door-2021010300008936912020FYFALSEus-gaap:AccountsPayableAndAccruedLiabilitiesCurrentus-gaap:AccountsPayableAndAccruedLiabilitiesCurrent703000008936912019-12-302021-01-03iso4217:USD00008936912020-06-28xbrli:shares00008936912021-02-2200008936912018-12-312019-12-2900008936912018-01-012018-12-30iso4217:USDxbrli:shares00008936912021-01-0300008936912019-12-2900008936912018-12-3000008936912017-12-310000893691us-gaap:CommonStockMember2019-12-290000893691us-gaap:CommonStockMember2018-12-300000893691us-gaap:CommonStockMember2017-12-310000893691us-gaap:CommonStockMember2019-12-302021-01-030000893691us-gaap:CommonStockMember2018-12-312019-12-290000893691us-gaap:CommonStockMember2018-01-012018-12-300000893691us-gaap:CommonStockMember2021-01-030000893691us-gaap:AdditionalPaidInCapitalMember2019-12-290000893691us-gaap:AdditionalPaidInCapitalMember2018-12-300000893691us-gaap:AdditionalPaidInCapitalMember2017-12-310000893691us-gaap:AdditionalPaidInCapitalMember2019-12-302021-01-030000893691us-gaap:AdditionalPaidInCapitalMember2018-12-312019-12-290000893691us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-300000893691us-gaap:AdditionalPaidInCapitalMember2021-01-030000893691us-gaap:RetainedEarningsMember2019-12-290000893691us-gaap:RetainedEarningsMember2018-12-300000893691us-gaap:RetainedEarningsMember2017-12-310000893691us-gaap:RetainedEarningsMember2019-12-302021-01-030000893691us-gaap:RetainedEarningsMember2018-12-312019-12-290000893691us-gaap:RetainedEarningsMember2018-01-012018-12-300000893691us-gaap:RetainedEarningsMember2021-01-030000893691us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-290000893691us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-300000893691us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310000893691us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-302021-01-030000893691us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-312019-12-290000893691us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-300000893691us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-030000893691us-gaap:NoncontrollingInterestMember2019-12-290000893691us-gaap:NoncontrollingInterestMember2018-12-300000893691us-gaap:NoncontrollingInterestMember2017-12-310000893691us-gaap:NoncontrollingInterestMember2019-12-302021-01-030000893691us-gaap:NoncontrollingInterestMember2018-12-312019-12-290000893691us-gaap:NoncontrollingInterestMember2018-01-012018-12-300000893691us-gaap:NoncontrollingInterestMember2021-01-03door:facilitydoor:Country0000893691door:Topic842Member2018-12-310000893691us-gaap:StandbyLettersOfCreditMember2021-01-030000893691us-gaap:StandbyLettersOfCreditMember2019-12-290000893691srt:MinimumMemberus-gaap:BuildingMember2019-12-302021-01-030000893691us-gaap:BuildingMembersrt:MaximumMember2019-12-302021-01-030000893691door:ToolingMembersrt:MinimumMember2019-12-302021-01-030000893691door:ToolingMembersrt:MaximumMember2019-12-302021-01-030000893691srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2019-12-302021-01-030000893691srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2019-12-302021-01-030000893691us-gaap:ToolsDiesAndMoldsMembersrt:MinimumMember2019-12-302021-01-030000893691us-gaap:ToolsDiesAndMoldsMembersrt:MaximumMember2019-12-302021-01-030000893691us-gaap:OfficeEquipmentMembersrt:MinimumMember2019-12-302021-01-030000893691us-gaap:OfficeEquipmentMembersrt:MaximumMember2019-12-302021-01-030000893691us-gaap:TechnologyEquipmentMembersrt:MinimumMember2019-12-302021-01-030000893691us-gaap:TechnologyEquipmentMembersrt:MaximumMember2019-12-302021-01-03door:Lease_Option0000893691srt:MinimumMember2019-12-302021-01-030000893691srt:MaximumMember2019-12-302021-01-030000893691srt:MaximumMember2021-01-030000893691door:NorthAmericanResidentialSegmentMember2018-12-312019-12-290000893691door:NorthAmericanResidentialSegmentMember2018-01-012018-12-300000893691door:NorthAmericanResidentialSegmentMember2019-12-302021-01-030000893691us-gaap:CustomerRelationshipsMembersrt:MaximumMember2019-12-302021-01-030000893691us-gaap:PatentsMembersrt:MaximumMember2019-12-302021-01-030000893691door:LowesDoorFabricationFacilityMember2020-12-042020-12-040000893691door:DevelopmentEntityMember2020-08-312020-08-310000893691door:TopDoorsMember2019-08-292019-08-290000893691door:BWIMember2018-11-012018-11-010000893691door:GrahamMaimanMember2018-06-012018-06-010000893691door:DW3Member2018-01-292018-01-290000893691door:BWIMember2018-11-010000893691door:GrahamMaimanMember2018-06-010000893691door:DW3Member2018-01-290000893691door:A2018AcquisitionsMember2018-12-300000893691door:A2018AcquisitionsMember2018-01-012018-12-300000893691door:BWIMember2019-12-302021-01-030000893691door:BWIMemberus-gaap:CustomerRelationshipsMember2018-11-012018-11-010000893691us-gaap:CustomerRelationshipsMemberdoor:GrahamMaimanMember2018-06-012018-06-010000893691door:DW3Memberus-gaap:CustomerRelationshipsMember2018-01-292018-01-290000893691door:BWIMemberus-gaap:TrademarksMember2018-11-012018-11-010000893691us-gaap:TrademarksMemberdoor:GrahamMaimanMember2018-06-012018-06-010000893691door:DW3Memberus-gaap:TrademarksMember2018-01-292018-01-290000893691door:DW3Memberus-gaap:PatentsMember2018-01-292018-01-290000893691door:BWIMemberus-gaap:OtherIntangibleAssetsMember2018-11-012018-11-010000893691door:DW3Memberus-gaap:OtherIntangibleAssetsMember2018-01-292018-01-290000893691door:BWIMember2018-01-012018-12-300000893691door:GrahamMaimanMember2018-01-012018-12-300000893691door:DW3Member2018-01-012018-12-300000893691door:A2018and2017AcquisitionsMember2018-12-312019-12-290000893691door:GrahamMaimanMember2018-12-312019-12-290000893691door:DW3Member2018-12-312019-12-290000893691door:A2018and2017AcquisitionsMember2018-01-012018-12-300000893691door:IndiaEntityMember2020-03-302020-06-280000893691door:WindowWidgetsMember2019-12-132019-12-130000893691door:WindowWidgetsMember2019-12-130000893691door:PerformanceDoorsetSolutionsMember2019-03-212019-03-210000893691door:PerformanceDoorsetSolutionsMember2019-03-21door:Customer0000893691us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2018-12-312019-12-290000893691us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2019-12-302021-01-03xbrli:pure0000893691us-gaap:AccountsReceivableMemberdoor:TheHomeDepotInc.Memberus-gaap:CustomerConcentrationRiskMember2019-12-302021-01-030000893691us-gaap:AccountsReceivableMemberdoor:TheHomeDepotInc.Memberus-gaap:CustomerConcentrationRiskMember2018-12-312019-12-290000893691us-gaap:LandMember2021-01-030000893691us-gaap:LandMember2019-12-290000893691us-gaap:BuildingMember2021-01-030000893691us-gaap:BuildingMember2019-12-290000893691us-gaap:MachineryAndEquipmentMember2021-01-030000893691us-gaap:MachineryAndEquipmentMember2019-12-290000893691door:NorthAmericanResidentialSegmentMember2018-12-300000893691door:EuropeSegmentMember2018-12-300000893691door:ArchitecturalSegmentMember2018-12-300000893691us-gaap:OperatingSegmentsMember2018-12-300000893691door:EuropeSegmentMember2018-12-312019-12-290000893691door:ArchitecturalSegmentMember2018-12-312019-12-290000893691us-gaap:OperatingSegmentsMember2018-12-312019-12-290000893691door:NorthAmericanResidentialSegmentMember2019-12-290000893691door:EuropeSegmentMember2019-12-290000893691door:ArchitecturalSegmentMember2019-12-290000893691us-gaap:OperatingSegmentsMember2019-12-290000893691door:EuropeSegmentMember2019-12-302021-01-030000893691door:ArchitecturalSegmentMember2019-12-302021-01-030000893691us-gaap:OperatingSegmentsMember2019-12-302021-01-030000893691door:NorthAmericanResidentialSegmentMember2021-01-030000893691door:EuropeSegmentMember2021-01-030000893691door:ArchitecturalSegmentMember2021-01-030000893691us-gaap:OperatingSegmentsMember2021-01-030000893691door:BWIMemberdoor:NorthAmericanResidentialSegmentMember2018-12-312019-12-290000893691door:TopDoorsMemberdoor:EuropeSegmentMember2018-12-312019-12-290000893691us-gaap:CustomerRelationshipsMember2021-01-030000893691us-gaap:CustomerRelationshipsMember2019-12-290000893691us-gaap:PatentsMember2021-01-030000893691us-gaap:PatentsMember2019-12-290000893691us-gaap:ComputerSoftwareIntangibleAssetMember2021-01-030000893691us-gaap:ComputerSoftwareIntangibleAssetMember2019-12-290000893691us-gaap:TrademarksMember2021-01-030000893691us-gaap:TrademarksMember2019-12-290000893691us-gaap:OtherIntangibleAssetsMember2021-01-030000893691us-gaap:OtherIntangibleAssetsMember2019-12-290000893691us-gaap:TrademarksAndTradeNamesMember2021-01-030000893691us-gaap:TrademarksAndTradeNamesMember2019-12-290000893691us-gaap:SeniorNotesMemberdoor:SeniorNotesDue2028Member2021-01-030000893691us-gaap:SeniorNotesMemberdoor:SeniorNotesDue2028Member2019-12-290000893691door:SeniorNotesDue2026Memberus-gaap:SeniorNotesMember2021-01-030000893691door:SeniorNotesDue2026Memberus-gaap:SeniorNotesMember2019-12-290000893691us-gaap:SeniorNotesMember2021-01-030000893691us-gaap:SeniorNotesMember2019-12-290000893691us-gaap:SeniorNotesMember2019-12-302021-01-030000893691us-gaap:SeniorNotesMember2018-12-312019-12-290000893691us-gaap:SeniorNotesMember2018-01-012018-12-300000893691us-gaap:SeniorNotesMemberdoor:SeniorNotesDue2028Member2019-07-250000893691us-gaap:SeniorNotesMemberdoor:SeniorNotesDue2028Member2019-07-252019-07-250000893691us-gaap:SeniorNotesMemberdoor:SeniorNotesDue2023Member2019-08-102019-08-100000893691us-gaap:DebtInstrumentRedemptionPeriodThreeMemberdoor:SeniorNotesDue2028Member2019-12-302021-01-030000893691door:SeniorNotesDue2026Memberus-gaap:SeniorNotesMember2018-08-270000893691door:SeniorNotesDue2026Memberus-gaap:SeniorNotesMember2018-08-272018-08-270000893691us-gaap:SeniorNotesMemberdoor:SeniorNotesDue2023Member2018-08-272018-08-270000893691us-gaap:SeniorNotesMemberdoor:SeniorNotesDue2023Member2018-09-122018-09-120000893691us-gaap:DebtInstrumentRedemptionPeriodThreeMemberdoor:SeniorNotesDue2026Member2019-12-302021-01-030000893691us-gaap:RevolvingCreditFacilityMemberdoor:ABLFacility2020Member2019-01-310000893691us-gaap:RevolvingCreditFacilityMemberdoor:ABLFacility2020Membersrt:MinimumMemberus-gaap:BaseRateMember2018-12-312019-12-290000893691us-gaap:RevolvingCreditFacilityMemberdoor:ABLFacility2020Membersrt:MaximumMemberus-gaap:BaseRateMember2018-12-312019-12-290000893691us-gaap:EurodollarMemberus-gaap:RevolvingCreditFacilityMemberdoor:ABLFacility2020Membersrt:MinimumMember2015-04-092015-04-090000893691us-gaap:EurodollarMemberus-gaap:RevolvingCreditFacilityMemberdoor:ABLFacility2020Membersrt:MaximumMember2015-04-092015-04-090000893691us-gaap:RevolvingCreditFacilityMemberdoor:ABLFacility2020Membersrt:MinimumMember2018-12-312019-12-290000893691us-gaap:RevolvingCreditFacilityMemberdoor:ABLFacility2020Member2018-12-312019-12-290000893691us-gaap:RevolvingCreditFacilityMemberdoor:ABLFacility2020Member2021-01-03door:complaint0000893691door:AntitrustClassActionProceedingsUnitedStatesMember2019-12-302021-01-030000893691door:InReInteriorMoldedDoorsDirectPurchaserAntitrustLitigationMember2020-08-312020-08-310000893691door:InReInteriorMoldedDoorsIndirectPurchaserAntitrustLitigationMember2020-09-042020-09-040000893691door:Plan2009Membersrt:ManagementMemberus-gaap:CommonStockMember2012-06-090000893691srt:DirectorMemberdoor:Plan2009Memberus-gaap:CommonStockMember2012-06-090000893691door:Plan2012Member2012-07-112012-07-120000893691door:Plan2012Memberus-gaap:CommonStockMember2013-06-210000893691door:Plan2012Memberus-gaap:CommonStockMember2021-01-030000893691us-gaap:StockAppreciationRightsSARSMember2019-12-302021-01-030000893691us-gaap:StockAppreciationRightsSARSMember2018-12-312019-12-290000893691us-gaap:StockAppreciationRightsSARSMember2018-01-012018-12-300000893691us-gaap:StockAppreciationRightsSARSMember2019-12-290000893691us-gaap:StockAppreciationRightsSARSMember2021-01-030000893691us-gaap:StockAppreciationRightsSARSMember2018-12-300000893691us-gaap:StockAppreciationRightsSARSMember2017-12-310000893691us-gaap:StockAppreciationRightsSARSMember2017-01-022017-12-310000893691us-gaap:RestrictedStockUnitsRSUMember2019-12-302021-01-030000893691us-gaap:RestrictedStockUnitsRSUMember2019-12-290000893691us-gaap:RestrictedStockUnitsRSUMember2018-12-300000893691us-gaap:RestrictedStockUnitsRSUMember2017-12-310000893691us-gaap:RestrictedStockUnitsRSUMember2018-12-312019-12-290000893691us-gaap:RestrictedStockUnitsRSUMember2018-01-012018-12-300000893691us-gaap:RestrictedStockUnitsRSUMember2021-01-030000893691us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2019-12-302021-01-030000893691us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:RestrictedStockUnitsRSUMember2019-12-302021-01-030000893691srt:MinimumMemberdoor:TwentyTwentyRestructuringPlansMember2021-01-030000893691srt:MaximumMemberdoor:TwentyTwentyRestructuringPlansMember2021-01-030000893691door:TwentyNineteenRestructuringPlansMembersrt:MinimumMember2021-01-030000893691door:TwentyNineteenRestructuringPlansMembersrt:MaximumMember2021-01-030000893691door:NorthAmericanResidentialSegmentMemberdoor:TwentyTwentyRestructuringPlansMember2019-12-302021-01-030000893691door:EuropeSegmentMemberdoor:TwentyTwentyRestructuringPlansMember2019-12-302021-01-030000893691door:ArchitecturalSegmentMemberdoor:TwentyTwentyRestructuringPlansMember2019-12-302021-01-030000893691us-gaap:CorporateAndOtherMemberdoor:TwentyTwentyRestructuringPlansMember2019-12-302021-01-030000893691door:TwentyTwentyRestructuringPlansMember2019-12-302021-01-030000893691door:NorthAmericanResidentialSegmentMemberdoor:TwentyNineteenRestructuringPlansMember2019-12-302021-01-030000893691door:TwentyNineteenRestructuringPlansMemberdoor:EuropeSegmentMember2019-12-302021-01-030000893691door:ArchitecturalSegmentMemberdoor:TwentyNineteenRestructuringPlansMember2019-12-302021-01-030000893691us-gaap:CorporateAndOtherMemberdoor:TwentyNineteenRestructuringPlansMember2019-12-302021-01-030000893691door:TwentyNineteenRestructuringPlansMember2019-12-302021-01-030000893691door:NorthAmericanResidentialSegmentMemberdoor:TwentyEighteenRestructuringPlansMember2019-12-302021-01-030000893691door:EuropeSegmentMemberdoor:TwentyEighteenRestructuringPlansMember2019-12-302021-01-030000893691door:ArchitecturalSegmentMemberdoor:TwentyEighteenRestructuringPlansMember2019-12-302021-01-030000893691us-gaap:CorporateAndOtherMemberdoor:TwentyEighteenRestructuringPlansMember2019-12-302021-01-030000893691door:TwentyEighteenRestructuringPlansMember2019-12-302021-01-030000893691us-gaap:CorporateAndOtherMember2019-12-302021-01-030000893691door:NorthAmericanResidentialSegmentMemberdoor:TwentyNineteenRestructuringPlansMember2018-12-312019-12-290000893691door:TwentyNineteenRestructuringPlansMemberdoor