| OMB APPROVAL |

|

OMB Number: 3235-0570 hours per response: 20.6

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-07242 |

| The Cutler Trust |

| (Exact name of registrant as specified in charter) |

| 525 Bigham Knoll Jacksonville, Oregon | 97530 |

| (Address of principal executive offices) | (Zip code) |

Matthew C. Patten

| Cutler Investment Counsel, LLC 525 Bigham Knoll Jacksonville, Oregon 97530 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (541) 770-9000 |

| Date of fiscal year end: | June 30 | |

| Date of reporting period: | June 30, 2021 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) |

CUTLER EQUITY FUND

ANNUAL REPORT

June 30, 2021

| CUTLER EQUITY FUND |

| TABLE OF CONTENTS |

| Page | |

| Letter to Shareholders | 2 |

| Management Discussion of Fund Performance | 4 |

| Performance Information | 7 |

| Portfolio Information | 8 |

| Schedule of Investments | 9 |

| Statement of Assets and Liabilities | 12 |

| Statement of Operations | 13 |

| Statements of Changes in Net Assets | 14 |

| Financial Highlights | 16 |

| Notes to Financial Statements | 17 |

| Report of Independent Registered Public Accounting Firm | 23 |

| About Your Fund’s Expenses | 24 |

| Federal Tax Information | 26 |

| Trustees and Officers of the Trust | 27 |

| Additional Information | 29 |

| Approval of Investment Advisory Agreement | 30 |

| CUTLER EQUITY FUND |

| LETTER TO SHAREHOLDERS |

To Shareholders of the Cutler Equity Fund:

What a difference a year makes! The past year has been challenging in many ways, but the economy has been in full recovery-mode since the pandemic recession. In response to last year’s shutdown policies, the government compensated for the commensurate drop in demand with a multi-faceted fiscal response: zero percent interest rates, continued quantitative easing through open market bond purchases, multiple rounds of financial support for individuals and businesses. And the stimulus has continued well into 2021. As we write this, a $1 trillion infrastructure bill is working its way through the halls of Congress.

Stocks rose rapidly in anticipation of this economic growth, proving that once again the “wisdom of crowds” can be a prescient forecaster. Markets anticipated the subsequent earnings growth achieved by S&P 500 companies, which has been nothing short of spectacular. The past four quarterly GDP numbers have been +33.8%, +4.5%, +6.3% and +6.5% - wow! Valuations are expensive, but growth is robust and the alternatives such as bonds are in many ways unattractive. Stocks continue to benefit from this lack of viable investment alternatives.

News of the spread of the Delta variant has shed light on the continued efforts of living through this pandemic era. Zoom calls are not going away, nor is the appeal of socially distant activities. Companies and consumers are learning to adjust to this new reality. There is no going back, but we also believe that markets will continue to look forward. While there are many risks on the horizon, quality dividend paying stocks have a long history of returns that we find attractive. We continue to like the risk profile of large capitalization, dividend paying companies, which showed their resolve during the market stress we witnessed last year. Should risk once again return to the markets, for example if GDP growth were to decelerate, we believe dividend stocks are an attractive option for conservatively minded investors. We continue to manage the Cutler Equity Fund with our long-term philosophy of buying companies with a track-record of dividend success.

Thank you for your continued support of Cutler through your participation in the Cutler Equity Fund. Should you have any questions about your investment in the Cutler Equity Fund, we would welcome the conversation.

Sincerely,

|

| |

| Matthew C. Patten | Erich M. Patten | |

| Chairman | Chief Investment Officer | |

| The Cutler Trust | Cutler Investment Counsel, LLC |

| CUTLER EQUITY FUND |

| LETTER TO SHAREHOLDERS |

| (Continued) |

The views in this report were those of the Cutler Equity Fund’s investment adviser as of June 30, 2021 and may not reflect its views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investment in the Cutler Equity Fund and do not constitute investment advice.

| CUTLER EQUITY FUND |

| MANAGEMENT DISCUSSION OF FUND PERFORMANCE |

1) How did the Equity Fund perform last year?

The Cutler Equity Fund has a net return of 38.64% for the year ended June 30, 2021.

| 2) | What were the most significant market factors affecting the Fund’s performance during the past year? |

Market factors included:

| 1) | Federal Reserve policy |

| 2) | GDP growth |

| 3) | Government economic support |

| 3) | How did the Fund perform relative to the benchmark? |

The Cutler Equity Fund lagged the S&P 500 Index, its benchmark, which had a return of 40.79%. The S&P 500 Index had a dramatic rise from the bear market lows earlier in the year. This index is increasingly dominated by a few Technology companies, who are largely not eligible for our dividend-based criteria. The Fund compares very well with the S&P 500 Value Index, the performance of which is included in the chart below. The Fund continues to be highly rated in Morningstar’s Large Value category, with a 4-star overall rating and a 5-star 3-year rating, as of June 30, 2021, out of 1141 funds for both time periods, based on risk-adjusted return*.

4) What strategies did you use to manage the Fund?

Cutler’s investment process focuses on dividends as the primary driver of investment returns. The strategy was unchanged in the previous year, and the management of the Fund was consistent with previous years. We look for holdings in the portfolio that maintain a 10-year record of consistent dividend payments (or equivalently through a corporate merger/spin-off) and typically have a total market capitalization of at least $10 billion. We seek relative value as compared to other companies in similar industries. The strategy is further detailed in the Fund’s prospectus.

| 5) | What were the primary strategic factors that guided your management of the Fund? |

Cutler’s dividend criteria have been the primary strategic factors used in managing the Fund this past year. For example, Cutler looks for companies that have at least a 10-year history of maintaining or increasing dividend. We believe this criterion results in a portfolio of companies

| CUTLER EQUITY FUND |

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Continued) |

with stable earnings and sound business models. In addition, the Fund’s portfolio managers continue to focus on companies they believe offer attractive current yields and the potential for total return.

Portfolio turnover of the Fund remained low this past year at 7%. We believe that lower turnover results in fewer shareholder costs, and we look to reduce unnecessary trading in the investment strategy.

| 6) | What were some of the key trends in each of the regions/significant industries in which the Fund invests? |

The Fund’s holdings are domiciled in the U.S., and the strategies employed do not have any additional regional bias. In certain cases, holdings may have legal registration outside of the U.S. but are considered domestic due to the locality of their operations.

The most impactful trend has been the broad rise of investment assets. Bonds, stocks, and real estate are all trading near all-time highs. Inflation thus far in 2021 has also been running above recent historical averages. Overall, the rising tide has lifted all boats, and equities generally have participated in this trend.

