Free Writing Prospectus to Preliminary Terms No. 10,047

Registration Statement Nos. 333-250103; 333-250103-01

Dated August 31, 2023; Filed pursuant to Rule 433

Morgan Stanley

13-Month Worst-of NDX, RTY and INDU Enhanced Trigger Jump Securities

This document provides a summary of the terms of the securities. Investors must carefully review the accompanying preliminary terms referenced below, product supplement, index supplement and prospectus, and the “Risk Considerations” on the following page, prior to making an investment decision.

|

Terms |

||

|

Issuing Entity: |

Morgan Stanley Finance LLC |

|

|

Guarantor: |

Morgan Stanley |

|

|

Underlying indices: |

NASDAQ-100 Index® (NDX), Russell 2000® Index (RTY) and Dow Jones Industrial AverageSM (INDU) |

|

|

Upside payment: |

10.40% to 12.40% of the stated principal amount |

|

|

Downside threshold value: |

70% of the initial index value for each underlying index |

|

|

Pricing date: |

September 29, 2023 |

|

|

Valuation date: |

October 29, 2024 |

|

|

Maturity date: |

November 1, 2024 |

|

|

CUSIP: |

61775HF28 |

|

|

Preliminary Terms: |

https://www.sec.gov/Archives/edgar/data/895421/000183988223023085/ms10047_fwp-12369.htm |

|

1All payments are subject to our credit risk

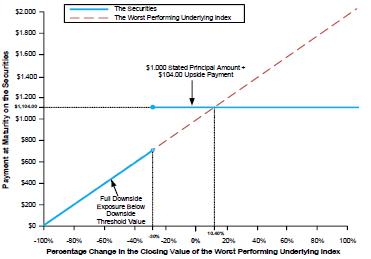

Hypothetical Payout at Maturity1

The payment at maturity will be based solely on the performance of the worst performing underlying index, which could be any underlying index. The graph and table below illustrate the payment at maturity depending on the performance of the worst performing underlying index.

|

Change in Worst Performing Underlying Index |

Return on Securities |

|

|

+70% |

10.40%* |

|

|

+60% |

10.40%* |

|

|

+50% |

10.40%* |

|

|

+40% |

10.40%* |

|

|

+30% |

10.40%* |

|

|

+20% |

10.40%* |

|

|

+10% |

10.40%* |

|

|

0% |

10.40%* |

|

|

-10% |

10.40%* |

|

|

-20% |

10.40%* |

|

|

-30% |

10.40%* |

|

|

-31% |

-31% |

|

|

-40% |

-40% |

|

|

-50% |

-50% |

|

|

-60% |

-60% |

|

|

-70% |

-70% |

|

|

-80% |

-80% |

|

|

-90% |

-90% |

|

|

-100% |

-100% |

|

|

*Assumes an upside payment of 10.40% of the stated principal amount |

||

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-584-6837.

Underlying Indices

For more information about the underlying indices, including historical performance information, see the accompanying preliminary terms.

Risk Considerations

The risks set forth below are discussed in more detail in the “Risk Factors” section in the accompanying preliminary terms. Please review those risk factors carefully prior to making an investment decision.

Risks Relating to an Investment in the Securities

●The securities do not pay interest or guarantee the return of any principal.

●Appreciation potential is fixed and limited.

●The amount payable on the securities is not linked to the values of the underlying indices at any time other than the valuation date.

●The securities will not be listed on any securities exchange and secondary trading may be limited.

●The market price of the securities may be influenced by many unpredictable factors.

●The securities are subject to our credit risk, and any actual or anticipated changes to our credit ratings or credit spreads may adversely affect the market value of the securities.

●As a finance subsidiary, MSFL has no independent operations and will have no independent assets.

●The estimated value of the securities is approximately $964.10 per security, or within $35.00 of that estimate, and is determined by reference to our pricing and valuation models, which may differ from those of other dealers and is not a maximum or minimum secondary market price.

●The rate we are willing to pay for securities of this type, maturity and issuance size is likely to be lower than the rate implied by our secondary market credit spreads and advantageous to us. Both the lower rate and the inclusion of costs associated with issuing, selling, structuring and hedging the securities in the original issue price reduce the economic terms of the securities, cause the estimated value of the securities to be less than the original issue price and will adversely affect secondary market prices.

●Investing in the securities is not equivalent to investing in the underlying indices.

●The calculation agent, which is a subsidiary of Morgan Stanley and an affiliate of MSFL, will make determinations with respect to the securities.

●Hedging and trading activity by our affiliates could potentially adversely affect the value of the securities.

●The U.S. federal income tax consequences of an investment in the securities are uncertain.

Risks Relating to the Underlying Indices

●You are exposed to the price risk of each underlying index.

●Because the securities are linked to the performance of the worst performing underlying index, you are exposed to greater risk of sustaining a significant loss on your investment than if the securities were linked to just one underlying index.

●The securities are linked to the Russell 2000® Index and are subject to risks associated with small-capitalization companies.

●Adjustments to the underlying indices could adversely affect the value of the securities.

Tax Considerations

You should review carefully the discussion in the accompanying preliminary terms under the caption “Additional Information About the Securities–Tax considerations” concerning the U.S. federal income tax consequences of an investment in the securities, and you should consult your tax adviser.