| Label |

Element |

Value |

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Document Type |

dei_DocumentType |

485BPOS

|

|

| Document Period End Date |

dei_DocumentPeriodEndDate |

Jun. 30, 2018

|

|

| Registrant Name |

dei_EntityRegistrantName |

CUTLER TRUST

|

|

| Central Index Key |

dei_EntityCentralIndexKey |

0000892568

|

|

| Amendment Flag |

dei_AmendmentFlag |

false

|

|

| Document Creation Date |

dei_DocumentCreationDate |

Oct. 26, 2018

|

|

| Document Effective Date |

dei_DocumentEffectiveDate |

Oct. 26, 2018

|

|

| Prospectus Date |

rr_ProspectusDate |

Oct. 26, 2018

|

|

| Cutler Equity Fund |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><font style="text-transform: uppercase"><b>RISK/RETURN SUMMARY</b></font></p>

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"> </p>

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>CUTLER EQUITY FUND</b></p>

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>INVESTMENT OBJECTIVE</b></p>

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The investment objective of the Cutler Equity

Fund (the “Equity Fund”) is to seek current income and long-term capital appreciation.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>FEES AND EXPENSES</b></p>

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

The following tables describe the fees and

expenses that you will pay if you buy and hold shares of the Equity Fund.

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>Annual Fund Operating Expenses</b><br />

(expenses that you pay each year as a percentage of the value of your investment)</p>

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

October 31, 2019

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>Portfolio Turnover</b></p>

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Equity Fund pays transaction costs, such

as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate

may indicate higher transaction costs and may result in higher taxes when Equity Fund shares are held in a taxable account. These

costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Equity Fund’s performance.

During the most recent fiscal year, the Equity Fund’s portfolio turnover rate was 10% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

10.00%

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>Example</b></p>

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This Example is intended to help you compare

the cost of investing in the Equity Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000 in

the Equity Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also

assumes that your investment has a 5% return each year, that the Equity Fund’s operating expenses remain the same and that

the expense limitation will expire after one year. Although your actual costs may be higher or lower, based on these assumptions

your costs would be:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>PRINCIPAL INVESTMENT STRATEGIES OF THE EQUITY FUND</b></p>

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

In seeking to meet its investment objective,

under normal conditions, at least 80% of the Equity Fund’s assets will be invested in a diversified portfolio of common stocks

according to the investment style of the Fund’s Adviser. For purposes of this policy, “assets” shall mean net

assets plus the amount of any borrowings for investment purposes (although the Equity Fund is not currently authorized by the Board

of Trustees to do so). The Adviser chooses investments in common stocks based on its judgment of fundamental value, which emphasizes

stocks that the Adviser judges to have favorable dividend yields and growth prospects relative to comparable companies. Factors

deemed particularly relevant in determining fundamental value include:

• earnings

• dividend and market price histories

• balance sheet characteristics

• perceived management skills

Changes in economic and political outlooks,

as well as corporate developments affecting individual companies, can influence specific security prices. The Equity Fund typically

invests in stocks of companies that have a total market capitalization of at least $10 billion and, in the Adviser’s opinion,

have institutional ownership that is sufficiently broad to provide adequate liquidity suitable to the Fund’s holdings.

The Adviser uses both “top-down”

and “bottom-up” approaches, and investment selections are made using a fundamental approach. Top-down research involves

the study of economic trends in the domestic and global economy, such as the fluctuation in interest or unemployment rates. These

factors help to identify industries and sectors with the potential to outperform as a result of major economic developments. Bottom-up

research involves detailed analysis of specific companies. Important factors include industry characteristics, profitability, growth

dynamics, industry positioning, strength of management, valuation and expected return for the foreseeable future. Particular attention

is paid to a company’s ability to pay or increase its current dividend.

The Adviser will sell securities for any one

of three possible reasons:

• When another company is found by the

Adviser to have a higher current dividend yield or better potential for capital appreciation and dividend growth.

• If the industry moves in an unforeseen

direction that negatively impacts the positioning of a particular investment or if the company’s strategy, execution or industry

positioning itself deteriorates. The Adviser develops specific views on how industries are likely to evolve and how individual

companies will participate in industry growth and change.

• If the Adviser believes that a company’s

management is not acting in a forthright manner.

|

|

| Risk [Heading] |

rr_RiskHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>PRINCIPAL RISKS OF INVESTING IN THE EQUITY FUND</b></p>

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the Equity Fund is subject

to investment risks; therefore you may lose money by investing in the Fund. There is no assurance that the Equity Fund will achieve

its investment objective. The Equity Fund’s net asset value and total return will fluctuate based upon changes in the value

of its portfolio securities. Upon redemption, an investment in the Equity Fund may be worth less than its original cost. The Equity

Fund, by itself, does not provide a complete investment program. The Equity Fund is subject to the following principal risks (presented

alphabetically):

Large-Cap Company Risk

The Equity Fund may invest in large-capitalization

(“large-cap”) companies. Large-cap companies may be unable to respond quickly to new competitive challenges, such as

changes in technology and consumer tastes, and may not be able to attain the high growth rate of successful smaller companies,

especially during extended periods of economic expansion.

Management Risk

Because the Equity Fund is actively managed,

it is subject to the risk that the investment strategies, techniques and risk analyses employed by the Adviser may not produce

the desired results. Poor security selection could cause the Equity Fund’s return to be lower than anticipated. Current income

may be significant or very little, depending upon the Adviser’s portfolio selections for the Equity Fund.

