UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934 |

For the transition period from ____________ to ____________

Commission File Number:

(Exact name of Registrant as Specified in Its Charter)

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

(Address of Principal Executive Offices) | (Zip Code) |

(

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer, “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |

☒ | Smaller Reporting Company | |||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

As of August 10, 2022, the registrant had

SYNTHETIC BIOLOGICS, INC.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In particular, statements contained in this Quarterly Report on Form 10-Q, including but not limited to, statements regarding the timing of our clinical trials, the development and commercialization of our pipeline products, the sufficiency of our cash, our ability to finance our operations and business initiatives and obtain funding for such activities and the timing of any such financing, our future results of operations and financial position, business strategy and plans prospects, or costs and objectives of management for future research, development or operations, are forward-looking statements. These forward-looking statements relate to our future plans, objectives, expectations and intentions and may be identified by words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “seeks,” “goals,” “estimates,” “predicts,” “potential” and “continue” or similar words. Readers are cautioned that these forward-looking statements are based on our current beliefs, expectations and assumptions and are subject to risks, uncertainties, and assumptions that are difficult to predict, including those identified below, under Part II, Item 1A. “Risk Factors” and elsewhere in this Quarterly Report on Form 10-Q, and those identified under Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2021 (the “2021 Form 10-K”) filed with the Securities and Exchange Commission (the “SEC”). Therefore, actual results may differ materially and adversely from those expressed, projected or implied in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

NOTE REGARDING COMPANY REFERENCES

Throughout this Quarterly Report on Form 10-Q, “Synthetic Biologics,” the “Company,” “we,” “us” and “our” refer to Synthetic Biologics, Inc. and our subsidiary VCN Biosciences S.L. ("VCN").

NOTE REGARDING TRADEMARKS

All trademarks, trade names and service marks appearing in this Quarterly Report on Form 10-Q are the property of their respective owners.

SYNTHETIC BIOLOGICS, INC.

FORM 10-Q

TABLE OF CONTENTS

2

PART I–FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

Synthetic Biologics, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands except share and par value amounts)

| June 30, 2022 |

| December 31, 2021 | |||

Assets |

|

|

|

| ||

Current Assets |

|

|

|

| ||

Cash and cash equivalents | $ | | $ | | ||

Prepaid expenses and other current assets |

| |

| | ||

Total Current Assets |

| |

| | ||

| ||||||

Non-Current Assets | ||||||

Property and equipment, net |

| |

| | ||

Restricted cash | | — | ||||

Right of use asset | | | ||||

In-process research and development |

| |

| — | ||

Goodwill | | — | ||||

Deposits and other assets |

| |

| | ||

| ||||||

Total Assets | $ | | $ | | ||

Liabilities and Stockholders' Equity |

|

|

| |||

Current Liabilities: |

|

|

| |||

Accounts payable | $ | | $ | | ||

Accrued expenses |

| |

| | ||

Accrued employee benefits |

| |

| | ||

Contingent consideration, current portion | | — | ||||

Loans Payable-current | | — | ||||

Operating lease liability |

| |

| | ||

Total Current Liabilities |

| |

| | ||

Non-current Liabilities | ||||||

Non-current contingent consideration | | — | ||||

Loan Payable - Long term | | — | ||||

Deferred tax liabilities, net | | — | ||||

Lease liability - Long term | | | ||||

Total Liabilities |

| |

| | ||

Commitments and Contingencies |

|

|

| |||

Stockholders' Equity (Deficit): |

|

|

| |||

Common stock, $ |

| |

| | ||

Additional paid-in capital |

| |

| | ||

Accumulated other comprehensive loss | ( | — | ||||

Accumulated deficit |

| ( |

| ( | ||

Total Stockholders' Equity |

| |

| | ||

Total Liabilities and Stockholders' Equity | $ | | $ | | ||

See accompanying notes to unaudited condensed consolidated financial statements.

3

Synthetic Biologics, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share amounts)

(Unaudited)

| For the three months ended June 30, |

| For the six months ended June 30, | |||||||||

2022 |

| 2021 | 2022 | 2021 | ||||||||

Operating Costs and Expenses: |

|

|

|

|

|

|

|

| ||||

General and administrative | $ | |

| $ | | $ | | $ | | |||

Research and development |

| |

|

| |

| |

| | |||

Total Operating Costs and Expenses |

| |

|

| |

| |

| | |||

| ||||||||||||

Loss from Operations |

| ( |

| ( |

| ( |

| ( | ||||

| ||||||||||||

Other Expense: | ||||||||||||

Exchange loss |

| ( |

| |

| ( |

| — | ||||

Interest income |

| |

| |

| |

| | ||||

Total Other Income(Expense) |

| |

| |

| ( |

| | ||||

Net Loss |

| ( |

| ( |

| ( |

| ( | ||||

Net Loss Attributable to Non-controlling Interest |

| |

| |

| — |

| ( | ||||

Net Loss Attributable to Synthetic Biologics, Inc. and Subsidiaries | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Series A Preferred Stock Dividends | | | — | ( | ||||||||

Effect of Series A Preferred Stock price adjustment | | | — | ( | ||||||||

Series B Preferred Stock Dividends |

| |

| |

| — |

| ( | ||||

Net Loss Attributable to Common Stockholders | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Net Loss Per Share - Basic and Dilutive | ( | ( | ( | ( | ||||||||

Weighted average number of shares outstanding during the period - Basic and Dilutive |

| |

| |

| |

| | ||||

Net Loss | ( | ( | ( | ( | ||||||||

Loss on foreign currency translation | ( | | ( | — | ||||||||

Total comprehensive loss | ( | ( | ( | ( | ||||||||

Comprehensive loss attributable to non-controlling interest | | | — | ( | ||||||||

Comprehensive loss attributable to Synthetic Biologics, Inc. and Subsidiaries | ( | ( | ( | ( | ||||||||

See accompanying notes to unaudited condensed consolidated financial statements.

4

Synthetic Biologics, Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders Equity (Deficit)

(In thousands, except share and par value amounts)

Common Stock $0.001 Par Value | Series B Preferred | Accumulated | ||||||||||||||||||||

Other | Total | |||||||||||||||||||||

Accumulated | Comprehensive | Stockholders' | ||||||||||||||||||||

| Shares |

| Amount |

| Shares |

| Amount |

| APIC |

| Deficit |

| income |

| Equity | |||||||

Balance at December 31, 2021 |

| | $ | |

| | $ | | $ | | $ | ( | $ | | $ | | ||||||

Stock-based compensation |

| |

| |

| |

| |

| |

| |

| |

| | ||||||

Issuance of Common Stock for VCN Acquisition |

| |

| |

| |

| |

| |

| |

| |

| | ||||||

Translation gains (losses) |

| |

| |

| |

| |

| |

| |

| |

| | ||||||

Net loss |

| |

| |

| |

| |

| |

| ( |

| |

| ( | ||||||

|

|

|

|

|

|

|

| |||||||||||||||

Balance at March 31, 2022 |

| | $ | |

| | $ | | $ | | $ | ( | $ | | $ | | ||||||

Stock-based compensation | | | | | | | | | ||||||||||||||

Translation gains (losses) | | | | | | | ( | ( | ||||||||||||||

Net loss | | | | | | ( | | ( | ||||||||||||||

Balance at June 30, 2022 | | $ | | | $ | | $ | | $ | ( | $ | ( | $ | | ||||||||

Common Stock $0.001 Par Value | Series B Preferred | |||||||||||||||||||||

|

| Non- | Total | |||||||||||||||||||

Accumulated | Controlling | Stockholders' | ||||||||||||||||||||

| Shares |

| Amount |

| Shares |

| Amount |

| APIC |

| Deficit |

| Interest |

| Deficit | |||||||

Balance at December 31, 2020 | | $ | | | $ | | $ | | $ | ( | $ | ( | $ | ( | ||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||

