United States

Securities and Exchange Commission

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

| ☑ Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §.240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | |

| ☑ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| GUIDE TO CHESAPEAKE’S PROXY |

| ONLINE

2024 PROXY STATEMENT investors.chk.com/annual-meeting-and- proxy ONLINE 2023 ANNUAL REPORT chk.com/investors/company-reports/ annual-reports First sent or made available on April 26, 2024 |

| In this Proxy Statement, we refer to Chesapeake Energy as the “Company,” “we,” “our,” “us,” “Chesapeake Energy” and “Chesapeake.” | |

| Chesapeake comes into the merger from a position of strength. Our strategic actions over the last three years have built a more resilient company focused on shareholder value. • Acquisitions of Vine and Chief: Consolidated key offset positions in Haynesville and Marcellus allowing cost reductions and efficient develop-ment of additional resources • Divestitures of Powder River Basin and Eagle Ford: Exited assets with limited actionable inventory economic in today’s market conditions; proceeds provided significant balance sheet strength and return to shareholders • Pausing Turn-in-Line (TIL) of New Wells (2024): Leveraged financial strength to reduce natural gas sales volumes in oversupplied market; retaining capacity to sell when demand recovers Targeting our two core assets in 2023, we delivered tangible results with bottom line impact — demonstrating the operational excellence which has come to define Chesapeake. Most importantly, we accomplished these operational milestones while improving our combined TRIR by 40%, to an industry-leading 0.14. We also continued to reduce our GHG emissions with a focus on methane, decreasing our methane emissions intensity by more than 80% com-pared to our 2020 baseline.(a) Our year-end 2023 methane emissions intensity was 0.015%, substantially below the industry standard of 0.20% (as defined by the Oil and Gas Climate Initiative). We will bring this same commitment, strategy and decision-making to the new company, post-merger. We have the portfolio, balance sheet and demonstrated operational track record to continue driving capital efficiencies, maximizing returns and reducing risk. Together, we will accelerate America’s energy reach and fuel a more affordable, reliable and lower carbon future. We are motivated by this opportunity for you, our shareholders, and the consumers and communities who benefit from the quality of life provided by natural gas. Thank you for your investment and partnership. In 2024, the oil and natural gas industry continues to face challenges. Today’s market remains oversupplied, with production peaking in late 2023 following significant capital expenditures in response to the pandemic’s low investment cycle and Russia’s invasion of Ukraine. In addition, this past winter’s milder temperatures brought low heating demand, leaving natural gas storage levels 40% above their five-year averages. Chesapeake was built for this moment. While market dynamics are resulting in cyclical lows for natural gas prices, demand is expected to rise materially over the next several years. In the U.S., growing markets of data centers and AI tools are requiring more elec-tricity, and power generators are increasingly looking to natural gas to supply the base load. Globally, the U.S. is preparing to connect its natural gas production to underserved markets by building liquefied natural gas (LNG) terminals, of which nearly 12 bcf/d is currently under construction. Our pending merger with Southwestern Energy will create a substantial opportunity to respond to evolving market dynamics and help connect crucial natural gas resources to consumers in need. We will have an unparalleled U.S. natural gas portfolio — an investment grade-quality company with expansive access to premium markets and the ability to seamlessly move capital and best operating practices across basins. Simply put, our combined company will deliver more gas to more markets more efficiently. As we look to the future, together we will materially advance the strategic pillars defined by Chesapeake. Dear Fellow Shareholders, Domenic J. “Nick” Dell’Osso, Jr. President, Chief Executive Officer and Director Michael A. Wichterich Chairman of the Board Strategic Pillars Superior Capital Returns Deep, Attractive Inventory Premier Balance Sheet Sustainability Leadership Combined Performance ~$1.0B – $1.5B of per annum dividends at current strip >5,000 pro forma gross locations across Appalachia and Haynesville Accelerates path to Investment Grade rating and lowers cost of capital 100% RSG certified across all basins and production MARCELLUS • Drilled 9 of the 10 longest laterals in our history in the basin • Improved well costs by 17% (1Q to 4Q) and increased our footage drilled per day by 40% HAYNESVILLE • Outpaced our peers (drilling performance) in the most difficult drilling environment in the Lower 48 • Benefited from improved gathering system hydraulics (a) Our baseline includes those assets we owned at YE 2020: Eagle Ford, legacy Haynesville, legacy Marcellus and Powder River Basin. Methane emissions intensity calculated as volume methane emissions / volume gross operated natural gas produced. |

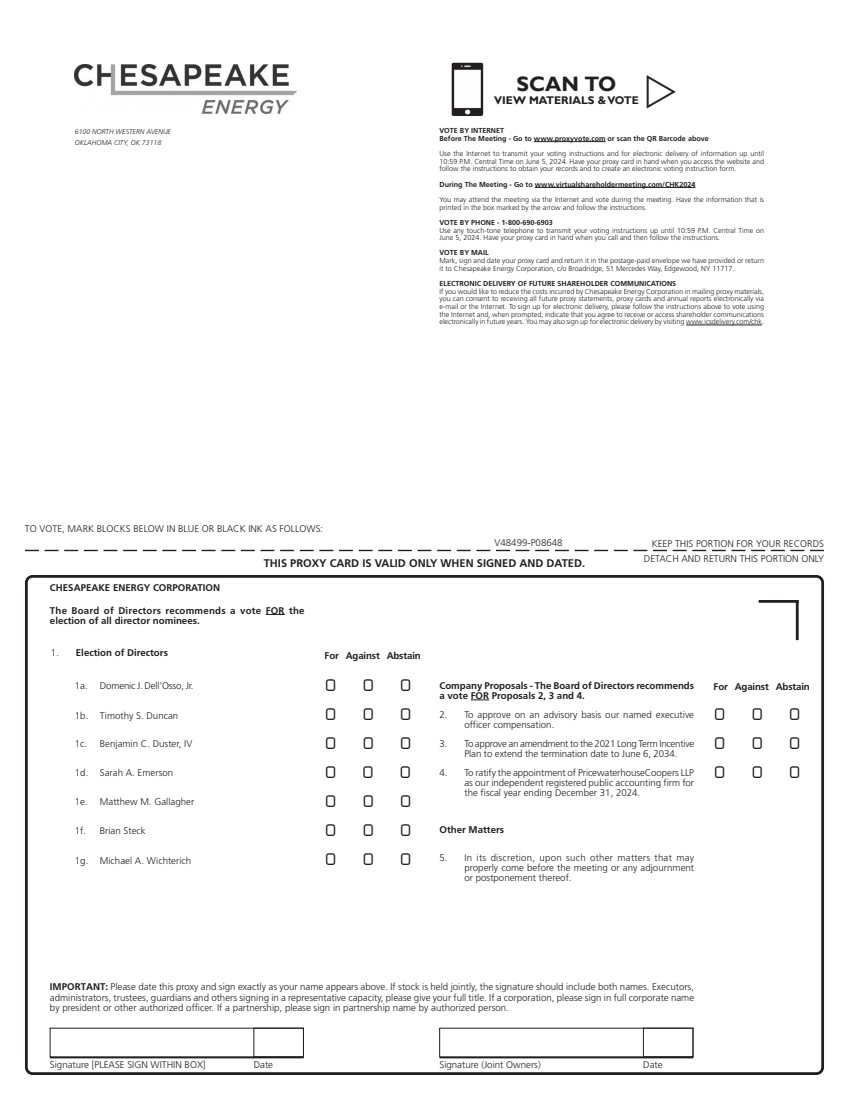

| VOTING Q&A Who can vote? Shareholders of record as of the close of business on the record date, April 8, 2024 How many shares are entitled to vote? 131,048,149 shares of common stock How many votes do I get? One vote for each director and one vote on each proposal for each share you hold as of April 8, 2024 How can I vote? You can submit your vote in any of the following ways: INTERNET VIA COMPUTER: Via the Internet at proxyvote.com. You will need the 16-digit number included in your notice, proxy card or voter instruction form. INTERNET VIA TABLET OR SMARTPHONE: By scanning the QR code. You will need the 16-digit number included in your notice, proxy card or voter instruction form. TELEPHONE: Call toll-free 800-690-6903 or the phone number on your voter instruction form. You will need the 16-digit number included in your notice, proxy card or voter instruction form. MAIL: If you received a paper copy of your proxy materials, send your completed and signed proxy card or voter instruction form using the enclosed postage-paid envelope. VIRTUALLY DURING MEETING: To vote your shares during the Annual Meeting, click on the vote button provided on the screen and follow the instructions provided. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the log-in page. 2 // CHESAPEAKE ENERGY CORPORATION AGENDA PROPOSAL 1: Elect seven director nominees named in the proxy for the coming year (read more on page 12). Your Board recommends a vote FOR the election of each director nominee. Vote required: majority of votes cast (pursuant to majority-vote policy). PROPOSAL 2: Approve named executive officer compensation in advisory vote (read more on page 31). Your Board recommends a vote FOR Proposal 2. Vote required: plurality of votes cast. PROPOSAL 3: Approve amendment to the 2021 Long Term Incentive Plan to extend its termination date from February 9, 2025 to June 6, 2034 (read more on page 62). Your Board recommends a vote FOR Proposal 3. Vote required: plurality of votes cast. PROPOSAL 4: Ratify the appointment of PricewaterhouseCoopers LLP (PwC) as independent auditor for 2024 (read more on page 70). Your Board recommends a vote FOR Proposal 4. Vote required: plurality of votes cast. Other Business: Shareholders will also transact any other business that properly comes before the meeting. Abstentions and Broker Non-Votes: For Proposal 4, abstentions will not be counted as a vote for or against and no broker non-votes are expected. For all other proposals, abstentions and broker non-votes will not be counted as a vote for or against. Roadmap of Voting Items: See “Roadmap of Voting Items” for more detailed information regarding each proposal. NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS You are invited to attend Chesapeake Energy Corporation’s 2024 Annual Meeting of Shareholders. This page contains important information about the meeting, including how you can make sure your views are represented by voting today. Sincerely, Benjamin E. Russ Executive Vice President – General Counsel and Corporate Secretary Date and Time: Thursday, June 6, 2024 10:00 a.m. Central Time Attending the Virtual Meeting: The Annual Meeting will be completely virtual. You may attend the meeting, submit questions and vote your shares electronically during the meeting via live webcast by visiting VirtualShareholderMeeting.com/ CHK2024. You will need the 16-digit control number that is printed in the box marked by the arrow on your proxy card to enter the Annual Meeting. We recom-mend that you log in at least 15 minutes before the meeting to ensure you are logged in when the meeting starts. Virtual Meeting Webcast: VirtualShareholderMeeting.com/CHK2024 |

| ROADMAP OF VOTING ITEMS PROPOSAL 1 Election of Directors (page 12) We are asking shareholders to vote on each director nominee to the Board of Directors (Board) named in the Proxy Statement. The Board and Nominating and Corporate Governance Committee believe that the director nominees have the qualifications, experience and skills necessary to represent shareholder inter-ests through service on the Board. FOR EACH NOMINEE PROPOSAL 2 Advisory Vote to Approve Named Executive Officer Compensation (Say on Pay) (page 31) We have designed our executive compensation program to attract and retain high-performing executives and align executive pay with Company performance and the long-term interests of its shareholders. We are seeking a non-binding advisory vote from our shareholders to approve the compensation of our named executive officers (NEOs) as described in this Proxy Statement. The Board values shareholders’ opinions, and the Compensation Committee will take into account the outcome of the advisory vote when considering future executive compensation decisions. FOR PROPOSAL 3 Approval of an Amendment to the 2021 Long Term Incentive Plan to Extend its termination date to June 6, 2034 (page 62) We are seeking approval of an amendment to our 2021 Long Term Incentive Plan (2021 LTIP) that will extend the termination date from February 9, 2025 to June 6, 2034, the tenth anniversary of the 2024 Annual Meeting of Shareholders. We are not seeking to increase the number of shares issuable under the 2021 LTIP or to make any other amendments to the 2021 LTIP. We believe that the 2021 LTIP allows us to: (i) attract, reward and retain highly qualified industry professionals; (ii) reinforce a pay for performance culture by providing equity incentives and rewards to employees and non-employee directors who are in a position to contribute materially to our success and long-term objectives; and (iii) align the interests of employees and non-employee directors with those of our shareholders. FOR PROPOSAL 4 Ratification of Appointment of Independent Registered Public Accounting Firm (page 70) The Audit Committee has appointed PwC to serve as the Company’s independent registered public ac-counting firm for the fiscal year ending December 31, 2024. The Audit Committee and the Board believe that the continued retention of PwC to serve as the independent auditor is in the best interests of the Company and its shareholders. As a matter of good corporate governance, shareholders are being asked to ratify the Audit Committee’s appointment of PwC. FOR ROADMAP OF VOTING ITEMS // 3 VOTING ITEM BOARD RECOMMENDATION |

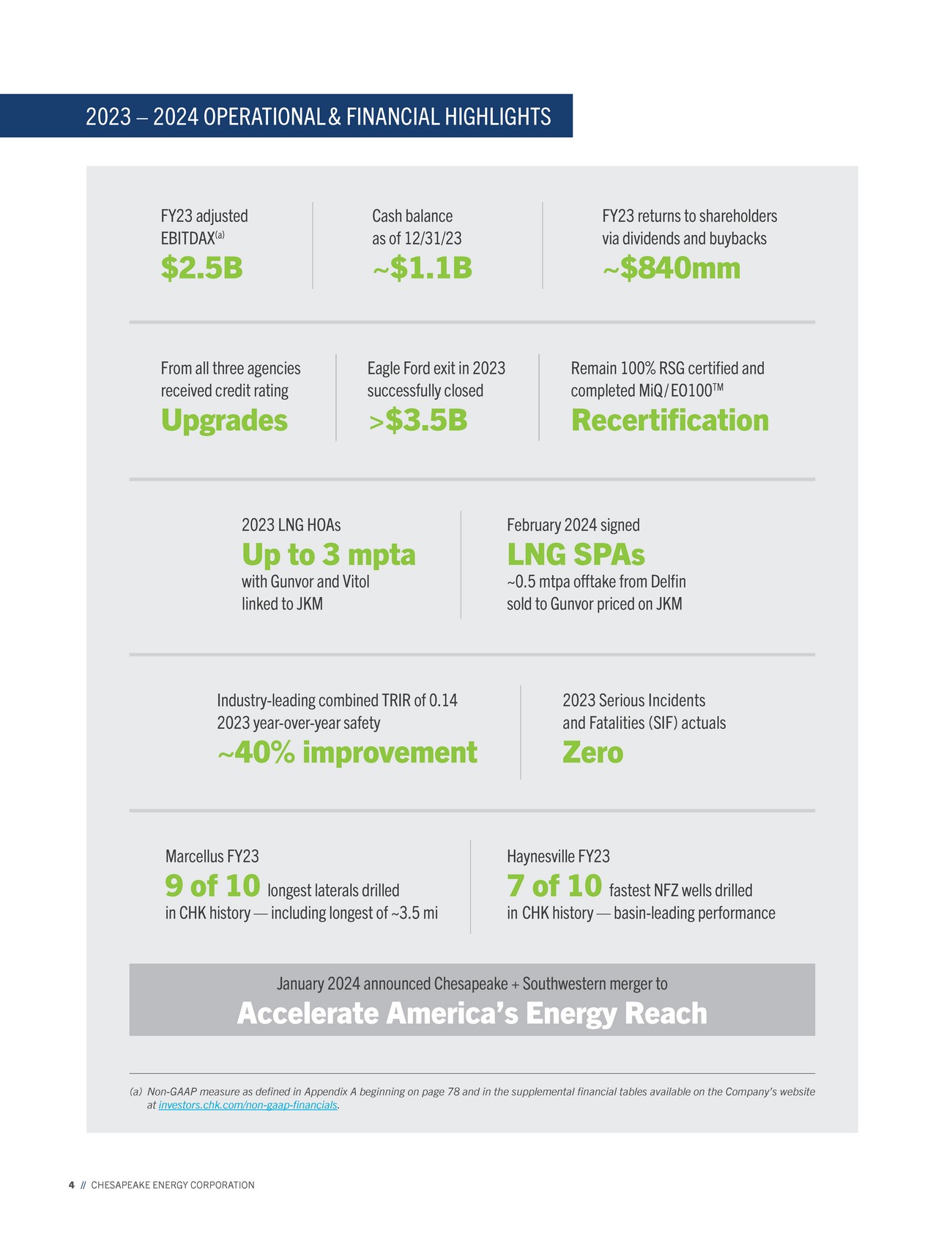

| 4 // CHESAPEAKE ENERGY CORPORATION 2023 – 2024 OPERATIONAL & FINANCIAL HIGHLIGHTS January 2024 announced Chesapeake + Southwestern merger to Accelerate America’s Energy Reach Marcellus FY23 9 of 10 longest laterals drilled in CHK history — including longest of ~3.5 mi Haynesville FY23 7 of 10 fastest NFZ wells drilled in CHK history — basin-leading performance 2023 LNG HOAs Up to 3 mpta with Gunvor and Vitol linked to JKM February 2024 signed LNG SPAs ~0.5 mtpa offtake from Delfin sold to Gunvor priced on JKM From all three agencies received credit rating Upgrades Eagle Ford exit in 2023 successfully closed >$3.5B Remain 100% RSG certified and completed MiQ / EO100TM Recertification (a) Non-GAAP measure as defined in Appendix A beginning on page 78 and in the supplemental financial tables available on the Company’s website at investors.chk.com/non-gaap-financials. 2023 Serious Incidents and Fatalities (SIF) actuals Zero Industry-leading combined TRIR of 0.14 2023 year-over-year safety ~40% improvement FY23 adjusted EBITDAX(a) $2.5B Cash balance as of 12/31/23 ~$1.1B FY23 returns to shareholders via dividends and buybacks ~$840mm |

| Recertified portfolio-wide RSG and leading safety in combined TRIR Sustainability Leadership Consistent and measurable progress on our path to net zero ~$1.1B of cash(b) and hedge-the-wedge preserves financial strength Premier Balance Sheet Investment grade-quality balance sheet provides strategic through-cycle advantages ~15 years of inventory in each basin Deep, Attractive Inventory Premium rock, returns, runway with best-in-class execution 2023: 8.3% shareholder return yield vs. 3.9% peer average(a) Superior Capital Returns Most efficient operator, returning more cash to shareholders than domestic gas peers HIGHLIGHTS // 5 Delivering Our Strategic Pillars (a) Data from Factset actuals and estimates as of February 16, 2024; peers include AR, CNX, CRK, CTRA, EQT, RRC and SWN. Shareholder return equals base dividend, variable dividend and buybacks. Yield uses market cap as of year-end 2023. (b) As of December 31, 2023. (c) FOB – Free on board; DES – Delivered ex-ship; FID – Final investment decision. We Are LNG Ready Natural Gas Producer LNG Facility LNG FOB(c) Buyer LNG DES(c) Buyer LNG ReGas Natural Gas User LNG Value Chain CHESAPEAKE COUNTERPARTY Illustrative LNG Netback $/mmbtu $11 JKM Futures Deduct (Tolling, Shipping, Fuel, etc.) Realized Netback ($5 – $7) $4 – $6 Chesapeake’s Recent Progress • ~0.5 mtpa LNG Sale and Purchase Agreement (SPA) with offtake from Delfin at a Henry Hub linked price and subsequent sale to Gunvor at a Japan Korea Marker (JKM) linked price • Gunvor offtake head of agreement (HOA) for up to an additional 1.5 mtpa with JKM linked price exposure • Vitol offtake HOA for up to 1 mtpa with JKM linked price exposure • Equity partner and anchor shipper on Momentum’s NG3 (Haynesville to Gulf Coast pipeline) Nearly 12 bcf/d of financed/FID(c) LNG export demand by ~2028 |

| 6 // CHESAPEAKE ENERGY CORPORATION 2 Investing in material emissions reduction with revenue-generating potential 3 Maintaining positive return propositions 4 Driving lower end-use customer costs 1 Targeting & replacing high-emission energy sources Our employees are committed to answering the call for the affordable, reliable lower carbon energy the world desperately needs. Our duty to being stewards of the communities in which we operate and live is not one we take lightly and is central to our culture and values. We are constantly innovating across all aspects of our business, firmly embracing a lower carbon future and playing our part in helping meet the ambitions of the Paris Agreement as we strive to achieve net zero GHG emissions by 2035. As we invest capital in sustain-ability-linked projects, we do so with the goal of: 2023 – 2024 SUSTAINABILITY HIGHLIGHTS Progress includes: • Recertifying all assets under the MiQ/EO100™ standards, maintaining 100% independent responsibly sourced gas (RSG) certification across our entire portfolio. • Continuing to advance our commitment to transparency and enhanced disclosures by joining the Oil & Gas Methane Partnership (OGMP) 2.0. OGMP 2.0 is the flagship oil and gas reporting and mitigation pro-gram of the United Nations Environment Programme, and the only comprehensive, measurement-based international reporting framework for the sector. • Improving our combined TRIR by approximately 40%, to an industry leading 0.14. • Expanding our ESG disclosures and demonstrating transparency and open communication, as evidenced by IR Magazine award as the “Best ESG Reporting Small to Mid-Cap Company.” |

| HIGHLIGHTS // 7 Environmental • >60% reduction in GHG intensity since 2020(a) • >80% reduction in methane emissions intensity since 2020(a) • Emissions detection methods include fixed methane sensors (>2,000 deployed), aerial flyovers and FLIR inspections across portfolio • Joined OGMP 2.0 to improve the transparency and accuracy of our methane emissions reporting • Member of the Appalachian Methane Initiative and a related methane monitoring program in the Haynesville operating area Social Responsibility • Dedicated community engagement at our in-person meetings in our field operations, including lunch and learns in every parish where we operate in Haynesville • Commitment to diversity, equity and inclusion (DEI), including active Diversity Council, dedicated DEI professional and mandatory employee training programs • LNG ready through executed agreements with Delfin LNG, Gunvor and Vitol • Human rights policy defines standards we have set for our operations and supply chain management, upholding the UN’s Guiding Principles on Business and Human Rights • Commitment to supporting the communities we serve through philanthropy and volunteerism Governance and Transparency • Transparent sustainability-related disclosures including reporting ESG metrics across multiple industry and other volun-tary frameworks and progress toward climate-related targets • Executive and employee compensation program cap Annual Incentive Plan payout at target for all performance metrics if we fail to achieve threshold levels of environmental and safety performance • Executive compensation program aligned with shareholder returns and environmental and safety performance • Code of Business Conduct which defines the responsibilities all employees bear toward supporting our core values • Annual Sustainability Report, which is available on our website and includes, among other items, a detailed update on progress in sustainability leadership • Implementation of a “Safe and Compliant Operations” Policy ESG Initiatives Sustainability Fundamentals (a) Time frame: 2020 – 2023; inclusive of acquisitions and divestitures made during this time period; our baseline includes those assets we owned at year-end 2020: Eagle Ford, legacy Haynesville, legacy Marcellus and Powder River Basin, consistent with U.S. EPA reporting protocols. Deliver energy to sustain economic progress and welfare Minimize emissions from operations Invest in low-carbon solutions with adjacent technologies Transparent disclosures with measurable progress |

| 8 // CHESAPEAKE ENERGY CORPORATION When is the Annual Meeting? The Annual Meeting will be held on June 6, 2024, at 10:00 a.m., Central Time. Where is the Annual Meeting? The Annual Meeting will be completely virtual. Shareholders can attend the virtual Annual Meeting by visiting VirtualShareholder Meeting.com/CHK2024. Who is entitled to vote? You may vote at the Annual Meeting, and any adjournment or postponement thereof, if you were a holder of record of Ches-apeake common stock as of the close of business on April 8, 2024, the record date for the Annual Meeting. Each share of Chesapeake common stock is entitled to one vote at the Annual Meeting. On the record date, there were 131,048,149 shares of common stock issued and outstanding and entitled to vote at the Annual Meeting. There are no cumulative voting rights asso-ciated with Chesapeake common stock. How many votes must be present to hold the Annual Meeting? A majority of the shares of the common stock entitled to vote must be present online or by proxy at the Annual Meeting to constitute a quorum and to transact business. Your shares will be counted as “present” at the Annual Meeting if you properly return a proxy by the Internet, telephone or mail, or if you join the virtual Annual Meeting. Abstentions and broker non-votes, if any, will be counted for purposes of establishing a quorum at the Annual Meeting. Who is soliciting my vote? Our Board is soliciting your proxy to vote your shares at the Annual Meeting. We have delivered these materials to you elec-tronically or by mail in connection with our solicitation of proxies for use at the Annual Meeting. What is included in the proxy materials for the Annual Meeting? The proxy materials for the Annual Meeting include: • The Notice of Annual Meeting of Shareholders • This Proxy Statement These proxy materials also include the proxy card or voting instruc-tion form for the Annual Meeting. These materials are expected to be first mailed to shareholders on or about April 26, 2024. What happens if other matters are properly presented at the Annual Meeting? We are not aware of any other proposals that will be submitted to shareholders at the Annual Meeting. However, if any matter not described in this Proxy Statement is properly presented for a vote at the meeting, the persons named on the proxy form will vote in accordance with their judgment. Discretionary authority to vote on other matters is included in the proxy. What happens if a director nominee is unable to serve? We do not know of any reason why any nominee would be unable to serve as a director. If any nominee is unable to serve, the Board can either nominate a different individual or reduce the Board’s size. If the Board nominates a different individual, the shares rep-resented by all valid proxies will be voted for that nominee. How do I vote? There are five ways to vote: INTERNET VIA COMPUTER: Via the Internet at proxy vote.com. You will need the 16-digit number included in your notice, proxy card or voter instruction form. INTERNET VIA TABLET OR SMARTPHONE: By scanning the QR code. You will need the 16-digit number included in your notice, proxy card or voter instruction form. TELEPHONE: Call toll-free 800-690-6903 or the tele-phone number on your voter instruction form. You will need the 16-digit number included in your notice, proxy card or voter instruction form. MAIL: If you received a paper copy of your proxy ma-terials, send your completed and signed proxy card or voter instruction form using the enclosed postage-paid envelope. VIRTUALLY DURING MEETING: To vote your shares during the Annual Meeting, click on the vote button pro-vided on the screen and follow the instructions provid-ed. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the log-in page. VOTING AND MEETING INFORMATION |

