Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| SM Energy Company | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Proxy Statement and Notice of

2015 Annual Meeting of Stockholders

May 19, 2015

Denver, Colorado

SM Energy Company

1775 Sherman Street, Suite 1200

Denver, Colorado 80203

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD

TUESDAY, MAY 19, 2015

To All Stockholders:

The 2015 Annual Meeting of Stockholders of SM Energy Company (the "Annual Meeting") is to be held in the J.D. Hershner Room of Wells Fargo Bank, located at 1700 Lincoln Street, Denver, Colorado, on Tuesday, May 19, 2015, at 3:30 p.m. local time. The purposes of the Annual Meeting are to:

- 1.

- elect

nine individuals to our Board of Directors, to serve until the next annual meeting of our stockholders;

- 2.

- ratify

the appointment by our Audit Committee of Ernst & Young LLP, as our independent registered public accounting firm for 2015;

- 3.

- hold

an advisory vote to approve the compensation of our named executive officers; and

- 4.

- transact such other business that may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof.

Only stockholders of record at the close of business on March 20, 2015, may vote at the Annual Meeting.

Only stockholders of record, holders of our shares of common stock in street name and our guests will be permitted to attend the 2015 Annual Meeting. If you are a stockholder of record, you will need to bring with you to the meeting either the Notice of Internet Availability of Proxy Materials or any proxy card that is sent to you. Otherwise, you will be admitted only upon other verification of record ownership at the site. If you own shares held in street name, you will need to bring the Notice of Internet Availability of Proxy Materials, any voting instruction form that is sent to you, or your most recent brokerage statement or a letter from your bank, broker, or other record holder indicating that you beneficially owned shares of our common stock on March 20, 2015. We can use that to verify your beneficial ownership of our common stock and admit you to the meeting. If you intend to vote at the meeting, you also will need to bring to the meeting a legal proxy from your bank, broker, or other holder of record that authorizes you to vote the shares that the record holder holds for you in its name.

Please vote by using the telephone or Internet voting systems described in the Notice of Internet Availability of Proxy Materials or the proxy card or, if the attached Proxy Statement and a proxy card were mailed to you, please sign, date, and return the proxy card in the enclosed envelope as soon as possible. Thank you for your support for the recommendations of our Board of Directors.

By Order of the Board of Directors, |

||

|

||

| David W. Copeland Executive Vice President, General Counsel and Corporate Secretary |

Denver,

Colorado

April 9, 2015

This Proxy Statement contains information about the 2015 Annual Meeting of Stockholders (the "Annual Meeting") of SM Energy Company to be held in the J.D. Hershner Room of Wells Fargo Bank, located at 1700 Lincoln Street, Denver, Colorado, on Tuesday, May 19, 2015, at 3:30 p.m. local time. Our Board of Directors ("Board") is using this Proxy Statement to solicit proxies for use at the Annual Meeting and at any adjournment(s) or postponement(s) thereof. In this Proxy Statement, the terms "we," "us," and "our" refer to SM Energy Company and its subsidiaries.

The proxy materials, including this Proxy Statement, a proxy card or voting instruction card, and our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 ("2014 Annual Report"), are being distributed and made available on or about April 9, 2015. In accordance with rules and regulations adopted by the United States Securities and Exchange Commission (the "SEC"), we are furnishing our proxy materials to many beneficial owners of our stock via the Internet. A Notice of Internet Availability of Proxy Materials (the "Notice") will be mailed by intermediaries on or about April 9, 2015, to beneficial owners of our common stock. Stockholders will have the ability to access the proxy materials on a website referred to in the Notice or may request that we send them a printed set of the proxy materials by following the instructions in the Notice. The Notice will also provide instructions on how to vote your shares. The proxy materials are being mailed to all stockholders of record, as of close of business on March 20, 2015, on or about April 9, 2015.

Purposes of the Annual Meeting

As stated in the accompanying Notice of Annual Meeting of Stockholders, at the Annual Meeting, our stockholders will be asked to vote on:

- •

- the election of nine individuals to our Board, to serve until the next annual meeting of our stockholders;

- •

- the ratification of the appointment by our Audit Committee of Ernst & Young LLP, as our independent registered public

accounting firm for 2015;

- •

- an advisory vote to approve the compensation of our named executive officers; and

- •

- such other business that may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof.

Each proposal is described in more detail in this Proxy Statement.

As of the date of this Proxy Statement, we are not aware of any business to come before the Annual Meeting other than the first three items noted above.

Only stockholders of record at the close of business on the record date, March 20, 2015, are entitled to receive notice of the Annual Meeting and to vote shares of our common stock held on that date. As of March 20, 2015, there were 67,463,060 shares of our common stock issued and outstanding,

1

net of zero shares held in treasury. Holders of our common stock are entitled to one vote per share and are not allowed to cumulate votes in the election of directors.

Differences Between Stockholders of Record and Street Name Holders

Most stockholders hold their shares through a bank, broker or other nominee (that is, in "street name") rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned in street name.

- •

- Stockholder of Record. If your shares are registered

directly in your name with our transfer agent, Computershare, Inc., you are considered, with respect to those shares, the stockholder of record. As the stockholder of record, you have the right to

grant your voting proxy directly or to vote in person at the Annual Meeting.

- •

- Street Name Stockholder. If your shares are held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in "street name." As the beneficial owner, you have the right to direct your broker or nominee how to vote and are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares.

Stockholder of Record. Stockholders whose shares are registered in their own name may vote via the Internet, by telephone or by mailing a completed proxy card. Instructions for voting via the Internet or by telephone are set forth on the enclosed proxy card. To vote by mailing a proxy card, you must sign, date and return the enclosed proxy card in the enclosed prepaid and addressed envelope, and your shares will be voted at the Annual Meeting in the manner you direct. In the event no directions are specified in a proxy, such proxy will be voted as follows:

- •

- FOR the election of the nine nominees named in this Proxy Statement under the caption "Proposal 1—Election of

Directors";

- •

- FOR the ratification of the appointment by our Audit Committee of Ernst & Young LLP as our independent registered public

accounting firm for 2015;

- •

- FOR the advisory approval of the compensation of our named executive officers; and

- •

- in the discretion of the proxy holders named on the proxy card as to any other matter that may properly come before the Annual Meeting, or any adjournment(s) or postponement(s) thereof.

Street Name Stockholder. If your shares are registered in the name of a bank, broker or other nominee and you have not elected to receive your proxy materials electronically, you may nevertheless be eligible to vote your shares via the Internet or by telephone rather than by mailing a completed voting instruction card provided by your bank, broker or other nominee. Please check the voting instruction card provided by your bank, broker or other nominee for availability and instructions.

If you hold shares in BOTH street name and as a stockholder of record, YOU MUST VOTE SEPARATELY for each set of shares.

2

If you are a stockholder of record, you can revoke your proxy at any time before it is exercised by:

- •

- submitting a new proxy with a later date either signed and returned by mail or transmitted using the telephone or Internet voting

procedures before the Annual Meeting;

- •

- voting in person at the Annual Meeting; however, attending the Annual Meeting without completing a ballot will not revoke any

previously submitted proxy; or

- •

- filing a written revocation before the Annual Meeting with our Corporate Secretary at our principal executive offices, which are located at 1775 Sherman Street, Suite 1200, Denver, CO 80203.

If you are a street name stockholder and you vote by proxy, you may change your vote by submitting new voting instructions to your bank, broker or other nominee in accordance with your nominee's procedures.

