As filed with the Securities and Exchange Commission on October 10, 2018

Registration No. 333-227400

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT

NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Synthetic Biologics, Inc.

(Exact name of Registrant as specified in its charter)

| Nevada | 2834 | 13-3808303 |

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization) | Classification Code Number) | Identification Number) |

9605 Medical Center Drive, Suite 270

Rockville, Maryland 20850

(301) 417-4364

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Steven A. Shallcross

Interim Chief Executive Officer and

Chief Financial Officer

Synthetic Biologics, Inc.

9605 Medical Center Drive, Suite 270

Rockville, Maryland 20850

(301) 417-4364

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Leslie Marlow, Esq. Hank Gracin, Esq. Patrick J. Egan, Esq. The Chrysler Building 405 Lexington Avenue, 26th Floor New York, New York 10174 (212) 907-6457 |

Oded Har-Even, Esq. Robert V. Condon III, Esq. Zysman, Aharoni, Gayer and Sullivan & Worcester LLP 1633 Broadway New York, NY 10019 (212) 660-5000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act of 1934.

| Large accelerated filer | ¨ | Accelerated filer | þ |

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

| Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered (1) | Proposed maximum aggregate offering price(1)(2)(3) | Amount of registration fee(4) | ||||||

| Class A Units consisting of:(5) | $ | 23,000,000 | $ | 2,787.60 | ||||

| (i) Common Stock, par value $0.001 par value | ||||||||

| (ii) Warrants to purchase shares of Common Stock (6) | ||||||||

| Class B Units consisting of:(5) | $ | 23,000,000 | $ | 2,787.60 | ||||

| (i) Series B Convertible Preferred Stock, par value $0.001 per share | ||||||||

| (ii) Warrants to purchase Common Stock (6) | ||||||||

| (iii) Common Stock issuable upon conversion of the Series B

Convertible Preferred Stock(6) | ||||||||

| Common Stock issuable upon exercise of Warrants (7) | $ | 55,200,000 | $ | 6,690.24 | ||||

| Total | $ | 101,200,000 | $ | 12,265.44 | (8) | |||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| (3) | Includes shares of common stock the underwriters have the option to purchase solely to cover over-allotments, if any. |

| (4) | Calculated under Section 6(b) of the Securities Act as .00012120 of the proposed maximum aggregate offering price. |

| (5) | The proposed maximum offering price of the Class A Units proposed to be sold in the offering will be reduced on a dollar-for-dollar basis on the offering price of any Class B Units offered and sold in the offering, and as such the proposed aggregate maximum offering price of the Class A Units and Class B Units if any, is $23,000,000. |

| (6) | No additional registration fee is payable pursuant to Rule 457(i) under the Securities Act. |

| (7) | The Warrants are exercisable at a per share exercise price equal to 120% of the public offering price of one share of Common Stock. The proposed maximum aggregate public offering price of the shares of Common Stock issuable upon exercise of the Warrants was calculated to be $55,200,000, which is equal to 120% of $46,000,000. |

| (8) | A filing fee of $8,641.56 was previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject to completion | dated October 10, 2018 |

Up to 9,523,809 Class A Units Consisting of Shares of Common Stock and Warrants

Up to 20,000 Class B Units Consisting of Series B Convertible Preferred Stock and Warrants

9,523,809 Shares of Common Stock Underlying the Series B Convertible Preferred Stock and

9,523,809 Shares of Common Stock Underlying the Warrants

We are offering up to 9,523,809 Class A Units, each Class A Unit consisting of one share of our common stock and one warrant to purchase one share of our common stock at a price of 120% of the public offering price of the Class A Units. Each warrant will be exercisable upon issuance and will expire five years from date of issuance. The shares of common stock and warrants that are part of a Class A Unit are immediately separable and will be issued separately in this offering. We are also offering the shares of common stock issuable upon exercise of warrants sold in Class A Units.

We are also offering to each purchaser whose purchase of Class A Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity in lieu of purchasing Class A Units, to purchase Class B Units. Each Class B Unit will consist of one share of Series B Convertible Preferred Stock, or the Series B Preferred, with a stated value of $1,000 and convertible into shares of our common stock at the public offering price of the Class A Units, together with the equivalent number of warrants as would have been issued to such purchaser of Class B Units if they had purchased Class A Units based on the public offering price. The Series B Preferred do not generally have any voting rights unless and until converted into shares of common stock. The shares of Series B Preferred and warrants that are part of a Class B Unit are immediately separable and will be issued separately in this offering. The number of shares of our common stock outstanding after this offering will fluctuate depending on how many Class B Units are sold in this offering and whether and to what extent holders of Series B Preferred shares convert their shares to common stock. We are also offering the shares of common stock issuable upon exercise of warrants sold in Class B Units and upon conversion of the Series B Preferred. For each Class B Unit we sell, the number of Class A Units we are offering will be decreased on a dollar-for-dollar basis. Because we will issue a common stock purchase warrant as part of the Class A Unit or Class B unit, the number of warrants sold in this offering will not change as a result of the change in the mix of Class A Units and Class B Units.

Our common stock is listed on the NYSE American under the symbol “SYN”. On October 8, 2018, the last reported sale price of our common stock on the NYSE American was $2.10 per share. The public offering price of the Class A Units will be determined between us, the underwriters and investors based on market conditions at the time of pricing, and may be at a discount to the current market price of our common stock. Therefore, the recent market price used throughout this prospectus may not be indicative of the final offering price. The public offering price of the Class B Units will be $1,000 per unit. There is no established trading market for the warrants or the Series B Preferred and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the warrants or the Series B Preferred on any national securities exchange or other trading market. Without an active trading market, the liquidity of the warrants and the Series B Preferred will be limited.

Investing in our securities involves risk. See “Risk Factors” beginning on page 15 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Class A Unit | Per Class B Unit | Total | ||||||||||

| Public offering price | $ | $ | $ | |||||||||

| Underwriting discounts and commissions(1) | $ | $ | $ | |||||||||

| Proceeds, before expenses, to us | $ | $ | $ | |||||||||

| (1) | We have also agreed to reimburse the underwriters for certain expenses incurred in connection with this offering. See “Underwriting” beginning on page 47 of this prospectus for a description of the compensation payable to the underwriters. |

We have granted a 45-day option to the representative of the underwriters to purchase additional shares of common stock and/or additional warrants in amounts up to 15% of the common stock, warrants and/or common stock issuable upon conversion of the Series B Preferred included in the Class B Units sold in the offering, solely to cover over-allotments, if any.

We expect that delivery of the securities offered hereby against payment will be made on or about , 2018.

A.G.P.

The date of this prospectus is , 2018.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and any free writing prospectus that we have authorized for use in connection with this offering. Neither we nor the underwriters have authorized anyone to provide you with information that is different. We are offering to sell, and seeking offers to buy, the securities covered hereby only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities covered hereby. Our business, financial condition, results of operations and prospects may have changed since that date. We are not, and the underwriters are not, making an offer of these securities in any jurisdiction where the offer is not permitted. You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find Additional Information” in the prospectus. In addition, this prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information.”

For investors outside the United States: Neither we nor any of the underwriters have taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside of the United States.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We believe that the data obtained from these industry publications and third-party research, surveys and studies are reliable. We are ultimately responsible for all disclosure included in this prospectus.

