UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2021

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES ACT OF 1934 |

For the transition period from ____________ to ____________

Commission File Number: 001-12584

SYNTHETIC BIOLOGICS, INC.

(Exact name of Registrant as Specified in Its Charter)

| Nevada | 13-3808303 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| 9605 Medical Center Drive, Suite 270 | |

| Rockville, MD | 20850 |

| (Address of Principal Executive Offices) | (Zip Code) |

(301) 417-4364

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | SYN | NYSE American |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer, “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ¨ | Accelerated Filer | ¨ | |||

| Non-accelerated Filer | x | Smaller Reporting Company | x | |||

| Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

As of May 4, 2021, the registrant had 132,042,538 shares of common stock, $0.001 par value per share, outstanding.

SYNTHETIC BIOLOGICS, INC.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In particular, statements contained in this Quarterly Report on Form 10-Q, including but not limited to, statements regarding the timing of our clinical trials, the development and commercialization of our pipeline products, the sufficiency of our cash, our ability to finance our operations and business initiatives and obtain funding for such activities and the timing of any such financing, our future results of operations and financial position, business strategy and plan prospects, or costs and objectives of management for future research, development or operations, are forward-looking statements. These forward-looking statements relate to our future plans, objectives, expectations and intentions and may be identified by words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “seeks,” “goals,” “estimates,” “predicts,” “potential” and “continue” or similar words. Readers are cautioned that these forward-looking statements are based on our current beliefs, expectations and assumptions and are subject to risks, uncertainties, and assumptions that are difficult to predict, including those identified below, under Part II, Item 1A. “Risk Factors” and elsewhere in this Quarterly Report on Form 10-Q, and those identified under Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2020 (the “2020 Form 10-K”) filed with the Securities and Exchange Commission (the “SEC”) on March 4, 2021. Therefore, actual results may differ materially and adversely from those expressed, projected or implied in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

NOTE REGARDING COMPANY REFERENCES

Throughout this Quarterly Report on Form 10-Q, “Synthetic Biologics,” the “Company,” “we,” “us” and “our” refer to Synthetic Biologics, Inc.

NOTE REGARDING TRADEMARKS

All trademarks, trade names and service marks appearing in this Quarterly Report on Form 10-Q are the property of their respective owners.

SYNTHETIC BIOLOGICS, INC.

FORM 10-Q

TABLE OF CONTENTS

2

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

Synthetic Biologics, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands except share and par value amounts)

| March 31, 2021 | December 31, 2020 | |||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 76,887 | $ | 6,227 | ||||

| Prepaid expenses and other current assets | 1,749 | 1,707 | ||||||

| Total Current Assets | 78,636 | 7,934 | ||||||

| Property and equipment, net | 156 | 174 | ||||||

| Right of use asset | 239 | 279 | ||||||

| Deposits and other assets | 23 | 23 | ||||||

| Total Assets | $ | 79,054 | $ | 8,410 | ||||

| Liabilities and Stockholders' Deficit | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | 621 | $ | 886 | ||||

| Accrued expenses | 854 | 925 | ||||||

| Accrued employee benefits | 350 | 868 | ||||||

| Operating lease liability | 297 | 287 | ||||||

| Total Current Liabilities | 2122 | 2,966 | ||||||

| Lease liability - Long term | 108 | 186 | ||||||

| Total Liabilities | 2,230 | 3,152 | ||||||

| Commitments and Contingencies | ||||||||

| Series A convertible preferred stock, $0.001 par value; 10,000,000 shares authorized; 0 and 120,000 issued and outstanding as of March 31, 2021 and December 31, 2020, respectively | - | 12,798 | ||||||

| Stockholders' Equity (Deficit): | ||||||||

| Series B convertible preferred stock, $1,000 par value; 10,000,000 shares authorized, 0 issued and outstanding and 3,973 issued and outstanding as of March 31, 2021 and December 31, 2020, respectively | - | 2,477 | ||||||

| Common stock, $0.001 par value; 200,000,000 shares authorized, 132,044,866 issued and 132,042,538 outstanding at March 31, 2021 and 29,252,253 issued and 29,249,925 outstanding at December 31, 2020 | 132 | 29 | ||||||

| Additional paid-in capital | 339,019 | 240,821 | ||||||

| Accumulated deficit | (259,553 | ) | (248,094 | ) | ||||

| Total Synthetic Biologics, Inc. and Subsidiaries Equity (Deficit) | 79,598 | (4,767 | ) | |||||

| Non-controlling interest | (2,774 | ) | (2,773 | ) | ||||

| Total Stockholders' Equity (Deficit) | 76,824 | (7,540 | ) | |||||

| Total Liabilities and Stockholders' Equity (Deficit) | $ | 79,054 | $ | 8,410 | ||||

See accompanying notes to unaudited condensed consolidated financial statements.

3

Synthetic Biologics, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(In thousands, except share and per share amounts)

(Unaudited)

| For the three months ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Operating Costs and Expenses: | ||||||||

| General and administrative | $ | 1,419 | $ | 1,393 | ||||

| Research and development | 1,118 | 1,635 | ||||||

| Total Operating Costs and Expenses | 2,537 | 3,028 | ||||||

| Loss from Operations | (2,537 | ) | (3,028 | ) | ||||

| Other Income: | ||||||||

| Interest income | - | 38 | ||||||

| Total Other Income | - | 38 | ||||||

| Net Loss | (2,537 | ) | (2,990 | ) | ||||

| Net Loss Attributable to Non-controlling Interest | (1 | ) | (26 | ) | ||||

| Net Loss Attributable to Synthetic Biologics, Inc. and Subsidiaries | $ | (2,536 | ) | $ | (2,964 | ) | ||

| Series A Preferred Stock Dividends | (24 | ) | (62 | ) | ||||

| Effect of Series A Preferred Stock price adjustment | (7,402 | ) | - | |||||

| Series B Preferred Stock Dividends | (1,497 | ) | (404 | ) | ||||

| Net Loss Attributable to Common Stockholders | $ | (11,459 | ) | $ | (3,430 | ) | ||

| Net Loss Per Share - Basic and Dilutive | $ | (0.13 | ) | $ | (0.20 | ) | ||

| Weighted average number of shares outstanding during the period - Basic and Dilutive | 90,807,693 | 17,093,920 | ||||||

See accompanying notes to unaudited condensed consolidated financial statements.

4

Synthetic Biologics, Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders Equity (Deficit)

(In thousands, except share and par value amounts)

| Common Stock $0.001 Par Value | Series B Preferred | Accumulated | Non-Controlling | Total Stockholders' | ||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | APIC | Deficit | Interest | Deficit | |||||||||||||||||||||||||

| Balance at December 31, 2020 | 29,249,925 | $ | 29 | 3,973 | $ | 2,477 | $ | 240,821 | $ | (248,094 | ) | $ | (2,773 | ) | $ | (7,540 | ) | |||||||||||||||

| Stock-based compensation | - | - | - | - | 101 | - | - | 101 | ||||||||||||||||||||||||

| Stock issued under "at-the-market" offering | 78,685,315 | 79 | - | - | 65,881 | - | - | 65,960 | ||||||||||||||||||||||||

| Warrants Exercised | 11,655,747 | 12 | - | - | 8,030 | - | - | 8,042 | ||||||||||||||||||||||||

| Series A Preferred Stock Dividends | - | - | - | - | - | (24 | ) | - | (24 | ) | ||||||||||||||||||||||

| Effect of Series A Preferred Stock price adjustment | - | - | - | - | 7,402 | (7,402 | ) | - | - | |||||||||||||||||||||||

| Conversion of Series A Preferred Stock to Common | 8,996,768 | 9 | - | - | 12,813 | - | - | 12,822 | ||||||||||||||||||||||||

| Conversion of Series B Preferred Stock to Common | 3,454,783 | 3 | (3,973 | ) | (2,477 | ) | 3,971 | (1,497 | ) | - | - | |||||||||||||||||||||

| Net loss | - | - | - | - | - | (2,536 | ) | - | (2,536 | ) | ||||||||||||||||||||||

| Non-controlling interest | - | - | - | - | - | - | (1 | ) | (1 | ) | ||||||||||||||||||||||

