As filed with the Securities and Exchange Commission on August 1, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

SYNTHETIC BIOLOGICS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada (State or Other Jurisdiction of Incorporation or Organization) |

13-3808303 (I.R.S. Employer Identification Number) |

9605 Medical Center Drive, Suite

270

Rockville, Maryland 20850

(734) 332-7800

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Steven A. Shallcross

Interim Chief Executive Officer and Chief Financial Officer

Synthetic Biologics, Inc.

9605 Medical Center Drive, Suite

270

Rockville, Maryland 20850

(734) 332-7800

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code of Agent for Service)

With copies to:

Leslie Marlow, Esq.

Hank Gracin, Esq.

Patrick J. Egan, Esq.

Gracin & Marlow, LLP

The Chrysler Building

405 Lexington Avenue, 26th Floor

New York, New York 10174

(212) 907-6457

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. þ

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ | |

| Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be registered(1)(2) | Proposed maximum offering price per share(4) | Proposed maximum aggregate offering price(5) | Amount of registration fee | ||||||||||||

| Warrants(3) | — | — | — | — | ||||||||||||

| Common Stock, par value $0.001 per share, issuable upon exercise of Warrants | 25,000,000 | $ | 1.43 | $ | 35,750,000 | $ | 4,450.88 | |||||||||

| Total | 25,000,000 | $ | 1.43 | $ | 35,750,000 | $ | 4,450.88 | |||||||||

| (1) | Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers such additional shares as may hereafter be offered or issued to prevent dilution resulting from stock splits, stock dividends, recapitalizations or certain other capital adjustments. |

| (2) | Represents shares of common stock underlying warrants issued to investors in our previous follow-on underwritten public offering. |

| (3) | No fee pursuant to Rule 457(g) under the Securities Act. |

| (4) | Represents the per share exercise price of the warrants. |

| (5) | Calculated pursuant to Rule 457(g) under the Securities Act. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated August 1, 2018

PROSPECTUS

25,000,000 Shares of Common Stock Issuable Upon

Exercise of Outstanding Warrants

This prospectus relates to the offer and sale by us of an aggregate of 25,000,000 shares of our common stock, par value $0.001 per share, that are issuable at an exercise price of $1.43 per share from time to time upon the exercise of currently outstanding warrants that we issued in November 2016 as part of an underwritten public offering (the “Warrants”).

We will receive the proceeds from any cash exercises of the outstanding Warrants. Additionally, the Warrants may be exercised on a cashless basis. If the Warrants are exercised on a cashless basis, we would not receive any cash payment upon any exercise of the Warrants. Each Warrant is exercisable at any time until its expiration date, which is November 15, 2020. Upon exercise of all of these outstanding Warrants for cash, we will receive aggregate proceeds of $35,750,000 for the Warrants. No securities are being offered pursuant to this prospectus other than the shares of our common stock that will be issued upon exercise of the outstanding Warrants.

Our common stock is listed on the NYSE American LLC under the symbol “SYN.” The last reported sale price of our common stock on the NYSE American LLC on July 31, 2018 was $0.18 per share. We urge prospective purchasers of our common stock to obtain current information about the market prices of our common stock.

INVESTING IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 6 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE DOCUMENTS INCORPORATED BY REFERENCE INTO THIS PROSPECTUS CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2018

TABLE OF CONTENTS

You should rely only on the information we have provided or incorporated by reference in this prospectus or in any prospectus supplement. We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus or in any prospectus supplement. This prospectus and any prospectus supplement is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information contained in this prospectus and in any prospectus supplement is accurate only as of their respective dates and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any prospective supplement or any sale of securities. The registration statement, including the exhibits and the documents incorporated herein by reference, can be read on the Securities and Exchange Commission website or at the Securities and Exchange Commission offices mentioned under the heading “Where You Can Find More Information.”

i

This prospectus is not an offer or solicitation in respect to these securities in any jurisdiction in which such offer or solicitation would be unlawful. This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”). The registration statement that contains this prospectus (including the exhibits to the registration statement) contains additional information about our company and the securities offered under this prospectus. That registration statement can be read at the SEC website or at the SEC’s offices listed under the heading “Where You Can Find More Information.” We have not authorized anyone else to provide you with different information or additional information. You should not assume that the information in this prospectus, or any supplement or amendment to this prospectus, is accurate at any date other than the date indicated on the cover page of such documents.

Unless otherwise stated or the context otherwise requires, references in this prospectus to “Synthetic,” the “Company,” “we,” “our” and “us” refer to Synthetic Biologics, Inc., a Delaware corporation and its consolidated subsidiaries, unless otherwise specified. When we refer to “you,” we mean the holders of the applicable series of securities.

ii

The items in the following summary are described in more detail elsewhere in this prospectus and in the documents incorporated by reference herein. This summary provides an overview of selected information and does not contain all the information you should consider before investing in our securities. Therefore, you should read the entire prospectus and any free writing prospectus that we have authorized for use in connection with this offering carefully, including the “Risk Factors” section and other documents or information included or incorporated by reference in this prospectus before making any investment decision.

