As filed with the Securities and Exchange Commission on May 15, 2020

Registration Nos. 33-54126

811-07332

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-1A

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | ☒ | |

| Pre-Effective Amendment No. | ☐ | |

| Post-Effective Amendment No. 325 | ☒ | |

| and | ||

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

☒ | |

| Amendment No. 329 | ☒ | |

BLACKROCK FUNDS III

(Exact Name of Registrant as Specified in Charter)

400 Howard Street, San Francisco, California 94105

(Address of Principal Executive Offices)

Registrant’s Telephone Number: 1-800-441-7450

John M. Perlowski

BlackRock Funds III

55 East 52nd Street

New York, New York 10055

United States of America

(Name and Address of Agent for Service)

With copies to:

| John A. MacKinnon, Esq. Jesse C. Kean Sidley Austin LLP 787 Seventh Avenue New York, New York 10019 |

Janey Ahn, Esq. BlackRock Fund Advisors 55 East 52nd Street New York, New York 10055 |

It is proposed that this filing will become effective (check appropriate box)

| ☐ | immediately upon filing pursuant to paragraph (b) |

| ☐ | on (date) pursuant to paragraph (b) |

| ☐ | 60 days after filing pursuant to paragraph (a)(1) |

| ☐ | on (date) pursuant to paragraph (a)(1) of Rule 485 |

| ☒ | 75 days after filing pursuant to paragraph (a)(2) |

| ☐ | on (date) pursuant to paragraph (a)(2) of Rule 485. |

If appropriate, check the following box:

| ☐ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

Title of Securities Being Registered: Shares of Beneficial Interest

|

[ ], 2020 |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This document is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 15, 2020

Prospectus

BlackRock Funds III | Investor A and Institutional Shares

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from BlackRock or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. If you hold accounts directly with BlackRock, you can call (800) 441-7762 to inform BlackRock that you wish to continue receiving paper copies of your shareholder reports. If you hold accounts through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds advised by BlackRock Advisors, LLC, BlackRock Fund Advisors or their affiliates, or all funds held with your financial intermediary, as applicable.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by: (i) accessing the BlackRock website at www.blackrock.com/edelivery and logging into your accounts, if you hold accounts directly with BlackRock, or (ii) contacting your financial intermediary, if you hold accounts through a financial intermediary. Please note that not all financial intermediaries may offer this service.

This Prospectus contains information you should know before investing, including information about risks. Please read it before you invest and keep it for future reference.

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| For More Information | Funds and Service Providers | Inside Back Cover | ||||

| Additional Information | Back Cover | |||||

LifePath® is a registered service mark of BlackRock Institutional Trust Company, N.A. and the LifePath products are covered by U.S. Patents 5,812,987 and 6,336,102.

Key Facts About BlackRock LifePath® ESG Index Retirement Fund

Investment Objective

The investment objective of BlackRock LifePath® ESG Index Retirement Fund (“LifePath ESG Index Retirement Fund” or the “Fund”), a series of BlackRock Funds III (the “Trust”), is to seek to provide for retirement outcomes based on quantitatively measured risk and to improve the environmental, social and governance (“ESG”) investment profile as measured by MSCI Inc. In pursuit of this objective, LifePath ESG Index Retirement Fund will be broadly diversified across global asset classes, including investing in underlying funds that seek to maximize exposure to companies with higher ESG ratings.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of LifePath ESG Index Retirement Fund.

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

Investor A Shares |

Institutional Shares |

||||||

| Management Fee1,2 |

[ ]% | [ ]% | ||||||

| Distribution and/or Service (12b-1) Fees |

0.25% | None | ||||||

| Other Expenses1,3,4 |

[ ]% | [ ]% | ||||||

| Administration Fees1 |

[ ]% | [ ]% | ||||||

| Independent Expenses4 |

[ ]% | [ ]% | ||||||

| Acquired Fund Fees and Expenses1,5 |

[ ]% | [ ]% | ||||||

| Total Annual Fund Operating Expenses |

[ ]% | [ ]% | ||||||

| Fee Waivers and/or Expense Reimbursements1,2,4 |

[ ]% | [ ]% | ||||||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements1,2,4 |

[ ]% | [ ]% | ||||||

| 1 | BlackRock Advisors, LLC (“BAL”) and BlackRock Fund Advisors (“BFA”) have contractually agreed to reimburse the Fund for Acquired Fund Fees and Expenses up to a maximum amount equal to the combined Management Fee and Administration Fee of each share class through [ ]. The contractual agreement may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund. |

| 2 | As described in the “Management of the Funds” section of the Fund’s prospectus beginning on page [ ], BFA has contractually agreed to waive its management fees by the amount of investment advisory fees the Fund pays to BFA indirectly through its investment in money market funds managed by BFA or its affiliates, through [ ]. The contractual agreement may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund. |

| 3 | Other Expenses are based on estimated amounts for the Fund’s current fiscal year. |

| 4 | Independent Expenses consist of the Fund’s allocable portion of the fees and expenses of the independent trustees of the Trust, counsel to such independent trustees and the independent registered public accounting firm that provides audit services to the Fund. BAL and BFA have contractually agreed to reimburse, or provide offsetting credits to, the Fund for Independent Expenses through [ ]. After giving effect to such contractual arrangements, Independent Expenses will be [0.00]%. Such contractual arrangements may not be terminated prior to [ ] without the consent of the Board of Trustees of the Trust. |

| 5 | Acquired Fund Fees and Expenses reflect the Fund’s pro rata share of the fees and expenses incurred by investing in certain other funds, including the underlying funds, and are based on estimated amounts for the Fund’s current fiscal year. |

Example:

This Example is intended to help you compare the cost of investing in shares of the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in shares of the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | |||||||

| Investor A Shares |

$ | [ ] | $ | [ ] | ||||

| Institutional Shares |

$ | [ ] | $ | [ ] | ||||

3

Portfolio Turnover:

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. There has been no portfolio turnover because the Fund has not commenced operations as of the date of this prospectus.

Principal Investment Strategies of the Fund

LifePath ESG Index Retirement Fund allocates and reallocates its assets among a combination of equity and bond index funds, including those that seek to maximize exposure to companies with higher ESG ratings as measured by MSCI, and money market funds (the “Underlying Funds”) in proportions based on its own comprehensive investment strategy.

The Fund seeks to provide for retirement outcomes based on quantitatively measured risk. BFA employs a multi-dimensional approach to assess risk for the Fund and to determine the Fund’s allocation across asset classes. As part of this multi-dimensional approach, BFA aims to quantify risk using proprietary risk measurement tools that, among other things, analyze historical and forward-looking securities market data, including risk, asset class correlations, and expected returns. Under normal circumstances, the Fund intends to invest primarily in affiliated open-end index funds and affiliated exchange-traded funds (“ETFs”).

The Fund will invest, under normal circumstances, at least 80% of its assets in securities or other financial instruments that are components of or have economic characteristics similar to the securities included in its custom benchmark index, the LifePath ESG Index Retirement Fund Custom Benchmark. The Fund is designed for investors expecting to retire or to begin withdrawing assets now or in the near future. Each Underlying Fund employs a “passive” management approach, attempting to invest in a portfolio of assets whose performance is expected to match approximately the performance of the Underlying Fund’s underlying index. As of the date of this prospectus, the Fund is expected to hold approximately [40]% of its assets in Underlying Funds designed to track particular equity indexes, approximately [60]% of its assets in Underlying Funds designed to track particular bond indexes and any remainder of its assets in Underlying Funds that invest primarily in money market instruments. Certain Underlying Funds may invest in real estate investment trusts (“REITs”), foreign securities, emerging market securities and derivative securities or instruments, such as options and futures, the value of which is derived from another security, a currency or an index, when seeking to match the performance of a particular market index. The Fund and certain Underlying Funds may also lend securities with a value up to 331/3% of their respective total assets to financial institutions that provide cash or securities issued or guaranteed by the U.S. Government as collateral.

Factors such as index construction methodology, fund classifications, historical risk and performance, and the relationship to other Underlying Funds in the Fund are considered when selecting Underlying Funds. A majority of the Fund’s assets will be invested in Underlying Funds that seek to track indexes that tilt toward higher ESG rated companies while maintaining diversification and tracking error targets (“Underlying iShares ESG Funds”). The Underlying iShares ESG Funds screen out certain companies or industries based on applicable ESG standards. The Fund, indirectly through its investments in certain Underlying Funds (other than the Underlying iShares ESG Funds), may have exposure to investments that generally would be screened out based on certain ESG standards. The specific Underlying Funds selected for the Fund are determined at BFA’s discretion and may change as deemed appropriate to allow the Fund to meet its investment objective. See the “Details About the Funds — Information About the Underlying Funds” section of the prospectus for a list of the Underlying Funds, their classification into equity, fixed income or money market funds and a brief description of their investment objectives and primary investment strategies.

