SECURITIES AND EXCHANGE COMMISSION

TO

UNDER

THE SECURITIES ACT OF 1933

| |

Oklahoma

(State or other jurisdiction of incorporation or organization) |

| |

1311

(Primary Standard Industrial Classification Code Number) |

| |

73-1395733

(I.R.S. Employer Identification No.) |

|

Oklahoma City, Oklahoma

(405) 848-8000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Executive Vice President - Chief Financial Officer

6100 North Western Avenue

Oklahoma City, Oklahoma 73118

(405) 848-8000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| |

William N. Finnegan IV

Kevin M. Richardson Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, Texas 77002 (713) 546-5400 |

| |

Benjamin E. Russ

Chesapeake Energy Corporation 6100 North Western Avenue Oklahoma City, Oklahoma 73118 (405) 848-8000 |

| |

Jonathan C. Curth

Vine Energy Inc. 5800 Granite Parkway, Suite 550 Plano, Texas 75024 (469) 606-0540 |

| |

Michael W. Rigdon

Kirkland & Ellis LLP 609 Main Street Houston, Texas 77002 (713) 836-3600 |

|

| |

Large accelerated filer

☐

|

| |

Accelerated filer

☐

|

|

| |

Non-accelerated filer

☒

|

| |

Smaller reporting company

☒

|

|

| | | | |

Emerging growth company

☐

|

|

President, Chief Executive Officer and Chairman of the Board

Vine Energy Inc.

![[MISSING IMAGE: lg_vineenergy-4clr.jpg]](lg_vineenergy-4clr.jpg)

TO BE HELD VIRTUALLY VIA THE INTERNET ON OCTOBER 28, 2021

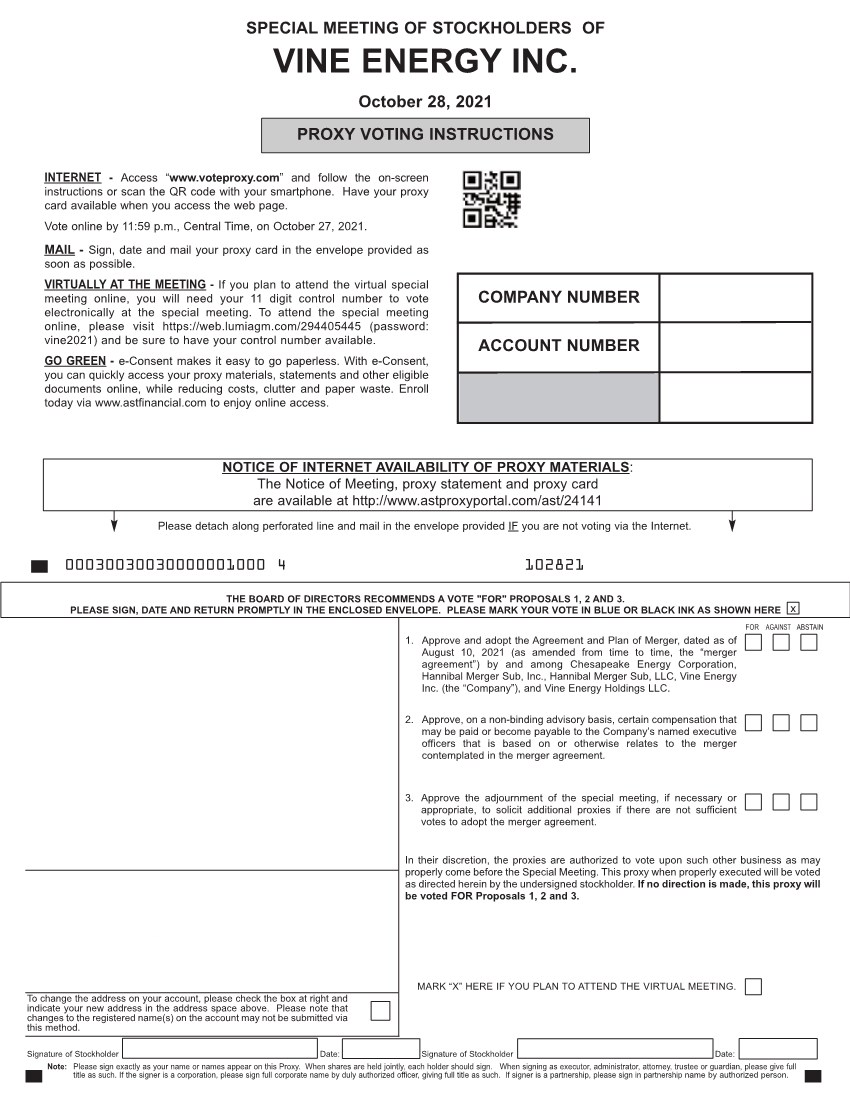

| | | Your vote is very important. Approval of the merger proposal by the Vine stockholders is a condition to the consummation of the merger and requires the affirmative vote of a majority of the outstanding shares of Vine common voting entitled to vote on the proposal. Approval of the non-binding compensation advisory proposal requires the affirmative vote of a majority of the shares of Vine common stock present in person or represented by proxy at the special meeting and entitled to vote on the proposal. Approval of the adjournment proposal requires the affirmative vote of a majority of the shares of Vine common stock present in person or represented by proxy at the special meeting and entitled to vote on the proposal. Vine stockholders are requested to complete, date, sign and return the enclosed proxy in the envelope provided, which requires no postage if mailed in the United States, or to submit their proxies by the Internet. Simply follow the instructions provided on the enclosed proxy card. Abstentions, broker non-votes and a failure to submit a proxy or vote via the Vine special meeting website will have the same effect as a vote “AGAINST” the merger proposal. | | |

President, Chief Executive Officer and Chairman of the Board

| | | |

Page

|

| |||

| | | | | ii | | | |

| | | | | ii | | | |

| | | | | iv | | | |

| | | | | 1 | | | |

| | | | | 17 | | | |

| | | | | 18 | | | |

| | | | | 30 | | | |

| | | | | 31 | | | |

| | | | | 32 | | | |

| | | | | 34 | | | |

| | | | | 35 | | | |

| | | | | 41 | | | |

| | | | | 43 | | | |

| | | | | 81 | | | |

| | | | | 111 | | | |

| | | | | 115 | | | |

| | | | | 122 | | | |

| | | | | 129 | | | |

| | | | | 139 | | | |

| | | | | 143 | | | |

| | | | | 144 | | | |

| | | | | 145 | | | |

| | | | | 146 | | | |

| | | | | 148 | | | |

| | | | | 148 | | | |

| | | | | A-1 | | | |

| | | | | B-1 | | | |

| | | | | C-1 | | | |

| | | | | D-1 | | | |

| | | | | E-1 | | | |

| | | | | F-1 | | | |

| | | | | G-1 | | | |

| |

Chesapeake Energy Corporation

6100 North Western Avenue Oklahoma City, Oklahoma 73118 Attention: Corporate Secretary Telephone: (405) 848-8000 |

| |

Vine Energy Inc.

5800 Granite Parkway, Suite 550 Plano, Texas 75024 Attention: Corporate Secretary Telephone: (469) 606-0540 |

|

5800 Granite Parkway, Suite 550

Plano, Texas 75024

Attention: Director — Investor Relations

(469) 605-2480

IR@VineEnergy.com

48 Wall Street, 22nd floor

New York, NY 10005

Call Toll-Free: (866) 387-7321

Banks and Brokers Call: (212) 269-5550

vine@dfking.com

6100 North Western Avenue

Oklahoma City, Oklahoma 73118

Phone: (405) 848-8000

c/o Chesapeake Energy Corporation

6100 North Western Avenue

Oklahoma City, Oklahoma 73118

Phone: (405) 848-8000

c/o Chesapeake Energy Corporation

6100 North Western Avenue

Oklahoma City, Oklahoma 73118

Phone: (405) 848-8000

5800 Granite Parkway, Suite 550

Phone: (615) 771-6701

| | | |

Chesapeake

Common Stock |

| |

Vine Class A

Common Stock |

| |

Implied Per Share

Value of Merger Consideration(1) |

| |||||||||

|

August 10, 2021

|

| | | $ | 55.50 | | | | | $ | 14.88 | | | | | $ | 15.00(2) | | |

|

September 17, 2021

|

| | | $ | 61.07 | | | | | $ | 16.14 | | | | | $ | 16.38 | | |

6100 North Western Avenue

Oklahoma City, Oklahoma 73118

Phone: (405) 848-8000

c/o Chesapeake Energy Corporation

6100 North Western Avenue

Oklahoma City, Oklahoma 73118

Phone: (405) 848-8000

c/o Chesapeake Energy Corporation

6100 North Western Avenue

Oklahoma City, Oklahoma 73118

Phone: (405) 848-8000

5800 Granite Parkway, Suite 550

Plano, Texas 75024

Phone: (615) 771-6701

48 Wall Street, 22nd floor

New York, NY 10005

Call Toll-Free: (866) 387-7321

Banks and Brokers Call: (212) 269-5550

vine@dfking.com

|

Name

|

| |

Unvested RSUs(1) (#)

|

| |

Estimated Value(2) ($)