Our Business

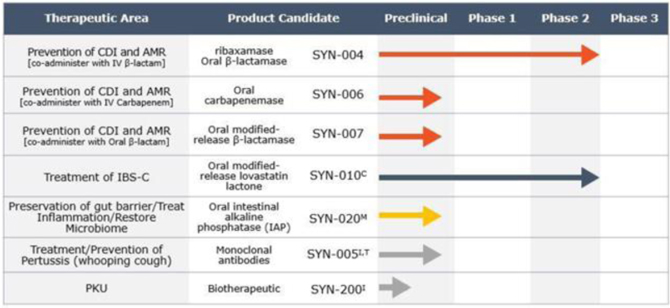

We are a late-stage clinical company focused on developing therapeutics designed to preserve the microbiome to protect and restore the health of patients. Our lead candidates poised for Phase 3 development are: (1) SYN-004 (ribaxamase) which is designed to protect the gut microbiome from the effects of certain commonly used intravenous (IV) beta-lactam antibiotics for the prevention of C. difficile infection (CDI), overgrowth of pathogenic organisms and the emergence of antimicrobial resistance (AMR), and (2) SYN-010 which is intended to reduce the impact of methane-producing organisms in the gut microbiome to treat an underlying cause of irritable bowel syndrome with constipation (IBS-C). Our preclinical pursuits include an oral formulation of the enzyme intestinal alkaline phosphatase (IAP) to treat both local GI and systemic diseases as well as monoclonal antibody therapies for the prevention and treatment of pertussis, and novel discovery stage biotherapeutics for the treatment of phenylketonuria (PKU).

Product Pipeline:

C- Cedars-Sinai Medical Center Collaboration

I- Intrexon Collaboration

T- The University of Texas at Austin Collaboration

M- Scientific collaboration with Massachusetts General Hospital

| 1 |

Summary of Clinical and Preclinical Programs

| Therapeutic Area | Product Candidate |

Status | ||

| Prevention of CDI, overgrowth of pathogenic organisms and AMR (Degrade IV beta-lactam antibiotics) | SYN-004 (ribaxamase) (oral enzyme) |

· Reported supportive Phase 1a/1b data (1Q 2015)

· Reported supportive topline data from two Phase 2a clinical trials (4Q 2015 & 2Q 2016)

· Initiated Phase 2b proof-of-concept clinical trial (3Q 2015)

· Received USAN approval of the generic name “ribaxamase” for SYN-004 (July 2016)

· Completed Enrollment of Phase 2b proof-of-concept clinical trial (3Q 2016)

· Awarded contract by the CDC (4Q 2016)

· Announced positive topline data from Phase 2b proof-of-concept clinical trial, including achievement of primary endpoint of significantly reducing CDI (1Q 2017)

· Announced additional results from Phase 2b proof-of-concept clinical trial demonstrating SYN-004 (ribaxamase) protected and maintained the naturally occurring composition of gut microbes from antibiotic-mediated dysbiosis in treated patients (2Q 2017)

· Announced additional results from Phase 2b proof-of-concept clinical trial funded by a contract awarded by the CDC, demonstrating that SYN-004 (ribaxamase) prevented significant change to the presence of certain AMR genes in the gut resistome of patients receiving SYN-004 compared to placebo (3Q 2017)

· Presented additional supportive results regarding several exploratory endpoints from Phase 2b proof-of-concept clinical trial designed to evaluate SYN-004’s (ribaxamase) ability to protect the gut microbiome from opportunistic bacterial infections and prevent the emergence of antimicrobial resistance (AMR) in the gut microbiome (4Q 2017)

· Reached preliminary agreement with the FDA on key elements of a proposed Phase 3 clinical trial program, including de-coupled co-primary endpoints designed to evaluate efficacy separate from safety in a patient population being treated with a representative selection of IV-beta-lactam antibiotics (1H 2018)

· Anticipated End of Phase 2 meeting with FDA to solidify remaining elements of planned Phase 3 clinical trial (2H 2018)

· Plan to initiate Phase 3 clinical trial(s) (2H 2019) |

| 2 |

| Treatment of IBS-C | SYN-010 (oral modified-release lovastatin lactone) |

· Collaboration with Cedars-Sinai Medical Center

· Reported supportive topline data from two Phase 2 clinical trials (4Q 2015 & 1Q 2016)

· Received Type C meeting responses from FDA regarding late-stage aspects of clinical pathway (2Q 2016)

· Presented detailed data supporting previously reported positive topline data from two Phase 2 clinical trials at DDW (May 2016)

· Held End of Phase 2 meeting with FDA (July 2016)

· Confirmed key elements of Pivotal Phase 2b/3 clinical trial design pursuant to consultations with FDA (1Q 2017) | ||

| · Announced issuance of key U.S. composition of matter patent providing important intellectual property protection in the U.S until at least 2035 (Q2 2018) | ||||

| Prevention of CDI, overgrowth of pathogenic organisms and AMR (Degrade IV carbapenem antibiotics) |

SYN-006 (oral enzyme) |

· Identified P2A as a potent carbapenemase that is stable in the GI tract

· Manufactured and formulated research lot for oral delivery (2017)

· Demonstrated microbiome protection in a pig model if ertapenem administration (Q1 2018) | ||

| Prevention of CDI, overgrowth of pathogenic organisms and AMR (Degrade oral beta-lactam antibiotics) | SYN-007 (oral enzyme) |

· Preclinical work ongoing to expand the utility of SYN-004 (ribaxamase) for use with oral beta-lactam antibiotics | ||

| Preserve gut barrier, treat local GI inflammation, restore gut microbiome | SYN-020 (oral IAP enzyme) |

· Generated high expressing manufacturing cell lines for intestinal alkaline phosphatase (IAP) (1H 2017)

· Identified downstream process and potential tablet formulations (2H 2017)