Certain industries have been reshaped by the coronavirus pandemic. Restaurants have struggled to find workers, airlines and cruise ship demand have bounced back but are well below pre-pandemic levels. Our universe of investable securities has been impacted by the Coronavirus Recession. While the portfolio has not seen significant dividend cuts, certain eligible airlines and energy companies no longer meet our investing criteria. This was also the case in previous downturns, such as when Financials largely cut their dividend during the Great Recession.

| 7) | Which securities helped the Fund’s performance? |

| a) | Deere & Company |

| b) | Carrier Global Corporation |

| c) | Charles Schwab Corporation (The) |

| 8) | Did any securities hurt the Fund’s performance? |

| a) | Intel Corporation |

| b) | Dominion Energy, Inc. |

| c) | Becton, Dickinson and Company |

| * | The Fund received 4 stars for the 5-year and the 10-year periods out 1012 funds and 740 funds, respectively. |

| CUTLER EQUITY FUND |

MANAGEMENT DISCUSSION OF FUND PERFORMANCE (Continued) |

The Morningstar Rating for funds, or “star rating,” is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

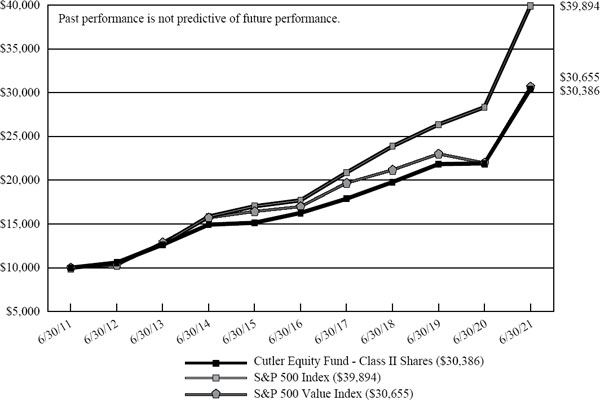

CUTLER EQUITY FUND PERFORMANCE INFORMATION June 30, 2021 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in

Cutler Equity Fund - Class II Shares(a), the S&P 500 Index and the S&P 500 Value Index

| Average Annual Total Returns | |||||||

| (for periods ended June 30, 2021) | |||||||

| 1 Year | 5 Years | 10 Years | |||||

| Cutler Equity Fund - Class II Shares(b) | 38.64% | 13.32% | 11.75% | ||||

| S&P 500 Index(c) | 40.79% | 17.65% | 14.84% | ||||

| S&P 500 Value Index(c) | 39.54% | 12.54% | 11.85% | ||||

| (a) | Class I Shares were converted to Class II Shares on October 28, 2020. The performance figures include the performance for Class I Shares for the periods prior to the start date of Class II Shares. |

| (b) | Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Total annual operating expenses, as disclosed in the Fund’s prospectus dated September 15, 2020, as amended February 1, 2021 and March 1, 2021, were 0.99% of average daily net assets. |

| (c) | The S&P 500 Index is a market capitalization weighted index that is widely used as a barometer of U.S. stock market performance. The S&P 500 Value Index measures value stocks using three factors: the ratios of book value, earnings, and sales to price. Constituents are drawn from the S&P 500 Index. The indices are unmanaged and shown for illustration purposes only. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. |

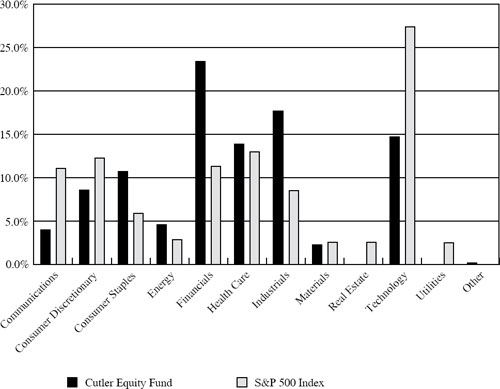

CUTLER EQUITY FUND PORTFOLIO INFORMATION June 30, 2021 (Unaudited) |

Sector Allocation (% of Net Assets)

| CUTLER EQUITY FUND |

| SCHEDULE OF INVESTMENTS |

| June 30, 2021 |

| COMMON STOCKS — 99.8% | Shares | Value | ||||||

| Communications — 4.0% | ||||||||

| Cable & Satellite — 2.0% | ||||||||

| Comcast Corporation - Class A | 70,000 | $ | 3,991,400 | |||||

| Telecommunications — 2.0% | ||||||||

| Verizon Communications, Inc. | 68,186 | 3,820,462 | ||||||

| Consumer Discretionary — 8.6% | ||||||||

| Leisure Facilities & Services — 3.9% | ||||||||

| McDonald’s Corporation | 32,555 | 7,519,879 | ||||||

| Retail - Discretionary — 4.7% | ||||||||

| Home Depot, Inc. (The) | 28,875 | 9,207,949 | ||||||

| Consumer Staples — 10.7% | ||||||||

| Beverages — 2.6% | ||||||||

| PepsiCo, Inc. | 34,295 | 5,081,490 | ||||||

| Household Products — 2.6% | ||||||||

| Procter & Gamble Company (The) | 37,130 | 5,009,951 | ||||||

| Retail - Consumer Staples — 5.5% | ||||||||

| Kroger Company (The) | 106,971 | 4,098,059 | ||||||

| Walmart, Inc. | 46,102 | 6,501,304 | ||||||

| 10,599,363 | ||||||||

| Energy — 4.5% | ||||||||

| Oil & Gas Producers — 4.5% | ||||||||

| Chevron Corporation | 39,570 | 4,144,562 | ||||||

| Exxon Mobil Corporation | 71,114 | 4,485,871 | ||||||

| 8,630,433 | ||||||||

| Financials — 23.4% | ||||||||

| Asset Management — 9.6% | ||||||||

| BlackRock, Inc. | 11,514 | 10,074,404 | ||||||

| Charles Schwab Corporation (The) | 118,000 | 8,591,580 | ||||||

| 18,665,984 | ||||||||

| Banking — 9.2% | ||||||||

| JPMorgan Chase & Company | 31,000 | 4,821,740 | ||||||

| M&T Bank Corporation | 25,890 | 3,762,076 | ||||||

| Northern Trust Corporation | 34,000 | 3,931,080 | ||||||

| PNC Financial Services Group, Inc. (The) | 27,900 | 5,322,204 | ||||||

| 17,837,100 | ||||||||

| CUTLER EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 99.8% (Continued) | Shares | Value | ||||||

