UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2011

Commission File Number 001-31539

SM ENERGY COMPANY

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 41-0518430 (I.R.S. Employer Identification No.) | |

1775 Sherman Street, Suite 1200, Denver, Colorado (Address of principal executive offices) | 80203 (Zip Code) | |

(303) 861-8140

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer o | |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of October 25, 2011, the registrant had 64,000,662 shares of common stock, $0.01 par value, outstanding.

SM ENERGY COMPANY

INDEX

PAGE | |||

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

SM ENERGY COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(in thousands, except share amounts)

September 30, 2011 | December 31, 2010 | ||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 29,923 | $ | 5,077 | |||

Accounts receivable | 183,943 | 163,190 | |||||

Refundable income taxes | — | 8,482 | |||||

Prepaid expenses and other | 30,937 | 45,522 | |||||

Derivative asset | 54,698 | 43,491 | |||||

Deferred income taxes | 5,203 | 8,883 | |||||

Total current assets | 304,704 | 274,645 | |||||

Property and equipment (successful efforts method), at cost: | |||||||

Land | 1,543 | 1,491 | |||||

Proved oil and gas properties | 4,070,916 | 3,389,158 | |||||

Less - accumulated depletion, depreciation, and amortization | (1,635,470 | ) | (1,326,932 | ) | |||

Unproved oil and gas properties | 107,651 | 94,290 | |||||

Wells in progress | 329,363 | 145,327 | |||||

Materials inventory, at lower of cost or market | 14,959 | 22,542 | |||||

Oil and gas properties held for sale (note 3) | 105,918 | 86,811 | |||||

Other property and equipment, net of accumulated depreciation of $18,312 in 2011 and $15,480 in 2010 | 47,655 | 21,365 | |||||

Total property and equipment, net | 3,042,535 | 2,434,052 | |||||

Other noncurrent assets: | |||||||

Derivative asset | 39,891 | 18,841 | |||||

Other noncurrent assets | 69,150 | 16,783 | |||||

Total other noncurrent assets | 109,041 | 35,624 | |||||

Total Assets | $ | 3,456,280 | $ | 2,744,321 | |||

LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable and accrued expenses | $ | 400,420 | $ | 417,654 | |||

Derivative liability | 21,106 | 82,044 | |||||

Deposit associated with oil and gas properties held for sale | 2,000 | 2,355 | |||||

Total current liabilities | 423,526 | 502,053 | |||||

Noncurrent liabilities: | |||||||

Long-term credit facility | — | 48,000 | |||||

3.50% Senior Convertible Notes, net of unamortized discount of $4,861 in 2011 and $11,827 in 2010 | 282,639 | 275,673 | |||||

6.625% Senior Notes | 350,000 | — | |||||

Asset retirement obligation | 73,693 | 69,052 | |||||

Asset retirement obligation associated with oil and gas properties held for sale (note 3) | 220 | 2,119 | |||||

Net Profits Plan liability | 108,489 | 135,850 | |||||

Deferred income taxes | 609,393 | 443,135 | |||||

Derivative liability | 3,184 | 32,557 | |||||

Other noncurrent liabilities | 17,383 | 17,356 | |||||

Total noncurrent liabilities | 1,445,001 | 1,023,742 | |||||

Commitments and contingencies (note 7) | |||||||

Stockholders' equity: | |||||||

Common stock, $0.01 par value - authorized: 200,000,000 shares; issued: 64,079,885 shares in 2011 and 63,412,800 shares in 2010; outstanding, net of treasury shares: 63,998,818 shares in 2011 and 63,310,165 shares in 2010 | 641 | 634 | |||||

Additional paid-in capital | 223,120 | 191,674 | |||||

Treasury stock, at cost: 81,067 shares in 2011 and 102,635 shares in 2010 | (1,544 | ) | (423 | ) | |||

Retained earnings | 1,371,869 | 1,042,123 | |||||

Accumulated other comprehensive loss | (6,333 | ) | (15,482 | ) | |||

Total stockholders' equity | 1,587,753 | 1,218,526 | |||||

Total Liabilities and Stockholders' Equity | $ | 3,456,280 | $ | 2,744,321 | |||

The accompanying notes are an integral part of these condensed consolidated financial statements. | |||||||

3

SM ENERGY COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(in thousands, except per share amounts)

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2011 | 2010 | 2011 | 2010 | ||||||||||||

Operating revenues and other income: | |||||||||||||||

Oil, gas, and NGL production revenue | $ | 325,231 | $ | 197,354 | $ | 935,478 | $ | 586,128 | |||||||

Realized hedge (loss) gain (note 10) | (6,843 | ) | 8,847 | (14,548 | ) | 20,771 | |||||||||

Gain on divestiture activity (note 3) | 190,728 | 4,184 | 245,662 | 132,183 | |||||||||||

Marketed gas system and other operating revenue | 21,458 | 16,499 | 57,184 | 59,634 | |||||||||||

Total operating revenues and other income | 530,574 | 226,884 | 1,223,776 | 798,716 | |||||||||||

Operating expenses: | |||||||||||||||

Oil, gas, and NGL production expense | 77,753 | 44,606 | 196,907 | 138,114 | |||||||||||

Depletion, depreciation, amortization, and asset retirement obligation liability accretion | 123,067 | 83,800 | 343,805 | 241,335 | |||||||||||

Exploration | 11,272 | 14,437 | 33,587 | 42,833 | |||||||||||

Impairment of proved properties | 48,525 | — | 48,525 | — | |||||||||||

Abandonment and impairment of unproved properties | — | 1,719 | 4,316 | 4,998 | |||||||||||

General and administrative | 29,787 | 26,219 | 82,958 | 75,103 | |||||||||||

Change in Net Profits Plan liability (note 8) | (24,930 | ) | 4,086 | (24,719 | ) | (29,785 | ) | ||||||||

Unrealized and realized derivative (gain) loss (note 10) | (128,425 | ) | 5,727 | (83,872 | ) | (4,095 | ) | ||||||||

Marketed gas system and other expense | 20,737 | 15,238 | 57,746 | 54,621 | |||||||||||

Total operating expenses | 157,786 | 195,832 | 659,253 | 523,124 | |||||||||||

Income from operations | 372,788 | 31,052 | 564,523 | 275,592 | |||||||||||

Nonoperating income (expense): | |||||||||||||||

Interest income | 27 | 85 | 382 | 268 | |||||||||||

Interest expense | (9,372 | ) | (6,339 | ) | (33,636 | ) | (19,469 | ) | |||||||

Income before income taxes | 363,443 | 24,798 | 531,269 | 256,391 | |||||||||||

Income tax expense | (133,346 | ) | (9,346 | ) | (195,142 | ) | (96,693 | ) | |||||||

Net income | $ | 230,097 | $ | 15,452 | $ | 336,127 | $ | 159,698 | |||||||

Basic weighted-average common shares outstanding | 63,904 | 63,031 | 63,665 | 62,914 | |||||||||||

Diluted weighted-average common shares outstanding | 67,386 | 64,794 | 67,390 | 64,599 | |||||||||||

Basic net income per common share (note 6) | $ | 3.60 | $ | 0.25 | $ | 5.28 | $ | 2.54 | |||||||

Diluted net income per common share (note 6) | $ | 3.41 | $ | 0.24 | $ | 4.99 | $ | 2.47 | |||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

SM ENERGY COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY AND COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

(in thousands, except share amounts)

Additional Paid-in Capital | Accumulated Other Comprehensive Income (Loss) | Total Stockholders' Equity | |||||||||||||||||||||||||||

Common Stock | Treasury Stock | Retained Earnings | |||||||||||||||||||||||||||

Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||

Balances, January 1, 2011 | 63,412,800 | $ | 634 | $ | 191,674 | (102,635 | ) | $ | (423 | ) | $ | 1,042,123 | $ | (15,482 | ) | $ | 1,218,526 | ||||||||||||

Comprehensive income, net of tax: | |||||||||||||||||||||||||||||

Net income | 336,127 | 336,127 | |||||||||||||||||||||||||||

Reclassification to earnings | 9,149 | 9,149 | |||||||||||||||||||||||||||

Total comprehensive income | 345,276 | ||||||||||||||||||||||||||||

Cash dividends, $ 0.10 per share | (6,381 | ) | (6,381 | ) | |||||||||||||||||||||||||

Issuance of common stock under Employee Stock Purchase Plan | 22,373 | 1 | 1,120 | 1,121 | |||||||||||||||||||||||||

