| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | (Registrant’s telephone number, including area code) | |||||||||||||||||||||

(Address of principal executive offices, including Zip Code) | |||||||||||||||||||||||

Securities registered pursuant to Section 12(b) of the Act: | ||||||||

| Title of each class | Trading Symbol(s) | Name of exchange on which registered | ||||||

| Depositary Shares, each representing 1/1,000th interest in a share of Floating Rate | ||||||||

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate | ||||||||

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate | ||||||||

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate | ||||||||

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate | ||||||||

| Depositary Shares, each representing 1/1,000th interest in a share of 4.875% | ||||||||

| Depositary Shares, each representing 1/1,000th interest in a share of 4.250% | ||||||||

| Depositary Shares, each representing 1/1,000th interest in a share of 6.500% | ||||||||

| of Morgan Stanley Finance LLC (and Registrant’s guarantee with respect thereto) | ||||||||

| of Morgan Stanley Finance LLC (and Registrant’s guarantee with respect thereto) | ||||||||

| ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

| Table of Contents | Part | Item | Page | |||||||||||

| I | ||||||||||||||

| I | 2 | |||||||||||||

| I | 3 | |||||||||||||

| I | 1 | |||||||||||||

| I | 4 | |||||||||||||

| II | ||||||||||||||

| II | 1 | |||||||||||||

| II | 1A | |||||||||||||

| II | 2 | |||||||||||||

| II | 5 | |||||||||||||

| II | 6 | |||||||||||||

2 | ||||||||

3 | ||||||||

4 | March 2024 Form 10-Q | |||||||

| Management’s Discussion and Analysis |  | ||||

| March 2024 Form 10-Q | 5 | |||||||

| Management’s Discussion and Analysis |  | ||||

6 | March 2024 Form 10-Q | |||||||

| Management’s Discussion and Analysis |  | ||||

| Three Months Ended March 31, | ||||||||

$ in millions, except per share data | 2024 | 2023 | ||||||

| Consolidated results | ||||||||

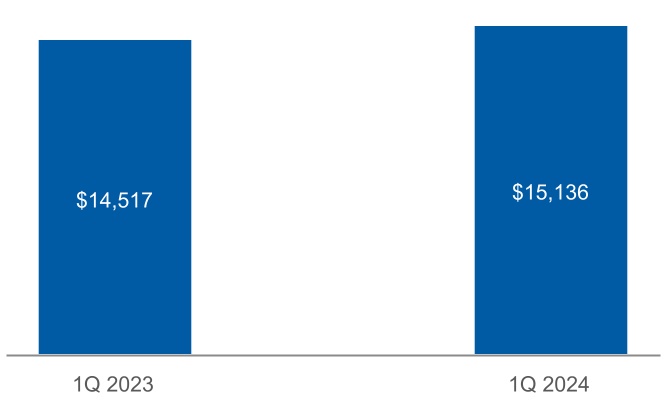

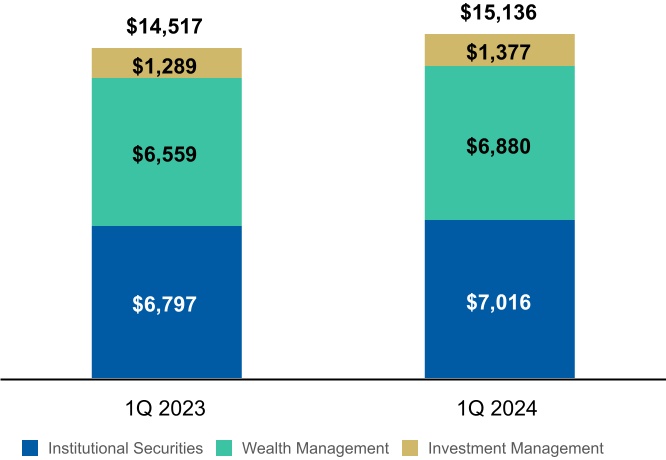

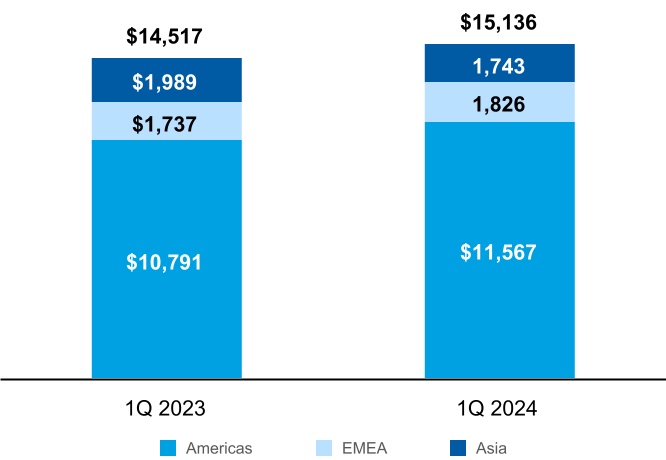

| Net revenues | $ | 15,136 | $ | 14,517 | ||||

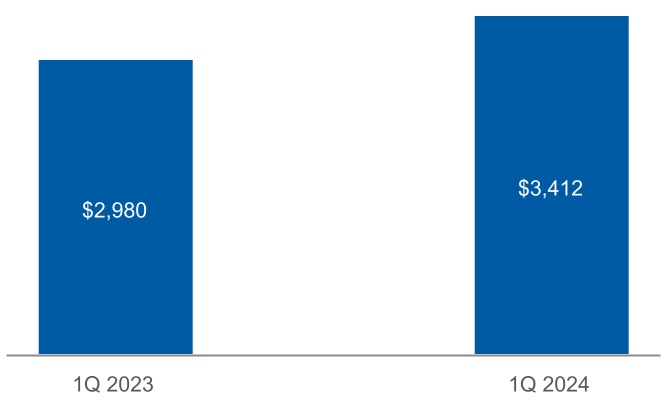

| Earnings applicable to Morgan Stanley common shareholders | $ | 3,266 | $ | 2,836 | ||||

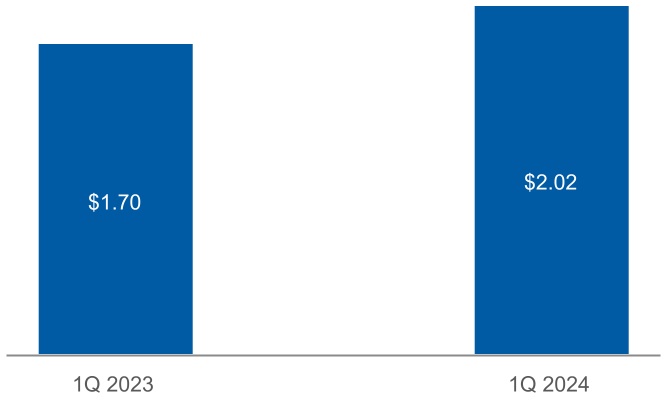

| Earnings per diluted common share | $ | 2.02 | $ | 1.70 | ||||

| Consolidated financial measures | ||||||||

Expense efficiency ratio1 | 71 | % | 72 | % | ||||

ROE2 | 14.5 | % | 12.4 | % | ||||

ROTCE2, 3 | 19.7 | % | 16.9 | % | ||||

Pre-tax margin4 | 29 | % | 26 | % | ||||

| Effective tax rate | 21.2 | % | 19.3 | % | ||||

Pre-tax margin by segment4 | ||||||||

| Institutional Securities | 34 | % | 28 | % | ||||

| Wealth Management | 26 | % | 26 | % | ||||

| Investment Management | 18 | % | 13 | % | ||||

$ in millions, except per share data, worldwide employees and client assets | At March 31, 2024 | At December 31, 2023 | ||||||

Average liquidity resources for three months ended5 | $ | 318,664 | $ | 314,504 | ||||

Loans6 | $ | 227,145 | $ | 226,828 | ||||

| Total assets | $ | 1,228,503 | $ | 1,193,693 | ||||

| Deposits | $ | 352,494 | $ | 351,804 | ||||

| Borrowings | $ | 271,383 | $ | 263,732 | ||||

Common equity | $ | 90,448 | $ | 90,288 | ||||

Tangible common equity3 | $ | 66,813 | $ | 66,527 | ||||

| Common shares outstanding | 1,627 | 1,627 | ||||||

Book value per common share7 | $ | 55.60 | $ | 55.50 | ||||

Tangible book value per common share3, 7 | $ | 41.07 | $ | 40.89 | ||||

| Worldwide employees (in thousands) | 80 | 80 | ||||||

Client assets8 (in billions) | $ | 7,000 | $ | 6,588 | ||||

Capital Ratios9 | ||||||||

| Common Equity Tier 1 capital—Standardized | 15.0 | % | 15.2 | % | ||||

| Tier 1 capital—Standardized | 16.9 | % | 17.1 | % | ||||

| Common Equity Tier 1 capital—Advanced | 15.4 | % | 15.5 | % | ||||

| Tier 1 capital—Advanced | 17.3 | % | 17.4 | % | ||||

| Tier 1 leverage | 6.7 | % | 6.7 | % | ||||

| SLR | 5.4 | % | 5.5 | % | ||||

| March 2024 Form 10-Q | 7 | |||||||

| Management’s Discussion and Analysis |  | ||||

| Three Months Ended March 31, | ||||||||

| $ in millions | 2024 | 2023 | ||||||

| Net revenues | $ | 15,136 | $ | 14,517 | ||||

Adjustment for mark-to-market losses (gains) on DCP1 | (187) | (153) | ||||||

| Adjusted Net revenues—non-GAAP | $ | 14,949 | $ | 14,364 | ||||

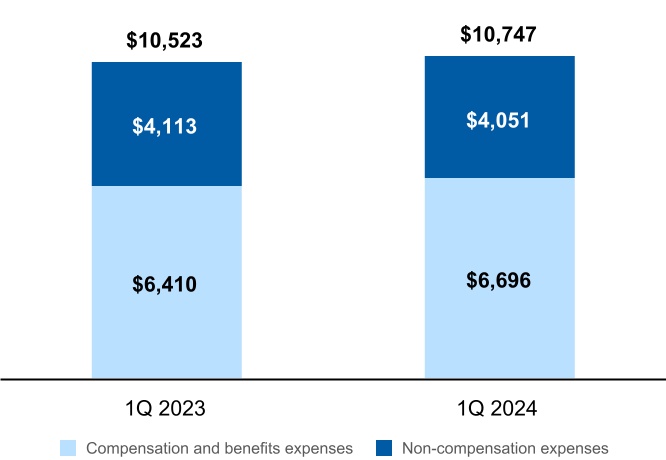

| Compensation expense | $ | 6,696 | $ | 6,410 | ||||

Adjustment for mark-to-market gains (losses) on DCP1 | (249) | (193) | ||||||

| Adjusted Compensation expense—non-GAAP | $ | 6,447 | $ | 6,217 | ||||

| Wealth Management Net revenues | $ | 6,880 | $ | 6,559 | ||||

Adjustment for mark-to-market losses (gains) on DCP1 | (140) | (101) | ||||||

| Adjusted Wealth Management Net revenues—non-GAAP | $ | 6,740 | $ | 6,458 | ||||

| Wealth Management Compensation expense | $ | 3,788 | $ | 3,477 | ||||

Adjustment for mark-to-market gains (losses) on DCP1 | (156) | (119) | ||||||

| Adjusted Wealth Management Compensation expense—non-GAAP | $ | 3,632 | $ | 3,358 | ||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | ||||||