· Ongoing preclinical efficacy studies | ||

| Prevention and treatment of pertussis | SYN-005 (monoclonal antibody therapies) |

· Reported supportive preclinical research findings (2014)

· The University of Texas at Austin (“UT Austin”) received a grant from the Bill and Melinda Gates Foundation to support a preclinical study to evaluate the prophylactic capability of SYN-005 (4Q 2015)

· Reported supportive preclinical data demonstrating hu1B7, a component of SYN-005, provided protection from pertussis for five weeks in neonatal non-human primate study (Q2 2017)

· Reported supportive preclinical data demonstrating that an extended half-life version of hu1B7, a component of SYN-005, provided protection from pertussis for five weeks in a non-human neonatal primate study (Q4 2017)

· Collaborations with Intrexon and UT Austin |

| 3 |

Our Microbiome-Focused Pipeline

Our CDI and IBS-C programs are focused on protecting the healthy function of the gut microbiome, or gut flora, which is composed of billions of microbial organisms including a natural balance of both “good” beneficial species and potentially “bad” pathogenic species. When the natural balance or normal function of these microbial species is disrupted, a person’s health can be compromised. All of our programs are supported by our growing intellectual property portfolio. We are maintaining and building our patent portfolio through: filing new patent applications; prosecuting existing applications; and licensing and acquiring new patents and patent applications. Our plan remains focused on the advancement of our two late-stage clinical programs. We continue to actively manage resources in preparation for the late-stage clinical advancement of our two lead microbiome-focused clinical programs, including our pursuit of successful and viable opportunities that will allow us to establish the clinical infrastructure and financial resources necessary to successfully initiate and complete this plan.

Company History

Our predecessor, Sheffield Pharmaceuticals, Inc., was incorporated in 1986, and in 2006 engaged in a reverse merger with Pipex Therapeutics, Inc., a Delaware corporation formed in 2001. After the merger, we changed our name to Pipex Pharmaceuticals, Inc., and in October 2008 we changed our name to Adeona Pharmaceuticals, Inc. On October 15, 2009, we engaged in a merger with a wholly owned subsidiary for the purpose of reincorporating in the State of Nevada. After reprioritizing our focus on the emerging area of synthetic biologics and entering into our first collaboration with Intrexon, we amended our Articles of Incorporation to change our name to Synthetic Biologics, Inc. on February 15, 2012.

Corporate Information

Our executive offices are located at 9605 Medical Center Drive, Suite 270, Rockville, Maryland 20850. Our telephone number is (732) 332-7800, and our website address is www.syntheticbiologics.com. The information contained on our website is not part of, and should not be construed as being incorporated by reference into this prospectus supplement.

| 4 |

|

Common stock offered by us pursuant to this prospectus |

25,000,000 shares of common stock that are issuable at an exercise price of $1.43 per share from time to time until November 15, 2020 upon the exercise of currently outstanding warrants that we issued in November 2016 as part of an underwritten public offering. |

|

Common stock to be outstanding after this offering if all of the Warrants are exercised |

157,969,743 shares(1) |

| Use of Proceeds | We intend to use the net proceeds, if any, from this offering for general corporate purposes, which may include, among other things, for clinical trials for our product candidates, paying general and administrative expenses and accounts payable, increasing our working capital, funding research and development and funding capital expenditures. We may also use a portion of the net proceeds for licensing or acquiring intellectual property to incorporate into our products and product candidates or our research and development programs and to in-license, acquire or invest in complementary businesses or products, although we have no commitments or agreements with respect to any such licenses, acquisitions or investments as of the date of this prospectus. See “Use of Proceeds.” |

| Risk Factors | See “Risk Factors” beginning on page 6 of this prospectus and the other information included in, or incorporated by reference into, this prospectus for a discussion of certain factors you should carefully consider before deciding to invest in shares of our common stock. |

| NYSE American, LLC Symbol | “SYN” |

(1) The number of shares of common stock shown above to be outstanding after this offering is based on 132,969,743 shares of our common stock outstanding as of July 31, 2018, which does not include the following, all as of July 31, 2018:

| · | 12,168,515 shares issuable upon the exercise of outstanding stock options with a weighted-average exercise price of $1.55 per share; |

| · | 5,973,607 shares of common stock which were reserved for future equity awards that may be granted in the future under our equity incentive plans; |

| · | 22,579,789 shares of our common stock issuable upon conversion of outstanding shares of preferred stock (the “Preferred Stock Shares”); and |

| · | 7,054,808 shares of our common stock reserved for issuance upon the exercise of outstanding warrants, of which 7,029,809 have an exercise price of $1.75 per share (the “2014 Warrant Shares”) and 25,000 have an exercise price of $0.52 per share (the “2017 Warrant Shares”). |

| 5 |

You should consider carefully the risks discussed under the section captioned “Risk Factors” contained in our most recent annual report on Form 10-K and in our subsequent quarterly reports on Form 10-Q, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), all of which we incorporate by reference herein, together with other information in this prospectus, and the information and documents incorporated by reference herein before you make a decision to invest in our common stock. If any of these events actually occur, our business, operating results, prospects or financial condition could be materially and adversely affected. This could cause the trading price of our common stock to decline and you may lose all or part of your investment.

| 6 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained or incorporated by reference in this prospectus may include forward-looking statements that reflect our current views with respect to our ongoing and planned clinical trials, business strategy, business plan, financial performance and other future events. These statements include forward-looking statements both with respect to us, specifically, and the biotechnology sector, in general. We make these statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “estimate,” “may,” “should,” “anticipate,” “will” and similar statements of a future or forward-looking nature identify forward-looking statements for purposes of the federal securities laws or otherwise.

