UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 10-K

____________________________

For the fiscal year ended December 31 , 2023

or

For the transition period from _____ to _____

Commission File Number: 001-11796

____________________________

| ||

(Exact name of registrant as specified in its charter)

____________________________

British Columbia, | ||||||||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices, zip code)

(800 ) 895-2723

(Registrant’s telephone number, including area code)

____________________________

Securities Registered Pursuant to Section 12(b) of the Act:

(Title of class) | (Trading symbol) | (Name of exchange on which registered) | ||||||

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||||||||

| Emerging growth company | ||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to management's assessment of the effectiveness of its internal control financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 2, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the shares of voting common stock held by non-affiliates of the registrant, computed by reference to the closing sales price of such shares on the New York Stock Exchange on July 2, 2023, was $2.2 billion.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of the securities under a plan confirmed by a court. Yes ☒ No ☐

The registrant had outstanding 21,932,452 shares of Common Stock, no par value, as of February 27, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2024 Annual General Meeting of Shareholders ("2024 Proxy Statement") are incorporated by reference into Part III, Items 10-14 of this Annual Report on Form 10-K. The 2024 Proxy Statement or an amendment to this Form 10-K ("Form 10-K Amendment") will be filed with the Securities and Exchange Commission not later than 120 days after December 31, 2023.

| ||

MASONITE INTERNATIONAL CORPORATION

INDEX TO ANNUAL REPORT ON FORM 10-K

December 31, 2023

| Page No. | |||||||||||

| PART I | |||||||||||

| Item 1 | |||||||||||

| Item 1A | |||||||||||

| Item 1B | |||||||||||

| Item 1C | |||||||||||

| Item 2 | |||||||||||

| Item 3 | |||||||||||

| Item 4 | |||||||||||

| PART II | |||||||||||

| Item 5 | |||||||||||

| Item 6 | |||||||||||

| Item 7 | |||||||||||

| Item 7A | |||||||||||

| Item 8 | |||||||||||

| Item 9 | |||||||||||

| Item 9A | |||||||||||

| Item 9B | |||||||||||

| Item 9C | |||||||||||

| PART III | |||||||||||

| Item 10 | |||||||||||

| Item 11 | |||||||||||

| Item 12 | |||||||||||

| Item 13 | |||||||||||

| Item 14 | |||||||||||

| PART IV | |||||||||||

| Item 15 | |||||||||||

| Item 16 | |||||||||||

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of the federal securities laws, including, without limitation, statements concerning the conditions in our industry, our operations, our economic performance and financial condition, including, in particular, statements relating to our business and growth strategy and product development efforts under "Management’s Discussion and Analysis of Financial Condition and Results of Operations." Forward-looking statements include all statements that do not relate solely to historical or current facts and can be identified by the use of words such as "may," "might," "could," "will," "would," "should," "expect," "believes," "outlook," "predict," "forecast," "objective," "remain," "anticipate," "estimate," "potential," "continue," "plan," "project," "targeting," and other similar expressions. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. These forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain and subject to a number of risks and uncertainties. These risks and uncertainties include, without limitation, those identified under "Risk Factors" and elsewhere in this Annual Report.

The following list represents some, but not necessarily all, of the factors that could cause actual results to differ from historical results or those anticipated or predicted by these forward-looking statements:

•restrictions during the pendency of the Acquisition (as defined herein) that may impact our ability to pursue certain business opportunities or strategic transactions;

•risks related to diverting management’s attention from ongoing business operations and disrupting our relationships with third-parties and employees during the pendency of the Acquisition;

•the risk that the Acquisition may not be completed in a timely manner or at all, which may adversely affect our business and the price of our common stock;

•the outcome of any legal proceedings that may be instituted against us related to the Arrangement Agreement (as defined herein) or the Acquisition;

•downward trends in our end markets and in economic conditions;

•reduced levels of residential new construction; residential repair, renovation and remodeling; and non-residential building construction activity due to increases in mortgage rates, changes in mortgage interest deductions and related tax changes and reduced availability of financing;

•competition;

•the continued success of, and our ability to maintain relationships with, certain key customers in light of customer concentration and consolidation;

•our ability to accurately anticipate demand for our products;

•impacts on our business from weather and climate change;

•our ability to successfully consummate and integrate mergers and acquisitions;

•our inability to remediate an identified material weakness on a timely basis;

•changes in prices of raw materials and fuel;

•tariffs and evolving trade policy and friction between the United States and other countries, including China, and the impact of anti-dumping and countervailing duties;

•increases in labor costs, the availability of labor or labor relations (i.e., disruptions, strikes or work stoppages);

•our ability to manage our operations including potential disruptions, manufacturing realignments (including related restructuring charges) and customer credit risk;

•product liability claims and product recalls;

•our ability to generate sufficient cash flows to fund our capital expenditure requirements and to meet our debt service obligations, including our obligations under our senior notes, our term loan credit agreement (the "Term Loan Facility") and our asset-based revolving credit facility (the "ABL Facility");

•limitations on operating our business as a result of covenant restrictions under our existing and future indebtedness, including our senior notes, the Term Loan Facility and the ABL Facility;

•fluctuating foreign exchange and interest rates;

•the continuous operation of our current information technology and enterprise resource planning ("ERP") systems, implementation of new ERPs and management of potential cyber security threats and attacks and data privacy requirements;

•political, economic and other risks that arise from operating a multinational business;

•retention of key management personnel;

ii

•environmental and other government regulations, including the United States Foreign Corrupt Practices Act ("FCPA"), and any changes in such regulations;

•the scale and scope of public health issues and their impact on our operations, customer demand and supply chain; and

•our ability to replace our expiring patents and to innovate and keep pace with technological developments.

We caution you that the foregoing list of important factors is not all-inclusive. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this Annual Report may not in fact occur. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

The Company may use its website and/or social media outlets, such as LinkedIn, as distribution channels of material company information. Financial and other important information regarding the Company is routinely posted on and accessible through the Company’s website at http://investor.masonite.com and its LinkedIn page at https://www.linkedin.com/company/masonitedoors/mycompany/. In addition, you may automatically receive email alerts and other information about the Company when you enroll your email address by visiting the "Email Alerts" section at http://investor.masonite.com.

iii

PART I

Unless we state otherwise or the context otherwise requires, in this Annual Report, all references to "Masonite," "we," "us," "our" and the "Company" refer to Masonite International Corporation and its subsidiaries.

Item 1. Business

Our Company

We are a leading global designer, manufacturer, marketer and distributor of interior and exterior doors and door solutions for the residential and non-residential building construction markets' new construction and repair, renovation and remodeling sectors. Masonite was founded in 1925 in Laurel, Mississippi, by William H. Mason, to utilize vastly available quantities of sawmill waste to manufacture a usable product. Since then, we have provided our customers with innovative products and superior service at compelling values.

We believe we hold either the number one or two market position in the seven product categories we target in North America: interior molded residential doors; interior stile and rail residential doors; exterior fiberglass residential doors; exterior steel residential doors; interior architectural wood doors; wood veneers; and door core. To serve our customers, we operate 64 manufacturing and distribution facilities strategically located in seven countries in North America, Europe, South America and Asia.

The Acquisition

On February 8, 2024, we entered into an Arrangement Agreement (the “Arrangement Agreement”) with Owens Corning (“Owens Corning”), a Delaware corporation, and MT Acquisition Co ULC (“Purchaser”), a British Columbia unlimited liability company and a wholly owned subsidiary of Owens Corning. Subject to the terms and conditions of the Arrangement Agreement, Owens Corning, through Purchaser, agreed to acquire the Company for $133.00 per issued and outstanding share of our common stock, no par value (the “Shares”), in an all-cash transaction. Pursuant to the Arrangement Agreement, following implementation of a court-approved plan of arrangement under the Business Corporations Act (British Columbia), the Company will be a wholly owned subsidiary of Owens Corning (the “Acquisition”). As a result of the Acquisition, we will cease to be a publicly traded company. We have agreed to various customary covenants and agreements, including, among others, agreements to conduct our business in the ordinary course during the period between the execution of the Arrangement Agreement and the effective time of the Acquisition (the “Effective Time”). We do not believe these restrictions will prevent us from meeting our debt service obligations, ongoing costs of operations, working capital needs or capital expenditure requirements.

