PROSPECTUS

DEBT SECURITIES

UNITS

WARRANTS

PURCHASE CONTRACTS

PREFERRED STOCK

COMMON STOCK

We, Morgan Stanley, may offer from time to time debt securities, units, warrants, purchase contracts, preferred stock and common stock. This prospectus describes the general terms of these securities and the general manner in which we will offer the securities. The specific terms of any securities we offer will be included in a supplement to this prospectus. The prospectus supplement will also describe the specific manner in which we will offer the securities.

Investing in the securities involves risks. See “Risk Factors” beginning on page 5.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

These securities are not deposits or savings accounts and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency or instrumentality, nor are they obligations of, or guaranteed by, a bank.

MORGAN STANLEY

November 21, 2011

TABLE OF CONTENTS

| |

Page

|

|

|

Page

|

|

Summary

|

1

|

|

Description of Purchase Contracts

|

45

|

|

Risk Factors

|

5

|

|

Description of Capital Stock

|

46

|

|

Where You Can Find More Information

|

7

|

|

Forms of Securities

|

55

|

|

Consolidated Ratios of Earnings to Fixed Charges and Earnings to Fixed Charges and Preferred Stock Dividends

|

9 |

|

Securities Offered on a Global Basis Through the Depositary

|

59

|

| |

United States Federal Taxation

|

63

|

|

Morgan Stanley

|

10

|

|

Plan of Distribution (Conflicts of Interest)

|

|

|

Use of Proceeds

|

11

|

|

Legal Matters

|

69

|

|

Description of Debt Securities

|

11

|

|

Experts

|

|

|

Description of Units

|

37

|

|

Benefit Plan Investor Considerations

|

|

|

Description of Warrants

|

42

|

|

|

|

You should rely only on the information we incorporate by reference or provide in this prospectus or the relevant prospectus supplement. We have not authorized anyone else to provide you with different or additional information. We are not making an offer of these securities in any state where the offer is not permitted. Except as we indicate under the headings “Consolidated Ratios of Earnings to Fixed Charges and Earnings to Fixed Charges and Preferred Stock Dividends,” “Morgan Stanley” and “Use of Proceeds,” the terms “Morgan Stanley,” “we,” “us” and “our” refer to Morgan Stanley excluding its consolidated subsidiaries.

SUMMARY

We, Morgan Stanley, may offer any of the following securities: debt securities; units; warrants; purchase contracts; preferred stock; and common stock. The following summary describes these securities in general terms only. You should read the summary together with the more detailed information contained in the rest of this prospectus and the applicable prospectus supplement.

|

Debt Securities

|

Our debt securities may be senior or subordinated in priority of payment. We will provide a prospectus supplement that describes the ranking, whether senior or subordinated, the specific designation, the aggregate principal amount, the purchase price, the maturity, the redemption terms, the interest rate or manner of calculating the interest rate, the time of payment of interest, if any, the terms for any conversion or exchange, including the terms relating to the adjustment of any conversion or exchange mechanism, the listing, if any, on a securities exchange and any other specific terms of the debt securities.

|

| |

|

| |

The senior and subordinated debt securities will be issued under separate indentures between us and a U.S. banking institution as trustee. None of the indentures that govern our debt securities limits the amount of additional indebtedness that we or any of our subsidiaries may incur. We have summarized the general features of the indentures under the heading “Description of Debt Securities.” We encourage you to read the indentures, which are exhibits to our registration statement.

|

| |

|

|

Units

|

We may sell any combination of warrants, purchase contracts, shares of preferred stock, shares of common stock and debt securities issued by us, debt obligations or other securities of an entity affiliated or not affiliated with us or other property together as units. In a prospectus supplement, we will describe the particular combination of warrants, purchase contracts, shares of preferred stock, shares of common stock and debt securities issued by us, or debt obligations or other securities of an entity affiliated or not affiliated with us or other property constituting any units and any other specific terms of the units.

|

| |

|

|

Warrants

|

We may sell warrants to purchase or sell:

|

| |

·

|

securities issued by us or by an entity affiliated or not affiliated with us, a basket of those securities, an index or indices of those securities or any other property;

|

| |

|

|

| |

·

|

currencies;

|

| |

|

|

| |

·

|

commodities;

|

| |

|

|

| |

·

|

any other property; or

|

| |

|

|

| |

·

|

any combination of the above.

|

| |

In a prospectus supplement, we will inform you of the exercise price and other specific terms of the warrants, including whether our or your obligations, if any, under any warrants may be satisfied by delivering or purchasing the underlying securities, currencies, commodities or other property or their cash value.

|

| |

|

|

Purchase Contracts

|

We may sell purchase contracts requiring the holders to purchase or sell:

|

| |

·

|

securities issued by us or by an entity affiliated or not affiliated with us, a basket of those securities, an index or indices of those securities or any other property;

|

| |

|

|

| |

·

|

currencies;

|

| |

|

|

| |

·

|

commodities;

|

| |

|

|

| |

·

|

any other property; or

|

| |

|

|

| |

·

|

any combination of the above.

|

| |

In a prospectus supplement, we will describe the specific terms of the purchase contracts, including whether we will satisfy our obligations, if any, or you will satisfy your obligations, if any, under any purchase contracts by delivering the underlying securities, currencies, commodities or other property or their cash value.

|

| |

|

|

Form

|

We may issue debt securities, units, warrants and purchase contracts in fully registered form or in bearer form and, in either case, in definitive form or global form. Debt securities in registered global form to be offered primarily outside the United States may be issued either under the new safekeeping structure or under the classic safekeeping structure. Debt securities in bearer form to be offered primarily outside the United States may be issued either in new global note form or in classic note form.

|

| |

|

|

Preferred Stock

|

We may sell our preferred stock, par value $0.01 per share, in one or more series. In a prospectus supplement, we will describe the specific designation, the aggregate number of shares offered, the dividend rate or manner of calculating the dividend rate, the dividend periods or manner of calculating the dividend periods, the stated value of the shares of the series, the voting rights of the shares of the series, whether or not and on what terms the shares of the series will be convertible or exchangeable, whether and on what terms we can redeem the shares of the series, whether we will offer

|

| |

depositary shares representing shares of the series and if so, the fraction or multiple of a share of preferred stock represented by each depositary share, whether we will list the preferred stock or depositary shares on a securities exchange and any other specific terms of the series of preferred stock.

|

| |

|

|

Common Stock

|

We may sell our common stock, par value $0.01 per share. In a prospectus supplement, we will describe the aggregate number of shares offered and the offering price or prices of the shares.

|

| |

|

|

Terms Specified in Prospectus Supplements

|

When we decide to sell particular securities, we will prepare one or more prospectus supplements, which in the case of securities such as medium-term notes may be further supplemented by a pricing supplement, describing the securities offering and the specific terms of the securities. You should carefully read this prospectus and any applicable prospectus supplement and pricing supplement. We may also prepare free writing prospectuses that describe particular securities. Any free writing prospectus should also be read in connection with this prospectus and with any other prospectus supplement referred to therein. For purposes of this prospectus, any reference to an applicable prospectus supplement may also refer to a pricing supplement or a free writing prospectus, unless the context otherwise requires.

