AS

FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION ON

| 1933 Act File No. 33-52850 |

| 1940 Act File No. 811-07242 |

| U.S. SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM

|

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | x |

| Pre-Effective Amendment No. | o |

| Post-Effective Amendment No. | [ 55 ] |

and/or

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | x |

| Amendment No. | [ 56 ] |

(Check appropriate box or boxes)

(Exact Name of Registrant as Specified in Charter)

525 Bigham Knoll

Jacksonville, Oregon 97530

Registrant’s Telephone Number, including Area Code: (888) 288-5374

The

Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, DE 19801

(Name and Address of Agent for Service)

It is proposed that this filing will become effective (check appropriate box):

| x | immediately upon filing pursuant to paragraph (b) |

| o | on (______________) pursuant to paragraph (b) |

| o | 60 days after filing pursuant to paragraph (a)(1) |

| o | on (date) pursuant to paragraph (a)(1) |

| o | 75 days after filing pursuant to paragraph (a)(2) |

| o | on (date) pursuant to paragraph (a)(2) of Rule 485 |

If appropriate, check the following box:

| o | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

CUTLER

EQUITY FUND

Ticker:

The

Cutler Equity Fund seeks current income and

long-term capital appreciation.

Prospectus

The U.S. Securities and Exchange Commission has not approved or disapproved the Fund’s shares or determined whether this Prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The Prospectus gives you important information about the Cutler Equity Fund (the “Fund” or the “Equity Fund”) that you should know before you invest. Please read this Prospectus carefully before investing and use it for future reference.

| Not A Deposit ● Not FDIC Insured ● May Lose Value ● No Bank Guarantee ● Not Insured By Any Government Agency |

| TABLE OF CONTENTS |

| Risk/Return Summary | 1 |

| Cutler Equity Fund | 1 |

| Investment Objective, Principal Investment Strategies and Principal Risks of the Fund | 9 |

| Related Risk | 11 |

| Management | 12 |

| The Adviser | 12 |

| Portfolio Managers | 12 |

| Other Service Providers | 13 |

| Your Account | 14 |

| How to Contact the Fund | 14 |

| General Information | 14 |

| Buying Shares | 15 |

| Investment Procedures | 17 |

| Selling Shares | 18 |

| Frequent Purchases and Redemptions of Fund Shares | 21 |

| Other Information | 22 |

| Distributions | 22 |

| Federal Taxes | 22 |

| Organization | 23 |

| Financial Highlights | 24 |

| Privacy Notice | 27 |

| For More Information | back cover |

2

| RISK/RETURN SUMMARY |

CUTLER EQUITY FUND

The investment objective of the Fund is to seek current income and long-term capital appreciation.

The following tables describe the fees and expenses that you will pay if you buy, hold and sell shares of the Equity Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

| Shareholder Fees (fees paid directly from your investment) |

(expenses that you pay each year as a percentage of the value of your investment) |

| Management Fees | |

| Service Fees(1) | |

| Other Expenses | |

Total Annual Fund Operating Expenses (2) |

| (1) |

| (2) |

3

This Example is intended to help you compare the cost of investing in the Equity Fund with the cost of investing in other mutual funds.

| 1 Year | 3 Years | 5 Years | 10 Years | |

| $ |

$ |

$ |

$ | |

The

Equity Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio).

A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Equity Fund shares are held

in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Equity Fund’s

performance. During the most recent fiscal year, the Equity Fund’s portfolio turnover rate was

In seeking to meet its investment objective, under normal conditions, at least 80% of the Equity Fund’s assets will be invested in a diversified portfolio of common stocks according to the investment style of the Fund’s Adviser. For purposes of this policy, “assets” shall mean net assets plus the amount of any borrowings for investment purposes (although the Equity Fund is not currently authorized by the Board to do so). The Adviser invests primarily in companies domiciled in the United States and chooses investments in common stocks based on its judgment of fundamental value, which emphasizes stocks that the Adviser judges to have favorable dividend yields and growth prospects relative to comparable companies. Factors deemed particularly relevant in determining fundamental value include:

| ● | earnings |

| ● | dividend and market price histories |

| ● | balance sheet characteristics |

| ● | perceived management skills |

Changes in economic and political outlooks, as well as corporate developments affecting individual companies, can influence specific security prices. The Equity Fund typically invests in stocks of companies that have a total market capitalization of at least $10 billion and, in the Adviser’s opinion, have institutional ownership that is sufficiently broad to provide adequate liquidity suitable to the Fund’s holdings.

The Adviser uses both “top-down” and “bottom-up” approaches, and investment selections are made using a fundamental approach. Top-down research involves the study of economic trends in the domestic and global economy, such as the fluctuation in interest or unemployment rates. These factors help to identify industries and sectors with the potential to outperform as a result of major economic developments. Bottom-up research involves detailed analysis of specific companies. Important factors include industry characteristics, profitability, growth dynamics, industry positioning, strength of management, valuation and expected return for the foreseeable future. Particular attention is paid to a company’s ability to pay or increase its current dividend.

The Adviser will sell securities for any one of three possible reasons:

| ● | When another company is found by the Adviser to have a higher current dividend yield or better potential for capital appreciation and dividend growth. |

| ● | If the industry moves in an unforeseen direction that negatively impacts the positioning of a particular investment or if the company’s strategy, execution or industry positioning itself deteriorates. The Adviser develops specific views on how industries are likely to evolve and how individual companies will participate in industry growth and change. |

| ● | If the Adviser believes that a company’s management is not acting in a forthright manner. |

4

Large-Cap Company Risk

The Equity Fund may invest in large-capitalization (“large-cap”) companies. Large-cap companies may be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes, and may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion.

Management Risk

Because the Equity Fund is actively managed, it is subject to the risk that the investment strategies, techniques and risk analyses employed by the Adviser may not produce the desired results. Poor security selection could cause the Equity Fund’s return to be lower than anticipated. Current income may be significant or very little, depending upon the Adviser’s portfolio selections for the Equity Fund.

Mid-Cap Company Risk

The Equity Fund may invest in mid-capitalization (“mid-cap”) companies. Mid-cap companies often involve higher risks than large-cap companies because these companies may lack the financial resources, product diversification and competitive strengths of larger companies. In addition, the frequency and volume of the trading of securities of mid-cap companies are substantially less than are typical of larger companies. Therefore, the securities of mid-cap companies may be subject to greater price fluctuations. Mid-cap companies also may not be widely followed by investors, which can lower the demand for their stock.

Stock Market Risk

All investments made by the Equity Fund have some risk. Among other things, the market value of any security in which the Equity Fund may invest is based upon the market’s perception of value and not necessarily the book value of an issuer or other objective measures of the issuer’s worth.

The Equity Fund may be an appropriate investment if you are seeking long-term growth in your investment and are willing to tolerate significant fluctuations in the value of your investment in response to changes in the market value of the stocks the Fund holds. This type of market movement may affect the price of the securities of a single issuer, a segment of the domestic stock market or the entire market. The investment style utilized for the Equity Fund could fall out of favor with the market. In addition, performance of the Equity Fund can be affected by unexpected local, state, regional, national or global events (e.g., significant earnings shortfalls or gains, war, political events, acts of terrorism, the spread of infectious diseases or other public health issues, and natural and environmental disasters) that cause major price changes in individual securities or market sectors.

