Exhibit 99.1

|

Media Relations: Jeanmarie McFadden 212-761-2433

|

Investor Relations: Celeste Mellet Brown 212-761-3896

|

Morgan Stanley Reports Fourth Quarter and Full Year 2012:

|

|

·

|

Fourth Quarter Net Revenues of $7.0 Billion Included the Negative Impact of $511 Million from the Tightening of Morgan Stanley’s Debt-Related Credit Spreads (DVA);1 Income from Continuing Operations of $0.28 per Diluted Share

|

|

|

·

|

Excluding DVA, Fourth Quarter Net Revenues were $7.5 Billion and Income from Continuing Operations was $0.45 per Diluted Share2, 3

|

|

|

·

|

Fourth Quarter Global Wealth Management Pre-Tax Margin of 17%, Highest Since the Inception of the Joint Venture; Investment Banking Ranked #1 in Global IPOs and #2 in Global Announced M&A and Global Equity;4 Solid Results in Equity Sales and Trading

|

|

|

·

|

Full Year Net Revenues of $26.1 Billion Included the Negative Impact of $4.4 Billion from DVA; Loss from Continuing Operations of $0.03 per Diluted Share; Excluding DVA, Net Revenues were $30.5 Billion and Income from Continuing Operations was $1.59 per Diluted Share2, 3

|

NEW YORK, January 18, 2013 – Morgan Stanley (NYSE: MS) today reported net revenues of $7.0 billion for the fourth quarter ended December 31, 2012 compared with $5.7 billion a year ago. For the current quarter, income from continuing operations applicable to Morgan Stanley was $573 million, or $0.28 per diluted share,5 which included a net tax benefit of approximately $155 million,6 or $0.08 per diluted share, compared with a loss of $222 million, or a loss of $0.13 per diluted share,5 for the same period a year ago. The prior year fourth quarter included a pre-tax loss of approximately $1.7 billion, or a loss of $0.58 per diluted share, related to the comprehensive settlement with MBIA Insurance Corporation (MBIA).

Results for the current quarter included negative revenue of $511 million compared with positive revenue of $216 million a year ago related to changes in Morgan Stanley’s debt-related credit spreads and other credit factors (Debt Valuation Adjustment, DVA).1

Excluding DVA, net revenues for the current quarter were $7.5 billion compared with $5.5 billion a year ago and income from continuing operations applicable to Morgan Stanley was $894 million, or $0.45 per diluted share, compared with a loss of $349 million, or $0.20 loss per diluted share a year ago.3, 5, 7

Compensation expense of $3.6 billion in the current quarter declined from $3.8 billion a year ago. Non-compensation expenses of $2.5 billion increased from $2.3 billion a year ago.

For the current quarter, net income applicable to Morgan Stanley, including discontinued operations, was $0.25 per diluted share, compared with a net loss of $0.15 per diluted share in the fourth quarter of 2011. Discontinued operations in the current quarter includes a provision of approximately $115 million related to a settlement with the Federal Reserve Board concerning the independent foreclosure review related to Saxon.8

1

|

Summary of Firm Results

(dollars in millions)

|

||||||

|

As Reported

|

Excluding DVA (2), (3)

|

|||||

|

Net

|

MS Earnings

|

Net

|

MS Earnings

|

|||

|

Revenues

|

Cont. Ops. (1)

|

Revenues

|

Cont. Ops. (1)

|

|||

|

4Q 2012

|

$6,966

|

$547

|

$7,477

|

$867

|

||

|

3Q 2012

|

$5,280

|

$(1,032)

|

$7,542

|

$534

|

||

|

4Q 2011

|

$5,675

|

$(247)

|

$5,459

|

$(374)

|

||

|

(1)

|

Represents income (loss) from continuing operations applicable to Morgan Stanley common shareholders less preferred dividends.

|

|

(2)

|

Net revenues for 4Q 2012, 3Q 2012 and 4Q 2011 exclude positive (negative) revenue from DVA of $(511) million, $(2,262) million and $216 million, respectively.

|

|

(3)

|

Earnings / (loss) from continuing operations applicable to Morgan Stanley common shareholders for 4Q 2012, 3Q 2012 and 4Q 2011 excludes after-tax DVA impact of $(321) million, $(1,568) million and $127 million, respectively, and includes a related allocation of earnings to Participating Restricted Stock Units of $1 million, $2 million and $0 million, respectively.

|

Fourth Quarter Business Overview

|

|

·

|

Global Wealth Management Group net revenues were $3.5 billion and pre-tax margin was 17%.9 Average annualized revenue per global representative was $824,000, highest since the inception of the Joint Venture.

|

|

|

·

|

Institutional Securities net revenues excluding DVA were $3.5 billion reflecting strong performance in Investment Banking, solid results in Equity sales and trading and a decline in Fixed Income & Commodities sales and trading.

|

|

|

·

|

Asset Management reported net revenues of $599 million with assets under management or supervision of $338 billion.