|

| |

|

| |

We will offer our debt securities, warrants, purchase contracts, units, preferred stock and common stock to investors on terms determined by market and other conditions. Our securities may be sold for U.S. dollars or foreign currency. Principal of, and any premium or interest on, debt securities and cash amounts payable under warrants or purchase contracts may be payable in U.S. dollars or foreign currency, as we specifically designate in the applicable prospectus supplement.

|

| |

|

| |

In any prospectus supplement we prepare, we will provide the name of and describe the compensation to each dealer, underwriter or agent, if any, involved in the sale of the securities being offered and the managing underwriters for any securities sold to or through underwriters. Any underwriters, including managing underwriters, dealers or agents in the United States will generally include Morgan Stanley & Co. LLC and any outside the United States will generally include Morgan Stanley & Co. International plc or other affiliates of ours.

|

| |

|

|

Structural Subordination; Our Receipt of Cash from Our Subsidiaries May Be Restricted

|

The securities are unsecured senior or subordinated obligations of ours, but our assets consist primarily of equity in our subsidiaries. As a result, our ability to make payments on our debt securities, units, warrants and purchase contracts and/or pay dividends on our preferred stock and common

|

| |

stock depends upon our receipt of dividends, loan payments and other funds from our subsidiaries. In addition, if any of our subsidiaries becomes insolvent, the direct creditors of that subsidiary will have a prior claim on its assets, and our rights and the rights of our creditors, including your rights as an owner of our debt securities, units, warrants, purchase contracts, preferred stock or common stock, will be subject to that prior claim, unless we are also a direct creditor of that subsidiary. This subordination of creditors of a parent company to prior claims of creditors of its subsidiaries is commonly referred to as structural subordination.

|

| |

|

| |

In addition, various statutes and regulations restrict some of our subsidiaries from paying dividends or making loans or advances to us. These restrictions could prevent those subsidiaries from paying the cash to us that we need in order to pay you. These restrictions include:

|

| |

·

|

the net capital requirements under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules of some exchanges and other regulatory bodies, which apply to some of our principal subsidiaries, such as Morgan Stanley & Co. LLC and Morgan Stanley & Co. International plc, and

|

| |

|

|

| |

·

|

banking regulations, which apply to Morgan Stanley Bank, N.A., a national bank, Morgan Stanley Private Bank, National Association (formerly Morgan Stanley Trust FSB), a national bank, and other bank subsidiaries of ours.

|

|

Market-making by Our Affiliates

|

Following the initial distribution of an offering of securities, Morgan Stanley & Co. LLC, Morgan Stanley & Co. International plc and other affiliates of ours may offer and sell those securities in the course of their businesses as broker dealers, subject, in the case of common stock, preferred stock and depositary shares, to obtaining any necessary approval of the New York Stock Exchange LLC for any of these offers and sales our United States affiliates may make. Morgan Stanley & Co. LLC, Morgan Stanley & Co. International plc and other affiliates of ours may act as a principal or agent in these transactions. This prospectus and the applicable prospectus supplement will also be used in connection with those transactions. Sales in any of those transactions will be made at varying prices related to prevailing market prices and other circumstances at the time of sale.

|

| |

|

|

How to Reach Us

|

You may contact us at our principal executive offices at 1585 Broadway, New York, New York 10036 (telephone number (212) 761-4000).

|

RISK FACTORS

For a discussion of the risk factors affecting Morgan Stanley and its business, including liquidity risk, market risk, credit risk, operational risk, competitive environment, legal risk and international risk, among others, see “Risk Factors” in Part I, Item 1A of our most recent annual report on Form 10-K and our current and periodic reports filed pursuant to the Securities and Exchange Act of 1934 that are incorporated by reference into this prospectus.

In addition, some of the securities we offer may be subject to foreign-currency risks as described below.

Foreign-Currency Risks

You should consult your financial and legal advisers as to any specific risks entailed by an investment in securities that are denominated or payable in, or the payment of which is linked to the value of, a currency other than the currency of the country in which you are resident or in which you conduct your business, which we refer to as your “home currency.” These securities are not appropriate investments for investors who are not sophisticated in foreign currency transactions. We disclaim any responsibility to advise prospective purchasers who are residents of countries other than the United States of any matters arising under non-U.S. law that may affect the purchase of or holding of, or the receipt of payments on, these securities. These persons should consult their own legal and financial advisers concerning these matters.

Exchange Rates and Exchange Controls May Affect Securities’ Value or Return

General Exchange Rate and Exchange Control Risks. An investment in a security that is denominated or payable in, or the payment of which is linked to the value of, currencies other than your home currency entails significant risks. These risks include the possibility of significant changes in rates of exchange between your home currency and the relevant foreign currencies and the possibility of the imposition or modification of exchange controls by the relevant governmental entities. These risks generally depend on economic and political events over which we have no control.

Exchange Rates Will Affect Your Investment. In recent years, rates of exchange between some currencies have been highly volatile and this volatility may continue in the future. Fluctuations in any particular exchange rate that have occurred in the past are not necessarily indicative, however, of fluctuations that may occur during the term of any security. Depreciation against your home currency of the currency in which a security is payable would result in a decrease in the effective yield of the security below its coupon rate or in the payout of the security and could result in an overall loss to you on a home currency basis. In addition, depending on the specific terms of a currency-linked security, changes in exchange rates relating to any of the relevant currencies could result in a decrease in its effective yield and in your loss of all or a substantial portion of the value of that security.

There May Be Specific Exchange Rate Risks Applicable to Warrants and Purchase Contracts. Fluctuations in the rates of exchange between your home currency and any other currency (i) in which the exercise price of a warrant or the purchase price of a purchase contract is payable, (ii) in which the value of the property underlying a warrant or purchase contract is quoted or (iii) to be purchased or sold by exercise of a warrant or pursuant to a purchase contract or in the rates of exchange among any of these currencies may change the value of a warrant, a purchase contract or a unit that includes a warrant or purchase contract. You could lose money on your investment as a result of these fluctuations, even if the spot price of the property underlying the warrant or purchase contract were such that the warrant or purchase contract appeared to be “in the money.”

We Have No Control Over Exchange Rates. Currency exchange rates can either float or be fixed by sovereign governments. Exchange rates of most economically developed nations are permitted to fluctuate in value relative to each other. However, from time to time governments may use a variety of techniques, such as intervention by a country’s central bank, the imposition of regulatory controls or taxes or changes in interest rates to influence the exchange rates of their currencies. Governments may also issue a new currency to replace an existing currency or alter the exchange rate or relative exchange characteristics by a devaluation or revaluation of a currency. These governmental actions could change or interfere with currency valuations and currency fluctuations that would

otherwise occur in response to economic forces, as well as in response to the movement of currencies across borders.

As a consequence, these government actions could adversely affect yields or payouts in your home currency for (i) securities denominated or payable in currencies other than your home currency, (ii) currency-linked securities, (iii) warrants or purchase contracts where the exercise price or the purchase price is denominated in a currency differing from your home currency or where the value of the property underlying the warrants or purchase contracts is quoted in a currency other than your home currency and (iv) warrants or purchase contracts to purchase or sell foreign currency.

