| Cutler Equity Fund | ||||||||||||||||||||||||||||

RISK/RETURN SUMMARY

CUTLER EQUITY FUND | ||||||||||||||||||||||||||||

INVESTMENT OBJECTIVE | ||||||||||||||||||||||||||||

The investment objective of the Cutler Equity Fund (the “Equity Fund”) is current income and long-term capital appreciation. | ||||||||||||||||||||||||||||

FEES AND EXPENSES | ||||||||||||||||||||||||||||

The following tables describe the fees and expenses that you will pay if you buy and hold shares of the Equity Fund. | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

Annual Fund Operating Expenses | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

Example | ||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the Equity Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000 in the Equity Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Equity Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

Portfolio Turnover | ||||||||||||||||||||||||||||

The Equity Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Equity Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Equity Fund’s performance. During the most recent fiscal year, the Equity Fund’s portfolio turnover rate was 5% of the average value of its portfolio. | ||||||||||||||||||||||||||||

PRINCIPAL INVESTMENT STRATEGIES OF THE EQUITY FUND | ||||||||||||||||||||||||||||

In seeking to meet its investment objective, under normal conditions, at least 80% of the Equity Fund’s assets will be invested in a diversified portfolio of common stocks according to the investment style of the Fund’s investment adviser, Cutler Investment Counsel, LLC (the “Adviser”). For purposes of this policy, “assets” shall mean net assets plus the amount of any borrowings for investment purposes (although the Equity Fund is not currently authorized by the Board of Trustees to do so). The Adviser chooses investments in common stocks based on its judgment of fundamental value, which emphasizes stocks that the Adviser judges to have favorable dividend yields and growth prospects relative to comparable companies. Factors deemed particularly relevant in determining fundamental value include:

● earnings

● dividend and market price histories

● balance sheet characteristics

● perceived management skills

Changes in economic and political outlooks, as well as corporate developments affecting individual companies, can influence specific security prices. The Equity Fund typically invests in stocks of companies that have a total market capitalization of at least $10 billion and, in the Adviser’s opinion, have institutional ownership that is sufficiently broad to provide adequate liquidity suitable to the Fund’s holdings.

The Adviser uses both “top-down” and “bottom-up” approaches, and investment selections are made using a fundamental approach. Top-down research involves the study of economic trends in the domestic and global economy, such as the fluctuation in interest or unemployment rates. These factors help to identify industries and sectors with the potential to outperform as a result of major economic developments. Bottom-up research involves detailed analysis of specific companies. Important factors include industry characteristics, profitability, growth dynamics, industry positioning, strength of management, valuation and expected return for the foreseeable future. Particular attention is paid to a company’s ability to pay or increase its current dividend.

The Adviser will sell securities for any one of three possible reasons:

● When another company is found by the Adviser to have a higher current dividend yield or better potential for capital appreciation and dividend growth.

● If the industry moves in an unforeseen direction that negatively impacts the positioning of a particular investment or if the company’s strategy, execution or industry positioning itself deteriorates. The Adviser develops specific views on how industries are likely to evolve and how individual companies will participate in industry growth and change.

● If the Adviser believes that a company’s management is not acting in a forthright manner. | ||||||||||||||||||||||||||||

PRINCIPAL RISKS OF INVESTING IN THE EQUITY FUND | ||||||||||||||||||||||||||||

An investment in the Equity Fund is subject to investment risks; therefore you may lose money by investing in the Fund. There is no assurance that the Equity Fund will achieve its investment objective. The Equity Fund’s net asset value and total return will fluctuate based upon changes in the value of its portfolio securities. Upon redemption, an investment in the Equity Fund may be worth less than its original cost. The Equity Fund, by itself, does not provide a complete investment program.

Stock Market Risk

All investments made by the Equity Fund have some risk. Among other things, the market value of any security in which the Equity Fund may invest is based upon the market’s perception of value and not necessarily the book value of an issuer or other objective measures of the issuer’s worth.