|

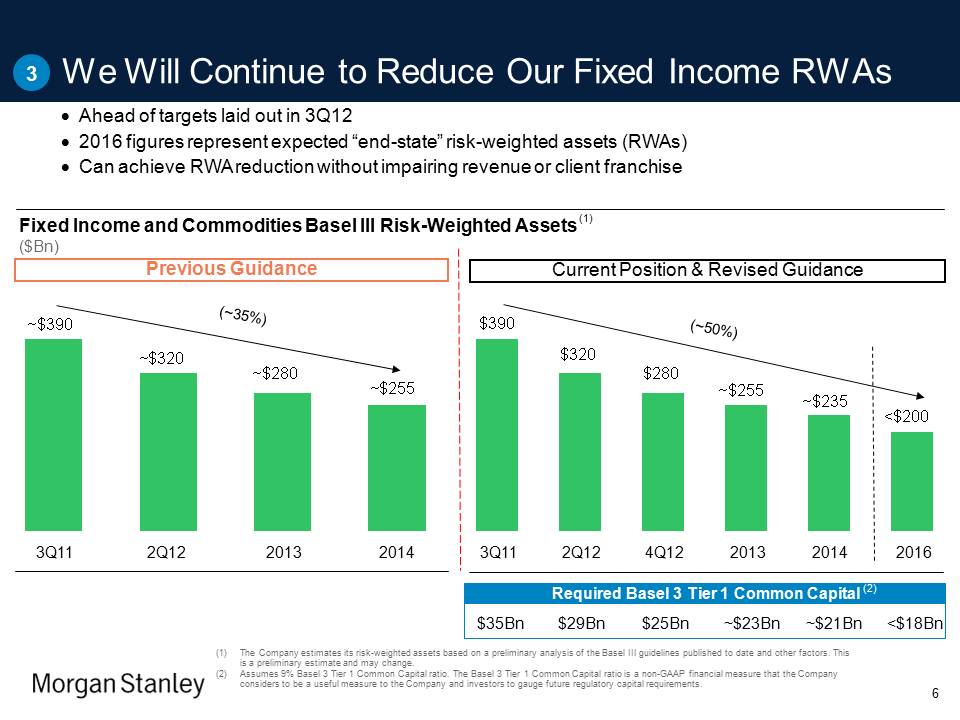

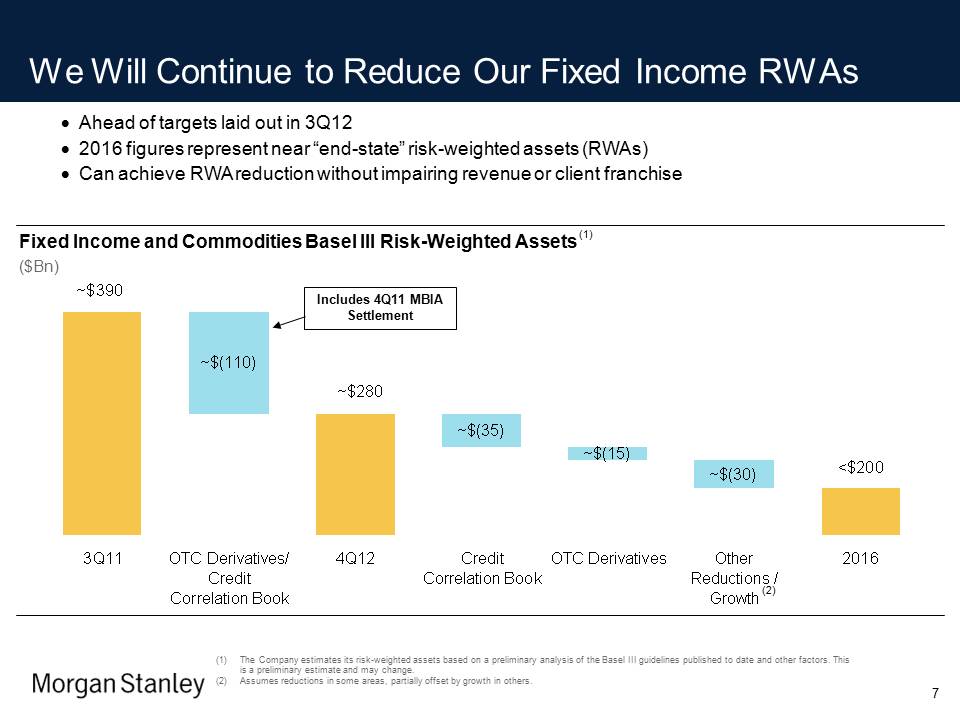

James P. Gorman, Chairman and Chief Executive Officer, said, “After a year of significant challenges, Morgan Stanley has reached a pivot point. We demonstrated meaningful progress in our Wealth Management Joint Venture, reaching the highest pre-tax margin since the inception of the JV. We charted a path to acquire the remainder of the JV. We are ahead of our risk weighted asset reduction targets for Fixed Income and Commodities, while continuing to focus on our strengths within business and strategic linkages across the Firm and investing for the evolving regulatory environment. We continued to demonstrate leadership in Investment Banking and Equity sales and trading. Our Firm is now poised to reach the returns of which it is capable on behalf of our shareholders.”

2

FOURTH QUARTER RESULTS

|

Summary of Institutional Securities Results

(dollars in millions)

|

||||||

|

As Reported

|

Excluding DVA (1)

|

|||||

|

Net

|

Pre-Tax

|

Net

|

Pre-Tax

|

|||

|

Revenues

|

Income

|

Revenues

|

Income

|

|||

|

4Q 2012

|

$2,951

|

$57

|

$3,462

|

$568

|

||

|

3Q 2012

|

$1,367

|

$(1,920)

|

$3,629

|

$342

|

||

|

4Q 2011

|

$2,068

|

$(772)

|

$1,852

|

$(988)

|

||

|

(1)

|

Net revenues and pre-tax income for 4Q 2012, 3Q 2012 and 4Q 2011 exclude positive (negative) revenue from DVA of $(511) million, $(2,262) million and $216 million, respectively.

|

INSTITUTIONAL SECURITIES

Institutional Securities reported a pre-tax gain from continuing operations of $57 million compared with a pre-tax loss of $772 million in the fourth quarter of last year. Net revenues for the current quarter were $3.0 billion compared with $2.1 billion, inclusive of MBIA, a year ago. DVA resulted in negative revenue of $511 million in the current quarter compared with positive revenue of $216 million a year ago. Excluding DVA, net revenues for the current quarter were $3.5 billion compared with $1.9 billion a year ago. The following discussion for sales and trading excludes DVA.

|

·

|

Advisory revenues were $454 million compared with $406 million a year ago reflecting higher levels of market activity. Equity underwriting revenues were $237 million compared with $189 million a year ago reflecting higher market volume. Fixed income underwriting revenues were $534 million, our highest reported quarter, compared with $288 million a year ago.

|

|

·

|

Fixed Income & Commodities sales and trading net revenues were $811 million compared with losses of $493 million a year ago. Fixed Income, after considering the impact of MBIA, reflected a decline in rates, partly offset by relative improvement in credit products. Commodities results declined meaningfully in a challenging market.10

|

|

·

|

Equity sales and trading net revenues of $1.3 billion were essentially unchanged from the prior year quarter, although stronger performances were noted in the derivatives and prime brokerage businesses.10

|

|

·

|

Compensation expense for the current quarter was $1.5 billion compared with $1.6 billion in the prior year quarter. Non-compensation expenses of $1.4 billion increased from $1.3 billion a year ago.

|

|

·

|

Morgan Stanley’s average trading Value-at-Risk (VaR) measured at the 95% confidence level was $78 million compared with $63 million in the third quarter of 2012 and $105 million in the fourth quarter of the prior year.11

|

3

|

Summary of Global Wealth Management Group Results

(dollars in millions)

|

|||

|

Net

|

Pre-Tax

|

||

|

Revenues

|

Income (1)

|

||

|

4Q 2012

|

$3,461

|

$581

|

|

|

3Q 2012

|

$3,336

|

$239

|

|

|

4Q 2011

|

$3,219

|

$238

|

|

|

(1)

|

3Q 2012 pre-tax income includes $193 million of non-recurring costs associated with the Morgan Stanley Wealth Management (MSWM) integration and purchase of an additional 14% stake in the Joint Venture.

|

GLOBAL WEALTH MANAGEMENT GROUP

Global Wealth Management Group reported pre-tax income from continuing operations of $581 million compared with $238 million in the fourth quarter of last year. The quarter’s pre-tax margin was 17%.9 Net revenues for the current quarter were $3.5 billion compared with $3.2 billion a year ago. Income after the noncontrolling interest allocation to Citigroup Inc. (Citi) and before taxes was $474 million.12

|

·

|

Asset management fee revenues of $1.9 billion increased 16% from last year’s fourth quarter primarily reflecting an increase in fee based assets and positive flows.

|

|

·

|

Transactional revenues13 of $1.1 billion decreased 3% from a year ago reflecting reduced commissions and fees and a decrease in principal trading revenues driven by lower gains from investments associated with the Firm’s deferred compensation and co-investment plans, offset by higher investment banking revenues.

|

|

·

|

Compensation expense for the current quarter was $2.0 billion compared with $2.1 billion a year ago. Non-compensation expenses were $901 million compared with $922 million a year ago.

|

|

·

|

Total client assets were $1.8 trillion at quarter end. Client assets in fee based accounts were $573 billion, or 32% of total client assets. Global fee based asset flows for the quarter were $3.7 billion.

|

|

·

|

Global representatives of 16,780 were relatively unchanged from the prior quarter. Average annualized revenue per global representative of $824,000 and total client assets per global representative of $106 million increased 13% and 14%, respectively, compared with the prior year quarter.

|

|

Summary of Asset Management Results

(dollars in millions)

|

|||

|

Net

|

Pre-Tax

|

||

|

Revenues

|

Income

|

||

|

4Q 2012

|

$599

|

$221

|

|

|

3Q 2012

|

$631

|

$198

|

|

|

4Q 2011

|

$424

|

$78

|

|

ASSET MANAGEMENT

Asset Management reported pre-tax income from continuing operations of $221 million compared with pre-tax income of $78 million in last year’s fourth quarter.14 The quarter’s pre-tax margin was 37%.9 Income after the noncontrolling interest allocation and before taxes was $172 million.

|

·

|

Net revenues of $599 million increased from $424 million in last year’s fourth quarter primarily reflecting higher results in the Traditional Asset Management business and gains on principal investments in the Merchant Banking and Real Estate Investing businesses.15

|

4

|

·

|

Compensation expense for the current quarter was $168 million compared with $183 million a year ago. Non-compensation expenses of $210 million increased from $163 million a year ago on higher brokerage and clearing expenses.