| Balance at March 31, 2021 | 132,042,538 | $ | 132 | - | $ | - | $ | 339,019 | $ | (259,553 | ) | $ | (2,774 | ) | $ | 76,824 | ||||||||||||||||

| Common Stock $0.001 Par Value | Series B Preferred | Accumulated | Non-Controlling | Total Stockholders' | ||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | APIC | Deficit | Interest | Equity | |||||||||||||||||||||||||

| Balance at December 31, 2019 | 16,806,430 | $ | 17 | 7,638 | $ | 4,761 | $ | 232,580 | $ | (235,537 | ) | $ | (2,878 | ) | $ | (1,057 | ) | |||||||||||||||

| Stock-based compensation | - | - | - | - | 83 | - | - | 83 | ||||||||||||||||||||||||

| Series A Preferred Stock Dividends | - | - | - | - | - | (62 | ) | - | (62 | ) | ||||||||||||||||||||||

| Issuance of SYN Biomics Stock | - | - | - | - | - | - | 26 | 26 | ||||||||||||||||||||||||

| Conversion of Series B Preferred Stock to Common | 933,045 | 1 | (1,073 | ) | (669 | ) | 1,072 | (404 | ) | - | - | |||||||||||||||||||||

| Net loss | - | - | - | - | - | (2,964 | ) | - | (2,964 | ) | ||||||||||||||||||||||

| Non-controlling interest | - | - | - | - | - | - | (26 | ) | (26 | ) | ||||||||||||||||||||||

| Balance at March 31, 2020 | 17,739,475 | $ | 18 | 6,565 | $ | 4,092 | $ | 233,735 | $ | (238,967 | ) | $ | (2,878 | ) | $ | (4,000 | ) | |||||||||||||||

See accompanying notes to unaudited condensed consolidated financial statements.

5

Synthetic Biologics, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| For the Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Cash Flows From Operating Activities: | ||||||||

| Net loss | $ | (2,537 | ) | $ | (2,990 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Stock-based compensation | 101 | 83 | ||||||

| Subsidiary stock issued to vendor | - | 26 | ||||||

| Depreciation | 33 | 58 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses and other current assets | (42 | ) | 297 | |||||

| Right of use asset | 39 | 33 | ||||||

| Accounts payable | (265 | ) | (1,068 | ) | ||||

| Accrued expenses | (71 | ) | (714 | ) | ||||

| Accrued employee benefits | (518 | ) | (626 | ) | ||||

| Lease liability | (68 | ) | (59 | ) | ||||

| Net Cash Used In Operating Activities | (3,328 | ) | (4,960 | ) | ||||

| Cash Flows from Investing Activities | ||||||||

| Purchase of property and equipment | (14 | ) | - | |||||

| Net Cash Used in Investing Activities | (14 | ) | - | |||||

| Cash Flows from Financing Activities | ||||||||

| Proceeds from "at the market" stock issuance | 65,960 | - | ||||||

| Proceeds from issuance of common stock for warrant exercises | 8,042 | - | ||||||

| Net Cash Provided by Financing Activities | 74,002 | - | ||||||

| Net increase (decrease) in cash and cash equivalents | 70,660 | (4,960 | ) | |||||

| Cash and cash equivalents at the beginning of this period | 6,227 | 15,045 | ||||||

| Cash and cash equivalents at the end of this period | $ | 76,887 | $ | 10,085 | ||||

| Noncash Financing Activities: | ||||||||

| Effect of Series A Preferred Stock price adjustment | $ | 7,402 | $ | - | ||||

| Conversion of Series B Preferred Stock | $ | 2,477 | $ | 669 | ||||

| Deemed dividends for accretion of Series B Preferred Stock discount | $ | 1,497 | $ | 404 | ||||

| In-kind dividends paid in preferred stock | $ | 23 | $ | 62 | ||||

See accompanying notes to unaudited condensed consolidated financial statements.

6

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Organization, Nature of Operations and Basis of Presentation

Description of Business

Synthetic Biologics, Inc. (the “Company” or “Synthetic Biologics”) is a diversified clinical-stage company developing therapeutics designed to prevent and treat gastrointestinal (GI) diseases in areas of high unmet need. The Company’s lead clinical development candidates are: (1) SYN-004 (ribaxamase) which is designed to degrade certain commonly used intravenous (IV) beta-lactam antibiotics within the gastrointestinal (GI) tract to prevent (a) microbiome damage, (b) Clostridioides difficile infection (CDI), (c) overgrowth of pathogenic organisms, (d) the emergence of antimicrobial resistance (AMR) and (e) acute graft-versus-host-disease (aGVHD) in allogeneic hematopoietic cell transplant (HCT) recipients, and (2) SYN-020, a recombinant oral formulation of the enzyme intestinal alkaline phosphatase (IAP) produced under Current Good Manufacturing Practice (cGMP) conditions and intended to treat both local GI and systemic diseases.

Basis of Presentation

The accompanying condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) for interim financial information. Accordingly, they do not include all of the information and notes required by Accounting Principles Generally Accepted in the United States of America (“U.S. GAAP”) for complete financial statements. The accompanying condensed consolidated financial statements include all adjustments, comprised of normal recurring adjustments, considered necessary by management to fairly state the Company’s results of operations, financial position and cash flows. The operating results for the interim periods are not necessarily indicative of results that may be expected for any other interim period or for the full year. These condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s 2020 Form 10-K. The interim results for the three months ended March 31, 2021 are not necessarily indicative of results for the full year.

The condensed consolidated financial statements are prepared in conformity with U.S. GAAP, which requires the use of estimates, judgments and assumptions that affect the amounts of assets and liabilities at the reporting date and the amounts of revenue and expenses in the periods presented. The Company believes that the accounting estimates employed are appropriate and the resulting balances are reasonable; however, due to the inherent uncertainties in making estimates, actual results may differ from the original estimates, requiring adjustments to these balances in future periods.

Recent Accounting Pronouncements and Developments

In August 2020, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2020-06 Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity. This ASU amends the guidance on convertible instruments and the derivatives scope exception for contracts in an entity’s own equity and improves and amends the related earnings per share guidance for both Subtopics. The ASU will be effective for annual reporting periods after December 15, 2023 and interim periods within those annual periods and early adoption is permitted in annual reporting periods ending after December 15, 2020. The Company is currently assessing the impact of ASU 2020-06 on its consolidated financial statements.

7

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

1. Organization, Nature of Operations and Basis of Presentation – (continued)

Impairment of Long-Lived Assets

Long-lived assets include property, equipment and right-of-use assets. In accordance with ASC 360, Property, Plant and Equipment (“ASC 360”), management reviews the Company’s long-lived assets for impairment annually or whenever events or changes in circumstances indicate that the carrying amount of an asset may not be fully recoverable. The Company determines the extent to which an asset may be impaired based upon its expectation of the asset’s future usability as well as whether there is reasonable assurance that the future cash flows associated with the asset will be in excess of its carrying amount. If the total of the expected undiscounted future cash flows is less than the carrying amount of the asset, a loss is recognized for the difference between the fair value and the carrying value of the asset. The Company identified COVID-19 as a triggering event and performed a qualitative assessment of the fair value of its long-lived assets. The results from this analysis determined that it is still more likely than not that the fair value of its long-lived assets remain higher than the carrying value of these assets. As a result, no impairment charges were recorded during the three months ended March 31, 2021 and 2020.

2. Fair Value of Financial Instruments

Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurement, defines fair value as the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is determined based upon assumptions that market participants would use in pricing an asset or liability. Fair value measurements are rated on a three-tier hierarchy as follows:

| · | Level 1 inputs: Quoted prices (unadjusted) for identical assets or liabilities in active markets; |

| · | Level 2 inputs: Inputs, other than quoted prices, included in Level 1 that are observable either directly or indirectly; and |

| · | Level 3 inputs: Unobservable inputs for which there is little or no market data, which require the reporting entity to develop its own assumptions. |

In many cases, a valuation technique used to measure fair value includes inputs from multiple levels of the fair value hierarchy described above. The lowest level of significant input determines the placement of the entire fair value measurement in the hierarchy.

The carrying amounts of the Company’s short-term financial instruments, including cash and cash equivalents, other current assets, accounts payable and accrued liabilities approximate fair value due to the relatively short period to maturity for these instruments.