A quorum of stockholders is necessary to hold a valid meeting. A quorum will exist if stockholders holding one-third of our outstanding shares of common stock are present at the Annual Meeting in person or by proxy. Abstentions and broker non-votes (as described below) count as present for establishing a quorum. Shares held by us as treasury shares are not entitled to vote and do not count toward a quorum. If a quorum is not present, the Annual Meeting may be adjourned until a quorum is obtained.

Voting Requirements; Vote Treatment

If you hold your shares in "street name," you will receive instructions from your bank, broker or other nominee describing how to vote your shares. If you do not instruct your bank, broker or other nominee how to vote your shares, it may vote your shares as it decides as to each matter for which it has discretionary authority under the rules of the New York Stock Exchange ("NYSE").

There are also non-discretionary matters for which banks, brokers and other nominees do not have discretionary authority to vote unless they receive timely instructions from you. When a bank, broker or other nominee does not have discretion to vote on a particular matter, you have not given timely instructions on how the bank, broker or other nominee should vote your shares, and the bank, broker or other nominee indicates it does not have authority to vote such shares on its proxy, a "broker non-vote" results. Although any broker non-vote would be counted as present at the meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to non-discretionary matters.

Abstentions occur when stockholders are present at the Annual Meeting but fail to vote or voluntarily withhold their vote for any of the matters upon which stockholders are voting.

If your shares are held in street name and you do not give voting instructions, pursuant to Rule 452 of the NYSE, the record holder will not be permitted to vote your shares with respect to Proposal 1 (Election of Directors) and Proposal 3 (Advisory Vote on Executive Compensation); and your shares will be considered "broker non-votes" with respect to these proposals; but will nevertheless be

3

entitled to vote your shares with respect to Proposal 2 (Ratification of Appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm for 2015) in the discretion of the record holder.

- •

- Proposal 1 (Election of Directors): Our Amended and Restated By-Laws (our

"By-Laws") provide that the election of directors will be decided by the vote of the holders of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote.

Abstentions will be counted in determining the total number of shares "entitled to vote" on the election of directors and will have the same effect as a vote "Against" a director. Broker non-votes

will have no effect on the outcome of the vote for directors.

- •

- Proposal 2 (Ratification of Appointment of Ernst & Young LLP as Our Independent Registered

Public Accounting Firm for 2015): Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending

December 31, 2015, requires the affirmative vote of the holders of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote. Abstentions will be counted

in determining the total number of shares "entitled to vote" on this proposal and will have the same effect as a vote "Against" the proposal.

- •

- Proposal 3 (Advisory Vote on Executive Compensation): Approval of this proposal requires the affirmative vote of the holders of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote. Abstentions will be counted in determining the total number of shares "entitled to vote" on this proposal and will have the same effect as a vote "Against" the proposal. Broker non-votes will have no effect on the outcome of the vote on this proposal. While this vote is required by law, it will not be binding, nor will it create or imply any change in the fiduciary duties of, nor impose any additional fiduciary duty on, us or the Board. However, the Compensation Committee of our Board will take into account the outcome of the vote when considering future executive compensation decisions.

Payment of Proxy Solicitation Costs

We will pay all costs of soliciting proxies. We have retained Alliance Advisors, LLC to assist in the solicitation of proxies for total fees of $8,500, plus reimbursement of reasonable out-of-pocket expenses. The solicitation may be made personally or by mail, facsimile, telephone, messenger, or via the Internet. In addition, our officers, directors, and employees may solicit proxies in person, by telephone, or by other electronic means of communication. Such directors, officers and employees will not be additionally compensated but may be reimbursed for reasonable out-of-pocket expenses incurred in connection with such solicitation. We may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners of our common stock for their reasonable out-of-pocket expenses in forwarding solicitation material to such beneficial owners.

We make available through the Governance section of our website (www.sm-energy.com) the following documents: our Corporate Governance Guidelines; our Financial Code of Ethics (the "Financial Code"); our Code of Business Conduct and Conflict of Interest Policy (the "Code of Conduct"); and the Charters of the Audit, Compensation, Executive, and Nominating and Corporate Governance Committees of our Board. These documents will be furnished in print to any stockholder upon request. Information on our website is not incorporated by reference into this Proxy Statement and should not be considered part of this document.

4

Stockholders Sharing the Same Address

We have adopted a procedure approved by the SEC called "householding." Under this procedure, stockholders of record who have the same address and last name will receive only one copy of our Notice of Internet Availability, 2014 Annual Report, and Proxy Statement until such time as one or more of these stockholders notify us that they want to receive separate copies. This procedure reduces our printing costs and postage fees. Stockholders who participate in householding will continue to have access to and may utilize separate proxy voting instructions.

If you receive a single set of proxy materials as a result of householding and you would like to receive a separate copy of our Notice of Internet Availability, 2014 Annual Report or Proxy Statement, please submit a request to our Corporate Secretary, at 1775 Sherman Street, Suite 1200, Denver, Colorado 80203 or call (303) 861-8140, and we will promptly send such to you. You may also contact our Corporate Secretary at the address and phone number above if you receive multiple copies of our proxy materials and you would prefer to receive a single copy in the future, or if you would like to opt out of householding for future mailings. Beneficial owners can request information about householding from their bank, broker, or other nominee.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF

PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 19, 2015

The Notice of Annual Meeting of Stockholders, the Proxy Statement for the 2015 Annual Meeting of Stockholders, and the Form 10-K for the fiscal year ended December 31, 2014, are available at http://www.viewproxy.com/sm-energy/2015/.

5

We are committed to sound corporate governance principles. To evidence this commitment, the Board has adopted charters for its committees, our Corporate Governance Guidelines, the Financial Code and the Code of Conduct. These documents provide the framework for our corporate governance. A complete copy of these documents is available on our website at www.sm-energy.com or in print, free of charge, to any stockholder who requests it by contacting our Corporate Secretary. The Board regularly reviews corporate governance developments and modifies our governance documents as appropriate.

The Financial Code, which applies to our principal executive officer, principal financial officer and principal accounting officer or controller, as well as persons performing similar functions and other officers and employees identified by our Chief Financial Officer, requires that any exception to or waiver for an executive officer subject to the Financial Code be made only by the Audit Committee of the Board and disclosed as required by law, SEC rules and regulations, and NYSE rules. Changes to, or waivers from, the Financial Code for any of our executive officers subject to the Financial Code will be disclosed on our website at www.sm-energy.com within two business days after such change or waiver. To date, the Audit Committee of our Board has not granted waivers of the Financial Code for any of our executive officers subject to the Financial Code.

Board and Committee Independence

The Board is comprised of a majority of independent directors, four of whom, Stephen R. Brand, Loren M. Leiker, Ramiro G. Peru and Rose M. Robeson joined the Board in the last four years. The Board has determined that Larry W. Bickle, Dr. Brand, William J. Gardiner, Mr. Leiker, Mr. Peru, Julio M. Quintana, Ms. Robeson, John M. Seidl and William D. Sullivan are independent and do not have any material relationship with us other than as a director and stockholder. In its review of the independence of these directors, the Board considered past employment, remuneration, and any other relationship with us. In making its determination as to the independence of its members, the Board considered the independence tests described in Section 303A.02 of the Corporate Governance Standards of the NYSE's Listed Company Manual.

The Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee ("NCG Committee") of our Board are each comprised solely of independent directors under the applicable requirements of the NYSE and SEC.