| Financials — 23.4% (Continued) | ||||||||

| Insurance — 4.6% | ||||||||

| Marsh & McLennan Companies, Inc. | 38,600 | $ | 5,430,248 | |||||

| Prudential Financial, Inc. | 33,500 | 3,432,745 | ||||||

| 8,862,993 | ||||||||

| Health Care — 13.9% | ||||||||

| Biotech & Pharma — 7.9% | ||||||||

| Bristol-Myers Squibb Company | 85,363 | 5,703,956 | ||||||

| Johnson & Johnson | 31,970 | 5,266,738 | ||||||

| Merck & Company, Inc. | 56,190 | 4,369,896 | ||||||

| 15,340,590 | ||||||||

| Medical Equipment & Devices — 6.0% | ||||||||

| Becton, Dickinson and Company | 25,025 | 6,085,830 | ||||||

| Medtronic plc | 44,400 | 5,511,372 | ||||||

| 11,597,202 | ||||||||

| Industrials — 17.7% | ||||||||

| Aerospace & Defense — 1.2% | ||||||||

| Raytheon Technologies Corporation | 28,010 | 2,389,533 | ||||||

| Commercial Support Services — 2.7% | ||||||||

| Republic Services, Inc. | 48,000 | 5,280,480 | ||||||

| Electrical Equipment — 2.2% | ||||||||

| Carrier Global Corporation | 85,210 | 4,141,206 | ||||||

| Machinery — 9.4% | ||||||||

| Caterpillar, Inc. | 38,330 | 8,341,758 | ||||||

| Deere & Company | 27,994 | 9,873,764 | ||||||

| 18,215,522 | ||||||||

| Transportation & Logistics — 2.2% | ||||||||

| Union Pacific Corporation | 19,600 | 4,310,628 | ||||||

| Materials — 2.3% | ||||||||

| Chemicals — 2.3% | ||||||||

| DuPont de Nemours, Inc. | 57,891 | 4,481,342 | ||||||

| Technology — 14.7% | ||||||||

| Semiconductors — 7.4% | ||||||||

| Intel Corporation | 96,465 | 5,415,545 | ||||||

| Texas Instruments, Inc. | 46,865 | 9,012,140 | ||||||

| 14,427,685 | ||||||||

| CUTLER EQUITY FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 99.8% (Continued) | Shares | Value | ||||||

| Technology — 14.7% (Continued) | ||||||||

| Software — 5.4% | ||||||||

| Microsoft Corporation | 38,475 | $ | 10,422,877 | |||||

| Technology Services — 1.9% | ||||||||

| International Business Machines Corporation | 25,000 | 3,664,750 | ||||||

| Total Common Stocks (Cost $95,534,725) | $ | 193,498,819 | ||||||

| MONEY MARKET FUNDS — 0.3% | Shares | Value | ||||||

| Inveso Short-Term Investment Trust Government & Agency Portfolio - Institutional Class, 0.03% (a) (Cost $589,852) | 589,852 | $ | 589,852 | |||||

| Total Investments at Value — 100.1% (Cost $96,124,577) | $ | 194,088,671 | ||||||

| Liabilities in Excess of Other Assets — (0.1%) | (135,286 | ) | ||||||

| Net Assets — 100.0% | $ | 193,953,385 | ||||||

| (a) | The rate shown is the 7-day effective yield as of June 30, 2021. |

See accompanying notes to financial statements.

| CUTLER EQUITY FUND |

| STATEMENT OF ASSETS AND LIABILITIES |

| June 30, 2021 |

| ASSETS | ||||

| Investments in securities: | ||||

| At cost | $ | 96,124,577 | ||

| At value (Note 2) | $ | 194,088,671 | ||

| Receivable for capital shares sold | 59,131 | |||

| Dividends receivable | 142,593 | |||

| Other assets | 16,443 | |||

| Total assets | 194,306,838 | |||

| LIABILITIES | ||||

| Distributions payable | 6,431 | |||

| Payable for capital shares redeemed | 177,734 | |||

| Payable to Adviser (Note 3) | 119,450 | |||

| Payable to administrator (Note 3) | 15,900 | |||

| Accrued shareholder servicing fees (Note 3) | 10,053 | |||

| Other accrued expenses | 23,885 | |||

| Total liabilities | 353,453 | |||

| NET ASSETS | $ | 193,953,385 | ||

| NET ASSETS CONSIST OF: | ||||

| Paid-in capital | $ | 90,896,052 | ||

| Accumulated earnings | 103,057,333 | |||

| NET ASSETS | $ | 193,953,385 | ||

| PRICING OF CLASS II SHARES (NOTE 1) | ||||

| Net assets applicable to Class II Shares | $ | 193,953,385 | ||

| Shares of Class II Shares outstanding (unlimited number of shares authorized, no par value) | 7,426,900 | |||

| Net asset value, offering price and redemption price per share (Note 2) | $ | 26.11 | ||

See accompanying notes to financial statements.

| CUTLER EQUITY FUND |

| STATEMENT OF OPERATIONS |

| For the Year Ended June 30, 2021 |

| INVESTMENT INCOME | ||||

| Dividend income | $ | 4,141,105 | ||

| Foreign withholding taxes on dividends | (1,191 | ) | ||

| Total investment income | 4,139,914 | |||

| EXPENSES | ||||

| Investment advisory fees (Note 3) | 1,292,387 | |||

| Administration fees (Note 3) | 172,585 | |||

| Shareholder servicing fees - Class I (Note 4) | 76,431 | |||

| Shareholder servicing fees - Class II (Note 4) | 27,313 | |||

| Trustees’ fees and expenses (Note 3) | 39,167 | |||

| Registration and filing fees | 38,067 | |||

| Legal fees | 20,493 | |||

| Audit and tax services fees | 20,110 | |||

| Custody and bank service fees | 18,254 | |||

| Insurance expense | 17,968 | |||

| Postage and supplies | 10,141 | |||

| Printing of shareholder reports | 6,963 | |||

| Other expenses | 14,680 | |||

| Total expenses | 1,754,559 | |||

| Previous investment advisory fee reductions recouped by the Adviser (Note 3) | 41,417 | |||

| Net expenses | 1,795,976 | |||

| NET INVESTMENT INCOME | 2,343,938 | |||

| REALIZED AND UNREALIZED GAINS ON INVESTMENTS | ||||

| Net realized gains from investment transactions | 9,112,405 | |||

| Net change in unrealized appreciation (depreciation) on investments | 44,107,435 | |||

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | 53,219,840 | |||

| NET INCREASE IN NET ASSETS FROM OPERATIONS | $ | 55,563,778 | ||

See accompanying notes to financial statements.

| CUTLER EQUITY FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| Year Ended | Year Ended | |||||||

| June 30, 2021(a) | June 30, 2020 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment income | $ | 2,343,938 | $ | 2,453,087 | ||||

| Net realized gains from investment transactions | 9,112,405 | 6,578,422 | ||||||

| Net change in unrealized appreciation (depreciation) on investments | 44,107,435 | (7,968,701 | ) | |||||

| Net increase in net assets from operations | 55,563,778 | 1,062,808 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | ||||||||

| Class I Shares | (568,111 | ) | (6,610,400 | ) | ||||

| Class II Shares | (8,746,837 | ) | — | |||||

| Decrease in net assets from distribution to shareholders | (9,314,948 | ) | (6,610,400 | ) | ||||

| CAPITAL SHARE TRANSACTIONS | ||||||||

| Class I Shares | ||||||||

| Proceeds from shares sold | 3,378,134 | 16,312,875 | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders | 561,598 | 6,575,694 | ||||||

| Payments for shares redeemed | (4,534,629 | ) | (29,798,264 | ) | ||||

| Shares exchanged for Class II | (153,468,061 | ) | — | |||||

| Net decrease in Class I Shares net assets from capital share transactions | (154,062,958 | ) | (6,909,695 | ) | ||||

| Class II Shares | ||||||||

| Proceeds from shares sold | 6,135,976 | — | ||||||

| Shares exchanged from Class I | 153,468,061 | — | ||||||

| Net asset value of shares issued in reinvestment of distributions to shareholders | 8,706,740 | — | ||||||

| Payments for shares redeemed | (13,750,751 | ) | — | |||||

| Net increase in Class II Shares net assets from capital share transactions | 154,560,026 | — | ||||||

| TOTAL INCREASE (DECREASE) IN NET ASSETS | 46,745,898 | (12,457,287 | ) | |||||

| NET ASSETS | ||||||||

| Beginning of year | 147,207,487 | 159,664,774 | ||||||

| End of year | $ | 193,953,385 | $ | 147,207,487 | ||||

| (a) | Effective October 28, 2020, all existing shares of the Fund converted to Class II shares (Note 1). |