:EuropeSegmentMember2018-12-312019-12-290000893691door:ArchitecturalSegmentMemberdoor:TwentyNineteenRestructuringPlansMember2018-12-312019-12-290000893691us-gaap:CorporateAndOtherMemberdoor:TwentyNineteenRestructuringPlansMember2018-12-312019-12-290000893691door:TwentyNineteenRestructuringPlansMember2018-12-312019-12-290000893691door:NorthAmericanResidentialSegmentMemberdoor:TwentyEighteenRestructuringPlansMember2018-12-312019-12-290000893691door:EuropeSegmentMemberdoor:TwentyEighteenRestructuringPlansMember2018-12-312019-12-290000893691door:ArchitecturalSegmentMemberdoor:TwentyEighteenRestructuringPlansMember2018-12-312019-12-290000893691us-gaap:CorporateAndOtherMemberdoor:TwentyEighteenRestructuringPlansMember2018-12-312019-12-290000893691door:TwentyEighteenRestructuringPlansMember2018-12-312019-12-290000893691us-gaap:CorporateAndOtherMember2018-12-312019-12-290000893691door:NorthAmericanResidentialSegmentMemberdoor:TwentyEighteenRestructuringPlansMember2018-01-012018-12-300000893691door:EuropeSegmentMemberdoor:TwentyEighteenRestructuringPlansMember2018-01-012018-12-300000893691door:TwentyEighteenRestructuringPlansMember2018-01-012018-12-300000893691door:EuropeSegmentMember2018-01-012018-12-300000893691door:NorthAmericanResidentialSegmentMemberdoor:TwentyTwentyRestructuringPlansMember2021-01-030000893691door:EuropeSegmentMemberdoor:TwentyTwentyRestructuringPlansMember2021-01-030000893691door:ArchitecturalSegmentMemberdoor:TwentyTwentyRestructuringPlansMember2021-01-030000893691us-gaap:CorporateAndOtherMemberdoor:TwentyTwentyRestructuringPlansMember2021-01-030000893691door:TwentyTwentyRestructuringPlansMember2021-01-030000893691door:NorthAmericanResidentialSegmentMemberdoor:TwentyNineteenRestructuringPlansMember2021-01-030000893691door:TwentyNineteenRestructuringPlansMemberdoor:EuropeSegmentMember2021-01-030000893691door:ArchitecturalSegmentMemberdoor:TwentyNineteenRestructuringPlansMember2021-01-030000893691us-gaap:CorporateAndOtherMemberdoor:TwentyNineteenRestructuringPlansMember2021-01-030000893691door:TwentyNineteenRestructuringPlansMember2021-01-030000893691door:NorthAmericanResidentialSegmentMemberdoor:TwentyEighteenRestructuringPlansMember2021-01-030000893691door:EuropeSegmentMemberdoor:TwentyEighteenRestructuringPlansMember2021-01-030000893691door:ArchitecturalSegmentMemberdoor:TwentyEighteenRestructuringPlansMember2021-01-030000893691us-gaap:CorporateAndOtherMemberdoor:TwentyEighteenRestructuringPlansMember2021-01-030000893691door:TwentyEighteenRestructuringPlansMember2021-01-030000893691us-gaap:CorporateAndOtherMember2021-01-030000893691door:TwentyTwentyRestructuringPlansMember2019-12-290000893691us-gaap:EmployeeSeveranceMemberdoor:TwentyTwentyRestructuringPlansMember2019-12-302021-01-030000893691us-gaap:FacilityClosingMemberdoor:TwentyTwentyRestructuringPlansMember2019-12-302021-01-030000893691door:TwentyNineteenRestructuringPlansMember2019-12-290000893691door:TwentyNineteenRestructuringPlansMemberus-gaap:EmployeeSeveranceMember2019-12-302021-01-030000893691door:TwentyNineteenRestructuringPlansMemberus-gaap:FacilityClosingMember2019-12-302021-01-030000893691door:TwentyEighteenRestructuringPlansMember2019-12-290000893691door:TwentyEighteenRestructuringPlansMemberus-gaap:EmployeeSeveranceMember2019-12-302021-01-030000893691door:TwentyEighteenRestructuringPlansMemberus-gaap:FacilityClosingMember2019-12-302021-01-030000893691us-gaap:EmployeeSeveranceMember2019-12-302021-01-030000893691us-gaap:FacilityClosingMember2019-12-302021-01-030000893691door:TwentyNineteenRestructuringPlansMember2018-12-300000893691door:TwentyNineteenRestructuringPlansMemberus-gaap:EmployeeSeveranceMember2018-12-312019-12-290000893691door:TwentyNineteenRestructuringPlansMemberus-gaap:FacilityClosingMember2018-12-312019-12-290000893691door:TwentyEighteenRestructuringPlansMember2018-12-300000893691door:TwentyEighteenRestructuringPlansMemberus-gaap:EmployeeSeveranceMember2018-12-312019-12-290000893691door:TwentyEighteenRestructuringPlansMemberus-gaap:FacilityClosingMember2018-12-312019-12-290000893691us-gaap:OtherRestructuringMember2018-12-300000893691us-gaap:OtherRestructuringMemberus-gaap:EmployeeSeveranceMember2018-12-312019-12-290000893691us-gaap:OtherRestructuringMemberus-gaap:FacilityClosingMember2018-12-312019-12-290000893691us-gaap:OtherRestructuringMember2018-12-312019-12-290000893691us-gaap:OtherRestructuringMember2019-12-290000893691us-gaap:EmployeeSeveranceMember2018-12-312019-12-290000893691us-gaap:FacilityClosingMember2018-12-312019-12-290000893691door:TwentyEighteenRestructuringPlansMember2017-12-310000893691door:TwentyEighteenRestructuringPlansMemberus-gaap:EmployeeSeveranceMember2018-01-012018-12-300000893691door:TwentyEighteenRestructuringPlansMemberus-gaap:FacilityClosingMember2018-01-012018-12-300000893691us-gaap:OtherRestructuringMember2017-12-310000893691us-gaap:OtherRestructuringMemberus-gaap:EmployeeSeveranceMember2018-01-012018-12-300000893691us-gaap:OtherRestructuringMemberus-gaap:FacilityClosingMember2018-01-012018-12-300000893691us-gaap:OtherRestructuringMember2018-01-012018-12-300000893691us-gaap:EmployeeSeveranceMember2018-01-012018-12-300000893691us-gaap:FacilityClosingMember2018-01-012018-12-300000893691door:NorthAmericanResidentialSegmentMemberdoor:AssetGroupThreeMemberus-gaap:FairValueInputsLevel3Member2019-12-302021-01-030000893691door:NorthAmericanResidentialSegmentMemberdoor:AssetGroupThreeMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-01-030000893691door:NorthAmericanResidentialSegmentMemberdoor:AssetGroupThreeMemberus-gaap:FairValueInputsLevel3Member2018-12-312019-12-290000893691door:NorthAmericanResidentialSegmentMemberdoor:AssetGroupThreeMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-290000893691door:AssetGroupThreeMemberdoor:EuropeSegmentMemberus-gaap:FairValueInputsLevel3Member2018-01-012018-12-300000893691door:AssetGroupThreeMemberdoor:EuropeSegmentMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2018-12-300000893691door:PeriodOneMembercountry:CA2021-01-030000893691us-gaap:ForeignCountryMemberdoor:PeriodOneMember2021-01-030000893691door:PeriodOneMember2021-01-030000893691door:PeriodTwoMembercountry:CA2021-01-030000893691us-gaap:ForeignCountryMemberdoor:PeriodTwoMember2021-01-030000893691door:PeriodTwoMember2021-01-030000893691country:CAdoor:PeriodThreeMember2021-01-030000893691us-gaap:ForeignCountryMemberdoor:PeriodThreeMember2021-01-030000893691door:PeriodThreeMember2021-01-030000893691country:CA2021-01-030000893691us-gaap:ForeignCountryMember2021-01-030000893691us-gaap:StockAppreciationRightsSARSMember2019-12-302021-01-030000893691us-gaap:StockAppreciationRightsSARSMember2018-12-312019-12-290000893691us-gaap:StockAppreciationRightsSARSMember2018-01-012018-12-300000893691door:NorthAmericanResidentialSegmentMemberus-gaap:OperatingSegmentsMember2019-12-302021-01-030000893691us-gaap:OperatingSegmentsMemberdoor:EuropeSegmentMember2019-12-302021-01-030000893691door:ArchitecturalSegmentMemberus-gaap:OperatingSegmentsMember2019-12-302021-01-030000893691us-gaap:CorporateAndOtherMemberus-gaap:OperatingSegmentsMember2019-12-302021-01-030000893691door:NorthAmericanResidentialSegmentMemberus-gaap:IntersegmentEliminationMember2019-12-302021-01-030000893691us-gaap:IntersegmentEliminationMemberdoor:EuropeSegmentMember2019-12-302021-01-030000893691door:ArchitecturalSegmentMemberus-gaap:IntersegmentEliminationMember2019-12-302021-01-030000893691us-gaap:CorporateAndOtherMemberus-gaap:IntersegmentEliminationMember2019-12-302021-01-030000893691us-gaap:IntersegmentEliminationMember2019-12-302021-01-030000893691door:NorthAmericanResidentialSegmentMemberus-gaap:OperatingSegmentsMember2018-12-312019-12-290000893691us-gaap:OperatingSegmentsMemberdoor:EuropeSegmentMember2018-12-312019-12-290000893691door:ArchitecturalSegmentMemberus-gaap:OperatingSegmentsMember2018-12-312019-12-290000893691us-gaap:CorporateAndOtherMemberus-gaap:OperatingSegmentsMember2018-12-312019-12-290000893691door:NorthAmericanResidentialSegmentMemberus-gaap:IntersegmentEliminationMember2018-12-312019-12-290000893691us-gaap:IntersegmentEliminationMemberdoor:EuropeSegmentMember2018-12-312019-12-290000893691door:ArchitecturalSegmentMemberus-gaap:IntersegmentEliminationMember2018-12-312019-12-290000893691us-gaap:CorporateAndOtherMemberus-gaap:IntersegmentEliminationMember2018-12-312019-12-290000893691us-gaap:IntersegmentEliminationMember2018-12-312019-12-290000893691door:NorthAmericanResidentialSegmentMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-300000893691us-gaap:OperatingSegmentsMemberdoor:EuropeSegmentMember2018-01-012018-12-300000893691door:ArchitecturalSegmentMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-300000893691us-gaap:CorporateAndOtherMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-300000893691us-gaap:OperatingSegmentsMember2018-01-012018-12-300000893691door:NorthAmericanResidentialSegmentMemberus-gaap:IntersegmentEliminationMember2018-01-012018-12-300000893691us-gaap:IntersegmentEliminationMemberdoor:EuropeSegmentMember2018-01-012018-12-300000893691door:ArchitecturalSegmentMemberus-gaap:IntersegmentEliminationMember2018-01-012018-12-300000893691us-gaap:CorporateAndOtherMemberus-gaap:IntersegmentEliminationMember2018-01-012018-12-300000893691us-gaap:IntersegmentEliminationMember2018-01-012018-12-300000893691door:ArchitecturalSegmentMember2018-01-012018-12-300000893691us-gaap:CorporateAndOtherMember2018-01-012018-12-300000893691door:InteriorProductsMember2019-12-302021-01-030000893691door:InteriorProductsMember2018-12-312019-12-290000893691door:InteriorProductsMember2018-01-012018-12-300000893691door:ExteriorProductsMember2019-12-302021-01-030000893691door:ExteriorProductsMember2018-12-312019-12-290000893691door:ExteriorProductsMember2018-01-012018-12-300000893691door:ComponentsMember2019-12-302021-01-030000893691door:ComponentsMember2018-12-312019-12-290000893691door:ComponentsMember2018-01-012018-12-300000893691country:US2019-12-302021-01-030000893691country:US2018-12-312019-12-290000893691country:US2018-01-012018-12-300000893691country:CA2019-12-302021-01-030000893691country:CA2018-12-312019-12-290000893691country:CA2018-01-012018-12-300000893691country:GB2019-12-302021-01-030000893691country:GB2018-12-312019-12-290000893691country:GB2018-01-012018-12-300000893691door:OtherCountriesMember2019-12-302021-01-030000893691door:OtherCountriesMember2018-12-312019-12-290000893691door:OtherCountriesMember2018-01-012018-12-300000893691door:TheHomeDepotInc.Member2019-12-302021-01-030000893691door:TheHomeDepotInc.Member2018-12-312019-12-290000893691door:TheHomeDepotInc.Member2018-01-012018-12-300000893691country:US2021-01-030000893691country:US2019-12-290000893691country:CA2021-01-030000893691country:CA2019-12-290000893691door:OtherCountriesMember2021-01-030000893691door:OtherCountriesMember2019-12-290000893691us-gaap:PensionPlansDefinedBenefitMembercountry:US2019-12-302021-01-030000893691us-gaap:PensionPlansDefinedBenefitMembercountry:US2018-12-312019-12-290000893691us-gaap:PensionPlansDefinedBenefitMembercountry:US2018-01-012018-12-3000008936912019-09-302019-12-290000893691us-gaap:PensionPlansDefinedBenefitMembercountry:US2019-12-290000893691us-gaap:PensionPlansDefinedBenefitMembercountry:US2018-12-300000893691us-gaap:PensionPlansDefinedBenefitMembercountry:US2021-01-030000893691country:US2019-12-302021-01-030000893691us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMembercountry:US2021-01-030000893691us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMembercountry:US2019-12-290000893691us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMembercountry:US2021-01-030000893691us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMembercountry:US2019-12-290000893691us-gaap:PensionPlansDefinedBenefitMembercountry:USus-gaap:OtherDebtSecuritiesMember2021-01-030000893691us-gaap:PensionPlansDefinedBenefitMembercountry:USus-gaap:OtherDebtSecuritiesMember2019-12-290000893691us-gaap:PensionPlansDefinedBenefitMembercountry:GB2019-12-302021-01-030000893691us-gaap:PensionPlansDefinedBenefitMembercountry:GB2018-12-312019-12-290000893691us-gaap:PensionPlansDefinedBenefitMembercountry:GB2018-01-012018-12-300000893691us-gaap:PensionPlansDefinedBenefitMembercountry:GB2019-12-290000893691us-gaap:PensionPlansDefinedBenefitMembercountry:GB2018-12-300000893691us-gaap:PensionPlansDefinedBenefitMembercountry:GB2021-01-030000893691country:GB2019-12-302021-01-030000893691us-gaap:PensionPlansDefinedBenefitMembercountry:GBus-gaap:DefinedBenefitPlanEquitySecuritiesMember2021-01-030000893691us-gaap:PensionPlansDefinedBenefitMembercountry:GBus-gaap:DefinedBenefitPlanEquitySecuritiesMember2019-12-290000893691us-gaap:PensionPlansDefinedBenefitMembercountry:GBus-gaap:DefinedBenefitPlanDebtSecurityMember2021-01-030000893691us-gaap:PensionPlansDefinedBenefitMembercountry:GBus-gaap:DefinedBenefitPlanDebtSecurityMember2019-12-290000893691us-gaap:PensionPlansDefinedBenefitMembercountry:GBus-gaap:OtherDebtSecuritiesMember2021-01-030000893691us-gaap:PensionPlansDefinedBenefitMembercountry:GBus-gaap:OtherDebtSecuritiesMember2019-12-290000893691us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-01-030000893691us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2019-12-290000893691us-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberdoor:SeniorNotesDue2028Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-01-030000893691us-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberdoor:SeniorNotesDue2028Member2021-01-030000893691us-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberdoor:SeniorNotesDue2028Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-290000893691us-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberdoor:SeniorNotesDue2028Member2019-12-290000893691us-gaap:FairValueInputsLevel2Memberdoor:SeniorNotesDue2026Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-01-030000893691us-gaap:FairValueInputsLevel2Memberdoor:SeniorNotesDue2026Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-01-030000893691us-gaap:FairValueInputsLevel2Memberdoor:SeniorNotesDue2026Memberus-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-290000893691us-gaap:FairValueInputsLevel2Memberdoor:SeniorNotesDue2026Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-2900008936912020-09-282021-01-0300008936912020-06-292020-09-2700008936912020-03-302020-06-2800008936912019-12-302020-03-2900008936912019-07-012019-09-2900008936912019-04-012019-06-3000008936912018-12-312019-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 10-K

