Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07238

SUNAMERICA SERIES TRUST

(Exact name of registrant as specified in charter)

21650 Oxnard Street, 10th Floor, Woodlands Hills, CA 91367

(Address of principal executive offices) (Zip code)

John T. Genoy

Senior Vice President

SunAmerica Asset Management, LLC

Harborside 5, 185 Hudson Street, Suite 3300

Jersey City, NJ 07311

(Name and address of agent for service)

Registrant’s telephone number, including area code: (201) 324-6414

Date of fiscal year end: December 31

Date of reporting period: December 31, 2017

Table of Contents

Item 1. Reports to Stockholders

This filing is on behalf of five of the fifty-five Investment Company Series of SunAmerica Series Trust. Also, attached to this filing are the financial statements with regard to the five Master Funds of the American Funds Insurance Series®.

Table of Contents

SUNAMERICA SERIES TRUST

ANNUAL REPORT

DECEMBER 31, 2017

Table of Contents

Table of Contents

SUNAMERICA SERIES TRUST

Dear SunAmerica Series Trust Investor

We are pleased to present the SunAmerica Series Trust annual report, which contains the investment portfolio information and the financial statements of the Trust portfolios that invest exclusively in shares of corresponding funds (“Master Funds”) of the American Funds Insurance Series (“AFIS”).

If you have any questions, please contact your investment representative, or you may contact us directly at 1-800-445-7862.

Thank you for the confidence you place in us with your financial future, and we look forward to reporting to you once again in six months.

Sincerely,

John T. Genoy

President

SunAmerica Series Trust

Note: All performance figures quoted are for the SunAmerica Series Trust. They do not reflect fees and charges associated with the variable annuity. Past performance is no guarantee of future results. Annuities are long-term investment vehicles designed for retirement purposes. Early withdrawal may be subject to withdrawal charges and if taken prior to age 59 1/2, a 10% federal tax penalty may apply. An investment in a variable annuity involves investment risk, including possible loss of principal. The contract, when redeemed, may be worth more or less than the total amount invested.

Investments in stocks and bonds are subject to risks. The Portfolios are indirectly exposed to these risks through their investments in the master funds. Investments in growth stocks may be subject to volatile price swings and therefore present a greater potential for loss than other investments. Income seeking investment strategies may not be realized due to changes in dividend policies or the availability of capital resources. Investments in non-U.S. stocks and bonds may be subject to additional risks such as fluctuations in foreign currencies, political and economic instability, differences in securities regulation and accounting standards, foreign tax laws, and limited availability of public information. Investments in lower rated bonds and “junk bonds” are considered speculative due to the heightened risk of default and are subject to unpredictable losses as a result of changes in the issuer’s creditworthiness.

There can be no assurance that the Portfolios will meet their investment objectives. The master funds’ asset allocation may result in underperformance relative to benchmarks and other funds with similar objectives.

A full description of the investment goals, principal strategies, and risks for each Portfolio are provided in the prospectus.

For a full description of the master funds, please consult the prospectus for the relevant underlying master fund.

Investments are not guaranteed or endorsed by any bank, is not a deposit or obligation of any bank, and is not federally insured by Federal Deposit Corporation (FDIC), the Federal Reserve Board or any other federal government agency.

• Not FDIC or NCUA/NCUSIF Insured

• May Lose Value • No Bank or Credit Union Guarantee

• Not a Deposit • Not insured by any Federal Government Agency

|

| ||

| 1 |

Table of Contents

SUNAMERICA SERIES TRUST

| December 31, 2017 |

(unaudited)

Disclosure of Portfolio Expenses in Shareholder Reports

As a shareholder of a seperate series (a “Portfolio”) in the SunAmerica Series Trust (the “Trust”), you incur ongoing costs, including management fees; service (12b-1) fees; and other Portfolio expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolios and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at July 1, 2017 and held until December 31, 2017. Shares of the Trust are not offered directly to the public. Instead, shares are currently issued and redeemed only in connection with investments in and payments under variable annuity contracts and variable life insurance policies (“Variable Contracts”) offered by life insurance companies affiliated with SunAmerica Asset Management, LLC, the Trust‘s investment adviser and manager. The fees and expenses associated with the Variable Contracts are not included in these Examples, and had such fees and expenses been included your costs would have been higher. Please see your variable contract prospectus for more details on the fees associated with the variable contract.