See accompanying notes to financial statements.

| CUTLER EQUITY FUND |

| STATEMENTS OF CHANGES IN NET ASSETS (Continued) |

| Year Ended | Year Ended | |||||||

| June 30, 2021(a) | June 30, 2020 | |||||||

| CAPITAL SHARE ACTIVITY | ||||||||

| Class I Shares | ||||||||

| Shares sold | 159,244 | 842,644 | ||||||

| Shares reinvested | 26,366 | 311,441 | ||||||

| Shares redeemed | (214,490 | ) | (1,483,313 | ) | ||||

| Shares exchanged for Class II shares | (7,367,646 | ) | — | |||||

| Net decrease in shares outstanding | (7,396,526 | ) | (329,228 | ) | ||||

| Shares outstanding at beginning of year | 7,396,526 | 7,725,754 | ||||||

| Shares outstanding at end of year | — | 7,396,526 | ||||||

| Class II Shares | ||||||||

| Shares sold | 254,795 | — | ||||||

| Shares issued in connection with exchange of Class I shares | 7,367,646 | — | ||||||

| Shares reinvested | 381,023 | — | ||||||

| Shares redeemed | (576,564 | ) | — | |||||

| Net increase in shares outstanding | 7,426,900 | — | ||||||

| Shares outstanding at beginning of year | — | — | ||||||

| Shares outstanding at end of year | 7,426,900 | — | ||||||

| (a) | Effective October 28, 2020, all existing shares of the Fund converted to Class II shares (Note 1). |

See accompanying notes to financial statements.

| CUTLER EQUITY FUND |

| CLASS II SHARES(a) |

| FINANCIAL HIGHLIGHTS |

| Per Share Data for a Share Outstanding Throughout Each Year |

| Years Ended June 30, | ||||||||||||||||||||

| 2021(a) | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Net asset value at beginning of year | $ | 19.90 | $ | 20.67 | $ | 19.82 | $ | 18.39 | $ | 17.15 | ||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||

| Net investment income | 0.32 | 0.33 | 0.31 | 0.28 | 0.28 | |||||||||||||||

| Net realized and unrealized gains (losses) on investments | 7.17 | (0.21 | ) | 1.62 | 1.68 | 1.42 | ||||||||||||||

| Total from investment operations | 7.49 | 0.12 | 1.93 | 1.96 | 1.70 | |||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income | (0.32 | ) | (0.33 | ) | (0.31 | ) | (0.28 | ) | (0.29 | ) | ||||||||||

| Net realized gains | (0.96 | ) | (0.56 | ) | (0.77 | ) | (0.25 | ) | (0.17 | ) | ||||||||||

| Total distributions | (1.28 | ) | (0.89 | ) | (1.08 | ) | (0.53 | ) | (0.46 | ) | ||||||||||

| Net asset value at end of year | $ | 26.11 | $ | 19.90 | $ | 20.67 | $ | 19.82 | $ | 18.39 | ||||||||||

| Total return (b) | 38.64 | % | 0.39 | % | 10.36 | % | 10.63 | % | 9.97 | % | ||||||||||

| Net assets at end of year (000’s) | $ | 193,953 | $ | 147,207 | $ | 159,665 | $ | 150,597 | $ | 141,585 | ||||||||||

| Ratios/supplementary data: | ||||||||||||||||||||

| Ratio of total expenses to average net assets | 1.02 | % | 1.16 | % | 1.16 | % | 1.16 | % | 1.14 | % | ||||||||||

| Ratio of net expenses to average net assets (c) | 1.04 | % | 1.15 | % | 1.15 | % | 1.15 | % | 1.14 | % | ||||||||||

| Ratio of net investment income to average net assets (c) | 1.36 | % | 1.58 | % | 1.56 | % | 1.41 | % | 1.54 | % | ||||||||||

| Portfolio turnover rate | 7 | % | 6 | % | 5 | % | 10 | % | 5 | % | ||||||||||

| (a) | Effective October 28, 2020, all existing shares of the Fund converted to Class II shares (Note 1). |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if the Adviser had not reduced advisory fees for the years ended June 30, 2020, 2019 and 2018 (Note 3). |

| (c) | Ratio was determined after investment advisory fee reductions and/or recoupments of previous investment advisory fee reductions (Note 3). |

See accompanying notes to financial statements.

| CUTLER EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS |

| June 30, 2021 |

| 1. | Organization |

Cutler Equity Fund (the “Fund”) is a diversified series of The Cutler Trust (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). Under its Trust Instrument, the Trust is authorized to issue an unlimited number of Fund shares of beneficial interest without par value.

The Fund seeks current income and long-term capital appreciation.

The Fund currently offers one class of shares: Class II Shares (sold without any sales loads, but effective February 18, 2021 subject to a shareholder service plan fee of up to 0.15% of the Fund’s net assets attributable to Class II Shares). Prior to October 28, 2020, the Fund offered Class I Shares (sold without any sales loads, but subject to a shareholder servicing fee of up to 0.25% of the Fund’s net assets attributable to Class I Shares). On October 28, 2020, all existing Class I Shares were converted into Class II Shares at the Class I net asset value per share as of October 28, 2020, which was $20.83. After October 28, 2020, Class I Shares were no longer offered by the Fund. The performance of Class I Shares is and will continue to be reflected in the current performance of the Class II Shares of the Fund.

| 2. | Significant Accounting Policies |

The following summarizes the significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

Securities Valuation — The Fund records investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Portfolio securities are valued as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally, 4:00 p.m., Eastern time) on each day the NYSE is open. Exchange traded securities are valued using the last reported sales price on the exchanges on which they are primarily traded. When using the last sales price and when the market is considered to be active, the security will be classified within Level 1 of the fair value hierarchy (see below). In the absence of a sale, such securities are valued at the mean of the last bid and asked price. Securities which are quoted by NASDAQ are valued

| CUTLER EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

at the NASDAQ Official Closing Price. Investments in shares of other open-end investment companies, including money market funds, are valued at their net asset value (“NAV”) as reported by such companies.