|

|

·

|

Assets under management or supervision at December 31, 2012 of $338 billion increased 18% from the prior year. The increase primarily reflected positive net customer flows in Morgan Stanley’s liquidity funds and market appreciation.

|

FULL YEAR RESULTS

Full year net revenues were $26.1 billion compared with $32.2 billion a year ago. Income from continuing operations applicable to Morgan Stanley for the current year was $48 million, or a loss of $0.03 per diluted share,5 compared with income of $4.2 billion, or $1.26 per diluted share,5 a year ago. Results for the current year included a net tax benefit of approximately $73 million or $0.04 per diluted share.6 The Firm’s prior year earnings reflected the impact of several key actions executed in connection with strategic and other matters.16

Results for the year included negative revenue of $4.4 billion compared with positive revenue of $3.7 billion a year ago related to DVA. Excluding DVA, net revenues for the current year were $30.5 billion compared with $28.6 billion in 2011 and income from continuing operations applicable to Morgan Stanley was $3.2 billion, or $1.59 per diluted share, compared with income of $1.9 billion, or a loss of $0.08 per diluted share a year ago.3,5,7

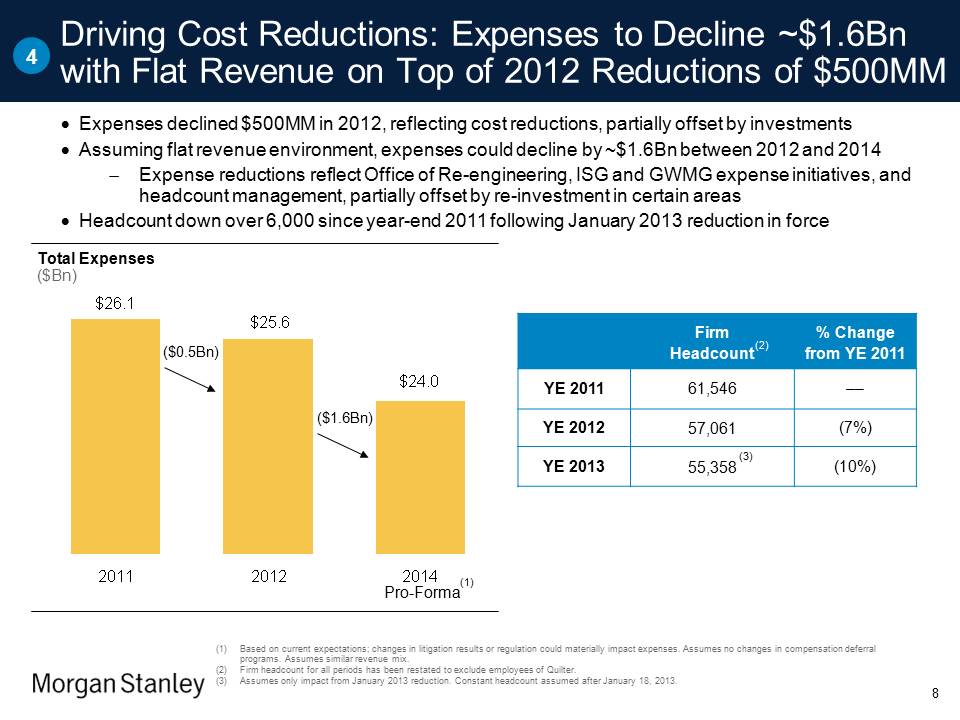

The Firm’s compensation expense of $15.6 billion for the current year decreased from $16.3 billion a year ago. Non-compensation expenses of $10.0 billion increased from $9.8 billion a year ago.

For the current year, the net loss applicable to Morgan Stanley, including discontinued operations, was $0.06 per diluted share, compared with net income of $1.23 per diluted share a year ago.8

|

Summary of Firm Results

(dollars in millions)

|

||||||

|

As Reported

|

Excluding DVA (2), (3)

|

|||||

|

Net

|

MS Earnings

|

Net

|

MS Earnings

|

|||

|

Revenues

|

Cont. Ops. (1)

|

Revenues

|

Cont. Ops. (1)

|

|||

|

FY 2012

|

$26,112

|

$(50)

|

$30,514

|

$3,055

|

||

|

FY 2011

|

$32,236

|

$2,117

|

$28,555

|

$(136)

|

||

|

(1)

|

Represents income (loss) from continuing operations applicable to Morgan Stanley common shareholders less preferred dividends and a one-time negative adjustment of $1.7 billion in FY 2011 related to the conversion of the Firm’s Series B Preferred Stock held by Mitsubishi UFJ Financial Group, Inc. (MUFG) into common stock.

|

|

(2)

|

Net revenues for FY 2012 and FY 2011 exclude positive (negative) revenue from DVA of $(4,402) million and $3,681 million, respectively.

|

|

(3)

|

Earnings / (loss) from continuing operations applicable to Morgan Stanley common shareholders for FY 2012 and FY 2011 excludes after-tax DVA impact of $(3,118) million and $2,275 million, respectively, and includes a related allocation of earnings to Participating Restricted Stock Units of $13 million and $(22) million, respectively.

|

5

|

Summary of Segments Results

(dollars in millions)

|

||||||||||

|

As Reported

|

Excluding DVA (1)

|

|||||||||

|

Net Revenues

|

Pre-Tax Income

|

Net Revenues

|

Pre-Tax Income

|

|||||||

|

FY 2012

|

FY 2011

|

FY 2012

|

FY 2011

|

FY 2012

|

FY 2011

|

FY 2012

|

FY 2011

|

|||

|

Institutional Securities

|

$10,553

|

$17,175

|

$(1,671)

|

$4,591

|

$14,955

|

$13,494

|

$2,731

|

$910

|

||

|

Global Wealth Management

|

$13,516

|

$13,289

|

$1,600

|

$1,255

|

$13,516

|

$13,289

|

$1,600

|

$1,255

|

||

|

Asset Management

|

$2,219

|

$1,887

|

$590

|

$253

|

$2,219

|

$1,887

|

$590

|

$253

|

||

|

(1)

|

Institutional Securities net revenues and pre-tax income for FY 2012 and FY 2011 exclude positive (negative) revenue from DVA of $(4,402) million and $3,681 million, respectively.

|

INSTITUTIONAL SECURITIES

Institutional Securities reported a pre-tax loss from continuing operations of $1.7 billion compared with pre-tax income of $4.6 billion in 2011. Net revenues for the current year were $10.6 billion compared with $17.2 billion, inclusive of MBIA, a year ago. DVA resulted in negative revenue of $4.4 billion in the current year compared with positive revenue of $3.7 billion a year ago. Excluding DVA, net revenues for the current year were $15.0 billion compared with $13.5 billion a year ago. Compensation expense was $6.7 billion compared with $7.2 billion a year ago. Non-compensation expenses of $5.6 billion increased from $5.4 billion a year ago primarily due to increased litigation costs.

GLOBAL WEALTH MANAGEMENT GROUP

Global Wealth Management Group reported pre-tax income from continuing operations of $1.6 billion compared with $1.3 billion a year ago. Net revenues for the current year were $13.5 billion compared with $13.3 billion a year ago. The year’s pre-tax margin was 12%.9 Income after the noncontrolling interest allocation to Citi and before taxes was $1.3 billion.12 Compensation expense was $8.1 billion compared with $8.3 billion a year ago. Non-compensation expenses of $3.8 billion increased from $3.7 billion a year ago reflecting non-recurring costs of approximately $176 million primarily associated with the MSWM integration.