Issuance of common stock upon vesting of RSUs and settlement of PSUs, net of shares used for tax withholdings, including income tax benefit of RSUs and PSUs | 278,595 | 3 | (9,969 | ) | (9,966 | ) | |||||||||||||||||||||||

Sale of common stock, including income tax benefit of stock option exercises | 366,117 | 3 | 19,624 | 19,627 | |||||||||||||||||||||||||

Stock-based compensation expense | 20,671 | 21,568 | (1,121 | ) | 19,550 | ||||||||||||||||||||||||

Balances, September 30, 2011 | 64,079,885 | $ | 641 | $ | 223,120 | (81,067 | ) | $ | (1,544 | ) | $ | 1,371,869 | $ | (6,333 | ) | $ | 1,587,753 | ||||||||||||

Balances, January 1, 2010 | 62,899,122 | $ | 629 | $ | 160,516 | (126,893 | ) | $ | (1,204 | ) | $ | 851,583 | $ | (37,954 | ) | $ | 973,570 | ||||||||||||

Comprehensive income, net of tax: | |||||||||||||||||||||||||||||

Net income | — | — | — | — | — | 159,698 | — | 159,698 | |||||||||||||||||||||

Change in derivative instrument fair value | — | — | — | — | — | — | 50,136 | 50,136 | |||||||||||||||||||||

Reclassification to earnings | — | — | — | — | — | — | 1,903 | 1,903 | |||||||||||||||||||||

Minimum pension liability adjustment | — | — | — | — | — | — | 4 | 4 | |||||||||||||||||||||

Total comprehensive income | 211,741 | ||||||||||||||||||||||||||||

Cash dividends, $ 0.10 per share | — | — | — | — | — | (6,297 | ) | — | (6,297 | ) | |||||||||||||||||||

Issuance of common stock under Employee Stock Purchase Plan | 27,456 | — | 799 | — | — | — | — | 799 | |||||||||||||||||||||

Issuance of common stock upon vesting of RSUs, net of shares used for tax withholdings, including income tax cost of RSUs | 57,687 | 1 | (909 | ) | — | — | — | — | (908 | ) | |||||||||||||||||||

Sale of common stock, including income tax benefit of stock option exercises | 163,348 | 1 | 3,692 | — | — | — | — | 3,693 | |||||||||||||||||||||

Stock-based compensation expense | — | — | 19,105 | 24,258 | 748 | — | — | 19,853 | |||||||||||||||||||||

— | |||||||||||||||||||||||||||||

Balances, September 30, 2010 | 63,147,613 | $ | 631 | $ | 183,203 | (102,635 | ) | $ | (456 | ) | $ | 1,004,984 | $ | 14,089 | $ | 1,202,451 | |||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

SM ENERGY COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(in thousands)

For the Nine Months Ended September 30, | |||||||

2011 | 2010 | ||||||

Cash flows from operating activities: | |||||||

Net income | $ | 336,127 | $ | 159,698 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Gain on divestiture activity | (245,662 | ) | (132,183 | ) | |||

Depletion, depreciation, amortization, and asset retirement obligation liability accretion | 343,805 | 241,335 | |||||

Exploratory dry hole expense | 49 | 289 | |||||

Impairment of proved properties | 48,525 | — | |||||

Abandonment and impairment of unproved properties | 4,316 | 4,998 | |||||

Stock-based compensation expense | 19,550 | 19,853 | |||||

Change in Net Profits Plan liability | (24,719 | ) | (29,785 | ) | |||

Unrealized derivative gain | (108,020 | ) | (4,095 | ) | |||

Amortization of debt discount and deferred financing costs | 14,698 | 10,022 | |||||

Deferred income taxes | 164,251 | 85,695 | |||||

Plugging and abandonment | (2,935 | ) | (7,106 | ) | |||

Other | (5,952 | ) | (3,085 | ) | |||

Changes in current assets and liabilities: | |||||||

Accounts receivable | (20,787 | ) | (4,937 | ) | |||

Refundable income taxes | 8,482 | 31,402 | |||||

Prepaid expenses and other | 14,732 | 512 | |||||

Accounts payable and accrued expenses | (41,558 | ) | 47,123 | ||||

Excess income tax benefit from the exercise of stock awards | (15,155 | ) | (1,376 | ) | |||

Net cash provided by operating activities | 489,747 | 418,360 | |||||

Cash flows from investing activities: | |||||||

Net proceeds from sale of oil and gas properties | 325,053 | 259,501 | |||||

Capital expenditures | (1,081,617 | ) | (488,684 | ) | |||

Acquisition of oil and gas properties | — | (685 | ) | ||||

Other | (340 | ) | (6,492 | ) | |||

Net cash used in investing activities | (756,904 | ) | (236,360 | ) | |||

Cash flows from financing activities: | |||||||

Proceeds from credit facility | 115,500 | 315,059 | |||||

Repayment of credit facility | (163,500 | ) | (501,059 | ) | |||

Debt issuance costs related to credit facility | (8,719 | ) | — | ||||

Net proceeds from 6.625% Senior Notes | 341,122 | — | |||||

Proceeds from sale of common stock | 5,593 | 3,116 | |||||

Dividends paid | (3,181 | ) | (3,144 | ) | |||

Excess income tax benefit from the exercise of stock awards | 15,155 | 1,376 | |||||

Other | (9,967 | ) | (908 | ) | |||

Net cash provided by (used in) financing activities | 292,003 | (185,560 | ) | ||||

Net change in cash and cash equivalents | 24,846 | (3,560 | ) | ||||

Cash and cash equivalents at beginning of period | 5,077 | 10,649 | |||||

Cash and cash equivalents at end of period | $ | 29,923 | $ | 7,089 | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

SM ENERGY COMPANY AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) (Continued)

Supplemental schedule of additional cash flow information and non-cash investing and financing activities:

For the Nine Months Ended September 30, | |||||||

2011 | 2010 | ||||||

(in thousands) | |||||||

Cash paid for interest | $ | (24,095 | ) | $ | (9,091 | ) | |

Net cash refunded for income taxes | $ | 2,346 | $ | 24,949 | |||

Dividends of approximately $3.2 million have been declared by the Company's Board of Directors, but not paid, as of September 30, 2011. Dividends of approximately $3.2 million were declared by the Company's Board of Directors, but not paid, as of September 30, 2010.

As of September 30, 2011, and 2010, $271.5 million, and $133.3 million, respectively, are included as additions to oil and gas properties and accounts payable and accrued expenses. These oil and gas property additions are reflected in cash used in investing activities in the periods that the payables are settled.

The accompanying notes are an integral part of these condensed consolidated financial statements.

7

SM ENERGY COMPANY AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Note 1 - The Company and Business

SM Energy Company (“SM Energy” or the “Company”) is an independent energy company engaged in the acquisition, exploration, exploitation, development, and production of crude oil, natural gas, and natural gas liquids (“NGLs”) in onshore North America, with a focus on oil and liquids-rich resource plays.

Note 2 - Basis of Presentation, Significant Accounting Policies, and Recently Issued Accounting Standards

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of SM Energy have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information and the instructions to Form 10-Q and Regulation S-X. They do not include all information and notes required by generally accepted accounting principles for complete financial statements. However, except as disclosed herein, there has been no material change in the information disclosed in the notes to consolidated financial statements included in SM Energy’s Annual Report on Form 10-K for the year ended December 31, 2010, (the “2010 Form 10-K”). In the opinion of management, all adjustments, consisting of normal recurring accruals that are considered necessary for a fair presentation of interim financial information, have been included. Operating results for the periods presented are not necessarily indicative of expected results for the full year. In connection with the preparation of its condensed consolidated financial statements, the Company evaluated subsequent events after the balance sheet date of September 30, 2011, through the filing date of this report.

Other Significant Accounting Policies

The accounting policies followed by the Company are set forth in Note 1 to the Company’s consolidated financial statements in the 2010 Form 10-K, and are supplemented throughout the notes to condensed consolidated financial statements in this report. It is suggested that these condensed consolidated financial statements be read in conjunction with the consolidated financial statements and notes included in the 2010 Form 10-K. As discussed in Note 10 - Derivative Financial Instruments, as of January 1, 2011, the Company elected to discontinue cash flow hedge accounting on a prospective basis.

Recently Issued Accounting Standards

In May 2011, the Financial Accounting Standards Board (“FASB”) issued new fair value measurement authoritative guidance clarifying the application of fair value measurement and disclosure requirements and changes particular principles or requirements for measuring fair value. This guidance is effective for interim and annual periods beginning after December 15, 2011. The Company is currently evaluating the provisions of this guidance and assessing the impact, if any, it may have on the Company’s fair value disclosures.