Mid-Cap Company Risk

The Equity Fund may invest in mid-capitalization

(“mid-cap”) companies. Mid-cap companies often involve higher risks than large-cap companies because these companies

may lack the financial resources, product diversification and competitive strengths of larger companies. In addition, the frequency

and volume of the trading of securities of mid-cap companies is substantially less than is typical of larger companies. Therefore,

the securities of mid-cap companies may be subject to greater price fluctuations. Mid-cap companies also may not be widely followed

by investors, which can lower the demand for their stock.

Stock Market Risk

All investments made by the Equity Fund have

some risk. Among other things, the market value of any security in which the Equity Fund may invest is based upon the market’s

perception of value and not necessarily the book value of an issuer or other objective measures of the issuer’s worth.

The Equity Fund may be an appropriate investment

if you are seeking long-term growth in your investment and are willing to tolerate significant fluctuations in the value of your

investment in response to changes in the market value of the stocks the Fund holds. This type of market movement may affect the

price of the securities of a single issuer, a segment of the domestic stock market or the entire market. The investment style utilized

for the Equity Fund could fall out of favor with the market.

In summary, but not inclusive of all possible

risks, you could lose money on your investment in the Equity Fund, or the Fund could underperform other investments, if any of

the following occurs:

• The stock market goes down

• The stock market undervalues the stocks

in the Equity Fund’s portfolio

• The Adviser’s judgment as to the

value of the Equity Fund’s stocks proves to be mistaken

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

An investment in the Equity Fund is subject to investment risks; therefore you may lose money by investing in the Fund.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>PERFORMANCE SUMMARY</b></p>

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

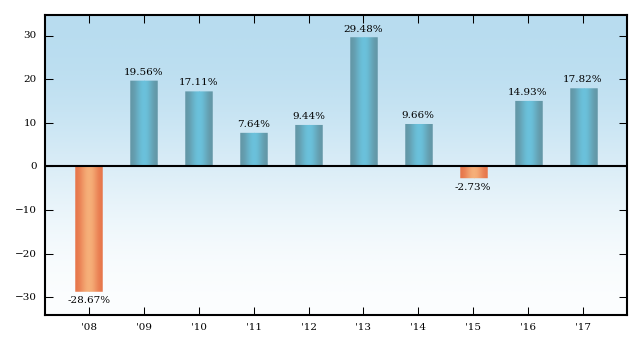

The bar chart and performance table that follow

provide some indication of the risks and variability of investing in the Equity Fund by showing the changes in the Fund’s

performance from year-to-year for the last ten calendar years, and by showing how the Fund’s average annual total returns

for 1, 5 and 10 years compare with those of a broad measure of market performance. The Equity Fund’s performance in the past

is not necessarily an indication of how the Fund will perform in the future. Updated performance information, current to the most

recent month end, is available by calling 1-888-CUTLER4 (1-888-288-5374).

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The bar chart and performance table that follow provide some indication of the risks and variability of investing in the Equity Fund by showing the changes in the Fund’s performance from year-to-year for the last ten calendar years, and by showing how the Fund’s average annual total returns for 1, 5 and 10 years compare with those of a broad measure of market performance.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

1-888-CUTLER4 (1-888-288-5374)

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Equity Fund’s performance in the past is not necessarily an indication of how the Fund will perform in the future.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0; text-align: center"><b>EQUITY FUND</b></p>

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0; text-align: center"><b> </b></p>

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0; text-align: center"><b>Year-by-year Annual Total Return as of 12/31

each year (%)</b></p>

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

The Equity Fund’s 2018 year-to-date total

return through September 30, 2018 is 2.83%.

During the periods shown in the bar chart,

the highest quarterly return was 14.31% during the quarter ended September 30, 2009 and the lowest quarterly return was -18.66%

during the quarter ended December 31, 2008.

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>Average Annual Total Returns For Periods Ended December 31, 2017</b></p>

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (IRAs).

|

|

| Performance Table Narrative |

rr_PerformanceTableNarrativeTextBlock |

After-tax returns are calculated using the

historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not

relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement

accounts (IRAs).

|

|

| Cutler Equity Fund | Cutler Equity Fund Shares |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Trading Symbol |

dei_TradingSymbol |

CALEX

|

|

| Shareholder Fees (fees paid directly from your investment) |

rr_ShareholderFeesColumnName |

None

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.75%

|

|

| Service Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.15%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.26%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.16%

|

|

| Fee Waivers and Expense Reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.01%)

|

[1] |

| Total Annual Fund Operating Expenses After Fee Waivers and Expense Reimbursements |

rr_NetExpensesOverAssets |

1.15%

|

[1] |

| One Year |

rr_ExpenseExampleYear01 |

$ 117

|

|

| Three Years |

rr_ExpenseExampleYear03 |

367

|

|

| Five Years |

rr_ExpenseExampleYear05 |

637

|

|

| Ten Years |

rr_ExpenseExampleYear10 |

$ 1,408

|

|

| Annual Return 2008 |

rr_AnnualReturn2008 |

(28.67%)

|

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

19.56%

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

17.11%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

7.64%

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

9.44%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

29.48%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

9.66%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

(2.73%)

|

|

| Annual Return 2016 |

rr_AnnualReturn2016 |

14.93%

|

|

| Annual Return 2017 |

rr_AnnualReturn2017 |

17.82%

|

|

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

year-to-date total return

|

|

| Bar Chart, Year to Date Return, Date |

rr_BarChartYearToDateReturnDate |

Sep. 30, 2018

|

|

| Bar Chart, Year to Date Return |

rr_BarChartYearToDateReturn |

2.83%

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

highest quarterly return

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Sep. 30, 2009

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

14.31%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

lowest quarterly return

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Dec. 31, 2008

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(18.66%)

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.82%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

13.34%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

8.21%

|

|

| Cutler Equity Fund | After Taxes on Distributions | Cutler Equity Fund Shares |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.07%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