All forward-looking statements involve inherent risks and uncertainties, and there are or will be important factors that could cause actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to, those factors set forth under the caption “Risk Factors” in this prospectus and under the captions “Risk Factors,” “Business,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in our most recent Annual Report on Form 10-K and our subsequent Quarterly Reports on Form 10-Q, all of which you should review carefully. Please consider our forward-looking statements in light of those risks as you read this prospectus supplement and the accompanying prospectus. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

If one or more of these or other risks or uncertainties materializes, or if our underlying assumptions prove to be incorrect, actual results may vary materially from what we anticipate. All subsequent written and oral forward-looking statements attributable to us or individuals acting on our behalf are expressly qualified in their entirety by this Note. Before purchasing any of our securities, you should consider carefully all of the factors set forth or referred to in this prospectus that could cause actual results to differ.

| 7 |

If all of the outstanding Warrants are exercised, we estimate that the proceeds of this offering will be approximately $35,750,000 for the exercise of the Warrants.

The net proceeds from any disposition of the shares of common stock covered hereby would be received by the investors selling such shares. We will not receive any of the proceeds from any such sale of the common stock offered by this prospectus other than the net proceeds of any Warrants exercised for cash. Additionally, the Warrants may be exercised on a cashless basis. If the Warrants are exercised on a cashless basis, we would not receive any cash payment upon any exercise of the Warrants.

We intend to use any proceeds that we do receive from the exercise of Warrants for general corporate purposes, which may include, among other things, for clinical trials for our product candidates, paying general and administrative expenses and accounts payable, increasing our working capital, funding research and development and funding capital expenditures. We may also use a portion of the net proceeds for licensing or acquiring intellectual property to incorporate into our products and product candidates or our research and development programs and to in-license, acquire or invest in complementary businesses or products, although we have no commitments or agreements with respect to any such licenses, acquisitions or investments as of the date of this prospectus.

The amounts and timing of our actual expenditures will depend on numerous factors, including our development and commercialization efforts, as well as the amount of cash used in our operations. We therefore cannot estimate with certainty the amount of net proceeds to be used for the purposes described above. We may find it necessary or advisable to use the net proceeds for other purposes, and we will have broad discretion in the application of the net proceeds. Pending the uses described above, we plan to invest the net proceeds from this offering in short-term, investment-grade, interest-bearing securities.

| 8 |

If you invest in our common stock, your interest will be diluted immediately to the extent of the difference between the offering price and the adjusted net tangible book value per share of our common stock after this offering.

Our net tangible book value on March 31, 2018 was approximately $7.0 million, or $0.054 per share. “Net tangible book value” is total assets minus the sum of liabilities and intangible assets. “Net tangible book value per share” is net tangible book value divided by the total number of shares outstanding.

After giving effect to the sale of an aggregate of 25,000,000 shares of common stock to investors exercising Warrants for aggregate cash net proceeds of $35,715,000 and after taking into account expenses of this offering and the sale of 4,402,857 shares subsequent to March 31, 2018 through July 31, 2018 for proceeds of $1,000,103, our pro forma as adjusted net tangible book value as of March 31, 2018 would have been approximately $43,718,103 million, or $0.28 per share of common stock. This represents an immediate increase in the pro forma net tangible book value of $0.22 per share to our existing stockholders and an immediate dilution in net tangible book value of $1.15 per share to investors participating in this offering. The following table illustrates this dilution per share to investors participating in this offering:

| Exercise price per share | $ | 1.43 | ||||||

| Pro forma net tangible book value per share as of March 31, 2018 | $ | 0.06 | ||||||

| Increase in pro forma net tangible book value per share attributable to this offering | $ | 0.22 | ||||||

| Pro forma as adjusted net tangible book value per share after giving effect to this offering | $ | 0.28 | ||||||

| Dilution per share to investors purchasing our common stock in this offering | $ | 1.15 |

The above discussion and table are based on 128,648,366 shares of our common stock outstanding as of March 31, 2018 (as adjusted to take into account 4,402,857 shares of common stock issued subsequent to March 31, 2018 through July 31, 2018 and the issuance of the 25,000,000 shares of common stock upon exercise of the Warrants), which does not include the following, all as of March 31, 2018:

| · | 12,564,098 shares issuable upon the exercise of outstanding stock options with a weighted-average exercise price of $1.55 per share; |

| · | 7,054,808 shares of our common stock reserved for issuance upon the exercise of outstanding warrants, of which 7,029,809 have an exercise price of $1.75 per share and 25,000 have an exercise price of $0.52 per share; |

| · | 5,973,607 shares of common stock which were reserved for future equity awards that may be granted in the future under our equity incentive plans; and |

| · | shares of our common stock issuable upon conversion of outstanding shares of preferred stock. |

To the extent that any outstanding options are exercised, the 2014 Warrant Shares or the 2017 Warrant Shares are issued, the preferred stock shares are issued or we issue additional shares under our equity incentive plans, there will be further dilution to new investors. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

| 9 |

We have never paid cash dividends on our common stock. Moreover, we do not anticipate paying periodic cash dividends on our common stock for the foreseeable future. We intend to use all available cash and liquid assets in the operation and growth of our business. Any future determination about the payment of dividends will be made at the discretion of our board of directors and will be subject to the rights of any outstanding preferred stock and will depend upon our earnings, if any, capital requirements, operating and financial conditions and on such other factors as our board of directors deems relevant. The Series A Preferred Stock ranks senior to the shares of our common stock with respect to dividend rights and holders of Series A Preferred Stock are entitled to a cumulative dividend at the rate of 2.0% per annum, payable quarterly in arrears, as set forth in the Certificate of Designation of Series A Convertible Preferred Stock.

| 10 |

General

The following is a summary of the rights of our common stock and preferred stock and related provisions of our articles of incorporation and bylaws. For more detailed information, please see our articles of incorporation and bylaws.