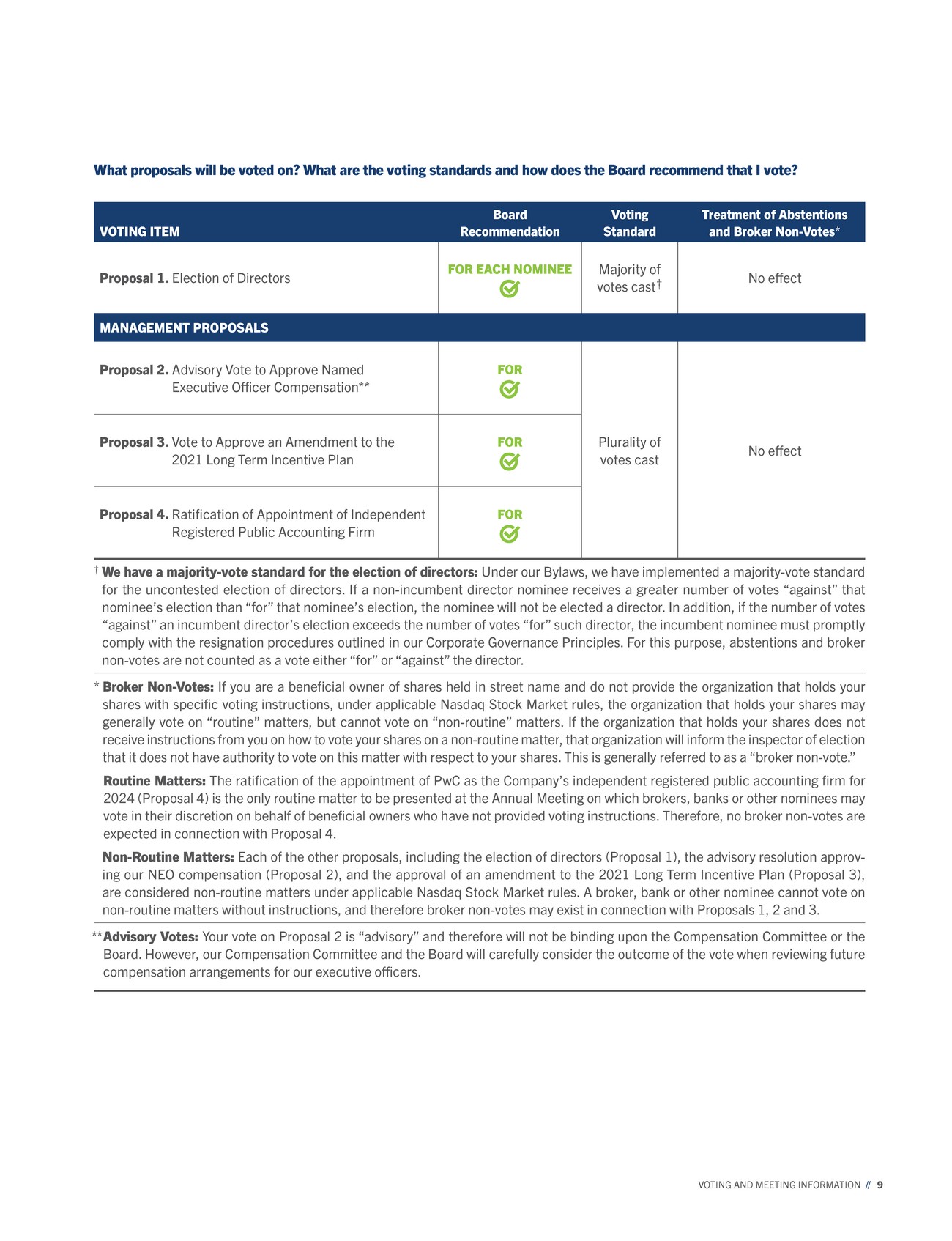

| VOTING AND MEETING INFORMATION // 9 What proposals will be voted on? What are the voting standards and how does the Board recommend that I vote? VOTING ITEM Board Recommendation Voting Standard Treatment of Abstentions and Broker Non-Votes* Proposal 1. Election of Directors FOR EACH NOMINEE Majority of votes cast† No effect MANAGEMENT PROPOSALS Proposal 2. Advisory Vote to Approve Named Executive Officer Compensation** FOR Plurality of votes cast No effect Proposal 3. Vote to Approve an Amendment to the 2021 Long Term Incentive Plan FOR Proposal 4. Ratification of Appointment of Independent Registered Public Accounting Firm FOR † We have a majority-vote standard for the election of directors: Under our Bylaws, we have implemented a majority-vote standard for the uncontested election of directors. If a non-incumbent director nominee receives a greater number of votes “against” that nominee’s election than “for” that nominee’s election, the nominee will not be elected a director. In addition, if the number of votes “against” an incumbent director’s election exceeds the number of votes “for” such director, the incumbent nominee must promptly comply with the resignation procedures outlined in our Corporate Governance Principles. For this purpose, abstentions and broker non-votes are not counted as a vote either “for” or “against” the director. * Broker Non-Votes: If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under applicable Nasdaq Stock Market rules, the organization that holds your shares may generally vote on “routine” matters, but cannot vote on “non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform the inspector of election that it does not have authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.” Routine Matters: The ratification of the appointment of PwC as the Company’s independent registered public accounting firm for 2024 (Proposal 4) is the only routine matter to be presented at the Annual Meeting on which brokers, banks or other nominees may vote in their discretion on behalf of beneficial owners who have not provided voting instructions. Therefore, no broker non-votes are expected in connection with Proposal 4. Non-Routine Matters: Each of the other proposals, including the election of directors (Proposal 1), the advisory resolution approv-ing our NEO compensation (Proposal 2), and the approval of an amendment to the 2021 Long Term Incentive Plan (Proposal 3), are considered non-routine matters under applicable Nasdaq Stock Market rules. A broker, bank or other nominee cannot vote on non-routine matters without instructions, and therefore broker non-votes may exist in connection with Proposals 1, 2 and 3. ** Advisory Votes: Your vote on Proposal 2 is “advisory” and therefore will not be binding upon the Compensation Committee or the Board. However, our Compensation Committee and the Board will carefully consider the outcome of the vote when reviewing future compensation arrangements for our executive officers. |

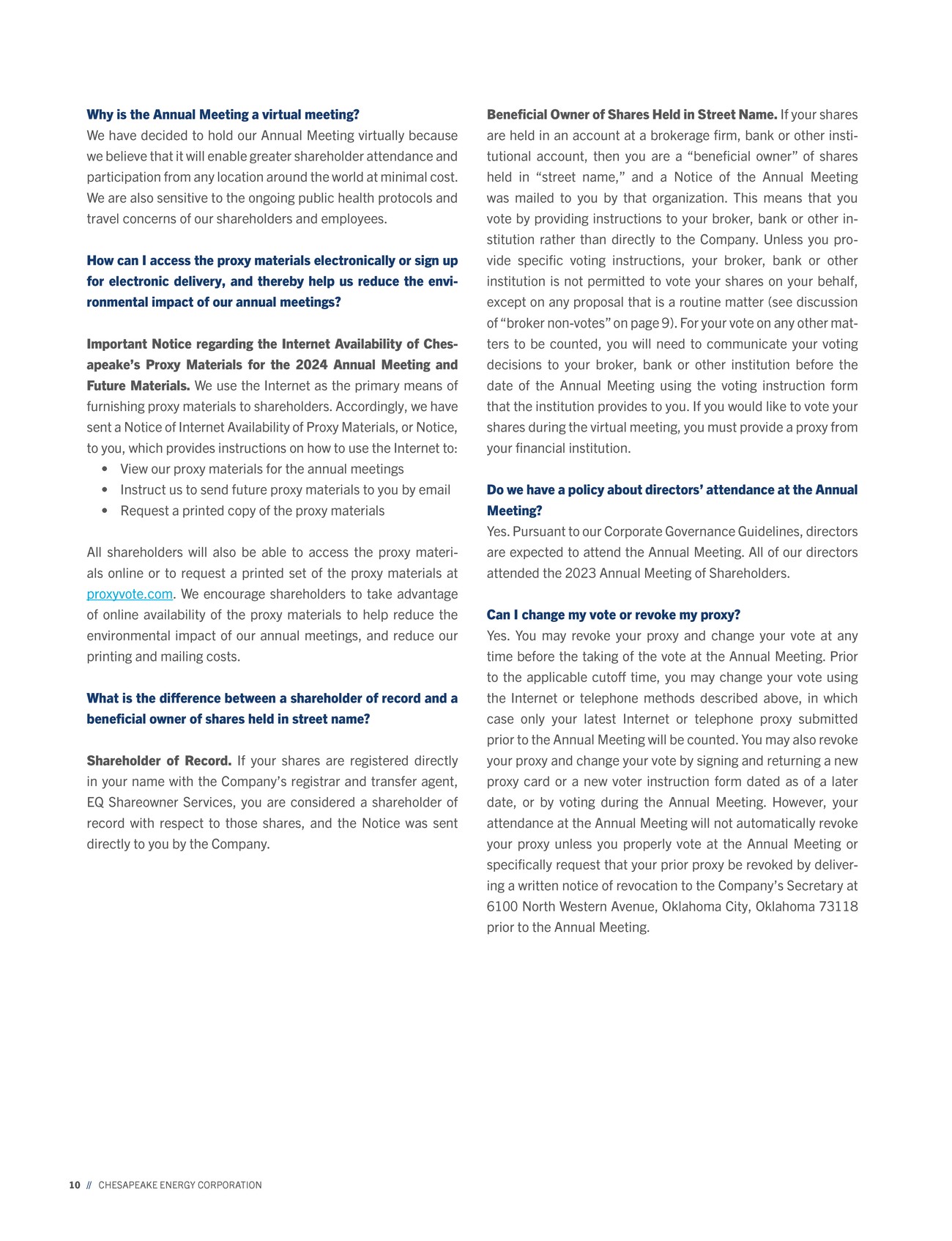

| 10 // CHESAPEAKE ENERGY CORPORATION Why is the Annual Meeting a virtual meeting? We have decided to hold our Annual Meeting virtually because we believe that it will enable greater shareholder attendance and participation from any location around the world at minimal cost. We are also sensitive to the ongoing public health protocols and travel concerns of our shareholders and employees. How can I access the proxy materials electronically or sign up for electronic delivery, and thereby help us reduce the envi-ronmental impact of our annual meetings? Important Notice regarding the Internet Availability of Ches-apeake’s Proxy Materials for the 2024 Annual Meeting and Future Materials. We use the Internet as the primary means of furnishing proxy materials to shareholders. Accordingly, we have sent a Notice of Internet Availability of Proxy Materials, or Notice, to you, which provides instructions on how to use the Internet to: • View our proxy materials for the annual meetings • Instruct us to send future proxy materials to you by email • Request a printed copy of the proxy materials All shareholders will also be able to access the proxy materi-als online or to request a printed set of the proxy materials at proxyvote.com. We encourage shareholders to take advantage of online availability of the proxy materials to help reduce the environmental impact of our annual meetings, and reduce our printing and mailing costs. What is the difference between a shareholder of record and a beneficial owner of shares held in street name? Shareholder of Record. If your shares are registered directly in your name with the Company’s registrar and transfer agent, EQ Shareowner Services, you are considered a shareholder of record with respect to those shares, and the Notice was sent directly to you by the Company. Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank or other insti-tutional account, then you are a “beneficial owner” of shares held in “street name,” and a Notice of the Annual Meeting was mailed to you by that organization. This means that you vote by providing instructions to your broker, bank or other in-stitution rather than directly to the Company. Unless you pro-vide specific voting instructions, your broker, bank or other institution is not permitted to vote your shares on your behalf, except on any proposal that is a routine matter (see discussion of “broker non-votes” on page 9). For your vote on any other mat-ters to be counted, you will need to communicate your voting decisions to your broker, bank or other institution before the date of the Annual Meeting using the voting instruction form that the institution provides to you. If you would like to vote your shares during the virtual meeting, you must provide a proxy from your financial institution. Do we have a policy about directors’ attendance at the Annual Meeting? Yes. Pursuant to our Corporate Governance Guidelines, directors are expected to attend the Annual Meeting. All of our directors attended the 2023 Annual Meeting of Shareholders. Can I change my vote or revoke my proxy? Yes. You may revoke your proxy and change your vote at any time before the taking of the vote at the Annual Meeting. Prior to the applicable cutoff time, you may change your vote using the Internet or telephone methods described above, in which case only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted. You may also revoke your proxy and change your vote by signing and returning a new proxy card or a new voter instruction form dated as of a later date, or by voting during the Annual Meeting. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you properly vote at the Annual Meeting or specifically request that your prior proxy be revoked by deliver-ing a written notice of revocation to the Company’s Secretary at 6100 North Western Avenue, Oklahoma City, Oklahoma 73118 prior to the Annual Meeting. |

| VOTING AND MEETING INFORMATION // 11 Why did my household receive a single set of proxy materials? How can I request an additional copy of the proxy materials and Annual Report? SEC rules permit us to send a single Notice, Proxy Statement and Annual Report to shareholders who share the same last name and address. This procedure is called “householding” and benefits both you and us, as it eliminates duplicate mailings and allows us to reduce printing and mailing costs and the environ-mental impact of our annual meetings. If you are a “shareholder of record” and would like to receive a separate copy of a proxy statement or annual report, either now or in the future, or if you are currently receiving multiple copies of the Notice or proxy materials and would like to request householding, please contact us: (i) by email at ir@chk.com; (ii) by telephone at 405-935-8870 or (iii) in writing to the following address: Attn: Investor Relations, P.O. Box 18496, Oklahoma City, Oklahoma 73154. If you are a “beneficial owner of shares held in street name” and would like additional copies of the Notice, Proxy Statement or Annual Report, or if you are currently receiving multiple copies of the Notice or proxy materials and would like to request house-holding, please contact your bank, broker or other intermediary. Alternatively, all shareholders can access our Proxy Statement, Annual Report on Form 10-K and other SEC filings on our investor website at investors.chk.com/sec-filings or on the SEC’s website at sec.gov. Where can I find the voting results of the Annual Meeting? Preliminary voting results will be announced at the Annual Meeting. We expect to report the final voting results in a Current Report on Form 8-K filed with the SEC within four busi-ness days following the Annual Meeting. Who will serve as the inspector of election and count the votes? A representative of Broadridge Financial Solutions, Inc. will serve as the inspector of election and count the votes. Is my vote confidential? Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties except: (i) as necessary to meet applicable legal requirements or to assert or defend claims for or against the Company; (ii) to allow for the tabulation and certifi-cation of votes; and (iii) to facilitate successful proxy solicitation efforts. If you write comments on your proxy card or ballot, the proxy card or ballot may be forwarded to our management and the Board for review. Who is paying for this proxy solicitation? Proxies will be solicited on behalf of the Board by mail, tele-phone, other electronic means or in person, and we will pay the solicitation costs. Copies of proxy materials will be supplied to brokers, dealers, banks and voting trustees, or their nominees to solicit proxies from beneficial owners, and we will reimburse these institutions for their reasonable expenses. Alliance Advi-sors has been retained to assist in soliciting proxies for a fee of $22,000 plus distribution costs and other expenses. We also pay brokerage firms, banks and similar organizations fees associ-ated with forwarding electronic and printed proxy materials to beneficial holders. In addition, our proxy solicitor and certain of our directors, officers and employees may solicit proxies by mail, by telephone, by electronic communication or in person. Those persons will receive no additional compensation for any solicita-tion activities. |

| 12 // CHESAPEAKE ENERGY CORPORATION Election of Directors WHO ARE YOU VOTING FOR? At the 2024 Annual Meeting, we are asking shareholders to elect seven directors to hold office until the 2025 Annual Meeting and until their successors have been elected and qualified. All are currently serving as Ches-apeake directors. Six of the seven directors were appointed to the Board in February 2021 in connection with our emergence from Chapter 11 bankruptcy, a process in which our current shareholders (and former creditors) were actively engaged. One director, Domenic J. Dell’Osso, Jr., was appointed to the Board in October 2021 upon his engagement as the Company’s President and CEO. Each current Board member was selected based on his or her substantial business, financial and/or environmental expertise and extensive E&P industry experience. Our Bylaws currently provide for a minimum of three directors and a maximum of ten directors, each serving a one-year term, each to hold office until a successor is elected and qualified or until the director’s earlier resignation or removal. Our Board currently has seven members. The Company’s Bylaws provide that, if any incumbent director or any non-incumbent nominee receives a greater number of votes against his or her election than in favor of his or her election, the non-incumbent nominee will not be elected as a director, and the incumbent director will comply with the resignation procedures established under the Company’s Corporate Governance Principles. The Board has nominated the following individuals to be elected as directors until the next annual meeting of shareholders and until their successors are duly elected and qualified. At the Annual Meeting, proxies can be voted only with respect to the seven nominees named in this Proxy Statement. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxy holders may vote for any nominee designated by the present Board to fill the vacancy. Your Board recommends a vote FOR the election of each nominee. PROPOSAL 1 GOVERNANCE |

| Benjamin C. Duster, IV Independent Director since February 2021 Cormorant IV Corporation, LLC, Founder and CEO, 2014 – Present Mobile Tech, Inc., CFO, 2022 – Present Age: 63 PRIOR BUSINESS EXPERIENCE CenterLight Health System, Inc., CEO, 2016 – 2018 Watermark Advisors, LLC, Co-Founder, 2002 – 2015 Wachovia Securities, Inc. (now Wells Fargo), various investment banking positions, 1997 – 2001 Salomon Brothers, Inc. (now CitiGroup Inc.), various investment banking positions, 1985 – 1997 CURRENT PUBLIC COMPANY BOARDS Weatherford International plc (Nasdaq: WFRD) Diamond Offshore Drilling, Inc. (NYSE: DO) Republic First Bancorp, Inc. (Nasdaq: FRBK) PRIOR PUBLIC COMPANY BOARDS Alaska Communications Systems Group, Inc. (Nasdaq: ALSK) RCN Corporation (Nasdaq: RCN) Multi-Fineline Electronics (Nasdaq: MFLX) Netia, S.A. (Warsaw Stock Exchange: NET) WBL Corporation Ltd. (Singapore Stock Exchange: WBL) Algoma Steel Inc. (Toronto Stock Exchange: AGA) OTHER POSITIONS Cardone Industries, Inc., Director The 1921 Institute, Director EDUCATION Yale University, BA Economics Harvard Law School, JD Harvard Business School, MBA Timothy S. Duncan Independent Director since February 2021 Talos Energy Inc. (NYSE: TALO), President, CEO and Director, 2018 – Present Age: 51 PRIOR BUSINESS EXPERIENCE Talos Energy LLC, Founder, President, CEO and Director, 2012 – 2018 Phoenix Exploration Company, LP, Senior Vice President of Business Development and Founder, 2006 – 2012 Gryphon Exploration Company, Manager of Reservoir Engineering and Evaluations, 2000 – 2005 Various reservoir engineering and portfolio evaluation functions for Amerada Hess Corporation, Zilkha Energy Company and Pennzoil E&P Company, 1995 – 2000 CURRENT PUBLIC COMPANY BOARD Talos Energy Inc. (NYSE: TALO) OTHER POSITIONS National Ocean Industries Association, Director American Cancer Society CEOs Against Cancer, Greater Houston Chapter, Board Member Mississippi State University, Member of Foundation Board and College of Engineering Dean’s Advisory Council EDUCATION Mississippi State University, BS Petroleum Engineering University of Houston, MBA Domenic J. Dell’Osso, Jr. Director since October 2021 Chesapeake Energy Corporation (Nasdaq: CHK), President and CEO, since October 2021 Age: 47 PRIOR BUSINESS EXPERIENCE Chesapeake Energy Corporation (Nasdaq: CHK) EVP and CFO, 2010 – 2021 VP – Finance and CFO Chesapeake Midstream Development LP, 2008 – 2010 Jefferies & Co., Investment Banker, 2006 – 2008 Banc of America Securities Investment Banker, 2004 – 2006 CURRENT PUBLIC COMPANY BOARD Transocean Ltd. (NYSE: RIG) PRIOR PUBLIC COMPANY BOARDS FTS International, Inc. (NYSE: FTSI) Access Midstream/Williams Midstream Partners, L.P. (NYSE: CHKM) OTHER POSITIONS Catholic Charities of Oklahoma City, Director Cristo Rey OKC, Director United Way of Central Oklahoma, Director FracTech International, LLC, former Director Sundrop Fuels, Inc., former Director EDUCATION Boston College, BA Economics University of Texas, MBA GOVERNANCE // 13 Michael A. Wichterich Chairman since February 2021 Three Rivers Operating Company LLC, Founder, CEO and Chairman, 2009 – Present Age: 57 PRIOR BUSINESS EXPERIENCE Chesapeake Energy Corporation (Nasdaq: CHK) Executive Chairman, October 2021 – December 2022 Interim CEO, April – October 2021 Texas American Resources Company, CFO, 2006 – 2009 New Braunfels Utilities, CFO, 2004 – 2005 Mariner Energy, Inc., CFO, 1998 – 2003 PricewaterhouseCoopers LLP, various positions, 1989 – 1997 PRIOR PUBLIC COMPANY BOARD Extraction Oil & Gas, Inc. (Nasdaq: XOG) OTHER POSITIONS Bruin E&P Operating, LLC, former Director Grizzly Energy, LLC, former Director Sabine Oil & Gas Corporation, former Director USA Compression Partners, LP, former Director EDUCATION University of Texas, BBA Accounting |