In summary, but not inclusive of all possible risks, you could lose money on your investment in the Equity Fund, or the Fund could underperform other investments, if any of the following occurs:

| ● | The stock market goes down; |

| ● | The stock market undervalues the stocks in the Equity Fund’s portfolio; or |

| ● | The Adviser’s judgment as to the value of the Equity Fund’s stocks proves to be mistaken. |

For additional information regarding Market Risk, refer to “Market Risk” in the section titled “Investment Objective, Principal Investment Strategies and Principal Risks of the Fund” in the Fund’s prospectus.

Sector Risk

The Adviser may allocate more of the Fund’s investments to a particular sector or sectors in the market. If the Fund invests a significant portion of its total assets in certain sectors, its investment portfolio will be more susceptible to the financial, economic, business, and political developments that affect those sectors. For additional information regarding Sector Risk, please refer to “Principal Risks of Investing in the Cutler Equity Fund” found in “Investment Objective, Principal Investment Strategies and Principal Risks of the Fund” in the Fund’s prospectus.

5

COVID-19 Risk

An outbreak of infectious respiratory illness caused by a novel coronavirus known as COVID-19 was first detected in China in December 2019 and since then has spread globally. On March 11, 2020, the World Health Organization announced that it had made the assessment that COVID-19 could be characterized as a pandemic. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty. The value of the Fund and the securities in which the Fund invests may be adversely affected by impacts caused by COVID-19 and other epidemics and pandemics that may arise in the future.

EQUITY FUND

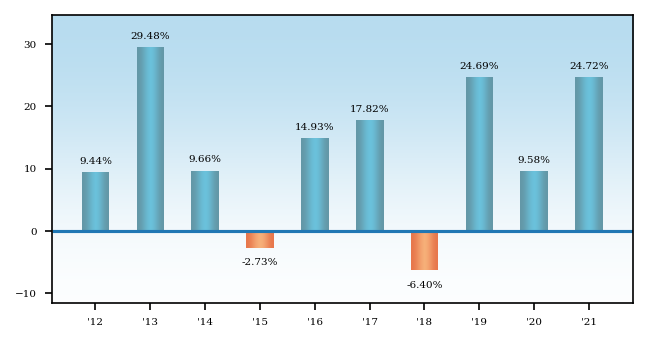

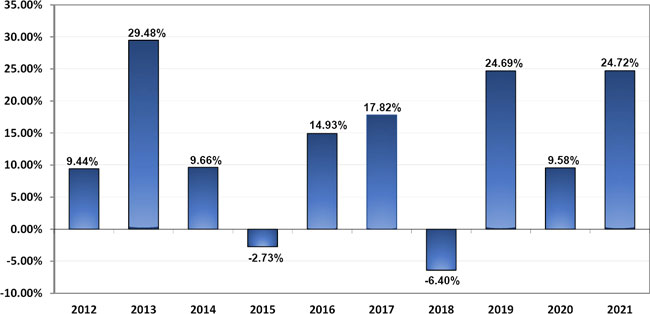

Year-by-year Annual Total Return as of 12/31 each year (%)

6

During

the periods shown in the bar chart,

| 1 Year | 5 Years | 10 Years | |

| Equity Fund | |||

| Return After Taxes on Distributions | |||

| Return After Taxes on Distributions and Sale of Fund Shares | |||

| Standard

& Poor’s 500 Index (S&P 500® Index) (1) ( |

|||

Standard & Poor’s 500 Value Index (S&P 500® Value Index)(2) ( |

|||

| (1) |

| (2) |

MANAGEMENT OF THE EQUITY FUND

Investment Adviser

Cutler Investment Counsel, LLC

Portfolio Managers

Matthew C. Patten and Erich M. Patten are jointly and primarily responsible for the day-to-day management of the portfolio of the Equity Fund. Matthew Patten is Chief Executive Officer and a Portfolio Manager of the Adviser and has been Co-Portfolio Manager of the Equity Fund since March 2003. Erich Patten is President and Chief Investment Officer and a Portfolio Manager of the Adviser and has been Co-Portfolio Manager of the Equity Fund since June 2003.

PURCHASE AND SALE OF FUND SHARES

Minimum Initial Investment

$2,500 ($2,000 for IRA)

7

Minimum Subsequent Investment

No minimum ($100 for Systematic Investment Plans)

General Information

You may purchase or redeem (sell) shares of the Equity Fund on each day that the New York Stock Exchange (the “NYSE”) is open for business. You may initiate transactions to purchase or redeem (sell) shares of the Equity Fund by written request, by telephone or through your financial intermediary.

TAX INFORMATION

The Equity Fund’s distributions are generally taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an IRA. If you are investing through a tax-deferred arrangement, you may be taxed later upon withdrawal of monies from such arrangement.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase the Equity Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Equity Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Equity Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

8

| INVESTMENT OBJECTIVE, PRINCIPAL INVESTMENT STRATEGIES AND PRINCIPAL RISKS OF THE FUND |

INVESTMENT OBJECTIVE

The investment objective of the Equity Fund is to seek current income and long-term capital appreciation. The investment objective of the Equity Fund may not be changed without shareholder approval.

PRINCIPAL INVESTMENT STRATEGIES OF THE CUTLER EQUITY FUND

In seeking to meet its investment objective, the Equity Fund expects that under normal conditions at least 80% of its assets will be invested in a diversified portfolio of common stocks according to the Adviser’s investment style. For purposes of this policy, “assets” shall mean net assets plus the amount of any borrowings for investment purposes (although the Equity Fund is not currently authorized by the Board to do so). The Equity Fund will provide the Fund’s shareholders with at least 60 days prior notice of any change by the Board in the Fund’s 80% investment policy.

The Adviser chooses investments in common stocks based on its judgment of fundamental value, which emphasizes stocks that the Adviser judges to have favorable dividend yields and growth prospects relative to comparable companies. Factors deemed particularly relevant in determining fundamental value include:

| ● | earnings |

| ● | dividend and market price histories |

| ● | balance sheet characteristics |

| ● | perceived management skills |

Changes in economic and political outlooks, as well as corporate developments affecting individual companies, can influence specific security prices. The Equity Fund typically invests in stocks of companies that have a total market capitalization of at least $10 billion and, in the Adviser’s opinion, have institutional ownership that is sufficiently broad to provide adequate liquidity suitable to the Fund’s holdings.

The Adviser uses both “top-down” and “bottom-up” approaches, and investment selections are made using a rigorous fundamental approach. Top-down research involves the study of economic trends in the domestic and global economy, such as the fluctuation in interest or unemployment rates. These factors help to identify industries and sectors with the potential to outperform as a result of major economic developments. Bottom-up research involves detailed analysis of specific companies. Important factors include industry characteristics, profitability, growth dynamics, industry positioning, strength of management, valuation and expected return for the foreseeable future. Particular attention is paid to a company’s ability to pay or increase its current dividend.

The Adviser will sell securities for any one of three possible reasons:

| ● | When another company is found by the Adviser to have a higher current dividend yield or better potential for capital appreciation and dividend growth. |

| ● | If the industry moves in an unforeseen direction that negatively impacts the positioning of a particular investment or if the company’s strategy, execution or industry positioning itself deteriorates. The Adviser develops specific views on how industries are likely to evolve and how individual companies will participate in industry growth and change. |

| ● | If the Adviser believes that a company’s management is not acting in a forthright manner. |

It is not the Equity Fund’s intent to engage in active and frequent trading of its portfolio securities based upon price movements alone. However, the Equity Fund’s rate of portfolio turnover will depend upon market and other conditions, and it will not be a limiting factor when portfolio changes are deemed necessary or appropriate by the Adviser. Frequent trading could increase the amount of capital gains realized by the Equity Fund and the Equity Fund’s transaction costs, which could reduce the Fund’s performance. The Equity Fund may hold cash or cash equivalents such as high quality, short-term money market instruments pending investment to retain flexibility in meeting redemptions and paying expenses.

