UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number:

VAALCO Energy, Inc.

(Exact name of registrant as specified on its charter)

| | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

9800 Richmond Avenue

Suite 700

(Address of principal executive offices) (Zip Code)

(Registrant’s telephone number, including area code): (

Securities registered under Section 12(b) of the Exchange Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | | |

| Common Stock, par value $0.10 | EGY | London Stock Exchange |

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15d of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | | Non-accelerated filer ☐ | Smaller reporting company |

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of June 30, 2022, the aggregate market value of the voting and non-voting common equity of the registrant held by non-affiliates was approximately $

As of March 31, 2023, there were outstanding

Documents incorporated by reference: Portions of the definitive Proxy Statement of VAALCO Energy, Inc. relating to the Annual Meeting of Stockholders to be filed within 120 days after the end of the fiscal year covered by this Form 10-K, which are incorporated into Part III of this Form 10-K.

TABLE OF CONTENTS

Glossary of Certain Crude Oil, Natural Gas and NGL Terms

All references to $ are to United States dollars and references to C$ are to Canadian dollars.

Terms used to describe quantities of crude oil, natural gas and NGLs

| • |

Bbl — One stock tank barrel, or 42 United States (“U.S.”) gallons liquid volume, of crude oil or other liquid hydrocarbons. |

|

| • | Bbl/d — Barrels per day | |

| • | Bcf — One billion cubic feet | |

| • | Boe — Barrel of oil equivalent. Volumes of natural gas converted to barrels of oil using a conversion factor of 6,000 cubic feet of natural gas to one barrel of oil. | |

| • | BOEPD — One Boe per day | |

| • |

BOPD — One Bbl per day. |

|

| • | Km2 — Square Kilometers | |

| • | M3 — Cubic Meters | |

| • |

MBbl — One thousand Bbls. |

|

| • | MMBbl — One million Bbls | |

| • | MBoe — One thousand Boes. | |

| • | MMBoe — One million Boes. | |

| • |

MBopd — One thousand Bbls per day. |

|

| • | MBOEPD – One thousand Boes per day. | |

| • | MCF — One thousand cubic feet. | |

| • | MCFD — One thousand cubic feet per day. | |

| • |

MMBbl — One million Bbls. |

|

| • | MMBoe – One million Boes. | |

| • | MMBTU – One million British Thermal Units. | |

| • | MMcf — One million cubic feet. | |

| • | NGLs — Natural Gas Liquids. | |

| • | NRI — working interest volumes less royalty volumes, where applicable. | |

| • | WI — working interest volumes. |

Terms used to describe legal ownership of crude oil, natural gas and NGLs properties, and other terms applicable to our operations

| • | Arta — The Arta field in the West Gharib concession in the Egyptian Eastern Desert. |

|

| • |

BWE Consortium — A consortium of the Company, BW Energy and Panoro Energy provisionally awarded two blocks, G12-13 and H12-13, in the 12th Offshore Licensing Round in Gabon. |

|

| • | C$ — means Canadian dollars. |

|

| • | Cardium — The Cardium formation that spans a large area from southwest Alberta to northeast British Columbia, with the producing area concentrated along the eastern slopes of the Rocky Mountains to the northwest of Calgary. |

|

| • |

Carried interest — Working Interest (as defined below) where the carried interest owner’s share of costs is paid by the non-carried working interest owners. The carried costs are repaid to the non-carried working interest owners from the revenues of the carried working interest owner. |

|

| • | Crown Royalty — The payments to be made to the Province of Alberta pursuant to the Alberta Crown Agreement or under the generic crown royalty scheme. |

|

| • | EGPC — Egyptian General Petroleum Corporation. |

|

| • | Egypt — Arab Republic of Egypt. |

|

| • |

Gabon — Republic of Gabon. |

|

| • |

Etame Consortium — A consortium of four companies granted rights and obligations in the Etame Marin block offshore Gabon under the Etame PSC. |

| • | Merged Concession — The modernized concession that merged the West Bakr, West Gharib and NW Gharib concessions. | |

| • | Merged Concession Agreement — The agreement with EGPC for the Merged Concession signed by the Ministry of Petroleum at an official signing ceremony on January 19, 2022. | |

| • |

PSC — A production sharing contract. |

|

| • |

FPSO — A floating, production, storage and offloading vessel. |

|

| • |

FSO – A floating storage and offloading vessel. |

|

| • | NW Gharib — The North West Gharib Concession area in Egypt. | |

| • | NW Sitra — The North West Sitra Concession area in Egypt. | |

| • |

Participating Interest — Working Interest (as defined below) attributable to a non-carried interest owner adjusted to include its relative share of the benefits and obligations attributable to carried working interest owners. |

|

| • |

Royalty interest — A real property interest entitling the owner to receive a specified portion of the gross proceeds of the sale of crude oil and, natural gas and NGLs production or, if the conveyance creating the interest provides, a specific portion of crude oil and, natural gas and NGLs produced, without any deduction for the costs to explore for, develop or produce the crude oil and, natural gas and NGLs. | |

| • | South Alamain — The South Alamain Concession area in Egypt. | |

| • | West Bakr — The West Bakr Concession area in Egypt. | |

| • | West Gharib — The West Gharib Concession area in Egypt. | |

| • |

Working Interest — A real property interest entitling the owner to receive a specified percentage of the proceeds of the sale of crude oil and, natural gas and NGLs production or a percentage of the production, but requiring the owner of the working interest to bear the cost to explore for, develop and produce such crude oil and, natural gas and NGLs. A working interest owner who owns a portion of the working interest may participate either as operator or by voting his percentage interest to approve or disapprove the appointment of an operator and drilling and other major activities in connection with the development and operation of a property. |

|

| • | $ — means U.S. dollars. | |

| • | Yusr — The Yusr reservoirs in the West Bakr concession in the Egyptian Eastern Desert. |

Terms used to describe interests in wells and acreage

| • |

Gross crude oil and, natural gas and NGLs wells or acres — Gross wells or gross acres represent the total number of wells or acres in which a working interest is owned, before consideration of the ownership percentage. |

| • |

Net crude oil and, natural gas and NGLs wells or acres — Determined by multiplying “gross” wells or acres by the owned working interest. |

Terms used to classify reserve quantities

| • |

Proved developed crude oil and, natural gas and NGLs reserves — Developed crude oil and, natural gas and NGLs reserves are reserves of any category that can be expected to be recovered: |

| (i) Through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well; and |

| (ii) Through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well. |

| • |

Proved crude oil and, natural gas and NGLs reserves — Proved crude oil and, natural gas and NGLs reserves are those quantities of crude oil and, natural gas and NGLs, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible (from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations) prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time. |

| (i) The area of the reservoir considered as proved includes: |

| (A) The area identified by drilling and limited by fluid contacts, if any, and |

| (B) Adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be continuous with it and to contain economically producible crude oil or natural gas on the basis of available geoscience and engineering data. |

| (ii) In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest known hydrocarbons (LKH) as seen in a well penetration unless geoscience, engineering, or performance data and reliable technology establishes a lower contact with reasonable certainty. |

| (iii) Where direct observation from well penetrations has defined a highest known crude oil (HKO) elevation and the potential exists for an associated natural gas cap, proved crude oil reserves may be assigned in the structurally higher portions of the reservoir only if geoscience, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty. |

| (iv) Reserves that can be produced economically through application of improved recovery techniques (including, but not limited to, fluid injection), are included in the proved classification when: |

| (A) Successful testing by a pilot project in an area of the reservoir with properties no more favorable than in the reservoir as a whole, the operation of an installed program in the reservoir or an analogous reservoir, or other evidence using reliable technology establishes the reasonable certainty of the engineering analysis on which the project or program was based; and |

| (B) The project has been approved for development by all necessary parties and entities, including governmental entities. |

| (v) Existing economic conditions include prices and costs at which economic producibility from a reservoir is to be determined. The price shall be the average price during the 12-month period prior to the ending date of the period covered by the report, determined as an unweighted arithmetic average of the first day of the month price for each month within such period, unless prices are defined by contractual arrangements, excluding escalations based upon future conditions. |