|

| ||||||

|

Eric D. Marsh

|

| | | | 507,142 | | | | | | 7,454,987 | | |

|

David M. Elkin

|

| | | | 271,428 | | | | | | 3,989,992 | | |

|

Wayne B. Stoltenberg

|

| | | | 235,714 | | | | | | 3,464,996 | | |

|

Jonathan C. Curth

|

| | | | 67,858 | | | | | | 997,513 | | |

|

Name

|

| |

Unvested RSUs (#)

|

| |

Estimated Value(1) ($)

|

| ||||||

|

Charles M. Sledge

|

| | | | 28,571 | | | | | | 419,994 | | |

|

H. Paulett Eberhart

|

| | | | 10,714 | | | | | | 157,496 | | |

|

Name

|

| |

Cash(1) ($)

|

| |

Equity(2) ($)

|

| |

Perquisites/Benefits(3) ($)

|

| |

Total ($)

|

| ||||||||||||

|

Eric D. Marsh

|

| | | | 8,316,508 | | | | | | 7,454,987 | | | | | | 1,732 | | | | | | 15,773,228 | | |

|

David M. Elkin

|

| | | | 1,581,855 | | | | | | 3,989,992 | | | | | | 29,014 | | | | | | 5,600,860 | | |

|

Wayne B. Stoltenberg

|

| | | | 1,842,286 | | | | | | 3,464,996 | | | | | | 28,016 | | | | | | 5,335,298 | | |

|

Jonathan C. Curth

|

| | | | 1,346,712 | | | | | | 997,513 | | | | | | 29,014 | | | | | | 2,373,239 | | |

|

Date Announced

|

| |

Buyer

|

| |

Seller

|

|

| 6/2/2021 | | | Southwestern Energy Company | | | Indigo II Louisiana Operating LLC | |

| 6/10/2019 | | | Comstock Resources, Inc. | | | Covey Park Energy LLC | |

| 11/19/2018 | | | Aethon Energy Management LLC | | | QEP Resources, Inc. | |

| 6/29/2018 | | | Osaka Gas USA Corporation | | | Sabine Oil & Gas Corporation | |

| 8/1/2017 | | | Rockcliff Energy II LLC | | | Samson Resources II, LLC | |

| 12/20/2016 | | | Covey Park Energy LLC | | |

Chesapeake Energy Corporation

|

|

| 12/5/2016 | | | Indigo Resources LLC | | |

Chesapeake Energy Corporation

|

|

| 11/2/2016 | | | Covey Park Energy LLC | | | EOG Resources, Inc. | |

|

Date Announced

|

| |

Buyer

|

| |

Seller

|

|

| 10/31/2016 | | | Castleton Commodities International LLC | | | Anadarko Petroleum Corporation | |

| 7/21/2016 | | | Ontario Teachers’ Pension Plan, Aethon Energy Management LLC, RedBird Capital Partners | | | J-W Energy Company | |

| 4/28/2016 | | | Indigo Minerals LLC | | | BEUSA Energy, Inc. | |

| 3/18/2016 | | | Covey Park Energy LLC | | | EP Energy Corporation | |

| 8/25/2015 | | | GeoSouthern Haynesville, LP, GSO Capital Partners LP | | | Encana Corporation | |

| | | |

RADR Approach

|

| |

WACC Approach

|

| |

Adjusted Exchange

Ratio |

| ||||||||||||||||||

| | | |

3P Reserves

NYMEX Strip Pricing |

| |

3P Reserves

Consensus Pricing |

| |

1P Reserves

NYMEX Strip Pricing |

| |

1P Reserves

Consensus Pricing |

| | | | ||||||||||||

|

Implied Equity

Value Per Share Reference Range |

| | | $ | 3.19 – $9.65 | | | | | $ | 4.72 – $11.54 | | | | | $ | 16.28 – $19.03 | | | | | $ | 18.28 – $21.17 | | | | | |

| | | |

RADR Approach

|

| |

WACC Approach

|

| |

Adjusted Exchange

Ratio |

| |||||||||||||||||||||

| | | |

3P Reserves

NYMEX Strip Pricing |

| |

3P Reserves

Consensus Pricing |

| |

1P Reserves

NYMEX Strip Pricing |

| |

1P Reserves

Consensus Pricing |

| | | | | | | ||||||||||||

|

Implied Exchange

Ratio Reference Range |

| | | | 0.0404 – 0.2056 | | | | | | 0.0669 – 0.2309 | | | | | | 0.2077 – 0.2660 | | | | | | 0.2172 – 0.2756 | | | | | | 0.2486 | | |

|

Date Announced

|

| |

Buyer

|

| |

Seller

|

|

| 6/8/2021 | | | Contango Oil & Gas Company | | | Independence Energy | |

| 6/2/2021 | | | Southwestern Energy Company | | | Indigo II Louisiana Operating LLC | |

| 5/6/2021 | | | EQT Corporation | | | ARD Operating | |

| 5/24/2021 | | | Cabot Oil & Gas Corporation | | | Cimarex Energy | |

| 12/21/2020 | | | Diamondback Energy | | | QEP Resources, Inc. | |

| 9/28/2020 | | | Devon Energy | | | WPX Energy | |

| 8/12/2020 | | | Southwestern Energy | | | Montage Resources | |

| 7/20/2020 | | | Chevron Corporation | | | Noble Energy | |

| 7/15/2019 | | | Callon Petroleum Company | | | Carrizo Oil & Gas, Inc. | |

| 6/10/2019 | | | Comstock Resources, Inc. | | | Covey Park Energy LLC | |

| 4/24/2019 | | | Occidental Petroleum | | | Anadarko Petroleum | |

| 8/27/2018 | | | Eclipse Resources | | | Blue Ridge Mountain Resources Inc. | |

| 6/19/2017 | | | EQT Corporation | | | Rice Energy Inc. | |

| 10/25/2016 | | | EQT Corporation | | | Republic Energy, Trans Energy Inc. | |

| 9/26/2016 | | | Rice Energy Inc. | | | Vantage Energy LLC, Vantage Energy II LLC | |

| 7/5/2016 | | | Mountain Capital Management | | | Harbinger Group Inc. | |

| | | |

RADR Approach

|

| |

WACC Approach

|

| ||||||||||||||||||

| | | |

3P Reserves

NYMEX Strip Pricing |

| |

3P Reserves

Consensus Pricing |

| |

1P Reserves

NYMEX Strip Pricing |

| |

1P Reserves

Consensus Pricing |

| ||||||||||||

|

Implied Equity Value Per Share Reference Range*

|

| | | $ | 41.10 – $49.20 | | | | | $ | 43.26 – $52.57 | | | | | $ | 67.04 – $72.60 | | | | | $ | 72.45 – $78.67 | | |

|

Implied Total Merger Consideration Reference Range

|

| | | $ | 11.42 – $13.43 | | | | | $ | 11.96 – $14.27 | | | | | $ | 17.87 – $19.25 | | | | | $ | 19.22 – $20.76 | | |

| | | |

Has:

|

| |

Gets:

|

| ||||||

| Selected Companies Analysis | | | | | | | | | | | | | |

|

2021E Average Daily Production

|

| | | $ | 15.29 – $21.83 | | | | | $ | 17.60 – $20.68 | | |

|

2021E EBITDAX

|

| | | $ | 16.09 – $24.16 | | | | | $ | 18.01 – $22.05 | | |

|

2022E EBITDAX

|

| | | $ | 17.19 – $26.16 | | | | | $ | 18.49 – $23.15 | | |

|

Selected Transactions Analysis

|

| | | | | | | | | | | | |

|

LQA Average Daily Production / Acreage

|

| | | $ | 18.06 – $26.11* | | | | | $ | 20.14 – $23.25 | | |

|

LQA EBITDAX

|

| | | $ | 18.14 – $24.19† | | | | | $ | 18.53 – $22.47 | | |

|

Discounted Cash Flow Analysis – Corporate

|

| | | $ | 19.85 – $28.07 | | | | | $ | 20.07 – $23.99 | | |

| Discounted Cash Flow Analysis – Net Asset Value | | | | | | | | | | | | | |

|

RADR Approach – 3P Reserves NYMEX Strip Pricing

|

| | | $ | 3.19 – $9.65 | | | | | $ | 10.58 – $13.85 | | |

|

RADR Approach – 3P Reserves Consensus Pricing

|

| | | $ | 4.72 – $11.54 | | | | | $ | 11.39 – $15.04 | | |

|

WACC Approach – 1P Reserves NYMEX Strip Pricing

|

| | | $ | 16.28 – $19.03 | | | | | $ | 19.54 – $21.55 | | |

|

WACC Approach – 1P Reserves Consensus Pricing

|

| | | $ | 18.28 – $21.17 | | | | | $ | 21.30 – $23.51 | | |

| | | |

NYMEX Strip Pricing(1)

|

| |||||||||||||||||||||||||||

| | | |

2021E

|

| |

2022E

|

| |

2023E

|

| |

2024E

|

| |

2025E

|

| |||||||||||||||

|

Natural Gas ($/MMBtu)

|

| | | $ | 3.36 | | | | | $ | 3.39 | | | | | $ | 2.88 | | | | | $ | 2.75 | | | | | $ | 2.75 | | |

| | | |

Vine Standalone Financial Projection(1)