Except where the context requires otherwise, in this prospectus the “Company,” “Synthetic Biologics,” “Synthetic,” “we,” “us” and “our” refer to Synthetic Biologics, Inc., a Nevada corporation, and, where appropriate, its wholly owned subsidiaries.

This summary highlights information contained in other parts of this prospectus or incorporated by reference into this prospectus from our filings with the Securities and Exchange Commission, or SEC, listed in the section of the prospectus entitled “Incorporation of Certain Documents by Reference.” Because it is only a summary, it does not contain all of the information that you should consider before purchasing our securities in this offering and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere or incorporated by reference into this prospectus. You should read the entire prospectus, the registration statement of which this prospectus is a part, and the information incorporated by reference herein in their entirety, including the “Risk Factors” and our financial statements and the related notes incorporated by reference into this prospectus, before purchasing our securities in this offering.

Our Business

Overview

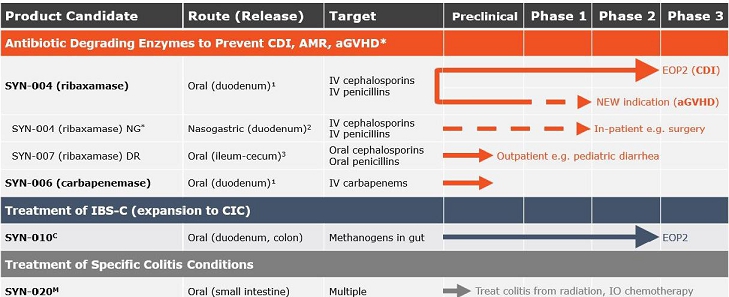

We are a late-stage clinical company focused on developing therapeutics designed to preserve the microbiome to protect and restore the health of patients. Our lead candidates poised for Phase 3 development are: (1) SYN-004 (ribaxamase) which is designed to protect the gut microbiome from the effects of certain commonly used intravenous (IV) beta-lactam antibiotics for the prevention of C. difficile infection (CDI), overgrowth of pathogenic organisms and the emergence of antimicrobial resistance (AMR), and (2) SYN-010 which is intended to reduce the impact of methane-producing organisms in the gut microbiome to treat an underlying cause of irritable bowel syndrome with constipation (IBS-C). Our preclinical pursuits include an oral formulation of the enzyme intestinal alkaline phosphatase (IAP) to treat both local GI and systemic diseases as well as monoclonal antibody therapies for the prevention and treatment of pertussis, and novel discovery stage biotherapeutics for the treatment of phenylketonuria (PKU).

Product Pipeline:

¹Designed to degrade excess antibiotic excreted into the GI tract before the antibiotic reaches the colon and causes dysbiosis.

²For use in patients who can’t swallow the capsule or its contents.

³Designed to degrade non-absorbed antibiotic remaining in the GI tract before the antibiotic reaches the colon and causes dysbiosis.

C - License and collaboration with Cedars-Sinai Medical Center

M - Scientific collaboration with Massachusetts General Hospital

* Development of nasogastric tube (NG) dosing is based on guidance and recommendations by physicians, surgeons, KOLs, our expert steering committee and the U.S. Food and Drug Administration (FDA).

| 3 |

Summary of Clinical and Preclinical Programs

| Therapeutic Area | Product Candidate |

Status | ||

| Prevention of CDI, overgrowth of pathogenic organisms and AMR (Degrade IV beta-lactam antibiotics) | SYN-004 (ribaxamase) (oral enzyme) |

● Reported supportive Phase 1a/1b data (1Q 2015)

● Reported supportive topline data from two Phase 2a clinical trials (4Q 2015 & 2Q 2016)

● Initiated Phase 2b proof-of-concept clinical trial (3Q 2015)

● Received USAN approval of the generic name “ribaxamase” for SYN-004 (July 2016)

● Completed Enrollment of Phase 2b proof-of-concept clinical trial (3Q 2016)

● Awarded contract by the CDC (4Q 2016)

● Announced positive topline data from Phase 2b proof-of-concept clinical trial, including achievement of primary endpoint of significantly reducing CDI (1Q 2017)

● Announced additional results from Phase 2b proof-of-concept clinical trial demonstrating SYN-004 (ribaxamase) protected and maintained the naturally occurring composition of gut microbes from antibiotic-mediated dysbiosis in treated patients (2Q 2017)

● Announced additional results from Phase 2b proof-of-concept clinical trial funded by a contract awarded by the CDC, demonstrating that SYN-004 (ribaxamase) prevented significant change to the presence of certain AMR genes in the gut resistome of patients receiving SYN-004 compared to placebo (3Q 2017)

● Presented additional supportive results regarding several exploratory endpoints from Phase 2b proof-of-concept clinical trial designed to evaluate SYN-004’s (ribaxamase) ability to protect the gut microbiome from opportunistic bacterial infections and prevent the emergence of antimicrobial resistance (AMR) in the gut microbiome (4Q 2017)

● Reached preliminary agreement with the FDA on key elements of a proposed Phase 3 clinical trial program, including de-coupled co-primary endpoints designed to evaluate efficacy separate from safety in a patient population being treated with a representative selection of IV-beta-lactam antibiotics (1H 2018)

● End of Phase 2 meeting with FDA held to solidify remaining elements of planned Phase 3 clinical trial (3Q 2018)

● Expect results from End of Phase 2 meeting with FDA (4Q 2018)

● Clarified market/partner needs and identified potential additional indications for SYN-004 in specialty patient populations such as allogenic hematopoietic cell transplant recipients

● Plan to initiate clinical trial(s) (2H 2019) which may include a broad Phase 3 clinical trial and/or Phase 1/2 clinical trial(s) in a specialty population leading to a subsequent Phase 3 clinical trial |

| Treatment of IBS-C | SYN-010 (oral modified-release lovastatin lactone) |

● Collaboration with Cedars-Sinai Medical Center (“CSMC”)

● Reported supportive topline data from two Phase 2 clinical trials (4Q 2015 & 1Q 2016)

● Received Type C meeting responses from FDA regarding late-stage aspects of clinical pathway (2Q 2016)

● Presented detailed data supporting previously reported positive topline data from two Phase 2 clinical trials at DDW (May 2016) |

| 4 |

● Held End of Phase 2 meeting with FDA (July 2016)

● Confirmed key elements of Pivotal Phase 2b/3 clinical trial design pursuant to consultations with FDA (1Q 2017) | ||||

● Announced issuance of key U.S. composition of matter patent providing important intellectual property protection in the U.S until at least 2035 (Q2 2018)

● Entered into agreement with CSMC for an investigator-sponsored Phase 2 clinical study of SYN-010 to evaluate SYN-010 dose response and inform Phase 3 clinical development (Q3 2018)

● Anticipate dosing first patient in the Phase 2b investigator sponsored clinical study during Q4 2018

● Anticipate data readout from the Phase 2b investigator sponsored clinical study during 2H 2019 | ||||

| Prevention of CDI, overgrowth of pathogenic organisms and AMR (Degrade IV carbapenem antibiotics) | SYN-006 (oral enzyme) |

● Identified P2A as a potent carbapenemase that is stable in the GI tract

● Manufactured and formulated research lot for oral delivery (2017)

● Demonstrated microbiome protection in a pig model of ertapenem administration (Q1 2018) | ||

| Prevention of CDI, overgrowth of pathogenic organisms and AMR (Degrade oral beta-lactam antibiotics) | SYN-007 (oral enzyme) |