| Tangible equity | ||||||||

Common equity | $ | 90,448 | $ | 90,288 | ||||

| Less: Goodwill and net intangible assets | (23,635) | (23,761) | ||||||

Tangible common equity—non-GAAP | $ | 66,813 | $ | 66,527 | ||||

| Average Monthly Balance | ||||||||

| Three Months Ended March 31, | ||||||||

| $ in millions | 2024 | 2023 | ||||||

| Tangible equity | ||||||||

Common equity | $ | 89,913 | $ | 91,382 | ||||

| Less: Goodwill and net intangible assets | (23,705) | (24,198) | ||||||

Tangible common equity—non-GAAP | $ | 66,208 | $ | 67,184 | ||||

| Three Months Ended March 31, | ||||||||

| $ in billions | 2024 | 2023 | ||||||

Average common equity2 | ||||||||

| Institutional Securities | $ | 45.0 | $ | 45.6 | ||||

| Wealth Management | 29.1 | 28.8 | ||||||

| Investment Management | 10.8 | 10.4 | ||||||

ROE3 | ||||||||

| Institutional Securities | 15 | % | 12 | % | ||||

| Wealth Management | 19 | % | 19 | % | ||||

| Investment Management | 7 | % | 5 | % | ||||

Average tangible common equity2 | ||||||||

| Institutional Securities | $ | 44.6 | $ | 45.2 | ||||

| Wealth Management | 15.5 | 14.8 | ||||||

| Investment Management | 1.1 | 0.7 | ||||||

ROTCE3 | ||||||||

| Institutional Securities | 15 | % | 12 | % | ||||

| Wealth Management | 35 | % | 36 | % | ||||

| Investment Management | 68 | % | 73 | % | ||||

8 | March 2024 Form 10-Q | |||||||

| Management’s Discussion and Analysis |  | ||||

| March 2024 Form 10-Q | 9 | |||||||

| Management’s Discussion and Analysis |  | ||||

| Three Months Ended March 31, | % Change | ||||||||||

| $ in millions | 2024 | 2023 | |||||||||

| Revenues | |||||||||||

| Advisory | $ | 461 | $ | 638 | (28) | % | |||||

| Equity | 430 | 202 | 113 | % | |||||||

| Fixed income | 556 | 407 | 37 | % | |||||||

| Total Underwriting | 986 | 609 | 62 | % | |||||||

| Total Investment banking | 1,447 | 1,247 | 16 | % | |||||||

| Equity | 2,842 | 2,729 | 4 | % | |||||||

| Fixed income | 2,485 | 2,576 | (4) | % | |||||||

| Other | 242 | 245 | (1) | % | |||||||

| Net revenues | $ | 7,016 | $ | 6,797 | 3 | % | |||||

| Provision for credit losses | 2 | 189 | (99) | % | |||||||

| Compensation and benefits | 2,343 | 2,365 | (1) | % | |||||||

| Non-compensation expenses | 2,320 | 2,351 | (1) | % | |||||||

| Total non-interest expenses | 4,663 | 4,716 | (1) | % | |||||||

| Income before provision for income taxes | 2,351 | 1,892 | 24 | % | |||||||

| Provision for income taxes | 482 | 363 | 33 | % | |||||||

| Net income | 1,869 | 1,529 | 22 | % | |||||||

| Net income applicable to noncontrolling interests | 50 | 51 | (2) | % | |||||||

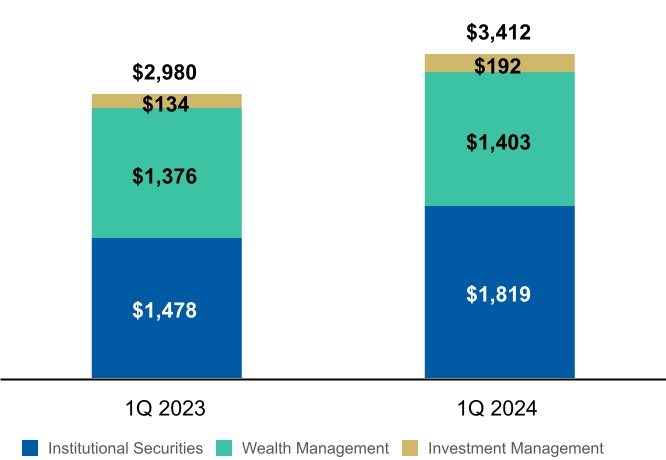

| Net income applicable to Morgan Stanley | $ | 1,819 | $ | 1,478 | 23 | % | |||||

| Three Months Ended March 31, | ||||||||

| $ in billions | 2024 | 2023 | ||||||

Completed mergers and acquisitions1 | $ | 115 | $ | 128 | ||||

Equity and equity-related offerings2, 3 | 16 | 11 | ||||||

Fixed income offerings2, 4 | 95 | 63 | ||||||

| Three Months Ended March 31, 2024 | |||||||||||||||||

Net Interest2 | All Other3 | ||||||||||||||||

| $ in millions | Trading | Fees1 | Total | ||||||||||||||

| Financing | $ | 2,022 | $ | 136 | $ | (891) | $ | 1 | $ | 1,268 | |||||||

| Execution services | 972 | 609 | (41) | 34 | 1,574 | ||||||||||||

| Total Equity | $ | 2,994 | $ | 745 | $ | (932) | $ | 35 | $ | 2,842 | |||||||

| Total Fixed Income | $ | 2,594 | $ | 104 | $ | (292) | $ | 79 | $ | 2,485 | |||||||

| Three Months Ended March 31, 2023 | |||||||||||||||||

Net Interest2 | All Other3 | ||||||||||||||||

| $ in millions | Trading | Fees1 | Total | ||||||||||||||

| Financing | $ | 1,696 | $ | 134 | $ | (541) | $ | 32 | $ | 1,321 | |||||||

| Execution services | 848 | 619 | (59) | — | 1,408 | ||||||||||||

| Total Equity | $ | 2,544 | $ | 753 | $ | (600) | $ | 32 | $ | 2,729 | |||||||

| Total Fixed Income | $ | 2,478 | $ | 109 | $ | (89) | $ | 78 | $ | 2,576 | |||||||

10 | March 2024 Form 10-Q | |||||||

| Management’s Discussion and Analysis |  | ||||

| March 2024 Form 10-Q | 11 | |||||||

| Management’s Discussion and Analysis |  | ||||

| Three Months Ended March 31, | % Change | ||||||||||

| $ in millions | 2024 | 2023 | |||||||||

| Revenues | |||||||||||

| Asset management | $ | 3,829 | $ | 3,382 | 13 | % | |||||

Transactional1 | 1,033 | 921 | 12 | % | |||||||

| Net interest | 1,856 | 2,158 | (14) | % | |||||||

Other1 | 162 | 98 | 65 | % | |||||||

| Net revenues | 6,880 | 6,559 | 5 | % | |||||||

| Provision for credit losses | (8) | 45 | (118) | % | |||||||

| Compensation and benefits | 3,788 | 3,477 | 9 | % | |||||||

| Non-compensation expenses | 1,294 | 1,325 | (2) | % | |||||||

| Total non-interest expenses | 5,082 | 4,802 | 6 | % | |||||||

Income before provision for income taxes | $ | 1,806 | $ | 1,712 | 5 | % | |||||

| Provision for income taxes | 403 | 336 | 20 | % | |||||||

| Net income applicable to Morgan Stanley | $ | 1,403 | $ | 1,376 | 2 | % | |||||

| $ in billions | At March 31, 2024 | At December 31, 2023 | ||||||

Total client assets1 | $ | 5,495 | $ | 5,129 | ||||

| U.S. Bank Subsidiary loans | $ | 147 | $ | 147 | ||||

Margin and other lending2 | $ | 23 | $ | 21 | ||||

Deposits3 | $ | 347 | $ | 346 | ||||

Annualized weighted average cost of deposits4 | ||||||||

| Period end | 2.96% | 2.92% | ||||||

Period average for three months ended | 2.92% | 2.86% | ||||||

| Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

Net new assets | $ | 94.9 | $ | 109.6 | ||||

| $ in billions | At March 31, 2024 | At December 31, 2023 | ||||||

Advisor-led client assets1 | $ | 4,302 | $ | 3,979 | ||||

Fee-based client assets2 | $ | 2,124 | $ | 1,983 | ||||

| Fee-based client assets as a percentage of advisor-led client assets | 49% | 50% | ||||||

| Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

Fee-based asset flows3 | $ | 26.2 | $ | 22.4 | ||||

| At March 31, 2024 | At December 31, 2023 | |||||||

Self-directed client assets1 (in billions) | $ | 1,194 | $ | 1,150 | ||||

Self-directed households2 (in millions) | 8.1 | 8.1 | ||||||

| Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

Daily average revenue trades (“DARTs”)3 (in thousands) | 841 | 831 | ||||||

| At March 31, 2024 | At December 31, 2023 | |||||||

Stock plan unvested assets2 (in billions) | $ | 457 | $ | 416 | ||||

Stock plan participants3 (in millions) | 6.6 | 6.6 | ||||||

12 | March 2024 Form 10-Q | |||||||

| Management’s Discussion and Analysis |  | ||||

| $ in billions | At December 31, 2023 | Inflows1 | Outflows2 | Market Impact3 | At March 31, 2024 | ||||||||||||

Separately managed4 | $ | 589 | $ | 16 | $ | (13) | $ | 39 | $ | 631 | |||||||

| Unified managed | 501 | 31 | (14) | 27 | 545 | ||||||||||||

| Advisor | 188 | 9 | (11) | 12 | 198 | ||||||||||||

| Portfolio manager | 645 | 32 | (24) | 35 | 688 | ||||||||||||

| Subtotal | $ | 1,923 | $ | 88 | $ | (62) | $ | 113 | $ | 2,062 | |||||||

| Cash management | 60 | 12 | (10) | — | 62 | ||||||||||||

Total fee-based client assets | $ | 1,983 | $ | 100 | $ | (72) | $ | 113 | $ | 2,124 | |||||||

| $ in billions | At December 31, 2022 | Inflows1 | Outflows2 | Market Impact3 | At March 31, 2023 | ||||||||||||

Separately managed4 | $ | 501 | $ | 16 | $ | (7) | $ | 18 | $ | 528 | |||||||

| Unified managed | 408 | 21 | (14) | 17 | 432 | ||||||||||||

| Advisor | 167 | 9 | (9) | 9 | 176 | ||||||||||||

| Portfolio manager | 552 | 26 | (20) | 20 | 578 | ||||||||||||

| Subtotal | $ | 1,628 | $ | 72 | $ | (50) | $ | 64 | $ | 1,714 | |||||||

| Cash management | 50 | 20 | (15) | — | 55 | ||||||||||||

Total fee-based client assets | $ | 1,678 | $ | 92 | $ | (65) | $ | 64 | $ | 1,769 | |||||||

| Three Months Ended March 31, | ||||||||

| Fee rate in bps | 2024 | 2023 | ||||||

| Separately managed | 12 | 13 | ||||||

| Unified managed | 91 | 93 | ||||||

| Advisor | 79 | 80 | ||||||

| Portfolio manager | 90 | 91 | ||||||

| Subtotal | 65 | 66 | ||||||

| Cash management | 6 | 6 | ||||||

| Total fee-based client assets | 63 | 65 | ||||||

| March 2024 Form 10-Q | 13 | |||||||

| Management’s Discussion and Analysis |  | ||||

| Three Months Ended March 31, | % Change | ||||||||||

| $ in millions | 2024 | 2023 | |||||||||

| Revenues | |||||||||||

| Asset management and related fees | $ | 1,346 | $ | 1,248 | 8 | % | |||||

Performance-based income and other1 | 31 | 41 | (24) | % | |||||||

| Net revenues | 1,377 | 1,289 | 7 | % | |||||||

| Compensation and benefits | 565 | 568 | (1) | % | |||||||

| Non-compensation expenses | 571 | 555 | 3 | % | |||||||

| Total non-interest expenses | 1,136 | 1,123 | 1 | % | |||||||

| Income before provision for income taxes | 241 | 166 | 45 | % | |||||||

| Provision for income taxes | 49 | 30 | 63 | % | |||||||

| Net income | 192 | 136 | 41 | % | |||||||

| Net income (loss) applicable to noncontrolling interests | — | 2 | (100) | % | |||||||

| Net income applicable to Morgan Stanley | $ | 192 | $ | 134 | 43 | % | |||||

| $ in billions | At Dec 31, 2023 | Inflows1 | Outflows2 | Market Impact3 | Other4 | At Mar 31, 2024 | ||||||||||||||

| Equity | $ | 295 | $ | 11 | $ | (16) | $ | 24 | $ | (4) | $ | 310 | ||||||||

Fixed Income | 171 | 17 | (13) | 1 | (2) | 174 | ||||||||||||||

| Alternatives and Solutions | 508 | 35 | (24) | 26 | (2) | 543 | ||||||||||||||

Long-Term AUM | $ | 974 | $ | 63 | $ | (53) | $ | 51 | $ | (8) | $ | 1,027 | ||||||||

