UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2015

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-11718

EQUITY LIFESTYLE PROPERTIES, INC.

(Exact name of registrant as specified in its charter)

Maryland | 36-3857664 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

Two North Riverside Plaza, Suite 800, Chicago, Illinois | 60606 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(312) 279-1400

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $0.01 Par Value | New York Stock Exchange | |

(Title of Class) | (Name of exchange on which registered) | |

6.75% Series C Cumulative Redeemable Perpetual Preferred Stock, $0.01 Par Value | New York Stock Exchange | |

(Title of Class) | (Name of exchange on which registered) | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x | Accelerated filer | o |

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of voting stock held by non-affiliates was approximately $4,139.9 million as of June 30, 2015 based upon the closing price of $52.58 on such date using beneficial ownership of stock rules adopted pursuant to Section 13 of the Securities Exchange Act of 1934 to exclude voting stock owned by Directors and Officers, some of whom may not be held to be affiliates upon judicial determination.

At February 19, 2016, 84,593,728 shares of the Registrant's common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Part III incorporates by reference portions of the Registrant's Proxy Statement relating to the Annual Meeting of Stockholders to be held on May 10, 2016.

Equity LifeStyle Properties, Inc.

TABLE OF CONTENTS

Page | |||

PART I. | |||

Item 1. | Business | ||

Item 1A. | Risk Factors | ||

Item 1B. | Unresolved Staff Comments | ||

Item 2. | Properties | ||

Item 3. | Legal Proceedings | ||

Item 4. | Mine Safety Disclosure | ||

PART II. | |||

Item 5. | Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | ||

Item 6. | Selected Financial Data | ||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | ||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | ||

Forward-Looking Statements | |||

Item 8. | Financial Statements and Supplementary Data | ||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | ||

Item 9A. | Controls and Procedures | ||

Item 9B. | Other Information | ||

PART III. | |||

Item 10. | Directors, Executive Officers and Corporate Governance | ||

Item 11. | Executive Compensation | ||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | ||

Item 13. | Certain Relationships and Related Transactions and Director Independence | ||

Item 14. | Principal Accountant Fees and Services | ||

PART IV. | |||

Item 15. | Exhibits and Financial Statement Schedules | ||

-i-

PART I

Item 1. Business

Equity LifeStyle Properties, Inc.

General

Equity LifeStyle Properties, Inc. ("ELS"), a Maryland corporation, together with MHC Operating Limited Partnership (the "Operating Partnership") and its other consolidated subsidiaries (the "Subsidiaries"), are referred to herein as "we," "us," and "our." We elected to be taxed as a real estate investment trust ("REIT"), for U.S. federal income tax purposes, commencing with our taxable year ended December 31, 1993.

We are a fully integrated owner and operator of lifestyle-oriented properties ("Properties") consisting primarily of manufactured home ("MH") communities and recreational vehicle ("RV") resorts and campgrounds. We were formed in December 1992 to continue the property operations, business objectives and acquisition strategies of an entity that had owned and operated Properties since 1969.

We have a unique business model where we own the land and provide our customers the opportunity to place factory built homes, cottages, cabins or RVs either permanently or on a long-term or short-term basis. Our customers may lease individual developed areas ("Sites") or enter right-to-use contracts which provide them access to specific Properties for limited stays. Compared to other types of real estate companies, our business model is characterized by low maintenance costs as well as low customer turnover costs. Our portfolio is spread through highly desirable locations with a focus on both retirement and vacation destinations attracting retirees, vacationing families, and second homeowners, while providing a lower cost home ownership alternative. We have 80 Properties with lake, river or ocean frontage and more than 100 Properties within 10 miles of the coastal United States.

We are one of the nation's largest real estate networks with a portfolio, as of December 31, 2015, of 387 Properties consisting of 143,938 residential Sites located throughout the United States and Canada. These Properties are located in 32 states and British Columbia.

Our Properties are designed and improved for several home options of various sizes and designs that are produced off-site by third-party manufacturers, installed and set on designated Sites ("Site Set") within the Properties. These homes can range from 400 to over 2,000 square feet. Properties may also have Sites that can accommodate a variety of RVs. Properties generally contain centralized entrances, internal road systems and designated Sites. In addition, Properties often provide a clubhouse for social activities and recreation and other amenities, which may include swimming pools, shuffleboard courts, tennis courts, pickleball courts, golf courses, lawn bowling, restaurants, laundry facilities, cable television and internet service. Some Properties provide

1

utilities, including water and sewer service, through municipal or regulated utilities while others provide these services to customers from on-site facilities.

Employees and Organizational Structure

We have an annual average of approximately 4,100 full-time, part-time and seasonal employees dedicated to carrying out our operating philosophy while focusing on providing good service to our customers. The operations of each Property are coordinated by an on-site team of employees that typically includes a manager, clerical staff and maintenance workers, each of whom works to provide maintenance and care to the Properties. The on-site team at each Property also provides customer service and coordinates lifestyle-oriented activities for customers. Direct supervision of on-site management is the responsibility of our regional vice presidents and regional and district managers who have substantial experience addressing the needs of customers and creating innovative approaches to maximize value and increase cash flow from property operations. Complementing the field management staff are approximately 200 full-time corporate employees who assist in all functions related to the management of our Properties.

Our Formation

Our operations are conducted primarily through our Operating Partnership. We contributed the proceeds from our initial public offering in 1993 and subsequent offerings to our Operating Partnership for a general partnership interest. The financial results of our Operating Partnership and our Subsidiaries are consolidated in our consolidated financial statements, which can be found beginning on page F-1 of this Form 10-K. In addition, since certain activities, if performed by us, may not be qualifying REIT activities under the Internal Revenue Code of 1986, as amended (the "Code"), we have formed taxable REIT Subsidiaries, as defined in the Code, to engage in such activities.

Realty Systems, Inc. ("RSI") is a wholly owned taxable REIT subsidiary of ours which is engaged in the business of purchasing, selling or leasing Site Set homes that are located in Properties owned and managed by us. RSI also provides brokerage services to residents at such Properties who move from a Property but do not relocate their homes. RSI may provide brokerage services, in competition with other local brokers, by seeking buyers for the Site Set homes. Subsidiaries of RSI also operate ancillary activities at certain Properties, such as golf courses, pro shops, stores and restaurants. Several Properties are also wholly owned by our taxable REIT Subsidiaries.

Business Objectives and Operating Strategies

Our primary business objective is to maximize both current and long-term income growth. Our operating strategy is to own and operate the highest quality Properties in sought-after locations near retirement and vacation destinations and urban areas across the United States.