Actual Expenses

The “Actual” section of the table provides information about your actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the column under the heading entitled “Expenses Paid During the Six Months Ended December 31, 2017”, to estimate the expenses you paid on your account during this period. The “Expenses Paid During the Six Months Ended December 31, 2017” column and the “Annualized Expense Ratio” column do not include fees and expenses that may be charged by the Variable Contracts, in which the Portfolios are offered. Had these fees and expenses been included, the “Expenses Paid During the Six Months Ended December 31, 2017” column would have been higher and the “Ending Account Value” column would have been lower.

Hypothetical Example for Comparison Purposes

The “Hypothetical” section of the table provides information about hypothetical account values and hypothetical expenses based on the Portfolio‘s actual expense ratio and an annual rate of return of 5% before expenses, which is not the Portfolio‘s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolios and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. The “Expenses Paid During the Six Months Ended December 31, 2017” column and the “Annualized Expense Ratio” column do not include fees and expenses that may be charged by the Variable Contracts, in which the Portfolios are offered. Had these fees and expenses been included, the “Expenses Paid During the Six Months Ended December 31, 2017” would have been higher and the “Ending Account Value” would have been lower.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the Variable Contracts. Please refer to your variable contract prospectus for more information. Therefore the “Hypothetical” example is useful in comparing ongoing costs and will not help you determine the relative total costs of owning different funds. In addition, if these fees and expenses were included, your costs would have been higher.

|

|

||

| 2 |

Table of Contents

SUNAMERICA SERIES TRUST

| EXPENSE EXAMPLE (continued) December 31, 2017 |

(unaudited)

| Actual | Hypothetical | |||||||||||||||||||||||||||

| Portfolio | Beginning Account Value at July 1, 2017 |

Ending Account Value Using Actual Return at December 31, 2017 |

Expenses Paid During the Six Months Ended December 31, 2017* |

Beginning Account Value at July 1, 2017 |

Ending Account Value Using a Hypothetical 5% Assumed Return at December 31, 2017 |

Expenses Paid During the Six Months Ended December 31, 2017* |

Annualized Expense Ratio* |

|||||||||||||||||||||

| SA American Funds® Asset Allocation† |

||||||||||||||||||||||||||||

| Class 1#@ |

$ | 1,000.00 | $ | 1,074.15 | $ | 1.46 | $ | 1,000.00 | $ | 1,023.79 | $ | 1.43 | 0.28 | % | ||||||||||||||

| Class 3#@ |

$ | 1,000.00 | $ | 1,073.20 | $ | 2.77 | $ | 1,000.00 | $ | 1,022.53 | $ | 2.70 | 0.53 | % | ||||||||||||||

| SA American Funds® Global Growth† |

||||||||||||||||||||||||||||

| Class 1#@ |

$ | 1,000.00 | $ | 1,108.36 | $ | 1.49 | $ | 1,000.00 | $ | 1,023.79 | $ | 1.43 | 0.28 | % | ||||||||||||||

| Class 3#@ |

$ | 1,000.00 | $ | 1,107.01 | $ | 2.81 | $ | 1,000.00 | $ | 1,022.53 | $ | 2.70 | 0.53 | % | ||||||||||||||

| SA American Funds® Growth† |

||||||||||||||||||||||||||||

| Class 1#@ |

$ | 1,000.00 | $ | 1,115.34 | $ | 1.49 | $ | 1,000.00 | $ | 1,023.79 | $ | 1.43 | 0.28 | % | ||||||||||||||

| Class 3#@ |

$ | 1,000.00 | $ | 1,114.10 | $ | 2.82 | $ | 1,000.00 | $ | 1,022.53 | $ | 2.70 | 0.53 | % | ||||||||||||||

