Pay vs Performance Disclosure

|

12 Months Ended |

24 Months Ended |

36 Months Ended |

|

Dec. 31, 2022

USD ($)

|

Dec. 31, 2021

USD ($)

|

Dec. 31, 2020

USD ($)

|

Dec. 31, 2022 |

Dec. 31, 2022 |

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Pay vs Performance [Table Text Block] |

|

|

|

|

|

PAY

VERSUS PERFORMANCEThe following table sets forth the pay versus performance disclosures required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 402(v) of Regulation S-K for the years indicated. Ms. McReynolds served as Principal Executive Officer (“PEO”) in each year. The names of the non-PEO Named Executive Officers (the “Non-PEO NEOs”) included for purposes of calculating the average amounts in each covered year are as follows: (i) for 2022, David R. Cobb, Michael E. Newcity, Seth Runser, Daniel E. Loe and Dennis L. Anderson II; (ii) for 2021, David R. Cobb, Michael E. Newcity, James A. Ingram and Dennis L. Anderson II; and (iii) for 2020, Timothy D. Thorne, David R. Cobb, Michael E. Newcity and James A. Ingram. The dollar amounts for Compensation Actually Paid (“CAP”) do not reflect the actual amount of compensation earned by or paid to the Named Executive Officers during the covered year. Please refer to the Compensation Discussion & Analysis section in this Proxy Statement and in our previous proxy statements for information about how the Compensation Committee has assessed the Company’s performance and Named Executive Officer compensation in a given year. Year

(a)

|

Summary

Compensation

Table

Total for

PEO

(b)

|

Compensation

Actually

Paid to

PEO(1)

(c)

|

Average

Summary

Compensation

Table

Total for

Non-PEO

NEOs

(d)

|

Average

Compensation

Actually

Paid to

Non-PEO

NEOs(1)

(e)

|

Value of Initial Fixed $100

Investment

Based On:

|

Net Income

(millions)(4)

(h)

|

Return on Capital

Employed

(ROCE)

|

Total

Shareholder

Return(2)

(f)

|

Peer Group

Total

Shareholder

Return(3)

(g)

|

1 Year(5)

(i)

|

Average

3

Year(5)

(j)

|

2022

|

6,430,893

|

384,908

|

2,097,211

|

342,776

|

259.47

|

179.25

|

298.21

|

39.9%

|

26.7%

|

2021

|

6,006,289

|

16,582,019

|

2,131,000

|

5,779,949

|

441.63

|

216.77

|

213.52

|

34.8%

|

19.4%

|

2020

|

4,174,608

|

6,594,027

|

1,648,558

|

2,599,276

|

156.55

|

130.97

|

71.10

|

15.4%

|

11.7%

|

(1)

Reflects the CAP for the PEO and the average CAP for the Non-PEO NEOs for the covered years, as computed in accordance with Item 402(v) of Regulation S-K. The following adjustments were made to the Summary Compensation Table total compensation to determine the CAP:

|

Year

|

Reported Summary

Compensation

Table Total(i)

A

|

Reported Value of

Equity

Awards(ii)

B

|

Equity Award

Adjustments(iii)

C

|

Reported Change in the Actuarial

Present

Value of Pension Benefits(iv)

D

|

Pension Benefit

Adjustments(v)

E

|

Compensation

Actually

Paid

A-B+C-D+E

|

Company’s PEO

|

2022

|

6,430,893

|

1,230,566

|

(4,799,292)

|

16,127

|

-

|

384,908

|

2021

|

6,006,289

|

990,774

|

11,576,989

|

10,485

|

-

|

16,582,019

|

2020

|

4,174,608

|

806,238

|

3,253,310

|

27,653

|

-

|

6,594,027

|

Average of Non-PEO NEOs

|

2022

|

2,097,211

|

302,547

|

(1,451,888)

|

-

|

-

|

342,776

|

2021

|

2,131,000

|

302,012

|

3,950,961

|

-

|

-

|

5,779,949

|

2020

|

1,648,558

|

296,860

|

1,247,578

|

-

|

-

|

2,599,276

|

(i)

Reflects the amounts (or the average amounts for the Non-PEO NEOs) reported in the “Total” column of the Summary Compensation Table for the covered years.