| Liquidity and Overlay Services | 485 | 522 | (531) | 6 | (4) | 478 | ||||||||||||||

| Total | $ | 1,459 | $ | 585 | $ | (584) | $ | 57 | $ | (12) | $ | 1,505 | ||||||||

| $ in billions | At Dec 31, 2022 | Inflows1 | Outflows2 | Market Impact3 | Other4 | At Mar 31, 2023 | ||||||||||||||

| Equity | $ | 259 | $ | 10 | $ | (12) | $ | 21 | $ | (1) | $ | 277 | ||||||||

Fixed Income | 173 | 16 | (17) | 4 | (1) | 175 | ||||||||||||||

| Alternatives and Solutions | 431 | 18 | (16) | 15 | — | 448 | ||||||||||||||

Long-Term AUM | $ | 863 | $ | 44 | $ | (45) | $ | 40 | $ | (2) | $ | 900 | ||||||||

| Liquidity and Overlay Services | 442 | 585 | (568) | 6 | (3) | 462 | ||||||||||||||

| Total | $ | 1,305 | $ | 629 | $ | (613) | $ | 46 | $ | (5) | $ | 1,362 | ||||||||

| Three Months Ended March 31, | ||||||||

| $ in billions | 2024 | 2023 | ||||||

| Equity | $ | 302 | $ | 271 | ||||

| Fixed income | 172 | 175 | ||||||

| Alternatives and Solutions | 523 | 441 | ||||||

| Long-term AUM subtotal | 997 | 887 | ||||||

| Liquidity and Overlay Services | 482 | 442 | ||||||

| Total AUM | $ | 1,479 | $ | 1,329 | ||||

14 | March 2024 Form 10-Q | |||||||

| Management’s Discussion and Analysis |  | ||||

| Three Months Ended March 31, | ||||||||

| Fee rate in bps | 2024 | 2023 | ||||||

| Equity | 71 | 72 | ||||||

| Fixed income | 36 | 35 | ||||||

| Alternatives and Solutions | 29 | 33 | ||||||

| Long-term AUM | 43 | 45 | ||||||

| Liquidity and Overlay Services | 13 | 13 | ||||||

| Total AUM | 33 | 35 | ||||||

| March 2024 Form 10-Q | 15 | |||||||

| Management’s Discussion and Analysis |  | ||||

| $ in billions | At March 31, 2024 | At December 31, 2023 | ||||||

| Investment securities: | ||||||||

| Available-for-sale at fair value | $ | 65.3 | $ | 66.6 | ||||

| Held-to-maturity | 50.7 | 51.4 | ||||||

| Total Investment securities | $ | 116.0 | $ | 118.0 | ||||

Wealth Management Loans2 | ||||||||

| Residential real estate | $ | 61.3 | $ | 60.3 | ||||

Securities-based lending and Other3 | 86.1 | 86.2 | ||||||

| Total, net of ACL | $ | 147.4 | $ | 146.5 | ||||

Institutional Securities Loans2 | ||||||||

| Corporate | $ | 7.9 | $ | 10.1 | ||||

| Secured lending facilities | 40.5 | 40.8 | ||||||

| Commercial and Residential real estate | 11.1 | 10.7 | ||||||

| Securities-based lending and Other | 4.4 | 4.1 | ||||||

| Total, net of ACL | $ | 63.9 | $ | 65.7 | ||||

| Total Assets | $ | 400.9 | $ | 396.1 | ||||

Deposits4 | $ | 346.6 | $ | 346.1 | ||||

16 | March 2024 Form 10-Q | |||||||

| Management’s Discussion and Analysis |  | ||||

| At March 31, 2024 | ||||||||||||||

| $ in millions | IS | WM | IM | Total | ||||||||||

| Assets | ||||||||||||||

| Cash and cash equivalents | $ | 73,593 | $ | 28,550 | $ | 162 | $ | 102,305 | ||||||

| Trading assets at fair value | 353,117 | 9,177 | 5,339 | 367,633 | ||||||||||

| Investment securities | 38,562 | 114,171 | — | 152,733 | ||||||||||

| Securities purchased under agreements to resell | 102,295 | 20,438 | — | 122,733 | ||||||||||

| Securities borrowed | 131,780 | 1,072 | — | 132,852 | ||||||||||

| Customer and other receivables | 47,665 | 32,489 | 1,485 | 81,639 | ||||||||||

Loans1 | 69,811 | 147,405 | 4 | 217,220 | ||||||||||

Goodwill | 444 | 10,196 | 6,082 | 16,722 | ||||||||||

Intangible assets | 35 | 3,306 | 3,573 | 6,914 | ||||||||||

Other assets2 | 15,391 | 11,120 | 1,241 | 27,752 | ||||||||||

| Total assets | $ | 832,693 | $ | 377,924 | $ | 17,886 | $ | 1,228,503 | ||||||

| At December 31, 2023 | ||||||||||||||

| $ in millions | IS | WM | IM | Total | ||||||||||

| Assets | ||||||||||||||

| Cash and cash equivalents | $ | 72,928 | $ | 16,172 | $ | 132 | $ | 89,232 | ||||||

| Trading assets at fair value | 353,841 | 7,962 | 5,271 | 367,074 | ||||||||||

| Investment securities | 39,212 | 115,595 | — | 154,807 | ||||||||||

| Securities purchased under agreements to resell | 90,701 | 20,039 | — | 110,740 | ||||||||||

| Securities borrowed | 119,823 | 1,268 | — | 121,091 | ||||||||||

| Customer and other receivables | 47,333 | 31,237 | 1,535 | 80,105 | ||||||||||

Loans1 | 72,110 | 146,526 | 4 | 218,640 | ||||||||||

Goodwill | 424 | 10,199 | 6,084 | 16,707 | ||||||||||

Intangible assets | 26 | 3,427 | 3,602 | 7,055 | ||||||||||

Other assets2 | 14,108 | 12,743 | 1,391 | 28,242 | ||||||||||

| Total assets | $ | 810,506 | $ | 365,168 | $ | 18,019 | $ | 1,193,693 | ||||||

| March 2024 Form 10-Q | 17 | |||||||

| Management’s Discussion and Analysis |  | ||||

| Average Daily Balance Three Months Ended | ||||||||

| $ in millions | March 31, 2024 | December 31, 2023 | ||||||

| Cash deposits with central banks | $ | 63,913 | $ | 64,205 | ||||

Unencumbered HQLA Securities1: | ||||||||

| U.S. government obligations | 140,628 | 137,635 | ||||||

| U.S. agency and agency mortgage-backed securities | 86,507 | 83,733 | ||||||

Non-U.S. sovereign obligations2 | 19,397 | 20,117 | ||||||

| Other investment grade securities | 969 | 678 | ||||||

Total HQLA1 | $ | 311,414 | $ | 306,368 | ||||

| Cash deposits with banks (non-HQLA) | 7,250 | 8,136 | ||||||

| Total Liquidity Resources | $ | 318,664 | $ | 314,504 | ||||

| Average Daily Balance Three Months Ended | ||||||||

| $ in millions | March 31, 2024 | December 31, 2023 | ||||||

| Bank legal entities | ||||||||

| U.S. | $ | 139,457 | $ | 132,870 | ||||

| Non-U.S. | 5,661 | 5,359 | ||||||

| Total Bank legal entities | 145,118 | 138,229 | ||||||

| Non-Bank legal entities | ||||||||

| U.S.: | ||||||||

| Parent Company | 59,420 | 58,494 | ||||||

| Non-Parent Company | 56,059 | 56,459 | ||||||

| Total U.S. | 115,479 | 114,953 | ||||||

| Non-U.S. | 58,067 | 61,322 | ||||||

| Total Non-Bank legal entities | 173,546 | 176,275 | ||||||

| Total Liquidity Resources | $ | 318,664 | $ | 314,504 | ||||

| Average Daily Balance Three Months Ended | ||||||||

| $ in millions | March 31, 2024 | December 31, 2023 | ||||||

Eligible HQLA | ||||||||

| Cash deposits with central banks | $ | 58,096 | $ | 58,047 | ||||

Securities1 | 192,944 | 194,970 | ||||||

Total Eligible HQLA | $ | 251,040 | $ | 253,017 | ||||

Net cash outflows | $ | 200,358 | $ | 196,488 | ||||

| LCR | 125 | % | 129 | % | ||||

18 | March 2024 Form 10-Q | |||||||

| Management’s Discussion and Analysis |  | ||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | ||||||

| Securities purchased under agreements to resell and Securities borrowed | $ | 255,585 | $ | 231,831 | ||||

| Securities sold under agreements to repurchase and Securities loaned | $ | 98,349 | $ | 77,708 | ||||

Securities received as collateral1 | $ | 3,357 | $ | 6,219 | ||||

| Average Daily Balance Three Months Ended | ||||||||

| $ in millions | March 31, 2024 | December 31, 2023 | ||||||

| Securities purchased under agreements to resell and Securities borrowed | $ | 228,978 | $ | 235,928 | ||||

| Securities sold under agreements to repurchase and Securities loaned | $ | 97,495 | $ | 87,285 | ||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | ||||||

| Savings and demand deposits: | ||||||||

Brokerage sweep deposits1 | $ | 141,996 | $ | 148,274 | ||||

| Savings and other | 146,457 | 139,978 | ||||||

| Total Savings and demand deposits | 288,453 | 288,252 | ||||||

Time deposits2 | 64,041 | 63,552 | ||||||

Total3 | $ | 352,494 | $ | 351,804 | ||||

| $ in millions | Parent Company | Subsidiaries | Total | ||||||||

| Original maturities of one year or less | $ | — | $ | 5,233 | $ | 5,233 | |||||

| Original maturities greater than one year | |||||||||||

| 2024 | $ | 6,433 | $ | 6,755 | $ | 13,188 | |||||

| 2025 | 20,183 | 14,023 | 34,206 | ||||||||

| 2026 | 24,314 | 11,429 | 35,743 | ||||||||

| 2027 | 20,603 | 7,506 | 28,109 | ||||||||

| 2028 | 11,245 | 10,366 | 21,611 | ||||||||

| Thereafter | 98,284 | 35,009 | 133,293 | ||||||||

| Total greater than one year | $ | 181,062 | $ | 85,088 | $ | 266,150 | |||||

| Total | $ | 181,062 | $ | 90,321 | $ | 271,383 | |||||

Maturities over next 12 months2 | $ | 19,701 | |||||||||

| March 2024 Form 10-Q | 19 | |||||||

| Management’s Discussion and Analysis |  | ||||

| Parent Company | |||||||||||

| Short-Term Debt | Long-Term Debt | Rating Outlook | |||||||||

| DBRS, Inc. | R-1 (middle) | A (high) | Stable | ||||||||

| Fitch Ratings, Inc. | F1 | A+ | Stable | ||||||||

| Moody’s Investors Service, Inc. | P-1 | A1 | Stable | ||||||||

| Rating and Investment Information, Inc. | a-1 | A+ | Stable | ||||||||

| S&P Global Ratings | A-2 | A- | Stable | ||||||||

| MSBNA | |||||||||||

| Short-Term Debt | Long-Term Debt | Rating Outlook | |||||||||

| Fitch Ratings, Inc. | F1+ | AA- | Stable | ||||||||

| Moody’s Investors Service, Inc. | P-1 | Aa3 | Stable | ||||||||

| S&P Global Ratings | A-1 | A+ | Stable | ||||||||

| MSPBNA | |||||||||||

| Short-Term Debt | Long-Term Debt | Rating Outlook | |||||||||

| Moody’s Investors Service, Inc. | P-1 | Aa3 | Stable | ||||||||

| S&P Global Ratings | A-1 | A+ | Stable | ||||||||

| Three Months Ended March 31, | ||||||||

| in millions, except for per share data | 2024 | 2023 | ||||||

| Number of shares | 12 | 16 | ||||||

| Average price per share | $ | 86.79 | $ | 95.16 | ||||

| Total | $ | 1,000 | $ | 1,500 | ||||

| Announcement date | April 16, 2024 | ||||

| Amount per share | $0.85 | ||||

| Date to be paid | May 15, 2024 | ||||

| Shareholders of record as of | April 30, 2024 | ||||

20 | March 2024 Form 10-Q | |||||||

| Management’s Discussion and Analysis |  | ||||

At March 31, 2024 and December 31, 2023 | ||||||||

| Standardized | Advanced | |||||||

| Capital buffers | ||||||||

| Capital conservation buffer | — | 2.5% | ||||||

SCB1 | 5.4% | N/A | ||||||

G-SIB capital surcharge2 | 3.0% | 3.0% | ||||||

CCyB3 | 0% | 0% | ||||||

| Capital buffer requirement | 8.4% | 5.5% | ||||||

| Regulatory Minimum | At March 31, 2024 and December 31, 2023 | ||||||||||

| Standardized | Advanced | ||||||||||

Required ratios1 | |||||||||||

CET1 capital ratio | 4.5 | % | 12.9% | 10.0% | |||||||

| Tier 1 capital ratio | 6.0 | % | 14.4% | 11.5% | |||||||

| Total capital ratio | 8.0 | % | 16.4% | 13.5% | |||||||

| March 2024 Form 10-Q | 21 | |||||||

| Management’s Discussion and Analysis |  | ||||

| Standardized | Advanced | ||||||||||||||||

| $ in millions | At March 31, 2024 | At Dec 31, 2023 | At March 31, 2024 | At Dec 31, 2023 | |||||||||||||