| • |

Reserves — Reserves are estimated remaining quantities of crude oil, natural gas, NGLs and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering crude oil, natural gas, NGLs or related substances to market, and all permits and financing required to implement the project. |

| • |

Proved undeveloped crude oil and, natural gas reserve and NGLs reserves, PUDs — Proved undeveloped crude oil and, natural gas and NGLs reserves are reserves that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion. |

| (i) Reserves on undrilled acreage shall be limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances. |

| (ii) Undrilled locations can be classified as having proved undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances, justify a longer time. |

| (iii) Under no circumstances shall estimates for proved undeveloped reserves be attributable to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual projects in the same reservoir or an analogous reservoir, or by other evidence using reliable technology establishing reasonable certainty. |

| • |

Unproved properties — Properties with no proved reserves. |

Terms used to assign a present value to reserves

| • |

Standardized measure — The standardized measure of discounted future net cash flows (“standardized measure”) is the present value, discounted at an annual rate of 10%, of estimated future net revenues to be generated from the production of proved reserves, determined in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”), using the 12-month unweighted average of first-day-of-the-month Brent prices adjusted for historical marketing differentials, (the “12-month average”), without giving effect to non–property related expenses such as certain general and administrative expenses, debt service, derivatives or to depreciation, depletion and amortization. |

Terms used to describe seismic operations

| • |

Seismic data — crude oil, natural gas and NGLs companies use seismic data as their principal source of information to locate crude oil, natural gas and NGLs deposits, both to aid in exploration for new deposits and to manage or enhance production from known reservoirs. To gather seismic data, an energy source is used to send sound waves into the subsurface strata. These waves are reflected back to the surface by underground formations, where they are detected by geophones that digitize and record the reflected waves. Computers are then used to process the raw data to develop an image of underground formations. |

| • |

3-D seismic data — 3-D seismic data is collected using a grid of energy sources, which are generally spread over several miles. A 3-D survey produces a three-dimensional image of the subsurface geology by collecting seismic data along parallel lines and creating a cube of information that can be divided into various planes, thus improving visualization. Consequently, 3-D seismic data is a more reliable indicator of potential crude oil, natural gas and NGLs reservoirs in the area evaluated. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are intended to be covered by the safe harbors created by those laws. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements include information about possible or assumed future results of our operations. All statements, other than statements of historical facts, included in this Annual Report that address activities, events or developments that we expect or anticipate may occur in the future, including without limitation, statements regarding our financial position, operating performance and results, reserve quantities and net present values, market prices, business strategy, derivative activities, the amount and nature of capital expenditures, payment of dividends and plans and objectives of management for future operations are forward-looking statements. When we use words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “forecast,” “outlook,” “aim,” “target,” “will,” “could,” “should,” “may,” “likely,” “plan,” and “probably” or the negative of such terms or similar expressions, we are making forward-looking statements. Many risks and uncertainties that could affect our future results and could cause results to differ materially from those expressed in our forward-looking statements include, but are not limited to:

| • |

volatility of, and declines and weaknesses in crude oil and, natural gas and NGLs prices, as well as our ability to offset volatility in prices through the use of hedging transactions; |

| • | our ability to remediate our material weaknesses; | |

| • |

the discovery, acquisition, development and replacement of crude oil, natural gas and NGLs reserves; |

| • |

impairments in the value of our crude oil, natural gas and NGLs assets; |

| • |

future capital requirements; |

| • |

our ability to maintain sufficient liquidity in order to fully implement our business plan; |

| • |

our ability to generate cash flows that, along with our cash on hand, will be sufficient to support our operations and cash requirements; |

| • |

the ability of the BWE Consortium to successfully execute its business plan; |

| • |

our ability to attract capital or obtain debt financing arrangements; |

| • |

our ability to pay the expenditures required in order to develop certain of our properties; |

| • |

operating hazards inherent in the exploration for and production of crude oil, natural gas and NGL; |

| • |

difficulties encountered during the exploration for and production of crude oil, natural gas and NGL; |

| • |

the impact of competition; |

| • |

our ability to identify and complete complementary opportunistic acquisitions; |

| • |

our ability to effectively integrate assets and properties that we acquire into our operations; |

| • |

weather conditions; |

| • |

the uncertainty of estimates of crude oil and, natural gas reserves; |

| • |

currency exchange rates and regulations; |

| • |

unanticipated issues and liabilities arising from non-compliance with environmental regulations; |

| • |

the ultimate resolution of our abandonment funding obligations with the government of Gabon and the audit of our operations in Gabon currently being conducted by the government of Gabon; |

| • | the ultimate resolution of our negotiations with EGPC relating to the Effective Date Adjustment (as defined below); | |

| • |

the availability and cost of seismic, drilling and other equipment; |

| • |

difficulties encountered in measuring, transporting and delivering crude oil, natural gas, and NGLs to commercial markets; |

| • |

timing and amount of future production of crude oil and, natural gas and NGL; |

| • |

hedging decisions, including whether or not to enter into derivative financial instruments; |

| • |

general economic conditions, including any future economic downturn, the impact of inflation, disruption in financial of credit; |

| • |

our ability to enter into new customer contracts; |

| • |

changes in customer demand and producers’ supply; |

| • |

actions by the governments of and events occurring in the countries in which we operate; |

| • |

actions by our joint venture owners; |

| • |

compliance with, or the effect of changes in, governmental regulations regarding our exploration, production, and well completion operations including those related to climate change; |

| • |

the outcome of any governmental audit; and |

| • |

actions of operators of our crude oil and, natural gas and NGLs properties. |

The information contained in this Annual Report, including the information set forth under the heading “Item 1A. Risk Factors,” identifies additional factors that could cause our results or performance to differ materially from those we express in forward-looking statements. Although we believe that the assumptions underlying our forward-looking statements are reasonable, any of these assumptions and therefore also the forward-looking statements based on these assumptions, could themselves prove to be inaccurate. In light of the significant uncertainties inherent in the forward-looking statements that are included in this Annual Report, our inclusion of this information is not a representation by us or any other person that our objectives and plans will be achieved. When you consider our forward-looking statements, you should keep in mind these risk factors and the other cautionary statements in this Annual Report.

Our forward-looking statements speak only as of the date the statements are made and reflect our best judgment about future events and trends based on the information currently available to us. Our results of operations can be affected by inaccurate assumptions we make or by risks and uncertainties known or unknown to us. Therefore, we cannot guarantee the accuracy of the forward-looking statements. Actual events and results of operations may vary materially from our current expectations and assumptions. Our forward-looking statements, express or implied, are expressly qualified by this “Cautionary Statement Regarding Forward-Looking Statements,” which constitute cautionary statements. These cautionary statements should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.

Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances occurring after the date of this Annual Report.

Risk Factor Summary

Below is a summary of our risk factors. The risks below are those that we believe are the material risks that we currently face but are not the only risks facing us and our business. If any of these risks actually occur, our business, financial condition and results of operations could be materially adversely affected. See “Risk Factors” beginning on page 32 and the other information included elsewhere or incorporated by reference in this annual report for a discussion of factors you should carefully consider before deciding to invest in our common stock.