If the Arrangement Agreement is terminated under certain specified circumstances, we or Owens Corning will be required to pay a termination fee. We will be required to pay Owens Corning a termination fee of $75.0 million under specified circumstances, including (a) termination of the Arrangement Agreement in connection with our entry into an agreement with respect to a Superior Proposal (as defined in the Arrangement Agreement) prior to us receiving stockholder approval of the Acquisition, (b) termination by Owens Corning upon an Adverse Recommendation Change (as defined in the Arrangement Agreement), or (c) termination in certain circumstances by either Owens Corning or us upon failure to obtain Masonite Shareholder Approval (as defined in the Arrangement Agreement) or by Owens Corning if we breach our representations, warranties or covenants in a manner that would result in a failure of an applicable closing condition to be satisfied and, if curable, we fail to cure such breach during specific time periods, in each case, if certain other conditions are met. Owens Corning will be required to pay us a reverse termination fee under specified circumstances, including termination of the Arrangement Agreement due to a permanent injunction arising from Competition Laws (as defined in the Arrangement Agreement) when we are not then in material breach of any provision of the Arrangement Agreement and if certain other conditions are met, in an amount equal to $150.0 million. The consummation of the Acquisition remains subject to customary closing conditions, including satisfaction of certain regulatory approvals, approval by our stockholders and other customary closing conditions. The Acquisition is currently expected to close by mid-2024.

For additional information related to the Acquisition, please refer to the preliminary proxy statement to be filed with the SEC and other relevant materials in connection with the transaction that we will file with the SEC and that will contain important information about the Company and the Acquisition.

1

Our Reportable Segments

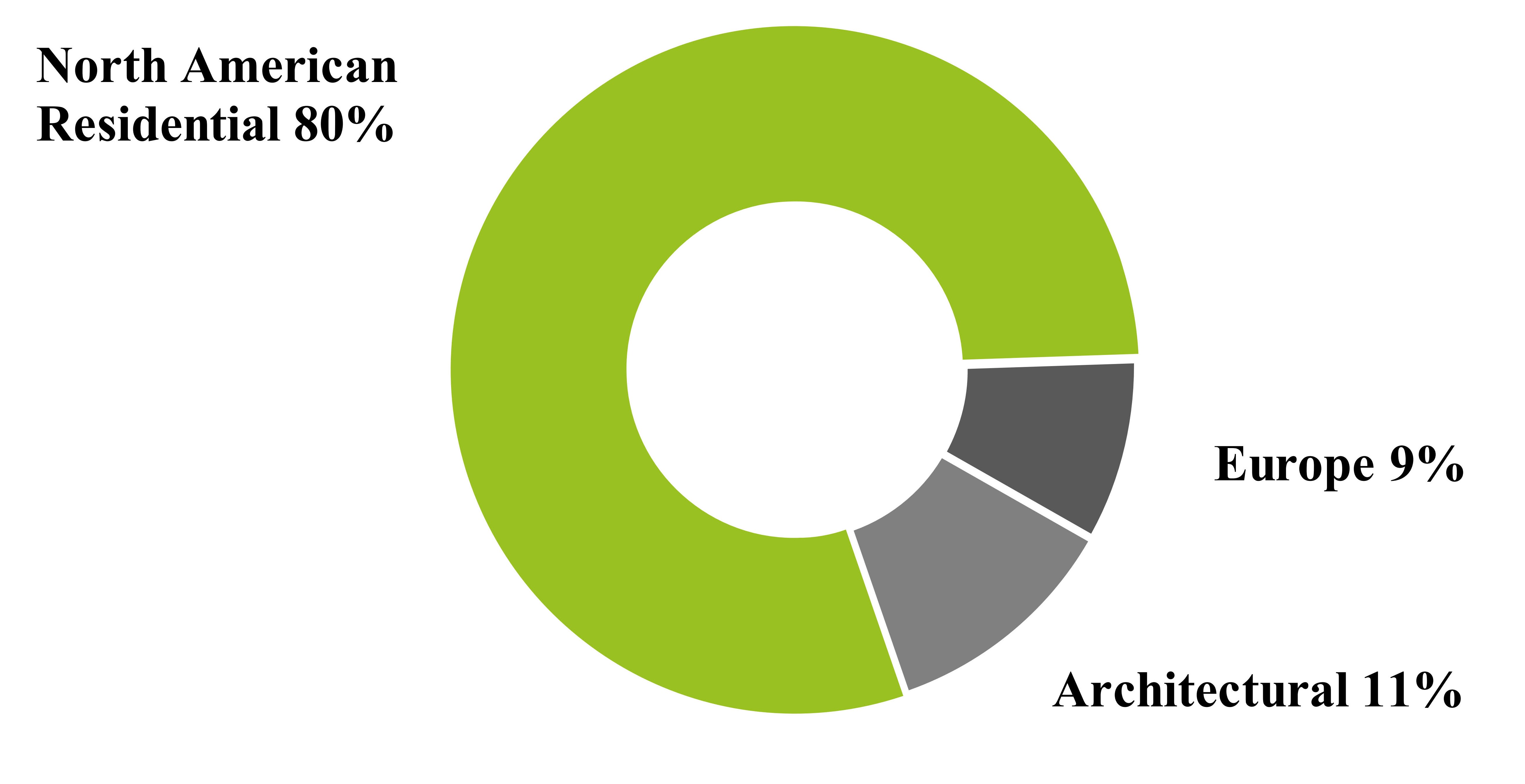

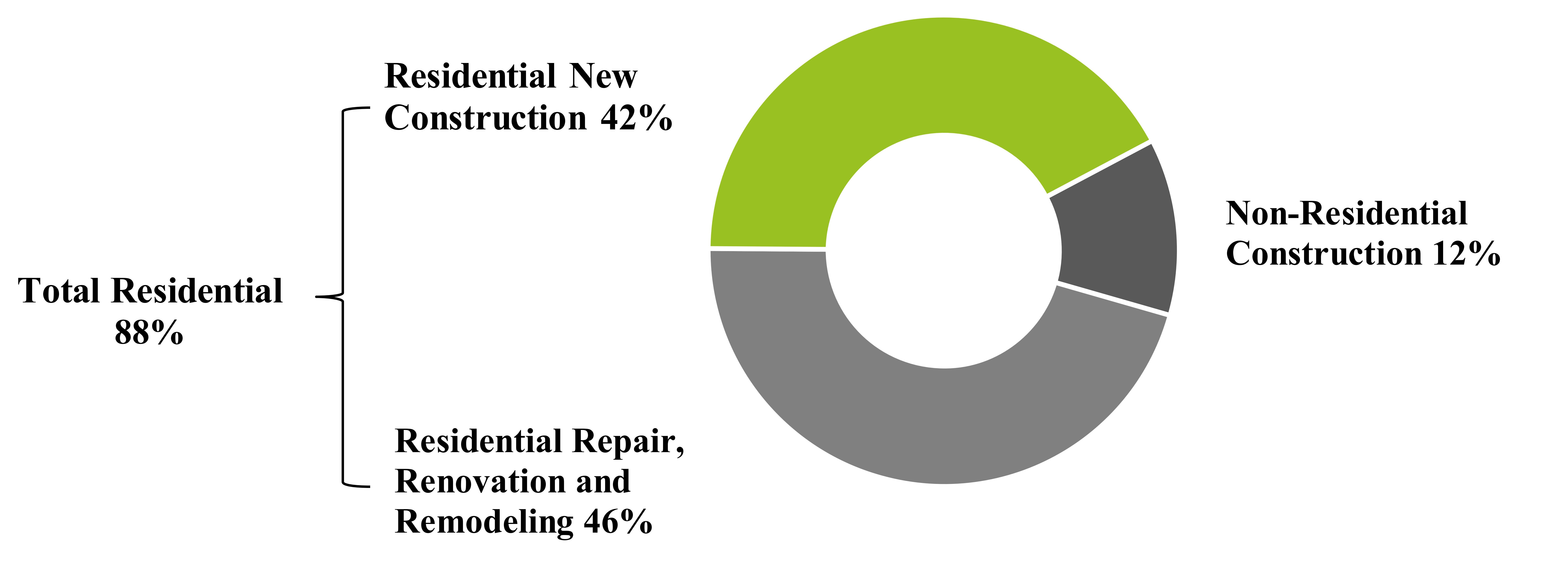

The Company has a vertically integrated business model with three reportable segments: North American Residential, Europe and Architectural.

North American Residential. Our North American Residential segment focuses on delivering high-quality interior doors made from wood and recycled wood fibers, durable exterior doors in various designs, materials and sizes and high-quality components to customers primarily in the United States and Canada. With an extensive product portfolio and a well-established presence in the industry, we serve the diverse needs of residential repair, remodel and new construction markets. Residential doors are primarily sold through wholesale and retail distribution channels ensuring that we reach and service a broad spectrum of customers. In the wholesale channel, we sell directly to homebuilders, contractors, lumberyards, dealers and building products retailers in one or two steps. One-step distributors sell doors directly to homebuilders and remodeling contractors, while two-step distributors purchase doors in bulk quantities for serving local door dealers who often perform additional value-added services such as pre-hanging or pre-finishing the door in preparation for installation. The retail channel serves consumers and contractors through retail home centers, both in-store and online. As of the end of 2023, we estimate that the residential repair, renovation and remodeling end market accounted for over half of the net sales for the segment.