For the Year Ended December 31, |

| |||||||||||||||||||||||||||

|

($ in millions)

|

| |

2021E

|

| |

2022E

|

| |

2023E

|

| |

2024E

|

| |

2025E

|

| |||||||||||||||

|

Net Gas Production (MMcf/d)

|

| | | | 998 | | | | | | 1,009 | | | | | | 1,068 | | | | | | 1,077 | | | | | | 1,139 | | |

|

Adjusted EBITDA(2)

|

| | | $ | 615 | | | | | $ | 683 | | | | | $ | 694 | | | | | $ | 683 | | | | | $ | 730 | | |

|

Operating Cash Flow(3)

|

| | | $ | 503 | | | | | $ | 567 | | | | | $ | 577 | | | | | $ | 565 | | | | | $ | 588 | | |

|

Adjusted Free Cash Flow(4)

|

| | | $ | 162 | | | | | $ | 200 | | | | | $ | 217 | | | | | $ | 208 | | | | | $ | 269 | | |

| | | |

NYMEX Strip Pricing(1)

|

| |||||||||||||||||||||||||||

| | | |

2021E

|

| |

2022E

|

| |

2023E

|

| |

2024E

|

| |

2025E

|

| |||||||||||||||

|

Natural Gas ($/MMBtu)

|

| | | $ | 3.36 | | | | | $ | 3.39 | | | | | $ | 2.88 | | | | | $ | 2.75 | | | | | $ | 2.75 | | |

| | | |

Chesapeake Standalone Financial Projection(1)

For the Year Ended December 31, |

| |||||||||||||||||||||||||||

|

($ in millions)

|

| |

2021E

|

| |

2022E

|

| |

2023E

|

| |

2024E

|

| |

2025E

|

| |||||||||||||||

|

Net Gas Production Equivalent (MMcfe/d)

|

| | | | 2,624 | | | | | | 2,678 | | | | | | 2,652 | | | | | | 2,552 | | | | | | 2,544 | | |

|

Adjusted EBITDA(2)

|

| | | $ | 1,769 | | | | | $ | 2,070 | | | | | $ | 2,074 | | | | | $ | 1,910 | | | | | $ | 1,854 | | |

|

Operating Cash Flow(3)

|

| | | $ | 1,691 | | | | | $ | 1,996 | | | | | $ | 1,994 | | | | | $ | 1,803 | | | | | $ | 1,717 | | |

|

Adjusted Free Cash Flow(4)

|

| | | $ | 990 | | | | | $ | 897 | | | | | $ | 1,042 | | | | | $ | 737 | | | | | $ | 801 | | |

JUNE 30, 2021

($ IN MILLIONS)

| | | | | | | | | | | | | | | |

Transaction Adjustments

|

| | | | | | | |||||||||

| | | |

Chesapeake

Historical |

| |

Vine

Historical |

| |

Reclass

Adjustments (Note 3) |

| |

Pro Forma

Adjustments (Note 3) |

| |

Chesapeake

Pro Forma Combined |

| |||||||||||||||

| Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Current assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Cash and cash equivalents

|

| | | $ | 612 | | | | | $ | 55 | | | | | $ | — | | | | | $ | (92)(b) | | | | | $ | 373 | | |

| | | | | | — | | | | | | — | | | | | | — | | | | | | (202)(c) | | | | | | | | |

|

Restricted cash

|

| | | | 10 | | | | | | — | | | | | | — | | | | | | — | | | | | | 10 | | |

|

Accounts receivable, net

|

| | | | 674 | | | | | | 116 | | | | | | 17(a) | | | | | | — | | | | | | 807 | | |

|

Joint interest billing receivable

|

| | | | — | | | | | | 17 | | | | | | (17)(a) | | | | | | — | | | | | | — | | |

|

Other current assets

|

| | | | 58 | | | | | | 7 | | | | | | — | | | | | | — | | | | | | 65 | | |

|

Total current assets

|

| | | | 1,354 | | | | | | 195 | | | | | | — | | | | | | (294) | | | | | | 1,255 | | |

| Property and equipment: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Oil and natural gas properties, successful efforts method

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Proved oil and natural gas properties

|

| | | | 4,960 | | | | | | 3,247 | | | | | | — | | | | | | (1,069)(d) | | | | | | 7,138 | | |

|

Unproved properties

|

| | | | 442 | | | | | | 90 | | | | | | — | | | | | | 635(d) | | | | | | 1,167 | | |

|

Other property and equipment

|

| | | | 491 | | | | | | 12 | | | | | | — | | | | | | — | | | | | | 503 | | |

|

Total property and equipment

|

| | | | 5,893 | | | | | | 3,349 | | | | | | — | | | | | | (434) | | | | | | 8,808 | | |

|

Less: accumulated depreciation, depletion and amortization

|

| | | | (346) | | | | | | (1,599) | | | | | | — | | | | | | 1,599(d) | | | | | | (346) | | |

|

Property and equipment held for sale, net

|

| | | | 3 | | | | | | — | | | | | | — | | | | | | — | | | | | | 3 | | |

|

Total property and equipment, net

|

| | | | 5,550 | | | | | | 1,750 | | | | | | — | | | | | | 1,165 | | | | | | 8,465 | | |

|

Operating lease right-of-use assets

|

| | | | — | | | | | | 16 | | | | | | (16)(a) | | | | | | — | | | | | | — | | |

|

Other long-term assets

|

| | | | 95 | | | | | | 11 | | | | | | 16(a) | | | | | | (10)(d) | | | | | | 112 | | |

|

Total assets

|

| | | $ | 6,999 | | | | | $ | 1,972 | | | | | $ | — | | | | | $ | 861 | | | | | $ | 9,832 | | |

| Liabilities and equity (deficit) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Accounts payable

|

| | | $ | 281 | | | | | $ | 7 | | | | | $ | — | | | | | $ | — | | | | | $ | 288 | | |

|

Accrued interest

|

| | | | 24 | | | | | | — | | | | | | — | | | | | | — | | | | | | 24 | | |

|

Short-term derivative liabilities

|

| | | | 780 | | | | | | 271 | | | | | | — | | | | | | — | | | | | | 1,051 | | |

|

Accrued liabilities

|

| | | | — | | | | | | 112 | | | | | | (112)(a) | | | | | | — | | | | | | — | | |

|

Revenue payable

|

| | | | — | | | | | | 52 | | | | | | (52)(a) | | | | | | — | | | | | | — | | |

|

Operating leases

|

| | | | — | | | | | | 9 | | | | | | (9)(a) | | | | | | — | | | | | | — | | |

|

Other current liabilities

|

| | | | 781 | | | | | | — | | | | | | 173(a) | | | | | | 45(e) | | | | | | 999 | | |

|

Total current liabilities

|

| | | | 1,866 | | | | | | 451 | | | | | | — | | | | | | 45 | | | | | | 2,362 | | |

|

Long-term debt, net

|

| | | | 1,261 | | | | | | — | | | | | | 1,110(a) | | | | | | 91(d) | | | | | | 2,282 | | |

| | | | | | | | | | | | | | | | | | | | | | | | (180)(c) | | | | | | | | |

|

New RBL

|

| | | | — | | | | | | 35 | | | | | | (35)(a) | | | | | | — | | | | | | — | | |

|

Second lien credit facility

|

| | | | — | | | | | | 145 | | | | | | (145)(a) | | | | | | — | | | | | | — | | |

|

Unsecured debt

|

| | | | — | | | | | | 930 | | | | | | (930)(a) | | | | | | — | | | | | | — | | |

|

Long-term derivative liabilities

|

| | | | 211 | | | | | | 113 | | | | | | — | | | | | | — | | | | | | 324 | | |

|

Asset retirement obligations, net of current portion

|

| | | | 241 | | | | | | 24 | | | | | | — | | | | | | — | | | | | | 265 | | |

|

Other long-term liabilities

|

| | | | 7 | | | | | | — | | | | | | 6(a) | | | | | | — | | | | | | 13 | | |

|

Tax Receivable Agreement liability

|

| | | | — | | | | | | 7 | | | | | | — | | | | | | (7)(f) | | | | | | — | | |

|

Operating leases

|

| | | | — | | | | | | 6 | | | | | | (6)(a) | | | | | | — | | | | | | — | | |

|

Total liabilities

|

| | | | 3,586 | | | | | | 1,711 | | | | | | — | | | | | | (51) | | | | | | 5,246 | | |

| Stockholders’ equity (deficit): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Common stock

|

| | | | 1 | | | | | | 1 | | | | | | — | | | | | | (1)(g) | | | | | | 1 | | |

|

Additional paid-in capital

|

| | | | 3,590 | | | | | | 355 | | | | | | — | | | | | | (355)(g) | | | | | | 4,759 | | |

| | | | | | — | | | | | | — | | | | | | — | | | | | | 1,169(h) | | | | | | | | |

|

Accumulated deficit

|

| | | | (178) | | | | | | (214) | | | | | | — | | | | | | 214(g) | | | | | | (174) | | |

| | | | | | — | | | | | | — | | | | | | — | | | | | | 71(i) | | | | | | | | |

| | | | | | — | | | | | | — | | | | | | — | | | | | | (45)(e) | | | | | | | | |

| | | | | | — | | | | | | — | | | | | | — | | | | | | (22)(c) | | | | | | | | |

|

Total stockholders’ equity (deficit)

|

| | | | 3,413 | | | | | | 142 | | | | | | — | | | | | | 1,031 | | | | | | 4,586 | | |

|

Noncontrolling interests

|

| | | | — | | | | | | 119 | | | | | | | | | | | | (119)(j) | | | | | | — | | |

|

Total equity (deficit)

|

| | | | 3,413 | | | | | | 261 | | | | | | — | | | | | | 912 | | | | | | 4,586 | | |

|

Total liabilities and stockholders’ equity (deficit)

|

| | | $ | 6,999 | | | | | $ | 1,972 | | | | | $ | — | | | | | $ | 861 | | | | | $ | 9,832 | | |