In June 2011, the FASB issued new authoritative guidance that states an entity that reports items of other comprehensive income has the option to present the components of net income and comprehensive income in either one continuous financial statement, or two consecutive financial statements. This guidance is effective for interim and annual periods beginning after December 15, 2011. The Company is currently evaluating the provisions of this guidance and assessing the impact it will have on the Company’s comprehensive income disclosures.

Note 3 - Divestitures and Assets Held for Sale

Eagle Ford Shale Divestiture

On August 2, 2011, the Company divested of certain operated Eagle Ford shale assets located in its South Texas & Gulf Coast region. This divestiture was comprised of the Company's entire operated acreage in LaSalle County, Texas, as well as an immaterial adjacent block of its operated acreage in Dimmit County, Texas. Total cash received, before marketing costs, was approximately $226.9 million. The final sales price is subject to post-closing adjustments and is expected to be finalized in the fourth quarter of 2011. The estimated gain on this divestiture is approximately $191.4 million. The Company determined the sale did not qualify for discontinued operations accounting under financial statement presentation authoritative guidance.

8

Mid-Continent Divestiture

In June 2011, the Company divested of certain non-strategic Constitution Field assets located in its Mid-Continent region. Total cash received, before marketing costs and Net Profits Interest Bonus Plan (“Net Profits Plan”) payments, was approximately $35.7 million. The final sales price is subject to post-closing adjustments and is expected to be finalized during the fourth quarter of 2011. The estimated gain on this divestiture is approximately $28.4 million. The Company determined the sale did not qualify for discontinued operations accounting under financial statement presentation authoritative guidance.

Rocky Mountain Divestiture

In January 2011, the Company divested of certain non-strategic assets located in its Rocky Mountain region. Total cash received, before marketing costs and Net Profits Plan payments, was approximately $45.5 million. The final gain related to the divestiture was approximately $27.2 million. The Company determined the sale did not qualify for discontinued operations accounting under financial statement presentation authoritative guidance.

Assets Held for Sale

Assets are classified as held for sale when the Company commits to a plan to sell the assets and there is reasonable certainty the sale will take place within one year. Upon classification as held for sale, long-lived assets are no longer depreciated or depleted and a measurement for impairment is performed to expense any excess of carrying value over fair value less costs to sell. Subsequent changes to estimated fair value less the cost to sell will impact the measurement of assets held for sale for which fair value is determined to be less than the carrying value of the assets.

As of September 30, 2011, the accompanying condensed consolidated balance sheets (“accompanying balance sheets”) included $105.9 million in book value of assets held for sale, net of accumulated depletion, depreciation and amortization and a corresponding asset retirement obligation liability is also separately presented. The above assets held for sale and asset retirement obligation liability amounts include certain assets located in Pennsylvania and the Company’s gathering assets as described in Note 12 - Acquisition and Development Agreement. The Company determined these planned asset sales do not qualify for discontinued operations accounting under financial statement presentation authoritative guidance.

In July 2011, the Company entered into an agreement to divest Marcellus shale assets located in Pennsylvania that were classified as held for sale at September 30, 2011, for $80.0 million subject to closing and post-closing adjustments. The agreement has an effective date of April 1, 2011. The agreement provided the purchaser with the option of extending the agreed upon closing date from October 15, 2011, to December 14, 2011, in exchange for an additional deposit. The purchaser has exercised this option and made the additional deposit. The closing of this transaction is subject to the satisfaction of certain closing conditions, including the resolution of any title defects exceeding specified levels. There can be no assurance that this transaction will be completed in the anticipated time frame, or at all.

Note 4 - Income Taxes

Income tax expense for the nine months ended September 30, 2011, and 2010, differs from the amounts that would be provided by applying the statutory U.S. federal income tax rate to income before income taxes as a result of the estimated effect of the domestic production activities deduction, percentage depletion, research and development credits, the effect of state income taxes, and other permanent differences.

The provision for income taxes consists of the following:

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2011 | 2010 | 2011 | 2010 | ||||||||||||

(in thousands) | |||||||||||||||

Current portion of income tax expense: | |||||||||||||||

Federal | $ | 20,699 | $ | 2,194 | $ | 29,855 | $ | 10,410 | |||||||

State | 637 | 277 | 1,036 | 588 | |||||||||||

Deferred portion of income tax expense | 112,010 | 6,875 | 164,251 | 85,695 | |||||||||||

Total income tax expense | $ | 133,346 | $ | 9,346 | $ | 195,142 | $ | 96,693 | |||||||

Effective tax rate | 36.7 | % | 37.7 | % | 36.7 | % | 37.7 | % | |||||||

9

On a year-to-date basis, a change in the Company’s effective tax rate between reported periods will generally reflect differences in its estimated highest marginal state tax rate due to changes in the composition of income from Company activities among state tax jurisdictions. Cumulative effects of state rate changes are reflected in the period legislation is enacted. Changes in the effective tax rate between periods also occur due to estimates for the domestic production activities deduction, percentage depletion, research and development credits, uncertain tax positions, valuation allowances, and for potential permanent state tax items which affect the presented periods differently due to oil and gas price variability and the impact of non-core asset sales. The quarterly rate can also be impacted by the proportion of income earned in reported periods.

The Company and its subsidiaries file income tax returns in the U.S. federal jurisdiction and in various states. With few exceptions, the Company is no longer subject to U.S. federal or state income tax examinations by these tax authorities for years before 2007. In the third quarter of 2011, the Company completed a research and development credit study and filed an amended 2007 federal return to claim a credit for that year. In the first quarter of 2011, the Company received a $5.5 million refund from its 2006 tax year as a result of a net operating loss carryback claim from the 2008 tax year. In the fourth quarter of 2010, the Internal Revenue Service initiated an audit of the Company for the 2009 tax year. The audit was concluded in the second quarter of 2011 with a $110,000 decrease to the Company's total 2005 refund claim of $25.0 million. A quick refund claim of $22.9 million from 2005 was received in the third quarter of 2010.

Note 5 - Long-Term Debt

Revolving Credit Facility

The Company executed a Fourth Amended and Restated Credit Agreement on May 27, 2011. This amended revolving credit facility replaced the Company’s previous facility. The Company incurred $8.7 million of deferred financing costs in association with the amended credit facility. Borrowings under the facility are secured by substantially all of the Company’s proved oil and gas properties. The credit facility has a maximum loan amount of $2.5 billion, with current aggregate lender commitments of $1.0 billion, and a maturity date of May 27, 2016. On September 29, 2011, the lending group redetermined the Company's borrowing base under the credit facility at an amount of $1.4 billion, up from $1.3 billion. The borrowing base is subject to regular semi-annual redeterminations by the Company's lenders. The borrowing base redetermination process considers the value of the Company’s oil and gas properties.

The Company must comply with certain financial and non-financial covenants under the terms of its credit facility agreement, including the limitation of the Company’s dividends to no more than $50.0 million per year. The Company was in compliance with all financial and non-financial covenants under the credit facility as of September 30, 2011, and through the filing of this report. Interest and commitment fees are accrued based on the borrowing base utilization grid below. Eurodollar loans accrue interest at the London Interbank Offered Rate plus the applicable margin from the utilization table below, and Alternate Base Rate (“ABR”) and swingline loans accrue interest at Prime plus the applicable margin from the utilization table below. Commitment fees are accrued on the unused portion of the aggregate commitment amount and are included in interest expense in the accompanying condensed consolidated statements of operations (“accompanying statements of operations”).

Borrowing Base Utilization Grid

Borrowing Base Utilization Percentage | <25% | ≥25% <50% | ≥50% <75% | ≥75% <90% | ≥90% | ||||||||||

Eurodollar Loans | 1.500 | % | 1.750 | % | 2.000 | % | 2.250 | % | 2.500 | % | |||||

ABR Loans or Swingline Loans | 0.500 | % | 0.750 | % | 1.000 | % | 1.250 | % | 1.500 | % | |||||

Commitment Fee Rate | 0.375 | % | 0.375 | % | 0.500 | % | 0.500 | % | 0.500 | % | |||||

The Company had no outstanding borrowings under its credit facility as of September 30, 2011. The Company had $48.0 million of outstanding borrowings under its previous credit facility at December 31, 2010. The Company had $999.4 million of available borrowing capacity under its current credit facility as of September 30, 2011, and had $629.5 million of available borrowing capacity under its previous facility at December 31, 2010, when the aggregate commitment amount was $678.0 million. The Company had two letters of credit outstanding for a total of $608,000 at September 30, 2011, and had one letter of credit outstanding in the amount of $483,000 at December 31, 2010. Outstanding letters of credit reduce the amount available under the commitment amount on a dollar-for-dollar basis.