Risk-based capital | |||||||||||||||||

| CET1 capital | $ | 70,298 | $ | 69,448 | $ | 70,298 | $ | 69,448 | |||||||||

| Tier 1 capital | 79,046 | 78,183 | 79,046 | 78,183 | |||||||||||||

| Total capital | 91,007 | 88,874 | 90,239 | 88,190 | |||||||||||||

| Total RWA | 467,763 | 456,053 | 456,511 | 448,154 | |||||||||||||

Risk-based capital ratios | |||||||||||||||||

| CET1 capital | 15.0 | % | 15.2 | % | 15.4 | % | 15.5 | % | |||||||||

| Tier 1 capital | 16.9 | % | 17.1 | % | 17.3 | % | 17.4 | % | |||||||||

| Total capital | 19.5 | % | 19.5 | % | 19.8 | % | 19.7 | % | |||||||||

Required ratios1 | |||||||||||||||||

| CET1 capital | 12.9 | % | 12.9 | % | 10.0 | % | 10.0 | % | |||||||||

| Tier 1 capital | 14.4 | % | 14.4 | % | 11.5 | % | 11.5 | % | |||||||||

| Total capital | 16.4 | % | 16.4 | % | 13.5 | % | 13.5 | % | |||||||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | ||||||

| Leveraged-based capital | ||||||||

Adjusted average assets1 | $ | 1,178,369 | $ | 1,159,626 | ||||

Supplementary leverage exposure2 | 1,464,030 | 1,429,552 | ||||||

Leveraged-based capital ratios | ||||||||

| Tier 1 leverage | 6.7 | % | 6.7 | % | ||||

| SLR | 5.4 | % | 5.5 | % | ||||

Required ratios3 | ||||||||

| Tier 1 leverage | 4.0 | % | 4.0 | % | ||||

| SLR | 5.0 | % | 5.0 | % | ||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | Change | ||||||||

CET1 capital | |||||||||||

Common shareholders' equity | $ | 90,448 | $ | 90,288 | $ | 160 | |||||

Regulatory adjustments and deductions | |||||||||||

| Net goodwill | (16,392) | (16,394) | 2 | ||||||||

| Net intangible assets | (5,394) | (5,509) | 115 | ||||||||

Impact of CECL transition | 62 | 124 | (62) | ||||||||

Other adjustments and deductions1 | 1,574 | 939 | 635 | ||||||||

Total CET1 capital | $ | 70,298 | $ | 69,448 | $ | 850 | |||||

| Additional Tier 1 capital | |||||||||||

| Preferred stock | $ | 8,750 | $ | 8,750 | $ | — | |||||

| Noncontrolling interests | 756 | 758 | (2) | ||||||||

| Additional Tier 1 capital | $ | 9,506 | $ | 9,508 | $ | (2) | |||||

| Deduction for investments in covered funds | (758) | (773) | 15 | ||||||||

| Total Tier 1 capital | $ | 79,046 | $ | 78,183 | $ | 863 | |||||

| Standardized Tier 2 capital | |||||||||||

| Subordinated debt | $ | 10,032 | $ | 8,760 | $ | 1,272 | |||||

| Eligible ACL | 2,090 | 2,051 | 39 | ||||||||

| Other adjustments and deductions | (161) | (120) | (41) | ||||||||

| Total Standardized Tier 2 capital | $ | 11,961 | $ | 10,691 | $ | 1,270 | |||||

| Total Standardized capital | $ | 91,007 | $ | 88,874 | $ | 2,133 | |||||

| Advanced Tier 2 capital | |||||||||||

| Subordinated debt | $ | 10,032 | $ | 8,760 | $ | 1,272 | |||||

| Eligible credit reserves | 1,322 | 1,367 | (45) | ||||||||

| Other adjustments and deductions | (161) | (120) | (41) | ||||||||

| Total Advanced Tier 2 capital | $ | 11,193 | $ | 10,007 | $ | 1,186 | |||||

| Total Advanced capital | $ | 90,239 | $ | 88,190 | $ | 2,049 | |||||

22 | March 2024 Form 10-Q | |||||||

| Management’s Discussion and Analysis |  | ||||

| Three Months Ended March 31, 2024 | ||||||||

| $ in millions | Standardized | Advanced | ||||||

| Credit risk RWA | ||||||||

| Balance at December 31, 2023 | $ | 407,731 | $ | 297,858 | ||||

| Change related to the following items: | ||||||||

| Derivatives | 1,072 | (4,757) | ||||||

| Securities financing transactions | 4,273 | 288 | ||||||

| Investment securities | (578) | (1,307) | ||||||

| Commitments, guarantees and loans | 373 | 7,051 | ||||||

| Equity investments | (22) | (241) | ||||||

| Other credit risk | 3,205 | 3,508 | ||||||

| Total change in credit risk RWA | $ | 8,323 | $ | 4,542 | ||||

| Balance at March 31, 2024 | $ | 416,054 | $ | 302,400 | ||||

| Market risk RWA | ||||||||

| Balance at December 31, 2023 | $ | 48,322 | $ | 48,201 | ||||

| Change related to the following items: | ||||||||

| Regulatory VaR | 1,336 | 1,336 | ||||||

| Regulatory stressed VaR | (738) | (738) | ||||||

| Incremental risk charge | 1,047 | 1,047 | ||||||

| Comprehensive risk measure | 81 | 202 | ||||||

| Specific risk | 1,661 | 1,661 | ||||||

| Total change in market risk RWA | $ | 3,387 | $ | 3,508 | ||||

| Balance at March 31, 2024 | $ | 51,709 | $ | 51,709 | ||||

| Operational risk RWA | ||||||||

| Balance at December 31, 2023 | N/A | $ | 102,095 | |||||

| Change in operational risk RWA | N/A | 307 | ||||||

| Balance at March 31, 2024 | N/A | $ | 102,402 | |||||

| Total RWA | $ | 467,763 | $ | 456,511 | ||||

| Actual Amount/Ratio | ||||||||||||||

| $ in millions | Regulatory Minimum | Required Ratio1 | At March 31, 2024 | At December 31, 2023 | ||||||||||

External TLAC2 | $ | 257,108 | $ | 250,914 | ||||||||||

| External TLAC as a % of RWA | 18.0 | % | 21.5 | % | 55.0 | % | 55.0 | % | ||||||

| External TLAC as a % of leverage exposure | 7.5 | % | 9.5 | % | 17.6 | % | 17.6 | % | ||||||

Eligible LTD3 | $ | 167,788 | $ | 162,547 | ||||||||||

| Eligible LTD as a % of RWA | 9.0 | % | 9.0 | % | 35.9 | % | 35.6 | % | ||||||

| Eligible LTD as a % of leverage exposure | 4.5 | % | 4.5 | % | 11.5 | % | 11.4 | % | ||||||

| March 2024 Form 10-Q | 23 | |||||||

| Management’s Discussion and Analysis |  | ||||

| Three Months Ended March 31, | ||||||||

| $ in billions | 2024 | 2023 | ||||||

| Institutional Securities | $ | 45.0 | $ | 45.6 | ||||

| Wealth Management | 29.1 | 28.8 | ||||||

| Investment Management | 10.8 | 10.4 | ||||||

Parent Company | 5.0 | 6.6 | ||||||

| Total | $ | 89.9 | $ | 91.4 | ||||

24 | March 2024 Form 10-Q | |||||||

| Management’s Discussion and Analysis |  | ||||

| March 2024 Form 10-Q | 25 | |||||||

| Three Months Ended | ||||||||||||||

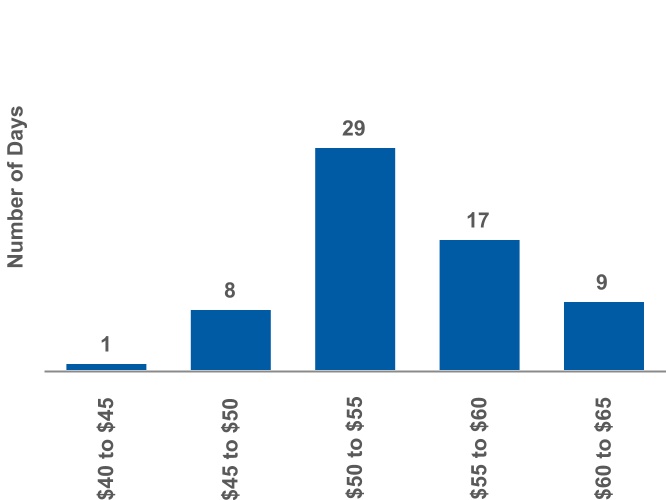

| March 31, 2024 | ||||||||||||||

| $ in millions | Period End | Average | High1 | Low1 | ||||||||||

| Interest rate and credit spread | $ | 40 | $ | 40 | $ | 52 | $ | 27 | ||||||

| Equity price | 23 | 21 | 24 | 17 | ||||||||||

| Foreign exchange rate | 8 | 9 | 15 | 6 | ||||||||||

| Commodity price | 18 | 13 | 18 | 10 | ||||||||||

Less: Diversification benefit2 | (36) | (35) | N/A | N/A | ||||||||||

| Primary Risk Categories | $ | 53 | $ | 48 | $ | 58 | $ | 38 | ||||||

| Credit Portfolio | 25 | 24 | 25 | 22 | ||||||||||

Less: Diversification benefit2 | (18) | (18) | N/A | N/A | ||||||||||

| Total Management VaR | $ | 60 | $ | 54 | $ | 62 | $ | 43 | ||||||

| Three Months Ended | ||||||||||||||

| December 31, 2023 | ||||||||||||||

| $ in millions | Period End | Average | High1 | Low1 | ||||||||||

| Interest rate and credit spread | $ | 29 | $ | 31 | $ | 39 | $ | 27 | ||||||

| Equity price | 19 | 22 | 38 | 15 | ||||||||||

| Foreign exchange rate | 6 | 7 | 14 | 5 | ||||||||||

| Commodity price | 11 | 13 | 20 | 10 | ||||||||||

Less: Diversification benefit2 | (27) | (35) | N/A | N/A | ||||||||||

| Primary Risk Categories | $ | 38 | $ | 38 | $ | 45 | $ | 33 | ||||||

| Credit Portfolio | 25 | 22 | 25 | 19 | ||||||||||

Less: Diversification benefit2 | (22) | (14) | N/A | N/A | ||||||||||

| Total Management VaR | $ | 41 | $ | 46 | $ | 54 | $ | 41 | ||||||

26 | March 2024 Form 10-Q | |||||||

| Risk Disclosures |  | ||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | ||||||

| Derivatives | $ | 5 | $ | 6 | ||||

| Borrowings carried at fair value | 49 | 48 | ||||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | ||||||

| Basis point change | ||||||||

| +100 | $ | 561 | $ | 585 | ||||

| -100 | (590) | (609) | ||||||

| March 2024 Form 10-Q | 27 | |||||||

| Risk Disclosures |  | ||||

| Loss from 10% Decline | ||||||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | ||||||

| Investments related to Investment Management activities | $ | 528 | $ | 481 | ||||

| Other investments: | ||||||||

| MUMSS | 129 | 134 | ||||||

| Other Firm investments | 408 | 399 | ||||||

| At March 31, 2024 | ||||||||||||||

| $ in millions | HFI | HFS | FVO1 | Total | ||||||||||

| Institutional Securities: | ||||||||||||||

| Corporate | $ | 7,171 | $ | 9,655 | $ | — | $ | 16,826 | ||||||

| Secured lending facilities | 38,692 | 3,564 | — | 42,256 | ||||||||||

| Commercial and Residential real estate | 8,689 | 205 | 4,479 | 13,373 | ||||||||||

| Securities-based lending and Other | 2,687 | — | 4,985 | 7,672 | ||||||||||

| Total Institutional Securities | 57,239 | 13,424 | 9,464 | 80,127 | ||||||||||

| Wealth Management: | ||||||||||||||

| Residential real estate | 61,339 | 2 | — | 61,341 | ||||||||||

| Securities-based lending and Other | 86,353 | — | — | 86,353 | ||||||||||

| Total Wealth Management | 147,692 | 2 | — | 147,694 | ||||||||||

Total Investment Management2 | 4 | — | 461 | 465 | ||||||||||

| Total loans | 204,935 | 13,426 | 9,925 | 228,286 | ||||||||||

| ACL | (1,141) | (1,141) | ||||||||||||

| Total loans, net of ACL | $ | 203,794 | $ | 13,426 | $ | 9,925 | $ | 227,145 | ||||||

