCI World ex USA Small Cap Index (net dividends), the Portfolio’s benchmark. The Master Funds’ greater emphasis on stocks with smaller market capitalizations had a negative impact on performance relative to the benchmark, as these stocks underperformed. The Master Fund’s exclusion of stocks with the lowest profitability and highest relative price detracted from performance relative to the benchmark, as those stocks outperformed. Conversely, the Master Funds’ exclusion of real estate investment trusts (REITs) contributed positively to relative performance, as REITs generally underperformed in developed ex U.S. markets.

Japanese Small Company Portfolio

The Japanese Small Company Portfolio invests in Japanese small company stocks by purchasing shares of the Japanese Small Company Series, a Master Fund managed by Dimensional that invests in such securities. The Master Fund generally excluded stocks with the lowest profitability and highest relative price. The investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Master Fund held approximately 1,710 securities. Average cash exposure throughout the year was less than 1% of the Master Fund’s assets.

For the 12 months ended October 31, 2020, total returns were -2.32% for the Portfolio and -1.46% for the MSCI Japan Small Cap Index (net dividends), the Portfolio’s benchmark. The Master Fund’s greater emphasis on stocks with smaller market capitalizations had a negative impact on performance relative to the benchmark, as these stocks underperformed. The Master Fund’s exclusion of stocks with the lowest profitability and highest relative price had a negative impact on performance relative to the benchmark, as those stocks outperformed. Conversely, the Master Fund’s exclusion of real estate investment trusts (REITs) contributed positively to relative performance, as REITs generally underperformed in Japan.

Asia Pacific Small Company Portfolio

The Asia Pacific Small Company Portfolio invests in small company stocks in Australia, Hong Kong, New Zealand, and Singapore by purchasing shares of the Asia Pacific Small Company Series, a Master Fund managed by Dimensional that invests in such securities. The Master Fund’s greater emphasis on stocks with smaller market capitalizations had a negative impact on performance relative to the benchmark, as these stocks underperformed. The Master Fund generally excluded stocks with the lowest profitability and highest relative price. The investment strategy is process driven,

18

emphasizing broad diversification. As of October 31, 2020, the Master Fund held approximately 750 securities in 4 eligible countries. Average cash exposure throughout the year was less than 1% of the Master Fund’s assets.

For the 12 months ended October 31, 2020, total returns were -0.23% for the Portfolio and 3.00% for the MSCI Pacific ex Japan Small Cap Index (net dividends), the Portfolio’s benchmark. The Master Fund’s exclusion of stocks with the lowest profitability and highest relative price had a negative impact on performance relative to the benchmark, as those securities outperformed. Conversely, the Master Fund’s exclusion of real estate investment trusts (REITs) contributed positively to relative performance, as REITs generally underperformed in Asia Pacific (ex Japan) markets.

United Kingdom Small Company Portfolio

The United Kingdom Small Company Portfolio invests in small company stocks in the U.K. by purchasing shares of The United Kingdom Small Company Series, a Master Fund managed by Dimensional that invests in such securities. The Master Fund generally excluded stocks with the lowest profitability and highest relative price. The investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Master Fund held approximately 330 securities. Average cash exposure throughout the year was less than 1% of the Master Fund’s assets.

For the 12 months ended October 31, 2020, total returns were -15.27% for the Portfolio and -14.04% for the MSCI United Kingdom Small Cap Index (net dividends), the Portfolio’s benchmark. The Master Fund’s greater emphasis on stocks with smaller market capitalizations had a negative impact on performance relative to the benchmark, as these stocks underperformed. The Master Fund’s exclusion of stocks with the lowest profitability and highest relative price detracted from performance relative to the benchmark, as those securities outperformed for the period. Conversely, the Master Fund’s exclusion of real estate investment trusts (REITs) contributed positively to relative performance, as REITs generally underperformed in the U.K.

Continental Small Company Portfolio

The Continental Small Company Portfolio invests in small company stocks in the developed markets of Europe (excluding the U.K.) and Israel by purchasing shares of the Continental Small Company Series, a Master Fund managed by Dimensional that invests in such securities. The Master Fund generally excluded stocks with the lowest profitability and highest relative price. The investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Master Fund held approximately 1,090 securities in 15 eligible countries. Average cash exposure throughout the year was less than 1% of the Portfolio’s assets.

For the 12 months ended October 31, 2020, total returns were -2.63% for the Portfolio and 3.14% for the MSCI Europe ex U.K. Small Cap Index (net dividends), the Portfolio’s benchmark. The Master Fund and its benchmark use different methodologies to determine which small-cap stocks are eligible for purchase or to hold. This methodology variance led to country by-country differences between the maximum market capitalization of small-cap stocks bought and held by the Master Fund relative to the benchmark, which in turn led to differences in holdings between the Master Fund and the benchmark. These holdings differences detracted from the Master Fund’s performance relative to the benchmark. The Master Fund’s greater emphasis on stocks with smaller market capitalizations had a negative impact on performance relative to the benchmark, as these stocks underperformed. The Master Fund’s exclusion of stocks with the lowest profitability and highest relative price also detracted

19

from relative performance, as those securities outperformed for the year. Conversely, the Master Fund’s exclusion of real estate investment trusts (REITs) contributed positively to relative performance, as REITs generally underperformed in eligible markets.

| Global Real Estate Market Review | 12 Months Ended October 31, 2020 |

Publicly traded global real estate investment trusts (REITs) had negative returns for the period. REITs underperformed U.S., developed non-U.S., and emerging markets equities. The U.S. REIT market, the world’s largest, had negative performance for the period and underperformed non-U.S. REITs. Among non-U.S. REIT markets, Saudi Arabia, New Zealand, and Turkey were among the strongest performers, while Taiwan, South Africa, and France lagged. At the REIT industry level, industrial and specialized REITs generally outperformed, while hotel and resort REITs and retail REITs generally underperformed.