We focus on Properties that have strong cash flow and plan to hold such Properties for long-term investment and capital appreciation. In determining cash flow potential, we evaluate our ability to attract high quality customers to our Properties and retain these customers who take pride in the Property and in their homes. Our operating, investment and financing strategies include:

• | Consistently providing high levels of services and amenities in attractive surroundings to foster a strong sense of community and pride of home ownership; |

• | Efficiently managing the Properties to increase operating margins by increasing occupancy, maintaining competitive market rents and controlling expenses; |

• | Increasing income and property values by strategic expansion and, where appropriate, renovation of the Properties; |

• | Utilizing technology to evaluate potential acquisitions, identify and track competing properties and monitor existing and prospective customer satisfaction; |

• | Selectively acquiring properties that have potential for long-term cash flow growth and creating property concentrations in and around retirement or vacation destinations and major metropolitan areas to capitalize on operating synergies and incremental efficiencies; |

• | Managing our debt balances in order to maintain financial flexibility, minimize exposure to interest rate fluctuations and maintain an appropriate degree of leverage to maximize return on capital; and |

• | Developing and maintaining relationships with various capital providers. |

These business objectives and their implementation are consistent with business strategies determined by our Board of Directors and may be changed at any time.

2

Acquisitions and Dispositions

Over the last decade we have continued to increase the number of Properties in our portfolio (including owned or partly owned Properties), from 285 Properties with over 106,300 Sites to 387 Properties with over 143,900 Sites. During the year ended December 31, 2015, we acquired three Properties (two RV resorts and one MH community) with a total of approximately 700 Sites. We continually review the Properties in our portfolio to ensure they fit our business objectives. Over the last five years, we redeployed capital to properties in markets we believe have greater long-term potential by acquiring 92 Properties primarily located in retirement and vacation destinations and selling 12 Properties that were not aligned with our long-term goals.

We believe that opportunities for property acquisitions are still available. Based on industry reports, we estimate there are approximately 50,000 manufactured home properties and approximately 8,750 RV resorts (excluding government owned properties) in North America. Most of these properties are not operated by large owner/operators, and approximately 3,600 of the MH properties and 1,300 of the RV resorts contain 200 Sites or more. We believe that this relatively high degree of fragmentation provides us, as a national organization with experienced management and substantial financial resources, the opportunity to purchase additional properties. We believe we have a competitive advantage in the acquisition of additional properties due to our experienced management, significant presence in major real estate markets and access to capital resources. We are actively seeking to acquire and are engaged at any time in various stages of negotiations relating to the possible acquisition of additional properties, which may include outstanding contracts to acquire properties that are subject to the satisfactory completion of our due diligence review.

We anticipate that new acquisitions will generally be located in the United States, although we may consider other geographic locations provided they meet our acquisition criteria. We utilize market information systems to identify and evaluate acquisition opportunities, including the use of a market database to review the primary economic indicators of the various locations in which we expect to expand our operations.

Acquisitions will be financed from the most appropriate available sources of capital, which may include undistributed funds from operations, issuance of additional equity securities, sales of investments, collateralized and uncollateralized borrowings and issuance of debt securities. In addition, we have and expect to acquire properties in transactions that include the issuance of limited partnership interests in our Operating Partnership ("OP Units") as consideration for the acquired properties. We believe that an ownership structure that includes our Operating Partnership has and will permit us to acquire additional properties in transactions that may defer all or a portion of the sellers' tax consequences.

When evaluating potential acquisitions, we consider, among others, the following factors:

• | Current and projected cash flow of the property and the potential for increased cash flow; |

• | Geographic area and the type of property; |

• | Replacement cost of the property, including land values, entitlements and zoning; |

• | Location, construction quality, condition and design of the property; |

• | Potential for capital appreciation of the property; |

• | Terms of tenant leases or usage rights, including the potential for rent increases; |

• | Potential for economic growth and the tax and regulatory environment of the community in which the property is located; |

• | Potential for expansion, including increasing the number of Sites; |

• | Occupancy and demand by customers for properties of a similar type in the vicinity and the customers' profiles; |

• | Prospects for liquidity through sale, financing or refinancing of the property; |

• | Competition from existing properties and the potential for the construction of new properties in the area; and |

• | Working capital demands. |

When evaluating potential dispositions, we consider, among others, the following factors:

• | Whether the Property meets our current investment criteria; |

• | Our desire to exit certain non-core markets and recycle the capital into core markets; and |

• | Our ability to sell the Property at a price that we believe will provide an appropriate return for our stockholders. |

When investing capital, we consider all potential uses of the capital, including returning capital to our stockholders. Our Board of Directors continues to review the conditions under which we may repurchase our stock. These conditions include, but are not limited to, market price, balance sheet flexibility, other opportunities and capital requirements.

Property Expansions

Several of our Properties have land available for expanding the number of Sites. Development of these Sites ("Expansion Sites") is evaluated based on the following factors: local market conditions; ability to subdivide; accessibility within the Property

3

and externally; infrastructure needs including utility needs and access as well as additional common area amenities; zoning and entitlement; costs and uses of working capital; topography; and ability to market new Sites. When justified, development of Expansion Sites allows us to leverage existing facilities and amenities to increase the income generated from the Properties. Our acquisition philosophy includes owning Properties with potential for Expansion Site development. Approximately 85 of our Properties have expansion potential, with up to approximately 5,300 acres available for expansion. Refer to Item 2. Properties. which includes detail regarding the developable acres available at each property.

Leases or Usage Rights

At our Properties, a typical lease for the rental of a Site between us and the owner or renter of a home is month-to-month or for a one-year term, renewable upon the consent of both parties or, in some instances, as provided by statute. These leases are cancelable, depending on applicable law, for non-payment of rent, violation of Property rules and regulations or other specified defaults. Long-term leases that are non-cancelable by the tenant are in effect at approximately 7,400 Sites in 39 of our Properties. Some of these leases are subject to rental rate increases based on the Consumer Price Index ("CPI"), in some instances allowing for pass-throughs of certain items such as real estate taxes, utility expenses and capital expenditures. Generally, adjustments to our market rates, if appropriate, are made on an annual basis.

In Florida, in connection with offering a Site in a MH community for rent, the MH community owner must deliver to the prospective resident a Prospectus required by Florida Statutes Chapter 723.001, et. seq., which must be approved by the applicable regulatory agency. The Prospectus contains certain required disclosures regarding the community, the rights and obligations of the MH community owner and residents, and a copy of the lease agreement. A Prospectus may contain limitations on the rights of the MH community owner to increase rental rates. However, in the absence of such limitations, the MH community owner may increase rental rates to market, subject to certain advance notice requirements and a statutory requirement that the rental rates be reasonable. See further discussion below related to rent control legislation.

At Properties zoned for RV use, we have long-term relationships with many of our customers who typically enter into short-term rental agreements. Many resort customers also leave deposits to reserve a Site for the following year. Generally, these customers cannot live full time on the Property. At resort Properties operated under the Thousand Trails brand designated for use by customers who have entered a right-to-use or membership contract, the contract generally grants the customer access to designated Properties on a continuous basis of up to 14 days in exchange for annual dues payments. The customer may make a nonrefundable upfront payment to upgrade the contract which increases usage rights during the contract term. We may finance the nonrefundable upfront payment. Most of the contracts provide for an annual dues increase, usually based on increases in the CPI. Approximately 31% of current customers are not subject to annual dues increases in accordance with the terms of their contracts, generally because the customers are over 61 years old or meet certain other specified restriction criteria.