(ii)

Reflects the grant date fair value of equity awards granted to the PEO (or the average amounts with regard to the Non-PEO NEOs) as reported in the “Stock Awards” column in the Summary Compensation Table for the covered years.

(iii)

The equity award adjustments for each covered year include the addition (or subtraction, as applicable) as set forth in the table below. The fair values of equity awards were calculated using closing stock price as of the applicable valuation dates and are not adjusted for present value of dividends (which are not payable with respect to RSUs granted to Named Executive Officers).

|

Year

|

Year End Fair Value of

Equity

Awards Granted

During

the Fiscal Year

|

Year over Year Change in Fair

Value

of Outstanding and Unvested

Equity

Awards

|

Year over Year Change in Fair Value of

Equity

Awards Granted in Prior Years that

Vested

in the Year

|

Total Equity Award

Adjustments

|

Company’s PEO

|

2022

|

1,099,628

|

(4,024,648)

|

(1,874,272)

|

(4,799,292)

|

2021

|

1,366,290

|

8,906,572

|

1,304,127

|

11,576,989

|

2020

|

1,804,941

|

1,549,196

|

(100,827)

|

3,253,310

|

Average of Non-PEO NEOs

|

2022

|

270,354

|

(1,154,596)

|

(567,646)

|

(1,451,888)

|

2021

|

416,479

|

3,075,623

|

458,860

|

3,950,961

|

2020

|

664,585

|

623,521

|

(40,529)

|

1,247,578

|

(iv)

Reflects the amounts reported in the “Change in Pension Value and Nonqualified Deferred Compensation Earnings” column of the Summary Compensation Table for the covered years.

(v)

These amounts reflect the actuarially determined service cost for services rendered during the applicable year. The Company’s legacy non-contractual defined benefit pension plan was terminated effective December 31, 2017, and fully liquidated as of December 31, 2019. Therefore, no services costs were incurred in any of the covered years.

|

(2)

Total Shareholder Return (TSR) is calculated assuming $100 was invested on December 31, 2019, with reinvestment of dividends. All calculations have been prepared by Zacks Investment Research, Inc.

(3)

The 2022 peer group includes the following companies: Covenant Logistics Group, Inc., Forward Air Corporation, Hub Group, Inc., J.B. Hunt Transport Services, Inc., Knight-Swift Transportation Holdings, Inc., Landstar System, Inc., Old Dominion Freight Line, Inc., Saia, Inc., Schneider National, Inc., TFI International Inc., U.S. Express Enterprises, Inc., Werner Enterprises, Inc. and Yellow Corporation. The 2021 peer group includes the same companies as the 2022 peer group, except that TFI International Inc. was added in 2022 following its acquisition of UPS Freight in April 2021. For the peer group TSR calculations, the peer companies were weighted by market capitalization at the beginning of each period shown. Assuming $100 was invested in the 2021 peer group for the period starting December 31, 2019, through the end of the years specified, the cumulative total shareholder returns for such peer group were $130.97 in 2020, $211.55 in 2021 and $173.29 in 2022.

(4)

Net income as reported in the Company’s audited financial statements for each covered year.

(5)

Reflects the one-year and three-year average ROCE of the Company as approved by the Compensation Committee for purposes of the Company’s annual cash incentive compensation plan and long-term cash incentive compensation plan for each covered year. The Company has determined that one-year ROCE (adjusted) as used in its annual cash incentive compensation plan is the financial performance measure that, in the Company’s assessment, represents the most important performance measure (that is not otherwise required to be disclosed in the table) used by the Company to link CAP to the Named Executive Officers, for the most recently completed fiscal year, to Company performance. Because the Company uses three-year average ROCE (adjusted) in its long-term cash incentive program as discussed in greater detail in “Compensation Discussion & Analysis — Components of Compensation — Long-Term Incentive Compensation,” the Company is providing, on a supplemental basis, its three-year average ROCE (adjusted) for each covered year. For more information, see the section below titled “Financial Performance Measures.”