12 Months Ended October 31, 2020

| Return in U.S. Dollars | ||||

| Dow Jones U.S. Select REIT IndexSM |

-25.14 | % | ||

| S&P Global ex U.S. REIT Index |

-24.67 | % | ||

| S&P Global REIT Index |

-22.87 | % | ||

Source: Returns are of Standard and Poor’s (S&P) indices net of foreign withholding taxes on dividends. Copyright S&P, 2020. All rights reserved. Dow Jones and S&P have different REIT eligibility criteria which can result in performance differences across different indices representing the same region.

For Portfolios investing in non-U.S. REITs and REIT-like securities traded outside of the U.S. market time zone, differences in the valuation timing and methodology between a Portfolio and its benchmark index may impact relative performance over the referenced period. The Portfolios price foreign exchange rates at the closing of the U.S. market, while their benchmark indices use rates at 4 p.m. London time. The Portfolios also may use fair value pricing to price certain portfolio securities at the closing of the U.S. market, while benchmark indices may use local market closing prices. For the one-year period ended October 31, 2020, these differences did not have material overall impact on the Portfolios’ relative performance.

DFA International Real Estate Securities Portfolio

The DFA International Real Estate Securities Portfolio invests in a broadly diversified portfolio of real estate securities in developed ex U.S. and emerging markets. As of October 31, 2020, the Portfolio held approximately 290 securities in 21 eligible developed ex U.S. and emerging markets. Average cash exposure throughout the year was less than 1% of the Portfolio’s assets.

For the 12 months ended October 31, 2020, total returns were -23.98% for the Portfolio and -24.67% for the S&P Global ex US REIT Index (net dividends), the Portfolio’s benchmark. Withholding tax rate differences between the Portfolio and the benchmark had a positive impact on performance relative to the benchmark as the Portfolio’s actual tax rate was lower than the assumed tax rates of the benchmark. Additionally, Thailand is not an eligible market for the Portfolio but the benchmark holds Thai securities, which had a positive impact on relative performance as those securities underperformed.

20

DFA Global Real Estate Securities Portfolio

The DFA Global Real Estate Securities Portfolio invests in a broadly diversified group of real estate securities in domestic and international markets, including emerging markets. As of the date of this report, the Portfolio’s investments included the DFA International Real Estate Securities Portfolio, the DFA Real Estate Securities Portfolio, and individual securities. As of October 31, 2020, the Portfolio held, either directly or through the underlying portfolios, approximately 450 securities in 22 eligible developed and emerging markets. Average cash exposure throughout the year was less than 1% of the Portfolio’s assets.

For the 12 months ended October 31, 2020, total returns were -19.28% for the Portfolio and -22.87% for the S&P Global REIT Index (net dividends), the Portfolio’s benchmark. The Portfolio’s broader inclusion of specialized REITs had a positive impact on performance relative to the benchmark as did withholding tax rate differences between the Portfolio and the benchmark.

| International Equity Market Review | 12 Months Ended October 31, 2020 |

Performance of non-U.S. developed markets was mostly negative for the period. As measured by the MSCI World ex USA indices, small-cap stocks outperformed large-cap stocks, and mid-cap stocks, a subset of the large-cap universe, outperformed large-cap stocks but underperformed small-cap stocks. Value stocks underperformed growth stocks as measured by the MSCI World ex USA indices.

12 Months Ended October 31, 2020

| Return in U.S. Dollars | ||||

| MSCI World ex USA Index |

-6.79 | % | ||

| MSCI World ex USA Mid Cap Index |

-3.83 | % | ||

| MSCI World ex USA Small Cap Index |

-0.65 | % | ||

| MSCI World ex USA Value Index |

-18.72 | % | ||

| MSCI World ex USA Growth Index |

5.65 | % | ||

For the 12 Months Ended October 31, 2020, the U.S. dollar depreciated against most non-U.S. developed markets currencies. Overall, currency movements had a positive impact on the U.S. dollar-denominated returns of developed markets.

12 Months Ended October 31, 2020

| Ten Largest Foreign Developed Markets by Market Cap |

Local Return | Return in U.S. Dollars | ||||||

| Japan |

-2.97 | % | 0.33 | % | ||||

| United Kingdom |

-22.19 | % | -22.25 | % | ||||

| France |

-17.43 | % | -13.79 | % | ||||

| Switzerland |

-4.37 | % | 2.95 | % | ||||

| Canada |

-4.70 | % | -6.05 | % | ||||

| Germany |

-10.77 | % | -6.84 | % | ||||

21

| Australia |

-11.01 | % | -9.29 | % | ||||

| Netherlands |

4.14 | % | 8.62 | % | ||||

| Hong Kong |

-8.06 | % | -7.15 | % | ||||

| Sweden |

0.79 | % | 9.10 | % |

Source: Returns are of MSCI standard indices net of foreign withholding taxes on dividends. Copyright MSCI 2020, all rights reserved.