The Fund’s selection of Underlying Funds that track equity indexes may be further diversified by style (including both value and growth), market capitalization (including both large cap and small cap), region (including domestic and international (including emerging markets)) or other factors, including ESG characteristics. The Fund’s selection of Underlying Funds that track fixed-income indexes may be further diversified by sector (including government, corporate, agency, and other sectors), duration (a calculation of the average life of a bond which measures its price risk), credit quality, geographic location (including U.S. and foreign-issued securities), or other factors, including ESG characteristics. The percentage allocation to the various styles of equity and fixed-income Underlying Funds is determined at the discretion of the investment team and can be changed to reflect the current market environment. Because the Fund is in its most conservative phase, its allocation generally does not become more conservative over time, although its allocation may change to maintain the Fund’s risk profile.

Principal Risks of Investing in the Fund

Risk is inherent in all investing. The value of your investment in LifePath ESG Index Retirement Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments.

4

An investment in the Fund is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The following is a summary description of principal risks of investing in the Fund and/or the Underlying Funds. References to the Fund in the description of risks below may include the Underlying Funds in which the Fund invests, as applicable.

Principal Risks of the Fund’s Investment Strategies

| ∎ | Debt Securities Risk — Debt securities, such as bonds, involve interest rate risk, credit risk, extension risk, and prepayment risk, among other things. |

Interest Rate Risk — The market value of bonds and other fixed-income securities changes in response to interest rate changes and other factors. Interest rate risk is the risk that prices of bonds and other fixed-income securities will increase as interest rates fall and decrease as interest rates rise.

The Fund may be subject to a greater risk of rising interest rates due to the current period of historically low rates. For example, if interest rates increase by 1%, assuming a current portfolio duration of ten years, and all other factors being equal, the value of the Fund’s investments would be expected to decrease by 10%. The magnitude of these fluctuations in the market price of bonds and other fixed-income securities is generally greater for those securities with longer maturities. Fluctuations in the market price of the Fund’s investments will not affect interest income derived from instruments already owned by the Fund, but will be reflected in the Fund’s net asset value. The Fund may lose money if short-term or long-term interest rates rise sharply in a manner not anticipated by Fund management.

To the extent the Fund invests in debt securities that may be prepaid at the option of the obligor (such as mortgage-backed securities), the sensitivity of such securities to changes in interest rates may increase (to the detriment of the Fund) when interest rates rise. Moreover, because rates on certain floating rate debt securities typically reset only periodically, changes in prevailing interest rates (and particularly sudden and significant changes) can be expected to cause some fluctuations in the net asset value of the Fund to the extent that it invests in floating rate debt securities.

These basic principles of bond prices also apply to U.S. Government securities. A security backed by the “full faith and credit” of the U.S. Government is guaranteed only as to its stated interest rate and face value at maturity, not its current market price. Just like other fixed-income securities, government-guaranteed securities will fluctuate in value when interest rates change.

A general rise in interest rates has the potential to cause investors to move out of fixed-income securities on a large scale, which may increase redemptions from funds that hold large amounts of fixed-income securities. Heavy redemptions could cause the Fund to sell assets at inopportune times or at a loss or depressed value and could hurt the Fund’s performance.

Credit Risk — Credit risk refers to the possibility that the issuer of a debt security (i.e., the borrower) will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on both the financial condition of the issuer and the terms of the obligation.

Extension Risk — When interest rates rise, certain obligations will be paid off by the obligor more slowly than anticipated, causing the value of these obligations to fall.

Prepayment Risk — When interest rates fall, certain obligations will be paid off by the obligor more quickly than originally anticipated, and the Fund may have to invest the proceeds in securities with lower yields.

| ∎ | Equity Securities Risk — Stock markets are volatile. The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. |

| ∎ | Investments in Underlying Funds Risk — Because the Fund invests substantially all of its assets in Underlying Funds, its investment performance is related to the performance of the Underlying Funds. The Fund’s net asset value will change with changes in the value of the Underlying Funds and other securities in which it invests. An investment in the Fund will entail more direct and indirect costs and expenses than a direct investment in the Underlying Funds. |

| ∎ | Allocation Risk — The Fund’s ability to achieve its investment objective depends upon the Fund’s asset class allocation and the mix of Underlying Funds. There is a risk that the asset class allocation or the combination of Underlying Funds may be incorrect in view of actual market conditions. In addition, the asset allocation or the combination of Underlying Funds determined by BFA could result in underperformance as compared to funds with similar investment objectives and strategies. |

| ∎ | Retirement Income Risk — The Fund does not provide a guarantee that sufficient capital appreciation will be achieved to provide adequate income at and through retirement. The Fund also does not ensure that you will have |

5

| assets in your account sufficient to cover your retirement expenses or that you will have enough saved to be able to retire in the target year identified in the Fund’s name; this will depend on the amount of money you have invested in the Fund, the length of time you have held your investment, the returns of the markets over time, the amount you spend in retirement, and your other assets and income sources. |

| ∎ | Risk of ESG Investing — The Fund intends to invest a portion of its assets in Underlying Funds that seek to maximize exposure to companies with higher ESG ratings. This may affect the Fund’s exposure to certain companies or industries and the Fund will forgo certain investment opportunities. The Fund’s results may be lower than other funds that do not seek to invest in companies based on ESG ratings and/or screen out certain companies or industries. The index provider for an Underlying Fund’s underlying index seeks to identify companies that it believes may have higher ESG ratings, but investors may differ in their views of ESG characteristics. Additionally, certain Underlying Funds may not screen out investments based on certain ESG standards. As a result, the Fund may invest in companies that do not reflect the beliefs and values of any particular investor. |

| ∎ | Affiliated Fund Risk — In managing the Fund, BFA will have authority to select and substitute underlying funds and ETFs. BFA may be subject to potential conflicts of interest in selecting underlying funds and ETFs because the fees paid to BFA by some underlying funds and ETFs are higher than the fees paid by other underlying funds and ETFs. However, BFA is a fiduciary to the Fund and is legally obligated to act in the Fund’s best interests when selecting underlying funds and ETFs. If an underlying fund or ETF holds interests in an affiliated fund, the Fund may be prohibited from purchasing shares of that underlying fund or ETF. |

| ∎ | Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. The value of a security or other asset may decline due to changes in general market conditions, economic trends or events that are not specifically related to the issuer of the security or other asset, or factors that affect a particular issuer or issuers, exchange, country, group of countries, region, market, industry, group of industries, sector or asset class. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues like pandemics or epidemics, recessions, or other events could have a significant impact on the Fund and its investments. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money. |

A recent outbreak of an infectious coronavirus has developed into a global pandemic that has resulted in numerous disruptions in the market and has had significant economic impact leaving general concern and uncertainty. The impact of this coronavirus, and other epidemics and pandemics that may arise in the future, could affect the economies of many nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time.

Principal Risks of the Underlying Funds

The order of the below risk factors does not indicate the significance of any particular risk factor.

| ∎ | Asset Class Risk — Securities and other assets in the Fund’s portfolio may underperform in comparison to the general financial markets, a particular financial market or other asset classes. |

| ∎ | Authorized Participant Concentration Risk — Only an authorized participant may engage in creation or redemption transactions directly with an ETF, and none of those authorized participants is obligated to engage in creation and/or redemption transactions. An ETF has a limited number of institutions that may act as authorized participants on an agency basis (i.e., on behalf of other market participants). To the extent that authorized participants exit the business or are unable to proceed with creation or redemption orders with respect to an ETF and no other authorized participant is able to step forward to create or redeem creation units, ETF shares may be more likely to trade at a premium or discount to net asset value and possibly face trading halts or delisting. |

| ∎ | Calculation Methodology Risk — An ETF’s underlying index relies on various sources of information to assess the criteria of issuers included in the underlying index (or its parent index), including information that may be based on assumptions and estimates. Neither the Fund nor BFA can offer assurances that an ETF’s underlying index’s calculation methodology or sources of information will provide an accurate assessment of included issuers. |

| ∎ | Commodities Related Investments Risk — Exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, embargoes, tariffs and international economic, political and regulatory developments. |

| ∎ | Concentration Risk — To the extent that an underlying index of an Underlying Fund is concentrated in the securities of companies, a particular market, industry, group of industries, sector or asset class, country, region or group of countries, that Underlying Fund may be adversely affected by the performance of those securities, may be subject to |

6

| increased price volatility and may be more susceptible to adverse economic, market, political or regulatory occurrences affecting that market, industry, group of industries, sector or asset class, country, region or group of countries. |

| ∎ | Depositary Receipts Risk — Depositary receipts are generally subject to the same risks as the foreign securities that they evidence or into which they may be converted. In addition to investment risks associated with the underlying issuer, depositary receipts expose the Fund to additional risks associated with the non-uniform terms that apply to depositary receipt programs, credit exposure to the depository bank and to the sponsors and other parties with whom the depository bank establishes the programs, currency risk and the risk of an illiquid market for depositary receipts. The issuers of unsponsored depositary receipts are not obligated to disclose information that is, in the United States, considered material. Therefore, there may be less information available regarding these issuers and there may not be a correlation between such information and the market value of the depositary receipts. |

| ∎ | Derivatives Risk — The Fund’s use of derivatives may increase its costs, reduce the Fund’s returns and/or increase volatility. Derivatives involve significant risks, including: |

Volatility Risk — Volatility is defined as the characteristic of a security, an index or a market to fluctuate significantly in price within a short time period. A risk of the Fund’s use of derivatives is that the fluctuations in their values may not correlate with the overall securities markets.