____________________________

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 3, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number: 001-11796

____________________________

Masonite International Corporation

(Exact name of registrant as specified in its charter)

____________________________

| | | | | | | | |

British Columbia, Canada | | 98-0377314 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2771 Rutherford Road

Concord, Ontario L4K 2N6 Canada

(Address of principal executive offices, zip code)

(800) 895-2723

(Registrant’s telephone number, including area code)

____________________________

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | |

Common Stock (no par value) | DOOR | New York Stock Exchange |

(Title of class) | (Trading symbol) | (Name of exchange on which registered) |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to management's assessment of the effectiveness of its internal control financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 28, 2020, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the shares of voting common stock held by non-affiliates of the registrant, computed by reference to the closing sales price of such shares on the New York Stock Exchange on June 28, 2020, was $1.7 billion.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of the securities under a plan confirmed by a court. Yes ☒ No ☐

The registrant had outstanding 24,435,058 shares of Common Stock, no par value, as of February 22, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2021 Annual General Meeting of Shareholders scheduled to be held on May 13, 2021, to be filed with the Securities and Exchange Commission not later than 120 days after January 3, 2021, are incorporated by reference into Part III, Items 10-14 of this Annual Report on Form 10-K.

MASONITE INTERNATIONAL CORPORATION

INDEX TO ANNUAL REPORT ON FORM 10-K

January 3, 2021

| | | | | | | | | | | |

| | | Page No. |

| PART I | | | |

| Item 1 | | | |

| Item 1A | | | |

| Item 1B | | | |

| Item 2 | | | |

| Item 3 | | | |

| Item 4 | | | |

| PART II | | | |

| Item 5 | | | |

| Item 6 | | | |

| Item 7 | | | |

| Item 7A | | | |

| Item 8 | | | |

| Item 9 | | | |

| Item 9A | | | |

| Item 9B | | | |

| PART III | | | |

| Item 10 | | | |

| Item 11 | | | |

| Item 12 | | | |

| Item 13 | | | |

| Item 14 | | | |

| PART IV | | | |

| Item 15 | | | |

| Item 16 | | | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of the federal securities laws, including, without limitation, statements concerning the conditions in our industry, our operations, our economic performance and financial condition, including, in particular, statements relating to our business and growth strategy and product development efforts under "Management’s Discussion and Analysis of Financial Condition and Results of Operations." Forward-looking statements include all statements that do not relate solely to historical or current facts and can be identified by the use of words such as "may," "might," "could," "will," "would," "should," "expect," "believes," "outlook," "predict," "forecast," "objective," "remain," "anticipate," "estimate," "potential," "continue," "plan," "project," "targeting," and other similar expressions. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. These forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain and subject to a number of risks and uncertainties. These risks and uncertainties include, without limitation, those identified under "Risk Factors" and elsewhere in this Annual Report.

The following list represents some, but not necessarily all, of the factors that could cause actual results to differ from historical results or those anticipated or predicted by these forward-looking statements:

•downward trends in our end markets and in economic conditions;

•reduced levels of residential new construction; residential repair, renovation and remodeling; and non-residential building construction activity due to increases in mortgage rates, changes in mortgage interest deductions and related tax changes and reduced availability of financing;

•competition;

•the continued success of, and our ability to maintain relationships with, certain key customers in light of customer concentration and consolidation;

•our ability to accurately anticipate demand for our products including seasonality;

•scale and scope of the coronavirus ("COVID-19") pandemic and its impact on our operations, customer demand and supply chain;

•increases in prices of raw materials and fuel;

•tariffs and evolving trade policy and friction between the United States and other countries, including China, and the impact of anti-dumping and countervailing duties;

•increases in labor costs, the availability of labor, or labor relations (i.e., disruptions, strikes or work stoppages);

•our ability to manage our operations including potential disruptions, manufacturing realignments (including related restructuring charges) and customer credit risk;

•product liability claims and product recalls;

•our ability to generate sufficient cash flows to fund our capital expenditure requirements, to meet our pension obligations, and to meet our debt service obligations, including our obligations under our senior notes and our asset-based revolving credit facility ("ABL Facility");

•limitations on operating our business as a result of covenant restrictions under our existing and future indebtedness, including our senior notes and ABL Facility;

•fluctuating foreign exchange and interest rates;

•our ability to replace our expiring patents and to innovate, keep pace with technological developments and successfully integrate acquisitions;

•the continuous operation of our information technology and enterprise resource planning systems and management of potential cyber security threats and attacks;

•political, economic and other risks that arise from operating a multinational business;

•uncertainty relating to the United Kingdom's exit from the European Union;

•retention of key management personnel; and

•environmental and other government regulations, including the United States Foreign Corrupt Practices Act ("FCPA"), and any changes in such regulations.

We caution you that the foregoing list of important factors is not all-inclusive. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this Annual Report may not in fact occur. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

PART I

Unless we state otherwise or the context otherwise requires, in this Annual Report all references to "Masonite", "we", "us", "our" and the "Company" refer to Masonite International Corporation and its subsidiaries.

Item 1. Business

Overview

We are a leading global designer, manufacturer, marketer and distributor of interior and exterior doors for the new construction and repair, renovation and remodeling sectors of the residential and non-residential building construction markets. Since 1925, we have provided our customers with innovative products and superior service at compelling values. Through innovative door solutions, a better door buying experience for our customers and partners and advanced manufacturing and service delivery, we deliver a commitment of Doors That Do MoreTM. Today, we believe we hold either the number one or two market positions in the seven product categories we target in North America: interior molded residential doors; interior stile and rail residential doors; exterior fiberglass residential doors; exterior steel residential doors; interior architectural wood doors; wood veneers and molded door facings; and door core.

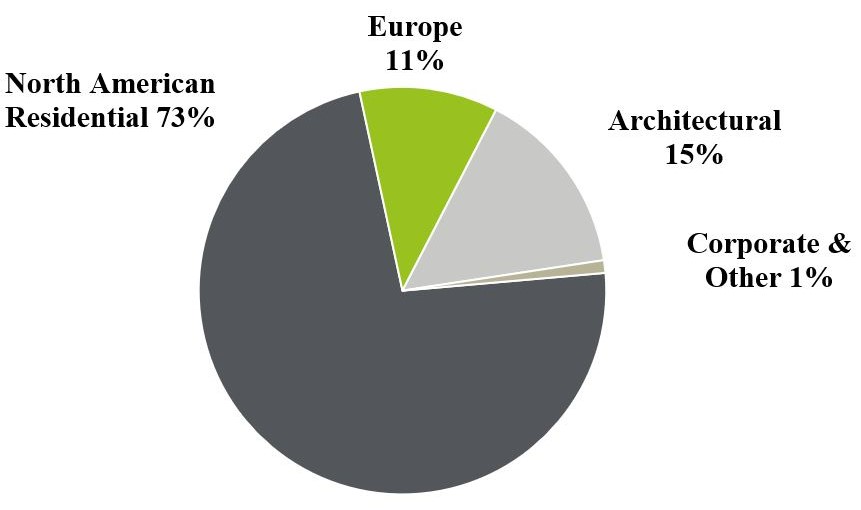

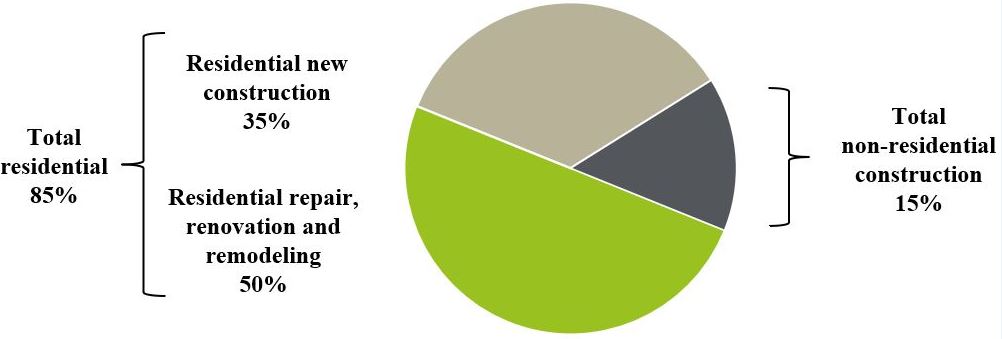

We market and sell our products to remodeling contractors, builders, homeowners, retailers, dealers, lumberyards, commercial and general contractors and architects through well-established wholesale and retail distribution channels. Our broad portfolio of brands, including Masonite®, Premdor®, Masonite ArchitecturalTM, Marshfield-AlgomaTM, USA Wood DoorTM, Mohawk®, Solidor®, Residor®, Nicedor®, Door-Stop InternationalTM, Harring DoorsTM, National HickmanTM, Graham-MaimanTM, Louisiana Millwork, BaillargeonTM and BWISM are among the most recognized in the door industry and are associated with innovation, quality and value. In the fiscal year ended January 3, 2021, we sold approximately 31 million doors to approximately 7,600 customers in 60 countries. Our fiscal year 2020 net sales by segment and global net sales of doors by end market are set forth below:

| | | | | | | | |

Net Sales by Segment

Fiscal 2020 | | Global Net Sales of Doors by End Market

Fiscal 2020 |

| | |

See Note 17 to our consolidated financial statements for additional information about our segments.

Over the past several years, we have invested in advanced manufacturing technologies to increase quality and shorten lead times and introduced targeted e-commerce and other consumer and channel marketing initiatives to improve our sales and marketing efforts and customer experience. In addition, we implemented a disciplined acquisition strategy that solidified our presence in the United Kingdom's interior and exterior residential door industry, the North American residential molded and stile and rail interior door industry and created leadership positions in the attractive North American commercial and architectural interior wood door, door core and wood veneer industry.