Regulations and Insurance

General. Our Properties are subject to a variety of laws, ordinances and regulations, including regulations relating to recreational facilities such as swimming pools, clubhouses and other common areas, regulations relating to providing utility services, such as electricity, and regulations relating to operating water and wastewater treatment facilities at certain of our Properties. We believe that each Property has all material permits and approvals necessary to operate. We renew these permits and approvals in the ordinary course of business.

Insurance. The Properties are insured against risks that may cause property damage and business interruption including events such as fire, flood, earthquake, or windstorm. The relevant insurance policies contain deductible requirements, coverage limits and particular exclusions. Our current property and casualty insurance policies, which we plan to renew, expire on April 1, 2016. We have a $100 million loss limit with respect to our all-risk property insurance program including named windstorms, which include, for example, hurricanes. This loss limit is subject to additional sub-limits as set forth in the policy form, including, among others, a $25 million aggregate loss limit for earthquakes in California. Policy deductibles primarily range from a $125,000 minimum to 5% per unit of insurance for most catastrophic events. A deductible indicates our maximum exposure, subject to policy limits and sub-limits, in the event of a loss.

Rent Control Legislation. At certain of our Properties, principally in California, state and local rent control laws limit our ability to increase rents and to recover increases in operating expenses and the costs of capital improvements. Enactment of such laws has been considered at various times in other jurisdictions. We presently expect to continue to maintain Properties, and may purchase additional properties, in markets that are either subject to rent control or in which rent-limiting legislation exists or may be enacted. For example, Florida law requires that rental increases be reasonable, and Delaware law requires rental increases greater than the change in the consumer price index to be justified. Also, certain jurisdictions in California in which we own Properties limit rent increases to changes in the CPI or some percentage of CPI. As part of our effort to realize the value of Properties

4

subject to restrictive regulation, we have initiated lawsuits at various times against various municipalities imposing such regulations in an attempt to balance the interests of our stockholders with the interests of our customers. (See Item 3. Legal proceedings).

Membership Properties. Many states also have consumer protection laws regulating right-to-use or campground membership sales and the financing of such sales. Some states have laws requiring us to register with a state agency and obtain a permit to market (see Item 1A. Risk Factors). At certain of our Properties primarily used as membership campgrounds, state statutes limit our ability to close a Property unless a reasonable substitute Property is made available for members' use.

Industry

We believe that our Properties and our business model provide an opportunity for increased cash flows and appreciation in value. These may be achieved through increases in occupancy rates and rents, as well as expense controls, expansion of existing Properties and opportunistic acquisitions, for the following reasons:

• | Barriers to Entry: We believe that the supply of new properties in locations we target will be constrained by barriers to entry. The most significant barrier has been the difficulty of securing zoning permits from local authorities. This has been the result of (i) the public's perception of manufactured housing, and (ii) the fact that MH communities and RV resorts generate less tax revenue than conventional housing properties because the homes are treated as personal property (a benefit to the homeowner) rather than real property. Further, the length of time between investment in a property's development and the attainment of stabilized occupancy and the generation of revenues is significant. The initial development of the infrastructure may take up to two or three years and once a property is ready for occupancy, it may be difficult to attract customers to an empty property. Substantial occupancy levels may take several years to achieve. |

• | Customer Base: We believe that properties tend to achieve and maintain a stable rate of occupancy due to the following factors: (i) customers typically own their own homes, (ii) properties tend to foster a sense of community as a result of amenities such as clubhouses and recreational and social activities, (iii) customers often sell their homes in-place (similar to site-built residential housing) with no interruption of rental payments to us, and (iv) moving a Site Set home from one property to another involves substantial cost and effort. |

• | Lifestyle Choice: According to the Recreational Vehicle Industry Association ("RVIA"), nearly one in eleven U.S. households owns an RV and there are currently 9.0 million RV owners. The 77 million people born from 1946 to 1964 or "baby boomers" make up the fastest growing segment of this market. According to Pew Research Center, every day 10,000 Americans turn 65. We believe that this population segment, seeking an active lifestyle, will provide opportunities for our future cash flow growth. As RV owners age and move beyond the more active RV lifestyle, they will often seek more permanent retirement or vacation establishments. Site Set housing has become an increasingly popular housing alternative for retirement, second-home, and "empty-nest" living. According to Pew Research Center, the baby-boom generation is expected to grow 28% within the next 15 years. |

We believe that the housing choices in our Properties are especially attractive to such individuals throughout this lifestyle cycle. Our Properties offer an appealing amenity package, close proximity to local services, social activities, low maintenance and a secure environment. In fact, many of our Properties allow for this cycle to occur within a single Property.

• | Construction Quality: The Department of Housing and Urban Development's ("HUD") standards for Site Set housing construction quality are the only federal standards governing housing quality of any type in the United States. Site Set homes produced since 1976 have received a "red and silver" government seal certifying that they were built in compliance with the federal code. The code regulates Site Set home design and construction, strength and durability, fire resistance and energy efficiency, and the installation and performance of heating, plumbing, air conditioning, thermal and electrical systems. In newer homes, top grade lumber and dry wall materials are common. Also, manufacturers are required to follow the same fire codes as builders of site-built structures. Although resort cottages, which are generally smaller homes, do not come under the same regulations, the resort cottages are built and certified in accordance with NFPA 1192-15 and ANSI A119.5-09 consensus standards for park model recreational vehicles and have many of the same quality features. |

• | Comparability to Site-Built Homes: Since inception, the Site Set housing industry has experienced a trend toward multi-section homes. Current Site Set homes are up to 80 feet long and 30 feet wide and approximately 1,438 square feet. Many such homes have nine-foot ceilings or vaulted ceilings, fireplaces and as many as four bedrooms, and closely resemble single-family ranch-style site-built homes. At our Properties, there is an active resale or rental market for these larger homes. According to the 2014 U.S. Census American Community Survey, manufactured homes represent 9.3% of total housing units. |

• | Second Home and Vacation Home Demographics: According to 2015 National Association of Realtors ("NAR") reports, sales of second homes in 2014 accounted for 40% of residential transactions, or 2.2 million second-home sales in 2014. There were approximately 8.0 million vacation homes in 2014. The typical vacation-home buyer is 43 years old and |

5

earned $94,400 in 2014. According to 2014 NAR reports, approximately 46% of vacation homes were purchased in the south; 25% were purchased in the west; 15% were purchased in the northeast; and 14% were purchased in the Midwest. Looking ahead, NAR believes that baby boomers are still in their peak earning years, and the leading edge of their generation is approaching retirement. As they continue to have the financial means to purchase a second home as a vacation property, investment opportunity, or perhaps as a retirement retreat, those baby boomers will continue to drive the market for second homes. We believe it is likely that over the next decade we will continue to see high levels of second-home sales, and resort homes and cottages in our Properties will continue to provide a viable second-home alternative to site-built homes.