Counterparty Risk — Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation.

Market and Illiquidity Risk — The possible lack of a liquid secondary market for derivatives and the resulting inability of the Fund to sell or otherwise close a derivatives position could expose the Fund to losses and could make derivatives more difficult for the Fund to value accurately.

Valuation Risk — Valuation may be more difficult in times of market turmoil since many investors and market makers may be reluctant to purchase complex instruments or quote prices for them.

Hedging Risk — Hedges are sometimes subject to imperfect matching between the derivative and the underlying security, and there can be no assurance that the Fund’s hedging transactions will be effective. The use of hedging may result in certain adverse tax consequences.

Tax Risk — Certain aspects of the tax treatment of derivative instruments, including swap agreements and commodity-linked derivative instruments, are currently unclear and may be affected by changes in legislation, regulations or other legally binding authority. Such treatment may be less favorable than that given to a direct investment in an underlying asset and may adversely affect the timing, character and amount of income the Fund realizes from its investments.

Regulatory Risk — Derivative contracts, including, without limitation, swaps, currency forwards and non-deliverable forwards, are subject to regulation under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) in the United States and under comparable regimes in Europe, Asia and other non-U.S. jurisdictions. Under the Dodd-Frank Act, certain derivatives are subject to margin requirements and swap dealers are required to collect margin from the Fund with respect to such derivatives. Specifically, regulations are now in effect that require swap dealers to post and collect variation margin (comprised of specified liquid instruments and subject to a required haircut) in connection with trading of over-the-counter (“OTC”) swaps with the Fund. Shares of investment companies (other than certain money market funds) may not be posted as collateral under these regulations. Requirements for posting of initial margin in connection with OTC swaps will be phased-in through at least 2021.

In addition, regulations adopted by global prudential regulators that are now in effect require certain bank-regulated counterparties and certain of their affiliates to include in certain financial contracts, including many derivatives contracts, terms that delay or restrict the rights of counterparties, such as the Fund, to terminate such contracts, foreclose upon collateral, exercise other default rights or restrict transfers of credit support in the event that the counterparty and/or its affiliates are subject to certain types of resolution or insolvency proceedings. The implementation of these requirements with respect to derivatives, as well as regulations under the Dodd-Frank Act regarding clearing, mandatory trading and margining of other derivatives, may increase the costs and risks to the Fund of trading in these instruments and, as a result, may affect returns to investors in the Fund.

In November 2019, the Securities and Exchange Commission proposed new regulations governing the use of derivatives by registered investment companies. If adopted as proposed, new Rule 18f-4 would impose limits on the amount of derivatives a fund could enter into, eliminate the asset segregation framework currently used by funds to comply with Section 18 of the Investment Company Act of 1940, as amended, treat derivatives as senior securities so that a failure to comply with the proposed limits would result in a statutory violation and require funds whose use of derivatives is more than a limited specified exposure amount to establish and maintain a comprehensive derivatives risk management program and appoint a derivatives risk manager.

7

| ∎ | Emerging Markets Risk — Emerging markets are riskier than more developed markets because they tend to develop unevenly and may never fully develop. Investments in emerging markets may be considered speculative. Emerging markets are more likely to experience hyperinflation and currency devaluations, which adversely affect returns to U.S. investors. In addition, many emerging securities markets have far lower trading volumes and less liquidity than developed markets. |

| ∎ | Foreign Securities Risk — Foreign investments often involve special risks not present in U.S. investments that can increase the chances that the Fund will lose money. These risks include: |

| ∎ | The Fund generally holds its foreign securities and cash in foreign banks and securities depositories, which may be recently organized or new to the foreign custody business and may be subject to only limited or no regulatory oversight. |

| ∎ | Changes in foreign currency exchange rates can affect the value of the Fund’s portfolio. |

| ∎ | The economies of certain foreign markets may not compare favorably with the economy of the United States with respect to such issues as growth of gross national product, reinvestment of capital, resources and balance of payments position. |

| ∎ | The governments of certain countries may prohibit or impose substantial restrictions on foreign investments in their capital markets or in certain industries. |

| ∎ | Many foreign governments do not supervise and regulate stock exchanges, brokers and the sale of securities to the same extent as does the United States and may not have laws to protect investors that are comparable to U.S. securities laws. |

| ∎ | Settlement and clearance procedures in certain foreign markets may result in delays in payment for or delivery of securities not typically associated with settlement and clearance of U.S. investments. |

| ∎ | The European financial markets have recently experienced volatility and adverse trends due to concerns about economic downturns in, or rising government debt levels of, several European countries. These events may spread to other countries in Europe. These events may affect the value and liquidity of certain of the Fund’s investments. |

| ∎ | Geographic Risk — A natural disaster could occur in a geographic region in which the Fund invests, which could adversely affect the economy or the business operations of companies in the specific geographic region, causing an adverse impact on the Fund’s investments in the affected region. |

| ∎ | High Portfolio Turnover Risk — The Fund may engage in active and frequent trading of its portfolio securities. High portfolio turnover (more than 100%) may result in increased transaction costs to the Fund, including brokerage commissions, dealer mark-ups and other transaction costs on the sale of the securities and on reinvestment in other securities. The sale of Fund portfolio securities may result in the realization and/or distribution to shareholders of higher capital gains or losses as compared to a fund with less active trading policies. These effects of higher than normal portfolio turnover may adversely affect Fund performance. |

| ∎ | Income Risk — Income risk is the risk that the Fund’s yield will vary as short-term securities in its portfolio mature and the proceeds are reinvested in securities with different interest rates. |

| ∎ | Index-Related Risk — There is no guarantee that an Underlying Fund’s investment results will have a high degree of correlation to those of its underlying index or that the Underlying Fund will achieve its investment objective. Market disruptions and regulatory restrictions could have an adverse effect on an Underlying Fund’s ability to adjust its exposure to the required levels in order to track its underlying index. Errors in index data, index computations or the construction of an underlying index in accordance with its methodology may occur from time to time and may not be identified and corrected by the index provider for a period of time or at all, which may have an adverse impact on an Underlying Fund and its shareholders. Unusual market conditions may cause the index provider to postpone a scheduled rebalance, which could cause the Underlying Index to vary from its normal or expected composition. |

| ∎ | Investment Style Risk — Under certain market conditions, growth investments have performed better during the later stages of economic expansion and value investments have performed better during periods of economic recovery. Therefore, these investment styles may over time go in and out of favor. At times when an investment style used by the Fund or an Underlying Fund is out of favor, the Fund may underperform other funds that use different investment styles. |

| ∎ | Issuer Risk — Fund performance depends on the performance of individual securities to which the Fund has exposure. Changes in the financial condition or credit rating of an issuer of those securities may cause the value of the securities to decline. |

| ∎ | Large Capitalization Companies Risk — Large-capitalization companies may be less able than smaller capitalization companies to adapt to changing market conditions. Large-capitalization companies may be more mature and subject to more limited growth potential compared with smaller capitalization companies. During different market cycles, the performance of large-capitalization companies has trailed the overall performance of the broader securities markets. |