The Fund values securities at fair value pursuant to procedures adopted by the Trust’s Board of Trustees (the “Board”) if (1) market quotations are insufficient or not readily available or (2) the Fund’s investment adviser believes that the prices or values available are unreliable due to, among other things, the occurrence of events after the close of the securities markets on which the Fund’s securities primarily trade but before the time as of which the Fund calculates its NAVs. In instances where the investment adviser believes that the prices received from the independent pricing service are unreliable, proprietary valuation models may be used that consider benchmark yield curves, estimated default rates, coupon rates, anticipated timing of principal repayments and other unique security features to estimate the relevant cash flows, which are discounted to calculate the fair values. Fair valued securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

The Board approves the independent pricing services used by the Fund.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| ● | Level 1 – quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement. |

| ● | Level 2 – quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model derived valuations in which all significant inputs and significant value drivers are observable. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers. |

| ● | Level 3 – model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

| CUTLER EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

The following is a summary of the Fund’s investments based on the inputs used to value the investments as of June 30, 2021 by security type:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Common Stocks | $ | 193,498,819 | $ | — | $ | — | $ | 193,498,819 | ||||||||

| Money Market Funds | 589,852 | — | — | 589,852 | ||||||||||||

| Total | $ | 194,088,671 | $ | — | $ | — | $ | 194,088,671 | ||||||||

Refer to the Fund’s Schedule of Investments for a listing of securities by sector and industry type. There were no derivatives or Level 3 securities held by the Fund as of or during the year ended June 30, 2021.

Share valuation — The NAV per share of the Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of the Fund is equal to its NAV per share.

Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Investment Transactions, Investment Income and Realized Gains and Losses — Investment transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income, if any, is recorded as earned. Realized gains and losses on investments sold are determined on a specific identification basis. Withholding taxes on foreign dividends have been recorded in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Distributions to Shareholders — Dividends from net investment income, if any, are declared and paid quarterly to shareholders of the Fund. Capital gain distributions, if any, are distributed to shareholders annually. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterizations of distributions made by the

| CUTLER EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

Fund. Dividends and distributions are recorded on the ex-dividend date. The tax character of distributions paid by the Fund during the years ended June 30, 2021 and June 30, 2020 was as follows:

| Ordinary | Long-term | Total | ||||||||||

| Year Ended | Income | Capital Gains | Distributions | |||||||||

| 6/30/2021 | $ | 2,367,877 | $ | 6,947,640 | $ | 9,315,517 | ||||||

| 6/30/2020 | $ | 2,450,654 | $ | 4,163,918 | $ | 6,614,572 | ||||||

Federal income tax — The Fund has qualified and intends to continue to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). By so qualifying, the Fund will not be subject to federal income taxes to the extent that 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of June 30, 2021:

| Tax cost of portfolio investments | $ | 96,131,587 | ||

| Gross unrealized appreciation | $ | 99,352,021 | ||

| Gross unrealized depreciation | (1,394,937 | ) | ||

| Net unrealized appreciation on investments | 97,957,084 | |||

| Undistributed ordinary income | 56,328 | |||

| Undistributed long-term capital gains | 5,050,352 | |||

| Distributions payable | (6,431 | ) | ||

| Accumulated earnings | $ | 103,057,333 |

The difference between the federal income tax cost of portfolio investments and the financial statement cost is due to certain differences in the recognition of capital gains and losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are related to losses deferred due to wash sales.

Additionally, GAAP requires certain components of net assets relating to permanent difference be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share. For the fiscal year ended June 30, 2021, no such reclassifications were made.

| CUTLER EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more-likely-than-not” to be sustained assuming examination by tax authorities. Management has reviewed the tax positions taken on Federal income tax returns for all open tax years (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. Therefore, no tax expense (including interest and penalties) was recorded in the current year and no adjustments were made to prior periods.

| 3. | Transactions with Related Parties |

Investment Adviser — Cutler Investment Counsel, LLC (the “Adviser”) is the investment adviser to the Fund. Pursuant to Investment Advisory Agreement, the Fund pays the Adviser a fee, which is accrued daily and paid monthly, at an annual rate of 0.75% of average daily net assets.

The Adviser has entered into an Expense Limitation Agreement under which it has contractually agreed, until October 31, 2021, to reduce its advisory fees and to pay the ordinary operating expenses to the extent necessary to limit annual ordinary operating expenses to 1.15% of average daily net assets. (Ordinary operating expenses exclude brokerage costs, taxes, interest, acquired fund fees and expenses and extraordinary expenses.) Any such fee reductions by the Adviser, or payments by the Adviser of expenses which are the Fund’s obligation, are subject to repayment by the Fund, provided that the repayment does not cause the ordinary operating expenses to exceed the foregoing expense limitation or any expense limitation in place at the time of repayment and provided further that the fees and expenses which are the subject of the repayment were incurred within three years of the repayment. During the year ended June 30, 2021, the Adviser recouped $41,417 of prior years’ investment advisory fee reductions and expense reimbursements. As of June 30, 2021, the Adviser has recouped all prior years’ investment advisory fee reductions and reimbursements that were eligible for recoupment.

Certain officers of the Trust are also officers of the Adviser.

Other Service Providers — Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting and transfer agency services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out of-pocket expenses including, but not limited to, postage, supplies and certain costs related to the pricing of the Fund’s portfolio securities. Certain officers of the Trust are also officers of Ultimus, or of Ultimus Fund Distributors, LLC (the “Distributor”), the principal underwriter of the Fund. The Distributor is a wholly-owned subsidiary of Ultimus.

Compensation of Trustees — Trustees and officers affiliated with the Adviser or Ultimus are not compensated by the Trust for their services. Each Trustee who is not an affiliated person of the Adviser or Ultimus receives from the Trust an annual retainer of $7,500, payable quarterly, plus a fee of $1,250 for attendance at each meeting of the Board, in addition to reimbursement of travel and other expenses incurred in attending the meetings. Effective February 18, 2021, the Board approved a $5,000 annual retainer for the Chairman of the Audit Committee.

| CUTLER EQUITY FUND |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| 4. | Shareholder Service Plan |

Prior to October 29, 2020, the Fund had a Shareholder Servicing Plan (the “Plan”) which allowed Class I Shares of the Fund to pay a shareholder servicing fee not to exceed an annual rate of 0.25% of its average daily net assets. These fees were to be paid to various financial institutions that provided shareholder and account maintenance services. During the year ended June 30, 2021, Class I Shares of the Fund paid $76,431 for such services. Effective October 29, 2020, the Class I Shares converted to Class II Shares and the Board of Trustees terminated the Plan and, as a result, the Fund was not assessing servicing fees pursuant to the Plan.

Effective February 18, 2021, the Board of Trustees approved a new shareholder services fee pursuant to a Shareholder Service Plan (the “New Plan”) in an amount not to exceed 0.15% per annum of the Fund’s average daily net assets, and of this amount, authorized the actual expenditure of shareholder services fees up to 0.05% per annum of the Fund’s average daily net assets. These fees are to compensate intermediaries and other entities for the performance of administrative, non-distribution related shareholder services. During the year ended June 30, 2021, Class II Shares of the Fund incurred $27,313 of shareholder services fees pursuant to the New Plan.

| 5. | Securities Transactions |

During the year ended June 30, 2021, cost of purchases and proceeds from sales and maturities of investment securities, other than short-term investments and U.S. government securities, totaled $12,329,459 and $18,088,348, respectively.

| 6. | Contingencies and Commitments |

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

| 7. | Subsequent Events |

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

| CUTLER EQUITY FUND |

| REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Shareholders and Board of Trustees of

The Cutler Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of The Cutler Trust, comprising Cutler Equity Fund (the “Fund”) as of June 30, 2021, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of June 30, 2021, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2021, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2017.