The Equity Fund may be an appropriate investment if you are seeking long-term growth in your investment and are willing to tolerate significant fluctuations in the value of your investment in response to changes in the market value of the stocks the Fund holds. This type of market movement may affect the price of the securities of a single issuer, a segment of the domestic stock market or the entire market. The investment style utilized for the Equity Fund could fall out of favor with the market.

Management Risk

Because the Equity Fund is actively managed, it is subject to the risk that the investment strategies, techniques and risk analyses employed by the Adviser may not produce the desired results. Poor security selection could cause the Equity Fund’s return to be lower than anticipated. Current income may be significant or very little, depending upon the Adviser’s portfolio selections for the Equity Fund.

Large-Cap Company Risk

The Equity Fund may invest in large-capitalization (“large-cap”) companies. Large-cap companies may be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes, and may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion.

Mid-Cap Company Risk

The Equity Fund may invest in mid-capitalization (“mid-cap”) companies. Mid-cap companies often involve higher risks than large-cap companies because these companies may lack the financial resources, product diversification and competitive strengths of larger companies. In addition, the frequency and volume of the trading of securities of mid-cap companies is substantially less than is typical of larger companies. Therefore, the securities of mid-cap companies may be subject to greater price fluctuations. Mid-cap companies also may not be widely followed by investors, which can lower the demand for their stock.

In summary, but not inclusive of all possible risks, you could lose money on your investment in the Equity Fund, or the Fund could underperform other investments, if any of the following occurs:

● The stock market goes down

● The stock market undervalues the stocks in the Equity Fund’s portfolio

● The Adviser’s judgment as to the value of the Equity Fund’s stocks proves to be mistaken | ||||||||||||||||||||||||||||

PERFORMANCE SUMMARY | ||||||||||||||||||||||||||||

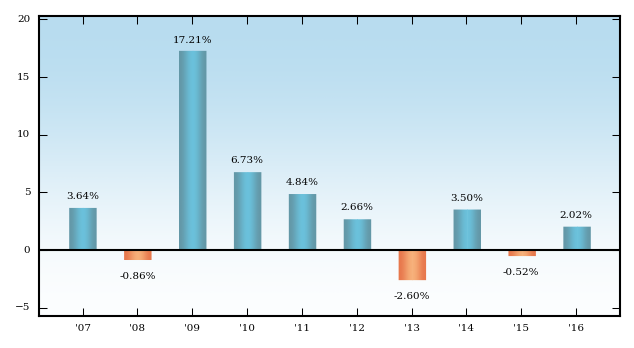

The bar chart and performance table that follow provide some indication of the risks and variability of investing in the Equity Fund by showing the changes in the Fund’s performance from year-to-year for the last ten calendar years, and by showing how the Fund’s average annual total returns for 1, 5 and 10 years compare with those of a broad measure of market performance. The Equity Fund’s performance in the past is not necessarily an indication of how the Fund will perform in the future. Updated performance information, current to the most recent month end, is available by calling 1-888-CUTLER4 (1-888-288-5374). | ||||||||||||||||||||||||||||

EQUITY FUND

Year-by-year Annual Total Return as of 12/31 each year (%) | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

The Equity Fund’s 2017 year-to-date total return through September 30, 2017 is 7.08%.

During the periods shown in the bar chart, the highest quarterly return was 14.31% during the quarter ended September 30, 2009 and the lowest quarterly return was -18.66% during the quarter ended December 31, 2008. | ||||||||||||||||||||||||||||

Average Annual Total Returns For Periods Ended December 31, 2016 | ||||||||||||||||||||||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (IRAs). | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