| • |

Our business requires significant capital expenditures, and we may not be able to obtain needed capital or financing to fund our exploration and development activities or potential acquisitions on satisfactory terms or at all. |

| • |

Unless we are able to replace the proved reserve quantities that we have produced through acquiring or developing additional reserves, our cash flows and production will decrease over time. |

| • |

We may not enter into definitive agreements with the BWE Consortium to explore and exploit new properties, and we may not be in a position to control the timing of development efforts, the associated costs or the rate of production of the reserves operated by the BWE Consortium or from any non-operated properties in which we have an interest. |

| • |

Our offshore operations involve special risks that could adversely affect our results of operations. |

| • |

Acquisitions and divestitures of properties and businesses may subject us to additional risks and uncertainties, including that acquired assets may not produce as projected, may subject us to additional liabilities and may not be successfully integrated with our business. In addition, any sales or divestments of properties we make may result in certain liabilities that we are required to retain under the terms of such sales or divestments. |

| • |

Our reserve information represents estimates that may turn out to be incorrect if the assumptions on which these estimates are based are inaccurate. Any material inaccuracies in these reserve estimates or underlying assumptions will materially affect the quantities and present values of our reserves. |

| • |

If our assumptions underlying accruals for abandonment/decommissioning costs are too low, we could be required to expend greater amounts than expected. |

| • | We may not generate sufficient cash to satisfy our payment obligations under the Merged Concession Agreement or be able to collect some or all of our receivables from the EGPC, which could negatively affect our operating results and financial condition. | |

| • | The Egyptian PSCs contain assignment provisions which, if triggered, could adversely affect our business. | |

| • |

We could lose our interest in Block P if we do not meet our commitments under the production sharing contract. |

| • |

Commodity derivative transactions that we enter into may fail to protect us from declines in commodity prices and could result in financial losses or reduce our income. |

| • | We are exposed to the credit risks of the third parties with whom we contract. | |

| • |

Our business could be materially and adversely affected by security threats, including cybersecurity threats, and other disruptions. |

| • | Events outside of our control, such as the ongoing COVID-19 pandemic and Russia’s invasion of Ukraine, could adversely impact our business, results of operations, cash flows, financial condition and liquidity. | |

| • | Production cuts mandated by the government of Gabon, a member of OPEC, could adversely affect our revenues, cash flow and results of operations. |

| • |

We have less control over our investments in foreign properties than we would have with respect to domestic investments. |

| • |

Our operations may be adversely affected by political and economic circumstances in the countries in which we operate. |

| • | Inflation could adversely impact our ability to control costs, including operating expenses and capital costs. | |

| • |

Our results of operations, financial condition and cash flows could be adversely affected by changes in currency exchange rates. |

| • |

We operate in international jurisdictions, and we could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act and similar worldwide anti-corruption laws. |

| • |

There are inherent limitations in all control systems, and misstatements due to error or fraud that could seriously harm our business may occur and not be detected. |

| • | We have identified material weaknesses in our internal control over financial reporting which has caused us to conclude our disclosure controls and procedures and our internal control over financial reporting were not effective as of December 31, 2022 and could, if not remediated, adversely affect our ability to report our financial condition and results of operations in a timely and accurate manner, investor confidence in our company and, as a result, the value of our common stock. | |

| • |

We may not have enough insurance to cover all of the risks we face. |

| • |

Our business could suffer if we lose the services of, or fail to attract, key personnel. |

| • | We may be exposed to the risk of earthquakes in Alberta, Canada. | |

| • | We may be adversely affected by changes in currency regulations. | |

| • | We may be adversely affected by changes to interest rates. | |

| • | The development of our estimated proved undeveloped reserves may take longer and may require higher levels of capital expenditures than we currently anticipate. Therefore, our estimated proved undeveloped reserves may not be ultimately developed or produced. | |

| • | There may be valid challenges to title or legislative changes which affect our title to the oil, natural gas and NGLs properties we control in Canada. | |

| • |

Crude oil, natural gas and NGLs prices are highly volatile and a depressed price regime, if prolonged, may negatively affect our financial results. |

| • | Exploring for, developing, or acquiring reserves is capital intensive and uncertain. | |

| • |

Competitive industry conditions may negatively affect our ability to conduct operations. |

| • |

Weather, unexpected subsurface conditions and other unforeseen operating hazards may adversely impact our crude oil, natural gas and NGLs activities, including but not limited to, earthquakes in Alberta and risks related to hydraulic fracking. |

| • |

An increased societal and governmental focus on ESG and climate change issues may adversely impact our business, impact our access to investors and financing, and decrease demand for our product. |

| • |

We face various risks associated with increased opposition to and activism against crude oil, natural gas and NGLs exploration and development activities. |

| • | Our operations are subject to risks associated with climate change and potential regulatory programs meant to address climate change; these programs may impact or limit our business plans, result in significant expenditures or reduce demand for our product. | |

| • |

Compliance with applicable laws, environmental and other government regulations could be costly and could negatively impact production. |

| • | A significant level of indebtedness incurred under the Facility may limit our ability to borrow additional funds or capitalize on acquisition or other business opportunities in the future. In addition, the covenants in the Facility impose restrictions that may limit our ability and the ability of our subsidiaries to take certain actions. Our failure to comply with these covenants could result in the acceleration of any future outstanding indebtedness under the Facility. |

|

| • | If we experience in the future a continued period of low commodity prices, our ability to comply with applicable debt covenants may be impacted. | |

| • | The borrowing base under the Facility may be reduced pursuant to the terms of the Facility Agreement, which may limit our available funding for exploration and development. We may have difficulty obtaining additional credit, which could adversely affect our operations and financial position. | |

| • | Restrictive debt covenants could limit our growth and our ability to finance our operations, fund our capital needs, respond to changing conditions and engage in other business activities that may be in our best interests. |

OVERVIEW

As used in this Annual Report, the terms, “we,” “us,” “our,” the “Company” and “VAALCO” refer to VAALCO Energy, Inc. and its consolidated subsidiaries, unless the context otherwise requires.

We are a Houston, Texas-based independent energy company engaged in the acquisition, exploration, development and production of crude oil, natural gas and natural gas liquids ("NGLs").

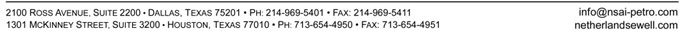

Our primary source of revenue historically has been from the Etame PSC related to the Etame Marin block located offshore Gabon in West Africa. The Etame Marin block covers an area of approximately 46,200 gross acres located 20 miles offshore in water depths of approximately 250 feet. Currently, our working interest in the Etame Marin block is 58.8%, and we are designated as the operator on behalf of the Etame Consortium. The block is subject to a 7.5% back-in carried interest by the government of Gabon, which they have assigned to a third party. Our working interest will decrease to 57.2% in June 2026 when the back-in carried interest increases to 10%.

We are also a member of a consortium with BW Energy and Panoro Energy (the “BWE Consortium”). The BWE Consortium has been provisionally awarded two blocks in the 12th Offshore Licensing Round in Gabon. The award is subject to concluding the terms of PSCs with the Gabonese government. BW Energy will be the operator with a 37.5% working interest, with VAALCO (37.5% working interest) and Panoro Energy (25% working interest) as non-operating joint owners. The two blocks, G12-13 and H12-13 are adjacent to our Etame PSC as well as BW Energy and Panoro’s Dussafu PSC offshore Southern Gabon and cover an area of 2,989 square kilometers and 1,929 square kilometers, respectively.

On October 13, 2022, VAALCO and VAALCO Energy Canada ULC (“AcquireCo”), our indirect wholly-owned subsidiary, completed the previously announced business combination involving TransGlobe Energy Corporation (“TransGlobe”), whereby AcquireCo acquired all of the issued and outstanding TransGlobe common shares pursuant to a plan of arrangement (the “Arrangement”) and TransGlobe became a direct wholly-owned subsidiary of AcquireCo and an indirect wholly-owned subsidiary of VAALCO in accordance with the terms of an arrangement agreement entered into by VAALCO, AcquireCo and TransGlobe on July 13, 2022 (the “Arrangement Agreement”). Prior to the Arrangement, TransGlobe was a cash flow-focused oil and gas exploration and development company whose activities were concentrated in Egypt and Canada. The post-Arrangement company (the “Combined Company”) is a leading African-focused operator with a strong production and reserve base and a diverse portfolio of assets in Gabon, Egypt, Equatorial Guinea and Canada. See Note 4 to the consolidated financial statements for further discussion regarding the Arrangement.

At December 31, 2022, net proved reserves related to Gabon were at 10.2 MBoe, net proved reserves related to Egypt were at 8.6 MBoe and net proved reserves related to Canada were at 9.2 MBoe.

We also currently own an interest in an undeveloped block offshore Equatorial Guinea, West Africa.

Recent developments are discussed below in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations."

STRATEGY

We own crude oil, natural gas and NGLs producing properties and conduct operating activities in Egypt, Canada, and offshore Gabon, with a focus on maximizing the value of our current resources and expanding into new development opportunities across Africa. Our financial results are heavily dependent upon the margins between prices received for our crude oil, natural gas and NGLs production and the costs to find and produce such crude oil, natural gas and NGLs.