FOR THE SIX MONTHS ENDED JUNE 30, 2021

($ IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Transaction Adjustments

|

| | | | | | | |||||||||

| | | |

Historical

Predecessor (Jan. 1, 2021 through Feb. 9, 2021) |

| | |

Historical

Successor (Feb. 10, 2021 through June 30, 2021) |

| |

Reorganization

Adjustments (Note 3) |

| |

Fresh Start

Adjustments (Note 3) |

| |

Chesapeake

Pro Forma |

| |

Vine

Historical |

| |

Brix

Companies Historical Through March 17, 2021 |

| |

Brix

Companies Acquisition Adjustments (Note 3) |

| |

Vine

Pro Forma |

| |

Reclass

Adjustments (Note 3) |

| |

Pro Forma

Adjustments (Note 3) |

| |

Chesapeake

Pro Forma Combined |

| ||||||||||||||||||||||||||||||||||||

| Revenues and other: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Oil, natural gas and NGL

|

| | | $ | 398 | | | | | | $ | 1,445 | | | | | $ | — | | | | | $ | — | | | | | $ | 1,843 | | | | | $ | 388 | | | | | $ | 47 | | | | | $ | — | | | | | $ | 435 | | | | | $ | — | | | | | $ | — | | | | | $ | 2,278 | | |

|

Marketing

|

| | | | 239 | | | | | | | 816 | | | | | | — | | | | | | — | | | | | | 1,055 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 1,055 | | |

|

Oil and natural gas derivatives

|

| | | | (382) | | | | | | | (694) | | | | | | — | | | | | | — | | | | | | (1,076) | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | (339)(a) | | | | | | — | | | | | | (1,415) | | |

|

Realized (loss) gain on commodity derivatives

|

| | | | — | | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | (25) | | | | | | (2) | | | | | | — | | | | | | (27) | | | | | | 27(a) | | | | | | — | | | | | | — | | |

|

Unrealized (loss) gain on commodity derivatives

|

| | | | — | | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | (309) | | | | | | (3) | | | | | | — | | | | | | (312) | | | | | | 312(a) | | | | | | — | | | | | | — | | |

|

Gains on sales of assets

|

| | | | 5 | | | | | | | 6 | | | | | | — | | | | | | — | | | | | | 11 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 11 | | |

|

Total revenues and other

|

| | | | 260 | | | | | | | 1,573 | | | | | | — | | | | | | — | | | | | | 1,833 | | | | | | 54 | | | | | | 42 | | | | | | — | | | | | | 96 | | | | | | — | | | | | | — | | | | | | 1,929 | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Production

|

| | | | 32 | | | | | | | 114 | | | | | | — | | | | | | — | | | | | | 146 | | | | | | 32 | | | | | | 4 | | | | | | — | | | | | | 36 | | | | | | — | | | | | | — | | | | | | 182 | | |

|

Gathering, processing and

transportation |

| | | | 102 | | | | | | | 322 | | | | | | — | | | | | | — | | | | | | 424 | | | | | | 49 | | | | | | 6 | | | | | | — | | | | | | 55 | | | | | | — | | | | | | — | | | | | | 479 | | |

|

Severance and ad valorem taxes

|

| | | | 18 | | | | | | | 65 | | | | | | — | | | | | | | | | | | | 83 | | | | | | 10 | | | | | | 1 | | | | | | — | | | | | | 11 | | | | | | — | | | | | | — | | | | | | 94 | | |

|

Marketing

|

| | | | 237 | | | | | | | 815 | | | | | | — | | | | | | — | | | | | | 1,052 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 1,052 | | |

|

General and administrative

|

| | | | 21 | | | | | | | 39 | | | | | | — | | | | | | — | | | | | | 60 | | | | | | 7 | | | | | | 1 | | | | | | — | | | | | | 8 | | | | | | 14(a) | | | | | | — | | | | | | 82 | | |

|

Monitoring fee

|

| | | | — | | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 2 | | | | | | 2 | | | | | | (4)(o) | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

|

Stock-based compensation for Existing Management Owners

|

| | | | — | | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 14 | | | | | | — | | | | | | — | | | | | | 14 | | | | | | (14)(a) | | | | | | — | | | | | | — | | |

|

Separation and other termination costs

|

| | | | 22 | | | | | | | 11 | | | | | | — | | | | | | — | | | | | | 33 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 33 | | |

|

Depreciation, depletion and amortization

|

| | | | 72 | | | | | | | 351 | | | | | | — | | | | | | 29(l) | | | | | | 452 | | | | | | 222 | | | | | | 31 | | | | | | (21)(o) | | | | | | 232 | | | | | | — | | | | | | (4)(p) | | | | | | 680 | | |

|

Impairments

|

| | | | — | | | | | | | 1 | | | | | | — | | | | | | — | | | | | | 1 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 1 | | |

|

Exploration

|

| | | | 2 | | | | | | | 2 | | | | | | — | | | | | | — | | | | | | 4 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 4 | | |

|

Other operating income

|

| | | | (12) | | | | | | | (2) | | | | | | — | | | | | | — | | | | | | (14) | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | (14) | | |

|

Total operating expenses

|

| | | | 494 | | | | | | | 1,718 | | | | | | — | | | | | | 29 | | | | | | 2,241 | | | | | | 336 | | | | | | 45 | | | | | | (25) | | | | | | 356 | | | | | | — | | | | | | (4) | | | | | | 2,593 | | |

|

Loss from operations

|

| | | | (234) | | | | | | | (145) | | | | | | — | | | | | | (29) | | | | | | (408) | | | | | | (282) | | | | | | (3) | | | | | | 25 | | | | | | (260) | | | | | | — | | | | | | 4 | | | | | | (664) | | |

FOR THE SIX MONTHS ENDED JUNE 30, 2021

($ IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Transaction Adjustments

|

| | | | | | | |||||||||

| | | |

Historical

Predecessor (Jan. 1, 2021 through Feb. 9, 2021) |

| | |

Historical

Successor (Feb. 10, 2021 through June 30, 2021) |

| |

Reorganization

Adjustments (Note 3) |

| |

Fresh Start

Adjustments (Note 3) |

| |

Chesapeake

Pro Forma |

| |

Vine

Historical |

| |

Brix

Companies Historical Through March 17, 2021 |

| |

Brix

Companies Acquisition Adjustments (Note 3) |

| |

Vine

Pro Forma |

| |

Reclass

Adjustments (Note 3) |

| |

Pro Forma

Adjustments (Note 3) |

| |

Chesapeake

Pro Forma Combined |

| ||||||||||||||||||||||||||||||||||||

|

Other income (expense):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Interest expense

|

| | | | (11) | | | | | | | (30) | | | | | | 4(k) | | | | | | — | | | | | | (37) | | | | | | (53) | | | | | | (2) | | | | | | (2)(o) | | | | | | (57) | | | | | | — | | | | | | 29(q) | | | | | | (65) | | |

|

Loss on extinguishment of debt

|

| | | | — | | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | (78) | | | | | | — | | | | | | 5(o) | | | | | | (73) | | | | | | — | | | | | | — | | | | | | (73) | | |

|

Other income

|

| | | | 2 | | | | | | | 31 | | | | | | — | | | | | | — | | | | | | 33 | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 33 | | |

|

Reorganization items, net

|

| | | | 5,569 | | | | | | | — | | | | | | (5,368)(k) | | | | | | (201)(m) | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

|

Total other income (expense)

|

| | | | 5,560 | | | | | | | 1 | | | | | | (5,364) | | | | | | (201) | | | | | | (4) | | | | | | (131) | | | | | | (2) | | | | | | 3 | | | | | | (130) | | | | | | — | | | | | | 29 | | | | | | (105) | | |

|

Income (loss) before income taxes

|

| | | | 5,326 | | | | | | | (144) | | | | | | (5,364) | | | | | | (230) | | | | | | (412) | | | | | | (413) | | | | | | (5) | | | | | | 28 | | | | | | (390) | | | | | | — | | | | | | 33 | | | | | | (769) | | |

|

Income tax expense (benefit)

|

| | | | (57) | | | | | | | — | | | | | | — | | | | | | 57(n) | | | | | | — | | | | | | 5 | | | | | | — | | | | | | — | | | | | | 5 | | | | | | — | | | | | | — | | | | | | 5 | | |

|

Net income (loss)

|

| | | | 5,383 | | | | | | | (144) | | | | | | (5,364) | | | | | | (287) | | | | | | (412) | | | | | | (418) | | | | | | (5) | | | | | | 28 | | | | | | (395) | | | | | | — | | | | | | 33 | | | | | | (774) | | |

|

Net loss attributable to Predecessor

|

| | | | — | | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 29 | | | | | | — | | | | | | (29)(o) | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

|

Net loss attributable to noncontrolling interests

|

| | | | — | | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 175 | | | | | | — | | | | | | 2(o) | | | | | | 177 | | | | | | — | | | | | | (177)(j) | | | | | | — | | |

|

Net income (loss) available to common stockholders

|

| | | $ | 5,383 | | | | | | $ | (144) | | | | | $ | (5,364) | | | | | $ | (287) | | | | | $ | (412) | | | | | $ | (214) | | | | | $ | (5) | | | | | $ | 1 | | | | | $ | (218) | | | | | $ | — | | | | | $ | (144) | | | | | $ | (774) | | |

|

Earnings (loss) per common share:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Basic

|

| | | $ | 550.35 | | | | | | $ | (1.47) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | (6.61) | | |

|

Diluted

|

| | | $ | 534.51 | | | | | | $ | (1.47) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | (6.61) | | |

|

Weighted average common and common equivalent shares outstanding (in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Basic

|

| | | | 9,781 | | | | | | | 97,922 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 19,135(r) | | | | | | 117,057 | | |

|

Diluted

|

| | | | 10,071 | | | | | | | 97,922 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 19,135(r) | | | | | | 117,057 | | |