Stock-based compensation | | | | | | | |

| | |||||||||||||

Stock issued under "at-the-market" offering | | | | | | | |

| | |||||||||||||

Warrants Exercised | | | | | | | |

| | |||||||||||||

Series A Preferred Stock Dividends | | | | | | ( | |

| ( | |||||||||||||

Effect of Series A Preferred Stock price adjustment | | | | | | ( | |

| | |||||||||||||

Conversion of Series A Preferred Stock to Common | | | | | | | |

| | |||||||||||||

Conversion of Series B Preferred Stock to Common | | | ( | ( | | ( | |

| | |||||||||||||

Net loss | | | | | | ( | |

| ( | |||||||||||||

Non-controlling interest | | | | | | | ( | ( | ||||||||||||||

Balance at March 31, 2021 | |

| $ | |

| |

| $ | |

| $ | |

| $ | ( |

| $ | ( |

| $ | | |

Stock-based compensation | | | | | | | | | ||||||||||||||

Net loss | | | | | | ( | | ( | ||||||||||||||

Balance at June 30, 2021 |

| |

| $ | |

| |

| $ | |

| $ | |

| $ | ( |

| $ | ( |

| $ | |

See accompanying notes to unaudited condensed consolidated financial statements.

5

Synthetic Biologics, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

For the Six Months Ended June 30, | ||||||

| 2022 |

| 2021 | |||

Cash Flows From Operating Activities: |

|

|

|

| ||

Net loss | $ | ( | $ | ( | ||

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

| |||

Stock-based compensation |

| |

| | ||

Change in fair value of contingent consideration |

| ( |

| | ||

Depreciation |

| |

| | ||

Changes in operating assets and liabilities: |

|

| ||||

Prepaid expenses and other current assets |

| |

| | ||

Right of use asset |

| |

| | ||

Accounts payable |

| ( |

| ( | ||

Accrued expenses |

| |

| ( | ||

Accrued employee benefits |

| ( |

| ( | ||

Lease liability |

| ( |

| ( | ||

Net Cash Used In Operating Activities |

| ( |

| ( | ||

Cash Flows from Investing Activities |

|

| ||||

Purchase of property and equipment | ( | ( | ||||

Cash paid for business combination, net of cash acquired | ( | | ||||

Pre-acquisition loan to VCN | ( | | ||||

Net Cash Used in Investing Activities | ( | ( | ||||

Cash Flows from Financing Activities |

|

| ||||

Payment of VCN's CDTI loan | ( | |||||

Proceeds from "at the market" stock issuance |

| |

| | ||

Proceeds from issuance of common stock for warrant exercises | | | ||||

Net Cash Provided (used in) by Financing Activities | ( | | ||||

Effects of FX on cash | ( | | ||||

Net increase (decrease) in cash and cash equivalents and restricted cash | ( | | ||||

Cash and cash equivalents and restricted at the beginning of this period |

| |

| | ||

Cash and cash equivalents and restricted cash at the end of this period | $ | | $ | | ||

Reconciliation of cash, cash equivalents, and restricted cash reported in the statement of financial position | ||||||

Cash and cash equivalents | $ | | $ | | ||

Restricted cash included in other long-term assets | | | ||||

Total cash, cash equivalents, and restricted cash shown in the statement of cash flows | $ | | $ | | ||

Supplemental non-cash investing and financing activities: |

|

| ||||

Fair value of contingent consideration issued in a business combination | $ | | $ | | ||

Fair value of equity issued as consideration in a business combination | $ | | $ | | ||

Effective settlement of pre-closing VCN financing | $ | | $ | | ||

Goodwill measurement period adjustment | $ | | $ | | ||

Effect of Series A Preferred Stock price adjustment | $ | | $ | | ||

Right of use asset from operating lease | $ | | $ | | ||

Conversion of Series B Preferred Stock | $ | | $ | | ||

Deemed dividends for accretion of Series B Preferred Stock discount | $ | | $ | | ||

In-kind dividends paid in preferred stock | $ | | $ | | ||

See accompanying notes to unaudited condensed consolidated financial statements.

6

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Organization, Nature of Operations and Basis of Presentation

Description of Business

Synthetic Biologics, Inc. (the “Company” or “Synthetic Biologics”) is a diversified clinical-stage company developing therapeutics in areas of high unmet need. Prior to the acquisition of VCN (the “Acquisition”), the Company’s focus was on developing therapeutics designed to treat gastrointestinal (GI) diseases in areas which included our lead clinical development candidates: (1) SYN-004 (ribaxamase) which is designed to degrade certain commonly used intravenous (IV) beta-lactam antibiotics within the GI tract to prevent microbiome damage, Clostridioides difficile infection (CDI), overgrowth of pathogenic organisms, the emergence of antimicrobial resistance (AMR), and acute graft-versus-host-disease (aGVHD) in allogeneic hematopoietic cell transplant (HCT) recipients, and (2) SYN-020, a recombinant oral formulation of the enzyme intestinal alkaline phosphatase (IAP) produced under cGMP conditions and intended to treat both local GI and systemic diseases. Upon consummation of the Acquisition of VCN, described in more detail below, the Company began transitioning its strategic focus to oncology through the development of VCN’s new oncolytic adenovirus platform designed for intravenous and intravitreal delivery to trigger tumor cell death, improve access of co-administered cancer therapies to the tumor, and promote a robust and sustained anti-tumor response by the patient’s immune system.

Basis of Presentation

On July 11, 2022, the Board of Directors of the Company approved a reverse stock split of the Company's authorized, issued and outstanding shares of common stock, par value $

As a result of the Reverse Stock Split, each ten (10) pre-split shares of common stock outstanding automatically combined into (1) new share of common stock without any action on the part of the holders, and the number of outstanding shares of common stock was reduced from

All share amounts and exercise/conversion prices in the condensed consolidated financial statements and footnotes below have been adjusted retrospectively for the Reverse Stock Split.

The accompanying condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) for interim financial information. Accordingly, they do not include all of the information and notes required by Accounting Principles Generally Accepted in the United States of America (“U.S. GAAP”) for complete financial statements. The accompanying condensed consolidated financial statements include all adjustments, comprised of normal recurring adjustments, considered necessary by management to fairly state the Company’s results of operations, financial position and cash flows. The operating results for the interim periods are not necessarily indicative of results that may be expected for any other interim period or for the full year. These condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s 2021 Form 10-K. The interim results for the three and six months ended June 30, 2022 are not necessarily indicative of results for the full year.

7

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

1. Organization, Nature of Operations and Basis of Presentation – (continued)

The condensed consolidated financial statements are prepared in conformity with U.S. GAAP, which requires the use of estimates, judgments and assumptions that affect the amounts of assets and liabilities at the reporting date and the amounts of revenue and expenses in the periods presented. The Company believes that the accounting estimates employed are appropriate and the resulting balances are reasonable; however, due to the inherent uncertainties in making estimates, actual results may differ from the original estimates, requiring adjustments to these balances in future periods. As of June 30, 2022 the Company has

Business Combination

The Company accounts for acquisitions using the acquisition method of accounting, which requires that all identifiable assets acquired, and liabilities assumed be recorded at their estimated fair values. The excess of the fair value of purchase consideration over the fair values of identifiable assets and liabilities is recorded as goodwill. When determining the fair values of assets acquired and liabilities assumed, management makes significant estimates and assumptions. Critical estimates in valuing certain intangible assets include but are not limited to future expected cash flows from acquired patented technology. Management’s estimates of fair value are based upon assumptions believed to be reasonable, but are inherently uncertain and unpredictable and, as a result, actual results may differ from estimates.