Authorized Capital

Our authorized capital consists of 350 million shares of common stock, par value $0.001 per share, and 10 million shares of preferred stock, par value $0.001 per share. As of July 31, 2018, 132,969,743 shares of common stock were issued and outstanding, and 120,000 shares of preferred stock were issued and outstanding.

Common Stock

We may issue shares of our common stock from time to time. We currently have authorized 350,000,000 shares of common stock, par value $.001 per share. We may offer shares of common stock alone or underlying the registered securities convertible into or exercisable for our common stock.

Voting. The holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders, including the election of directors, and do not have cumulative voting rights. Accordingly, the holders of a majority of the shares of our common stock entitled to vote in any election of directors can elect all of the directors standing for election.

Dividends. Subject to preferences that may be applicable to any then outstanding preferred stock, the holders of common stock are entitled to receive dividends, if any, as may be declared from time to time by our board of directors out of legally available funds.

Liquidation. In the event of our liquidation, dissolution or winding up, holders of our common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities, subject to the satisfaction of any liquidation preference granted to the holders of any then outstanding shares of preferred stock.

Rights and Preferences. The holders of our common stock have no preemptive, conversion or subscription rights, and there are no redemption or sinking fund provisions applicable to our common stock. The rights, preferences and privileges of the holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of our preferred stock that we may designate and issue in the future.

Fully Paid and Nonassessable. All of our outstanding shares of common stock are, and the shares of common stock to be issued under this prospectus will be, fully paid and nonassessable.

In this prospectus, we have summarized certain general features of our common stock under “Description of Our Securities—Common Stock.” We urge you, however, to read the applicable prospectus supplement (and any related free writing prospectus that we may authorize to be provided to you) related to any common stock being offered.

| 11 |

Preferred Stock

Our Board of Directors has the authority, without action by our stockholders, to designate and issue up to 10 million shares of preferred stock in one or more series or classes and to designate the rights, preferences and privileges of each series or class, which may be greater than the rights of our common stock. It is not possible to state the actual effect of the issuance of any shares of preferred stock upon the rights of holders of our common stock until our Board of Directors determines the specific rights of the holders of the preferred stock. However, the effects might include:

| ● | restricting dividends on our common stock; | |

| ● | diluting the voting power of our common stock; | |

| ● | impairing liquidation rights of our common stock; or | |

| ● | delaying or preventing a change in control of us without further action by our stockholders. |

The Board of Directors’ authority to issue preferred stock without stockholder approval could make it more difficult for a third-party to acquire control of our company, and could discourage such attempt. We have no present plans to issue any shares of preferred stock.

Series A Preferred

We had 120,000 shares of Series A Preferred Stock outstanding as of the date of this prospectus.

The Series A Preferred Stock ranks senior to the shares of our common stock, and any other class or series of stock issued by us with respect to dividend rights, redemption rights and rights on the distribution of assets on our voluntary or involuntary liquidation, dissolution or winding up. Holders of Series A Preferred Stock are entitled to a cumulative dividend at the rate of 2.0% per annum, payable quarterly in arrears, as set forth in the Certificate of Designation of Series A Preferred Stock classifying the Series A Preferred Stock. The Series A Preferred Stock is convertible at the option of the holders at any time into shares of common stock based upon its Accreted Value (as defined below) at an initial conversion price of $0.54 per share, subject to certain customary anti-dilution adjustments.

Any conversion of Series A Preferred Stock may be settled by us in shares of common stock only.

The holder’s ability to convert the Series A Preferred Stock into common stock is subject to (i) a 19.99% blocker provision to comply with NYSE American Listing Rules, (ii) if so elected by the holder, a 4.99% blocker provision that will prohibit beneficial ownership of more than 4.99% of our outstanding shares common stock or voting power at any time, and (iii) applicable regulatory restrictions.

In the event of our liquidation, dissolution or winding-up, holders of the Series A Preferred Stock are entitled to a preference on liquidation equal to the greater of (i) an amount per share equal to the original issue price plus any accrued and unpaid dividends on such share of Series A Preferred Stock (the “Accreted Value”), and (ii) the amount such holders would receive in such liquidation if they converted their shares of Series A Preferred Stock (based on the Accreted Value and without regard to any conversion limitation) into shares of the common stock immediately prior to any such liquidation, dissolution or winding-up (the greater of (i) and (ii), is referred to as the “Liquidation Value”).

Except as otherwise required by law, the holders of Series A Preferred Stock have no voting rights, other than customary protections against adverse amendments and issuance of pari passu or senior preferred stock. Upon certain change of control events involving our company, we will be required to repurchase all of the Series A Preferred Stock at a redemption price equal to the greater of (i) the Accreted Value, and (ii) the amount that would be payable upon a change of control (as defined in the Certificate of Designation) in respect of common stock issuable upon conversion of such share of Series A Preferred Stock if all outstanding shares of Series A Preferred Stock were converted into common stock immediately prior to the change of control.