We will not make any adjustment or change in the terms of the securities in the event that exchange rates should become fixed, or in the event of any devaluation or revaluation or imposition of exchange or other regulatory controls or taxes, or in the event of other developments affecting your home currency or any applicable foreign currency. You will bear those risks.

Some Foreign Currencies May Become Unavailable. Governments have imposed from time to time, and may in the future impose, exchange controls that could also affect the availability of a specified currency. Even if there are no actual exchange controls, it is possible that the applicable currency for any security would not be available when payments on that security are due.

Alternative Payment Method Used if Payment Currency Becomes Unavailable. Unless otherwise specified in the applicable prospectus supplement, if a payment currency is unavailable, we would make required payments in U.S. dollars on the basis of the market exchange rate, which might be an extremely unfavorable rate at the time of any such unavailability. However, if the applicable currency for any security is not available because the euro has been substituted for that currency, we would make the payments in euro. The mechanisms for making payments in these alternative currencies are explained in “Description of Debt Securities—Interest and Principal Payments” below.

Currency Conversions May Affect Payments on Some Securities

The applicable prospectus supplement may provide for (i) payments on a non-U.S. dollar denominated security to be made in U.S. dollars or (ii) payments on a U.S. dollar denominated security to be made in a currency other than U.S. dollars. In these cases, Morgan Stanley & Co. International plc, in its capacity as exchange rate agent, or a different exchange rate agent identified in the applicable prospectus supplement, will convert the currencies. You will bear the costs of conversion through deductions from those payments. Morgan Stanley & Co. International plc is our affiliate.

Exchange Rates May Affect the Value of a New York Judgment Involving Non-U.S. Dollar Securities

The securities will be governed by and construed in accordance with the laws of the State of New York. If a New York court were to enter a judgment in an action on any securities denominated in a foreign currency, such court would enter a judgment in the foreign currency and convert the judgment or decree into U.S. dollars at the prevailing rate of exchange on the date such judgment or decree is entered.

Additional risks specific to particular securities will be detailed in the applicable prospectus supplements.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document we file at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. In addition, the SEC maintains a website that contains reports, proxy statements and other information that we electronically file. The address of the SEC’s website is http://www.sec.gov. You can find information we have filed with the SEC by reference to file number 001-11758.

This prospectus is part of a registration statement we filed with the SEC. This prospectus omits some information contained in the registration statement in accordance with SEC rules and regulations. You should review the information and exhibits in the registration statement for further information on us and our consolidated subsidiaries and the securities we are offering. Statements in this prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to these filings. You should review the complete document to evaluate these statements.

Our common stock, par value $0.01 per share, is listed on the New York Stock Exchange LLC under the symbol “MS.” You may inspect reports, proxy statements and other information concerning us and our consolidated subsidiaries at the offices of the New York Stock Exchange LLC, 20 Broad Street, New York, New York 10005.

The SEC allows us to incorporate by reference much of the information we file with them, which means that we can disclose important information to you by referring you to those publicly available documents. The information that we incorporate by reference in this prospectus is considered to be part of this prospectus. Because we are incorporating by reference future filings with the SEC, this prospectus is continually updated and those future filings may modify or supersede some of the information included or incorporated by reference in this prospectus. This means that you must look at all of the SEC filings that we incorporate by reference to determine if any of the statements in this prospectus or in any document previously incorporated by reference have been modified or superseded. This prospectus incorporates by reference the documents listed below and any future filings we make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934 (other than information in the documents or filings that is deemed to have been furnished and not filed) until we complete our offering of the securities to be issued under the registration statement or, if later, the date on which any of our affiliates cease offering and selling these securities:

|

|

·

|

Annual Report on Form 10-K for the fiscal year ended December 31, 2010;

|

|

|

·

|

Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2011, June 30, 2011 and September 30, 2011;

|

|

|

·

|

Current Reports on Form 8-K dated January 4, 2011, January 13, 2011, January 20, 2011, March 21, 2011, March 24, 2011, April 21, 2011 (two filings), May 18, 2011, June 30, 2011, July 20, 2011, July 21, 2011, September 15, 2011 and October 19, 2011;

|

|

|

·

|

description of our common stock in our Registration Statement on Form 10 filed with the SEC pursuant to Section 12 of the Exchange Act, on January 15, 1993, as amended by the description contained in the Forms 8 dated February 11, February 21 and February 22, 1993 and as further amended by the description contained in the Form 8-K dated June 19, 2007; and

|

|

|

·

|

in addition, solely with regard to the securities covered by this prospectus that were initially offered and sold under previously filed registration statements of Morgan Stanley and that from time to time may be reoffered and resold in market-making transactions under this prospectus, the information in the prospectus supplements relating to those securities that were previously filed by Morgan Stanley in connection with its initial offer and sale (except to the extent that any such information has been modified or superseded by other information included or incorporated by reference in this prospectus) is incorporated by reference into this prospectus.

|

You can request a copy of these documents, excluding exhibits not specifically incorporated by reference into these documents, at no cost, by writing or telephoning us at the following address:

Morgan Stanley

1585 Broadway

New York, New York 10036

Attention: Investor Relations

(212) 761-4000

CONSOLIDATED RATIOS OF EARNINGS TO FIXED CHARGES

AND EARNINGS TO FIXED CHARGES AND PREFERRED STOCK DIVIDENDS

The following table sets forth our consolidated ratios of earnings to fixed charges and earnings to fixed charges and preferred stock dividends for the periods indicated.

| |

|

|

|

|

Fiscal Year Ended

|

|

|

|

|

| |

|

Nine Months Ended September

30, 2011

|

|

|

December 31, 2010

|

|

|

December 31, 2009

|

|

|

November 30, 2008

|

|

|

November 30, 2007

|

|

|

November 30, 2006

|

|

|

One Month Ended December 31, 2008

|

|

|

Ratio of earnings to fixed charges

|

|

|

2.2 |

|

|

|

1.7 |

|

|

|

1.1 |

|

|

|

1.0 |

|

|

|

1.0 |

|

|

|

1.2 |

|

|

|

* |

|

|

Ratio of earnings to fixed charges and preferred stock dividends

|

|

|

2.1 |

|

|

|

1.5 |

|

|

|

0.9 |

|

|

|

1.0 |

|

|

|

1.0 |

|

|

|

1.2 |

|

|

|

* |

|

* The earnings for the one month ended December 31, 2008 were inadequate to cover total fixed charges and total fixed charges and preferred stock dividends. The coverage deficiency for total fixed charges for the one month ended December 31, 2008 was $1,996 million, and the coverage deficiency for total fixed charges and preferred stock dividends for the one month ended December 31, 2008 was $2,493 million.

For purposes of calculating the ratio of earnings to fixed charges and the ratio of earnings to fixed charges and preferred stock dividends,earnings before income taxes do not include dividends on preferred securities subject to mandatory redemption, gain (loss) on discontinued operations, non-controlling interests and income or loss from equity investees. Fixed charges consist of interest cost, including interest on deposits, interest on discontinued operations, dividends on preferred securities subject to mandatory redemption, and that portion of rent expense to be representative of the interest factor. Fixed charges do not include interest expense on uncertain tax liabilities as the Company records these amounts within the Provision for income taxes.