12.45%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

7.64%

|

|

| Cutler Equity Fund | After Taxes on Distributions and Sales | Cutler Equity Fund Shares |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

10.65%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

10.54%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

6.60%

|

|

| Cutler Equity Fund | Standard & Poor’s 500 Index (S&P 500 Index) (reflects no deduction for fees, expenses or taxes) |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

21.83%

|

[2] |

| 5 Years |

rr_AverageAnnualReturnYear05 |

15.79%

|

[2] |

| 10 Years |

rr_AverageAnnualReturnYear10 |

8.50%

|

[2] |

| Cutler Fixed Income Fund |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><font style="text-transform: uppercase"><b>RISK/RETURN SUMMARY</b></font></p>

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"> </p>

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>CUTLER FIXED INCOME FUND</b></p>

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>INVESTMENT OBJECTIVE</b></p>

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The investment objective of the Cutler Fixed

Income Fund (the “Fixed Income Fund”) is to seek to achieve high income over the long-term.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>FEES AND EXPENSES</b></p>

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

The following tables describe the fees and

expenses that you will pay if you buy and hold shares of the Fixed Income Fund.

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>Annual Fund Operating Expenses</b><br />

(expenses that you pay each year as a percentage of the value of your investment)</p>

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>Portfolio Turnover</b></p>

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fixed Income Fund pays transaction costs,

such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover

rate may indicate higher transaction costs and may result in higher taxes when Fixed Income Fund shares are held in a taxable

account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fixed Income Fund’s

performance. During the most recent fiscal year, the Fixed Income Fund’s portfolio turnover rate was 36% of the average

value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

36.00%

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>Example</b></p>

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This Example is intended to help you compare

the cost of investing in the Fixed Income Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000

in the Fixed Income Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example

also assumes that your investment has a 5% return each year and that the Fixed Income Fund’s operating expenses remain the

same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0; text-align: justify"><b>PRINCIPAL INVESTMENT STRATEGIES OF THE

FIXED INCOME FUND</b></p>

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

The Fixed Income Fund invests principally

in a diversified portfolio of investment grade fixed income securities that are believed to generate a high level of current income.

The Fixed Income Fund normally invests in investment grade fixed income securities consisting primarily of obligations issued

by the U.S. Government, agencies of the U.S. Government, instruments related to U.S. Government securities, mortgage-backed and

other asset-backed securities and U.S. corporate debt securities. The Adviser considers these types of securities to be the Fixed

Income Fund’s core holdings. In seeking to meet its investment objective, under normal conditions, at least 80% of the Fixed

Income Fund’s assets will be invested in fixed income securities. For purposes of this policy, “assets” shall

mean net assets plus the amount of any borrowings for investment purposes (although the Fixed Income Fund is not currently authorized

by the Board of Trustees to do so).

An investment grade security is one which is

rated investment grade by either Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s

Ratings Services (“S&P”) or Fitch Ratings Ltd. (“Fitch”), or an unrated security that the Adviser believes

to be of comparable quality. The Fixed Income Fund may invest in:

• United States Treasury obligations,

including T-bills, notes, bonds, inflation-indexed bonds and other debt obligations issued by the U.S. Treasury, and obligations

of U.S. Government Agencies that are backed by the full faith and credit of the U.S. Government. U.S. Government Agencies include

the Private Export Funding Corporation, Overseas Private Investment Corporation, Small Business Administration, Government National

Mortgage Association (GNMA), Department of Housing and Urban Development and U.S. Maritime Administration.

• Securities issued or guaranteed by agencies

and instrumentalities of the U.S. Government, but not explicitly backed by the full faith and credit of the U.S. Government. These

include the Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac), Federal Farm

Credit Banks, Tennessee Valley Authority, and Federal Home Loan Bank.

• Mortgage-Backed and Other Asset-Backed

Securities. Mortgage-backed securities are obligations representing an undivided interest in, or collateralized by, pools of mortgages.

These obligations, in effect, “pass-through” the monthly interest and principal payments (including prepayments) made

by the individual borrowers on the pooled mortgage loans to the holders of the securities. U.S. Government agency mortgage-backed

issues include securities issued by GNMA, Fannie Mae and Freddie Mac. GNMA securities are guaranteed as to payment of principal

and interest (but not as to price and yield) by the U.S. Government, while Fannie Mae and Freddie Mac securities are guaranteed

only by the issuing agency. Stripped Mortgage-Backed Securities (“SMBS”) are derivative multi-class mortgage securities.

SMBS are usually structured with two classes that receive different proportions of the interest and principal distributions on

a pool of mortgage assets. An SMBS will have one class that will receive all of the interest (the interest-only or “IO”

class), while the other class will receive the entire principal (the principal-only or “PO” class). The Fixed Income

Fund may also invest in corporate mortgage-backed securities or other asset-backed securities that have an investment grade rating.

Asset-backed securities represent a group of assets that are combined or pooled for sale to investors and may be backed by receivables

such as credit card, auto and student loans. The Fixed Income Fund may also invest in corporate mortgage-backed securities or other

asset-backed securities that have an investment grade rating. Asset-backed securities represent a group of assets that are combined

or pooled for sale to investors and may be backed by receivables such as credit card, auto and student loans.

• U.S. corporate debt securities (obligations

of a corporation to pay interest and repay principal). These include commercial paper, notes, bonds and debentures.