COHEN & COMPANY, LTD.

Cleveland, Ohio

August 26, 2021

| CUTLER EQUITY FUND |

| ABOUT YOUR FUND’S EXPENSES (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Fund, you incur ongoing costs, including management fees and other operating expenses. These ongoing costs, which are deducted from the Fund’s gross income, directly reduce the investment return of the Fund.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples below are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period (January 1, 2021 through June 30, 2021).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual Fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the returns used are not the Fund’s actual returns, the results do not apply to your investment. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transaction fees, such as purchase or redemption fees, nor does it impose any sales loads.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

| CUTLER EQUITY FUND |

| ABOUT YOUR FUND’S EXPENSES (Unaudited) (Continued) |

More information about the Fund’s expenses, including annual expense ratios for the past five fiscal years, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| Beginning | Ending | |||||||

| Account Value | Account Value | Expenses | ||||||

| January 1, | June 30, | Net Expense | Paid During | |||||

| Class II Shares | 2021 | 2021 | Ratio(a) | Period(b) | ||||

| Based on Actual Fund Return | $1,000.00 | $1,160.70 | 0.98% | $5.25 | ||||

| Based on Hypothetical 5% Return (before expenses) | $1,000.00 | $1,019.93 | 0.98% | $4.91 |

| (a) | Annualized, based on the Fund’s most recent one-half year expenses. |

| (b) | Expenses are equal to the Fund’s annualized net expense ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| CUTLER EQUITY FUND |

| FEDERAL TAX INFORMATION (Unaudited) |

For the fiscal year ended June 30, 2021, the Fund designated $6,947,640 as a long-term capital gain distribution.

Qualified Dividend Income – For the fiscal year ended June 30, 2021, the Fund designated 100% of ordinary income distributions, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for a reduced tax rate.

Dividends Received Deduction – Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividends that qualify under tax law. For the fiscal year ended June 30, 2021, 100% of ordinary income dividends paid by the Fund qualifies for the corporate dividends received deduction.

| CUTLER EQUITY FUND |

| TRUSTEES

AND OFFICERS OF THE TRUST (Unaudited) |

The Board of Trustees is responsible for managing the Trust’s business affairs and exercising all the Trust’s powers except those reserved for shareholders. The following tables give information about each Board member and the senior officers of the Trust. Each Trustee holds office until the person resigns, is removed, or is replaced. Officers are elected for an annual term. Unless otherwise noted, the Trustees and officers have held their principal occupations for more than five years. The Fund’s Statement of Additional Information includes additional information about the Trustees and is available, without charge and upon request, by calling 1-888-CUTLER4.

| Name,

Date of Birth and Address |

Position

with the Trust |

Length of Time Served(1) |

Principal

Occupation(s) During the Past Five Years |

Number

of Portfolios in Fund Complex Overseen by Trustee |

Other

Directorships of Public Companies Held by Trustee During the Past Five Years |

| Interested Trustee: | |||||

| Matthew

C. Patten (2)(3) Born: December 1975 525 Bigham Knoll Jacksonville, OR 97530 |

Chairman/ Trustee/ Treasurer | Treasurer Since March 2004 Trustee Since September 2006 |

Chief Executive Officer and Partner of Cutler Investment Counsel, LLC since 2014; Portfolio Manager of Cutler Investment Counsel, LLC since 2003; President of Cutler Investment Counsel, LLC from 2004-2014 | 1 | None |

| Independent Trustees: | |||||

| John

P. Cooney Born: January 1932 525 Bigham Knoll Jacksonville, OR 97530 |

Lead Independent Trustee | Since April 2007 | Retired | 1 | None |

| Robert

F. Turner Born: June 1946 525 Bigham Knoll Jacksonville, OR 97530 |

Trustee | Since September 2012 | Retired | 1 | None |

| Edward

T. Alter, CPA Born: July 1941 525 Bigham Knoll Jacksonville, OR 97530 |

Trustee | Since August 2013 | Retired | 1 | None |

| CUTLER EQUITY FUND |

| TRUSTEES

AND OFFICERS OF THE TRUST (Unaudited) (Continued) |

| Name,

Date of Birth and Address |

Position

with the Trust |

Length of Time Served(1) |

Principal

Occupation(s) During the Past Five Years |

| Executive Officers: | |||

| Erich

M. Patten (3) Born: October 1977 525 Bigham Knoll Jacksonville, OR 97530 |

President | Since March 2004 | President, Portfolio Manager, Corporate Secretary, Chief Investment Officer and Partner of Cutler Investment Counsel, LLC since 2014; prior to 2014, Portfolio Manager and Corporate Secretary of Cutler Investment Counsel, LLC |

| Brooke

C. Ashland (3) Born: December 1951 525 Bigham Knoll Jacksonville, OR 97530 |

Vice President and Chief Compliance Officer | Since June 2002 | Chair of Cutler Investment Counsel, LLC since 2014; Chief Compliance Officer of Cutler Investment Counsel, LLC since 2003; Chief Executive Officer of Cutler Investment Counsel, LLC (2003 to 2014). |

| Linda

J. Hoard Born: October 1947 225 Pictoria Drive Suite 450 Cincinnati, OH 45246 |

Secretary | Since August 2018 | Senior Vice President and Associate General Counsel (since January 2020), Legal Administration, Ultimus Fund Solutions, LLC; Director (January 2019 to January 2020) and Associate Director (April 2018 to January 2019), Legal Administration, Ultimus Fund Solutions, LLC; Independent Legal Consultant (June 2016 to April 2018). |

| Jennifer

L. Learner Born: August 1976 225 Pictoria Drive Suite 450 Cincinnati, OH 45246 |

Vice President | Since November 2020 | Senior Vice President, Fund Accounting of Ultimus Fund Solutions, LLC since 2014 |

| Stephen

L. Preston Born: October 1966 225 Pictoria Drive Suite 450 Cincinnati, OH 45246 |

Anti-Money Laundering Officer and AVP | Since November 2016 | Chief Compliance Officer, Ultimus Fund Distributors, LLC since June 2011; Chief Compliance Officer, Ultimus Fund Solutions, LLC (June 2011 to August 2019). |

| (1) | Each Trustee holds office until he resigns or is removed. Officers are elected annually. |

| (2) | Matthew C. Patten is an Interested Trustee because of the positions he holds with the Adviser and its affiliates. |

| (3) | Matthew C. Patten and Erich M. Patten are brothers and the sons of Brooke C. Ashland. |

| CUTLER EQUITY FUND |

| ADDITIONAL INFORMATION (Unaudited) |

Proxy Voting Information

A description of the policies and procedures that the Fund use to determine how to vote proxies relating to securities held in the Fund’s portfolios is available without charge, upon request, by calling 1-800-228-8537 or on the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling 1-800-228-8537 or on the SEC’s website at www.sec.gov.

