UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended March 31, 2014 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934 |

| For the transition period from ____________ to ____________ |

Commission File Number: 1-12584

SYNTHETIC BIOLOGICS, INC.

(Name of small business issuer in its charter)

| Nevada | 13-3808303 | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) | |

| 155 Gibbs Street, Suite 412 | ||

| Rockville, MD | 20850 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:

(734) 332-7800

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $0.001 par value per share

Securities registered pursuant to Section 12(g) of the Act:

None.

(Title of Class)

Indicate by check mark whether the issuer: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated file, a non-accelerated file, or a smaller reporting company. See the definitions of “large accelerated filer, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-Accelerated filer ¨ | Smaller reporting company x |

| (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of May 12, 2014 the registrant had 58,453,528 shares of common stock outstanding.

SYNTHETIC BIOLOGICS, INC.

FORM 10-Q

TABLE OF CONTENTS

Synthetic Biologics, Inc. and Subsidiaries

Consolidated Balance Sheets

(In thousands except per share amounts)

| March 31, 2014 | December 31, 2013 | |||||||

| (Unaudited) | (Audited) | |||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 11,155 | $ | 14,625 | ||||

| Prepaid expenses and other current assets | 1,332 | 1,591 | ||||||

| Total Current Assets | 12,487 | 16,216 | ||||||

| Property and equipment, net | 38 | 37 | ||||||

| Deposits and other assets | 6 | 4 | ||||||

| Total Assets | $ | 12,531 | $ | 16,257 | ||||

| Liabilities and Stockholders' Equity | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | 773 | $ | 142 | ||||

| Accrued liabilities | - | 885 | ||||||

| Total Current Liabilities | 773 | 1,027 | ||||||

| Total Liabilities | 773 | 1,027 | ||||||

| Stockholders' Equity | ||||||||

| Preferred stock, $0.001 par value; 10,000,000 shares authorized, none issued and outstanding | - | - | ||||||

| Common stock, $0.001 par value; 100,000,000 shares authorized, 58,524,052 issued and 58,442,570 outstanding and 58,295,808 issued and 58,214,326 outstanding | 58 | 58 | ||||||

| Additional paid-in capital | 96,796 | 96,430 | ||||||

| Accumulated deficit | (85,096 | ) | (81,258 | ) | ||||

| Total Synthetic Biologics, Inc. and Subsidiaries Equity | 11,758 | 15,230 | ||||||

| Non-controlling interest | - | - | ||||||

| Total Equity | 11,758 | 15,230 | ||||||

| Total Liabilities and Equity | $ | 12,531 | $ | 16,257 | ||||

See accompanying notes to unaudited consolidated financial statements.

| 3 |

Synthetic Biologics, Inc. and Subsidiaries

Consolidated Statements of Operations

(In thousands except share and per share amounts)

(Unaudited)

| For the three months ended March 31, | ||||||||

| 2014 | 2013 | |||||||

| Operating Costs and Expenses: | ||||||||

| General and administrative | $ | 1,122 | $ | 1,122 | ||||

| Research and development | 2,717 | 1,118 | ||||||

| Total Operating Costs and Expenses | 3,839 | 2,240 | ||||||

| Loss from Operations | (3,839 | ) | (2,240 | ) | ||||

| Other Income: | ||||||||

| Interest income | 1 | 11 | ||||||

| Other income | - | 1 | ||||||

| Total Other Income | 1 | 12 | ||||||

| Net Loss | (3,838 | ) | (2,228 | ) | ||||

| Net Loss Attributable to Non-controlling Interest | - | - | ||||||

| Net Loss Attributable to Synthetic Biologics, Inc. and Subsidiaries | $ | (3,838 | ) | $ | (2,228 | ) | ||

| Net Loss Per Share - Basic and Dilutive | $ | (0.07 | ) | $ | (0.05 | ) | ||

| Net Loss Per Share Attributable to Synthetic Biologics, Inc. and Subsidiaries | $ | (0.07 | ) | $ | (0.05 | ) | ||

| Weighted average number of shares outstanding during the period - Basic and Dilutive | 58,324,260 | 44,601,396 | ||||||

See accompanying notes to unaudited consolidated financial statements.

| 4 |

Synthetic Biologics, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| For the three months ended March 31, | ||||||||

| 2014 | 2013 | |||||||

| Cash Flows From Operating Activities: | ||||||||

| Net Loss | $ | (3,838 | ) | $ | (2,228 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Stock-based compensation | 362 | 457 | ||||||

| Depreciation | 3 | 11 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses and other current assets | 259 | 275 | ||||||

| Deposits and other assets | (2 | ) | 22 | |||||

| Accounts payable | 631 | (199 | ) | |||||

| Accrued liabilities | (885 | ) | - | |||||

| Net Cash Used In Operating Activities | (3,470 | ) | (1,662 | ) | ||||

| Cash Flows From Investing Activities: | ||||||||

| Purchases of property and equipment | (4 | ) | (3 | ) | ||||

| Net Cash Used In Investing Activities | (4 | ) | (3 | ) | ||||

| Cash Flows From Financing Activities: | ||||||||

| Proceeds from issuance of common stock for stock option exercises | 4 | 231 | ||||||

| Net Cash Provided By Financing Activities | 4 | 231 | ||||||

| Net decrease in cash and cash equivalents | (3,470 | ) | (1,434 | ) | ||||

| Cash and cash equivalents at beginning of period | 14,625 | 9,954 | ||||||

| Cash and cash equivalents at end of period | $ | 11,155 | $ | 8,520 | ||||

| Supplemental disclosures of cash flow information: | ||||||||

| Cash paid for interest | $ | - | $ | - | ||||

| Cash paid for taxes | $ | - | $ | - | ||||

See accompanying notes to unaudited consolidated financial statements.

| 5 |

Synthetic Biologics, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(Unaudited)

| 1. | Organization and Nature of Operations and Basis of Presentation |

Description of Business

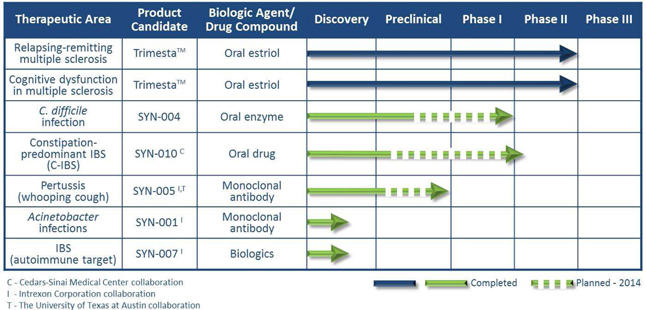

Synthetic Biologics, Inc. (the “Company” or “Synthetic Biologics”) is a biotechnology company focused on the development of novel anti-infective biologic and drug candidates targeting specific pathogens that cause serious infections and diseases. The Company is developing an oral biologic to protect the gastrointestinal (GI) microflora from the effects of intravenous (IV) antibiotics for the prevention of C. diff infection, an oral treatment to reduce the impact of methane producing organisms on constipation-predominant irritable bowel syndrome (C-IBS), a series of monoclonal antibodies for the treatment of Pertussis and Acinetobacter infections, and a biologic targeted at the prevention and treatment of a root cause of a subset of IBS. In addition, the Company has two legacy programs. The Company is developing an oral estriol drug for the treatment of relapsing-remitting multiple sclerosis (MS) and cognitive dysfunction in MS. The Company has also partnered the development of a treatment for fibromyalgia.