Emerging markets had mostly positive performance for the period, outperforming non-U.S. developed markets but underperforming the U.S. As measured by the MSCI Emerging Markets indices, small-cap stocks underperformed large-cap stocks, and mid-cap stocks, a subset of the large-cap universe, underperformed large-cap stocks and small-cap stocks. Value stocks underperformed growth stocks as measured by the MSCI Emerging Markets indices.

12 Months Ended October 31, 2020

| Return in U.S. Dollars | ||||

| MSCI Emerging Markets Index |

8.25 | % | ||

| MSCI Emerging Markets Mid Cap Index |

-3.22 | % | ||

| MSCI Emerging Markets Small Cap Index |

2.39 | % | ||

| MSCI Emerging Markets Value Index |

-8.47 | % | ||

| MSCI Emerging Markets Growth Index |

25.97 | % | ||

For the 12 Months Ended October 31, 2020, the U.S. dollar depreciated against some emerging markets currencies and appreciated against others. Overall, currency movements had a negative impact on the U.S. dollar denominated returns of emerging markets.

12 Months Ended October 31, 2020

| Ten Largest Emerging Markets by Market Cap |

Local Return | Return in U.S. | ||||||

| Dollars |

||||||||

| China |

33.57 | % | 35.19 | % | ||||

| Taiwan |

18.86 | % | 26.49 | % | ||||

| Korea |

11.33 | % | 14.15 | % | ||||

| India |

1.83 | % | -2.54 | % | ||||

| Brazil |

-11.13 | % | -38.13 | % | ||||

| South Africa |

-6.49 | % | -13.31 | % | ||||

| Saudi Arabia |

-0.90 | % | -0.90 | % | ||||

| Russia |

-14.17 | % | -29.27 | % | ||||

| Thailand |

-28.54 | % | -30.77 | % | ||||

| Malaysia |

-6.02 | % | -5.49 | % | ||||

22

Source: Returns are of MSCI standard indices net of foreign withholding taxes on dividends. Copyright MSCI 2020, all rights reserved.

For Portfolios investing in non-U.S. equities traded outside of the U.S. market time zone, differences in the valuation timing and methodology between a Portfolio and its benchmark index may impact relative performance over the referenced period. The Portfolios price foreign exchange rates at the closing of the U.S. market, while their benchmark indices use rates at 4 p.m. London time. The Portfolios also may use fair value pricing to price certain portfolio securities at the closing of the U.S. market, while benchmark indices may use local market closing prices. For the one-year period ended October 31, 2020, these differences generally contributed positively to the Portfolios’ relative performance.

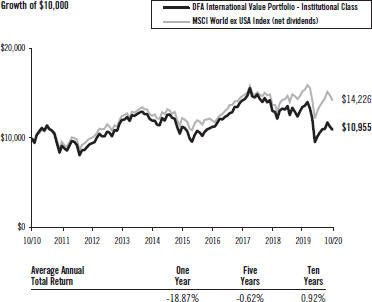

DFA International Small Cap Value Portfolio

The DFA International Small Cap Value Portfolio invests in small-cap value stocks in developed ex U.S. markets, with an emphasis on those with higher profitability. The investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Portfolio held approximately 1,990 securities in 22 eligible developed markets. Average cash exposure throughout the year was less than 1% of the Portfolio’s assets.

For the 12 months ended October 31, 2020, total returns were -13.03% for the Portfolio and -0.65% for the MSCI World ex USA Small Cap Index (net dividends), the Portfolio’s benchmark. With low relative price (value) stocks underperforming high relative price (growth) stocks, the Portfolio’s focus on value stocks detracted from performance relative to the style-neutral benchmark. Conversely, the Portfolio’s exclusion of real estate investment trusts (REITs) had a positive impact on relative performance, as REITs generally underperformed in developed ex U.S. markets.

International Vector Equity Portfolio

The International Vector Equity Portfolio invests in a broadly diversified group of stocks in developed ex U.S. markets, with increased exposure to stocks with smaller market capitalization, lower relative price (value), and higher profitability. The Portfolio’s increased exposure to small capitalization and value stocks may be achieved by decreasing the allocation to or excluding the largest high relative price (growth) stocks in developed ex U.S. markets. The investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Portfolio held approximately 4,700 securities in 22 eligible developed markets. Average cash exposure throughout the year was less than 1% of the Portfolio’s assets.

For the 12 months ended October 31, 2020, total returns were -8.41% for the Portfolio and -6.79% for the MSCI World ex USA Index (net dividends), the Portfolio’s benchmark. The Portfolio’s greater emphasis on low relative price (value) stocks detracted from performance relative to the benchmark, as value stocks underperformed high relative price (growth) stocks.

International High Relative Profitability Portfolio

The International High Relative Profitability Portfolio invests in developed ex U.S. large-cap stocks with higher profitability. The investment strategy is process driven, emphasizing broad diversification, with increased exposure to stocks with smaller total market capitalizations, lower

23

relative price (value), and higher profitability within the large cap high relative profitability segment of developed ex U.S. markets. As of October 31, 2020, the Portfolio held approximately 530 securities in 22 eligible developed markets. Average cash exposure throughout the year was less than 1% of the Portfolio’s assets.

For the 12 months ended October 31, 2020, total returns were 0.80% for the Portfolio and -6.79% for the MSCI World ex USA Index (net dividends), the Portfolio’s benchmark. The Portfolio’s focus on stocks with higher profitability contributed positively to performance relative to the benchmark, as higher-profitability stocks generally outperformed lower profitability stocks for the period. The Portfolio’s exclusion of real estate investment trusts (REITs) also had a positive impact on relative performance, as REITs generally underperformed in developed ex U.S. markets.