Since February 2007, our Board's leadership structure has separated the roles of Chief Executive Officer and Chairman of the Board. Mr. Sullivan, an independent director serving on our Board since 2004, who has experience serving on several other public company boards and over 32 years of experience working with oil and gas exploration and production companies, including as an executive officer, serves as our Chairman of the Board. Mr. Sullivan does not serve on any committee of our Board, other than the Executive Committee, which meets infrequently and did not take action on any matter in 2014. Javan D. Ottoson serves as our Chief Executive Officer.

Our Board believes that, at this time, this leadership structure is optimal for us and our stockholders. The Chairman of the Board is responsible for providing leadership to the Board;

6

facilitating communications among the directors; setting the Board meeting agenda in consultation with the Chief Executive Officer; presiding at Board meetings and Executive Committee meetings; and serving as a liaison between our management and directors.

Our Corporate Governance Guidelines allow our Board to choose whether to keep the roles of Chief Executive Officer and Chairman of our Board separate or whether to permit one person to serve in both capacities. As part of its annual self-evaluation process, our NCG Committee evaluates our leadership structure and makes recommendations to the Board. While recognizing that different board leadership structures may be appropriate at different times and under different circumstances, based on the recommendation of the NCG Committee, our Board has determined that our current leadership structure is preferable, with Mr. Ottoson serving as our Chief Executive Officer, and Mr. Sullivan serving as our Chairman of the Board.

In addition to having an independent Chairman of the Board, the Board has a separate lead independent director. Mr. Bickle assumed that role on January 1, 2012, upon his appointment as Chair of the NCG Committee. The lead independent director is responsible for presiding at executive sessions of non-management directors. In the lead independent director's absence, the Chairman of the Board serves as lead independent director.

As of the filing date of this Proxy Statement, the Board has nine independent members and only two non-independent members: Javan D. Ottoson, our Chief Executive Officer and Anthony J. Best, our former Chief Executive Officer who retired from the company as of January 31, 2015 and has elected not to stand for re-election to the Board. Additionally, Mr. Seidl has notified the Board that he does not intend to stand for re-election at the Annual Meeting. A number of our independent Board members are currently serving or have served as members of senior management of other companies in the oil and gas industry and are currently serving or have served as directors of other public companies. As discussed above, our Board has three committees comprised solely of independent directors, and each has a different independent director serving as chair of the committee. The specific experiences, qualifications, attributes, and skills of each independent director, which enable him or her to effectively serve on his or her respective Board committees, are briefly described in each director nominee's biographical information below. We believe that the number of independent and experienced directors that make up our Board, the specific experiences and skills that they bring to their respective Board committees, and the overall leadership of the Board by the Chairman of the Board are beneficial to our stockholders.

The Board welcomes questions or comments about our company. Interested parties and stockholders may contact the Board as a whole, only the non-management directors, or any one or more specified individual directors, by sending a letter to the intended recipients' attention in care of SM Energy Company, Corporate Secretary, 1775 Sherman Street, Suite 1200, Denver, CO 80203. All such communications will be provided to the Chair of the NCG Committee, who will facilitate the review of such communications.

Our Board met 12 times during 2014. Our non-management directors routinely meet in executive session immediately before or after each regularly scheduled meeting of the Board or as otherwise deemed necessary and met five times during 2014. Each incumbent director participated in at least 83% of the Board meetings and in at least 86% of his or her appointed committee meetings held during the director's tenure on the Board in 2014. It is our policy that each director is expected to

7

attend the annual meeting of our stockholders, and each director then serving on the Board attended the 2014 Annual Meeting of Stockholders.

The following table identifies the members of each committee, as of March 1, 2015, and sets forth the number of meetings held in 2014:

Name of Director

|

Audit Committee |

Nominating and Corporate Governance Committee |

Compensation Committee |

Executive Committee |

||||

|---|---|---|---|---|---|---|---|---|

| Anthony J. Best |

|

|||||||

| Larry W. Bickle |

|

|

||||||

| Stephen R. Brand |

|

|

||||||

| William J. Gardiner |

|

|

||||||

| Loren M. Leiker |

|

|

|

|||||

| Javan D. Ottoson |

|

|||||||

| Ramiro G. Peru |

|

|

||||||

| Julio M. Quintana |

|

|

||||||

| Rose M. Robeson |

|

|

||||||

| John M. Seidl |

|

|||||||

| William D. Sullivan |

|

|||||||

| Number of meetings held in 2014 | 7 | 3 | 8 | 0 |

|

|

Chair | |

Member |

The Audit Committee assists the Board in fulfilling its oversight responsibilities over our financial reporting and internal control processes. Pursuant to the Audit Committee charter, members are prohibited from serving on more than three audit committees of public companies (one of which is us), and no Audit Committee member currently serves on more than two such committees. The Audit Committee is solely responsible for the engagement and discharge of our independent registered public accounting firm and reviews our quarterly and annual financial results. The Audit Committee reviews the audit plan and the results of the audit with our independent auditors and reviews the independence of our auditors, the range of audit fees, the scope and adequacy of our system of internal accounting controls, and our financial risk management policies. The Audit Committee also has oversight responsibility for our internal audit functions and any related party transactions. The Audit Committee is currently composed of five directors, each of whom is independent as defined by the NYSE listing standards. See the "Report of the Audit Committee" contained in this Proxy Statement. While all of the Audit Committee members are considered financially literate, the Board has determined that four members of the current Audit Committee, Mr. Bickle, Mr. Gardiner, Mr. Peru and Ms. Robeson, are audit committee financial experts as the term is defined by the SEC. As noted above, Mr. Bickle, Mr. Gardiner, Mr. Peru and Ms. Robeson are also independent.

The NCG Committee's primary functions are to recommend individuals to be elected to the Board, to evaluate and plan for management succession, to review the structure and composition of all committees of the Board, and to oversee all of our corporate governance functions, including the Board

8

and committee self-evaluation process. For additional information on the functions performed by the NCG Committee, see "Director Nominations and Qualifications" below.

The Compensation Committee's primary function is to establish and administer our compensation policies and oversee the administration of our employee benefit plans. The Compensation Committee approves and/or recommends to the Board the compensation arrangements for our senior management and directors, adoption of compensation plans in which our officers and directors are eligible to participate, and the granting of equity based compensation or other benefits under compensation plans. The "Compensation Discussion and Analysis" section of this Proxy Statement describes these responsibilities and the manner in which they are discharged.

The Executive Committee has the authority to act on behalf of the Board with respect to matters as to which it has been authorized to act by the Board, provided that such matters are not in conflict with our Certificate of Incorporation, our By-Laws, applicable laws, regulations, or rules or the listing standards of the NYSE.

Our Board and each of its committees separately evaluated their performance during 2014, and the Audit Committee, Compensation Committee and NCG Committee each completed written evaluations. The Executive Committee did not complete a written evaluation due to its unique, limited purpose and infrequent meeting schedule. This performance evaluation process was directed by the NCG Committee and the evaluations were discussed and accepted by the Board.

There are no arrangements or understandings between any director and any other person pursuant to which that director was or is to be elected.

While the Board oversees our risk management processes, with particular focus on the most significant risks we face, management is responsible for day-to-day risk management. We believe this division of responsibilities is the most effective approach for addressing the risks we face, and that the current Board leadership structure, with Mr. Sullivan serving as our Chairman of the Board and Mr. Ottoson serving as our Chief Executive Officer, supports this approach by facilitating communication between management and the Board regarding risk management issues. We also believe that this design places the Board in a better position to evaluate the performance of management, more efficiently facilitates communication of the views of the independent directors, and contributes to effective corporate governance.