| Therapeutic Area | Product Candidate | Status | ||

| Relapsing-remitting MS |

Trimesta (oral estriol) |

The lead principal investigator from UCLA presented positive Phase II topline results at the American Academy of Neurology Annual Meeting in April 2014 | ||

| Cognitive dysfunction in MS |

Trimesta (oral estriol) |

Patient enrollment underway in Phase II clinical trial | ||

| C. difficile infection prevention |

SYN-004 (oral enzyme) |

SYN-004, second generation candidate in preclinical studies; Intend to initiate Phase Ia and Ib clinical trials during 2nd half of 2014 | ||

| Constipation-predominant irritable bowel syndrome (C-IBS) |

SYN-010 (oral compound) |

Planning for in vivo studies underway; Intend to initiate Phase II clinical trial during 2nd half of 2014; Collaboration with Cedars-Sinai Medical Center | ||

| Pertussis |

SYN-005 (monoclonal antibody) |

Positive preclinical research findings reported in April 2014; Collaborations with Intrexon and The University of Texas at Austin | ||

| Acinetobacter infection |

SYN-001 (monoclonal antibody) |

Discovery; Collaboration with Intrexon | ||

| IBS |

SYN-007 (biologic) |

Discovery; Collaboration with Intrexon | ||

| Fibromyalgia |

Effirma (oral flupirtine) |

Partnered with Meda AB |

Basis of Presentation

The accompanying consolidated financial statements have been prepared pursuant to the rules and regulations of Securities and Exchange Commission (“SEC”) for interim financial information. Accordingly, they do not include all of the information and notes required by U.S. Generally Accepted Accounting Principles (“GAAP”) for complete financial statements. The accompanying consolidated financial statements include all adjustments, comprised of normal recurring adjustments, considered necessary by management to fairly state our results of operations, financial position and cash flows. The operating results for the interim periods are not necessarily indicative of results that may be expected for any other interim period or for the full year. These consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2013 (“2013 Form 10-K”) as filed with the SEC. The interim results for the three months ended March 31, 2014, are not necessarily indicative of results for the full year.

| 6 |

The consolidated financial statements are prepared in conformity with U.S. GAAP, which requires the use of estimates, judgments and assumptions that affect the amounts of assets and liabilities at the reporting date and the amounts of revenue and expenses in the periods presented. We believe that the accounting estimates employed are appropriate and the resulting balances are reasonable; however, due to the inherent uncertainties in making estimates actual results could differ from the original estimates, requiring adjustments to these balances in future periods.

| 2. | Management’s Plan |

The Company has incurred an accumulated deficit of $85.1 million through March 31, 2014. With the exception of the quarter ended June 30, 2010, the Company has incurred negative cash flow from operations since it started the business. The Company has spent, and expects to continue to spend, substantial amounts in connection with implementing its business strategy, including the planned product development efforts, clinical trials, and research and discovery efforts.

The actual amount of funds the Company will need to operate is subject to many factors, some of which are beyond our control. These factors include the following:

| · | the progress of research activities; | |

| · | the number and scope of research programs; | |

| · | the progress of preclinical and clinical development activities; | |

| · | the progress of the development efforts of parties with whom the Company has entered into research and development agreements; | |

| · | costs associated with additional clinical trials of product candidates; | |

| · | the ability to maintain current research and development licensing arrangements and to establish new research and development and licensing arrangements; | |

| · | the ability to achieve milestones under licensing arrangements; | |

| · | the costs involved in prosecuting and enforcing patent claims and other intellectual property rights; and | |

| · | the costs and timing of regulatory approvals. |

The Company has based its estimate on assumptions that may prove to be wrong. The Company may need to obtain additional funds sooner or in greater amounts than it currently anticipates. Potential sources of financing include strategic relationships, public or private sales of the Company’s shares or debt and other sources.

The Company may seek to access the public or private equity markets when conditions are favorable due to long-term capital requirements. The Company does not have any committed sources of financing at this time, and it is uncertain whether additional funding will be available when needed on terms that will be acceptable to it, or at all. If the Company raises funds by selling additional shares of common stock or other securities convertible into common stock, the ownership interest of the existing stockholders will be diluted. If the Company is not able to obtain financing when needed, it may be unable to carry out the business plan. As a result, the Company may have to significantly limit its operations and its business, financial condition and results of operations would be materially harmed.

| 3. | Fair Value of Financial Instruments |

The fair value accounting standards define fair value as the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is determined based upon assumptions that market participants would use in pricing an asset or liability. Fair value measurements are rated on a three-tier hierarchy as follows:

| · | Level 1 inputs: Quoted prices (unadjusted) for identical assets or liabilities in active markets; |

| · | Level 2 inputs: Inputs, other than quoted prices included in Level 1 that are observable either directly or indirectly; and |

| · | Level 3 inputs: Unobservable inputs for which there is little or no market data, which require the reporting entity to develop its own assumptions. |

If the inputs used to measure fair value fall in different levels of the fair value hierarchy, the hierarchy level is based upon the lowest level of input that is significant to the fair value measurement.

Cash and cash equivalents include money market accounts of $9.0 million and $11.0 million as of March 31, 2014 and December 31, 2013, respectively, that are measured using Level 1 inputs.

| 7 |

| 4. | Selected Balance Sheet Information |

Prepaid expenses and other current assets (in thousands)

| March 31, 2014 | December 31, 2013 | |||||||

| Intrexon prepaid research and development expenses | $ | 1,163 | $ | 1,361 | ||||

| Prepaid insurance | 121 | 177 | ||||||

| Prepaid expenses | 48 | 53 | ||||||

| Total | $ | 1,332 | $ | 1,591 | ||||

The anticipated Intrexon research and development expenses for the next twelve months are classified as a current asset. The Company may terminate the arrangement at any time and receive a cash refund of the remaining balance minus any amounts owed to Intrexon.

Property and equipment (in thousands)

| March 31, 2014 | December 31, 2013 | |||||||

| Computer and office equipment | $ | 49 | $ | 45 | ||||

| Software | 11 | 11 | ||||||

| 60 | 56 | |||||||

| Less accumulated depreciation | (22 | ) | (19 | ) | ||||

| Total | $ | 38 | $ | 37 | ||||

| 5. | Stock-Based Compensation |

Stock Incentive Plan

During 2001, the Company’s Board of Directors and stockholders adopted the 2001 Stock Incentive Plan (the “2001 Stock Plan”). The total number of shares of stock with respect to which stock options and stock appreciation rights may be granted to any one employee of the Company or a subsidiary during any one-year period under the 2001 Stock Plan shall not exceed 250,000. All awards pursuant to the 2001 Stock Plan shall terminate upon the termination of the grantee’s employment for any reason. Awards include options, restricted shares, stock appreciation rights, performance shares and cash-based awards (the “Awards”). The 2001 Stock Plan contains certain anti-dilution provisions in the event of a stock split, stock dividend or other capital adjustment, as defined in the plan. The 2001 Stock Plan provides for a Committee of the Board to grant Awards and to determine the exercise price, vesting term, expiration date and all other terms and conditions of the Awards, including acceleration of the vesting of an Award at any time. As of March 31, 2014, there were 953,507 options issued and outstanding under the 2001 Stock Plan.

On March 20, 2007, the Company’s Board of Directors approved the 2007 Stock Incentive Plan (the “2007 Stock Plan”) for the issuance of up to 2,500,000 shares of common stock to be granted through incentive stock options, nonqualified stock options, stock appreciation rights, dividend equivalent rights, restricted stock, restricted stock units and other stock-based awards to officers, other employees, directors and consultants of the Company and its subsidiaries. This plan was approved by stockholders on November 2, 2007. The exercise price of stock options under the 2007 Stock Plan is determined by the compensation committee of the Board of Directors, and may be equal to or greater than the fair market value of the Company’s common stock on the date the option is granted. The total number of shares of stock with respect to which stock options and stock appreciation rights may be granted to any one employee of the Company or a subsidiary during any one-year period under the 2007 plan shall not exceed 250,000. Options become exercisable over various periods from the date of grant, and generally expire ten years after the grant date. As of March 31, 2014, there are 436,990 options issued and outstanding under the 2007 Stock Plan.

On November 2, 2010, the Board of Directors and stockholders adopted the 2010 Stock Incentive Plan (“2010 Stock Plan”) for the issuance of up to 3,000,000 shares of common stock to be granted through incentive stock options, nonqualified stock options, stock appreciation rights, dividend equivalent rights, restricted stock, restricted stock units and other stock-based awards to officers, other employees, directors and consultants of the Company and its subsidiaries. On October 22, 2013, the stockholders approved and adopted an amendment to the Company’s 2010 Incentive Stock Plan to increase the number of shares of the Company’s common stock reserved for issuance under the Plan from 3,000,000 to 6,000,000. The exercise price of stock options under the 2010 Stock Plan is determined by the compensation committee of the Board of Directors, and may be equal to or greater than the fair market value of the Company’s common stock on the date the option is granted. Options become exercisable over various periods from the date of grant, and generally expire ten years after the grant date. As of March 31, 2014, there are 3,100,000 options issued and outstanding under the 2010 Stock Plan.

| 8 |

In the event of an employee’s termination, the Company will cease to recognize compensation expense for that employee. There is no deferred compensation recorded upon initial grant date, instead, the fair value of the stock-based payment is recognized ratably over the stated vesting period.