Europe. Our European segment offers an extensive portfolio of both recycled wood fiber interior doors and energy-efficient, durable composite exterior doors. Serving customers primarily in the United Kingdom, interior product sales are roughly split between interior and exterior products. Our distribution channels include wholesaler and retail outlets similar to our North American residential strategy, as well as sale of pre-hung interior doors to large housebuilders and sale of pre-finished exterior door systems direct to renovation contractors. Additionally, our Ireland manufacturing facility supplies door facings to Western Europe, contributing to our strong presence and commitment to sustainable building solutions.

Architectural. Our Architectural segment specializes in crafting precision wood interior doors for non-residential building applications. Serving a variety of sectors, including hospitality, healthcare, education and mixed-use facilities, we provide high quality door solutions that comply with diverse needs such as acoustical control, fire rated applications and attack-resistant options. Architectural doors are primarily sold through specialized one-step wholesale distribution channels where distributors sell to general contractors and end-use clients.

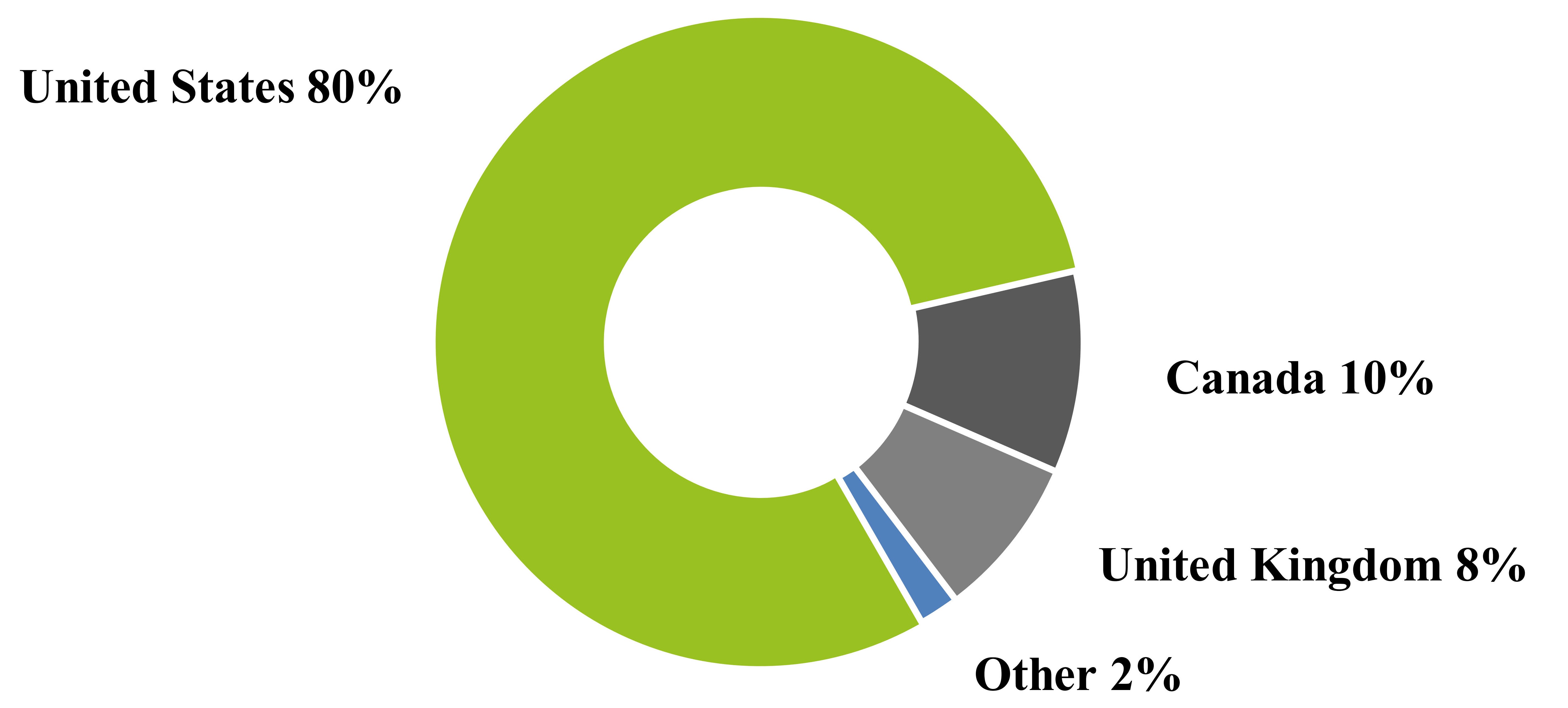

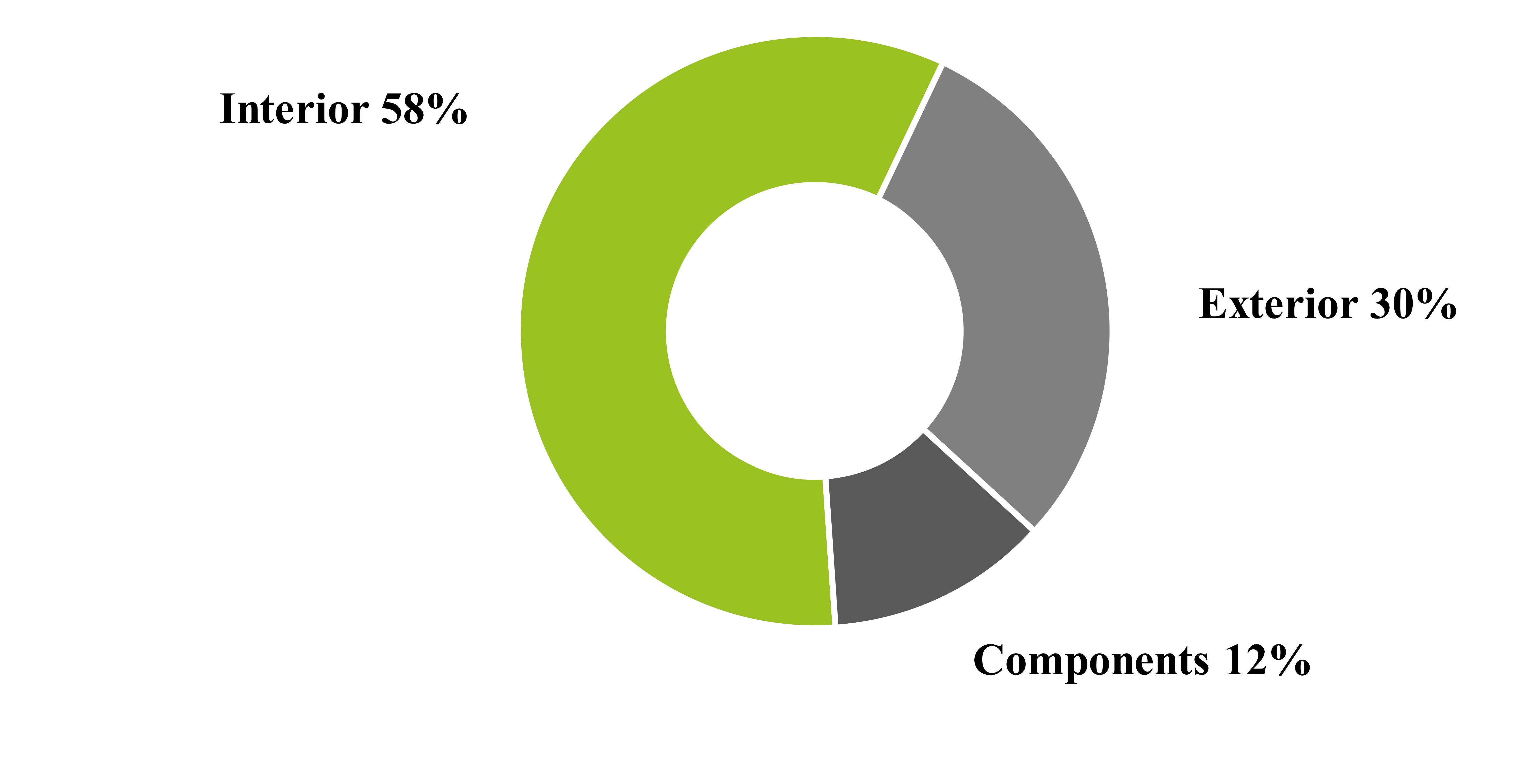

In the fiscal year ended December 31, 2023, we sold approximately 26 million doors to approximately 6,600 customers globally. Our fiscal year 2023 net sales by segment and estimated global net sales of doors by end market, geographies and products are set forth below:

| Business Segments | End Markets | ||||

|  | ||||

| Geographies | Products | ||||

|  | ||||

2

See Note 17 to our consolidated financial statements in this Annual Report for additional information about our segments.