The Adviser’s primary focus is on individual

security selection, rather than attempting to anticipate major interest rate moves. The Adviser uses a value-oriented buy discipline

to identify securities that are believed to offer a yield advantage over others of similar quality or to exhibit stable or improving

credit quality that may be unrecognized by other investors. Portfolio securities may be sold when price appreciation causes a security

to lose its yield advantage, or when credit quality begins to deteriorate. In the event the rating of a fixed income security held

by the Fixed Income Fund is reduced below investment grade, the Adviser is not required to sell the security, but will consider

this event in its determination of whether the Fund should continue to hold such security.

To increase the Fixed Income Fund’s income

potential, the Adviser may invest any amount it deems desirable in each of the various types of fixed income securities, and adjust

the investment ratios from time to time, so long as the Fund remains diversified. There is no set average maturity for the portfolio.

The Fixed Income Fund allocates its assets among different types of securities and maturities based upon the Adviser’s view

of the relative value of each security or maturity. The Adviser may respond to changing market and other conditions by adjusting

the type of securities held by the Fixed Income Fund and its average portfolio maturity. The Fixed Income Fund may invest in either

fixed rate or variable rate debt securities.

|

|

| Risk [Heading] |

rr_RiskHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>PRINCIPAL RISKS OF INVESTING IN THE FIXED INCOME FUND</b></p>

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the Fixed Income Fund is subject

to investment risks; therefore you may lose money by investing in the Fund. There is no assurance that the Fixed Income Fund will

achieve its investment objective. The Fixed Income Fund’s net asset value and total return will fluctuate based upon changes

in the value of its portfolio securities. Upon redemption, an investment in the Fixed Income Fund may be worth less than its original

cost. The Fixed Income Fund, by itself, does not provide a complete investment program. The Fixed Income Fund is subject to the

following principal risks (presented alphabetically):

Fixed Income Securities Risk

• Asset-Backed Securities Risk.

Asset-backed securities are fixed-income securities backed by other assets such as credit card, automobile or consumer loan receivables,

retail installment loans, or participations in pools of leases. The values of these securities are sensitive to changes in the

credit quality of the underlying collateral, the credit strength of any credit enhancement feature, changes in interest rates,

and, at times, the financial condition of the issuer.

• Call Risk. Call risk for corporate

bonds is the possibility that borrowers will prepay their debt prior to the scheduled maturity date, resulting in the probability

of reinvesting the proceeds in bonds with lower yields. If interest rates decline when the Fixed Income Fund is emphasizing longer

maturing securities, you are exposed to greater call risk because issuers of callable bonds are more likely to pay off their bonds

before the maturity date. This may cause a reduction of income to the Fixed Income Fund.

• Corporate Debt Securities Risk.

Investment grade U.S. corporate debt securities are generally considered to carry greater credit and call risk than U.S. Government

obligations. The credit risk of corporate debt obligations varies widely among issuers and may be affected by factors such as adverse

economic changes and changes in interest rates. The Adviser relies, in part, on the quality ratings assigned by S&P, Moody’s,

Fitch and other rating services. There is risk associated with such reliance. Rating agencies evaluate the credit risk—the

safety of principal and interest payments—but not market value, which is affected by interest rate trends, economic conditions

and other factors, including those unique to an issuer or industry. Rating agencies may fail to move quickly enough to change ratings

in response to changing circumstances and a rating may not reflect the fine shadings of risks within a given quality grade. For

example, two bonds with the same rating are not likely to be precisely the same in quality. The Adviser performs independent analyses

in an attempt to identify issuers within a given quality grade that, because of improving fundamentals or other factors, are likely

to result in improving quality, greater market value and lower risk.

• Credit Risk. Credit risk is associated

with a borrower’s ability to pay interest and principal when due. A borrower’s inability to make its payment obligations

could result in a significant loss of income, causing the Fixed Income Fund’s price to decline. Credit risk increases as

overall portfolio quality decreases. Thus, when the Fixed Income Fund invests in lower-quality securities, you are exposed to increased

credit risk.

• Interest Rate Risk. When interest

rates rise, bond prices generally fall and when interest rates fall, bond prices generally rise. In an environment of relatively

low interest rates, the risk that fixed income prices may fall is potentially greater. Interest rate risk increases as average

maturity increases. Interest rate increases can cause the price of a fixed income security to decline, resulting in a price decline

for the Fixed Income Fund. Thus, when the Fixed Income Fund emphasizes securities with longer maturities, you are exposed to greater

interest rate risk. The interest earned on the Fixed Income Fund’s investments in fixed income securities may decline when

prevailing interest rates fall. All income-oriented securities, even those of highest quality, are subject to some degree of interest

rate risk.

• Liquidity Risk. Liquidity risk

is the risk that a bond could not be sold at an advantageous time or price due to limited market demand. If a bond is downgraded

or drops in price, or if adverse conditions exist within the bond market, the demand for a bond may be limited, making that bond

difficult to sell.

• Mortgage-Backed Securities Risk.

Mortgage-backed securities are subject to greater call/prepayment risk than many fixed income securities, especially when interest

rates decline. Prepayment risk could reduce yield and market value and cause the Fixed Income Fund to reinvest its assets at a

lower prevailing interest rate. These securities are also subject to extension risk, or the risk of a security lengthening in duration

due to the deceleration of prepayments. Extension risk is mainly the result of rising interest rates. As interest rates rise, the

likelihood of prepayment decreases and if this occurs, the Fixed Income Fund may be unable to capitalize on other investments that

have higher interest rates. Mortgage-backed securities may be subject to risks unique to the housing industry, including mortgage

lending practices, defaults and foreclosures, changes in real estate values and housing inventories, mortgage securitization practices

and rating assignments by credit rating agencies. Stripped mortgage-backed securities, particularly IOs, are more volatile and

sensitive to the rate of prepayments than other types of mortgage-backed securities, and their value can fall dramatically in response

to rapid or unexpected changes in the mortgage, interest rate or economic environment.