9

PRINCIPAL RISKS OF INVESTING IN THE CUTLER EQUITY FUND

An investment in the Equity Fund is subject to investment risks; therefore you may lose money by investing in the Fund. There is no assurance that the Equity Fund will achieve its investment objective. The Equity Fund’s net asset value and total return will fluctuate based upon changes in the value of its portfolio securities. Upon redemption, an investment in the Equity Fund may be worth less than its original cost. The Equity Fund, by itself, does not provide a complete investment program. The Equity Fund is subject to the following principal risks (presented alphabetically):

COVID-19 Risk

An outbreak of infectious respiratory illness caused by a novel coronavirus known as COVID-19 was first detected in China in December 2019 and since then has spread globally. On March 11, 2020, the World Health Organization announced that it had made the assessment that COVID-19 could be characterized as a pandemic. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty. The value of the Fund and the securities in which the Fund invests may be adversely affected by impacts caused by COVID-19 and other epidemics and pandemics that may arise in the future.

Large-Cap Company Risk

The Equity Fund may invest in large-cap companies. Large-cap companies may be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes, and may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion. If valuations of large-cap companies appear to be greatly out of proportion to the valuations of small or medium capitalization companies, investors may migrate to the stocks of small and medium-sized companies.

Management Risk

Because the Equity Fund is actively managed, it is subject to the risk that the investment strategies, techniques and risk analyses employed by the Adviser may not produce the desired results. Poor security selection and/or investments that have unfavorable portfolio maturities could cause the Equity Fund’s return to be lower than anticipated. Current income may be significant or very little, depending upon the Adviser’s portfolio selections for the Equity Fund.

Mid-Cap Company Risk

The Equity Fund may invest in mid-cap companies. Mid-cap companies often involve higher risks than large cap companies because these companies may lack the financial resources, product diversification and competitive strengths of larger companies. In addition, the frequency and volume of the trading of securities of mid-cap companies are substantially less than are typical of larger companies. Therefore, the securities of mid-cap companies may be subject to greater price fluctuations. Mid-cap companies also may not be widely followed by investors, which can lower the demand for their stock. Mid-cap companies may also require substantial additional capital to support their operations, to finance expansion or to maintain their competitive position; and may have substantial borrowings or may otherwise have a weak financial condition, and may be susceptible to bankruptcy. Transaction costs for these investments are often higher than those of large-cap companies.

Some mid-cap companies also may be relatively new issuers, which carries risks in addition to the risks of other mid-cap companies. New issuers may be more speculative because such companies are relatively unseasoned. These companies will often be involved in the development or marketing of a new product with no established market, which could lead to significant losses.

Sector Risk

The Adviser may allocate more of the Fund’s investments to a particular sector or sectors in the market. If the Fund invests a significant portion of its total assets in certain sectors, its investment portfolio will be more susceptible to the financial, economic, business, and political developments that affect those sectors. A Fund overweight in its

10

investments in a particular sector may be more impacted by events that impact that sector and may be subject to greater risk of loss than a Fund that has a more diversified portfolio of investments.

Financial Sector Risk. Financial services companies are subject to extensive governmental regulation which may limit both the amounts and types of loans and other financial commitments they can make, the interest rates and fees they can charge, the scope of their activities, the prices they can charge and the amount of capital they must maintain. Profitability is largely dependent on the availability and cost of capital funds and can fluctuate significantly when interest rates change or due to increased competition. In addition, deterioration of the credit markets generally may cause an adverse impact in a broad range of markets, including U.S. and international credit and interbank money markets generally, thereby affecting a wide range of financial institutions and markets.

Stock Market Risk

All investments made by the Equity Fund have some risk. Among other things, the market value of any security in which the Equity Fund may invest is based upon the market’s perception of value and not necessarily the book value of an issuer or other objective measures of the issuer’s worth. A security’s value may also fall because of factors affecting not just the company but also companies in the same industry or in a number of different industries such as increases in production costs. The Equity Fund’s share price can fall because of, among other things, weakness in the broad market, a particular industry or specific holding, or changes in general economic conditions, such as prevailing interest rates or investor sentiment. The market as a whole can decline for many reasons, including disappointing corporate earnings, adverse political or economic developments here or abroad, changes in investor psychology, or heavy institutional selling.

The Equity Fund may be an appropriate investment if you are seeking long-term growth in your investment and are willing to tolerate significant fluctuations in the value of your investment in response to changes in the market value of the stocks the Fund holds. This type of market movement may affect the price of the securities of a single issuer, a segment of the domestic stock market or the entire market. The investment style utilized for the Equity Fund could fall out of favor with the market.

In addition, performance of the Equity Fund can be affected by unexpected local, state, regional, national or global events (e.g., significant earnings shortfalls or gains, war, political events, acts of terrorism, the spread of infectious diseases or other public health issues, and natural and environmental disasters) that cause major price changes in individual securities or market sectors. Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes and tsunamis, and widespread disease, including pandemics and epidemics, have been and can be highly disruptive to economies and the markets. Economies and financial markets throughout the world have become interconnected which increases the possibility that economic, financial, or political events in one country, sector or region could have potentially adverse effects on global economies or markets. Russia’s military invasion of Ukraine, the responses and sanctions by other countries, and the potential for wider conflicts, could continue to have adverse effects on regional and global economies and may further strain global supply chains and negatively affect global growth and inflation. Policy changes by the U.S. government and/or Federal Reserve and political events with the U.S. and abroad, such as changes in the U.S. presidential administration and Congress, may affect investor and consumer confidence, and adversely impact the financial markets.

In summary, you could lose money on your investment in the Equity Fund, or the Fund could underperform other investments, if any of the following occurs:

| ● | The stock market goes down; |

| ● | The stock market undervalues the stocks in the Equity Fund’s portfolio; or |

| ● | The Adviser’s judgment as to the value of the Equity Fund’s stocks proves to be mistaken. |

RELATED RISK

Temporary Defensive Position. In order to respond to adverse market, economic, or other conditions, the Fund may assume a temporary defensive position and invest without limit in cash or prime cash equivalents. As a result, the Fund may be unable to achieve its investment objective.

11

| MANAGEMENT |

The business of the Fund is managed under the direction of the Board of the Trust. The Board formulates the general policies of the Fund and meets periodically to review the Fund’s performance, monitor investment activities and practices and consider other matters affecting the Fund. Additional information regarding the Board, as well as the executive officers of the Trust, may be found in the Statement of Additional Information (the “SAI”).

THE ADVISER

Cutler Investment Counsel, LLC (the “Adviser”), 525 Bigham Knoll, Jacksonville, Oregon 97530, serves as investment adviser to the Equity Fund. The Adviser makes investment decisions for the Fund subject to the general oversight of the Board. The Adviser and its affiliated companies have provided investment management services since 1977.

For investment advisory services, the Equity Fund pays the Adviser a fee, which is accrued daily and paid monthly, at an annual rate of 0.75% of the Fund’s average daily net assets.

Effective October 28, 2021, the Fund’s Adviser has contractually agreed, until October 31, 2023, to reduce its management fees and to pay the Fund’s ordinary operating expenses to the extent necessary to limit Annual Fund Operating Expenses to an amount not exceeding 0.99% of the Fund’s average daily net assets. Any management fees reduced and ordinary operating expenses paid by the Adviser are subject to repayment by the Fund for a period of 3 years after such fees and expenses were reduced or paid, provided that the repayments do not cause Annual Fund Operating Expenses to exceed the foregoing expense limitation. Annual Fund Operating Expenses exclude brokerage costs, taxes, interest, acquired fund fees and expenses and extraordinary expenses. Prior to October 31, 2023, the expense limitation agreement may be modified or terminated only with approval by the Board of Trustees.