The Company has applied fair value accounting for all share based payment awards since inception. The fair value of each option or warrant granted is estimated on the date of grant using the Black-Scholes option pricing model. The Black-Scholes assumptions used in the three months ended March 31, 2014 and 2013 are as follows:

| Three Months Ended March 31, | ||||||||

| 2014 | 2013 | |||||||

| Expected dividends | 0 | % | 0 | % | ||||

| Expected volatility | 126 | % | 148 | % | ||||

| Risk free interest rate | 1.57 | % | 0.77 | % | ||||

| Expected life of option | 5 years | 5 years | ||||||

| Expected forfeitures | 0 | % | 0 | % | ||||

The Company records stock-based compensation based upon the stated vested provisions in the related agreements. The vesting provisions for these agreements have various terms as follows:

| · | immediate vesting, |

| · | half vesting immediately and the remainder over three years, |

| · | quarterly over three years, |

| · | annually over three years, |

| · | one-third immediate vesting and remaining annually over two years, |

| · | one half immediate vesting with remaining vesting over nine months, |

| · | one quarter immediate vesting with the remaining over three years, |

| · | one quarter immediate vesting with the remaining over 33 months; and |

| · | monthly over three years. |

During the three months ended March 31, 2014, the Company granted 587,500 options to employees and consultants having an approximate fair value of $1.4 million based upon the Black-Scholes option pricing model. During the same period in 2013, the Company granted 117,500 options to employees and consultants having an approximate fair value of $185,000 based upon the Black-Scholes option pricing model.

A summary of stock option activities as of March 31, 2014, and for the year ended December 31, 2013, is as follows:

| Weighted | ||||||||||||||

| Average | ||||||||||||||

| Weighted | Remaining | Aggregate | ||||||||||||

| Average Exercise | Contractual | Intrinsic | ||||||||||||

| Options | Price | Life | Value | |||||||||||

| Balance - December 31, 2012 | 4,453,746 | $ | 1.78 | 6.43 years | $ | 1,308,000 | ||||||||

| Granted | 222,500 | $ | 1.69 | |||||||||||

| Exercised | (291,666 | ) | $ | 0.79 | ||||||||||

| Forfeited | (475,000 | ) | $ | 2.30 | ||||||||||

| Balance - December 31, 2013 | 3,909,580 | $ | 1.78 | 5.59 years | $ | 785,000 | ||||||||

| Granted | 587,500 | $ | 2.73 | |||||||||||

| Exercised | (6,583 | ) | $ | 0.58 | ||||||||||

| Forfeited | - | $ | - | |||||||||||

| Balance – March 31, 2014 - outstanding | 4,490,497 | $ | 1.91 | 5.55 years | $ | 3,183,000 | ||||||||

| Balance – March 31, 2014 - exercisable | 3,202,164 | $ | 1.72 | 5.08 years | $ | 2,946,000 | ||||||||

| Grant date fair value of options granted - March 31, 2014 | $ | 1,358,000 | ||||||||||||

| Weighted average grant date fair value - March 31, 2014 | $ | 2.31 | ||||||||||||

| Grant date fair value of options granted - December 31, 2013 | $ | 350,000 | ||||||||||||

| Weighted average grant date fair value - December 31, 2013 | $ | 1.57 | ||||||||||||

| 9 |

Stock-based compensation expense included in general and administrative expenses and research and development expenses relating to stock options issued to employees and consultants for the three months ended March 31, 2014 and 2013 were $362,000 and $457,000, respectively

As of March 31, 2014, total unrecognized stock-based compensation expense related to stock options was $2.5 million, which is expected to be expensed through February 2017.

| 6. | Stock Purchase Warrants |

On October 25, 2012, the Company entered into a Common Stock Purchase Agreement with certain accredited investors. As part of this agreement, the Company issued warrants to purchase 635,855 shares of common stock to the placement agent, or its permitted assigns. The warrants have an exercise price of $1.60 and a life of five years. The warrants vested immediately and expire October 25, 2017. Since these warrants were granted as part of an equity raise, the Company has treated them as a direct offering cost. The result of the transaction has no affect to equity. Warrants outstanding as of March 31, 2014 were 316,522.

On March 15, 2012, the Company entered into a consulting agreement for a financial communications program, for a period of twelve months that began on February 20, 2012. As compensation for such program, the consultant is paid a monthly fee and will be issued a performance warrant exercisable for 250,000 shares of the Company’s common stock based on achievement of certain stock price milestones. Upon initiation of the program, 50,000 of the performance warrants vested. The performance warrant is exercisable for a period of two years from the date of issuance for an exercise price equal to the price ($2.20 per share) of the Company’s common stock on the date of execution (March 15, 2012). In March 2013, the performance warrants’ vesting period was extended to March 14, 2014. All other provisions of the performance warrants remain unchanged. These warrants expired unexercised on March 14, 2014.

On December 20, 2011, the Company entered into a consulting agreement for financial advisory services, for a period of twelve months. As compensation for such services, the consultant was paid a monthly fee and on February 2, 2012, was issued warrants exercisable for 100,000 shares of the Company’s common stock. The warrant is exercisable upon issuance for a period of five years from the date of issue at an exercise price equal to the price ($1.14) of the Company’s common stock on the date of issue. As of March 31, 2014, all of these warrants have been exercised.

A summary of warrant activity for the Company for the three months ended March 31, 2014 and for the year ended December 31, 2013 is as follows:

| Weighted Average | ||||||||

| Number of Warrants | Exercise Price | |||||||

| Balance at December 31, 2012 | 1,632,501 | $ | 1.99 | |||||

| Granted | - | - | ||||||

| Exercised | - | - | ||||||

| Forfeited | - | - | ||||||

| Balance at December 31, 2013 | 1,632,501 | 1.99 | ||||||

| Granted | - | - | ||||||

| Exercised | (221,661 | ) | 1.48 | |||||

| Forfeited | (447,672 | ) | 1.89 | |||||

| Balance at March 31, 2014 | 963,168 | $ | 2.15 | |||||

There was no stock-based compensation expense included in general and administrative expense relating to warrants for the three months ended March 31, 2014 and 2013.

A summary of all outstanding and exercisable warrants as of March 31, 2014 is as follows:

| Weighted Average | ||||||||||||||||

| Exercise | Warrants | Warrants | Remaining | Aggregate | ||||||||||||

| Price | Outstanding | Exercisable | Contractual Life | Intrinsic Value | ||||||||||||

| $ | 1.32 | 18,182 | 18,182 | 1.75 years | $ | 23,000 | ||||||||||

| $ | 1.60 | 316,522 | 316,522 | 3.57 years | $ | 307,000 | ||||||||||

| $ | 2.22 | 517,257 | 517,257 | 2.66 years | $ | 181,000 | ||||||||||

| $ | 3.30 | 61,207 | 61,207 | 1.16 years | $ | - | ||||||||||

| $ | 3.75 | 50,000 | 50,000 | 1.88 years | $ | - | ||||||||||

| $ | 2.15 | 963,168 | 963,168 | 2.81 years | $ | 511,000 | ||||||||||

| 10 |

| 7. | Stockholders’ Equity |

During the three months ended March 31, 2014, the Company issued 6,583 shares of common stock, in connection with the exercise of stock options, for proceeds of approximately $4,000. The Company also issued 221,661 shares of common stock, in connection with cashless warrant exercises for the three months ended March 31, 2014.

| 8. | Net Loss per Share |

Net loss per share is computed by dividing net loss by the weighted average number of common shares outstanding. Diluted loss per share is computed by dividing net loss by the weighted average number of common shares outstanding including the effect of common share equivalents. All common equivalent shares were anti-dilutive at March 31, 2013 and 2014, as such there is no separate computation for diluted loss per share. The number of options and warrants for the purchase of common stock, that were excluded from the computations of net loss per common share for the three months ended March 31, 2014 were 4,490,497 and 963,168, respectively, and for the three months ended March 31, 2013 were 3,909,580 and 1,632,501, respectively.

| 11 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL INFORMATION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the attached unaudited consolidated financial statements and notes thereto, and with our audited consolidated financial statements and notes thereto for the fiscal year ended December 31, 2013, found in our Annual Report on Form 10-K. In addition to historical information, the following discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Where possible, we have tried to identify these forward looking statements by using words such as “anticipate,” “believe,” “intends,” or similar expressions. Our actual results could differ materially from those anticipated by the forward-looking statements due to important factors and risks including, but not limited to, those set forth under “Risk Factors” in this 10-Q and as applicable in Part I, Item 1A of our Annual Report on Form 10-K.