● Preclinical work ongoing to expand the utility of SYN-004 (ribaxamase) for use with oral beta-lactam antibiotics

● Presented supportive data from canine animal model at the Microbiome World Congress, America (Q4 2017)

● Reported supportive data from a second canine animal model demonstrating that when co-administered with oral amoxicillin and oral Augmentin, oral SYN-007 did not interfere with systemic absorption of antibiotics but did diminish microbiome damage associated with these antibiotics (2Q 2018) | ||

| Preserve gut barrier, treat local GI inflammation, restore gut microbiome | SYN-020 (oral IAP enzyme) |

● Generated high expressing manufacturing cell lines for intestinal alkaline phosphatase (IAP) (1H 2017)

● Identified downstream process and tablet formulations (2H 2017)

● Identified three potential clinical indications in areas of unmet medical need including, enterocolitis associated with radiation therapy, enterocolitis associated with checkpoint inhibitor therapy for cancer, and microscopic colitis (2H 2018)

● Ongoing preclinical efficacy studies

● Anticipated IND filing (Q4 2019)

● Plan to initiate Phase 1 clinical trial (Q1 2020) | ||

| Prevention and treatment of pertussis | SYN-005 (monoclonal antibody therapies) |

● Reported supportive preclinical research findings (2014)

● The University of Texas at Austin (“UT Austin”) received a grant from the Bill and Melinda Gates Foundation to support a preclinical study to evaluate the prophylactic capability of SYN-005 (4Q 2015)

● Reported supportive preclinical data demonstrating hu1B7, a component of SYN-005, provided protection from pertussis for five weeks in neonatal non-human primate study (Q2 2017)

● Reported supportive preclinical data demonstrating that an extended half-life version of hu1B7, a component of SYN-005, provided protection from pertussis for five weeks in a non-human neonatal primate study (Q4 2017)

● Collaborations with Intrexon and UT Austin |

| 5 |

Our Microbiome-Focused Pipeline

Our SYN-004 (ribaxamase) and SYN-010 programs are focused on protecting the healthy function of the gut microbiome, or gut flora, which is composed of billions of microbial organisms including a natural balance of both “good” beneficial species and potentially “bad” pathogenic species. When the natural balance or normal function of these microbial species is disrupted, a person’s health can be compromised. All of our programs are supported by our growing intellectual property portfolio. We are maintaining and building our patent portfolio through: filing new patent applications; prosecuting existing applications; and licensing and acquiring new patents and patent applications. Our plan remains focused on the advancement of our two late-stage clinical programs. We continue to actively manage resources in preparation for the advancement of our two late-stage microbiome-focused clinical programs, including our pursuit of opportunities that will allow us to establish the clinical infrastructure and financial resources necessary to successfully initiate and complete this plan.

SYN-004 (ribaxamase) — Prevention of C. difficile infections (CDI), overgrowth by pathogenic organisms, and the emergence of antimicrobial resistance (AMR)

SYN-004 (ribaxamase) is a proprietary oral 75 mg capsule prophylactic therapy designed to degrade certain IV beta-lactam antibiotics excreted into the GI tract and maintain the natural balance of the gut microbiome to prevent CDI, reduce overgrowth of pathogenic organisms, and suppress the emergence of antimicrobial-resistant organisms. Published clinical literature has also suggested that preventing microbiome damage caused by IV beta-lactam antibiotics excreted into the GI tract may have potential therapeutic benefit as a means of preventing acute graft-vs-host disease in hematopoietic cell transplant patients. SYN-004 (ribaxamase) is a beta-lactamase enzyme intended to be administered as two-75 mg capsules which, when released in the proximal small intestine, can degrade beta-lactam antibiotics in the GI tract without altering systemic antibiotic levels. Beta-lactam antibiotics are a mainstay in hospital infection management and include the commonly used penicillin and cephalosporin classes of antibiotics.

In November 2012, we acquired a series of oral beta-lactamase enzymes (P1A, P2A and P3A) and related assets targeting the prevention of CDI, the leading healthcare-associated infection that generally occurs secondary to treatment with IV antibiotics from Prev ABR LLC. The acquired assets include a pre-Investigational New Drug (IND) package for P3A, Phase 1 and Phase 2 clinical data for P1A, manufacturing processes and data, and a portfolio of issued and pending U.S. and foreign patents intended to support an IND and Biologics License Application (BLA) with the FDA. Utilizing this portfolio of assets, we developed a proprietary, second generation oral beta-lactamase enzyme product candidate that we now refer to as SYN-004 or by its generic name “ribaxamase”.

Compared to the first generation oral enzyme candidate of P1A, we believe that the second generation candidate, SYN-004 (ribaxamase), will have activity against a broader spectrum of beta-lactam antibiotics, including both penicillins and certain cephalosporins. Due to the structural similarities between P1A and SYN-004 (ribaxamase), and based on previous discussions with the FDA, certain preclinical data collected on P1A was used in support of an IND application for SYN-004 (ribaxamase).

Specifically, P1A had been evaluated in four Phase 1 and one Phase 2 clinical trials conducted in Europe. In total, 112 patients and 143 healthy volunteers participated in these studies.

C. difficile

C. difficile is the leading type of hospital acquired infection and is frequently associated with IV beta-lactam antibiotic treatment. According to a paper published in BMC Infectious Diseases (Desai K et al. BMC Infect Dis. 2016; 16: 303) the economic cost of CDI was approximately $5.4 billion in 2016 ($4.7 billion in healthcare settings; $725 million in the community) in the U.S., mostly due to hospitalizations. CDI is a rising global hospital acquired infection (HAI) problem in which the toxins produced by C. difficile bacteria result in C. difficile associated diarrhea (CDAD), and in the most serious cases, pseudomembranous colitis (severe inflammation of the lower GI tract) that can lead to death. The CDC identified C. difficile as an “urgent public health threat,” particularly given its resistance to many drugs used to treat other infections. CDI is a major unintended risk associated with the prophylactic or therapeutic use of IV antibiotics, which may alter the natural balance of microflora that normally protect the GI tract, leading to C. difficile overgrowth and infection. Other risk factors for CDI include hospitalization, prolonged length of stay (estimated at 7 days), underlying illness, and immune-compromising conditions including the administration of chemotherapy and advanced age. In addition, approximately 20% of patients who have been diagnosed with CDI experience a recurrence of CDI within one to three months.

| 6 |

Limitations of Current Treatments and Market Opportunity

CDI is a widespread and often drug resistant infectious disease. According to an article published in the New England Journal of Medicine (Leffler DA et al. N Engl J Med 2015; 372:1539-1548), it is estimated that 453,000 patients are infected with C. difficile annually in the U.S., and it has been reported that approximately 29,000 patients die due to CDI-associated complications each year. Controlling the spread of CDI has proven challenging, as the C. difficile spores are easily transferred to patients via normal contact with healthcare personnel and with inanimate objects. There is currently no vaccine or approved product for the prevention of primary (incident) CDI.