Our Strategy

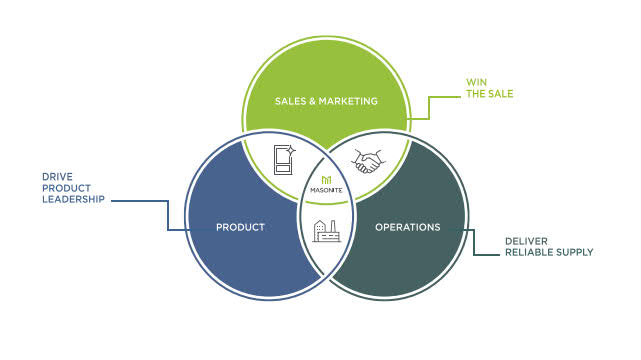

The Doors That Do MoreTM strategy is our plan for achieving sustainable growth and value creation that benefits our stakeholders, and is centered on in three pillars: (1) Drive Product Leadership, (2) Win the Sale and (3) Deliver Reliable Supply.

Drive Product Leadership. Drive Product Leadership emphasizes developing differentiated and innovative door solutions that solve life and living problems. We continually strive to push the boundaries of creativity, employing innovative technology, market insights and customer feedback to design products that enhance the quality of life within the home environment. We strive to provide products and solutions that meet growing homeowner needs for privacy, security, comfort, connectivity, light and style.

Win the Sale. Win the Sale focuses on creating and capturing end-market demand by building our brand through meaningful engagement with homeowners, builders and remodelers and working with our channel partners to identify mutually beneficial growth opportunities. Investing in our channel relationships has always been our priority and our strong partnerships are a primary reason we are a market leader today.

Deliver Reliable Supply. Deliver Reliable Supply is our commitment to be the best supplier in the industry by consistently providing high-quality products and exceptional services for our customers and partners. This pillar is important to supporting our brand and value proposition for our customers, and is achieved by leveraging our large and vertically integrated manufacturing network and our Mvantage operating system.

To enhance our Doors That Do MoreTM strategy, we may pursue targeted acquisitions in adjacent product categories to expand our portfolio of innovative product offerings and unlock the value of fully integrated door systems. In 2023, we acquired EPI Holdings, Inc. (“Endura”) and Fleetwood Aluminum Products, LLC (“Fleetwood”). Endura is a leading innovator and manufacturer of high-performance door frames and door system components including engineered frames, self-adjusting sill systems, weather sealing, multi-point locks and installation accessories used by builders and contractors.

Fleetwood is a leading designer and manufacturer of premium, aluminum-framed glass door and window solutions including multi-slide and pocket glass patio doors, pivot and hinged glass entry doors and folding glass door wall systems for luxury homes.

3

Our Products

Our focus on consumer-driven innovation led us to think broadly about the entire door system and the value it can bring when integrated. We believe that designing differentiated value-added door systems that solve life and living problems can drive growth in any housing cycle. Recognizing human needs for privacy, security, comfort, connectivity, light and style, we provide an extensive product assortment offering good, better, and best options.

This focus, combined with Masonite’s business relationships in the industry, led to the development of award-winning products such as the M-PwrTM Smart Door and the Masonite Performance Door System. Masonite’s M-PwrTM Smart Doors are the first residential exterior doors to integrate power, light, a video doorbell and a smart lock into the door system. We employ patent-pending, Underwriters Laboratories (“UL”) certified technology to connect residential front doors to a home’s electrical system and wireless internet network. The Masonite Performance Door System features the company’s industry-leading 4-Point Performance Seal, which includes Premium Square Edge Fiberglass Doors, Endura’s Z-Articulating Cap SillTM, PE650 Weatherstripping, Simple Solution® Corner Pads and FrameSaver® rot-proof door frame. The addition of Fleetwood enables us to offer an expansive range of products to the high-end market. Fleetwood’s innovative product lines include the EDGE Collection, the Gen4 Series and the 3-Series. These luxurious, best-in-class doors and windows are complemented by high-quality components and hardware such as the Arche-Duct sub-floor draining system and the patented Archetype Locking and Rolling system.

Components

In addition to residential and non-residential doors, we also sell several crucial door components to the building materials industry. Within the residential door market, we provide sills, frames, astragals, locking systems, molded interior door facings, agri-fiber and particleboard door cores, and wood cut stock components. Within the non-residential door market, we are a supplier of mineral and particleboard door cores and veneer door facings.

Molded door facings are thin sheets of molded hardboard produced by grinding or defibrating wood chips, adding resin and other ingredients to create a thick mat of wood fibers, which is then pressed between steel die plates to form a molded sheet. Surfaces may be smooth or contain a wood grain pattern. Following pressing, molded door facings are trimmed, primed and shipped to door manufacturing plants where they are mounted on frames to produce molded doors.

Door framing materials, commonly called cut stock, are wood or MDF components that constitute the frame on which interior and exterior door facings are attached. Door cores are pressed fiber mats of refined wood chips or agri-fiber used to construct solid core doors. For doors that must achieve a fire rating higher than 45 minutes or longer, the door core typically consists of an inert mineral core or similar compounds.

Interior Doors

Designed for versatility and durability, our molded panel doors are available with either a hollow or solid core. Assembled with two molded door facing panels around a wood or MDF frame, these doors are used in closets, bedrooms, bathrooms and hallways. Our solid core interior doors are crafted to provide more sound dampening material to enhance comfort and privacy within living spaces. Our molded panel product line is subdivided into several distinct product groups: our Classic Molded Panel series is a combination of classic styling and durable construction in a variety

4

of styles preferred by our customers when price sensitivity is a factor in product selection; the West EndTM Collection introduces modern linear designs to the molded panel interior door category; the Heritage® Series features recessed, flat panels and sharp, Shaker-style profiles which integrate into transitional styles found in many homes today; and the Livingston lines features versatile and timeless design for any style of home. Our doors can be upgraded to our environmentally friendly EmeraldTM door construction, which enables homeowners, builders and architects to meet specific product requirements and "green" specifications to attain Leadership in Energy and Environmental Design ("LEED") certification.

Our flush interior doors, available with either a hollow or solid core, are crafted by assembling two plywood facings, MDF, composite wood or hardboard over a wood or MDF frame. Our flush door range offers solutions for every preference, from base residential flush doors made of unfinished composite wood to high-end wood veneer doors.

Exterior Doors

Our exterior doors are made primarily of steel, fiberglass or composite materials. Fiberglass doors, recognized for their premier quality, feature an assembly of two fiberglass facings encompassing a sturdy wood frame. Innovative design, coupled with polyurethane insulation, ensures resilience against varying temperatures and the elements. We introduce light and style into living spaces with our VistaGrande flush-glazed fiberglass doors, seamlessly integrating aesthetics and functionality. Featuring glass inserts, these doors add an elegant touch to any entryway or interior space.

In the United Kingdom, Door-StopTM branded composite doors are manufactured into pre-hung door sets, while our Solidor® exterior doors are assembled around a solid timber core that provides enhanced security. Both product lines offer the benefits of durable materials that require minimal maintenance, and numerous designs and color choices. Innovative consumer marketing has led Solidor® to become one of the United Kingdom's most recognized manufacturers and suppliers of composite doors.

Stile and rail doors are made from wood or MDF with individual panels that have been cut, milled, veneered and assembled from various species of lumber, such as clear pine, knotty pine, oak and cherry. Within our stile and rail line, glass panels can be inserted to create what is commonly referred to as a French door, and we offer several glass designs for use in this purpose. Stile and rail doors are used as entry doors for exterior purposes, often including decorative glass inserts.

Steel doors are exterior doors made by assembling two interlocking, flat or paneled steel facings or by attaching two steel facings to a wood or steel frame and injecting the core with polyurethane insulation. With our functional Utility Steel series, the design-centric High Definition family and the pre-finished Sta-Tru® HD, we offer customers the freedom to select the right combination of design, protection and compliance required for any paint-grade exterior door application. In addition, our product offering is significantly increased through our variety of compatible clear or decorative glass designs.