Overview

We are a biotechnology company focused on the development of novel anti-infective biologic and drug candidates targeting specific pathogens that cause serious infections and diseases. We are developing an oral biologic to protect the gastrointestinal (GI) microflora from the effects of intravenous (IV) antibiotics for the prevention of Clostridium difficile ( C. diff) infection, an oral treatment to reduce the impact of methane producing organisms on constipation-predominant irritable bowel syndrome (C-IBS), a series of monoclonal antibodies (mAbs) for the treatment of Pertussis and Acinetobacter infections, and a biologic targeted at the prevention and treatment of a root cause of a subset of IBS. In addition, we have two legacy programs. We are developing an oral estriol drug for the treatment of relapsing-remitting multiple sclerosis (MS) and cognitive dysfunction in MS. We have also partnered the development of a treatment for fibromyalgia.

Product Pipeline:

Summary of Pathogen-Specific Anti-Infective Biologic and Drug Programs:

| · | C. diff infections: We are in preclinical development of a novel second-generation oral enzyme drug candidate, SYN-004, for co-administration with commonly used IV antibiotics intended to prevent the development of severe effects of C. diff infections. C. diff infections are a leading cause of hospital acquired infections (HAIs), that generally occur secondary to treatment with IV antibiotics. Designed to be given orally to protect the gut while certain IV beta-lactam antibiotics (penicillins and cephalosporins) fight the primary infection, SYN-004 is believed to have a similar profile to its first-generation predecessor, which demonstrated favorable protection of the gut flora (microbiome) during treatment with certain penicillins, with the potentially added ability to act against a broader spectrum of IV beta-lactam antibiotics. Beta-lactam antibiotics are a mainstay in hospital infection management and include the commonly used penicillin and cephalosporin classes of antibiotics. Approximately 14.4 million patients are administered "SYN-004 target" IV beta-lactam antibiotics annually, representing an estimated target market for SYN-004 of 117.6 million beta-lactam doses purchased by U.S. hospitals. The addressable market for SYN-004 is significant. Currently there are no approved treatments designed to protect the microbiome from the damaging effects of IV antibiotics. This worldwide opportunity could represent a multi-billion dollar market.* We intend to initiate Phase Ia and Ib clinical trials during the second half of 2014, with preliminary topline data expected by year-end 2014. |

| * | This information is an estimate derived from the use of information under license from the following IMS Health Incorporated information service: CDM Hospital database for full year 2012. IMS expressly reserves all rights, including rights of copying, distribution and republication. |

| 12 |

| · | C-IBS: In December 2013, through our majority-owned subsidiary, Synthetic Biomics, Inc., we entered into a worldwide exclusive license agreement with Cedars-Sinai Medical Center (CSMC) for the right to develop products for therapeutic and prophylactic treatments for acute and chronic diseases. An investigational team led by Mark Pimentel, M.D. at CSMC has discovered that these products are intended to target the production of methane gas by certain pathogenic gastrointestinal (GI) microorganisms that are perceived as the underlying cause of gas, pain and constipation associated with C-IBS, as well as diseases such as obesity and type 2 diabetes. Initially we will focus on the development of an oral treatment to reduce the impact of methane producing organisms on C-IBS. We intend to initiate in vivo/pharmacokinetic/pharmacodynamic studies in the first half of 2014, and to initiate a Phase II clinical trial during the second half of 2014 under an Investigational New Drug application (IND). Expected timing of topline data is mid-2015. |

| · | Pertussis: In April 2014, positive preclinical research findings for SYN-005, our proprietary monoclonal antibody (mAb) combination therapy for treating Pertussis (whooping cough), in two non-human primate studies (n=15). In December 2012, in collaboration with Intrexon Corporation (NYSE: XON) (Intrexon), we initiated development of a mAb therapy for the treatment of Pertussis infections, more commonly known as whooping cough. We are developing a mAb therapy, SYN-005, designed to target and neutralize the pertussis toxin, in order to reduce the mortality rate in infants and shorten the duration of chronic cough in afflicted adults. To further the development of this potential therapy for Pertussis, we entered into an agreement with The University of Texas at Austin to license the rights to certain research and pending patents related to pertussis antibodies. According to the World Health Organization, each year, B. pertussis infection causes an estimated 300,000 deaths worldwide, primarily among young, unvaccinated infants. Based on positive non-human primate and murine model findings, we intend to file an IND application to support a Phase I clinical trial expected to initiate during the first half of 2015. Topline data is expected to be available within approximately 90 days of the start of the trial. This is expected to be followed by a Phase II trial, with topline results expected in the second half of 2015. We also intend to request an Orphan Drug designation for SYN-005 for the treatment of Pertussis. |

| · | Acinetobacter infections: In September 2012, in collaboration with Intrexon, we initiated efforts to develop a mAb therapy for the treatment of Acinetobacter infections. Many strains of Acinetobacter are multidrug-resistant and pose an increasing global threat to hospitalized patients, wounded military personnel and those affected by natural disasters. A treatment for Acinetobacter infections represents a billion dollar market opportunity. The generation of a panel of antibodies is ongoing. |

| · | IBS: In December 2013, in collaboration with Intrexon, and partially utilizing the intellectual property optioned from CSMC, we intend to develop biologic approaches targeted at the prevention, and acute and chronic treatment of a subset of IBS pathologies specifically caused by auto-antibodies. |

Summary of Multiple Sclerosis Program:

| · | The Phase II, double-blinded, placebo-controlled Trimesta trial randomized 158 women with relapsing-remitting MS at 16 sites across the U.S. Positive Phase II topline efficacy and safety results were presented in April 2014 by lead principal investigator, Dr. Rhonda Voskuhl of the University of California, Los Angeles (UCLA) David Geffen School of Medicine at the 66th American Academy of Neurology Annual Meeting. The UCLA-led Phase II study was designed to show statistical significance at 12 months for the MS relapse rate reduction in patients treated with Trimesta plus Copaxone® compared to patients given placebo plus Copaxone®. The trial was only powered to trend toward statistical significance at the 24-month time point. According to the protocol, the results of topline data demonstrate that Trimesta met the pre-specified goal of the study with rapid onset of activity observed for Trimesta plus Copaxone® compared to placebo plus Copaxone®. The Trimesta study also demonstrated a clinically significant near-normalization of cognitive scores at 12 months of therapy in women taking Trimesta plus Copaxone®. This outcome is of high importance for MS specialists and patients and we believe it is the result of oral estriol’s unique neuroprotective effect. In addition, adjunctive oral Trimesta plus injectable standard of care Copaxone® was generally safe and well tolerated by women in the study. This investigator-initiated trial evaluating our drug candidate, Trimesta, is supported by grants awarded to the UCLA exceeding $8.0 million, which should be sufficient to fund the trial through completion of patient follow-up. Annual worldwide sales of current MS therapies are estimated at $14.1 billion. We are engaging with the neurology community and potential partners, as we determine next steps for Trimesta. |

| · | Trimesta is also being developed for the treatment of cognitive dysfunction in female MS patients. This 12-month randomized, double-blind, placebo-controlled Phase II clinical trial is being conducted at four sites in the United States, including UCLA. The primary endpoint is the effect on cognitive function as assessed by Paced Auditory Serial Addition Test (PASAT). Patient enrollment is ongoing. The majority of the costs of this trial are being funded by grants from foundations and charitable organizations and we have pledged approximately $500,000 to UCLA to partially fund this trial payable over three years. An estimated 50-65% of MS patients are expected to develop disabilities due to cognitive dysfunction and there is currently no approved treatment. |

Summary of Fibromyalgia Program:

| · | EffirmaTM (flupirtine) is being developed for the treatment of fibromyalgia by Meda AB (Meda), a multi-billion dollar international pharmaceutical company. On May 6, 2010, we entered into a sublicense agreement with Meda covering all of our patents’ rights on the use of flupirtine for fibromyalgia in the United States, Canada and Japan. The sublicense agreement provides that all ongoing and future development costs are to be borne by Meda and we are entitled to receive certain payments if milestones are achieved and royalties on sales. According to Meda’s 2012 Year-End Report filed in February 2013, Meda has received the go-ahead from the United States Food and Drug Administration (FDA) to conduct a Phase II proof of concept study for the treatment of fibromyalgia. Meda also announced that the randomized, double-blind, placebo and active-controlled study of patients with fibromyalgia will be conducted at 25 clinics in the United States Based on an estimated annual price of $1,200 per fibromyalgia patient, we estimate that the total market potential in the United States is $6.0 billion. |

| 13 |

Recent Developments

On December 11, 2013, we completed a firm commitment underwritten public offering of 13,225,000 shares of our common stock at a closing price of $1.00 per share for gross proceeds of $13.2 million. We paid direct offering costs of $1.0 million.