|

|

| Company Selected Measure Name |

|

|

|

|

|

Return on Capital

Employed

(ROCE)

|

| Peer Group Issuers, Footnote [Text Block] |

|

|

|

|

(3)

The 2022 peer group includes the following companies: Covenant Logistics Group, Inc., Forward Air Corporation, Hub Group, Inc., J.B. Hunt Transport Services, Inc., Knight-Swift Transportation Holdings, Inc., Landstar System, Inc., Old Dominion Freight Line, Inc., Saia, Inc., Schneider National, Inc., TFI International Inc., U.S. Express Enterprises, Inc., Werner Enterprises, Inc. and Yellow Corporation. The 2021 peer group includes the same companies as the 2022 peer group, except that TFI International Inc. was added in 2022 following its acquisition of UPS Freight in April 2021. For the peer group TSR calculations, the peer companies were weighted by market capitalization at the beginning of each period shown. Assuming $100 was invested in the 2021 peer group for the period starting December 31, 2019, through the end of the years specified, the cumulative total shareholder returns for such peer group were $130.97 in 2020, $211.55 in 2021 and $173.29 in 2022.

|

|

| PEO Total Compensation Amount |

|

$ 6,430,893

|

$ 6,006,289

|

$ 4,174,608

|

|

|

| PEO Actually Paid Compensation Amount |

[1] |

384,908

|

16,582,019

|

6,594,027

|

|

|

| Adjustment To PEO Compensation, Footnote [Text Block] |

|

|

|

|

|

(1)

Reflects the CAP for the PEO and the average CAP for the Non-PEO NEOs for the covered years, as computed in accordance with Item 402(v) of Regulation S-K. The following adjustments were made to the Summary Compensation Table total compensation to determine the CAP:

Year

|

Reported Summary

Compensation

Table Total(i)

A

|

Reported Value of

Equity

Awards(ii)

B

|

Equity Award

Adjustments(iii)

C

|

Reported Change in the Actuarial

Present

Value of Pension Benefits(iv)

D

|

Pension Benefit

Adjustments(v)

E

|

Compensation

Actually

Paid

A-B+C-D+E

|

Company’s PEO

|

2022

|

6,430,893

|

1,230,566

|

(4,799,292)

|

16,127

|

-

|

384,908

|

2021

|

6,006,289

|

990,774

|

11,576,989

|

10,485

|

-

|

16,582,019

|

2020

|

4,174,608

|

806,238

|

3,253,310

|

27,653

|

-

|

6,594,027

|

Average of Non-PEO NEOs

|

2022

|

2,097,211

|

302,547

|

(1,451,888)

|

-

|

-

|

342,776

|

2021

|

2,131,000

|

302,012

|

3,950,961

|

-

|

-

|

5,779,949

|

2020

|

1,648,558

|

296,860

|

1,247,578

|

-

|

-

|

2,599,276

|

(i)

Reflects the amounts (or the average amounts for the Non-PEO NEOs) reported in the “Total” column of the Summary Compensation Table for the covered years.

(ii)

Reflects the grant date fair value of equity awards granted to the PEO (or the average amounts with regard to the Non-PEO NEOs) as reported in the “Stock Awards” column in the Summary Compensation Table for the covered years.

(iii)

The equity award adjustments for each covered year include the addition (or subtraction, as applicable) as set forth in the table below. The fair values of equity awards were calculated using closing stock price as of the applicable valuation dates and are not adjusted for present value of dividends (which are not payable with respect to RSUs granted to Named Executive Officers).

|

Year

|

Year End Fair Value of

Equity

Awards Granted

During

the Fiscal Year

|

Year over Year Change in Fair

Value

of Outstanding and Unvested

Equity

Awards

|

Year over Year Change in Fair Value of

Equity

Awards Granted in Prior Years that

Vested

in the Year

|

Total Equity Award

Adjustments

|

Company’s PEO

|

2022

|

1,099,628

|

(4,024,648)

|

(1,874,272)

|

(4,799,292)

|

2021

|

1,366,290

|

8,906,572

|

1,304,127

|

11,576,989

|

2020

|

1,804,941

|

1,549,196

|

(100,827)

|

3,253,310

|

Average of Non-PEO NEOs

|

2022

|

270,354

|

(1,154,596)

|

(567,646)

|

(1,451,888)

|

2021

|

416,479

|

3,075,623

|

458,860

|

3,950,961

|

2020

|

664,585

|

623,521

|

(40,529)

|

1,247,578

|

(iv)