As a result of the acquisition of VCN (see Note 2), the Company has

IPR&D

IPR&D assets represent the fair value assigned to technologies that the Company acquired, which at the time of acquisition have not reached technological feasibility and have no alternative future use. IPR&D assets are considered to have indefinite-lives until the completion or abandonment of the associated research and development projects. If and when development is complete, which generally occurs upon regulatory approval and the ability to commercialize products associated with the IPR&D assets, these assets are then deemed to have definite lives and are amortized based on their estimated useful lives at that point in time. If development is terminated or abandoned, the Company may have a full or partial impairment charge related to the IPR&D assets, calculated as the excess of carrying value of the IPR&D assets over fair value.

During the period that the assets are considered indefinite-lived, they are tested for impairment on an annual basis on October 1, or more frequently if the Company becomes aware of any events occurring or changes in circumstances that could indicate an impairment. The impairment test consists of a comparison of the estimated fair value of the IPR&D with its carrying amount. If the carrying amount exceeds the fair value, an impairment charge is recognized in an amount equal to that excess.

Goodwill

The Company tests the carrying amounts of goodwill for recoverability on an annual basis on October 1 or more frequently if events or changes in circumstances indicate that the asset might be impaired. The Company performs a one-step test in its evaluation of the carrying value of goodwill if qualitative factors determine it is necessary to complete a goodwill impairment test. In the evaluation, the fair value of the relevant reporting unit is determined and compared to its carrying value. If the fair value is greater than the carrying value, then the carrying value is deemed to be recoverable, and no further action is required. If the fair value estimate is less than the carrying value, goodwill is considered impaired for the amount by which the carrying amount exceeds the reporting unit’s fair value, and a charge is reported in impairment of goodwill in the Company’s consolidated statements of operations. As of June 30, 2022, the Company has determined that it has

8

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

1. Organization, Nature of Operations and Basis of Presentation – (continued)

Contingent Consideration

Consideration paid in a business combination may include potential future payments that are contingent upon the acquired business achieving certain milestones in the future (“contingent consideration”). Contingent consideration liabilities are measured at their estimated fair value as of the date of acquisition, with subsequent changes in fair value recorded in the consolidated statements of operations. The Company estimates the fair value of the contingent consideration as of the acquisition date using the estimated future cash outflows based on the probability of meeting future milestones. The milestone payments will be made upon the achievement of clinical and commercialization milestones as well as single low digit royalty payments and payments upon receipt of sublicensing income. Subsequent to the date of acquisition, the Company reassesses the actual consideration earned and the probability-weighted future earn-out payments at each balance sheet date. Any adjustment to the contingent consideration liability will be recorded in the consolidated statements of operations. Contingent consideration liabilities expected to be settled within 12 months after the balance sheet date are presented in current liabilities, with the non-current portion recorded under long term liabilities in the consolidated balance sheets.

Impairment of Long-Lived Assets

Long-lived assets include property, equipment and right-of-use assets. Management reviews the Company’s long-lived assets for impairment annually or whenever events or changes in circumstances indicate that the carrying amount of an asset or asset group may not be fully recoverable. The Company determines the extent to which an asset may be impaired based upon its expectation of the asset’s future usability as well as whether there is reasonable assurance that the future cash flows associated with the asset will be in excess of its carrying amount. If the total of the expected undiscounted future cash flows is less than the carrying amount of the asset, a loss is recognized for the difference between the fair value and the carrying value of the asset. As a result,

Recent Accounting Pronouncements and Developments

In August 2020, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2020-06 Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity. This ASU amends the guidance on convertible instruments and the derivatives scope exception for contracts in an entity’s own equity and improves and amends the related earnings per share guidance for both Subtopics. The ASU will be effective for annual reporting periods after December 15, 2023 and interim periods within those annual periods and early adoption is permitted in annual reporting periods ending after December 15, 2020. The Company is currently assessing the impact of ASU 2020-06 on its consolidated financial statements.

9

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

2. Business Combination

Summary

On March 10, 2022, the Company completed the acquisition of all the outstanding shares of VCN (the “VCN Shares”) from the shareholders of VCN. VCN is a private, clinical-stage biopharmaceutical company developing new oncolytic adenoviruses for the treatment of cancer. VCN’s lead product candidate, VCN-01, is being studied in clinical trials for pancreatic cancer and retinoblastoma. VCN-01 is designed to be administered systemically, intratumorally or intravitreally, either as a monotherapy or in combination with standard of care, to treat a wide variety of cancer indications. VCN-01 is designed to replicate selectively and aggressively within tumor cells, and to degrade the tumor stroma barrier that serves as a significant physical and immunosuppressive barrier to cancer treatment. Degrading the tumor stroma has been shown to improve access to the tumor by the virus and additional therapies such as chemo- and immuno-therapies. Importantly, degrading the stroma exposes tumor antigens, turning “cold” tumors “hot” and enabling a sustained anti-tumor immune response. VCN has the rights to four exclusive patents for proprietary technologies, as well as technologies developed in collaboration with the Virotherapy Group of the Catalan Institute of Oncology (ICO-IDIBELL) and with Hospital Sant Joan de Deu (HSJD), with a number of additional patents pending. As consideration for the purchase of the VCN Shares, the Company paid $

In anticipation of the Acquisition, prior to the Closing, the Company loaned VCN $

Total purchase consideration including cash, restricted shares and contingent consideration was valued at approximately $

Cash paid at Closing | $ | | |

Receivable from VCN "effectively settled" |

| | |

FV of common shares issued |

| | |

FV of contingent consideration |

| | |

$ | |

As of March 31, 2022, the fair value of the contingent consideration was approximately $

The Company acquired VCN due to its track record of being a research and development growth engine capable of fueling sustainable growth, to expand the Company’s research and development pipeline, and to diversify the Company’s potential future revenue opportunities.

10

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

2. Business Combination - (continued)

The preliminary allocation of the fair value of the VCN acquisition is shown in the table below.

| Estimated fair value | ||

($in thousands) | |||

Cash and cash equivalents | $ | | |

Receivables |

| | |

Property and equipment |

| | |

In-process research and development intangible asset |

| | |

Goodwill |

| | |

Deferred tax assets (liabilities), net |

| ( | |

Accounts payable |

| ( | |

Accrued expenses |

| ( | |

Accrued employee benefits |

| ( | |

Loan Payable-current |

| ( | |

Other long-term liabilities |

| ( | |

Total purchase consideration | $ | | |

The above allocation of the purchase price is based upon certain preliminary valuations and other analyses that have not been finalized as of the date of this filing. Any changes in the estimated fair values of the purchase consideration and of the net assets recorded for this business combination upon the finalization of more detailed analyses of the facts and circumstances that existed at the date of the transaction may change the amount and allocation of the purchase price. As such, the purchase price amount and allocations for this transaction are preliminary estimates including in-process research and development, goodwill and contingent consideration, which may be subject to change within the measurement period. During the three months ended June 30, 2022 the Company recognized a measurement period adjustment related to the estimate of acquired liabilities resulting in a $

The net assets were recorded at their estimated fair value. In valuing acquired assets and liabilities, fair value estimates were based primarily on future expected cash flows, market rate assumptions for contractual obligations, and appropriate discount rates. In connection with the acquisition, we recognized $