Architectural Doors

Architectural doors are typically highly specified products designed, constructed and rigorously tested to ensure that regulatory standards, such as fire codes and environmental certifications, such as Forest Stewardship Council are met. These doors are sold into institutional (schools, healthcare and government) and commercial (hotels, offices and retail) end markets that often require doors that provide fire safety, security, acoustic comfort and sustainability. Our architectural portfolio is represented by two series, AspiroTM and CenduraTM, comprised of stile and rail, flush wood veneer and painted and laminate doors. The AspiroTM series offers premium, custom aesthetic with high-performance options in acoustic, fire-rated, lead-lined, attack- and bullet-resistant and sustainability categories. The CenduraTM series balances performance and value and is available with our standard aesthetic options with acoustic and fire-rated options. Our portfolio allows us to provide a wide range of solutions to cover the varied needs of commercial and institutional end markets.

Research and Development

We are a global leader in the innovation and development of complete door solutions and the manufacturing processes involved in making such products. As part of the Doors That Do MoreTM strategy, we increased our investment in research and development with a significant focus on developing new, differentiated products, such as our M-PwrTM Smart Doors and Masonite Performance Door Systems, as well as processes and material improvements to enhance quality. We believe that research and development is a competitive advantage for us, and we intend to

5

capitalize on our leadership in this area. Over the last several years, we have built technical and process competencies at the Masonite Innovation Center, our research and development center in West Chicago, IL, which we believe is the largest facility of its kind in the industry. Our end-user experience, research and development and engineering capabilities enable us to organically curate innovative ideas, methodically validate commercial and technical viability, and use cross-functional teams to launch new product concepts and manufacturing processes. The result of this rigorous approach enables us to launch new, proprietary solutions, enhance the manufacturing efficiency and quality of our products and reduce operational costs.

Intellectual Property

We protect the intellectual property that we develop through, among other things, filing for patents in the United States and various foreign countries. In the United States, we currently have 324 design patents and design patent applications and 249 utility patents and patent applications. We currently have 307 foreign design patents and patent applications and 229 foreign utility patents and patent applications. Our United States utility patents are generally applicable for 20 years from the earliest filing date, our United States design patents for 15 years and our United States registered trademarks and tradenames are generally applicable for 10 years and are renewable. Our foreign patents and trademarks have terms as set by the particular country, although trademarks generally are renewable.

Raw Materials

While Masonite is vertically integrated, we require a regular supply of raw materials, such as wood chips, some cut stock components, various composites, steel, glass, aluminum, paint, stain and primer as well as petroleum-based products such as binders, resins and plastic injection frames to manufacture and assemble our products. In 2023, our materials cost accounted for approximately 49% of the total cost of the finished product, from which more than half of the material supply comes from the United States. Wood chips, logs, resins, binders and other additives utilized in manufacturing interior molded facings, exterior fiberglass door facings and door cores are purchased from global, regional and local suppliers, considering the relative freight cost of these materials. Internal framing components, MDF, cut stock and internal door cores are manufactured internally at our facilities and supplemented by suppliers worldwide. We utilize a network of suppliers based in North America, Europe, South America and Asia to purchase other components, including MDF, plywood and hardboard facings, door jambs and frames, glass frames and inserts, and steel coils for the stamping of steel door facings.

Manufacturing Process

As a vertically integrated door manufacturer, we exercise control over every stage of the production process, from initial design and development to the assembly of finished products. Our components plants supply high-quality door facings, door frames and hardware components such as rails, cores and sills to our manufacturing operations. The interior door assembly facilities combine the components to produce a standard hollow or Masonite solid core door. The exterior door facilities assemble steel or fiberglass doors by injecting insulating foam into the facings produced by the component plants. At our door fabrication facilities, final attributes such as painting and framing are added to the door before packaging the doors for delivery.

Our commitment to operational excellence is deeply embedded in our manufacturing process, designed to ensure a reliable supply of high-quality products and exceptional service. The cornerstone of our operational efficiency

6

is Mvantage, our lean operating system which systematically focuses on eliminating waste and creating operational consistency.

In recent years, our commitment to operational excellence has led us to invest in advanced manufacturing technologies and extend the deployment of the Mvantage operating system across our enterprise. This approach is particularly evident in our European facility in Stoke-on-Trent, where material flow and safety are optimized through advanced manufacturing automation. Similarly, our Fort Mill facility in North America, designed with our best Mvantage practices, incorporates the latest technology to optimize manufacturing.

The Mvantage operating system utilizes a wide array of lean management tools to support three distinct areas: Model Plant Transformation; Process Improvement Teams; and Global Standards and Training. The Model Plant Transformation Process aims to improve factory throughput and efficiency using approaches such as equipment reconfiguration for enhanced safety and material flow, inventory optimization, and the implementation and tracking of sustaining performance metrics. Our dedicated team of Process Improvement experts drives critical initiatives to identify and resolve specific areas of inefficiency, while engaging employees at all levels in Kaizen workshops to embed a culture of continuous improvement into our day-to-day operating rhythm. Our Global Standards and Training processes provide our employees with a comprehensive set of tools and operating standards used in every plant to drive a common look and feel across all Masonite facilities.

Our commitment to training extends beyond traditional Kaizen facilitator training, including Six Sigma training certifying Masonite-trained Green and Black Belts. This structured approach, ingrained in our continuous improvement culture, propels improvements in quality and productivity while maintaining an unwavering focus on reliable customer service.

We focus on making Masonite the brand that customers never substitute, aligning with their needs for style, comfort, safety and convenience. Our curated product portfolio reflects our commitment to meeting needs around the home and positions Masonite for future growth. We recognize the importance of simplifying and streamlining the research and decision-making part of the buyer’s journey. As one of North America’s largest designers, manufacturers and marketers of doors, Masonite is positioned as the go-to source for homeowners researching doors and door options.

Our sales and marketing efforts concentrate on key initiatives designed to build a strong brand preference through creative end-user purchasing experience. This targeted approach is driven by our consumer-centric research that uncovers unmet needs around the home. Our commitment involves dedicating more resources to training sales personnel and influencers, improving the in-store experience and launching a revamped Masonite.com.

The new Masonite.com features, such as the visualizer and back-end content distribution tools, are designed to make the buying process more accessible and consistent. The visualizer allows buyers to digitally render their space with a new Masonite door, instilling confidence in their choice.

As part of our cross-merchandising strategy, we market and sell our products through well-established wholesale, retail and direct distribution channels. In North America, our doors are marketed primarily under the Masonite® brand. Other North American brands include: Premdor®, Masonite Architectural®, Barrington®, Oakcraft®, Sta-Tru® HD, Vistagrande®, Flagstaff®, Hollister®, Sierra®, Fast-Frame®, Safe ’N Sound®, Livingston®, AquaSeal®, Cheyenne®, Riverside®, Fast-Fit®, Megantic®, Lemieux Doors®, Harring Doors®, FyreWerks® and Marshfield-

7

Algoma®, Fleetwood® and EDGE. In Europe, doors are marketed under the Masonite®, Premdor®, Premdor Speed Set®, Door-Stop International®, National Hickman®, Defining Spaces®, Solidor®, Residor® and Nicedor® brands.

Our newly acquired component product lines, such as Z-Articulating Cap Sill®, ADAptive, and Ultimate Astragals,Trilennium®, Simple Solution® Corner Pads and PanoLock® are marketed primarily under the Endura Products® brand. We consider the use of trademarks and trade names to be important in the development of product awareness and for differentiating products from competitors and between customers.

In the residential market, we utilize an "All Products" merchandising strategy, providing our retail and wholesale customers access to our entire product range. Our residential wholesale sales professionals focus on down-channel initiatives to ensure our products are "pulled" through our North American wholesale distribution network.

Our North American architectural customers are serviced by a dedicated sales and marketing team, providing architects, door and hardware distributors, general contractors and project owners with a wide range of product application advice, technical specifications and applicable compliance and regulatory certifications.

Service Innovation

We leverage our marketing, sales and customer service activities to ensure our products are strategically pulled through multiple distribution channels. The back-end content distribution tools enable us to push the newest and most up-to-date content to partner websites, ensuring better access to information and consistent messaging. Our proprietary web-based tools, including Mconnect® in North America and the Solidor® and Door-Stop International websites in Europe, provide our channel customers with direct access to a wide range of information and materials, making it easier for them to sell our products.

In our Architectural business, our cloud-based door configurator, DoorBuilderTM Live, enables customers to select and order the correct door easily and intuitively. Our DoorUniversity training program also helps architects select solutions to meet their project and client goals while earning American Institute of Architects continuing education units.