The preferred stock dividend amounts represent pre-tax earnings required to cover dividends on preferred stock.

MORGAN STANLEY

Morgan Stanley is a global financial services firm that, through its subsidiaries and affiliates, provides its products and services to a large and diversified group of clients and customers, including corporations, governments, financial institutions and individuals. Morgan Stanley was originally incorporated under the laws of the State of Delaware in 1981, and its predecessor companies date back to 1924. Morgan Stanley is a financial holding company regulated by the Board of Governors of the Federal Reserve System under the Bank Holding Company Act of 1956, as amended.

Morgan Stanley conducts its business from its headquarters in and around New York City, its regional offices and branches throughout the United States, and its principal offices in London, Tokyo, Hong Kong and other world financial centers. Morgan Stanley maintains significant market positions in each of its business segments—Institutional Securities, Global Wealth Management Group and Asset Management.

A summary of the activities of each of Morgan Stanley’s business segments is as follows:

|

|

·

|

Institutional Securities provides capital raising; financial advisory services, including advice on mergers and acquisitions, restructurings, real estate and project finance; corporate lending; sales, trading, financing and market-making activities in equity and fixed income securities and related products, including foreign exchange and commodities; and investment activities.

|

|

|

·

|

Global Wealth Management Group, which includes Morgan Stanley’s 51% interest in Morgan Stanley Smith Barney Holdings LLC, provides brokerage and investment advisory services to individual investors and small-to-medium sized businesses and institutions covering various investment alternatives; financial and wealth planning services; annuity and other insurance products; credit and other lending products; cash management services; retirement services; and trust and fiduciary services and engages in fixed income principal trading, which primarily facilitates clients’ trading or investments in such securities.

|

|

|

·

|

Asset Management provides a broad array of investment strategies that span the risk/return spectrum across geographies, asset classes and public and private markets to a diverse group of clients across the institutional and intermediary channels as well as high net worth clients.

|

Morgan Stanley’s principal executive offices are at 1585 Broadway, New York, New York 10036, and its telephone number is (212) 761-4000.

USE OF PROCEEDS

Unless otherwise set forth in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities we offer by this prospectus for general corporate purposes, which may include, among other things:

|

|

·

|

additions to working capital;

|

|

|

·

|

the repurchase of outstanding common stock; and

|

|

|

·

|

the repayment of indebtedness.

|

We anticipate that we will raise additional funds from time to time through equity or debt financing, including borrowings under revolving credit agreements, to finance our businesses worldwide.

DESCRIPTION OF DEBT SECURITIES

Debt May Be Senior or Subordinated

We may issue senior or subordinated debt securities. The senior debt securities and, in the case of debt securities in bearer form, any coupons to these securities, will constitute part of our senior debt, will be issued under our Senior Debt Indenture, as defined below, and will rank on a parity with all of our other unsecured and unsubordinated debt. The subordinated debt securities and any coupons will constitute part of our subordinated debt, will be issued under our Subordinated Debt Indenture, as defined below, and will be subordinate and junior in right of payment, as set forth in the Subordinated Debt Indenture, to all of our “senior indebtedness,” which is defined in our Subordinated Debt Indenture. If this prospectus is being delivered in connection with a series of subordinated debt securities, the accompanying prospectus supplement or the information we incorporate in this prospectus by reference will indicate the approximate amount of senior indebtedness outstanding as of the end of the most recent fiscal quarter. We refer to our Senior Debt Indenture and our Subordinated Debt Indenture individually as an “indenture” and collectively as the “indentures.”

We have summarized below the material provisions of the indentures and the debt securities, or indicated which material provisions will be described in the related prospectus supplement. These descriptions are only summaries, and each investor should refer to the applicable indenture and any supplements thereto, which describe completely the terms and definitions summarized below and contains additional information regarding the debt securities. Where appropriate, we use parentheses to refer you to the particular sections of the applicable indenture. Any reference to particular sections or defined terms of the applicable indenture in any statement under this heading qualifies the entire statement and incorporates by reference the applicable section or definition into that statement. The indentures are substantially identical, except for the provisions relating to Morgan Stanley’s negative pledge and to debt securities in NGN form or issued under the NSS (each as defined below), which are included in the Senior Debt Indenture only and the provisions relating to subordination and the shorter list of events of default under the Subordinated Debt Indenture.

We may issue debt securities from time to time in one or more series. The provisions of each indenture allow us to “reopen” a previous issue of a series of debt securities and issue additional debt securities of that issue. The debt securities may be denominated and payable in U.S. dollars or foreign currencies. We may also issue debt securities, from time to time, with the principal amount or interest payable on any relevant payment date to be determined by reference to one or more currency exchange rates or indices of currency exchange rates, securities or baskets or indices of securities or other property, commodity prices or indices, or any other property, or any combination of the foregoing. Holders of these types of debt securities will receive payments of principal or interest that depend upon the value of the applicable underlying asset on the relevant payment dates.

Debt securities may bear interest at a fixed rate or a floating rate, which, in either case, may be zero, or at a rate that varies during the lifetime of the debt security. Debt securities bearing no interest or interest at a rate that at the time of issuance is below the prevailing market rate may be sold at a discount below their stated principal amount.

Terms Specified in Prospectus Supplement

The prospectus supplement will contain, where applicable, the following terms of and other information relating to any offered debt securities:

|

|

·

|

classification as senior or subordinated debt securities and the specific designation;

|

|

|

·

|

aggregate principal amount, purchase price and denomination;

|

|

|

·

|

currency in which the debt securities are denominated and/or in which principal, and premium, if any, and/or interest, if any, is payable;

|

|

|

·

|

the interest rate or rates or the method by which the calculation agent will determine the interest rate or rates, if any;

|

|

|

·

|

whether interest will be payable in cash or payable in kind;

|

|

|

·

|

the interest payment dates, if any;

|

|

|

·

|

the place or places for payment of the principal of and any premium and/or interest on the debt securities;

|

|

|

·

|

any repayment, redemption, prepayment or sinking fund provisions, including any redemption notice provisions;

|

|

|

·

|

whether we will issue the debt securities in registered form or bearer form or both, if we are offering debt securities in registered form primarily outside the United States, whether those debt securities in registered form will or will not be issued under the NSS, and if we are offering debt securities in bearer form, any restrictions applicable to the exchange of one form for another, to the offer, sale and delivery of those debt securities in bearer form and whether those debt securities in bearer form will or will not be issued in NGN form;

|

|

|

·

|

whether we will issue the debt securities in definitive form and under what terms and conditions;

|

|

|

·

|

the terms on which holders of the debt securities may convert or exchange these securities into or for common or preferred stock or other securities of ours offered hereby, into or for common or preferred stock or other securities of an entity affiliated with us or debt or equity or other securities of an entity not affiliated with us, or into any other property or for the cash value of our stock or any of the above securities, the terms on which conversion or exchange may occur, including whether conversion or exchange is mandatory, at the option of the holder or at our option, the period during which conversion or exchange may occur, the initial conversion or exchange price or rate and the circumstances or manner in which the amount of common or preferred stock or other securities issuable upon conversion or exchange may be adjusted;