The Company uses Monte Carlo simulations to estimate the fair value of its stock warrants. In using this model, the fair value is determined by applying Level 3 inputs for which there is little or no observable market data, requiring the Company to develop its own assumptions. The assumptions used in calculating the estimated fair value of the warrants represent the Company’s best estimates; however, these estimates involve inherent uncertainties and the application of management judgment. As a result, if factors change and different assumptions are used, the warrant liability and the change in estimated fair value could be materially different.

8

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

3. Selected Balance Sheet Information

Prepaid expenses and other current assets (in thousands)

| March 31, 2021 | December 31, 2020 | |||||||

| Prepaid clinical research organizations | $ | 1,138 | $ | 470 | ||||

| Prepaid insurances | 442 | 639 | ||||||

| Prepaid consulting, subscriptions and other expenses | 169 | 90 | ||||||

| Stock sales receivable | - | 469 | ||||||

| Prepaid manufacturing expenses | - | 39 | ||||||

| Total | $ | 1,749 | $ | 1,707 | ||||

Prepaid clinical research organizations (CROs) expense is classified as a current asset. The Company makes payments to the CROs based on agreed upon terms that include payments in advance of study services.

Property and equipment, net (in thousands)

| March 31, 2021 | December 31, 2020 | |||||||

| Computers and office equipment | $ | 828 | $ | 813 | ||||

| Leasehold improvements | 439 | 439 | ||||||

| Software | 11 | 11 | ||||||

| 1,278 | 1,263 | |||||||

| Less: accumulated depreciation and amortization | (1,122 | ) | (1,089 | ) | ||||

| Total | $ | 156 | $ | 174 | ||||

Accrued expenses (in thousands)

| March 31, 2021 | December 31, 2020 | |||||||

| Accrued clinical consulting services | $ | 669 | $ | 700 | ||||

| Accrued vendor payments | 137 | 225 | ||||||

| Accrued manufacturing costs | 46 | - | ||||||

| Other accrued expenses | 2 | - | ||||||

| Total | $ | 854 | $ | 925 | ||||

Accrued employee benefits (in thousands)

| March 31, 2021 | December 31, 2020 | |||||||

| Accrued bonus expense | $ | 180 | $ | 724 | ||||

| Accrued vacation expense | 170 | 144 | ||||||

| Total | $ | 350 | $ | 868 | ||||

9

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

4. Stock-Based Compensation

Stock Incentive Plans

On March 20, 2007, the Company’s Board of Directors approved the 2007 Stock Incentive Plan (the “2007 Stock Plan”) for the issuance of up to 71,429 shares of common stock to be granted through incentive stock options, nonqualified stock options, stock appreciation rights, dividend equivalent rights, restricted stock, restricted stock units and other stock-based awards to officers, other employees, directors and consultants of the Company and its subsidiaries. This plan was approved by the stockholders on November 2, 2007. The exercise price of stock options under the 2007 Stock Plan was determined by the compensation committee of the Board of Directors and could be equal to or greater than the fair market value of the Company’s common stock on the date the option is granted. The total number of shares of stock with respect to which stock options and stock appreciation rights may be granted to any one employee of the Company or a subsidiary during any one-year period under the 2007 stock plan shall not exceed 7,143. Options become exercisable over various periods from the date of grant and generally expire ten years after the grant date. As of March 31, 2021, there were 5,145 options issued and outstanding under the 2007 Stock Plan.

On November 2, 2010, the Board of Directors and stockholders adopted the 2010 Stock Incentive Plan (“2010 Stock Plan”) for the issuance of up to 85,714 shares of common stock to be granted through incentive stock options, nonqualified stock options, stock appreciation rights, dividend equivalent rights, restricted stock, restricted stock units and other stock-based awards to officers, other employees, directors and consultants of the Company and its subsidiaries. On October 22, 2013, the stockholders approved and adopted an amendment to the Company’s 2010 Stock Plan to increase the number of shares of Company’s common stock reserved for issuance under the Plan from 85,714 to 171,429; on May 15, 2015, increased the number of shares from 171,429 to 228,572; on August 25, 2016, increased the number of shares from 228,572 to 400,000; on September 7, 2017, increased the number of shares from 400,000 to 500,000; on September 24, 2018 increased the number of shares from 500,000 to 1,000,000; and on September 5, 2019, increased the number of shares from 1,000,000 to 4,000,000. The exercise price of stock options under the 2010 Stock Plan is determined by the compensation committee of the Board of Directors and may be equal to or greater than the fair market value of the Company’s common stock on the date the option is granted. Options become exercisable over various periods from the date of grant and expire between five and ten years after the grant date. As of March 31, 2021, there were 2,452,273 options issued and outstanding under the 2010 Stock Plan.

On September 17, 2020, the stockholders approved and adopted the 2020 Stock Incentive Plan (“2020 Stock Plan”) for the issuance of up to 4,000,000 shares of Common Stock to be granted through incentive stock options, nonqualified stock options, stock appreciation rights, dividend equivalent rights, restricted stock, restricted stock units and other stock-based awards to officers, other employees, directors and consultants of the Company and its subsidiaries. As of March 31, 2021, there were 1,540,000 options issued and outstanding under the 2010 Stock Plan.

In the event of an employee’s termination, the Company will cease to recognize compensation expense for that employee. Stock forfeitures are recognized as incurred. There is no deferred compensation recorded upon initial grant date. Instead, the fair value of the stock-based payment is recognized over the stated vesting period.

The Company has applied fair value accounting for all stock-based payment awards since inception. The fair value of each option granted is estimated on the date of grant using the Black-Scholes option pricing model. There were no options granted during the three months ended March 31, 2021 and 2020.

10

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

4. Stock-Based Compensation – (continued)

Expected dividends —The Company has never declared or paid dividends on its common stock and has no plans to do so in the foreseeable future.

Expected volatility—Volatility is a measure of the amount by which a financial variable such as a share price has fluctuated (historical volatility) or is expected to fluctuate (expected volatility) during a period. The expected volatility assumption is derived from the historical volatility of the Company’s common stock over a period approximately equal to the expected term.

Risk-free interest rate—The assumed risk free rate used is a zero coupon U.S. Treasury security with a maturity that approximates the expected term of the option.

Expected life of the option—The period of time that the options granted are expected to remain unexercised. Options granted during the year have a maximum term of seven years. The Company estimates the expected life of the option term based on the weighted average life between the dates that options become fully vested and the maximum life of options granted.

The Company records stock-based compensation based upon the stated vesting provisions in the related agreements. The vesting provisions for these agreements have various terms as follows:

| · | immediate vesting, |

| · | in full on the one-year anniversary date of the grant date, |

| · | half vesting immediately and the remaining over three years, |

| · | quarterly over three years, |

| · | annually over three years, |

| · | one-third immediate vesting and the remaining annually over two years, |

| · | one-half immediate vesting and the remaining over nine months, |

| · | one-quarter immediate vesting and the remaining over three years, |

| · | one-quarter immediate vesting and the remaining over 33 months, |

| · | monthly over one year, and |

| · | monthly over three years. |

11

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

4. Stock-Based Compensation– (continued)

A summary of stock option activity for the three months ended March 31, 2021 and the year ended December 31, 2020 is as follows:

| Options | Weighted Average Exercise Price |

Weighted Average Remaining Contractual Life |

Aggregate Intrinsic Value |

|||||||||||||

| Balance - December 31, 2019 | 2,502,012 | $ | 3.62 | 6.51 years | $ | 153,353 | ||||||||||

| Granted | 1,540,000 | 0.42 | ||||||||||||||

| Exercised | - | - | ||||||||||||||

| Expired | (14,944 | ) | 17.57 | |||||||||||||

| Forfeited | (29,650 | ) | 0.55 | |||||||||||||

| Balance - December 31, 2020 | 3,997,418 | 2.35 | 6.09 years | - | ||||||||||||

| Granted | - | - | ||||||||||||||

| Exercised | - | - | ||||||||||||||

| Expired | - | - | ||||||||||||||

| Forfeited | - | - | ||||||||||||||

| Balance - March 31, 2021 - outstanding | 3,997,418 | $ | 2.35 | 5.53 years | $ | 856,227 | ||||||||||

| Balance - March 31, 2021 - exercisable | 1,645,161 | $ | 5.10 | 4.52 years | $ | 268,034 | ||||||||||

| Grant date fair value of options granted – three months ended March 31, 2021 | $ | - | ||||||||||||||

| Weighted average grant date fair value – three months ended March 31, 2021 | $ | - | ||||||||||||||

| Grant date fair value of options granted – year ended December 31, 2020 | $ | 412,000 | ||||||||||||||

| Weighted average grant date fair value – year ended December 31, 2020 | $ | 0.27 | ||||||||||||||

Stock-based compensation expense included in general and administrative expenses and research and development expenses relating to stock options issued to employees for the three months ended March 31, 2021 and 2020 was $49,000 and $55,000, respectively. Stock-based compensation expense included in general and administrative expenses and research and development expenses relating to stock options issued to consultants for the three months ended March 31, 2021 and 2020 were $52,000 and $28,000, respectively.