Customers

During fiscal year 2023, we sold our products worldwide to approximately 6,600 customers. Investing in our channel partners has always been our priority, as we see our strong partnerships as one of the main reasons we are a market leader today. In early 2023, we implemented a new Go-To-Market strategy in North America focused on unlocking additional value for our customers and achieving strategic growth objectives. This collaborative approach allowed us to create a shared vision and set of priorities with our channel partners, develop joint business plans and partner with them to deliver best-in-class execution of everyday sales. By achieving further integration and collaboration with our channel partners, we can unlock additional opportunities to win the sale with our end customers.

Although we have many customers worldwide, our largest customer, The Home Depot, accounted for approximately 20% of our total net sales in fiscal year 2023. Due to the depth and breadth of the relationship with this customer, which operates in multiple North American geographic regions and sells a variety of our products, our management believes that this relationship is likely to continue.

Competition

The door manufacturing industry is highly competitive and includes a number of global and local participants. The primary participants in the North American residential interior door industry are Masonite and JELD-WEN, the only vertically integrated manufacturers of molded door facings. Several smaller competitors in the residential interior door industry include Steves and Sons Inc. and Lynden Door, Inc. who primarily source door facings from third-party suppliers. The primary North American residential exterior door industry participants are Masonite, JELD-WEN, Plastpro, Therma-Tru, Feather River and Steves and Sons Inc. The primary participants in the North American non-residential building construction door industry are Masonite and VT Industries, with the remainder supplied by multiple regional manufacturers. Our primary market in Europe is the United Kingdom which is similarly competitive and includes a number of global and local participants. The primary participants in the United Kingdom are our subsidiary Premdor, JELD-WEN, Vicaima and Distinction Doors. Competition in these markets is primarily based on product quality, design characteristics, brand awareness, serviceability, distribution capabilities and value. We also face competition in the other countries in which we operate.

8

A sizable portion of our net sales are sold to large home centers and retailers. The consolidation of our customers and our reliance on fewer larger customers has increased the competitive pressures as some of our largest customers, such as The Home Depot, perform periodic product line reviews to assess their product offerings and suppliers.

Other Corporate Information

Human Capital Resources

Our Company culture is based upon a strong set of values. Our Cultural Pillars define how we act and interact as individuals and as an organization. They reflect the environment we create where people are empowered, collaborative and focused on doing the right thing for our customers, teammates, shareholders, suppliers and communities in which we work.

Our workforce includes over 10,000 employees and contract personnel in seven different countries. This includes approximately 2,200 unionized employees, approximately 85% of whom are located in North America and with the remainder in various foreign locations. Nine of our North American facilities have individual collective bargaining agreements, which are negotiated locally and the terms of which vary by location.

Our Company’s Purpose: We Help People Walk Through WallsSM is reflected in our talent strategy that is focused on attracting and selecting exceptional talent, helping them develop and grow professionally and providing opportunities to recognize and reward their performance, in order to engage and retain our skilled, diverse and motivated workforce. We focus on the employee experience, removing barriers to inclusion, in an effort to enable our people to realize their full potential and highest performance levels. We aspire to be the employer of choice within the markets we operate and seek to grow and develop the capabilities and skills we need for the future while maintaining a robust pipeline of available talent throughout the organization.

We embrace the diversity of our employees and customers, including their unique backgrounds, experiences and talents. In 2021, we formed a corporate Diversity Council and five regional councils representing Canada, the United States, Chile, Mexico and the United Kingdom/Ireland regions. These councils are comprised of cross-functional individuals and leaders from across their respective regions who represent a broad cross section of demographics and assist in our implementation of diversity initiatives. In 2022, our diversity strategy was further enhanced by establishing affinity groups that provide employees with a place of belonging, support and allyship. At Masonite, everyone is valued and appreciated for their unique contributions to the growth and sustainability of our business. We strive to cultivate a culture that supports and enhances our ability to recruit, develop, engage and retain diverse talent at every level. We monitor engagement, partially through a voluntary turnover metric as our goal is to maintain a highly engaged team, thereby reducing voluntary turnover year over year. During fiscal year 2023, our voluntary employee turnover rate for employees in the United States, Canada and the United Kingdom was approximately 16%, a reduction of approximately 500 bps from 2022. These locations collectively make up approximately 85% of our global workforce. We also track 12-month retention rates, which have improved over time. At the end of 2023, our combined hourly employee retention rate in the United States, Canada and the United Kingdom was over 87% across all locations.

We use various methods to listen to our employees and capture their feedback. These methods include all-employee calls, focus groups, employee and manager forums, town hall meetings and company-wide employee engagement surveys. An external analytics and advisory firm conducts our annual employee engagement survey. In 2023, the employee response rate increased to our highest-ever rate of 91%, with seven facilities having a 100% response rate. Since we initially administered the survey in 2017, our mean results have increased, reaching 3.79 out of 5.00 in 2023.

In support of our Company's purpose, in 2021, we launched a quarterly grant program to provide funding to assist individuals, organizations and causes in the communities where we live and work. Our We Help People Walk Through WallsSM Community Grant Program funds the organizations our employees care about most in their local communities. The program has awarded approximately $300,000 in community grants to 68 different causes.

We believe that safety is as vital to our success as productivity and quality. This is reflected in our goal of Target Zero injuries and our continued effort to create an injury-free workplace. Incidents can be prevented through proper management, employee involvement, standardized operations and equipment and attention to detail. Safety programs and training are provided throughout the company to ensure employees and managers have practical tools to help identify and address both unsafe conditions and at-risk behaviors. In 2023, our total incident rate ("TIR"), or the

9

annual number of injuries per 100 full-time equivalent employees, decreased from 1.86 in 2022 to 1.64 in 2023, representing a 12% improvement in workplace incidents. Excluding the Endura acquisition, TIR decreased to 1.35, representing a 27% improvement. While our total incident rate remains well below the industry average, our ambition is to advance workplace safety by striving toward our goal of zero harm operations or Target Zero.

Environmental and Other Regulatory Matters

Masonite was founded nearly a century ago on sustainability principles by turning waste wood from a local sawmill in central Mississippi into a useful hardboard product. At the heart of our business philosophy is the continuous pursuit of waste reduction and resource conservation. Our operations deeply integrate the Mvantage lean operating system, rooted in the lean principle of waste elimination. This system equips Masonite employees with essential skills, empowering them to identify and eliminate sources of waste, including defects, over-processing and transportation.

Our unwavering commitment to sustainability extends to the proactive management of manufacturing waste. The Mvantage system guides us in actively seeking opportunities to divert waste from landfills by recycling materials back into the production process or repurposing them for beneficial use as byproducts. We comprehensively assess our manufacturing process, spanning supply sourcing to shipping, to identify ways to conserve natural resources and reduce solid waste, wastewater and air emissions. By identifying and eliminating waste, we cultivate a safer, more efficient and more productive operational environment at Masonite.

In 2022, we continued to develop a comprehensive carbon reduction strategy to reduce our Scope 1 and 2 greenhouse gas emissions. This strategy is centered on reducing our reliance on fossil fuels, increasing our renewable energy supply and improving overall operational efficiencies. We established a cross-functional committee to develop our responsible wood sourcing program. Our global sourcing team continues to educate our suppliers on our Wood Sourcing Policy.

We are subject to extensive environmental laws and regulations. The geographic breadth of our facilities subjects us to environmental laws, regulations and guidelines in several jurisdictions, including, among others, the United States, Canada, Mexico, the United Kingdom, Ireland, Chile and Malaysia. Such laws, regulations and guidelines relating to, among other things, the discharge of contaminants into water and air and onto land, the storage and handling of certain regulated materials used in the manufacturing process, waste minimization, the disposal of wastes and the remediation of contaminated sites. Many of our products are also subject to various regulations, such as building and construction codes, product safety regulations, health and safety laws and regulations and mandates related to energy efficiency.

Our efforts to ensure environmental compliance include the review of our operations on an ongoing basis, utilizing in-house staff and, on a selective basis, by specialized environmental consultants. The Environmental, Health and Safety team participates in industry groups to monitor developing regulatory actions and actively develop comments on specific issues. Furthermore, environmental assessments are conducted as part of our due diligence review process for our prospective acquisition targets. Based on recent experience and current projections, environmental protection requirements and liabilities are not expected to have a material effect on our business, capital expenditures, operations or financial position.

In addition to the various environmental laws and regulations, our operations are subject to numerous foreign, federal, state and local laws and regulations, including those relating to the presence of hazardous materials and protection of worker health and safety, consumer protection, trade, labor and employment, tax and others. We believe we comply in all material respects with existing applicable laws and regulations affecting our operations. Environmental laws have changed rapidly in recent years, and we may be subject to more stringent environmental laws in the future. Our operations may result in noncompliance with or liability for remediation under environmental laws. Should such eventualities occur, we would record liabilities for remediation costs when remediation costs are probable and can be reasonably estimated. See Item 1A. Risk Factors: "Changes in environmental and health and safety laws and regulations could negatively impact our operations and financial performance."