8

| ∎ | Management Risk — As an Underlying Fund may not fully replicate its underlying index, it is subject to the risk that the Underlying Fund’s investment manager’s investment strategy may not produce the intended results. |

| ∎ | National Closed Market Trading Risk — To the extent that the underlying securities and/or other assets held by an ETF trade on foreign exchanges or in foreign markets that may be closed when the securities exchange on which the ETF’s shares trade is open, there are likely to be deviations between the current price of an underlying security and the last quoted price for the underlying security (i.e., the ETF’s quote from the closed foreign market). These deviations could result in premiums or discounts to the ETF’s net asset value that may be greater than those experienced by other ETFs. |

| ∎ | Passive Investment Risk — Because BFA does not select individual companies in the underlying indexes for certain Underlying Funds, those Underlying Funds may hold securities of companies that present risks that an investment adviser researching individual securities might seek to avoid. |

| ∎ | Real Estate-Related Securities Risk — The main risk of real estate-related securities is that the value of the underlying real estate may go down. Many factors may affect real estate values. These factors include both the general and local economies, vacancy rates, tenant bankruptcies, the ability to re-lease space under expiring leases on attractive terms, the amount of new construction in a particular area, the laws and regulations (including zoning, environmental and tax laws) affecting real estate and the costs of owning, maintaining and improving real estate. The availability of mortgage financing and changes in interest rates may also affect real estate values. If the Fund’s real estate-related investments are concentrated in one geographic area or in one property type, the Fund will be particularly subject to the risks associated with that area or property type. Many issuers of real estate-related securities are highly leveraged, which increases the risk to holders of such securities. The value of the securities the Fund buys will not necessarily track the value of the underlying investments of the issuers of such securities. |

| ∎ | REIT Investment Risk — Investments in REITs involve unique risks. REITs may have limited financial resources, may trade less frequently and in limited volume, may engage in dilutive offerings of securities and may be more volatile than other securities. REIT issuers may also fail to maintain their exemptions from investment company registration or fail to qualify for the “dividends paid deduction” under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), which allows REITs to reduce their corporate taxable income for dividends paid to their shareholders. |

| ∎ | Restricted Securities Risk — Limitations on the resale of restricted securities may have an adverse effect on their marketability, and may prevent the Fund from disposing of them promptly at advantageous prices. Restricted securities may not be listed on an exchange and may have no active trading market. In order to sell such securities, the Fund may have to bear the expense of registering the securities for resale and the risk of substantial delays in effecting the registration. Other transaction costs may be higher for restricted securities than unrestricted securities. Restricted securities may be difficult to value because market quotations may not be readily available, and the securities may have significant volatility. Also, the Fund may get only limited information about the issuer of a given restricted security, and therefore may be less able to predict a loss. Certain restricted securities may involve a high degree of business and financial risk and may result in substantial losses to the Fund. |

| ∎ | Shares of an ETF May Trade at Prices Other Than Net Asset Value — Shares of an ETF trade on exchanges at prices at, above or below their most recent net asset value. The per share net asset value of an ETF is calculated at the end of each business day and fluctuates with changes in the market value of the ETF’s holdings since the most recent calculation. The trading prices of an ETF’s shares fluctuate continuously throughout trading hours based on market supply and demand rather than net asset value. The trading prices of an ETF’s shares may deviate significantly from net asset value during periods of market volatility. Any of these factors may lead to an ETF’s shares trading at a premium or discount to net asset value. However, because shares can be created and redeemed in creation units, which are aggregated blocks of shares that authorized participants who have entered into agreements with the ETF’s distributor can purchase or redeem directly from the ETF, at net asset value (unlike shares of many closed-end funds, which frequently trade at appreciable discounts from, and sometimes at premiums to, their net asset values), large discounts or premiums to the net asset value of an ETF are not likely to be sustained over the long-term. While the creation/redemption feature is designed to make it likely that an ETF’s shares normally trade on exchanges at prices close to the ETF’s next calculated net asset value, exchange prices are not expected to correlate exactly with an ETF’s net asset value due to timing reasons as well as market supply and demand factors. In addition, disruptions to creations and redemptions or the existence of extreme market volatility may result in trading prices that differ significantly from net asset value. If a shareholder purchases at a time when the market price is at a premium to the net asset value or sells at a time when the market price is at a discount to the net asset value, the shareholder may sustain losses. |

| ∎ | Small and Mid-Capitalization Company Risk — Companies with small or mid-size market capitalizations will normally have more limited product lines, markets and financial resources and will be dependent upon a more limited management group than larger capitalized companies. In addition, it is more difficult to get information on smaller companies, which tend to be less well known, have shorter operating histories, do not have significant ownership by large investors and are followed by relatively few securities analysts. |

9

| ∎ | Tracking Error Risk — Tracking error is the divergence of an Underlying Fund’s performance from that of its underlying index. Tracking error may occur because of differences between the securities and other instruments held in an Underlying Fund’s portfolio and those included in its underlying index, pricing differences (including, as applicable, differences between a security’s price at the local market close and an Underlying Fund’s valuation of a security at the time of calculation of an Underlying Fund’s net asset value), transaction costs incurred by the Underlying Fund, an Underlying Fund’s holding of uninvested cash, differences in timing of the accrual of or the valuation of dividends or interest, the requirements to maintain pass-through tax treatment, portfolio transactions carried out to minimize the distribution of capital gains to shareholders, changes to an underlying index or the costs to an Underlying Fund of complying with various new or existing regulatory requirements. This risk may be heightened during times of increased market volatility or other unusual market conditions. Tracking error also may result because an Underlying Fund incurs fees and expenses, while its underlying index does not. |

| ∎ | U.S. Government Mortgage-Related Securities Risk — There are a number of important differences among the agencies and instrumentalities of the U.S. Government that issue mortgage-related securities and among the securities that they issue. Mortgage-related securities guaranteed by the Government National Mortgage Association (“GNMA” or “Ginnie Mae”) are guaranteed as to the timely payment of principal and interest by GNMA and such guarantee is backed by the full faith and credit of the United States. GNMA securities also are supported by the right of GNMA to borrow funds from the U.S. Treasury to make payments under its guarantee. Mortgage-related securities issued by Fannie Mae or Freddie Mac are solely the obligations of Fannie Mae or Freddie Mac, as the case may be, and are not backed by or entitled to the full faith and credit of the United States but are supported by the right of the issuer to borrow from the Treasury. |

Performance Information

Because the LifePath ESG Index Retirement Fund has not commenced operations as of the date of this prospectus, it does not have performance information an investor would find useful in evaluating the risks of investing in the Fund. Current performance information, including its current net asset value, can be obtained by visiting http://www.blackrock.com or can be obtained by phone at (800) 882-0052. The Fund will compare its performance to that of the Bloomberg Barclays MSCI U.S. Aggregate ESG Focus Index and the LifePath ESG Index Retirement Fund Custom Benchmark. The LifePath ESG Index Retirement Fund Custom Benchmark is a customized weighted index comprised of the Bloomberg Barclays MSCI U.S. Aggregate ESG Focus Index, Bloomberg Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index (Series-L), FTSE EPRA Nareit Developed Index, MSCI Canada Custom Capped Index, MSCI EAFE Extended ESG Focus Index, MSCI EAFE Small Cap Index, MSCI Emerging Markets Extended ESG Focus Index, MSCI Emerging Markets Small Cap Index, MSCI USA Extended ESG Focus Index and MSCI USA Small Cap Extended ESG Focus Index.

Investment Adviser

The Fund’s investment manager is BlackRock Fund Advisors (previously defined as “BFA”).

Portfolio Managers

| Name |

Portfolio Manager of the Fund Since | Title | ||

| Chris Chung, CFA |

2020 | Director of BlackRock, Inc. | ||

| Alan Mason |

2020 | Managing Director of BlackRock, Inc. | ||

| Lisa O’Connor, CFA |

2020 | Managing Director of BlackRock, Inc. | ||

| Matthew O’Hara, PhD, CFA |

2020 | Managing Director of BlackRock, Inc. | ||

| Greg Savage, CFA |

2020 | Managing Director of BlackRock, Inc. | ||

| Amy Whitelaw |

2020 | Managing Director of BlackRock, Inc. | ||

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the Fund each day the New York Stock Exchange is open. To purchase or sell shares, you should contact your financial professional or your selected securities dealer, broker, investment adviser, service provider or industry professional (including BFA and its affiliates) (each a “Financial Intermediary”), or, if you hold your shares through BlackRock, Inc. or its affiliates (collectively, “BlackRock”), you should contact BlackRock by phone at (800) 441-7762, by mail (c/o BlackRock Funds III, P.O. Box 9819, Providence, Rhode Island 02940-8019),

10

or by the Internet at www.blackrock.com. The Fund’s initial and subsequent investment minimums generally are as follows, although the Fund may reduce or waive the minimums in some cases:

| Investor A Shares | Institutional Shares | |||

| Minimum Initial Investment | $1,000 for all accounts except: • $50, if establishing an Automatic Investment Plan. • There is no investment minimum for employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs or SARSEPs). • There is no investment minimum for certain fee-based programs. |

There is no minimum initial investment for: • Employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs or SARSEPs), state sponsored 529 college savings plans, collective trust funds, investment companies or other pooled investment vehicles, unaffiliated thrifts and unaffiliated banks and trust companies, each of which may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares. • Clients of Financial Intermediaries that: (i) charge such clients a fee for advisory, investment consulting, or similar services or (ii) have entered into an agreement with the Fund’s distributor to offer Institutional Shares through a no-load program or investment platform.

$2 million for individuals and “Institutional Investors,” which include, but are not limited to, endowments, foundations, family offices, local, city, and state governmental institutions, corporations and insurance company separate accounts who may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares.