Availability of Portfolio Schedule

The Trust files a complete listing of the Fund’s portfolio holdings with the SEC as of the end of the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The filings are available without charge, upon request, by calling 1-800-228-8537. Furthermore, you may obtain a copy of the filings on the SEC’s website at www.sec.gov.

| CUTLER EQUITY FUND |

| APPROVAL

OF INVESTMENT ADVISORY AGREEMENT (Unaudited) |

At a meeting of the Board of Trustees (the “Board”) of The Cutler Trust (the “Trust”) held on April 28, 2021, the Trustees, including those Trustees who are not parties to the investment advisory agreement or “interested persons” (as defined by the Investment Company Act of 1940 Act, as amended, the “1940 Act”) of any such party (the “Independent Trustees”) voting separately, reviewed and approved the continuance of the Investment Advisory Agreement (the “Advisory Agreement”) with Cutler Investment Counsel, LLC (the “Adviser”) on behalf of the Cutler Equity Fund (the “Fund”) for an additional one year period. Approval of the Advisory Agreement took place at a meeting held in person at the offices of the Adviser located at 525 Bigham Knoll, Jacksonville, Oregon, at which time all of the Trustees were present, and a majority of the Independent Trustees were present in person.

The Independent Trustees were advised by their counsel of their fiduciary obligations in approving the Advisory Agreement, which included a review of applicable case law, recent SEC pronouncements and the legal framework set forth in Gartenberg v. Merrill Lynch Asset Management. In connection with the approval, the Independent Trustees requested such information from the Adviser as they deemed reasonably necessary to evaluate the terms of the Advisory Agreement and to determine whether the Advisory Agreement continues to be in the best interests of the Fund and its shareholders. The Independent Trustees’ review included, but was not limited to: (1) the nature, extent and quality of the services provided by the Adviser; (2) the investment performance of the Fund and the Adviser; (3) the costs of the services provided and profits realized by the Adviser and its affiliates from their relationship with the Fund; (4) the extent to which economies of scale would be realized as the Fund grows; (5) whether fee levels reflect these economies of scale for the benefit of Fund investors; (6) whether and how the Board relied on comparisons of services to be rendered to and fees to be paid by the Fund with the services provided by and the fees paid to other investment advisers or the services provided to and the fees paid by other clients of the Adviser; and (7) any benefits derived or to be derived by the Adviser from its relationship with the Fund, such as soft dollar arrangements by which brokers provide research to the Fund or the Adviser in return for allocating brokerage.

The Adviser provided the Board members with information to assist them in their deliberations, which included responses and supporting materials pursuant to the request for information in connection with the annual approval of the continuation of the Advisory Agreement between the Trust and the Adviser in accordance with Section 15(c) of the 1940 Act. The Board also noted its ongoing review of various materials provided by the Adviser on a quarterly basis. The Independent Trustees, in consultation with their counsel, concluded that the materials presented by the Adviser were sufficient to make an informed decision about the approval of the renewal of the Advisory Agreement.

The Independent Trustees were advised by their counsel throughout the process. It was reported that no single factor was considered in isolation or considered to be determinative to the decision of the Independent Trustees to approve the continuance of the Advisory Agreement. Instead, the Independent Trustees concluded, in light of a weighing and balancing of all factors considered, that it would be in

| CUTLER EQUITY FUND |

| APPROVAL

OF INVESTMENT ADVISORY AGREEMENT (Unaudited) (Continued) |

the best interests of not only the Fund, but also its shareholders, to renew the Advisory Agreement for an additional annual period. The following is a summary of the Board’s discussion and views regarding the factors it considered in evaluating the continuation of the Advisory Agreement:

Nature, Extent and Quality of the Services Provided by the Adviser. With respect to this factor, the Independent Trustees discussed the background, qualifications, education and experience of the Adviser’s investment and operational personnel, each individual’s area of responsibility and the percentage of time committed to the Fund’s activities. The Independent Trustees reviewed the services provided by the Adviser to the Fund which include: (1) investing the Fund’s assets in accordance with the Fund’s investment objective and investment policies; (2) determining the portfolio securities to be purchased, sold or otherwise disposed of and the timing of such transactions; (3) overseeing the voting of all proxies with respect to the Fund’s portfolio securities; (4) maintaining the required books and records for transactions that the Adviser effects on behalf of the Fund; and (5) selecting broker-dealers to execute orders on behalf of the Fund. The Independent Trustees also discussed and considered the quality of administrative and other services provided by the Adviser to the Fund, the Adviser’s and the Trust’s compliance programs, and the Adviser’s role in coordinating such services and programs. The Independent Trustees also noted the Adviser’s distribution and marketing services provided at the Fund level, as well as the investment in additional personnel resources to promote the Fund’s growth. The Trustees determined that they are very satisfied with the nature, extent and quality of services that the Adviser has provided under the Advisory Agreement.

Fund and Adviser Investment Performance. The Independent Trustees noted the review, analysis and discussion which took place during the meeting with respect to both Adviser and Fund performance. The Independent Trustees stated that their review had encompassed the Fund’s performance over various time periods compared to its benchmark index and a peer group of funds of similar size with similar investment styles as categorized by Morningstar, taking into account management’s discussion of the Fund’s performance as well as the Fund’s investment strategies. The Independent Trustees noted that the Morningstar peer group comparison presented was filtered by total net assets so that the Fund was compared to other similarly sized funds.

The Independent Trustees observed that the Fund underperformed the average and median return for funds that have assets under $500 million categorized by Morningstar as large cap value (the “Equity Fund Peer Group”) for the one-year period ended March 31, 2021, but had outperformed the Equity Fund Peer Group for the three-, five- and ten-year periods ended March 31, 2021. The Independent Trustees also observed that the Fund underperformed the S&P 500 Index, its benchmark index, for the one-, five- and ten-year periods ended March 31, 2021. In explaining the Fund’s underperformance during the past year, the Adviser noted that the Fund’s strategy has typically underperformed during very strong bull markets, such as that experienced in 2020, but historically had outperformed during market drops. The Adviser also expressed the view that the S&P 500 Index had outperformed for all periods primarily due to a reliance on big-cap technology stocks, which for the most part were not

| CUTLER EQUITY FUND |

| APPROVAL

OF INVESTMENT ADVISORY AGREEMENT (Unaudited) (Continued) |

eligible investments for the Fund’s dividend-based criteria. The Independent Trustees then considered the consistency of the Adviser’s management of the Fund in accordance with its investment objective, strategy and policies.

After further review and consideration of the information provided to them, the Independent Trustees determined that the Fund’s overall performance had been satisfactory and competitive in relation to the returns of relevant securities indices and other similarly situated mutual funds.