On December 5, 2013, through our newly formed, majority owned subsidiary, Synthetic Biomics, Inc. (“SYN Biomics”), we entered into a worldwide exclusive license agreement (the “CSMC License Agreement”) and option agreement (the “CSMC Option Agreement”) with CSMC for the right to develop, manufacture, use, and sell products for the human and veterinary therapeutic and prophylactic treatments for acute and chronic diseases. An investigational team lead by Mark Pimentel, M.D. at CSMC has discovered that these products are intended to target certain pathogenic GI microorganisms that are perceived as an underlying cause of diseases such as C-IBS, obesity and type 2 diabetes. The portfolio of intellectual property licensed to SYN Biomics under the License Agreement includes nine issued U.S. patents, one issued European patent validated in 18 countries, one issued European patent validated in three countries, two issued Australian patents, and one issued Japanese patent as well as 13 pending U.S. and international patent applications for most fields of use and modalities (subject to certain agreed-upon exceptions); two pending U.S. patent applications are optioned to SYN Biomics under the Option Agreement.”

Under the CSMC License Agreement we issued 291,569 unregistered shares of our common stock to CSMC, as payment of an initial license fee and patent reimbursement fees of $150,000 and $220,000, respectively. The parties also entered into a Stock Purchase Agreement with respect to such stock issuance and other issuances of our unregistered shares of common stock that may be issued to CSMC in lieu of cash, including license fees, milestone payments expense reimbursements and options fees under the CSMC License Agreement or CSMC Option Agreement. Any and all such stock issuances by us shall be subject to the prior approval of the NYSE MKT, LLC. The CSMC License Agreement also provides that commencing on the second anniversary of the CSMC License Agreement, SYN Biomics will pay an annual maintenance fee, which payment shall be creditable against annual royalty payments owed under the CSMC License Agreement. In addition to royalty payments which are a percentage of Net Sales (as defined in the CSMC License Agreement) of Licensed Products (as defined in the CSMC License Agreement) and Licensed Technology products (as defined in the CSMC License Agreement), SYN Biomics is obligated to pay CMSC a percentage of any non-royalty sublicense revenues as well as additional consideration upon the achievement of the following milestones (the first two of which are payable in cash or our unregistered shares of stock at our option): (i) successful Phase I trial completion of the first Licensed Product or first Licensed Technology Product; (ii) successful Phase II trial completion of the first Licensed Product or first Licensed Technology Product; (iii) initiation of Phase III dosing for each additional indication of a Licensed Product or Licensed Technology Product; (iv) successful Phase III trial completion for each Licensed Product and each Licensed Technology Product; (v) the FDA’s acceptance of a New Drug Application for each Licensed Product and each Licensed Technology Product; (vi) regulatory approval for each Licensed Product and each Licensed Technology Product; and (vii) the first commercial sale of each Licensed Product and each Licensed Technology Product. The stock issuances are subject to prior approval of the NYSE MKT, LLC. The CSMC License Agreement automatically terminates upon the occurrence of certain events and SYN Biomics has the right to terminate the CSMC License Agreement without cause, upon six months notice to CSMC however, upon such termination, SYN Biomics is obligated to pay a termination fee with the amount of such fee reduced: (i) if such termination occurs after an IND submission to the FDA but prior to completion of a Phase II clinical trial; (ii) reduced further if such termination is after completion of Phase II clinical trial but prior to completion of a Phase III clinical trial; and (iii) reduced to zero if such termination occurs after completion of a Phase III clinical trial.

Prior to the execution of the License Agreement, we issued shares of common stock of SYN Biomics to each of CSMC and Mark Pimentel, M.D. (the primary inventor of the intellectual property), representing 11.5% and 8.5%, respectively, of the outstanding shares of SYN Biomics (the “SYN Biomics Shares”). The Stock Purchase Agreements for the SYN Biomics Shares provide for certain anti-dilution protection until such time as an aggregate of $3.0 million in proceeds from equity financings are received by SYN Biomics as well as a right, under certain circumstances in the event that the SYN Biomics Shares are not then freely tradeable, and subject to NYSE MKT, LLC approval, as of the 18 and 36 month anniversary date of the effective date of the Stock Purchase Agreements, for each of CSMC and Dr. Pimentel to exchange up to 50% of their SYN Biomics shares for unregistered shares of our common stock, with the rate of exchange based upon the relative contribution of the valuation of SYN Biomics to our public market valuation at the time of each exchange. The Stock Purchase Agreements also provide for tag-along rights in the event of the sale by us of our shares of SYN Biomics.

Pursuant to the terms of the CSMC Option Agreement, SYN Biomics has a period of six months to negotiate an exclusive license to develop, manufacture, use, and sell biologic products relating to the prevention, acute treatment and chronic treatment of IBS or other indications utilized or derived from certain optioned patent applications pending completion of certain limited testing of technology embodied in the patents applications. Under terms of the CSMC Option Agreement we issued 43,342 shares of our unregistered stock to CSMC, as payment of a non-refundable option fee of $55,000. In addition, SYN Biomics has the right to extend the option period for an additional six months, for an additional non-refundable extension fee of $25,000, payable in our unregistered shares of common stock having a market value of 110% of such amount, subject to approval of NYSE MKT, LLC, or in cash. At any time during the 6 or 12 month option period (if so extended) SYN Biomics has the right to exercise the option and negotiate an exclusive license to be optioned patent applications, which shall provide for (i) a $50,000 license issue fee plus reimbursement of patent expenses incurred by CSMC prior to the exclusive license payable to CSMC in our unregistered shares of stock having a market value of 110% of such amount, subject to approval of the NYSE MKT, LLC, or in cash, (ii) the same milestone payments, royalties and sublicense fees as are payable under the CSMC License Agreement, and (iii) such other customary terms and conditions CSMC typically includes in its license agreements.

| 14 |

In collaboration with Intrexon, and partially utilizing the intellectual property optioned or licensed from CSMC described in the CSMC Option Agreement, we and SYN Biomics intend to develop biologic approaches for the prevention, and acute and chronic treatment of a subset of IBS pathologies specifically caused by auto-antibodies. During the option period, we, SYN Biomics and Intrexon will seek to create and test a variety of biologic candidates for the treatment of IBS. This biologic program has been selected as the third target under our Exclusive Channel Collaboration Agreement with Intrexon dated August 6, 2012.

Since our inception in January 2001, our efforts and resources have been focused primarily on acquiring and developing our product candidates, our clinical trials, raising capital, manufacturing and recruiting personnel. As of June 30, 2010, we emerged from the development stage after entering into a sublicense agreement with Meda AB and receiving an up-front payment of $2.5 million. We consider this sublicense agreement to be an indication that we commenced our principal operations.

To date, we have financed our operations primarily through public and private sales of our common stock, and we expect to continue to seek to obtain the required capital in a similar manner. We have incurred an accumulated deficit of $85.1 million through March 31, 2014. We cannot provide any assurance that we will be able to achieve profitability on a sustained basis, if at all, obtain the required funding, obtain the required regulatory approvals, or complete additional corporate partnering or acquisition transactions.