10

6.625% Senior Notes Due 2019

On February 7, 2011, the Company issued $350.0 million in aggregate principal amount of 6.625% Senior Notes Due 2019 (the “6.625% Senior Notes”). The 6.625% Senior Notes were issued at par and mature on February 15, 2019. The Company received net proceeds of approximately $341.1 million after deducting fees of approximately $8.9 million, which will be amortized as deferred financing costs over the life of the 6.625% Senior Notes. The net proceeds were used to repay all borrowings under the Company’s previous credit facility, and the remaining proceeds were used to fund the Company’s ongoing capital expenditure program and general corporate purposes.

Prior to February 15, 2014, the Company may redeem up to 35 percent of the aggregate principal amount of the 6.625% Senior Notes with the net cash proceeds of one or more equity offerings at a redemption price of 106.625% of the principal amount thereof, plus accrued and unpaid interest. The Company may also redeem the 6.625% Senior Notes, in whole or in part, at any time prior to February 15, 2015, at a redemption price equal to 100% of the principal amount, plus a specified make whole premium and accrued and unpaid interest.

The Company may also redeem all or, from time to time, a portion of the 6.625% Senior Notes on or after February 15, 2015, at the prices set forth below, during the twelve-month period beginning on February 15 of the applicable year, expressed as a percentage of the principal amount redeemed, plus accrued and unpaid interest:

2015 | 103.313 | % |

2016 | 101.656 | % |

2017 and thereafter | 100.000 | % |

The 6.625% Senior Notes are unsecured senior obligations and rank equal in right of payment with all of the Company’s existing and any future unsecured senior debt and are senior in right of payment to any future subordinated debt. There are no subsidiary guarantors of the 6.625% Senior Notes. The Company is subject to certain covenants under the indenture governing the 6.625% Senior Notes that limit incurring additional indebtedness, issuing preferred stock, and making restricted payments in excess of specified amounts. The payment of dividends on the Company’s common stock must comply with the restricted payment covenant; provided, however, the first $6.5 million of dividends paid each year are not restricted by this covenant. To pay any additional dividends, the Company must comply with this covenant. The Company was in compliance with all covenants under its 6.625% Senior Notes as of September 30, 2011, and through the filing of this report.

Additionally, on February 7, 2011, the Company entered into a registration rights agreement that provides holders of the 6.625% Senior Notes certain registration rights for the 6.625% Senior Notes under the Securities Act of 1933, as amended (the “Securities Act”). Pursuant to the registration rights agreement, the Company will file an exchange offer registration statement with the Securities and Exchange Commission with respect to an offer to exchange the 6.625% Senior Notes for substantially identical notes that are registered under the Securities Act. Under certain circumstances, in lieu of a registered exchange offer, the Company has agreed to file a shelf registration statement relating to the resale of the 6.625% Senior Notes. If the exchange offer is not completed on or before February 7, 2012, or the shelf registration statement, if required, is not declared effective within the time periods specified in the registration rights agreement, then the Company has agreed to pay additional interest with respect to the 6.625% Senior Notes in an amount not to exceed one percent of the principal amount of the 6.625% Senior Notes until the exchange offer is completed or the shelf registration statement is declared effective.

3.50% Senior Convertible Notes Due 2027

On April 4, 2007, the Company issued $287.5 million in aggregate principal amount of 3.50% Senior Convertible Notes Due 2027 (the “3.50% Senior Convertible Notes”). The 3.50% Senior Convertible Notes mature on April 1, 2027, unless they are converted prior to maturity, redeemed, or purchased by the Company.

Holders of the 3.50% Senior Convertible Notes may elect to surrender all or a portion of their 3.50% Senior Convertible Notes for conversion under certain circumstances, including during a calendar quarter if the closing price of the Company’s common stock was more than 130 percent of the conversion price of $54.42 per share for at least 20 trading days in the 30 consecutive trading days ending on the last trading day of the immediately preceding calendar quarter. If holders elect to convert all or a portion of the 3.50% Senior Convertible Notes during a calendar quarter in which they are eligible to do so, they will receive cash, shares of the Company’s common stock, or any combination thereof as may be elected by the Company under the indenture for the 3.50% Senior Convertible Notes. As of December 31, 2010, the 3.50% Senior Convertible Notes were not convertible. The closing price of the Company's common stock exceeded the conversion trigger price of $70.75 per share for the quarter ended March 31, 2011; however,

11

none of the holders opted to convert their 3.50% Senior Convertible Notes during the second quarter of 2011. The closing price of the Company's common stock did not exceed the conversion trigger price for the quarters ended June 30, 2011, and September 30, 2011; therefore, the 3.50% Senior Convertible Notes were not eligible to be converted during the third quarter of 2011 and will not be eligible to be converted during the fourth quarter of 2011.

Note 6 - Earnings per Share

Basic net income per common share of stock is calculated by dividing net income available to common stockholders by the basic weighted-average common shares outstanding for the respective period. The Company’s earnings per share calculations reflect the impact of any repurchases of shares of common stock made by the Company.

Diluted net income per common share of stock is calculated by dividing adjusted net income by the number of diluted weighted-average common shares outstanding, which includes the effect of potentially dilutive securities. Potentially dilutive securities for this calculation consist of unvested restricted stock units (“RSUs”), in-the-money outstanding options to purchase the Company’s common stock, contingent Performance Share Awards ("PSAs") and contingent Performance Stock Units, and shares into which the 3.50% Senior Convertible Notes are convertible.

Performance Stock Units are structurally the same as the previously granted PSAs (collectively known as "Performance Stock Units" or "PSUs"). PSUs represent the right to receive, upon settlement of the PSUs after completion of the three-year performance period, a number of shares of the Company’s common stock that may range from zero to two times the number of PSUs granted on the award date. The number of potentially dilutive shares related to PSUs is based on the number of shares, if any, which would be issuable at the end of the respective reporting period, assuming that date was the end of the contingency period. For additional discussion on PSUs, please refer to Note 8 - Compensation Plans under the heading Performance Stock Units Under the Equity Incentive Compensation Plan.

The Company’s 3.50% Senior Convertible Notes have a net-share settlement right giving the Company the option to irrevocably elect, by notice to the trustee under the indenture for the notes, to settle the Company’s obligation to deliver shares of the Company’s common stock, in the event that holders of the notes elect to convert all or a portion of their notes, by delivering cash in an amount equal to each $1,000 principal amount of notes surrendered for conversion and, if applicable, at the Company’s option, shares of common stock or cash, or any combination of common stock and cash, for the amount of conversion value in excess of the principal amount. For accounting purposes, the treasury stock method is used to measure the potentially dilutive impact of shares associated with this conversion feature. Shares of the Company’s common stock traded at a quarterly average closing price exceeding the $54.42 conversion price for the three and nine-month periods ended September 30, 2011, making them dilutive for those respective periods. The 3.50% Senior Convertible Notes were not dilutive for the three and nine-month periods ended September 30, 2010.

The treasury stock method is used to measure the dilutive impact of unvested RSUs, contingent PSUs, and in-the-money stock options.

The following table sets forth the calculation of basic and diluted earnings per share:

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2011 | 2010 | 2011 | 2010 | ||||||||||||

(in thousands, except per share amounts) | |||||||||||||||

Net income | $ | 230,097 | $ | 15,452 | $ | 336,127 | $ | 159,698 | |||||||

Basic weighted-average common shares outstanding | 63,904 | 63,031 | 63,665 | 62,914 | |||||||||||

Add: dilutive effect of stock options, unvested RSUs, and contingent PSUs | 2,062 | 1,763 | 2,589 | 1,685 | |||||||||||

Add: dilutive effect of 3.50% Senior Convertible Notes | 1,420 | — | 1,136 | — | |||||||||||

Diluted weighted-average common shares outstanding | 67,386 | 64,794 | 67,390 | 64,599 | |||||||||||

Basic net income per common share | $ | 3.60 | $ | 0.25 | $ | 5.28 | $ | 2.54 | |||||||

Diluted net income per common share | $ | 3.41 | $ | 0.24 | $ | 4.99 | $ | 2.47 | |||||||

12

Note 7 - Commitments and Contingencies

During the second quarter of 2011, the Company entered into two natural gas gathering and services agreements whereby it is subject to certain natural gas gathering through-put commitments for up to ten years pursuant to each contract. The Company may be required to make periodic deficiency payments for any shortfalls in delivering the minimum applicable annual or semi-annual volume commitments. In the event that no gas is delivered in accordance with the agreements, the aggregate deficiency payments will total approximately $726.2 million as of September 30, 2011. If a shortfall in the minimum volume commitment arises, the Company can arrange for third party gas to be delivered into the applicable gathering system and applied to the Company’s minimum commitment.