On or at any time after (i) the VWAP (as defined in the Certificate of Designation) for at least 20 trading days in any 30 trading day period is greater than $2.00, subject to adjustment in the case of stock split, stock dividends or the like we have the right, after providing notice not less than 6 months prior to the redemption date, to redeem, in whole or in part, on a pro rata basis from all holders thereof based on the number of shares of Series A Preferred Stock then held, the outstanding Series A Preferred Stock, for cash, at a redemption price per share of Series A Preferred Stock of $225.00, subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Series A Convertible Preferred Stock, or (ii) the five year anniversary of the issue date, we have the right to redeem, in whole or in part, on a pro rata basis from all holders thereof based on the number of shares of Series A Convertible Preferred Stock then held, the outstanding Series A Preferred Stock, for cash, at a redemption price per share equal to the Liquidation Value.

| 12 |

Warrants

As of July 31, 2018, we had issued and outstanding a total of 32,054,809 warrants to purchase our common stock outstanding at a weighted-average price of $1.50.

The Warrants

On November 18, 2016, we completed a public offering of 25,000,000 shares of common stock in combination with accompanying warrants to purchase an aggregate of 50,000,000 shares of the common stock, of which warrants to purchase 25,000,000 shares of common stock are outstanding. The initial per share exercise price of the Warrants is $1.43, subject to adjustment as specified in the warrant agreement. The Warrants may be exercised at any time until the four-year anniversary of the issuance date (November 18, 2020).

Pursuant to the terms of the Warrant, a holder of a Warrant will not have the right to exercise any portion of the Warrant if the holder (together with its affiliates) would beneficially own in excess of 9.99% of the number of shares of Common Stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Warrant provided that at the election of a holder and notice to us such percentage ownership limitation shall be 4.99% of the number of shares of common stock outstanding immediately after giving effect to the exercise. However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99% upon at least 61 days’ prior notice from the holder.

If, at the time a holder exercises its Warrant there is no effective registration statement registering, or the prospectus contained therein is not available for an issuance of the shares underlying the Warrant to the holder, then in lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of our common stock determined according to a formula set forth in the Warrant. In the event of a cashless exercise, if we fail to timely deliver the shares underlying the Warrants, we will be subject to certain buy-in provisions.

In the event of any extraordinary transaction, as described in the Warrants and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our common stock, the holder will have the right to have the Warrants and all obligations and rights thereunder assumed by the successor or acquiring corporation. In the event of an extraordinary transaction, we or any successor entity will pay at the holder’s option, exercisable at any time concurrently with or within 30 days after the consummation of the extraordinary transaction, an amount of cash equal to the value of the Warrant as determined in accordance with the Black Scholes option pricing model and the terms of the Warrants.

Subject to applicable laws and the restriction on transfer set forth in the Warrant, the Warrant may be transferred at the option of the holder upon surrender of the Warrant to us together with the appropriate instruments of transfer.

There is no established public trading market for the Warrants, and we do not expect a market to develop. In addition, we have not applied to list the Warrants on any securities exchange or recognized trading system.

| 13 |

October 2014 Warrants

On October 10, 2014, we issued 14,059,616 units at a price of $1.47 per unit to certain institutional investors in a registered direct offering, each unit consisted of one share of our common stock and a warrant to purchase 0.5 shares of common stock (the “October 2014 warrants”).

As of July 31, 2018, we had issued and outstanding October 2014 Warrants that are exercisable for a total of 7,029,808 shares of common stock. Below is a summary of the October 2014 Warrants.

Each October 2014 warrant is exercisable at any time after the closing date (October 10, 2014) and expires in five years after issuance (October 10, 2019). The October 2014 Warrants are exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and payment in full for the number of shares of our common stock purchased upon such exercise, except in the case of a cashless exercise as discussed below.

The holder may exercise the October 2014 Warrant on a cashless basis. When exercised on a cashless basis, a portion of the October 2014 Warrant is cancelled in payment of the purchase price payable in respect of the number of shares of our common stock purchasable upon such exercise.

Each October 2014 Warrant represents the right to purchase up to one half of a share of common stock at an exercise price of $1.75 per share. The exercise price per share is subject to adjustment for stock dividends, distributions, subdivisions, combinations, or reclassifications. Subject to limited exceptions, a holder of October 2014 Warrants will not have the right to exercise any portion of the October 2014 Warrant to the extent that, after giving effect to the exercise, the holder, together with its affiliates, would beneficially own in excess of 4.99% or 9.99%, depending on the holder’s initial election, of the number of shares of our common stock outstanding immediately after giving effect to its exercise. The holder may elect to increase or decrease this beneficial ownership limitation to any other percentage, but not in excess of 19.9% of the total number of issued and outstanding shares of common stock (including for such purpose the shares of common stock issuable upon such exercise), provided that any such increase or decrease will not be effective until 61 days after such written notice is delivered.

