mli10q1q15.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended March 28, 2015

|

Commission file number 1–6770

|

MUELLER INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

25-0790410

|

|

(State or other jurisdiction

|

(I.R.S. Employer

|

|

of incorporation or organization)

|

Identification No.)

|

|

8285 Tournament Drive, Suite 150

|

|

|

Memphis, Tennessee

|

38125

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(901) 753-3200

(Registrant’s telephone number, including area code)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx Noo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yesx Noo

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x

|

Accelerated filer o

|

|

Non-accelerated filer o

|

Smaller reporting company o

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yeso Nox

The number of shares of the Registrant’s common stock outstanding as of April 20, 2015, was 56,969,586.

MUELLER INDUSTRIES, INC.

FORM 10-Q

For the Quarterly Period Ended March 28, 2015

__________________________

As used in this report, the terms “Company,” “Mueller,” and “Registrant” mean Mueller Industries, Inc. and its consolidated subsidiaries taken as a whole, unless the context indicates otherwise.

__________________________

| |

|

Page

Number

|

|

Part I. Financial Information

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

3

|

| |

|

|

| |

|

4

|

| |

|

|

| |

|

5

|

| |

|

|

| |

|

6

|

| |

|

|

| |

|

7

|

| |

|

|

| |

|

16

|

| |

|

|

| |

|

23

|

| |

|

|

| |

|

24

|

| |

|

|

|

|

|

| |

|

|

| |

|

25

|

| |

|

|

| |

|

25

|

| |

|

|

| |

|

26

|

| |

|

|

| |

|

27

|

| |

|

|

|

|

28

|

|

PART I

|

FINANCIAL INFORMATION

|

|

|

Financial Statements

|

MUELLER INDUSTRIES, INC.

(Unaudited)

| |

|

For the Quarter Ended

|

|

| |

|

|

|

|

(In thousands, except per share data)

|

|

March 28, 2015

|

|

|

March 29, 2014

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Net sales

|

|

$

|

537,242

|

|

|

$

|

574,374

|

|

| |

|

|

|

|

|

|

|

|

|

Cost of goods sold

|

|

|

460,834

|

|

|

|

495,777

|

|

|

Depreciation and amortization

|

|

|

7,853

|

|

|

|

8,107

|

|

|

Selling, general, and administrative expense

|

|

|

32,831

|

|

|

|

32,183

|

|

| |

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

35,724

|

|

|

|

38,307

|

|

| |

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(2,076

|

)

|

|

|

(1,026

|

)

|

|

Other income, net

|

|

|

105

|

|

|

|

88

|

|

| |

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

33,753

|

|

|

|

37,369

|

|

| |

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

|

(11,413

|

)

|

|

|

(12,415

|

)

|

| |

|

|

|

|

|

|

|

|

|

Consolidated net income

|

|

|

22,340

|

|

|

|

24,954

|

|

| |

|

|

|

|

|

|

|

|

|

Net income attributable to noncontrolling interest

|

|

|

(362

|

)

|

|

|

(248

|

)

|

| |

|

|

|

|

|

|

|

|

|

Net income attributable to Mueller Industries, Inc.

|

|

$

|

21,978

|

|

|

$

|

24,706

|

|

| |

|

|

|

|

|

|

|

|

|

Weighted average shares for basic earnings per share

|

|

|

56,193

|

|

|

|

55,918

|

|

|

Effect of dilutive stock-based awards

|

|

|

731

|

|

|

|

853

|

|

| |

|

|

|

|

|

|

|

|

|

Adjusted weighted average shares for diluted earnings per share

|

|

|

56,924

|

|

|

|

56,771

|

|

| |

|

|

|

|

|

|

|

|

|

Basic earnings per share

|

|

$

|

0.39

|

|

|

$

|

0.44

|

|

| |

|

|

|

|

|

|

|

|

|

Diluted earnings per share

|

|

$

|

0.39

|

|

|

$

|

0.44

|

|

| |

|

|

|

|

|

|

|

|

|

Dividends per share

|

|

$

|

0.075

|

|

|

$

|

0.075

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

See accompanying notes to condensed consolidated financial statements.

|

|

MUELLER INDUSTRIES, INC.

(Unaudited)

| |

|

|

For the Quarter Ended

|

|

| |

|

|

|

|

|

(In thousands)

|

|

|

March 28, 2015

|

|

|

March 29, 2014

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Consolidated net income

|

|

$

|

22,340

|

|

|

$

|

24,954

|

|

| |

|

|

|

|

|

|

|

|

|

Other comprehensive (loss) income, net of tax:

|

|

|

|

|

|

|

|

|

|

Foreign currency translation

|

|

|

(8,404

|

)

|

|

|

1,167

|

|

|

Net change with respect to derivative instruments and hedging activities, net of tax of $274 in 2015 and $590 in 2014

|

|

|

(198

|

)

|

|

|

(1,116

|

)

|

|

Net actuarial loss on pension and postretirement obligations, net of tax of $(501) in 2015 and $28 in 2014

|

|

|

1,416

|

|

|

|

3

|

|

|

Other, net

|

|

|

(27

|

)

|

|

|

(15

|

)

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Total other comprehensive (loss) income

|

|

|

(7,213

|

)

|

|

|

39

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Comprehensive income

|

|

|

15,127

|

|

|

|

24,993

|

|

|

Comprehensive loss (income) attributable to noncontrolling interest

|

|

|

345

|

|

|

|

(253

|

)

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Comprehensive income attributable to Mueller Industries, Inc.

|

|

$

|

15,472

|

|

|

$

|

24,740

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

See accompanying notes to condensed consolidated financial statements.

|

|

MUELLER INDUSTRIES, INC.