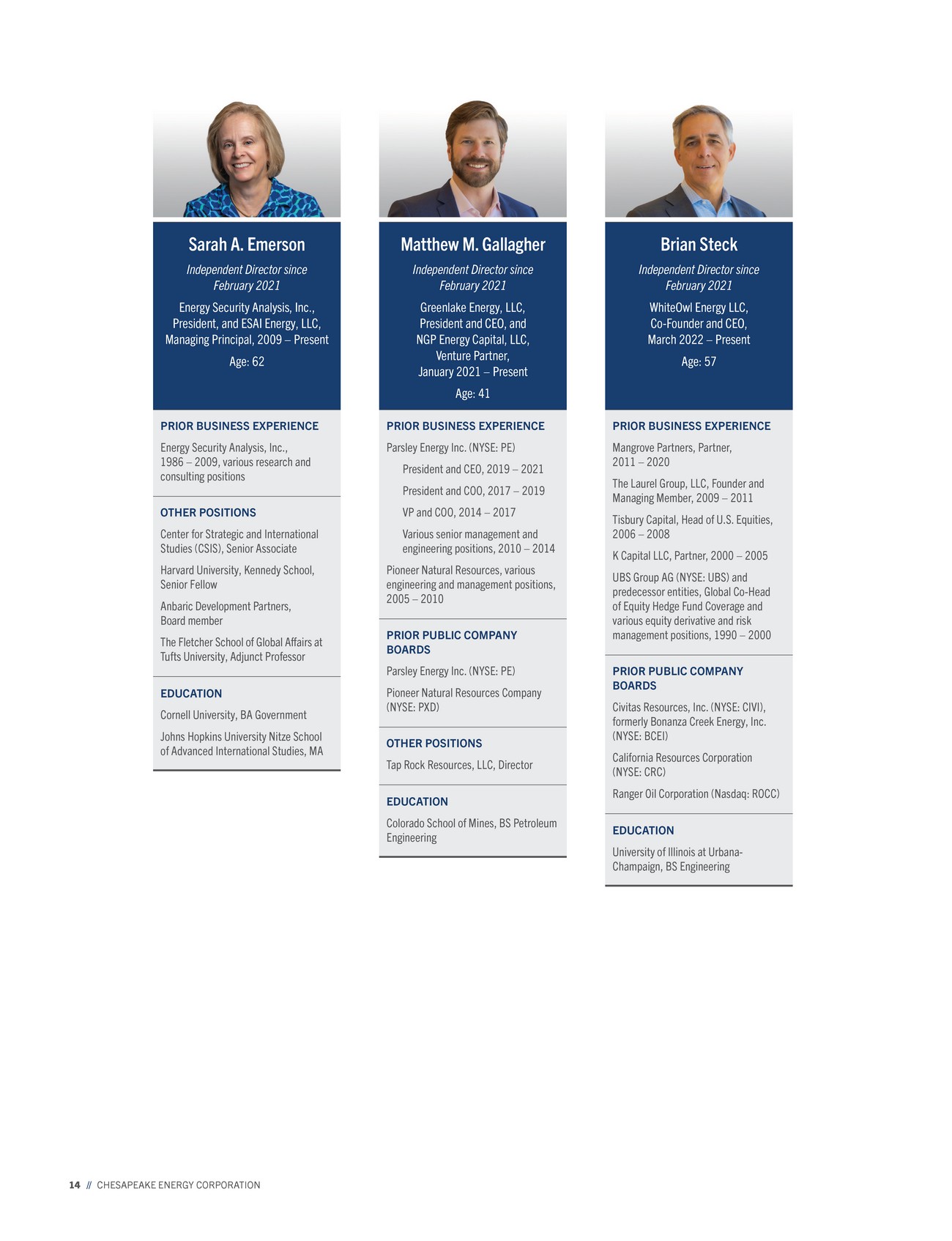

| 14 // CHESAPEAKE ENERGY CORPORATION Sarah A. Emerson Independent Director since February 2021 Energy Security Analysis, Inc., President, and ESAI Energy, LLC, Managing Principal, 2009 – Present Age: 62 PRIOR BUSINESS EXPERIENCE Energy Security Analysis, Inc., 1986 – 2009, various research and consulting positions OTHER POSITIONS Center for Strategic and International Studies (CSIS), Senior Associate Harvard University, Kennedy School, Senior Fellow Anbaric Development Partners, Board member The Fletcher School of Global Affairs at Tufts University, Adjunct Professor EDUCATION Cornell University, BA Government Johns Hopkins University Nitze School of Advanced International Studies, MA Brian Steck Independent Director since February 2021 WhiteOwl Energy LLC, Co-Founder and CEO, March 2022 – Present Age: 57 PRIOR BUSINESS EXPERIENCE Mangrove Partners, Partner, 2011 – 2020 The Laurel Group, LLC, Founder and Managing Member, 2009 – 2011 Tisbury Capital, Head of U.S. Equities, 2006 – 2008 K Capital LLC, Partner, 2000 – 2005 UBS Group AG (NYSE: UBS) and predecessor entities, Global Co-Head of Equity Hedge Fund Coverage and various equity derivative and risk management positions, 1990 – 2000 PRIOR PUBLIC COMPANY BOARDS Civitas Resources, Inc. (NYSE: CIVI), formerly Bonanza Creek Energy, Inc. (NYSE: BCEI) California Resources Corporation (NYSE: CRC) Ranger Oil Corporation (Nasdaq: ROCC) EDUCATION University of Illinois at Urbana-Champaign, BS Engineering Matthew M. Gallagher Independent Director since February 2021 Greenlake Energy, LLC, President and CEO, and NGP Energy Capital, LLC, Venture Partner, January 2021 – Present Age: 41 PRIOR BUSINESS EXPERIENCE Parsley Energy Inc. (NYSE: PE) President and CEO, 2019 – 2021 President and COO, 2017 – 2019 VP and COO, 2014 – 2017 Various senior management and engineering positions, 2010 – 2014 Pioneer Natural Resources, various engineering and management positions, 2005 – 2010 PRIOR PUBLIC COMPANY BOARDS Parsley Energy Inc. (NYSE: PE) Pioneer Natural Resources Company (NYSE: PXD) OTHER POSITIONS Tap Rock Resources, LLC, Director EDUCATION Colorado School of Mines, BS Petroleum Engineering |

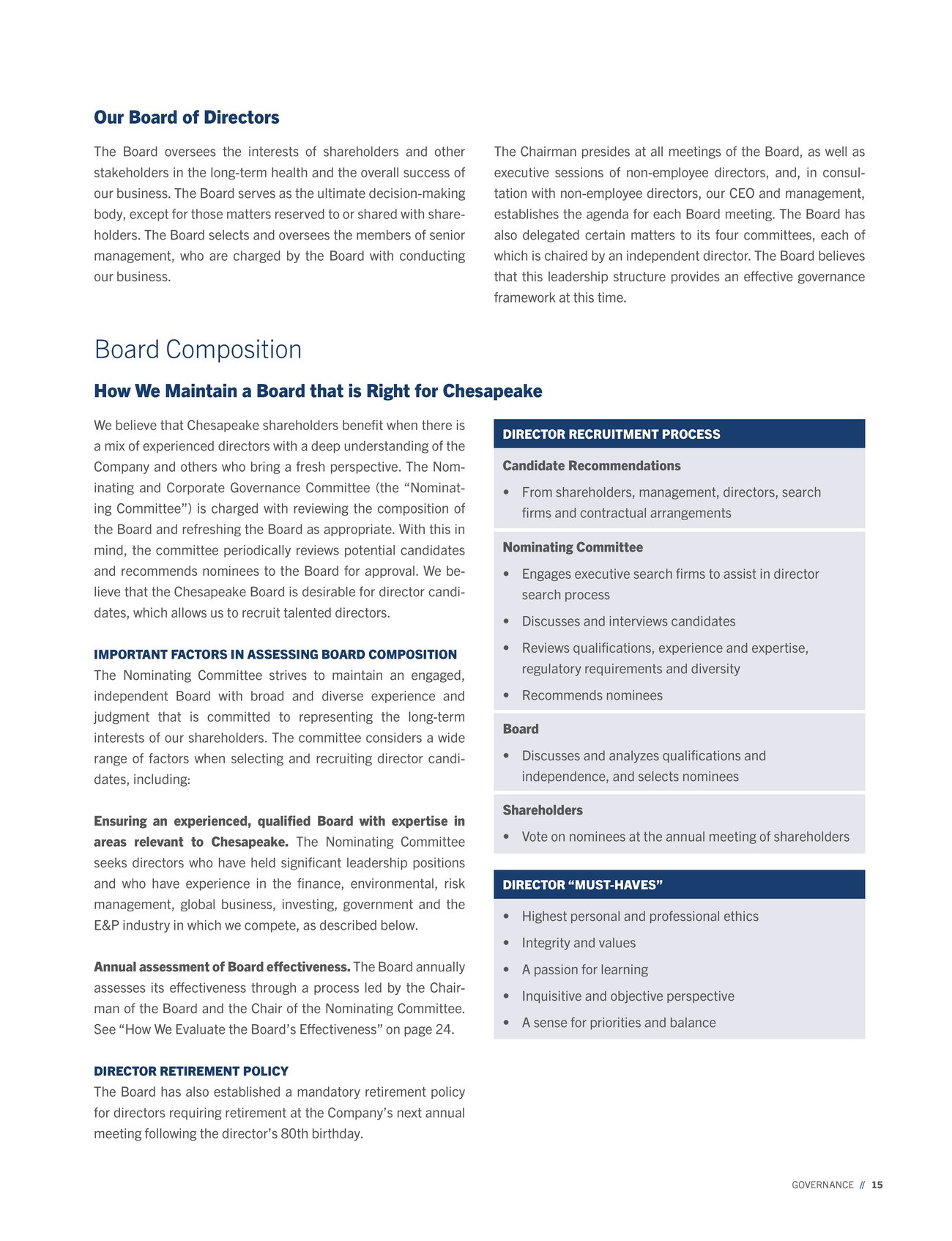

| GOVERNANCE // 15 How We Maintain a Board that is Right for Chesapeake Our Board of Directors Board Composition We believe that Chesapeake shareholders benefit when there is a mix of experienced directors with a deep understanding of the Company and others who bring a fresh perspective. The Nom-inating and Corporate Governance Committee (the “Nominat-ing Committee”) is charged with reviewing the composition of the Board and refreshing the Board as appropriate. With this in mind, the committee periodically reviews potential candidates and recommends nominees to the Board for approval. We be-lieve that the Chesapeake Board is desirable for director candi-dates, which allows us to recruit talented directors. IMPORTANT FACTORS IN ASSESSING BOARD COMPOSITION The Nominating Committee strives to maintain an engaged, independent Board with broad and diverse experience and judgment that is committed to representing the long-term interests of our shareholders. The committee considers a wide range of factors when selecting and recruiting director candi-dates, including: Ensuring an experienced, qualified Board with expertise in areas relevant to Chesapeake. The Nominating Committee seeks directors who have held significant leadership positions and who have experience in the finance, environmental, risk management, global business, investing, government and the E&P industry in which we compete, as described below. Annual assessment of Board effectiveness. The Board annually assesses its effectiveness through a process led by the Chair-man of the Board and the Chair of the Nominating Committee. See “How We Evaluate the Board’s Effectiveness” on page 24. DIRECTOR RETIREMENT POLICY The Board has also established a mandatory retirement policy for directors requiring retirement at the Company’s next annual meeting following the director’s 80th birthday. The Board oversees the interests of shareholders and other stakeholders in the long-term health and the overall success of our business. The Board serves as the ultimate decision-making body, except for those matters reserved to or shared with share-holders. The Board selects and oversees the members of senior management, who are charged by the Board with conducting our business. DIRECTOR RECRUITMENT PROCESS Candidate Recommendations • From shareholders, management, directors, search firms and contractual arrangements Nominating Committee • Engages executive search firms to assist in director search process • Discusses and interviews candidates • Reviews qualifications, experience and expertise, regulatory requirements and diversity • Recommends nominees Board • Discusses and analyzes qualifications and independence, and selects nominees Shareholders • Vote on nominees at the annual meeting of shareholders DIRECTOR “MUST-HAVES” • Highest personal and professional ethics • Integrity and values • A passion for learning • Inquisitive and objective perspective • A sense for priorities and balance The Chairman presides at all meetings of the Board, as well as executive sessions of non-employee directors, and, in consul-tation with non-employee directors, our CEO and management, establishes the agenda for each Board meeting. The Board has also delegated certain matters to its four committees, each of which is chaired by an independent director. The Board believes that this leadership structure provides an effective governance framework at this time. |

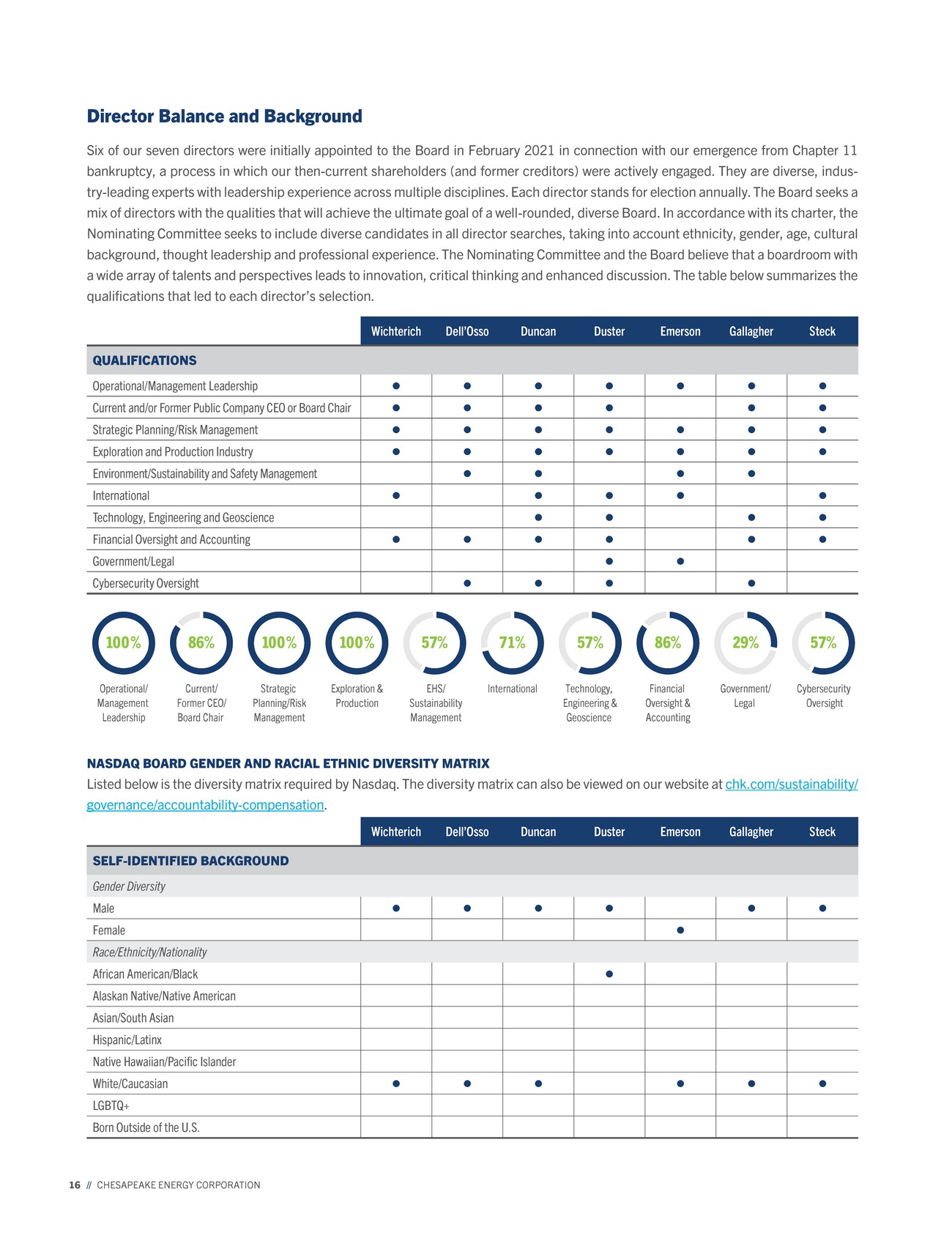

| 16 // CHESAPEAKE ENERGY CORPORATION Director Balance and Background Six of our seven directors were initially appointed to the Board in February 2021 in connection with our emergence from Chapter 11 bankruptcy, a process in which our then-current shareholders (and former creditors) were actively engaged. They are diverse, indus-try-leading experts with leadership experience across multiple disciplines. Each director stands for election annually. The Board seeks a mix of directors with the qualities that will achieve the ultimate goal of a well-rounded, diverse Board. In accordance with its charter, the Nominating Committee seeks to include diverse candidates in all director searches, taking into account ethnicity, gender, age, cultural background, thought leadership and professional experience. The Nominating Committee and the Board believe that a boardroom with a wide array of talents and perspectives leads to innovation, critical thinking and enhanced discussion. The table below summarizes the qualifications that led to each director’s selection. Wichterich Dell’Osso Duncan Duster Emerson Gallagher Steck QUALIFICATIONS Operational/Management Leadership • • • • • • • Current and/or Former Public Company CEO or Board Chair • • • • • • Strategic Planning/Risk Management • • • • • • • Exploration and Production Industry • • • • • • • Environment/Sustainability and Safety Management • • • • International • • • • • Technology, Engineering and Geoscience • • • • Financial Oversight and Accounting • • • • • • Government/Legal • • Cybersecurity Oversight • • • • Wichterich Dell’Osso Duncan Duster Emerson Gallagher Steck SELF-IDENTIFIED BACKGROUND Gender Diversity Male • • • • • • Female • Race/Ethnicity/Nationality African American/Black • Alaskan Native/Native American Asian/South Asian Hispanic/Latinx Native Hawaiian/Pacific Islander White/Caucasian • • • • • • LGBTQ+ Born Outside of the U.S. Operational/ Management Leadership 100% Exploration & Production 100% 57% EHS/ Sustainability Management 57% Cybersecurity Oversight International 71% Government/ Legal 29% Current/ Former CEO/ Board Chair 86% Technology, Engineering & Geoscience 57% Strategic Planning/Risk Management 100% Financial Oversight & Accounting 86% NASDAQ BOARD GENDER AND RACIAL ETHNIC DIVERSITY MATRIX Listed below is the diversity matrix required by Nasdaq. The diversity matrix can also be viewed on our website at chk.com/sustainability/ governance/accountability-compensation. |

| GOVERNANCE // 17 SKILLS AND EXPERIENCE INDEPENDENCE 5 Directors are independent FINANCIAL EXPERTISE 3 All Audit Committee members qualify as financial experts TENURE (as of 2024 Annual Meeting) 100% 5 years or less 3.2 Average tenure (years) AGE DIVERSITY 54 Average age 71% Younger than 60 80 CHESAPEAKE POLICY: retirement age Joined the Board Wichterich Dell’Osso Duncan Duster Emerson Gallagher Steck Left the Board Lawler (May 2021) BOARD REFRESHMENT (since February 2021) Enhancing the Board’s Diversity of Background Our goal is to assemble and maintain a Board composed of individuals that not only bring a wealth of business and/or technical ex-pertise, experience and achievement, but that also demonstrate a commitment to ethics in carrying out the Board’s responsibilities with respect to oversight of the Company’s operations. We believe our current Board reflects these principles and our commitment to diversity. In this regard, one of our directors is female and one is African American, and they hold critical leadership positions on our Board as Chairs of the ESG Committee and Audit Committee, respectively. GENDER RACIAL/ETHNIC DIVERSITY GENDER & RACIAL/ETHNIC DIVERSITY 14% of director nominees self-identify as female 14% of director nominees self-identify as racially/ ethnically diverse 29% of director nominees self-identify as gender and racially/ethnically diverse BOARD MEMBERS All of our director nominees (listed under “Election of Directors,” beginning on page 12) other than two directors, Mr. Dell’Osso, our CEO, and Mr. Wichterich, who served as our Executive Chair-man during 2022, are independent. The Board’s guidelines. For a director to be considered indepen-dent, the Board, through its Nominating Committee, must deter-mine that he or she does not have any relationship that, in the opinion of the Board, would interfere with his or her independent judgment as a director. The Board’s guidelines for director inde-pendence conform to the independence requirements in the list-ing standards of the Nasdaq Stock Market. In addition to apply-ing these guidelines, the Board considers all relevant facts and circumstances when making an independence determination. How We Assess Director Independence Applying the guidelines in 2023. In determining director inde-pendence, the Board considered relevant transactions, relation-ships and arrangements in assessing independence, including relationships among Board members, their family members and the Company in 2021 – 2023 and the 2024 first quarter, as described below under the caption “Relationships and Trans-actions Considered for Director Independence.” In accordance with our Corporate Governance Principles and the listing stan-dards of the Nasdaq Stock Market, the Nominating Committee determined that all transactions and relationships it considered during its review were not material transactions or relationships with the Company and did not impair the independence of any of the independent directors. |

| 18 // CHESAPEAKE ENERGY CORPORATION Director Candidate Recommendations The Nominating Committee will consider all shareholder recommendations for director candidates, evaluating them in the same manner as candidates suggested by other directors or third-party search firms (which the Board may retain from time to time, to help identify potential candidates). TRANSACTIONS WITH RELATED PERSONS The Company has adopted a written related party transaction policy with respect to any transaction, arrangement or relationship or series of similar transactions, arrangements or relationships (including any indebtedness or guarantee of indebtedness) in which: (1) the aggregate amount involved will or may be expected to exceed $120,000; (2) the Company is a participant; and (3) any of its currently serving directors and executive officers, or those serving as such at any time since the beginning of the last fiscal year, or greater than 5% shareholders, or any of the immediate family members of the foregoing persons, has or will have a direct or indirect material interest. The Audit Committee reviews and approves all interested transactions, as defined above, subject to certain enu-merated exceptions that the Audit Committee has determined do not present a “direct or indirect material interest” on behalf of the related party, consistent with the rules and regulations of the SEC. Such transactions are subject to the Company’s Code of Business Conduct. Certain transactions with former executive officers and directors that fall within the enumerated exceptions are reviewed by the Audit Committee. The Audit Committee approves or ratifies only those transactions that it determines in good faith are in, or are not inconsistent with, the best interests of the Company and its shareholders. Director/ Nominee Organization/ Individual Relationship Transactions Size for Each of Last Three Years All directors Various charitable organizations Director or Trustee Charitable donations <1% of organization’s revenues Relationships and Transactions Considered for Director Independence COMMITTEE MEMBERS All members of the Audit Committee, Compensation Committee and Nominating Committee must be independent, as defined by the Board’s Governance Principles. • Heightened standards for Audit Committee members. Under a separate SEC independence requirement, Audit Committee mem-bers may not accept any consulting, advisory or other fee from Chesapeake or any of its subsidiaries, except compensation for Board service. • Heightened standards for members of the Compensation and Nominating Committees. As a policy matter, the Board also applies a separate, heightened independence standard to members of the Compensation and Nominating Committees: no mem-ber of either committee may be a partner, member or principal of a law firm, accounting firm or investment banking firm that accepts consulting or advisory fees from Chesapeake or a subsidiary. In addition, in determining that Compensation Committee members are independent, Nasdaq Stock Market rules require the Board to consider their sources of compensation, including any consulting, advisory or other compensation paid by Chesapeake or a subsidiary. The Board has determined that all members of the Audit, Compensation and Nominating Committees, as well as the Environmental and Social Governance (ESG) Committee, are independent and, where applicable, also satisfy these committee-specific independence requirements. |