Goodwill is considered an indefinite-lived asset and relates primarily to intangible assets that do not qualify for separate recognition, such as the assembled workforce and synergies between the entities. Goodwill of $

VCN operations recorded a net loss of $

Pro Forma Consolidated Financial Information (unaudited)

The following unaudited pro forma consolidated financial information summarizes the results of operations for the periods indicated as if the VCN acquisition had been completed as of January 1, 2021 (in thousands):

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||

(in thousands) |

| 2022 |

| 2021 |

| 2022 |

| 2021 | ||||

Net revenues | $ | | $ | | | $ | | |||||

Net loss | $ | ( | $ | ( | ( | $ | ( | |||||

11

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

2. Business Combination - (continued)

Transaction Costs

In conjunction with the Acquisition, the Company incurred approximately $

3. Goodwill and Intangibles

Goodwill of $

The following table provides the Company’s goodwill as of June 30, 2022. During the three months ended June 30, 2022 the Company recognized a measurement period adjustment related to the estimate of acquired liabilities resulting in a $

| Goodwill (in thousands) | ||

Balance at December 31, 2021 | $ | — | |

Goodwill from Acquisition of VCN |

| | |

Goodwill impairment loss |

| — | |

Measurement Period Adjustment | ( | ||

Effects of exchange rates | ( | ||

Balance at June 30, 2022 | $ | | |

The following table provides the Company’s in-process R&D as of June 30, 2022. There was no change in in-process R&D during the quarter ended June 30, 2022.

| In-process | ||

R&D (in thousands) | |||

Balance at December 31, 2021 | $ | | |

Acquired IPR&D - |

| | |

In-process R&D impairment loss |

| | |

Effects of exchange rates | ( | ||

Balance at June 30, 2022 | $ | | |

4. Fair Value of Financial Instruments

Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurement, defines fair value as the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is determined based upon assumptions that market participants would use in pricing an asset or liability. Fair value measurements are rated on a three-tier hierarchy as follows:

| ● | Level 1 inputs: Quoted prices (unadjusted) for identical assets or liabilities in active markets; |

| ● | Level 2 inputs: Inputs, other than quoted prices, included in Level 1 that are observable either directly or indirectly; and |

| ● | Level 3 inputs: Unobservable inputs for which there is little or no market data, which require the reporting entity to develop its own assumptions. |

12

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

4. Fair Value of Financial Instruments – (continued)

In many cases, a valuation technique used to measure fair value includes inputs from multiple levels of the fair value hierarchy described above. The lowest level of significant input determines the placement of the entire fair value measurement in the hierarchy.

The carrying amounts of the Company’s short-term financial instruments, including cash and cash equivalents, other current assets, accounts payable and accrued liabilities approximate fair value due to the relatively short period to maturity for these instruments.

In connection with the Acquisition of VCN, the Company will be required pay up to $

The fair value of financial instruments measured on a recurring basis is as follows (in thousands):

| As of March 10, 2022 | |||||||||

Description | Total | Level 1 | Level 2 | Level 3 | ||||||

Liabilities: |

|

|

|

|

|

|

|

| ||

Contingent consideration | $ | |

| — |

| — | $ | | ||

| As of June 30, 2022 | |||||||||

Description | Total | Level 1 | Level 2 | Level 3 | ||||||

Liabilities: |

|

|

|

|

|

|

|

| ||

Contingent consideration | $ | |

| — |

| — | $ | | ||

The following table summarizes the change in fair value, as determined by Level 3 inputs, for all assets and liabilities using unobservable Level 3 inputs for the six months ended June 30, 2022 (in thousands):

| Contingent | ||

Consideration | |||

Balance at March 10, 2022 | $ | | |

Change in fair value |

| ( | |

Balance at June 30, 2022 | $ | | |

13

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

4. Fair Value of Financial Instruments – (continued)

The recurring Level 3 fair value measurements of contingent consideration for which a liability is recorded include the following significant unobservable inputs:

As of March 10, 2022 |

| ||||||

Valuation | Significant | Weighted Average |

| ||||

| Methodology |

| Unobservable Input |

| (range, if applicable) |

| |

Contingent Consideration |

| Probability weighted |

| Milestone dates |

| 2022-2027 | |

| income approach | ||||||

|

|

| Discount rate |

| |||

|

|

| Weighted Average Discount rate |

| |||

|

|

| Probability of Occurrence (periodic for each Milestone) |

| |||

|

|

| Probability of occurrence (cumulative through each Milestone) |

| |||

| As of June 30, 2022 |

| |||||

Valuation | Significant | Weighted Average |

| ||||

| Methodology |

| Unobservable Input |

| (range, if applicable) |

| |

Contingent Consideration |

| Probability weighted |

| Milestone dates |

| 2022-2027 | |

income approach | |||||||

|

| Discount rate | |||||

Weighted Average Discount rate | |||||||

Probability of Occurrence (periodic for each Milestone) | |||||||

|

| Probability of occurrence (cumulative through each Milestone) | |||||

5. Selected Balance Sheet Information

Prepaid expenses and other current assets (in thousands)

June 30, | December 31, | |||||

| 2022 |

| 2021 | |||

Prepaid clinical research organizations | $ | | $ | | ||

Prepaid manufacturing expenses | | | ||||

Prepaid insurances | | | ||||

VAT receivable | | | ||||

Prepaid consulting, subscriptions and other expenses | | | ||||

Total | $ | | $ | | ||

Prepaid clinical research organizations (CROs) expense is classified as a current asset. The Company makes payments to the CROs based on agreed upon terms that include payments in advance of study services.

14

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

5. Selected Balance Sheet Information – (continued)

Property and equipment, net (in thousands)

| June 30, | December 31, | ||||

2022 |

| 2021 | ||||

Computers and office equipment | $ | | $ | | ||

Other Property, Plant and Equipment | | — | ||||

Leasehold improvements |

| |

| | ||

Software |

| |

| | ||

|

| |

| | ||

Less: accumulated depreciation and amortization |

| ( |

| ( | ||

|

|

| ||||

Total | $ | | $ | | ||

Accrued expenses (in thousands)

| June 30, | December 31, | ||||

2022 |

| 2021 | ||||

Accrued clinical consulting services | $ | | $ | | ||

Accrued manufacturing costs | | | ||||

Accrued vendor payments | | | ||||

VAT payable | | — | ||||

|

|

| ||||

Total | $ | | $ | | ||

Accrued employee benefits (in thousands)

| June 30, | December 31, | ||||

2022 |

| 2021 | ||||

Accrued bonus expense | $ | | $ | | ||

Accrued vacation expense | | | ||||

Accrued compensation expense |

| |

| — | ||

|

|

| ||||

Total | $ | | $ | | ||

6. Stock-Based Compensation

Stock Incentive Plans

On March 20, 2007, the Company’s Board of Directors approved the 2007 Stock Incentive Plan (the “2007 Stock Plan”) for the issuance of up to

15

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

6. Stock-Based Compensation – (continued)

On November 2, 2010, the Board of Directors and stockholders adopted the 2010 Stock Incentive Plan (“2010 Stock Plan”) for the issuance of up to

On September 17, 2020, the stockholders approved and adopted the 2020 Stock Incentive Plan (“2020 Stock Plan”) for the issuance of up to

In the event of an employee’s termination, the Company will cease to recognize compensation expense for that employee. Stock forfeitures are recognized as incurred. There is no deferred compensation recorded upon initial grant date. Instead, the fair value of the stock-based payment is recognized over the stated vesting period.