The S&P 500 Index is a market capitalization weighted index of 500 large U.S. companies chosen for market size, liquidity and industry group representation and includes reinvested dividends. The index is unmanaged and is widely used as a barometer of U.S. stock market performance. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. | ||||||||||||||||||||||||||||

| Cutler Fixed Income Fund | ||||||||||||||||||||||||||||

RISK/RETURN SUMMARY

CUTLER FIXED INCOME FUND | ||||||||||||||||||||||||||||

INVESTMENT OBJECTIVE | ||||||||||||||||||||||||||||

The investment objective of the Cutler Fixed Income Fund (the “Fixed Income Fund”) is to seek to achieve high income over the long-term. | ||||||||||||||||||||||||||||

FEES AND EXPENSES | ||||||||||||||||||||||||||||

The following tables describe the fees and expenses that you will pay if you buy and hold shares of the Fixed Income Fund. | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

Annual Fund Operating Expenses | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

Example | ||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the Fixed Income Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000 in the Fixed Income Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fixed Income Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

Portfolio Turnover | ||||||||||||||||||||||||||||

The Fixed Income Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fixed Income Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fixed Income Fund’s performance. During the most recent fiscal year, the Fixed Income Fund’s portfolio turnover rate was 24% of the average value of its portfolio. | ||||||||||||||||||||||||||||

PRINCIPAL INVESTMENT STRATEGIES OF THE FIXED INCOME FUND | ||||||||||||||||||||||||||||

The Fixed Income Fund invests principally in a diversified portfolio of investment grade fixed income securities that are believed to generate a high level of current income. The Fixed Income Fund normally invests in investment grade fixed income securities consisting primarily of obligations issued by the U.S. Government, agencies of the U.S. Government, instruments related to U.S. Government securities, mortgage-backed and other asset-backed securities and U.S. corporate debt securities. The Adviser considers these types of securities to be the Fixed Income Fund’s core holdings. In seeking to meet its investment objective, under normal conditions, at least 80% of the Fixed Income Fund’s assets will be invested in fixed income securities. For purposes of this policy, “assets” shall mean net assets plus the amount of any borrowings for investment purposes (although the Fixed Income Fund is not currently authorized by the Board of Trustees to do so).

An investment grade security is one which is rated investment grade by either Moody’s Investors Service, Inc. (“Moody’s”), Standard & Poor’s Ratings Services (“S&P”) or Fitch Ratings Ltd. (“Fitch”), or an unrated security that the Adviser believes to be of comparable quality. The Fixed Income Fund may invest in:

● United States Treasury obligations, including T-bills, notes, bonds, inflation-indexed bonds and other debt obligations issued by the U.S. Treasury, and obligations of U.S. Government Agencies that are backed by the full faith and credit of the U.S. Government. Such U.S. Government Agencies include the Private Export Funding Corporation, Overseas Private Investment Corporation, Small Business Administration, Government National Mortgage Association (GNMA), Department of Housing and Urban Development and U.S. Maritime Administration.

● Securities issued or guaranteed by agencies and instrumentalities of the U.S. Government, but not explicitly backed by the full faith and credit of the U.S. Government. These include the Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac), Federal Farm Credit Banks, Tennessee Valley Authority, and Federal Home Loan Bank.

● Mortgage-Backed and Other Asset-Backed Securities. Mortgage-backed securities are obligations representing an undivided interest in, or collateralized by, pools of mortgages. These obligations, in effect, “pass-through” the monthly interest and principal payments (including prepayments) made by the individual borrowers on the pooled mortgage loans to the holders of the securities. U.S. Government agency mortgage-backed issues include securities issued by GNMA, Fannie Mae and Freddie Mac. GNMA securities are guaranteed as to payment of principal and interest (but not as to price and yield) by the U.S. Government, while Fannie Mae and Freddie Mac securities are guaranteed only by the issuing agency. Stripped Mortgage-Backed Securities (“SMBS”) are derivative multi-class mortgage securities. SMBS are usually structured with two classes that receive different proportions of the interest and principal distributions on a pool of mortgage assets. An SMBS will have one class that will receive all of the interest (the interest-only or “IO” class), while the other class will receive the entire principal (the principal-only or “PO” class). The Fixed Income Fund may also invest in corporate mortgage-backed securities or other asset-backed securities that have an investment grade rating. Asset-backed securities represent a group of assets that are combined or pooled for sale to investors and may be backed by receivables such as credit card, auto and student loans. The Fixed Income Fund may also invest in corporate mortgage-backed securities or other asset-backed securities that have an investment grade rating. Asset-backed securities represent a group of assets that are combined or pooled for sale to investors and may be backed by receivables such as credit card, auto and student loans.