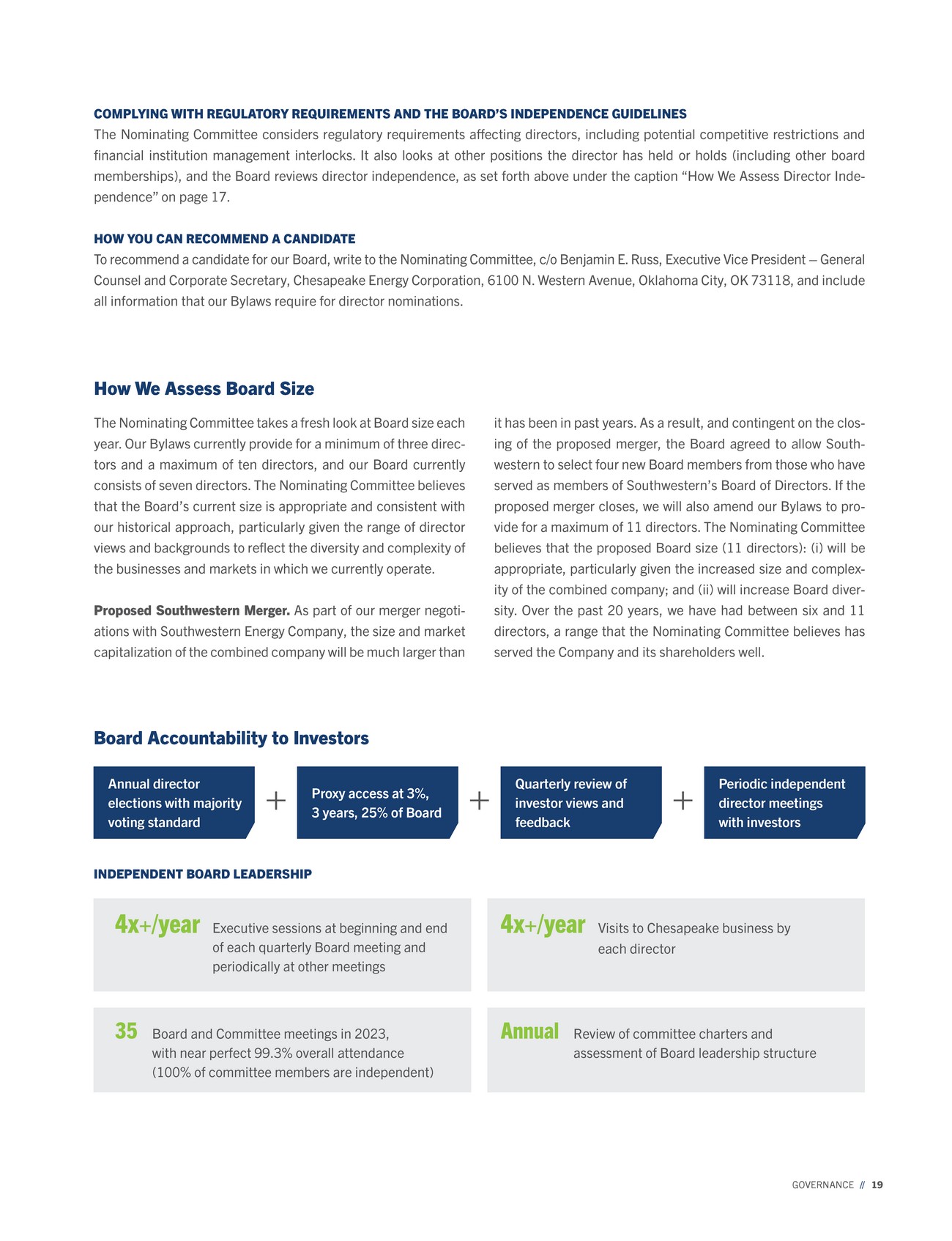

| GOVERNANCE // 19 How We Assess Board Size The Nominating Committee takes a fresh look at Board size each year. Our Bylaws currently provide for a minimum of three direc-tors and a maximum of ten directors, and our Board currently consists of seven directors. The Nominating Committee believes that the Board’s current size is appropriate and consistent with our historical approach, particularly given the range of director views and backgrounds to reflect the diversity and complexity of the businesses and markets in which we currently operate. Proposed Southwestern Merger. As part of our merger negoti-ations with Southwestern Energy Company, the size and market capitalization of the combined company will be much larger than it has been in past years. As a result, and contingent on the clos-ing of the proposed merger, the Board agreed to allow South-western to select four new Board members from those who have served as members of Southwestern’s Board of Directors. If the proposed merger closes, we will also amend our Bylaws to pro-vide for a maximum of 11 directors. The Nominating Committee believes that the proposed Board size (11 directors): (i) will be appropriate, particularly given the increased size and complex-ity of the combined company; and (ii) will increase Board diver-sity. Over the past 20 years, we have had between six and 11 directors, a range that the Nominating Committee believes has served the Company and its shareholders well. Board Accountability to Investors INDEPENDENT BOARD LEADERSHIP Annual director elections with majority voting standard Proxy access at 3%, 3 years, 25% of Board Quarterly review of investor views and feedback Periodic independent director meetings with investors + + + 4x+/year Executive sessions at beginning and end of each quarterly Board meeting and periodically at other meetings 4x+/year Visits to Chesapeake business by each director 35 Board and Committee meetings in 2023, with near perfect 99.3% overall attendance (100% of committee members are independent) Annual Review of committee charters and assessment of Board leadership structure COMPLYING WITH REGULATORY REQUIREMENTS AND THE BOARD’S INDEPENDENCE GUIDELINES The Nominating Committee considers regulatory requirements affecting directors, including potential competitive restrictions and financial institution management interlocks. It also looks at other positions the director has held or holds (including other board memberships), and the Board reviews director independence, as set forth above under the caption “How We Assess Director Inde-pendence” on page 17. HOW YOU CAN RECOMMEND A CANDIDATE To recommend a candidate for our Board, write to the Nominating Committee, c/o Benjamin E. Russ, Executive Vice President – General Counsel and Corporate Secretary, Chesapeake Energy Corporation, 6100 N. Western Avenue, Oklahoma City, OK 73118, and include all information that our Bylaws require for director nominations. |

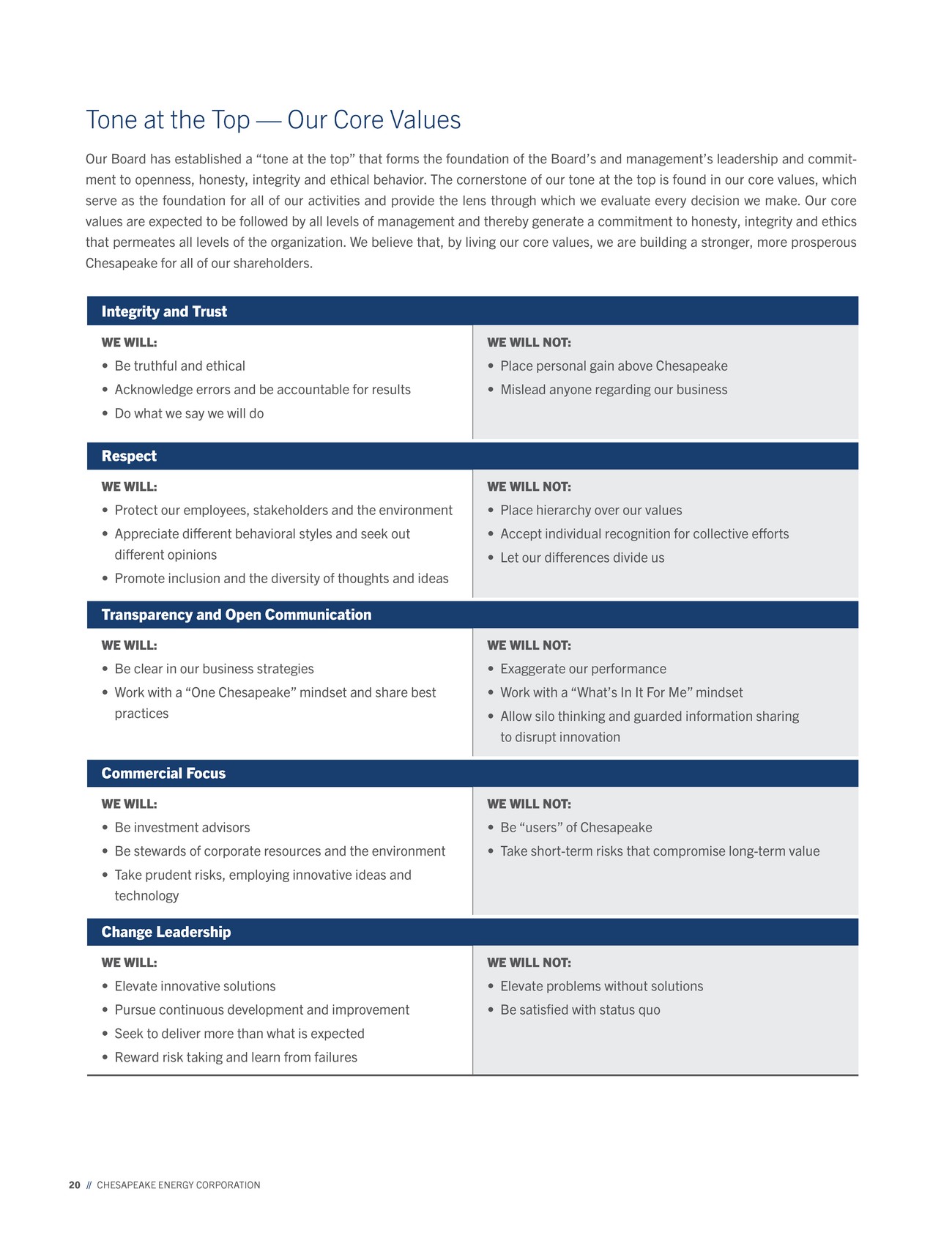

| 20 // CHESAPEAKE ENERGY CORPORATION Tone at the Top — Our Core Values Our Board has established a “tone at the top” that forms the foundation of the Board’s and management’s leadership and commit-ment to openness, honesty, integrity and ethical behavior. The cornerstone of our tone at the top is found in our core values, which serve as the foundation for all of our activities and provide the lens through which we evaluate every decision we make. Our core values are expected to be followed by all levels of management and thereby generate a commitment to honesty, integrity and ethics that permeates all levels of the organization. We believe that, by living our core values, we are building a stronger, more prosperous Chesapeake for all of our shareholders. Integrity and Trust WE WILL: • Be truthful and ethical • Acknowledge errors and be accountable for results • Do what we say we will do WE WILL NOT: • Place personal gain above Chesapeake • Mislead anyone regarding our business Respect WE WILL: • Protect our employees, stakeholders and the environment • Appreciate different behavioral styles and seek out different opinions • Promote inclusion and the diversity of thoughts and ideas WE WILL NOT: • Place hierarchy over our values • Accept individual recognition for collective efforts • Let our differences divide us Transparency and Open Communication WE WILL: • Be clear in our business strategies • Work with a “One Chesapeake” mindset and share best practices WE WILL NOT: • Exaggerate our performance • Work with a “What’s In It For Me” mindset • Allow silo thinking and guarded information sharing to disrupt innovation Commercial Focus WE WILL: • Be investment advisors • Be stewards of corporate resources and the environment • Take prudent risks, employing innovative ideas and technology WE WILL NOT: • Be “users” of Chesapeake • Take short-term risks that compromise long-term value Change Leadership WE WILL: • Elevate innovative solutions • Pursue continuous development and improvement • Seek to deliver more than what is expected • Reward risk taking and learn from failures WE WILL NOT: • Elevate problems without solutions • Be satisfied with status quo |

| GOVERNANCE // 21 Our Board of Directors The Board is elected by the shareholders to oversee their interest in the long-term health and the overall success of our business and its financial strength. The Board serves as the ultimate decision-making body, except for those matters reserved to or shared with shareholders. The Board selects and oversees the members of senior management, who are charged by the Board with conducting our business. We have maintained separate roles for our Chairman and CEO for the past 12 years. Since February 2021, Michael Wichterich has served as the Board’s Chairman and Matthew Gallagher has served as the Board’s “lead independent director.” Mr. Wich-terich also served as Interim Chief Executive Officer from April 2021, following the departure of Chesapeake’s prior Chief Exec-utive Officer, through October 2021, when Domenic J. Dell’Osso, Jr. was hired as the new Chief Executive Officer. From October 2021 through December 2022, Mr. Wichterich also served as Chesapeake’s Executive Chairman. The Board is composed of the Chairman, Chief Executive Officer and five independent non-employee members. The directors are skilled and experi-enced leaders in business, education, government and public policy. They currently serve or have served as chief executives, members of senior management and board members of Fortune Board Leadership Structure and Oversight 1000 companies, investment banking/private equity firms, envi-ronmental consulting firms and private for-profit and nonprofit organizations and are well-equipped to promote our long-term success and to provide effective oversight of, and advice and counsel to, the CEO and other members of senior management. The Chairman presides at all meetings of the Board, as well as executive sessions of non-employee directors, and, in consulta-tion with non-employee directors and management, establishes the agenda for each Board meeting. The lead independent direc-tor performs these duties when the Chairman is unavailable. The Board has also delegated certain matters to its four committees, each of which is chaired by an independent director. The Board believes that this leadership structure provides an effective gov-ernance framework at this time. In addition to our tone at the top and our core values, our Board has adopted Corporate Governance Principles, which include information regarding the Board’s role and responsibilities, di-rector qualifications and determination of director independence and other guidelines, and charters for each of the Board commit-tees. The Board has also adopted a Code of Business Conduct applicable to all directors, officers and employees, including our principal executive officer, principal financial officer and princi-pal accounting officer. These documents, along with our Certifi-cate of Incorporation and Bylaws, provide the framework for the functioning of the Board. The Code of Business Conduct is avail-Other Governance Policies and Practices able on our website at chk.com/documents/governance/code-of-business-conduct.pdf. All committee charters and the Corporate Governance Principles are available on our website at chk.com/ about/board-of-directors. Waivers of provisions of the Code of Business Conduct, if any, as to any director or executive officer are required to be evaluated by the Audit Committee or the Board and amendments to the Code of Business Conduct must be ap-proved by the Board. We intend to post any such waivers from, or changes to, the Code of Business Conduct on our website within four business days of such approval. The Compensation Committee is comprised of Brian Steck (Chair), Timothy S. Duncan and Benjamin C. Duster, IV, each of whom is an independent director. None of the members of the Compensation Committee during fiscal year 2023, or as of the date of this Proxy Statement, is or has been an officer or employee of Chesapeake and no executive officer of Chesapeake served on the compensation committee or board of any company that employed any member of Chesapeake’s Compensation Committee or Board. Compensation Committee Interlocks and Insider Participation |