During the first quarter of 2011, the Company entered into a hydraulic fracturing services contract. The total commitment is $180.0 million over a two-year term commencing January 1, 2011. As of September 30, 2011, the remaining commitment was $112.5 million. However, the Company’s liability in the event of early termination of this contract without cause is not to exceed $24.0 million. In the event of early termination of this contract with cause there is no termination fee.

The Company is subject to litigation and claims that have arisen in the ordinary course of its business. The Company accrues for such items when a liability is probable and the amount can be reasonably estimated. The Company currently has no such accruals. In the opinion of management, any adverse results in any such pending litigation and claims will not have a material effect on the results of operations, the financial position, or cash flows of the Company.

The Company is currently a defendant in litigation where the plaintiffs claim an aggregate overriding royalty interest of 7.46875 percent in production from approximately 22,000 of the Company’s net acres in the Eagle Ford shale play in South Texas. The plaintiffs seek to quiet title to their claimed overriding royalty interest and seek the recovery of unpaid overriding royalty interest proceeds allegedly due. The Texas District Court issued an order granting plaintiffs’ motion for summary judgment, but the Company believes that the summary judgment order is incorrect under the governing agreements and applicable law, and the Company intends to appeal and continue to contest the claim. The court entered judgment against all defendants awarding the plaintiffs damages of approximately $5.1 million. If the plaintiffs were to ultimately prevail, the overriding royalty interest would reduce the Company’s net revenue interest in the affected acreage. The Company does not currently believe that an unfavorable ultimate outcome is probable, nor that if the plaintiffs prevail there would be a material effect on the financial position of the Company. Based on the Company’s current view of the facts and circumstances of the case, no accrual has been made for any loss.

The Company initiated an arbitration proceeding on May 11, 2011, against Anadarko E&P Company, LP (“Anadarko”), alleging that Anadarko breached a Joint Exploration Agreement (“JEA”) originally executed between Anadarko and TXCO Energy Corp. (“TXCO”) in March 2008, and relating to oil and gas properties located in Maverick, Dimmitt, Webb and LaSalle Counties, Texas. The Company has been a party to the JEA since May 15, 2008. The Company asserts that Anadarko is required under the JEA to tender to the Company its proportionate share of the leasehold interests that Anadarko acquired in TXCO's bankruptcy proceeding in February 2010. The arbitration hearing related to this dispute was held in September 2011; however, the arbitration panel has not announced its determination. If the Company prevails in this matter, Anadarko could be obligated to sell to the Company an undivided interest of up to 8.333% (or up to approximately 27,000 net acres) of the total leasehold governed by the JEA in return for the Company's payment of a proportionate share of the price Anadarko paid TXCO in the bankruptcy proceeding (adjusted for revenues and expenses attributable to the purchased interest since January 1, 2010), or in the alternative, pay the Company damages in an amount to be determined by the arbitration panel.

In a separate, unrelated matter, the Company initiated an arbitration proceeding against Springfield Pipeline, LLC (“Springfield”), a wholly owned affiliate of Anadarko Petroleum Corporation, and another party in October 2011, alleging that Springfield and the other party had unreasonably withheld or delayed consents, which are closing conditions of the Company's Acquisition and Development Agreement with Mitsui E&P Texas LP, and which are required (but are not to be unreasonably withheld or delayed) under an Agreement for the Construction, Ownership and Operation of Midstream Assets in Maverick, Dimmit, Webb and La Salle Counties, Texas, executed by the Company and Springfield and under certain other related gathering agreements. The Company has dismissed its claims in the arbitration proceeding against the other party in return for its consent. The Company has requested an expedited arbitration hearing under the commercial rules of the American Arbitration Association and is endeavoring to conclude this arbitration proceeding against Springfield during the fourth quarter of 2011.

Note 8 - Compensation Plans

Cash Bonus Plan

During the first quarters of 2011 and 2010, the Company paid $21.6 million and $7.7 million for cash bonuses earned in the 2010 and 2009 performance years, respectively. Within the general and administrative expense and exploration expense line items in

13

the accompanying statements of operations was $3.8 million and $3.1 million of accrued cash bonus plan expense related to the specific performance year for the three-month periods ended September 30, 2011, and 2010, respectively, and $11.3 million and $9.2 million for the nine-month periods ended September 30, 2011, and 2010, respectively.

Performance Stock Units Under the Equity Incentive Compensation Plan

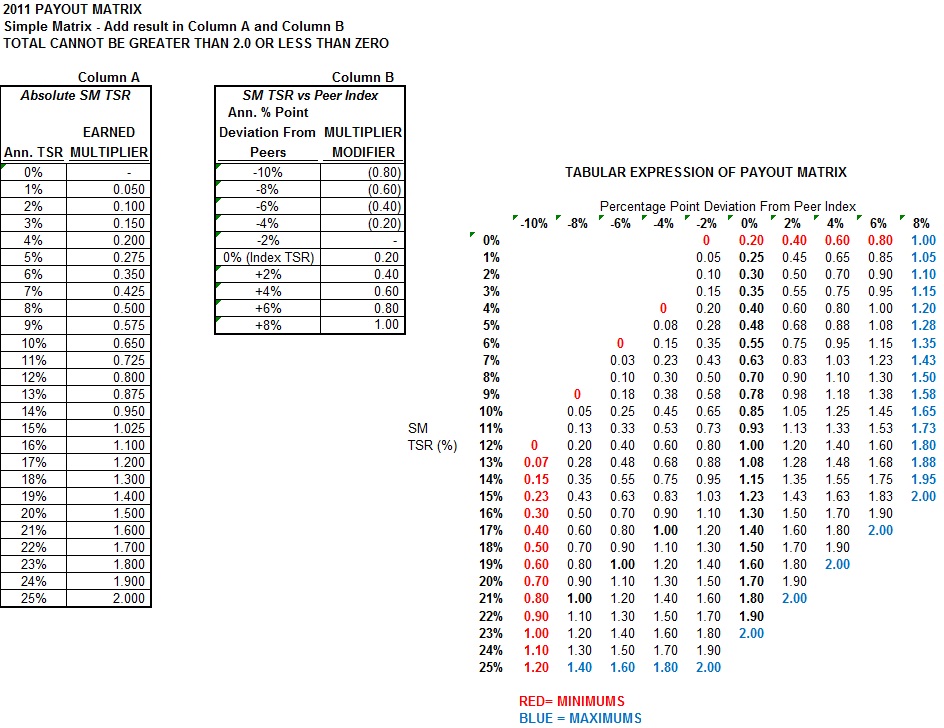

PSUs are the primary form of long-term equity incentive compensation for the Company. The PSU multiplier is based on the Company’s performance after completion of a three-year performance period. The performance criteria for PSUs is based on a combination of the Company’s annualized total shareholder return (“TSR”) for the performance period and the relative measure of the Company’s TSR compared with the annualized TSR of an index comprised of certain peer companies for the performance period. In addition, there are separate employment service vesting provisions. PSUs are recognized as general and administrative and exploration expense over the vesting period of the award.

Total stock-based compensation expense related to PSUs for the three-month periods ended September 30, 2011, and 2010, was $5.9 million and $5.6 million, respectively, and $14.3 million and $13.0 million for the nine-month periods ended September 30, 2011, and 2010, respectively. As of September 30, 2011, there was $31.9 million of total unrecognized compensation expense related to unvested PSUs that is being amortized through 2014.