ASSET MANAGEMENT

Asset Management reported pre-tax income from continuing operations of $590 million compared with $253 million a year ago.14 The year’s reported pre-tax margin was 27%.9 Income after the noncontrolling interest allocation and before taxes was $403 million. Net revenues of $2.2 billion increased from $1.9 billion a year ago primarily reflecting higher results in the Traditional Asset Management business and gains on principal investments in the Merchant Banking and Real Estate Investing businesses.15 Compensation expense of $841 million and non-compensation expenses of $788 million were essentially unchanged from a year ago.

6

CAPITAL

Morgan Stanley’s Tier 1 capital ratio under Basel I was approximately 17.9% and Tier 1 common ratio was approximately 14.7% at December 31, 2012.17

At December 31, 2012, book value and tangible book value per common share were $30.65 and $26.81,18 respectively, based on approximately 2.0 billion shares outstanding.

OTHER MATTERS

The effective tax rate from continuing operations for the current quarter was 11.1%. The current quarter includes a net tax benefit of approximately $155 million consisting of a discrete benefit from remeasurement of reserves and an out of period tax provision to adjust previously recorded deferred tax assets.6

The Firm declared a $0.05 quarterly dividend per common share. The dividend is payable on February 15, 2013 to common shareholders of record on February 5, 2013.

Morgan Stanley is a leading global financial services firm providing a wide range of investment banking, securities, investment management and wealth management services. The Firm’s employees serve clients worldwide including corporations, governments, institutions and individuals from more than 1,200 offices in 43 countries. For further information about Morgan Stanley, please visit www.morganstanley.com.

A financial summary follows. Financial, statistical and business-related information, as well as information regarding business and segment trends, is included in the Financial Supplement. Both the earnings release and the Financial Supplement are available online in the Investor Relations section at www.morganstanley.com.

# # #

(See Attached Schedules)

The information above contains forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management's current estimates, projections, expectations or beliefs and which are subject to risks and uncertainties that may cause actual results to differ materially. For a discussion of additional risks and uncertainties that may affect the future results of the Company, please see “Forward-Looking Statements” immediately preceding Part I, Item 1, “Competition” and “Supervision and Regulation” in Part I, Item 1, “Risk Factors” in Part I, Item 1A, “Legal Proceedings” in Part I, Item 3, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 and “Quantitative and Qualitative Disclosures about Market Risk” in Part II, Item 7A, each of the Company's Annual Report on Form 10-K for the year ended December 31, 2011 and other items throughout the Form 10-K, the Company’s Quarterly Reports on Form 10-Q, including “Risk Factors” in Part II, Item 1A therein, and the Company’s Current Reports on Form 8-K, including any amendments thereto.

7

1 Represents the change in the fair value of certain of Morgan Stanley’s long-term and short-term borrowings resulting from fluctuations in its credit spreads and other credit factors (commonly referred to as “DVA”).

2 From time to time, Morgan Stanley may disclose certain “non-GAAP financial measures” in the course of its earnings releases, earnings conference calls, financial presentations and otherwise. For these purposes, “GAAP” refers to generally accepted accounting principles in the United States. The Securities and Exchange Commission (SEC) defines a “non-GAAP financial measure” as a numerical measure of historical or future financial performance, financial positions, or cash flows that is subject to adjustments that effectively exclude, or include amounts from the most directly comparable measure calculated and presented in accordance with GAAP. Non-GAAP financial measures disclosed by Morgan Stanley are provided as additional information to investors in order to provide them with greater transparency about, or an alternative method for assessing our financial condition and operating results. These measures are not in accordance with, or a substitute for, GAAP, and may be different from or inconsistent with non-GAAP financial measures used by other companies. Whenever we refer to a non-GAAP financial measure, we will also generally present the most directly comparable financial measure calculated and presented in accordance with GAAP, along with a reconciliation of the differences between the non-GAAP financial measure we reference with such comparable GAAP financial measure.

3 Income (loss) per diluted share amounts, excluding DVA, are non-GAAP financial measures that the Firm considers useful for investors to allow better comparability of period to period operating performance. Such exclusions are provided to differentiate revenues associated with Morgan Stanley borrowings, regardless of whether the impact is either positive, or negative, that result solely from fluctuations in credit spreads and other credit factors. The reconciliation of income (loss) per diluted share from continuing operations applicable to Morgan Stanley common shareholders and average diluted shares from a non-GAAP to GAAP basis is as follows (shares and DVA are presented in millions):

|

4Q 2012

|

4Q 2011

|

FY 2012

|

FY 2011

|

|

|

Income (loss) per diluted share applicable to MS – Non-GAAP

|

$0.45

|

$(0.20)

|

$1.59

|

$(0.08)

|

|

DVA impact

|

$(0.17)

|

$0.07

|

$(1.62)

|

$1.34

|

|

Income (loss) per diluted share applicable to MS – GAAP

|

$0.28

|

$(0.13)

|

$(0.03)

|

$1.26

|

|

Average diluted shares – Non-GAAP

|

1,937

|

1,850

|

1,919

|

1,655

|

|

DVA impact

|

0

|

0

|

(33)

|

20

|

|

Average diluted shares – GAAP

|

1,937

|

1,850

|

1,886

|

1,675

|

4 Source: Thomson Reuters – for the period of January 1, 2012 to December 31, 2012 as of January 3, 2013.

5 Includes preferred dividends and other adjustments related to the calculation of earnings per share for the fourth quarter of 2012 and 2011 of approximately $26 million and $25 million, respectively. Includes preferred dividends and other adjustments related to the calculation of earnings per share for the year ended 2012 and 2011 of approximately $98 million and $2.0 billion, respectively. Refer to page 3 of Morgan Stanley’s Financial Supplement accompanying this release for the calculation of earnings per share.

6 For the quarter ended December 31, 2012, the Firm recognized, in income from continuing operations, a net tax benefit of approximately $155 million. This included a discrete benefit of approximately $299 million related to the remeasurement of reserves due to either the expiration of the applicable statute of limitations, or new information regarding the status of certain Internal Revenue Service examinations. The Firm also recognized, in the quarter ended December 31, 2012, an out of period net tax provision of approximately $144 million, principally in the Asset Management business segment, primarily related to the overstatement of deferred tax assets associated with partnership investments in prior periods. For the full year ended December 31, 2012, the Firm recognized, in income from continuing operations, the discrete tax benefit noted above and an out of period net tax provision of approximately $226 million to adjust previously recorded deferred tax assets. The Firm has evaluated the effects of the understatement of the income tax provision both qualitatively and quantitatively and concluded that it did not have a material impact on any prior annual or quarterly consolidated results. A comprehensive review of the Firm’s deferred tax accounts continues, and as such, the net tax provisions noted above could be subject to revision.

8

7 Income (loss) applicable to Morgan Stanley, excluding DVA, is a non-GAAP financial measure that the Firm considers useful for investors to allow for better comparability of period-to-period operating performance. The reconciliation of income (loss) from continuing operations applicable to Morgan Stanley from a non-GAAP to GAAP basis is as follows (amounts are presented in millions):

|

4Q 2012

|

3Q 2012

|

4Q 2011

|

FY 2012

|

FY 2011

|

|

|

Income (loss) applicable to MS – Non-GAAP

|

$894

|

$560

|

$(349)

|

$3,166

|

$1,886

|

|

DVA after-tax impact

|

$(321)

|

$(1,568)

|

$127

|

$(3,118)

|

$2,275

|

|

Income (loss) applicable to MS – GAAP

|

$573

|

$(1,008)

|

$(222)

|

$48

|

$4,161

|

8 Discontinued operations for the current year primarily reflected an after-tax gain and other operating income related to Quilter Holdings Ltd. (reported in the Global Wealth Management business segment), and an after-tax loss and operating results related to Saxon (reported in the Institutional Securities business segment), which includes the fourth quarter provision of approximately $115 million related to a settlement with the Federal Reserve Board concerning the independent foreclosure review related to Saxon. The independent foreclosure review was one of the requirements imposed by the April 2, 2012 Consent Order that the Firm entered into with the Federal Reserve Board. The other requirements of the Consent Order are not impacted by the settlement and the settlement does not include civil money penalties which may be imposed by the Federal Reserve Board.