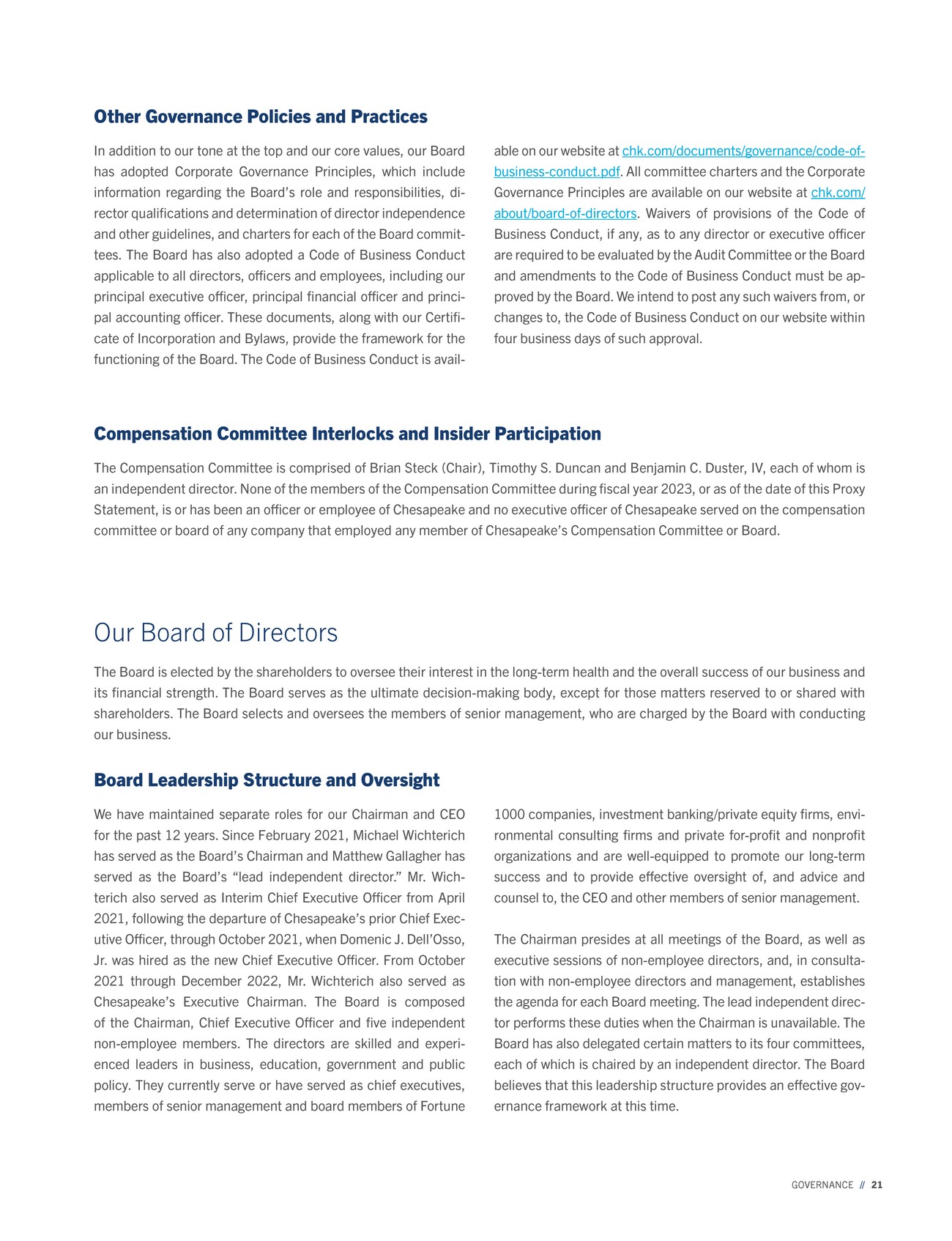

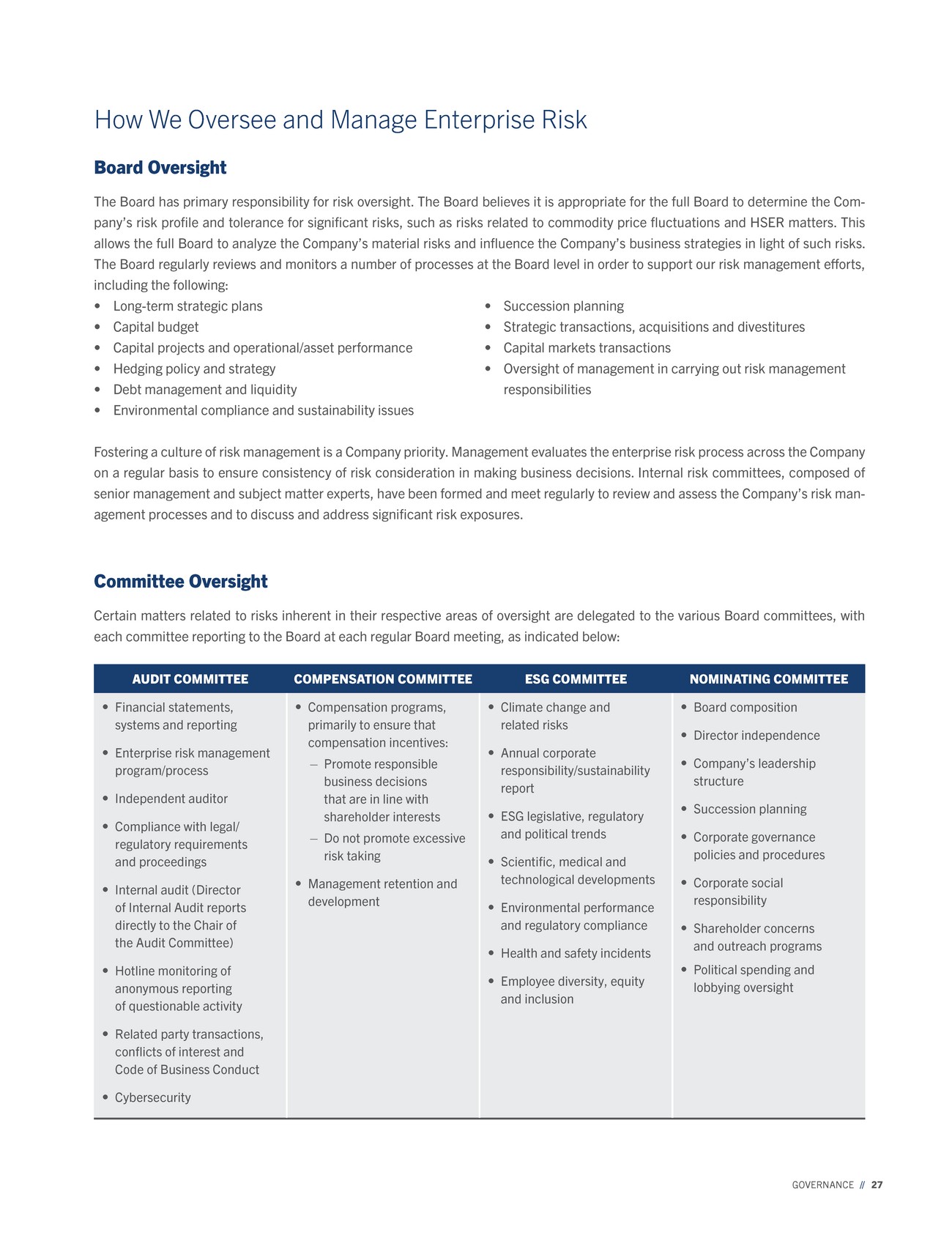

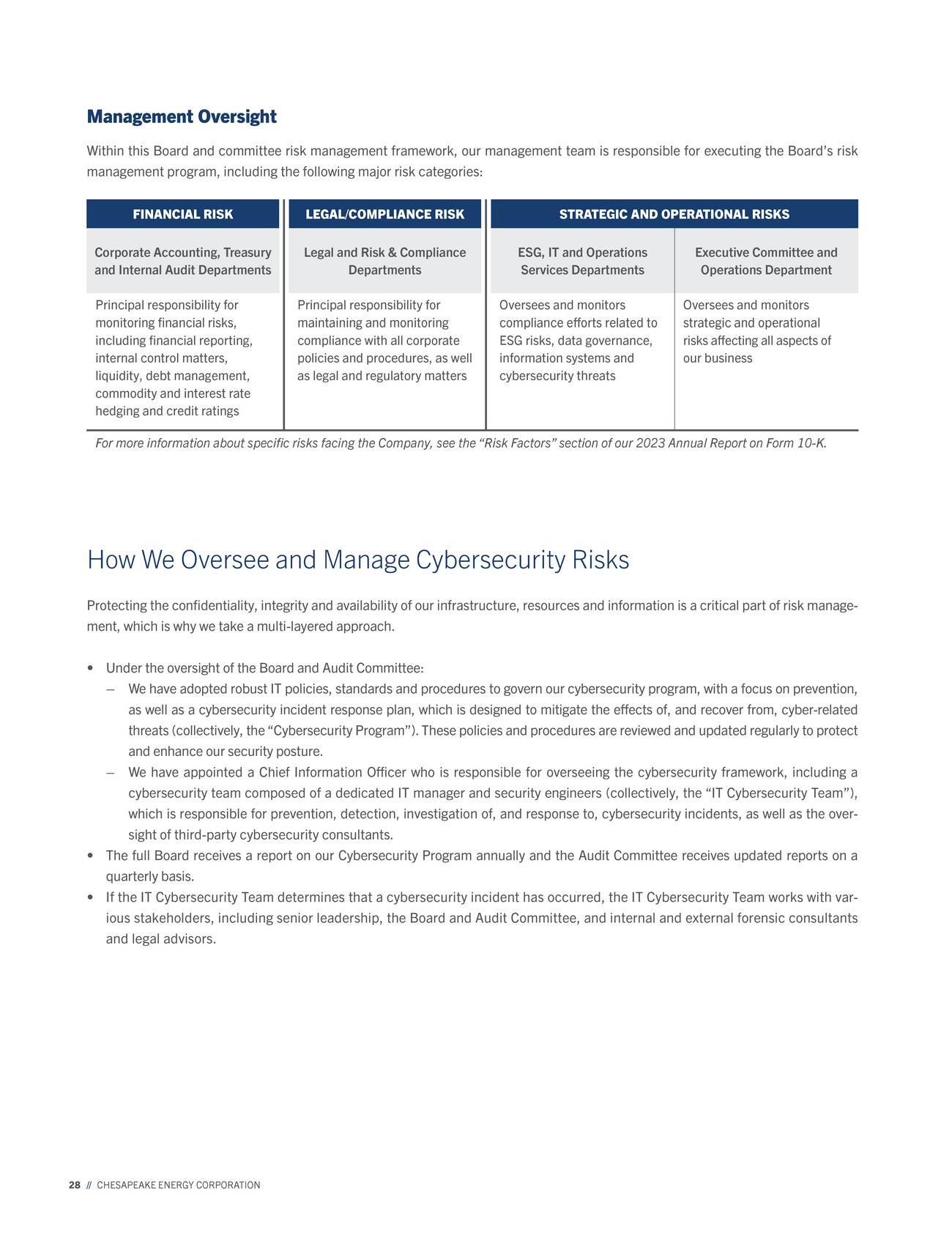

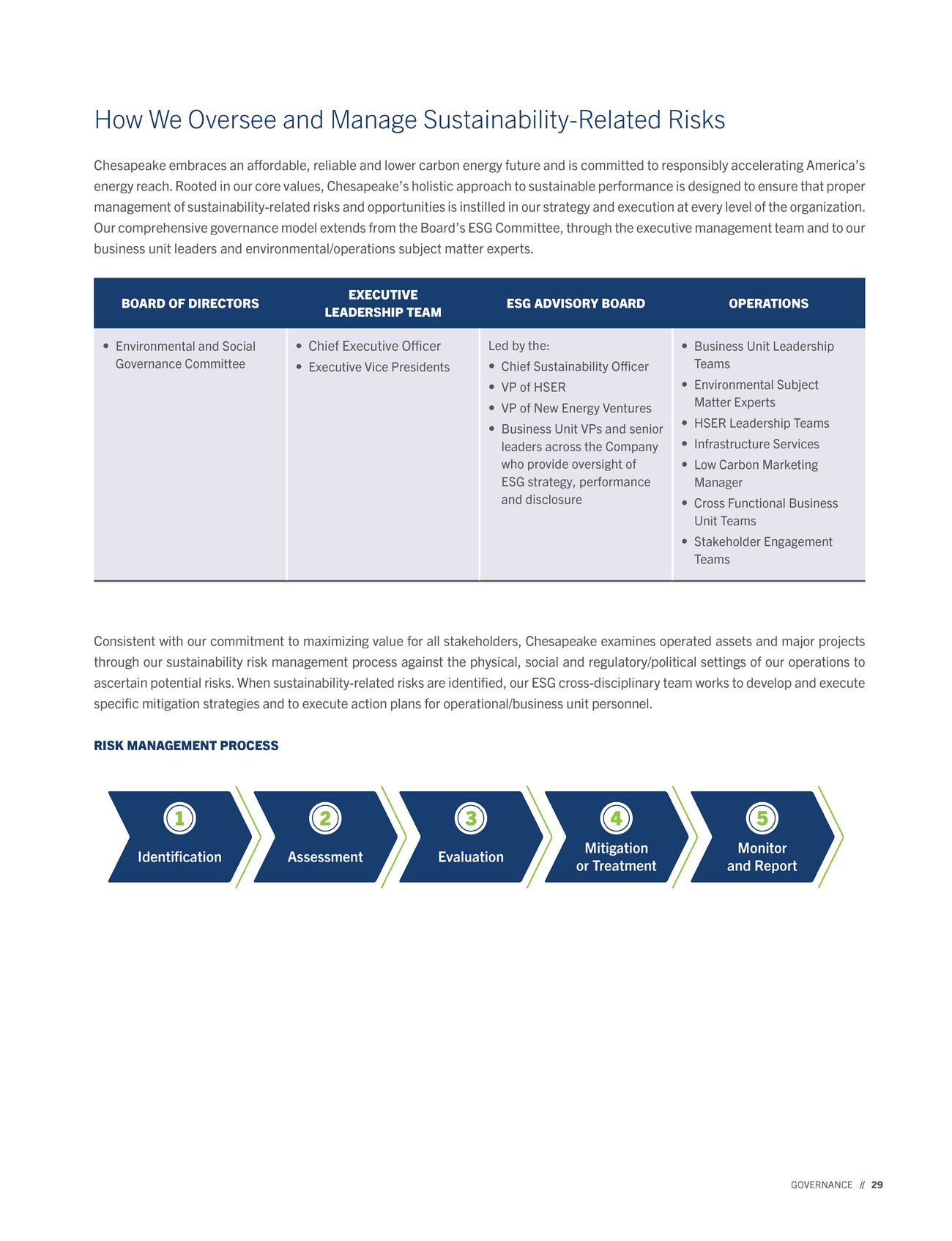

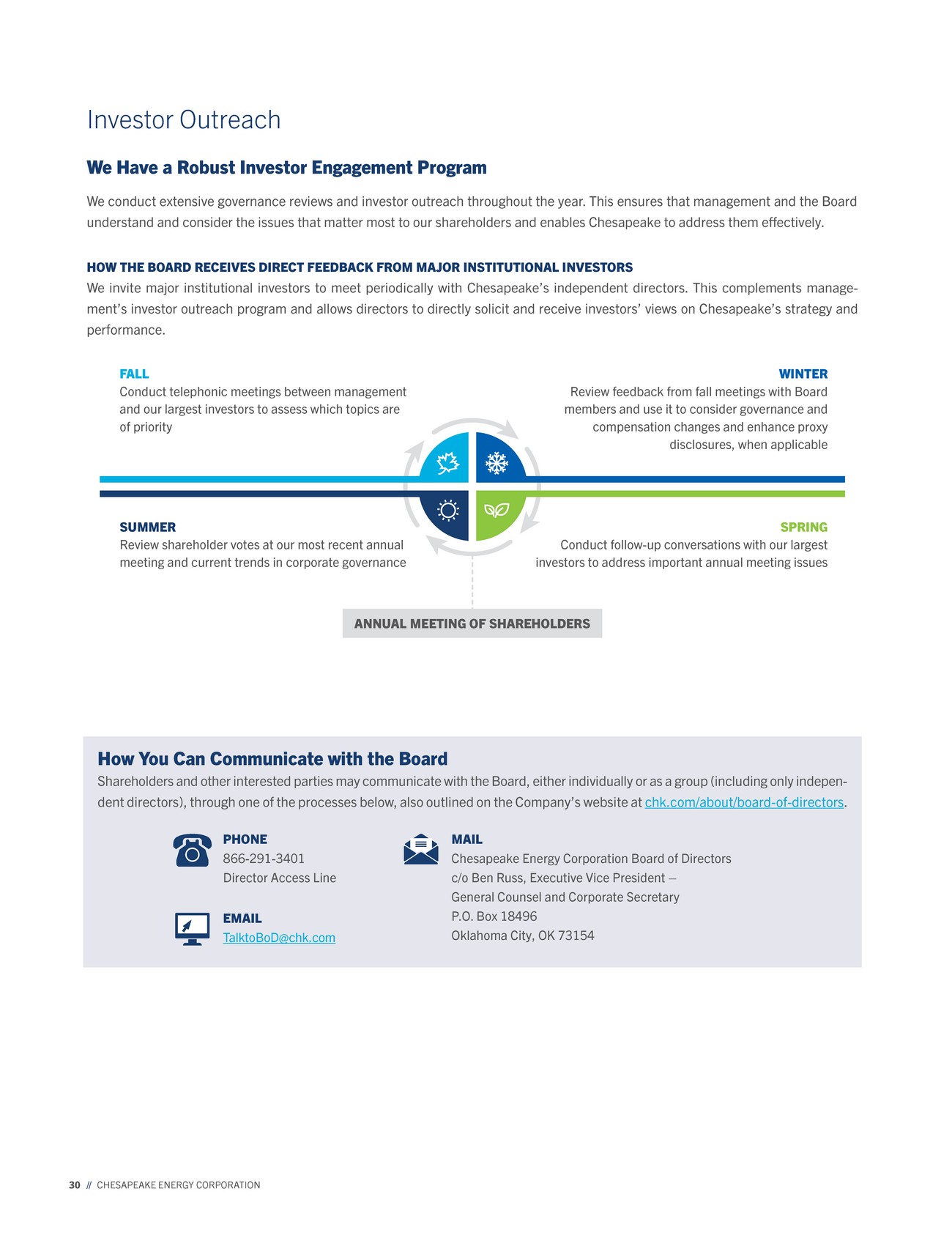

| 22 // CHESAPEAKE ENERGY CORPORATION The chart and disclosure below explain the purpose of each level of hierarchy in our leadership structure and provide additional detail on composition, meetings and activities of the Board. More detail with regard to the composition, meetings and activities of each of the committees can be found below under “Board Committees” on page 25. AUDIT COMMITTEE Purpose: Oversee financial reporting, legal compliance, internal and external audit functions and risk manage-ment systems COMPENSATION COMMITTEE Purpose: Establish and oversee compensation policies and standards that effectively attract, retain and motivate executive officers to achieve strategic and financial goals ENVIRONMENTAL AND SOCIAL GOVERNANCE COMMITTEE Purpose: Oversee ESG poli-cies, programs and practices relating to climate change, alternative energy/natural resources, safety and diversity matters NOMINATING AND CORPORATE GOVERNANCE COMMITTEE Purpose: Oversee corporate governance structure and practices, Board composi-tion and performance and corporate social responsibility matters CHESAPEAKE BOARD OF DIRECTORS Purpose: Promote the long-term success of Chesapeake for its shareholders and ensure proper oversight of management CHAIRMAN OF THE BOARD Purpose: Leads our Board and sets the tone for the Board’s culture, ensuring Board effectiveness and responsiveness to Chesapeake’s shareholders. Oversees the scheduling, preparation and agenda for each Board meeting, including executive sessions of non-employee directors, which take place at least quarterly. Members: 7 Independent: 5 2023 Meetings: 14 Responsibilities and Significant Events: • Culture of financial and managerial oversight, Board accountability and risk management • Maintain “best practice” corporate governance initiatives and accountability measures, including Board declassification, proxy access, no supermajority voting provisions and separation of Chairman and CEO roles • Development of corporate strategy focused on financial discipline and generation of operating efficiencies from captured resources • Oversee and evaluate opportunities to improve margins and liquidity, while maintaining a strong balance sheet, including: – Mergers and acquisitions – Asset sales – Capital allocation – Disciplined utilization of assets to generate operating scale, free cash flow and improved margins – Entering/renegotiating long-term, high-value contracts, including GP&T agreements – Return of capital through cash dividends and equity repurchases via open market and/or negotiated transactions – Credit facility amendments – Hedging activities • Development of an executive compensation plan that appropriately ties executive pay to Company performance • Full Board review and evaluation of significant Company risks at each regular meeting, including commodity prices, significant ESG issues and enterprise risk management • Oversee and monitor workplace safety and environmental matters |

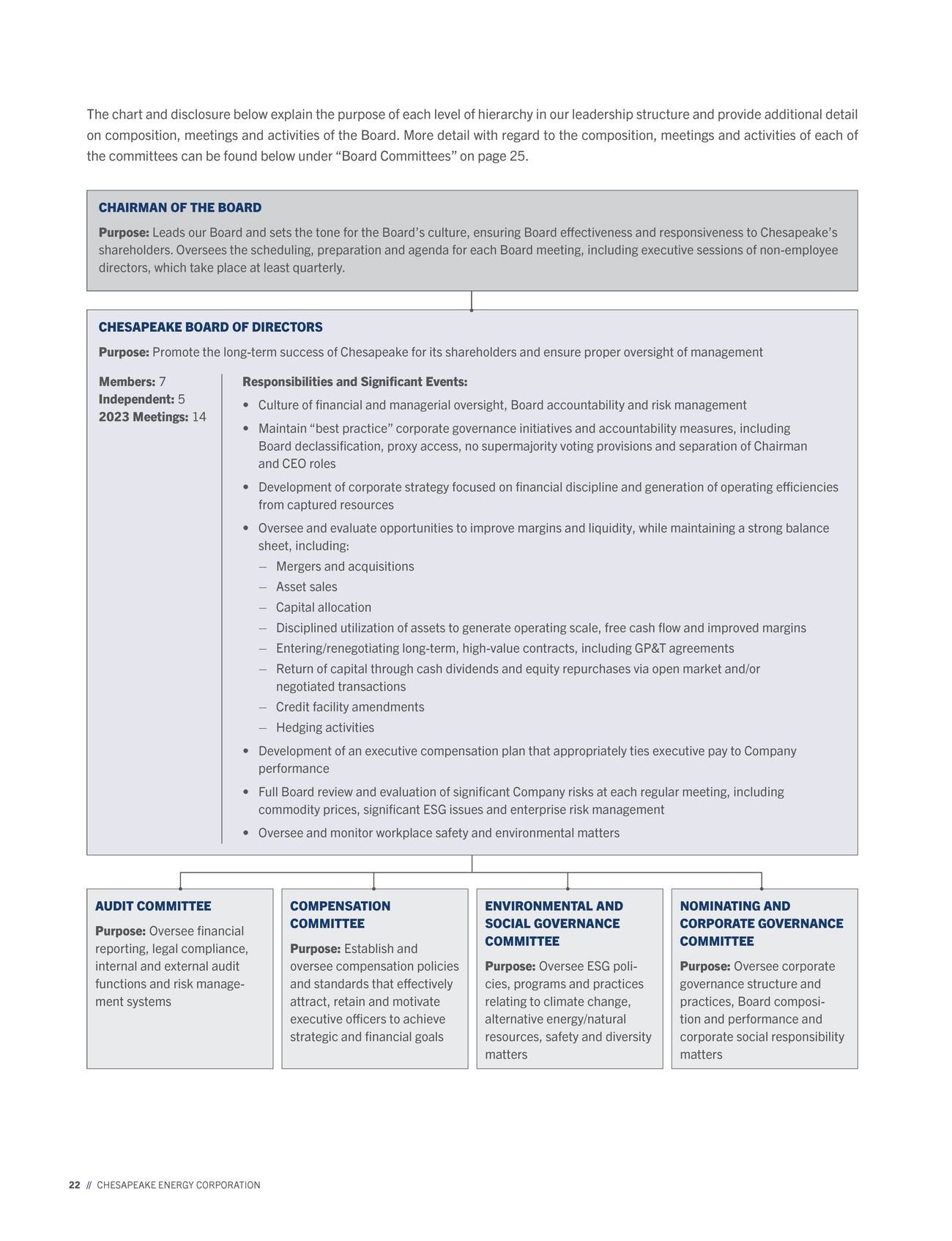

| GOVERNANCE // 23 Outside of formal Board and committee meetings, management frequently discusses matters with directors on an informal basis. Non-employee directors meet in executive sessions, without management, before and after each regularly scheduled Board meeting. Messrs. Wichterich and Gallagher preside over all executive sessions. Each director attended, either in person or by telephone conference, at least 97% of the Board and committee meetings held while serving as a director or committee member in 2023. We expect all serving directors to attend Annual Meetings of Shareholders. WHY OUR BOARD LEADERSHIP STRUCTURE IS APPROPRIATE FOR CHESAPEAKE Our leadership structure allows the CEO to speak for Chesapeake’s management, while providing for effective independent Board oversight led by our Chairman and lead independent director. Our CEO, Chairman and lead independent director work together to focus the independent directors’ attention on the issues of greatest importance to the Company and its shareholders. HOW WE SELECT THE CHAIRMAN The Nominating Committee considers feedback from our Board members as part of an annual self-assessment, and then makes a recommendation to the Board. Acting on this recommendation, the independent directors elected Mr. Wichterich as the Chairman and Mr. Gallagher as lead independent director. RESPONSIBILITIES OF THE CHAIRMAN The Chairman focuses on optimizing the Board’s processes and ensuring that the Board is prioritizing the right matters. Specifically, he has the following responsibilities (and may also perform other functions at the Board’s request), as detailed in the Board’s Gover-nance Principles:* 1 Board leadership Chairs all Board meetings 2 Oversight of all meetings Oversees quarterly Board meetings and calls additional Board or independent director meetings as needed 3 Leadership of executive sessions Leads executive sessions of the Board, without any management directors or Chesapeake employees present (unless invited), which are held at each quarterly Board meeting and as needed at other periodic meetings (in addition to the numerous informal sessions that occur throughout the year) 4 Serves as liaison between CEO and independent directors Regularly meets with and serves as liaison between the CEO and independent directors 5 Shareholder communications Makes himself available for direct communication with our major shareholders 6 Board discussion items Works with the independent directors/committee chairs, CEO and management to propose a quarterly schedule of major Board discussion items 7 Board agenda, schedule and information Approves the agenda, schedule and information sent to directors 8 Board governance processes Works with the Nominating Committee to guide the Board’s governance processes, including succession planning and the annual Board self-evaluation 9 Board leadership structure review Oversees the Board’s periodic review and evaluation of its leadership structure 10 Evaluation of CEO Oversees annual CEO evaluation 11 Committee chair and member selection Advises the Nominating Committee in choosing committee chairs and membership *If the Chairman is unavailable, the lead independent director performs these functions. |

| 24 // CHESAPEAKE ENERGY CORPORATION BOARD/COMMITTEE MEETINGS Board members had near perfect attendance at Board and com-mittee meetings held during 2023, as summarized in the chart below, with each director attending at least 97% of the meetings held by the Board and committees on which the member served during the period the member was on the Board or committee. Director Attendance ANNUAL MEETING OF SHAREHOLDERS Pursuant to our Corporate Governance Guidelines, directors are expected to attend the Annual Meeting. All of our directors attended the 2023 Annual Meeting of Shareholders. As dictated by our core values (as discussed above), the Board has established a boardroom culture that results in informed deci-sions through meaningful and robust discussion, where views are readily challenged based on each director’s diverse background and opinions. The directors are expected to, and do, ask hard questions of management. Each member of the Board is committed to maximizing shareholder value and promoting shareholder interests. The Board’s key areas of focus are on our strategy and vision, enhancing financial and management oversight, Board accountability and risk management. The Board has demonstrated its focus through the following actions: • Development of a corporate strategy focused on financial discipline, operating efficiencies and the generation of free cash flow, particularly in an era of challenging commodity prices • Approval and execution of proposals to implement leading corporate governance practices related to Board accountability, includ-ing Board declassification, proxy access and removal of supermajority voting provisions • Development of an executive compensation program that appropriately ties short-term executive pay to short-term goals and long-term pay to the Company’s stock performance and other long-term metrics (see “Executive Compensation — Compensation Discussion and Analysis” on page 34) • Full Board review and evaluation of significant Company risks at each regular meeting, including commodity price and HSER risks (see “How We Oversee and Manage Enterprise Risk” on page 27) Board Culture and Focus How We Evaluate the Board’s Effectiveness ANNUAL EVALUATION PROCESS Each year, directors complete written assessments and the Chair of the Nominating Committee interviews each director to obtain his or her assessment of director performance, Board dynamics, and the effectiveness of the Board and its committees. The Chairman summarizes the directors’ assessments for discussion at executive sessions of the Board and its committees. For more information on this evaluation process, see the Nominating Committee’s Charter and the Board’s Corporate Governance Principles, which are available on our website at chk.com/about/board-of-directors. 0 2 6 10 12 14 Board Audit Compensation ESG Number of meetings in 2023 Near perfect overall attendance Nominating 99% 100% 100% 100% 4 8 100% 99.3% 0 2 6 10 12 14 Board Audit Compensation ESG Number of meetings in 2023 Near perfect overall attendance Nominating 99% 100% 100% 100% 4 8 100% 99.3% BOARD/COMMITTEE ATTENDANCE Each director nominee attended at least 97% of the meetings of the Board and committees on which he or she served in 2023. |

| GOVERNANCE // 25 COMMITTEE CHARTERS COMMITTEE COMPOSITION COMMITTEE OPERATIONS COMMITTEE RESPONSIBILITIES Each committee has a charter that can be found on our website at chk.com/about/ board-of-directors. Each committee member satisfies Nasdaq’s and Chesapeake’s definitions of an “independent director,” and all three members of the Audit Committee are “audit committee financial experts” (as defined under SEC rules), in each case as determined by the Board. Each committee meets quar-terly, and periodically as need-ed throughout the year, reports its actions and recommenda-tions to the Board, receives reports from senior manage-ment, annually evaluates its performance and has the authority and funding to retain outside advisors. Committee chairs have the opportunity to call for executive sessions at each meeting. The primary responsibilities of each committee are listed below (and committee responsibilities relating to risk oversight are described under “How We Oversee and Manage Enterprise Risk” on page 27). For more detail, see the committee charters on our website. A significant portion of the Board’s oversight responsibilities is carried out through its four standing committees, each of which is composed solely of independent non-employee directors. A biographical overview of the members of our committees can be found under “Election of Directors” beginning on page 12. Board Committees AUDIT Benjamin C. Duster, IV Chair Members: 3 // Independent: 3 // 2023 Meetings: 8 Audit Committee Financial Experts: 3 Key Oversight Responsibilities: • Independent auditor engagement • Integrity of financial statements and financial disclosure • Financial reporting and accounting standards • Disclosure and internal controls • Enterprise risk management program • Compliance with legal and regulatory requirements • Oversight of corporate compliance and Director of Internal Audit, who reports directly to the Audit Committee • Compliance and integrity programs • Internal audit functions • Employee/vendor anonymous hotline • Cybersecurity • Related party transactions Members: Benjamin C. Duster, IV, Chair † Timothy S. Duncan † Matthew M. Gallagher † † Audit Committee Financial Expert COMPENSATION Brian Steck Chair Members: 3 // Independent: 3 // 2023 Meetings: 5 Key Oversight Responsibilities: • Oversight of compensation plans that attract, retain and motivate executive officers and employees • Implementation of executive compensation plan with appropriate goals and objectives • CEO and senior executive performance evaluation • Incentive compensation programs, including the 2021 Long Term Incentive Plan • Broad-based plans available to all employees, including 401(k) plan and health-benefit plans • Compensation of non-employee directors • Establishment and monitoring of compliance with share own-ership guidelines applicable to executive officers and directors Members: Brian Steck, Chair Timothy S. Duncan Benjamin C. Duster, IV |