Reflects the amounts reported in the “Change in Pension Value and Nonqualified Deferred Compensation Earnings” column of the Summary Compensation Table for the covered years.

(v)

These amounts reflect the actuarially determined service cost for services rendered during the applicable year. The Company’s legacy non-contractual defined benefit pension plan was terminated effective December 31, 2017, and fully liquidated as of December 31, 2019. Therefore, no services costs were incurred in any of the covered years.

|

|

| Non-PEO NEO Average Total Compensation Amount |

|

2,097,211

|

2,131,000

|

1,648,558

|

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

[1] |

342,776

|

5,779,949

|

2,599,276

|

|

|

| Adjustment to Non-PEO NEO Compensation Footnote [Text Block] |

|

|

|

|

|

(1)

Reflects the CAP for the PEO and the average CAP for the Non-PEO NEOs for the covered years, as computed in accordance with Item 402(v) of Regulation S-K. The following adjustments were made to the Summary Compensation Table total compensation to determine the CAP:

Year

|

Reported Summary

Compensation

Table Total(i)

A

|

Reported Value of

Equity

Awards(ii)

B

|

Equity Award

Adjustments(iii)

C

|

Reported Change in the Actuarial

Present

Value of Pension Benefits(iv)

D

|

Pension Benefit

Adjustments(v)

E

|

Compensation

Actually

Paid

A-B+C-D+E

|

Company’s PEO

|

2022

|

6,430,893

|

1,230,566

|

(4,799,292)

|

16,127

|

-

|

384,908

|

2021

|

6,006,289

|

990,774

|

11,576,989

|

10,485

|

-

|

16,582,019

|

2020

|

4,174,608

|

806,238

|

3,253,310

|

27,653

|

-

|

6,594,027

|

Average of Non-PEO NEOs

|

2022

|

2,097,211

|

302,547

|

(1,451,888)

|

-

|

-

|

342,776

|

2021

|

2,131,000

|

302,012

|

3,950,961

|

-

|

-

|

5,779,949

|

2020

|

1,648,558

|

296,860

|

1,247,578

|

-

|

-

|

2,599,276

|

(i)

Reflects the amounts (or the average amounts for the Non-PEO NEOs) reported in the “Total” column of the Summary Compensation Table for the covered years.

(ii)

Reflects the grant date fair value of equity awards granted to the PEO (or the average amounts with regard to the Non-PEO NEOs) as reported in the “Stock Awards” column in the Summary Compensation Table for the covered years.

(iii)

The equity award adjustments for each covered year include the addition (or subtraction, as applicable) as set forth in the table below. The fair values of equity awards were calculated using closing stock price as of the applicable valuation dates and are not adjusted for present value of dividends (which are not payable with respect to RSUs granted to Named Executive Officers).

|

Year

|

Year End Fair Value of

Equity

Awards Granted

During

the Fiscal Year

|

Year over Year Change in Fair

Value

of Outstanding and Unvested

Equity

Awards

|

Year over Year Change in Fair Value of

Equity

Awards Granted in Prior Years that

Vested

in the Year

|

Total Equity Award

Adjustments

|

Company’s PEO

|

2022

|

1,099,628

|

(4,024,648)

|

(1,874,272)

|

(4,799,292)

|

2021

|

1,366,290

|

8,906,572

|

1,304,127

|

11,576,989

|

2020

|

1,804,941

|

1,549,196

|

(100,827)

|

3,253,310

|

Average of Non-PEO NEOs

|

2022

|

270,354

|

(1,154,596)

|

(567,646)

|

(1,451,888)

|

2021

|

416,479

|

3,075,623

|

458,860

|

3,950,961

|

2020

|

664,585

|

623,521

|

(40,529)

|

1,247,578

|

(iv)

Reflects the amounts reported in the “Change in Pension Value and Nonqualified Deferred Compensation Earnings” column of the Summary Compensation Table for the covered years.