We operate 61 manufacturing and distribution facilities in eight countries in North America, Europe, South America and Asia, which are strategically located to serve our customers. We are one of the few vertically integrated door manufacturers in the world and one of only two in the North American residential molded interior door industry as well as the only vertically integrated door manufacturer in the North American architectural interior wood door industry. Our vertical integration extends to all steps of the production process from initial design, development and production of steel press plates to produce interior molded and exterior fiberglass door facings to the manufacturing of door components, such as door cores, wood veneers and molded facings, to door slab assembly. We also offer

incremental value by pre-machining doors for hardware, hanging doors in frames with glass and hardware and pre-finishing doors with paint or stain. We believe that our vertical integration and automation enhance our ability to develop new and proprietary products, provide greater value and improved customer service and create high barriers to entry. We also believe vertical integration enhances our ability to be more cost efficient, although our cost structure is subject to certain factors beyond our control, such as global commodity shocks.

Product Lines

Residential Doors

We sell an extensive range of interior and exterior doors in a wide array of designs, materials and sizes. Our interior doors are made with wood and related materials such as hardboard (including wood composite molded and flat door facings). Our exterior doors are made primarily of steel or fiberglass. Our residential doors are molded panel, flush, stile and rail, routed medium-density fiberboard (“MDF”), steel or fiberglass.

Molded panel doors are interior doors available either with a hollow or solid core and are made by assembling two molded door skin panels around a wood or MDF frame. Molded panel doors are routinely used for closets, bedrooms, bathrooms and hallways. Our molded panel product line is subdivided into several distinct product groups: our original Molded Panel series is a combination of classic styling, period and architectural style-specific designs, durable construction and a variety of profiles preferred by our customers when price sensitivity is a critical component in the product selection; the West EndTM Collection strengthens our tradition of design innovation by introducing the clean and simple aesthetics found in modern linear designs to the molded panel interior door category; the Heritage® Series, which features recessed, flat panels and sharp, Shaker-style profiles which speak to a clean, modern aesthetic while retaining comfortable familiarity found in today’s interiors; and the Livingston door, which features versatile and timeless design for any style of home and was introduced in 2019. All of our molded panel doors can be upgraded with our proprietary Safe ‘N Sound® door core or our environmentally friendly EmeraldTM door construction which enables homeowners, builders and architects to meet specific product requirements and “green” specifications to attain Leadership in Energy and Environmental Design ("LEED") certification for a building or dwelling.

Flush interior doors are available either with a hollow or solid core and are made by assembling two facings of plywood, MDF, composite wood or hardboard over a wood or MDF frame. These doors can either have a wood veneer surface suitable for paint or staining or a composite wood surface suitable for paint. Our flush doors range from base residential flush doors consisting of unfinished composite wood to the ultra high-end exotic wood veneer doors.

Stile and rail doors are made from wood or MDF with individual vertical stiles, horizontal rails and panels, which have been cut, milled, veneered and assembled from lumber such as clear pine, knotty pine, oak and cherry. Within our stile and rail line, glass panels can be inserted to create what is commonly referred to as a French door and we have over 50 glass designs for use in making French doors. Where horizontal slats are inserted between the stiles and rails, the resulting door is referred to as a louver door. For interior purposes, stile and rail doors are primarily used for hallways, room dividers, closets and bathrooms. For exterior purposes, these doors are used as entry doors with decorative glass inserts (known as lites) often inserted into them.

Routed MDF doors are produced by using a computer controlled router carver to machine a single piece of double refined MDF. Our routed MDF door category is sold under the Carte Blanche® brand. The offering of designs in this category is extensive, as the manufacturing of routed MDF doors is based on a routing program where the milling machine selectively removes material to reveal the final design.

Steel doors are exterior doors made by assembling two interlocking steel facings (paneled or flat) or attaching two steel facings to a wood or steel frame and injecting the core with polyurethane insulation. With our functional Utility Steel series, the design centric High Definition family and the prefinished Sta-Tru® HD, we offer customers the freedom to select the right combination of design, protection and compliance required for essentially any paint grade exterior door application. In addition, our product offering is significantly increased through our variety of compatible clear or decorative glass designs.

Fiberglass doors are considered premier exterior doors and are made by assembling two fiberglass door facings to a wood frame or composite material and injecting the core with polyurethane insulation. Fiberglass is strong, durable, lightweight and impervious to many caustics and to extreme temperatures. These attributes make fiberglass an ideal material for an exterior door that may face extremes in temperature, exposure to the elements and general wear and tear. In the United Kingdom, Door-StopTM branded fiberglass doors are manufactured into prehung door sets and shipped to

our customers with industry-leading lead times. We believe our innovative designs, construction and finishes will help our fiberglass door collections retain a distinct role in the exterior product category in the future.

Architectural Doors

Architectural doors are typically highly specified products designed, constructed and tested to ensure that regulatory compliance and environmental certifications such as Forest Stewardship Council and LEED certifications are met. These doors are sold into institutional (schools, healthcare and government facilities) and commercial projects (hotels, offices and retail facilities). We believe that the architectural door industry is shifting focus from transactional, component sales to selling total opening solutions in key performance areas such as fire, security, acoustics and technology. Our two primary product series for the architectural business, AspiroTM and CenduraTM, are comprised of four product categories: stile and rail, flush wood veneer, painted and laminate doors. The Aspiro series offers high-end aesthetic and performance qualities, and its doors are available in exotic and domestic veneers, with acoustic, fire-rated, lead-lined, attack- and bullet-resistant options and include lifetime warranties. The Cendura series provides a balance of performance and value and its doors are available with domestic veneers, with acoustic and fire-rated options and include limited warranties. These product offerings provide a wide range of solutions to cover the needs of commercial and institutional projects.

Components

In addition to residential and architectural doors, we also sell several door components to the building materials industry. Within the residential new construction market, we provide interior door facings, agri-fiber and particleboard door cores, MDF and wood cut stock components to multiple manufacturers. Within the architectural building construction market, we are a leading component supplier of various critical door components and one of the largest wood veneer door skin suppliers. Additionally, we are one of the leading providers of mineral and particleboard door cores to the North American architectural door industry.

Molded door facings are thin sheets of molded hardboard produced by grinding or defibrating wood chips, adding resin and other ingredients, creating a thick fibrous mat composed of dry wood fibers and pressing the mat between two steel press plates to form a molded sheet, the surface of which may be smooth or may contain a wood grain pattern. Following pressing, molded door facings are trimmed, primed and shipped to door manufacturing plants where they are mounted on frames to produce molded doors.

Door framing materials, commonly referred to as cut stock, are wood or MDF components that constitute the frame on which interior and exterior door facings are attached. Door cores are pressed fiber mats of refined wood chips or agri-fiber used in the construction of solid core doors. For doors that must achieve a fire rating higher than 45 minutes, the door core consists of an inert mineral core or inorganic intumescent compounds.

Sales and Marketing

Our sales and marketing efforts are focused around several key initiatives designed to drive organic growth, influence the mix sold and strengthen our customer relationships.

Multi-Level/Segment Distribution Strategy

We market our products through and to wholesale distributors, retail stores, independent and pro dealers, builders, remodelers, architects, door and hardware distributors and general contractors.

In the residential market, we deploy an "All Products" cross merchandising strategy, which provides our retail and wholesale customers access to our entire product range. Our "All Products" customers benefit from consolidating their purchases, leveraging our branding, marketing and selling strategies and improving their ability to influence the mix of products sold to generate greater value. We service our big box retail customers directly from our own door fabrication facilities which provide value added services and logistics, including store direct delivery of doors and entry systems and a full complement of in-store merchandising, displays and field service. Our wholesale residential channel customers are managed by our own sales professionals who focus on down channel initiatives designed to ensure our products are "pulled" through our North American wholesale distribution network.

Our architectural building construction customers are serviced by a separate and distinct sales team providing architects, door and hardware distributors, general contractors and project owners a wide variety of technical specifications, specific brand differentiation, compliance and regulatory approvals, product application advice and

multisegment specialization work across North America. Additionally, our sales team is supported by marketing strategies aimed to drive product specification throughout our value chains via distributors, architects and end users.

Service Innovation

We leverage our marketing, sales and customer service activities to ensure our products are strategically pulled through our multiple distribution channels rather than deploying a more common, tactical "push" strategy like some of our competitors. Our marketing approach is designed to increase the value of each and every door opening we fill with our doors and entry systems, regardless of the channel being used to access our products.

Our proprietary web-based tools accessible on our website also provide our customers with a direct link to our information systems to allow for accelerated and easy access to a wide variety of information and selling aids designed to increase customer satisfaction. Within our North American Residential business, our web-based tools include Mconnect®, an online service portal allowing our customers access to several other e-commerce tools designed to enhance the manufacturer-customer relationship. Once connected to our system, customers have secure access to MAX®, Masonite’s Xpress Configurator®, a web-based tool created to design customized door systems and influence the mix, improve selection and ordering processes, reduce order entry and quoting errors and improve overall communication throughout the channel; the Product Corner, a section advising customers of the features and benefits of our newest products; the Media Library, a comprehensive supply of marketing materials and self-service resources; and Order Tracker, which allows customers to follow their purchase orders through the production process and confirm delivery dates. Our newest commercial configurator, eMerge®, was introduced in 2019 as a future replacement for MAX®. eMerge® affords our customers the same benefits as MAX® and introduces an enhanced user experience with the added capability for seamless integration with customer systems using the latest cloud technology to streamline demand and reduce the need for manual order entry.