● U.S. corporate debt securities (obligations of a corporation to pay interest and repay principal). They include commercial paper, notes, bonds and debentures.

The Adviser’s primary focus is on individual security selection, rather than attempting to anticipate major interest rate moves. The Adviser uses a value-oriented buy discipline to identify securities that are believed to offer a yield advantage over others of similar quality or to exhibit stable or improving credit quality that may be unrecognized by other investors. Portfolio securities may be sold when price appreciation causes a security to lose its yield advantage, or when credit quality begins to deteriorate. In the event the rating of a fixed income security held by the Fixed Income Fund is reduced below investment grade, the Adviser is not required to sell the security, but will consider this event in its determination of whether the Fund should continue to hold such security.

To increase the Fixed Income Fund’s income potential, the Adviser may invest any amount it deems desirable in each of the various types of fixed income securities, and adjust the investment ratios from time to time, so long as the Fund remains diversified. There is no set average maturity for the portfolio. The Fixed Income Fund allocates its assets among different types of securities and maturities based upon the Adviser’s view of the relative value of each security or maturity. The Adviser may respond to changing market and other conditions by adjusting the type of securities held by the Fixed Income Fund and its average portfolio maturity. The Fixed Income Fund may invest in either fixed rate or variable rate debt securities. | ||||||||||||||||||||||||||||

PRINCIPAL RISKS OF INVESTING IN THE FIXED INCOME FUND | ||||||||||||||||||||||||||||

An investment in the Fixed Income Fund is subject to investment risks; therefore you may lose money by investing in the Fund. There is no assurance that the Fixed Income Fund will achieve its investment objective. The Fixed Income Fund’s net asset value and total return will fluctuate based upon changes in the value of its portfolio securities. Upon redemption, an investment in the Fixed Income Fund may be worth less than its original cost. The Fixed Income Fund, by itself, does not provide a complete investment program.

Management Risk

Because the Fixed Income Fund is actively managed, it is subject to the risk that the investment strategies, techniques and risk analyses employed by the Adviser may not produce the desired results. Poor security selection and/or investments that have unfavorable portfolio maturities could cause the Fixed Income Fund’s return to be lower than anticipated. Current income may be significant or very little, depending upon the Adviser’s portfolio selections for the Fixed Income Fund.

Fixed Income Securities Risk

● Interest Rate Risk. When interest rates rise, bond prices generally fall and when interest rates fall, bond prices generally rise. In an environment of relatively low interest rates, the risk that fixed income prices may fall is potentially greater. Interest rate risk increases as average maturity increases. Interest rate increases can cause the price of a fixed income security to decline, resulting in a price decline for the Fixed Income Fund. Thus, when the Fixed Income Fund emphasizes securities with longer maturities, you are exposed to greater interest rate risk. All income-oriented securities, even those of highest quality, are subject to some degree of interest rate risk.

● Credit Risk. Credit risk is associated with a borrower’s ability to pay interest and principal when due. A borrower’s inability to make its payment obligations could result in a significant loss of income, causing the Fixed Income Fund’s price to decline. Credit risk increases as overall portfolio quality decreases. Thus, when the Fixed Income Fund invests in lower-quality securities, you are exposed to increased credit risk.

● Call Risk. Call risk for corporate bonds is the possibility that borrowers will prepay their debt prior to the scheduled maturity date, resulting in the probability of reinvesting the proceeds in bonds with lower yields. If interest rates decline when the Fixed Income Fund is emphasizing longer maturing securities, you are exposed to greater call risk because issuers of callable bonds are more likely to pay off their bonds before the maturity date. This may cause a reduction of income to the Fixed Income Fund.