(Unaudited)

|

(In thousands, except share data)

|

|

March 28, 2015

|

|

|

December 27, 2014

|

|

|

Assets

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

326,894

|

|

|

$

|

352,134

|

|

|

Accounts receivable, less allowance for doubtful accounts of $565 in 2015 and $666 in 2014

|

|

|

307,984

|

|

|

|

275,065

|

|

|

Inventories

|

|

|

246,395

|

|

|

|

256,585

|

|

|

Other current assets

|

|

|

59,858

|

|

|

|

57,429

|

|

| |

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

941,131

|

|

|

|

941,213

|

|

| |

|

|

|

|

|

|

|

|

|

Property, plant, and equipment, net

|

|

|

244,909

|

|

|

|

245,910

|

|

|

Goodwill

|

|

|

102,582

|

|

|

|

102,909

|

|

|

Other assets

|

|

|

36,208

|

|

|

|

38,064

|

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

1,324,830

|

|

|

$

|

1,328,096

|

|

| |

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

Current portion of debt

|

|

$

|

31,676

|

|

|

$

|

36,194

|

|

|

Accounts payable

|

|

|

100,813

|

|

|

|

100,735

|

|

|

Accrued wages and other employee costs

|

|

|

30,070

|

|

|

|

41,595

|

|

|

Other current liabilities

|

|

|

61,601

|

|

|

|

59,545

|

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

224,160

|

|

|

|

238,069

|

|

| |

|

|

|

|

|

|

|

|

|

Long-term debt, less current portion

|

|

|

205,000

|

|

|

|

205,250

|

|

|

Pension liabilities

|

|

|

18,461

|

|

|

|

20,070

|

|

|

Postretirement benefits other than pensions

|

|

|

21,368

|

|

|

|

21,486

|

|

|

Environmental reserves

|

|

|

21,832

|

|

|

|

21,842

|

|

|

Deferred income taxes

|

|

|

23,100

|

|

|

|

24,556

|

|

|

Other noncurrent liabilities

|

|

|

3,107

|

|

|

|

1,389

|

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

517,028

|

|

|

|

532,662

|

|

| |

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

Mueller Industries, Inc. stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock - $1.00 par value; shares authorized 5,000,000; none outstanding

|

|

|

—

|

|

|

|

—

|

|

|

Common stock - $.01 par value; shares authorized 100,000,000; issued 80,183,004; outstanding 56,943,098 in 2015 and 56,901,445 in 2014

|

|

|

802

|

|

|

|

802

|

|

|

Additional paid-in capital

|

|

|

269,636

|

|

|

|

268,575

|

|

|

Retained earnings

|

|

|

1,010,505

|

|

|

|

992,798

|

|

|

Accumulated other comprehensive loss

|

|

|

(49,429

|

)

|

|

|

(42,923

|

)

|

|

Treasury common stock, at cost

|

|

|

(456,651

|

)

|

|

|

(457,102

|

)

|

| |

|

|

|

|

|

|

|

|

|

Total Mueller Industries, Inc. stockholders’ equity

|

|

|

774,863

|

|

|

|

762,150

|

|

|

Noncontrolling interest

|

|

|

32,939

|

|

|

|

33,284

|

|

| |

|

|

|

|

|

|

|

|

|

Total equity

|

|

|

807,802

|

|

|

|

795,434

|

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

—

|

|

|

|

—

|

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and equity

|

|

$

|

1,324,830

|

|

|

$

|

1,328,096

|

|

| |

|

|

|

|

|

|

|

|

|

See accompanying notes to condensed consolidated financial statements.

|

|

MUELLER INDUSTRIES, INC.

(Unaudited)

| |

|

For the Quarter Ended

|

|

| |

|

|

|

|

(In thousands)

|

|

March 28, 2015

|

|

|

March 29, 2014

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

|

|

Consolidated net income

|

|

$

|

22,340

|

|

|

$

|

24,954

|

|

|

Reconciliation of consolidated net income to net cash provided by (used in) operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

8,015

|

|

|

|

8,165

|

|

|

Stock-based compensation expense

|

|

|

1,349

|

|

|

|

1,194

|

|

|

Loss (gain) on disposal of properties

|

|

|

1

|

|

|

|

(1,413

|

)

|

|

Deferred income taxes

|

|

|

(570

|

)

|

|

|

(1,484

|

)

|

|

Income tax benefit from exercise of stock options

|

|

|

(69

|

)

|

|

|

(156

|

)

|

|

Changes in assets and liabilities, net of business acquired:

|

|

|

|

|

|

|

|

|

|

Receivables

|

|

|

(36,692

|

)

|

|

|

(49,482

|

)

|

|

Inventories

|

|

|

7,534

|

|

|

|

(10,055

|

)

|

|

Other assets

|

|

|

9,257

|

|

|

|

(14,467

|

)

|

|

Current liabilities

|

|

|

(7,389

|

)

|

|

|

(1,337

|

)

|

|

Other liabilities

|

|

|

(131

|

)

|

|

|

(989

|

)

|

|

Other, net

|

|

|

245

|

|

|

|

398

|

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

|

3,890

|

|

|

|

(44,672

|

)

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

|

|

|

|

|

Acquisition of business

|

|

|

—

|

|

|

|

(30,137

|

)

|

|

Capital expenditures

|

|

|

(7,392

|

)

|

|

|

(9,199

|

)

|

|

Net (deposits into) withdrawals from restricted cash

|

|

|

(12,593

|

)

|

|

|

1,771

|

|

|

Proceeds from the sale of assets

|

|

|

492

|

|

|

|

4,833

|

|

| |

|

|

|

|

|

|

|

|

|

Net cash used in investing activities

|

|

|

(19,493

|

)

|

|

|

(32,732

|

)

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

|

|

|

|

|

Repayments of long-term debt

|

|

|

(250

|

)

|

|

|

(250

|

)

|

|

Dividends paid to stockholders of Mueller Industries, Inc.