We intend to increase stockholder value by accretively growing production and value through organic drilling in a capital efficient manner to unlock the inherent value of our assets and making disciplined strategic acquisitions that meet our strategic and financial objectives. Specifically, we seek to:

| • |

Focus on maintaining production and lowering costs to increase margins and preserve optionality to capitalize on an increase in crude oil, natural gas and NGLs prices; |

| • |

Manage capital expenditures related to our drilling programs so that expenditures can be funded by cash on hand and cash from operations; |

| • |

Continue our focus on operating safely and complying with internationally accepted environmental operating standards; |

| • |

Optimize production through careful management of wells and infrastructure; |

| • |

Maximize our cash flow and income generation; |

| • |

Continue planning for additional development at Etame, Egypt, and Canada as well as future activity in Equatorial Guinea; |

| • |

Preserve a strong balance sheet by maintaining conservative leverage ratios and exhibiting financial discipline; |

| • |

Opportunistically hedge against exposures to changes in crude oil, natural gas or NGLs prices; and |

| • |

Actively pursue strategic, value-accretive mergers and acquisitions of similar properties to diversify our portfolio of producing assets. |

We believe that we have strong management and technical expertise specific to the markets in which we operate, and that our strengths include:

| • |

Our reputation as a safe and efficient operator in Africa and Canada; |

| • |

Our history of establishing favorable operating relationships with host governments and local joint venture owners; |

| • |

Our subsurface knowledge of key plays and risks in the broader regional framework of discoveries and fields; |

| • |

Our operational capacity to take on new development projects; |

| • |

Our familiarity with local practices and infrastructure; and |

| • |

Our market intelligence to provide early insight into available opportunities. |

SEGMENT AND GEOGRAPHIC INFORMATION

For operating segment and geographic financial information, see Note 5 to the Consolidated Financial Statements. Our reportable operating segments are Gabon, Egypt, Canada and Equatorial Guinea.

Gabon Segment

Offshore – Etame Marin Block

The Etame PSC related to the Etame Marin block is located offshore Gabon. The Etame Marin block covers an area of approximately 46,200 gross acres located 20 miles offshore in water depths of approximately 250 feet. Currently, our working interest in the Etame Marin block is 58.8%, and we are designated as the operator on behalf of the Etame Consortium. The block is subject to a 7.5% back-in carried interest by the government of Gabon, which they have assigned to a third party. Our working interest will decrease to 57.2% in June 2026 when the back-in carried interest increases to 10%. The terms of the Etame PSC include provisions for payments to the government of Gabon for: royalties based on 13% of production at the published price and a shared portion of “Profit Oil” determined based on daily production rates, as well as a gross carried working interest of 7.5% (increasing to 10% beginning June 20, 2026) for all costs. The term of the Etame PSC with Gabon related to the Etame Marin block located offshore Gabon extends through 2028 with two five-year options to extend the PSC (“PSC Extension”). The PSC Extension provides us with the extended time horizon necessary to pursue developing the resources we have identified at Etame. Prior to February 1, 2018, the government of Gabon did not take any of its share of Profit Oil in-kind. Beginning February 1, 2018, the government of Gabon elected to, and has continued to, take its Profit Oil in-kind.

As of December 31, 2022, our core areas in Gabon are illustrated below:

Egypt Segment

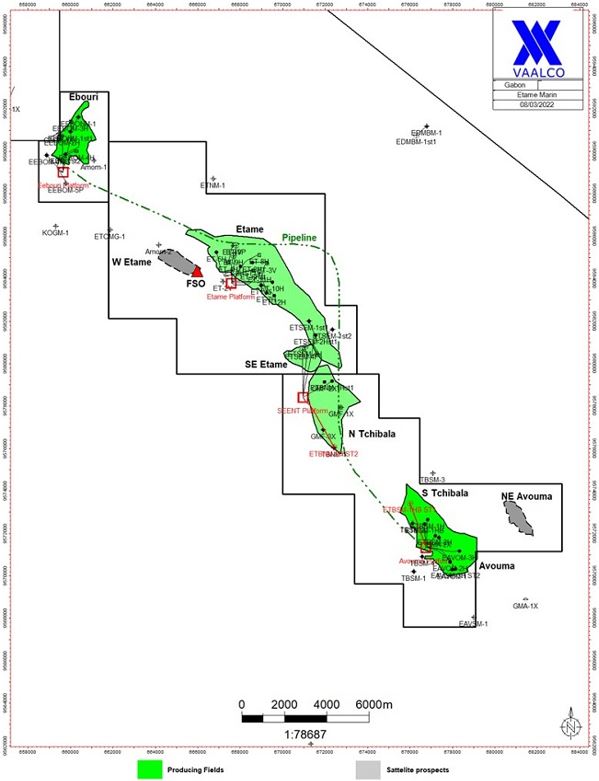

In Egypt, as of December 31, 2022, our interests are spread across two regions: the Eastern Desert, which contains the West Gharib, West Bakr and North West Gharib merged concessions, and the Western Desert, which contains the South Ghazalat concession. The Eastern Desert merged concession is approximately 45,067 acres and the Western Desert, South Ghazalat concession, is approximately 7,340 acres. Both of our Egyptian blocks are PSCs among the Egyptian General Petroleum Corporation (“EGPC”), the Egyptian government and us. We are the operator and have a 100% working interest in both PSCs. Our oil entitlement is the sum of cost oil, profit oil and excess cost oil, if any. The government takes their share of production based on the terms and conditions of the respective contracts. Our share of royalties is paid out of the government's share of production. Taxes are captured in the Egyptian government's net entitlement oil due and therefore there is no additional tax burden to us.

On January 20, 2022, prior to the consummation of the Arrangement, TransGlobe announced a fully executed Merged Concession Agreement with EGPC that merged the three existing Eastern Desert concessions with a 15-year primary term and improved economics. In advance of the Minister of Petroleum and Mineral Resources of the Arab Republic of Egypt (the “Minister”) executing the Merged Concession Agreement, TransGlobe paid the first modernization payment of $15.0 million and signature bonus of $1.0 million as part of the conditions precedent to the official signing ceremony on January 19, 2022. On February 1, 2022, TransGlobe paid the second modernization payment of $10.0 million. In accordance with the Merged Concession, we agreed to substitute the 2023 payment and issue a $10.0 million credit against receivables owed from EGPC. We will make three further annual equalization payments of $10.0 million each beginning February 1, 2024, until February 1, 2026. We also have minimum financial work commitments of $50.0 million per each five-year period of the primary development term, commencing on February 1, 2020 (the "Merged Concession Effective Date"). As of December 31, 2022, the $50 million of financial work commitments had been delivered to EGPC. As the Merger Concession Agreement is effective as of February 1, 2020, there will be an effective date adjustment owed to us for the difference in the historic commercial terms and the revised commercial terms applied against the production since the Merged Concession Effective Date. The cumulative amount of the effective date adjustment was estimated at $67.5 million. However, the cumulative amount to be received as a result of the effective date adjustment is currently being finalized with EGPC and could result in a range of outcomes based on the final price per barrel negotiated. At December 31, 2022, we received $17.2 million of the receivable and the remaining $50.3 million is recorded on our consolidated balance sheet in Receivables-Other, net.

The Egyptian PSCs provide for the government to receive a percentage gross royalty on the gross production. The remaining oil production, after deducting the gross royalty, if any, is split between cost sharing oil and production sharing oil. Cost sharing oil is up to a maximum percentage as defined in the specific PSC. Cost oil is assigned to recover approved operating and capital costs spent on the specific project. Unutilized cost sharing oil or excess cost oil (maximum cost recovery less actual cost recovery) is shared between the government and the contractor as defined in the specific PSCs. Each PSC is treated individually in respect of cost recovery and production sharing purposes. The remaining production sharing oil (total production less cost oil) is shared between the government and the contractor as defined in the specific PSC. The Egyptian PSCs do not contain minimum production or sales requirements, and there are no restrictions with respect to pricing of the contractor's sales volumes. Except as otherwise disclosed, all crude oil sales are priced at current market rates at the time of sale.