Available Information

On July 4, 2011, pursuant to an amalgamation under the Business Corporations Act (British Columbia), Masonite Inc. amalgamated with Masonite International Corporation to form an amalgamated corporation named Masonite Inc., which then changed its name to Masonite International Corporation. On September 9, 2013, our shares commenced listing on the New York Stock Exchange under the symbol "DOOR," and we became subject to periodic

10

reporting requirements under the United States federal securities laws. We are currently not a reporting issuer, or the equivalent, in any province or territory of Canada and our shares are not listed on any recognized Canadian stock exchange.

We make our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 available through our website, free of charge, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission ("SEC"). Our website is www.masonite.com. Information on our website does not constitute part of this Annual Report on Form 10-K.

Our United States executive offices are located at 1242 E. 5th Avenue, Tampa, Florida 33605, and our Canadian executive offices are located at 2771 Rutherford Road, Concord, Ontario L4K 2N6.

11

Item 1A. Risk Factors

You should carefully consider the following factors in addition to the other information set forth in this Annual Report before investing in our common shares. The risks and uncertainties described below are not the only ones facing us. If any of the following risks actually occur, our business, financial condition, results of operations or cash flows could be adversely affected, and the trading price of our common shares could decline, and you may lose all or part of your investment.

Risks Related to the Acquisition

While the Arrangement Agreement is in effect, we are subject to certain interim covenants.

On February 8, 2024, we entered into the Arrangement Agreement with Owens Corning pursuant to which Owens Corning, through Purchaser, agreed to acquire the Company in an all-cash transaction for $133.00 per share of our issued and outstanding common stock.

The Arrangement Agreement generally requires us to operate our business in the ordinary course, subject to certain exceptions, including as required by applicable law, pending consummation of the Acquisition, and subjects us to customary interim operating covenants that restrict us, without Owens Corning’s approval (such approval not to be unreasonably conditioned, withheld or delayed), from taking certain specified actions until the Acquisition is completed or the Arrangement Agreement is terminated in accordance with its terms. These restrictions could prevent us from pursuing certain business opportunities that may arise prior to the consummation of the Acquisition and may affect our ability to execute our business strategies and attain financial and other goals and may impact our financial condition, results of operations and cash flows.

The announcement and pendency of the Acquisition may result in disruptions to our business, and the Acquisition could divert management's attention, disrupt our relationships with third parties and employees, and result in negative publicity or legal proceedings, any of which could negatively impact our operating results and ongoing business.

In connection with the pending Acquisition, our current and prospective employees may experience uncertainty about their future roles with us following the Acquisition, which may materially adversely affect our ability to attract and retain key personnel and other employees while the Acquisition is pending. Key employees may depart because of issues relating to the uncertainty and difficulty of integration or a desire not to remain with us following the Acquisition, and may depart prior to the consummation of the Acquisition. Accordingly, no assurance can be given that we will be able to attract and retain key employees to the same extent that we have been able to in the past.

The proposed Acquisition could cause disruptions to our business or business relationships with our existing and potential customers, suppliers, vendors, landlords, and other business partners, and this could have an adverse impact on our results of operations. Parties with which we have business relationships may experience uncertainty as to the future of such relationships and may delay or defer certain business decisions, seek alternative relationships with third parties, or seek to negotiate changes or alter their present business relationships with us. Parties with whom we otherwise may have sought to establish business relationships may seek alternative relationships with third parties.

The pursuit of the Acquisition may place a significant burden on management and internal resources, which may have a negative impact on our ongoing business. It may also divert management’s time and attention from the day-to-day operation of our remaining businesses and the execution of our other strategic initiatives. This could adversely affect our financial results. In addition, we have incurred and will continue to incur other significant costs, expenses, and fees for professional services and other transaction costs in connection with the proposed Acquisition, and many of these fees and costs are payable regardless of whether or not the pending Acquisition is consummated.

Any of the foregoing, individually or in combination, could materially and adversely affect our business, our financial condition and our results of operations and prospects.

The Acquisition may not be completed within the expected timeframe, or at all, for a variety of reasons, including the possibility that the Arrangement Agreement is terminated prior to the consummation of the Acquisition, and the failure to complete the Acquisition could adversely affect our business, results of operations, financial condition, and the market price of our common stock.

There can be no assurance that the Acquisition will be completed in the expected timeframe, or at all. The Arrangement Agreement contains a number of customary closing conditions that must be satisfied or waived prior to

12

the completion of the Acquisition, including, among others, (1) the adoption of a resolution approving the Acquisition by at least two-thirds of the votes cast on such resolution by our stockholders entitled to vote thereon and represented in person or by proxy at the applicable special meeting of our stockholders, (2) the issuance of interim and final orders by the Supreme Court of British Columbia approving the Acquisition, (3) the expiration or termination of any applicable waiting period or periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (as amended) and the receipt of certain required regulatory clearances and approvals in other jurisdictions under applicable antitrust and foreign direct investment laws and regulations, including in Canada, Mexico and the United Kingdom, and (4) absence of any law, injunction, order or other judgment prohibiting, rendering illegal or permanently enjoining the consummation of the Acquisition. Each party’s obligation to consummate the Acquisition is also subject to the accuracy of the other party’s representations and warranties contained in the Arrangement Agreement (subject, with specified exceptions, to materiality or “Material Adverse Effect” standards), the other party’s performance of its covenants and agreements in the Arrangement Agreement in all material respects, and in the case of Purchaser’s obligation to consummate the Acquisition, the absence of any “Material Adverse Effect” relating to us.

There can be no assurance that all required approvals will be obtained or that all closing conditions will otherwise be satisfied (or waived, if applicable), and, if all required approvals are obtained and all closing conditions are satisfied (or waived, if applicable), we can provide no assurance as to the terms, conditions and timing of such approvals or that the Acquisition will be completed in a timely manner or at all. Many of the conditions to completion of the Acquisition are not within our or Owens Corning’s control, and we cannot predict when or if these conditions will be satisfied (or waived, as applicable). Even if regulatory approval is obtained, it is possible conditions will be imposed that could result in a material delay in, or the abandonment of, the Acquisition or otherwise have an adverse effect on us.

The Arrangement Agreement contains customary mutual termination rights for us and Owens Corning, which could prevent the consummation of the Acquisition, including if the Acquisition is not completed by February 8, 2025 (subject to automatic extension first to May 8, 2025 then to August 8, 2025 in each case, to the extent the regulatory closing conditions are the only conditions that remain outstanding).

The Arrangement Agreement also contains customary termination rights for the benefit of each party, including if the other party breaches its representations, warranties, or covenants under the Arrangement Agreement in a way that would result in a failure of the other party’s condition to closing being satisfied (subject to certain procedures and cure periods). Additionally, the Arrangement Agreement provides termination rights, if certain conditions are met, including (1) for Owens Corning, if our Board of Directors changes its recommendation in favor of the Acquisition, and (2) for us, if our Board of Directors authorizes entry into a definitive agreement with respect to a Superior Proposal (as defined in the Arrangement Agreement) prior to us receiving stockholder approval of the Acquisition.

If the Acquisition is not completed within the expected timeframe or at all, we may be subject to a number of material risks, including:

•the market price of our common stock may decline to the extent that current market prices reflect a market assumption that the Acquisition will be completed;

•if the Arrangement Agreement is terminated under certain specified circumstances, we or Owens Corning will be required to pay a termination fee, including that we will be required to pay Owens Corning a termination fee of $75.0 million under specified circumstances, and Owens Corning will be required to pay us a reverse termination fee of $150.0 million under specified circumstances;

•some costs related to the Acquisition must be paid whether or not the Acquisition is completed, and we have incurred, and will continue to incur, significant costs, expenses and fees for professional services and other transaction costs in connection with the proposed transaction, as well as the diversion of management and resources towards the Acquisition, for which we will have received little or no benefit if completion of the Acquisition does not occur; and

•we may experience negative publicity and/or reactions from our investors, customers, partners, suppliers, vendors, landlords, other business partners and employees.

Stockholder litigation could prevent or delay the closing of the pending Acquisition or otherwise negatively impact our business, operating results and financial condition.

13

We may incur additional costs in connection with the defense or settlement of stockholder litigation in connection with the pending Acquisition. Such litigation may adversely affect our ability to complete the pending Acquisition. We could incur significant costs in connection with such litigation, including costs associated with the indemnification obligations to our directors and officers. Such litigation may be distracting to management and may require us to incur additional, significant costs. Such litigation could result in the Acquisition being delayed and/or enjoined by a court of competent jurisdiction, which could prevent the Acquisition from becoming effective.