FOR THE YEAR ENDED DECEMBER 31, 2020

($ IN MILLIONS, EXCEPT PER SHARE AMOUNTS)

| | | | | | | | | | | | | | | |

Transaction Adjustments

|

| | | | | | | |||||||||

| | | |

Chesapeake

Pro Forma |

| |

Vine

Pro Forma |

| |

Reclass

Adjustments (Note 3) |

| |

Pro Forma

Adjustments (Note 3) |

| |

Chesapeake

Pro Forma Combined |

| |||||||||||||||

| Revenues and other: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Oil, natural gas and NGL

|

| | | $ | 2,745 | | | | | $ | 571 | | | | | $ | — | | | | | $ | — | | | | | $ | 3,316 | | |

|

Marketing

|

| | | | 1,869 | | | | | | — | | | | | | — | | | | | | — | | | | | | 1,869 | | |

|

Oil and natural gas derivatives

|

| | | | 596 | | | | | | — | | | | | | (43)(a) | | | | | | — | | | | | | 553 | | |

|

Realized (loss) gain on commodity derivatives

|

| | | | — | | | | | | 162 | | | | | | (162)(a) | | | | | | — | | | | | | — | | |

|

Unrealized (loss) gain on commodity derivatives

|

| | | | — | | | | | | (205) | | | | | | 205(a) | | | | | | — | | | | | | — | | |

|

Gain on sales of assets

|

| | | | 30 | | | | | | — | | | | | | — | | | | | | — | | | | | | 30 | | |

|

Total revenues and other

|

| | | | 5,240 | | | | | | 528 | | | | | | — | | | | | | — | | | | | | 5,768 | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Production

|

| | | | 373 | | | | | | 66 | | | | | | — | | | | | | — | | | | | | 439 | | |

|

Gathering, processing and transportation

|

| | | | 1,082 | | | | | | 102 | | | | | | — | | | | | | — | | | | | | 1,184 | | |

|

Severance and ad valorem taxes

|

| | | | 149 | | | | | | 18 | | | | | | — | | | | | | — | | | | | | 167 | | |

|

Exploration

|

| | | | 427 | | | | | | — | | | | | | — | | | | | | — | | | | | | 427 | | |

|

Marketing

|

| | | | 1,889 | | | | | | — | | | | | | — | | | | | | — | | | | | | 1,889 | | |

|

General and administrative

|

| | | | 267 | | | | | | 15 | | | | | | — | | | | | | — | | | | | | 282 | | |

|

Separation and other termination costs

|

| | | | 44 | | | | | | — | | | | | | — | | | | | | — | | | | | | 44 | | |

|

Depreciation, depletion and amortization

|

| | | | 980 | | | | | | 392 | | | | | | — | | | | | | 132(p) | | | | | | 1,504 | | |

|

Impairments

|

| | | | 8,535 | | | | | | — | | | | | | — | | | | | | — | | | | | | 8,535 | | |

|

Other operating expense

|

| | | | 80 | | | | | | — | | | | | | 8(a) | | | | | | 45(e) | | | | | | 133 | | |

|

Strategic

|

| | | | — | | | | | | 2 | | | | | | (2)(a) | | | | | | — | | | | | | — | | |

|

Write-off of deferred IPO expenses

|

| | | | — | | | | | | 6 | | | | | | (6)(a) | | | | | | — | | | | | | — | | |

|

Total operating expenses

|

| | | | 13,826 | | | | | | 601 | | | | | | — | | | | | | 177 | | | | | | 14,604 | | |

|

Loss from operations

|

| | | | (8,586) | | | | | | (73) | | | | | | — | | | | | | (177) | | | | | | (8,836) | | |

| Other income (expense): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Interest expense

|

| | | | (81) | | | | | | (116) | | | | | | — | | | | | | 64(q) | | | | | | (133) | | |

|

Gains (losses) on purchases or exchanges of debt

|

| | | | 65 | | | | | | — | | | | | | — | | | | | | (22)(c) | | | | | | 43 | | |

|

Other income (expense)

|

| | | | (4) | | | | | | — | | | | | | — | | | | | | 7(f) | | | | | | 3 | | |

|

Total other expense

|

| | | | (20) | | | | | | (116) | | | | | | — | | | | | | 49 | | | | | | (87) | | |

|

Loss before income taxes

|

| | | | (8,606) | | | | | | (189) | | | | | | — | | | | | | (128) | | | | | | (8,923) | | |

|

Current income tax benefit

|

| | | | (9) | | | | | | — | | | | | | — | | | | | | — | | | | | | (9) | | |

|

Deferred income tax benefit

|

| | | | (10) | | | | | | — | | | | | | — | | | | | | (71)(i) | | | | | | (81) | | |

|

Income tax benefit

|

| | | | (19) | | | | | | — | | | | | | — | | | | | | (71) | | | | | | (90) | | |

|

Net loss

|

| | | | (8,587) | | | | | | (189) | | | | | | — | | | | | | (57) | | | | | | (8,833) | | |

|

Net loss attributable to noncontrolling interests

|

| | | | 16 | | | | | | 96 | | | | | | — | | | | | | (96)(j) | | | | | | 16 | | |

|

Net loss attributable to Chesapeake

|

| | | | (8,571) | | | | | | (93) | | | | | | — | | | | | | (153) | | | | | | (8,817) | | |

|

Preferred stock dividends

|

| | | | (22) | | | | | | — | | | | | | — | | | | | | — | | | | | | (22) | | |

|

Net loss available to common stockholders

|

| | | $ | (8,593) | | | | | $ | (93) | | | | | $ | — | | | | | $ | (153) | | | | | $ | (8,839) | | |

| Loss per common share: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Basic

|

| | | $ | (87.77) | | | | | | | | | | | | | | | | | | | | | | | $ | (75.52) | | |

|

Diluted

|

| | | $ | (87.77) | | | | | | | | | | | | | | | | | | | | | | | $ | (75.52) | | |

|

Weighted average common and common equivalent shares outstanding (in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Basic

|

| | | | 97,907 | | | | | | | | | | | | | | | | | | 19,135(r) | | | | | | 117,042 | | |

|

Diluted

|

| | | | 97,907 | | | | | | | | | | | | | | | | | | 19,135(r) | | | | | | 117,042 | | |

| | | |

Preliminary

Purchase Price Allocation |

| |||

| | | |

($ in millions)

|

| |||

| Consideration: | | | | | | | |

|

Cash(a)

|

| | | $ | 92 | | |

|

Fair value of Chesapeake common stock to be issued(b)

|

| | | | 1,169 | | |

|

Total consideration

|

| | | $ | 1,261 | | |

| Fair Value of Liabilities Assumed: | | | | | | | |

|

Current liabilities

|

| | | $ | 451 | | |

|

Long-term debt

|

| | | | 1,201 | | |

|

Deferred tax liabilities

|

| | | | 71 | | |

|

Other long-term liabilities

|

| | | | 143 | | |

|

Amounts attributable to liabilities assumed

|

| | | | 1,866 | | |

| Fair Value of Assets Acquired: | | | | | | | |

|

Cash and cash equivalents

|

| | | $ | 55 | | |

|

Other current assets

|

| | | | 140 | | |

|

Proved oil and natural gas properties

|

| | | | 2,178 | | |

|

Unproved properties

|

| | | | 725 | | |

|

Other property and equipment

|

| | | | 12 | | |

|

Other long-term assets

|

| | | | 17 | | |

|

Amounts attributable to assets acquired

|

| | | | 3,127 | | |

|

Total identifiable net assets

|

| | | $ | 1,261 | | |

| |

Shares of Chesapeake common stock to be issued

|

| | | | 19,134,592 | | |

| |

Closing price per share of Chesapeake common stock on September 17, 2021

|

| | | $ | 61.07 | | |

| |

Total fair value of shares of Chesapeake common stock to be issued

|

| | | $ | 1,169 | | |

| |

Increase in Chesapeake common stock ($0.01 par value per share) as of June 30, 2021