$1,000 for: • Clients investing through Financial Intermediaries that offer such shares on a platform that charges a transaction based sales commission outside of the Fund. • Tax-qualified accounts for insurance agents that are registered representatives of an insurance company’s broker-dealer that has entered into an agreement with the Fund’s distributor to offer Institutional Shares, and the family members of such persons. | ||

| Minimum Additional Investment | $50 for all accounts (with the exception of certain employer-sponsored retirement plans which may have a lower minimum). | No subsequent minimum. |

Tax Information

Different income tax rules apply depending on whether you are invested through a qualified tax-exempt plan described in section 401(a) of the Internal Revenue Code. If you are invested through such a plan (and Fund shares are not “debt-financed property” to the plan), then the dividends paid by the Fund and the gain realized from a redemption or exchange of Fund shares will generally not be subject to U.S. federal income taxes until you withdraw or receive distributions from the plan. If you are not invested through such a plan, then the Fund’s dividends and gain from a redemption or exchange may be subject to U.S. federal income taxes and may be taxed as ordinary income or capital gains, unless you are a tax-exempt investor.

11

Payments to Broker/Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a Financial Intermediary, the Fund and BlackRock Investments, LLC, the Fund’s distributor, or its affiliates may pay the Financial Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the Financial Intermediary and your individual financial professional to recommend the Fund over another investment.

Ask your individual financial professional or visit your Financial Intermediary’s website for more information.

12

Fund Overview

Key Facts About BlackRock LifePath® ESG Index 2025 Fund

Investment Objective

The investment objective of BlackRock LifePath® ESG Index 2025 Fund (“LifePath ESG Index 2025 Fund” or the “Fund”), a series of BlackRock Funds III (the “Trust”), is to seek to provide for retirement outcomes based on quantitatively measured risk and to improve the environmental, social and governance (“ESG”) investment profile as measured by MSCI Inc. In pursuit of this objective, LifePath ESG Index 2025 Fund will be broadly diversified across global asset classes, including investing in underlying funds that seek to maximize exposure to companies with higher ESG ratings. Additionally, the Fund’s asset allocation will become more conservative over time.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of LifePath ESG Index 2025 Fund.

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

Investor A Shares |

Institutional Shares | ||||||||

| Management Fee1,2 |

[ ]% | [ ]% | ||||||||

| Distribution and/or Service (12b-1) Fees |

0.25 | % | None | |||||||

| Other Expenses1,3,4 |

[ ]% | [ ]% | ||||||||

| Administration Fees1 |

[ ]% | [ ]% | ||||||||

| Independent Expenses4 |

[ ]% | [ ]% | ||||||||

| Acquired Fund Fees and Expenses1,5 |

[ ]% | [ ]% | ||||||||

| Total Annual Fund Operating Expenses |

[ ]% | [ ]% | ||||||||

| Fee Waivers and/or Expense Reimbursements1,2,4 |

[ ]% | [ ]% | ||||||||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements1,2,4 |

[ ]% | [ ]% | ||||||||

| 1 | BlackRock Advisors, LLC (“BAL”) and BlackRock Fund Advisors (“BFA”) have contractually agreed to reimburse the Fund for Acquired Fund Fees and Expenses up to a maximum amount equal to the combined Management Fee and Administration Fee of each share class through [ ]. The contractual agreement may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund. |

| 2 | As described in the “Management of the Funds” section of the Fund’s prospectus beginning on page [ ], BFA has contractually agreed to waive its management fees by the amount of investment advisory fees the Fund pays to BFA indirectly through its investment in money market funds managed by BFA or its affiliates, through [ ]. The contractual agreement may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund. |

| 3 | Other Expenses are based on estimated amounts for the Fund’s current fiscal year. |

| 4 | Independent Expenses consist of the Fund’s allocable portion of the fees and expenses of the independent trustees of the Trust, counsel to such independent trustees and the independent registered public accounting firm that provides audit services to the Fund. BAL and BFA have contractually agreed to reimburse, or provide offsetting credits to, the Fund for Independent Expenses through [ ]. After giving effect to such contractual arrangements, Independent Expenses will be [0.00]%. Such contractual arrangements may not be terminated prior to [ ] without the consent of the Board of Trustees of the Trust. |

| 5 | Acquired Fund Fees and Expenses reflect the Fund’s pro rata share of the fees and expenses incurred by investing in certain other funds, including the underlying funds, and are based on estimated amounts for the Fund’s current fiscal year. |

Example:

This Example is intended to help you compare the cost of investing in shares of the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in shares of the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | |||||||

| Investor A Shares |

$ | [ ] | $ | [ ] | ||||

| Institutional Shares |

$ | [ ] | $ | [ ] | ||||

13

Portfolio Turnover:

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. There has been no portfolio turnover because the Fund has not commenced operations as of the date of this prospectus.

Principal Investment Strategies of the Fund

LifePath ESG Index 2025 Fund allocates and reallocates its assets among a combination of equity and bond index funds, including those that seek to maximize exposure to companies with higher ESG ratings as measured by MSCI, and money market funds (the “Underlying Funds”) in proportions based on its own comprehensive investment strategy.

The Fund seeks to provide for retirement outcomes based on quantitatively measured risk. BFA employs a multi-dimensional approach to assess risk for the Fund and to determine the Fund’s allocation across asset classes. As part of this multi-dimensional approach, BFA aims to quantify risk using proprietary risk measurement tools that, among other things, analyze historical and forward-looking securities market data, including risk, asset class correlations, and expected returns. Under normal circumstances, the Fund intends to invest primarily in affiliated open-end index funds and affiliated exchange-traded funds (“ETFs”).

The Fund will invest, under normal circumstances, at least 80% of its assets in securities or other financial instruments that are components of or have economic characteristics similar to the securities included in its custom benchmark index, the LifePath ESG Index 2025 Fund Custom Benchmark. The Fund is designed for investors expecting to retire or to begin withdrawing assets around the year 2025. Each Underlying Fund employs a “passive” management approach, attempting to invest in a portfolio of assets whose performance is expected to match approximately the performance of the Underlying Fund’s underlying index. As of the date of this prospectus, the Fund is expected to hold approximately [53]% of its assets in Underlying Funds designed to track particular equity indexes, approximately [47]% of its assets in Underlying Funds designed to track particular bond indexes and any remainder of its assets in Underlying Funds that invest primarily in money market instruments. Certain Underlying Funds may invest in real estate investment trusts (“REITs”), foreign securities, emerging market securities and derivative securities or instruments, such as options and futures, the value of which is derived from another security, a currency or an index, when seeking to match the performance of a particular market index. The Fund and certain Underlying Funds may also lend securities with a value up to 331/3% of their respective total assets to financial institutions that provide cash or securities issued or guaranteed by the U.S. Government as collateral.

14

Under normal circumstances, the asset allocation will change over time according to a predetermined “glidepath” as the Fund approaches its target date. The glidepath represents the shifting of asset classes over time. The glidepath allocations become more conservative as time elapses and reaches its most conservative allocation at retirement.