Pipeline Programs and Therapeutic Areas

Pathogen-Specific Anti-Infective Biologic and Drug Programs

We are a biotechnology company focused on the development of novel anti-infective biologic and drug candidates targeting specific pathogens that cause serious infections and other diseases. Infectious disease outbreaks are increasing while intervention options are declining due to widespread multidrug-resistant bacteria, increasing numbers of immuno-compromised patients (e.g., the elderly and cancer patients), and the isolation of new pathogens. We are developing an oral biologic to protect the gastrointestinal microflora from the effects of IV antibiotics for the prevention of C. diff infection, an oral treatment to reduce the impact of methane producing organisms on C-IBS, a series of monoclonal antibodies for the treatment of Pertussis and Acinetobacter infections, and a biologic targeted at the prevention and treatment of a root cause of a subset of IBS.

Several of our programs are focused on protecting the microbiome, or our gut flora, which is home to millions of bacteria, composed of a natural balance of both “good” beneficial bacteria and “bad” pathogenic bacteria. When that natural balance of all of these bacteria is disrupted, a person’s health is compromised.

C. difficile:

According to the Agency for Healthcare Research and Quality, aggregate costs associated with C. diff infection (CDI)-related stays in the hospital were $8.2 billion in the U.S. during 2009. CDI is a rising global HAI problem in which the toxins produced by C. difficile bacteria result in diarrhea antibiotic-associated diarrhea (AAD), and in the most serious cases, pseudomembranous colitis (erosion of the lower GI tract) that can lead to death. The Centers for Disease Control and Prevention (CDC) recently identified C. diff as an “urgent public health threat,” particularly given its resistance to many drugs used to treat other infections. CDI is a major, unintended risk associated with the prophylactic or therapeutic use of IV antibiotics, which may alter the natural balance of microflora that normally protect the GI tract, leading to C. difficile overgrowth and infection. Other risk factors for CDI include hospitalization, prolonged length of stay, underlying illness, immune-compromising conditions including the administration of chemotherapy, and advanced age.

CDI is a widespread and often drug resistant infectious disease, and it is estimated that 1.1 million patients are infected with C. diff annually in the U.S.*, and it has been reported that 30,000 patients die with a C. diff infection each year. CDI has surpassed methicillin-resistant staphylococcus aureus (MRSA) as the most frequent infection acquired in the hospital. Controlling the spread of CDI has proven challenging, as the C. difficile spores are easily transferred to patients via normal contact with healthcare personnel and other inanimate objects. There is currently no vaccine or approved product for the prevention of C. diff infection.

| * | This information is an estimated derived from the use of information under license from the following IMS Health Incorporated information service: CDM Hospital database for full year 2012. IMS expressly reserves all rights, including rights of copying, distribution and republication. |

C. difficile: Acquisition of Clinical-Stage Program

In November 2012, we acquired a series of oral beta-lactamase enzymes (P1A, P2A and P3A) and related assets targeting the prevention of CDI, the leading cause of HAIs that generally occurs secondary to treatment with IV antibiotics. The acquired assets include a pre-IND package for P3A (SYN-004), Phase I and Phase II clinical data for P1A, manufacturing processes and data, and a portfolio of issued and pending U.S. and international patents intended to support an IND and Biologics License Application (BLA) with the FDA. Utilizing this portfolio of assets, we intend to develop a proprietary oral beta-lactamase enzyme product candidate, SYN-004, previously known as P3A. When co-administered with certain IV beta-lactam antibiotics, it is expected that SYN-004 can degrade the antibiotic that is excreted in the GI tract, thus preserving the natural balance of the patient's microflora, and preventing opportunistic infections including CDI. Beta-lactam antibiotics are a mainstay in hospital infection management and include the commonly used penicillin and cephalosporin classes of antibiotics. Approximately 14.4 million patients are administered "SYN-004 target" IV beta-lactam antibiotics annually, representing an estimated target market for SYN-004 of 117.6 million beta-lactam doses purchased by U.S. hospitals. The addressable market is significant and currently there are no approved treatments designed to protect the microbiome from the damaging effects of IV antibiotics. This worldwide opportunity could represent a multi-billion dollar market.*

| 15 |

| * | This information is an estimated derived from the use of information under license from the following IMS Health Incorporated information service: CDM Hospital database for full year 2012. IMS expressly reserves all rights, including rights of copying, distribution and republication. |

C. difficile: Oral Enzyme Background

We acquired a series of oral beta-lactamase enzymes. Beta-lactamase enzymes have the ability to degrade beta-lactam antibiotics that may be excreted into the GI tract. P1A (the first generation candidate) showed acceptable safety and tolerability in a Phase I study. In addition, two Phase II clinical studies demonstrated that P1A had the ability to preserve GI microflora in hospitalized patients treated with intravenous ampicillin or the combination of piperacillin and tazobactam.

C. difficile: Preclinical and Clinical Development

Compared to the first generation oral enzyme candidate, P1A, we believe that the second generation candidate, SYN-004 (formerly P3A), will have activity against a broader spectrum of beta-lactam antibiotics, including both penicillins and certain cephalosporins. Due to the structural similarities between P1A and SYN-004, and based on previous discussions with the FDA, it is anticipated that certain preclinical data collected on P1A may be used in support of an IND for our new product candidate, SYN-004.

In October 2013, we initiated manufacturing of SYN-004 material to support our planned preclinical and clinical studies. We intend to initiate Phase Ia and Ib clinical trials during the second half of 2014, with preliminary topline data expected by year-end 2014.

C-IBS:

Irritable Bowel Syndrome (IBS) is a functional GI disorder characterized by gas, abdominal pain, bloating and diarrhea or constipation, or alternating episodes of both. According to reports published by The International Foundation for Functional Gastrointestinal Disorders (IFFGD), IBS affects an estimated 10 to 15 percent of the population, or as many as 40 million Americans. The illness affects both men and women; two-thirds of diagnosed sufferers are women. The onset of IBS can begin anytime from adolescence to adulthood. Four bowel patterns may be seen with IBS, including: C-IBS (constipation predominant), D-IBS (diarrhea predominant), M-IBS (mixed diarrhea and constipation) and A-IBS (alternating diarrhea and constipation).

It has been reported that one-third of all IBS patients have C-IBS. Current FDA-approved therapies for the treatment of C-IBS include AMITIZA® (lubiprostone) and LINZESS® (linaclotide). Prescription and over-the-counter laxatives are also used by C-IBS patients for symptomatic relief. According to GlobalData, sales of approved drugs to treat C-IBS in seven major markets are projected to reach $1.3 billion by 2018.

C-IBS: Acquisition of Clinical-Stage Program

In December 2013, we entered into a worldwide exclusive license agreement with CSMC for the right to develop products for therapeutic and prophylactic treatments for acute and chronic diseases. We licensed and optioned from CSMC a portfolio of intellectual property comprised of several U.S. and international patents and pending patent applications for various fields of use, including C-IBS, obesity and diabetes. An investigational team led by Mark Pimentel, M.D. at CSMC has discovered that these products are intended to target the production of methane gas by certain pathogenic gastrointestinal microorganisms that are perceived as the underlying cause of gas, pain and constipation associated with C-IBS, as well as diseases such as obesity and type 2 diabetes. Initially we will focus on the development of an oral treatment to reduce the impact of methane producing organisms on C-IBS.

IBS: Gas Producing Organisms Background

In the 1990’s, research showed that IBS patients (over a given time) produced five times more gas than did people without IBS. Since the only source of those gases was bacterial, the initial presumption was that IBS patients had excessive bacteria in the colon. Subsequent studies showed that IBS patients had excessive quantities of gas in the small bowel; these data were the catalyst for studying small bowel bacteria in IBS. Normally the small intestine contains a very small quantity of bacteria. In published studies, indirect measures of small bowel bacteria suggest that 84% of IBS sufferers have excessive quantities of bacteria typically found in the colon.

| 16 |

The CSMC investigational team led by Dr. Pimentel is researching a recent theory that defines IBS as a bacterial disease. Gut microflora that should normally be confined to the large intestine inappropriately colonize the small intestine. This process is referred to as small intestine bacterial overgrowth (SIBO), which results in gas, bloating, abdominal pain and altered stool habits characterized by IBS.

C-IBS: Methane Producing Organisms Background

Further research by the CSMC investigational team led by Dr. Pimentel is focused on the C-IBS patient population. The theory that defines this patient set is that the constipation associated with C-IBS is due to an infectious disease. Overgrowth of certain gut microflora may lead to overproduction of methane gas resulting in pain, bloating and constipation. CSMC investigators have discovered that inhibiting intestinal methane production may treat the underlying cause of major diseases, including constipation associated with C-IBS.