As of March 31, 2021, total unrecognized stock-based compensation expense related to stock options was $585,000, which is expected to be expensed through February 2023.

The FASB’s guidance for stock-based payments requires cash flows from excess tax benefits to be classified as a part of cash flows from operating activities. Excess tax benefits are realized tax benefits from tax deductions for exercised options in excess of the deferred tax asset attributable to stock compensation costs for such options. The Company did not record any excess tax benefits during the three months ended March 31, 2021 and 2020.

12

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

5. Stock Warrants

On October 15, 2018, the Company closed its underwritten public offering pursuant to which it received gross proceeds of approximately $18.6 million before deducting underwriting discounts, commissions and other offering expenses payable by the Company and sold an aggregate of (i) 2,520,000 Class A Units (the “Class A Units”), with each Class A Unit consisting of one share of the Common Stock, and one five-year warrant to purchase one share of Common Stock at an initial exercise price of $1.38 per share, which subsequently was reduced to $0.69 per share (each a “Warrant” and collectively, the “Warrants”), with each Class A Unit to be offered to the public at a public offering price of $1.15, and (ii) 15,723 Class B Units (the “Class B Units”, and together with the Class A Units, the “Units”), with each Class B Unit offered to the public at a public offering price of $1,000 per Class B Unit and consisting of one share of the Company’s Series B Convertible Preferred Stock (the “Series B Preferred Stock”), with a stated value of $1,000 and convertible into shares of Common Stock at the stated value divided by a conversion price of $1.15 per share, with all shares of Series B Preferred Stock convertible into an aggregate of 13,672,173 shares of Common Stock, and issued with an aggregate of 13,672,173 Warrants. On November 16, 2020, the exercise price of the Warrants was reduced from $1.38 per Warrant per full share of the Company’s common stock, $0.001 par value per share (the “Common Stock”), to $0.69 per Warrant per full share of Common Stock in accordance with the anti-dilution terms of the Warrant. The reduction was the result of the issuance of shares of Common Stock by the Company through its “at the market offering” facility. The effect of the change in the exercise price of the warrants as a result of the triggering of the down round protection clause in the Warrants was recorded as a deemed dividend of $880,000, which reduces the income available to common stockholders. In addition, pursuant to the underwriting agreement that the Company had entered into with A.G.P./Alliance Global Partners (the “Underwriters”), as representative of the underwriters, the Company granted the Underwriters a 45 day option (the “Over-allotment Option”) to purchase up to an additional 2,428,825 shares of Common Stock and/or additional Warrants to purchase an additional 2,428,825 shares of Common Stock. The Underwriters partially exercised the Over-allotment Option by electing to purchase from the Company additional Warrants to purchase 1,807,826 shares of Common Stock.

The Warrants are immediately exercisable at a price of $1.38 ($0.69 effective November 16, 2020) per share of Common Stock (which was 120% of the public offering price of the Class A Units) and expire on October 15, 2023. If, at the time of exercise, there is no effective registration statement registering, or no current prospectus available for, the issuance of the shares of Common Stock to the holder, then the Warrants may only be exercised through a cashless exercise. No fractional shares of Common Stock will be issued in connection with the exercise of a Warrant. In lieu of fractional shares, the holder will receive an amount in cash equal to the fractional amount multiplied by the fair market value of any such fractional shares. The Company has concluded that the Warrants are required to be equity classified. The Warrants were valued on the date of grant using Monte Carlo simulations. During the three months ended March 31, 2021, 11,655,747 warrants were exercised for cash proceeds of $8.0 million.

On November 18, 2016, the Company completed a public offering of 714,286 shares of common stock in combination with accompanying warrants to purchase an aggregate of 1,428,571 shares of the common stock. The stock and warrants were sold in combination, with two warrants for each share of common stock sold, a Series A warrant and a Series B warrant, each representing the right to purchase one share of common stock. The purchase price for each share of common stock and accompanying warrants was $35.00. The shares of common stock were immediately separable from the warrants and were issued separately. The initial per share exercise price of the Series A warrants was $50.05 and the per share exercise price of the Series B warrants was $60.20, each subject to adjustment as specified in the warrant agreements. The Series A and Series B warrants could be exercised at any time on or after the date of issuance. The Series A warrants were exercisable until the four-year anniversary of the issuance date. The Series B warrants expired December 31, 2017 and none were exercised prior to expiration. The Series A warrants expired November 18, 2020 and none were exercised prior to expiration. The warrants included a provision, that if the Company were to enter into a certain transaction, as defined in the agreement, the warrants would be purchased from the holder for cash. Accordingly, the Company recorded the warrants as a liability at their estimated fair value on the issuance date of $15.7 million and changes in estimated fair value will be recorded as non-cash income or expense in the Company’s Statement of Operations at each subsequent period. At December 31, 2019, the fair value of the warrant liability was $100. The warrants were valued on the date of grant and on each remeasurement period.

13

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

5. Stock Warrants – (continued)

A summary of all warrant activity for the Company for the quarter ended March 31, 2021 and the year ended December 31, 2020 is as follows:

| Number of Warrants |

Weighted Average |

|||||||

| Balance at December 31, 2019 | 18,714,999 | 3.24 | ||||||

| Granted | - | - | ||||||

| Exercised | - | - | ||||||

| Forfeited | (714,286 | ) | 50.05 | |||||

| Balance at December 31, 2020 | 18,000,713 | $ | 0.69 | |||||

| Granted | - | - | ||||||

| Exercised | 11,655,747 | .69 | ||||||

| Forfeited | - | - | ||||||

| Balance at March 31, 2021 | 6,344,966 | $ | .69 | |||||

On December 26, 2017, the Company entered into a consulting agreement for advisory services for a period of six months. As compensation for such services, the consultant was paid an upfront payment, was paid a monthly fee and on January 24, 2018 was issued a warrant exercisable for 714 shares of the Company’s common stock on the date of issue. The warrant is equity classified and the fair value of the warrant approximated $9,000 and was measured using the Black-Scholes option pricing model.

A summary of all outstanding and exercisable common stock warrants as of March 31, 2021 is as follows:

| Exercise Price | Warrants Outstanding |

Warrants Exercisable |

Weighted Average Remaining Contractual Life |

|||||||||||

| $ | 0.69 | 6,344,252 | 6,344,252 | 2.53 years | ||||||||||

| 18.20 | 714 | 714 | 1.74 years | |||||||||||

| $ | 0.69 | 6,344,966 | 6,344,966 | 2.53 years | ||||||||||

14

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

6. Net Loss per Share

Basic net loss per share is computed by dividing net loss by the weighted average number of common shares outstanding. Diluted net loss per share is computed by dividing net loss by the weighted average number of common shares outstanding including the effect of common share equivalents. Diluted net loss per share assumes the issuance of potential dilutive common shares outstanding for the period and adjusts for any changes in income and the repurchase of common shares that would have occurred from the assumed issuance, unless such effect is anti-dilutive. Net loss attributable to common stockholders for the three months ended March 31, 2021 excludes net loss attributable to non-controlling interest of $0.1 million and includes the accretion of the Series B preferred discount of $1.5 million as a result of converted shares and Series A preferred stock accrued dividends of $0.1 million and the deemed dividend of $7.4 million resulting from the effect of the Series A preferred stock price adjustment during the first quarter of 2021. Net loss attributable to common stockholders for the three months ended March 31, 2020 excludes net loss attributable to non-controlling interest of $0.1 million, includes the accretion of Series B preferred discount of $0.4 million on converted shares and $0.1 million of Series A accrued dividends. There were no shares of common stock underlying Series B Preferred shares convertible to common stock that were excluded from the computations of net loss per common share for the three months ended March 31, 2021 since all remaining Series B preferred stock were converted to common stock. The number of shares of common stock underlying Series B Preferred shares convertible to common stock that were excluded from the computations of net loss per common share for the three months ended March 31, 2020 were 5,708,696. The number of options and warrants for the purchase of common stock that were excluded from the computations of net loss per common share and for the three months ended March 31, 2021 were 3,997,418 and 6,344,966, respectively and for the three months ended March 31, 2020 were 2,502,012 and 18,714,999, respectively, because their effect is anti-dilutive.