Prior to the expense limitation as stated in the preceding paragraph becoming effective on October 28, 2021, the Adviser had entered into an Expense Limitation Agreement under which it had contractually agreed to reduce its advisory fees and to pay the ordinary operating expenses of the Fund to the extent necessary to limit annual ordinary operating expenses to 1.15% of the Fund’s average daily net assets. Ordinary operating expenses exclude brokerage costs, taxes, interest, acquired fund fees and expenses and extraordinary expenses.

During the fiscal year ended June 30, 2022, the Adviser received an aggregate fee, net of any fee reductions or payments of ordinary operating expenses pursuant to applicable expense limitations, of 0.75% for investment advisory services performed, expressed as a percentage of average annual net assets of the Equity Fund. During the fiscal year ended June 30, 2022, the Adviser did not waive or reduce any advisory fees. As of June 30, 2022, no prior year fee reductions are available for repayment to the Adviser.

A discussion regarding the factors considered by the Board in its most recent approval of the Fund’s investment advisory agreement with the Adviser, including its conclusions with respect thereto, is available in the Fund’s annual report for the fiscal year ended June 30, 2022.

PORTFOLIO MANAGERS

Matthew C. Patten and Erich M. Patten are the portfolio managers of the Equity Fund and are responsible for the day-to-day investment policy, portfolio management and investment research for the Fund. Matthew Patten is responsible for the macro-economic analysis of the Equity Fund, reviewing sector allocations and industry weightings within the portfolio. Erich Patten analyzes which specific securities should be purchased or sold by the Equity Fund and then reviews these specific securities with Matthew Patten to determine if they are consistent with his macro-economic analysis of the Fund. While Erich Patten executes the timing of all purchase and sell orders, no securities are bought or sold by Erich Patten without the concurrence of Matthew Patten. The business experience and educational backgrounds of Matthew and Erich Patten are described below.

Mr. Matthew C. Patten, Co-Portfolio Manager of the Equity Fund, received his B.A. degree from Boston College in Economics and Environmental Geo-Science. He was awarded his MBA from the University of Chicago. Mr. Patten has been Chairman of the Board of The Cutler Trust since September, 2006. He has been a Member and

12

Portfolio Manager of the Adviser and its affiliates since 2003 and Chief Executive Officer of the Adviser since 2014.

Mr. Erich M. Patten, Co-Portfolio Manager of the Equity Fund, received his B.S. in Economics from The Wharton School, University of Pennsylvania. He received his Masters degree in Public Policy from The Harris School, University of Chicago. Mr. Patten has been President of The Cutler Trust since March, 2004. He has been a Member and Portfolio Manager of the Adviser and its affiliates since 2003 and Chief Investment Officer of the Adviser since 2014.

The SAI provides additional information about the portfolio managers’ compensation, other accounts managed and ownership of shares of the Equity Fund.

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus” or the “Transfer Agent”), provides certain administration, portfolio accounting, and transfer agent and shareholder services to the Equity Fund.

US Bank, N.A., provides custody services to the Equity Fund.

Ultimus Fund Distributors, LLC (the “Distributor”), the principal underwriter of the Equity Fund, acts as the Fund’s representative in connection with the offering of Fund shares. The Fund may be offered by other broker-dealers as well. The Distributor is affiliated with Ultimus but is not affiliated with the Adviser or its affiliated companies.

13

YOUR ACCOUNT

HOW TO CONTACT THE EQUITY FUND

Write to us at:

The

Cutler Trust

c/o Ultimus Fund Solutions, LLC

P.O. Box 46707

Cincinnati, Ohio 45246-0707

Overnight address:

The

Cutler Trust

c/o Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

Telephone us Toll-Free at:

(888)

CUTLER4

(888) 288-5374

GENERAL INFORMATION

The Equity Fund’s shares identified as TICKER: DIVHX are offered in this prospectus. The Equity Fund’s shares charge no front-end sales charges, impose no deferred sales charges and are not subject to any distribution (Rule 12b-1) fees. Pursuant to a Shareholder Service Plan, the Fund pays a shareholder service fee in an amount not to exceed 0.15% per annum of the Fund’s average daily net assets, and of this amount, the Board of the Trust has authorized the Fund to incur the actual expenditure of shareholder service fees up to 0.05% per annum of the Fund’s average daily net assets. For additional information, please see “Shareholder Service Plan” in this Prospectus.

You pay no sales charge to purchase or sell (redeem) shares of the Equity Fund. Shares are purchased and redeemed at the net asset value per share, or NAV, next calculated after the Transfer Agent receives your request in proper form. If the Transfer Agent receives your purchase or redemption request in proper form on a business day prior to 4:00 p.m., Eastern time, your transaction will be priced at that day’s NAV. If the Transfer Agent receives your purchase or redemption request after 4:00 p.m. on a business day or on a non-business day, your transaction will be priced at the next business day’s NAV. The Fund will not accept orders that request a particular day or price for the transaction or any other special conditions.

The Fund does not issue share certificates.

You will receive quarterly statements and a confirmation of each transaction. You should verify the accuracy of all transactions in your account as soon as you receive your confirmation.

The Fund may temporarily suspend the offering of shares during unusual market conditions or discontinue any shareholder service or privilege.

When and How NAV is Determined The Equity Fund calculates its NAV as of the close of the NYSE (normally 4:00 p.m., Eastern time) on each weekday, except on days when the NYSE is closed. The time at which the NAV is calculated may be changed in case of an emergency or if the NYSE closes early.

The Equity Fund’s NAV is determined by taking the market value of all securities owned by the Fund (plus all other assets such as cash), subtracting all liabilities and then dividing the result (net assets) by the total number of shares outstanding. To the extent any assets of the Fund are invested in other open-end management investment companies that are registered under the Investment Company Act of 1940 (the “1940 Act”), the Fund’s NAV with respect to those assets is calculated based upon the net asset values of the registered open-end management investment companies in which it invests, and the prospectuses for those companies explain the circumstances under which those companies will use fair value pricing and the effects of using fair value pricing.

The Equity Fund values securities for which market quotations are readily available at current market value. The Equity Fund values securities at fair value pursuant to procedures adopted by the Board if (1) market quotations are

14

insufficient or not readily available or (2) the Adviser believes that the prices or values available are unreliable due to, among other things, the occurrence of events after the close of the securities markets on which a Fund’s securities primarily trade but before the time as of which the Fund calculates its NAV (for example, if the exchange on which a portfolio security is principally traded closes early or if trading in a particular portfolio security was halted during the day and did not resume prior to the Fund’s NAV calculation). When fair value pricing is employed by the Fund, the prices of the securities used by the Fund to calculate its NAV may differ from quoted or published prices of the same securities.

Transactions Through Third Parties If you invest through a broker or other financial institution, the policies and fees charged by that institution may be different than those of the Equity Fund. Banks, brokers, retirement plans and financial advisers may charge transaction fees and may set different minimum investments or limitations on buying or selling shares. The Adviser may compensate certain financial institutions or broker-dealers in connection with the sale or expected sale of Fund shares. Consult a representative of your financial institution or retirement plan for further information.