| SA American Funds® Growth-Income† |

||||||||||||||||||||||||||||

| Class 1#@ |

$ | 1,000.00 | $ | 1,114.68 | $ | 1.55 | $ | 1,000.00 | $ | 1,023.74 | $ | 1.48 | 0.29 | % | ||||||||||||||

| Class 3#@ |

$ | 1,000.00 | $ | 1,113.42 | $ | 2.88 | $ | 1,000.00 | $ | 1,022.48 | $ | 2.75 | 0.54 | % | ||||||||||||||

| SA America Funds® VCP Managed Asset Allocation† |

||||||||||||||||||||||||||||

| Class 1#@ |

$ | 1,000.00 | $ | 1,068.92 | $ | 1.36 | $ | 1,000.00 | $ | 1,023.89 | $ | 1.33 | 0.26 | % | ||||||||||||||

| Class 3#@ |

$ | 1,000.00 | $ | 1,067.03 | $ | 2.71 | $ | 1,000.00 | $ | 1,022.58 | $ | 2.65 | 0.52 | % | ||||||||||||||

| † | See Note 1 |

| * | Expenses are equal to the Portfolio’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184 days divided by 365 (to reflect the one-half year period). These ratios do not reflect expenses associated with the Variable Contracts. If such fees and expenses had been included, the expenses would have been higher. Please refer to your Variable Contract prospectus for details on the expenses that apply to the Variable Contracts of the insurance companies. |

| # | During the stated period, the investment adviser either waived fees and assumed expenses for the Portfolios or through recoupment provisions, recovered a portion of or all fees and expenses waived or reimbursed in the previous two fiscal years. As a result, if these fees and expenses had not been waived, the “Actual/Hypothetical Ending Account Value” would have been lower and the “Actual/Hypothetical Expenses Paid During the Six Months Ended December 31, 2017” and “Annualized Expense Ratios” would have been higher. If these fees and expenses had not been recouped, the “Actual/Hypothetical Ending Account Value” would have been higher and the “Actual/Hypothetical Expenses Paid During the Six Months Ended December 31, 2017” and the “Annualized Expense Ratio” would have been lower. |

| @ | Does not include the expenses of the underlying Funds of the American Funds Insurance Series (“Master Funds”) that the Portfolios bear indirectly. If these indirect expenses had been included, the “Actual/Hypothetical Expenses Paid During the Six Months Ended December 31, 2017” and the “Annualized Expense Ratios” would have been higher and the “Actual/Hypothetical Ending Account Value” would have been lower. |

|

| ||

| 3 |

Table of Contents

SunAmerica Series Trust SA American Funds® Asset Allocation Portfolio

PORTFOLIO PROFILE — December 31, 2017 — (unaudited)

|

|

||

| 4 |

Table of Contents

SunAmerica Series Trust SA American Funds® Asset Allocation Portfolio

PORTFOLIO OF INVESTMENTS — December 31, 2017

| Shares | Value (Note 2) |

|||||||

| REGISTERED INVESTMENT COMPANIES — 100.1% |

||||||||

| Asset Allocation Investment Companies —100.1% |

||||||||

| American Funds Insurance Series® — Asset Allocation Fund, Class 1 |

23,147,557 | $ | 548,828,572 | |||||

|

|

|

|||||||

| TOTAL INVESTMENTS |

100.1 | % | 548,828,572 | |||||

| Liabilities in excess of other assets |

(0.1 | ) | (292,295 | ) | ||||

|

|

|

|

|

|||||

| NET ASSETS |

100.0 | % | $ | 548,536,277 | ||||

|

|

|

|

|

|||||

| @ | See Note 3 for cost of investments on a tax basis. |

The following is a summary of the inputs used to value the Portfolio’s net assets as of December 31, 2017 (see Note 2):

| Level 1 - Unadjusted Quoted Prices |

Level 2 - Other Observable Inputs |

Level 3 -

Significant Unobservable Inputs |

Total | |||||||||||||

| ASSETS: |

||||||||||||||||

| Investments at Value:* |

||||||||||||||||

| Registered Investment Companies | $ | 548,828,572 | $ | — | $ | — | $ | 548,828,572 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| * | For a detailed presentation of investments, please refer to the Portfolio of Investments. |

The Portfolio’s policy is to recognize transfers between Levels as of the end of the reporting period. There were no transfers between Levels during the reporting period.