We have an Enterprise Risk Management Committee comprised of our President and Chief Executive Officer, Chief Financial Officer, General Counsel, Executive Vice President—Operations, Senior Vice President—Human Resources, and Treasurer. The committee meets quarterly to update our enterprise risk management process and plan (the "ERM Plan"), utilizing the Committee of Sponsoring Organizations of the Treadway Commission Enterprise Risk Management framework, and incorporating information gathered during our business strategy sessions. Minutes of these meetings are kept, and the activities of the committee are regularly reported to the Audit Committee and the Board. Risk prevention or mitigation steps are documented for the material risks identified based upon projected likelihood and impact of any occurrence of the particular risk. The ERM Plan is reviewed with our Board annually.

We also have a Financial Risk Management Committee comprised of our President and Chief Executive Officer, Chief Financial Officer, Executive Vice President—Operations and Treasurer. The committee meets quarterly and more frequently, as necessary, to discuss our interest rate and

9

commodity hedging activities and, as appropriate, to approve additional hedges. Minutes of these meetings are kept, and the activities of the committee are regularly reported to the Audit Committee.

The Audit Committee provides significant assistance to the Board in the oversight of our financial risk management processes. The Audit Committee reviews and discusses with management our risk assessment and risk management guidelines and policies with respect to our significant financial risk exposures, and the steps management has taken, as well as the specific guidelines and policies that have been established, to monitor, control, mitigate, and report those exposures. These reviews and discussions include a review of our oil, natural gas and natural gas liquids commodity price hedging arrangements, interest rate risk management, and insurance coverage, as appropriate. In addition, our internal auditors, who report directly to the Audit Committee with respect to internal audit matters, provide the Audit Committee and management with ongoing assessments of our risk management processes. The Audit Committee also has oversight responsibility for the integrity of our financial statements and financial reporting processes and systems of internal controls regarding finance, accounting, and compliance with legal and regulatory requirements. In addition, the Compensation Committee periodically reviews our compensation programs to ensure that they do not encourage excessive risk-taking. The Audit Committee and Compensation Committee report regularly to the full Board on their respective risk management oversight activities.

Director Nominations and Qualifications

Our Corporate Governance Guidelines and the Charter of the NCG Committee provide that the NCG Committee is responsible for identifying and recommending directors for nomination by the Board for election as members of the Board. The NCG Committee selects a nominee based on the nominee's skills, achievements, and experience. As set forth in the director qualification standards included in our Corporate Governance Guidelines and reflected in the discussion below, the Board as a whole should have broad and relevant experience in high-level business policymaking and a commitment to represent the long-term interests of our stockholders. These standards also provide that each director should have experience in positions of responsibility and leadership, an understanding of our business environment, and a reputation for integrity. In addition, our Corporate Governance Guidelines provide that a director who retires or experiences a significant change in his or her professional or business responsibilities, including a change in his or her principal occupation, position or business affiliation, should, if requested by the NCG Committee, be prepared to offer his or her resignation from the Board. Upon tender of a resignation, the NCG Committee and the Board may review the continued appropriateness of Board membership under the circumstances. In accordance with our Corporate Governance Guidelines, each director has signed and delivered to the Board a resignation letter that is contingent upon (i) his or her failure to receive, in accordance with our By-Laws, the affirmative vote of the holders of a majority of the shares of capital stock in an election of directors at the 2015 Annual Meeting of Stockholders; and (ii) acceptance of his or her resignation by the Board in accordance with the policies and procedures adopted by the Board for such purpose.

Under the framework of the Corporate Governance Guidelines, the NCG Committee evaluates each potential nominee individually and in the context of the Board as a whole. The objective is to recommend individuals and a group that will effectively contribute to our long-term success and represent the interests of all of our stockholders. In determining whether to recommend a director for re-election, the NCG Committee also considers the director's past attendance at meetings and participation in and contributions to Board activities.

When seeking new director candidates, the NCG Committee considers suggestions from incumbent directors, management, stockholders, and others. The NCG Committee screens all potential candidates in the same manner regardless of the source of the recommendation. The NCG Committee

10

retained a search firm during 2014 in connection with its recommendation of Mr. Peru and Ms. Robeson to fill Board vacancies.

Although the NCG Committee does not have a formal policy with regard to the consideration of diversity in identifying director nominees, the NCG Committee believes that the Board should reflect diversity in its broadest sense, including persons diverse in professional experiences relevant to us, skills, backgrounds, perspectives, gender, race, ethnicity, and national origin. In considering diversity in identifying director nominees, the NCG Committee considers the Board as a whole, without reference to specific representative directors, with the overall objective of establishing a group of directors that reflects diversity, that can work in a collaborative and effective manner, and that can best contribute to our long-term success. The NCG Committee believes that current Board members and director nominees reflect our commitment to diversity. Following the 2015 Annual Meeting, assuming all nine of the current nominees are elected to the Board, we will have two Hispanic directors, one who has served since 2006 and one who has served since 2014, and one female director who has served since 2014.

As noted above, the NCG Committee will consider stockholder recommendations for candidates for the Board. All stockholder recommendations must comply with the notice requirements contained in Section 4(g) of our By-Laws, which requires, among other things, detailed information concerning the stockholder making the proposal (and the beneficial owner on whose behalf the proposal is made, if any), the name and address of the stockholder and specific information concerning such stockholder's interests in our securities. In addition, the notice must include the recommended candidate's name, biographical data, qualifications, details regarding any material monetary agreements between the stockholder and the proposed nominee and a written questionnaire completed by the proposed nominee. We will furnish copies of our By-Laws to any person who requests them without charge. Requests for copies should be directed to our Corporate Secretary. For additional information about stockholder nominations, including nominations for the 2016 Annual Meeting of Stockholders, see "Stockholder Proposals for the 2016 Annual Meeting of Stockholders." No stockholder director nominations were received in connection with the Annual Meeting.

11

Policies and Procedures on Transactions with Related Persons

Our Related Person Transactions Policy sets forth the policies and procedures for the Audit Committee's review of any transaction, arrangement, or relationship (including any indebtedness or guarantee of indebtedness) or series of similar transactions, arrangements, or relationships in which (a) we are a participant, (b) the aggregate amount involved will or may be expected to exceed $120,000 per annum, and (c) a related person has or will have a direct or indirect material interest. For purposes of our Related Person Transactions Policy, a "related person" means (i) any of our directors, executive officers, or nominees for director, (ii) any stockholder that beneficially owns more than 5% of our outstanding shares of common stock, and (iii) any immediate family member of any of the foregoing. The Audit Committee approves or ratifies only those transactions that it determines in good faith are in, or are not inconsistent with, our best interests and the best interests of our stockholders.

In determining whether to approve or ratify a transaction with a related person, the Audit Committee takes into account the factors it deems appropriate, which may include, among others, the benefits to us, the availability of other sources for comparable products or services, the impact on a director's independence in the event the related person is a director, and the extent of the related person's interest in the transaction. The Audit Committee reviews and assesses ongoing relationships with a related person on at least an annual basis to ensure that they are in compliance with the policy and remain appropriate.

In addition, our By-Laws provide that a director, officer, or employee of our company may not pursue for his or her own account a business or investment opportunity that he or she learned about through his or her affiliation with us. These restrictions do not apply to the acquisition of less than 1% of the publicly traded stock of another company.