● Liquidity Risk. Liquidity risk is the risk that a bond could not be sold at an advantageous time or price due to limited market demand. If a bond is downgraded or drops in price, or if adverse conditions exist within the bond market, the demand for a bond may be limited, making that bond difficult to sell.

● Mortgage-Backed Securities Risk. Mortgage-backed securities are subject to greater call/prepayment risk than many fixed income securities, especially when interest rates decline. Prepayment risk could reduce yield and market value and cause the Fixed Income Fund to reinvest its assets at a lower prevailing interest rate. These securities are also subject to extension risk, or the risk of a security lengthening in duration due to the deceleration of prepayments. Extension risk is mainly the result of rising interest rates. As interest rates rise, the likelihood of prepayment decreases and if this occurs, the Fixed Income Fund may be unable to capitalize on other investments that have higher interest rates. Mortgage-backed securities may be subject to risks unique to the housing industry, including mortgage lending practices, defaults and foreclosures, changes in real estate values and housing inventories, mortgage securitization practices and rating assignments by credit rating agencies. Stripped mortgage-backed securities, particularly IOs, are more volatile and sensitive to the rate of prepayments than other types of mortgage-backed securities, and their value can fall dramatically in response to rapid or unexpected changes in the mortgage, interest rate or economic environment.

In summary, but not inclusive of all possible risks, you could lose money on your investment in the Fixed Income Fund, or the Fund could underperform other investments, if any of the following occurs:

● Interest rates rise

● A borrower is unable to pay interest or principal when due

● The fixed income market becomes illiquid

● The stock market goes down

● The Adviser’s judgment as to the direction of interest rates or the attributes of the Fixed Income Fund’s securities proves to be mistaken | ||||||||||||||||||||||||||||

PERFORMANCE SUMMARY | ||||||||||||||||||||||||||||

The bar chart and performance table that follow provide some indication of the risks and variability of investing in the Fixed Income Fund by showing the changes in the Fund’s performance from year to year for the last ten calendar years, and by showing how the Fund’s average annual total returns for 1, 5 and 10 years compare with those of a broad measure of market performance. The Fixed Income Fund is the successor to The Elite Income Fund (the “Predecessor Fund”), a mutual fund which had substantially similar investment objectives, strategies and policies. The performance provided in the bar chart and performance table that follow includes that of the Predecessor Fund for periods prior to September 28, 2012. For certain periods, performance has been positively impacted by expense reimbursements made by the investment adviser of the Predecessor Fund. The Fixed Income Fund’s and the Predecessor Fund’s performance in the past is not necessarily an indication of how the Fund will perform in the future. Updated performance information, current to the most recent month end, is available by calling 1-888-CUTLER4 (1-888-288-5374). | ||||||||||||||||||||||||||||

FIXED INCOME FUND

Year-by-year Annual Total Return as of 12/31 each year (%) | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

The Fixed Income Fund’s 2017 year-to-date total return through September 30, 2017 is -0.63%.

During the periods shown in the bar chart, the highest quarterly return was 7.20% during the quarter ended June 30, 2009 and the lowest quarterly return was -3.65% during the quarter ended December 31, 2015. | ||||||||||||||||||||||||||||

Average Annual Total Returns For Periods Ended December 31, 2016 | ||||||||||||||||||||||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (IRAs). | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

The Bloomberg Barclays Intermediate U.S. Government/Credit Index and the Bloomberg Barclays Short-Term U.S. Government Index cover intermediate and short-term fixed income securities, respectively, of the U.S government and publicly-issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements. The indices are unmanaged. An investor cannot invest in an index and its returns are not indicative of the performance or any specific investment. | ||||||||||||||||||||||||||||

| Cutler Emerging Markets Fund | ||||||||||||||||||||||||||||

RISK/RETURN SUMMARY

CUTLER EMERGING MARKETS FUND | ||||||||||||||||||||||||||||

INVESTMENT OBJECTIVE | ||||||||||||||||||||||||||||

The investment objective of the Cutler Emerging Markets Fund (the “Emerging Markets Fund”) is current income and long-term capital appreciation. | ||||||||||||||||||||||||||||

