How Can I Revoke My Proxy?

You can revoke your proxy at any time before your shares are voted by (1) delivering a

written revocation notice prior to the annual meeting to Martin M. Cohen, Corporate Secretary, Morgan Stanley, 1585 Broadway, Suite C, New York, New York 10036; (2) submitting a later dated proxy that we receive no later than when the polls

close during the annual meeting; or (3) voting at the annual meeting. Attending the annual meeting does not revoke your proxy unless you vote at the meeting.

Why Did I Receive a One-Page Notice Regarding the Internet Availability

of Proxy Materials?

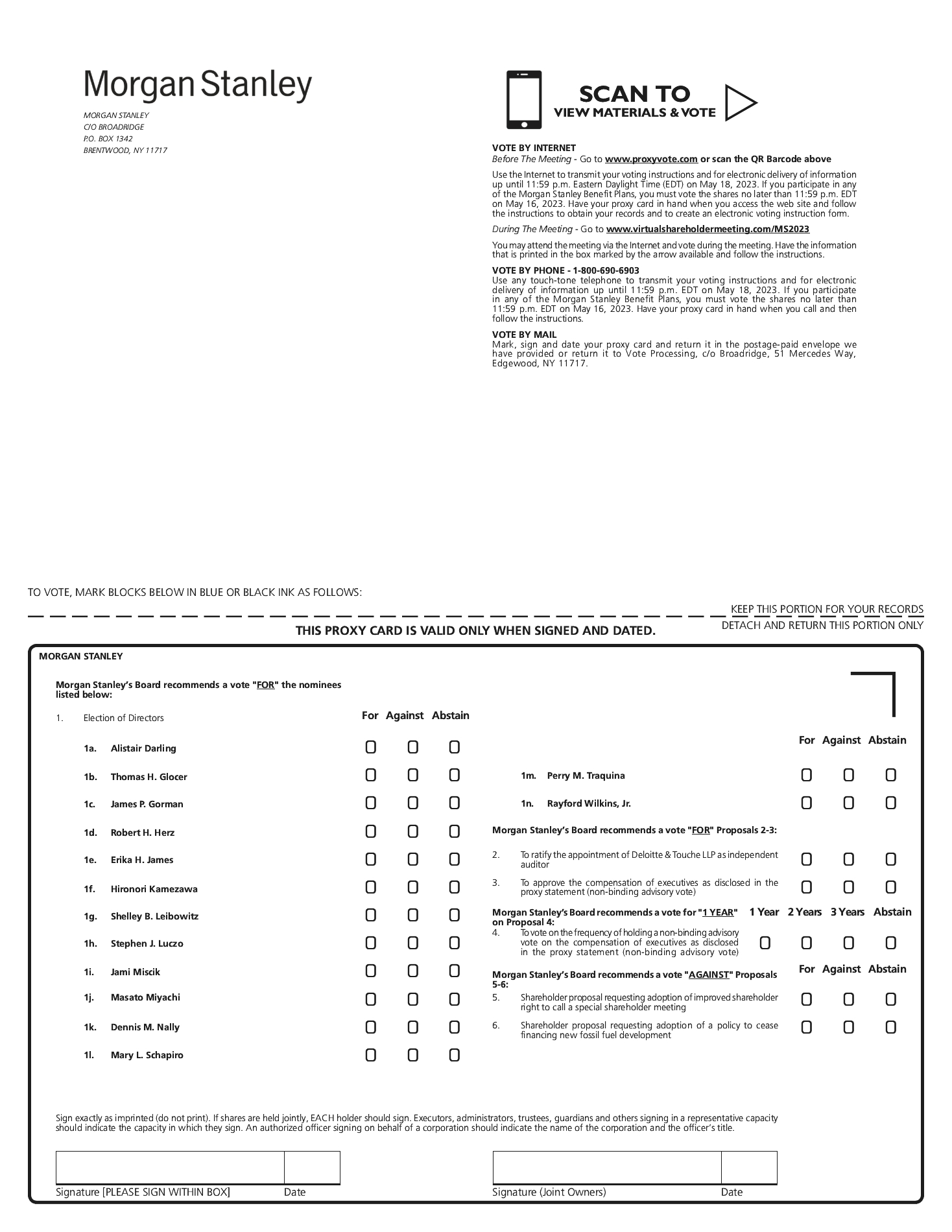

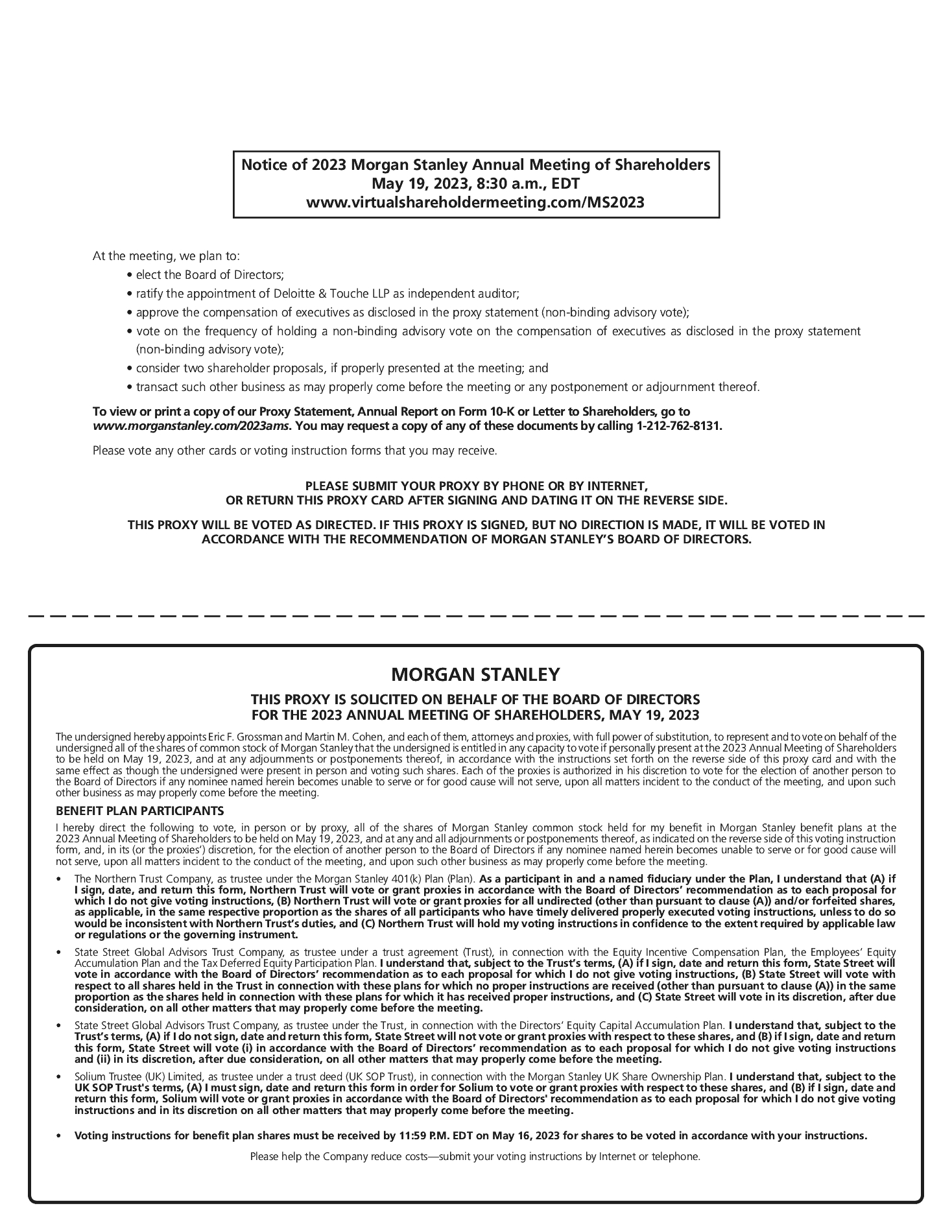

Pursuant to SEC rules, we are mailing to certain of our shareholders a Notice about the

availability of proxy materials on the Internet instead of paper copies of the proxy materials. This process allows us to expedite our shareholders’ receipt of proxy materials, lower the costs of distribution and reduce the environmental impact

of our annual meeting. All shareholders receiving the Notice will have the ability to access the proxy materials and submit a proxy over the Internet. It is important that you submit your proxy to have your

shares voted.