7. Non-controlling Interest

The Company’s non-controlling interest is accounted for under ASC 810, Consolidation (“ASC 810”), and represents the minority shareholder’s ownership interest related to the Company’s subsidiary, Synthetic Biomics, Inc. (“SYN Biomics”). In accordance with ASC 810, the Company reports its non-controlling interest in subsidiaries as a separate component of equity in the Consolidated Balance Sheets and reports both net loss attributable to the non-controlling interest and net loss attributable to the Company’s common stockholders on the face of the Consolidated Statements of Operations. On September 5, 2018, the Company entered into an agreement with CSMC for an investigator-sponsored Phase 2b clinical study of SYN-010 to be co-funded by the Company and CSMC (the “Study”). The Study was to provide further evaluation of the efficacy and safety of SYN-010, the Company’s modified-release reformulation of lovastatin lactone, which was exclusively licensed to the Company by CSMC. SYN-010 is designed to reduce methane production by certain microorganisms (M. smithii) in the gut to treat an underlying cause of irritable bowel syndrome with constipation (IBS-C). After the 2018 transaction with CSMC, the Company’s equity interest in SYN Biomics is 83% and the non-controlling stockholder’s interest is 17%. As of March 31, 2021 and 2020, the accumulated net loss attributable to the non-controlling interest is $2.8 million and $2.9 million, respectively.

In consideration of the support provided by CSMC for the Study, the Company paid $328,000 to support the Study and the Company entered into a Stock Purchase Agreement with CSMC pursuant to which the Company, upon the approval of the Study protocol by the Institutional Review Board (IRB) : (i) issued to CSMC fifty thousand (50,000) shares of common stock of the Company; and (ii) transferred to CSMC an additional two million four hundred twenty thousand (2,420,000) shares of common stock of its subsidiary SYN Biomics, Inc. (“Synbiomics”) owned by the Company, such that after such issuance CSMC owns an aggregate of seven million four hundred eighty thousand (7,480,000) shares of common stock of SYN Biomics, representing seventeen percent (17%) of the issued and outstanding shares of SYN Biomics’ common stock. The services rendered are recorded to research and development expense in proportion with the progress of the study and based overall on the fair value of the shares ($285,000) as determined at the date of IRB approval. During the three months ended March 31, 2020, research and development expense recorded related to this transaction approximated $67,000. There was no expense recorded related to this transaction during the three months ended March 31, 2021.

The Agreement also provided CSMC with a right, commencing on the six month anniversary of issuance of the stock under certain circumstances in the event that the shares of stock of SYN Biomics are not then freely tradeable, and subject to NYSE American, LLC approval, to exchange its SYN Biomics shares for unregistered shares of the Company’s common stock, with the rate of exchange based upon the relative contribution of the valuation of SYN Biomics to the public market valuation of the Company at the time of each exchange. The Stock Purchase Agreement also provides for tag-along rights in the event of the sale by the Company of its shares of SYN Biomics.

15

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

7. Non-controlling Interest – (continued)

On September 30, 2020, CSMC MAST formally agreed to discontinue the ongoing Phase 2b investigator-sponsored clinical study of SYN-010 following the results of a planned interim futility analysis. Although it was concluded that SYN-010 was well tolerated, SYN-010 was unlikely to meet its primary endpoint by the time enrollment is completed.

On November 9, 2020, the Company and its subsidiary, Synthetic Biomics, Inc. and CSMC mutually agreed to terminate the exclusive license agreement dated December 5, 2013 and all amendments thereto and the clinical trial agreement relating to SYN-010. The determination to terminate the SYN-010 license agreement was agreed following the completion of a planned interim futility analysis of the Phase 2b investigator-sponsored clinical trial of SYN-010. On September 30, 2020, CSMC (the Company’s SYN-010 clinical development partner) informed the Company that it discontinued the ongoing Phase 2b investigator-sponsored clinical study of SYN-010 IBS-C patients.

8. Common and Preferred Stock

Series B Preferred Stock

On October 15, 2018, the Company closed its underwritten public offering pursuant to which it received gross proceeds of approximately $18.6 million before deducting underwriting discounts, commissions and other offering expenses payable by the Company and sold an aggregate of (i) 2,520,000 Class A Units, with each Class A Unit offered to the public at a public offering price of $1.15, and (ii) 15,723 Class B Units, with each Class B Unit offered to the public at a public offering price of $1,000 per Class B Unit and consisting of one share of the Company’s Series B Preferred Stock, with a stated value of $1,000 and convertible into shares of Common Stock at the stated value divided by a conversion price of $1.15 per share, with all shares of Series B Preferred Stock convertible into an aggregate of 13,672,173 shares of Common Stock, and issued with an aggregate of 13,672,173 October 2018 Warrants. Since the above units are equity instruments, the proceeds were allocated on a relative fair value basis which created the Series B Preferred Stock discount.

In addition, pursuant to the Underwriting Agreement that the Company entered into with the Underwriters on October 10, 2018, the Company granted the Underwriters a 45 day option (the “Over-allotment Option”) to purchase up to an additional 2,428,825 shares of Common Stock and/or additional warrants to purchase an additional 2,428,825 shares of Common Stock. Each Warrant is exercisable for one share of common stock. The Underwriters partially exercised the Over-allotment Option by electing to purchase from the Company additional Warrants to purchase 1,807,826 shares of Common Stock.

The Units were offered by the Company pursuant to a registration statement on Form S-1 (File No. 333-227400), as amended, filed with the SEC, which was declared effective by the SEC on October 10, 2018.

The conversion price of the Series B Preferred Stock and exercise price of the October 2018 Warrants is subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting the Common Stock. The exercise price of the Warrants is subject to adjustment in the event of certain dilutive issuances.

On November 16, 2020, the exercise price of the Warrants was reduced from $1.38 per Warrant per full share of common stock to $0.69 per Warrant per full share of common stock. The reduction was the result of the issuance of shares of Common Stock by the Company through its “at the market offering” facility. The effect of the change in the exercise price of the warrants as a result of the triggering of the down round protection clause in the Warrants was recorded as a deemed dividend in accumulated deficit of $880,000, which reduces the income available to common stockholders for the year ended December 31, 2020.

The October 2018 Warrants are immediately exercisable at a price of $1.38 ($0.69 effective November 16, 2020) per share of common stock (which was 120% of the public offering price of the Class A Units) and will expire on October 15, 2023. If, at the time of exercise, there is no effective registration statement registering, or no current prospectus available for, the issuance of the shares of common stock to the holder, then the October 2018 warrants may only be exercised through a cashless exercise. No fractional shares of common stock will be issued in connection with the exercise of any October 2018 warrants. In lieu of fractional shares, the holder will receive an amount in cash equal to the fractional amount multiplied by the fair market value of any such fractional shares.

16

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

8. Common and Preferred Stock – (continued)

Since the effective conversion price of the Series B Preferred Stock is less than the fair value of the underlying common stock at the date of issuance, there is a beneficial conversion feature (“BCF”) at the issuance date. Because the Series B Preferred Stock has no stated maturity or redemption date and is immediately convertible at the option of the holder, the discount created by the BCF is immediately charged to accumulated deficit as a “deemed dividend” and impacts earnings per share. During the three months ended March 31, 2021 and 2020, 3,973 and 1,073, respectively, shares were converted resulting in the recognition of a deemed dividends of $1.5 million and $404,000, respectively, for the amortization of the Series B Preferred Stock discount upon conversion.