FEES AND EXPENSES | ||||||||||||||||||||||||||||

The following tables describe the fees and expenses that you may pay if you buy and hold shares of the Emerging Markets Fund. | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

Annual Fund Operating Expenses | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

Example | ||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the Emerging Markets Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year, that the Emerging Markets Fund’s operating expenses remain the same and that the expense limitation will expire after one year. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

Portfolio Turnover | ||||||||||||||||||||||||||||

The Emerging Markets Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Emerging Markets Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Emerging Markets Fund’s performance. During the most recent fiscal year, the Emerging Markets Fund’s portfolio turnover rate was 15% of the average value of its portfolio. | ||||||||||||||||||||||||||||

PRINCIPAL INVESTMENT STRATEGIES OF THE EMERGING MARKETS FUND | ||||||||||||||||||||||||||||

In seeking to meet its investment objective, under normal conditions, at least 80% of the Emerging Markets Fund’s assets will be invested in a diversified portfolio of securities of issuers whose principal activities are in, or economically tied to, emerging markets countries selected in accordance with the Adviser’s long standing dividend focused investment philosophy. For purposes of this policy, “assets” shall mean net assets plus the amount of any borrowings for investment purposes (although the Fund is not currently authorized by the Board of Trustees to do so). Securities in which the Emerging Markets Fund may invest include common stocks, preferred stocks, American Depositary Receipts (“ADRs”) and exchange-traded funds (“ETFs”). The Fund considers “emerging markets” generally to include any country defined or classified currently or in the future as an emerging market by the Morgan Stanley Capital International (“MSCI”) Emerging Markets Index but may include other countries in the discretion of the Adviser.

The Adviser will manage the Emerging Markets Fund in accordance with the Adviser’s dividend focused investment philosophy with appropriate adjustments for emerging market economies, sectors and securities. The Adviser chooses investments based on its judgment of fundamental value, which emphasizes companies that the Adviser judges to have favorable dividend yields and growth prospects relative to comparable companies. Factors deemed particularly relevant in determining fundamental value include:

● earnings

● dividend and market price histories

● balance sheet characteristics

● perceived management skills

In selecting investments for the Emerging Markets Fund, the Portfolio Managers, based upon their experience with and analysis of emerging markets economies, sectors and securities, will take into account the various opportunities presented by companies in rapidly growing emerging markets and the correlative risks presented by emerging markets securities.

The Emerging Markets Fund typically invests in stocks of companies that have a total market capitalization of at least $5 billion and, in the Adviser’s opinion, have institutional ownership that is sufficiently broad to provide adequate liquidity suitable to the Fund’s holdings. The Emerging Markets Fund normally expects that its assets will be invested in multiple emerging market countries, industries and market sectors.

The Adviser uses both “top-down” and “bottom-up” approaches, and investment selections are made using a fundamental approach. Top-down research involves the study of economic trends in emerging market economies, such as the fluctuation in interest or unemployment rates. These factors help to identify countries, industries and sectors with the potential to outperform as a result of major economic developments. Bottom-up research involves detailed analysis of specific companies. Important factors include industry characteristics, profitability, growth dynamics, industry positioning, strength of management, valuation and expected return for the foreseeable future. Particular attention is paid to a company’s ability to pay or increase its current dividend.

The Emerging Markets Fund may use ETFs in certain situations to gain access to a broader exposure to a specific emerging stock market without purchasing a large number of individual securities. The Emerging Markets Fund may invest in ETFs that have a total market capitalization and which invest in securities with a market capitalization of any size. The Emerging Markets Fund may invest both in ADRs, which are listed on domestic stock exchanges, as well as directly in common stock traded on foreign exchanges. The Emerging Markets Fund may invest in securities of both U.S. and non-U.S. issuers, which can be both U.S. dollar-based and non-U.S. dollar-based.