Management Risk

Because the Fixed Income Fund is actively managed,

it is subject to the risk that the investment strategies, techniques and risk analyses employed by the Adviser may not produce

the desired results. Poor security selection and/or investments that have unfavorable portfolio maturities could cause the Fixed

Income Fund’s return to be lower than anticipated. Current income may be significant or very little, depending upon the Adviser’s

portfolio selections for the Fixed Income Fund.

In summary, but not inclusive of all possible

risks, you could lose money on your investment in the Fixed Income Fund, or the Fund could underperform other investments, if any

of the following occurs:

• Interest rates rise

• A borrower is unable to pay interest

or principal when due

• The fixed income market becomes illiquid

• The stock market goes down

• The Adviser’s judgment as to the

direction of interest rates or the attributes of the Fixed Income Fund’s securities proves to be mistaken

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

An investment in the Fixed Income Fund is subject to investment risks; therefore you may lose money by investing in the Fund.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>PERFORMANCE SUMMARY</b></p>

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

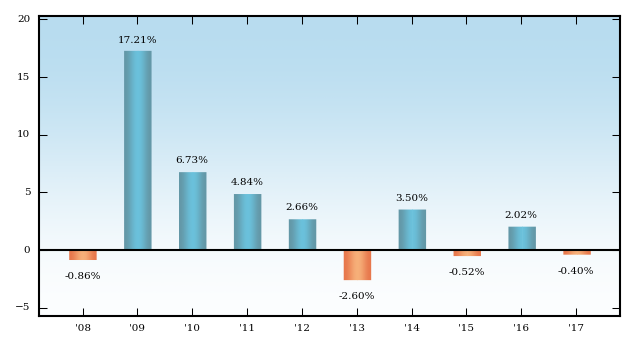

The bar chart and performance table that follow

provide some indication of the risks and variability of investing in the Fixed Income Fund by showing the changes in the Fund’s

performance from year to year for the last ten calendar years, and by showing how the Fund’s average annual total returns

for 1, 5 and 10 years compare with those of a broad measure of market performance. The Fixed Income Fund is the successor to The

Elite Income Fund (the “Predecessor Fund”), a mutual fund which had substantially similar investment objectives, strategies

and policies. The performance provided in the bar chart and performance table that follow includes that of the Predecessor Fund

for periods prior to September 28, 2012. For certain periods, performance has been positively impacted by expense reimbursements

made by the investment adviser of the Predecessor Fund. The Fixed Income Fund’s and the Predecessor Fund’s performance

in the past is not necessarily an indication of how the Fund will perform in the future. Updated performance information, current

to the most recent month end, is available by calling 1-888-CUTLER4 (1-888-288-5374).

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The bar chart and performance table that follow provide some indication of the risks and variability of investing in the Fixed Income Fund by showing the changes in the Fund’s performance from year to year for the last ten calendar years, and by showing how the Fund’s average annual total returns for 1, 5 and 10 years compare with those of a broad measure of market performance.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

1-888-CUTLER4 (1-888-288-5374)

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Fixed Income Fund’s and the Predecessor Fund’s performance in the past is not necessarily an indication of how the Fund will perform in the future.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0; text-align: center"><b>FIXED INCOME FUND</b></p>

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0; text-align: center"><b> </b></p>

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0; text-align: center"><b>Year-by-year Annual Total Return as of 12/31

each year (%)</b></p>

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

The Fixed Income Fund’s 2018 year-to-date

total return through September 30, 2018 is -3.03%.

During the periods shown in the bar chart,

the highest quarterly return was 7.20% during the quarter ended June 30, 2009 and the lowest quarterly return was -3.65% during

the quarter ended December 31, 2015.

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>Average Annual Total Returns For Periods Ended December 31, 2017</b></p>

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (IRAs).

|

|

| Performance Table Narrative |

rr_PerformanceTableNarrativeTextBlock |

After-tax returns are calculated using the

historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not

relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement

accounts (IRAs).

|

|

| Cutler Fixed Income Fund | Cutler Fixed Income Fund Shares |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Trading Symbol |

dei_TradingSymbol |

CALFX

|

|

| Shareholder Fees (fees paid directly from your investment) |

rr_ShareholderFeesColumnName |

None

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.50%

|

|

| Service Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

1.15%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.65%

|

|

| One Year |

rr_ExpenseExampleYear01 |

$ 168

|

|

| Three Years |

rr_ExpenseExampleYear03 |

520

|

|

| Five Years |

rr_ExpenseExampleYear05 |

897

|

|

| Ten Years |

rr_ExpenseExampleYear10 |

$ 1,955

|

|

| Annual Return 2008 |

rr_AnnualReturn2008 |

(0.86%)

|

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

17.21%

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

6.73%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

4.84%

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

2.66%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

(2.60%)

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

3.50%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

(0.52%)

|

|

| Annual Return 2016 |

rr_AnnualReturn2016 |

2.02%

|

|

| Annual Return 2017 |

rr_AnnualReturn2017 |

(0.40%)

|

|

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

year-to-date total return

|

|

| Bar Chart, Year to Date Return, Date |

rr_BarChartYearToDateReturnDate |

Sep. 30, 2018

|

|

| Bar Chart, Year to Date Return |

rr_BarChartYearToDateReturn |

(3.03%)

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

highest quarterly return

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Jun. 30, 2009

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

7.20%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

lowest quarterly return

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Dec. 31, 2015

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(3.65%)

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(0.40%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

0.38%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

3.13%

|

|

| Cutler Fixed Income Fund | After Taxes on Distributions | Cutler Fixed Income Fund Shares |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(0.82%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

(1.33%)