|

|

|

(4,216

|

)

|

|

|

(4,196

|

)

|

|

Repayment of debt by joint venture, net

|

|

|

(3,817

|

)

|

|

|

(1,407

|

)

|

|

Issuance of debt

|

|

|

—

|

|

|

|

4,373

|

|

|

Net cash received to settle stock-based awards

|

|

|

93

|

|

|

|

224

|

|

|

Income tax benefit from exercise of stock options

|

|

|

69

|

|

|

|

156

|

|

| |

|

|

|

|

|

|

|

|

|

Net cash used in financing activities

|

|

|

(8,121

|

)

|

|

|

(1,100

|

)

|

| |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash

|

|

|

(1,516

|

)

|

|

|

179

|

|

| |

|

|

|

|

|

|

|

|

|

Decrease in cash and cash equivalents

|

|

|

(25,240

|

)

|

|

|

(78,325

|

)

|

|

Cash and cash equivalents at the beginning of the period

|

|

|

352,134

|

|

|

|

311,800

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at the end of the period

|

|

$

|

326,894

|

|

|

$

|

233,475

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

See accompanying notes to condensed consolidated financial statements.

|

MUELLER INDUSTRIES, INC.

(Unaudited)

General

Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted. Results of operations for the interim periods presented are not necessarily indicative of results which may be expected for any other interim period or for the year as a whole. This Quarterly Report on Form 10-Q should be read in conjunction with the Company’s Annual Report on Form 10-K, including the annual financial statements incorporated therein.

The accompanying unaudited interim financial statements include all normal recurring adjustments which are, in the opinion of management, necessary for a fair presentation of the results for the interim periods included herein.

Note 1 – Earnings per Common Share

Basic per share amounts have been computed based on the average number of common shares outstanding. Diluted per share amounts reflect the increase in average common shares outstanding that would result from the assumed exercise of outstanding stock options and vesting of restricted stock awards, computed using the treasury stock method. Approximately 180 thousand stock-based awards were excluded from the computation of diluted earnings per share for the quarter ended March 28, 2015 because they were antidilutive.

Note 2 – Commitments and Contingencies

The Company is involved in certain litigation as a result of claims that arose in the ordinary course of business, which management believes will not have a material adverse effect on the Company’s financial position, results of operations, or cash flows. The Company may also realize the benefit of certain legal claims and litigation in the future; these gain contingencies are not recognized in the Condensed Consolidated Financial Statements.

United States Department of Commerce Antidumping Review

On December 23, 2009, the Department of Commerce (DOC) initiated an antidumping administrative review of the antidumping duty order covering circular welded non-alloy steel pipe and tube from Mexico for the November 1, 2008 through October 31, 2009 period of review. The DOC selected Mueller Comercial de Mexico, S. de R.L. de C.V. (Mueller Comercial) as a respondent in the review. On June 21, 2011, the DOC published the final results of the review and assigned Mueller Comercial an antidumping duty rate of 19.8 percent. On August 22, 2011, the Company appealed the final results to the U.S. Court of International Trade (CIT). On December 21, 2012, the CIT issued a decision upholding the DOC’s final results in part. The CIT issued its final judgment on May 2, 2013. On May 6, 2013, the Company appealed the CIT decision to the U.S. Court of Appeals for the Federal Circuit (Federal Circuit). On May 29, 2014, the Federal Circuit issued its decision vacating the CIT’s decision and remanding the case back to the DOC to reconsider the Company’s rate. The Company and the United States have reached an agreement to settle the appeal. In accordance with that agreement, on February 18, 2015, the DOC published the amended final results of the review and assigned Mueller Comercial an amended antidumping rate of 13.70 percent. The Company anticipates that certain of its subsidiaries will incur antidumping duties on subject imports made during the period of review and, as such, has previously established a reserve of approximately $1.1 million for this matter.

Subsequent to October 31, 2009, Mueller Comercial did not ship subject merchandise to the United States. Therefore, there is zero antidumping duty liability for periods of review after October 31, 2009.

Guarantees

Guarantees, in the form of letters of credit, are issued by the Company generally to assure the payment of insurance deductibles and certain retiree health benefits. The terms of the Company’s guarantees are generally one year but are renewable annually as required. These letters are primarily backed by the Company’s revolving credit facility. The maximum payments that the Company could be required to make under its guarantees at March 28, 2015 were $10.2 million.

Note 3 – Inventories

|

(In thousands)

|

|

March 28, 2015

|

|

|

December 27, 2014

|

|

| |

|

|

|

|

|

|

|

Raw materials and supplies

|

|

$

|

53,327

|

|

|

$

|

53,586

|

|

|

Work-in-process

|

|

|

30,912

|

|

|

|

39,707

|

|

|

Finished goods

|

|

|

167,033

|

|

|

|

168,481

|

|

|

Valuation reserves

|

|

|

(4,877

|

)

|

|

|

(5,189

|

)

|

| |

|

|

|

|

|

|

|

|

|

Inventories

|

|

$

|

246,395

|

|

|

$

|

256,585

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Note 4 – Industry Segments

The Company’s reportable segments are Plumbing & Refrigeration and Original Equipment Manufacturers (OEM). For disclosure purposes, as permitted under Accounting Standards Codification (ASC) 280, Segment Reporting, certain operating segments are aggregated into reportable segments. The Plumbing & Refrigeration segment is composed of Standard Products (SPD), European Operations, and Mexican Operations. The OEM segment is composed of Industrial Products (IPD), Engineered Products (EPD), and Jiangsu Mueller–Xingrong Copper Industries Limited (Mueller-Xingrong). These segments are classified primarily by the markets for their products. Performance of segments is generally evaluated by their operating income.