See Notes to Financial Statements

|

| ||

| 5 |

Table of Contents

SunAmerica Series Trust SA American Funds® Global Growth Portfolio

PORTFOLIO PROFILE — December 31, 2017 — (unaudited)

|

|

||

| 6 |

Table of Contents

SunAmerica Series Trust SA American Funds® Global Growth Portfolio

PORTFOLIO OF INVESTMENTS — December 31, 2017

| Shares | Value (Note 2) |

|||||||

| REGISTERED INVESTMENT COMPANIES — 100.1% |

||||||||

| International Equity Investment Companies — 100.1% |

||||||||

| American Funds Insurance Series® — Global Growth Fund, Class 1 |

14,414,883 | $ | 439,798,078 | |||||

|

|

|

|||||||

| TOTAL INVESTMENTS |

100.1 | % | 439,798,078 | |||||

| Liabilities in excess of other assets |

(0.1 | ) | (258,303 | ) | ||||

|

|

|

|

|

|||||

| NET ASSETS |

100.0 | % | $ | 439,539,775 | ||||

|

|

|

|

|

|||||

| @ | See Note 3 for cost of investments on a tax basis. |

The following is a summary of the inputs used to value the Portfolio’s net assets as of December 31, 2017 (see Note 2):

| Level 1 - Unadjusted Quoted Prices |

Level 2 - Other Observable Inputs |

Level 3 -

Significant Unobservable Inputs |

Total | |||||||||||||

| ASSETS: |

||||||||||||||||

| Investments at Value:* |

||||||||||||||||

| Registered Investment Companies | $ | 439,798,078 | $ | — | $ | — | $ | 439,798,078 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| * | For a detailed presentation of investments, please refer to the Portfolio of Investments. |

The Portfolio’s policy is to recognize transfers between Levels as of the end of the reporting period. There were no transfers between Levels during the reporting period.

See Notes to Financial Statements

|

| ||

| 7 |

Table of Contents

SunAmerica Series Trust SA American Funds® Growth Portfolio

PORTFOLIO PROFILE — December 31, 2017 — (unaudited)

Industry Allocation*

| Domestic Equity Investment Companies |

100.1 | % | ||

|

|

|

| * | Calculated as a percentage of net assets. |

|

|

||

| 8 |

Table of Contents

SunAmerica Series Trust SA American Funds® Growth Portfolio

PORTFOLIO OF INVESTMENTS — December 31, 2017

| Shares | Value (Note 2) |

|||||||

| REGISTERED INVESTMENT COMPANIES — 100.1% |

||||||||

| Domestic Equity Investment Companies — 100.1% |

||||||||

| American Funds Insurance Series ® — Growth Fund, Class 1 |

4,509,651 | $ | 351,076,368 | |||||

|

|

|

|||||||

| TOTAL INVESTMENTS |

100.1 | % | 351,076,368 | |||||

| Liabilities in excess of other assets |

(0.1 | ) | (218,116 | ) | ||||

|

|

|

|

|

|||||

| NET ASSETS |

100.0 | % | $ | 350,858,252 | ||||

|

|

|

|

|

|||||

| @ | See Note 3 for cost of investments on a tax basis. |

The following is a summary of the inputs used to value the Portfolio’s net assets as of December 31, 2017 (see Note 2):

| Level 1 - Unadjusted Quoted Prices |

Level 2 - Other Observable Inputs |

Level 3 -

Significant Unobservable Inputs |

Total | |||||||||||||

| ASSETS: |

||||||||||||||||

| Investments at Value:* |

||||||||||||||||

| Registered Investment Companies | $ | 351,076,368 | $ | — | $ | — | $ | 351,076,368 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| * | For a detailed presentation of investments, please refer to the Portfolio of Investments. |

The Portfolio’s policy is to recognize transfers between Levels as of the end of the reporting period. There were no transfers between Levels during the reporting period.