Lending commitments3 | $ | 134,938 | $ | 22,148 | $ | 600 | $ | 157,686 | ||||||

| Total exposure | $ | 338,732 | $ | 35,574 | $ | 10,525 | $ | 384,831 | ||||||

| At December 31, 2023 | ||||||||||||||

| $ in millions | HFI | HFS | FVO1 | Total | ||||||||||

| Institutional Securities: | ||||||||||||||

| Corporate | $ | 6,758 | $ | 11,862 | $ | — | $ | 18,620 | ||||||

| Secured lending facilities | 39,498 | 3,161 | — | 42,659 | ||||||||||

| Commercial and Residential real estate | 8,678 | 209 | 3,331 | 12,218 | ||||||||||

| Securities-based lending and Other | 2,818 | — | 4,402 | 7,220 | ||||||||||

| Total Institutional Securities | 57,752 | 15,232 | 7,733 | 80,717 | ||||||||||

| Wealth Management: | ||||||||||||||

| Residential real estate | 60,375 | 22 | — | 60,397 | ||||||||||

| Securities-based lending and Other | 86,423 | 1 | — | 86,424 | ||||||||||

| Total Wealth Management | 146,798 | 23 | — | 146,821 | ||||||||||

Total Investment Management2 | 4 | — | 455 | 459 | ||||||||||

| Total loans | 204,554 | 15,255 | 8,188 | 227,997 | ||||||||||

| ACL | (1,169) | (1,169) | ||||||||||||

| Total loans, net of ACL | $ | 203,385 | $ | 15,255 | $ | 8,188 | $ | 226,828 | ||||||

Lending commitments3 | $ | 128,134 | $ | 21,329 | $ | 510 | $ | 149,973 | ||||||

| Total exposure | $ | 331,519 | $ | 36,584 | $ | 8,698 | $ | 376,801 | ||||||

28 | March 2024 Form 10-Q | |||||||

| Risk Disclosures |  | ||||

| $ in millions | Three Months Ended March 31, 2024 | ||||

| ACL—Loans | |||||

| Beginning balance | $ | 1,169 | |||

| Provision for credit losses | (22) | ||||

| Other | (6) | ||||

Ending balance | $ | 1,141 | |||

ACL—Lending commitments | |||||

| Beginning balance | $ | 551 | |||

| Provision for credit losses | 16 | ||||

| Other | (2) | ||||

Ending balance | $ | 565 | |||

Total ending balance | $ | 1,706 | |||

| Three Months Ended March 31, 2024 | |||||||||||

| $ in millions | IS | WM | Total | ||||||||

| Loans | $ | (16) | $ | (6) | $ | (22) | |||||

| Lending commitments | 18 | (2) | 16 | ||||||||

| Total | $ | 2 | $ | (8) | $ | (6) | |||||

4Q 2024 | 4Q 2025 | |||||||

| Year-over-year growth rate | 1.0 | % | 2.0 | % | ||||

| At March 31, 2024 | At December 31, 2023 | |||||||||||||

| IS | WM | IS | WM | |||||||||||

| Accrual | 99.0 | % | 99.7 | % | 98.9 | % | 99.8 | % | ||||||

Nonaccrual1 | 1.0 | % | 0.3 | % | 1.1 | % | 0.2 | % | ||||||

| At March 31, 2024 | |||||||||||||||||

| Contractual Years to Maturity | |||||||||||||||||

| $ in millions | <1 | 1-5 | 5-15 | >15 | Total | ||||||||||||

| Loans | |||||||||||||||||

| AA | $ | 1 | $ | 11 | $ | 68 | $ | — | $ | 80 | |||||||

| A | 1,316 | 1,068 | 176 | — | 2,560 | ||||||||||||

| BBB | 5,455 | 9,821 | 389 | — | 15,665 | ||||||||||||

| BB | 10,925 | 18,090 | 2,525 | 315 | 31,855 | ||||||||||||

| Other NIG | 9,356 | 11,661 | 2,851 | 171 | 24,039 | ||||||||||||

Unrated2 | 271 | 1,509 | 94 | 3,202 | 5,076 | ||||||||||||

| Total loans, net of ACL | 27,324 | 42,160 | 6,103 | 3,688 | 79,275 | ||||||||||||

| Lending commitments | |||||||||||||||||

| AAA | — | 50 | — | — | 50 | ||||||||||||

| AA | 2,531 | 3,164 | 586 | — | 6,281 | ||||||||||||

| A | 6,627 | 21,372 | 970 | — | 28,969 | ||||||||||||

| BBB | 9,623 | 47,594 | 890 | — | 58,107 | ||||||||||||

| BB | 3,238 | 18,980 | 3,809 | 465 | 26,492 | ||||||||||||

| Other NIG | 1,497 | 14,817 | 2,296 | 3 | 18,613 | ||||||||||||

Unrated2 | 4 | 24 | 222 | — | 250 | ||||||||||||

| Total lending commitments | 23,520 | 106,001 | 8,773 | 468 | 138,762 | ||||||||||||

| Total exposure | $ | 50,844 | $ | 148,161 | $ | 14,876 | $ | 4,156 | $ | 218,037 | |||||||

| March 2024 Form 10-Q | 29 | |||||||

| Risk Disclosures |  | ||||

| At December 31, 2023 | |||||||||||||||||

| Contractual Years to Maturity | |||||||||||||||||

| $ in millions | <1 | 1-5 | 5-15 | >15 | Total | ||||||||||||

| Loans | |||||||||||||||||

| AA | $ | 3 | $ | 11 | $ | 216 | $ | — | $ | 230 | |||||||

| A | 1,054 | 950 | 182 | — | 2,186 | ||||||||||||

| BBB | 7,117 | 10,076 | 346 | — | 17,539 | ||||||||||||

| BB | 11,723 | 16,367 | 1,775 | 277 | 30,142 | ||||||||||||

| Other NIG | 9,586 | 12,961 | 2,924 | 156 | 25,627 | ||||||||||||

Unrated2 | 111 | 1,036 | 62 | 2,910 | 4,119 | ||||||||||||

| Total loans, net of ACL | 29,594 | 41,401 | 5,505 | 3,343 | 79,843 | ||||||||||||

| Lending commitments | |||||||||||||||||

| AAA | — | 50 | — | — | 50 | ||||||||||||

| AA | 2,610 | 3,064 | 154 | — | 5,828 | ||||||||||||

| A | 7,704 | 21,256 | 593 | — | 29,553 | ||||||||||||

| BBB | 9,161 | 46,304 | 106 | — | 55,571 | ||||||||||||

| BB | 4,069 | 16,431 | 1,594 | 414 | 22,508 | ||||||||||||

| Other NIG | 1,916 | 13,842 | 1,077 | 3 | 16,838 | ||||||||||||

Unrated2 | 6 | 7 | — | — | 13 | ||||||||||||

| Total lending commitments | 25,466 | 100,954 | 3,524 | 417 | 130,361 | ||||||||||||

| Total exposure | $ | 55,060 | $ | 142,355 | $ | 9,029 | $ | 3,760 | $ | 210,204 | |||||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | ||||||

| Industry | ||||||||

| Financials | $ | 61,171 | $ | 57,804 | ||||

| Real estate | 35,543 | 35,342 | ||||||

| Industrials | 17,780 | 18,056 | ||||||

| Communications services | 15,348 | 15,301 | ||||||

| Consumer discretionary | 14,653 | 12,190 | ||||||

| Information technology | 14,501 | 12,430 | ||||||

| Healthcare | 13,251 | 14,274 | ||||||

| Utilities | 11,102 | 11,522 | ||||||

| Consumer staples | 9,588 | 9,305 | ||||||

| Energy | 9,468 | 9,156 | ||||||

| Materials | 6,671 | 6,503 | ||||||

| Insurance | 6,329 | 6,486 | ||||||

| Other | 2,632 | 1,835 | ||||||

| Total exposure | $ | 218,037 | $ | 210,204 | ||||

| At March 31, 2024 | ||||||||||||||

| Contractual Years to Maturity | ||||||||||||||

| $ in millions | <1 | 1-5 | 5-15 | Total | ||||||||||

| Loans, net of ACL | $ | 2,096 | $ | 693 | $ | 2,562 | $ | 5,351 | ||||||

| Lending commitments | 1,537 | 1,069 | 1,552 | 4,158 | ||||||||||

| Total exposure | $ | 3,633 | $ | 1,762 | $ | 4,114 | $ | 9,509 | ||||||

| At December 31, 2023 | ||||||||||||||

| Contractual Years to Maturity | ||||||||||||||

| $ in millions | <1 | 1-5 | 5-15 | Total | ||||||||||

| Loans, net of ACL | $ | 1,974 | $ | 2,564 | $ | 2,580 | $ | 7,118 | ||||||

| Lending commitments | 3,564 | 685 | 549 | 4,798 | ||||||||||

| Total exposure | $ | 5,538 | $ | 3,249 | $ | 3,129 | $ | 11,916 | ||||||

| At March 31, 2024 | |||||||||||

| $ in millions | Loans | Lending Commitments | Total | ||||||||

| Corporate | $ | 7,171 | $ | 96,771 | $ | 103,942 | |||||

| Secured lending facilities | 38,692 | 18,045 | 56,737 | ||||||||

| Commercial real estate | 8,689 | 351 | 9,040 | ||||||||

| Securities-based lending and Other | 2,687 | 847 | 3,534 | ||||||||

| Total, before ACL | $ | 57,239 | $ | 116,014 | $ | 173,253 | |||||

| ACL | $ | (852) | $ | (548) | $ | (1,400) | |||||

| At December 31, 2023 | |||||||||||

| $ in millions | Loans | Lending Commitments | Total | ||||||||

| Corporate | $ | 6,758 | $ | 91,752 | $ | 98,510 | |||||

| Secured lending facilities | 39,498 | 15,589 | 55,087 | ||||||||

| Commercial real estate | 8,678 | 266 | 8,944 | ||||||||

| Securities-based lending and Other | 2,818 | 915 | 3,733 | ||||||||

| Total, before ACL | $ | 57,752 | $ | 108,522 | $ | 166,274 | |||||

| ACL | $ | (874) | $ | (533) | $ | (1,407) | |||||

30 | March 2024 Form 10-Q | |||||||

| Risk Disclosures |  | ||||

| At March 31, 2024 | At December 31, 2023 | ||||||||||||||||||||||

| $ in millions | Loans1 | LC1 | Total | Loans1 | LC1 | Total | |||||||||||||||||