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

1.50%

|

|

| Cutler Fixed Income Fund | After Taxes on Distributions and Sales | Cutler Fixed Income Fund Shares |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

(0.23%)

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

(0.45%)

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

1.81%

|

|

| Cutler Fixed Income Fund | Bloomberg Barclays Intermediate U.S. Government/Credit Index (reflects no deduction for fees, expenses or taxes) |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

2.14%

|

[3] |

| 5 Years |

rr_AverageAnnualReturnYear05 |

1.50%

|

[3] |

| 10 Years |

rr_AverageAnnualReturnYear10 |

3.32%

|

[3] |

| Cutler Fixed Income Fund | Bloomberg Barclays Short-Term U.S. Government Index (reflects no deduction for taxes) |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

0.45%

|

[3] |

| 5 Years |

rr_AverageAnnualReturnYear05 |

0.58%

|

[3] |

| 10 Years |

rr_AverageAnnualReturnYear10 |

3.32%

|

[3] |

| Cutler Emerging Markets Fund |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><font style="text-transform: uppercase"><b>RISK/RETURN SUMMARY</b></font></p>

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"> </p>

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>CUTLER EMERGING MARKETS FUND</b></p>

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>INVESTMENT OBJECTIVE</b></p>

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The investment objective of the Cutler Emerging

Markets Fund (the “Emerging Markets Fund”) is to seek current income and long-term capital appreciation.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>FEES AND EXPENSES</b></p>

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

The following tables describe the fees and

expenses that you may pay if you buy and hold shares of the Emerging Markets Fund.

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>Annual Fund Operating Expenses</b><br />

(expenses that you pay each year as a percentage of the value of your investment)</p>

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

October 31, 2019

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>Portfolio Turnover</b></p>

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Emerging Markets Fund pays transaction

costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover

rate may indicate higher transaction costs and may result in higher taxes when Emerging Markets Fund shares are held in a taxable

account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Emerging Markets

Fund’s performance. During the most recent fiscal year, the Emerging Markets Fund’s portfolio turnover rate was 2%

of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

2.00%

|

|

| Expenses Not Correlated to Ratio Due to Acquired Fund Fees [Text] |

rr_ExpensesNotCorrelatedToRatioDueToAcquiredFundFees |

<p>“Total Annual Fund Operating Expenses” will not correlate to the Emerging Markets Fund’s ratio of net expenses

to average net assets in the Fund’s Financial Highlights, which reflects the operating expenses of the Fund but does not

include “Acquired Fund Fees and Expenses.”</p>

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>Example</b></p>

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This Example is intended to help you compare

the cost of investing in the Emerging Markets Fund with the cost of investing in other mutual funds. It assumes that you invest

$10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example

also assumes that your investment has a 5% return each year, that the Emerging Markets Fund’s operating expenses remain

the same and that the expense limitation will expire after one year. Although your actual costs may be higher or lower, based

on these assumptions your costs would be:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>PRINCIPAL INVESTMENT STRATEGIES OF THE EMERGING MARKETS FUND</b></p>

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

In seeking to meet its investment objective,

under normal conditions, at least 80% of the Emerging Markets Fund’s assets will be invested in a diversified portfolio of

securities of issuers whose principal activities are in, or economically tied to, emerging markets countries selected in accordance

with the Adviser’s long standing dividend focused investment philosophy. For purposes of this policy, “assets”

shall mean net assets plus the amount of any borrowings for investment purposes (although the Fund is not currently authorized

by the Board of Trustees to do so). Securities in which the Emerging Markets Fund may invest include common stocks, preferred stocks,

American Depositary Receipts (“ADRs”) and exchange-traded funds (“ETFs”). The Fund considers “emerging

markets” generally to include any country defined or classified currently or in the future as an emerging market by the Morgan

Stanley Capital International (“MSCI”) Emerging Markets Index but may include other countries in the discretion of

the Adviser.

The Adviser will manage the Emerging Markets

Fund in accordance with the Adviser’s dividend focused investment philosophy with appropriate adjustments for emerging market

economies, sectors and securities. The Adviser chooses investments based on its judgment of fundamental value, which emphasizes

companies that the Adviser judges to have favorable dividend yields and growth prospects relative to comparable companies. Factors

deemed particularly relevant in determining fundamental value include:

• earnings

• dividend and market price histories

• balance sheet characteristics

• perceived management skills

In selecting investments for the Emerging Markets

Fund, the Fund’s portfolio managers, based upon their experience with and analysis of emerging markets economies, sectors

and securities, will take into account the various opportunities presented by companies in rapidly growing emerging markets and

the correlative risks presented by emerging markets securities.

The Emerging Markets Fund typically invests

in stocks of companies that have a total market capitalization of at least $5 billion and, in the Adviser’s opinion, have

institutional ownership that is sufficiently broad to provide adequate liquidity suitable to the Fund’s holdings. The Emerging

Markets Fund normally expects that its assets will be invested in multiple emerging market countries, industries and market sectors.

The Adviser uses both “top-down”

and “bottom-up” approaches, and investment selections are made using a fundamental approach. Top-down research involves

the study of economic trends in emerging market economies, such as the fluctuation in interest or unemployment rates. These factors

help to identify countries, industries and sectors with the potential to outperform as a result of major economic developments.

Bottom-up research involves detailed analysis of specific companies. Important factors include industry characteristics, profitability,

growth dynamics, industry positioning, strength of management, valuation and expected return for the foreseeable future. Particular

attention is paid to a company’s ability to pay or increase its current dividend.