See Notes to Financial Statements

|

| ||

| 9 |

Table of Contents

SunAmerica Series Trust SA American Funds® Growth-Income Portfolio

PORTFOLIO PROFILE — December 31, 2017 — (unaudited)

|

|

||

| 10 |

Table of Contents

SunAmerica Series Trust SA American Funds® Growth-Income Portfolio

PORTFOLIO OF INVESTMENTS — December 31, 2017

| Shares | Value (Note 2) |

|||||||

| REGISTERED INVESTMENT COMPANIES — 100.1% |

||||||||

| Domestic Equity Investment Companies — 100.1% |

||||||||

| American Funds Insurance Series® — Growth-Income Fund, Class 1 |

5,605,238 | $ | 281,495,053 | |||||

|

|

|

|||||||

| TOTAL INVESTMENTS |

100.1 | % | 281,495,053 | |||||

| Liabilities in excess of other assets |

(0.1 | ) | (179,241 | ) | ||||

|

|

|

|

|

|||||

| NET ASSETS |

100.0 | % | $ | 281,315,812 | ||||

|

|

|

|

|

|||||

| @ | See Note 3 for cost of investments on a tax basis. |

The following is a summary of the inputs used to value the Portfolio’s net assets as of December 31, 2017 (see Note 2):

| Level 1 - Unadjusted Quoted Prices |

Level 2 - Other Observable Inputs |

Level 3 -

Significant Unobservable Inputs |

Total | |||||||||||||

| ASSETS: |

||||||||||||||||

| Investments at Value:* |

||||||||||||||||

| Registered Investment Companies | $ | 281,495,053 | $ | — | $ | — | $ | 281,495,053 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| * | For a detailed presentation of investments, please refer to the Portfolio of Investments. |

The Portfolio’s policy is to recognize transfers between Levels as of the end of the reporting period. There were no transfers between Levels during the reporting period.

See Notes to Financial Statements

|

| ||

| 11 |

Table of Contents

SunAmerica Series Trust SA American Funds® VCP Managed Asset Allocation Portfolio

PORTFOLIO PROFILE — December 31, 2017 — (unaudited)

|

|

||

| 12 |

Table of Contents

SunAmerica Series Trust SA American Funds® VCP Managed Asset Allocation Portfolio

PORTFOLIO OF INVESTMENTS — December 31, 2017

| Shares | Value (Note 2) |

|||||||

| REGISTERED INVESTMENT COMPANIES — 100.0% |

||||||||

| Asset Allocation Investment Companies — 100.0% |

||||||||

| American Funds Insurance Series® — Managed Risk Asset Allocation FundSM, Class P1 |

121,813,924 | $ | 1,655,451,221 | |||||

|

|

|

|||||||

| TOTAL INVESTMENTS |

100.0 | % | 1,655,451,221 | |||||

| Liabilities in excess of other assets |

(0.0 | ) | (815,439 | ) | ||||

|

|

|

|

|

|||||

| NET ASSETS |

100.0 | % | $ | 1,654,635,782 | ||||

|

|

|

|

|

|||||

| @ | See Note 3 for cost of investments on a tax basis. |

The following is a summary of the inputs used to value the Portfolio’s net assets as of December 31, 2017 (see Note 2):

| Level 1 - Unadjusted Quoted Prices |

Level 2 - Other Observable Inputs |

Level 3 -

Significant Unobservable Inputs |

Total | |||||||||||||

| ASSETS: |

||||||||||||||||

| Investments at Value:* |

||||||||||||||||

| Registered Investment Companies | $ | 1,655,451,221 | $ | — | $ | — | $ | 1,655,451,221 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| * | For a detailed presentation of investments, please refer to the Portfolio of Investments. |

The Portfolio’s policy is to recognize transfers between Levels as of the end of the reporting period. There were no transfers between Levels during the reporting period.