Anti-Money Laundering Program Customer identification and verification are part of the Fund’s overall obligation to deter money laundering under federal law. When you open an account, the Fund will ask for your name, address, date of birth, social security number or taxpayer identification number, and other information that will allow the Fund to identify you. The Fund may also ask to see your driver’s license or other identifying documents. The Fund has adopted an Anti-Money Laundering Compliance Program designed to prevent the Fund from being used for money laundering or the financing of terrorist activities. In this regard, the Fund reserves the right, to the extent permitted by law, to (i) refuse, cancel or rescind any purchase order, (ii) freeze any account and/or suspend account services or (iii) involuntarily close your account in cases of threatening conduct or suspected fraudulent or illegal activity involving your investment in the Fund. These actions will be taken when, at the sole discretion of the Fund’s management, they are deemed to be in the best interest of the Fund or in cases when the Fund is requested or compelled to do so by governmental or law enforcement authorities. Any account closed by the Fund will be valued at the NAV as of the close of the NYSE on the day the account is closed, and redemption proceeds may be worth more or less than the original investment. If your account is closed at the request of governmental or law enforcement authority, you may not receive proceeds of the redemption if the Fund is required to withhold such proceeds and in some circumstances, the law may not permit the Fund to inform the shareholder that it has taken the actions described above.

BUYING SHARES

How to Make Payments All investments must be made by check or bank wire. All checks must be payable in U.S. dollars and drawn on a U.S. financial institution. The Equity Fund does not accept cash, drafts, third party checks, “starter” checks, traveler’s checks, credit card checks, post-dated checks, money orders, or cashier’s checks.

Checks Checks should be made payable to the Equity Fund or to The Cutler Trust. By sending your check to us, please be aware that you are authorizing the Fund to make a one-time electronic debit from your account at the financial institution indicated on your check. Your bank account will be debited as early as the same day we receive your payment in the amount of your check; no additional amount will be added to the total. The transaction will appear on your bank statement. Your original check will be destroyed once processed, and you will not receive your cancelled check back. If we cannot post the transaction electronically, you authorize us to present an image copy of your check for payment.

Bank Wires Instruct your financial institution with whom you have an account to make a federal funds wire payment to the Fund. Your financial institution may charge you a fee for this service. The Fund requires advance notification of all wire purchases in order to ensure that the wire is received in proper form and that your account is subsequently credited in a timely fashion for a given trade date. Failure to notify the Transfer Agent prior to the transmittal of the bank wire may result in a delay in purchasing shares of the Fund. An order is considered received when the Fund receives payment by wire in proper form. However, the completed and signed account application must be mailed to the Transfer Agent on the same day the wire payment is made.

Through Your Broker or Financial Institution Shares of the Equity Fund may be purchased through certain brokerage firms and financial institutions that are authorized to accept orders on behalf of the Fund and such organizations may be authorized to designate intermediaries to accept orders on behalf of the Fund. Orders will be

15

deemed to have been received by the Equity Fund when the authorized broker, or broker-authorized designee, receives the purchase order and orders will be priced at the NAV next determined after your order is received by such organization, or its authorized designee, in proper form. These organizations may charge you transaction fees on purchases of Fund shares and may impose other charges or restrictions or account options that differ from those applicable to shareholders who purchase shares directly through the Fund. These organizations may be the shareholder of record of your shares. The Fund is not responsible for ensuring that these organizations carry out their obligations to their customers. Shareholders investing in this manner should look to the organization through which they invest for specific instructions on how to purchase and redeem shares.

Retirement Accounts The Equity Fund offers IRA accounts, including traditional and Roth IRAs. Fund shares may also be an appropriate investment for other retirement plans. Before investing in any IRA or other retirement plan, you should consult your tax advisor. Whenever making an investment in an IRA, be sure to indicate the year for which the contribution is made.

Minimum Investments The Equity Fund accepts payment in the following minimum amounts:

|

Minimum Initial Investment |

Minimum Additional Investment |

| Standard Account | $2,500 | None |

| Traditional and Roth IRA Accounts | $2,000 | None |

| Accounts with Systematic Investment Plans | $2,500 | $100 |

The Adviser may, at its discretion, waive the above investment minimums.

Account Requirements

| Type of Account | Requirements |

Individual, Sole Proprietorship and Joint Accounts

Individual accounts are owned by one person, as are sole proprietorship accounts. Joint accounts have two or more owners (tenants). |

● Instructions must be signed by all persons exactly as their names appear on the account |

Gifts or Transfers to a Minor (UGMA,UTMA)

These custodial accounts provide a way to give money to a child and obtain tax benefits. |

● Depending on state laws, you can set up a custodial account under the UGMA or the UTMA

● The custodian must sign instructions in a manner indicating custodial capacity |

| Business Entities | ● Submit a secretary’s (or similar) certificate covering incumbency and authority |

Trusts

|

● The trust must be established before an account can be opened

● Provide the first and signature pages from the trust document and the pages identifying the trustees |

16

INVESTMENT PROCEDURES

| How to Open an Account | How to Add to Your Account |

By Check

● Call or write us for an account application

● Complete the application (and other required documents)

● Mail us your application (and other required documents) and a check |

By Check

● Fill out an investment slip from a confirmation or write us a letter

● Write your account number on your check

● Mail us the slip (or your letter) and a check |

By Bank Wire

● Call or write us for an account application

● Complete the application (and other required documents)

● Call us to fax the completed application (and other required documents) and we will assign you an account number

● Mail us your application (and other required documents)

● Instruct your financial institution to wire your money to us

|

By Bank Wire

● Call to notify us of your incoming wire

● Instruct your financial institution to wire your money to us |

By Systematic Investment

● Complete the Systematic Investment section of the application

● Attach a voided check to your application

● Mail us the completed application and the voided check

● We will electronically debit the purchase amount from the financial institution account identified in your account application | |

By Automated Clearing House (ACH)

● Complete the ACH Authorization section of the account application

● Attach a voided check to your application, if applicable

● Mail us the completed application and the voided check

● We will electronically debit the purchase amount from the financial institution account identified in your account application | |

Systematic Investments You may invest a specified amount of money in the Equity Fund once or twice a month on specified dates. These payments are taken from your account at your designated financial institution by ACH payment. ACH refers to the “Automated Clearing House” System maintained by the Federal Reserve Bank, which allows banks to process checks, transfer funds and perform other tasks. Systematic investments must be for at least $100.

Limitations on Purchases The Fund reserves the right to refuse any purchase request, particularly requests that could adversely affect the Fund or its operations. If the Fund refuses a purchase request, it will inform the investor of such rejection generally within one business day but may take up to three business days. This includes those from any individual or group who, in the Fund’s view, are likely to engage in excessive trading as described in “Frequent Purchases and Redemptions of Fund Shares” below.

Canceled or Failed Payments The Fund accepts checks and ACH transfers at full value subject to collection. If the Fund does not receive your payment for shares or you pay with a check or ACH transfer that does not clear, your purchase will be canceled. You will be responsible for any losses or expenses incurred by the Fund or the Transfer Agent, including a fee of $25 to defray bank charges, and the Fund may redeem other shares you own in the account as reimbursement. The Fund and their agents have the right to reject or cancel any purchase or redemption due to nonpayment.