Notwithstanding our belief that the industry information highlighted above provides us with significant long-term growth opportunities, our short-term growth opportunities could be disrupted by the following:

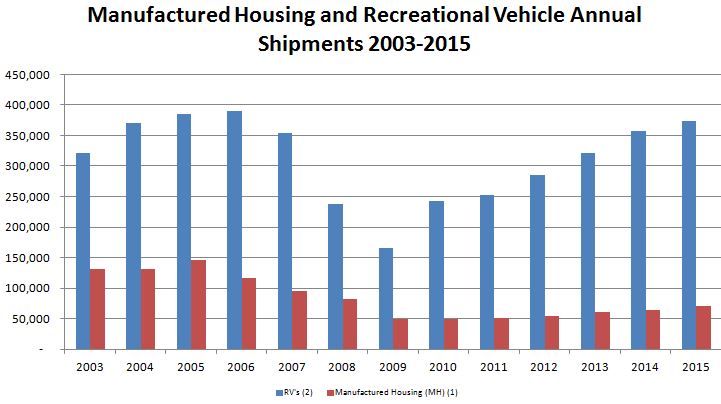

• | Shipments—According to statistics compiled by the U.S. Census Bureau, shipments of new manufactured homes declined from 2005 through 2009. Since then, manufactured home shipments have increased each year and are on pace for a seventh straight year of growth. Although new manufactured home shipments continue to be below historical levels, shipments in 2015 increased about 9.6% to 70,500 units as compared to shipments in 2014 of 64,300 units. According to the RVIA, wholesale shipments of RVs increased 4.9% in 2015 to approximately 374,100 units as compared to 2014, which continued a positive trend in RV shipments that started in late 2009. Certain industry experts have predicted that 2016 RV shipments will increase by about 2% as compared to 2015. |

———————————————————————————————————————————

———————————————————————————————————————————1. | U.S. Census: Manufactured Homes Survey |

2. | Source: RVIA |

• | Sales: Retail sales of RVs totaled approximately 305,800 in 2015, a 18.1% increase from 2014 RV sales of 259,000 and a 24.9% increase from 2013 RV sales of 244,800. We believe that consumers remain concerned about the current economy, and by prospects that the economy might remain sluggish in the years ahead. However, the enduring appeal of the RV lifestyle has translated into continued strength in RV sales despite the economic turmoil. According to RVIA, RV ownership has reached record levels: 9.0 million American households now own an RV, the highest level ever recorded, which constitutes an increase of 13.9% since 2005. RV sales could continue to benefit as aging baby-boomers continue to enter the age range in which RV ownership is highest. RV dealers typically have relationships with third party lenders who provide financing for the purchase of an RV. |

• | Availability of financing: Since 2008 only a few sources of financing have been available for manufactured home and RV manufacturers. In addition, the economic and legislative environment has made it difficult for purchasers of manufactured homes and RVs to obtain financing. Legislation enacted in 2010 known as the SAFE Act (Safe Mortgage Licensing Act) requires community owners interested in providing financing for customer purchases of manufactured homes to register as a mortgage loan originator in states where they engage in such financing. In comparison to financing available to |

6

purchasers of site-built homes, the few third party financing sources available to purchasers of manufactured homes offer financing with higher down payments, higher rates and shorter maturities, and loan approval is subject to more stringent underwriting criteria. During 2013 we entered into an agreement with an unaffiliated third party home manufacturer to create a joint venture, ECHO Financing, LLC, to buy and sell homes and purchase loans made by an unaffiliated lender to residents at our Properties.

Please see our risk factors in Item 1A - Risk Factors and financial statements and related notes beginning on page F-1 of this Form 10-K for more detailed information.

Available Information

We file reports electronically with the Securities and Exchange Commission ("SEC"). The public may read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy information and statements and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. We maintain an Internet site with information about us and hyperlinks to our filings with the SEC at http://www.equitylifestyle.com, free of charge. Requests for copies of our filings with the SEC and other investor inquiries should be directed to:

Investor Relations Department

Equity LifeStyle Properties, Inc.

Two North Riverside Plaza

Chicago, Illinois 60606

Phone: 1-800-247-5279

e-mail: investor_relations@equitylifestyle.com

Item 1A. Risk Factors

Our business faces many risks. The risks described below may not be the only risks we face but are the risks we know or that we believe may be material at this time. Additional risks that we do not yet know of, or that we currently think are immaterial, may also impair our business operations or financial results. This Item 1A. also includes forward-looking statements. You should refer to our discussion of the qualifications and limitations on forward-looking statements included in Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Risks Relating to Our Operations and Real Estate Investments

Adverse Economic Conditions and Other Factors Could Adversely Affect the Value of our Properties and our Cash Flow.

Several factors may adversely affect the economic performance and value of our Properties. These factors include:

• | changes in the national, regional and/or local economic climate; |

• | fluctuation in the exchange rate of the U.S. dollar to other currencies and its impact on foreign customers of our northern and southern Properties; |

• | the attractiveness of our Properties to customers, competition from manufactured home communities and other lifestyle-oriented properties and alternative forms of housing (such as apartment buildings and site-built single family homes); |

• | the ability of manufactured home and RV manufacturers to adapt to changes in the economic climate and the availability of units from these manufacturers; |

• | the ability of our potential customers to sell or lease their existing site-built residences in order to purchase resort homes or cottages at our Properties, and heightened price sensitivity for seasonal and second homebuyers; |

• | the possible reduced ability of our potential customers to obtain financing on the purchase of resort homes, resort cottages or RVs; |

• | the ability of our potential customers to obtain affordable chattel financing from MH lenders; |

• | government stimulus intended to primarily benefit purchasers of site-built housing; |

• | our ability to collect rent, annual payments and principal and interest from customers and pay or control maintenance, insurance and other operating costs (including real estate taxes), which could increase over time; |

• | unfavorable weather conditions, especially on holiday weekends in the summer, could reduce the economic performance at our resort Properties; |

• | the failure of our assets to generate income sufficient to pay our expenses, service our debt and maintain our Properties, which may adversely affect our ability to make expected distributions to our stockholders or may result in claims including, but not limited to, foreclosure by a lender in the event of our inability to service our debt; |

• | changes in laws and governmental regulations (including rent control laws and regulations governing usage, zoning and taxes and chattel financing), which may adversely affect our financial condition; |

7

• | changes in laws and governmental regulations related to proposed minimum wage increases may adversely affect our financial condition; and |

• | our ability to attract customers to enter new or upgraded right-to-use contracts and to retain customers who have previously entered right-to-use contracts. |

Economic Downturn in the States or Markets with a Large Concentration of Our Properties May Adversely Affect Our Cash Flows, Financial Condition and Ability to Make Distributions.

Our success is dependent upon economic conditions in the U.S. generally and in the geographic areas in which a substantial number of our Properties are located. Adverse changes in national economic conditions and in the economic conditions of the regions in which we conduct substantial business may have an adverse effect on the real estate values of our Properties, our financial performance and the market price of our common stock. As we have a large concentration of properties in certain markets, most notably Florida, California, and Arizona, adverse market and economic conditions in these areas of high concentration, which significantly affect such factors as occupancy and rental rates, could have a significant impact on our revenues, cash flows, financial condition and ability to make distributions. In a recession or under other adverse economic conditions, non-earning assets and write-downs are likely to increase as debtors fail to meet their payment obligations. Although we maintain reserves for credit losses and an allowance for doubtful accounts in amounts that we believe should be sufficient to provide adequate protection against potential write-downs in our portfolio, these amounts could prove to be insufficient.