According to IMS Health Incorporated,* in 2016, 227 million doses of SYN-004 (ribaxamase)-addressable intravenous Penicillin and Cephalosporin antibiotics were administered in the United States which may contribute to the onset of CDI. Additional data derived from IMS Health Incorporated states that in 2016, the worldwide market for SYN-004 (ribaxamase)-addressable intravenous beta-lactam antibiotics was approximately 7.5 billion doses, which may represent a multi-billion dollar opportunity for us. According to the CDC report Antibiotic Resistance Threats in the United States, 2013, at least 2 million people in the U.S. each year acquire serious infections with bacteria that are resistant to one or more of the antibiotics designed to treat those infections, which results in an estimated $20 billion in excess direct healthcare costs.

| * | This information is an estimate derived from the use of information under license from the following IMS Health Incorporated information service: IMS Health Analytics for the full year 2016. IMS expressly reserves all rights, including rights of copying, distribution, and republication. |

Clinical Update

On April 23, 2018, we announced that we had reached preliminary agreement with the FDA on key elements of a proposed clinical trial program for our planned Phase 3 clinical trial for ribaxamase. In accordance with recommendations and guidance received from the FDA, we expect the Phase 3 trial to evaluate the efficacy and safety of ribaxamase as separate, co-primary endpoints in a patient population being treated with a representative selection of intravenous (IV) beta-lactam antibiotics, which will include ceftriaxone and piperacillin/tazobactam. The inclusion of more than one beta-lactam antibiotic in this trial is intended to evaluate the potential utility of ribaxamase for co-administration with a greater number of cephalosporin and penicillin beta-lactam antibiotics. The proposed Phase 3 clinical trial discussed with the FDA will comprise a global, event-driven clinical trial with a fixed maximum number of patients and will seek to evaluate the efficacy and safety of ribaxamase in a broader patient population by enrolling patients with a variety of underlying infections. We expect the primary efficacy endpoint of the proposed Phase 3 trial will be the reduction in the incidence of CDI in the ribaxamase treatment group compared to placebo. We have also reached preliminary agreement with the FDA to evaluate mortality risk as the primary safety endpoint for this trial, which will be separate from the primary efficacy endpoint of reduction of the incidence of CDI. The designation of efficacy and safety as separate and decoupled endpoints is critical for clinical studies of this nature, where the underlying population is projected to have a comparatively high incidence of safety events that may significantly dilute the smaller number of CDI events.

We plan to continue collaborative discussions with the FDA to solidify the remaining details of the proposed Phase 3 clinical trial program during an anticipated End of Phase 2 meeting with the FDA in the third quarter of 2018. In parallel with clinical and regulatory efforts, we have recently completed a Health Economics Outcomes Research study, which was conducted to generate key insights on how we can expect Health Care Practitioners, or HCPs, to evaluate patient access for ribaxamase while also providing a framework for potential reimbursement strategies. After evaluating findings from the study, and after extensive discussions with pharmaceutical companies, physicians, research institutions and clinical development groups worldwide, we believe that there is significant potential value in exploring the development of SYN-004 (ribaxamase) in a more narrow patient population where the incidence of the disease endpoint is high and the clinical development may be less costly. One potential narrow patient population for SYN-004 could be allogenic hematopoietic cell transplant (HCT) recipients, who have a very high risk of CDI, VRE colonization and potentially fatal bacteremia, and acute-graft-vs-host disease. Published literature has demonstrated a strong association between these adverse outcomes and microbiome damage caused by IV beta-lactam antibiotics in these patients. Further examination and discussions with key opinion leaders (KOLs) who are experts in allogenic HCT are ongoing to evaluate a potential clinical development pathway forward for SYN-004 in such a narrow, specialty patient population.

Contingent on potential interest from prospective partners and/or appropriate funding, we anticipate initiating the Phase 3 clinical trial currently under discussion with the FDA in 2H 2019 which will evaluate SYN-004 (ribaxamase) effects on CDI in a broad and diverse patient population. In parallel, discussions with KOLs are ongoing to determine if further investigation in the form of a potential Phase 1 and/or Phase 2 clinical trial(s) evaluating SYN-004 (ribaxamase) in a specialized patient population such as allogenic HCT patients may also and/or alternatively be pursued in 2H 2019. If it is determined that the clinical advancement of SYN-004 is more favorable and significantly less costly in a specialized patient population, we may elect to prioritize and pursue this strategy in advance of pursuing the broader, Phase 3 clinical program currently under discussion with the FDA. If approved by the FDA, SYN-004 (ribaxamase) would be the first available drug designed to prevent primary Clostridium difficile infection by protecting the gut microbiome from antibiotic-mediated dysbiosis.

| 7 |

SYN-010 — Treatment of Irritable Bowel Syndrome with Constipation (IBS-C)

SYN-010 is our proprietary, modified-release formulation of lovastatin lactone that is intended to reduce methane production by certain microorganisms (M. smithii) in the gut while minimizing disruption to the microbiome. Methane produced by M. smithii is an underlying cause of pain, bloating and constipation associated with IBS-C, and published reports have associated higher intestinal methane production with increased constipation severity in IBS-C patients. SYN-010 is intended to act primarily in the intestinal lumen while avoiding systemic absorption, thereby targeting the major cause of IBS-C, not just the patient’s symptoms.

In December 2013, through our subsidiary Synthetic Biomics, Inc. (SYN Biomics), we entered into a worldwide exclusive license agreement with Cedars-Sinai Medical Center (CSMC) and acquired the rights to develop products for therapeutic and prophylactic treatments of acute and chronic diseases, including the development of SYN-010 to target IBS-C. We licensed from CSMC a portfolio of intellectual property comprised of several U.S. and foreign patents and pending patent applications for various fields of use, including IBS-C, obesity and diabetes. An investigational team, led by Mark Pimentel, M.D. at CSMC, discovered that these products may reduce the production of methane gas by certain GI microorganisms.

We believe SYN-010 may reduce the impact of methane producing organisms on IBS-C.

Irritable Bowel Syndrome

IBS is a functional GI disorder characterized by gas, abdominal pain, bloating and diarrhea or constipation, or alternating episodes of both. The illness affects both men and women; however, two-thirds of diagnosed sufferers are women. The onset of IBS can begin anytime from adolescence to adulthood. Four bowel patterns may be seen with IBS including: IBS-C (constipation predominant), IBS-D (diarrhea predominant), IBS-M (mixed diarrhea and constipation) and IBS-U (unsubtyped). According to GlobalData’s IBS — Global Drug Forecast and Market Analysis to 2023 (December 2014 ), the prevalence of IBS in adults in the United States, Europe and Japan was expected to be 41.1 million in 2016, and it has been reported that up to 20 percent of all IBS patients have IBS-C. Extensive studies conducted by Dr. Pimentel and collaborators have shown that overproduction of methane gas is directly associated with bloating, pain and constipation in IBS-C patients. Investigators at CSMC have discovered that inhibiting intestinal methane production may reverse constipation associated with IBS-C, and may be beneficial in treating other major diseases such as obesity, insulin resistance and type 2 diabetes.

Limitations of Current Treatments and Market Opportunity

Currently, the FDA approved therapies for the treatment of IBS-C include prescription and over-the-counter laxatives, which provide patients with temporary symptomatic relief and often cause diarrhea, but are not designed to and do not treat the underlying cause of pain, bloating and constipation associated with IBS-C. Additionally, these same therapies may come with undesirable safety side-effect profiles, the most common of which is diarrhea. As a result, these therapies have struggled to find adoption in several key markets, including Europe. We believe this presents an important opportunity for SYN-010. Towards the end of 2017, we engaged outside consultants to evaluate the potential regulatory pathway towards EMA marketing approval. According to IMS Health Analytics, U.S. sales in 2016 for IBS-C and Chronic Idiopathic Constipation (CIC) therapeutics as well as OTC laxatives/products were approximately $2.5 billion, representing a constant annual growth rate (CAGR) of 19% from 2012.