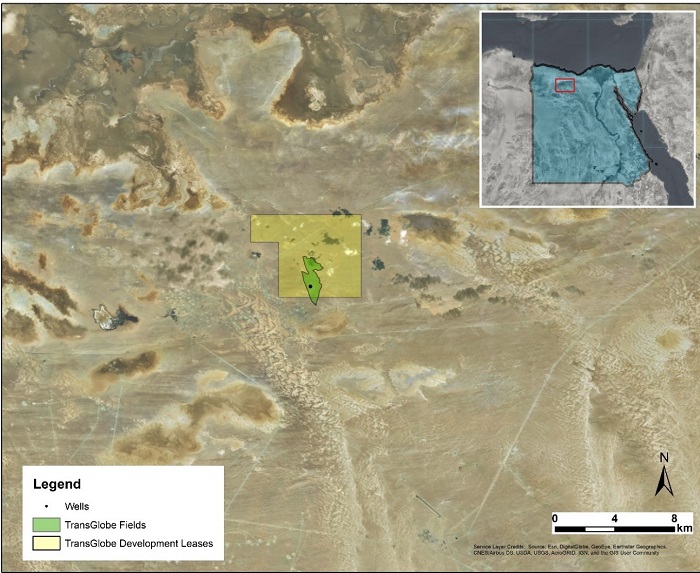

The following illustrates our Merged Concession in the Eastern Desert:

The following illustrates our concession, South Ghazalat, in the Western Desert:

The following table summarizes our Egyptian PSC terms for the first tranche(s) of production for each block. The contracts have different terms for production levels above the first tranche, which are unique to each contract. The government's share of production increases and the contractor's share of production decreases as the production volumes go to the next production tranche. We are the contractor in all of our PSCs.

| Block |

Merged Concession |

South Ghazalat |

| Year acquired (1) |

2020 |

2013 |

| Block Area (acres) |

45,067 |

7,340 |

| Expiry date |

2035 |

2039 |

| Extensions |

||

| Exploration |

N/A |

N/A |

| Development |

+ 5 years |

20 + 5 years |

| Production Tranche (MBopd) |

0-25 |

0-5 |

| Maximum cost oil |

40% |

25% |

| Excess cost oil - Contractor |

15% |

5% |

| Depreciation per quarter |

||

| Operating |

100% |

100% |

| Capital |

6% |

5% |

| Production Sharing Oil: |

||

| Contractor |

30%* |

17% |

| Government |

70%* |

83% |

(1) - Represents the year acquired by TransGlobe, prior to the Arrangement.

| *Merged Concession profit oil is set on a scale according to average Brent price and production: |

||||||||||

| Crude oil produced (MBopd) |

||||||||||

| Brent Price ($/bbl) | Less than or equal to 5 MBopd | More than 5 MBopd and less than or equal to 10 MBopd | More than 10 MBopd and less than or equal to 15 MBopd | More than 15 MBopd and less than or equal to 25 MBopd | More than 25 MBopd | |||||

| Government % |

Contractor % |

Government % |

Contractor % |

Government % |

Contractor % |

Government % |

Contractor % |

Government % |

Contractor % |

|

| Less than or equal to $40/bbl |

67 |

33 |

68 |

32 |

69 |

31 |

70 |

30 |

71 |

29 |

| More than $40/bbl and less than or equal to $60/bbl |

68 |

32 |

69 |

31 |

70 |

30 |

71 |

29 |

72 |

28 |

| More than $60/bbl and less than or equal to $80/bbl |

70 |

30 |

71 |

29 |

72 |

28 |

74 |

26 |

76 |

24 |

| More than $80/bbl and less than or equal to $100/bbl |

72.5 |

27.5 |

73 |

27 |

74 |

26 |

76 |

24 |

78 |

22 |

| More than $100/bbl |

75 |

25 |

76 |

24 |

77 |

23 |

78 |

22 |

80 |

20 |

Canada Segment

In Harmattan, Canada, we now own production and working interests in certain facilities in the Cardium light oil and Mannville liquids-rich gas assets. Harmattan is located approximately 80 kilometers north of Calgary, Alberta. This property produces oil and associated natural gas from the Cardium and Viking zones and liquids-rich natural gas from zones in the Lower Mannville and Rock Creek formations at vertical depths of 1,200 to 2,600 meters. The Harmattan property covers 46,100 gross acres of developed land and 29,300 gross acres of undeveloped land. We also own a 100% working interest in a large oil battery and a compressor station where a majority of oil volumes are handled. All gas is delivered to a third party non-operated gas plant for processing.

Under the Modernized Royalty Framework (the “MRF”) in Alberta, producers initially pay a flat royalty of 5% on production revenue from each producing well until payout, which is the point at which cumulative gross revenues from the well equals the applicable drilling and completion cost allowance. After payout, producers pay an increased royalty of up to 40% that will vary depending on the nature of the resource and market prices. Once the rate of production from a well is too low to sustain the full royalty burden, its royalty rate is gradually adjusted downward as production declines, eventually reaching a floor of 5%. The MRF applies to the hydrocarbons produced by wells spud or re-entered on or after January 1, 2017. The Royalty Guarantee Act (Alberta) came into effect in July 2019, amending the Mines and Minerals Act (Alberta) and guaranteeing no major changes to the oil and gas royalty structure for a period of 10 years.

Royalty rates for the production of privately owned oil and natural gas are negotiated between the producer and the resource owner. The Government of Alberta levies annual freehold mineral taxes for production from freehold mineral lands. On average, the tax levied in Alberta is 4% of revenues reported from freehold mineral title properties and is payable by the registered owner of the mineral rights.

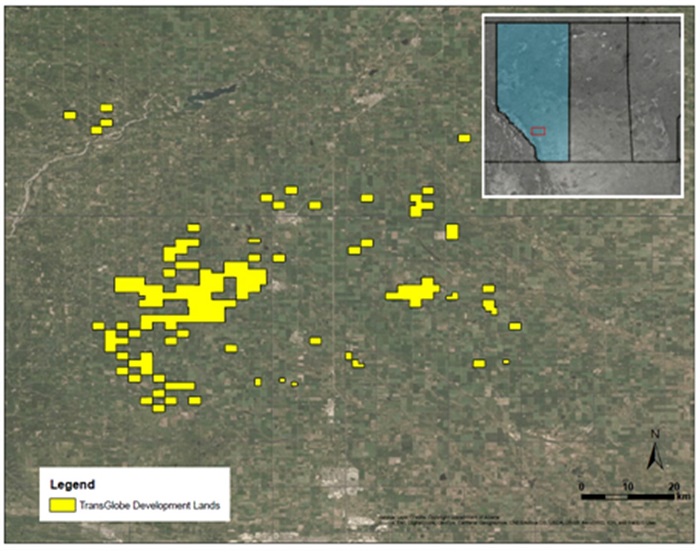

Below is an illustration of our Canadian assets:

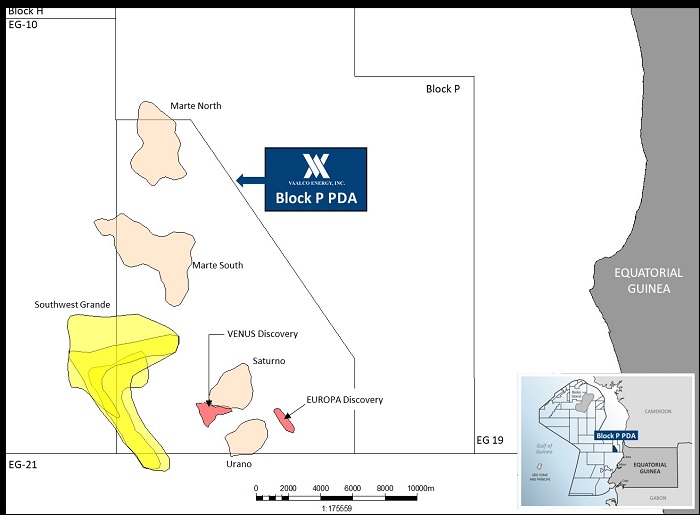

In February of 2023, we acquired an additional 14.1% participating interest, increasing our participating interest in the Block to 60.0%. In March 2023, Atlas voted to participate in the Venus Development. Amendment 5 of the PSC was approved by all parties in March 2023, with this updated participating interest, and execution of the Venus development plan has been initiated. This increase of 14.1% participating interest increases our future payment to GEPetrol to $6.80 million at first commercial production of the Block. As of December 31, 2022, our Block P license in Equatorial Guinea is illustrated below:

DRILLING ACTIVITY

In Gabon, we commenced the 2019/2020 drilling campaign in September 2019 and the 2021/2022 drilling campaign in December 2021. The following table sets forth the total number of completed exploratory and development wells in 2022, 2021 and 2020 on a gross and net basis:

| Gabon |

||||||||||||||||||

| Gross |

Net |

|||||||||||||||||

| 2022 |

2021 |

2020 |

2022 |

2021 |

2020 |

|||||||||||||

| Exploratory wells |

||||||||||||||||||

| Productive |

— | — | 1 | — | — | 0.3 | ||||||||||||

| Dry |

— | — | — | — | — | — | ||||||||||||

| In progress |

— | — | — | — | — | — | ||||||||||||

| Development wells |

||||||||||||||||||

| Productive |

4 | — | 2 | 2.4 | — | 0.6 | ||||||||||||

| Dry |

— | — | — | — | — | — | ||||||||||||

| In progress |

— |

1 | — | — |

0.6 | — | ||||||||||||

| Total wells |

4 | 1 | 3 | 2.4 | 0.6 | 0.9 | ||||||||||||

In December 2021 we began drilling the ETAME 8H-ST development well that was completed in February 2022. In 2022 we completed the Etame 8H-ST, North Tchibala 2H-ST, South Tchibala-1HB-ST2 and Avouma 3H-ST development wells.

The following table sets forth the total number of exploratory and development wells from October 14, 2022 through December 31, 2022 in Canada and Egypt on a gross and net basis:

| Canada |

Egypt |

|||||||||||||||

| Gross |

Net |

Gross |

Net |

|||||||||||||

| 2022 |

2022 |

2022 |

2022 |

|||||||||||||

| Exploratory wells |

||||||||||||||||

| Productive |

— | — | — | — | ||||||||||||

| Dry |

— | — | 2 | 2 | ||||||||||||

| In progress |

— | — | — | — | ||||||||||||

| Development wells |

||||||||||||||||

| Productive |

3 | (3) | 3 | 2 | (1) |

2 | ||||||||||

| Dry |

— | — | — | — | ||||||||||||

| In progress |

— | — | 1 | (2) |

1 | |||||||||||

| Total wells |

3 | 3 | 5 | 5 | ||||||||||||

(1) - Includes M-17 Development well which was spud on 28-Sept-22 and rig released on 17-Oct-22 and the NWG-2INJ-1A planned as injector well but encountered oil and came online 23-Dec-22

(2) - Includes the Arta-77Hz well in progress and coming online in the first quarter of 2023

(3) - Includes the 4-10-29-3W5 well, the 4-18-29-3W5 well and the 4-24-39-4W5 well

ACREAGE AND PRODUCTIVE WELLS

Below is the total acreage under lease or covered by the Etame PSC, Egypt PSCs, Canada PSCs and Block P and the total number of productive crude oil, natural gas and NGLs wells as of December 31, 2022:

| Developed |

Undeveloped |

Total |

|||||||||||||||||||||||

| Acreage in thousands |

Gross |

Net |

Gross |

Net |

Gross |

Net |

|||||||||||||||||||

| Gabon |

6.9 | 4.1 | 39.4 | 23.1 | 46.3 | 27.2 | |||||||||||||||||||

| Canada |

46.1 | 41.6 | 29.3 | 24.8 | 75.4 | 66.4 | |||||||||||||||||||

| Egypt |

29.2 | 29.2 | 23.3 | 23.3 | 52.5 | 52.5 | |||||||||||||||||||

| Equatorial Guinea |

— | — | 57.3 | 26.3 | 57.3 | 26.3 | |||||||||||||||||||

| Total acreage |

82.2 | 74.9 | 149.3 | 97.5 | 231.5 | 172.4 | |||||||||||||||||||

| Productive crude oil wells |

Gross |

Net |

|||||||||||||||||||||||

| Gabon |

15 | (1) |

8.8 | ||||||||||||||||||||||

| Canada |

63 | 59.5 | |||||||||||||||||||||||

| Egypt |

105 | 105.0 | |||||||||||||||||||||||

| Total Productive crude oil wells |

183 | 173.3 | |||||||||||||||||||||||

| Productive natural gas wells |

Gross | Net | |||||||||||||||||||||||

| Gabon |

— | — | |||||||||||||||||||||||

| Canada |

40 | 37.6 | |||||||||||||||||||||||

| Egypt |

— | — | |||||||||||||||||||||||

| Total productive natural gas wells |

40 | 37.6 | |||||||||||||||||||||||

(1) - Excludes three wells shut-in due to the presence of high levels of H2S.

RESERVE INFORMATION

Estimated Reserves and Estimated Future Net Revenues

Reserve Data

In accordance with the current SEC guidelines, estimates of future net cash flow from our properties and the present value thereof are made using the average of the first-day-of-the-month price for each of the twelve months of the year adjusted for quality, transportation fees and market differentials. Such prices are held constant throughout the life of the properties except where such guidelines permit alternate treatment, including the use of fixed and determinable contractual price escalations. For 2022, the average of such prices used for our reserve estimates was $100.35 per Bbl for crude oil from Gabon. Prices were between $84.76 and $85.65 per Bbl for crude oil from Egypt and $89.61 per Bbl for crude oil from Canada. For Gabon, this compares to the average of such price used for 2021 of $69.10 per Bbl and $42.46 per Bbl for 2020.

For 2022, the adjusted average price for our reserves associated with natural gas was $4.13 per MCF, $12.77 per Bbl for Ethane, $40.27 per Bbl for propane, $43.85 per Bbl for butane and $91.57 per Bbl for condensates.

Reserves reported below consist of net proved reserves related to the Etame Marin block located offshore Gabon in West Africa, the eastern desert and western area of Egypt and Harmattan area of west central Alberta, Canada. The tables below sets forth our estimated net proved reserve quantities for the years ended December 31, 2022, 2021 and 2020. The Gabon information was prepared by the independent petroleum engineering firm, Netherland, Sewell & Associates, Inc. (“NSAI”). The Egypt and Canada information was prepared by the independent firm, GLJ Ltd. ("GLJ"). The 2021 information includes the Sasol interest in the Etame Marin block as we acquired Sasol’s interest on February 25, 2021.

| As of December 31, 2022 | ||||||||

| Crude Oil (MBbls) |

Natural Gas (MMcf) |

NGLs (MBbls) |

Total (MBoe)(1) |

|||||

| Proved developed reserves |

||||||||

| Gabon |

10,219 | — | — | 10,219 | ||||

| Egypt |

8,001 | — | — | 8,001 | ||||

| Canada |

1,722 | 11,023 | 1,855 | 5,414 | ||||

| Total proved developed reserves |

19,942 | 11,023 | 1,855 | 23,634 | ||||

| Proved undeveloped reserves |

||||||||

| Gabon |

— | — | — | — | ||||

| Egypt |

576 | — | — | 576 | ||||

| Canada |

1,885 | 5,516 | 942 | 3,747 | ||||

| Total proved undeveloped reserves |

2,461 | 5,516 | 942 | 4,323 | ||||

| Total proved reserves |

22,403 | 16,539 | 2,797 | 27,957 | ||||

(1) To convert Natural Gas to MBoe, MMcf is divided by 6.