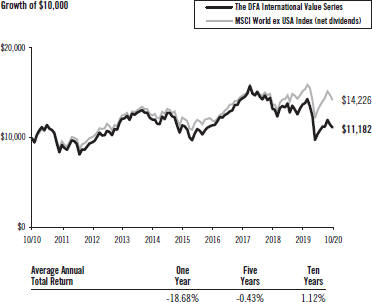

World ex U.S. Value Portfolio

The World ex U.S. Value Portfolio is designed to capture the returns of value stocks across all market capitalizations in developed ex U.S. and emerging markets. The Portfolio may pursue its objective by holding direct securities; by purchasing shares of funds managed by Dimensional: the DFA International Value Series, the DFA International Small Cap Value Portfolio, and the Dimensional Emerging Markets Value Fund (the “Underlying Funds”); or by a combination of securities and Underlying Funds. The investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Portfolio, directly and through the Underlying Funds, held approximately 5,320 securities in 44 eligible developed ex U.S. and emerging markets.

For the 12 months ended October 31, 2020, total returns were -15.76% for the Portfolio and -2.61% for the MSCI All Country World ex USA Index (net dividends), the Portfolio’s benchmark. The Underlying Funds’ focus on low relative price (value) stocks had a negative impact on performance relative to the style-neutral benchmark, as value stocks underperformed high relative price (growth) stocks globally.

World ex U.S. Core Equity Portfolio

The World ex U.S. Core Equity Portfolio invests in a broadly diversified group of stocks in developed ex U.S. and emerging markets with increased exposure to stocks with smaller market capitalization, lower relative price (value), and higher profitability. The investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Portfolio held approximately 9,820 securities in 46 eligible developed ex U.S. and emerging markets. Average cash exposure throughout the year was less than 1% of the Portfolio’s assets.

For the 12 months ended October 31, 2020, total returns were -4.42% for the Portfolio and -2.61% for the MSCI All Country World ex USA Index (net dividends), the Portfolio’s benchmark. The Portfolio’s greater emphasis on low relative price (value) stocks detracted from performance relative to the benchmark, as value stocks underperformed high relative price (growth) stocks in developed ex U.S. and emerging markets. Conversely, the Portfolio’s exclusion of real estate investment trusts (REITs) contributed positively to performance, as REITs generally underperformed in developed ex U.S. and emerging markets.

World Core Equity Portfolio

The World Core Equity Portfolio seeks long-term capital appreciation generally by investing in a combination of mutual funds managed by Dimensional. As of the date of this report, the Portfolio’s

24

investments included the U.S. Core Equity 1 Portfolio, International Core Equity Portfolio, and Emerging Markets Core Equity Portfolio (collectively, the “Underlying Funds”). The investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Underlying Funds collectively held more than 13,230 equity securities in 47 eligible developed and emerging markets.

For the 12 months ended October 31, 2020, total returns were 1.25% for the Portfolio and 4.89% for the MSCI All Country World Index (net dividends), the Portfolio’s benchmark. With low relative price (value) stocks underperforming high relative price (growth) stocks globally, the Underlying Funds’ greater emphasis on value stocks had a negative impact on performance relative to the benchmark. With small-caps underperforming large-caps globally for the period, the Underlying Funds’ inclusion of and emphasis on small-cap stocks also detracted from performance relative to the benchmark, which is composed primarily of large- and mid-cap stocks. Conversely, the Underlying Funds’ exclusion of real estate investment trusts (REITs) contributed positively to performance, as REITs generally underperformed.

Selectively Hedged Global Equity Portfolio

The Selectively Hedged Global Equity Portfolio seeks long-term capital appreciation by investing in a combination of other mutual funds managed by Dimensional. As of the date of this report, the Portfolio invests in the U.S. Core Equity 2 Portfolio, International Core Equity Portfolio, and Emerging Markets Core Equity Portfolio (the “Underlying Funds”). The Portfolio hedges foreign currency exposure on a selective basis to capture positive forward currency premiums. The investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Underlying Funds collectively held approximately 13,270 securities in 47 eligible developed and emerging markets.

For the 12 months ended October 31, 2020, total returns were 0.47% for the Portfolio and 4.89% for the MSCI All Country World Index (net dividends), the Portfolio’s benchmark. With low relative price (value) stocks generally underperforming high relative price (growth) stocks globally, the Underlying Funds’ greater emphasis on value stocks had a negative impact on performance relative to the benchmark. With small-caps underperforming large-caps globally for the period, the Underlying Funds’ inclusion of and emphasis on small-cap stocks also detracted from performance relative to the benchmark (which is composed primarily of large- and mid-cap stocks). The Portfolio’s strategy of selectively hedging foreign currency exposure detracted from performance relative to the benchmark (which does not hedge currency exposure), as the U.S. dollar generally weakened against the currencies to which the Portfolio had hedged its exposure.

Emerging Markets Portfolio

The Emerging Markets Portfolio invests in large-cap stocks in emerging markets by purchasing shares of The Emerging Markets Series, a Master Fund managed by Dimensional that invests in such securities. The investment strategy is process driven, emphasizing broad diversification with increased exposure to stocks with smaller market capitalizations, lower relative price (value), and higher-profitability within the large-cap segment of emerging markets. As of October 31, 2020, the Master Fund held approximately 1,610 securities in 24 eligible emerging markets. Average cash exposure throughout the year was less than 1% of the Master Fund’s assets.