(v)

These amounts reflect the actuarially determined service cost for services rendered during the applicable year. The Company’s legacy non-contractual defined benefit pension plan was terminated effective December 31, 2017, and fully liquidated as of December 31, 2019. Therefore, no services costs were incurred in any of the covered years.

|

|

| Compensation Actually Paid vs. Total Shareholder Return [Text Block] |

|

|

|

|

|

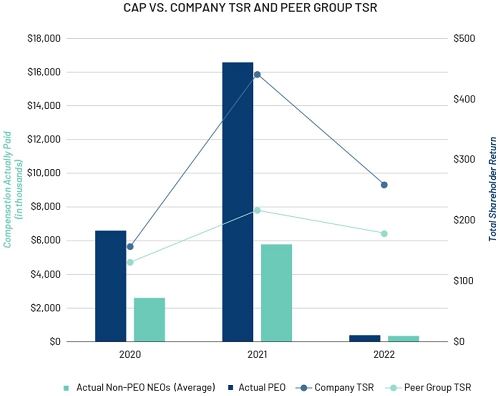

CAP vs. Company TSR and Peer Group TSR

The following graph compares the CAP to Ms. McReynolds and the average amount of CAP to the non-PEO NEOs with the Company’s cumulative TSR and the peer group TSR over the three years presented. TSR is calculated assuming $100 was invested on December 31, 2019, with reinvestment of dividends. The Company’s cumulative TSR over the three-year period was $259.47, while the cumulative TSR of the peer group was $179.25 over the same period.

|

| Compensation Actually Paid vs. Net Income [Text Block] |

|

|

|

|

|

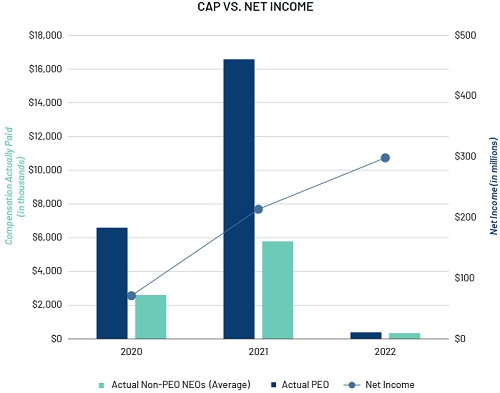

CAP vs. Net Income

The following graph compares the CAP to Ms. McReynolds and the average amount of CAP to the non-PEO NEOs with our net income over the three years presented. While we do not use net income as a compensation performance metric in our executive compensation program, the measure of net income may correlate to operating income, which we use in our AIP. Because a significant portion of CAP is comprised of equity awards, which have multi-year vesting periods, CAP is more heavily impacted by fluctuations in stock price year-over-year, as compared to net income.

|

| Compensation Actually Paid vs. Company Selected Measure [Text Block] |

|

|

|

|

|

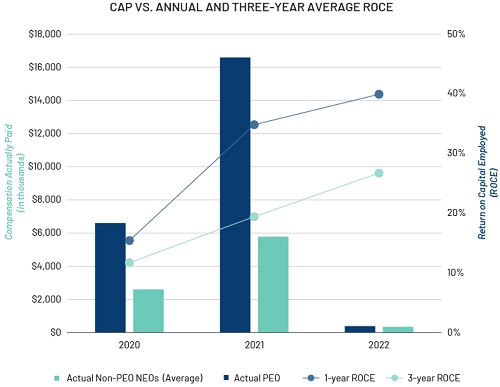

CAP vs. Annual and Three-Year Average ROCE

The following graph compares the CAP to Ms. McReynolds and the average amount of CAP to the non-PEO NEOs with (i) our one-year ROCE (adjusted), calculated in accordance with our AIP, and (ii) on a supplemental basis, the average three-year ROCE (adjusted), calculated in accordance with our C-LTIP program, each over the three years presented. While the Company uses several financial performance measures to evaluate performance for purposes of its executive compensation program, the Company has determined that one-year ROCE (adjusted) as used in the AIP is the financial performance measure that, in the Company’s assessment, represents the most important performance measure (that is not otherwise required to be disclosed in the table) used by the Company to link CAP to the Named Executive Officers, for the most recently completed fiscal year, to Company performance.