Standardized Measure and Changes in Proved Reserves

The following table shows changes in total proved Gabon reserves for all presented years:

| Proved Reserves |

As of December 31, |

|||||||||||

| (MBoe) |

2022 |

2021 |

2020 |

|||||||||

| Proved reserves, beginning of year |

11,218 | 3,216 | 4,966 | |||||||||

| Production |

(2,971 | ) | (2,599 | ) | (1,776 | ) | ||||||

| Revisions of previous estimates |

1,972 | 7,968 | (471 | ) | ||||||||

| Extensions and discoveries |

— | — | 497 | |||||||||

| Purchase of reserves |

— | 2,633 | — | |||||||||

| Proved reserves, end of year |

10,219 | 11,218 | 3,216 | |||||||||

In 2020, we completed the Southeast Etame 4H development whose reserves is included in extensions and discoveries in the December 2020 balance. In February 2021, we completed the acquisition of Sasol’s interest in the Etame Marin block. The reserves associated with the acquisition is included in the purchase of reserves category of the December 2021 balance. In 2022, we drilled four wells that were previously included in the proved undeveloped category of the 2021 reserves.

In comparing the net proved reserves of 10.2 MMBbls at December 31, 2022 to the 11.2 MMBbls at December 31, 2021, we added 2.0 MMBbls of reserves through positive revisions of previous estimates. 1.3 MMBbls of the positive revisions were due to price and 0.7 MMBbls of positive revisions through performance. The increase of 45% in the average of the first-day-of-the-month prices for each of the year of the year, adjusted for quality, transportation fees and market differentials required by SEC rules to determine reserves, was $100.35 for this 2022 Annual Report up from $69.10 for the 2021 Annual Report.

The following table shows changes in total proved Egypt reserves for the period October 14, 2022 through December 31, 2022:

| Proved Reserves |

As of December 31, |

|||||||||||

| (MBoe) |

2022 |

2021 |

2020 |

|||||||||

| Proved reserves, beginning of year |

— | — | — | |||||||||

| Production |

(639 | ) | — | — | ||||||||

| Revisions of previous estimates |

— | — | — | |||||||||

| Purchase of reserves |

9,216 | — | — | |||||||||

| Proved reserves, end of year |

8,577 | — | — | |||||||||

The following table shows changes in total proved Canada reserves for the period October 14, 2022 through December 31, 2022:

| Proved Reserves |

As of December 31, |

|||||||||||

| (MBoe) |

2022 |

2021 |

2020 |

|||||||||

| Proved reserves, beginning of year |

— | — | — | |||||||||

| Production |

(247 | ) | — | — | ||||||||

| Revisions of previous estimates |

— | — | — | |||||||||

| Purchase of reserves |

9,408 | — | — | |||||||||

| Proved reserves, end of year |

9,161 | — | — | |||||||||

The following table sets forth the standardized measure of discounted future net cash flows:

| As of December 31, |

||||||||||||

| 2022 |

2021 |

2020 |

||||||||||

| (in thousands) |

||||||||||||

| Gabon |

$ | 244,427 | $ | 99,258 | $ | 14,733 | ||||||

| Egypt |

226,888 | — | — | |||||||||

| Canada |

153,150 | — | — | |||||||||

| Standardized measure of discounted future net cash flows |

$ | 624,465 | $ | 99,258 | $ | 14,733 | ||||||

The information set forth in the tables includes revisions for certain reserve estimates attributable to proved properties included in preceding years’ estimates. Such revisions are the result of additional information from subsequent completions and production history from the properties involved or the result of an increase or decrease in the projected economic life of such properties resulting from changes in product prices, estimated operating costs and other factors. Crude oil amounts shown for Gabon are recoverable under the Etame PSC, and the reserves in place at the end of the contract remain the property of the Gabon government. Crude oil amounts shown for Egypt are recoverable under the Merged Concession and the western desert South Ghazalat concession, and the reserves in place at the end of those concessions remain the property of the Egyptian government. The reserves at the end of the contract are not included in the table above.

We do not reflect proved reserves on discoveries in our reserve estimates until such time as a development plan has been prepared and approved by our joint venture owners and the government, where applicable.

There are numerous uncertainties inherent in estimating quantities of proved reserves and in projecting future rates of production and timing of development expenditures, including many factors beyond our control. Reserve engineering is a subjective process of estimating underground accumulations of crude oil, natural gas and NGLs that cannot be measured in an exact manner, and the accuracy of any reserve estimate is a function of the quality of available data and of engineering and geological interpretation and judgment. The quantities of crude oil, natural gas and NGLs that are ultimately recovered, production and operating costs, the amount and timing of future development expenditures and future crude oil, natural gas and NGLs sales prices may all differ from those assumed in these estimates. The standardized measure of discounted future net cash flows should not be construed as the current market value of the estimated crude oil, natural gas and NGLs reserves attributable to our properties.

Proved undeveloped reserves

Historically, we have reviewed on an annual basis all of our PUDs to ensure an appropriate plan for development exists.

For Gabon, in December 2021 we began drilling the ETAME 8-H development well that was completed in February 2022. In 2022 we drilled and completed the Etame 8H-ST, North Tchibala 2H-ST, South Tchibala-1HB-ST2 and Avouma 3H-ST development wells. These wells were considered PUDs in the December 2021 reserve report. We estimate the cost of the current 2021/2022 drilling program with the four wells and two additional workovers to be $180 million, or $114 million, net to VAALCO’s participating interest. For 2022, we incurred approximately $148 million, or about $94 million net to VAALCO’s participating interest. At December 31, 2022, we had no PUDs included in our year-end reserve report.

At December 31, 2022, as a result of the acquisition of TransGlobe, we had 31 PUD locations included in our reserves which we will complete within the next five years. Twenty-five of the PUD wells are in Canada and six are in Egypt.

Controls over Reserve Estimates

Our policies and practices regarding internal controls over the recording of reserves are structured to objectively and accurately estimate our crude oil, natural gas, and NGLs reserves quantities and present values in compliance with SEC regulations and generally accepted accounting principles in the U.S. (“GAAP”). Compliance with these rules and regulations with respect to our reserves is the responsibility of our Technical Reserve Committee and our reservoir engineer, who is our principal engineer. Our principal engineer has over 30 years of experience in the crude oil and natural gas industry, including over 10 years as a reserve evaluator and trainer, and is a qualified reserves estimator, as defined by the Society of Petroleum Engineers’ standards. Further professional qualifications include a Master’s degree in petroleum engineering and Texas Professional Engineering (PE) certification, extensive internal and external reserve training, and asset evaluation and management. In addition, the principal engineer is an active participant in industry reserve seminars, professional industry groups and is a member of the Society of Petroleum Engineers. The Technical Reserve Committee of the Board of Directors meets periodically with management to discuss matters and policies related to reserves.

Our controls over reserve estimation include engaging and retaining qualified independent petroleum and geological firms with respect to reserves information. We provide information to our independent reserve engineers about our crude oil, natural gas and NGLs properties in Gabon, Egypt and Canada. which includes, but is not limited to, production profiles, ownership and production sharing rights, prices, costs and future drilling plans. Our independent reserve engineers prepare their own estimates of the reserves attributable to our properties. The reserves estimates for our Gabon, Egypt and Canada assets shown herein have been independently evaluated by NSAI (Gabon), GLJ (Egypt and Canada) and our Technical Reserve Committee.