SPD manufactures copper tube and fittings, plastic fittings, and line sets. These products are manufactured in the U.S. SPD also imports and resells brass and plastic plumbing valves, malleable iron fittings, faucets, and plumbing specialty products. Outside the U.S., the Company’s European Operations manufacture copper tube, which is sold primarily in Europe. Mexican Operations consist of pipe nipple manufacturing and import distribution businesses including product lines of malleable iron fittings and other plumbing specialties. The Plumbing & Refrigeration segment’s products are sold primarily to plumbing, refrigeration, and air-conditioning wholesalers, hardware wholesalers and co-ops, and building product retailers. For the quarter ended March 29, 2014, cost of goods sold included a decrease in accruals related to import duties of $3.1 million.

IPD manufactures brass rod, impact extrusions, and forgings, as well as a wide variety of end products including plumbing brass, automotive components, valves, and fittings. EPD manufactures and fabricates valves and assemblies primarily for the refrigeration, air-conditioning, gas appliance, and barbecue grill markets and specialty copper, copper-alloy, and aluminum tube. Mueller-Xingrong manufactures engineered copper tube primarily for air-conditioning applications. These products are sold primarily to OEM customers.

Summarized segment information is as follows:

| |

|

For the Quarter Ended March 28, 2015

|

|

| |

|

|

|

|

(In thousands)

|

|

Plumbing & Refrigeration Segment

|

|

|

OEM

Segment

|

|

|

Corporate and Eliminations

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$

|

305,017

|

|

|

$

|

235,317

|

|

|

$

|

(3,092

|

)

|

|

$

|

537,242

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold

|

|

|

260,463

|

|

|

|

203,433

|

|

|

|

(3,062

|

)

|

|

|

460,834

|

|

|

Depreciation and amortization

|

|

|

4,523

|

|

|

|

2,855

|

|

|

|

475

|

|

|

|

7,853

|

|

|

Selling, general, and administrative expense

|

|

|

20,540

|

|

|

|

6,481

|

|

|

|

5,810

|

|

|

|

32,831

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

19,491

|

|

|

|

22,548

|

|

|

|

(6,315

|

)

|

|

|

35,724

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2,076

|

)

|

|

Other income, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

105

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

33,753

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Quarter Ended March 29, 2014

|

|

| |

|

|

|

|

(In thousands)

|

|

Plumbing & Refrigeration Segment

|

|

|

OEM

Segment

|

|

|

Corporate and Eliminations

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$

|

338,027

|

|

|

$

|

240,030

|

|

|

$

|

(3,683

|

)

|

|

$

|

574,374

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold

|

|

|

289,025

|

|

|

|

210,403

|

|

|

|

(3,651

|

)

|

|

|

495,777

|

|

|

Depreciation and amortization

|

|

|

4,420

|

|

|

|

3,083

|

|

|

|

604

|

|

|

|

8,107

|

|

|

Selling, general, and administrative expense

|

|

|

20,697

|

|

|

|

5,258

|

|

|

|

6,228

|

|

|

|

32,183

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

23,885

|

|

|

|

21,286

|

|

|

|

(6,864

|

)

|

|

|

38,307

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,026

|

)

|

|

Other income, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

88

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

37,369

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note 5 –Benefits Plans

The Company sponsors several qualified and nonqualified pension plans and other postretirement benefit plans for certain of its employees. The components of net periodic benefit cost (income) are as follows:

| |

|

For the Quarter Ended

|

|

| |

|

|

|

|

(In thousands)

|

|

March 28, 2015

|

|

|

March 29, 2014

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

Pension benefits:

|

|

|

|

|

|

|

|

Service cost

|

|

$

|

272

|

|

|

$

|

222

|

|

|

Interest cost

|

|

|

2,054

|

|

|

|

2,068

|

|

|

Expected return on plan assets

|

|

|

(2,654

|

)

|

|

|

(3,201

|

)

|

|

Amortization of net loss

|

|

|

714

|

|

|

|

188

|

|

| |

|

|

|

|

|

|

|

|

|

Net periodic benefit cost (income)

|

|

$

|

386

|

|

|

$

|

(723

|

)

|

| |

|

|

|

|

|

|

|

|

|

Other benefits:

|

|

|

|

|

|

|

|

|

|

Service cost

|

|

$

|

96

|

|

|

$

|

89

|

|

|

Interest cost

|

|

|

196

|

|

|

|

177

|

|

|

Amortization of prior service cost

|

|

|

2

|

|

|

|

—

|

|

|

Amortization of net loss (gain)

|

|

|

3

|

|

|

|

(64

|

)

|

| |

|

|

|

|

|

|

|

|

|

Net periodic benefit cost

|

|

$

|

297

|

|

|

$

|

202

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Note 6 – Income Taxes

The Company’s effective tax rate for the first quarter of 2015 was 34 percent compared with 33 percent for the same period last year. The difference between the effective tax rate and the amount computed using the U.S. federal statutory tax rate for the first quarter of 2015 was primarily attributable to reductions for the U.S. production activities deduction of $1.0 million and the effect of foreign tax rates lower than statutory tax rates of $0.5 million. These items were partially offset by the provision for state income taxes, net of the federal benefit, of $0.8 million.

For the first quarter of 2014, the difference between the effective tax rate and what would be computed using the U.S. federal statutory tax rate was attributable to reductions related to the U.S. production activities deduction of $1.2 million and decreases in valuation allowances of $0.9 million. These items were partially offset by the provision for state income taxes, net of the federal benefit, of $1.3 million.

The Company files a consolidated U.S. federal income tax return and numerous consolidated and separate-company income tax returns in many state, local, and foreign jurisdictions. The statute of limitations is open for the Company’s federal tax return and most state income tax returns for 2011 and all subsequent years and is open for certain state and foreign returns for earlier tax years due to ongoing audits and differing statute periods. The Internal Revenue Service has audited the 2012 federal income tax return, the results of which were immaterial to the Company’s financial position, results of operations, and cash flows. While the Company believes that it is adequately reserved for possible future audit adjustments, the final resolution of these examinations cannot be determined with certainty and could result in final settlements that differ from current estimates.