See Notes to Financial Statements

|

| ||

| 13 |

Table of Contents

SUNAMERICA SERIES TRUST

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2017

| SA American Funds® Asset Allocation Portfolio† |

SA American Funds® Global Growth Portfolio† |

SA American Funds® Growth Portfolio† |

SA American Funds® Growth- Income Portfolio† |

SA American Funds® VCP Managed Asset Allocation Portfolio† |

||||||||||||||||

| ASSETS: |

||||||||||||||||||||

| Investment at value (unaffiliated)* |

$ | 548,828,572 | $ | 439,798,078 | $ | 351,076,368 | $ | 281,495,053 | $ | 1,655,451,221 | ||||||||||

| Cash |

246,787 | 257,211 | 175,239 | 138,409 | 914,583 | |||||||||||||||

| Receivable for: |

||||||||||||||||||||

| Fund shares sold |

1,512,738 | 12,806 | — | 33,807 | 18,661,055 | |||||||||||||||

| Investments sold |

— | 3,531,198 | 5,148,221 | 2,789,031 | — | |||||||||||||||

| Prepaid expenses and other assets |

4,682 | 4,691 | 4,680 | 4,674 | 4,510 | |||||||||||||||

| Due from investment adviser for expense reimbursements/fee waivers |

270,521 | 263,134 | 181,293 | 144,647 | 962,853 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

550,863,300 | 443,867,118 | 356,585,801 | 284,605,621 | 1,675,994,222 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES: |

||||||||||||||||||||

| Payable for: |

||||||||||||||||||||

| Fund shares redeemed |

106,198 | 3,801,215 | 5,323,460 | 2,961,247 | 39 | |||||||||||||||

| Investments purchased |

1,653,327 | — | — | — | 19,575,599 | |||||||||||||||

| Investment advisory and management fees |

383,240 | 357,111 | 256,831 | 204,916 | 1,306,727 | |||||||||||||||

| Service fees |

112,683 | 93,950 | 75,511 | 60,243 | 343,850 | |||||||||||||||

| Transfer agent fees |

144 | 174 | 174 | 174 | 131 | |||||||||||||||

| Trustees' fees and expenses |

791 | 734 | 582 | 464 | 2,599 | |||||||||||||||

| Other accrued expenses |

70,640 | 74,159 | 70,991 | 62,765 | 129,495 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities |

2,327,023 | 4,327,343 | 5,727,549 | 3,289,809 | 21,358,440 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET ASSETS |

$ | 548,536,277 | $ | 439,539,775 | $ | 350,858,252 | $ | 281,315,812 | $ | 1,654,635,782 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET ASSETS REPRESENTED BY: |

||||||||||||||||||||

| Paid-in capital |

471,815,517 | 312,806,763 | 246,853,290 | 203,808,489 | 1,445,921,147 | |||||||||||||||

| Accumulated undistributed net investment income (loss) |

6,733,360 | 1,438,313 | 1,486,855 | 3,124,249 | 3,813,360 | |||||||||||||||

| Accumulated undistributed net realized gain (loss) on investments and capital gain distributions from underlying funds |

15,411,632 | 30,196,732 | 43,801,003 | 23,067,752 | 17,296,853 | |||||||||||||||

| Unrealized appreciation (depreciation) on investments |

54,575,768 | 95,097,967 | 58,717,104 | 51,315,322 | 187,604,422 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET ASSETS |

$ | 548,536,277 | $ | 439,539,775 | $ | 350,858,252 | $ | 281,315,812 | $ | 1,654,635,782 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Class 1 (unlimited shares authorized): |

||||||||||||||||||||

| Net assets |

$ | 201,142 | $ | 125,956 | $ | 131,794 | $ | 126,712 | $ | 122,810 | ||||||||||

| Shares of beneficial interest issued and outstanding |

13,541 | 9,596 | 10,020 | 9,756 | 8,546 | |||||||||||||||

| Net asset value, offering and redemption price per share |

$ | 14.85 | $ | 13.13 | $ | 13.15 | $ | 12.99 | $ | 14.37 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Class 3 (unlimited shares authorized): |