Certain of Our Properties, Primarily our RV Resorts, are Subject to Seasonality and Cyclicality.

Some of our RV Resorts are used primarily by vacationers and campers. These Properties experience seasonal demand, which generally increases in the spring and summer months and decreases in the fall and winter months. As such, results for a certain quarter may not be indicative of the results of future quarters. In addition, as our RV Resorts are primarily used by campers and vacationers, economic cyclicality resulting in a downturn that affects discretionary spending and disposable income for leisure-time activities, as well as unfavorable weather conditions during the spring and summer months, could adversely affect our cash flows.

Competition for Acquisitions May Result in Increased Prices for Properties and Associated Costs and Increased Costs of Financing.

We expect that other real estate investors with significant capital will compete with us for attractive investment opportunities. These competitors may include other publicly traded REITs, private REITs, individuals, corporations, and other types of real estate investors. Such competition increases prices for Properties and can also result in increased fixed costs, such as real estate taxes. To the extent we are unable to effectively compete or acquire properties at a lower purchase price, our business may be adversely affected. Further, we expect to acquire Properties with cash from sources including but not limited to secured or unsecured financings, proceeds from offerings of equity or debt, offerings of OP Units, undistributed funds from operations and sales of investments. We may not be in a position or have the opportunity in the future to make suitable Property acquisitions on favorable terms. Increased competition can cause difficulties obtaining new financing or securing favorable financing terms.

New Acquisitions May Fail to Perform as Expected and the Intended Benefits of Our Acquisitions May Not Be Realized, Which Could Have a Negative Impact on Our Operations and the Market Price of Our Common Stock.

We intend to continue to acquire Properties. However, newly acquired Properties may fail to perform as expected and could pose risks for our ongoing operations including the following

• | integration may prove costly or time-consuming and may divert senior management's attention from the management of daily operations; |

• | difficulties or inability to access capital or increases in financing costs; |

• | we may incur costs and expenses associated with any undisclosed or potential liabilities; |

• | development and expansion projects may include long planning and involve complex and costly activities; |

• | unforeseen difficulties may arise in integrating an acquisition into our portfolio; |

• | we may acquire properties in new markets where we face risks associated with lack of market knowledge such as: understanding of the local economy, the local governmental and/or local permit procedures. |

As a result of the foregoing, we may underestimate the costs necessary to bring an acquired Property up to standards established for our intended market position. As such, we cannot assure you that any acquisitions that we make will be accretive to us in the near term or at all. Furthermore, if we fail to realize the intended benefits of an acquisition, the market price of our common stock could decline to the extent that the market price reflects those benefits.

8

Because Real Estate Investments Are Illiquid, We May Not be Able to Sell Properties When Appropriate.

Real estate investments generally cannot be sold quickly. We may not be able to vary our portfolio promptly in response to economic or other conditions, forcing us to accept lower than market value. This inability to respond promptly to changes in the performance of our investments could adversely affect our financial condition and ability to service debt and make distributions to our stockholders.

Our Inability to Sell or Rent Manufactured Homes Could Adversely Affect Our Cash Flows.

Selling and renting homes is a primary part of our business. Our ability to sell or rent manufactured homes could be adversely affected by any of the following factors:

• | downturns in economic conditions disrupting the single family housing market; |

• | local conditions, such as an oversupply of lifestyle-oriented properties or a reduction in demand for lifestyle-oriented properties; |

• | the ability of customers to obtain affordable financing; and |

• | demographics, such as the retirement of the "baby boomers", and their demand for access to our lifestyle-oriented Properties. |

Our Investments in Joint Ventures Could be Adversely Affected by Our Lack of Sole Decision-Making Authority Regarding Major Decisions, Our Reliance on Our Joint Venture Partners' Financial Condition, Any Disputes that may Arise Between Us and Our Joint Venture Partners and Our Exposure to Potential Losses from the Actions of Our Joint Venture Partners.

We have joint ventures with other investors. We currently and may continue in the future to acquire properties or make investments in joint ventures with other persons or entities when we believe circumstances warrant the use of such structures. Joint venture investments involve risks not present with respect to our wholly owned properties, including the following:

• | our joint venture partners might experience financial distress, become bankrupt or fail to fund their share of required capital contributions, which may delay construction or development of a property or increase our financial commitment to the joint venture; |

• | our joint venture partners may have business interests or goals with respect to a property that conflict with our business interests and goals, which could increase the likelihood of disputes regarding the ownership, management or disposition of the property; and |

• | we may be unable to take actions that are opposed by our joint venture partners under arrangements that require us to share decision-making authority over major decisions affecting the ownership or operation of the joint venture and any property owned by the joint venture, such as the sale or financing of the property or the making of additional capital contributions for the benefit of the venture. |

At times we have entered into agreements providing for joint and several liability with our partners. Frequently, we and our partners may each have the right to trigger a buy-sell arrangement, which could cause us to sell our interest, or acquire our partners' interest, at a time when we otherwise would not have initiated such a transaction. Any of these risks could materially and adversely affect our ability to generate and recognize attractive returns on our joint venture investments, which could have a material adverse effect on our results of operations, financial condition and distributions to our stockholders.

Risks Relating to Governmental Regulation and Potential Litigation

Risks of Governmental Action and of Litigation.

We own Properties in certain areas of the country where the rental rates in our Properties have not increased as fast as the real estate values either because of locally imposed rent control or long term leases. In such areas, certain local government entities have at times investigated the possibility of seeking to take our Properties by eminent domain at values below the value of the underlying land. While no such eminent domain proceeding has been commenced, and we would exercise all of our rights in connection with any such proceeding, successful condemnation proceedings by municipalities could adversely affect our financial condition. Moreover, certain of our Properties located in California are subject to rent control ordinances, some of which not only severely restrict ongoing rent increases but also prohibit us from increasing rents upon turnover. Such regulations allow customers to sell their homes for a premium representing the value of the future rent discounts resulting from rent-controlled rents.

Tenant groups have filed lawsuits against us seeking to limit rent increases and/or seeking large damage awards for our alleged failure to properly maintain certain Properties or other tenant related matters, such as the case currently pending in the California Court of Appeal, Sixth Appellate District, Case No. H041913, involving our California Hawaiian manufactured home property. (See Note 18 to the Consolidated Financial Statements for additional detail regarding our current litigation matters).

9

Laws and Regulations Relating to Campground Membership Sales and Properties Could Adversely Affect the Value of Certain Properties and Our Cash Flow.

Many of the states in which we do business have laws regulating right-to-use or campground membership sales. These laws generally require comprehensive disclosure to prospective purchasers, and usually give purchasers the right to rescind their purchase between three to five days after the date of sale. Some states have laws requiring us to register with a state agency and obtain a permit to market. We are subject to changes, from time to time, in the application or interpretation of such laws that can affect our business or the rights of our members.

In some states, including California, Oregon and Washington, laws place limitations on the ability of the owner of a campground property to close the property unless the customers at the property receive access to a comparable property. The impact of the rights of customers under these laws is uncertain and could adversely affect the availability or timing of sale opportunities or our ability to realize recoveries from Property sales.