Clinical Update

On September 5, 2018, we entered into an agreement with CSMC for an investigator-sponsored Phase 2 clinical study of SYN-010 to be co-funded by us and CSMC (the “Study”).

The Study will provide further evaluation of the efficacy and safety of SYN-010, our modified-release reformulation of lovastatin lactone, which is exclusively licensed to us by CSMC. SYN-010 is designed to reduce methane production by certain microorganisms (M. smithii) in the gut to treat an underlying cause of irritable bowel syndrome with constipation (IBS-C). The data from this study will provide additional insights into potential SYN-010 clinical efficacy, including dose response and microbiome effects, ideally solidifying existing clinical outcomes data, and potentially simplifying Phase 3 clinical development.

The Study will be conducted out of the Pimentel Laboratory at CSMC and is expected to be a 12-week, placebo-controlled, double-blind, randomized clinical trial to evaluate two dose strengths of oral SYN-010 (21 mg and 42 mg) in approximately 150 patients diagnosed with IBS-C. The investigator-sponsored Study will be led by the gastrointestinal microbiota researcher Ruchi Mathur, M.D., director of Metabolism, Clinical Research and Administrative Operations at the Medically Associated Science and Technology (MAST) Program at CSMC. The Study is expected to begin enrollment during the fourth quarter of 2018, contingent upon approval of the clinical study protocol by the CSMC Institutional Review Board.

The primary objective for the Study will be to determine the efficacy of SYN-010, measured as an improvement from baseline in the weekly average number of complete spontaneous bowel movements (CSBMs) during the 12-week treatment period for SYN-010 21 mg and 42 mg daily doses relative to placebo. Secondary efficacy endpoints for both dose strengths of SYN-010 are expected to measure changes from baseline in abdominal pain, bloating, stool frequency as well as the use of rescue medication relative to placebo. Exploratory outcomes include Adequate Relief and quality of life measures using the well-validated EQ-5D-5L and PAC-SYM patient questionnaires.

| 8 |

We expect that CSMC will dose the first patient in the investigator-sponsored Phase 2b clinical study in Q4 2018. A data readout from this clinical trial study is anticipated in 2H 2019.

Allowance of Key U.S. Patent

On May 1, 2018, the United States Patent and Trademark Office (USPTO) issued U.S. Patent No. 9,956,292 which includes claims related to composition of matter for the use of anti-methanogenic compositions to treat IBS-C. The patent will provide key intellectual property protection in the U.S. for SYN-010 and will expire no later than 2035.

Research Programs

Infectious disease outbreaks are increasing while intervention options are declining due to widespread multidrug-resistant bacteria, increasing numbers of immuno-compromised patients (e.g., the elderly and cancer patients) and the isolation of new pathogens.

SYN-007 — Prevention of CDI, overgrowth of pathogenic organisms and the emergence of antimicrobial resistance (AMR)

SYN-007 is a specially formulated version of SYN-004 (ribaxamase) designed to degrade orally administered beta-lactam antibiotics to protect the gut microbiome from antibiotic-mediated dysbiosis. SYN-007 is formulated for release in the distal small intestine to allow systemic absorption of the oral antibiotic while still providing protection upstream of the colon and to the gut microbiome. SYN-007 is designed for patients who have been administered SYN-004 (ribaxamase) in combination with intravenous beta-lactam antibiotics and who are then transferred to an oral beta-lactam antibiotic, thereby extending gut microbiome protection from antibiotic-mediated dysbiosis. Data from a recent canine study completed during the second half of 2017 demonstrated that, when co-administered with oral amoxicillin, oral SYN-007 did not interfere with amoxicillin absorption and did demonstrate protection of the gut microbiome. The data from this canine study were presented during recent microbiome conferences in Q4 2017 and Q1 2018. A second canine study was completed during Q2 2018 in which oral SYN-007 was co-administered with oral amoxicillin and oral Augmentin. Again, SYN-007 did not interfere with systemic absorption of the antibiotics but did diminish the microbiome damage associated with these antibiotics.

SYN-006 — Prevention of CDI, overgrowth of pathogenic organisms and the emergence of antimicrobial resistance (AMR)

The second pipeline product, termed SYN-006, has the potential to further expand the utility of our SYN-004 (ribaxamase) program to a broader spectrum of IV beta-lactam antibiotics in the GI tract to include carbapenem antibiotics. Carbapenems are broad-spectrum beta-lactam antibiotics that have been shown to significantly damage the gut microbiome, incur a high risk for C. difficile infection, and enable GI overgrowth with multidrug resistant organisms. Carbapenems are frequently a last line of defense antibiotic, therefore the emergence and spread of carbapenem resistance presents an urgent threat. SYN-006 is a carbapenemase designed to degrade intravenous (IV) carbapenem antibiotics within the GI tract to maintain the natural balance of the gut microbiome for the prevention of CDI, overgrowth of pathogenic organisms and the emergence of antimicrobial resistance (AMR). It is anticipated that, by protecting the gut microbiome from exposure to carbapenem antibiotics, SYN-006 may potentially diminish the spread of such resistance. At the ID Week 2017 conference, we presented a poster demonstrating SYN-006’s broad activity against four carbapenem antibiotics as well as efficacy in a canine model. The poster also showed data from a porcine model indicating that the carbapenem, ertapenem, potently damaged gut microbiomes and mediated expansion of antibiotic resistance genes in the GI tract. More recently, we successfully formulated SYN-006 for oral delivery and evaluated it in a porcine efficacy model in conjunction with IV ertapenem. The data, presented at a clinical conference during the first quarter of 2018, demonstrated that SYN-006 did not interfere with serum levels of ertapenem and did diminish antibiotic-mediated dysbiosis.

SYN-005 — Pertussis (Whooping Cough)

The SYN-005 program is developing monoclonal antibodies both as a prophylaxis and a treatment for pertussis. Bordetella pertussis (B. pertussis) is a gram-negative bacterium that infects the upper respiratory tract, causing uncontrollable and violent coughing. Antibiotic treatment does not have a major effect on the course of pertussis. While such treatment can eliminate the B. pertussis bacteria from the respiratory tract, it does not neutralize the pertussis toxin. Infants with pertussis often require hospitalization in pediatric intensive care units, frequently requiring mechanical ventilation. The incidence of pertussis is increasing due to the declining effectiveness of the acellular vaccine introduced in the 1990s, exposure of unvaccinated and under-vaccinated individuals including infants who are not yet fully vaccinated and exposure of individuals whose immunity has diminished over time.

According to the Centers for Disease Control and Prevention (CDC) , there were 24.1 million cases of whooping cough worldwide in 2014, and it is estimated that B. pertussis infection caused up to 167,700 deaths in children younger than 5 years in 2014.

| 9 |

Intrexon Collaboration and The University of Texas at Austin Agreement

In August 2012, we entered into a worldwide exclusive channel collaboration with Intrexon develop monoclonal antibody (mAb) therapies for the treatment of certain infectious diseases not adequately addressed by existing therapies. In December 2012, we initiated mAb development for the prevention and treatment of pertussis focusing on toxin neutralization. Unlike antibiotics, we are developing a mAb therapy to target and neutralize the pertussis toxin as a prophylaxis for high-risk newborns and in order to shorten the course, diminish the long-term complications, and reduce the mortality rate in infected infants.