Note 7 – Derivative Instruments and Hedging Activities

The Company’s earnings and cash flows are subject to fluctuations due to changes in commodity prices, foreign currency exchange rates, and interest rates. The Company uses derivative instruments such as commodity futures contracts, foreign currency forward contracts, and interest rate swaps to manage these exposures.

All derivatives are recognized in the Condensed Consolidated Balance Sheets at their fair value. On the date the derivative contract is entered into, it is designated as (i) a hedge of a forecasted transaction or the variability of cash flow to be paid (cash flow hedge), or (ii) a hedge of the fair value of a recognized asset or liability (fair value hedge). Changes in the fair value of a derivative that is qualified, designated and highly effective as a cash flow hedge are recorded in accumulated other comprehensive income (AOCI), to the extent effective, until they are reclassified to earnings in the same period or periods during which the hedged transaction affects earnings. Changes in the fair value of a derivative that is qualified, designated and highly effective as a fair value hedge, along with the gain or loss on the hedged recognized asset or liability that is attributable to the hedged risk, are recorded in current earnings. Changes in the fair value of undesignated derivative instruments and the ineffective portion of designated derivative instruments are reported in current earnings.

The Company documents all relationships between hedging instruments and hedged items, as well as the risk-management objective and strategy for undertaking various hedge transactions. This process includes linking all derivatives that are designated as fair value hedges to specific assets and liabilities in the Condensed Consolidated Balance Sheets and linking cash flow hedges to specific forecasted transactions or variability of cash flow.

The Company also assesses, both at the hedge’s inception and on an ongoing basis, whether the designated derivatives that are used in hedging transactions are highly effective in offsetting changes in cash flow or fair values of hedged items. When a derivative is determined not to be highly effective as a hedge or the underlying hedged transaction is no longer probable of occurring, hedge accounting is discontinued prospectively, in accordance with the derecognition criteria for hedge accounting.

Commodity Futures Contracts

Copper and brass represent the largest component of the Company’s variable costs of production. The cost of these materials is subject to global market fluctuations caused by factors beyond the Company’s control. The Company occasionally enters into forward fixed-price arrangements with certain customers; the risk of these arrangements is generally managed with commodity futures contracts. These futures contracts have been designated as cash flow hedges.

At March 28, 2015, the Company held open futures contracts to purchase approximately $32.4 million of copper over the next nine months related to fixed price sales orders. The fair value of those futures contracts was a $354 thousand net gain position, which was determined by obtaining quoted market prices (Level 1 hierarchy as defined by ASC 820, Fair Value Measurements and Disclosures (ASC 820)). In the next twelve months, the Company will reclassify into earnings realized gains or losses relating to cash flow hedges. At March 28, 2015, this amount was approximately $317 thousand of deferred net gains, net of tax.

The Company may also enter into futures contracts to protect the value of inventory against market fluctuations. These futures contracts have been designated as fair value hedges.

At March 28, 2015, the Company held open futures contracts to sell approximately $20.1 million of copper over the next four months related to copper inventory. The fair value of those futures contracts was a $181 thousand gain position, which was determined by obtaining quoted market prices (Level 1 hierarchy as defined by ASC 820).

Foreign Currency Forward Contracts

The Company has entered into certain contracts to purchase heavy machinery and equipment denominated in euros. In anticipation of entering into these contracts, the Company entered into forward contracts to purchase euros to protect itself against adverse foreign exchange rate fluctuations.

At March 28, 2015, the Company held open forward contracts to purchase approximately 326 thousand euros over the next four months. The fair value of these contracts, which was determined by obtaining quoted market prices (Level 1 hierarchy as defined by ASC 820), was a $9 thousand loss position. At March 28, 2015, there was $101 thousand of deferred gains, net of tax, included in AOCI that are expected to be reclassified into depreciation expense over the useful life of the heavy machinery and equipment.

Interest Rate Swap

On February 20, 2013, the Company entered into a two-year forward-starting interest rate swap agreement with an effective date of January 12, 2015, and an underlying notional amount of $200.0 million, pursuant to which the Company receives variable interest payments based on one-month LIBOR and pays fixed interest at a rate of 1.4 percent. Based on the Company’s current variable premium pricing on its Term Loan Facility, the all-in fixed rate on the effective date was 2.7 percent. The interest rate swap will mature on December 11, 2017, and is structured to offset the interest rate risk associated with the Company’s floating-rate, LIBOR-based Term Loan Facility Agreement. The swap was designated and accounted for as a cash flow hedge from inception.

The fair value of the interest rate swap is estimated based on the present value of the difference between expected cash flows calculated at the contracted interest rate and the expected cash flows at the current market interest rate using observable benchmarks for LIBOR forward rates at the end of the period (Level 2 hierarchy as defined by ASC 820). Interest payable and receivable under the swap agreement is accrued and recorded as an adjustment to interest expense. The fair value of the interest rate swap was a $2.4 million loss position at March 28, 2015, and there was $1.6 million of deferred net losses, net of tax, included in AOCI that are expected to be reclassified into interest expense over the term of the hedged item.