The government authorities regulating our activities have broad discretionary power to enforce and interpret the statutes and regulations that they administer, including the power to enjoin or suspend sales activities, require or restrict construction of additional facilities and revoke licenses and permits relating to business activities. We monitor our sales and marketing programs and debt collection activities to control practices that might violate consumer protection laws and regulations or give rise to consumer complaints.

Certain consumer rights and defenses that vary from jurisdiction to jurisdiction may affect our portfolio of contracts receivable. Examples of such laws include state and federal consumer credit and truth-in-lending laws requiring the disclosure of finance charges, and usury and retail installment sales laws regulating permissible finance charges.

In certain states, as a result of government regulations and provisions in certain of the right-to-use or campground membership agreements, we are prohibited from selling more than ten memberships per site. At the present time, these restrictions do not preclude us from selling memberships in any state. However, these restrictions may limit our ability to utilize Properties for public usage and/or our ability to convert Sites to more profitable or predictable uses, such as annual rentals.

Environmental Risks

Changes in Oil and Gasoline Prices May Have an Adverse Impact on Our Properties and the RV Industry.

In the event the cost to power recreational vehicles increases, customers may reduce the amount of time spent traveling in their RVs. This may negatively impact revenues at our Properties that target these customers.

We have Properties located in geographic areas that are dependent on the energy industry for jobs. In the event the local economies in these areas are negatively impacted by declining oil prices, we may experience reduced property occupancy or be unable to increase rental rates at such Properties.

Environmental and Utility-Related Problems are Possible and Can be Costly.

Federal, state and local laws and regulations relating to the protection of the environment may require a current or previous owner or operator of real property to investigate and clean up hazardous or toxic substances or petroleum product releases at such property. The owner or operator may have to pay a governmental entity or third parties for property damage and for investigation and clean-up costs incurred by such parties in connection with the contamination. Such laws typically impose clean-up responsibility and liability without regard to whether the owner or operator knew of or caused the presence of the contaminants. Even if more than one person may have been responsible for the contamination, each person covered by the environmental laws may be held responsible for all of the clean-up costs incurred. In addition, third parties may sue the owner or operator of a site for damages and costs resulting from environmental contamination emanating from that site.

Environmental laws also govern the presence, maintenance and removal of asbestos. Such laws require that owners or operators of property containing asbestos properly manage and maintain the asbestos, that they notify and train those who may come into contact with asbestos and that they undertake special precautions, including removal or other abatement, if asbestos would be disturbed during renovation or demolition of a building. Such laws may impose fines and penalties on real property owners or operators who fail to comply with these requirements and may allow third parties to seek recovery from owners or operators for personal injury associated with exposure to asbestos fibers.

10

We Have a Significant Concentration of Properties in Florida and California, and Natural Disasters or Other Catastrophic Events in These or Other States Could Adversely Affect the Value of Our Properties and Our Cash Flow.

As of December 31, 2015, we owned or had an ownership interest in 387 Properties located in 32 states and British Columbia, including 122 Properties located in Florida and 49 Properties located in California. The occurrence of a natural disaster or other catastrophic event in any of these areas may cause a sudden decrease in the value of our Properties. While we have obtained insurance policies providing certain coverage against damage from fire, flood, property damage, earthquake, soil erosion, wind storm and business interruption, these insurance policies contain coverage limits, limits on covered property and various deductible amounts that we must pay before insurance proceeds are available. Such insurance may therefore be insufficient to restore our economic position with respect to damage or destruction to our Properties caused by such occurrences. Moreover, each of these coverages must be renewed every year and there is the possibility that all or some of the coverages may not be available at a reasonable cost. In addition, in the event of such a natural disaster or other catastrophic event, the process of obtaining reimbursement for covered losses, including the lag between expenditures we incurred and reimbursements received from the insurance providers, could adversely affect our economic performance.

We Face Possible Risks Associated With the Physical Effects of Climate Change.

We cannot predict with certainty whether climate change is occurring and, if so, at what rate. However, the physical effects of climate change could have a material adverse effect on our Properties, operations and business. For example, many of our properties are located in the southeast and southwest regions of the United States, particularly in Florida, California and Arizona. To the extent climate change causes changes in weather patterns, our markets could experience increases in storm intensity and rising sea-levels. Over time, these conditions could result in declining demand for space in our Properties or our inability to operate them. Climate change may also have indirect effects on our business by increasing the cost of (or making unavailable) property insurance on terms we find acceptable, increasing the cost of energy and increasing the cost of snow removal or related costs at our Properties. Proposed legislation to address climate change could increase utility and other costs of operating our Properties which, if not offset by rising rental income, would reduce our net income. There can be no assurance that climate change will not have a material adverse effect on our Properties, operations or business.

Risks Relating to Debt and the Financial Markets

Debt Payments Could Adversely Affect Our Financial Condition.

Our business is subject to risks normally associated with debt financing. The total principal amount of our outstanding indebtedness was approximately $2.1 billion as of December 31, 2015, of which approximately $138.2 million, or 6.4%, matures in 2016 and 2017. Our substantial indebtedness and the cash flow associated with serving our indebtedness could have important consequences, including the risks that:

• | our cash flow could be insufficient to pay distributions at expected levels and meet required payments of principal and interest; |

• | we might be required to use a substantial portion of our cash flow from operations to pay our indebtedness, thereby reducing the availability of our cash flow to fund the implementation of our business strategy, acquisitions, capital expenditures and other general corporate purposes; |

• | our debt service obligations could limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

• | we may not be able to refinance existing indebtedness (which requires substantial principal payments at maturity) and, if we can, the terms of such refinancing might not be as favorable as the terms of existing indebtedness; |

• | if principal payments due at maturity cannot be refinanced, extended or paid with proceeds of other capital transactions, such as new equity capital, our cash flow will not be sufficient in all years to repay all maturing debt; and |

• | if prevailing interest rates or other factors at the time of refinancing (such as the possible reluctance of lenders to make commercial real estate loans) result in higher interest rates, increased interest expense would adversely affect net income, cash flow and our ability to service debt and make distributions to stockholders; and |

• | to the extent that any Property is cross-collateralized with any other Properties, any default under the mortgage note relating to one Property will result in a default under the financing arrangements relating to other Properties that also provide security for that mortgage note or are cross-collateralized with such mortgage note. |

Ability To Obtain Mortgage Financing Or To Refinance Maturing Mortgages May Adversely Affect Our Financial Condition.

Lenders' demands on borrowers as to the quality of the collateral and related cash flows may make it challenging to secure financing on attractive terms or at all. If terms are no longer attractive or if financing proceeds are no longer available for any reason, these factors may adversely affect cash flow and our ability to service debt and make distributions to stockholders.

11

Financial Covenants Could Adversely Affect Our Financial Condition.