A summary of the status and activity concerning PSUs for the nine-month period ended September 30, 2011, is presented in the following table:

PSUs | Weighted-Average Grant-Date Fair Value | |||||

Non-vested, at January 1, 2011 | 1,110,666 | $ | 39.48 | |||

Granted | 266,282 | $ | 91.45 | |||

Vested (1) | (359,671 | ) | $ | 35.53 | ||

Forfeited | (125,849 | ) | $ | 32.89 | ||

Non-vested, at September 30, 2011 | 891,428 | $ | 58.77 | |||

___________________________________________________

(1) | The number of awards vested assumes a multiplier of one. The final number of shares vested may vary depending on the ending three-year multiplier, which ranges from zero to two. |

During the third quarter of 2011, the Company granted a total of 266,282 PSUs as part of its regular annual long-term equity compensation process with a fair value of $24.3 million. These PSUs will vest 1/7th on July 1, 2012, 2/7ths on July 1, 2013, and 4/7ths on July 1, 2014. During the third quarter of 2011, the Company settled 305,423 PSUs that related to awards granted in 2008 through the issuance of shares of the Company's common stock in accordance with the terms of the PSU awards. As a result, the Company issued a net of 206,468 shares of common stock associated with these grants. The remaining 98,955 shares were withheld to satisfy income and payroll tax withholding obligations that arose upon delivery of the shares underlying those PSUs.

Restricted Stock Units Under the Equity Incentive Compensation Plan

The Company grants RSUs for a portion of its annual long-term equity compensation. An RSU represents a right to receive one share of the Company’s common stock to be delivered upon settlement of the RSU when it vests. Total RSU compensation expense for the three-month periods ended September 30, 2011, and 2010, was $1.6 million and $2.1 million, respectively, and $3.6 million and $5.7 million for the nine-month periods ended September 30, 2011, and 2010, respectively. As of September 30, 2011, there was $9.2 million of total unrecognized compensation expense related to unvested RSU awards that is being amortized through 2014.

14

A summary of the status and activity concerning RSUs for the nine-month period ended September 30, 2011, is presented in the following table:

RSUs | Weighted-Average Grant-Date Fair Value | |||||

Non-vested, at January 1, 2011 | 333,359 | $ | 31.16 | |||

Granted | 98,952 | $ | 72.69 | |||

Vested | (105,554 | ) | $ | 30.63 | ||

Forfeited | (17,270 | ) | $ | 36.06 | ||

Non-vested, at September 30, 2011 | 309,487 | $ | 44.34 | |||

During the third quarter of 2011, the Company granted a total of 90,665 RSUs as part of its regular annual long-term equity compensation process with a fair value of $6.7 million. These RSUs will vest 1/7th on July 1, 2012, 2/7ths on July 1, 2013, and 4/7ths on July 1, 2014. During the first nine months of 2011, the Company settled 105,554 RSUs that related to awards granted in 2008, 2009 and 2010 through the issuance of shares of the Company’s common stock in accordance with the terms of the RSU awards. As a result, the Company issued a net of 72,127 shares of common stock associated with these grants. The remaining 33,427 shares were withheld to satisfy income and payroll tax withholding obligations that arose upon delivery of the shares underlying those RSUs.

Stock Option Grants Under Prior Stock Option Plans

The following table summarizes stock option activity for the nine months ended September 30, 2011:

Options | Weighted- Average Exercise Price | Aggregate Intrinsic Value | ||||||||

Outstanding, January 1, 2011 | 920,765 | $ | 13.11 | $ | 42,192,057 | |||||

Exercised | (366,117 | ) | $ | 12.22 | ||||||

Forfeited | — | $ | — | |||||||

Outstanding, September 30, 2011 | 554,648 | $ | 13.69 | $ | 26,043,950 | |||||

Vested and exercisable, September 30, 2011 | 554,648 | $ | 13.69 | $ | 26,043,950 | |||||

As of September 30, 2011, there was no unrecognized compensation expense related to stock option awards.

Director Shares

During the nine months ended September 30, 2011, and 2010, the Company issued 21,568 and 24,258 shares, respectively, of the Company’s common stock held as treasury shares to the Company’s non-employee directors. The shares were issued pursuant to the Company’s Equity Incentive Compensation Plan. There was no compensation expense recorded for the three months ended September 30, 2011. The Company recorded $33,000 of related compensation expense for the three months ended September 30, 2010, and $1.0 million and $748,000 of related compensation expense for the nine months ended September 30, 2011, and 2010, respectively.

Employee Stock Purchase Plan

Under the Company’s Employee Stock Purchase Plan (the “ESPP”), eligible employees may purchase shares of the Company’s common stock through payroll deductions of up to 15 percent of eligible compensation without accruing in excess of $25,000 in fair market value from such purchases for each calendar year. The purchase price of the stock is 85 percent of the lower of the fair market value of the stock on the first or last day of the purchase period. The ESPP is intended to qualify under Section 423 of the Internal Revenue Code. The Company has set aside 2,000,000 shares of its common stock to be available for issuance under the ESPP, of which 1,392,954 shares were available for issuance as of September 30, 2011. There were 22,373 and 27,456 shares issued under the ESPP during the first nine months of 2011 and 2010, respectively, with a six month minimum holding period. Shares issued under the ESPP on or after July 1, 2011, have no minimum holding period. The fair value of ESPP grants is measured at the date of grant using the Black-Scholes option-pricing model.

15

Net Profits Plan

Under the Company’s Net Profits Plan, all of the Company's oil and gas wells that were completed or acquired during a year were designated within a specific pool. Key employees recommended by senior management and designated as participants by the Compensation Committee of the Company’s Board of Directors (“Board”) and employed by the Company on the last day of that year became entitled to payments under the Net Profits Plan after the Company had received net cash flows returning 100 percent of all costs associated with that pool. Thereafter, ten percent of future net cash flows generated by the pool are allocated among the participants and distributed at least annually. The portion of net cash flows from a pool to be allocated among the participants increases to 20 percent after the Company has recovered 200 percent of the total costs for the pool, including payments made under the Net Profits Plan at the ten percent level. In December 2007, the Board discontinued the creation of new pools under the Net Profits Plan. As a result, the 2007 Net Profits Plan pool was the last pool established by the Company.

Cash payments made or accrued under the Net Profits Plan that have been recorded as either general and administrative expense or exploration expense are detailed in the table below:

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2011 | 2010 | 2011 | 2010 | ||||||||||||

(in thousands) | |||||||||||||||

General and administrative expense | $ | 4,229 | $ | 3,918 | $ | 14,820 | $ | 16,233 | |||||||

Exploration expense | 507 | 638 | 1,569 | 1,896 | |||||||||||

Total | $ | 4,736 | $ | 4,556 | $ | 16,389 | $ | 18,129 | |||||||

Additionally, the Company accrued or made cash payments under the Net Profits Plan of $686,000, relating to divestiture proceeds for the three months ended September 30, 2010, and $6.3 million and $20.8 million for the nine months ended September 30, 2011, and 2010, respectively. There were no cash payments made or accrued for relating to divestiture proceeds for the three months ended September 30, 2011. The cash payments are accounted for as a reduction of the gain on divestiture activity in the accompanying statements of operations.

The Company records changes in the present value of estimated future payments under the Net Profits Plan as a separate line item in the accompanying statements of operations. The change in the estimated liability is recorded as a non-cash expense or benefit in the current period. The amount recorded as an expense or benefit associated with the change in the estimated liability is not allocated to general and administrative expense or exploration expense because it is associated with the future net cash flows from oil and gas properties in the respective pools rather than results being realized through current period production. If the Company allocated the change in liability to these specific functional line items, based on the current allocation of actual distributions made by the Company, such expenses or benefits would predominately be allocated to general and administrative expense. The amount that would be allocated to exploration expense is minimal in comparison. Over time, less of the amount distributed relates to prospective exploration efforts as more of the amount distributed is to employees that have terminated employment and do not provide ongoing exploration support to the Company.

Note 9 - Pension Benefits

Pension Plans

The Company has a non-contributory pension plan covering substantially all employees who meet age and service requirements (the “Qualified Pension Plan”). The Company also has a supplemental non-contributory pension plan covering certain management employees (the “Nonqualified Pension Plan”).

16

Components of Net Periodic Benefit Cost for Both Plans

The following table presents the components of the net periodic benefit cost for both the Qualified Pension Plan and the Nonqualified Pension Plan:

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2011 | 2010 | 2011 | 2010 | ||||||||||||

(in thousands) | |||||||||||||||

Service cost | $ | 950 | $ | 848 | $ | 2,850 | $ | 2,544 | |||||||

Interest cost | 296 | 280 | 888 | 840 | |||||||||||

Expected return on plan assets | (220 | ) | (159 | ) | (660 | ) | (477 | ) | |||||||

Amortization of net actuarial loss | 102 | 91 | 304 | 273 | |||||||||||

Net periodic benefit cost | $ | 1,128 | $ | 1,060 | $ | 3,382 | $ | 3,180 | |||||||

Prior service costs are amortized on a straight-line basis over the average remaining service period of active participants. Gains and losses in excess of ten percent of the greater of the benefit obligation or the market-related value of assets are amortized over the average remaining service period of active participants.