To further the development of this potential therapy for pertussis, we entered into an agreement with UT Austin to license the rights to certain research and pending patents related to pertussis antibodies. These research efforts are being conducted at the Cockrell School of Engineering in the laboratory of Associate Professor, Jennifer A. Maynard, Ph.D., the Laurence E. McMakin, Jr. Centennial Faculty Fellow in the McKetta Department of Chemical Engineering. Dr. Maynard brings to the project her expertise in defining the key neutralizing epitopes of pertussis toxin to optimize the potential efficacy of antibody therapeutics.

Preclinical Development

Working with our collaborator, Intrexon, and our academic collaborator, UT Austin, we have established a humanized mAb product candidate, SYN-005, designed to neutralize pertussis toxin, a major cause of pertussis-mediated infant morbidity and mortality. The two humanized mAbs, hu1B7 and hu11E6, bound tightly to the toxin and potently neutralized the toxin. In addition, the antibodies, individually or in combination, were highly efficacious in a murine model of pertussis in which they completely mitigated elevations of the white blood cell count that is characteristic of the illness.

In April 2014, and again in September 2014, we received positive preclinical research findings of SYN-005 for the treatment of pertussis in three non-human primate studies (n = 19). In the latter two pertussis studies in particular, SYN-005 rapidly stopped the rise in white blood cell count that is characteristic of the disease and accelerated its return to baseline.

In September 2014, we received U.S. Orphan Drug Designation from the FDA for SYN-005 for the treatment of pertussis.

In October 2015, the Bill & Melinda Gates Foundation awarded a grant to UT Austin to generate preclinical proof-of-concept data in the neonatal non-human primate model to test the hypothesis that antibody administration at birth may have a role in the prevention of pertussis.

In December 2015, the non-human primate prophylaxis study was initiated by UT Austin to determine if administration of hu1B7, one component of SYN-005, at two days of age could protect animals from a subsequent pertussis infection. On April 19, 2017, we announced supportive preclinical data demonstrating hu1B7 provided five weeks of protection from pertussis in neonatal non-human primates. Control animals (n=6), infected with Bordetella pertussis (B. pertussis) at five weeks of age, demonstrated marked elevations in white blood cell counts and most exhibited behavioral signs of pertussis, including coughing and diminished activity. In contrast, the experimental animals (n=7), who were treated with hu1B7 at two days of age and then infected five weeks later, had significantly lower peak white blood cell counts (p=0.004) that remained within the normal range or were only slightly elevated. Importantly, all seven of the animals that received prophylactic hu1B7 appeared healthy and none exhibited any behavioral signs of pertussis. Building on this early success, we performed preclinical testing of a modified version of hu1B7 that has the potential to extend the plasma half-life. The modified hu1B7 achieved higher plasma levels at five weeks than the parental hu1B7 antibody and was efficacious in preventing clinical pertussis. The extended half-life antibody has the potential to substantially reduce the required dose and cost for prophylaxis for application in the Developing World. This current study expands the potential clinical utility beyond treatment to also include prophylaxis.

SYN-020 — Oral Intestinal Alkaline Phosphatase

SYN-020 is in the preclinical development stage. SYN-020 is being developed as a modified-release oral dosage form of intestinal alkaline phosphatase (IAP). IAP is an endogenous enzyme expressed in the upper GI tract that functions as a broadly acting phosphatase that generally serves to maintain GI homeostasis and promote commensal microbiota. In animal models, IAP is anti-inflammatory, tightens the gut barrier to diminish “leaky gut,” and accelerates gut microbiome recovery from antibiotic-mediated dysbiosis. Published reports have demonstrated efficacy for several indications with oral IAP in many animal models including colitis, antibiotic-mediated dysbiosis, and metabolic syndrome as well as in a pilot human clinical trial with ulcerative colitis patients.

| 10 |

Limitations of Current Treatments and Clinical Update

Despite its therapeutic potential, clinical application of an oral IAP product has been hindered by inefficient manufacturing with a high cost of goods. We have established manufacturing processes with the potential to yield product with a cost of goods which we believe to be suitable for commercialization. Recent advances include cell lines that express up to 3 grams/L along with a chromatographic downstream process and potential tablet formulations. We are currently optimizing these technologies and pursuing animal efficacy studies. During Q2 2018, we completed several preclinical animal studies that support the clinical utility of SYN-020 for multiple gastrointestinal disorders. We are currently evaluating and establishing strategies to advance IAP to and through clinical trials for several novel indications, including enterocolitis associated with radiation therapy for cancer and checkpoint inhibitor therapy for cancer and microscopic colitis, all of which have unmet medical needs and span a range of market sizes. Importantly, we believe that with a small capital commitment, we can begin moving SYN-020 towards an IND. We are targeting filing an IND during Q4 2019 and commencing a Phase 1 clinical trial during Q1 2020.

SYN-200 — Treatment of Phenylketonuria (PKU)

PKU is a genetic disease that begins at birth characterized by a deficiency in the liver enzyme that breaks down the essential amino acid phenylalanine (Phe), a building block of proteins normally obtained through the foods we eat. As a result, Phe accumulates in the body, becoming toxic and leading to serious health consequences, including profound mental retardation, brain damage, mental illness, behavioral problems, seizures, tremors, limited cognitive ability and hyperactivity. If left untreated, the most severe form of PKU leads to permanent cognitive damage. PKU affects more than 14,000 people in the U.S. and 50,000 people in developed nations globally. There is no existing cure for PKU, requiring patients to maintain a life-long treatment program and a carefully controlled diet.

Intrexon Collaboration

In August 2015, we initiated the SYN-200 discovery program for development and commercialization of novel biotherapeutics for the treatment of patients with PKU pursuant to an exclusive channel collaboration with Intrexon. We intend to utilize Intrexon’s ActoBiotics platform to provide a proprietary method of delivering therapeutic protein to the GI tract through food-grade microbes. This program is in the discovery stage.

Company History

Our predecessor, Sheffield Pharmaceuticals, Inc., was incorporated in 1986, and in 2006 engaged in a reverse merger with Pipex Therapeutics, Inc., a Delaware corporation formed in 2001. After the merger, we changed our name to Pipex Pharmaceuticals, Inc., and in October 2008 we changed our name to Adeona Pharmaceuticals, Inc. On October 15, 2009, we engaged in a merger with a wholly owned subsidiary for the purpose of reincorporating in the State of Nevada. After reprioritizing our focus on the emerging area of synthetic biologics and entering into our first collaboration with Intrexon, we amended our Articles of Incorporation to change our name to Synthetic Biologics, Inc. on February 15, 2012.