The Company has applied fair value accounting for all stock-based payment awards since inception. The fair value of each option or warrant granted is estimated on the date of grant using the Black-Scholes option pricing model. There were

| 2022 |

| ||

Exercise price | | |||

Expected dividends |

| | % | |

Expected volatility |

| | % | |

Risk free interest rate |

| | % | |

Expected life of option (years) |

| |||

Expected dividends —The Company has never declared or paid dividends on its common stock and has no plans to do so in the foreseeable future.

Expected volatility—Volatility is a measure of the amount by which a financial variable such as a share price has fluctuated (historical volatility) or is expected to fluctuate (expected volatility) during a period. The expected volatility assumption is derived from the historical volatility of the Company’s common stock over a period approximately equal to the expected term.

Risk-free interest rate—The assumed risk-free rate used is a zero coupon U.S. Treasury security with a maturity that approximates the expected term of the option.

Expected life of the option—The period of time that the options granted are expected to remain unexercised. Options granted during the year have a maximum term of seven years. The Company estimates the expected life of the option term based on the weighted average life between the dates that options become fully vested and the maximum life of options granted.

16

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

6. Stock-Based Compensation – (continued)

The Company records stock-based compensation based upon the stated vesting provisions in the related agreements. The vesting provisions for these agreements have various terms as follows:

| ● | immediate vesting, |

| ● | in full on the one-year anniversary date of the grant date, |

| ● | half vesting immediately and the remaining over three years, |

| ● | quarterly over three years, |

| ● | annually over three years, |

| ● | one-third immediate vesting and the remaining annually over two years, |

| ● | one-half immediate vesting and the remaining over nine months, |

| ● | one-quarter immediate vesting and the remaining over three years, |

| ● | one-quarter immediate vesting and the remaining over 33 months, |

| ● | monthly over one year, and |

| ● | monthly over three years |

During the three and six months ended June 30, 2022, the Company granted

17

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

6. Stock-Based Compensation – (continued)

A summary of stock option activity for the six months ended June 30, 2022 and the year ended December 31, 2021 is as follows:

|

| Weighted |

| Weighted Average |

| Aggregate | ||||

Average Exercise | Remaining | Intrinsic | ||||||||

Options | Price | Contractual Life | Value | |||||||

Balance - December 31, 2020 |

| | $ | |

| $ | | |||

|

|

|

| |||||||

Granted |

| | |

|

|

|

| |||

Exercised |

| | |

|

| |||||

Expired |

| ( | |

|

|

|

| |||

Forfeited |

| | |

|

|

|

| |||

Balance - December 31, 2021 | | | | |||||||

Granted | | | ||||||||

Exercised | — | | ||||||||

Expired | ( | | ||||||||

Forfeited | ( | | ||||||||

|

|

|

| |||||||

Balance - June 30, 2022 - outstanding |

| | $ |

| $ | | ||||

|

|

|

|

| ||||||

Balance - June 30, 2022 - exercisable |

| | $ |

| $ | | ||||

|

| |||||||||

Grant date fair value of options granted – three months ended June 30, 2022 | $ | |

|

|

|

| ||||

|

| |||||||||

Weighted average grant date fair value – three months ended June 30, 2022 | $ | |

|

|

|

| ||||

|

| |||||||||

Grant date fair value of options granted – year ended December 31, 2021 | $ | |

|

|

|

| ||||

|

| |||||||||

Weighted average grant date fair value – year ended December 31, 2021 | $ | |

|

|

|

| ||||

Stock-based compensation expense included in general and administrative expenses relating to stock options issued to employees for the three and six months ended June 30, 2022 was $

Stock-based compensation expense included in general and administrative expenses relating to stock options issued to consultants for the three and six months ended June 30, 2022 was $

As of June 30, 2022, total unrecognized stock-based compensation expense related to stock options was $

18

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

6. Stock-Based Compensation – (continued)

The FASB’s guidance for stock-based payments requires cash flows from excess tax benefits to be classified as a part of cash flows from operating activities. Excess tax benefits are realized tax benefits from tax deductions for exercised options in excess of the deferred tax asset attributable to stock compensation costs for such options. The Company did not record any excess tax benefits during the three and six months ended June 30, 2022 and 2021.

7. Stock Warrants

On October 15, 2018, the Company closed its underwritten public offering pursuant to which it received gross proceeds of approximately $

On November 16, 2020, the exercise price of the Warrants was reduced from $

A summary of all warrant activity for the Company for the quarter ended June 30, 2022 and the year ended December 31, 2021 is as follows:

| Number of |

| Weighted Average | ||

Warrants | Exercise Price | ||||

Balance at December 31, 2020 |

| | | ||

Granted |

| — |

| — | |

Exercised |

| ( |

| | |

Forfeited |

| — |

| — | |

Balance at December 31, 2021 |

| | $ | | |

Granted | | | |||

Exercised | — | — | |||

Forfeited | — | — | |||

Balance at June 30, 2022 | $ | ||||

19

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

7. Stock Warrants – (continued)

On December 26, 2017, the Company entered into a consulting agreement for advisory services for a period of six months. As compensation for such services, the consultant was paid an upfront payment, a monthly fee and on January 24, 2018 was issued a warrant exercisable for

A summary of all outstanding and exercisable common stock warrants as of June 30, 2022 is as follows:

|

|

| Weighted Average | ||||

Warrants | Warrants | Remaining | |||||

Exercise Price | Outstanding | Exercisable | Contractual Life | ||||

$ | |

| |

| |

| |

|

| |

| |

| ||

$ | |

| |

| |

| |

8. Net Loss per Share

Basic net loss per share is computed by dividing net loss by the weighted average number of common shares outstanding. Diluted net loss per share is computed by dividing net loss by the weighted average number of common shares outstanding including the effect of common share equivalents. Diluted net loss per share assumes the issuance of potential dilutive common shares outstanding for the period and adjusts for any changes in income and the repurchase of common shares that would have occurred from the assumed issuance, unless such effect is anti-dilutive. Net loss attributable to common stockholders for the three and six months ended June 30, 2022 was approximately $

9. Non-controlling Interest and Related Party

On September 5, 2018, the Company entered into an agreement (the ‘Stock Purchase Agreement”) with Cedars-Sinai Medical Center (CSMC) for an investigator-sponsored Phase 2b clinical study of SYN-010 to be co-funded by the Company and CSMC (the “Study”). The Study will provide further evaluation of the efficacy and safety of SYN-010, the Company’s modified-release reformulation of lovastatin lactone, which is exclusively licensed to the Company by CSMC. SYN-010 is designed to reduce methane production by certain microorganisms (M. smithii) in the gut to treat an underlying cause of irritable bowel syndrome with constipation (IBS-C).

In consideration of the support provided by CSMC for the Study, the Company paid $

20

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

9. Non-controlling Interest and Related Party – (continued)

The Agreement also provided CSMC with a right, commencing on the six month anniversary of issuance of the stock under certain circumstances in the event that the shares of stock of SYN Biomics are not then freely tradeable, and subject to NYSE American, LLC approval, to exchange its SYN Biomics shares for unregistered shares of the Company’s common stock, with the rate of exchange based upon the relative contribution of the valuation of SYN Biomics to the public market valuation of the Company at the time of each exchange. The Stock Purchase Agreement also provides for tag-along rights in the event of the sale by the Company of its shares of SYN Biomics.

On September 30, 2020, CSMC MAST formally agreed to discontinue the ongoing Phase 2b investigator-sponsored clinical study of SYN-010 following the results of a planned interim futility analysis. Although it was concluded that SYN-010 was well tolerated, SYN-010 was unlikely to meet its primary endpoint by the time enrollment is completed.