| Americas | $ | 6,066 | $ | 286 | $ | 6,352 | $ | 5,410 | $ | 289 | $ | 5,699 | |||||||||||

| EMEA | 3,223 | 158 | 3,381 | 3,127 | 56 | 3,183 | |||||||||||||||||

| Asia | 545 | 2 | 547 | 485 | — | 485 | |||||||||||||||||

Total | $ | 9,834 | $ | 446 | $ | 10,280 | $ | 9,022 | $ | 345 | $ | 9,367 | |||||||||||

| At March 31, 2024 | At December 31, 2023 | ||||||||||||||||||||||

| $ in millions | Loans1 | LC1 | Total | Loans1 | LC1 | Total | |||||||||||||||||

| Office | $ | 3,143 | $ | 167 | $ | 3,310 | $ | 3,310 | $ | 186 | $ | 3,496 | |||||||||||

| Industrial | 2,898 | 111 | 3,009 | 2,435 | 5 | 2,440 | |||||||||||||||||

| Multifamily | 1,802 | 93 | 1,895 | 1,715 | 74 | 1,789 | |||||||||||||||||

| Hotel | 1,013 | 69 | 1,082 | 718 | 73 | 791 | |||||||||||||||||

| Retail | 978 | 6 | 984 | 842 | 7 | 849 | |||||||||||||||||

| Other | — | — | — | 2 | — | 2 | |||||||||||||||||

Total | $ | 9,834 | $ | 446 | $ | 10,280 | $ | 9,022 | $ | 345 | $ | 9,367 | |||||||||||

| Three Months Ended March 31, 2024 | |||||||||||||||||

| $ in millions | Corporate | Secured Lending Facilities | CRE | Other | Total | ||||||||||||

| ACL—Loans | |||||||||||||||||

Beginning balance | $ | 241 | $ | 153 | $ | 463 | $ | 17 | $ | 874 | |||||||

Provision (release) | 1 | (17) | 1 | (1) | (16) | ||||||||||||

| Other | (1) | (1) | (3) | (1) | (6) | ||||||||||||

Ending balance | $ | 241 | $ | 135 | $ | 461 | $ | 15 | $ | 852 | |||||||

ACL—Lending commitments | |||||||||||||||||

Beginning balance | $ | 431 | $ | 70 | $ | 26 | $ | 6 | $ | 533 | |||||||

Provision (release) | (2) | 25 | (3) | (2) | 18 | ||||||||||||

| Other | (3) | (1) | — | 1 | (3) | ||||||||||||

Ending balance | $ | 426 | $ | 94 | $ | 23 | $ | 5 | $ | 548 | |||||||

Total ending balance | $ | 667 | $ | 229 | $ | 484 | $ | 20 | $ | 1,400 | |||||||

| At March 31, 2024 | At December 31, 2023 | |||||||

| Corporate | 3.4 | % | 3.6 | % | ||||

| Secured lending facilities | 0.3 | % | 0.4 | % | ||||

| Commercial real estate | 5.3 | % | 5.3 | % | ||||

| Securities-based lending and Other | 0.6 | % | 0.6 | % | ||||

| Total Institutional Securities loans | 1.5 | % | 1.5 | % | ||||

| At March 31, 2024 | |||||||||||||||||

| Contractual Years to Maturity | |||||||||||||||||

| $ in millions | <1 | 1-5 | 5-15 | >15 | Total | ||||||||||||

Securities-based lending and Other | $ | 76,968 | $ | 7,751 | $ | 1,302 | $ | 132 | $ | 86,153 | |||||||

Residential real estate | 1 | 101 | 1,214 | 59,936 | 61,252 | ||||||||||||

| Total loans, net of ACL | $ | 76,969 | $ | 7,852 | $ | 2,516 | $ | 60,068 | $ | 147,405 | |||||||

| Lending commitments | 15,966 | 2,582 | 16 | 360 | 18,924 | ||||||||||||

| Total exposure | $ | 92,935 | $ | 10,434 | $ | 2,532 | $ | 60,428 | $ | 166,329 | |||||||

| At December 31, 2023 | |||||||||||||||||

| Contractual Years to Maturity | |||||||||||||||||

| $ in millions | <1 | 1-5 | 5-15 | >15 | Total | ||||||||||||

Securities-based lending and Other | $ | 76,923 | $ | 7,679 | $ | 1,494 | $ | 133 | $ | 86,229 | |||||||

Residential real estate | 1 | 91 | 1,255 | 58,950 | 60,297 | ||||||||||||

| Total loans, net of ACL | $ | 76,924 | $ | 7,770 | $ | 2,749 | $ | 59,083 | $ | 146,526 | |||||||

| Lending commitments | 16,312 | 2,937 | 19 | 344 | 19,612 | ||||||||||||

| Total exposure | $ | 93,236 | $ | 10,707 | $ | 2,768 | $ | 59,427 | $ | 166,138 | |||||||

| March 2024 Form 10-Q | 31 | |||||||

| Risk Disclosures |  | ||||

| At March 31, 2024 | At December 31, 2023 | ||||||||||||||||||||||

| $ in millions | Loans1 | LC1 | Total | Loans1 | LC1 | Total | |||||||||||||||||

| Retail | $ | 2,297 | $ | — | $ | 2,297 | $ | 2,180 | $ | 3 | $ | 2,183 | |||||||||||

| Multifamily | 1,965 | 187 | 2,152 | 1,891 | 159 | 2,050 | |||||||||||||||||

| Office | 1,734 | 16 | 1,750 | 1,736 | 16 | 1,752 | |||||||||||||||||

| Industrial | 452 | — | 452 | 454 | — | 454 | |||||||||||||||||

| Hotel | 387 | — | 387 | 400 | — | 400 | |||||||||||||||||

| Other | 249 | — | 249 | 253 | — | 253 | |||||||||||||||||

Total | $ | 7,084 | $ | 203 | $ | 7,287 | $ | 6,914 | $ | 178 | $ | 7,092 | |||||||||||

| Three Months Ended March 31, 2024 | |||||||||||

| $ in millions | Residential Real Estate | SBL and Other | Total | ||||||||

| ACL—Loans | |||||||||||

| Beginning balance | $ | 100 | $ | 195 | $ | 295 | |||||

| Provision (release) | (11) | 5 | (6) | ||||||||

Ending balance | $ | 89 | $ | 200 | $ | 289 | |||||

| ACL—Lending commitments | |||||||||||

| Beginning balance | $ | 4 | $ | 14 | $ | 18 | |||||

| Provision (release) | — | (2) | (2) | ||||||||

| Other | — | 1 | 1 | ||||||||

Ending balance | $ | 4 | $ | 13 | $ | 17 | |||||

Total ending balance | $ | 93 | $ | 213 | $ | 306 | |||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | ||||||

| Institutional Securities | $ | 24,071 | $ | 24,208 | ||||

| Wealth Management | 23,393 | 21,436 | ||||||

| Total | $ | 47,464 | $ | 45,644 | ||||

32 | March 2024 Form 10-Q | |||||||

| Risk Disclosures |  | ||||

Counterparty Credit Rating1 | ||||||||||||||||||||

| $ in millions | AAA | AA | A | BBB | NIG | Total | ||||||||||||||

| At March 31, 2024 | ||||||||||||||||||||

| Less than 1 year | $ | 1,161 | $ | 10,878 | $ | 33,637 | $ | 19,901 | $ | 8,625 | $ | 74,202 | ||||||||

| 1-3 years | 1,124 | 6,575 | 17,723 | 10,978 | 6,582 | 42,982 | ||||||||||||||

| 3-5 years | 1,107 | 7,777 | 8,493 | 5,249 | 3,914 | 26,540 | ||||||||||||||

| Over 5 years | 3,119 | 28,963 | 48,383 | 27,306 | 7,059 | 114,830 | ||||||||||||||

| Total, gross | $ | 6,511 | $ | 54,193 | $ | 108,236 | $ | 63,434 | $ | 26,180 | $ | 258,554 | ||||||||

| Counterparty netting | (3,099) | (41,773) | (80,599) | (44,702) | (14,299) | (184,472) | ||||||||||||||

| Cash and securities collateral | (2,475) | (10,237) | (24,557) | (13,362) | (6,101) | (56,732) | ||||||||||||||

| Total, net | $ | 937 | $ | 2,183 | $ | 3,080 | $ | 5,370 | $ | 5,780 | $ | 17,350 | ||||||||

Counterparty Credit Rating1 | ||||||||||||||||||||

| $ in millions | AAA | AA | A | BBB | NIG | Total | ||||||||||||||

| At December 31, 2023 | ||||||||||||||||||||

| Less than 1 year | $ | 2,013 | $ | 16,885 | $ | 37,517 | $ | 25,529 | $ | 10,084 | $ | 92,028 | ||||||||

| 1-3 years | 1,013 | 7,274 | 18,451 | 12,757 | 7,360 | 46,855 | ||||||||||||||

| 3-5 years | 504 | 8,897 | 8,814 | 5,989 | 3,825 | 28,029 | ||||||||||||||

| Over 5 years | 3,955 | 29,511 | 50,512 | 28,003 | 6,597 | 118,578 | ||||||||||||||

| Total, gross | $ | 7,485 | $ | 62,567 | $ | 115,294 | $ | 72,278 | $ | 27,866 | $ | 285,490 | ||||||||

| Counterparty netting | (3,691) | (48,821) | (86,826) | (53,178) | (15,888) | (208,404) | ||||||||||||||

| Cash and securities collateral | (2,709) | (10,704) | (25,921) | (13,025) | (5,554) | (57,913) | ||||||||||||||

| Total, net | $ | 1,085 | $ | 3,042 | $ | 2,547 | $ | 6,075 | $ | 6,424 | $ | 19,173 | ||||||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | ||||||

| Industry | ||||||||

| Financials | $ | 5,511 | $ | 7,215 | ||||

| Utilities | 4,606 | 4,267 | ||||||

| Regional governments | 1,181 | 1,319 | ||||||

| Industrials | 940 | 937 | ||||||

| Communications services | 802 | 841 | ||||||

| Energy | 643 | 533 | ||||||

| Consumer discretionary | 590 | 684 | ||||||

| Information technology | 521 | 677 | ||||||

| Healthcare | 481 | 468 | ||||||

| Consumer staples | 477 | 515 | ||||||

| Materials | 358 | 383 | ||||||

| Sovereign governments | 247 | 262 | ||||||

| Insurance | 160 | 156 | ||||||

| Real estate | 136 | 167 | ||||||

| Not-for-profit organizations | 135 | 166 | ||||||

| Other | 562 | 583 | ||||||

| Total | $ | 17,350 | $ | 19,173 | ||||

| At March 31, 2024 | |||||||||||||||||

| $ in millions | United Kingdom | France | Germany | Brazil | China | ||||||||||||

| Sovereign | |||||||||||||||||

Net inventory1 | $ | 122 | $ | 2,407 | $ | (713) | $ | 5,064 | $ | 2,161 | |||||||

Net counterparty exposure2 | 14 | — | 120 | 3 | 334 | ||||||||||||

| Exposure before hedges | 136 | 2,407 | (593) | 5,067 | 2,495 | ||||||||||||

Hedges3 | (55) | (6) | (253) | (154) | — | ||||||||||||

| Net exposure | $ | 81 | $ | 2,401 | $ | (846) | $ | 4,913 | $ | 2,495 | |||||||

| Non-sovereign | |||||||||||||||||

Net inventory1 | $ | 1,476 | $ | 1,113 | $ | 852 | $ | 129 | $ | 2,293 | |||||||

Net counterparty exposure2 | 6,737 | 2,977 | 2,920 | 329 | 171 | ||||||||||||

| Loans | 7,192 | 721 | 1,404 | 381 | 344 | ||||||||||||

| Lending commitments | 9,736 | 3,091 | 5,500 | 456 | 666 | ||||||||||||

| Exposure before hedges | 25,141 | 7,902 | 10,676 | 1,295 | 3,474 | ||||||||||||