Corporate Information

Our executive offices are located at 9605 Medical Center Drive, Suite 270, Rockville, Maryland 20850. Our telephone number is (301) 417-4364, and our website address is www.syntheticbiologics.com. The information contained on our website is not part of, and should not be construed as being incorporated by reference into this prospectus supplement.

| 11 |

| Class A Units offered by us | Up to 9,523,809 Class A Units. Each Class A Unit will consist of one share of our common stock and a warrant to purchase one share of our common stock at an exercise price equal to 120% of the public offering price of the Class A Unit. The Class A Units will not be certificated and the shares of common stock and warrant that are part of such unit will be immediately separable and will be issued separately in this offering. Assuming no exercise of the over-allotment option and we sell all Class A Units (and no Class B Units) being offered in this offering at an assumed public offering price of $ 2.10 per share (which was the last reported sale price of our common stock on the NYSE American on October 8, 2018), we would issue in this offering an aggregate of 9,523,809 shares of our common stock and warrants to purchase 9,523,809 shares of our common stock. The actual offering price per each Class A Unit will be negotiated between us and the underwriters based on the trading of our common stock prior to the offering, among other things, and may be at a discount to the current market price. We are also offering the shares of common stock issuable upon exercise of warrants sold in Class A Units. |

Assumed Public Offering Price |

$2.10 per Class A Unit. |

| Class B Units offered by us | Up to 20,000 Class B Units. We are also offering to each purchaser whose purchase of Class A Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the holder, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, Class B Units, in lieu of Class A Units. Each Class B Unit will consist of one share of our Series B Preferred, with a stated value of $1,000 and convertible into shares of our common stock, at the public offering price of the Class A Units, together with an equivalent number of warrants as would have been issued to such purchaser if they had purchased Class A Units based on the public offering price of the Class A Units. The Series B Preferred do not generally have any voting rights but are convertible into shares of common stock. The Class B Units will not be certificated and the shares of Series B Preferred and warrants that are part of such unit will be immediately separable and will be issued separately in this offering. We are also offering the shares of common stock issuable upon exercise of warrants sold in Class B Units and upon conversion of the Series B Preferred. For each Class B Unit we sell, the number of Class A Units we are offering will be decreased on a dollar-for-dollar basis. Because we will issue a warrant as part of each Unit, the number of warrants sold in this offering will not change as a result of a change in the mix of the Units sold. |

Public Offering Price Per |

$1,000 per Class B Unit. |

| Warrants offered by us | Each warrant included in the Units will have an exercise price of 120% of the public offering price of the Class A Units, will be exercisable upon issuance and will expire five years from the date of issuance. Each warrant will be exercisable to purchase one share of our common stock. No fractional shares of common stock will be issued in connection with the exercise of a warrant. In lieu of fractional shares, we will round up to the next whole share. The warrants also provide that in the event of a fundamental transaction we are required to cause any successor entity to assume our obligations under the warrants. In addition, the holder of the warrant will be entitled to receive upon exercise of the warrant the kind and amount of securities, cash or property that the holder would have received had the holder exercised the warrant immediately prior to such fundamental transaction. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the warrants. Subject to certain exceptions, the warrants provide for adjustment of the exercise price, which initially will be 120% of the public offering price of the Class A Units, if we or any of our subsidiaries, as applicable, sell or grant any right to reprice, or otherwise dispose of or issue (or announce any offer, sale, grant or any option to purchase or other disposition) any shares of our common stock or common stock equivalents, at an effective price per share that is less than the exercise price then in effect (such lower price, the “Base Share Price” and such issuances collectively, a “Dilutive Issuance”). In the event a Dilutive Issuance occurs, the exercise price shall be reduced to equal the Base Share Price. |

| 12 |

| Over-allotment option | We have granted the underwriters a 45-day option to purchase up to 1,428,571 additional shares of common stock at an assumed offering price of $2.10 per share and/or additional warrants to purchase up to an additional 1,428,571 shares of our common stock from us at a price of $0.01 per warrant, to cover over-allotments, if any, of the shares of common stock, shares of common stock issuable upon conversion of the Series B Preferred and warrants comprising the Units. |

| Common stock to be outstanding after the offering | 16,732,129 shares of our common stock (at an assumed public offering price of $2.10 per share which was the last reported sale price of our common stock on the NYSE American on October 8, 2018) and assumes that no shares of Series B Preferred are sold in this offering and that none of the warrants are exercised. If the underwriters’ over-allotment option is exercised in full, the total number of shares of common stock outstanding immediately after this offering would be 18,160,700 (at an assumed public offering price of $2.10 per share which was the last reported sale price of our common stock on the NYSE American on October 8, 2018) and assuming all shares of Series B Preferred sold in this offering convert to common stock and that none of the warrants are exercised). This prospectus also includes the shares of our common stock issuable upon conversion of the Series B Preferred and exercise of the warrants. |

| Series B Convertible Preferred Stock | The Series B Preferred will be convertible into shares of our common stock (subject to adjustment as provided in the related certificate of designation of preferences, rights and limitations) at any time at the option of the holder, at a conversion price equal to the public offering price of the Class A Units. See “Description of Securities We Are Offering— Preferred Stock — Series B Convertible Preferred Stock” for a discussion of the terms of the Series B Preferred. |

| 13 |

| Use of Proceeds | We intend to use the net proceeds, if any, from the sales of securities offered by this prospectus to fund our and our subsidiaries’ preclinical and clinical programs, (including, but not limited to, provide approximately $5.0-$7.0 million in funding for manufacturing scale-up activities to progress SYN-004 towards a potential Phase 3 clinical trial (broad indication) and/or initiate a Phase 1/2 clinical trial(s) in a specialty population, approximately $7.5 million in funding for preclinical development and related manufacturing activities for our IND and Phase 1 clinical trial for our SYN-020 program and required milestone payments) and for working capital and general corporate purposes, including, to acquire, license or invest in complementary businesses, technologies, product candidates or other intellectual property. We have broad discretion in determining how the proceeds of this offering will be used, and our discretion is not limited by the aforementioned possible uses. Our board of directors believes the flexibility in application of the net proceeds is prudent. See “Use of Proceeds.” |

| Risk Factors | See the section entitled “Risk Factors” beginning on page 15 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our securities. |

| Market symbol and trading | Our common stock is listed on the NYSE American under the symbol “SYN”. There is no established trading market for the Series B Preferred or warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Series B Preferred or warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Series B Preferred and warrants will be limited. |

The number of shares of common stock shown above to be outstanding after this offering is based on 7,208,320 shares outstanding as of October 8, 2018, and assumes the issuance and sale of 9,523,809 Class A Units in this offering and no Class B Units.

Unless we indicate otherwise, all information in this prospectus is as of October 8, 2018 and:

| · | reflects a one-for-thirty-five reverse stock split of our issued and outstanding shares of common stock, options and warrants effected on August 10, 2018 and the corresponding adjustment of all common stock prices per share and stock option and warrant exercise prices per share and preferred stock conversion ratios without taking into account fractional shares which are rounded up to the nearest whole number; |

| · | assumes no exercise by the underwriters of their over-allotment option; |

| · | excludes 634,921 shares of our common stock issuable upon conversion of outstanding shares of preferred stock; |

| · | excludes 347,765 shares of our common stock issuable upon exercise of outstanding options under our equity incentive plans at a weighted-average exercise price of $54.19 per share; |

| · | excludes 915,854 shares of our common stock reserved for issuance upon the exercise of outstanding warrants with a weighted-average exercise price of $75.16 per share and assumes no exercise of the warrants issued in this offering; |

| · | assumes no shares of Series B Preferred are sold in this offering; and |

| · | excludes 170,674 shares of our common stock that are reserved for equity awards that may be granted under our equity incentive plans. |

To the extent we sell any Class B Units in this offering, the same aggregate number of common stock equivalents resulting from this offering would be convertible under the Series B Preferred issued as part of the Class B Units.

| 14 |

An investment in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all of the other information contained or incorporated by reference in this prospectus, including our consolidated financial statements and the related notes, before making a decision to invest in our securities. You should also consider the risks, uncertainties and assumptions discussed under Item 1A, “Risk Factors,” in Part I of our Annual Report on Form 10-K for the year ended December 31, 2017 and Item 1A, “Risk Factors,” in Part II of our Quarterly Report on Form 10-Q for the quarter ended June 30, 2018 and any updates or other risks contained in other filings that we may make with the SEC after the date of this prospectus, all of which are incorporated herein by reference, and may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future and any additional prospectus supplement. If any of these risks actually occur, our business, results of operations and financial condition could suffer. In that case, the market price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO THIS OFFERING

Investors will experience immediate and substantial dilution in the book value per share of the securities purchased in this offering.