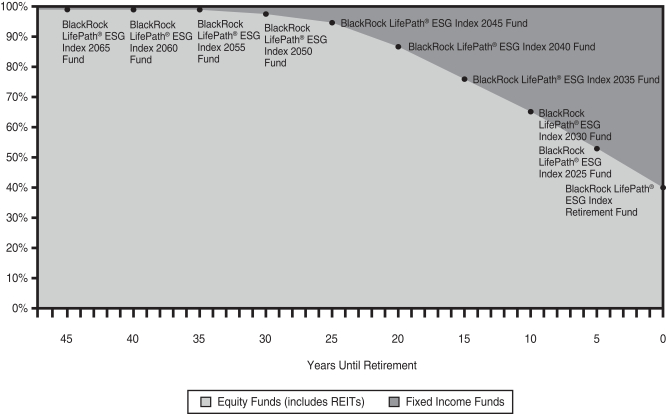

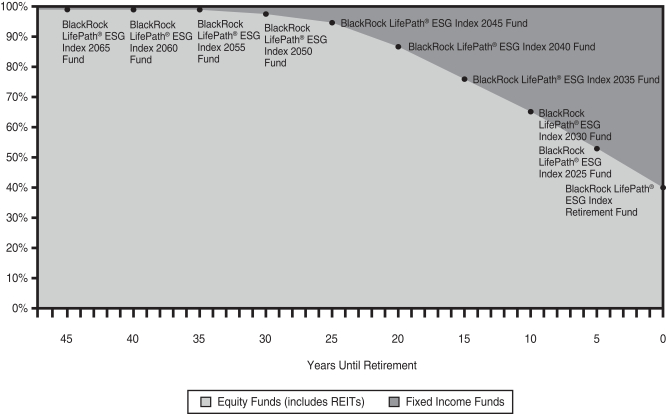

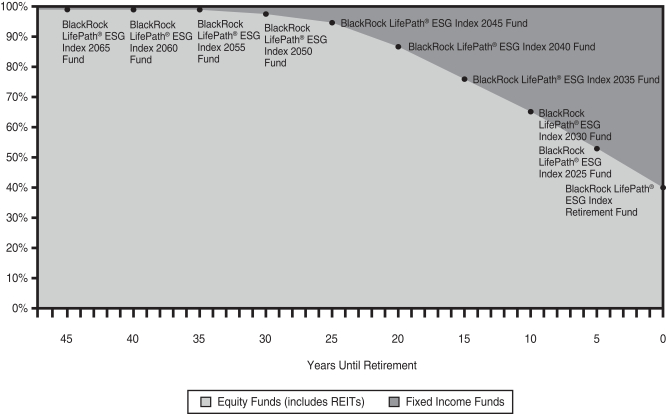

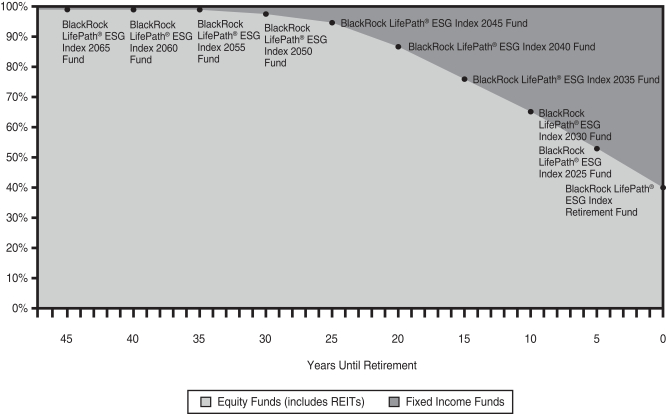

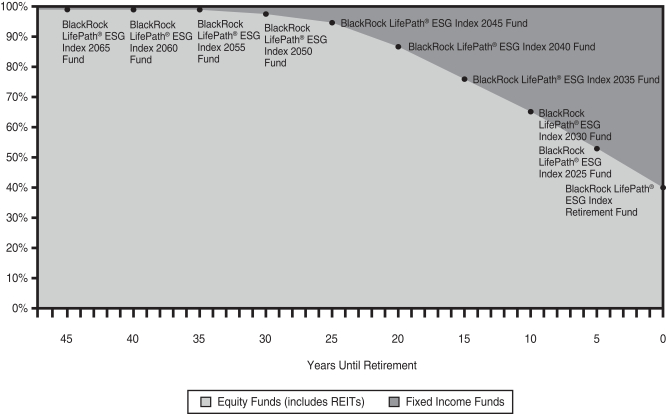

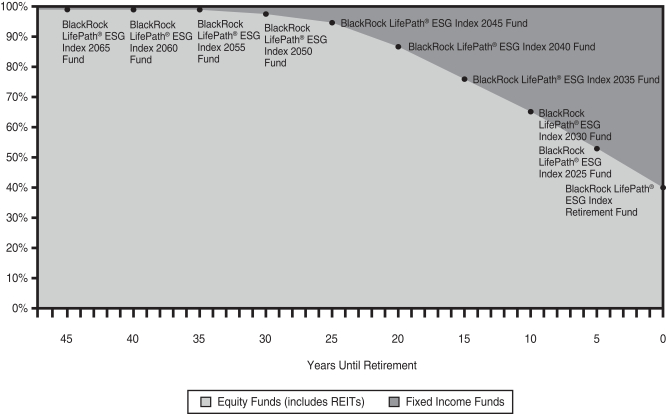

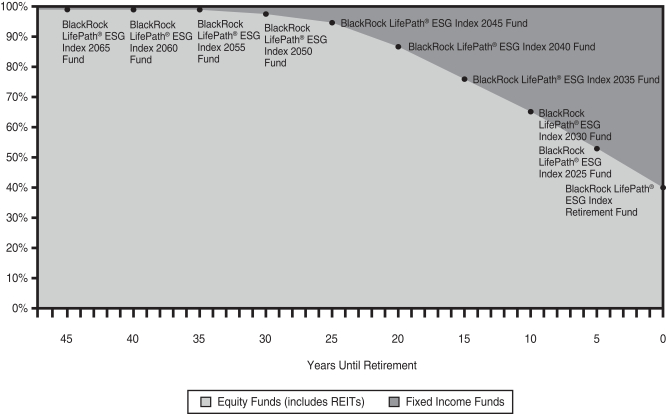

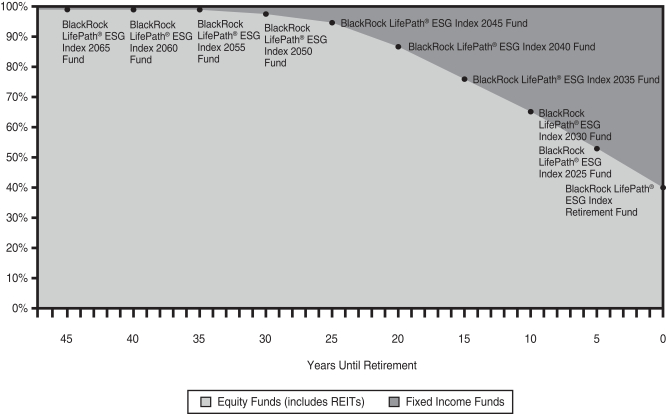

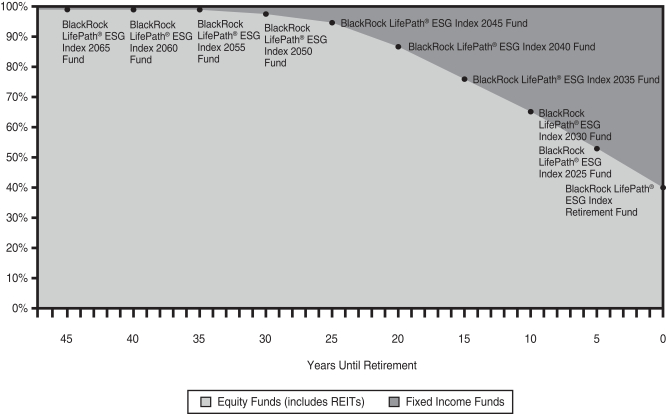

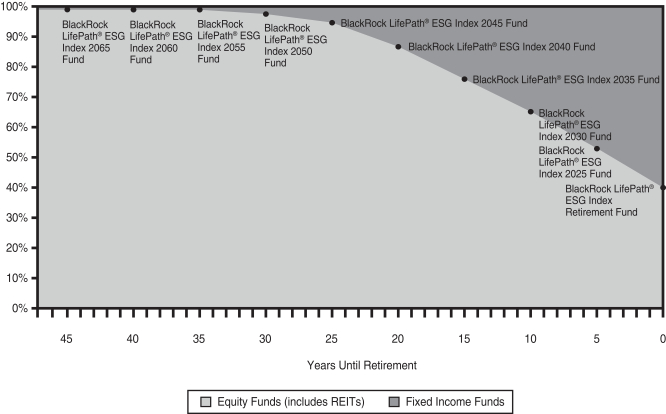

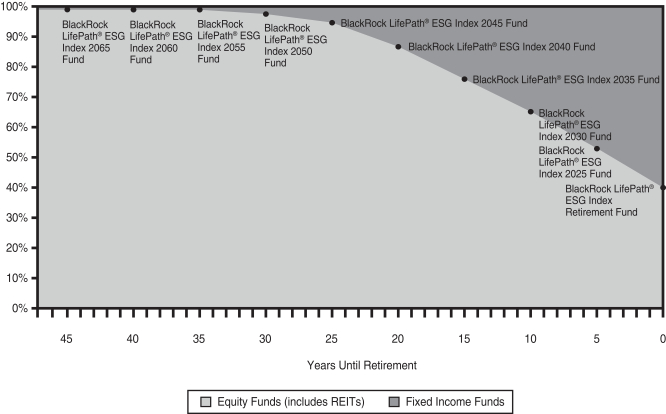

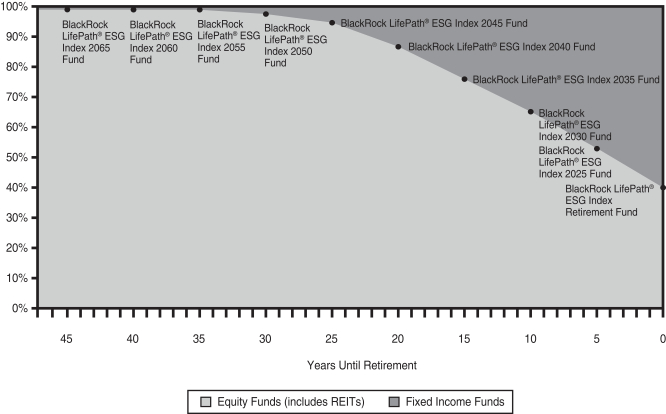

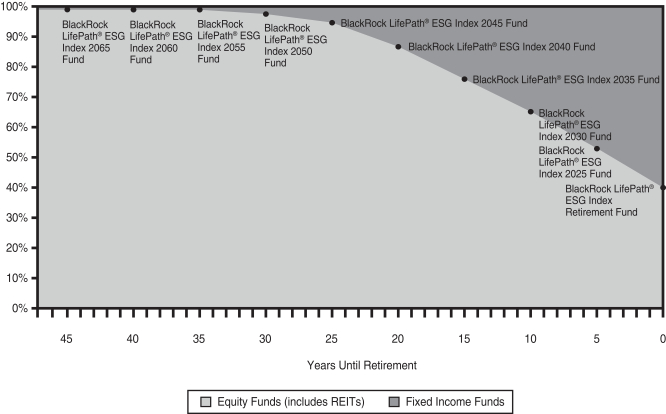

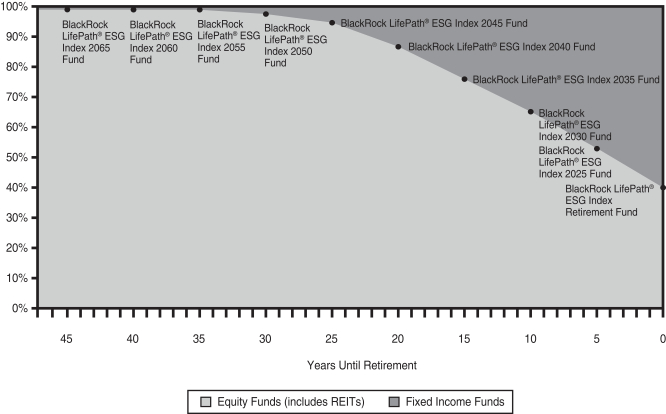

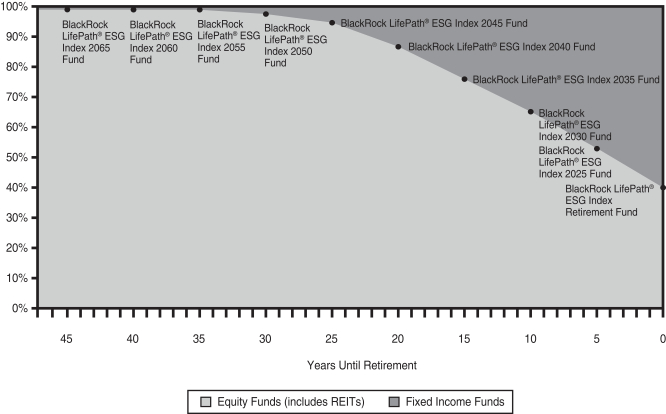

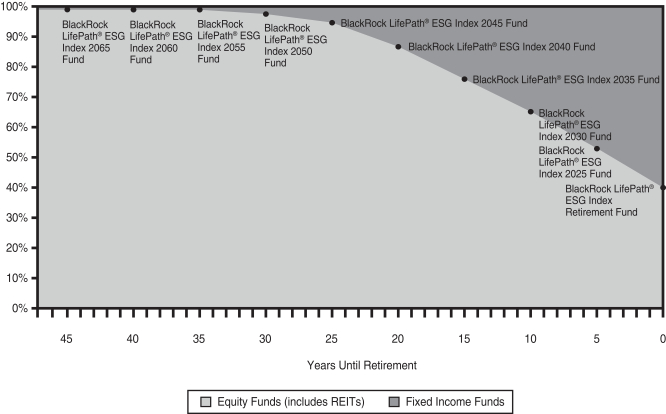

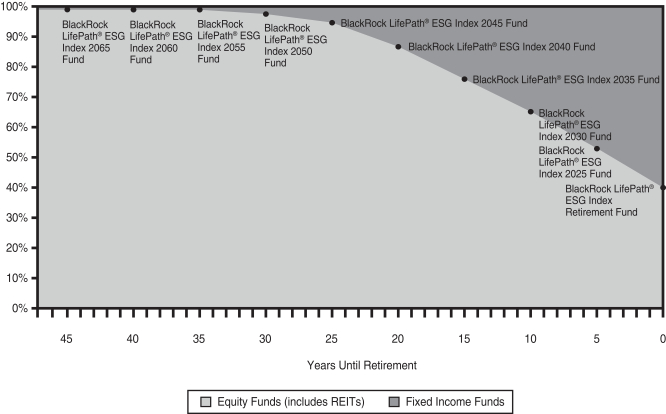

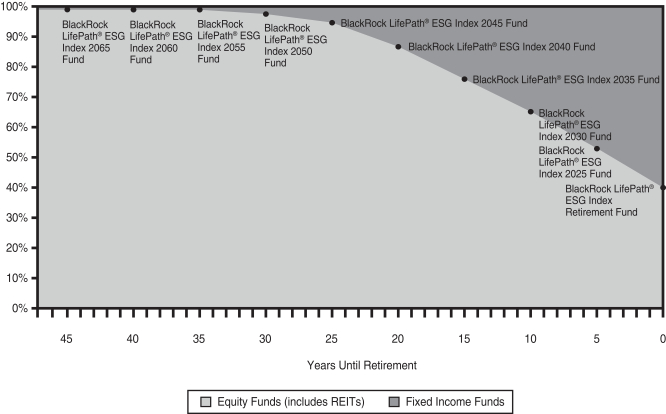

LifePath ESG Index 2025 Fund is one of a group of funds referred to as the “LifePath ESG Index Funds,” each of which seeks to provide for retirement outcomes based on quantitatively measured risk that investors on average may be willing to accept given a particular time horizon. The following chart illustrates the glidepath — the target allocation among asset classes as the LifePath ESG Index Funds approach their target dates:

The following table lists the target allocation by years until retirement:

| Years Until Retirement | Equity Funds (includes REITs) |

Fixed-Income Funds | ||||||||

| 45 |

[99 | ]% | [1 | ]% | ||||||

| 40 |

[99 | ]% | [1 | ]% | ||||||

| 35 |

[99 | ]% | [1 | ]% | ||||||

| 30 |

[98 | ]% | [2 | ]% | ||||||

| 25 |

[95 | ]% | [5 | ]% | ||||||

| 20 |

[87 | ]% | [13 | ]% | ||||||

| 15 |

[76 | ]% | [24 | ]% | ||||||

| 10 |

[65 | ]% | [35 | ]% | ||||||

| 5 |

[53 | ]% | [47 | ]% | ||||||

| 0 |

[40 | ]% | [60 | ]% | ||||||

The asset allocation targets are established by the portfolio managers and the lifecycle investment team. The investment team meets regularly to assess market conditions, review the asset allocation targets of the Fund, and determine whether any changes are required to enable the Fund to achieve its investment objective.

Although the asset allocation targets listed for the glidepath are general, long-term targets, BFA may periodically adjust the proportion of equity index funds and fixed-income index funds in the Fund, based on an assessment of the current market conditions, the potential contribution of each asset class to the expected risk and return characteristics of the Fund, reallocations of Fund composition to reflect intra-year movement along the glidepath and other factors. In general, such adjustments will be limited; however, BFA may determine that a greater degree of variation is warranted to protect the Fund or achieve its investment objective.

15