Series A Preferred Stock

On September 11, 2017, the Company entered into a share purchase agreement (the “Purchase Agreement”) with an investor (the “Investor”), pursuant to which the Company offered and sold in a private placement 120,000 shares of its Series A Convertible Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”) for an aggregate purchase price of $12 million, or $100 per share.

The Series A Preferred Stock ranks senior to the shares of the Company’s common stock, and any other class or series of stock issued by the Company with respect to dividend rights, redemption rights and rights to the distribution of assets on any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company. Holders of Series A Preferred Stock are entitled to a cumulative dividend at the rate of 2.0% per annum, payable quarterly in arrears, as set forth in the Certificate of Designation of Series A Preferred Stock classifying the Series A Preferred Stock. The Series A Preferred Stock is convertible at the option of the holders at any time into shares of common stock at an initial conversion price of $0.54 per share which was increased to $18.90 after taking into account the 2018 reverse stock split, subject to certain customary anti-dilution adjustments and was decreased to $1.50 on January 27, 2021, see below.

Any conversion of Series A Preferred Stock may be settled by the Company in shares of common stock only.

The holder’s ability to convert the Series A Preferred Stock into common stock is subject to (i) a 19.99% blocker provision to comply with NYSE American Listing Rules, (ii) if so elected by the Investor, a 4.99% blocker provision that will prohibit beneficial ownership of more than 4.99% of the outstanding shares of the Company’s common stock or voting power at any time, and (iii) applicable regulatory restrictions.

In the event of any liquidation, dissolution or winding-up of the Company, holders of the Series A Preferred Stock are entitled to a preference on liquidation equal to the greater of (i) an amount per share equal to the stated value plus any accrued and unpaid dividends on such share of Series A Preferred Stock (the “Accreted Value”), and (ii) the amount such holders would receive in such liquidation if they converted their shares of Series A Preferred Stock (based on the Accreted Value and without regard to any conversion limitation) into shares of the common stock immediately prior to any such liquidation, dissolution or winding-up (the greater of (i) and (ii), is referred to as the “Liquidation Value”).

Except as otherwise required by law, the holders of Series A Preferred Stock have no voting rights, other than customary protections against adverse amendments and issuance of pari passu or senior preferred stock. Upon certain change of control events involving the Company, prior to the filing of the amendment to the Certificate of Designation for the Series A Preferred Stock described below, the Company will be required to repurchase all of the Series A Preferred Stock at a redemption price equal to the greater of (i) the Accreted Value and (ii) the amount that would be payable upon a change of control (as defined in the Certificate of Designation) in respect of common stock issuable upon conversion of such share of Series A Preferred Stock if all outstanding shares of Series A Preferred Stock were converted into common stock immediately prior to the change of control.

On or at any time after (i) the VWAP (as defined in the Certificate of Designation) for at least 20 trading days in any 30 trading day period is greater than $70.00, subject to adjustment in the case of stock split, stock dividends or the like the Company has the right, after providing notice not less than 6 months prior to the redemption date, to redeem, in whole or in part, on a pro rata basis from all holders thereof based on the number of shares of Series A Preferred Stock then held, the outstanding Series A Preferred Stock, for cash, at a redemption price per share of Series A Preferred Stock of $7,875.00, subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Series A Convertible Preferred Stock or (ii) the five year anniversary of the issue date, the Company shall have the right to redeem, in whole or in part, on a pro rata basis from all holders thereof

17

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

8. Common and Preferred Stock – (continued)

based on the number of shares of Series A Convertible Preferred Stock then held, the outstanding Series A Preferred Stock, for cash, at a redemption price per share equal to the Liquidation Value.

The Series A Preferred Stock is classified as temporary equity due to the shares being redeemable based on contingent events outside of the Company’s control. Since the effective conversion price of the Series A Preferred Stock is less than the fair value of the underlying common stock at the date of issuance, there is a beneficial conversion feature (“BCF”) at the issuance date. Because the Series A Preferred Stock has no stated maturity or redemption date and is immediately convertible at the option of the holder, the discount created by the BCF is immediately charged to accumulated deficit as a “deemed dividend” and impacts earnings per share. During the year ended December 31, 2017, the Company recorded a discount of $6.9 million. Because the Series A Preferred Stock is not currently redeemable, the discount arising from issuance costs was allocated to temporary equity and will not be accreted until such time that redemption becomes probable. The stated dividend rate of 2% per annum is cumulative and the Company accrues the dividend on a quarterly basis (in effect accreting the dividend regardless of declaration because the dividend is cumulative). During the three months ended March 31, 2021 and 2020, the Company accrued dividends of $24,000 and $62,000, respectively. Once the dividend is declared, the Company will reclassify the declared amount from temporary equity to a dividends payable liability. When the redemption of the Series A Preferred Stock becomes probable, the temporary equity will be accreted to redemption value as a deemed dividend.

On January 27, 2021, the Company filed an amendment to the Certificate of Designation for the Series A Preferred Stock to (i) lower the stated Conversion Price through September 30, 2021 and (ii) remove their change in control put, as an inducement for the holder to fully convert its Series A Preferred Stock. The Amendment to the Certificate of Designation for its Series A Convertible Preferred Stock (the “Certificate of Amendment”) with the Secretary of State of the State of Nevada adjusted the conversion price from $18.90 per share to $1.50 per share and removed the redemption upon change of control. The Company received notice from the holder of the Series A Preferred Stock that it was increasing the Maximum Percentage as defined in the “Certificate of Designation” from 4.99% to 9.99%, such increase to be effective 61 days from the date hereof. During the three months ended March 31, 2021, all outstanding shares of Series A Convertible Preferred Stock were converted to approximately 9.0 million shares of the Company’s common stock. There are no remaining shares of the Series A Convertible Preferred stock outstanding after these conversions. During January and February 2021, the Company issued 8,996,768 shares of its common stock upon the conversion effected on such date by the holder of 120,000 shares of its Series A Convertible Preferred Stock. The fair value of the consideration issued to the holder to induce conversion is accounted for as a deemed dividend and increased net loss available to common shareholders for purposes of calculating loss per share. The Company estimated fair value of the inducement consideration of $7.4 million and as a result has recorded a corresponding deemed dividend of $7.4 million during the three months ended March 31, 2021.

B. Riley Securities Sales Agreement

On August 5, 2016, the Company entered into the B. Riley FBR Sales Agreement with FBR Capital Markets & Co. (now known as B. Riley Securities), which enables the Company to offer and sell shares of common stock from time to time through B. Riley Securities, Inc. as the Company’s sales agent. Sales of common stock under the B. Riley Securities Sales Agreement are made in sales deemed to be “at-the-market” equity offerings as defined in Rule 415 promulgated under the Securities Act. B. Riley Securities, Inc. is entitled to receive a commission rate of up to 3.0% of gross sales in connection with the sale of the Common Stock sold on the Company’s behalf. The Company did not sell any shares of common stock during the three months ended March 31, 2020 through the Riley Securities Sales Agreement.

On February 9, 2021, the Company entered into an amended and restated sales agreement with B. Riley Securities, Inc. (“B. Riley”) and A.G.P./Alliance Global Partners (“AGP”) in order to include AGP as an additional sales agent for the Company’s “at the market offering” program (the “Amended and Restated Sales Agreement”). The Sales Agreement amended and restated the At Market Issuance Sales Agreement, dated August 5, 2016, with B. Riley Securities, Inc. (formerly known as B. Riley FBR, Inc.), as amended by amendment no. 1, dated May 7, 2018, to the At Market Issuance Sales Agreement.

During the three months ended March 31, 2021, the Company sold through the At Market Issuance Sales Agreement and the Amended and Restated Sales Agreement approximately 78.7 million shares of the Company’s common stock and received net proceeds of approximately $66.0 million.

18

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

9. Related Party Transactions

On September 5, 2018, the Company entered into an agreement with CSMC for an investigator-sponsored Phase 2b clinical study of SYN-010 to be co-funded by the Company and CSMC (the “Study”). The Study will provide further evaluation of the efficacy and safety of SYN-010, the Company’s modified-release reformulation of lovastatin lactone, which is exclusively licensed to the Company by CSMC. SYN-010 is designed to reduce methane production by certain microorganisms (M. smithii) in the gut to treat an underlying cause of irritable bowel syndrome with constipation (IBS-C).