In Europe, our Solidor and Door-Stop International websites are fully functional configuration and order platforms that support our entry door customers in the United Kingdom. The dynamic integration of Solidor's and Door-Stop's enterprise resource planning systems and their websites ensures that the products customers see, configure and order are in stock, which ensures that we are able to deliver on our promise of dependable lead-times.

In our Architectural business, we continue to roll out our new door configurator, DoorBuilderTM Live, for mill direct customers that makes selecting and ordering the right door easier and more intuitive. DoorBuilderTM Live is a cloud-based software that streamlines the door ordering process for fast, accurate results. Additionally, we enhanced our DoorUniversity training program and developed a suite of American Institute of Architects continuing education units designed to educate architects to help them select the right solutions to meet their project and client goals.

Customers

During fiscal year 2020, we sold our products worldwide to approximately 7,600 customers. We have developed strong relationships with these customers through our "All Products" cross merchandising strategy. Our vertical integration facilitates our "All Products" strategy with our door fabrication facilities in particular providing value-added fabrication and logistical services to our customers, including store delivery of pre-hung interior and exterior doors to our customers in North America. All of our top 20 customers have purchased doors from us for at least 10 years.

Although we have a large number of customers worldwide, our largest customer, The Home Depot, accounted for approximately 18% of our total net sales in fiscal year 2020. Due to the depth and breadth of the relationship with this customer, which operates in multiple North American geographic regions and which sells a variety of our products, our management believes that this relationship is likely to continue.

Distribution

Residential doors are primarily sold through wholesale and retail distribution channels.

•Wholesale. In the wholesale channel, door manufacturers sell their products to homebuilders, contractors, lumber yards, dealers and building products retailers in two steps or one step. Two-step distributors typically purchase doors from manufacturers in bulk and customize them by installing windows, or "lites", and pre-hanging them. One-step distributors sell doors directly to homebuilders and remodeling contractors who install the doors.

•Retail. The retail channel generally targets consumers and smaller remodeling contractors who purchase doors through retail home centers and smaller specialty retailers. Retail home centers offer large, warehouse size retail space with large selections, while specialty retailers are niche players that focus on certain styles and types of doors.

Architectural doors are primarily sold through specialized one-step wholesale distribution channels where distributors sell to general contractors and end-use clients.

Research and Development

We believe we are a global leader in end user focused innovation and development of doors, door components and full door solutions as well as the manufacturing processes involved in making such products. We believe that research and development is a competitive advantage for us, and we intend to capitalize on our leadership in this area through focus on end user problems that lead to the development of more new and innovative products. As part of Masonite’s Doors That Do MoreTM strategy, our end user experience, research and development and engineering capabilities enable us to organically create and solicit external innovative ideas; methodically validate commercial and technical viability; use cross functional teams to develop business case hypotheses for promising concepts; and implement new to world products and manufacturing process improvements. The result of this rigorous approach enables us to launch new innovative, proprietary end user valued solutions, enhance the manufacturing efficiency of our products, improve quality and reduce costs. As part of our North American Investment Plan announced in late 2019, we have invested in innovation activities with a significant focus on the development of new, differentiated products as well as focusing on process and material improvements to improve quality. In the Architectural wood door market, we have directed research and development to address the growing need for specified door systems in critical areas of safety and security, including our first attack resistant door system and expanded offerings of sound-dampening and fire-resistant products.

As an integrated manufacturer focused on the door industry, we believe that we are well positioned to take advantage of the growing demand for new, innovative door designs, components and solutions. We leverage our deep knowledge and experience in door construction and assembly as well as our ability to manufacture our own molds for use in our own facilities. We believe this provides us with a unique ability to offer a combination of sought after high value door solutions as well as the breadth of line to meet the needs of a variety of end users and customers. This capability also enables us to develop and implement product and process improvements with respect to the production of door solutions and components which increase average unit price, enhance production efficiency and/or reduce costs.

Manufacturing Process

Our manufacturing operations consist of three major manufacturing processes: (1) component manufacturing, (2) door slab assembly and (3) value-added ready to install door fabrication.

We have a leading position in the manufacturing of door components, including internal framing components (stile and rails), glass inserts (lites), door core, interior door facings (molded and veneer) and exterior door facings. The manufacturing of interior molded door facings is the most complex of these processes requiring a significant investment in large scale wood fiber processing equipment. Interior molded door facings are produced by combining fine wood particles, synthetic resins and other additives under heat and pressure in large multi-opening automated presses utilizing Masonite proprietary steel plates. The facings are then primed, cut and inspected in a second highly automated continuous operation prior to being packed for shipping to our door assembly plants. We operate five interior molded door facing plants around the world, two in North America and one in each of South America, Europe and Asia. Our plant in Laurel, Mississippi, is one of the largest door facing plants in the world and we believe one of the most technologically advanced in the industry.

Interior residential hollow and solid core door manufacturing is an assembly operation that is primarily accomplished through the use of semi-skilled manual labor. The construction process for a standard flush or molded interior door is based on assembly of door facings and various internal framing and support components, followed by the doors being trimmed to their final specifications.

The assembly process varies by type of door, from a relatively simple process for flush and molded doors, where the door facings are glued to a wood frame, to more complex processes where many pieces of solid and engineered wood are converted to louver or stile and rail door slabs. Architectural interior doors require another level of customization and sophistication employing the use of solid cores with varying degrees of sound dampening and fire

retarding attributes, furniture quality wood veneer facings, as well as secondary machining operations to incorporate more sophisticated commercial hardware, openers and locks. Additionally, architectural doors are typically pre-finished prior to sale.

The manufacturing of steel and fiberglass exterior door slabs is a semi-automated process that entails combining laminated wood or rot free composite framing components between two door facings and then injecting the resulting hollow core structure with insulating polyurethane expanding foam core materials. We invested in fiberglass manufacturing technology, including the vertical integration of our own fiberglass sheet molding compound plant at our Laurel, Mississippi, facility in 2006. In 2008, we consolidated fiberglass slab manufacturing from multiple locations throughout North America into a single highly automated facility in Dickson, Tennessee, significantly improving the reliability and quality of these products while simultaneously lowering cost and reducing lead times.

Short set-up times, proper production scheduling and coordinated material movement are essential to achieve a flexible process capable of producing a wide range of door types, sizes, materials and styles. We make use of our vertically integrated and flexible manufacturing operations together with scalable logistics primarily through the use of common carriers to fill customers’ orders and to minimize our investment in finished goods inventory.

Finally, door slabs manufactured at our door assembly plants are either sold directly to our customers or transferred to our door fabrication facilities where value added services are performed. These value added services include machining doors for hinges and locksets, installing the door slabs into ready to install frames, installing hardware, adding glass inserts and side lites, painting and staining, packaging and logistical services to our customers.

Within our manufacturing processes, we leverage the Mvantage operating system to systemically focus on the elimination of waste and non-value-added activities within the organization. In 2020, we continued to progress our deployment of Mvantage throughout our enterprise. Despite the challenges of COVID-19, we continued to drive operational performance through our three-prong strategy, at times using a virtual approach, which includes the Model Plant Transformation Process, Process Improvement Teams and the focus on global standards and training. Our Model Plant Transformation Process is designed to improve the throughput and the efficiency of our factories using multiple approaches such as reconfiguring equipment to enhance safety and material flow, optimizing inventory levels and implementing and tracking sustaining performance metrics. Our Process Improvements Teams work closely with manufacturing sites to utilize Mvantage to diagnose operational inefficiencies and apply corrective actions in specific areas of the factory. Our focus on training, through our Internal Training and Certification programs, and implementing global standards has allowed us to drive continuous improvement through an increased number of Kaizen events that are being led by our trained facilitators.Through this structured approach, we realized improvements in certain key performance indicators in 2020.

Raw Materials

While Masonite is vertically integrated, we require a regular supply of raw materials, such as wood chips, some cut stock components, various composites, steel, glass, paint, stain and primer as well as petroleum-based products such as binders, resins and plastic injection frames to manufacture and assemble our products. In 2020, our materials cost accounts for approximately 50% of the total cost of the finished product. In certain instances, we depend on a single or limited number of suppliers for these supplies. Wood chips, logs, resins, binders and other additives utilized in the manufacturing of interior molded facings, exterior fiberglass door facings and door cores are purchased from global, regional and local suppliers taking into consideration the relative freight cost of these materials. Internal framing components, MDF, cut stock and internal door cores are manufactured internally at our facilities and supplemented from suppliers located throughout the world. We utilize a network of suppliers based in North America, Europe, South America and Asia to purchase other components including steel coils for the stamping of steel door facings, MDF, plywood and hardboard facings, door jambs and frames and glass frames and inserts.