We recognize that transactions with related persons may raise questions among stockholders regarding whether those transactions are consistent with our best interests and the best interests of our stockholders. It is our policy to enter into or ratify such transactions only when the Board, acting through the Audit Committee or as otherwise described herein, determines that the transaction in question is in, or is not inconsistent with, our best interests and the best interests of our stockholders. Such transactions include, but are not limited to, situations where we may obtain products or services of a nature, quantity or quality, or on other terms, that are not readily available from alternate sources, or when we obtain products or services from, or provide products or services to, related persons on an arm's length basis on terms comparable to those obtained from or provided to unrelated third parties or on terms comparable to those obtained from or provided to employees generally. The only transaction between our company and a related person since January 1, 2014, involves our relationship with Tesco Corporation ("Tesco"). Mr. Quintana was the President, Chief Executive Officer, and a director of Tesco before his retirement in January 2015. Tesco designs, manufactures, and delivers technology based solutions for the upstream energy industry, including oilfield drilling and completion technology, services, and equipment. In 2006, we entered into an agreement with Tesco to provide equipment and services to us in connection with our drilling and completion operations based on Tesco's industry-recognized ability to supply specific high-quality equipment and services for drilling and casing needs, which are particularly well suited for certain of our operations. Under our agreement,

12

Tesco from time to time upon our request, provides equipment or services to us. This agreement continues until canceled by either us or Tesco on 30 days advance written notice. Pursuant to this agreement, we are obligated to pay Tesco only for services actually performed or equipment provided. This agreement does not require us to make any other payments to Tesco, nor does it obligate us to use Tesco for any services or equipment. Mr. Quintana did not have any direct or indirect interest in the transaction, other than as a result of having served as an executive officer and director of Tesco. Mr. Quintana had no input in our selection of Tesco for equipment and services or the terms of our agreement with Tesco. Decisions to use Tesco are made by technical professionals supervising the relevant regional activity, based on their assessment of Tesco's equipment and services and related costs in comparison to other providers. In 2014, we paid Tesco $1,115,956. The amount we paid Tesco during 2014 for equipment and services represented approximately 8% of the total amount paid by us to all service providers (including Tesco) for similar equipment and services during 2014. In accordance with our Related Person Transactions Policy, the Audit Committee reviewed the relationship between us and Tesco and determined that the relationship is in our best interests and the best interests of our stockholders.

13

Common Stock

The following table shows beneficial ownership of shares of our common stock as known to us as of March 13, 2015, by all beneficial owners of more than 5% of the outstanding shares of our common stock, by each director, director nominee, and named executive officer, and all directors and executive officers as a group. Restricted stock units and performance share units are not included in this table as no actual shares have been issued with respect to our outstanding restricted stock units and performance share units. A supplemental table has been included later in this section describing the number of restricted stock units and performance share units owned by the individuals described below.

Name of Beneficial Owner

|

Shares beneficially owned, excluding options |

Options exercisable within 60 days of 3/13/2015 |

Total shares beneficially owned(1) |

Percent beneficially owned(2) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name and Address of Stockholders Owning More Than 5% |

|||||||||||||

BlackRock, Inc.(3) |

5,326,737 | — | 5,326,737 | 7.9 | % | ||||||||

55 East 52nd Street |

|||||||||||||

New York, NY 10022 |

|||||||||||||

Vanguard Group, Inc.(4) |

4,917,190 | — | 4,917,190 | 7.3 | % | ||||||||

100 Vanguard Blvd. |

|||||||||||||

Malvern, PA 19355 |

|||||||||||||

Artisan Partners Asset Management Inc.(5) |

4,234,067 | — | 4,234,067 | 6.3 | % | ||||||||

875 East Wisconsin Avenue, Suite 800 |

|||||||||||||

Milwaukee, WI 53202 |

|||||||||||||

Name and Position of Directors, Director Nominees and Named Executive Officers |

|||||||||||||

Anthony J. Best, Director |

205,161 | — | 205,161 | * | |||||||||

Larry W. Bickle, Director |

144,167 | — | 144,167 | * | |||||||||

Stephen R. Brand, Director |

10,514 | — | 10,514 | * | |||||||||

William J. Gardiner, Director |

56,135 | — | 56,135 | * | |||||||||

Loren M. Leiker, Director |

11,097 | — | 11,097 | * | |||||||||

Ramiro G. Peru, Director |

6,752 | — | 6,752 | * | |||||||||

Julio M. Quintana, Director |

17,822 | — | 17,822 | * | |||||||||

Rose M. Robeson, Director |

2,951 | — | 2,951 | * | |||||||||

John M. Seidl, Director |

3,010 | — | 3,010 | * | |||||||||

William D. Sullivan, Director |

42,821 | — | 42,821 | * | |||||||||

Javan D. Ottoson, President, Chief Executive Officer and Director |

100,358 | — | 100,358 | * | |||||||||

A. Wade Pursell, Executive Vice President and Chief Financial Officer |

67,750 | — | 67,750 | * | |||||||||

David W. Copeland, Executive Vice President, General Counsel and Corporate Secretary |

54,561 | — | 54,561 | * | |||||||||

Herbert S. Vogel, Executive Vice President—Operations |

6,737 | — | 6,737 | * | |||||||||

All executive officers and directors as a group (21 persons, including those named above) |

977,491 | 977,491 | 1.4 | % | |||||||||

- *

- Less than 1%.

14

- (1)

- According

to SEC rules, beneficial ownership includes shares as to which the individual or entity has voting power or investment power and

any shares that the individual has the right to acquire within 60 days of a date reasonably selected by us, through the exercise of any stock option or other right. We selected March 13,

2015, as the determination date.

- (2)

- Based

on an aggregate of 67,463,060 shares of common stock outstanding as of March 13, 2015.

- (3)

- According

to a Statement on Schedule 13G/A filed by BlackRock, Inc. ("BlackRock") on January 23, 2015, by reason of advisory

and other relationships with persons who own shares of our common stock, BlackRock may be deemed to be the beneficial owner of a total of 5,326,737 shares, with shared voting power as to zero

shares, shared dispositive power as to zero shares, and sole voting power as to 5,098,004 shares and sole dispositive power as to 5,326,737 shares.

- (4)

- According

to a Statement on Schedule 13G/A filed by Vanguard Group, Inc. ("Vanguard") on February 11, 2015, by reason of

advisory and other relationships with persons who own shares of our common stock, Vanguard may be deemed to be the beneficial owner of a total of 4,917,190 shares, with shared voting power as

to zero shares, shared dispositive power as to 39,448 shares, and sole voting power as to 45,048 shares and sole dispositive power as to 4,877,742 shares.

- (5)

- According to a Statement on Schedule 13G filed by Artisan Partners Asset Management Inc. ("Artisan") on January 30, 2015, by reason of advisory and other relationships with persons who own shares of our common stock, Artisan may be deemed to be the beneficial owner of a total of 4,234,067 shares, with shared voting power as to 4,117,866 shares, shared dispositive power as to 4,234,067 shares, and sole voting power as to zero shares and sole dispositive power as to zero shares.

Restricted Stock Units and Performance Share Units

Restricted stock units ("RSUs") represent the right to receive shares of our common stock to be delivered upon settlement, subject to risk of forfeiture and cancellation. The holders of RSUs do not have voting rights, nor are they entitled to receive cash payments equal to any cash dividends and other distributions paid in cash on our common stock. The RSU awards vest pursuant to dates established by their corresponding Restricted Stock Unit Award Agreements.