In consideration of the support provided by CSMC for the Study, the Company entered into a Stock Purchase Agreement with CSMC pursuant to which the Company: (i) issued to CSMC fifty thousand (50,000) shares of common stock of the Company; and (ii) transferred to CSMC an additional two million four hundred twenty thousand (2,420,000) shares of common stock of its subsidiary Synthetic Biomics, Inc. (“SYN Biomics”) owned by the Company, such that after such issuance CSMC owns an aggregate of seven million four hundred eighty thousand (7,480,000) shares of common stock of SYN Biomics, representing seventeen percent (17%) of the issued and outstanding shares of SYN Biomics’ common stock.

The Agreement also provided CSMC with a right, commencing on the six month anniversary of issuance of the stock under certain circumstances in the event that the shares of stock of SYN Biomics are not then freely tradeable, and subject to NYSE American, LLC approval, to exchange its SYN Biomics shares for unregistered shares of the Company’s common stock, with the rate of exchange based upon the relative contribution of the valuation of SYN Biomics to the public market valuation of the Company at the time of each exchange. The Stock Purchase Agreement also provides for tag-along rights in the event of the sale by the Company of its shares of SYN Biomics.

On September 30, 2020, CSMC MAST formally agreed to discontinue the ongoing Phase 2b investigator-sponsored clinical study of SYN-010 following the results of a planned interim futility analysis. Although it was concluded that SYN-010 was well tolerated, SYN-010 was unlikely to meet its primary endpoint by the time enrollment is completed.

On November 9, 2020, the Company and its subsidiary, Synthetic Biomics, Inc. and CSMC mutually agreed to terminate the exclusive license agreement dated December 5, 2013 and all amendments thereto and the clinical trial agreement relating to SYN-010. The determination to terminate the SYN-010 license agreement was agreed following the completion of a planned interim futility analysis of the Phase 2b investigator-sponsored clinical trial of SYN-010.

In December 2013, through the Company’s subsidiary, Synthetic Biomics, Inc., the Company entered into a worldwide exclusive license agreement with CSMC and acquired the rights to develop products for therapeutic and prophylactic treatments of acute and chronic diseases, including the development of SYN-010 to target IBS-C. The Company licensed from CSMC a portfolio of intellectual property comprised of several U.S. and foreign patents and pending patent applications for various fields of use, including IBS-C, obesity and diabetes. An investigational team led by Mark Pimentel, M.D. at CSMC discovered that these products may reduce the production of methane gas by certain GI microorganisms. During the three months ended March 31, 2021 and 2020, the Company did not owe and did not pay CSMC for milestone payments related to this license agreement.

19

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

10. Commitments and Contingencies

Leases

All of the Company’s existing leases as of March 31, 2021 are classified as operating leases. As of March 31, 2021, the Company has one material operating lease for facilities with a remaining term expiring in 2022. The existing lease has fair value renewal options, none of which are considered certain of being exercised or included in the minimum lease term. The discount rate used in the calculation of the lease liability was 9.9%. The rates implicit within the Company's leases are generally not determinable, therefore, the Company's incremental borrowing rate is used to determine the present value of lease payments. The determination of the Company’s incremental borrowing rate requires judgment. Because the Company currently has no outstanding debt, the incremental borrowing rate for each lease is primarily based on publicly available information for companies within the same industry and with similar credit profiles. The rate is then adjusted for the impact of collateralization, the lease term and other specific terms included in the Company’s lease arrangements. The incremental borrowing rate is determined at lease commencement, or as of January 1, 2019 for operating leases in existence upon adoption of ASC 842. The incremental borrowing rate is subsequently reassessed upon a modification to the lease arrangement. ROU assets are subsequently assessed for impairment in accordance with the Company’s accounting policy for long-lived assets. Operating lease costs are presented as part of general and administrative expenses in the condensed consolidated statements of operations, and for the three months ended March 31, 2021 and 2020 approximated $51,000 and $50,000, respectively. During the same periods, operating cash flows used for operating leases approximated $79,000 and $77,000, respectively, and right of use assets exchanged for operating lease obligations was $0. The day one non-cash addition of right of use assets due to adoption of ASC 842 was $538,000.

A maturity analysis of our operating leases as of March 31, 2021 is as follows (amounts in thousands of dollars):

| Future undiscounted cash flow for the years ending March 31: | ||||

| 2021 | $ | 242 | ||

| 2022 | 192 | |||

| Total | $ | 434 | ||

| Discount factor | $ | (29 | ) | |

| Lease liability | $ | 405 | ||

| Amount due within 12 months | $ | (297 | ) | |

| Lease liability – long term | $ | 108 | ||

20

Synthetic Biologics, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

10. Commitments and Contingencies – (continued)

Risks and Uncertainties

On January 30, 2020, the World Health Organization (“WHO”) announced a global health emergency because of a new strain of coronavirus originating in Wuhan, China (the “COVID-19” outbreak) and the risks to the international community as the virus spreads globally beyond its point of origin. In March 2020, the WHO classified the COVID-19 outbreak as a pandemic, based on the rapid increase in exposure globally.

As COVID-19 continued to spread around the globe, the Company experienced disruptions that impacted its business and clinical trials, including halting the postponement of clinical site initiation of the Phase 1b/2a clinical trial of SYN-004. The extent to which the COVID-19 pandemic impacts the Company’s business, the clinical development of SYN-004 (ribaxamase) and SYN-020, the business of the Company’s suppliers and other commercial partners, the Company’s corporate development objectives and the value of and market for the Company’s common stock, will depend on future developments that are highly uncertain and cannot be predicted with confidence at this time, such as the ultimate duration of the pandemic, travel restrictions, quarantines, social distancing and business closure requirements in the United States, Europe and other countries, and the effectiveness of actions taken globally to contain and treat the disease. The global economic slowdown, the overall disruption of global healthcare systems and the other risks and uncertainties associated with the pandemic could have a material adverse effect on the Company’s business, financial condition, results of operations and growth prospects. In addition, to the extent the ongoing COVID-19 pandemic adversely affects the Company’s business and results of operations, it may also have the effect of heightening many of the other risks and uncertainties which the Company faces.

21

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion should be read in conjunction with our unaudited condensed consolidated financial statements and notes thereto included in this Quarterly Report on Form 10-Q, and our audited consolidated financial statements and notes thereto for the year ended December 31, 2020 included in our 2020 Form 10-K. This discussion contains forward-looking statements reflecting our current expectations that involve risks and uncertainties. See “Note Regarding Forward-Looking Statements” for a discussion of the uncertainties, risks and assumptions associated with these statements. Our actual results and the timing of events could differ materially from those expressed or implied by the forward-looking statements due to important factors and risks including, but not limited to, those set forth below under “Risk Factors” and elsewhere herein, and those identified under Part I, Item 1A of our 2020 Form 10-K.

Overview

We are a diversified clinical-stage company developing therapeutics designed to treat gastrointestinal (GI) diseases in areas of high unmet need. Our lead clinical development candidates are: (1) SYN-004 (ribaxamase) which is designed to degrade certain commonly used intravenous (IV) beta-lactam antibiotics within the GI tract to prevent microbiome damage, Clostridioides difficile infection (CDI), overgrowth of pathogenic organisms, the emergence of antimicrobial resistance (AMR), and acute graft-versus-host-disease (aGVHD) in allogeneic hematopoietic cell transplant (HCT) recipients, and (2) SYN-020, a recombinant oral formulation of the enzyme intestinal alkaline phosphatase (IAP) produced under cGMP conditions and intended to treat both local GI and systemic diseases.

We plan to explore and evaluate a range of strategic options, which may include: in-licensing opportunities; evaluation of potential acquisitions; or other potential strategic transactions. In the meantime, we remain focused on working with our clinical development partners to advance the planned Phase 1b/2a clinical trial of SYN-004 (ribaxamase) in allogeneic hematopoietic cell transplant (HCT) patients, and advancing the clinical development program for SYN-020 intestinal alkaline phosphatase (IAP) in multiple potential indications.