The Emerging Markets Fund may, but is not required to, hedge against currency risk through the use of forward foreign currency contracts which are entered into directly with dealers.

The Adviser will sell securities for any one of four possible reasons:

● When another company is found by the Adviser to have a higher current dividend yield or better potential for capital appreciation and dividend growth.

● If the industry moves in an unforeseen direction that negatively impacts the positioning of a particular investment or if the company’s strategy, execution or industry positioning itself deteriorates. The Adviser develops specific views on how industries are likely to evolve and how individual companies will participate in industry growth and change.

● If the Adviser believes that a company’s management is not acting in a forthright manner.

● If the Adviser believes that a country’s significant geopolitical concerns raise cause for concern for a particular issuer. | ||||||||||||||||||||||||||||

PRINCIPAL RISKS OF INVESTING IN THE EMERGING MARKETS FUND | ||||||||||||||||||||||||||||

An investment in the Emerging Markets Fund is subject to investment risks; therefore you may lose money by investing in the Fund. There is no assurance that the Emerging Markets Fund will achieve its investment objective. The Emerging Markets Fund’s net asset value and total return will fluctuate based upon changes in the value of its portfolio securities. Upon redemption, an investment in the Emerging Markets Fund may be worth less than its original cost. The Emerging Markets Fund, by itself, does not provide a complete investment program.

Foreign Investment Risk

Investments in foreign securities involve different risks than U.S. investments, including fluctuations in currency exchange rates, potentially unstable political and economic structures, less efficient trade settlement practices, reduced availability of public information, and lack of uniform financial reporting and regulatory practices similar to those that apply to U.S. issuers. Foreign stock markets may also be less liquid and more volatile than U.S. stock markets.

Emerging Markets Risk

The economies of emerging market countries may be more dependent on relatively few industries that may be highly vulnerable to local and global changes. The governments of emerging market countries may be less stable than the governments of more developed countries. Countries in the emerging markets generally have less developed securities markets or exchanges, and less developed legal and accounting systems, reduced availability of public information, and lack of uniform financial reporting and regulatory practices, which in turn may adversely impact the Emerging Markets Fund’s ability to calculate accurately the intrinsic value of the securities. Securities of emerging market companies may be less liquid and more volatile than securities in countries with more mature markets. The value of emerging market currencies may fluctuate more than the currencies of countries with more mature markets. Investments in emerging market countries may be subject to greater risks of government restrictions, including confiscatory taxation, expropriation or nationalization of a company’s assets, restrictions on foreign ownership of local companies and restrictions on withdrawing assets from the country. Investments in securities of issuers in emerging market countries may be considered speculative and higher risk.

Currency Risk

Because the Emerging Markets Fund holds securities valued in foreign currencies and holds foreign currencies when it purchases and sells foreign securities, changes in exchange rates will impact the value of the Fund’s assets. Thus, investments in foreign securities involve currency risk, which is the risk that the values of the foreign securities and other assets denominated in foreign currencies will decrease due to adverse changes in the value of the U.S. dollar relative to the value of foreign currencies.

Forward foreign currency contracts involve the risk of loss due to the imposition of exchange controls by a foreign government, the delivery failure or default by the other party to the transaction, or the inability of the Emerging Markets Fund to close out a position if the trading market becomes illiquid. There can be no assurance that any currency hedging transactions will be successful, and the Emerging Markets Fund may suffer losses from these transactions.

Stock Market Risk

Among other things, the market value of any security in which the Emerging Markets Fund may invest is based upon the market’s perception of value and not necessarily the book value of an issuer or other objective measures of the issuer’s worth.