For the 12 months ended October 31, 2020, total returns were 2.36% for the Portfolio and 8.25% for the MSCI Emerging Markets Index (net dividends), the Portfolio’s benchmark. The Master Fund’s greater emphasis on low relative price (value) stocks had a negative impact on performance

25

relative to the benchmark, as value stocks underperformed high relative price (growth) stocks in emerging markets for the period. The Master Fund’s greater allocation to stocks with smaller market capitalizations within the large cap universe also detracted from relative performance, as these stocks underperformed their larger counterparts for the period.

Emerging Markets Small Cap Portfolio

The Emerging Markets Small Cap Portfolio invests in small company stocks in emerging markets by purchasing shares of The Emerging Markets Small Cap Series, a Master Fund managed by Dimensional that invests in such securities. The Master Fund generally excludes stocks with the lowest profitability and highest relative price. The Master Fund’s investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Master Fund held approximately 4,550 securities in 21 eligible emerging markets. Average cash exposure throughout the year was less than 1% of the Master Fund’s assets.

For the 12 months ended October 31, 2020, total returns were 0.81% for the Portfolio and 8.25% for the MSCI Emerging Markets Index (net dividends), the Portfolio’s benchmark. With small-cap stocks underperforming large-cap stocks in emerging markets, the Master Fund’s inclusion of stocks with smaller market capitalizations detracted from performance relative to the benchmark, which is composed primarily of large- and mid-cap stocks.

Emerging Markets Value Portfolio

The Emerging Markets Value Portfolio invests in value stocks of large and small companies in emerging markets by purchasing shares of the Dimensional Emerging Markets Value Fund, a Master Fund managed by Dimensional that invests in such securities. The investment strategy is process driven, emphasizing broad diversification with increased exposure to stocks with smaller market capitalizations, lower relative price (value), and higher profitability within the value segment of emerging markets. As of October 31, 2020, the Master Fund held approximately 2,870 securities in 22 eligible emerging markets. Average cash exposure throughout the year was less than 1% of the Master Fund’s assets.

For the 12 months ended October 31, 2020, total returns were -9.98% for the Portfolio’s Class R2 shares, -9.75% for the Portfolio’s Institutional Class shares, and 8.25% for the MSCI Emerging Markets Index (net dividends), the Portfolio’s benchmark. The Master Fund’s focus on low relative price (value) stocks had a negative impact on performance relative to the style-neutral benchmark, as value stocks underperformed high relative price (growth) stocks in emerging markets for the period. With small-cap stocks underperforming large-cap stocks, the Master Fund’s inclusion of small-caps also detracted from performance relative to the benchmark, which is composed primarily of large- and mid-cap stocks.

Emerging Markets Core Equity Portfolio

The Emerging Markets Core Equity Portfolio invests in a broadly diversified group of stocks in emerging markets, with increased exposure to stocks with smaller market capitalization, lower relative price (value), and higher profitability. The investment strategy is process driven, emphasizing broad diversification. As of October 31, 2020, the Portfolio held approximately 5,600 securities in 24 eligible emerging markets. Average cash exposure throughout the year was less than 1% of the Portfolio’s assets.

26

For the 12 months ended October 31, 2020, total returns were 1.13% for the Portfolio and 8.25% for the MSCI Emerging Markets Index (net dividends), the Portfolio’s benchmark. With low relative price (value) stocks underperforming high relative price (growth) stocks, the Portfolio’s greater emphasis value stocks detracted from performance relative to the benchmark. With small-cap stocks underperforming large-cap stocks in emerging markets for the period, the Portfolio’s inclusion of and emphasis on small-caps also had a negative impact on relative performance, which is composed primarily of large- and mid-cap stocks.

Emerging Markets Targeted Value Portfolio

The Emerging Markets Targeted Value Portfolio invests in value stocks of small- and mid-cap companies in emerging markets. The investment strategy is process driven, emphasizing broad diversification with increased exposure to smaller total market capitalizations, lower relative price (value) stocks, and higher-profitability stocks within the small- and mid-cap value segment of emerging markets. As of October 31, 2020, the Portfolio held approximately 2,180 securities in 21 eligible emerging markets. Average cash exposure throughout the year was less than 1% of the Portfolio’s assets.

For the 12 months ended October 31, 2020, total returns were -3.89% for the Portfolio and 8.25% for the MSCI Emerging Markets Index (net dividends), the Portfolio’s benchmark. The Portfolio’s focus on low relative price (value) stocks had a negative impact on performance relative to the style-neutral benchmark, as value stocks underperformed high relative price (growth) stocks in emerging markets for the period. With small-cap and mid-cap stocks underperforming large-cap stocks, the Portfolio’s focus on small- and mid-cap stocks also detracted from relative performance, which is composed primarily of large- and mid-cap stocks.

27

DFA INVESTMENT DIMENSIONS GROUP INC.

(Unaudited)

The following Expense Tables are shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. Operating expenses and legal and audit services, which are deducted from a fund’s gross income, directly reduce the investment return of the fund. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs, in dollars, of investing in the fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Tables below illustrate your fund’s costs in two ways.