9 Pre-tax margin is a non-GAAP financial measure that the Firm considers useful for investors to assess operating performance. Pre-tax margin represents income (loss) from continuing operations before taxes, divided by net revenues.

10 Sales and trading net revenues, including Fixed Income & Commodities (FIC) and Equity sales and trading net revenues excluding DVA, are non-GAAP financial measures that the Firm considers useful for investors to allow better comparability of period-to-period operating performance. The reconciliation of sales and trading, including FIC and Equity sales and trading net revenues from a non-GAAP to GAAP basis is as follows (amounts are presented in millions):

|

4Q 2012

|

4Q 2011

|

FY 2012

|

FY 2011

|

|

|

Sales & Trading – Non-GAAP

|

$2,047

|

$867

|

$10,612

|

$9,268

|

|

DVA impact

|

$(511)

|

$216

|

$(4,402)

|

$3,681

|

|

Sales & Trading – GAAP

|

$1,536

|

$1,083

|

$6,210

|

$12,949

|

|

FIC Sales & Trading – Non-GAAP

|

$811

|

$(493)

|

$5,631

|

$4,444

|

|

DVA impact

|

$(330)

|

$239

|

$(3,273)

|

$3,062

|

|

FIC Sales & Trading – GAAP

|

$481

|

$(254)

|

$2,358

|

$7,506

|

|

Equity Sales & Trading – Non-GAAP

|

$1,271

|

$1,277

|

$5,477

|

$6,151

|

|

DVA impact

|

$(181)

|

$(23)

|

$(1,130)

|

$619

|

|

Equity Sales & Trading – GAAP

|

$1,090

|

$1,254

|

$4,347

|

$6,770

|

11 VaR represents the loss amount that one would not expect to exceed, on average, more than five times every one hundred trading days in the Firm's trading positions if the portfolio were held constant for a one-day period. Further discussion of the calculation of VaR and the limitations of the Firm's VaR methodology will be disclosed in Part II, Item 7A “Quantitative and Qualitative Disclosures about Market Risk” included in Morgan Stanley’s Annual Report on Form 10-K for the year ended December 31, 2012. Refer to page 8 of Morgan Stanley’s Financial Supplement accompanying this release for the VaR disclosure.

9

12 During the quarter ended September 30, 2012, Morgan Stanley completed the purchase of an additional 14% stake in the Joint Venture from Citi, increasing the Firm’s interest from 51% to 65%. Prior to September 17, 2012, Citi’s results related to its 49% interest were reported in net income (loss) applicable to nonredeemable noncontrolling interests on page 10 of Morgan Stanley’s Financial Supplement accompanying this release. Due to the terms of the revised agreement with Citi, subsequent to the purchase of the additional 14% stake, Citi’s results related to the 35% interest are reported in net income (loss) applicable to redeemable noncontrolling interests on page 10 of Morgan Stanley’s Financial Supplement accompanying this release.

13 Transactional revenues include investment banking, principal transactions - trading and commissions and fee revenues.

14 Results for the fourth quarter of 2012 and 2011 included pre-tax income of $49 million and $44 million, respectively, related to principal investments held by certain consolidated real estate funds. Results for the full year ended 2012 and 2011 included pre-tax income of $185 million and $145 million, respectively, related to principal investments held by certain consolidated real estate funds. The limited partnership interests in these funds are reported in net income (loss) applicable to noncontrolling interests on page 12 of Morgan Stanley’s Financial Supplement accompanying this release.

15 Results for the current quarter included gains of $50 million compared with gains of $45 million in the prior year quarter related to principal investments held by certain consolidated real estate funds. Results for the current year included gains of $192 million compared with gains of $169 million in the prior year related to principal investments held by certain consolidated real estate funds.

16 Morgan Stanley executed several key strategic actions in 2011 which affected earnings including the conversion of the Firm’s Series B Preferred Stock held by MUFG into common stock which resulted in a negative adjustment to earnings per share of approximately $1.7 billion, a pre-tax loss of approximately $1.7 billion related to MBIA and the restructuring of the sale of Revel Entertainment Group, LLC (Revel) which resulted in a discrete net tax benefit of $447 million. Also impacting the Firm’s 2011 earnings was a pre-tax loss of approximately $783 million arising from the Firm’s 40% stake in a Japanese securities joint venture (Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. or MUMSS) controlled and managed by our partner, MUFG.

17 The Firm calculates its Tier 1 capital ratio and risk-weighted assets in accordance with the capital adequacy standards for financial holding companies adopted by the Federal Reserve Board. These standards are based upon a framework described in the International Convergence of Capital Measurement and Capital Standards, July 1988, as amended, also referred to as Basel I. In accordance with the Federal Reserve Board’s definition, Tier 1 common capital is defined as Tier 1 capital less non-common elements in Tier 1 capital, including perpetual preferred stock and related surplus, minority interest in subsidiaries, trust preferred securities and mandatory convertible preferred securities. These computations are preliminary estimates as of January 18, 2013 (the date of this release) and could be subject to revision in Morgan Stanley’s Annual Report on Form 10-K for the year ended December 31, 2012.

18 Tangible common equity and tangible book value per common share are non-GAAP financial measures that the Firm considers to be useful measures of capital adequacy. Tangible common equity equals common equity less goodwill and intangible assets net of allowable mortgage servicing rights deduction and includes only the Firm’s share of the Joint Venture’s goodwill and intangible assets. Tangible book value per common share equals tangible common equity divided by period end common shares outstanding.

10

|

MORGAN STANLEY

|

|

Quarterly Financial Summary

|

|

(unaudited, dollars in millions)

|

|

Quarter Ended

|

Percentage Change From:

|

Twelve Months Ended

|

Percentage

|

|||||||||||||||||||||||||||||

|

Dec 31, 2012

|

Sept 30, 2012

|

Dec 31, 2011

|

Sept 30, 2012

|

Dec 31, 2011

|

Dec 31, 2012

|

Dec 31, 2011

|

Change

|

|||||||||||||||||||||||||

|

Net revenues

|

||||||||||||||||||||||||||||||||

|

Institutional Securities

|

$ | 2,951 | $ | 1,367 | $ | 2,068 | 116 | % | 43 | % | $ | 10,553 | $ | 17,175 | (39 | %) | ||||||||||||||||

|

Global Wealth Management Group

|

3,461 | 3,336 | 3,219 | 4 | % | 8 | % | 13,516 | 13,289 | 2 | % | |||||||||||||||||||||

|

Asset Management

|

599 | 631 | 424 | (5 | %) | 41 | % | 2,219 | 1,887 | 18 | % | |||||||||||||||||||||

|

Intersegment Eliminations

|

(45 | ) | (54 | ) | (36 | ) | 17 | % | (25 | %) | (176 | ) | (115 | ) | (53 | %) | ||||||||||||||||

|

Consolidated net revenues

|

$ | 6,966 | $ | 5,280 | $ | 5,675 | 32 | % | 23 | % | $ | 26,112 | $ | 32,236 | (19 | %) | ||||||||||||||||

|

Income (loss) from continuing operations before tax

|

||||||||||||||||||||||||||||||||

|

Institutional Securities

|

$ | 57 | $ | (1,920 | ) | $ | (772 | ) | * | * | $ | (1,671 | ) | $ | 4,591 | * | ||||||||||||||||