Costs of the Services Provided and Profits Realized by the Adviser. With respect to this factor, the Independent Trustees considered the profitability of the Adviser with respect to its Fund management. The Independent Trustees notes that the Fund currently pays an investment advisory fee computed at the annual rate of 0.75% of the Fund’s average daily net assets. In addition, the Independent Trustees noted that the Adviser had contractually agreed to waive its advisory fees and pay operating expenses of the Fund to the extent necessary to limit annual fund operating expenses to 1.15% of the Fund’s average daily net assets until October 31, 2021. However, it was noted that given that the Fund’s expense accruals were well below 1.15%, the Adviser would not recommend renewal of its expense limitation agreement with the Trust upon the agreement’s expiration.

In reviewing the advisory fees and total expense ratios of the Fund, the Independent Trustees were provided with comparative expense and advisory fee information of other mutual funds of similar size and with similar investment styles. A comparison of fees paid by clients of the Adviser other than the Fund to the advisory fees paid by the Fund was provided and the services provided to the Adviser’s other clients was discussed. The Trustees reviewed and discussed such information, which included average and median total expense ratios and advisory fees for the Equity Fund Peer Group. The Independent Trustees noted that the Fund’s contractual advisory fee was higher than the average and median advisory fee for the Equity Fund Peer Group, that the Fund’s net expense ratio was higher than the Equity Fund Peer Group average and median, and that the Fund’s gross expense ratio was the same as the median and lower than the average of the Equity Fund Peer Group.

The Independent Trustees reviewed the Adviser’s balance sheet as of December 31, 2020. They also reviewed an analysis prepared by the Adviser reflecting its revenues and expenses with respect to its services to the Fund, and discussed with the Adviser calculations of the Adviser’s estimated total profits and profit margin, including the manner in which expenses were allocated. The Adviser reviewed with the Board the portfolio managers’ compensation structure, as well as the equity ownership structure of the Adviser.

The Independent Trustees concluded that the Adviser’s profitability was reasonable given the quality and scope of services that the Adviser had provided and the overall Fund investment performance. After a full discussion and review of the information offered, the Independent Trustees concluded that

| CUTLER EQUITY FUND |

| APPROVAL

OF INVESTMENT ADVISORY AGREEMENT (Unaudited) (Continued) |

the advisory fee payable under the Advisory Agreement was fair and reasonable when considered in light of all relevant factors, including the services provided to the Equity Fund by the Adviser as well as services provided by the Adviser to the Equity Fund’s shareholders.

Economies of Scale. The Independent Trustees further determined that, based on the Fund’s current asset level, the extent to which economies of scale would be realized as the Fund grew, and whether fee levels reflected these economies of scale were not relevant to their consideration whether to renew the Advisory Agreement with the Adviser. After further discussion, it was the determination of the Independent Trustees that there are not sufficient economies of scale to require fee breakpoints at the present time.

Other Benefits. Regarding this factor, the Independent Trustees noted that the Trust did not have any soft dollar arrangements with broker-dealers that would otherwise benefit the Adviser. The Independent Trustees also considered other benefits the Adviser may have received from its management of the Fund and concluded that the Adviser would not receive additional material financial benefits from services rendered to the Fund.

In approving the Advisory Agreement, the Independent Trustees reached the following conclusions: (1) based on the Fund’s performance, risk characteristics and effectiveness in achieving its stated objective, the Adviser had provided quality advisory services; (2) the Adviser had the financial resources and personnel to continue to provide quality advisory services to the Trust; (3) the advisory fees and the total expenses of the Fund were reasonable; and (4) the continuance of the Advisory Agreement was in the best interests of the Fund and its shareholders.

| CUTLER INVESTMENT COUNSEL, LLC |

| INVESTMENT ADVISER TO THE TRUST |

| 525 Bigham Knoll |

| Jacksonville, OR 97530 |

| (800)228-8537 ● (541)770-9000 |

| Fax:(541)779-0006 |

| info@cutler.com |

| Cutler-AR-21 |

| (b) | Not applicable |

Item 2. Code of Ethics.

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. Pursuant to Item 12(a)(1), a copy of registrant’s code of ethics is filed as an exhibit to this Form N-CSR. During the period covered by this report, the code of ethics has not been amended, and the registrant has not granted any waivers, including implicit waivers, from the provisions of the code of ethics.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that the registrant has an audit committee financial expert serving on its audit committee. The name of the audit committee financial expert is Edward T. Alter. Mr. Alter is “independent” for purposes of this item.

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. The aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the principal accountant in connection with statutory and regulatory filings or engagements were $14,000 and $14,000 with respect to the registrant’s fiscal years ended June 30, 2021 and June 30, 2020, respectively. |

| (b) | Audit-Related Fees. No fees were billed in either of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. |

| (c) | Tax Fees. The aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning were $3,500 and $11,000 with respect to the fiscal years ended June 30, 2021 and June 30, 2020, respectively. The services comprising these fees are related to the preparation of the Funds’ federal income and excise tax returns. |

| (d) | All Other Fees. No fees were billed in either of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item. |

| (e)(1) | The audit committee has not adopted pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

| (e)(2) | None of the services described in paragraph (b) through (d) of this Item were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | Less than 50% of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees. |

| (g) | No non-audit fees were billed by the registrant’s principal accountant in either of the last two fiscal years for services rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the Adviser that provides ongoing services to the Trust. |

| (h) | The principal accountant has not provided any non-audit services to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, |

controlled by, or under common control with the investment adviser that provides ongoing services to the registrant.

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Schedule of Investments.

| (a) | Not applicable [schedule filed with Item 1] |

| (b) | Not applicable |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies. |

Not applicable

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant has not adopted procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

(a) Based on their evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) as of a date within 90 days of the filing date of this report, the registrant’s principal executive officer and principal financial officer have concluded that such disclosure controls and procedures are reasonably designed and are operating effectively to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to them by others within those entities, particularly during the period in which this report is being prepared, and that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 13. Exhibits.

File the exhibits listed below as part of this Form. Letter or number the exhibits in the sequence indicated.

(a)(1) Any code of ethics, or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy the Item 2 requirements through filing of an exhibit: Attached hereto

(a)(2) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act (17 CFR 270.30a-2(a)): Attached hereto

(a)(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act (17 CFR 270.23c-1) sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons: Not applicable

(a)(4) Change in the registrant’s independent public accountants: Not applicable.

(b) Certifications required by Rule 30a-2(b) under the Act (17 CFR 270.30a-2(b)): Attached hereto

Exhibit 99.CODE ETH Code of Ethics

Exhibit 99.CERT Certifications required by Rule 30a-2(a) under the Act

Exhibit 99.906CERT Certifications required by Rule 30a-2(b) under the Act

| SIGNATURES |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The Cutler Trust

By (Signature and Title)* /s/ Erich M. Patten

Erich M. Patten, President

Date September 2, 2021

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/ Erich M. Patten

Erich M. Patten, President

Date September 2, 2021

By (Signature and Title)* /s/ Matthew C. Patten

Matthew C. Patten, Treasurer

Date _ September 2, 2021