Actual Fund Return

This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and “Expenses Paid During Period” reflects the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, a $7,500 account value divided by $1,000 = 7.5), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes

This section is intended to help you compare your fund’s costs with those of other mutual funds. The hypothetical “Ending Account Value” and “Expenses Paid During Period” are derived from the fund’s actual expense ratio and an assumed 5% annual return before expenses. In this case, because the return used is not the fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% annual return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the tables are meant to highlight and help you compare ongoing costs only and do not reflect any transactional costs, if applicable. The “Annualized Expense Ratio” represents the actual expenses for the six-month period indicated.

Six Months Ended October 31, 2020

EXPENSE TABLES

| Beginning Account Value 05/01/20 |

Ending Account Value 10/31/20 |

Annualized Expense Ratio (1) |

Expenses Paid During Period (1) |

|||||||||||||

| Large Cap International Portfolio |

||||||||||||||||

| Actual Fund Return |

$1,000.00 | $1,104.70 | 0.22 | % | $1.16 | |||||||||||

| Hypothetical 5% Annual Return |

$1,000.00 | $1,024.03 | 0.22 | % | $1.12 | |||||||||||

| International Core Equity Portfolio |

||||||||||||||||

| Actual Fund Return |

$1,000.00 | $1,126.60 | 0.30 | % | $1.60 | |||||||||||

| Hypothetical 5% Annual Return |

$1,000.00 | $1,023.63 | 0.30 | % | $1.53 | |||||||||||

28

DISCLOSURE OF FUND EXPENSES

CONTINUED

| Beginning Account Value 05/01/20 |

Ending Account Value 10/31/20 |

Annualized Expense Ratio (1) |

Expenses Paid During Period (1) |

|||||||||||||

| Global Small Company Portfolio (2) |

||||||||||||||||

| Actual Fund Return |

$1,000.00 | $1,168.00 | 0.47 | % | $2.56 | |||||||||||

| Hypothetical 5% Annual Return |

$1,000.00 | $1,022.77 | 0.47 | % | $2.39 | |||||||||||

| International Small Company Portfolio (2) |

||||||||||||||||

| Actual Fund Return |

$1,000.00 | $1,151.90 | 0.53 | % | $2.87 | |||||||||||

| Hypothetical 5% Annual Return |

$1,000.00 | $1,022.47 | 0.53 | % | $2.69 | |||||||||||

| Japanese Small Company Portfolio (3) |

||||||||||||||||

| Actual Fund Return |

$1,000.00 | $1,136.50 | 0.54 | % | $2.90 | |||||||||||

| Hypothetical 5% Annual Return |

$1,000.00 | $1,022.42 | 0.54 | % | $2.75 | |||||||||||

| Asia Pacific Small Company Portfolio (3) |

||||||||||||||||

| Actual Fund Return |

$1,000.00 | $1,219.30 | 0.54 | % | $3.01 | |||||||||||

| Hypothetical 5% Annual Return |

$1,000.00 | $1,022.42 | 0.54 | % | $2.75 | |||||||||||

| United Kingdom Small Company Portfolio (3) |

||||||||||||||||

| Actual Fund Return |

$1,000.00 | $1,075.60 | 0.59 | % | $3.08 | |||||||||||

| Hypothetical 5% Annual Return |

$1,000.00 | $1,022.17 | 0.59 | % | $3.00 | |||||||||||

| Continental Small Company Portfolio (3) |

||||||||||||||||

| Actual Fund Return |

$1,000.00 | $1,157.80 | 0.54 | % | $2.93 | |||||||||||

| Hypothetical 5% Annual Return |

$1,000.00 | $1,022.42 | 0.54 | % | $2.75 | |||||||||||

| DFA International Real Estate Securities Portfolio |

||||||||||||||||

| Actual Fund Return |

$1,000.00 | $1,056.00 | 0.26 | % | $1.34 | |||||||||||

| Hypothetical 5% Annual Return |

$1,000.00 | $1,023.83 | 0.26 | % | $1.32 | |||||||||||

| DFA Global Real Estate Securities Portfolio (4) |

||||||||||||||||

| Actual Fund Return |

$1,000.00 | $1,025.70 | 0.24 | % | $1.22 | |||||||||||

| Hypothetical 5% Annual Return |

$1,000.00 | $1,023.93 | 0.24 | % | $1.22 | |||||||||||

| DFA International Small Cap Value Portfolio |

||||||||||||||||

| Actual Fund Return |

$1,000.00 | $1,100.90 | 0.65 | % | $3.43 | |||||||||||

| Hypothetical 5% Annual Return |

$1,000.00 | $1,021.87 | 0.65 | % | $3.30 | |||||||||||

| International Vector Equity Portfolio |

||||||||||||||||

| Actual Fund Return |

$1,000.00 | $1,126.60 | 0.47 | % | $2.51 | |||||||||||

| Hypothetical 5% Annual Return |

$1,000.00 | $1,022.77 | 0.47 | % | $2.39 | |||||||||||

| International High Relative Profitability Portfolio |

||||||||||||||||

| Actual Fund Return |

$1,000.00 | $1,129.50 | 0.30 | % | $1.61 | |||||||||||

| Hypothetical 5% Annual Return |

$1,000.00 | $1,023.63 | 0.30 | % | $1.53 | |||||||||||

29