|

Global Wealth Management Group

|

581 | 239 | 238 | 143 | % | 144 | % | 1,600 | 1,255 | 27 | % | |||||||||||||||||||||

|

Asset Management

|

221 | 198 | 78 | 12 | % | 183 | % | 590 | 253 | 133 | % | |||||||||||||||||||||

|

Intersegment Eliminations

|

0 | 0 | 0 | -- | -- | (4 | ) | 0 | * | |||||||||||||||||||||||

|

Consolidated income (loss) from continuing operations before tax

|

$ | 859 | $ | (1,483 | ) | $ | (456 | ) | * | * | $ | 515 | $ | 6,099 | (92 | %) | ||||||||||||||||

|

Income (loss) applicable to Morgan Stanley

|

||||||||||||||||||||||||||||||||

|

Institutional Securities

|

$ | 353 | $ | (1,269 | ) | $ | (359 | ) | * | * | $ | (833 | ) | $ | 3,468 | * | ||||||||||||||||

|

Global Wealth Management Group

|

277 | 157 | 131 | 76 | % | 111 | % | 799 | 658 | 21 | % | |||||||||||||||||||||

|

Asset Management

|

(57 | ) | 104 | 6 | * | * | 86 | 35 | 146 | % | ||||||||||||||||||||||

|

Intersegment Eliminations

|

0 | 0 | 0 | -- | -- | (4 | ) | 0 | * | |||||||||||||||||||||||

|

Consolidated income (loss) applicable to Morgan Stanley

|

$ | 573 | $ | (1,008 | ) | $ | (222 | ) | * | * | $ | 48 | $ | 4,161 | (99 | %) | ||||||||||||||||

|

Earnings (loss) applicable to Morgan Stanley common shareholders

|

$ | 481 | $ | (1,047 | ) | $ | (275 | ) | * | * | $ | (117 | ) | $ | 2,067 | * | ||||||||||||||||

|

Earnings per basic share:

|

||||||||||||||||||||||||||||||||

|

Income from continuing operations

|

$ | 0.29 | $ | (0.55 | ) | $ | (0.13 | ) | * | * | $ | (0.03 | ) | $ | 1.28 | * | ||||||||||||||||

|

Discontinued operations

|

$ | (0.04 | ) | $ | - | $ | (0.02 | ) | * | (100 | %) | $ | (0.03 | ) | $ | (0.03 | ) | -- | ||||||||||||||

|

Earnings per basic share

|

$ | 0.25 | $ | (0.55 | ) | $ | (0.15 | ) | * | * | $ | (0.06 | ) | $ | 1.25 | * | ||||||||||||||||

|

Earnings per diluted share:

|

||||||||||||||||||||||||||||||||

|

Income from continuing operations

|

$ | 0.28 | $ | (0.55 | ) | $ | (0.13 | ) | * | * | $ | (0.03 | ) | $ | 1.26 | * | ||||||||||||||||

|

Discontinued operations

|

$ | (0.03 | ) | $ | - | $ | (0.02 | ) | * | (50 | %) | $ | (0.03 | ) | $ | (0.03 | ) | -- | ||||||||||||||

|

Earnings per diluted share

|

$ | 0.25 | $ | (0.55 | ) | $ | (0.15 | ) | * | * | $ | (0.06 | ) | $ | 1.23 | * | ||||||||||||||||

|

Financial Metrics:

|

||||||||||||||||||||||||||||||||

|

Return on average common equity

|

||||||||||||||||||||||||||||||||

|

from continuing operations

|

3.6 | % | * | * | * | 3.9 | % | |||||||||||||||||||||||||

|

Return on average common equity

|

3.2 | % | * | * | * | 3.8 | % | |||||||||||||||||||||||||

|

Tier 1 common capital ratio

|

14.7 | % | 13.9 | % | 12.6 | % | ||||||||||||||||||||||||||

|

Tier 1 capital ratio

|

17.9 | % | 16.9 | % | 16.2 | % | ||||||||||||||||||||||||||

|

Book value per common share

|

$ | 30.65 | $ | 30.53 | $ | 31.42 | ||||||||||||||||||||||||||

|

Tangible book value per common share

|

$ | 26.81 | $ | 26.65 | $ | 27.95 | ||||||||||||||||||||||||||

|

Notes:

|

- |

Results for the quarters ended December 31, 2012, September 30, 2012 and December 31, 2011, include positive (negative) revenue of $(511) million, $(2,262) million and $216 million, respectively, related to the movement in Morgan Stanley's credit spreads and other credit factors on certain long-term and short-term debt (Debt Valuation Adjustment, DVA). The twelve months ended December 31, 2012 and December 31, 2011 include positive (negative) revenue of $(4,402) million and $3,681 million, respectively, related to the movement in DVA.

|

| - |

Income (loss) applicable to Morgan Stanley represents income (loss) from continuing operations, adjusted for the portion of net income (loss) applicable to noncontrolling interests related to continuing operations. For the quarters ended December 31, 2012, September 30, 2012 and December 31, 2011 net income (loss) applicable to noncontrolling interests include $3 million, $17 million, and $2 million respectively, reported as a gain in discontinued operations. The twelve months ended December 31, 2012 and December 31, 2011 net income (loss) applicable to noncontrolling interests include $29 million and $7 million respectively, reported as a gain in discontinued operations.

|

|

| - |

Tier 1 common capital ratio equals Tier 1 common equity divided by Risk Weighted Assets (RWA).

|

|

| - |

Tier 1 capital ratio equals Tier 1 capital divided by RWA.

|

|

| - |

Book value per common share equals common equity divided by period end common shares outstanding.

|

|

| - |

Tangible book value per common share equals tangible common equity divided by period end common shares outstanding.

|

|

| - |

The return on average common equity and tangible book value per common share are non-GAAP measures that the Firm considers to be a useful measure that the Firm and investors use to assess operating performance and capital adequacy.

|

|

| - |

See page 4 of the financial supplement for additional information related to the calculation of the financial metrics.

|

11

|

MORGAN STANLEY

|

|

Quarterly Consolidated Income Statement Information

|

|

(unaudited, dollars in millions)

|

|

Quarter Ended

|

Percentage Change From:

|

Twelve Months Ended

|

Percentage

|

|||||||||||||||||||||||||||||

|

Dec 31, 2012

|

Sept 30, 2012

|

Dec 31, 2011

|

Sept 30, 2012

|

Dec 31, 2011

|

Dec 31, 2012

|

Dec 31, 2011

|

Change

|

|||||||||||||||||||||||||

|

Revenues:

|

||||||||||||||||||||||||||||||||

|

Investment banking

|

$ | 1,439 | $ | 1,152 | $ | 1,051 | 25 | % | 37 | % | $ | 4,758 | $ | 4,991 | (5 | %) | ||||||||||||||||

|

Principal transactions:

|

||||||||||||||||||||||||||||||||

|

Trading

|

1,513 | 607 | 969 | 149 | % | 56 | % | 6,991 | 12,384 | (44 | %) | |||||||||||||||||||||

|

Investments

|

304 | 290 | 140 | 5 | % | 117 | % | 742 | 573 | 29 | % | |||||||||||||||||||||

|

Commissions and fees

|

1,052 | 988 | 1,149 | 6 | % | (8 | %) | 4,257 | 5,347 | (20 | %) | |||||||||||||||||||||

|

Asset management, distribution and admin. fees

|

2,331 | 2,257 | 2,004 | 3 | % | 16 | % | 9,008 | 8,410 | 7 | % | |||||||||||||||||||||

|

Other

|

152 | 141 | 92 | 8 | % | 65 | % | 555 | 175 | * | ||||||||||||||||||||||

|

Total non-interest revenues

|

6,791 | 5,435 | 5,405 | 25 | % | 26 | % | 26,311 | 31,880 | (17 | %) | |||||||||||||||||||||