|

| | | $ | — | | |

| |

Increase in Chesapeake additional paid-in capital as of June 30, 2021

|

| | | $ | 1,169 | | |

| | | |

Oil (mmbbls)

|

| |||||||||||||||

| | | |

Chesapeake

Historical |

| |

Vine Pro

Forma |

| |

Chesapeake

Pro Forma Combined |

| |||||||||

|

As of December 31, 2019

|

| | | | 358.0 | | | | | | — | | | | | | 358.0 | | |

|

Extensions, discoveries and other additions

|

| | | | 1.1 | | | | | | — | | | | | | 1.1 | | |

|

Revisions of previous estimates

|

| | | | (148.2) | | | | | | — | | | | | | (148.2) | | |

|

Production

|

| | | | (37.3) | | | | | | — | | | | | | (37.3) | | |

|

Sale of reserves-in-place

|

| | | | (12.3) | | | | | | — | | | | | | (12.3) | | |

|

Purchase of reserves-in-place

|

| | | | — | | | | | | — | | | | | | — | | |

|

As of December 31, 2020

|

| | | | 161.3 | | | | | | — | | | | | | 161.3 | | |

| Proved developed reserves: | | | | | | | | | | | | | | | | | | | |

|

December 31, 2019

|

| | | | 201.4 | | | | | | — | | | | | | 201.4 | | |

|

December 31, 2020

|

| | | | 158.1 | | | | | | — | | | | | | 158.1 | | |

| Proved undeveloped reserves: | | | | | | | | | | | | | | | | | | | |

|

December 31, 2019

|

| | | | 156.6 | | | | | | — | | | | | | 156.6 | | |

|

December 31, 2020

|

| | | | 3.2 | | | | | | — | | | | | | 3.2 | | |

| | | |

Natural Gas (bcf)

|

| |||||||||||||||

| | | |

Chesapeake

Historical |

| |

Vine Pro

Forma |

| |

Chesapeake

Pro Forma Combined |

| |||||||||

|

As of December 31, 2019

|

| | | | 6,566 | | | | | | 2,862 | | | | | | 9,428 | | |

|

Extensions, discoveries and other additions

|

| | | | 100 | | | | | | 815 | | | | | | 915 | | |

|

Revisions of previous estimates

|

| | | | (2,326) | | | | | | (1,135) | | | | | | (3,461) | | |

|

Production

|

| | | | (684) | | | | | | (327) | | | | | | (1,011) | | |

|

Sale of reserves-in-place

|

| | | | (126) | | | | | | — | | | | | | (126) | | |

|

Purchase of reserves-in-place

|

| | | | — | | | | | | 98 | | | | | | 98 | | |

|

As of December 31, 2020

|

| | | | 3,530 | | | | | | 2,313 | | | | | | 5,843 | | |

| Proved developed reserves: | | | | | | | | | | | | | | | | | | | |

|

December 31, 2019

|

| | | | 3,377 | | | | | | 586 | | | | | | 3,963 | | |

|

December 31, 2020

|

| | | | 3,196 | | | | | | 590 | | | | | | 3,786 | | |

| Proved undeveloped reserves: | | | | | | | | | | | | | | | | | | | |

| | | |

Natural Gas (bcf)

|

| |||||||||||||||

| | | |

Chesapeake

Historical |

| |

Vine Pro

Forma |

| |

Chesapeake

Pro Forma Combined |

| |||||||||

|

December 31, 2019

|

| | | | 3,189 | | | | | | 2,276 | | | | | | 5,465 | | |

|

December 31, 2020

|

| | | | 334 | | | | | | 1,723 | | | | | | 2,057 | | |

| | |||||||||||||||||||

| | | |

Natural Gas Liquids (mmbbls)

|

| |||||||||||||||

| | | |

Chesapeake

Historical |

| |

Vine Pro

Forma |

| |

Chesapeake

Pro Forma Combined |

| |||||||||

|

As of December 31, 2019

|

| | | | 120.0 | | | | | | — | | | | | | 120.0 | | |

|

Extensions, discoveries and other additions

|

| | | | 0.4 | | | | | | — | | | | | | 0.4 | | |

|

Revisions of previous estimates

|

| | | | (50.6) | | | | | | — | | | | | | (50.6) | | |

|

Production

|

| | | | (11.3) | | | | | | — | | | | | | (11.3) | | |

|

Sale of reserves-in-place

|

| | | | (6.5) | | | | | | — | | | | | | (6.5) | | |

|

Purchase of reserves-in-place

|

| | | | — | | | | | | — | | | | | | — | | |

|

As of December 31, 2020

|

| | | | 52.0 | | | | | | — | | | | | | 52.0 | | |

| Proved developed reserves: | | | | | | | | | | | | | | | | | | | |

|

December 31, 2019

|

| | | | 82.1 | | | | | | — | | | | | | 82.1 | | |

|

December 31, 2020

|

| | | | 51.4 | | | | | | — | | | | | | 51.4 | | |

| Proved undeveloped reserves: | | | | | | | | | | | | | | | | | | | |

|

December 31, 2019

|

| | | | 37.9 | | | | | | — | | | | | | 37.9 | | |

|

December 31, 2020

|

| | | | 0.6 | | | | | | — | | | | | | 0.6 | | |

| | | |

Total Reserves (mmboe)

|

| |||||||||||||||

| | | |

Chesapeake

Historical |

| |

Vine Pro

Forma |

| |

Chesapeake

Pro Forma Combined |

| |||||||||

|

As of December 31, 2019

|

| | | | 1,572 | | | | | | 477 | | | | | | 2,049 | | |

|

Extensions, discoveries and other additions

|

| | | | 18 | | | | | | 135 | | | | | | 153 | | |

|

Revisions of previous estimates

|

| | | | (586) | | | | | | (189) | | | | | | (775) | | |

|

Production

|

| | | | (163) | | | | | | (54) | | | | | | (217) | | |

|

Sale of reserves-in-place

|

| | | | (39) | | | | | | — | | | | | | (39) | | |

|

Purchase of reserves-in-place

|

| | | | — | | | | | | 16 | | | | | | 16 | | |

|

As of December 31, 2020

|

| | | | 802 | | | | | | 386 | | | | | | 1,187 | | |

| Proved developed reserves: | | | | | | | | | | | | | | | | | | | |

|

December 31, 2019

|

| | | | 846 | | | | | | 98 | | | | | | 944 | | |

|

December 31, 2020

|

| | | | 742 | | | | | | 98 | | | | | | 840 | | |

| Proved undeveloped reserves: | | | | | | | | | | | | | | | | | | | |

|

December 31, 2019

|

| | | | 726 | | | | | | 379 | | | | | | 1,105 | | |

|

December 31, 2020

|

| | | | 60 | | | | | | 287 | | | | | | 347 | | |

| | | |

As of December 31, 2020

|

| |||||||||||||||

| | | |

Chesapeake

Historical |

| |

Vine Pro

Forma |

| |

Chesapeake

Pro Forma Combined |

| |||||||||

|

Future cash inflows

|

| | | $ | 8,247 | | | | | $ | 4,013 | | | | | $ | 12,260 | | |

|

Future production costs

|

| | | | (2,963) | | | | | | (1,496) | | | | | | (4,459) | | |

|

Future development costs

|

| | | | (563) | | | | | | (1,407) | | | | | | (1,970) | | |

|

Future income tax expense

|

| | | | (9) | | | | | | (51) | | | | | | (60) | | |

|

Future net cash flows

|

| | | | 4,712 | | | | | | 1,059 | | | | | | 5,771 | | |

|

Less effect of a 10% discount factor

|

| | | | (1,626) | | | | | | (356) | | | | | | (1,982) | | |

|

Standardized measure of discounted future net cash flows

|

| | | $ | 3,086 | | | | | $ | 703 | | | | | $ | 3,789 | | |

| | | |

As of December 31, 2020

|

| |||||||||||||||

| | | |

Chesapeake

Historical |

| |

Vine Pro

Forma |

| |

Chesapeake

Pro Forma Combined |

| |||||||||

|

Standardized measure, beginning of period

|

| | | $ | 9,000 | | | | | $ | 1,288 | | | | | $ | 10,288 | | |

|

Sales of oil, natural gas and LNGs produced, net of production costs and

gathering, processing and transportation |

| | | | (1,140) | | | | | | (385) | | | | | | (1,525) | | |

|

Net changes in prices and production costs

|

| | | | (5,576) | | | | | | (515) | | | | | | (6,091) | | |

|

Extensions and discoveries, net of production and development costs

|

| | | | 71 | | | | | | — | | | | | | 71 | | |

|

Changes in estimated future development costs

|

| | | | 1,933 | | | | | | 58 | | | | | | 1,991 | | |

|

Previously estimated development costs incurred during the period

|

| | | | 665 | | | | | | 246 | | | | | | 911 | | |

|

Revisions of previous quantity estimates

|

| | | | (1,839) | | | | | | (84) | | | | | | (1,923) | | |

|

Purchase of reserves-in-place

|

| | | | — | | | | | | 15 | | | | | | 15 | | |

|

Sales of reserves-in-place

|

| | | | (112) | | | | | | — | | | | | | (112) | | |

|

Accretion of discount

|

| | | | 902 | | | | | | 129 | | | | | | 1,031 | | |

|

Net changes in income taxes

|

| | | | 14 | | | | | | (37) | | | | | | (23) | | |

|

Changes in production rates and other

|

| | | | (832) | | | | | | (12) | | | | | | (844) | | |

|

Standardized measure, end of period

|

| | | $ | 3,086 | | | | | $ | 703 | | | | | $ | 3,789 | | |

STOCKHOLDERS OF VINE

| |

Chesapeake

|

| |

Vine

|

|

| |

Capital Stock

|

| |||

| |

Chesapeake’s charter authorizes 450,000,000 shares of common stock, par value $0.01 per share, and 45,000,000 shares of preferred stock, par value $0.01 per share.