DISCLOSURE OF FUND EXPENSES

CONTINUED

| Beginning Account Value 05/01/20 |

Ending Account Value 10/31/20 |

Annualized Expense Ratio (1) |

Expenses Paid During Period (1) |

|||||||||||||

| World ex U.S. Value Portfolio (2) |

||||||||||||||||

| Actual Fund Return |

$ | 1,000.00 | $ | 1,088.70 | 0.40 | % | $ | 2.10 | ||||||||

| Hypothetical 5% Annual Return |

$ | 1,000.00 | $ | 1,023.13 | 0.40 | % | $ | 2.03 | ||||||||

| World ex U.S. Core Equity Portfolio |

||||||||||||||||

| Actual Fund Return |

$ | 1,000.00 | $ | 1,143.60 | 0.35 | % | $ | 1.89 | ||||||||

| Hypothetical 5% Annual Return |

$ | 1,000.00 | $ | 1,023.38 | 0.35 | % | $ | 1.78 | ||||||||

| World Core Equity Portfolio (2) |

||||||||||||||||

| Actual Fund Return |

$ | 1,000.00 | $ | 1,147.60 | 0.32 | % | $ | 1.73 | ||||||||

| Hypothetical 5% Annual Return |

$ | 1,000.00 | $ | 1,023.53 | 0.32 | % | $ | 1.63 | ||||||||

| Selectively Hedged Global Equity Portfolio (2) |

||||||||||||||||

| Actual Fund Return |

$ | 1,000.00 | $ | 1,140.70 | 0.36 | % | $ | 1.94 | ||||||||

| Hypothetical 5% Annual Return |

$ | 1,000.00 | $ | 1,023.33 | 0.36 | % | $ | 1.83 | ||||||||

| Emerging Markets Portfolio (3) |

||||||||||||||||

| Actual Fund Return |

$ | 1,000.00 | $ | 1,194.00 | 0.44 | % | $ | 2.43 | ||||||||

| Hypothetical 5% Annual Return |

$ | 1,000.00 | $ | 1,022.93 | 0.44 | % | $ | 2.24 | ||||||||

| Emerging Markets Small Cap Portfolio (3) |

||||||||||||||||

| Actual Fund Return |

$ | 1,000.00 | $ | 1,220.00 | 0.69 | % | $ | 3.85 | ||||||||

| Hypothetical 5% Annual Return |

$ | 1,000.00 | $ | 1,021.67 | 0.69 | % | $ | 3.51 | ||||||||

| Emerging Markets Value Portfolio (3) |

||||||||||||||||

| Actual Fund Return |

||||||||||||||||

| Class R2 Shares |

$ | 1,000.00 | $ | 1,116.60 | 0.77 | % | $ | 4.10 | ||||||||

| Institutional Class Shares |

$ | 1,000.00 | $ | 1,117.90 | 0.52 | % | $ | 2.77 | ||||||||

| Hypothetical 5% Annual Return |

||||||||||||||||

| Class R2 Shares |

$ | 1,000.00 | $ | 1,021.27 | 0.77 | % | $ | 3.91 | ||||||||

| Institutional Class Shares |

$ | 1,000.00 | $ | 1,022.52 | 0.52 | % | $ | 2.64 | ||||||||

| Emerging Markets Core Equity Portfolio |

||||||||||||||||

| Actual Fund Return |

$ | 1,000.00 | $ | 1,196.90 | 0.49 | % | $ | 2.71 | ||||||||

| Hypothetical 5% Annual Return |

$ | 1,000.00 | $ | 1,022.67 | 0.49 | % | $ | 2.49 | ||||||||

| Emerging Markets Targeted Value Portfolio |

||||||||||||||||

| Actual Fund Return |

$ | 1,000.00 | $ | 1,191.40 | 0.84 | % | $ | 4.63 | ||||||||

| Hypothetical 5% Annual Return |

$ | 1,000.00 | $ | 1,020.91 | 0.84 | % | $ | 4.27 | ||||||||

| (1) | Expenses are equal to the fund’s annualized expense ratio for the six-month period, multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period (184), then divided by the number of days in the year (366) to reflect the six-month period. |

30

DISCLOSURE OF FUND EXPENSES

CONTINUED

| (2) | The Portfolio is a Fund of Funds. The expenses shown reflect the direct expenses of the Fund of Funds and the Fund of Funds’ portion of the expenses of its Underlying Funds (Affiliated Investment Companies). |

| (3) | The Portfolio is a Feeder Fund. The expenses shown reflect the direct expenses of the Feeder Fund and the allocation of the Feeder Fund’s portion of the expenses of its Master Fund (Affiliated Investment Company). |

| (4) | The Portfolio invests directly and indirectly through other funds. The expenses shown reflect the direct expenses of the fund and the fund’s portion of the expenses of its Master and/or Underlying Funds (Affiliated Investment Companies). |

31

DFA INVESTMENT DIMENSIONS GROUP INC.

DISCLOSURE OF PORTFOLIO HOLDINGS

(Unaudited)

The SEC requires that all funds file a complete Schedule of Investments with the SEC for their first and third fiscal quarters as an exhibit to their reports on Form N-PORT. For DFA Investment Dimensions Group Inc., this would be for the fiscal quarters ending January 31 and July 31. Such Form N-PORT filing must be made within 60 days of the end of the quarter. DFA Investment Dimensions Group Inc. filed its most recent Form N-PORT with the SEC on September 29, 2020. They are available upon request,, without charge, by calling collect: (512) 306- 7400; by mailing a request to Dimensional Fund Advisors LP, 6300 Bee Cave Road, Building One, Austin, TX 78746; or by visiting the SEC’s website at http://www.sec.gov.