The Emerging Markets Fund may be an appropriate investment if you are seeking long-term growth in your investment and are willing to tolerate significant fluctuations in the value of your investment in response to changes in the market value of the stocks the Fund holds. This type of market movement may affect the price of the securities of a single issuer, a segment of the foreign stock markets or the entire market. The investment style utilized for the Emerging Markets Fund could fall out of favor with the market.

ETF Risk

An investment in an ETF generally presents the same primary risks as an investment in a conventional investment company, including the risk that the general level of security prices owned by the ETF may decline, thereby affecting the value of the shares of the ETF. In addition, ETFs are subject to certain risks that do not apply to conventional open-end mutual funds, including the risk that the market price of an ETF’s shares may trade at a discount to its net asset value, or that an active trading market for an ETF’s shares may not be developed or maintained. An ETF is also subject to the risks of the underlying securities it holds or sectors that the ETF is designed to track. When the Emerging Markets Fund invests in an ETF, the Fund’s shareholders will indirectly pay a proportionate share of the management fee and operating expenses of the ETF, in addition to the Fund’s direct fees and expenses.

Management Risk

Because the Emerging Markets Fund is actively managed, it is subject to the risk that the investment strategies, techniques and risk analyses employed by the Adviser and may not produce the desired results. Poor security selection could cause the Emerging Markets Fund’s return to be lower than anticipated.

Large-Cap Company Risk

The Emerging Markets Fund may invest in large-cap companies. Large-cap companies may be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes, and may not be able to attain the high growth rate of successful smaller companies, especially during extended period of economic expansion.

Mid-Cap Company Risk

The Emerging Markets Fund may invest in mid-cap companies. Mid-cap companies often involve higher risks than large-cap companies because these companies may lack the financial resources, product diversification and competitive strengths of larger companies. In addition, the frequency and volume of the trading of securities of mid-cap companies is substantially less than is typical of larger companies. Therefore, the securities of mid-cap companies may be subject to greater price fluctuations. Mid-cap companies also may not be widely followed by investors, which can lower the demand for their stock.

New Fund Risk

The Emerging Markets Fund was formed in 2015 and has limited operating history. Accordingly, investors in the Emerging Markets Fund bear the risk that the Fund may not be successful in implementing its investment strategy or growing to an economically viable size. In addition, the Emerging Markets Fund may not have access to all emerging markets, as trading relationships may not have been established.

In summary, but not inclusive of all possible risks, you could lose money on your investment in the Emerging Markets Fund, or the Fund could underperform other investments, if any of the following occurs:

● The stock market goes down

● The stock market undervalues the stocks in the Emerging Markets Fund’s portfolio

● The Adviser’s judgment as to the value of the Emerging Markets Fund’s stocks proves to be mistaken | ||||||||||||||||||||||||||||

PERFORMANCE SUMMARY | ||||||||||||||||||||||||||||

The bar chart and performance table that follow provide some indication of the risks of investing in the Emerging Markets Fund by showing the Fund’s performance since its inception, and by showing how the Fund’s average annual total returns for the 1-year and since inception periods compare with those of a broad measure of market performance. The Emerging Markets Fund’s performance in the past is not necessarily an indication of how the Fund will perform in the future. Updated performance information, current to the most recent month end, is available by calling 1-888-CUTLER4 (1-888-288-5374). | ||||||||||||||||||||||||||||

EMERGING MARKETS FUND

Annual Total Return as of 12/31 (%) | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

The Emerging Markets Fund’s 2017 year-to-date total return through September 30, 2017 is 18.34%.

During the period shown in the bar chart, the highest quarterly return was 5.37% during the quarter ended September 30, 2016 and the lowest quarterly return was -5.50% during the quarter ended December 31, 2016. | ||||||||||||||||||||||||||||

Average Annual Total Returns For Periods Ended December 31, 2016 | ||||||||||||||||||||||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (IRAs). | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

The MSCI EM Index captures large and mid-cap representation across 24 emerging markets: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Russia, Qatar, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. The index is unmanaged. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. | ||||||||||||||||||||||||||||