As of August 31, 2021 there were 98,286,364 shares of Chesapeake common stock outstanding and 33,781,887 warrants to purchase shares of Chesapeake common stock outstanding. No shares of Chesapeake preferred stock are outstanding.

|

| |

Vine’s charter authorizes 350,000,000 shares of Class A common stock, par value $0.01 per share, 150,000,000 shares of Class B common stock, par value $0.01 per share, and 50,000,000 shares of preferred stock, par value $0.01 per share.

As of the Vine record date, there were 41,040,721 shares of Vine Class A common stock outstanding, 34,218,535 shares of Vine Class B common stock outstanding and no shares of Vine preferred stock outstanding.

|

|

| |

Board of Directors

|

| |||

| | Section 1027.B of the OGCA provides that the number of directors constituting the board may be fixed by the charter or bylaws of a corporation. Chesapeake’s bylaws provide that, subject to the rights of the holders of any series of preferred stock to elect directors under specified circumstances, if any, the board of directors will consist of not less than three nor more than ten directors. Chesapeake currently has six directors. The Chesapeake board is not classified. All directors are elected annually for one-year terms. | | |

Section 141(b) of the DGCL provides that the number of directors constituting the board may be fixed by the charter or bylaws of a corporation.

Vine’s charter provides that the number of directors on Vine’s board shall be determined from time to time exclusively by resolution adopted by the board. Vine currently has six directors. The Vine board of directors is classified with directors serving three-year terms.

Additionally, Vine’s charter provides that, subject to the rights granted to the holders of any one or more series of preferred stock then outstanding or the rights granted pursuant to the Stockholders’ Agreement, dated March 22, 2021, by and among Vine and certain affiliates of The Blackstone Group L.P. (together with its affiliates, subsidiaries, successors and assigns, collectively, “Blackstone”) (such agreement, the “Stockholders’ Agreement”), any newly created directorship on the board that results from an increase in the number of directors

|

|

| |

Chesapeake

|

| |

Vine

|

|

| | | | | and any vacancy occurring in the board (whether by death, resignation, retirement, disqualification, removal or other cause) shall be filled by a majority of the directors then in office, although less than a quorum, by a sole remaining director or by the stockholders; provided, however, that at any time when Blackstone beneficially owns, in the aggregate, less than 30% in voting power of Vine’s stock entitled to vote generally in the election of directors, any newly created directorship on the board that results from an increase in the number of directors and any vacancy occurring in the board shall be filled only by a majority of the directors then in office, although less than a quorum, or by a sole remaining director (and not by the stockholders). Any director elected to fill a vacancy or newly created directorship shall hold office until the next election of the class for which such director shall have been chosen and until his or her successor shall be elected and qualified, or until his or her earlier death, resignation, retirement, disqualification or removal. | |

| |

Removal of Directors

|

| |||

| |

As described above under “— Board of Directors,” Chesapeake has a declassified board.

Chesapeake’s bylaws provide that a director may be removed, with or without cause, by the affirmative vote of the holders of a majority of the shares then entitled to vote at an election of directors.

|

| |

As described above under “— Board of Directors,” Vine has a classified board.

Vine’s charter provides that a director may be removed from office at any time, with or without cause, by the affirmative vote of the holders of a majority of the voting power of the outstanding shares of Vine then entitled to vote generally in the election of directors, voting as a single class; provided, however, that at any time when Blackstone beneficially owns, in the aggregate, less than 30% in voting power of the stock of Vine entitled to vote generally in the election of directors, any such director or all such directors may be removed only for cause and only by the affirmative vote of the holders of at least 66 2/3% in voting power of all the then-outstanding shares of stock of Vine entitled to vote thereon, voting together as a single class.

|

|

| |

Filling Vacancies on the Board of Directors

|

| |||

| | Chesapeake’s bylaws provide that all vacancies, including vacancies resulting from newly created directorships resulting from any increase in the authorized number of directors, may be filled by a majority vote of the directors then in office, even if less than a quorum, and any director so chosen will hold office until the next annual meetings of shareholders and until his or her successor is duly elected and qualified, or until his or her earlier resignation or removal. | | | Vine’s charter provides that, subject to the rights of the holders of any series of preferred stock then outstanding or the rights granted pursuant to the Stockholders’ Agreement, any vacancy occurring in the Vine board and newly created directorships resulting from any increase in the number of directors may be filled by a majority of the directors then in office, although less than a quorum, by a sole remaining director or by the stockholders; provided, however, that at any time when | |

| |

Chesapeake

|

| |

Vine

|

|

| | | | | Blackstone beneficially owns, in the aggregate, less than 30% in voting power of Vine’s stock entitled to vote generally in the election of directors, any newly created directorship on the board that results from an increase in the number of directors and any vacancy occurring in the board shall be filled only by a majority of the directors then in office, although less than a quorum, or by a sole remaining director (and not by the stockholders), and any director elected to fill a vacancy or newly created directorship will hold office until the next election of the class for which such director shall have been chosen and until his or her successor is elected and qualified, or until his or her earlier death, resignation, retirement, disqualification or removal. | |

| |

Amendment of Certificate of Incorporation

|

| |||

| |

Section 1077 of the OGCA provides that any amendment to a corporation’s certificate of incorporation must be approved at a special or annual meeting by a majority of the outstanding shares of each class entitled to vote as a class upon a proposed amendment, whether or not entitled to vote by the provisions of the certificate of incorporation, if the amendment would increase or decrease the aggregate number of authorized shares of the class, increase or decrease the par value of the shares of the class, or alter or change the powers, preferences or special rights of the shares of the class so as to affect them adversely.

Chesapeake’s charter requires that the affirmative vote of the holders of at least 60% of the voting power of all outstanding stock entitled to vote, voting together as a single class, to amend certain provisions of Chesapeake’s charter, including those provisions dealing with amendments to Chesapeake’s charter, director liability, related party transactions, board of directors, indemnities, forum selection, corporate opportunities and amendments to bylaws.

|

| |

As provided under the DGCL, any amendment to Vine’s charter requires (i) the approval of the Vine board, (ii) the approval of a majority of the voting power of the outstanding shares of capital stock entitled to vote upon the proposed amendment and (iii) the approval of the holders of a majority of the outstanding stock of each class entitled to vote thereon as a class, if any.

Vine’s charter further requires that at any time when Blackstone beneficially owns, in the aggregate, less than 30% in voting power of Vine stock entitled to vote generally in the election of directors, in addition to any vote required by applicable law, the affirmative vote of holders of at least 66 2/3% in voting power of all the then-outstanding shares of Vine stock entitled to vote thereon, voting together as a single class is required to amend, alter, repeal or rescind any provision inconsistent with certain provisions of Vine’s charter, including those provisions dealing with amendments to the charter or bylaws, board makeup, elections and appointment, director and officer liability, certain stockholder matters, competition and corporate opportunities, Section 203 of the DGCL, severability and forum selection.

|

|

| |

Amendment of Bylaws

|

| |||

| | Chesapeake’s charter provides that its bylaws may be adopted, repealed, altered, amended or rescinded by Chesapeake’s board or by the affirmative vote of the holders of at least a majority of the outstanding stock of Chesapeake entitled to vote thereon, provided that the affirmative vote of the holders of at least 60% of the outstanding stock of Chesapeake entitled to vote at an election of directors is required to amend certain provisions of Chesapeake’s bylaws dealing with listing requests of Chesapeake’s | | | Vine’s charter provides that its bylaws may be made, repealed, altered, amended or rescinded by Vine’s board without the assent or vote of the stockholders in any manner not inconsistent with the laws of the State of Delaware or Vine’s charter. Notwithstanding anything to the contrary contained in Vine’s charter or any provision of law that might otherwise permit a lesser vote of the stockholders, at any time when Blackstone beneficially owns, in the aggregate, less than 30% in | |

| |

Chesapeake

|

| |

Vine

|

|

| | common stock, requests that Chesapeake make certain filings with the SEC and the process required to amend the bylaws. | | | voting power of Vine stock entitled to vote generally in the election of directors, in addition to any vote of the holders of any class or series of capital stock of Vine required (including any certificate of designation relating to any series of preferred stock), Vine’s bylaws or applicable law, the affirmative vote of the holders of at least 66 2/3% in voting power of all of Vine’s then-outstanding shares of stock entitled to vote thereon, voting together as a single class, shall be required in order for the Vine stockholders to alter, amend, repeal or rescind, in whole or in part, any provision of Vine’s bylaws or to adopt any provision inconsistent therewith. | |