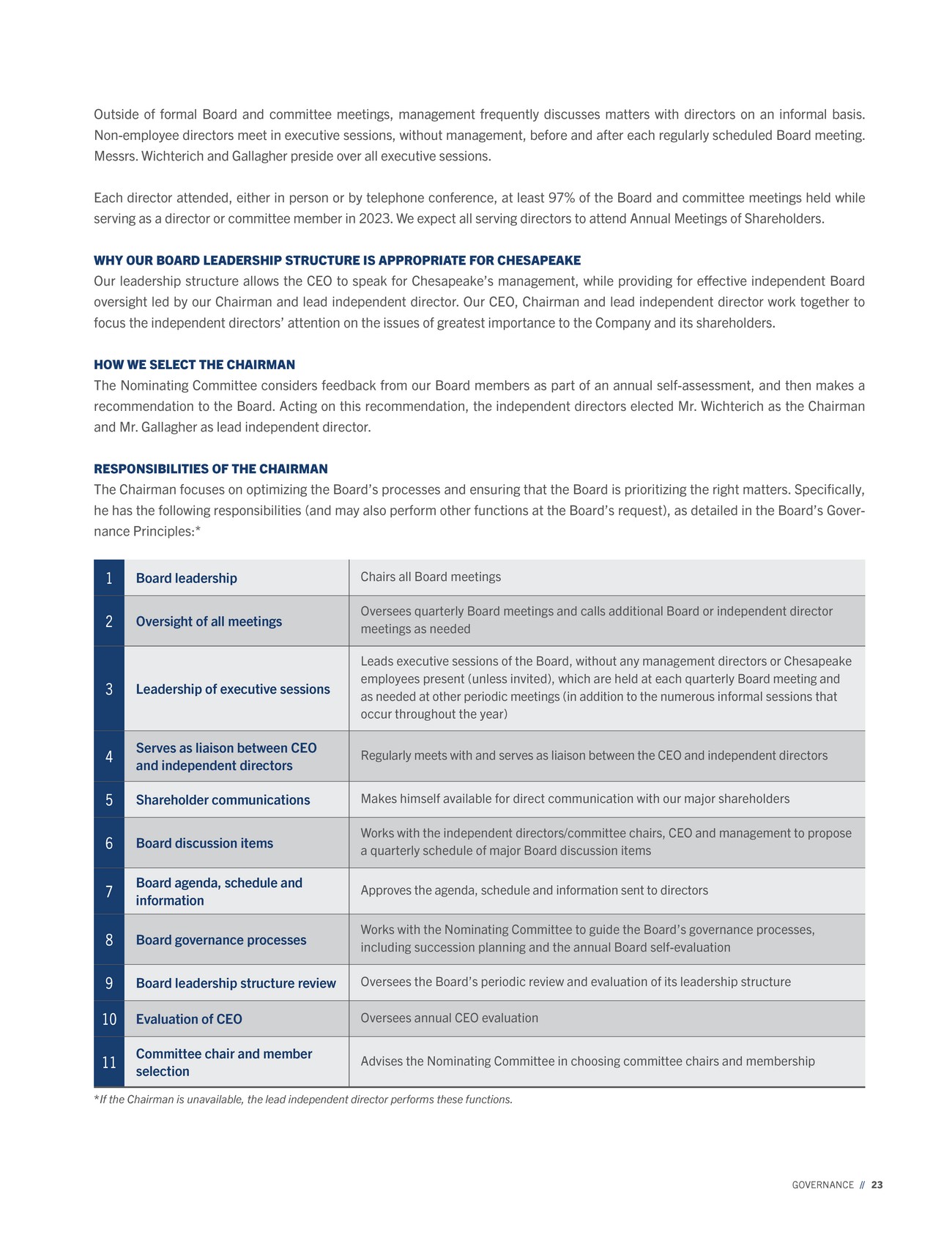

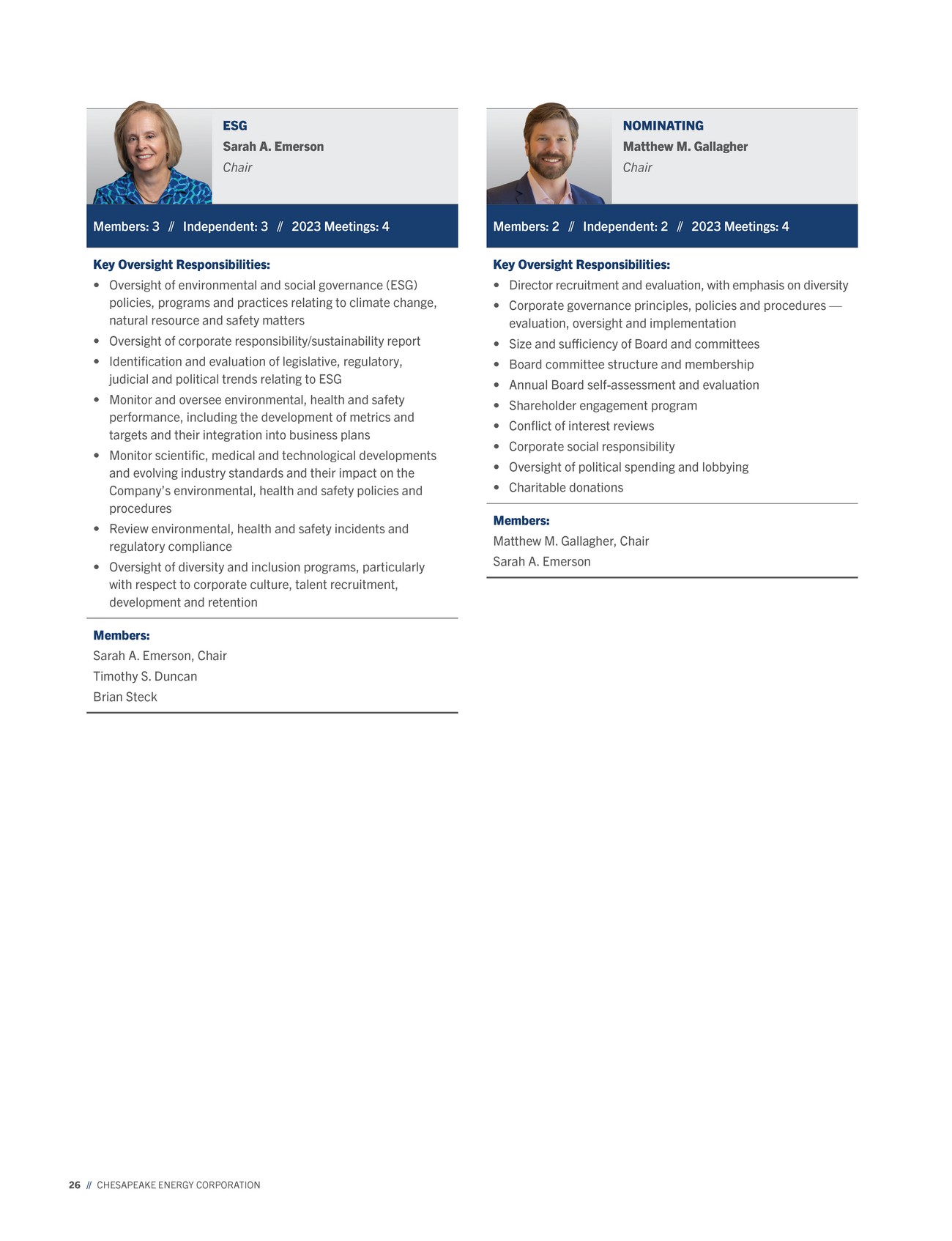

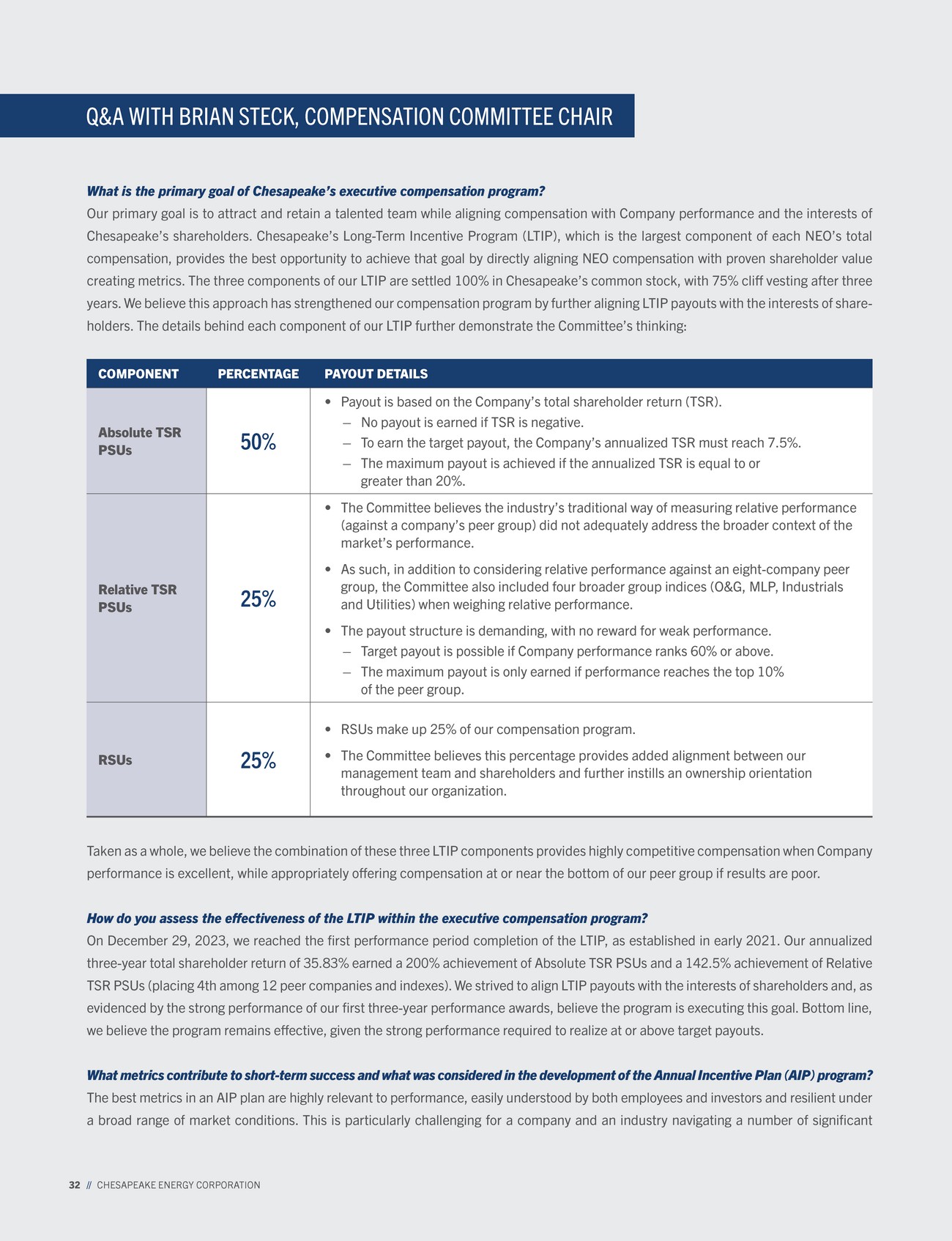

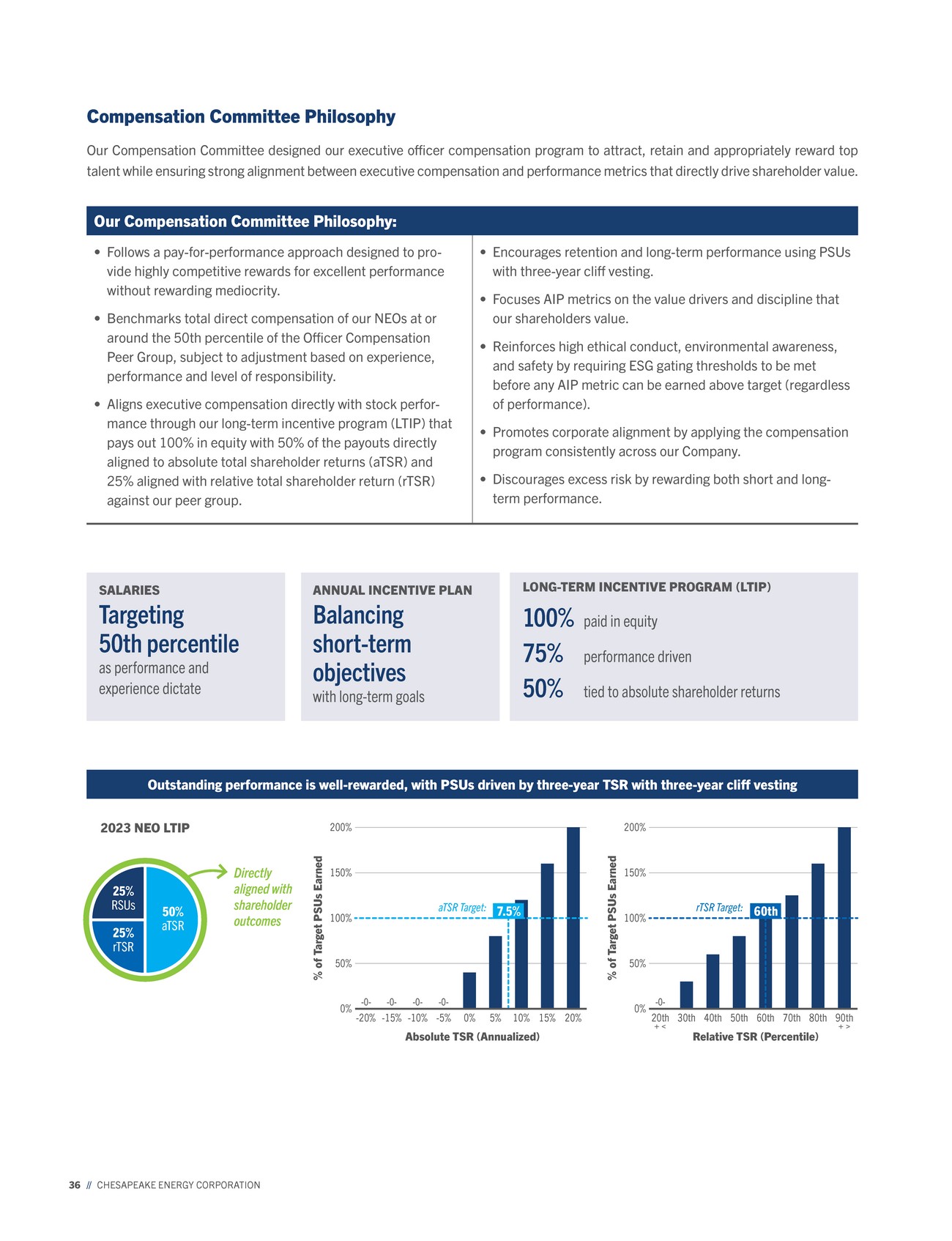

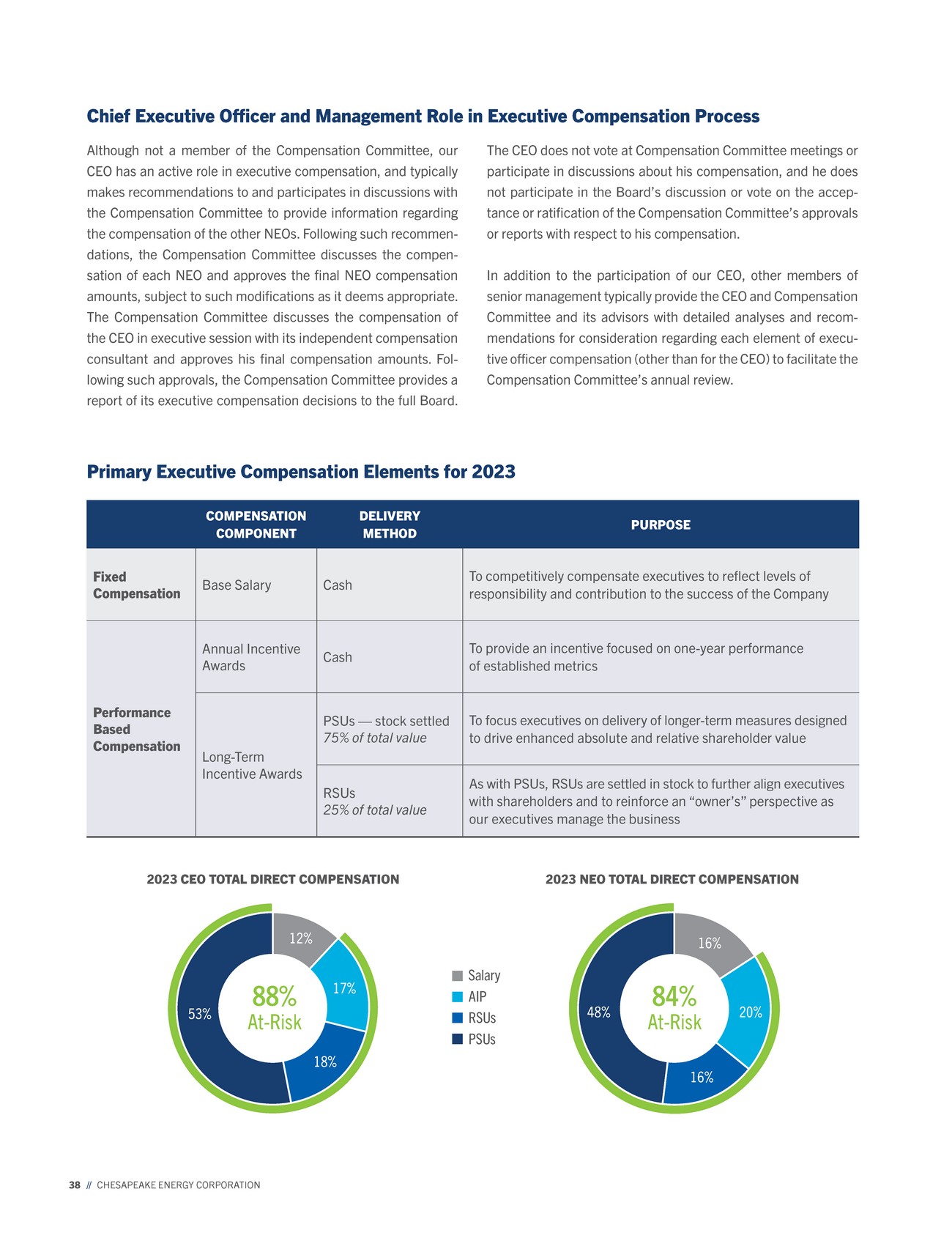

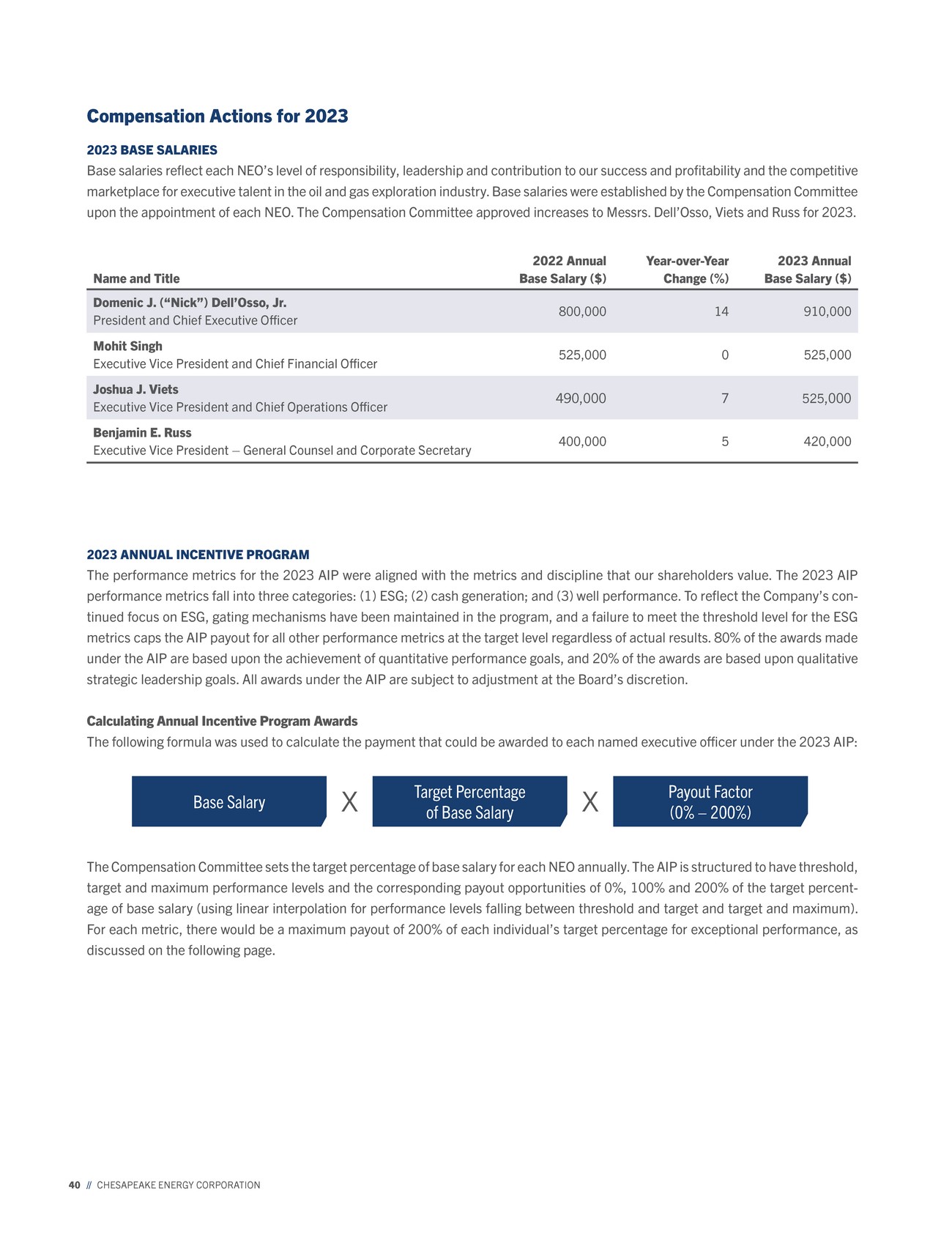

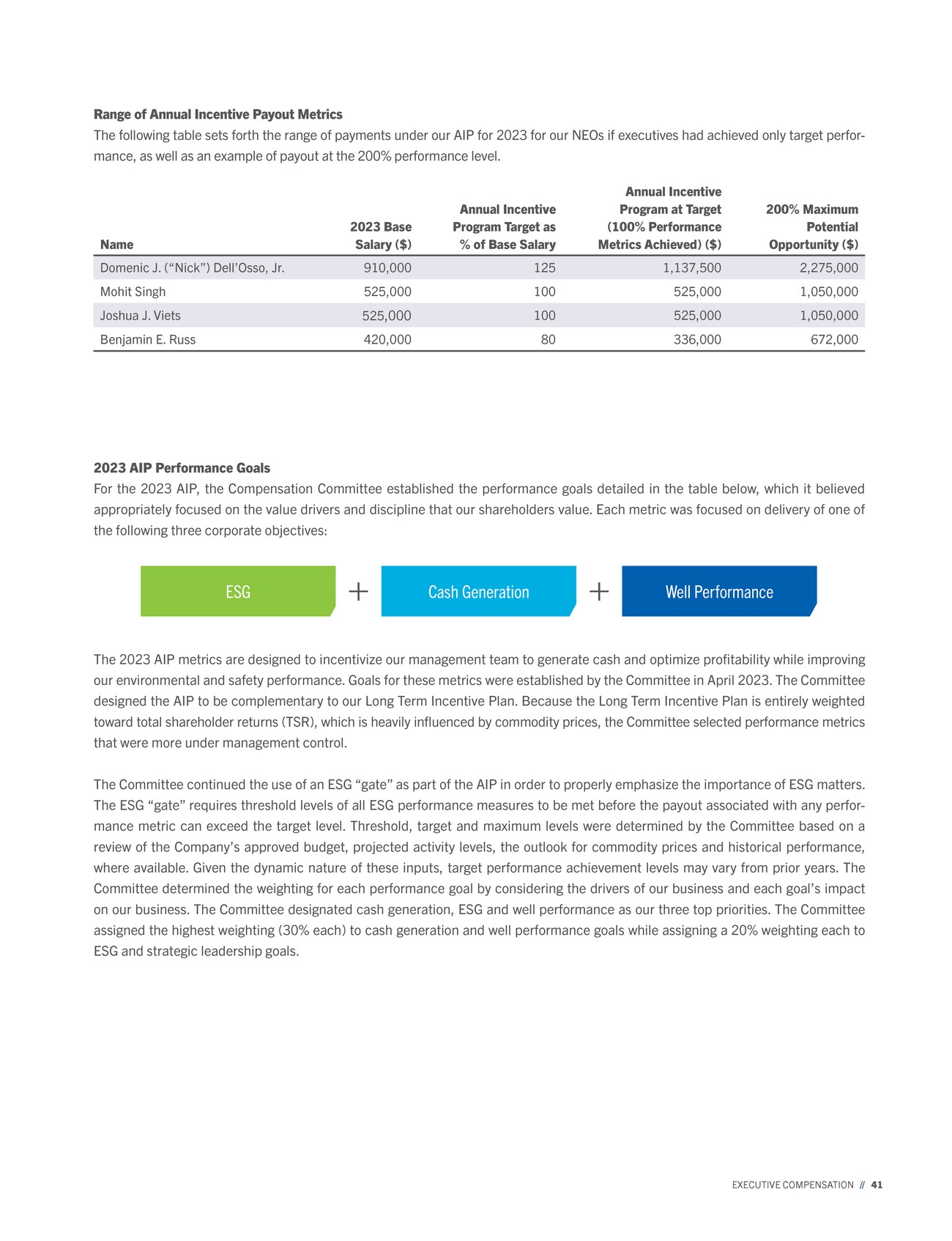

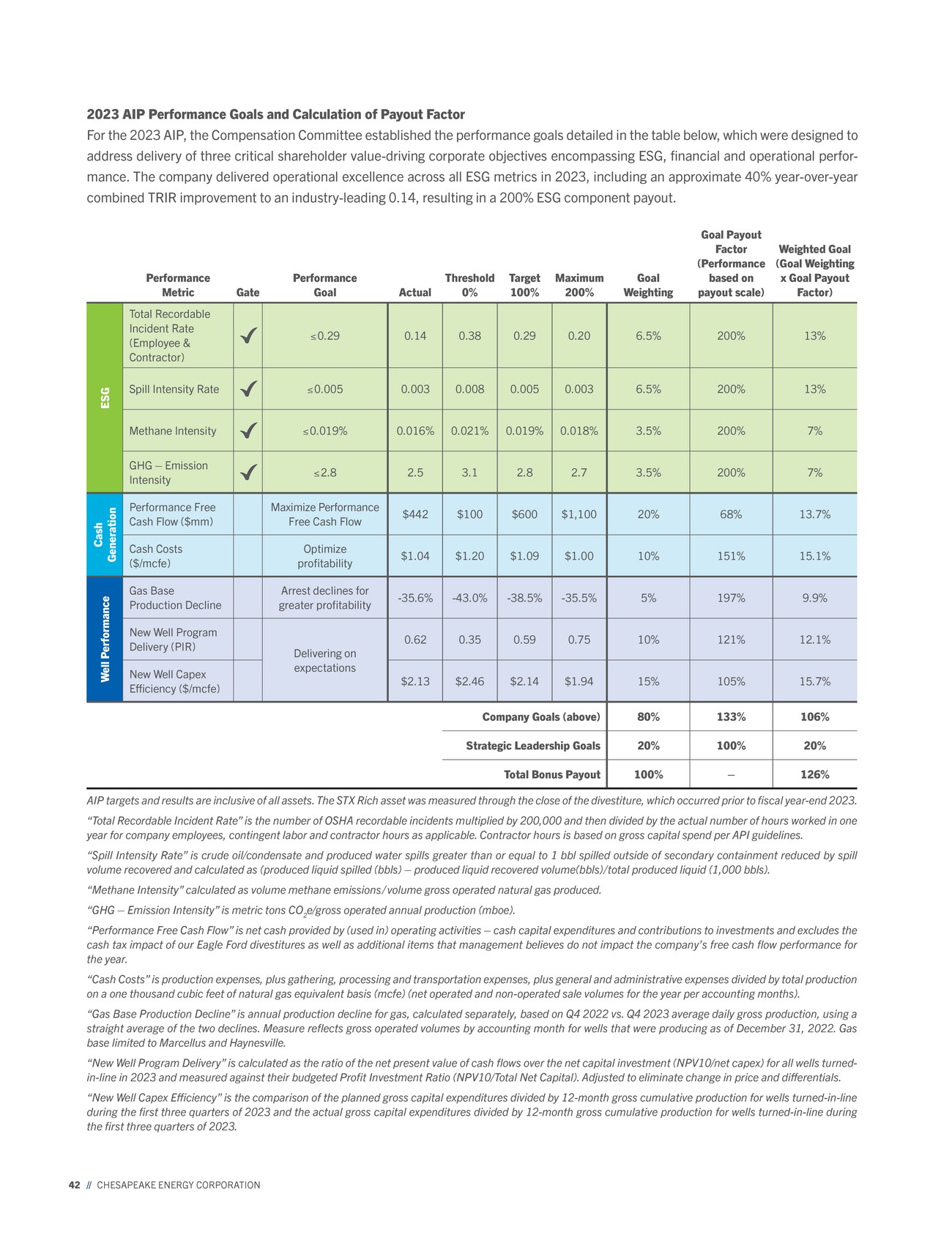

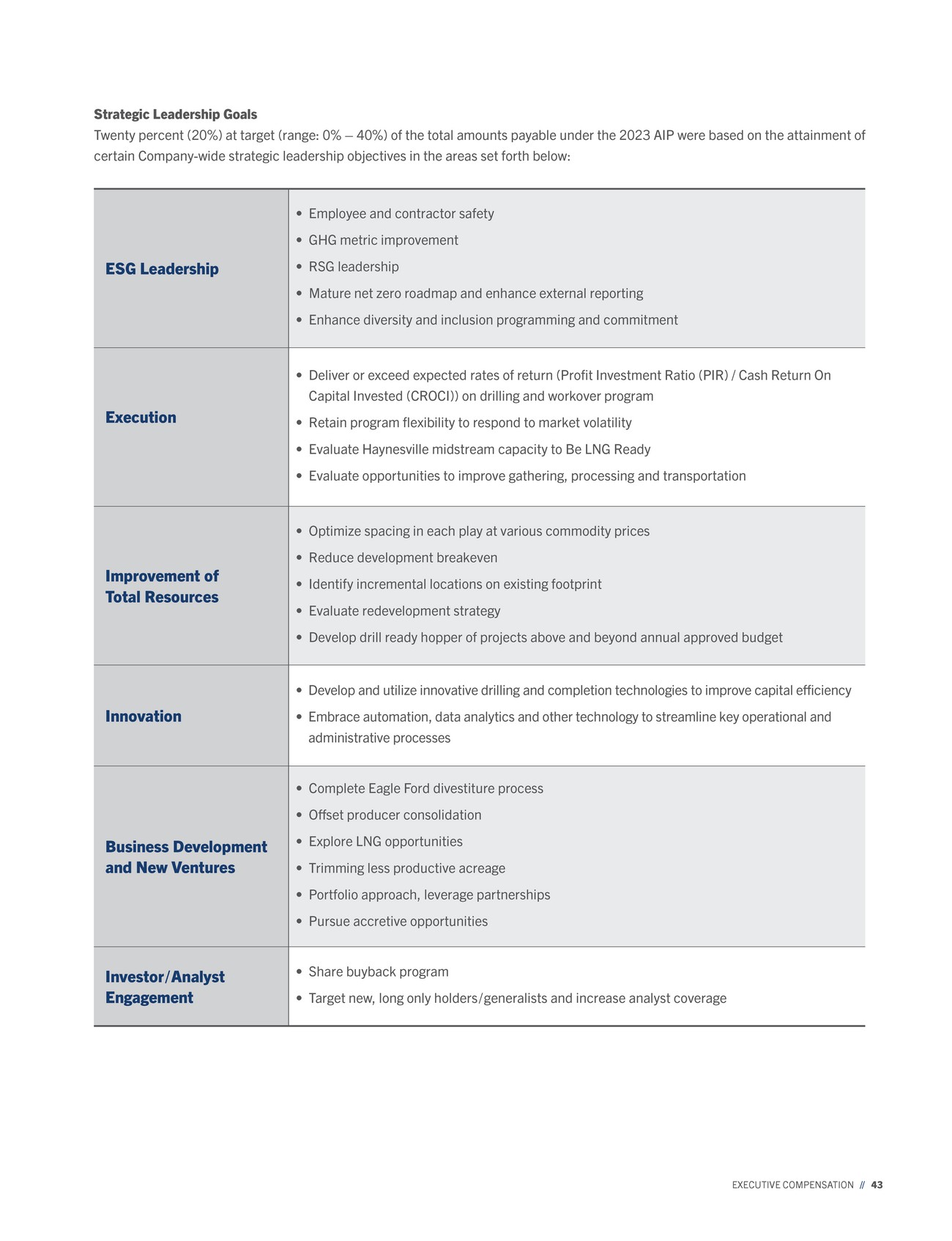

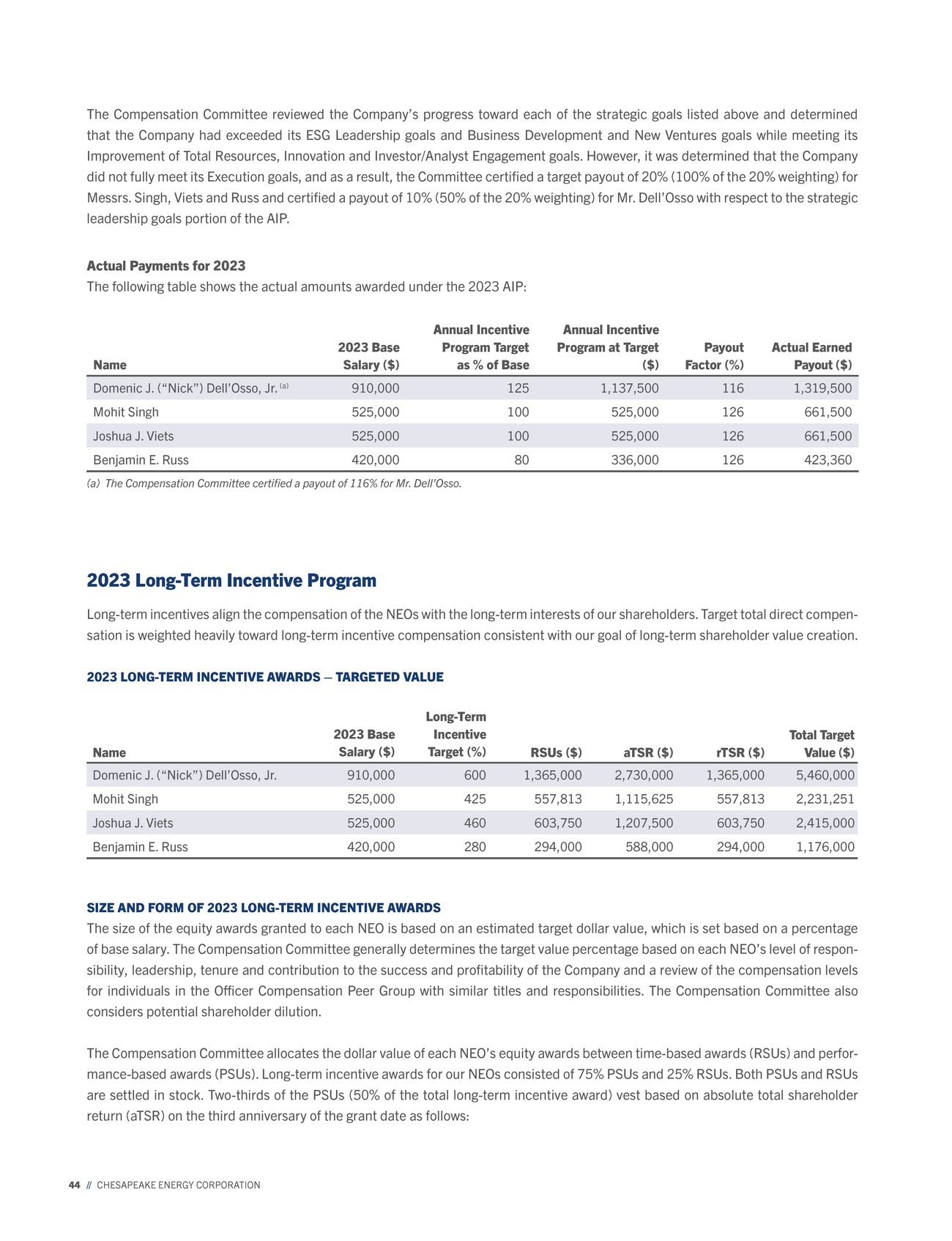

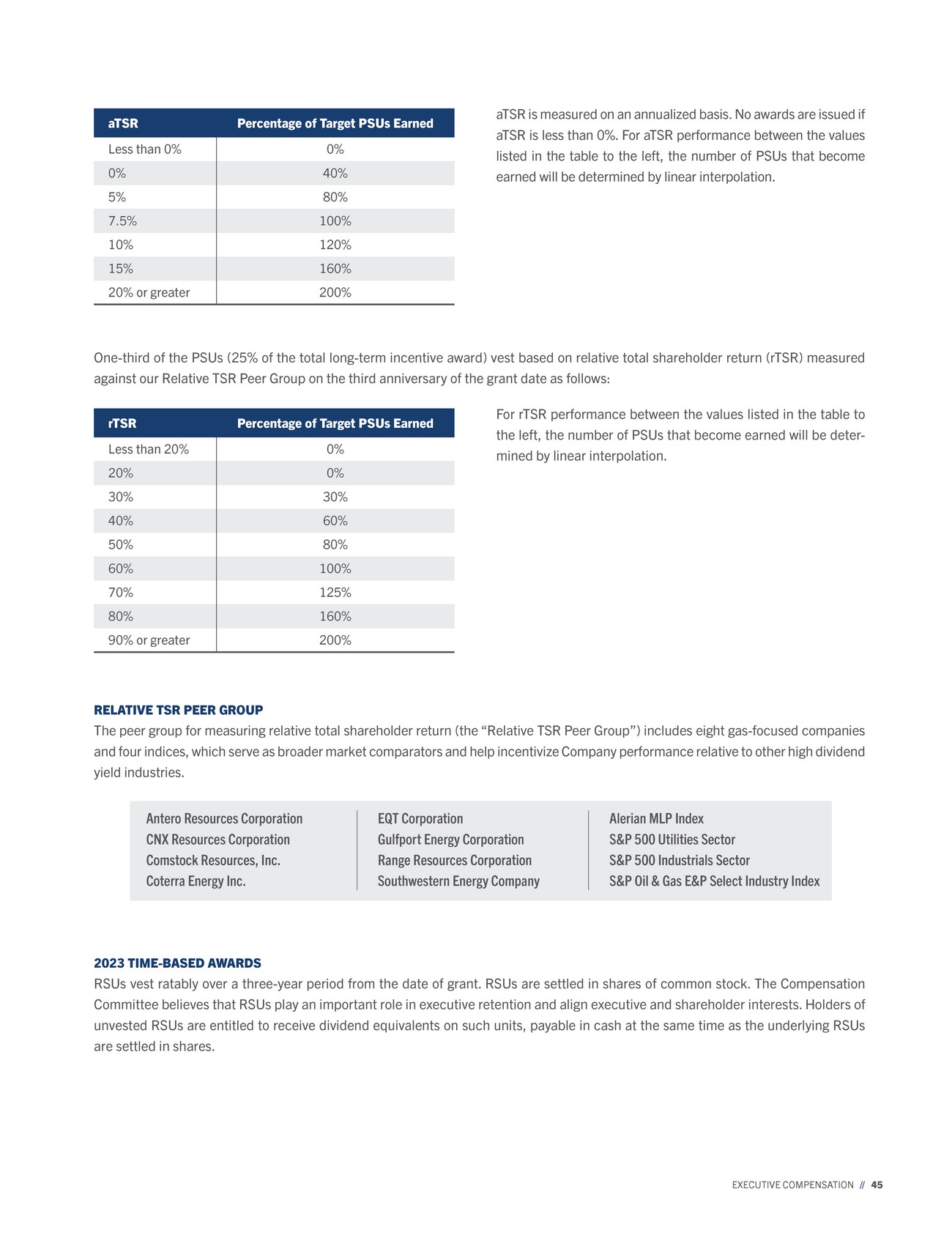

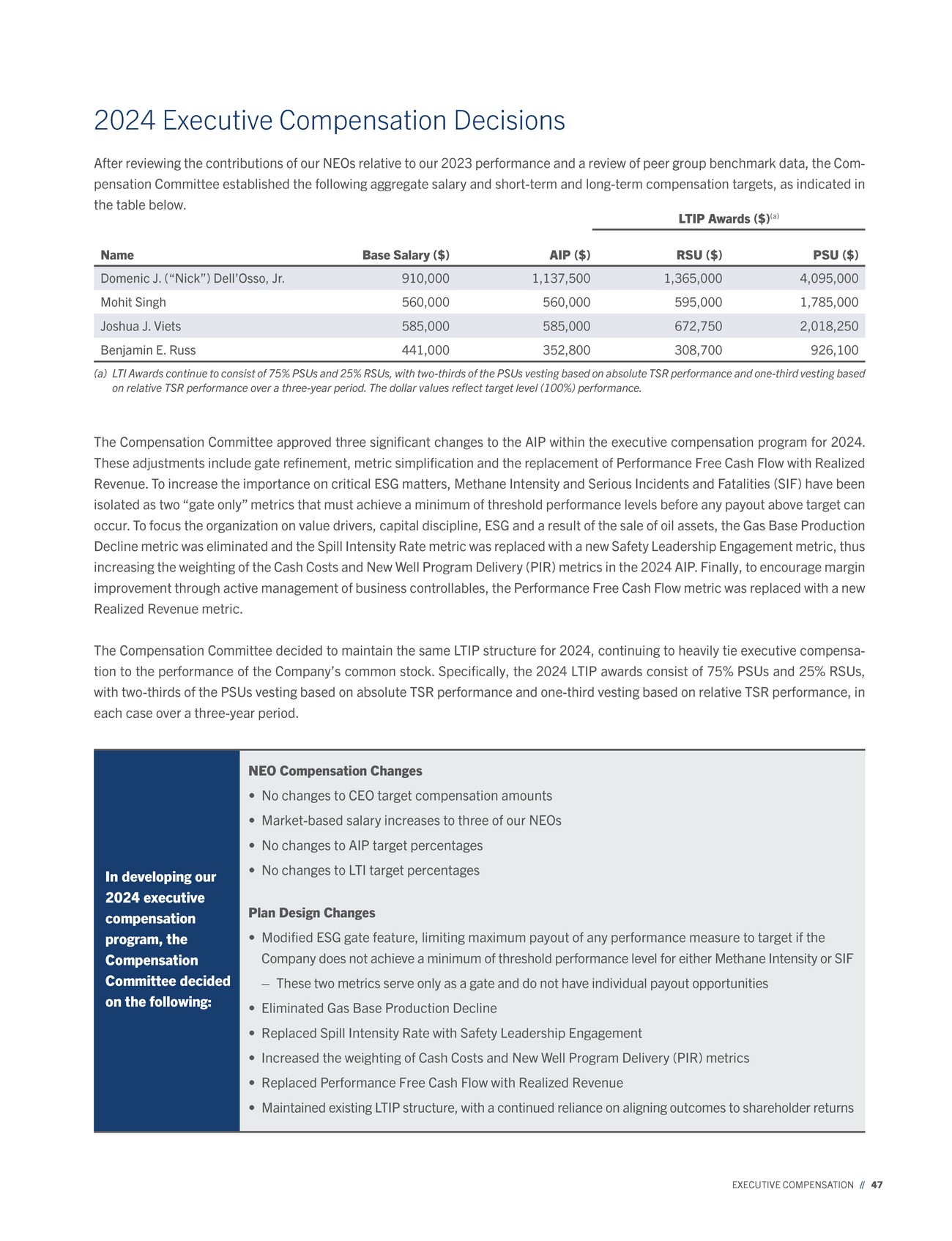

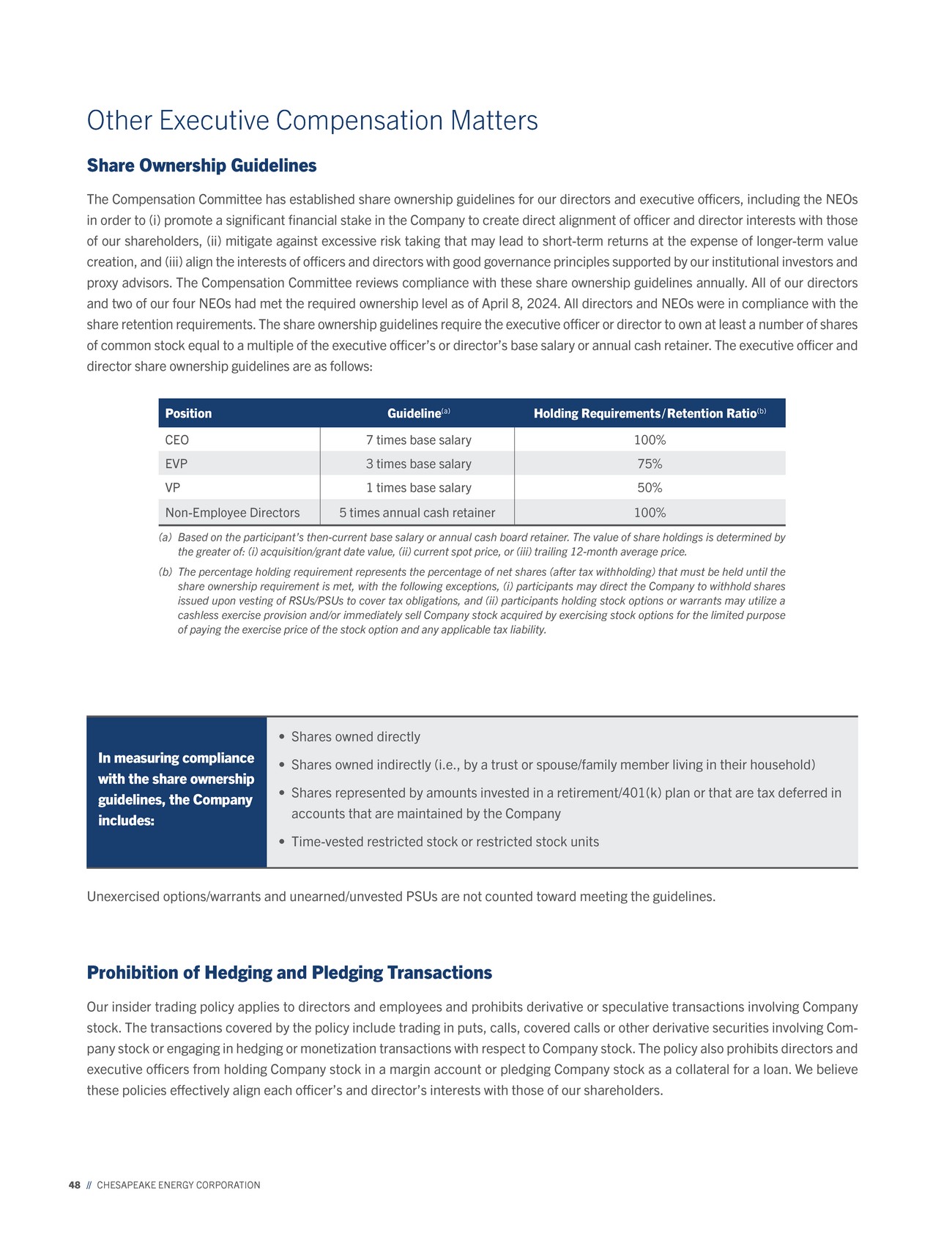

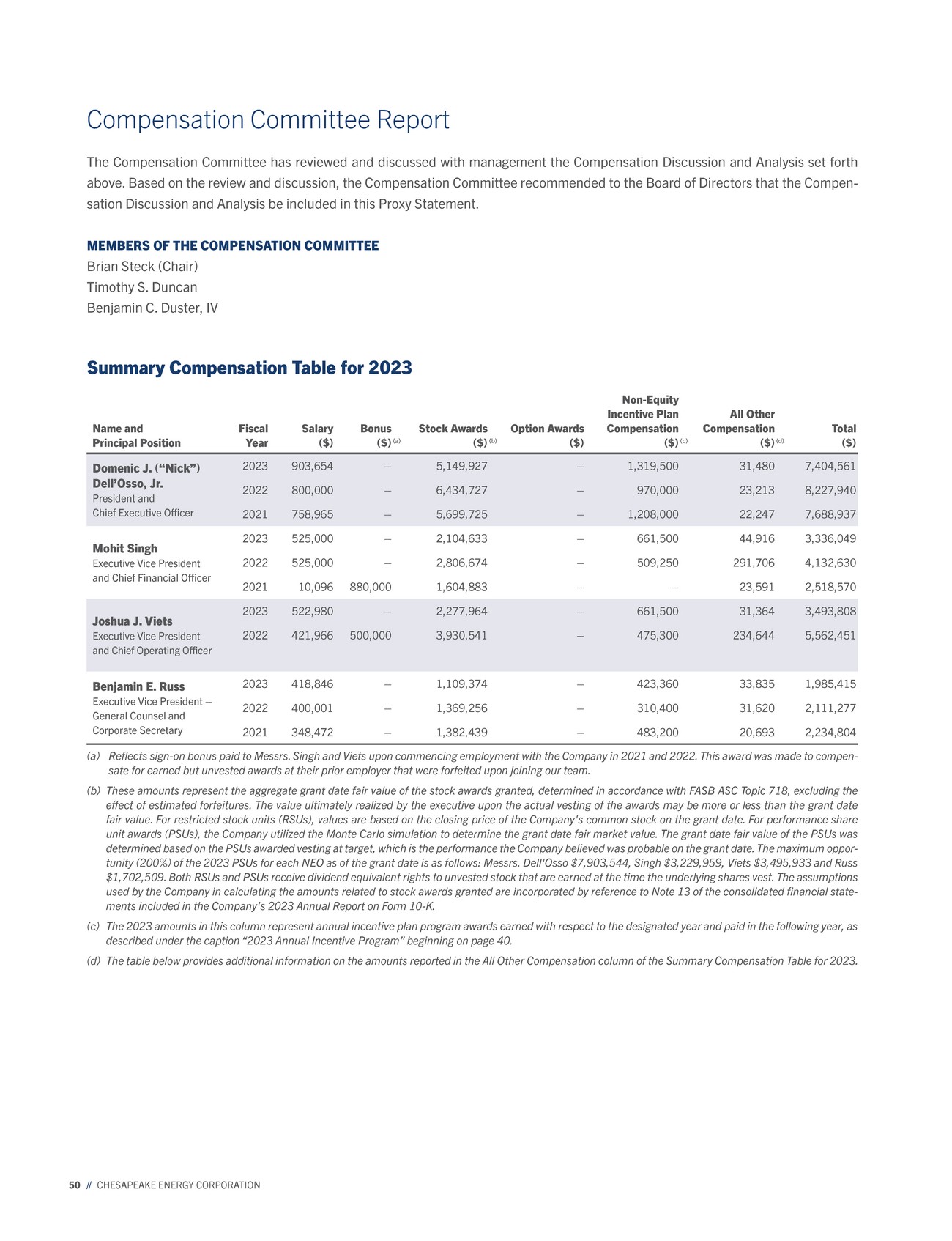

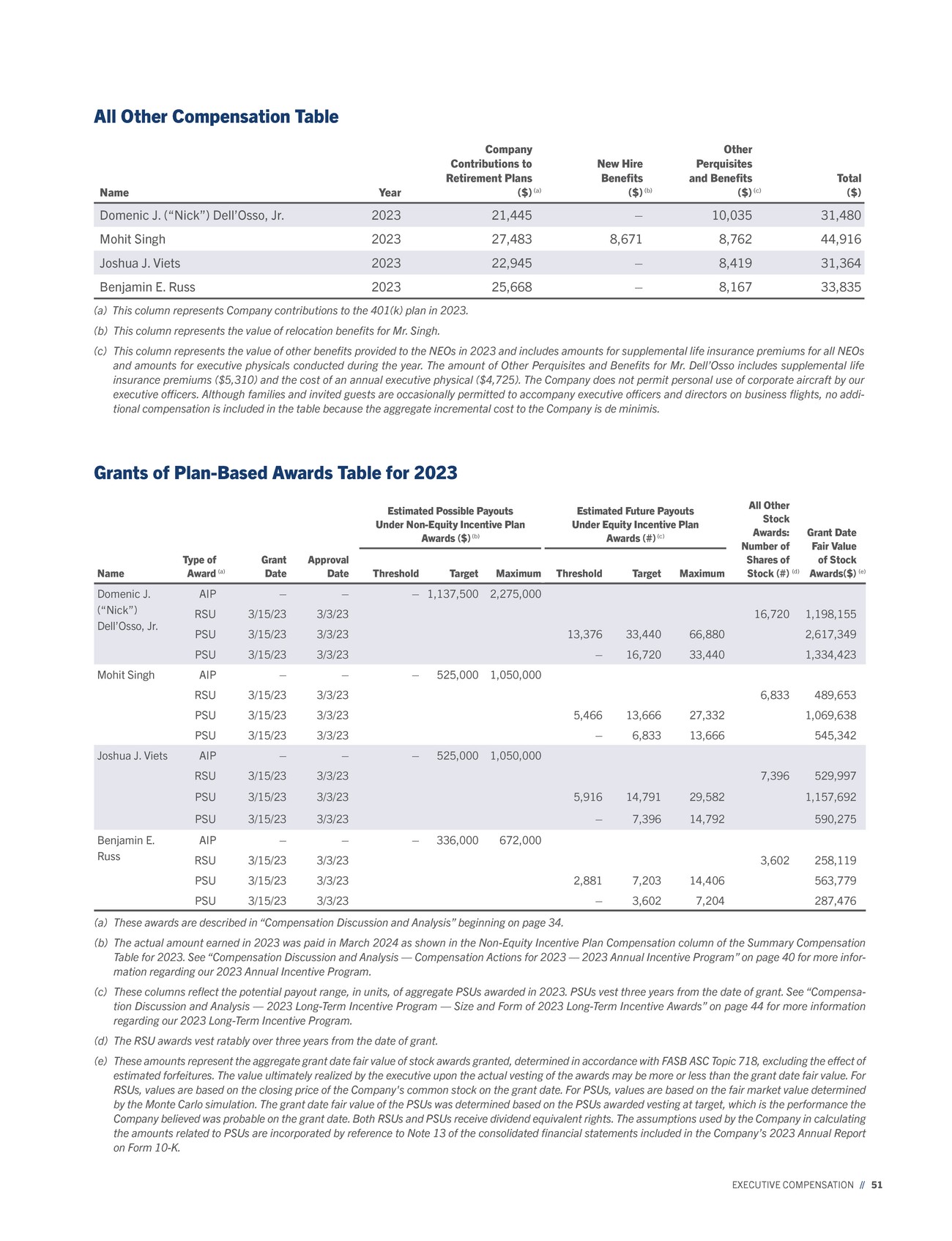

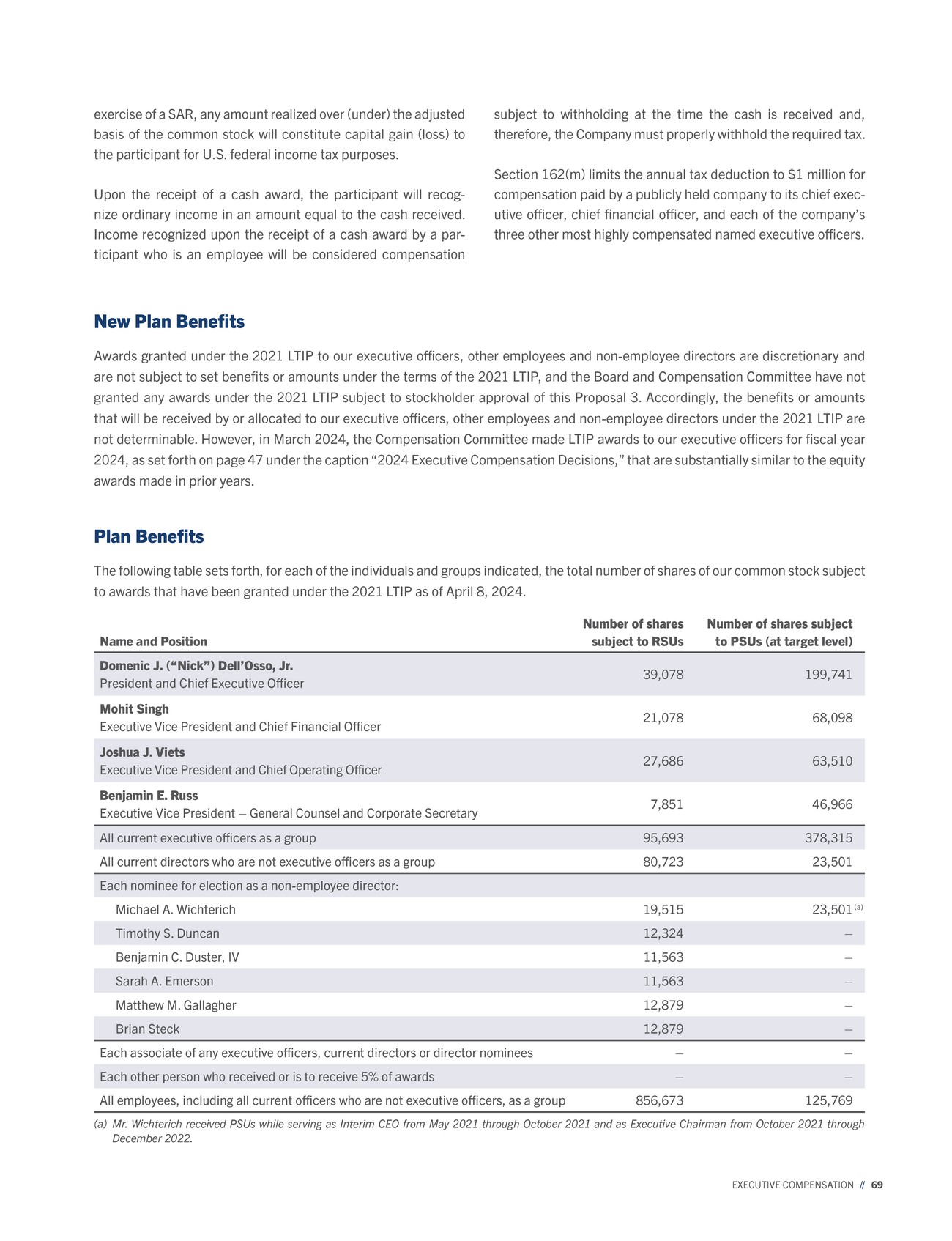

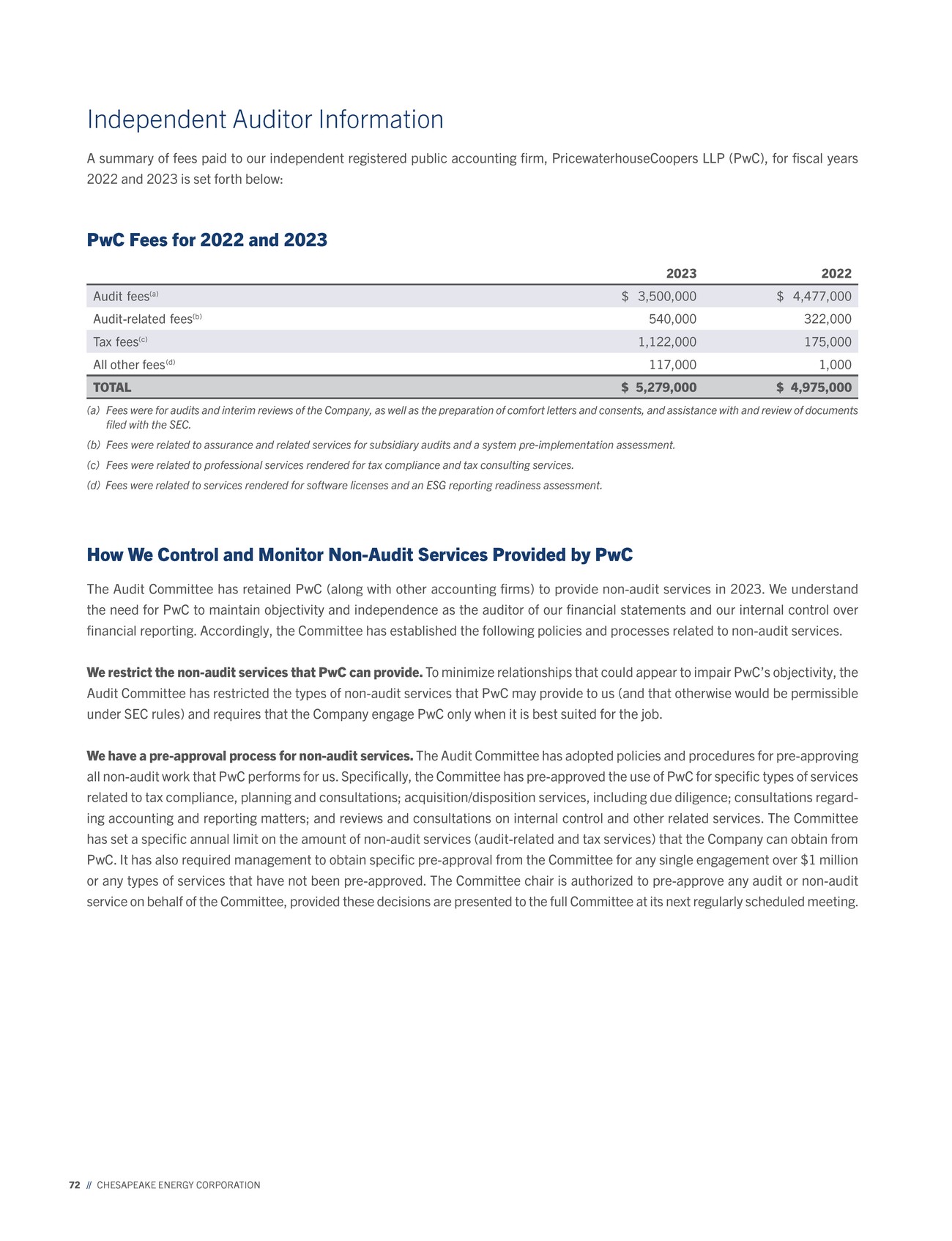

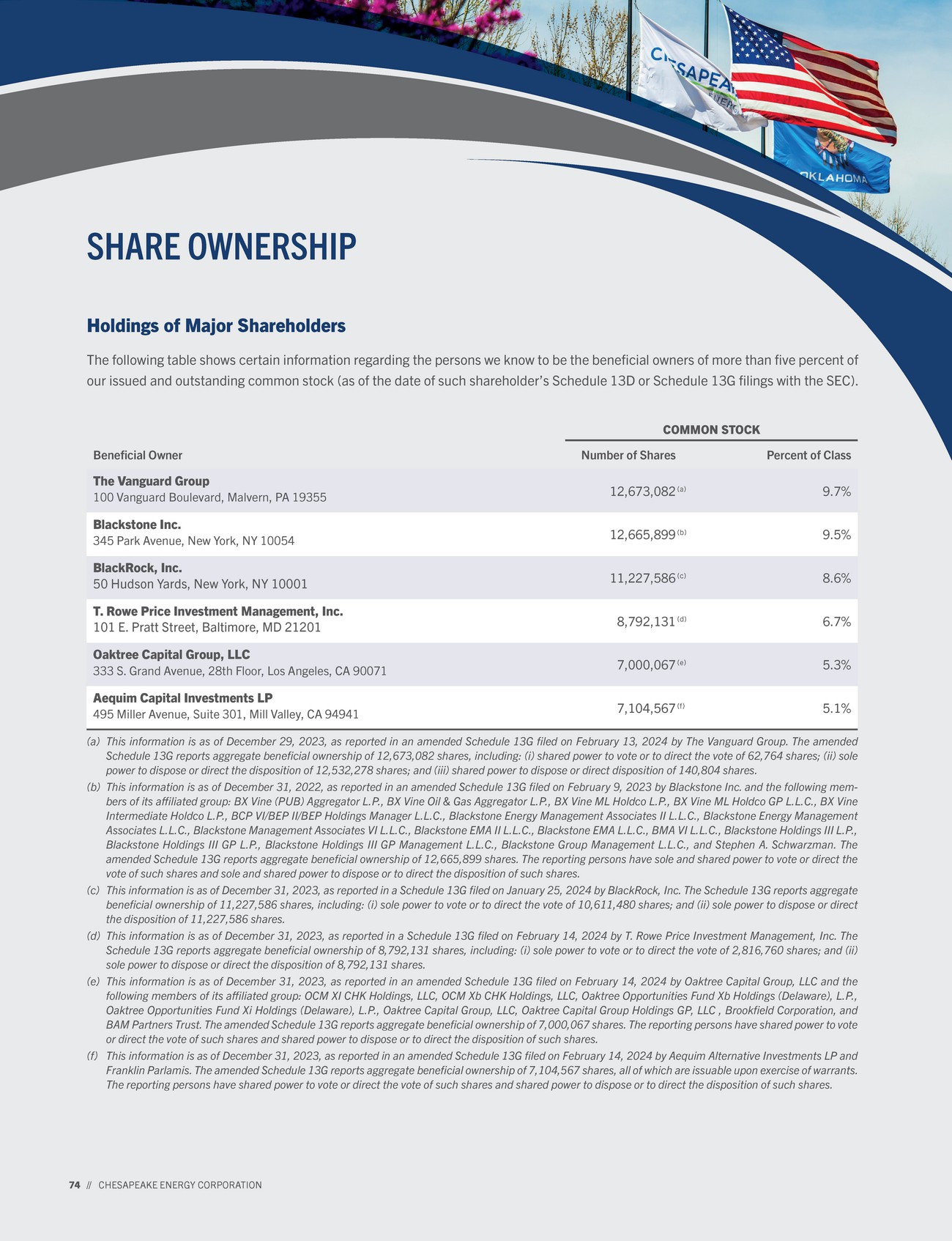

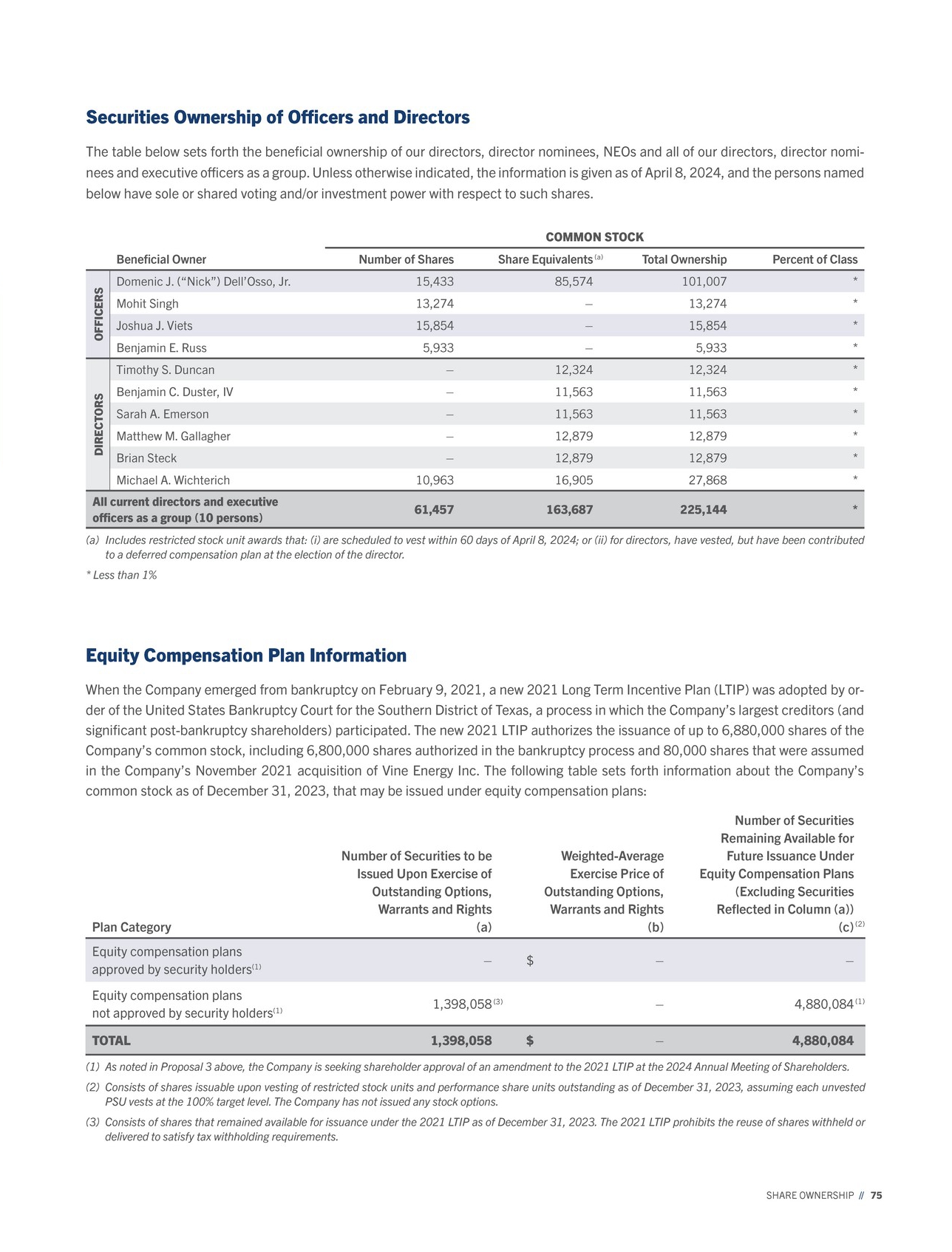

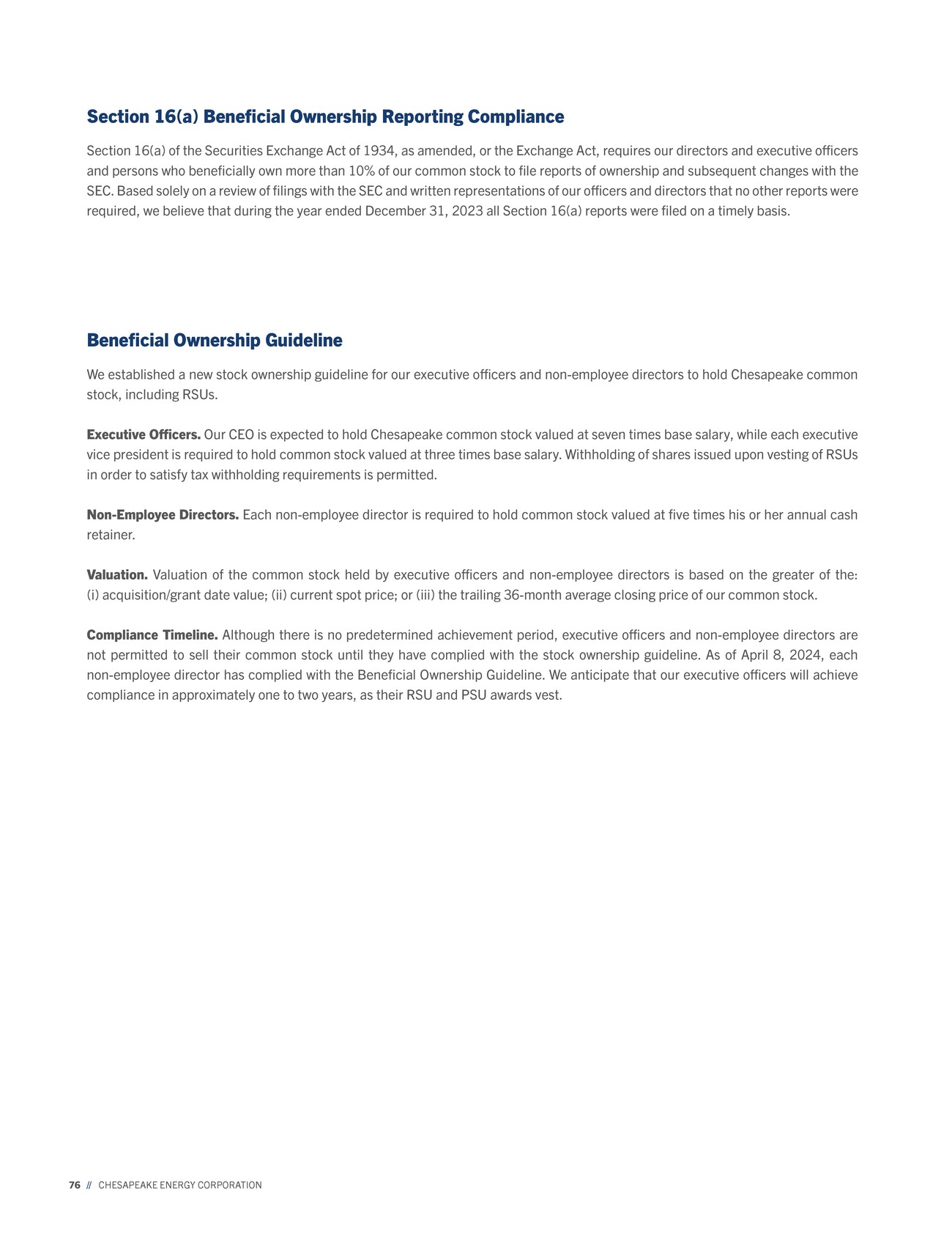