BFA’s second step in the structuring of the Fund is the selection of the Underlying Funds. Factors such as index construction methodology, fund classifications, historical risk and performance, and the relationship to other Underlying Funds in the Fund are considered when selecting Underlying Funds. A majority of the Fund’s assets will be invested in Underlying Funds that seek to track indexes that tilt toward higher ESG rated companies while maintaining diversification and tracking error targets (“Underlying iShares ESG Funds”). The Underlying iShares ESG Funds screen out certain companies or industries based on applicable ESG standards. The Fund, indirectly through its investments in certain Underlying Funds (other than the Underlying iShares ESG Funds), may have exposure to investments that generally would be screened out based on certain ESG standards. The specific Underlying Funds selected for the Fund are determined at BFA’s discretion and may change as deemed appropriate to allow the Fund to meet its investment objective. See the “Details About the Funds — Information About the Underlying Funds” section of the prospectus for a list of the Underlying Funds, their classification into equity, fixed income or money market funds and a brief description of their investment objectives and primary investment strategies.

Within the prescribed percentage allocations to equity and fixed-income index funds, BFA seeks to diversify the Fund. The allocation to Underlying Funds that track equity indexes may be further diversified by style (including both value and growth), market capitalization (including both large cap and small cap), region (including domestic and international (including emerging markets)) or other factors, including ESG characteristics. The allocation to Underlying Funds that track fixed-income indexes may be further diversified by sector (including government, corporate, agency, and other sectors), duration (a calculation of the average life of a bond which measures its price risk), credit quality, geographic location (including U.S. and foreign-issued securities), or other factors, including ESG characteristics. The percentage allocation to the various styles of equity and fixed-income Underlying Funds is determined at the discretion of the investment team and can be changed to reflect the current market environment.

Principal Risks of Investing in the Fund

Risk is inherent in all investing. The value of your investment in LifePath ESG Index 2025 Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments. An investment in the Fund is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The following is a summary description of principal risks of investing in the Fund and/or the Underlying Funds. References to the Fund in the description of risks below may include the Underlying Funds in which the Fund invests, as applicable.