C-IBS: Preclinical and Clinical Development

Ongoing efforts led by Dr. Pimentel include formulating and testing non-antibiotic FDA-approved oral drug candidates for ultimate product registration via potential expedited pathways. Such candidates are intended for the specific elimination of methane gas production within the intestines, with the goal of having little or no unintended impact on a patient's normal intestinal microflora. Initially we will focus on the development of an oral treatment to reduce the impact of methane producing organisms on C-IBS.

We intend to initiate in vivo/pharmacokinetic/pharmacodynamic studies in the first half of 2014, and to initiate a Phase II clinical trial during the second half of 2014 under an IND. Expected timing of topline data is mid-2015.

Monoclonal Antibodies:

Monoclonal Antibodies for Infectious Diseases

Acting as the body's army, antibodies are proteins, generally found in the bloodstream, that provide immunity in detecting and destroying pathogens, such as viruses and bacteria and their associated toxins. MAbs can also be designed and produced as therapeutic agents, utilizing protein engineering and recombinant production technologies. The mAbs being developed under our collaboration with Intrexon are intended to supplement a patient's own immune system by providing the means to specifically and rapidly neutralize and/or clear specific pathogens and toxins of interest in a process known as “passive immunity”. Many pathogens that cause infectious diseases are innately resistant to, or over time have developed increased resistance to, antibiotics and other drugs.

Intrexon Collaboration: Monoclonal Antibodies for Infectious Diseases

In August 2012, we entered into a worldwide exclusive channel collaboration (“Second ECC”) with Intrexon through which we intend to develop a series of mAb therapies for the treatment of certain infectious diseases not adequately addressed by existing therapies. Utilizing Intrexon’s comprehensive suite of proprietary technologies, including the mAbLogix TM platform for rapid discovery of fully human mAbs and the LEAP TM cell processing station, our initial efforts will target three infectious disease indications.*** We also have the option to target an additional five infectious disease indications under this collaboration. To date, we have initiated development of a mAb therapy for the treatment of Pertussis and Acinetobacter infections.

***mAbLogixTM and LEAPTM are registered trademarks of Intrexon Corporation.

Pertussis:

Bordetella pertussis (B. pertussis) is a gram-negative bacterium that infects the upper respiratory tract, causing uncontrollable, and violent coughing. Antibiotic treatment does not have a major effect on the course of Pertussis, because while it can eliminate the B. pertussis bacteria from the respiratory tract, it does not neutralize the pertussis toxin. Infants with Pertussis often require hospitalization in pediatric intensive care units, frequently requiring mechanical ventilation. Pertussis in adults generally leads to a chronic cough referred to as the "cough of 100 days." The incidence of Pertussis is increasing due to a less effective acellular vaccine introduced in the 1990s, exposure of unvaccinated and under-vaccinated individuals including infants who are not yet fully vaccinated, exposure of individuals whose immunity has diminished over time, as well as asymptomatic carriers.

According to the World Health Organization there are 50 million cases of whooping cough and B. pertussis infection that causes an estimated 300,000 deaths each year worldwide, primarily among young, unvaccinated infants. Recent news reports throughout the U.S. indicate that the pertussis vaccine introduced in the 1990s does not provide long-term protection and, as a result, whooping cough cases have increased to a 60-year high. There is no approved treatment for Pertussis, and antibiotic treatment does not have a major effect on the course of Pertussis, because while it can eliminate the B. pertussis bacteria from the respiratory tract, it does not neutralize the pertussis toxin.

Pertussis: Intrexon Collaboration and The University of Texas at Austin Agreement

In December 2012, we initiated mAb development for the treatment of Pertussis focusing on toxin neutralization pursuant to our August 2012 collaboration with Intrexon. Unlike antibiotics, we are developing a mAb therapy, SYN-005, to target and neutralize the pertussis toxin, in order to reduce the mortality rate in infants and shorten the duration of chronic cough in afflicted adults.

| 17 |

To further the development of this potential therapy for pertussis, we have entered into an agreement with The University of Texas at Austin to license the rights to certain research and pending patents related to pertussis antibodies. These research efforts are being conducted at the Cockrell School of Engineering in the laboratory of Assistant Professor, Jennifer A. Maynard, Ph.D., the Laurence E. McMakin, Jr. Centennial Faculty Fellow in the McKetta Department of Chemical Engineering. Dr. Maynard brings to the project her expertise in defining the key neutralizing epitopes of pertussis toxin to optimize the potential efficacy of antibody therapeutics.

Pertussis: Preclinical and Clinical Development

Working with our collaborator, Intrexon, and our academic collaborator, The University of Texas at Austin, we have established a combination of two humanized antibodies designed to neutralize pertussis toxin, a major cause of pertussis-mediated infant morbidity and mortality. Benchtop studies demonstrated high affinity binding to the toxin, as well as potent neutralization of the toxin. In addition, the antibodies were highly efficacious in a murine model of pertussis in which they completely mitigated elevations of the white blood cell count that is characteristic of the illness.

In April 2014, positive preclinical research findings for SYN-005, our proprietary monoclonal antibody (mAb) combination therapy for treating Pertussis (whooping cough), in two non-human primate studies (n=15). In the second pertussis study in particular, SYN-005 was associated with favorable decreases in white blood cell counts within two days and the achievement of nearly normal levels within one week.

Based on positive non-human primate and murine model findings, we have filed an additional patent application around pertussis antibodies, intend to move into cGMP manufacturing of SYN-005, and intend to file an IND application to support a Phase I clinical trial expected to initiate during the first half of 2015. Topline data is expected to be available within approximately 90 days of the start of the trial. This is expected to be followed by a Phase II trial, with topline results expected in the second half of 2015. We also intend to request an Orphan Drug designation for SYN-005 for the treatment of Pertussis.

Acinetobacter Infections:

Acinetobacter baumanii is a difficult to treat pathogen due to its rapid and well-established development of resistance to most antibiotics, making it a multidrug-resistant pathogen. In addition, as a biofilm-forming pathogen, Acinetobacter baumanii has the ability to survive up to twice as long as non-biofilm-forming pathogens. In the U.S., Acinetobacter baumanii has been reported to be the cause of up to 2.6% of hospital acquired infections, 1.3% of bloodstream infections and 7.0% of ICU respiratory tract infections, and more than half of the Acinetobacter baumanii isolates are multidrug-resistant. According to published articles, mortality rates associated with Acinetobacter infections as high as 43.0% are reported in hospitals and ICU settings. While Acinetobacter baumanii is a well-documented pathogen in the hospital setting, this pathogen also poses an increasing danger to wounded servicemen and women in military treatment centers and to those treated in trauma centers following natural disasters.

A treatment for Acinetobacter infections represents a billion dollar market opportunity.

Acinetobacter: Intrexon Collaboration

In August 2012, we initiated a mAb discovery and development program for Acinetobacter infections pursuant to our August 2012 collaboration with Intrexon. Discovery efforts for the development of a mAb are currently underway.

IBS:

Existing IBS therapies, which are primarily focused on supportive care, are unlikely to address the treatment needs of the patient population with auto-antibodies, an underlying immune-specific pathology. Through our collaboration with Intrexon, we intend to address the unmet medical need in these patients with personalized medicine and target the root causes of a subset of IBS-associated pathologies.

IBS: Intrexon Collaboration

In December 2013, in collaboration with Intrexon, and partially utilizing the intellectual property optioned from CSMC, we announced an intent to develop biologic approaches targeted at the prevention, and acute and chronic treatment of a subset of IBS pathologies specifically caused by auto-antibodies.

We intend to utilize intellectual property optioned from CSMC. According to an increasing body of recent work conducted by CSMC, a subset of IBS cases appear to be causally initiated by one or more encounters with acute infectious gastroenteritis, such as the foodborne illness, Campylobacter jejuni. CSMC has identified a novel autoimmune target for this subset of IBS cases because of the development of cross-reacting antibodies between a bacterial toxin and a protein important for controlling GI motility. This program is in the discovery stage.

| 18 |

Multiple Sclerosis Program

Relapsing-Remitting MS:

MS is a progressive neurological disease in which the body loses the ability to transmit messages along the central nervous system, leading to pain, loss of muscle control, paralysis, cognitive impairment and in some cases death. According to the National Multiple Sclerosis Society (NMSS), more than 2.3 million people worldwide (approximately 400,000 patients in the U.S. of which approximately 65% are women) have been diagnosed with MS. The diagnosis is typically made in young adults, ages 20 to 50. According to the NMSS, approximately 85% of MS patients are initially diagnosed with the relapsing-remitting form, and 10-15% with other progressive forms.