| 26 // CHESAPEAKE ENERGY CORPORATION NOMINATING Matthew M. Gallagher Chair Members: 2 // Independent: 2 // 2023 Meetings: 4 Key Oversight Responsibilities: • Director recruitment and evaluation, with emphasis on diversity • Corporate governance principles, policies and procedures — evaluation, oversight and implementation • Size and sufficiency of Board and committees • Board committee structure and membership • Annual Board self-assessment and evaluation • Shareholder engagement program • Conflict of interest reviews • Corporate social responsibility • Oversight of political spending and lobbying • Charitable donations Members: Matthew M. Gallagher, Chair Sarah A. Emerson ESG Sarah A. Emerson Chair Members: 3 // Independent: 3 // 2023 Meetings: 4 Key Oversight Responsibilities: • Oversight of environmental and social governance (ESG) policies, programs and practices relating to climate change, natural resource and safety matters • Oversight of corporate responsibility/sustainability report • Identification and evaluation of legislative, regulatory, judicial and political trends relating to ESG • Monitor and oversee environmental, health and safety performance, including the development of metrics and targets and their integration into business plans • Monitor scientific, medical and technological developments and evolving industry standards and their impact on the Company’s environmental, health and safety policies and procedures • Review environmental, health and safety incidents and regulatory compliance • Oversight of diversity and inclusion programs, particularly with respect to corporate culture, talent recruitment, development and retention Members: Sarah A. Emerson, Chair Timothy S. Duncan Brian Steck |