|

Interest income

|

1,744 | 1,379 | 1,685 | 26 | % | 4 | % | 5,988 | 7,258 | (17 | %) | |||||||||||||||||||||

|

Interest expense

|

1,569 | 1,534 | 1,415 | 2 | % | 11 | % | 6,187 | 6,902 | (10 | %) | |||||||||||||||||||||

|

Net interest

|

175 | (155 | ) | 270 | * | (35 | %) | (199 | ) | 356 | * | |||||||||||||||||||||

|

Net revenues

|

6,966 | 5,280 | 5,675 | 32 | % | 23 | % | 26,112 | 32,236 | (19 | %) | |||||||||||||||||||||

|

Non-interest expenses:

|

||||||||||||||||||||||||||||||||

|

Compensation and benefits

|

3,633 | 3,928 | 3,792 | (8 | %) | (4 | %) | 15,622 | 16,333 | (4 | %) | |||||||||||||||||||||

|

Non-compensation expenses:

|

||||||||||||||||||||||||||||||||

|

Occupancy and equipment

|

394 | 386 | 381 | 2 | % | 3 | % | 1,546 | 1,548 | -- | ||||||||||||||||||||||

|

Brokerage, clearing and exchange fees

|

369 | 359 | 379 | 3 | % | (3 | %) | 1,536 | 1,633 | (6 | %) | |||||||||||||||||||||

|

Information processing and communications

|

474 | 493 | 471 | (4 | %) | 1 | % | 1,913 | 1,811 | 6 | % | |||||||||||||||||||||

|

Marketing and business development

|

163 | 138 | 160 | 18 | % | 2 | % | 602 | 595 | 1 | % | |||||||||||||||||||||

|

Professional services

|

558 | 476 | 487 | 17 | % | 15 | % | 1,923 | 1,794 | 7 | % | |||||||||||||||||||||

|

Other

|

516 | 983 | 461 | (48 | %) | 12 | % | 2,455 | 2,423 | 1 | % | |||||||||||||||||||||

|

Total non-compensation expenses

|

2,474 | 2,835 | 2,339 | (13 | %) | 6 | % | 9,975 | 9,804 | 2 | % | |||||||||||||||||||||

|

Total non-interest expenses

|

6,107 | 6,763 | 6,131 | (10 | %) | -- | 25,597 | 26,137 | (2 | %) | ||||||||||||||||||||||

|

Income (loss) from continuing operations before taxes

|

859 | (1,483 | ) | (456 | ) | * | * | 515 | 6,099 | (92 | %) | |||||||||||||||||||||

|

Income tax provision / (benefit) from continuing operations

|

95 | (525 | ) | (298 | ) | * | * | (152 | ) | 1,410 | * | |||||||||||||||||||||

|

Income (loss) from continuing operations

|

764 | (958 | ) | (158 | ) | * | * | 667 | 4,689 | (86 | %) | |||||||||||||||||||||

|

Gain (loss) from discontinued operations after tax

|

(63 | ) | 2 | (26 | ) | * | (142 | %) | (38 | ) | (44 | ) | 14 | % | ||||||||||||||||||

|

Net income (loss)

|

$ | 701 | $ | (956 | ) | $ | (184 | ) | * | * | $ | 629 | $ | 4,645 | (86 | %) | ||||||||||||||||

|

Net income applicable to redeemable noncontrolling interests

|

116 | 8 | 0 | * | * | 124 | 0 | * | ||||||||||||||||||||||||

|

Net income applicable to nonredeemable noncontrolling interests

|

78 | 59 | 66 | 32 | % | 18 | % | 524 | 535 | (2 | %) | |||||||||||||||||||||

|

Net income (loss) applicable to Morgan Stanley

|

507 | (1,023 | ) | (250 | ) | * | * | (19 | ) | 4,110 | * | |||||||||||||||||||||

|

Preferred stock dividend / Other

|

26 | 24 | 25 | 8 | % | 4 | % | 98 | 2,043 | (95 | %) | |||||||||||||||||||||

|

Earnings (loss) applicable to Morgan Stanley common shareholders

|

$ | 481 | $ | (1,047 | ) | $ | (275 | ) | * | * | $ | (117 | ) | $ | 2,067 | * | ||||||||||||||||

|

Amounts applicable to Morgan Stanley:

|

||||||||||||||||||||||||||||||||

|

Income (loss) from continuing operations

|

573 | (1,008 | ) | (222 | ) | * | * | 48 | 4,161 | (99 | %) | |||||||||||||||||||||

|

Gain (loss) from discontinued operations after tax

|

(66 | ) | (15 | ) | (28 | ) | * | (136 | %) | (67 | ) | (51 | ) | (31 | %) | |||||||||||||||||

|

Net income (loss) applicable to Morgan Stanley

|

$ | 507 | $ | (1,023 | ) | $ | (250 | ) | * | * | $ | (19 | ) | $ | 4,110 | * | ||||||||||||||||

|

Pre-tax profit margin

|

12 | % | * | * | 2 | % | 19 | % | ||||||||||||||||||||||||

|

Compensation and benefits as a % of net revenues

|

52 | % | 74 | % | 67 | % | 60 | % | 51 | % | ||||||||||||||||||||||

|

Non-compensation expenses as a % of net revenues

|

36 | % | 54 | % | 41 | % | 38 | % | 30 | % | ||||||||||||||||||||||

|

Effective tax rate from continuing operations

|

11.1 | % | 35.4 | % | 65.4 | % | * | 23.1 | % | |||||||||||||||||||||||

|

Notes:

|

- |

Pre-tax profit margin is a non-GAAP financial measure that the Firm considers to be a useful measure that the Firm and investors use to assess operating performance. Percentages represent income from continuing operations before income taxes as a percentage of net revenues.

|

| - |

The quarter and full year ended December 31, 2011, Principal Transactions - Trading included a loss of $1,742 million related to the comprehensive settlement with MBIA Insurance Corporation (MBIA).

|

|

| - |

Other revenues for the full year ended December 31, 2011, included a loss of approximately $783 million related to the 40% stake in a Japanese securities joint venture, Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. ("MUMSS") controlled and managed by our partner, Mitsubishi UFJ Financial Group Inc. (MUFG).

|

|

| - |

In the quarter ended December 31, 2012, discontinued operations included the provision of $115 million related to a settlement with the Federal Reserve Board concerning the independent foreclosure review related to Saxon. For the full year ended December 31, 2012, discontinued operations primarily reflected an after-tax gain and other operating income related to Quilter Holdings Ltd. (reported in the Global Wealth Management business segment), and an after-tax loss and operating results related to Saxon (reported in the Institutional Securities business segment), which includes the provision related to a settlement with the Federal Reserve Board concerning Saxon.

|

|

| - |

For the quarter ended December 31, 2012, the effective tax rate from continuing operations was 11.1%. The current quarter includes a net tax benefit of approximately $155 million consisting of a discrete benefit from remeasurement of reserves and an out of period tax provision to adjust previously recorded deferred tax assets.

|

|

| - |

During the quarter ended September 30, 2012, Morgan Stanley completed the purchase of an additional 14% stake in Morgan Stanley Smith Barney (Joint Venture) from Citigroup Inc. (Citi), increasing the Firm’s interest from 51% to 65%. Prior to September 17, 2012, Citi’s results related to its 49% interest were reported in net income (loss) applicable to nonredeemable noncontrolling interests. Due to the terms of the revised agreement with Citi, subsequent to the purchase of the additional 14% stake, Citi’s results related to the 35% interest are reported in net income (loss) applicable to redeemable noncontrolling interests.

|

|

| - |

The portion of net income attributable to noncontrolling interests for consolidated entities is presented as either net income (loss) applicable to redeemable noncontrolling interests or net income (loss) applicable to nonredeemable noncontrolling interests.