|

|

|

·

|

information as to the methods for determining the amount of principal or interest payable on any date and/or the currencies, securities or baskets of securities, commodities or indices to which the amount payable on that date is linked;

|

|

|

·

|

any agents for the debt securities, including trustees, depositories, authenticating or paying agents, transfer agents or registrars or any other agents with respect to the debt securities;

|

|

|

·

|

any applicable U.S. federal income tax consequences, including:

|

|

|

o

|

whether and under what circumstances we will pay additional amounts on debt securities held by a person who is not a U.S. person for any tax, assessment or governmental charge withheld or deducted and, if so, whether we will have the option to redeem those debt securities rather than pay the additional amounts;

|

|

|

o

|

tax considerations applicable to any discounted debt securities or to debt securities issued at par that are treated as having been issued at a discount for U.S. federal income tax purposes; and

|

|

|

o

|

tax considerations applicable to any debt securities denominated and payable in foreign currencies; and

|

|

|

·

|

any other specific terms of the debt securities, including any additions, modifications or deletions in the defaults, events of default or covenants, and any terms required by or advisable under applicable laws or regulations.

|

Some Definitions

We have defined some of the terms that we use frequently in this prospectus below:

A “business day” means any day, other than a Saturday or Sunday, (i) that is neither a legal holiday nor a day on which banking institutions are authorized or required by law or regulation to close (a) in The City of New York or (b) for debt securities denominated in a specified currency other than U.S. dollars, euro or Australian dollars, in the principal financial center of the country of the specified currency or (c) for debt securities denominated in Australian dollars, in Sydney, and (ii) for debt securities denominated in euro, that is also a TARGET Settlement Day.

“Clearstream, Luxembourg” means Clearstream Banking, société anonyme, Luxembourg.

“Depositary” means The Depository Trust Company, New York, New York.

“Euro LIBOR debt securities” means LIBOR debt securities for which the index currency is euros.

“Euroclear” means Euroclear Bank S.A./N.V.

An “interest payment date” for any debt security means a date on which, under the terms of that debt security, regularly scheduled interest is payable.

“London banking day” means any day on which dealings in deposits in the relevant index currency are transacted in the London interbank market.

“NGN form” for any debt security in bearer form means that such debt security is to be issued in new global note form and deposited with a common safekeeper for Euroclear and/or Clearstream, Luxembourg.

The “NSS” means the new safekeeping structure for certain debt securities in registered global form. Any debt security in registered global form issued under the NSS is to be deposited with a common safekeeper for Euroclear and/or Clearstream, Luxembourg.

The “record date” for any interest payment date, unless otherwise specified in the applicable prospectus supplement, is the date 15 calendar days prior to that interest payment date, whether or not that date is a business day.

“TARGET Settlement Day” means any day on which the Trans-European Automated Real-time Gross Settlement Express Transfer payment system, which utilizes a single shared platform and was launched on November 19, 2007, is open for the settlement of payment in euro.

References in this prospectus to “U.S. dollar,” or “U.S.$” or “$” are to the currency of the United States of America. References in this prospectus to “euro” and “€” are to the single currency introduced at the commencement of the third stage of the European Economic and Monetary Union pursuant to the Treaty establishing the European Community, as amended.

Interest and Principal Payments

Payments, Exchanges and Transfers. Holders may present debt securities for payment of principal, premium, if any, and interest, if any, register the transfer of the debt securities and exchange the debt securities at the agency in the Borough of Manhattan, The City of New York, maintained by us for that purpose. However, holders of global debt securities may transfer and exchange global debt securities only in the manner and to the extent set forth under “Forms of Securities—Global Securities” below. On the date of this prospectus, the agent for the payment, transfer and exchange of debt securities issued under our senior indenture is The Bank of New York Mellon (as successor to JPMorgan Chase Bank, N.A. (formerly known as JPMorgan Chase Bank)) acting through its corporate trust office at 101 Barclay Street, New York, New York 10286. On the date of this prospectus, the agent for the payment, transfer and exchange of debt securities issued under our subordinated indenture is The Bank of New York Mellon (as successor to J.P. Morgan Trust Company, National Association), acting through its corporate trust office at 101 Barclay Street, New York, New York 10286. We refer to The Bank of New York Mellon, acting in this capacity for the respective debt securities, as the paying agent.

We will not be required to:

|

|

·

|

register the transfer of or exchange any debt security if the holder has exercised the holder’s right, if any, to require us to repurchase the debt security, in whole or in part, except the portion of the debt security not required to be repurchased;

|

|

|

·

|

register the transfer of or exchange debt securities to be redeemed for a period of fifteen calendar days preceding the mailing of the relevant notice of redemption; or

|

|

|

·

|

register the transfer of or exchange any registered debt security selected for redemption in whole or in part, except the unredeemed or unpaid portion of that registered debt security being redeemed in part.

|

No service charge will be made for any registration or transfer or exchange of debt securities, but we may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection with the registration of transfer or exchange of debt securities.

Holders may transfer debt securities in bearer form and the related coupons, if any, by delivery to the transferee. If any of the securities are held in global form, the procedures for transfer of interests in those securities will depend upon the procedures of the depositary for those global securities. See “Forms of Securities” below.

Although we anticipate making payments of principal, premium, if any, and interest, if any, on most debt securities in U.S. dollars, some debt securities may be payable in foreign currencies as specified in the applicable prospectus supplement. Currently, few facilities exist in the United States to convert U.S. dollars into foreign currencies and vice versa. In addition, most U.S. banks do not offer non-U.S. dollar denominated checking or savings account facilities. Accordingly, unless alternative arrangements are made, we will pay principal, premium, if any, and interest, if any, on debt securities that are payable in a foreign currency to an account at a bank outside the United States, which, in the case of a debt security payable in euro, will be made by credit or transfer to a euro account specified by the payee in a country for which the euro is the lawful currency.

Recipients of Payments. The paying agent will pay interest to the person in whose name the debt security is registered at the close of business on the applicable record date. However, upon maturity, redemption or repayment, the paying agent will pay any interest due to the person to whom it pays the principal of the debt security. The paying agent will make the payment of interest on the date of maturity, redemption or repayment, whether or not that date is an interest payment date. The paying agent will make the initial interest payment on a debt security on the first interest payment date falling after the date of issuance, unless the date of issuance is less than 15 calendar days before an interest payment date. In that case, the paying agent will pay interest or, in the case of an amortizing debt security, principal and interest, on the next succeeding interest payment date to the holder of record on the record date corresponding to the succeeding interest payment date.

Book-Entry Debt Securities. The paying agent will make payments of principal, premium, if any, and interest, if any, to the account of the Depositary, as holder of book-entry debt securities, by wire transfer of immediately available funds. We expect that the Depositary, upon receipt of any payment, will immediately credit its

participants’ accounts in amounts proportionate to their respective beneficial interests in the book-entry debt securities as shown on the records of the Depositary. We also expect that payments by the Depositary’s participants to owners of beneficial interests in the book-entry debt securities will be governed by standing customer instructions and customary practices and will be the responsibility of those participants.