If a Property is mortgaged to secure payment of indebtedness, and we are unable to meet mortgage payments, the mortgagee could foreclose on the Property, resulting in loss of income and asset value. The mortgages on our Properties contain customary negative covenants, which among other things limit our ability, without the prior consent of the lender, to further mortgage the Property and to discontinue insurance coverage. In addition, our unsecured credit facilities contain certain customary restrictions, requirements and other limitations on our ability to incur indebtedness, including total debt-to-assets ratios, debt service coverage ratios and minimum ratios of unencumbered assets to unsecured debt. Foreclosure on mortgaged Properties or an inability to refinance existing indebtedness would likely have a negative impact on our financial condition and results of operations.

Our Degree of Leverage Could Limit Our Ability to Obtain Additional Financing.

Our debt-to-market-capitalization ratio (total debt as a percentage of total debt plus the market value of the outstanding common stock and OP Units held by parties other than us) was approximately 26% as of December 31, 2015. The degree of leverage could have important consequences to stockholders, including an adverse effect on our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, development or other general corporate purposes, and makes us more vulnerable to a downturn in business or the economy generally.

We May Be Able To Incur Substantially More Debt, Which Would Increase The Risks Associated With Our Substantial Leverage.

Despite our current indebtedness levels, we may still be able to incur substantially more debt in the future. If new debt is added to our current debt levels, an even greater portion of our cash flow will be needed to satisfy our debt service obligations. As a result, the related risks that we now face could intensify and increase the risk of a default on our indebtedness.

Risks Related to Our Company Ownership

Provisions of Our Charter and Bylaws Could Inhibit Changes of Control.

Certain provisions of our charter and bylaws may delay or prevent a change of control or other transactions that could provide our stockholders with a premium over the then-prevailing market price of their common stock or Series C Preferred Stock or which might otherwise be in the best interest of our stockholders. These include the Ownership Limit described below. Also, any future series of preferred stock may have certain voting provisions that could delay or prevent a change of control or other transaction that might involve a premium price or otherwise be beneficial to our stockholders.

Maryland Law Imposes Certain Limitations on Changes of Control.

Certain provisions of Maryland law prohibit "business combinations" (including certain issuances of equity securities) with any person who beneficially owns 10% or more of the voting power of our outstanding common stock, or with an affiliate of ours, who, at any time within the two-year period prior to the date in question, was the owner of 10% or more of the voting power of our outstanding voting stock (an "Interested Stockholder"), or with an affiliate of an Interested Stockholder. These prohibitions last for five years after the most recent date on which the Interested Stockholder became an Interested Stockholder. After the five-year period, a business combination with an Interested Stockholder must be approved by two super-majority stockholder votes unless, among other conditions, our common stockholders receive a minimum price for their shares and the consideration is received in cash or in the same form as previously paid by the Interested Stockholder for shares of our common stock. The Board of Directors has exempted from these provisions under the Maryland law any business combination with Samuel Zell, who is our Chairman of the Board, certain holders of OP Units who received them at the time of our initial public offering, and our officers who acquired common stock at the time we were formed and each and every affiliate of theirs.

Conflicts of Interest Could Influence Our Decisions.

Certain stockholders could exercise influence in a manner inconsistent with stockholders' best interests. As of December 31, 2015, Mr. Samuel Zell and certain affiliated holders beneficially owned approximately 9.0% of our outstanding common stock (in each case including common stock issuable upon the exercise of stock options and the exchange of OP Units). Mr. Zell is the chairman of our Board of Directors. Accordingly, Mr. Zell has significant influence on our management and operation. Such influence could be exercised in a manner that is inconsistent with the interests of other stockholders.

In addition, Mr. Zell and his affiliates continue to be involved in other investment activities. Mr. Zell and his affiliates have a broad and varied range of investment interests, including interests in other real estate investment companies owning manufactured home communities and involving other forms of housing, including multifamily housing. Mr. Zell and his affiliates may acquire interests in other companies. Mr. Zell may not be able to control whether any such company competes with us. Consequently, Mr. Zell's

12

continued involvement in other investment activities could result in competition to us as well as management decisions that might not reflect the interests of our stockholders.

Risks Relating to Our Common and Preferred Stock

We Depend on Our Subsidiares' Dividends and Distributions.

Substantially all of our assets are owned indirectly by the Operating Partnership. As a result, we have no source of cash flow other than distributions from our Operating Partnership. For us to pay dividends to holders of our common stock and preferred stock, the Operating Partnership must first distribute cash to us. Before it can distribute the cash, our Operating Partnership must first satisfy its obligations to its creditors.

Market Interest Rates May Have an Effect on the Value of Our Common Stock.

One of the factors that investors consider important in deciding whether to buy or sell shares of a REIT is the distribution rates with respect to such shares (as a percentage of the price of such shares) relative to market interest rates. If market interest rates go up, prospective purchasers of REIT shares may expect a higher distribution rate. Higher interest rates would not, however, result in more of our funds to distribute and, in fact, would likely increase our borrowing costs and potentially decrease funds available for distribution. Thus, higher market interest rates could cause the market price of our publicly traded securities to go down.

Any Weaknesses Identified in Our Internal Control Over Financial Reporting Could Have an Adverse Effect on Our Stock Price.

Section 404 of the Sarbanes-Oxley Act 2002 requires us to evaluate and report on our internal control over financial reporting. If we identify one or more material weaknesses in our internal control over financial reporting, we could lose investor confidence in the accuracy and completeness of our financial reports. which in turn could have an adverse effect on our stock price.

Our Depositary Shares, Which Represent Our 6.75% Series C Cumulative Redeemable Perpetual Preferred Stock, Have Not Been Rated and are Subordinated to Our Debt.

We have not obtained and do not intend to obtain a rating for our depositary shares (the "Depositary Shares") which represent our 6.75% Series C Cumulative Redeemable Perpetual Preferred Stock (the "Series C Preferred Stock"). No assurance can be given, however, that one or more rating agencies might not independently determine to issue such a rating or that such a rating, if issued, would not adversely affect the market price of the Depositary Shares. In addition, the Depositary Shares are subordinate to all of our existing and future debt. As described above, our existing debt may restrict, and our future debt may include restrictions on, our ability to pay distributions to preferred stockholders or to make an optional redemption payment to preferred stockholders. The issuance of additional shares of preferred stock on parity with or senior to our Series C Preferred Stock represented by the Depositary Shares would dilute the interests of the holders of our Depositary Shares, and any issuance of preferred stock senior to our Series C Preferred Stock (and, therefore, the Depositary Shares) or of additional indebtedness could affect our ability to pay distributions on, redeem or pay the liquidation preference on our Depositary Shares. Other than the conversion rights afforded to holders of our preferred shares that may occur in connection with a change of control triggering event, none of the provisions relating to our preferred shares contain any provision affording the holders of our preferred shares protection in the event of a highly leveraged or other transaction, including a merger or the sale, lease or conveyance of all or substantially all our assets or business, that might materially and adversely affect the holders of our preferred shares, so long as the rights of the holders of our preferred shares are not materially and adversely affected.

Risks Relating to REITs and Income Taxes

We are Dependent on External Sources of Capital.