There are nine FDA-approved therapies for the treatment of relapsing-remitting MS: Betaseron®, Rebif®, Avonex®, Copaxone®, Tysabri®, Gilenya®, Extavia®, Aubagio ® and TecfideraTM. Many of these therapies provide only a modest benefit for patients with relapsing-remitting MS. All of these drugs except Gilenya®, Aubagio® and TecfideraTM require frequent (daily, weekly & monthly) injections (or infusions) on an ongoing basis and can be associated with unpleasant side effects (such as flu-like symptoms) and high rates of non-compliance among users. Despite the availability of therapies for the treatment of relapsing-remitting MS, the disease is highly underserved and exacts a heavy personal and economic toll. Annual worldwide sales of current MS therapies are estimated at $14.1 billion.

Relapsing-Remitting MS: Background

Research has shown that pregnant women with MS tend to experience a spontaneous reduction of disease symptoms during pregnancy, particularly in the third trimester. The PRIMS (Pregnancy In MS) study published in 1998, a landmark observational clinical study published in the New England Journal of Medicine followed 254 women with MS during 269 pregnancies and for up to one year after delivery. The PRIMS study demonstrated that relapse rates were significantly reduced by 71% (p < 0.001) through the third trimester of pregnancy compared to pre-pregnancy-rates, and that relapse rates increased by 120% (p < 0.001) during the first three months after birth (post-partum) and then return to pre-pregnancy rates. It has been hypothesized that the female hormone, estriol, produced by the placenta during pregnancy, plays a role in “fetal immune privilege”, a process that prevents a mother’s immune system from attacking and rejecting the fetus. The maternal levels of estriol increase linearly through the third trimester of pregnancy until birth, whereupon it abruptly returns to low circulating levels. The anti-autoimmune effects of estriol are thought to be responsible for the therapeutic effects of pregnancy on MS.

Rhonda Voskuhl, M.D., Director, UCLA MS program, UCLA Department of Neurology, has found that plasma levels of estriol achieved during pregnancy have potent immunomodulatory effects. She further postulated and tested in a pilot clinical study that oral doses of estriol may have a therapeutic benefit when administered to non-pregnant female MS patients by, in essence, mimicking the spontaneous reduction in relapse rates seen in MS patients during pregnancy.

Estriol has been approved and marketed for over 40 years throughout Europe and Asia for the oral treatment of post-menopausal symptoms. It has never been approved by the U.S. FDA for any indication.

Relapsing-Remitting MS: Clinical Development

Trimesta (oral estriol) is being developed as an adjunctive oral once-daily treatment for relapsing-remitting MS in women. An investigator-initiated, 10-patient, 22-month, single-agent, crossover clinical trial to study the therapeutic effects of 8 mg. of oral Trimesta taken daily in non-pregnant female relapsing-remitting MS patients was completed in the U.S. The total volume and number of gadolinium-enhancing lesions were measured by brain magnetic resonance imaging (an established neuroimaging measure of disease activity in MS). Over the next three months of treatment with Trimesta, the median total enhancing lesion volumes decreased by 79% (p = 0.02) and the number of lesions decreased by 82% (p = 0.09). They remained decreased during the next 3 months of treatment, with lesion volumes decreased by 82% (p = 0.01), and numbers decreased by 82% (p =0.02). Following a six-month drug holiday during which the patients were not on any drug therapies, median lesion volumes and numbers returned to near baseline pretreatment levels. Trimesta therapy was reinitiated during a four-month retreatment phase of this clinical trial. The relapsing-remitting MS patients again demonstrated a decrease in enhancing lesion volumes of 88% (p = 0.008) and a decrease in the number of lesions by 48% (p = 0.04) compared with original baseline scores.

The Phase II, double-blinded, placebo-controlled trial randomized 158 women with relapsing-remitting MS at 16 sites across the U.S. The study evaluated Trimesta as an oral, once-daily dose of 8 mg per day plus Copaxone® in women with relapsing-remitting MS, aged 18-50 years. Positive topline efficacy and safety results were presented in April 2014 by lead principal investigator, Dr. Rhonda Voskuhl of UCLA David Geffen School of Medicine at the 66th American Academy of Neurology Annual Meeting. The UCLA-led Phase II study was designed to show statistical significance at 12 months for the MS relapse rate reduction in patients treated with Trimesta plus Copaxone® compared to patients given placebo plus Copaxone®. The trial was only powered to trend toward statistical significance at the 24-month time point. According to the protocol, the results of topline data demonstrate that Trimesta met the pre-specified goal of the study with rapid onset of activity observed for Trimesta plus Copaxone® compared to placebo plus Copaxone®. Dr. Voskuhl and her team anticipated an approximately 29% reduction in MS relapse rate, per the study protocol. A statistically significant 47% decrease in relapse rate was observed at 12 months of therapy (p-value = 0.03 / powered for significance level of 0.05), as well as a clear trend toward a 32% reduction at 24 months (p-value = 0.15 / powered for significance level of 0.10), which far surpassed the investigator’s expectations. The Trimesta study also demonstrated a clinically significant near-normalization of cognitive scores at 12 months of therapy in women taking Trimesta plus Copaxone®. This outcome is of high importance for MS specialists and patients and we believe it is the result of oral estriol’s unique neuroprotective effect. In addition, adjunctive oral Trimesta plus injectable standard of care Copaxone® was generally safe and well tolerated by women in the study.

By demonstrating the therapeutic potential and safety of Trimesta in the Phase II exploratory trial, we achieved a key goal of the Trimesta program, which is providing further support to enable us to attract a strategic partner to accelerate development of this innovative therapy for MS. We are engaging with the neurology community and potential partners, as we determine next steps for Trimesta.

With over $8 million in grant funding awarded to UCLA to date, from organizations such as the National Institutes for Health and the National Multiple Sclerosis Society, the ongoing Trimesta clinical trial should be funded to its completion of patient follow-up.

| 19 |

Relapsing-Remitting MS: Patents

In March 2014, we announced that the U.S. Patent & Trademark Office issued U.S. Patent No. 8,658,627 entitled, Pregnancy Hormone Combination for Treatment of Autoimmune Diseases, to the Regents of the University of California. The patent includes claims to the use of our drug candidate, Trimesta (oral estriol), in conjunction with a gestagen for the treatment of multiple sclerosis (MS) and other autoimmune diseases. The patent also includes a claim for the administration of Trimesta, a gestagen and a third standard of care MS agent, such as glatiramer acetate injection (Copaxone ®), interferon beta-1a (Avonex®, Rebif®), interferon beta-1b (Betaseron®, Extavia®) or sphingosine-1-phosphate receptor modulator (Gilenya®).

In April 2013, we announced that the U.S. Patent & Trademark Office issued U.S. Patent No. 8,372,826 entitled, Estriol Therapy for Multiple Sclerosis and Other Autoimmune Diseases , to the Regents of the University of California which includes claims to the use of our drug candidate, Trimesta (oral estriol), in combination with glatiramer acetate injection (Copaxone®). According to Teva Pharmaceutical Industries Ltd.’s Form 20-F for the year ended December 31, 2012, filed with the SEC on February 12, 2013. Copaxone® is the number one selling drug for multiple sclerosis with approximately $4 billion in annual sales. Currently marketed exclusively by Teva Pharmaceutical Industries Ltd., Copaxone® is expected to face generic competition as certain patent terms begin to expire in 2014.

Through our wholly owned subsidiary, we hold the exclusive worldwide license to issued U.S. Patents 8,658,627, 8,372,826 and 6,936,599 and pending patents for multiple sclerosis and other autoimmune diseases covering the uses of our drug candidate, Trimesta.

Cognitive Dysfunction in MS:

According to the NMSS and the Multiple Sclerosis Society of Canada publication, Hold that Thought! Cognition and MS, it is fairly common for people with MS to complain of cognitive difficulties, such as remembering things, finding the right words and the ability to concentrate. Among MS patients, 50-65% have some degree of cognitive dysfunction.