Certificated Debt Securities. Except as indicated below for payments of interest at maturity, redemption or repayment, the paying agent will make U.S. dollar payments of interest either:

|

|

·

|

by check mailed to the address of the person entitled to payment as shown on the debt security register; or

|

|

|

·

|

for a holder of at least $10,000,000 in aggregate principal amount of certificated debt securities of a series having the same interest payment date, by wire transfer of immediately available funds, if the holder has given written notice to the paying agent not later than 15 calendar days prior to the applicable interest payment date.

|

U.S. dollar payments of principal, premium, if any, and interest, if any, upon maturity, redemption or repayment on a debt security will be made in immediately available funds against presentation and surrender of the debt security.

Unavailability of Foreign Currency. The relevant specified currency may not be available to us for making payments of principal of, premium, if any, or interest, if any, on any debt security. This could occur due to the imposition of exchange controls or other circumstances beyond our control or if the specified currency is no longer used by the government of the country issuing that currency or by public institutions within the international banking community for the settlement of transactions. If the specified currency is unavailable, we may satisfy our obligations to holders of the debt securities by making those payments on the date of payment in U.S. dollars on the basis of the noon dollar buying rate in The City of New York for cable transfers of the currency or currencies in which a payment on any debt security was to be made, published by the Federal Reserve Bank of New York, which we refer to as the “market exchange rate.” If that rate of exchange is not then available or is not published for a particular payment currency, the market exchange rate will be based on the highest bid quotation in The City of New York received by the exchange rate agent at approximately 11:00 a.m., New York City time, on the second business day preceding the applicable payment date from three recognized foreign exchange dealers for the purchase by the quoting dealer:

|

|

·

|

of the specified currency for U.S. dollars for settlement on the payment date;

|

|

|

·

|

in the aggregate amount of the specified currency payable to those holders or beneficial owners of debt securities; and

|

|

|

·

|

at which the applicable dealer commits to execute a contract.

|

One of the dealers providing quotations may be the exchange rate agent unless the exchange rate agent is our affiliate. If those bid quotations are not available, the exchange rate agent will determine the market exchange rate at its sole discretion.

These provisions do not apply if a specified currency is unavailable because it has been replaced by the euro. If the euro has been substituted for a specified currency, we may at our option, or will, if required by applicable law, without the consent of the holders of the affected debt securities, pay the principal of, premium, if any, or interest, if any, on any debt security denominated in the specified currency in euro instead of the specified currency, in conformity with legally applicable measures taken pursuant to, or by virtue of, the Treaty establishing the European Community, as amended. Any payment made in U.S. dollars or in euro as described above where the required payment is in an unavailable specified currency will not constitute an event of default.

Discount Debt Securities. Some debt securities may be considered to be issued with original issue discount, which must be included in income for U.S. federal income tax purposes at a constant yield. We refer to these debt securities as “discount notes.” See the discussion under “United States Federal Taxation—Tax Consequences to U.S. Holders—Discount Notes” below. In the event of a redemption or repayment of any discount note or if the principal of any debt security that is considered to be issued with original issue discount is declared to be due and

payable immediately as described under “Description of Debt Securities—Events of Default” below, the amount of principal due and payable on that debt security will be limited to:

|

|

·

|

the aggregate principal amount of the debt security multiplied by the sum of

|

|

|

o

|

its issue price, expressed as a percentage of the aggregate principal amount, plus

|

|

|

o

|

the original issue discount amortized from the interest accrual date for the applicable discount note to the date of declaration, expressed as a percentage of the aggregate principal amount.

|

For purposes of determining the amount of original issue discount that has accrued as of any date on which a redemption, repayment or acceleration of maturity occurs for a discount note, original issue discount will be accrued using a constant yield method. The constant yield will be calculated using a 30-day month, 360-day year convention, a compounding period that, except for the initial period (as defined below), corresponds to the shortest period between interest payment dates for the applicable discount note (with ratable accruals within a compounding period), and an assumption that the maturity of a discount note will not be accelerated. If the period from the date of issue to the first interest payment date for a discount note (the “initial period”) is shorter than the compounding period for the discount note, a proportionate amount of the yield for an entire compounding period will be accrued. If the initial period is longer than the compounding period, then the period will be divided into a regular compounding period and a short period with the short period being treated as provided in the preceding sentence. The accrual of the applicable original issue discount discussed above may differ from the accrual of original issue discount for purposes of the Internal Revenue Code of 1986, as amended (the “Code”), certain discount notes may not be treated as having original issue discount within the meaning of the Code, and debt securities other than discount notes may be treated as issued with original issue discount for federal income tax purposes. See the discussion under “United States Federal Taxation” below. See the applicable prospectus supplement for any special considerations applicable to these debt securities.

Fixed Rate Debt Securities

Each fixed rate debt security will bear interest from the date of issuance at the annual rate stated on its face until the principal is paid or made available for payment.

How Interest Is Calculated. Interest on fixed rate debt securities will be computed on the basis of a 360-day year of twelve 30-day months.

How Interest Accrues. Interest on fixed rate debt securities will accrue from and including the most recent interest payment date to which interest has been paid or duly provided for, or, if no interest has been paid or duly provided for, from and including the issue date or any other date specified in a prospectus supplement on which interest begins to accrue. Interest will accrue to but excluding the next interest payment date, or, if earlier, the date on which the principal has been paid or duly made available for payment, except as described below under “—If a Payment Date Is Not a Business Day.”

When Interest Is Paid. Payments of interest on fixed rate debt securities will be made on the interest payment dates specified in the applicable prospectus supplement. However, if the period of time between the issue date and the first interest payment date thereafter is less than the period of time between a record date and an interest payment date, interest will not be paid on the first interest payment date, but will be paid on the second interest payment date.

Amount of Interest Payable. Interest payments for fixed rate debt securities will include accrued interest from and including the date of issue (or any other date specified in a prospectus supplement on which interest begins to accrue) or from and including the last date in respect of which interest has been paid, as the case may be, to but excluding the relevant interest payment date or date of maturity or earlier redemption or repayment, as the case may be.

If a Payment Date Is Not a Business Day. If any scheduled interest payment date is not a business day, we will pay interest on the next business day, but interest on that payment will not accrue during the period from and after the scheduled interest payment date. If the scheduled maturity date or date of redemption or repayment is not a business day, we may pay interest, if any, and principal and premium, if any, on the next succeeding business day,

but interest on that payment will not accrue during the period from and after the scheduled maturity date or date of redemption or repayment.

Amortizing Debt Securities. A fixed rate debt security may pay scheduled amounts in respect of both interest and principal amortized over the life of the debt security. Payments of principal and interest on amortizing debt securities will be made on the interest payment dates specified in the applicable prospectus supplement, and at maturity or upon any earlier redemption or repayment. Payments on amortizing debt securities will be applied first to interest due and payable and then to the reduction of the unpaid principal amount. We will provide to the original purchaser, and will furnish to subsequent holders upon request to us, a table setting forth repayment information for each amortizing debt security.

Floating Rate Debt Securities

Each floating rate debt security will mature on the date specified in the applicable prospectus supplement.