| |

Notice of Meetings of Stockholders

|

| |||

| | Section 1067 of the OCGA and Chesapeake’s bylaws provide that written notice of any shareholders’ meeting must be given to each shareholder not less than ten nor more than 60 days before the meeting date; provided, that in the case of a proposed merger, the notice must be not less than 20 days nor more than 60 days before the meeting. | | | Vine’s bylaws provide that unless otherwise provided by law, Vine’s charter or Vine’s bylaws, notice of any stockholders’ meeting must be given not less than ten days nor more than 60 days before the date of the meeting. The DGCL requires a corporation to provide not less than 20 days’ notice of a stockholders’ meeting to vote on a proposed merger. | |

| |

Right to Call Special Meeting of Stockholders

|

| |||

| | Chesapeake’s charter and its bylaws authorize the calling of a special meeting of shareholders for any purpose or purposes, unless otherwise prescribed by the OGCA and may be called only by (i) the chairman of the board, the chief executive officer or the president, (ii) the board of directors acting pursuant to a resolution adopted by a majority of the directors then in office or (iii) the secretary at the written request or requests of holders of record of at least 35% of the voting power of Chesapeake’s outstanding common stock. Business transacted at any special meeting of shareholders will be limited to the purposes stated in Chesapeake’s notice of meeting. | | | Vine’s charter authorizes, subject to the rights of the holders of preferred stock, the calling of a special meeting for any purpose or purposes only by or at the direction of the board or the chairman of the board; provided, however, that at any time when Blackstone beneficially owns, in the aggregate, at least 30% in voting power of Vine stock entitled to vote generally in the election of directors, special meetings of the Vine stockholders for any purpose or purposes shall also be called by or at the direction of the board or the chairman of the board at the request of Blackstone. | |

| |

Nominations and Proposals by Stockholders

|

| |||

| |

Chesapeake’s bylaws provide that business may be brought before an annual meeting (i) by or at the direction of the board of directors or (ii) by any shareholder of Chesapeake who was a shareholder of record at the time of giving notice provided for in Chesapeake’s bylaws and at the time of the annual meeting, who is entitled to vote at such meeting and who complies with the procedures set forth in Chesapeake’s bylaws. The Chesapeake bylaws do not otherwise provide for submission of shareholder proposals for consideration at special meetings.

To be timely, a shareholder must give written notice to the corporate secretary not later than the close of

|

| | Vine’s bylaws provide that nominations of persons for election to the board and the proposal of other business to be considered by the stockholders may be made at an annual meeting of stockholders only (i) as provided in the Stockholders’ Agreement (with respect to nominations of persons for election to the board only), (ii) pursuant to Vine’s notice of meeting (or any supplement thereto) delivered, (iii) by or at the direction of the board or any authorized committee thereof or (iv) by any Vine stockholder who (a) is entitled to vote at the meeting, (b) subject to Vine’s bylaws, complied with the notice procedures set forth in Vine’s bylaws and (c) was a stockholder of record at the time such | |

| |

Chesapeake

|

| |

Vine

|

|

| | business on the 90th day nor earlier than the close of business on the 120th day before the anniversary date of the immediately preceding annual meeting of shareholders. If the annual meeting is called for a date that is more than 30 days earlier or more than 60 days after such anniversary date, or in the case of a special meeting of shareholders called for the purpose of electing directors, notice by the shareholder must be so received (1) no earlier than the closing of business on the 120th day before the meeting and (2) not later than the close of business on the 90th day before the meeting, or the tenth day following the day on which public announcement of the date of such meeting is first made by Chesapeake. | | |

notice is delivered to Vine’s secretary, on the record date for the determination of Vine stockholders and at the time of the meeting.

Other than proposals included in the notice of meeting pursuant to Rule 14a-8 promulgated under the Exchange Act, to be timely, a stockholder must give written notice to the corporate secretary not later than the close of business on the 90th day nor earlier than the close of business on the 120th day before the anniversary date of the immediately preceding annual meeting of stockholders. If the annual meeting is called for a date that is more than 30 days earlier or more than 70 days after such anniversary date, notice by the stockholder to be timely must be delivered (i) no earlier than the close of business on the 120th day before the meeting and (ii) not later than the close of business on the later of the 90th day before the meeting or the 10th day following the day of the first public announcement of such meeting.

|

|

| |

Indemnification of Officers, Directors and Employees

|

| |||

| | Under Section 1031 of the OGCA, a corporation may indemnify its directors and officers made a party to a proceeding because the person was a director or officer, against expenses, including attorneys’ fees, judgements and fines, and amounts paid in settlement actually and reasonably incurred, whether in civil, criminal, administrative, or investigative proceedings, by him or her if the person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. A corporation may not indemnify a director or officer under this section in respect of any claim or matter as to which the person shall have been adjudged to be liable to the corporation unless and only to the extent that the court in which the action was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnity for expenses which the court shall deem proper. Chesapeake’s bylaws provide that Chesapeake will indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding whether civil, criminal, administrative or investigative, including an action by or in the right of Chesapeake, because he or she is or was a director, officer, employee or agent of Chesapeake | | | Vine’s bylaws provide that Vine will indemnify and hold harmless, to the fullest extent permitted by applicable law, any person who was or is made or is threatened to be made a party or is otherwise involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (a “proceeding”), by reason of the fact that he or she is or was serving at the request of Vine as a director, officer, employee, agent or trustee of another corporation or of a partnership, joint venture, trust or other enterprise, including service with respect to an employee benefit plan (hereinafter an “indemnitee”), whether the basis of such proceeding is alleged action in an official capacity as a director, officer, employee, agent or trustee or in any other capacity while serving as a director, officer, employee, agent or trustee, shall be indemnified and held harmless by Vine to the fullest extent permitted by Delaware law against all expense, liability and loss (including attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and amounts paid in settlement) reasonably incurred or suffered by such indemnitee in connection therewith; provided, however, that, except as otherwise provided in Vine’s bylaws with respect to proceedings to enforce rights to indemnification or advancement of expenses or with respect to any compulsory counterclaim brought by such indemnitee, Vine will indemnify any such indemnitee in connection with a proceeding (or part thereof) initiated by such indemnitee only if such proceeding (or part thereof) | |

| |

Chesapeake

|

| |

Vine

|

|

| |

or is or was serving at the request of Chesapeake as a director, officer, employee or agent of another corporation, partnership, joint venture or other enterprise against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him or her in connection with such action, suit or proceeding, if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interest of Chesapeake and, with respect to any criminal action or proceeding, had no reasonable cause to believe that his or her conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction or upon a plea of nolo contendere or its equivalent will not of itself create a presumption that the person did not act in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interest of Chesapeake and, with respect to any criminal action or proceeding, had reasonable cause to believe that his or her conduct was unlawful. In an action by or in the right of Chesapeake, Chesapeake will not indemnify a person who has been adjudged liable to it unless and only to the extent that the court rendering judgment has determined that despite the adjudication of liability, but in the view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses that the court deems proper.

Chesapeake’s bylaws provide that Chesapeake may pay the expenses incurred in defending a civil or criminal action, suit or proceeding in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of the director, officer, employee or agent to repay such amount if it is ultimately determined that he or she is not entitled to be indemnified by Chesapeake as authorized by Chesapeake’s bylaws.

|

| |

was authorized by the board.

Vine’s bylaws provide that an indemnitee will also have the right to be paid by Vine for the expenses (including any attorney’s fees) incurred in appearing at, participating in or defending any such proceeding in advance of its final disposition or in connection with a proceeding brought to establish or enforce a right to indemnification or advancement of expenses under certain sections of Vine’s bylaws; provided, however, that, if the DGCL requires or in the case of an advance made in a proceeding brought to establish or enforce a right to indemnification or advancement, an advancement of expenses incurred by an indemnitee in his or her capacity as a director or officer of Vine (and not in any other capacity in which service was or is rendered by such indemnitee, including, without limitation, service to an employee benefit plan) will be made solely upon delivery to Vine of an undertaking by or on behalf of such indemnitee, to repay all amounts so advanced if it shall ultimately be determined by final judicial decision from which there is no further right to appeal that such indemnitee is not entitled to be indemnified or entitled to advancement of expenses.

Under the DGCL, except with respect to an action by or in the right of a corporation, a corporation may indemnify its directors, officers, employees or agents (or a person who is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise) against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful. In the case of actions by or in the right of the corporation, the corporation may indemnify its directors, officers, employees or agents (or a person who is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise) against expenses (including attorneys’ fees) actually and reasonably incurred by him or her if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification may be made in

|

|

| |

Chesapeake

|

| |

Vine

|

|

| | | | | respect of any claim, issue or matter as to which such person has been adjudged to be liable to the corporation, unless and only to the extent a court finds that, in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnification for such expenses as the court deems proper. | |

| |

Special Vote Requirements for Certain Transactions

|

| |||

| | Section 1090.3 of the OGCA provides generally that a corporation is prohibited from engaging in any business combination with an interested shareholder for three years from the date on which the shareholder first becomes an interested shareholder. Chesapeake’s charter provides that Chesapeake has elected to not be governed by Section 1090.3 of the OGCA. | | |

Vine’s charter contains a provision electing for Vine not to be subject to Section 203 of the DGCL.