Principal Risks of the Fund’s Investment Strategies

| ∎ | Equity Securities Risk — Stock markets are volatile. The price of equity securities fluctuates based on changes in a company’s financial condition and overall market and economic conditions. |

| ∎ | Debt Securities Risk — Debt securities, such as bonds, involve interest rate risk, credit risk, extension risk, and prepayment risk, among other things. |

Interest Rate Risk — The market value of bonds and other fixed-income securities changes in response to interest rate changes and other factors. Interest rate risk is the risk that prices of bonds and other fixed-income securities will increase as interest rates fall and decrease as interest rates rise.

The Fund may be subject to a greater risk of rising interest rates due to the current period of historically low rates. For example, if interest rates increase by 1%, assuming a current portfolio duration of ten years, and all other factors being equal, the value of the Fund’s investments would be expected to decrease by 10%. The magnitude of these fluctuations in the market price of bonds and other fixed-income securities is generally greater for those securities with longer maturities. Fluctuations in the market price of the Fund’s investments will not affect interest income derived from instruments already owned by the Fund, but will be reflected in the Fund’s net asset value. The Fund may lose money if short-term or long-term interest rates rise sharply in a manner not anticipated by Fund management.

To the extent the Fund invests in debt securities that may be prepaid at the option of the obligor (such as mortgage-backed securities), the sensitivity of such securities to changes in interest rates may increase (to the detriment of the Fund) when interest rates rise. Moreover, because rates on certain floating rate debt securities typically reset only periodically, changes in prevailing interest rates (and particularly sudden and significant changes) can be expected to cause some fluctuations in the net asset value of the Fund to the extent that it invests in floating rate debt securities.

These basic principles of bond prices also apply to U.S. Government securities. A security backed by the “full faith and credit” of the U.S. Government is guaranteed only as to its stated interest rate and face value at maturity, not its current market price. Just like other fixed-income securities, government-guaranteed securities will fluctuate in value when interest rates change.

16

A general rise in interest rates has the potential to cause investors to move out of fixed-income securities on a large scale, which may increase redemptions from funds that hold large amounts of fixed-income securities. Heavy redemptions could cause the Fund to sell assets at inopportune times or at a loss or depressed value and could hurt the Fund’s performance.

Credit Risk — Credit risk refers to the possibility that the issuer of a debt security (i.e., the borrower) will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on both the financial condition of the issuer and the terms of the obligation.

Extension Risk — When interest rates rise, certain obligations will be paid off by the obligor more slowly than anticipated, causing the value of these obligations to fall.

Prepayment Risk — When interest rates fall, certain obligations will be paid off by the obligor more quickly than originally anticipated, and the Fund may have to invest the proceeds in securities with lower yields.

| ∎ | Investments in Underlying Funds Risk — Because the Fund invests substantially all of its assets in Underlying Funds, its investment performance is related to the performance of the Underlying Funds. The Fund’s net asset value will change with changes in the value of the Underlying Funds and other securities in which it invests. An investment in the Fund will entail more direct and indirect costs and expenses than a direct investment in the Underlying Funds. |

| ∎ | Allocation Risk — The Fund’s ability to achieve its investment objective depends upon the Fund’s asset class allocation and the mix of Underlying Funds. There is a risk that the asset class allocation or the combination of Underlying Funds may be incorrect in view of actual market conditions. In addition, the asset allocation or the combination of Underlying Funds determined by BFA could result in underperformance as compared to funds with similar investment objectives and strategies. |

| ∎ | Retirement Income Risk — The Fund does not provide a guarantee that sufficient capital appreciation will be achieved to provide adequate income at and through retirement. The Fund also does not ensure that you will have assets in your account sufficient to cover your retirement expenses or that you will have enough saved to be able to retire in the target year identified in the Fund’s name; this will depend on the amount of money you have invested in the Fund, the length of time you have held your investment, the returns of the markets over time, the amount you spend in retirement, and your other assets and income sources. |

| ∎ | Risk of ESG Investing — The Fund intends to invest a portion of its assets in Underlying Funds that seek to maximize exposure to companies with higher ESG ratings. This may affect the Fund’s exposure to certain companies or industries and the Fund will forgo certain investment opportunities. The Fund’s results may be lower than other funds that do not seek to invest in companies based on ESG ratings and/or screen out certain companies or industries. The index provider for an Underlying Fund’s underlying index seeks to identify companies that it believes may have higher ESG ratings, but investors may differ in their views of ESG characteristics. Additionally, certain Underlying Funds may not screen out investments based on certain ESG standards. As a result, the Fund may invest in companies that do not reflect the beliefs and values of any particular investor. |

| ∎ | Affiliated Fund Risk — In managing the Fund, BFA will have authority to select and substitute underlying funds and ETFs. BFA may be subject to potential conflicts of interest in selecting underlying funds and ETFs because the fees paid to BFA by some underlying funds and ETFs are higher than the fees paid by other underlying funds and ETFs. However, BFA is a fiduciary to the Fund and is legally obligated to act in the Fund’s best interests when selecting underlying funds and ETFs. If an underlying fund or ETF holds interests in an affiliated fund, the Fund may be prohibited from purchasing shares of that underlying fund or ETF. |

| ∎ | Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. The value of a security or other asset may decline due to changes in general market conditions, economic trends or events that are not specifically related to the issuer of the security or other asset, or factors that affect a particular issuer or issuers, exchange, country, group of countries, region, market, industry, group of industries, sector or asset class. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues like pandemics or epidemics, recessions, or other events could have a significant impact on the Fund and its investments. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money. |

A recent outbreak of an infectious coronavirus has developed into a global pandemic that has resulted in numerous disruptions in the market and has had significant economic impact leaving general concern and uncertainty. The impact of this coronavirus, and other epidemics and pandemics that may arise in the future, could affect the economies of many nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time.

17

Principal Risks of the Underlying Funds

The order of the below risk factors does not indicate the significance of any particular risk factor.

| ∎ | Asset Class Risk — Securities and other assets in the Fund’s portfolio may underperform in comparison to the general financial markets, a particular financial market or other asset classes. |

| ∎ | Authorized Participant Concentration Risk — Only an authorized participant may engage in creation or redemption transactions directly with an ETF, and none of those authorized participants is obligated to engage in creation and/or redemption transactions. An ETF has a limited number of institutions that may act as authorized participants on an agency basis (i.e., on behalf of other market participants). To the extent that authorized participants exit the business or are unable to proceed with creation or redemption orders with respect to an ETF and no other authorized participant is able to step forward to create or redeem creation units, ETF shares may be more likely to trade at a premium or discount to net asset value and possibly face trading halts or delisting. |

| ∎ | Calculation Methodology Risk — An ETF’s underlying index relies on various sources of information to assess the criteria of issuers included in the underlying index (or its parent index), including information that may be based on assumptions and estimates. Neither the Fund nor BFA can offer assurances that an ETF’s underlying index’s calculation methodology or sources of information will provide an accurate assessment of included issuers. |

| ∎ | Commodities Related Investments Risk — Exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, embargoes, tariffs and international economic, political and regulatory developments. |

| ∎ | Concentration Risk — To the extent that an underlying index of an Underlying Fund is concentrated in the securities of companies, a particular market, industry, group of industries, sector or asset class, country, region or group of countries, that Underlying Fund may be adversely affected by the performance of those securities, may be subject to increased price volatility and may be more susceptible to adverse economic, market, political or regulatory occurrences affecting that market, industry, group of industries, sector or asset class, country, region or group of countries. |

| ∎ | Depositary Receipts Risk — Depositary receipts are generally subject to the same risks as the foreign securities that they evidence or into which they may be converted. In addition to investment risks associated with the underlying issuer, depositary receipts expose the Fund to additional risks associated with the non-uniform terms that apply to depositary receipt programs, credit exposure to the depository bank and to the sponsors and other parties with whom the depository bank establishes the programs, currency risk and the risk of an illiquid market for depositary receipts. The issuers of unsponsored depositary receipts are not obligated to disclose information that is, in the United States, considered material. Therefore, there may be less information available regarding these issuers and there may not be a correlation between such information and the market value of the depositary receipts. |

| ∎ | Derivatives Risk — The Fund’s use of derivatives may increase its costs, reduce the Fund’s returns and/or increase volatility. Derivatives involve significant risks, including: |

Volatility Risk — Volatility is defined as the characteristic of a security, an index or a market to fluctuate significantly in price within a short time period. A risk of the Fund’s use of derivatives is that the fluctuations in their values may not correlate with the overall securities markets.

Counterparty Risk — Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation.

Market and Illiquidity Risk — The possible lack of a liquid secondary market for derivatives and the resulting inability of the Fund to sell or otherwise close a derivatives position could expose the Fund to losses and could make derivatives more difficult for the Fund to value accurately.

Valuation Risk — Valuation may be more difficult in times of market turmoil since many investors and market makers may be reluctant to purchase complex instruments or quote prices for them.