Each floating rate debt security will bear interest at a floating rate determined by reference to an interest rate or interest rate formula, which we refer to as the “base rate.” The base rate may be one or more of the following:

|

|

·

|

the commercial paper rate;

|

|

|

·

|

the federal funds rate;

|

|

|

·

|

the federal funds (open) rate;

|

|

|

·

|

any other rate or interest rate formula specified in the applicable prospectus supplement and in the floating rate debt security.

|

Formula for Interest Rates. The interest rate on each floating rate debt security will be calculated by reference to:

|

|

·

|

the specified base rate based on the index maturity;

|

|

|

·

|

plus or minus the spread, if any; and/or

|

|

|

·

|

multiplied by the spread multiplier, if any.

|

For any floating rate debt security, “index maturity” means the period of maturity of the instrument or obligation from which the base rate is calculated and will be specified in the applicable prospectus supplement. The “spread” is the number of basis points (one one-hundredth of a percentage point) specified in the applicable prospectus supplement to be added to or subtracted from the base rate for a floating rate debt security. The “spread multiplier” is the percentage specified in the applicable prospectus supplement to be applied to the base rate for a floating rate debt security. The interest rate on any inverse floating rate debt security will also be calculated by reference to a fixed rate.

Limitations on Interest Rate. A floating rate debt security may also have either or both of the following limitations on the interest rate:

|

|

·

|

a maximum limitation, or ceiling, on the rate of interest which may accrue during any interest period, which we refer to as the “maximum interest rate”; and/or

|

|

|

·

|

a minimum limitation, or floor, on the rate of interest that may accrue during any interest period, which we refer to as the “minimum interest rate.”

|

Any applicable maximum interest rate or minimum interest rate will be set forth in the applicable prospectus supplement.

In addition, the interest rate on a floating rate debt security may not be higher than the maximum rate permitted by New York law, as that rate may be modified by United States law of general application. Under current New York law, the maximum rate of interest, subject to some exceptions, for any loan in an amount less than $250,000 is 16% and for any loan in the amount of $250,000 or more but less than $2,500,000 is 25% per annum on a simple interest basis. These limits do not apply to loans of $2,500,000 or more.

How Floating Interest Rates Are Reset. The interest rate in effect from the date of issue (or any other date specified in a prospectus supplement on which interest begins to accrue) to the first interest reset date for a floating rate debt security will be the initial interest rate specified in the applicable prospectus supplement. We refer to this rate as the “initial interest rate.” The interest rate on each floating rate debt security may be reset daily, weekly, monthly, quarterly, semiannually or annually. This period is the “interest reset period” and the first day of each interest reset period is the “interest reset date.” The “interest determination date” for any interest reset date is the day the calculation agent will refer to when determining the new interest rate at which a floating rate will reset, and is applicable as follows:

|

|

·

|

for federal funds rate debt securities, federal funds (open) rate debt securities, and prime rate debt securities, the interest determination date will be on the business day prior to the interest rate reset date;

|

|

|

·

|

for CD rate debt securities, commercial paper rate debt securities and CMT rate debt securities, the interest determination date will be the second business day prior to the interest reset date;

|

|

|

·

|

for EURIBOR debt securities or Euro LIBOR debt securities, the interest determination date will be the second TARGET Settlement Day, as defined above under “—General Terms of Debt securities—Some Definitions,” prior to the interest reset date;

|

|

|

·

|

for LIBOR debt securities (other than Euro LIBOR debt securities), the interest determination date will be the second London banking day prior to the interest reset date, except that the interest determination date pertaining to an interest reset date for a LIBOR debt security for which the index currency is pounds sterling will be the interest reset date;

|

|

|

·

|

for Treasury rate debt security, the interest determination date will be the day of the week in which the interest reset date falls on which Treasury bills would normally be auctioned. Treasury bills are normally sold at auction on Monday of each week, unless that day is a legal holiday, in which case the auction is normally held on the following Tuesday, except that the auction may be held on the preceding Friday; provided, however, that if an auction is held on the Friday of the week preceding the interest reset date, the interest determination date will be that preceding Friday; and

|

|

|

·

|

for debt securities with two or more base rates, the interest determination date will be the latest business day that is at least two business days before the applicable interest reset date on which each base rate is determinable.

|

If Treasury bills are sold at an auction that falls on a day that is an interest reset date, that interest reset date will be the next following business day.

The interest reset dates will be specified in the applicable prospectus supplement. If an interest reset date for any floating rate debt security falls on a day that is not a business day, it will be postponed to the following business day, except that, in the case of a EURIBOR debt security or a LIBOR debt security, if that business day is in the next calendar month, the interest reset date will be the immediately preceding business day.

The interest rate in effect for the ten calendar days immediately prior to maturity, redemption or repayment will be the one in effect on the tenth calendar day preceding the maturity, redemption or repayment date.

In the detailed descriptions of the various base rates which follow, the “calculation date” pertaining to an interest determination date means the earlier of (i) the tenth calendar day after that interest determination date, or, if that day is not a business day, the next succeeding business day, or (ii) the business day immediately preceding the applicable interest payment date or maturity date or, for any principal amount to be redeemed or repaid, any redemption or repayment date.

How Interest Is Calculated. Interest on floating rate debt securities will accrue from and including the most recent interest payment date to which interest has been paid or duly provided for, or, if no interest has been paid or duly provided for, from and including the issue date or any other date specified in a prospectus supplement on which interest begins to accrue. Interest will accrue to but excluding the next interest payment date or, if earlier, the date on which the principal has been paid or duly made available for payment, except as described below under “—If a Payment Date Is Not a Business Day.”

The applicable prospectus supplement will specify a calculation agent for any issue of floating rate debt securities. Upon the request of the holder of any floating rate debt security, the calculation agent will provide the interest rate then in effect and, if determined, the interest rate that will become effective on the next interest reset date for that floating rate debt security. The calculation agent will notify the U.K. Financial Services Authority (the “FSA”) and/or the London Stock Exchange plc, in the case of debt securities admitted to the Official List of the FSA and admitted to trading on the Regulated Market of the London Stock Exchange plc, where the rules of the FSA and/or the London Stock Exchange plc require it, and the paying agents of each determination of the interest rate applicable to any floating rate debt security promptly after the determination is made.

For a floating rate debt security, accrued interest will be calculated by multiplying the principal amount of the floating rate debt security by an accrued interest factor. This accrued interest factor will be computed by adding the interest factors calculated for each day in the period for which interest is being paid. The interest factor for each day is computed by dividing the interest rate applicable to that day:

|

|

·

|

by 360, in the case of CD rate debt securities, commercial paper rate debt securities, EURIBOR debt securities, federal funds rate debt securities, federal funds (open) rate debt securities, LIBOR debt securities (except for LIBOR debt securities denominated in pounds sterling) and prime rate debt securities;

|

|

|

·

|

by 365, in the case of LIBOR debt securities denominated in pounds sterling; or

|

|

|

·

|

by the actual number of days in the year, in the case of Treasury rate debt securities, CMT rate debt securities and securities for which the applicable prospectus supplement provides that the day count convention will be “actual/actual.”

|

For these calculations, the interest rate in effect on any interest reset date will be the applicable rate as reset on that date. The interest rate applicable to any other day is the interest rate from the immediately preceding interest reset date or, if none, the initial interest rate.