We are continuing to assess the potential impact of the COVID-19 pandemic. We are in close contact with our clinical development partners in order to assess the impact of COVID-19 on our studies and current timelines and costs. While we currently do not anticipate any interruptions in our operations due to COVID-19, it is possible that if the COVID-19 pandemic persists for an extended period of time, we could experience significant disruptions to our clinical development timelines due to the COVID-19 pandemic, which would adversely affect our business, financial condition, results of operations and growth prospects.

In response to the spread of COVID-19 as well as public health directives and orders, we have implemented a number of measures designed to ensure employee safety and business continuity. We have limited access to our offices and are allowing our administrative employees to continue their work outside of our offices in order to support the community efforts to reduce the transmission of COVID-19 and protect employees, complying with guidance from federal, state and local government and health authorities. The full extent to which the COVID-19 outbreak will directly or indirectly impact our business, results of operations and financial condition will depend on future developments that are highly uncertain and cannot be accurately predicted. The effects of the governmental orders and our work-from-home policies may negatively impact productivity, disrupt our business and delay our clinical programs and timelines, the magnitude of which will depend, in part, on the length and severity of the restrictions and other limitations on our ability to conduct our business in the ordinary course.

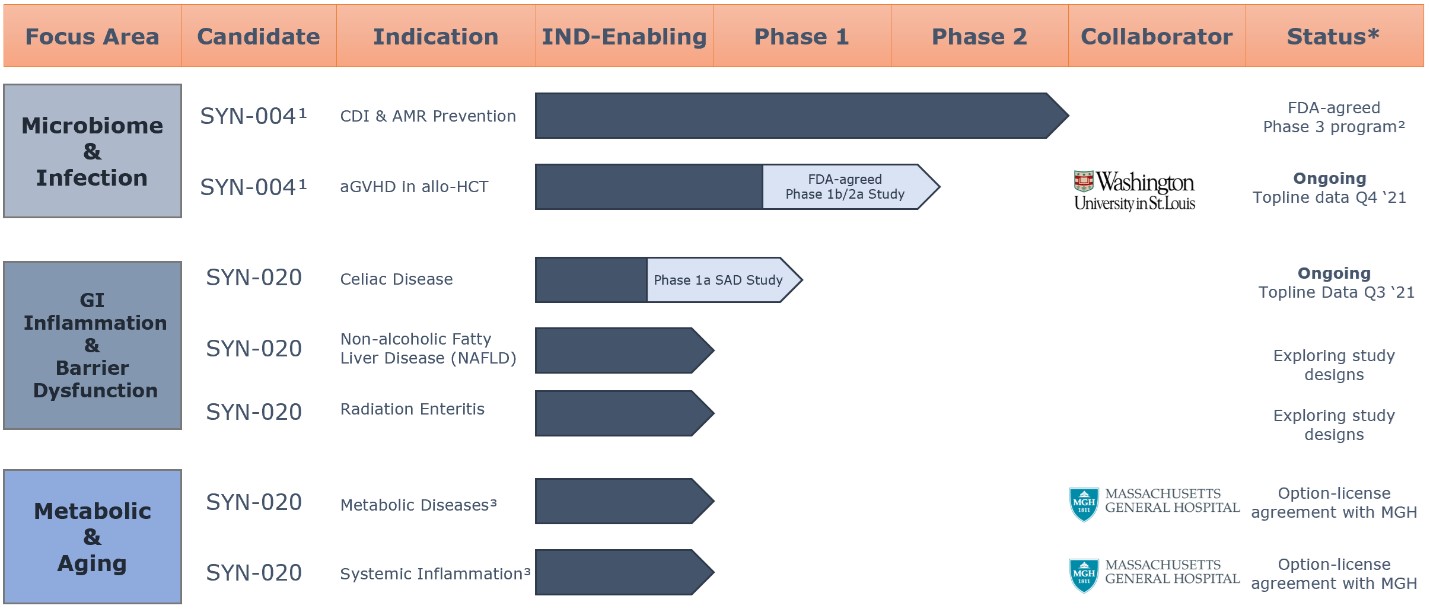

Our Product Pipeline:

*Based on management’s current beliefs and expectations

aGVHD acute graft-vs-host disease; allo-HCT allogeneic hematopoietic cell transplant patients; AMR antimicrobial resistance; CDI Clostridioides difficile infection. SAD single ascending dose

¹Additional products with preclinical proof-of-concept include SYN-006 (carbapenemase) to prevent aGVHD and infection by carbapenem resistant enterococci and SYN-007 (ribaxamase) DR to prevent antibiotic associated diarrhea with oral β-lactam antibiotics.

²Dependent on funding/partnership.

³Announced option-license agreement with Massachusetts General Hospital to develop SYN-020 in several potential indications related to inflammation and gut barrier dysfunction.

Additional pipeline products with preclinical proof-of-concept include SYN-006 (carbapenemase) being designed to prevent aGVHD, microbiome damage and infection due to treatment with carbapenem antibiotics, and SYN-007 (ribaxamase) DR being designed to prevent antibiotic associated diarrhea with oral β-lactam antibiotics.

22

Summary of Clinical and Preclinical Programs

| Therapeutic Area | Product Candidate |

Current Status | ||

| Prevention of microbiome damage, CDI, overgrowth of pathogenic organisms, AMR, and aGVHD in allogeneic HCT recipients (Degrade IV beta-lactam antibiotics) |

SYN-004 (ribaxamase) |

· Announced outcomes from End of Phase 2 meeting, including Food and Drug Administration (FDA)-proposed criteria for Phase 3 clinical efficacy and safety which, if achieved, may support submission for marketing approval on the basis of a single Phase 3 clinical trial (Q4 2018)

· Clarified market/potential partner needs and identified potential additional indications in specialty patient populations such as allogeneic hematopoietic cell transplant (HCT) patients

· Announced clinical trial agreement (CTA) with Washington University School of Medicine to conduct a Phase 1b/2a clinical trial to evaluate safety, tolerability and pharmacokinetics in up to 36 evaluable adult allogeneic HCT recipients (Q3 2019)

· Received official meeting minutes from FDA Type-C meeting held on December 2, 2019 to discuss development in allogeneic HCT recipients who are administered IV beta-lactam antibiotics in response to fever (Q1 2020)

· Received written notification from the FDA informing the Company that the FDA determined the Phase 1b/2a clinical program in adult allogeneic hematopoietic cell transplant (HCT) recipients may proceed per the submitted clinical program protocol (Q3 2020)

· Washington University began enrollment and the first patient was dosed in the first of three antibiotic cohorts for the Phase 1b/2a clinical trial of SYN-004 in adult HCT recipients (Q2 2021) |

23

| Preserve gut barrier, treat local GI inflammation, and restore gut microbiome | SYN-020 (oral IAP enzyme) |

· Generated high expressing manufacturing cell lines for intestinal alkaline phosphatase (IAP) (1H 2017)

· Identified basic Drug Supply manufacturing process and potential tablet formulation (2H 2017)

· Identified potential clinical indications with unmet medical need including enterocolitis associated with radiation therapy for cancer (Q1 2019)

· Completed pre-IND (Investigational New Drug) meeting with the FDA to clarify requirements for IND-enabling toxicology studies and manufacturing requirements (Q2 2019)

· Entered into an agreement with Massachusetts General Hospital (“MGH”) granting the Company an option for an exclusive license to intellectual property and technology related to the use of IAP to maintain GI and microbiome health, diminish systemic inflammation, and treat age-related diseases (Q2 2020)

· Submitted IND application with U.S. FDA supporting an initial indication for the treatment of radiation enteropathy secondary to pelvic cancer therapy (Q2 2020)

· Received study-may-proceed letter from U.S. FDA to conduct a Phase 1 single ascending dose study in healthy volunteers, designed to evaluate SYN-020 for safety, tolerability, and pharmacokinetic parameters (Q3 2020)

· Announced enrollment commenced and three out of a total of four cohorts have been dosed in a Phase 1a single-ascending-dose (SAD) study of SYN-020 (Q2 2021).

| ||

| Prevention of CDI, overgrowth of pathogenic organisms and AMR (Degrade IV carbapenem antibiotics) |

SYN-006 (oral enzyme) |

· Identified P2A as a potent carbapenemase that is stable in the GI tract

· Manufactured a formulated research lot for oral delivery (2017)

· Demonstrated microbiome protection in a pig model of ertapenem administration (Q1 2018) | ||

|