We present our derivative assets and liabilities in our Condensed Consolidated Balance Sheets on a net basis by counterparty. The following table summarizes the location and fair value of the derivative instruments and disaggregates our net derivative assets and liabilities into gross components on a contract-by-contract basis:

| |

Asset Derivatives

|

|

Liability Derivatives

|

|

| |

|

|

|

|

| |

|

|

Fair Value

|

|

|

|

Fair Value

|

|

| |

|

|

|

|

|

|

|

|

|

(In thousands)

|

Balance Sheet Location

|

|

March 28, 2015

|

|

|

December 27, 2014

|

|

Balance Sheet Location

|

|

March 28, 2015

|

|

|

December 27, 2014

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hedging instrument:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commodity contracts - gains

|

Other current assets

|

|

$

|

941

|

|

|

$

|

99

|

|

Other current liabilities

|

|

$

|

310

|

|

|

$

|

15

|

|

|

Commodity contracts - losses

|

Other current assets

|

|

|

(102

|

)

|

|

|

(4

|

)

|

Other current liabilities

|

|

|

(614

|

)

|

|

|

(832

|

)

|

|

Foreign currency contracts

|

Other current assets

|

|

|

—

|

|

|

|

—

|

|

Other current liabilities

|

|

|

(9

|

)

|

|

|

(81

|

)

|

|

Interest rate swap

|

Other assets

|

|

|

—

|

|

|

|

—

|

|

Other liabilities

|

|

|

(2,436

|

)

|

|

|

(927

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total derivatives (1)

|

|

|

$

|

839

|

|

|

$

|

95

|

|

|

|

$

|

(2,749

|

)

|

|

$

|

(1,825

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Does not include the impact of cash collateral provided to counterparties.

|

|

The following tables summarize the effects of derivative instruments in our Condensed Consolidated Statements of Income:

| |

|

|

Three Months Ended

|

|

| |

|

|

|

|

|

(In thousands)

|

Location

|

|

March 28, 2015

|

|

|

March 29, 2014

|

|

| |

|

|

|

|

|

|

|

|

Fair value hedges:

|

|

|

|

|

|

|

|

|

Gain on commodity contracts (qualifying)

|

Cost of goods sold

|

|

$

|

213

|

|

|

$

|

6,291

|

|

|

Loss on hedged item - Inventory

|

Cost of goods sold

|

|

|

(247

|

)

|

|

|

(5,800

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

Undesignated derivatives:

|

|

|

|

|

|

|

|

|

|

|

Gain on commodity contracts (nonqualifying)

|

Cost of goods sold

|

|

$

|

234

|

|

|

$

|

1,538

|

|

The following tables summarize amounts recognized in and reclassified from AOCI during the period:

| |

|

Three Months Ended March 28, 2015

|

|

|

| |

|

|

|

|

|

(In thousands)

|

|

Gain (Loss) Recognized in AOCI (Effective Portion), Net of Tax

|

|

|

Classification Gains (Losses)

|

|

|

Loss (Gain)

Reclassified from AOCI (Effective Portion), Net of Tax

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Cash flow hedges:

|

|

|

|

|

|

|

|

|

|

|

|

|

Commodity contracts

|

|

$

|

274

|

|

|

Cost of goods sold

|

|

$

|

571

|

|

|

|

Foreign currency contracts

|

|

|

(55

|

)

|

|

Depreciation expense

|

|

|

—

|

|

|

|

Interest rate swap

|

|

|

(1,032

|

)

|

|

Interest expense

|

|

|

68

|

|

|

| |

|

Three Months Ended March 29, 2014

|

|

|

| |

|

|

|

|

|

(In thousands)

|

|

(Loss) Gain Recognized in AOCI (Effective Portion), Net of Tax

|

|

|

Classification Gains (Losses)

|

|

|

Loss (Gain)

Reclassified from AOCI (Effective Portion), Net of Tax

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Cash flow hedges:

|

|

|

|

|

|

|

|

|

|

|

|

|

Commodity contracts

|

|

$

|

(1,010

|

)

|

|

Cost of goods sold

|

|

$

|

291

|

|

|

|

Foreign currency contracts

|

|

|

22

|

|

|

Depreciation expense

|

|

|

(174

|

)

|

|

|

Interest rate swap

|

|

|

(245

|

)

|

|

Interest expense

|

|

|

—

|

|

|

The Company enters into futures and forward contracts that closely match the terms of the underlying transactions. As a result, the ineffective portion of the open hedge contracts through March 28, 2015 was not material to the Condensed Consolidated Statements of Income.

The Company primarily enters into International Swaps and Derivatives Association (ISDA) master netting agreements with major financial institutions that permit the net settlement of amounts owed under their respective derivative contracts. Under these master netting agreements, net settlement generally permits the Company or the counterparty to determine the net amount payable for contracts due on the same date and in the same currency for similar types of derivative transactions. The master netting agreements generally also provide for net settlement of all outstanding contracts with a counterparty in the case of an event of default or a termination event. The Company does not offset fair value amounts for derivative instruments and fair value amounts recognized for the right to reclaim cash collateral. At March 28, 2015 and December 27, 2014, the Company had recorded restricted cash in other current assets of $1.7 million and $0.5 million, respectively, as collateral related to open derivative contracts under the master netting arrangements.

Note 8 – Accumulated Other Comprehensive Income

AOCI includes certain foreign currency translation adjustments from those subsidiaries not using the U.S. dollar as their functional currency, net deferred gains and losses on certain derivative instruments accounted for as cash flow hedges, adjustments to pension and OPEB liabilities, and unrealized gains and losses on marketable securities classified as available-for-sale.