NET VOLUMES SOLD, PRICES, AND PRODUCTION COSTS

Net volumes sold, average sales prices per unit, and production costs per unit for our 2022, 2021 and 2020 operations are shown in the tables below.

| Sales Volumes (2) |

Average Sales Price (2) |

Average Production Cost (2) |

||||||||||||||||||||||||||

| Crude Oil (MBbl) |

Natural Gas (MMcf) |

NGLs (MBbl) |

Crude Oil (Per Bbl) |

Natural Gas (per Mcf) |

NGLs (Per Bbl) |

Total (per BoE) |

||||||||||||||||||||||

| Year Ended December 31, 2022 |

||||||||||||||||||||||||||||

| Gabon |

2,919 | — | — | $ | 103.09 | $ | — | $ | — | $ | 33.18 | |||||||||||||||||

| Egypt(1) |

547 | — | — | 69.00 | — | — | 21.84 | |||||||||||||||||||||

| Canada(1) |

93 | 335 | 63 | 79.56 | 4.00 | 36.12 | 9.33 | |||||||||||||||||||||

| Total |

3,559 | 335 | 63 | $ | 97.24 | $ | 4.00 | $ | 36.12 | $ | 30.12 | |||||||||||||||||

| Year Ended December 31, 2021 |

||||||||||||||||||||||||||||

| Gabon |

2,711 | — | — | $ | 70.66 | — | — | $ | 29.97 | |||||||||||||||||||

| Year Ended December 31, 2020 |

||||||||||||||||||||||||||||

| Gabon |

1,627 | — | — | $ | 40.29 | — | — | $ | 22.93 | |||||||||||||||||||

(1) - Reflects sales and production costs after the acquisition date, October 13, 2022

(2) - The sales volumes and per Boe information are reported on NRI basis

AVAILABLE INFORMATION

VAALCO Energy, Inc. is a Delaware corporation, incorporated in 1985 and headquartered at 9800 Richmond Avenue, Suite 700, Houston, Texas 77042. Our telephone number is (713) 623-0801 and our website address is www.vaalco.com. We make available, free of charge on our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports, at https://www.vaalco.com/investors/sec-filings as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. These reports and other information are also available on the SEC's website at https://www.sec.gov. Information contained on our website and the SEC’s website is not incorporated by reference into this Annual Report. We have placed on our website copies of charters for our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee as well as our Code of Business Conduct and Ethics (“Code of Ethics”), Corporate Governance Principles and Code of Ethics for the CEO and Senior Financial Officers. Stockholders may request a printed copy of these governance materials by writing to the Company Secretary, VAALCO Energy, Inc., 9800 Richmond Avenue, Suite 700, Houston, Texas 77042. We intend to disclose updates or amendments to our Code of Ethics and Code of Ethics for the CEO and Senior Financial Officers on our website within four business days following the date of such update or amendment.

CUSTOMERS

For the years ended December 31, 2022, 2021 and 2020, we sold our crude oil production from Gabon under a term contract with pricing in the month of lifting, adjusted for location and market factors. Our contract and three extension amendments with ExxonMobil Sales and Supply LLC (“ExxonMobil”), covered 100% of our crude oil sales from February 2020 through the end of July 2022 with pricing based upon an average of Dated Brent in the month of lifting, adjusted for location and market factors. Revenues from sales of crude oil to Glencore were 100% of our Gabonese revenues from customers for the period of August 2022 through December 2022.

Egypt

For the period of October 14, 2022 through December 31, 2022, EGPC covered 100% of our crude oil sales in Egypt.

Canada

For the period of October 14, 2022 through December 31, 2022, revenues in Canada were concentrated in three separate customers that constituted approximately 54%, 32% and 14% of revenues in Canada.

EMPLOYEES AND HUMAN CAPITAL RESOURCE MANAGEMENT

We operate on the fundamental philosophy that people are our most valuable asset as every person who works for us has the potential to impact our success. Identifying quality talent is at the core of everything we do and our success is dependent upon our ability to attract, develop and retain highly qualified employees. Our core values include honesty/integrity, treating people fairly, high performance, efficient and effective processes, open communication and being respected in our local communities. These values establish the foundation on which the culture is built and represent the key expectations we have of our employees. We believe our culture and commitment to our employees creates an environment that allows us to attract and retain our qualified talent, while simultaneously providing significant value to us and our stockholders by helping our employees attain their highest level of creativity and efficiency.

Demographics

As of December 31, 2022, we had 185 full-time employees, 90 of whom were located in Gabon, 30 in Egypt, 21 in Canada and 44 in Houston. Likewise, there are 56 contractors in Gabon, 6 contractors in Egypt, 5 contractors in Canada and 6 contractors in Houston. We are not subject to any collective bargaining agreements, although some of the national employees in Gabon are members of the NEOP (National Organization of Petroleum Workers) union. We believe relations with our employees are satisfactory.

Diversity and Inclusion

We value building diverse teams, embracing different perspectives and fostering an inclusive, empowering work environment for our employees. We have a long-standing commitment to equal employment opportunity as evidenced by our Equal Employment Opportunity policy. Approximately 16% of our management team are female employees and 93.3% of our Gabon workforce is Gabonese.

Compensation and Benefits

Critical to our success is identifying, recruiting, retaining, and incentivizing our existing and future employees. We strive to attract and retain the most talented employees in the industry by offering competitive compensation and benefits. Our pay-for-performance compensation philosophy is based on rewarding each employee’s individual contributions and striving to achieve equal pay for equal work regardless of gender, race or ethnicity. We use a combination of fixed and variable pay including base salary, bonus, and merit increases, which vary across the business. In addition, as part of our long-term incentive plan for executives and certain employees, we provide share-based compensation to foster our pay-for-performance culture and to attract, retain and motivate our key leaders.

As the success of our business is fundamentally connected to the well-being of our people, we offer benefits that support their physical, financial and emotional well-being. We provide our employees with access to flexible and convenient medical programs intended to meet their needs and the needs of their families. In addition to this medical coverage, we offer eligible employees dental and vision coverage, health savings and flexible spending accounts, paid time off, employee assistance programs, employee loans, voluntary short-term and long-term disability insurance and term life insurance. Additionally, we offer a 401(k) Savings Plan and Deferred Compensation Plan to certain employees. Certain employees receive additional compensation for working in foreign jurisdictions. Our benefits vary by location and are designed to meet or exceed local laws and to be competitive in the marketplace.

Commitment to Values and Ethics

Along with our core values, we act in accordance with our Code of Ethics, which sets forth expectations and guidance for employees to make appropriate decisions. Our Code of Ethics covers topics such as anti-corruption, discrimination, harassment, privacy, appropriate use of company assets, protecting confidential information, and reporting Code of Ethics violations. The Code of Ethics reflects our commitment to operating in a fair, honest, responsible and ethical manner and also provides direction for reporting complaints in the event of alleged violations of our policies (including through an anonymous hotline). Our executive officers and supervisors maintain “open door” policies and any form of retaliation is strictly prohibited.

Professional Development, Safety and Training

We believe that key factors in employee retention are professional development, safety and training. We have training programs across all levels to meet the needs of various roles, specialized skill sets and departments across the Company. We provide compliance education as well as general workplace safety training to our employees and offer Occupational Safety and Health Administration training to key employees. We are committed to the security and confidentiality of our employees’ personal information and employs software tools and periodic employee training programs to promote security and information protection at all levels. We utilize certain employee turnover rates and productivity metrics in assessing our employee programs to ensure that they are structured to instill high levels of in-house employee tenure, low levels of voluntary turnover and the optimization of productivity and performance across our entire workforce. Additionally, we have a performance evaluation program which adopts a modern approach to valuing and strengthening individual performance through on-going interactive progress assessments related to established goals and objectives.

Communication and Engagement

We strongly believe that our success depends on employees understanding how their work contributes to our overall strategy. To this end, we communicate with our workforce through a variety of channels and encourage open and direct communication, including: (i) quarterly company-wide CEO updates; (ii) regular company-wide calls with management and (iii) frequent corporate email communications.

COVID-19 Pandemic

In response to the COVID-19 pandemic, related government legislation and guidelines and orders issued by key authorities, we implemented changes that we determined were in the best interest of our employees, as well as the communities in which we operate. These changes included quarantining and testing of employees and persons before going to our offshore platforms, having the majority of our employees work from home for several months, and implementing additional safety measures for employees continuing critical on-site work. We continue to maintain a high level of safety protocols and embrace a flexible working arrangement for our employees in all our locations.

COMPETITION

The crude oil, natural gas and NGLs industry is highly competitive. Competition is particularly intense from other independent operators and from major crude oil, natural gas and NGLs companies with respect to acquisitions and development of desirable crude oil, natural gas and NGLs properties and licenses, and contracting for drilling equipment. There is also competition for the hiring of experienced personnel. In addition, the drilling, producing, processing and marketing of crude oil, natural gas and NGLs is affected by a number of factors beyond our control, which may delay drilling, increase prices and have other adverse effects, which cannot be accurately predicted.