The Emerging Markets Fund may use ETFs in certain

situations to gain access to a broader exposure to a specific emerging stock market without purchasing a large number of individual

securities. The Emerging Markets Fund may invest in ETFs that have a total market capitalization and which invest in securities

with a market capitalization of any size. The Emerging Markets Fund may invest both in ADRs, which are listed on domestic stock

exchanges, as well as directly in common stock traded on foreign exchanges. The Emerging Markets Fund may invest in securities

of both U.S. and non-U.S. issuers, which can be both U.S. dollar-based and non-U.S. dollar-based.

The Emerging Markets Fund may, but is not required

to, hedge against currency risk through the use of forward foreign currency contracts which are entered into directly with dealers.

The Adviser will sell securities for any one

of four possible reasons:

• When another company is found by the

Adviser to have a higher current dividend yield or better potential for capital appreciation and dividend growth.

• If the industry moves in an unforeseen

direction that negatively impacts the positioning of a particular investment or if the company’s strategy, execution or industry

positioning itself deteriorates. The Adviser develops specific views on how industries are likely to evolve and how individual

companies will participate in industry growth and change.

• If the Adviser believes that a company’s

management is not acting in a forthright manner.

• If the Adviser believes that a country’s

significant geopolitical concerns raise cause for concern for a particular issuer.

|

|

| Risk [Heading] |

rr_RiskHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>PRINCIPAL RISKS OF INVESTING IN THE EMERGING MARKETS FUND</b></p>

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the Emerging Markets Fund

is subject to investment risks; therefore you may lose money by investing in the Fund. There is no assurance that the Emerging

Markets Fund will achieve its investment objective. The Emerging Markets Fund’s net asset value and total return will fluctuate

based upon changes in the value of its portfolio securities. Upon redemption, an investment in the Emerging Markets Fund may be

worth less than its original cost. The Emerging Markets Fund, by itself, does not provide a complete investment program. The Emerging

Markets Fund is subject to the following principal risks (presented alphabetically):

Currency Risk

Because the Emerging Markets Fund holds securities

valued in foreign currencies and holds foreign currencies when it purchases and sells foreign securities, changes in exchange rates

will impact the value of the Fund’s assets. Thus, investments in foreign securities involve currency risk, which is the risk

that the values of the foreign securities and other assets denominated in foreign currencies will decrease due to adverse changes

in the value of the U.S. dollar relative to the value of foreign currencies.

Emerging Markets Risk

The economies of emerging market countries

may be more dependent on relatively few industries that may be highly vulnerable to local and global changes. The governments of

emerging market countries may be less stable than the governments of more developed countries. Countries in the emerging markets

generally have less developed securities markets or exchanges, and less developed legal and accounting systems, reduced availability

of public information, and lack of uniform financial reporting and regulatory practices, which in turn may adversely impact the

Emerging Markets Fund’s ability to calculate accurately the intrinsic value of the securities. Securities of emerging market

companies may be less liquid and more volatile than securities in countries with more mature markets. The value of emerging market

currencies may fluctuate more than the currencies of countries with more mature markets. Investments in emerging market countries

may be subject to greater risks of government restrictions, including confiscatory taxation, expropriation or nationalization of

a company’s assets, restrictions on foreign ownership of local companies and restrictions on withdrawing assets from the

country. Investments in securities of issuers in emerging market countries may be considered speculative and higher risk.

ETF Risk

An investment in an ETF generally presents

the same primary risks as an investment in a conventional investment company, including the risk that the general level of security

prices owned by the ETF may decline, thereby affecting the value of the shares of the ETF. In addition, ETFs are subject to certain

risks that do not apply to conventional open-end mutual funds, including the risk that the market price of an ETF’s shares

may trade at a discount to its net asset value, or that an active trading market for an ETF’s shares may not be developed

or maintained. An ETF is also subject to the risks of the underlying securities it holds or sectors that the ETF is designed to

track. When the Emerging Markets Fund invests in an ETF, the Fund’s shareholders will indirectly pay a proportionate share

of the management fee and operating expenses of the ETF, in addition to the Fund’s direct fees and expenses.

Foreign Investment Risk

Investments in foreign securities involve different

risks than U.S. investments, including fluctuations in currency exchange rates, potentially unstable political and economic structures,

less efficient trade settlement practices, reduced availability of public information, and lack of uniform financial reporting

and regulatory practices similar to those that apply to U.S. issuers. Foreign stock markets may also be less liquid and more volatile

than U.S. stock markets.

Forward Foreign Currency Contracts Risk

The Emerging Markets Fund may use forward foreign

currency contracts to hedge against currency risk. Forward foreign currency contracts involve the risk of loss due to the imposition

of exchange controls by a foreign government, the delivery failure or default by the other party to the transaction, or the inability

of the Emerging Markets Fund to close out a position if the trading market becomes illiquid. There can be no assurance that any

currency hedging transactions will be successful, and the Emerging Markets Fund may suffer losses from these transactions.

Large-Cap Company Risk

The Emerging Markets Fund may invest in large-cap

companies. Large-cap companies may be unable to respond quickly to new competitive challenges, such as changes in technology and

consumer tastes, and may not be able to attain the high growth rate of successful smaller companies, especially during extended

periods of economic expansion.

Management Risk

Because the Emerging Markets Fund is actively

managed, it is subject to the risk that the investment strategies, techniques and risk analyses employed by the Adviser and may

not produce the desired results. Poor security selection could cause the Emerging Markets Fund’s return to be lower than

anticipated.

Mid-Cap Company Risk

The Emerging Markets Fund may invest in mid-cap

companies. Mid-cap companies often involve higher risks than large-cap companies because these companies may lack the financial

resources, product diversification and competitive strengths of larger companies. In addition, the frequency and volume of the

trading of securities of mid-cap companies is substantially less than is typical of larger companies. Therefore, the securities

of mid-cap companies may be subject to greater price fluctuations. Mid-cap companies also may not be widely followed by investors,

which can lower the demand for their stock.