Risks Related to Economic Conditions and Market Factors

We are exposed to global political, economic and other risks that arise from operating a multinational business that could adversely affect our results of operations.

We have operations in the United States, Canada, Europe and, to a lesser extent, other foreign jurisdictions. In fiscal 2023, approximately 79% of our net sales were derived from the United States, 10% from Canada and 8% from the United Kingdom. Managing a global business is complex and subjects the Company to certain risks inherent with doing business internationally that could disrupt our operations. These risks include, but are not limited to, the following:

•difficulties in enforcing contractual obligations and collecting receivables;

•translations into U.S. dollars for financial reporting purposes of the assets and liabilities of our non-U.S. operations conducted in local currencies;

•tax rates in foreign countries and the imposition of withholding requirements on foreign earnings;

•restrictive governmental trade policies, customs, tariffs, import or export and other trade compliance regulations;

•difficulty in staffing and managing widespread operations and the application of foreign labor regulations;

•the impact of geopolitical events, such as the ongoing conflicts in the Middle East and Eastern Europe or political uncertainty related to the upcoming U.S. presidential election;

•required compliance with a variety of foreign laws and regulations; and

•changes in general economic and political conditions affecting countries where we operate.

Volatility and uncertainty in general business, economic conditions or financial markets could adversely impact our business, financial performance, results of operations and cash flow.

Our business has been sensitive to, and our financial performance is substantially dependent on, the general business and economic conditions in the regions and primary end markets in which we operate. The overall demand for our products could decline as a result of a large number of factors outside of our control, including an economic recession, inflation, deflation, fluctuations in interest rates and foreign exchange rates, availability and cost of capital, supply chain constraints, consumer spending rates, energy and labor availability and costs and the effects of governmental fiscal and monetary policies in the regions in which we operate. Any prolonged economic downturn or volatility in the financial markets that is detrimental to the primary end markets in which we operate could have a material adverse impact on our business, financial performance, results of operations and cash flow.

Volatility of the financial and credit markets and its impact to the construction and building product industries and housing markets, could adversely affect our business, financial performance, results of operations and cash flow.

The current macroeconomic conditions of heightened inflation and interest rates have challenged our primary end markets (residential new construction, home repair, renovation and remodeling and non-residential building construction). Challenging economic conditions, either upward or downward, have historically had a direct correlation to the demand for our products and directly impacts our business, financial performance, results of operations and cash flow. Accordingly, the following factors have had and may continue to have a direct impact on our business in the countries and regions in which our products are sold:

•the amount and type of residential and non-residential construction;

•housing sales and home values;

•the age of existing home stock, home vacancy rates and foreclosures;

•non-residential building occupancy rates;

•increases in the cost of raw materials, energy or wages or any shortage in supplies or labor;

•the availability and cost of credit;

•employment rates and consumer confidence; and

14

•demographic factors such as immigration and migration of the population and trends in household formation.

Steep increases in mortgage rates and reduced availability of financing for the purchase of new homes and home repair, renovations and remodeling could have a material adverse effect on our sales and profitability.

Our business primarily relies on new home construction and home repair, renovation and remodeling projects. The ability of consumers to finance these purchases is affected by increases in mortgage rates and reduced access to consumer financing due to the tightening of lending standards by financial institutions. Mortgage rates increased dramatically from March 2022 through the end of 2023 and, if mortgage rates continue to increase or remain at current levels, consumers may delay or exit homeownership or shift to building smaller homes, which requires less of our products. These outcomes could have a material adverse effect on our business, financial condition and results of operations.

Energy and transportation price fluctuations may adversely impact our manufacturing operations and costs.

The cost of producing our products is impacted by the price of energy, including its impact on transportation costs. Energy prices, in particular oil and natural gas, have fluctuated in recent years, and have been further strained by the ongoing war between Russia and Ukraine. Fuel prices rose significantly during extended portions of 2022. While fuels costs appeared to have moderated in 2023, if fuel prices were to rise again for any reason, including fuel supply shortages or unusual price volatility, the resulting higher fuel prices could materially increase our shipping costs, adversely affecting our results of operations. We are highly reliant on the trucking industry for the transportation of our products. The overall profitability of our operations may be negatively impacted by higher transportation costs as freight carriers raise prices to address the continued shortage of drivers and price of fuel. There can be no assurance that we will be able to recoup any past or future increases in the cost of energy and transportation or pass these costs onto our customers.

Risk Related to Industry Conditions

We operate in a highly competitive industry.

The building products industry is highly competitive. Competitive factors we face include price, quality, customer service and on-time and complete deliveries. To the extent any of our competitors become more successful with respect to any of these competitive factors, we could lose customers and our financial condition and results of operations could decline. Some of our competitors may have access to greater financial resources, larger manufacturing capacity and distribution network than we do, which may allow for more operating and financial flexibility to respond to changes within our industry and end markets and product demand by our customers. Also, a substantial increase in the supply of door and door components resulting from increased production capacity by our competitors could lead us to decrease pricing in order to remain competitive, which in turn could adversely impact our ability to pass on future increases in raw material, labor and other costs to our customers and could reduce profit margins, sales and the profitability of our business. Although price is a significant basis of competition in our industry, we also compete on the basis of on-time delivery and our reputation for quality and customer service. If we fail to maintain our current standards for product quality, the scope of our distribution capabilities or our customer relationships, our reputation, financial condition, results of operations and cash flows could be adversely affected.

The loss of any of our significant customers could adversely affect our business.

Our customers consist mainly of wholesalers, retail home centers and contractors. Our top ten customers together accounted for approximately 50% of our net sales in fiscal year 2023, while our largest customer, The Home Depot, accounted for approximately 20% of our net sales during the same period. We expect that a small number of customers will continue to account for a substantial portion of our net sales for the foreseeable future. Customers that have accounted for a significant portion of our net sales in past periods, individually or as a group, may not continue to do so in future periods, or if continued, may not reach or exceed historical net sales levels in any period. For example, many of our largest customers, including The Home Depot, perform periodic line reviews to assess their product offerings, which have, on past occasions, led to loss of business and pricing pressures. In addition, as a result of competitive bidding processes, we may not be able to increase or maintain the margins at which we sell our products to our most significant customers. Moreover, if any of our customers fail to remain competitive in their respective markets or encounters financial or operational problems, our net sales and profitability may decline. We generally do not enter into long-term contracts with our customers, and they generally do not have an obligation to purchase products from us. Therefore, we could lose a significant customer with little or no notice. Alternatively, our customers could expect that

15

we lower the prices of our products should the cost of raw materials decrease, and our failure to do so could cause such customers to seek similar products from our competitors. The loss of, or a significant adverse change in, our relationships with The Home Depot or any other major customer could cause a material decrease in our net sales. The loss of, or a reduction in orders from, any significant customers, losses arising from customer disputes regarding shipments, fees, merchandise condition or related matters or our inability to collect accounts receivable from any major customer, could have a material adverse effect on results of operation and cash flow.

Consolidation of our customers and suppliers could adversely affect our results of operations.

Over the past few years, many of our customers, distributors and suppliers have undergone consolidation due to being acquired by, or acquiring, another company with similar operations. Consolidation of our customers could result in the loss of a customer or a portion of their business, in addition to an increased reliance on certain key customers. Future consolidation of our customers or distributors and their increased purchasing power, could result in our customers seeking more favorable terms, including pricing, which may limit our ability to maintain pricing or raise pricing in the future. The consolidation of our suppliers has resulted in limiting, and may further limit, our sources of supply and impact pricing. Any future consolidation of our customers, distributors or suppliers could impact our margin growth, results of operations and cash flow.

If we are unable to develop new or improved product offerings that respond to industry trends, demands and consumer preferences, our business and results of operations could be materially affected.

Our business is sensitive to consumer and industry trends, demands and preferences. A key element to our continued success is our ability to improve our existing products or innovate and develop new product lines to respond to industry trends, demands and consumer preferences. Our failure to accurately identify and respond to changing consumer trends successfully, could lead to, among other things, rejection of new or existing product lines, increased substitution of our products and price reductions. In addition, we are subject to the risk that new products, proprietary designs and/or changes in manufacturing technologies may reduce demand for or render our products obsolete. In response, we may not be able to manufacture products at prices that would be competitive in the marketplace or have the financial resources to make necessary technology investments, including the use of artificial intelligence (“AI”), or acquire necessary intellectual property rights to develop new products or improve our existing products. Changes to consumer shopping habits and potential trends towards online purchases could also impact our ability to compete as we currently sell our products mainly through our distribution channels.

Risks Related to our Operations

Availability of raw materials, price fluctuations, and supply chain disruptions may adversely affect our profitability, margins and net sales.