17

SELLING SHARES

The Equity Fund processes redemption orders promptly. The length of time the Fund typically expects to pay redemption proceeds is similar regardless of whether the payment is made by check, wire, or ACH. The Fund typically expects to pay redemption proceeds for shares redeemed within the following days after receipt by the Transfer Agent of a redemption request in proper form:

| ● | For payment by check, the Fund typically expects to mail the check within one to three business days; |

| ● | For payment by wire or ACH, the Fund typically expects to process the payment within one to three business days. |

Payment of redemption proceeds may take longer than the time the Fund typically expects and may take up to 7 days, as permitted under the 1940 Act. Under unusual circumstances as permitted by the U.S. Securities and Exchange Commission (the “SEC”), the Fund may suspend the right of redemption or delay payment of redemption proceeds for more than 7 days. When shares are purchased by check or through ACH, the proceeds from the redemption of those shares will not be paid until the purchase check or ACH transfer has been converted to federal funds, which could take up to 15 calendar days.

How To Sell Shares From Your Account

By Mail

● Prepare a written request including:

● Your name(s) and signature(s)

● Your account number

● The Fund name

● The dollar amount or number of shares you want to sell

● How and where to send your proceeds

● Obtain a signature guarantee (if required)

● Obtain other documentation (if required)

● Mail us your request and documentation

|

By Telephone

● Call us with your request (unless you declined telephone authorization privileges on your account application)

● Provide the following information:

● Your account number

● Exact name(s) in which the account is registered

● Additional forms of identification

● Redemption proceeds will be:

● Mailed to your address on record or

● Wired to you (unless you declined wire redemption privileges on your account application)

|

By Bank Wire

● Wire redemptions are only available if your redemption is for $10,000 or more and you did not decline wire redemption privileges on your account application

● Call us with your request (unless you declined telephone redemption privileges on your account application) or

● Mail us your request

|

Through Broker or Financial Institutions

● Contact your broker or financial institution

● Request must be in proper form

● Third party may charge you additional transaction/redemption fees

|

Systematically

● Complete the systematic withdrawal section of the application

● Attach a voided check to your application

● Mail us your completed application

● Redemption proceeds will be electronically credited to your account at the financial institution identified on your account application |

|

Redemptions By Mail You may redeem shares by mailing a written request to The Cutler Trust, c/o Ultimus Fund Solutions, LLC, P.O. Box 46707, Cincinnati, Ohio 45246-0707. Written requests must state the shareholder’s name, the name of the Fund, the account number and the shares or dollar amount to be redeemed and be signed exactly as the shares are registered and may require a signature guarantee as discussed below.

If you own an IRA or other retirement plan, you must indicate on your redemption request whether the Fund should withhold federal income tax. Unless you elect in your redemption request that you do not want to have federal tax

18

withheld, the redemption will be subject to withholding. Please consult your tax adviser for any tax related IRA distribution questions.

Telephone and Bank Wire Redemption Privileges You may redeem Fund shares having a value of $50,000 or less by telephone unless you declined telephone redemption privileges on your account application. Telephone redemptions may be requested only if the proceeds are to be sent to the shareholder of record and mailed to the address on record with the Fund. Upon request, redemption proceeds of $100 or more may be transferred electronically from an account you maintain with a financial institution by ACH payment, and proceeds of $10,000 or more may be transferred by wire, in either case to the account stated on the account application. Shareholders will be charged a fee of $15 by the Fund’s custodian for outgoing wires. Account designations may be changed by sending the Transfer Agent a written request with all signatures guaranteed as described below.

IRA distributions may also be made by telephone. Shareholders who redeem shares held in an IRA will be asked to designate whether or not to withhold federal income taxes from the distribution. If no such instruction is provided, IRA redemptions will be subject to federal tax withholding. Please consult your tax adviser for any tax related IRA distribution questions.

The Transfer Agent requires personal identification before accepting any redemption request by telephone. Telephone redemption instructions may be recorded. If reasonable procedures are followed by the Transfer Agent to verify that the order is genuine, neither the Transfer Agent nor the Fund will be liable for losses due to unauthorized or fraudulent telephone instructions. In the event of drastic economic or market changes, a shareholder may experience difficulty in redeeming shares by telephone. If such an event should occur, redemption by mail should be considered.

During periods of high market activity, you may encounter higher than usual wait times for telephone transactions. Please allow sufficient time to ensure that you will be able to complete your telephone transaction prior to market close. Neither the Fund nor its transfer agent will be held liable if you are unable to place your trade due to high call volume.

Systematic Withdrawals If you own shares of the Equity Fund with an aggregate value of at least $10,000, you may request a specified amount of money from your account once each month or once each quarter on a specified date. These payments are sent from your account to a designated bank account by ACH payment. Systematic withdrawals must be for at least $100.

Through Your Broker or Financial Institution You may also redeem shares through a brokerage firm or financial institution that has been authorized to accept orders on behalf of the Equity Fund at the NAV next determined after your order is received by such organization in proper form. NAV is normally determined as of 4:00 p.m., Eastern time. Your brokerage firm or financial institution may require a redemption request to be received at an earlier time during the day in order for your redemption to be effective as of the day the order is received. These organizations may be authorized to designate other intermediaries to act in this capacity. In addition, orders will be deemed to have been received by the Fund when the authorized broker, or broker-authorized designee, receives the redemption order. Such an organization may charge you transaction fees on redemptions of Fund shares and may impose other charges or restrictions or account options that differ from those applicable to shareholders who redeem shares directly through the Transfer Agent.

Signature Guarantee Requirements To protect you and the Equity Fund against fraud, certain requests require a signature guarantee. A signature guarantee verifies the authenticity of your signature. You will need to have your signature guaranteed in certain situations, such as:

| ● | If the shares redeemed have a value greater than $50,000 |

| ● | If you are changing a shareholder’s name of record |

| ● | If the payment of the proceeds of a redemption of any amount are to be sent to any person, address or bank account not on record |

| ● | If the redemption of any amount is to occur where the name(s) or the address on your account has changed within the previous 15 days |

19

| ● | If you are transferring redemption proceeds to another account with a different registration (name/ownership) from yours |

The Equity Fund will accept signatures guaranteed by a domestic bank or trust company, broker, dealer, clearing agency, savings association, or other financial institution which participates in the STAMP Medallion signature guarantee program sponsored by the Securities Transfer Association. Signature guarantees from financial institutions which do not participate in the STAMP Medallion program will not be accepted. A notary public cannot provide a signature guarantee. Members of the STAMP Medallion program are subject to dollar limitation which must be considered when requesting their guarantee. The Fund may reject any signature guarantee if it believes the transaction would otherwise be improper.

The Fund and its Transfer Agent reserve the right to require signature guarantees on all redemptions. The Fund and its Transfer Agent reserve the right to amend these standards at any time without notice.

Redemption requests by corporate and fiduciary shareholders must be accompanied by appropriate documentation establishing the authority of the person seeking to act on behalf of the account. Forms of resolutions and other documentation to assist in compliance with the Transfer Agent’s procedures may be obtained by calling the Transfer Agent.

Minimum Account Balance If the value of your Fund account falls below $2,500 (not including IRAs), the Fund may ask you to increase your balance. If the account value is still below $2,500 after 60 days, the Fund may close your account and send you the proceeds. The Fund will not close your account if the value of your account falls below $2,500 solely as a result of a reduction in your account’s market value.