On November 9, 2020, the Company and its subsidiary, Synthetic Biomics, Inc. and CSMC mutually agreed to terminate the exclusive license agreement dated December 5, 2013 and all amendments thereto and the clinical trial agreement relating to SYN-010. The determination to terminate the SYN-010 license agreement was agreed following the completion of a planned interim futility analysis of the Phase 2b investigator-sponsored clinical trial of SYN-010. On September 30, 2020, CSMC (the Company’s SYN-010 clinical development partner) informed the Company that it discontinued the ongoing Phase 2b investigator-sponsored clinical study of SYN-010 IBS-C patients. During 2021, CSMC returned its shares of SYN Biomics to the Company. The Company’s interest in SYN Biomics is now

The Company’s non-controlling interest was accounted for under ASC 810, Consolidation and represents the minority stockholder’s ownership interest related to the Company’s subsidiary, SYN Biomics. In accordance with ASC 810, the Company reports its non-controlling interest in subsidiaries as a separate component of equity in the Consolidated Balance Sheets and reports both net loss attributable to the non-controlling interest and net loss attributable to the Company’s common stockholders in the face of the Consolidated Statements of Operations.

10. Common and Preferred Stock

Series B Preferred Stock

On October 15, 2018, the Company closed its underwritten public offering pursuant to which it received gross proceeds of approximately $

In addition, pursuant to the Underwriting Agreement that the Company entered into with the Underwriters on October 10, 2018, the Company granted the Underwriters a 45 day option (the “Over-allotment Option”) to purchase up to an additional

The conversion price of the Series B Preferred Stock and exercise price of the October 2018 Warrants is subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting the Common Stock. The exercise price of the Warrants is subject to adjustment in the event of certain dilutive issuances.

21

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

10. Common and Preferred Stock – (continued)

On November 16, 2020, the exercise price of the Warrants was reduced from $

The October 2018 Warrants are immediately exercisable at a price of $

Since the effective conversion price of the Series B Preferred Stock is less than the fair value of the underlying common stock at the date of issuance, there is a beneficial conversion feature (“BCF”) at the issuance date. Because the Series B Preferred Stock has no stated maturity or redemption date and is immediately convertible at the option of the holder, the discount created by the BCF is immediately charged to accumulated deficit as a “deemed dividend” and impacts earnings per share. During the three months ended March 31, 2021,

Series A Preferred Stock

On September 11, 2017, the Company entered into a share purchase agreement (the “Purchase Agreement”) with an investor (the “Investor”), pursuant to which the Company offered and sold in a private placement

The Series A Preferred Stock ranks senior to the shares of the Company's common stock, and any other class or series of stock issued by the Company with respect to dividend rights, redemption rights and rights to the distribution of assets on any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company. Holders of Series A Preferred Stock are entitled to a cumulative dividend at the rate of

Any conversion of Series A Preferred Stock may be settled by the Company in shares of common stock only.

The holder’s ability to convert the Series A Preferred Stock into common stock is subject to

In the event of any liquidation, dissolution or winding-up of the Company, holders of the Series A Preferred Stock are entitled to a preference on liquidation equal to the greater of (i) an amount per share equal to the stated value plus any accrued and unpaid dividends on such share of Series A Preferred Stock (the “Accreted Value”), and (ii) the amount such holders would receive in such liquidation if they converted their shares of Series A Preferred Stock (based on the Accreted Value and without regard to any conversion limitation) into shares of the common stock immediately prior to any such liquidation, dissolution or winding-up (the greater of (i) and (ii), is referred to as the “Liquidation Value”).

22

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

10. Common and Preferred Stock – (continued)

Except as otherwise required by law, the holders of Series A Preferred Stock have no voting rights, other than customary protections against adverse amendments and issuance of pari passu or senior preferred stock. Upon certain change of control events involving the Company, prior to the filing of the amendment to the Certificate of Designation for the Series A Preferred Stock described below, the Company will be required to repurchase all of the Series A Preferred Stock at a redemption price equal to the greater of (i) the Accreted Value and (ii) the amount that would be payable upon a change of control (as defined in the Certificate of Designation) in respect of common stock issuable upon conversion of such share of Series A Preferred Stock if all outstanding shares of Series A Preferred Stock were converted into common stock immediately prior to the change of control.

On or at any time after (i) the VWAP (as defined in the Certificate of Designation) for at least

The Series A Preferred Stock was classified as temporary equity due to the shares being redeemable based on contingent events outside of the Company’s control. Since the effective conversion price of the Series A Preferred Stock is less than the fair value of the underlying common stock at the date of issuance, there is a beneficial conversion feature (“BCF”) at the issuance date. Because the Series A Preferred Stock has no stated maturity or redemption date and is immediately convertible at the option of the holder, the discount created by the BCF is immediately charged to accumulated deficit as a “deemed dividend” and impacts earnings per share. During the year ended December 31, 2017, the Company recorded a discount of $

On January 27, 2021, the Company filed an amendment to the Certificate of Designation for the Series A Preferred Stock to (i) lower the stated Conversion Price through September 30, 2021 and (ii) remove their change in control put, as an inducement for the holder to fully convert its Series A Preferred Stock. The Amendment to the Certificate of Designation for its Series A Convertible Preferred Stock (the “Certificate of Amendment”) with the Secretary of State of the State of Nevada adjusted the conversion price from $

23

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

10. Common and Preferred Stock – (continued)

B. Riley Securities Sales Agreement

On August 5, 2016, the Company entered into the B. Riley FBR Sales Agreement with FBR Capital Markets & Co. (now known as B. Riley Securities), which enables the Company to offer and sell shares of common stock from time to time through B. Riley Securities, Inc. as the Company’s sales agent. Sales of common stock under the B. Riley Securities Sales Agreement are made in sales deemed to be “at-the-market” equity offerings as defined in Rule 415 promulgated under the Securities Act. B. Riley Securities, Inc. is entitled to receive a commission rate of up to

On February 9, 2021, the Company entered into an amended and restated sales agreement with B. Riley Securities, Inc. (“B. Riley”) and A.G.P./Alliance Global Partners (“AGP”) in order to include AGP as an additional sales agent for the Company’s “at the market offering” program (the “Amended and Restated Sales Agreement”). The Sales Agreement amended and restated the At Market Issuance Sales Agreement, dated August 5, 2016, with B. Riley Securities, Inc. (formerly known as B. Riley FBR, Inc.), as amended by amendment no. 1, dated May 7, 2018, to the At Market Issuance Sales Agreement.

During the three months ended March 31, 2021, the Company sold through the At Market Issuance Sales Agreement and the Amended and Restated Sales Agreement approximately

11. Indebtedness

As a result of the acquisition of VCN the company acquired interest-free or below-market interest rates loans (

| June 30, 2022 |

| June, 2022 | |||

Current | Non-current | |||||

|

|

|

| |||

NEBT Loan | $ | | $ | | ||

RETOS 2015 | | | ||||

$ | | $ | | |||

The difference between the fair value of these liabilities (when relevant conditions associated with the grants are met) and the amount received is recognized as a government grant and classified as other operating income in the statement of profit and loss.