|

| Tabular List [Table Text Block] |

|

|

|

|

|

Performance Measure

|

Compensation Weighting

|

For More Information

|

Operating Income

|

50% of AIP

|

Page 34

|

Annual Return on Capital Employed (ROCE)

|

50% of AIP

|

Page 34

|

Relative TSR

|

50% of C-LTIP

|

Page 36

|

Average ROCE for the three-year performance period

|

50% of C-LTIP

|

Page 36

|

|

| Total Shareholder Return Amount |

[2] |

259.47

|

441.63

|

156.55

|

|

|

| Peer Group Total Shareholder Return Amount |

[3] |

179.25

|

216.77

|

130.97

|

|

|

| Net Income (Loss) |

[4] |

$ 298.21

|

$ 213.52

|

$ 71.1

|

|

|

| Measure [Axis]: 1 |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Measure Name |

|

|

|

|

|

Operating Income

|

| Measure [Axis]: 2 |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Measure Name |

|

|

|

|

|

Annual Return on Capital Employed (ROCE)

|

| Measure [Axis]: 3 |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Measure Name |

|

|

|

|

|

Relative TSR

|

| Measure [Axis]: 4 |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Measure Name |

|

|

|

|

|

Average ROCE for the three-year performance period

|

| Company Selected Measure 1 [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Company Selected Measure Amount |

[5] |

39.9

|

34.8

|

15.4

|

|

|

| Company Selected Measure 2 [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Company Selected Measure Amount |

[5] |

26.7

|

19.4

|

11.7

|

|

|

| PEO [Member] | Adjustment Type 1 [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Adjustment to Compensation Amount |

[6] |

$ 1,230,566

|

$ 990,774

|

$ 806,238

|

|

|

| PEO [Member] | Adjustment Type 2 [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Adjustment to Compensation Amount |

[7] |

(4,799,292)

|

11,576,989

|

3,253,310

|

|

|

| PEO [Member] | Adjustment Type 3 [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Adjustment to Compensation Amount |

[8] |

16,127

|

10,485

|

27,653

|

|

|

| PEO [Member] | Adjustment Type 4 [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Adjustment to Compensation Amount |

|

1,099,628

|

1,366,290

|

1,804,941

|

|

|

| PEO [Member] | Adjustment Type 5 [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Adjustment to Compensation Amount |

|

(4,024,648)

|

8,906,572

|

1,549,196

|

|

|

| PEO [Member] | Adjustment Type 6 [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Adjustment to Compensation Amount |

|

(1,874,272)

|

1,304,127

|

(100,827)

|

|

|

| Non-PEO NEO [Member] | Adjustment Type 1 [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Adjustment to Compensation Amount |

[6] |

302,547

|

302,012

|

296,860

|

|

|

| Non-PEO NEO [Member] | Adjustment Type 2 [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Adjustment to Compensation Amount |

[7] |

(1,451,888)

|

3,950,961

|

1,247,578

|

|

|

| Non-PEO NEO [Member] | Adjustment Type 4 [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Adjustment to Compensation Amount |

|

270,354

|

416,479

|

664,585

|

|

|

| Non-PEO NEO [Member] | Adjustment Type 5 [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Adjustment to Compensation Amount |

|

(1,154,596)

|

3,075,623

|

623,521

|

|

|

| Non-PEO NEO [Member] | Adjustment Type 6 [Member] |

|

|

|

|

|

|

| Pay vs Performance Disclosure [Table] |

|

|

|

|

|

|

| Adjustment to Compensation Amount |

|

$ (567,646)

|

$ 458,860

|

$ (40,529)

|

|

|

|

|