Hedges3 | (1,963) | (2,112) | (2,031) | (14) | (1) | ||||||||||||

| Net exposure | $ | 23,178 | $ | 5,790 | $ | 8,645 | $ | 1,281 | $ | 3,473 | |||||||

| Total net exposure | $ | 23,259 | $ | 8,191 | $ | 7,799 | $ | 6,194 | $ | 5,968 | |||||||

| $ in millions | Japan | India | Korea | Canada | Australia | ||||||||||||

| Sovereign | |||||||||||||||||

Net inventory1 | $ | (42) | $ | 2,450 | $ | 3,054 | $ | 838 | $ | 117 | |||||||

Net counterparty exposure2 | 17 | — | 387 | 15 | 91 | ||||||||||||

| Exposure before hedges | (25) | 2,450 | 3,441 | 853 | 208 | ||||||||||||

Hedges3 | — | — | — | — | — | ||||||||||||

| Net exposure | $ | (25) | $ | 2,450 | $ | 3,441 | $ | 853 | $ | 208 | |||||||

| Non-sovereign | |||||||||||||||||

Net inventory1 | $ | 1,426 | $ | 979 | $ | 37 | $ | 259 | $ | 208 | |||||||

Net counterparty exposure2 | 4,766 | 1,317 | 822 | 1,002 | 722 | ||||||||||||

| Loans | 23 | 116 | — | 316 | 1,719 | ||||||||||||

| Lending commitments | — | — | — | 1,703 | 936 | ||||||||||||

| Exposure before hedges | 6,215 | 2,412 | 859 | 3,280 | 3,585 | ||||||||||||

Hedges3 | (234) | — | — | (106) | (14) | ||||||||||||

| Net exposure | $ | 5,981 | $ | 2,412 | $ | 859 | $ | 3,174 | $ | 3,571 | |||||||

| Total net exposure | $ | 5,956 | $ | 4,862 | $ | 4,300 | $ | 4,027 | $ | 3,779 | |||||||

| March 2024 Form 10-Q | 33 | |||||||

| Risk Disclosures |  | ||||

| $ in millions | At March 31, 2024 | |||||||

| Country of Risk | Collateral2 | |||||||

| United Kingdom | U.K., U.S., and France | $ | 8,039 | |||||

| Japan | Japan and U.S. | 5,831 | ||||||

| Other | U.S., Italy and France | 15,119 | ||||||

34 | March 2024 Form 10-Q | |||||||

/s/ Deloitte & Touche LLP | ||

| New York, New York | ||

| May 3, 2024 | ||

| March 2024 Form 10-Q | 35 | |||||||

| Consolidated Income Statement (Unaudited) |  | ||||

| Three Months Ended March 31, | ||||||||

| in millions, except per share data | 2024 | 2023 | ||||||

| Revenues | ||||||||

| Investment banking | $ | $ | ||||||

| Trading | ||||||||

| Investments | ||||||||

| Commissions and fees | ||||||||

| Asset management | ||||||||

| Other | ||||||||

| Total non-interest revenues | ||||||||

Interest income1 | ||||||||

Interest expense1 | ||||||||

| Net interest | ||||||||

| Net revenues | ||||||||

| Provision for credit losses | ( | |||||||

| Non-interest expenses | ||||||||

| Compensation and benefits | ||||||||

| Brokerage, clearing and exchange fees | ||||||||

| Information processing and communications | ||||||||

| Professional services | ||||||||

| Occupancy and equipment | ||||||||

| Marketing and business development | ||||||||

| Other | ||||||||

| Total non-interest expenses | ||||||||

| Income before provision for income taxes | ||||||||

| Provision for income taxes | ||||||||

| Net income | $ | $ | ||||||

| Net income applicable to noncontrolling interests | ||||||||

| Net income applicable to Morgan Stanley | $ | $ | ||||||

| Preferred stock dividends | ||||||||

| Earnings applicable to Morgan Stanley common shareholders | $ | $ | ||||||

| Earnings per common share | ||||||||

| Basic | $ | $ | ||||||

| Diluted | $ | $ | ||||||

| Average common shares outstanding | ||||||||

| Basic | ||||||||

| Diluted | ||||||||

| Three Months Ended March 31, | ||||||||

| $ in millions | 2024 | 2023 | ||||||

| Net income | $ | $ | ||||||

| Other comprehensive income (loss), net of tax: | ||||||||

| Foreign currency translation adjustments | ( | |||||||

| Change in net unrealized gains (losses) on available-for-sale securities | ||||||||

| Pension and other | ( | |||||||

| Change in net debt valuation adjustment | ( | ( | ||||||

| Net change in cash flow hedges | ( | |||||||

| Total other comprehensive income (loss) | $ | ( | $ | |||||

| Comprehensive income | $ | $ | ||||||

| Net income applicable to noncontrolling interests | ||||||||

| Other comprehensive income (loss) applicable to noncontrolling interests | ( | ( | ||||||

| Comprehensive income applicable to Morgan Stanley | $ | $ | ||||||

| March 2024 Form 10-Q | 36 | See Notes to Consolidated Financial Statements | ||||||

| Consolidated Balance Sheet |  | ||||

| $ in millions, except share data | (Unaudited) At March 31, 2024 | At December 31, 2023 | ||||||

| Assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

Trading assets at fair value ($ | ||||||||

| Investment securities: | ||||||||

Available-for-sale at fair value (amortized cost of $ | ||||||||

Held-to-maturity (fair value of $ | ||||||||

Securities purchased under agreements to resell (includes $ | ||||||||

| Securities borrowed | ||||||||

| Customer and other receivables | ||||||||

| Loans: | ||||||||

Held for investment (net of allowance for credit losses of $ | ||||||||

| Held for sale | ||||||||

| Goodwill | ||||||||

Intangible assets (net of accumulated amortization of $ | ||||||||

| Other assets | ||||||||

| Total assets | $ | $ | ||||||

| Liabilities | ||||||||

Deposits (includes $ | $ | $ | ||||||

| Trading liabilities at fair value | ||||||||

Securities sold under agreements to repurchase (includes $ | ||||||||

| Securities loaned | ||||||||

Other secured financings (includes $ | ||||||||

| Customer and other payables | ||||||||

| Other liabilities and accrued expenses | ||||||||

Borrowings (includes $ | ||||||||

| Total liabilities | ||||||||

| Commitments and contingent liabilities (see Note 13) | ||||||||

| Morgan Stanley shareholders’ equity: | ||||||||

| Preferred stock | ||||||||

Common stock, $ | ||||||||

Shares authorized: | ||||||||

| Additional paid-in capital | ||||||||

| Retained earnings | ||||||||

| Employee stock trusts | ||||||||

| Accumulated other comprehensive income (loss) | ( | ( | ||||||

Common stock held in treasury at cost, $ | ( | ( | ||||||

| Common stock issued to employee stock trusts | ( | ( | ||||||

| Total Morgan Stanley shareholders’ equity | ||||||||

| Noncontrolling interests | ||||||||

| Total equity | ||||||||

| Total liabilities and equity | $ | $ | ||||||

| See Notes to Consolidated Financial Statements | 37 | March 2024 Form 10-Q | ||||||

Consolidated Statement of Changes in Total Equity (Unaudited) |  | |||||||

| Three Months Ended March 31, | ||||||||

| $ in millions | 2024 | 2023 | ||||||

| Preferred Stock | ||||||||

| Beginning and ending balance | ||||||||

| Common Stock | ||||||||

| Beginning and ending balance | ||||||||

| Additional Paid-in Capital | ||||||||

| Beginning balance | ||||||||

| Share-based award activity | ( | ( | ||||||

| Ending balance | ||||||||

| Retained Earnings | ||||||||

| Beginning balance | ||||||||

Cumulative adjustment related to the adoption of an accounting standard update1 | ( | |||||||

| Net income applicable to Morgan Stanley | ||||||||

Preferred stock dividends2 | ( | ( | ||||||

Common stock dividends2 | ( | ( | ||||||

| Other net increases (decreases) | ( | ( | ||||||

| Ending balance | ||||||||

| Employee Stock Trusts | ||||||||

| Beginning balance | ||||||||

| Share-based award activity | ( | |||||||

| Ending balance | ||||||||

| Accumulated Other Comprehensive Income (Loss) | ||||||||

| Beginning balance | ( | ( | ||||||

| Net change in Accumulated other comprehensive income (loss) | ( | |||||||

| Ending balance | ( | ( | ||||||

| Common Stock Held in Treasury at Cost | ||||||||

| Beginning balance | ( | ( | ||||||

| Share-based award activity | ||||||||

| Repurchases of common stock and employee tax withholdings | ( | ( | ||||||

| Ending balance | ( | ( | ||||||

| Common Stock Issued to Employee Stock Trusts | ||||||||

| Beginning balance | ( | ( | ||||||

| Share-based award activity | ( | |||||||

| Ending balance | ( | ( | ||||||

| Noncontrolling Interests | ||||||||

| Beginning balance | ||||||||

| Net income applicable to noncontrolling interests | ||||||||

| Net change in Accumulated other comprehensive income (loss) applicable to noncontrolling interests | ( | ( | ||||||

| Other net increases (decreases) | ||||||||

| Ending balance | ||||||||

| Total Equity | $ | $ | ||||||

| March 2024 Form 10-Q | 38 | See Notes to Consolidated Financial Statements | ||||||

| Consolidated Cash Flow Statement (Unaudited) |  | ||||

| Three Months Ended March 31, | ||||||||

| $ in millions | 2024 | 2023 | ||||||

| Cash flows from operating activities | ||||||||

| Net income | $ | $ | ||||||

| Adjustments to reconcile net income to net cash provided by (used for) operating activities: | ||||||||

| Stock-based compensation expense | ||||||||

| Depreciation and amortization | ||||||||

| Provision for credit losses | ( | |||||||

| Other operating adjustments | ( | |||||||

| Changes in assets and liabilities: | ||||||||

| Trading assets, net of Trading liabilities | ( | |||||||

| Securities borrowed | ( | ( | ||||||

| Securities loaned | ( | |||||||

| Customer and other receivables and other assets | ||||||||

| Customer and other payables and other liabilities | ||||||||

| Securities purchased under agreements to resell | ( | ( | ||||||

| Securities sold under agreements to repurchase | ( | |||||||

| Net cash provided by (used for) operating activities | ( | |||||||

| Cash flows from investing activities | ||||||||

| Proceeds from (payments for): | ||||||||

| Other assets—Premises, equipment and software | ( | ( | ||||||

| Changes in loans, net | ( | ( | ||||||

| AFS securities: | ||||||||

| Purchases | ( | ( | ||||||

| Proceeds from sales | ||||||||

| Proceeds from paydowns and maturities | ||||||||

| HTM securities: | ||||||||

| Purchases | ( | |||||||

| Proceeds from paydowns and maturities | ||||||||

| Other investing activities | ( | ( | ||||||

| Net cash provided by (used for) investing activities | ( | |||||||

| Cash flows from financing activities | ||||||||

| Net proceeds from (payments for): | ||||||||

| Other secured financings | ||||||||

| Deposits | ( | |||||||

| Proceeds from issuance of Borrowings | ||||||||

| Payments for: | ||||||||

| Borrowings | ( | ( | ||||||

| Repurchases of common stock and employee tax withholdings | ( | ( | ||||||

| Cash dividends | ( | ( | ||||||

| Other financing activities | ( | |||||||

| Net cash provided by (used for) financing activities | ( | |||||||

| Effect of exchange rate changes on cash and cash equivalents | ( | |||||||

| Net increase (decrease) in cash and cash equivalents | ( | |||||||

| Cash and cash equivalents, at beginning of period | ||||||||

| Cash and cash equivalents, at end of period | $ | $ | ||||||

| Supplemental Disclosure of Cash Flow Information | ||||||||

| Cash payments for: | ||||||||

| Interest | $ | $ | ||||||

| Income taxes, net of refunds | ||||||||

| See Notes to Consolidated Financial Statements | 39 | March 2024 Form 10-Q | ||||||

| Notes to Consolidated Financial Statements (Unaudited) |  | ||||

| March 2024 Form 10-Q | 40 | |||||||

| Notes to Consolidated Financial Statements (Unaudited) |  | ||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | ||||||