The following table provides changes in AOCI by component, net of taxes and noncontrolling interest (amounts in parentheses indicate debits to AOCI):

| |

For the Quarter Ended March 28, 2015

|

|

| |

|

|

|

(In thousands)

|

Cumulative Translation Adjustment

|

|

|

Unrealized (Losses)/Gains on Derivatives

|

|

|

Minimum Pension/OPEB Liability Adjustment

|

|

|

Unrealized Gains on Equity Investments

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 27, 2014

|

$

|

(7,076

|

)

|

|

$

|

(953

|

)

|

|

$

|

(35,164

|

)

|

|

$

|

270

|

|

|

$

|

(42,923

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) before reclassifications

|

|

(7,697

|

)

|

|

|

(837

|

)

|

|

|

895

|

|

|

|

(27

|

)

|

|

|

(7,666

|

)

|

|

Amounts reclassified from accumulated OCI

|

|

—

|

|

|

|

639

|

|

|

|

521

|

|

|

|

—

|

|

|

|

1,160

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net current-period other comprehensive income

|

|

(7,697

|

)

|

|

|

(198

|

)

|

|

|

1,416

|

|

|

|

(27

|

)

|

|

|

(6,506

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at March 28, 2015

|

$

|

(14,773

|

)

|

|

$

|

(1,151

|

)

|

|

$

|

(33,748

|

)

|

|

$

|

243

|

|

|

$

|

(49,429

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

For the Quarter Ended March 29, 2014

|

|

| |

|

|

|

(In thousands)

|

Cumulative Translation Adjustment

|

|

|

Unrealized (Losses)/Gains on Derivatives

|

|

|

Minimum Pension/OPEB Liability Adjustment

|

|

|

Unrealized Gains on Equity Investments

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 28, 2013

|

$

|

(462

|

)

|

|

$

|

1,546

|

|

|

$

|

(12,158

|

)

|

|

$

|

255

|

|

|

$

|

(10,819

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) before reclassifications

|

|

1,162

|

|

|

|

(1,233

|

)

|

|

|

(107

|

)

|

|

|

(15

|

)

|

|

|

(193

|

)

|

|

Amounts reclassified from accumulated OCI

|

|

—

|

|

|

|

117

|

|

|

|

110

|

|

|

|

—

|

|

|

|

227

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net current-period other comprehensive income

|

|

1,162

|

|

|

|

(1,116

|

)

|

|

|

3

|

|

|

|

(15

|

)

|

|

|

34

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at March 29, 2014

|

$

|

700

|

|

|

$

|

430

|

|

|

$

|

(12,155

|

)

|

|

$

|

240

|

|

|

$

|

(10,785

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reclassification adjustments out of accumulated OCI were as follows:

| |

|

Amount reclassified from AOCI

|

| |

|

|

| |

|

For the Quarter Ended

|

|

|

| |

|

|

|

|

|

(In thousands)

|

|

March 28, 2015

|

|

|

March 29, 2014

|

|

Affected line item

|

| |

|

|

|

|

|

|

|

|

Unrealized losses/(gains) on derivatives:

|

|

|

|

|

|

|

|

|

Commodity contracts

|

|

$

|

762

|

|

|

$

|

357

|

|

Cost of goods sold

|

|

Foreign currency contracts

|

|

|

|

|

|

|

(276

|

)

|

Depreciation Expense

|

|

Interest rate swap

|

|

|

106

|

|

|

|

—

|

|

Interest expense

|

| |

|

|

(229

|

)

|

|

|

36

|

|

Income tax (expense) benefit

|

| |

|

|

639

|

|

|

|

117

|

|

Net of tax

|

| |

|

|

—

|

|

|

|

—

|

|

Noncontrolling interest

|

| |

|

|

|

|

|

|

|

|

|

| |

|

$

|

639

|

|

|

$

|

117

|

|

Net of tax and noncontrolling

interest

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Amortization of net loss and prior service cost on employee benefit plans

|

|

$

|

719

|

|

|

$

|

124

|

|

Selling, general, and administrative

expense

|

| |

|

|

(198

|

)

|

|

|

(14

|

)

|

Income tax expense

|

| |

|

|

521

|

|

|

|

110

|

|

Net of tax

|

| |

|

|

—

|

|

|

|

—

|

|

Noncontrolling interest

|

| |

|

|

|

|

|

|

|

|

|

| |

|

$

|

521

|

|

|

$

|

110

|

|

Net of tax and noncontrolling

interest

|

| |

|

|

|

|

|

|

|

|

|

Note 9 – Acquisitions

On October 18, 2013, the Company entered into a definitive agreement with KME Yorkshire Limited to acquire certain assets and assume certain liabilities of its copper tube business. Yorkshire Copper Tube (Yorkshire) produces European standard copper distribution tubes. This transaction received regulatory approval in the United Kingdom on February 11, 2014 and closed on February 28, 2014. The purchase price was approximately $30.1 million, paid in cash. The acquisition of Yorkshire complements the Company’s existing copper tube businesses in the Plumbing & Refrigeration segment. In 2012, Yorkshire had annual revenue of approximately $196.1 million. During the third quarter of 2014, the purchase price allocation, including all fair value measurements, was finalized. The fair value of the assets acquired totaled $20.7 million, consisting primarily of inventories of $17.6 million, property, plant, and equipment of $2.1 million, and other current assets of $1.0 million. The fair value of the liabilities assumed totaled $15.6 million, consisting primarily of accounts payable and accrued expenses of $15.2 million and other current liabilities of $0.4 million. Of the remaining purchase price, $8.1 million was allocated to tax-deductible goodwill and $16.9 million was allocated to other intangible assets.

The Company expects to recognize approximately $2.7 million of severance costs related to the reorganization of Yorkshire during the remainder of 2015.

On March 30, 2015, subsequent to the end of the first quarter, the Company entered into a Stock Purchase Agreement with Turbotec Products, Inc. (Turbotec) providing for the purchase of all of the outstanding capital stock of Turbotec for approximately $14.2 million in cash, net of working capital adjustments. Turbotec manufactures coaxial heat exchangers and twisted tubes for the HVAC, geothermal, refrigeration, swimming pool heat pump, marine, ice machine, commercial boiler, and heat reclamation markets. The acquisition of Turbotec complements the Company’s existing refrigeration business, a component of the OEM segment. For the twelve months ended March 31, 2015, Turbotec’s net sales were approximately $21.8 million.