Performance share units ("PSUs") represent the right to receive, upon settlement of the PSUs after the completion of a three-year performance period, a number of shares of our common stock that may be from zero to two hundred percent of the number of PSUs granted on the award date, depending on the extent to which we have achieved our performance goals and the extent to which the PSUs have vested. The holders of PSUs do not have voting rights, nor are they entitled to receive cash payments equal to any cash dividends or other distributions paid in cash on our common stock.

15

The following table shows the number of RSUs and PSUs owned by each of the directors, our named executive officers and all directors and executive officers as a group, as of March 13, 2015.

| |

Total Restricted Stock Units |

Total Performance Share Units |

Total Vested Performance Share Units(1) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Larry W. Bickle |

— | — | — | |||||||

Stephen R. Brand |

— | — | — | |||||||

William J. Gardiner |

— | — | — | |||||||

Loren M. Leiker |

— | — | — | |||||||

Julio M. Quintana |

— | — | — | |||||||

Ramiro G. Peru |

— | — | — | |||||||

Rose M. Robeson |

— | — | — | |||||||

John M. Seidl |

— | — | — | |||||||

William D. Sullivan |

— | — | — | |||||||

Anthony J. Best |

27,221 | 123,086 | 123,086 | |||||||

Javan D. Ottoson |

26,042 | 66,322 | 15,390 | |||||||

A. Wade Pursell |

12,043 | 50,976 | 12,504 | |||||||

David W. Copeland |

4,683 | 20,499 | 5,290 | |||||||

Herbert S. Vogel |

4,594 | 18,941 | 4,424 | |||||||

All Executive Officers and Directors as a group (21 persons, including those named above) |

93,810 | 366,226 | 183,968 | |||||||

- (1)

- PSUs granted on July 1, 2012, vested one-third on each of July 1, 2013, and July 1, 2014 and will vest one-third on July 1, 2015. PSUs granted on July 1, 2013, and July 1, 2014, will not vest until July 1, 2016 and July 1, 2017, respectively. Mr. Best was retirement eligible at his January 31, 2015 retirement date, and pursuant to the terms of his award agreements, became vested in all PSUs as of such date. The amounts shown reflect the vested portion of the PSUs owned by each director, named executive officer and all directors and executive officers as a group. The actual number of shares of our common stock issued to settle the PSUs at the end of the performance period may vary from zero to two hundred percent of the number of PSUs indicated, depending on the extent to which we have achieved our performance goals.

16

Under United States securities laws, directors, executive officers, and persons beneficially holding more than 10% of our common stock must report their initial ownership of our common stock and any subsequent changes in that ownership in reports that must be filed with the SEC and provided to us. The SEC has designated specific deadlines for these reports and we must identify in this Proxy Statement those persons who did not file these reports when due.

Based solely on a review of reports furnished to us, and written representations from our officers and directors, all directors, executive officers, and 10% owners timely filed all reports regarding transactions in our securities required to be filed for 2014 under Section 16(a) under the Exchange Act.

17

The following table sets forth the names, ages (as of March 13, 2015) and positions of SM Energy's executive officers:

Name

|

Age | Position | |||

|---|---|---|---|---|---|

Javan D. Ottoson |

56 | President, Chief Executive Officer and Director | |||

A. Wade Pursell |

50 | Executive Vice President and Chief Financial Officer | |||

David W. Copeland |

58 | Executive Vice President, General Counsel and Corporate Secretary | |||

Herbert S. Vogel |

54 | Executive Vice President—Operations | |||

Kenneth J. Knott |

50 | Senior Vice President—Business Development and Land and Assistant Secretary | |||

Gregory T. Leyendecker |

57 | Senior Vice President and Regional Manager | |||

Mark D. Mueller |

50 | Senior Vice President and Regional Manager | |||

Lehman E. Newton, III |

59 | Senior Vice President and Regional Manager | |||

Mary Ellen Lutey |

43 | Vice President and Regional Manager | |||

Mark T. Solomon |

46 | Vice President—Controller and Assistant Secretary | |||

David J. Whitcomb |

52 | Vice President—Marketing | |||

Javan D. Ottoson. Mr. Ottoson joined the Company in December 2006 as Executive Vice President and Chief Operating Officer. Mr. Ottoson was appointed as Chief Executive Officer of the Company in February 2015, President of the Company in October 2012 and appointed to the Board in September 2014. Mr. Ottoson has been in the energy industry for over 33 years. From April 2006 until he joined the Company in December 2006, Mr. Ottoson was Senior Vice President—Drilling and Engineering at Energy Partners, Ltd., an independent oil and natural gas exploration and production company, where his responsibilities included overseeing all aspects of drilling and engineering functions. Mr. Ottoson managed Permian Basin assets for Pure Resources, Inc., a Unocal subsidiary, and its successor owner, Chevron, from July 2003 to April 2006. From April 2000 to July 2003, Mr. Ottoson owned and operated a homebuilding company in Colorado and ran his family farm. Prior to 2000, Mr. Ottoson worked for ARCO in management and operational roles, including serving as President of ARCO China, Commercial Director of ARCO United Kingdom, and Vice President of Operations and Development, ARCO Permian.

A. Wade Pursell. Mr. Pursell joined the Company in September 2008 as Executive Vice President and Chief Financial Officer. Mr. Pursell was Executive Vice President and Chief Financial Officer for Helix Energy Solutions Group, Inc., a global provider of life-of-field services and development solutions to offshore energy producers and an oil and gas producer, from February 2007 to September 2008. From October 2000 to February 2007, he was Senior Vice President and Chief Financial Officer of Helix. He joined Helix in May 1997, as Vice President—Finance and Chief Accounting Officer. From 1988 through May 1997, Mr. Pursell was with Arthur Andersen LLP, serving lastly as an Experienced Manager specializing in the offshore services industry. Mr. Pursell has over 27 years of experience in the energy industry.

David W. Copeland. Mr. Copeland joined the Company in January 2011 as Senior Vice President and General Counsel. He was appointed as the Company's Corporate Secretary in July 2011 and Executive Vice President in May 2013. Mr. Copeland has over 32 years of experience in the legal profession, including over 23 years as internal counsel for various energy companies. Prior to joining the Company, he co-founded Concho Resources Inc., in Midland, Texas, where he served as its Vice President, General Counsel and Secretary from April 2004 through November 2009, and then as its

18

Senior Counsel through December 2010. From August 1997 through March 2004, Mr. Copeland served as an executive officer and general counsel of two energy companies he co-founded in Midland, Texas. Mr. Copeland started his career in 1982 with the Stubbeman, McRae, Sealy, Laughlin & Browder law firm in Midland, Texas.

Herbert S. Vogel. Mr. Vogel was appointed as Executive Vice President—Operations of the Company in August 2014. Mr. Vogel joined the Company in March 2012 as Senior Vice President—Portfolio Development and Technical Services, and has over 30 years of experience in the oil and gas business. He joined the Company after his retirement from BP, where he most recently served as the President of BP Energy Co. and Regional Business Unit Leader of North American Gas & Power from March 2010 until his retirement in February 2012. His previous roles included COO-NGL, Power & Financial Products in Houston, Managing Director Gas Europe & Africa in London, and Sr. VP of the Tangguh LNG Project in Indonesia. Mr. Vogel started his career as a reservoir engineer with ARCO Alaska, Inc., and progressed through a series of positions of increasing responsibility in engineering, operations management, new ventures development, and business unit management at ARCO and BP.