| Cash and due from banks | $ | $ | ||||||

| Interest bearing deposits with banks | ||||||||

| Total Cash and cash equivalents | $ | $ | ||||||

| Restricted cash | $ | $ | ||||||

| At March 31, 2024 | |||||||||||||||||

| $ in millions | Level 1 | Level 2 | Level 3 | Netting1 | Total | ||||||||||||

| Assets at fair value | |||||||||||||||||

| Trading assets: | |||||||||||||||||

| U.S. Treasury and agency securities | $ | $ | $ | $ | — | $ | |||||||||||

| Other sovereign government obligations | — | ||||||||||||||||

| State and municipal securities | — | ||||||||||||||||

| MABS | — | ||||||||||||||||

Loans and lending commitments2 | — | ||||||||||||||||

| Corporate and other debt | — | ||||||||||||||||

Corporate equities3,5 | — | ||||||||||||||||

| Derivative and other contracts: | |||||||||||||||||

| Interest rate | — | ||||||||||||||||

| Credit | — | ||||||||||||||||

| Foreign exchange | — | ||||||||||||||||

| Equity | — | ||||||||||||||||

| Commodity and other | — | ||||||||||||||||

Netting1 | ( | ( | ( | ( | ( | ||||||||||||

| Total derivative and other contracts | ( | ||||||||||||||||

Investments4,5 | — | ||||||||||||||||

| Physical commodities | — | ||||||||||||||||

Total trading assets4 | ( | ||||||||||||||||

| Investment securities—AFS | — | ||||||||||||||||

| Total assets at fair value | $ | $ | $ | $ | ( | $ | |||||||||||

41 | March 2024 Form 10-Q | |||||||

| Notes to Consolidated Financial Statements (Unaudited) |  | ||||

| At March 31, 2024 | |||||||||||||||||

| $ in millions | Level 1 | Level 2 | Level 3 | Netting1 | Total | ||||||||||||

| Liabilities at fair value | |||||||||||||||||

| Deposits | $ | $ | $ | $ | — | $ | |||||||||||

| Trading liabilities: | |||||||||||||||||

| U.S. Treasury and agency securities | — | ||||||||||||||||

| Other sovereign government obligations | — | ||||||||||||||||

| Corporate and other debt | — | ||||||||||||||||

Corporate equities3 | — | ||||||||||||||||

| Derivative and other contracts: | |||||||||||||||||

| Interest rate | — | ||||||||||||||||

| Credit | — | ||||||||||||||||

| Foreign exchange | — | ||||||||||||||||

| Equity | — | ||||||||||||||||

| Commodity and other | — | ||||||||||||||||

Netting1 | ( | ( | ( | ( | ( | ||||||||||||

| Total derivative and other contracts | ( | ||||||||||||||||

| Total trading liabilities | ( | ||||||||||||||||

| Securities sold under agreements to repurchase | — | ||||||||||||||||

| Other secured financings | — | ||||||||||||||||

| Borrowings | — | ||||||||||||||||

| Total liabilities at fair value | $ | $ | $ | $ | ( | $ | |||||||||||

| At December 31, 2023 | |||||||||||||||||

| $ in millions | Level 1 | Level 2 | Level 3 | Netting1 | Total | ||||||||||||

| Assets at fair value | |||||||||||||||||

| Trading assets: | |||||||||||||||||

| U.S. Treasury and agency securities | $ | $ | $ | $ | — | $ | |||||||||||

| Other sovereign government obligations | — | ||||||||||||||||

| State and municipal securities | — | ||||||||||||||||

| MABS | — | ||||||||||||||||

Loans and lending commitments2 | — | ||||||||||||||||

| Corporate and other debt | — | ||||||||||||||||

Corporate equities3 | — | ||||||||||||||||

| Derivative and other contracts: | |||||||||||||||||

| Interest rate | — | ||||||||||||||||

| Credit | — | ||||||||||||||||

| Foreign exchange | — | ||||||||||||||||

| Equity | — | ||||||||||||||||

| Commodity and other | — | ||||||||||||||||

Netting1 | ( | ( | ( | ( | ( | ||||||||||||

| Total derivative and other contracts | ( | ||||||||||||||||

Investments4 | — | ||||||||||||||||

| Physical commodities | — | ||||||||||||||||

Total trading assets4 | ( | ||||||||||||||||

| Investment securities—AFS | — | ||||||||||||||||

| Securities purchased under agreements to resell | — | ||||||||||||||||

| Total assets at fair value | $ | $ | $ | $ | ( | $ | |||||||||||

| At December 31, 2023 | |||||||||||||||||

| $ in millions | Level 1 | Level 2 | Level 3 | Netting1 | Total | ||||||||||||

| Liabilities at fair value | |||||||||||||||||

| Deposits | $ | $ | $ | $ | — | $ | |||||||||||

| Trading liabilities: | |||||||||||||||||

| U.S. Treasury and agency securities | — | ||||||||||||||||

| Other sovereign government obligations | — | ||||||||||||||||

| Corporate and other debt | — | ||||||||||||||||

Corporate equities3 | — | ||||||||||||||||

| Derivative and other contracts: | |||||||||||||||||

| Interest rate | — | ||||||||||||||||

| Credit | — | ||||||||||||||||

| Foreign exchange | — | ||||||||||||||||

| Equity | — | ||||||||||||||||

| Commodity and other | — | ||||||||||||||||

Netting1 | ( | ( | ( | ( | ( | ||||||||||||

| Total derivative and other contracts | ( | ||||||||||||||||

| Total trading liabilities | ( | ||||||||||||||||

| Securities sold under agreements to repurchase | — | ||||||||||||||||

| Other secured financings | — | ||||||||||||||||

| Borrowings | — | ||||||||||||||||

| Total liabilities at fair value | $ | $ | $ | $ | ( | $ | |||||||||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | ||||||

| Commercial Real Estate | $ | $ | ||||||

| Residential Real Estate | ||||||||

| Securities-based lending and Other loans | ||||||||

| Total | $ | $ | ||||||

| $ in millions | At March 31, 2024 | At December 31, 2023 | ||||||

| Customer and other receivables (payables), net | $ | $ | ||||||

| March 2024 Form 10-Q | 42 | |||||||

| Notes to Consolidated Financial Statements (Unaudited) |  | ||||

| Three Months Ended March 31, | ||||||||

| $ in millions | 2024 | 2023 | ||||||

| U.S. Treasury and agency securities | ||||||||

| Beginning balance | $ | $ | ||||||

| Purchases | ( | |||||||

| Sales | ( | |||||||

| Ending balance | $ | $ | ||||||

| Unrealized gains (losses) | $ | $ | ||||||

| Other sovereign government obligations | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized gains (losses) | ( | |||||||

| Purchases | ||||||||

| Sales | ( | ( | ||||||

| Net transfers | ( | ( | ||||||

| Ending balance | $ | $ | ||||||

| Unrealized gains (losses) | $ | $ | ||||||

| State and municipal securities | ||||||||

| Beginning balance | $ | $ | ||||||

| Purchases | ||||||||

| Sales | ( | ( | ||||||

| Net transfers | ( | |||||||

| Ending balance | $ | $ | ||||||

| Unrealized gains (losses) | $ | $ | ||||||

| MABS | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized gains (losses) | ||||||||

| Purchases | ||||||||

| Sales | ( | ( | ||||||

| Net transfers | ( | |||||||

| Ending balance | $ | $ | ||||||

| Unrealized gains (losses) | $ | ( | $ | |||||

| Loans and lending commitments | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized gains (losses) | ( | ( | ||||||

| Purchases and originations | ||||||||

| Sales | ( | ( | ||||||

| Settlements | ( | ( | ||||||

| Net transfers | ( | ( | ||||||

| Ending balance | $ | $ | ||||||

| Unrealized gains (losses) | $ | ( | $ | ( | ||||

| Three Months Ended March 31, | ||||||||

| $ in millions | 2024 | 2023 | ||||||

| Corporate and other debt | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized gains (losses) | ||||||||

| Purchases and originations | ||||||||

| Sales | ( | ( | ||||||

| Settlements | ( | |||||||

| Net transfers | ( | |||||||

| Ending balance | $ | $ | ||||||

| Unrealized gains (losses) | $ | $ | ||||||

| Corporate equities | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized gains (losses) | ( | ( | ||||||

| Purchases | ||||||||

| Sales | ( | ( | ||||||

| Net transfers | ||||||||

| Ending balance | $ | $ | ||||||

| Unrealized gains (losses) | $ | ( | $ | ( | ||||

| Investments | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized gains (losses) | ||||||||

| Purchases | ||||||||

| Sales | ( | ( | ||||||

| Net transfers | ( | |||||||

| Ending balance | $ | $ | ||||||

| Unrealized gains (losses) | $ | ( | $ | |||||

| Investment securities—AFS | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized gains (losses) | ||||||||

| Net transfers | ( | |||||||

| Ending balance | $ | $ | ||||||

| Unrealized gains (losses) | $ | $ | ||||||

| Net derivatives: Interest rate | ||||||||

| Beginning balance | $ | ( | $ | ( | ||||

| Realized and unrealized gains (losses) | ( | |||||||

| Purchases | ||||||||

| Issuances | ( | ( | ||||||

| Settlements | ( | |||||||

| Net transfers | ( | |||||||

| Ending balance | $ | $ | ( | |||||

| Unrealized gains (losses) | $ | $ | ||||||

43 | March 2024 Form 10-Q | |||||||

| Notes to Consolidated Financial Statements (Unaudited) |  | ||||

| Three Months Ended March 31, | ||||||||

| $ in millions | 2024 | 2023 | ||||||

| Net derivatives: Credit | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized gains (losses) | ( | ( | ||||||

| Settlements | ( | |||||||

| Net transfers | ( | ( | ||||||

| Ending balance | $ | $ | ||||||

| Unrealized gains (losses) | $ | ( | $ | ( | ||||

| Net derivatives: Foreign exchange | ||||||||

| Beginning balance | $ | ( | $ | |||||

| Realized and unrealized gains (losses) | ( | |||||||

| Purchases | ||||||||

| Issuances | ( | |||||||

| Settlements | ( | |||||||

| Net transfers | ( | |||||||

| Ending balance | $ | $ | ||||||

| Unrealized gains (losses) | $ | $ | ( | |||||

| Net derivatives: Equity | ||||||||

| Beginning balance | $ | ( | $ | ( | ||||

| Realized and unrealized gains (losses) | ||||||||

| Purchases | ||||||||

| Issuances | ( | ( | ||||||

| Settlements | ( | |||||||

| Net transfers | ( | |||||||

| Ending balance | $ | ( | $ | ( | ||||

| Unrealized gains (losses) | $ | $ | ( | |||||

| Net derivatives: Commodity and other | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized gains (losses) | ||||||||

| Purchases | ||||||||

| Issuances | ( | ( | ||||||

| Settlements | ( | ( | ||||||

| Net transfers | ( | |||||||

| Ending balance | $ | $ | ||||||

| Unrealized gains (losses) | $ | ( | $ | |||||

| Deposits | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized losses (gains) | ||||||||

| Issuances | ||||||||

| Settlements | ( | |||||||

| Net transfers | ||||||||

| Ending balance | $ | $ | ||||||

| Unrealized losses (gains) | $ | $ | ||||||

| Nonderivative trading liabilities | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized losses (gains) | ( | |||||||

| Purchases | ( | ( | ||||||

| Sales | ||||||||

| Net transfers | ||||||||

| Ending balance | $ | $ | ||||||

| Unrealized losses (gains) | $ | $ | ( | |||||

| Three Months Ended March 31, | ||||||||

| $ in millions | 2024 | 2023 | ||||||

| Securities sold under agreements to repurchase | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized losses (gains) | ||||||||

| Settlements | ( | |||||||

| Ending balance | $ | $ | ||||||

| Unrealized losses (gains) | $ | $ | ||||||

| Other secured financings | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized losses (gains) | ( | |||||||

| Issuances | ||||||||

| Settlements | ( | ( | ||||||

| Ending balance | $ | $ | ||||||

| Unrealized losses (gains) | $ | ( | $ | |||||

| Borrowings | ||||||||

| Beginning balance | $ | $ | ||||||

| Realized and unrealized losses (gains) | ||||||||

| Issuances | ||||||||

| Settlements | ( | ( | ||||||

| Net transfers | ( | ( | ||||||

| Ending balance | $ | $ | ||||||