Environmental and Other Regulatory Matters

We strive to minimize any adverse environmental impact our operations might have to our employees, the general public and the communities of which we are a part. We are subject to extensive environmental laws and regulations. The geographic breadth of our facilities subjects us to environmental laws, regulations and guidelines in a number of jurisdictions, including, among others, the United States, Canada, Mexico, the United Kingdom, the Republic of Ireland, the Czech Republic, Chile and Malaysia. Such laws, regulations and guidelines relate to, among other things, the discharge of contaminants into water and air and onto land, the storage and handling of certain regulated materials used in the manufacturing process, waste minimization, the disposal of wastes and the remediation

of contaminated sites. Many of our products are also subject to various regulations such as building and construction codes, product safety regulations, health and safety laws and regulations and mandates related to energy efficiency.

Our efforts to ensure environmental compliance include the review of our operations on an ongoing basis utilizing in-house staff and on a selective basis by specialized environmental consultants. The Environmental, Health and Safety team participates in industry groups to monitor developing regulatory actions and actively develop comments on specific issues. Furthermore, for our prospective acquisition targets, environmental assessments are conducted as part of our due diligence review process. Based on recent experience and current projections, environmental protection requirements and liabilities are not expected to have a material effect on our business, capital expenditures, operations or financial position.

In addition to the various environmental laws and regulations, our operations are subject to numerous foreign, federal, state and local laws and regulations, including those relating to the presence of hazardous materials and protection of worker health and safety, consumer protection, trade, labor and employment, tax and others. We believe we are in compliance in all material respects with existing applicable laws and regulations affecting our operations.

Intellectual Property

In North America, our doors are marketed primarily under the Masonite® brand. Other North American brands include: Premdor®, Masonite Architectural®, Barrington®, Oakcraft®, Sta-Tru® HD, AvantGuard®, Vistagrande®, Flagstaff®, Hollister®, Sierra®, Fast-Frame®, Safe ’N Sound®, Heritage Series®, Livingston®, AquaSealTM, Cheyenne®, Glenview®, Riverside®, Saddlebrook®, Fast-Fit®, Mohawk®, Megantic®, Birchwood Best®, Algoma®, Vignette®, RhinoDoor®, Lemieux®, Harring DoorsTM, FyreWerks®, Graham-MaimanTM, MaimanTM and Marshfield-Algoma®. In Europe, doors are marketed under the Masonite®, Premdor®, Premdor Speed Set®, Door-Stop International®, National Hickman®, Defining Spaces®, Solidor®, Residor® and Nicedor® brands. We consider the use of trademarks and trade names to be important in the development of product awareness, and for differentiating products from competitors and between customers.

We protect the intellectual property that we develop through, among other things, filing for patents in the United States and various foreign countries. In the United States, we currently have 280 design patents and design patent applications and 169 utility patents and patent applications. We currently have 181 foreign design patents and patent applications and 224 foreign utility patents and patent applications. Our United States utility patents are generally applicable for 20 years from the earliest filing date, our United States design patents for 15 years and our United States registered trademarks and tradenames are generally applicable for 10 years and are renewable. Our foreign patents and trademarks have terms as set by the particular country, although trademarks generally are renewable.

Competition

The North American door industry is highly competitive and includes a number of global and local participants. In the North American residential interior door industry, the primary participants are Masonite and JELD-WEN, which are the only vertically integrated manufacturers of molded door facings. There are also a number of smaller competitors in the residential interior door industry that primarily source door facings from third party suppliers. In the North American residential exterior door industry, the primary participants are Masonite, JELD-WEN, Plastpro, Therma-Tru, Feather River and Steves and Sons Inc. In the North American non-residential building construction door industry, the primary participants are Masonite and VT Industries with the remainder supplied by multiple regional manufacturers. Our primary market in Europe is the United Kingdom. The United Kingdom door industry is similarly competitive, including a number of global and local participants. The primary participants in the United Kingdom are our subsidiary Premdor, JELD-WEN, Vicaima and Distinction Doors. Competition in these markets is primarily based on product quality, design characteristics, brand awareness, serviceability, distribution capabilities and value. We also face competition in the other countries in which we operate. In Europe, South America and Asia, we face significant competition from a number of regionally based competitors and importers.

A large portion of our products are sold through large home centers and other large retailers. The consolidation of our customers and our reliance on fewer larger customers has increased the competitive pressures as some of our largest customers, such as The Home Depot, perform periodic product line reviews to assess their product offerings and suppliers.

We are one of the largest manufacturers of molded door facings in the world. The rest of the industry consists of one other large, integrated door manufacturer and a number of smaller regional manufacturers. Competition in the

molded door facing business is based on quality, price, product design, logistics and customer service. We produce molded door facings to meet our own requirements and outside of North America we serve as an important supplier to the door industry at large.

Human Capital Resources

As of January 3, 2021, we employed approximately 10,500 employees and contract personnel. This includes approximately 3,000 unionized employees, approximately 80% of whom are located in North America with the remainder in various foreign locations. Ten of our North American facilities have individual collective bargaining agreements, which are negotiated locally and the terms of which vary by location.

Our Company’s Purpose: We Help People Walk Through Walls, is reflected in our talent strategy that is focused on attracting and selecting exceptional talent, helping them develop and grow professionally, and providing opportunities to recognize and reward their performance, in order to engage and retain our skilled, diverse and motivated workforce. We focus on the employee experience, removing barriers to inclusion, in an effort for our people to realize their full potential and highest levels of performance. We aspire to be the employer of choice within our markets we serve and seek to grow and develop the different capabilities and skills we need for the future, while maintaining a robust pipeline of available talent throughout the organization.

We embrace the diversity of our employees and our customers, including their unique backgrounds, experiences and talents. Everyone is valued and appreciated for their unique contributions to the growth and sustainability of our business. We strive to cultivate a culture that supports and enhances our ability to recruit, develop, engage and retain diverse talent at every level. We monitor engagement in part through a voluntary turnover metric as our goal is to retain a highly engaged team, thereby reducing voluntary turnover year over year. During fiscal year 2020, our voluntary employee turnover rate for employees in the United States and Canada was approximately 19%, representing a 300 bps reduction from the prior year. Additionally, we track 12-month retention rates, which have also improved over time. At the end of 2020, our retention rate in the United States and Canada was nearly 88% across all locations. This level reflects a 220 bps improvement over 2019 in the retention rate for our hourly employees and a 120 bps improvement from 2019 for our salaried employees.

We believe that safety is as important to our success as productivity and quality. This is reflected in our goal of Target Zero injuries and our continued effort to create an injury-free workplace. We also believe that incidents can be prevented through proper management, employee involvement, standardized operations and equipment and attention to detail. Safety programs and training are provided throughout the company to ensure employees and managers have effective tools to help identify and address both unsafe conditions and at-risk behaviors.

Through a continued commitment to improve our safety performance, we have historically been successful in reducing the number of injuries sustained by our employees. In 2020, the total incident rate, the annual number of injuries per 100 full time equivalent employees, was 1.89 representing a 10% improvement on a comparable basis when adjusting for the impacts of acquisitions. Our exit rate safety performance in 2020 was positive and suggests a continuation of our improvements in 2021.

History and Reporting Status

Masonite was founded in 1925 in Laurel, Mississippi, by William H. Mason, to utilize vastly available quantities of sawmill waste to manufacture a usable end product. Masonite was acquired by Premdor from International Paper Company in August 2001.

Prior to 2005, Masonite was a public company with shares of our predecessor’s common stock listed on both the New York and Toronto Stock Exchanges. In March 2005, we were acquired by an affiliate of Kohlberg Kravis Roberts & Co. L.P.

On March 16, 2009, Masonite International Corporation and several affiliated companies, voluntarily filed to reorganize under the Company's Creditors Arrangement Act (the "CCAA") in Canada in the Ontario Superior Court of Justice. Additionally, Masonite International Corporation and Masonite Inc. (the former parent of the Company) and all of its U.S. subsidiaries filed voluntary petitions for reorganization under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court in the District of Delaware. On June 9, 2009, we emerged from reorganization proceedings under the CCAA in Canada and under Chapter 11 of the U.S. Bankruptcy Code in the United States.

Effective July 4, 2011, pursuant to an amalgamation under the Business Corporations Act (British Columbia), Masonite Inc. amalgamated with Masonite International Corporation to form an amalgamated corporation named Masonite Inc., which then changed its name to Masonite International Corporation.

On September 9, 2013, our shares commenced listing on the New York Stock Exchange under the symbol "DOOR" and we became subject to periodic reporting requirements under the United States federal securities laws. We are currently not a reporting issuer, or the equivalent, in any province or territory of Canada and our shares are not listed on any recognized Canadian stock exchange.