Kenneth J. Knott. Mr. Knott was appointed Senior Vice President—Business Development and Land and Assistant Secretary in August 2014. Mr. Knott was appointed Vice President—Land and Assistant Secretary in October 2012 and was appointed Vice President of Business Development & Land and Assistant Secretary in August 2008. Mr. Knott joined SM Energy in November 2000 as Senior Landman for the Gulf Coast region in Lafayette, Louisiana, and later assumed the position of Gulf Coast Regional Land Manager when the office was moved to Houston in March 2004.

Gregory T. Leyendecker. Mr. Leyendecker was appointed Senior Vice President and Regional Manager in May 2010. From July 2007 to May 2010, he served as Vice President and Regional Manager. Mr. Leyendecker joined the Company in December 2006 as Operations Manager for the South Texas & Gulf Coast region in Houston, Texas. Mr. Leyendecker has over 34 years of experience in the energy industry, and held various positions with Unocal Corporation, an independent oil and natural gas exploration and production company, from 1980 until its acquisition in 2005. During his career with Unocal, he was the Asset Manager for Unocal Gulf Region USA from 2003 to June 2004 and Production and Reservoir Engineering Technology Manager for Unocal from June 2004 to August 2005. He was appointed Drilling and Workover Manager for the San Joaquin Valley business unit of Chevron, as successor-by-merger of Unocal Corporation, in Bakersfield, California in August 2005, and held this position until January 2006. Immediately prior to joining the Company, Mr. Leyendecker was Vice President of Drilling Management Services from February 2006 to November 2006 for Enventure Global Technology, a provider of solid expandable tubular technology.

Mark D. Mueller. Mr. Mueller joined the Company in September 2007 as Senior Vice President. Mr. Mueller was appointed as the Regional Manager of the Rocky Mountain region effective January 1, 2008. Mr. Mueller has been in the energy industry for over 28 years. From September 2006 to September 2007, he was Vice President and General Manager at Samson Exploration Ltd., an oil and gas exploration and production company that was a subsidiary of Samson Investment Company, in Calgary, Canada, where his responsibilities included fiscal performance, reserves, and all operational functions of the company. From April 2005 until its sale in August 2006, Mr. Mueller was Vice President and General Manager for Samson Canada Ltd., an oil and gas exploration and production company that was a subsidiary of Samson Investment Company, where he was responsible for all business units and the eventual sale of the company. Mr. Mueller joined Samson Canada Ltd. as Project Manager in May 2003 to build a new basin-centered gas business unit and was Vice President from December 2003 to August 2006. Prior to joining Samson, Mr. Mueller was West Central Alberta Engineering Manager for Northrock Resources Ltd., a Canadian oil and gas company that was a wholly-owned subsidiary of Unocal Corporation, in Calgary, Canada. From 1986 to 2003, Mr. Mueller

19

held positions of increasing responsibility in engineering and management for Unocal throughout North America and Southeast Asia.

Lehman E. Newton, III. Mr. Newton joined the Company in December 2006 as General Manager for the Midland, Texas office, was appointed Vice President and Regional Manager of the Permian region in June 2007, and was appointed Senior Vice President and Regional Manager in May 2010. Mr. Newton has over 36 years of experience in the energy industry. From November 2005 to November 2006, Mr. Newton served as Project Manager for one of Chevron's largest Lower 48 projects. Mr. Newton joined Pure Resources in February 2003 as the Business Development Manager and worked in that capacity until October 2005. Mr. Newton was a founding partner in Westwin Energy, an independent Permian Basin exploration and production company, from June 2000 to January 2003. Prior to that, Mr. Newton spent 21 years with ARCO in various engineering, operations and management roles, including as Asset Manager, ARCO's East Texas operations, Vice President, Business Development, ARCO Permian, and Vice President of Operations and Development, ARCO Permian.

Mary Ellen Lutey. Ms. Lutey was appointed Vice President and Regional Manager of the Mid-Continent region in December 2012. She joined SM Energy in June 2008 as North Rockies Asset Manager, where she managed the Company's activities in the Williston Basin. Prior to joining SM Energy, Ms. Lutey held various technical and managerial positions in several regions of the United States and Canada. She was a Senior Reservoir Engineer with Chesapeake Energy Corporation from September 2007 until June 2008, where she was responsible for the resource development of the Fayetteville Shale in Arkansas. Ms. Lutey was a Team Lead for Engineering and Geoscience, with ConocoPhillips Canada from April 2006 until September 2007, where she was responsible for the technical and business performance of two multi-discipline groups in Western Canada. From July 2005 until April 2006, she was a Team Lead for Engineering and Geoscience with Burlington Resources Canada, where she managed the growth and development of resource plays in Western Canada. From 1994 until 2005, Ms. Lutey held various engineering and leadership positions of increasing responsibility for Burlington Resources. Ms. Lutey has over 23 years of experience in the energy industry.

Mark T. Solomon. Mr. Solomon was appointed Vice President—Controller and Assistant Secretary of the Company in May 2011. He was appointed Controller of the Company in January 2007. Mr. Solomon served as the Company's Acting Principal Financial Officer from April 2008 to September 2008, which was during the period of time that the Company's Chief Financial Officer position was vacant. Mr. Solomon joined the Company in 1996. He served as Financial Reporting Manager from February 1999 to September 2002, Assistant Vice President—Financial Reporting from September 2002 to May 2006 and Assistant Vice President—Assistant Controller from May 2006 to January 2007. Prior to joining the Company, Mr. Solomon was an auditor with Ernst & Young. Mr. Solomon has over 18 years of experience in the energy industry.

David J. Whitcomb. Mr. Whitcomb was appointed Vice President—Marketing in August 2008. Mr. Whitcomb joined SM Energy in November 1994 as Gas Contract Analyst and was named Assistant Vice President of Gas Marketing in October 1995. In March 2007, his responsibilities were expanded to include oil marketing, at which time his title was changed to Assistant Vice President and Director of Marketing.

20

Compensation Discussion and Analysis

This section describes the objectives and elements of the compensation programs for our Chief Executive Officer, Chief Financial Officer and each of our three other most highly compensated executive officers employed at the end of the 2014 fiscal year, whom we collectively refer to in this "Executive Compensation" section as our "NEOs" or "Named Executive Officers." Our NEOs for fiscal 2014 were:

- •

- Anthony J. Best, Chief Executive Officer (Mr. Best retired from our

company on January 31, 2015)

- •

- Javan D. Ottoson, President and Chief Operating Officer

- •

- A. Wade Pursell, Executive Vice President and Chief Financial Officer

- •

- David W. Copeland, Executive Vice President, General Counsel and Corporate

Secretary

- •

- Herbert S. Vogel, Executive Vice President—Operations

This Compensation Discussion and Analysis is divided into four sections:

Section 1—Executive Summary

Section 2—Objectives of Executive Compensation Program

Section 3—Compensation Determination Process

Section 4—Elements of Compensation

SECTION 1—EXECUTIVE SUMMARY

Our leadership and culture encourage long-term stockholder value creation. We evaluate performance using both quantitative and qualitative factors and review not only "what" is achieved, but also "how" it is achieved. We provide what we believe to be a balanced mix of base salary, annual cash incentives through our Short-Term Incentive Plan ("STIP"), and long-term equity incentives through our Long-Term Incentive Plan ("LTIP"). We balance incentives tied to short-term annual performance with incentives tied to our multi-year performance. In this way, our executives are motivated to consider the impact of their decisions over the short, intermediate, and long term. The performance metrics used in our 2014 STIP include those we believe are the key drivers of long-term stockholder value creation: production volume; proved developed reserve additions; finding and development costs; cash flow; net income; environmental, health, and safety goals; and exploration success and inventory growth. The STIP program is not completely formulaic because the Compensation Committee has the discretion to adjust bonuses based on the "quality" of the results as well as individual performance and behavior, and has used that discretion to adjust calculated bonuses in the past. Our LTIP rewards total stockholder return, both on an absolute basis and relative to an index of peer exploration and production companies.