Contributions

The Company is currently required to contribute $6.3 million to its Qualified Pension Plan for the 2011 plan year. The Company has contributed $4.3 million as of September 30, 2011.

Note 10 - Derivative Financial Instruments

To mitigate a portion of the exposure to potentially adverse market changes in oil, natural gas, and NGL prices and the associated impact on cash flows, the Company has entered into various derivative commodity contracts. The Company’s derivative contracts in place include swap and collar arrangements for oil, natural gas, and NGLs. As of September 30, 2011, and through the filing date of this report, the Company has commodity derivative contracts in place through the second quarter of 2014 for a total of approximately 9 MMBbls of anticipated crude oil production, 63 million MMBtu of anticipated natural gas production, and 2 MMBbls of anticipated NGL production.

The Company’s oil, natural gas, and NGL derivatives are measured at fair value and are included in the accompanying balance sheets as derivative assets and liabilities. The Company derives internal valuation estimates that take into consideration the counterparties’ credit ratings, the Company’s credit rating, and the time value of money. These valuations are then compared to the respective counterparties’ mark-to-market statements. The pertinent factors result in an estimated exit-price that management believes provides a reasonable and consistent methodology for valuing derivative instruments. The derivative instruments utilized by the Company are not considered by management to be complex, structured, or illiquid. The oil, natural gas, and NGL derivative markets are highly active. The fair value of the commodity derivative contracts was a net asset of $70.3 million and a net liability of $52.3 million at September 30, 2011, and December 31, 2010, respectively.

Discontinuance of Cash Flow Hedge Accounting

Prior to January 1, 2011, the Company designated its commodity derivative contracts as cash flow hedges, for which unrealized changes in fair value were recorded to accumulated other comprehensive income (loss) (“AOCIL”), to the extent the hedges were effective. As of January 1, 2011, the Company elected to de-designate all of its commodity derivative contracts that had been previously designated as cash flow hedges at December 31, 2010. As a result, subsequent to December 31, 2010, the Company recognizes all gains and losses from changes in commodity derivative fair values immediately in earnings rather than deferring any such amounts in AOCIL.

At December 31, 2010, accumulated other comprehensive loss (“AOCL”) included $18.6 million ($11.8 million, net of income tax) of unrealized losses, representing the change in fair value of the Company’s open commodity derivative contracts designated as cash flow hedges as of that balance sheet date, less any ineffectiveness recognized. As a result of discontinuing hedge accounting on January 1, 2011, such fair values at December 31, 2010 were frozen in AOCL as of the de-designation date and are reclassified into earnings as the original derivative transactions settle. During the nine months ended September 30, 2011, $14.5 million ($9.1 million, net of income tax) of derivative losses relating to de-designated commodity hedges were reclassified from

17

AOCL into earnings. As of September 30, 2011, AOCL included $4.1 million ($2.7 million, net of income tax) of unrealized losses on commodity derivative contracts that had been previously designated as cash flow hedges. The Company expects to reclassify into earnings from AOCL $2.4 million, net of income tax, related to de-designated commodity derivative contracts during the next twelve months.

The following table details the fair value of derivatives recorded in the accompanying balance sheets, by category:

As of September 30, 2011 | |||||||||||

Derivative Assets | Derivative Liabilities | ||||||||||

Balance Sheet Classification | Fair Value | Balance Sheet Classification | Fair Value | ||||||||

(in thousands) | |||||||||||

Commodity Contracts | Current Assets | $ | 54,698 | Current Liabilities | $ | 21,106 | |||||

Commodity Contracts | Noncurrent Assets | 39,891 | Noncurrent liabilities | 3,184 | |||||||

Derivatives not designated as hedging instruments | $ | 94,589 | $ | 24,290 | |||||||

As of December 31, 2010 | |||||||||||

Derivative Assets | Derivative Liabilities | ||||||||||

Balance Sheet Classification | Fair Value | Balance Sheet Classification | Fair Value | ||||||||

(in thousands) | |||||||||||

Commodity Contracts | Current Assets | $ | 43,491 | Current Liabilities | $ | 82,044 | |||||

Commodity Contracts | Noncurrent Assets | 18,841 | Noncurrent Liabilities | 32,557 | |||||||

Derivatives designated as hedging instruments | $ | 62,332 | $ | 114,601 | |||||||

The following table summarizes the unrealized and realized gains and losses on derivative cash settlements and changes in fair value of derivative contracts as presented in the accompanying statements of operations.

For the Three Months Ended September 30, 2011 | For the Nine Months Ended September 30, 2011 | ||||||

(in thousands) | |||||||

Cash settlement (gain) loss: | |||||||

Oil contracts | $ | 1,058 | $ | 18,421 | |||

Natural gas contracts | (1,434 | ) | (3,751 | ) | |||

NGL contracts | 4,131 | 9,478 | |||||

Total cash settlement loss | $ | 3,755 | $ | 24,148 | |||

Unrealized (gain) loss on changes in fair value: | |||||||

Oil contracts | $ | (106,780 | ) | $ | (90,629 | ) | |

Natural gas contracts | (19,083 | ) | (21,504 | ) | |||

NGL contracts | (6,317 | ) | 4,113 | ||||

Total net unrealized (gain) on change in fair value | $ | (132,180 | ) | $ | (108,020 | ) | |

Total unrealized and realized derivative (gain) | $ | (128,425 | ) | $ | (83,872 | ) | |

18

The following table details the effect of derivative instruments on AOCIL and the accompanying statements of operations (net of income tax):

Location on Consolidated Statement of Operations | For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||||||

Derivatives | 2011 | 2010 | 2011 | 2010 | ||||||||||||||||

(in thousands) | (in thousands) | |||||||||||||||||||

Amount of loss reclassified from AOCIL to realized hedge (loss) gain | Commodity Contracts | Realized hedge (loss) gain | $ | 4,271 | $ | 2,685 | $ | 9,149 | $ | 1,903 | ||||||||||

The realized net hedge loss for the three and nine-month periods ended September 30, 2011, is comprised of realized cash settlements on commodity derivative contracts that were previously designated as cash flow hedges, whereas the realized net hedge gain for the three and nine-month periods ended September 30, 2010, is comprised of realized cash settlements on all commodity derivative contracts. Realized hedge gains or losses from the settlement of commodity derivatives previously designated as cash flow hedges are reported in the total operating revenues and other income section of the accompanying statements of operations. The Company realized a net hedge loss of $6.8 million and a net hedge gain of $8.8 million from its commodity derivative contracts for the three months ended September 30, 2011, and 2010, respectively, and a net loss of $14.5 million and a net gain of $20.8 million from its commodity derivative contracts for the nine months ended September 30, 2011, and 2010, respectively.

As noted above, effective January 1, 2011, the Company elected to de-designate all of its commodity derivative contracts that had been previously designated as cash flow hedges at December 31, 2010, and as such no new gains or losses are deferred in AOCIL at September 30, 2011. The following table details the effect of derivative instruments on AOCIL and the balance sheets (net of income tax):

Derivatives | Location on Consolidated Balance Sheets | For the Nine Months Ended September 30, 2010 | For the Year Ended December 31, 2010 | ||||||||

(in thousands) | |||||||||||

Amount of gain on derivatives recognized in AOCIL during the period (effective portion) | Commodity Contracts | AOCIL | $ | 50,136 | $ | 16,811 | |||||

The Company has no derivatives designated as cash flow hedges at September 30, 2011. The following table details the ineffective portion of derivative instruments classified as cash flow hedges on the accompanying statements of operations for the three and nine-month periods ended September 30, 2010.

Location on Consolidated Statements of Operations | Loss (Gain) Recognized in Earnings (Ineffective Portion) | |||||||||

Derivatives Qualifying as Cash Flow Hedges | For the Three Months Ended September 30, 2010 | For the Nine Months Ended September 30, 2010 | ||||||||

(in thousands) | ||||||||||

Commodity Contracts | Unrealized and realized derivative (gain) loss | $ | 5,727 | $ | (4,095 | ) | ||||

Credit Related Contingent Features

As of September 30, 2011, and through the filing of this report, all of the Company’s derivative counterparties were members of the Company’s credit facility syndicate. The Company’s credit facility is secured by liens on substantially all of the Company’s proved oil and gas properties; therefore such counterparties do not currently require the Company to post cash collateral in instances where the Company is in a liability position under its derivative instruments. No collateral was posted as of September 30, 2011, or through the filing of this report.