Note 10 – Recently Issued Accounting Standards

In May 2014, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers (Topic 606) (ASU 2014-09). The ASU will supersede virtually all existing revenue recognition guidance under U.S. GAAP and will be effective for annual reporting periods beginning after December 15, 2016. The fundamental principles of the new guidance are that companies should recognize revenue in a manner that reflects the timing of the transfer of services to customers and the amount of revenue recognized reflects the consideration that a company expects to receive for the goods and services provided. The new guidance establishes a five-step approach for the recognition of revenue. The Company is in the process of evaluating the impact of ASU 2014-09 on its Consolidated Financial Statements.

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

General Overview

We are a leading manufacturer of plumbing, HVAC, refrigeration, and industrial products. The range of these products is broad: copper tube and fittings; brass and copper alloy rod, bar, and shapes; aluminum and brass forgings; aluminum and copper impact extrusions; plastic fittings and valves; refrigeration valves and fittings; fabricated tubular products; and steel nipples. We also resell imported brass and plastic plumbing valves, malleable iron fittings, faucets and plumbing specialty products. Mueller’s operations are located throughout the United States and in Canada, Mexico, Great Britain, and China.

The Company’s businesses are aggregated into two reportable segments:

|

●

|

Plumbing & Refrigeration: The Plumbing & Refrigeration segment is composed of SPD, European Operations, and Mexican Operations. SPD manufactures and sells copper tube, copper and plastic fittings, line sets, and valves in North America and sources products for import distribution in North America. European Operations manufacture copper tube in the United Kingdom, which is sold throughout Europe. Mexican Operations consist of pipe nipple manufacturing and import distribution businesses including product lines of malleable iron fittings and other plumbing specialties. The Plumbing & Refrigeration segment sells products to wholesalers in the HVAC, plumbing, and refrigeration markets, to distributors to the manufactured housing and recreational vehicle industries, and to building material retailers.

|

|

●

|

OEM: The OEM segment is composed of IPD, EPD, and Mueller-Xingrong, the Company’s Chinese joint venture. The OEM segment manufactures and sells brass and copper alloy rod, bar, and shapes; aluminum and brass forgings; aluminum and copper impact extrusions; refrigeration valves and fittings; fabricated tubular products; and gas valves and assemblies. Mueller-Xingrong manufactures engineered copper tube primarily for air-conditioning applications; these products are sold primarily to OEMs located in China. The OEM segment sells its products primarily to original equipment manufacturers, many of which are in the HVAC, plumbing, and refrigeration markets.

|

New housing starts and commercial construction are important determinants of the Company’s sales to the HVAC, refrigeration, and plumbing markets because the principal end use of a significant portion of our products is in the construction of single and multi-family housing and commercial buildings. Repairs and remodeling projects are also important drivers of underlying demand for these products.

Residential construction activity in 2014 and into the first quarter of 2015 has shown improvement, but remains at levels below historical averages. Continued improvement is expected, but may be tempered by continuing low labor participation rates, the pace of household formations, higher interest rates, and tighter lending standards. Per the U.S. Census Bureau, the March 2015 seasonally adjusted annual rate of new housing starts was 0.9 million compared with the March 2014 rate of 1.0 million. While mortgage rates have risen in 2015 and 2014, they remain at historically low levels, as the average 30-year fixed mortgage rate was 3.72 percent for the first three months of 2015 and 4.17 percent for the twelve months ended December 2014.

The private non-residential construction sector, which includes offices, industrial, health care and retail projects, began showing modest improvement in 2015 and 2014 after declines in previous years. Per the U.S. Census Bureau, the actual (not seasonally adjusted) value of private non-residential construction put in place was $337.6 billion in 2014 compared to $304.9 billion in 2013. The seasonally adjusted annual value of private non-residential construction put in place was $348.4 billion in February 2015 compared to the December 2014 rate of $354.8 billion and the February 2014 rate of $328.9 billion. The Company expects that most of these conditions will gradually improve, but at an irregular pace.

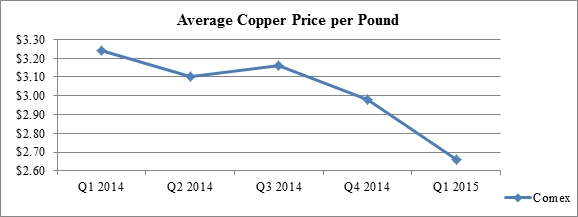

Profitability of certain of the Company’s product lines depends upon the “spreads” between the cost of raw material and the selling prices of its products. The open market prices for copper cathode and scrap, for example, influence the selling price of copper tube, a principal product manufactured by the Company. The Company attempts to minimize the effects on profitability from fluctuations in material costs by passing through these costs to its customers. The Company’s earnings and cash flow are dependent upon these spreads that fluctuate based upon market conditions.

Earnings and profitability are also impacted by unit volumes that are subject to market trends, such as substitute products, imports, technologies, and market share. In core product lines, the Company intensively manages its pricing structure while attempting to maximize its profitability. From time-to-time, this practice results in lost sales opportunities and lower volume. For plumbing systems, plastics are the primary substitute product; these products represent an increasing share of consumption. U.S. consumption of copper tube is still predominantly supplied by U.S. manufacturers. For certain air-conditioning and refrigeration applications, aluminum based systems are the primary substitution threat. The Company cannot predict the acceptance or the rate of switching that may occur. In recent years, brass rod consumption in the U.S. has declined due to the outsourcing of many manufactured products from offshore regions.

Results of Operations

Consolidated Results

The following table compares summary operating results for the first quarter of 2015 and 2014:

| |

|

Three Months Ended

|

|

|

Percent Change

|

|

| |

|

|

|

|

|

|

|

(In thousands)

|

|

March 28, 2015

|

|

|

March 29, 2014

|

|

|

2015 vs. 2014

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Net sales

|