21

Business Highlights

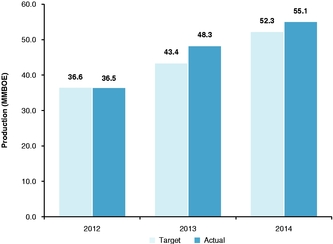

The year 2014 was a strong one for us. Our production of 55.1 million barrels of oil equivalent ("MMBOE") exceeded our target, set a new production record for our company, and represented 14.1% growth in production from 2013. We also exceeded our proved developed reserve additions target—102.0 MMBOE—by 15.7%, adding 118.0 MMBOE to our proved developed reserves. Our financial performance in 2014 matched our strong operational results. We exceeded our cash flow target of $1,579.3 million by 4.3%, with a cash flow of $1,647.9 million. Our strong cash flow and continued efforts to reduce costs led to net income of $666.1 million, which exceeded our target by 115.6%. Our finding and development costs also beat our target by 5.2%. Our performance with respect to our qualitative STIP factors was also positive, with strong exploration success and inventory growth performance driven largely by our achievements in our Eagle Ford shale and Bakken/Three Forks programs. We also achieved top-quartile performance for many of the health and safety metrics that we believe are important measures of risk to our employees, our contractors and the public.

Compensation Program and Corporate Governance Highlights

|

What We Do: |

What We Do Not Do: |

|||||

|---|---|---|---|---|---|---|

| | | | | | | |

| ü | We generally target pay opportunities at the market median. | c | We typically do not provide severance benefits in the event of termination without cause, unless it is related to a change in control. | |||

| ü | The majority of our executive pay is variable and linked to meeting our short-term and long-term financial and strategic goals and to creating of long-term stockholder value. | c | We do not provide "single-trigger" cash severance or equity vesting acceleration upon a change in control. | |||

| ü | A significant portion of executive compensation is in the form of equity, with the majority of the value settled based on a combination of our absolute and relative total shareholder return. | c | We do not provide golden parachute excise tax or other tax gross-ups. | |||

| ü | We require executive officers and directors to maintain meaningful ownership of our stock to ensure their interests are closely aligned with the long-term financial interests of our stockholders. | c | We do not pay dividends on unearned restricted and performance share units. | |||

| ü | The Compensation Committee retains an independent compensation consultant who provides no other services to us. | c | We do not permit option repricing, or exchange of underwater options for other awards or cash, without shareholder approval. | |||

| ü | The Compensation Committee annually reviews an analysis of our incentive compensation plans prepared by the Compensation Committee's independent compensation consultant to ensure they are designed appropriately and do not encourage excessive risk taking, while taking into account market changes and peer group comparisons. | c | We do not permit officers, employees or directors to enter into transactions that "hedge" the value of our stock, hold our securities in margin accounts, pledge our securities to secure indebtedness, or buy or sell options or derivatives with respect to our securities. | |||

| ü | We have adopted a clawback policy for our NEOs. | |||||

22

Our performance in 2014 is exemplary of the excellence we strive to achieve. We beat the targets set by the Compensation Committee in all five quantitative areas and generally performed well with respect to our qualitative metrics. These results influenced our Compensation Committee to pay actual 2014 bonuses for the NEOs that were at approximately 155% the applicable STIP target percentage. We believe that this result indicates that our STIP is appropriately designed to link compensation earned to the achievement of our financial and strategic objectives. See the "Short-Term Incentive Plan" section below for additional discussion.

Our LTIP uses a combination of service-vesting RSUs and performance-based PSUs. We believe these types of long-term incentives appropriately balance risk and reward, because such units have both upside potential and downside risk. The performance measures used in our LTIP reward total stockholder return, both on an absolute basis and relative to an index of peer exploration and production companies. At the completion of the 2011–2014 performance period, we settled PSUs granted on July 1, 2011, using an earned percentage of 55% (as compared to a target of 100%). We achieved this result based upon our annualized absolute total shareholder return ("TSR") for the performance period of 6.2%, which resulted in an earned percentage of 35%. In addition, our TSR exceeded the TSR for our comparative peer group of companies for the period, which increased the earned percentage by 20%. We believe that this result indicates that our LTIP appropriately links compensation to the achievement of our long-term financial and strategic objectives.

Stockholder Advisory Vote on Compensation

At our 2014 Annual Meeting of Stockholders, our stockholders were provided the opportunity to cast a non-binding advisory vote on the compensation of our NEOs. Over 98% of votes cast approved the compensation of our NEOs. Because the vote was advisory, the result was not binding on the Compensation Committee. However, the Compensation Committee believes that our stockholders' overwhelming approval of the compensation of our NEOs indicates that they consider our compensation philosophy and our executive compensation policies to be effective and aligned with their interests. The Compensation Committee took into account the outcome of the vote and other factors, as more fully discussed herein, in reviewing our executive compensation policies for 2014 and in determining that no significant changes to our executive compensation programs and policies were necessary in 2014.

SECTION 2—OBJECTIVES OF EXECUTIVE COMPENSATION PROGRAM

Our overall executive compensation program is designed to promote superior returns for our stockholders through the exploration for and development and growth of our oil, natural gas and natural gas liquid assets. The objectives of our executive compensation program are to:

- 1.

- Provide competitive total compensation opportunities that allow us to attract, retain, compensate, and motivate talented management.

Our pay philosophy is to target overall compensation opportunities at levels competitive with equivalent positions at companies with which we may compete for talent. In general, based on analysis performed by the Compensation Committee's independent compensation consultant, Frederic W. Cook & Co., Inc. ("F. W. Cook"), we target total direct compensation for our NEOs around the median of our industry peer group (see "Section 3—Compensation Determination Process" for further detail). Actual compensation earned by a particular individual may be above or below the target level based on company and individual performance measured against the established metrics of our incentive compensation programs.

23

- 2.

- Link compensation earned to the achievement of our short-term and long-term financial and strategic objectives.

- 3.

- Align performance incentives with the long-term interests of our stockholders.

We believe that the proportion of total compensation that is performance-based, and therefore "at risk," should increase with an individual's level of responsibility. Our compensation system is intended to provide the appropriate balance between fixed and variable compensation, cash and equity compensation, and short-term and long-term incentives. To this end, our STIP rewards annual operating and financial performance based upon quantitative measures of cash flow, net income, production volume, proved developed reserve growth, and finding and development costs, and discretionary qualitative measures of environmental, health, and safety and exploration success and inventory growth (see "Elements of Compensation—Short-Term Incentive Plan"). Our LTIP rewards total stockholder return, both on an absolute basis and relative to an index of peer exploration and production companies (see "Elements of Compensation—Long-Term Incentive Plan").

- 4.

- Ensure programs are cost-effective and financially efficient.

We believe that we achieve alignment of long-term interests between stockholders and management by paying a substantial portion of total compensation in the form of equity-based incentives and through stock ownership guidelines that ensure our executives have a meaningful ownership stake during their tenure. In addition, the metrics used for our STIP include those we believe drive long-term value creation, while realized compensation under our LTIP is aligned with absolute and relative returns realized by our stockholders.