Redemption Requests The Fund typically expects that it will take up to three business days following receipt of your redemption request to pay out redemption proceeds by check or electronic transfer. The Fund typically expects to pay redemptions from cash, cash equivalents, proceeds from the sale of Fund shares, any lines of credit, and then from the sale of portfolio securities. These redemption payment methods will be used in regular and stressed market conditions. On a less regular basis, and if the Adviser believes it is in the best interest of the Fund and its shareholders not to sell portfolio assets, the Fund may satisfy redemption requests by using short-term borrowing from the Fund’s custodian. In addition to paying redemption proceeds in cash, the Fund reserves the right to make payment for a redemption in securities rather than cash, which is known as a “redemption in kind.” Redemptions in kind will be made only under extraordinary circumstances and if the Fund deems it advisable for the benefit of all shareholders, such as a very large redemption that could affect Fund operations (for example, more than 1% of the Fund’s net assets). A redemption in kind will consist of securities equal in market value to the Fund shares being redeemed, using the same valuation procedures that the Fund uses to compute its NAV. Pursuant to procedures adopted by the Board, redemption in kind transactions will typically be made by delivering readily marketable securities to the redeeming shareholder within 7 days after the Fund’s receipt of the redemption order in proper form. Readily marketable securities may include illiquid securities, which may take a while for the redeeming shareholder to sell. If the Fund redeems your shares in kind, it will value the securities pursuant to the policies and procedures adopted by the Board. If the Adviser has no pecuniary interest influencing the selection of securities, then the Adviser has discretion with respect to the Fund’s redemptions in-kind, subject to its fiduciary duties, as long as such redemptions in-kind are made in accordance with the Fund’s procedures. If the Adviser has a pecuniary interest influencing the selection of securities, then the Adviser will (i) submit for the Board’s approval a proposed distribution method in accordance with the Fund’s procedures, or (ii) distribute each security held by the Fund on a pro rata basis, excluding certain types of securities such as those that are unregistered, not publicly traded, or for which market quotations are not readily available, among others pursuant to the Fund’s procedures. You will bear the market risks associated with maintaining or selling the securities that are transferred as redemption proceeds. In addition, when you sell these securities, you will pay taxes and brokerage charges associated with selling the securities.

Lost Accounts The Transfer Agent will consider your account lost if correspondence to your address of record is returned as undeliverable on more than two consecutive occasions, unless the Transfer Agent determines your new address. When an account is lost, all distributions on the account will be reinvested in additional Fund shares. In addition, the amount of any outstanding checks (unpaid for six months or more) or checks that have been returned to the Transfer Agent will be reinvested at the then-current NAV and the checks will be canceled. However, checks will not be reinvested into accounts with a zero balance. If a check is not reinvested due to the account having a

20

zero balance, the Transfer Agent will continue to search for the lost shareholder until such time as the funds are escheated to the applicable state government, in accordance with the laws of such state.

Online Account Access To establish internet transaction privileges, you must enroll through the website. You automatically have the ability to establish internet transaction privileges unless you decline the privileges on your New Account Application or IRA Application. You will be required to enter into a user’s agreement through the website in order to enroll in these privileges. To purchase shares through the website, you must also have ACH instructions on your account. Redemption proceeds may be sent to you by check to the address or record, or if your account has existing bank information, by wire or ACH. Only bank accounts held at domestic financial institutions that are ACH members can be used for transactions through the Fund’s website. Transactions through the website are subject to the same minimums and maximums as other transaction methods. Please call (888) 288-5374 for assistance in establishing online access.

You should be aware that the internet is an unsecured, unstable, unregulated and unpredictable environment. Your ability to use the website for transactions is dependent upon the internet and equipment, software, systems, data and services provided by various vendors and third parties. While the Fund and its service providers have established certain security procedures, the Fund, their distributor and their transfer agent cannot assure you that trading information will be completely secure.

There may also be delays, malfunctions, or other inconveniences generally associated with this medium. There also may be times when the website is unavailable for Fund transactions or other purposes. Should this happen, you should consider purchasing or redeeming shares by another method. Neither the Fund nor their transfer agent, distributor nor Adviser will be liable for any such delays or malfunctions or unauthorized interception or access to communications or account information.

FREQUENT PURCHASES AND REDEMPTIONS OF FUND SHARES

The Equity Fund has been designed as a long-term investment and not as a frequent or short-term trading (“market timing”) option. The Fund discourages frequent purchases and redemptions. Accordingly, the Board has adopted policies and procedures in an effort to detect and prevent market timing in the Fund. The Fund, through its service providers, monitor shareholder trading activity to ensure it complies with the Fund’s policies. The Fund prepares reports illustrating purchase and redemption activity to detect market timing activity. These actions, in the Board’s opinion, should help reduce the risk of abusive trading in the Fund. In addition, the Fund also reserves the right to reject any purchase request that it believes to be market timing or potentially disruptive in nature. The Fund may also modify any terms or conditions relating to the purchase of shares or withdraw all or any part of the offering made by this Prospectus.

The Fund believes that market timing activity is not in the best interest of shareholders. Market timing can be disruptive to the portfolio management process and may adversely impact the ability of the Adviser to implement the Fund’s investment strategies. In addition to being disruptive, the risks to the Fund presented by market timing are higher expenses through increased trading and transaction costs; forced and unplanned portfolio turnover; large asset swings that decrease the Fund’s ability to maximize investment return; and potentially diluting the value of the Fund’s shares. These risks can have an adverse effect on the Fund’s performance.

When financial intermediaries establish omnibus accounts in the Equity Fund for their clients, the Fund cannot monitor the individual clients’ trading activity. However, the Fund’s service providers, along with the Fund’s Chief Compliance Officer, review trading activity at the omnibus account level and look for activity that may indicate potential frequent trading or market timing. If the Fund detects suspicious trading activity, the Fund will seek the assistance of the intermediary to investigate that trading activity and take appropriate action, including prohibiting additional purchases of Fund shares by the intermediary and/or its client. Each intermediary that offers the Fund’s shares through an omnibus account has entered into an information sharing agreement with the Fund designed to assist the Fund in stopping future disruptive trading. Intermediaries may apply frequent trading policies that differ from those described in this Prospectus. If you invest through an intermediary, please read that firm’s program materials carefully to learn of any rules or fees that apply.

Although the Fund has taken these steps to discourage frequent purchases and redemptions of shares, the Fund cannot guarantee that such trading will not occur.

21

SHAREHOLDER SERVICE PLAN

The Fund has adopted a Shareholder Service Plan (the “Plan”) permitting the Fund to compensate broker-dealers and financial institutions for providing shareholder services, including but not limited to, (i) establishing and maintaining accounts and records; (ii) answering shareholder inquiries regarding the manner in which purchases, exchanges and redemptions of shares may be effected and other matters pertaining to the Trust’s services; (iii) providing necessary personnel and facilities to establish and maintain shareholder accounts and records; (iv) assisting shareholders in arranging for processing purchase, exchange and redemption transactions; (v) arranging for the wiring of funds; (vi) guaranteeing shareholder signatures in connection with redemption orders and transfers and changes in shareholder-designated accounts; (vii) responding to customer inquiries and requests regarding statements of additional information, shareholder reports, notices, proxies and proxy statements and other Fund documents, or integrating periodic statements with other shareholder transactions; and (viii) providing such other related services as the shareholder may request. The maximum amount that may be incurred under the Plan is 0.15% per annum of the Fund’s average daily net assets. The Board has authorized the Fund to spend not more than 0.05% of the Fund’s average net assets under the Plan without further approval from the Board. During the fiscal year ended June 30, 2022, the Fund incurred $76,252 of shareholder services fees pursuant to this Plan.

| OTHER INFORMATION |

DISTRIBUTIONS

The Equity Fund declares dividends, if any, from net investment income and pays those dividends quarterly. Any net capital gains realized by the Fund will be distributed at least annually.

All distributions are reinvested in additional shares, unless you elect to receive distributions in cash. For federal income tax purposes, distributions are treated the same whether they are received in cash or reinvested in additional shares. Shares become entitled to receive distributions on the day after the shares are issued.