SEC regulations permit a fund to include in its reports to shareholders a “Summary Schedule of Portfolio Holdings” in lieu of a full Schedule of Investments. The Summary Schedule of Portfolio Holdings reports the fund’s 50 largest holdings in unaffiliated issuers and any investments that exceed one percent of the fund’s net assets at the end of the reporting period. The regulations also require that the Summary Schedule of Portfolio Holdings identify each category of investments that are held.

A fund is required to file a complete Schedule of Investments with the SEC on Form N-CSR within ten days after mailing the annual and semi-annual reports to shareholders. It will be available upon request, without charge, by calling collect: (512)306-7400; by mailing a request to Dimensional Fund Advisors LP, 6300 Bee Cave Road, Building One, Austin, TX 78746; or by visiting the SEC’s website at http://www.sec.gov.

PORTFOLIO HOLDINGS

The SEC requires that all funds present their categories of portfolio holdings in a table, chart, or graph format in their annual and semi-annual shareholder reports, whether or not a Schedule of Investments is used. The following table, which presents portfolio holdings as a percentage of total investments before short-term investments and collateral for loaned securities, is provided in compliance with this requirement. The categories shown below represent broad industry sectors. Each industry sector consists of one or more specific industry classifications.

The categories of industry classification for the Affiliated Investment Companies are represented in their Disclosures of Portfolio Holdings, which are included elsewhere in the report. Refer to the Schedule of Investments/Summary Schedule of Portfolio Holdings for each of the underlying Affiliated Investment Company’s holdings, which reflect the investments by category or country.

FEEDER FUNDS

| Affiliated Investment Companies | ||||

| Japanese Small Company Portfolio |

100.0 | % | ||

| Asia Pacific Small Company Portfolio |

100.0 | % | ||

| United Kingdom Small Company Portfolio |

100.0 | % | ||

| Continental Small Company Portfolio |

100.0 | % | ||

| Emerging Markets Portfolio |

100.0 | % | ||

| Emerging Markets Small Cap Portfolio |

100.0 | % | ||

| Emerging Markets Value Portfolio |

100.0 | % | ||

FUNDS OF FUNDS

| Affiliated Investment Companies | ||||

| Global Small Company Portfolio |

100.0 | % | ||

| International Small Company Portfolio |

100.0 | % | ||

| World ex U.S. Value Portfolio |

100.0 | % | ||

| World Core Equity Portfolio |

100.0 | % | ||

| Selectively Hedged Global Equity Portfolio |

100.0 | % | ||

32

DISCLOSURE OF PORTFOLIO HOLDINGS

CONTINUED

INTERNATIONAL EQUITY PORTFOLIOS

33

LARGE CAP INTERNATIONAL PORTFOLIO

SUMMARY SCHEDULE OF PORTFOLIO HOLDINGS

October 31, 2020

| Shares |

Value» |

Percentage |

||||||||||

| COMMON STOCKS — (95.9%) |

||||||||||||

| AUSTRALIA — (5.9%) |

||||||||||||

| BHP Group, Ltd. |

842,811 | $ | 20,203,550 | 0.4 | % | |||||||

| Commonwealth Bank of Australia |

470,347 | 22,836,066 | 0.5 | % | ||||||||

| CSL, Ltd. |

137,898 | 27,918,453 | 0.6 | % | ||||||||

| Other Securities |

212,542,899 | 4.5 | % | |||||||||

|

|

|

|

|

|||||||||

| TOTAL AUSTRALIA |

283,500,968 | 6.0 | % | |||||||||

|

|

|

|

|

|||||||||

| AUSTRIA — (0.1%) |

||||||||||||

| Other Securities |

4,826,219 | 0.1 | % | |||||||||

|

|

|

|

|

|||||||||

| BELGIUM — (0.9%) |

||||||||||||

| Anheuser-Busch InBev SA |

265,831 | 13,750,419 | 0.3 | % | ||||||||

| Other Securities |

27,813,601 | 0.6 | % | |||||||||

|

|

|

|

|

|||||||||

| TOTAL BELGIUM |

41,564,020 | 0.9 | % | |||||||||

|

|

|

|

|

|||||||||

| CANADA — (8.9%) |

||||||||||||

| Canadian National Railway Co. |

149,760 | 14,877,082 | 0.3 | % | ||||||||

| # Royal Bank of Canada |

335,579 | 23,465,090 | 0.5 | % | ||||||||

| Royal Bank of Canada |

216,240 | 15,134,638 | 0.3 | % | ||||||||

| Other Securities |

378,134,979 | 8.1 | % | |||||||||

|

|

|

|

|

|||||||||

| TOTAL CANADA |

431,611,789 | 9.2 | % | |||||||||

|

|

|

|

|

|||||||||

| DENMARK — (2.5%) |

||||||||||||

| Novo Nordisk A.S., Class B |

541,515 | 34,530,047 | 0.7 | % | ||||||||

| Other Securities |

86,377,814 | 1.9 | % | |||||||||

|

|

|

|

|

|||||||||

| TOTAL DENMARK |

120,907,861 | 2.6 | % | |||||||||

|

|

|

|

|

|||||||||

| FINLAND — (1.3%) |

||||||||||||

| Other Securities |

61,160,733 | 1.3 | % | |||||||||

|

|

|

|

|

|||||||||

| FRANCE — (9.0%) |

||||||||||||

| Air Liquide SA |

137,694 | 20,136,133 | 0.4 | % | ||||||||

| * Airbus SE |

183,285 | 13,410,237 | 0.3 | % | ||||||||