Stock Market Risk

Among other things, the market value of any

security in which the Emerging Markets Fund may invest is based upon the market’s perception of value and not necessarily

the book value of an issuer or other objective measures of the issuer’s worth.

The Emerging Markets Fund may be an appropriate

investment if you are seeking long-term growth in your investment and are willing to tolerate significant fluctuations in the value

of your investment in response to changes in the market value of the stocks the Fund holds. This type of market movement may affect

the price of the securities of a single issuer, a segment of the foreign stock markets or the entire market. The investment style

utilized for the Emerging Markets Fund could fall out of favor with the market.

In summary, but not inclusive of all possible

risks, you could lose money on your investment in the Emerging Markets Fund, or the Fund could underperform other investments,

if any of the following occurs:

• The stock market goes down

• The stock market undervalues the stocks

in the Emerging Markets Fund’s portfolio

• The Adviser’s judgment as to the

value of the Emerging Markets Fund’s stocks proves to be mistaken

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

An investment in the Emerging Markets Fund is subject to investment risks; therefore you may lose money by investing in the Fund.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>PERFORMANCE SUMMARY</b></p>

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

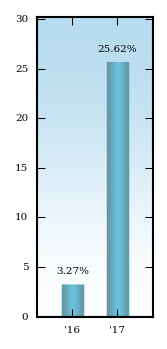

The bar chart and performance table that follow

provide some indication of the risks of investing in the Emerging Markets Fund by showing changes in the Fund’s performance

from year to year since its inception, and by showing how the Fund’s average annual total returns for the 1-year and since

inception periods compare with those of a broad measure of market performance. The Emerging Markets Fund’s performance in

the past is not necessarily an indication of how the Fund will perform in the future. Updated performance information, current

to the most recent month end, is available by calling 1-888-CUTLER4 (1-888-288-5374).

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The bar chart and performance table that follow provide some indication of the risks of investing in the Emerging Markets Fund by showing changes in the Fund’s performance from year to year since its inception, and by showing how the Fund’s average annual total returns for the 1-year and since inception periods compare with those of a broad measure of market performance.

|

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

1-888-CUTLER4 (1-888-288-5374)

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Emerging Markets Fund’s performance in the past is not necessarily an indication of how the Fund will perform in the future.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0; text-align: center"><b>EMERGING MARKETS FUND</b></p>

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0; text-align: center"><b> </b></p>

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0; text-align: center"><b>Annual Total Return as of 12/31 (%)</b></p>

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

The Emerging Markets Fund’s 2018 year-to-date

total return through September 30, 2018 is -7.65%.

During the period shown in the bar chart, the

highest quarterly return was 10.62% during the quarter ended March 31, 2017 and the lowest quarterly return was -5.50% during the

quarter ended December 31, 2016.

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

<p style="font: 11pt Times New Roman, Times, Serif; margin: 0"><b>Average Annual Total Returns For Periods Ended December 31, 2017</b></p>

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (IRAs).

|

|

| Performance Table Narrative |

rr_PerformanceTableNarrativeTextBlock |

After-tax returns are calculated using the

historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not

relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement

accounts (IRAs).

|

|

| Cutler Emerging Markets Fund | Cutler Emerging Markets Fund Shares |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| Trading Symbol |

dei_TradingSymbol |

CUTDX

|

|

| Shareholder Fees (fees paid directly from your investment) |

rr_ShareholderFeesColumnName |

None

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.85%

|

|

| Service Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

1.22%

|

|

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.13%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

2.20%

|

[4] |

| Fee Waivers and Expense Reimbursements |

rr_FeeWaiverOrReimbursementOverAssets |

(0.52%)

|

[5] |

| Total Annual Fund Operating Expenses After Fee Waivers and Expense Reimbursements |

rr_NetExpensesOverAssets |

1.68%

|

[4],[5] |

| One Year |

rr_ExpenseExampleYear01 |

$ 171

|

|

| Three Years |

rr_ExpenseExampleYear03 |

638

|

|

| Five Years |

rr_ExpenseExampleYear05 |

1,132

|

|

| Ten Years |

rr_ExpenseExampleYear10 |

$ 2,493

|

|

| Annual Return 2016 |

rr_AnnualReturn2016 |

3.27%

|

|

| Annual Return 2017 |

rr_AnnualReturn2017 |

25.62%

|

|

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

year-to-date total return

|

|

| Bar Chart, Year to Date Return, Date |

rr_BarChartYearToDateReturnDate |

Sep. 30, 2018

|

|

| Bar Chart, Year to Date Return |

rr_BarChartYearToDateReturn |

(7.65%)

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

highest quarterly return

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Mar. 31, 2017

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

10.62%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

lowest quarterly return

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Dec. 31, 2016

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(5.50%)

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

25.62%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

2.27%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jul. 02, 2015

|

|

| Cutler Emerging Markets Fund | After Taxes on Distributions | Cutler Emerging Markets Fund Shares |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

25.37%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

2.00%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jul. 02, 2015

|

|

| Cutler Emerging Markets Fund | After Taxes on Distributions and Sales | Cutler Emerging Markets Fund Shares |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

14.68%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

1.67%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jul. 02, 2015

|

|

| Cutler Emerging Markets Fund | MSCI Emerging Markets Index (MSCI EM Index) (reflects no deduction for fees, expenses or taxes) |

|

|

|

| Risk Return Abstract |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

37.28%

|

[6] |

| Since Inception |

rr_AverageAnnualReturnSinceInception |

9.74%

|

[6] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jul. 02, 2015

|

[6] |

|

|