Instructions on how to access the proxy materials over the Internet or to request a paper

copy of the proxy materials may be found in the Notice. The Notice is not a proxy card and cannot be returned to submit your vote. You must follow the instructions on the Notice to submit your proxy to have your shares voted.

We do not know of any other matters that may be presented for action at the meeting other

than those described in this proxy statement. If any other matter is properly brought before the meeting, the proxy holders will vote on such matter in their discretion as permitted under SEC rules.

How Can I Submit a Shareholder Proposal or Nominate a Director for the

2024 Annual Meeting?

Shareholders intending to present a proposal at the 2024 annual meeting and have it

included in our proxy statement for that meeting must submit the proposal in writing to Martin M. Cohen, Corporate Secretary, 1585 Broadway, Suite C, New York, New York 10036 or by email to shareholderproposals@morganstanley.com. We must

receive the proposal no later than December 8, 2023.

Shareholders intending to present a proposal at the 2024 annual meeting (but not to

include the proposal in our proxy statement) or to nominate a person for election as a director (but not to include such nominee in our proxy materials) must comply with the requirements set forth in our bylaws. The bylaws require, among other

things, that our Corporate Secretary receive written notice from the record shareholder of intent to present such proposal or nomination no earlier than the close of business on the 120th day and no later than the close of business

on the 90th day prior to the anniversary of the preceding year’s annual meeting. Therefore, the Company must receive notice of such a proposal or nomination for the 2024 annual meeting no earlier than the close of business on

January 20, 2024 and no later than the close of business on February 19, 2024. The notice must contain the information required by the bylaws.

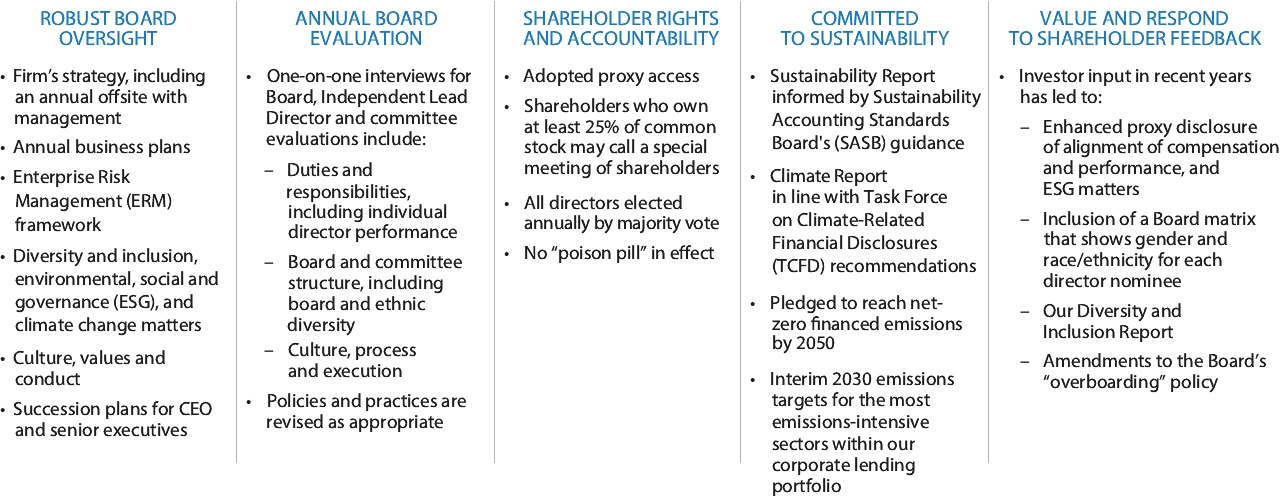

As described under “Corporate Governance Matters — Corporate Governance Practices —

Shareholder Rights and Accountability,” we have adopted proxy access. Under our bylaws, shareholders who meet the requirements set forth in our bylaws may nominate a person for election as a director and include such nominee in our proxy

materials. The bylaws require, among other things, that our Corporate Secretary receive written notice of the nomination no earlier than the close of business on the 150th day and no later than the close of business on the 120th

day prior to the anniversary of the mailing date of the proxy statement for the preceding year’s annual meeting. Therefore, the Company must receive notice of such a nomination for the 2024 annual meeting no earlier than the close of business

on November 8, 2023 and no later than the close of business on December 8, 2023.