FEDERAL TAXES

The following information is meant as a general summary for U.S. taxpayers. Additional information appears in the SAI. Shareholders should rely on their own tax advisors for advice about the particular federal, state and local tax consequences of investing in the Fund.

The Fund intends to operate in a manner such that it will not be liable for federal income or excise taxes.

You will generally be taxed on the Fund’s distributions, regardless of whether you reinvest them or receive them in cash. Distributions of net investment income (including short-term capital gains) are generally taxable to you as ordinary income. A portion of the dividends paid by the Fund may be eligible for the dividends-received deduction for corporate shareholders. Distributions of long-term capital gains are taxable to you as long-term capital gains, regardless of how long you have held your shares. Distributions may also be subject to certain state and local taxes.

A portion of the Fund’s distributions may be treated as “qualified dividend income,” taxable to individuals at a maximum federal income tax rate of 20%. A distribution is treated as qualified dividend income to the extent that the Fund receives dividend income from taxable domestic corporations and certain qualified foreign corporations, provided that holding periods and other requirements are met.

Distributions of capital gains and net investment income reduce the NAV of the Fund’s shares by the amount of the distribution. If you purchase shares prior to these distributions, you are taxed on the distribution even though the distribution represents a return of your investment.

The sale of Fund shares is a taxable transaction for federal income tax purposes. You will recognize a gain or loss on such transaction equal to the difference, if any, between the amount of your net sales proceeds and your tax basis in the Fund shares. Such gain or loss will be a capital gain or loss if you held your Fund shares as capital assets. Any capital gain or loss will be treated as a long-term capital gain or loss if you held your Fund shares for more than one year at the time of the sale.

The Fund may be required to withhold federal income tax at the required federal backup withholding rate (currently 24%) on all taxable distributions payable to you if you fail to provide the Fund with your correct taxpayer

22

identification number or to make required certifications, or if you have been notified by the Internal Revenue Service (the “IRS”) that you are subject to backup withholding. Backup withholding is not an additional tax. Any amounts withheld may be credited against your federal income tax liability.

The Fund is required to report to the IRS, and furnish to shareholders, on Form 1099-B the basis, holding period and gross proceeds received with respect to any sale of Fund shares acquired after January 1, 2012 (“Covered Shares”). The Fund has selected Average Cost, which is the mutual fund industry standard, as the Fund’s default basis calculation method. If a shareholder determines that another IRS-approved basis calculation method is more beneficial, the shareholder may be able to elect such other method by contacting the Fund at the time of or in advance of the redemption of Covered Shares. IRS regulations do not permit the change of a basis election on previously executed trades. All Covered Shares purchased in non-retirement accounts are subject to these basis reporting requirements. Basis information will not be reported to the IRS or shareholder upon the redemption of any non-covered shares. Non-covered shares will be treated as having been redeemed before any covered shares, unless otherwise specified. You should consult your tax or financial advisor about the application of the basis reporting rules to you, especially whether you should elect a method other than Average Cost.

All Covered Shares purchased in non-retirement accounts are subject to the cost basis reporting legislation. Non-covered shares are mutual fund shares that were acquired prior to the effective date of January 1, 2012. Cost basis information will not be reported to the IRS or shareholder upon the sale of any non-covered mutual fund shares. Non-covered shares will be redeemed first unless otherwise specified.

The Equity Fund will mail a statement to you annually containing information about the income tax status of distributions paid during the year.

ORGANIZATION

The Cutler Trust (the “Trust”) is a Delaware statutory trust registered with the SEC as an open-end management investment company, or mutual fund. The Equity Fund is a series of the Trust. It is not intended that meetings of shareholders be held except when required by federal or Delaware law. Shareholders of the Equity Fund are entitled to vote at shareholders’ meetings for such things as approval of an investment advisory agreement.

23

FINANCIAL HIGHLIGHTS

The financial highlights tables on the following pages are intended to help you understand the Equity Fund’s financial performance for the past 5 years. Certain information reflects financial results for a single Fund share. The total returns in the tables represent the rate that an investor would have earned or lost on an investment in the Fund (assuming the reinvestment of all dividends and distributions). The annual financial statements have been audited by Cohen & Company, Ltd., independent registered public accounting firm, whose report, along with the Fund’s financial statements, is included in the Fund’s annual report and is available upon request.

Please turn to the back cover of this Prospectus to find out how you can obtain a copy of these reports without charge.

24

| CUTLER EQUITY FUND |

| FINANCIAL HIGHLIGHTS |

| Per Share Data for a Share Outstanding Throughout Each Year |

| Years Ended June 30, | ||||||||||||||||||||

| 2022 | 2021(a) | 2020 | 2019 | 2018 | ||||||||||||||||

| Net asset value at beginning of year | $ | 26.11 | $ | 19.90 | $ | 20.67 | $ | 19.82 | $ | 18.39 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income | 0.33 | 0.32 | 0.33 | 0.31 | 0.28 | |||||||||||||||

| Net realized and unrealized gains (losses) on investments | (1.46) | 7.17 | (0.21) | 1.62 | 1.68 | |||||||||||||||

| Total from investment operations | (1.13) | 7.49 | 0.12 | 1.93 | 1.96 | |||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.32) | (0.32) | (0.33) | (0.31 | ) | (0.28) | ||||||||||||||

| Net realized gains | (1.77) | (0.96) | (0.56) | (0.77 | ) | (0.25) | ||||||||||||||

| Total distributions | (2.09) | (1.28) | (0.89) | (1.08 | ) | (0.53) | ||||||||||||||

| Net asset value at end of year | $ | 22.89 | $ | 26.11 | $ | 19.90 | $ | 20.67 | $ | 19.82 | ||||||||||

| Total return (b) | (5.04%) | 38.64% | 0.39% | 10.36% | 10.63% | |||||||||||||||

| Net assets at end of year (000’s) | $ | 175,816 | $ | 193,953 | $ | 147,207 | $ | 159,665 | $ | 150,597 | ||||||||||

| Ratios/supplementary data: | ||||||||||||||||||||

| Ratio of total expenses to average net assets | 0.99% | 1.02% | 1.16% | 1.16% | 1.16% | |||||||||||||||

| Ratio of net expenses to average net assets (c) | 0.99% | 1.04% | 1.15% | 1.15% | 1.15% | |||||||||||||||

| Ratio of net investment income to average net assets (c) | 1.26% | 1.36% | 1.58% | 1.56% | 1.41% | |||||||||||||||

| Portfolio turnover rate | 1% | 7% | 6% | 5% | 10 | % | ||||||||||||||

| (a) | Effective October 28, 2020, all existing shares of the Fund converted to Class II shares. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if the Adviser had not reduced advisory fees for the years ended June 30, 2020, 2019 and 2018 and would have been higher for the year ended June 30, 2021 had the Adviser not recouped prior year fee reductions. |

| (c) | Ratio was determined after investment advisory fee reductions and/or recoupments of previous investment advisory fee reductions for the years ended June 30, 2021, 2020, 2019 and 2018. |

25

[Page

intentionally left blank.]

26

|

PRIVACY NOTICE

Rev. August 2010 |

| FACTS | WHAT DOES THE CUTLER TRUST DO WITH YOUR PERSONAL INFORMATION? | ||

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. | ||

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include:

■ Social Security number

■ Assets

■ Retirement Assets

■ Transaction History

■ Checking Account Information

■ Purchase History

■ Account Balances

■ Account Transactions

■ Wire Transfer Instructions

When you are no longer our customer, we continue to share your information as described in this notice. | ||

| How? | All financial companies need to share your personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons The Cutler Trust chooses to share; and whether you can limit this sharing. | ||