|

|

| - |

The full year ended December 31, 2011, preferred stock dividend/other included a one-time negative adjustment of approximately $1.7 billion related to the conversion of Series B Non-Cumulative Non-Voting Perpetual Convertible Preferred Stock held by MUFG, into Morgan Stanley common stock (MUFG conversion).

|

|

| - |

Preferred stock dividend / other includes allocation of earnings to Participating Restricted Stock Units (RSUs).

|

12

|

MORGAN STANLEY

|

|

Quarterly Earnings Per Share

|

|

(unaudited, dollars in millions, except for per share data)

|

|

Quarter Ended

|

Percentage Change From:

|

Twelve Months Ended

|

Percentage

|

|||||||||||||||||||||||||||||

|

Dec 31, 2012

|

Sept 30, 2012

|

Dec 31, 2011

|

Sept 30, 2012

|

Dec 31, 2011

|

Dec 31, 2012

|

Dec 31, 2011

|

Change

|

|||||||||||||||||||||||||

|

Income (loss) from continuing operations

|

$ | 764 | $ | (958 | ) | $ | (158 | ) | * | * | $ | 667 | $ | 4,689 | (86 | %) | ||||||||||||||||

|

Net income applicable to redeemable noncontrolling interests

|

116 | 8 | 0 | * | * | 124 | 0 | * | ||||||||||||||||||||||||

|

Net income applicable to nonredeemable noncontrolling interests

|

75 | 42 | 64 | 79 | % | 17 | % | 495 | 528 | (6 | %) | |||||||||||||||||||||

|

Net income (loss) from continuing operations applicable to noncontrolling interest

|

191 | 50 | 64 | * | 198 | % | 619 | 528 | 17 | % | ||||||||||||||||||||||

|

Income (loss) from continuing operations applicable to Morgan Stanley

|

573 | (1,008 | ) | (222 | ) | * | * | 48 | 4,161 | (99 | %) | |||||||||||||||||||||

|

Less: Preferred Dividends

|

24 | 24 | 24 | -- | -- | 96 | 292 | (67 | %) | |||||||||||||||||||||||

|

Less: MUFG preferred stock conversion

|

- | - | - | -- | -- | - | 1,726 | * | ||||||||||||||||||||||||

|

Income from continuing operations applicable to Morgan Stanley, prior to allocation of income to Participating Restricted Stock Units

|

549 | (1,032 | ) | (246 | ) | * | * | (48 | ) | 2,143 | * | |||||||||||||||||||||

|

Basic EPS Adjustments:

|

||||||||||||||||||||||||||||||||

|

Less: Allocation of earnings to Participating Restricted Stock Units

|

2 | 0 | 1 | * | 100 | % | 2 | 26 | (92 | %) | ||||||||||||||||||||||

|

Earnings (loss) from continuing operations applicable to Morgan Stanley common shareholders

|

$ | 547 | $ | (1,032 | ) | $ | (247 | ) | * | * | $ | (50 | ) | $ | 2,117 | * | ||||||||||||||||

|

Gain (loss) from discontinued operations after tax

|

(63 | ) | 2 | (26 | ) | * | (142 | %) | (38 | ) | (44 | ) | 14 | % | ||||||||||||||||||

|

Less: Gain (loss) from discontinued operations after tax applicable to noncontrolling interests

|

3 | 17 | 2 | (82 | %) | 50 | % | 29 | 7 | * | ||||||||||||||||||||||

|

Gain (loss) from discontinued operations after tax applicable to Morgan Stanley

|

(66 | ) | (15 | ) | (28 | ) | * | (136 | %) | (67 | ) | (51 | ) | (31 | %) | |||||||||||||||||

|

Less: Allocation of earnings to Participating Restricted Stock Units

|

0 | 0 | 0 | -- | -- | 0 | (1 | ) | * | |||||||||||||||||||||||

|

Earnings (loss) from discontinued operations applicable to Morgan Stanley common shareholders

|

(66 | ) | (15 | ) | (28 | ) | * | (136 | %) | (67 | ) | (50 | ) | (34 | %) | |||||||||||||||||

|

Earnings (loss) applicable to Morgan Stanley common shareholders

|

$ | 481 | $ | (1,047 | ) | $ | (275 | ) | * | * | $ | (117 | ) | $ | 2,067 | * | ||||||||||||||||

|

Average basic common shares outstanding (millions)

|

1,892 | 1,889 | 1,850 | -- | 2 | % | 1,886 | 1,655 | 14 | % | ||||||||||||||||||||||

|

Earnings per basic share:

|

||||||||||||||||||||||||||||||||

|

Income from continuing operations

|

$ | 0.29 | $ | (0.55 | ) | $ | (0.13 | ) | * | * | $ | (0.03 | ) | $ | 1.28 | * | ||||||||||||||||

|

Discontinued operations

|

$ | (0.04 | ) | $ | - | $ | (0.02 | ) | * | (100 | %) | $ | (0.03 | ) | $ | (0.03 | ) | -- | ||||||||||||||

|

Earnings per basic share

|

$ | 0.25 | $ | (0.55 | ) | $ | (0.15 | ) | * | * | $ | (0.06 | ) | $ | 1.25 | * | ||||||||||||||||

|

Earnings (loss) from continuing operations applicable to Morgan Stanley common shareholders

|

$ | 547 | $ | (1,032 | ) | $ | (247 | ) | * | * | $ | (50 | ) | $ | 2,117 | * | ||||||||||||||||

|

Diluted EPS Adjustments:

|

||||||||||||||||||||||||||||||||

|

Earnings (loss) from continuing operations applicable to Morgan Stanley common shareholders

|

$ | 547 | $ | (1,032 | ) | $ | (247 | ) | * | * | $ | (50 | ) | $ | 2,117 | * | ||||||||||||||||

|

Earnings (loss) from discontinued operations applicable to Morgan Stanley common shareholders

|

(66 | ) | (15 | ) | (28 | ) | * | (136 | %) | (67 | ) | (50 | ) | (34 | %) | |||||||||||||||||

|

Earnings (loss) applicable to Morgan Stanley common shareholders

|

$ | 481 | $ | (1,047 | ) | $ | (275 | ) | * | * | $ | (117 | ) | $ | 2,067 | * | ||||||||||||||||

|

Average diluted common shares outstanding and common stock equivalents (millions)

|

1,937 | 1,889 | 1,850 | 3 | % | 5 | % | 1,886 | 1,675 | 13 | % | |||||||||||||||||||||

|

Earnings per diluted share:

|

||||||||||||||||||||||||||||||||

|

Income from continuing operations

|

$ | 0.28 | $ | (0.55 | ) | $ | (0.13 | ) | * | * | $ | (0.03 | ) | $ | 1.26 | * | ||||||||||||||||

|

Discontinued operations

|

$ | (0.03 | ) | $ | - | $ | (0.02 | ) | * | (50 | %) | $ | (0.03 | ) | $ | (0.03 | ) | -- | ||||||||||||||

|

Earnings per diluted share

|

$ | 0.25 | $ | (0.55 | ) | $ | (0.15 | ) | * | * | $ | (0.06 | ) | $ | 1.23 | * | ||||||||||||||||

| Notes: | - |

The portion of net income attributable to noncontrolling interests for consolidated entities is presented as either net income (loss) applicable to redeemable noncontrolling interests or net income (loss) applicable to nonredeemable noncontrolling interests.

|

| - |

The Firm calculates earnings per share using the two-class method as described under the accounting guidance for earnings per share. For further discussion of the Firm's earnings per share calculations, see pages 15 and 16 of the financial supplement and Note 2 to the consolidated financial statements in the Firm's Annual Report on Form 10-K for the year ended December 31, 2011.

|

13