All percentages used in or resulting from any calculation of the rate of interest on a floating rate debt security will be rounded, if necessary, to the nearest one hundred-thousandth of a percentage point, with .000005% rounded up to .00001%, and all U.S. dollar amounts used in or resulting from these calculations on floating rate debt securities will be rounded to the nearest cent, with one-half cent rounded upward. All Japanese Yen amounts used in or resulting from these calculations will be rounded downward to the next lower whole Japanese Yen amount. All amounts denominated in any other currency used in or resulting from these calculations will be rounded to the nearest two decimal places in that currency, with .005 rounded up to .01.

When Interest Is Paid. We will pay interest on floating rate debt securities on the interest payment dates specified in the applicable prospectus supplement. However, if the period of time between the issue date and the first interest payment date thereafter is less than the period of time between a record date and an interest payment date, interest will not be paid on the first interest payment date, but will be paid on the second interest payment date.

If a Payment Date Is Not a Business Day. If any scheduled interest payment date, other than the maturity date or any earlier redemption or repayment date, for any floating rate debt security falls on a day that is not a business day, it will be postponed to the following business day, except that, in the case of a EURIBOR debt security or a LIBOR debt security, if that business day would fall in the next calendar month, the interest payment date will be the immediately preceding business day. If the scheduled maturity date or any earlier redemption or repayment date of a floating rate debt security falls on a day that is not a business day, the payment of principal, premium, if any, and interest, if any, will be made on the next succeeding business day, but interest on that payment will not accrue during the period from and after the maturity, redemption or repayment date.

Base Rates

CD Rate Debt Securities. CD rate debt securities will bear interest at the interest rates specified in the CD rate debt securities and in the applicable prospectus supplement. Those interest rates will be based on the CD rate and any spread and/or spread multiplier and will be subject to the minimum interest rate and the maximum interest rate, if any.

The “CD rate” means, for any interest determination date, the rate on that date for negotiable U.S. dollar certificates of deposit having the index maturity specified in the applicable prospectus supplement as published by the Board of Governors of the Federal Reserve System in “Statistical Release H.15(519), Selected Interest Rates,” or any successor publication of the Board of Governors of the Federal Reserve System (“H.15(519)”) under the heading “CDs (Secondary Market).”

The following procedures will be followed if the CD rate cannot be determined as described above:

|

|

·

|

If the above rate is not published in H.15(519) by 3:00 p.m., New York City time, on the calculation date, the CD rate will be the rate on that interest determination date set forth in the daily update of H.15(519), available through the world wide website of the Board of Governors of the Federal Reserve System at http://www.federalreserve.gov/releases/h15/update, or any successor site or publication, which is commonly referred to as the “H.15 Daily Update,” for the interest determination date for certificates of deposit having the index maturity specified in the applicable prospectus supplement, under the caption “CDs (Secondary Market).”

|

|

|

·

|

If the above rate is not yet published in either H.15(519) or the H.15 Daily Update by 3:00 p.m., New York City time, on the calculation date, the calculation agent will determine the CD rate to be the arithmetic mean of the secondary market offered rates as of 10:00 a.m., New York City time, on that interest determination date of three leading nonbank dealers in negotiable U.S. dollar certificates of deposit in The City of New York, which may include the agent and its affiliates, selected by the calculation agent, after consultation with us, for negotiable U.S. dollar certificates of deposit of major U.S. money center banks of the highest credit standing in the market for negotiable certificates of deposit with a remaining maturity closest to the index maturity specified in the applicable prospectus supplement in an amount that is representative for a single transaction in that market at that time.

|

|

|

·

|

If the dealers selected by the calculation agent are not quoting as set forth above, the CD rate for that interest determination date will remain the CD rate for the immediately preceding interest reset period, or, if there was no interest reset period, the rate of interest payable will be the initial interest rate.

|

Commercial Paper Rate Debt Securities. Commercial paper rate debt securities will bear interest at the interest rates specified in the commercial paper rate debt securities and in the applicable prospectus supplement. Those interest rates will be based on the commercial paper rate and any spread and/or spread multiplier and will be subject to the minimum interest rate and the maximum interest rate, if any.

The “commercial paper rate” means, for any interest determination date, the money market yield, calculated as described below, of the rate on that date for U.S dollar commercial paper having the index maturity specified in the applicable prospectus supplement, as that rate is published in H.15(519), under the heading “Commercial Paper—Nonfinancial.”

The following procedures will be followed if the commercial paper rate cannot be determined as described above:

|

|

·

|

If the above rate is not published by 3:00 p.m., New York City time, on the calculation date, then the commercial paper rate will be the money market yield of the rate on that interest determination date for commercial paper of the index maturity specified in the applicable prospectus supplement as published in the H.15 Daily Update, or other recognized electronic source used for the purpose of displaying the applicable rate, under the heading “Commercial Paper—Nonfinancial.”

|

|

|

·

|

If by 3:00 p.m., New York City time, on that calculation date the rate is not yet published in either H.15(519) or the H.15 Daily Update, or other recognized electronic source used for the purpose of displaying the applicable rate, then the calculation agent will determine the commercial paper rate to be the money market yield of the arithmetic mean of the offered rates as of 11:00 a.m., New York City time, on that interest determination date of three leading dealers of U.S. dollar commercial paper in The City of New York, which may include the agent and its affiliates, selected by the calculation agent, after consultation with us, for commercial paper of the index maturity specified in the applicable prospectus supplement, placed for an industrial issuer whose bond rating is “Aa,” or the equivalent, from a nationally recognized statistical rating agency.

|

|

|

·

|

If the dealers selected by the calculation agent are not quoting as set forth above, the commercial paper rate for that interest determination date will remain the commercial paper rate for the immediately preceding interest reset period, or, if there was no interest reset period, the rate of interest payable will be the initial interest rate.

|

The “money market yield” will be a yield calculated in accordance with the following formula:

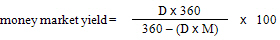

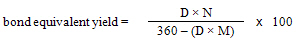

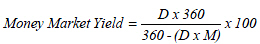

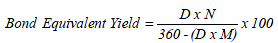

where “D” refers to the applicable per year rate for commercial paper quoted on a bank discount basis and expressed as a decimal and “M” refers to the actual number of days in the interest period for which interest is being calculated.

EURIBOR Debt Securities. EURIBOR debt securities will bear interest at the interest rates specified in the EURIBOR debt securities and in the applicable prospectus supplement. That interest rate will be based on EURIBOR and any spread and/or spread multiplier and will be subject to the minimum interest rate and the maximum interest rate, if any.

“EURIBOR” means, for any interest determination date, the rate for deposits in euros as sponsored, calculated and published jointly by the European Banking Federation and ACI - The Financial Market Association, or any company established by the joint sponsors for purposes of compiling and publishing those rates, for the index maturity specified in the applicable prospectus supplement as that rate appears on the display on Reuters 3000 Xtra Service (“Reuters”), or any successor service, on page EURIBOR01 or any other page as may replace page EURIBOR01 on that service, which is commonly referred to as “Reuters Page EURIBOR01” as of 11:00 a.m., Brussels time.

The following procedures will be followed if the rate cannot be determined as described above:

|

|

·

|