To qualify as a REIT, we must distribute to our stockholders each year at least 90% of our REIT taxable income (determined without regard to the deduction for dividends paid and excluding any net capital gain). In addition, we intend to distribute all or substantially all of our net income so that we will generally not be subject to U.S. federal income tax on our earnings. Because of these distribution requirements, it is not likely that we will be able to fund all future capital needs, including acquisitions, from income from operations. We therefore will have to rely on third-party sources of debt and equity capital financing, which may or may not be available on favorable terms or at all. Our access to third-party sources of capital depends on a number of things, including conditions in the capital markets generally and the market's perception of our growth potential and our current and potential future earnings. It may be difficult for us to meet one or more of the requirements for qualification as a REIT, including but not limited to our distribution requirement. Moreover, additional equity offerings may result in substantial dilution of stockholders' interests, and additional debt financing may substantially increase our leverage.

13

We Have a Stock Ownership Limit for REIT Tax Purposes.

To remain qualified as a REIT for U.S. federal income tax purposes, not more than 50% in value of our outstanding shares of capital stock may be owned, directly or indirectly, by five or fewer individuals (as defined in the federal income tax laws applicable to REITs) at any time during the last half of any taxable year. To facilitate maintenance of our REIT qualification, our charter, subject to certain exceptions, prohibits Beneficial Ownership (as defined in our charter) by any single stockholder of more than 5% (in value or number of shares, whichever is more restrictive) of our outstanding capital stock. We refer to this as the "Ownership Limit." Within certain limits, our charter permits the Board of Directors to increase the Ownership Limit with respect to any class or series of stock. The Board of Directors, upon receipt of a ruling from the IRS, opinion of counsel, or other evidence satisfactory to the Board of Directors and upon 15 days prior written notice of a proposed transfer which, if consummated, would result in the transferee owning shares in excess of the Ownership Limit, and upon such other conditions as the Board of Directors may direct, may exempt a stockholder from the Ownership Limit. Absent any such exemption, capital stock acquired or held in violation of the Ownership Limit will be transferred by operation of law to us as trustee for the benefit of the person to whom such capital stock is ultimately transferred, and the stockholder's rights to distributions and to vote would terminate. Such stockholder would be entitled to receive, from the proceeds of any subsequent sale of the capital stock we transferred as trustee, the lesser of (i) the price paid for the capital stock or, if the owner did not pay for the capital stock (for example, in the case of a gift, devise or other such transaction), the market price of the capital stock on the date of the event causing the capital stock to be transferred to us as trustee or (ii) the amount realized from such sale. A transfer of capital stock may be void if it causes a person to violate the Ownership Limit. The Ownership Limit could delay or prevent a change in control of us and, therefore, could adversely affect our stockholders' ability to realize a premium over the then-prevailing market price for their common stock or adversely affect the best interest of our stockholders.

Our Qualification as a REIT is Dependent on Compliance with U.S. Federal Income Tax Requirements.

We believe we have been organized and operated in a manner so as to qualify for taxation as a REIT, and we intend to continue to operate so as to qualify as a REIT for U.S. federal income tax purposes. Our current and continuing qualification as a REIT depends on our ability to meet the various requirements imposed by the Code, which relate to organizational structure, distribution levels, diversity of stock ownership and certain restrictions with regard to owned assets and categories of income. If we qualify for taxation as a REIT, we are generally not subject to U.S. federal income tax on our taxable income that is distributed to our stockholders. However, qualification as a REIT for U.S. federal income tax purposes is governed by highly technical and complex provisions of the Code for which there are only limited judicial or administrative interpretations. In connection with certain transactions, we have received, and relied upon, advice of counsel as to the impact of such transactions on our qualification as a REIT. Our qualification as a REIT requires analysis of various facts and circumstances that may not be entirely within our control, and we cannot provide any assurance that the Internal Revenue Service (the "IRS") will agree with our analysis or the analysis of our tax counsel. In particular, the proper U.S. federal income tax treatment of right-to-use membership contracts and rental income from certain short-term stays at RV communities is uncertain and there is no assurance that the IRS will agree with our treatment of such contracts or rental income. If the IRS were to disagree with our analysis or our tax counsel's analysis of various facts and circumstances, our ability to qualify as a REIT could be adversely affected.

In addition, legislation, new regulations, administrative interpretations or court decisions might significantly change the tax laws with respect to the requirements for qualification as a REIT or the U.S. federal income tax consequences of qualification as a REIT. For example, the Protecting Americans from Tax Hikes Act (PATH Act) was enacted in December 2015, and included numerous law changes applicable to REITs The provisions have various effective dates beginning as early as 2016. Investors are urged to consult their tax advisors with respect to these changes and the potential impact on their investment in our stock.

If, with respect to any taxable year, we failed to maintain our qualification as a REIT (and if specified relief provisions under the Code were not applicable to such disqualification), we would be disqualified from treatment as a REIT for the four taxable years following the year during which qualification was lost. If we lost our REIT status, we could not deduct distributions to stockholders in computing our net taxable income at regular corporate rates and we would be subject to U.S. federal income tax (including any applicable alternative minimum tax) on our net taxable incomes. If we had to pay U.S. federal income tax, the amount of money available to distribute to stockholders and pay indebtedness would be reduced for the year or years involved, and we would no longer be required to distribute money to stockholders. Although we currently intend to operate in a manner designed to allow us to qualify as a REIT, future economic, market, legal, tax or other considerations may cause us to revoke the REIT election.

Furthermore, we own a direct interest in certain subsidiary REITs which elected to be taxed as REITs under Sections 856 through 860 of the Code. Provided that each subsidiary REIT qualifies as a REIT, our interest in such subsidiary REIT will be treated as a qualifying real estate asset for purposes of the REIT asset tests, and any dividend income or gains derived by us from such subsidiary REIT will generally be treated as income that qualifies for purposes of the REIT gross income tests. To qualify as a REIT, the subsidiary REIT must independently satisfy all of the REIT qualification requirements. If such subsidiary REIT were to fail to qualify as a REIT, and certain relief provisions did not apply, it would be treated as a regular taxable corporation and its

14

income would be subject to U.S. federal income tax. In addition, a failure of the subsidiary REIT to qualify as a REIT could have an adverse effect on our ability to comply with the REIT income and asset tests, and thus our ability to qualify as a REIT.

We May Pay Some Taxes, Reducing Cash Available for Stockholders.

Even if we qualify as a REIT for U.S. federal income tax purposes, we may be subject to some U.S. federal, foreign, state and local taxes on our income and property. Since January 1, 2001, certain of our corporate subsidiaries have elected to be treated as "taxable REIT subsidiaries" for U.S. federal income tax purposes, and are taxable as regular corporations and subject to certain limitations on intercompany transactions. If tax authorities determine that amounts paid by our taxable REIT subsidiaries to us are greater than what would be paid under similar arrangements among unrelated parties, we could be subject to a 100% penalty tax on the excess payments, and ongoing intercompany arrangements could have to change, resulting in higher ongoing tax payments. To the extent we are required to pay U.S. federal, foreign, state or local taxes or U.S. federal penalty taxes due to existing laws or changes to them, we will have less cash available for distribution to our stockholders.

Other Risk Factors Affecting Our Business

Some Potential Losses Are Not Covered by Insurance.