A maturity analysis of the debt as of June 30, 2022 is as follows (amounts in thousands of dollars):

2023 |

| $ | |

2024 |

| | |

2025 |

| | |

2026 |

| | |

2027 |

| | |

2028 |

| | |

Total |

| $ | |

24

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

12. Commitments and Contingencies

The Company’s existing lease as of June 30, 2022 for its U.S. location is classified as an operating lease. As of June 30, 2022, the Company has

The Company also leases research and office facilities in Barcelona Spain. The current lease is short term agreement with a termination notice provision that can be exercised by either party. On the closing date of the VCN Acquisition, a sublease was executed for the Company to lease research and office facilities at a new location in Parets del Valles (Barcelona) from the former owner of VCN. This lease was executed for an initial term estimated to begin in January 2023 until October 2026, with an option to renew for an additional

Operating lease costs are presented as part of general and administrative expenses in the condensed consolidated statements of operations, and for the three and six months ended June 30, 2022 approximated $

A maturity analysis of our operating leases as of June 30, 2022 is as follows (amounts in thousands of dollars):

Future undiscounted cash flow for the years ending March 31, |

|

| |

2022 | $ | | |

2023 | | ||

2024 | | ||

2025 | | ||

2026 | | ||

2027 | | ||

Total | | ||

Discount factor | ( | ||

Lease liability | | ||

Lease liability – current | ( | ||

Lease liability – long term | $ | |

Risks and Uncertainties

On January 30, 2020, the World Health Organization (“WHO”) announced a global health emergency because of COVID-19 and the risks to the international community as the virus spreads globally beyond its point of origin. In March 2020, the WHO classified the COVID-19 outbreak as a pandemic, based on the rapid increase in exposure globally.

25

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

12. Commitments and Contingencies – (continued)

As COVID-19 continued to spread around the globe, the Company experienced disruptions that impacted its business and clinical trials, including the postponement of clinical site initiation of the Phase 1b/2a clinical trial of SYN-004. The extent to which the COVID-19 pandemic impacts the Company’s business, the clinical development of VCN-01, SYN-004 (ribaxamase) and SYN-020, the business of the Company’s suppliers and other commercial partners, the Company’s corporate development objectives and the value of and market for the Company’s common stock, will depend on future developments that are highly uncertain and cannot be predicted with confidence at this time, especially in light of the new variants, such as the ultimate duration of the pandemic, travel restrictions, quarantines, social distancing and business closure requirements in the United States, Europe and other countries, and the effectiveness of actions taken globally to contain and treat the disease. The global economic slowdown, the overall disruption of global healthcare systems and the other risks and uncertainties associated with the pandemic could have a material adverse effect on the Company's business, financial condition, results of operations and growth prospects. In addition, to the extent the ongoing COVID-19 pandemic adversely affects the Company’s business and results of operations, it may also have the effect of heightening many of the other risks and uncertainties which the Company faces.

Through the VCN Acquisition, the Company has operations in Spain and may conduct research and development, manufacturing, and clinical trials in Western European countries. The invasion of Ukraine by Russia and the retaliatory measures that have been taken, or could be taken in the future, by the United States, NATO, and other countries have created global security concerns that could result in a regional conflict and otherwise have a lasting impact on regional and global economies, any or all of which could disrupt our supply chain, and despite the fact that we currently do not plan any clinical trials in Eastern Europe, may adversely impact the cost and conduct of R&D, manufacturing, and international clinical trials of our product candidates.

13. Subsequent Events

On July 29, 2022, the Company closed a private placement offering pursuant to the terms of a Securities Purchase Agreement dated as of July 28, 2022 entered into with MSD Credit Opportunity Master Fund, L.P. (the “SPA”), pursuant to which the Company agreed to issue and sell

In order to comply with Section 122 of the NYSE American Company Guide, on August 9, 2022 the Company and the holder of the Company’s Series C preferred stock and Series D preferred stock amended the SPA to provide that the holder may only submit

On August 3, 2022 the Company announced the exercise price of warrants issued by the Company in October 2018 was reduced from $

26

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion should be read in conjunction with our unaudited condensed consolidated financial statements and notes thereto included in this Quarterly Report on Form 10-Q, and our audited consolidated financial statements and notes thereto for the year ended December 31, 2021 included in our 2021 Form 10-K. This discussion contains forward-looking statements reflecting our current expectations that involve risks and uncertainties. See “Note Regarding Forward-Looking Statements” for a discussion of the uncertainties, risks and assumptions associated with these statements. Our actual results and the timing of events could differ materially from those expressed or implied by the forward-looking statements due to important factors and risks including, but not limited to, those set forth below under “Risk Factors” and elsewhere herein, and those identified under Part I, Item 1A of our 2021 Form 10-K.

Overview

We are a diversified clinical-stage company developing therapeutics in areas of high unmet need. Prior to the Acquisition of VCN, our focus was on developing therapeutics designed to treat gastrointestinal (GI) diseases which included. our lead clinical development candidates: (1) SYN-004 (ribaxamase) which is designed to degrade certain commonly used intravenous (IV) beta-lactam antibiotics within the GI tract to prevent microbiome damage, Clostridioides difficile infection (CDI), overgrowth of pathogenic organisms, the emergence of antimicrobial resistance (AMR), and acute graft-versus-host-disease (aGVHD) in allogeneic hematopoietic cell transplant (HCT) recipients, and (2) SYN-020, a recombinant oral formulation of the enzyme intestinal alkaline phosphatase (IAP) produced under cGMP conditions and intended to treat both local GI and systemic diseases. Upon consummation of the Acquisition of VCN, described in more detail below, we are transitioning our strategic focus to oncology, through the development of new oncolytic adenovirus products designed for intravenous and intravitreal delivery to trigger tumor cell death, improve access of co-administered cancer therapies to the tumor, and promote a robust and sustained anti-tumor response by the patient’s immune system.

As part of our strategic transformation into an oncology focused company, we are exploring value creation options around our SYN-020 and SYN-004 assets. SYN-004 and SYN-020 both have significant potential opportunity in non-oncology related indications. Advancement of these products may be better achieved through out-licensing or partnering and we will explore opportunities for both SYN-004 and SYN-020 moving forward.

Acquisition of VCN Biosciences, S.L

On March 10, 2022, pursuant to the terms of the Share Purchase Agreement (“Purchase Agreement”) we entered into with VCN and the shareholders of VCN Biosciences S.L. (the “Sellers”), we completed our acquisition of all the outstanding shares of VCN (the “VCN Shares”) from the shareholders of VCN. Pursuant to the Purchase Agreement, as consideration for the purchase of the VCN Shares of capital stock, we paid $4,700,000 (the “Closing Cash Consideration”) to Grifols Innovation and New Technologies Limited (“Grifols”), the owner of approximately 86% of the equity of VCN, and issued to the remaining Sellers 2,639,530 shares of our common stock, $.001 par value (the “Closing Shares”), representing 19.99% of the outstanding shares of our common stock on December 14, 2021, the date of the Purchase Agreement. As additional consideration for the purchase of the VCN Shares held by Grifols, we also agreed to make certain milestone payments to Grifols. Pursuant to the terms of the Purchase Agreement we loaned VCN $417,000 to help finance the costs of certain of VCN’s research and development activities. In addition, at Closing VCN and Grifols entered into a sublease agreement for the sublease by VCN of the laboratory and office space as well as a transitional services agreement. We agreed as a post- Closing covenant to commit to fund VCN’s research and development programs, including but not limited to VCN-01 PDAC phase 2 trial, VCN-01 RB trial and necessary G&A within a budgetary plan of approximately $27.8 million.