19

Convertible Note Derivative Instruments

The contingent interest provision of the 3.50% Senior Convertible Notes is an embedded derivative instrument. As of September 30, 2011, and December 31, 2010, the fair value of this derivative was determined to be immaterial.

Note 11 - Fair Value Measurements

The Company follows fair value measurement authoritative guidance for all assets and liabilities measured at fair value. That guidance defines fair value as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the measurement date. Market or observable inputs are the preferred sources of values, followed by assumptions based on hypothetical transactions in the absence of market inputs. The hierarchy for grouping these assets and liabilities is based on the significance level of the following inputs:

• | Level 1 — quoted prices in active markets for identical assets or liabilities |

• | Level 2 — quoted prices in active markets for similar assets and liabilities, quoted prices for identical or similar instruments in markets that are not active, and model-derived valuations whose inputs are observable or whose significant value drivers are observable |

• | Level 3 — significant inputs to the valuation model are unobservable |

The following is a listing of the Company’s financial assets and liabilities that are measured at fair value and where they are classified within the hierarchy as of September 30, 2011:

Level 1 | Level 2 | Level 3 | |||||||||

(in thousands) | |||||||||||

Assets: | |||||||||||

Derivatives (a) | $ | — | $ | 94,589 | $ | — | |||||

Proved oil and gas properties (b) | $ | — | $ | — | $ | 19,113 | |||||

Liabilities: | |||||||||||

Derivatives (a) | $ | — | $ | 24,290 | $ | — | |||||

Net Profits Plan (a) | $ | — | $ | — | $ | 108,489 | |||||

(a) This represents a financial asset or liability that is measured at fair value on a recurring basis.

(b) This represents a nonfinancial asset that is measured at fair value on a nonrecurring basis.

The following is a listing of the Company’s financial assets and liabilities that are measured at fair value on a recurring basis and where they are classified within the hierarchy as of December 31, 2010:

Level 1 | Level 2 | Level 3 | |||||||||

(in thousands) | |||||||||||

Assets: | |||||||||||

Derivatives | $ | — | $ | 62,332 | $ | — | |||||

Liabilities: | |||||||||||

Derivatives | $ | — | $ | 114,601 | $ | — | |||||

Net Profits Plan | $ | — | $ | — | $ | 135,850 | |||||

Both financial and non-financial assets and liabilities are categorized within the hierarchy based on the lowest level of input that is significant to the fair value measurement. The following is a description of the valuation methodologies used by the Company as well as the general classification of such instruments pursuant to the hierarchy. There were no nonfinancial assets or liabilities measured at fair value on a nonrecurring basis at December 31, 2010.

20

Derivatives

The Company uses Level 2 inputs to measure the fair value of oil, natural gas, and NGL commodity derivatives. Fair values are based upon interpolated data. The Company derives internal valuation estimates taking into consideration the counterparties’ credit ratings, the Company’s credit rating, and the time value of money. These valuations are then compared to the respective counterparties’ mark-to-market statements. The considered factors result in an estimated exit-price that management believes provides a reasonable and consistent methodology for valuing derivative instruments.

Generally, market quotes assume that all counterparties have near zero, or low, default rates and have equal credit quality. However, an adjustment may be necessary to reflect the credit quality of a specific counterparty to determine the fair value of the instrument. The Company monitors the credit ratings of its counterparties and may ask counterparties to post collateral if their ratings deteriorate. In some instances the Company will attempt to novate the trade to a more stable counterparty.

Valuation adjustments are necessary to reflect the effect of the Company’s credit quality on the fair value of any liability position with a counterparty. This adjustment takes into account any credit enhancements, such as cash collateral that the Company may have posted with a counterparty, as well as any letters of credit between the parties. The methodology to determine this adjustment is consistent with how the Company evaluates counterparty credit risk, taking into account the Company’s credit rating, current credit facility margins, and any change in such margins since the last measurement date. All of the Company’s derivative counterparties are members of the Company's credit facility bank syndicate.

The methods described above may result in a fair value estimate that may not be indicative of net realizable value or may not be reflective of future fair values and cash flows. While the Company believes that the valuation methods utilized are appropriate and consistent with accounting authoritative guidance and with other marketplace participants, the Company recognizes that third parties may use different methodologies or assumptions to determine the fair value of certain financial instruments that could result in a different estimate of fair value at the reporting date.

Net Profits Plan

The Net Profits Plan is a standalone liability for which there is no available market price, principal market, or market participants. The inputs available for this instrument are unobservable and are therefore classified as Level 3 inputs. The Company employs the income approach, which converts expected future cash flow amounts to a single present value amount. This technique uses the estimate of future cash payments, expectations of possible variations in the amount and/or timing of cash flows, the risk premium, and nonperformance risk to calculate the fair value. There is a direct correlation between realized oil and gas commodity prices driving net cash flows and the Net Profits Plan liability. Generally, higher commodity prices result in a larger Net Profits Plan liability and vice versa.

The Company records the estimated fair value of the long-term liability for estimated future payments under the Net Profits Plan based on the discounted value of estimated future payments associated with each individual pool. The calculation of this liability is a significant management estimate. For those pools currently in payout, a discount rate of 12 percent is used to calculate this liability. A discount rate of 15 percent is used to calculate the liability for pools that have not reached payout. These rates are intended to represent the best estimate of the present value of expected future payments under the Net Profits Plan.

The Company’s estimate of its liability is highly dependent on commodity prices, cost assumptions, and the discount rates used in the calculations. The Company continually evaluates the assumptions used in this calculation in order to consider the current market environment for oil and gas prices, costs, discount rates, and overall market conditions. The Net Profits Plan liability is determined using price assumptions of five one-year strip prices with the fifth year’s pricing then carried out indefinitely. The average price is adjusted for realized price differentials and to include the effects of the forecasted production covered by derivatives contracts in the relevant periods. The non-cash expense associated with this significant management estimate is highly volatile from period to period due to fluctuations that occur in the crude oil, natural gas, and NGL commodity markets.

If the commodity prices used in the calculation changed by five percent, the liability recorded at September 30, 2011, would differ by approximately $9.1 million. A one percent increase in the discount rate would decrease the liability by approximately $4.8 million whereas a one percent decrease in the discount rate would increase the liability by approximately $5.3 million. Actual cash payments to be made to participants in future periods are dependent on realized actual production, realized commodity prices, and costs associated with the properties in each individual pool of the Net Profits Plan. Consequently, actual cash payments are inherently different from the amounts estimated.

No published market quotes exist on which to base the Company’s estimate of fair value of the Net Profits Plan liability. As

21

such, the recorded fair value is based entirely on management estimates that are described within this footnote. While some inputs to the Company’s calculation of fair value on the Net Profits Plan’s future payments are from published sources, others, such as the discount rate and the expected future cash flows, are derived from the Company’s own calculations and estimates.

The following table reflects the activity for the Net Profits Plan liability measured at fair value using Level 3 inputs:

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | ||||||||||||||

2011 | 2010 | 2011 | 2010 | ||||||||||||

(in thousands) | |||||||||||||||

Beginning balance | $ | 133,419 | $ | 136,420 | $ | 135,850 | $ | 170,291 | |||||||

Net (decrease) increase in liability (a) | (20,194 | ) | 9,328 | (2,001 | ) | 9,110 | |||||||||

Net settlements (a)(b)(c) | (4,736 | ) | (5,242 | ) | (25,360 | ) | (38,895 | ) | |||||||

Transfers in (out) of Level 3 | — | — | — | — | |||||||||||

Ending balance | $ | 108,489 | $ | 140,506 | $ | 108,489 | $ | 140,506 | |||||||

____________________________

(a) | Net changes in the Net Profits Plan liability are shown in the Change in Net Profits Plan liability line item of the accompanying statements of operations. |

(b) | Settlements represent cash payments made or accrued under the Net Profits Plan. The Company accrued or made cash payments under the Net Profits Plan relating to divestiture proceeds of $686,000 for the three months ended September 30, 2010, and $6.3 million and $20.8 million for the nine months ended September 30, 2011, and 2010, respectively. There were no cash payments made or accrued relating to divestiture proceeds for the three months ended September 30, 2011. |

(c) | During the first quarter of 2011, the Company made the decision to cash out several Net Profits Plan pools associated with the acquisition of Nance Petroleum Corporation in 1999, through a $2.6 million direct payment. As a result, the Company reduced its Net Profits Plan liability by that amount. There is no impact on the accompanying statements of operations for the three-month or nine-month periods ended September 30, 2011, related to these settlements. |