In the event we effect certain mergers, consolidations, sales of substantially all of our assets, tender or exchange offers, reclassification or share exchange in which our common stock is effectively converted into or exchanged for other securities, cash or property, we consummate a business combination in which another person acquires 50% of the outstanding shares of our common stock, or any person or group becomes the beneficial owner of 50% of the aggregate ordinary voting power represented by our issued and outstanding common stock (a “Fundamental Transaction”), then, upon any subsequent exercise of the October 2014 Warrants, the holders of October 2014 Warrants will have the right to receive any shares of the acquiring corporation or other consideration it would have been entitled to receive if it had been a holder of the number of shares of common stock then issuable upon exercise in full of the October 2014 Warrants. Except in connection with a Fundamental Transaction in which the consideration for each share of common stock is at least 300% of the exercise price of the October 2014 Warrant, we or the successor entity will, at the holder’s option, purchase the unexercised portion of the October 2014 Warrant from the holder (i) in the case of an all cash transaction or a transaction in which the consideration consists partially of cash or securities of a successor entity to the extent of the percentage of the cash consideration, for an amount of cash equal to equal to the Black-Scholes value of the remaining unexercised portion of the October 2014 Warrant on the date of the consummation of the transaction and (ii) in the case of any other Fundamental Transaction or in a transaction in which the consideration consists partially of cash or securities of a successor entity to the extent the consideration is represented by securities, for a number of shares of common stock equal to the Black Scholes value of the portion of the warrant subject to redemption divided by 95% of the closing sale price of the common stock on the day preceding the date on which the Fundamental Transaction is consummated.

Subject to applicable laws and restrictions, a holder may transfer an October 2014 Warrant upon surrender of the October 2014 Warrant to us with a completed and signed assignment in the form attached to the October 2014 Warrant. The transferring holder will be responsible for any tax that liability that may arise as a result of the transfer.

There is no established public trading market for the October 2014 Warrants, and we do not expect a market to develop. In addition, we have not applied to list the October 2014 Warrants on any securities exchange or recognized trading system.

December 2017 Warrants

On December 26, 2017, we issued warrants to purchase 25,000 shares of our common stock as consideration for advisory services. The December 2017 Warrants have an exercise price of $0.52 and expire December 26, 2022. The exercise price is subject to stock dividends, distributions, subdivisions, combinations or reclassifications.

There is no established public trading market for the December 2017 Warrants and we do not expect a market to develop. In addition, we have not applied to list the December 2017 Warrants on any securities exchange or recognized trading system.

| 14 |

Options

As of July 31, 2018, options to purchase an aggregate of 12,168,515 shares of common stock were outstanding under our equity incentive plans.

| 15 |

The common stock referenced on the cover page of this prospectus will be offered solely by us and will be issued and sold upon the exercise of the outstanding Warrants described in this prospectus. We will deliver shares of our common stock upon exercise of the warrants, however, no fractional shares will be issued. The Warrants are exercisable for a total of 25,000,000 shares of our common stock (subject to adjustment), and no more of these warrants will be issued by us. Each of the Warrants contains instructions for exercise. In order to exercise any of the Warrants, the holder must deliver to us or our transfer agent the information required in the Warrants, along with payment for the exercise price of the shares of common stock to be purchased.

| 16 |

Gracin & Marlow, LLP, New York, New York will pass upon certain legal matters related to the issuance and sale of the Warrants offered on our behalf and Parsons Behle & Latimer, Reno, Nevada will pass upon certain legal matters relating to the issuance and sale of the common stock offered hereby on our behalf.

The financial statements of Synthetic Biologics, Inc. as of December 31, 2017 and 2016 and for each of the three years in the period ended December 31, 2017 and management’s assessment of the effectiveness of internal control over financial reporting as of December 31, 2017 incorporated by reference in this prospectus have been so incorporated in reliance on the reports of BDO USA, LLP, an independent registered public accounting firm, incorporated herein by reference, given on authority of said firm as experts in auditing and accounting. The report on the financial statements contains an explanatory paragraph regarding our ability to continue as a going concern.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and special reports, proxy statements and other information with the SEC. You may read and copy any document we file at the SEC’s public reference room located at 100 F Street N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room. Our public filings are also available to the public at the SEC’s web site at http://www.sec.gov.

This prospectus is part of a registration statement on Form S-3 that we have filed with the SEC under the Securities Act. This prospectus does not contain all of the information in the registration statement. We have omitted certain parts of the registration statement, as permitted by the rules and regulations of the SEC. You may inspect and copy the registration statement, including exhibits, at the SEC’s public reference room or Internet site.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with it which means that we can disclose important information to you by referring you to those documents instead of having to repeat the information in this prospectus. The information incorporated by reference is considered to be part of this prospectus, and later information that we file with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below and any future filings made with the SEC (other than any portions of any such documents that are not deemed “filed” under the Exchange Act in accordance with the Exchange Act and applicable SEC rules) under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after (i) the date of the initial registration statement and prior to the effectiveness of the registration statement, and (ii) the date of this prospectus and before the completion of the offerings of the securities included in this prospectus.

| · | Our annual report on Form 10-K for the fiscal year ended December 31, 2017 filed with the SEC on February 22, 2018 (File No. 001-12584); |

| · | Our quarterly report on Form 10-Q for the quarter ended March 31, 2018 filed with the SEC on May 8, 2018 (File No. 001-12584); |

| · | Our current reports on Form 8-K (File No. 001-12584) filed with the SEC on January 8, 2018, March 7, 2018; April 23, 2018, May 7, 2018 and May 22, 2018; |

| · | Our definitive proxy statement on Schedule 14A filed with the SEC on July 18, 2017 (File No. 001-12584); and |

| · | The description of our common stock set forth in our registration statement on Form 8-A12B, filed with the SEC on June 20, 2007 (File No. 000-12584). |

| 17 |

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will furnish without charge to you, on written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus but not delivered with the prospectus, including exhibits which are specifically incorporated by reference into such documents. You should direct any requests for documents to Synthetic Biologics, Inc., Attn: Steven A. Shallcross, Interim Chief Executive Officer and Chief Financial Officer, 9605 Medical Center Drive, Suite 270, Rockville, Maryland 20850, or telephoning us at (301) 417-4364.