Investors purchasing securities in this offering will incur immediate and substantial dilution in net tangible book value per share of our common stock. After giving effect to the sale of 9,523,809 Class A Units, at an assumed public offering price of $2.10 per Class A Unit (which was the last reported sale price of our common stock on the NYSE American on October 8, 2018) assuming no sale of any Class B Units and after deducting the estimated underwriting discount and estimated offering expenses payable by us, purchasers of our Class A units in this offering will incur immediate dilution of $0.10 per share in the net tangible book value of the common stock they acquire. For a further description of the dilution that investors in this offering will experience, see “Dilution”.

In addition, to the extent that outstanding stock options or warrants or preferred stock (including the exercise of any warrants) have been or may be exercised or converted or other shares issued, you may experience further dilution.

Our management will have broad discretion over the use of proceeds from this offering and may not use the proceeds effectively.

Our management will have broad discretion over the use of proceeds from this offering. The net proceeds from this offering will be used to fund our and our subsidiaries’ preclinical and clinical programs (including, but not limited to, provide approximately $5.0-$7.0 in funding for manufacturing scale-up activities to progress SYN-004 towards a potential Phase 3 (broad indication) clinical trial and/or initiate a Phase1/2 clinical trial(s) in a specialty population, approximately $7.5 million in funding for preclinical development and related manufacturing activities in preparation for our IND and Phase 1 clinical trial for our SYN-020 program and required milestone payments) and for working capital and general corporate purposes, including, to acquire, license or invest in complementary businesses, technologies, product candidates or other intellectual property. Our management will have considerable discretion in the application of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. The net proceeds may be used for corporate purposes that do not improve our operating results or enhance the value of our common stock.

Even if this offering is successful, we will need to raise additional capital in the future to continue operations, which may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

We have had recurring losses from operations, negative operating cash flow and an accumulated deficit. We do not generate any cash from operations and must raise additional funds in order to continue operating our business. We expect to continue to fund our operations primarily through equity and debt financings in the future. Our cash requirements may vary from those now planned depending upon numerous factors, including the result of future research and development activities. We expect our expenses to increase in connection with our ongoing activities, particularly as we continue research and development activities and initiate and conduct clinical trials of, and seek marketing approval for, our product candidates. In addition, if we obtain marketing approval for any of our product candidates, we expect to incur significant commercialization expenses related to product sales, marketing, manufacturing and distribution. We expect that our existing cash together with the proceeds from this offering, will be sufficient to meet our anticipated cash requirements for the next twelve months. We will, however, require additional financing in order to complete our planned Phase 3 clinical trial for SYN-004 and/or our planned Phase 2b/3 clinical trial for SYN-010. Accordingly, we will need to obtain substantial additional funding in connection with our continuing operations. There are no other commitments by any person for future financing. Our securities may be offered to other investors at a price lower than the price per share offered to current stockholders, or upon terms which may be deemed more favorable than those offered to current stockholders. In addition, the issuance of securities in any future financing may dilute an investor's equity ownership and have the effect of depressing the market price for our securities. Moreover, we may issue derivative securities, including options and/or warrants, from time to time, to procure qualified personnel or for other business reasons. The issuance of any such derivative securities, which is at the discretion of our board of directors, may further dilute the equity ownership of our stockholders. No assurance can be given as to our ability to procure additional financing, if required, and on terms deemed favorable to us. To the extent additional capital is required and cannot be raised successfully, we may then have to limit our then current operations and/or may have to curtail certain, if not all, of our business objectives and plans.

| 15 |

There is no established market for the Series B Preferred or warrants being offered in this offering.

There is no established trading market for the Series B Preferred or warrants and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Series B Preferred or warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Series B Preferred or warrants will be limited.

Holders of Series B Preferred will have limited voting rights.

Except with respect to certain material changes in the terms of the Series B Preferred and certain other matters and except as may be required by Nevada law, holders of Series B Preferred will have no voting rights. Holders of Series B Preferred will have no right to vote for any members of our board of directors.

The warrants are speculative and holders of the warrants will not have rights of common stockholders until such warrants are exercised.

The warrants being offered do not confer any rights of common stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of common stock at a fixed price for a limited period of time. Specifically, commencing on the date of issuance, holders of the warrants may exercise their right to acquire the common stock and pay an exercise price per share equal to 120% of the public offering price, or $2.52 per share (assuming a public offering price of $2.10 per Class A Unit, which was the last reported sale price of our common stock on the NYSE American on October 8, 2018) prior to three years from the date of issuance, after which date any unexercised warrants will expire and have no further value. Moreover, there can also be no assurance that the market price of the common stock will ever equal or exceed the exercise price of the warrants, and consequently, whether it will ever be profitable for holders of the warrants to exercise the warrants.

The proceeds received from the exercise of the warrants issued in this offering on a cash basis could be decreased upon the occurrence of certain events, which could result in a decrease in our stock price and have a dilutive effect on our existing stockholders.

The warrants being offered do not confer any rights of common stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of common stock at a fixed price for a limited period of time. Specifically, commencing on the date of issuance, holders of the warrants may exercise their right to acquire the common stock and pay an exercise price per share equal to 120% of the public offering price, or $2.52 per share (assuming a public offering price of $2.10 per Class A Unit, which was the last reported sale price of our common stock on the NYSE American on October 8, 2018) prior to five years from the date of issuance, after which date any unexercised warrants will expire and have no further value. Moreover, there can also be no assurance that the market price of the common stock will ever equal or exceed the exercise price of the warrants, and consequently, whether it will ever be profitable for holders of the warrants to exercise the warrants.

RISKS RELATING TO OUR BUSINESS

We will need to raise additional capital to operate our business and our failure to obtain funding when needed may force us to delay, reduce or eliminate our development programs or commercialization efforts.

During the six months ended June 30, 2018, our operating activities used net cash of approximately $10.4 million and as of June 30, 2018 our cash and cash equivalents were $7.1 million. With the exception of the three months ended June 30, 2010, we have experienced significant losses since inception and have a significant accumulated deficit. As of June 30, 2018, our accumulated deficit totaled approximately $200.8 million on a consolidated basis. We expect to incur additional operating losses in the future and therefore expect our cumulative losses to increase. With the exception of the quarter ended June 30, 2010, and limited laboratory revenues from Adeona Clinical Laboratory, which we sold in March 2012, we have generated very minimal revenues. We do not expect to derive revenue from any source in the near future until we or our potential partners successfully commercialize our products. We expect our expenses to increase in connection with our anticipated activities, particularly as we continue research and development, initiate and conduct clinical trials, and seek marketing approval for our product candidates. Until such time as we receive approval from the FDA and other regulatory authorities for our product candidates, we will not be permitted to sell our products and therefore will not have product revenues from the sale of products. For the foreseeable future we will have to fund all of our operations and capital expenditures from equity and debt offerings, cash on hand, licensing and collaboration fees and grants, if any.