VCN is a private, clinical-stage biopharmaceutical company developing new oncolytic adenoviruses for the treatment of cancer. VCN’s lead product candidate, VCN-01, is being studied in clinical trials for pancreatic cancer and retinoblastoma. VCN-01 is designed to be administered systemically, intratumorally or intravitreally, either as a monotherapy or in combination with standard of care, to treat a wide variety of cancer indications. VCN-01 is designed to replicate selectively and aggressively within tumor cells, and to degrade the tumor stroma barrier that serves as a significant physical and immunosuppressive barrier to cancer treatment, Degrading the tumor stroma has been shown to improve access to the tumor by the virus and additional therapies such as chemo- and immuno-therapies. Importantly, degrading the stroma exposes tumor antigens, turning “cold” tumors “hot” and enabling a sustained anti-tumor immune response. VCN has the rights to four exclusive patents for proprietary technologies, as well as technologies developed in collaboration with the Virotherapy Group of the Catalan Institute of Oncology (ICO-IDIBELL) and with Hospital Sant Joan de Deu (HSJD), with a number of additional patents pending.

27

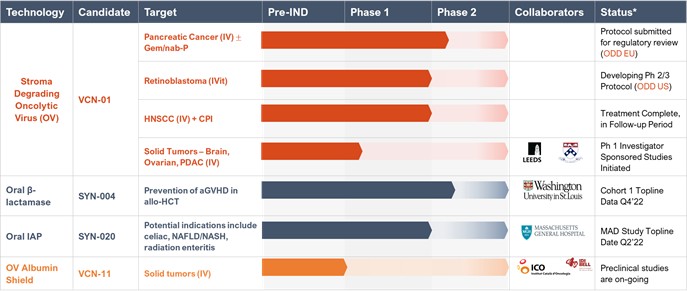

Our Current Product Pipeline

*Based on management’s current beliefs and expectations

aGVHD acute graft-vs-host disease; allo-HCT allogeneic hematopoietic cell transplant. IAP recombinant bovine intestinal alkaline phosphatase II. CPI immune checkpoint inhibitor. Gem/nab-P Gemcitabine + Abraxane® (nab-paclitaxel). HNSCC head and neck squamous cell carcinoma. IV intravenous. IVit intravitreal. MAD multiple ascending dose. ODD Orphan Drug Designation. OV oncolytic adenovirus engineered to selectively replicate in tumors and express hyaluronidase enzyme PH20.

¹Additional products with preclinical proof-of-concept include SYN-006 (carbapenemase) to prevent aGVHD and infection by carbapenem resistant Enterobacteriaceae and SYN-007 (ribaxamase) DR to prevent antibiotic associated diarrhea with oral β-lactam antibiotics.

²Depending on funding/partnership. SYN-004 may enter an FDA-agreed Phase 3 clinical trial for the treatment of Clostridioides difficile infection.

³We have an option-license agreement with Massachusetts General Hospital to develop SYN-020 in several potential indications related to inflammation and gut barrier dysfunction.

Our Gastrointestinal (GI) and Microbiome-Focused Pipeline

Our SYN-004 (ribaxamase) and SYN-020 clinical programs are focused on the gastrointestinal tract (GI) and the gut microbiome, which is home to billions of microbial species and composed of a natural balance of both “good” beneficial species and potentially “bad” pathogenic species. When the natural balance or normal function of these microbial species is disrupted, a person’s health can be compromised. All of our programs are supported by our growing intellectual property portfolio. We are maintaining and building our patent portfolio through: filing new patent applications; prosecuting existing applications; and licensing and acquiring new patents and patent applications.

28

Clinical and Pre-Clinical Update

SYN-004 (ribaxamase) — Prevention of antibiotic-mediated microbiome damage, C. difficile infections (CDI), overgrowth of pathogenic organisms, the emergence of antimicrobial resistance (AMR) and acute graft-versus-host disease (aGVHD) in allogeneic HCT recipients

Phase 1b/2a Clinical Study in Allogeneic HCT Recipients

In August 2019, we entered into a Clinical Trial Agreement (CTA) with the Washington University School of Medicine (Washington University) to conduct a Phase 1b/2a clinical trial of SYN-004 (ribaxamase). Under the terms of this agreement, we serve as the sponsor of the study and supply SYN-004 (ribaxamase). Dr. Erik R. Dubberke, Professor of Medicine and Clinical Director, Transplant Infectious Diseases at Washington University and a member of the SYN-004 (ribaxamase) steering committee serves as the principal investigator of the clinical trial in collaboration with his Washington University colleague Dr. Mark A. Schroeder, Associate Professor of Medicine, Division of Oncology, Bone Marrow Transplantation and Leukemia.

On January 7, 2020, we announced the receipt of official meeting minutes from the FDA following a Type-C meeting held on December 2, 2019 at our request to discuss the development of SYN-004 (ribaxamase) for treatment of allogeneic HCT recipients who are administered IV beta-lactam antibiotics in response to fever. Based on the final meeting minutes, the Phase 1b/2a clinical trial will comprise a single center, randomized, double-blinded, placebo-controlled clinical trial of oral SYN-004 (ribaxamase) in up to 36 evaluable adult allogeneic HCT recipients. The goal of this study is to evaluate the safety, tolerability and potential absorption into the systemic circulation (if any) of oral SYN-004 (ribaxamase; 150 mg four times daily) administered to allogeneic HCT recipients who receive an IV carbapenem or beta-lactam antibiotic to treat fever. Study participants will be enrolled into three sequential cohorts administered a different study-assigned IV antibiotic. Each cohort seeks to complete eight evaluable participants treated with SYN-004 (ribaxamase) and four evaluable participants treated with placebo. Safety and pharmacokinetic data for each cohort will be reviewed by an independent Data and Safety Monitoring Committee, which will make a recommendation on whether to proceed to the next IV antibiotic cohort. The study will also evaluate potential protective effects of SYN-004 on the gut microbiome as well as generate preliminary information on potential therapeutic benefits and patient outcomes of SYN-004 in allogeneic HCT recipients.

On July 30, 2020, we received written notification from the FDA informing us that they determined the Phase 1b/2a clinical program in adult allogeneic HCT recipients may proceed per the submitted clinical study protocol. On December 22, 2020, we announced that we received approval from the Institutional Review Board (IRB) at Washington University to commence the Phase 1b/2a clinical trial of SYN-004. During the first quarter of 2021, Washington University began screening patients for enrollment of the first of three antibiotic cohorts in the Phase 1b/2a clinical trial of SYN-004 in allogeneic HCT recipients. On April 14, 2021, we announced that the first patient had been dosed in our Phase 1b/2a clinical trial of SYN-004 (ribaxamase) in allogeneic hematopoietic cell transplant (HCT) recipients for the prevention of acute graft-versus-host-disease (aGVHD. To date, we have dosed 19 patients in Cohort 1 of the study (12 that are considered evaluable) in the study. A topline data readout from the first Cohort 1 is expected in the second half of 2022 after review by a protocol-specified review by a Data and Safety Monitoring Committee. If enrollment proceeds on the current schedule, we may be positioned to announce data readouts for the second cohort during the second half of 2023 and the third cohort during the second half of 2024.

Due to the unique challenges posed by the global COVID-19 pandemic, Washington University had previously halted the commencement of the Phase 1b/2a clinical trial and they continue to evaluate non-essential activities which may have a direct impact on the continuation of the ongoing clinical trial. Continuation of the Phase 1b/2a clinical trial including, but not limited to, the enrollment of new patients remains largely at the discretion of Washington University and is contingent upon their ability to conduct this clinical program free from the impact of COVID-19. We remain in close contact with Washington University and are actively monitoring the potential impact of COVID-19 on the clinical development plans of SYN-004 (ribaxamase) program.

29

SYN-020 — Oral Intestinal Alkaline Phosphatase