You should rely only on information contained in, or incorporated by reference into, this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus or incorporated by reference in this prospectus. We are not making offers to sell the securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

DISCLOSURE OF SECURITIES AND EXCHANGE

COMMISSION POSITION ON INDEMNIFICATION

FOR SECURITIES ACT LIABILITIES

Our amended and restated bylaws and Articles of Incorporation contain provisions that permit us to indemnify our directors and officers to the full extent permitted by Nevada law, and our Articles of Incorporation, as amended, contains provisions that eliminate the personal liability of our directors in each case for monetary damages to us or our stockholders for breach of their fiduciary duties, except to the extent that Nevada law prohibits indemnification or elimination of liability. These provisions do not limit or eliminate our rights or the rights of any stockholder to seek an injunction or any other non-monetary relief in the event of a breach of a director’s or officer’s fiduciary duty. In addition, these provisions apply only to claims against a director or officer arising out of his or her role as a director or officer and do not relieve a director or officer from liability if he or she engaged in willful misconduct or a knowing violation of the criminal law or any federal or state securities law.

The rights of indemnification provided in our amended and restated bylaws are not exclusive of any other rights that may be available under any insurance or other agreement, by vote of stockholders or disinterested directors or otherwise.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing provisions, we have been informed that in the opinion of the SEC this type of indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

| 18 |

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 14. | Other Expenses of Issuance and Distribution. |

The following table sets forth the estimated fees and expenses in connection with the shelf registration of the common stock registered under this registration statement. The actual amounts of such fees and expenses will be determined from time to time. All amounts shown are estimates except for the Securities and Exchange Commission (the “SEC”) registration fee.

| SEC registration fee | $ | 4,451 | ||

| Legal fees and expenses | 15,000 | |||

| Accounting fees and expenses | 5,000 | |||

| Miscellaneous expenses | 10,549 | |||

| Total | $ | 35,000 |

| Item 15. | Indemnification of Directors and Officers. |

Section 78.138 of the Nevada Revised Statute provides that a director or officer is not individually liable to the corporation or its stockholders or creditors for any damages as a result of any act or failure to act in his capacity as a director or officer unless it is proven that (1) his act or failure to act constituted a breach of his fiduciary duties as a director or officer and (2) his breach of those duties involved intentional misconduct, fraud or a knowing violation of law.

This provision is intended to afford directors and officers protection against and to limit their potential liability for monetary damages resulting from suits alleging a breach of the duty of care by a director or officer. As a consequence of this provision, stockholders of our company will be unable to recover monetary damages against directors or officers for action taken by them that may constitute negligence or gross negligence in performance of their duties unless such conduct falls within one of the foregoing exceptions. The provision, however, does not alter the applicable standards governing a director’s or officer’s fiduciary duty and does not eliminate or limit the right of our company or any stockholder to obtain an injunction or any other type of non-monetary relief in the event of a breach of fiduciary duty.

The Registrant’s Articles of Incorporation, as amended, and amended and restated bylaws provide for indemnification of directors, officers, employees or agents of the Registrant to the fullest extent permitted by Nevada law (as amended from time to time). Section 78.7502 of the Nevada Revised Statute provides that such indemnification may only be provided if the person acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the best interest of the Registrant and, with respect to any criminal action or proceeding, had no reasonable cause to behave his conduct was unlawful.

| II-1 |

| Item 16. | Exhibits. |

| * | Filed herewith |

| II-2 |

| Item 17. | Undertakings |

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; provided, however , that the undertakings set forth in paragraphs (1)(i), (1)(ii) and (1)(iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement or is contained in a form of prospectus filed pursuant to Rule 424(b) that is a part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; and

| II-3 |

(iii) Each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness; provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

(6) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities:

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) That, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Exchange Act that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(h) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

(5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

| II-4 |

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers, and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer, or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer, or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

| II-5 |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Rockville, State of Maryland, August 1, 2018.

| SYNTHETIC BIOLOGICS, INC. | ||

| By: | /s/ Steven A. Shallcross | |

| Interim Chief Executive Officer and | ||

| Chief Financial Officer | ||

| (Principal Executive Officer, Principal | ||

| Financial Officer and Principal Accounting Officer) | ||

We, the undersigned hereby severally constitute and appoint Steven A. Shallcross our true and lawful attorney and agent, with full power to sign for us, and in our names in the capacities indicated below, any and all amendments to this registration statement, any subsequent registration statements pursuant to Rule 462 of the Securities Act of 1933, as amended, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof. This power of attorney may be executed in counterparts.

Pursuant to the requirements of the Securities Act 1933, this report has been signed by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| /s/ Steven A. Shallcross | Interim Chief Executive Officer and Chief Financial Officer | |||

| Steven A. Shallcross | (Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer) | August 1, 2018 | ||

| /s/ Jeffrey J. Kraws | Chairman | August 1, 2018 | ||

| Jeffrey J. Kraws | ||||

| /s/ Scott L. Tarriff | Director | August 1, 2018 | ||

| Scott L. Tarriff | ||||

| /s/ Jeffrey Wolf | Director | August 1, 2018 | ||

| Jeffrey Wolf |