||||||||||||||||||||

| Net assets |

$ | 548,335,135 | $ | 439,413,819 | $ | 350,726,458 | $ | 281,189,100 | $ | 1,654,512,972 | ||||||||||

| Shares of beneficial interest issued and outstanding |

37,018,180 | 33,569,778 | 26,740,019 | 21,713,642 | 115,448,564 | |||||||||||||||

| Net asset value, offering and redemption price per share |

$ | 14.81 | $ | 13.09 | $ | 13.12 | $ | 12.95 | $ | 14.33 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

||||||||||||||||||||

| * Cost |

||||||||||||||||||||

| Investment securities (unaffiliated) |

$ | 494,252,804 | $ | 344,700,111 | $ | 292,359,264 | $ | 230,179,731 | $ | 1,467,846,799 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| † | See Note 1 |

See Notes To Financial Statements

|

|

||

| 14 |

Table of Contents

SUNAMERICA SERIES TRUST

For the Year Ended December 31, 2017

| SA American Funds® Asset Allocation Portfolio† |

SA American Funds® Global Growth Portfolio† |

SA American Funds® Growth Portfolio† |

SA American Funds® Growth- Income Portfolio† |

SA American Funds® VCP Managed Asset Allocation Portfolio† |

||||||||||||||||

| INVESTMENT INCOME: |

||||||||||||||||||||

| Dividends (unaffiliated) |

$ | 8,555,703 | $ | 3,755,215 | $ | 2,509,755 | $ | 4,385,556 | $ | 11,452,205 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total investment income |

8,555,703 | 3,755,215 | 2,509,755 | 4,385,556 | 11,452,205 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EXPENSES: |

||||||||||||||||||||

| Investment advisory and management fees |

3,281,213 | 4,153,579 | 2,930,620 | 2,334,152 | 13,827,513 | |||||||||||||||

| Service fees — Class 3 |

964,775 | 1,092,764 | 861,650 | 686,228 | 3,638,543 | |||||||||||||||

| Transfer agent fees |

816 | 1,045 | 1,045 | 1,045 | 818 | |||||||||||||||

| Custodian and accounting fees |

11,022 | 11,050 | 11,053 | 11,038 | 11,020 | |||||||||||||||

| Reports to shareholders |

52,659 | 55,310 | 40,718 | 35,895 | 201,201 | |||||||||||||||

| Audit and tax fees |

25,372 | 25,372 | 25,372 | 25,372 | 25,370 | |||||||||||||||

| Legal fees |

8,570 | 9,667 | 8,949 | 8,453 | 15,384 | |||||||||||||||

| Trustees' fees and expenses |

9,001 | 10,394 | 8,301 | 6,649 | 34,476 | |||||||||||||||

| Interest expense |

30 | 116 | 69 | 46 | 250 | |||||||||||||||

| Other expenses |

12,921 | 18,137 | 25,903 | 18,636 | 19,720 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total expenses before fee waivers and expense reimbursements |

4,366,379 | 5,377,434 | 3,913,680 | 3,127,514 | 17,774,295 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (fees waived and expenses reimbursed)/recouped by investment adviser (Note 4) |

(2,316,150 | ) | (3,060,532 | ) | (2,068,673 | ) | (1,647,637 | ) | (10,135,451 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net expenses |

2,050,229 | 2,316,902 | 1,845,007 | 1,479,877 | 7,638,844 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net investment income (loss) |

6,505,474 | 1,438,313 | 664,748 | 2,905,679 | 3,813,361 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: |

||||||||||||||||||||

| Net realized gain (loss) on investments (unaffiliated) |

1,170,265 | 19,050,338 | 21,505,230 | 19,028,360 | 3,486,842 | |||||||||||||||

| Net realized gain (loss) from capital gain distributions received from underlying funds (unaffiliated) |

16,058,354 | 13,141,564 | 32,759,157 | 17,451,941 | 13,810,011 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net realized gain (loss) on investments |

17,228,619 | 32,191,902 | 54,264,387 | 36,480,301 | 17,296,853 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net change in unrealized appreciation (depreciation) on investments (unaffiliated) |

30,861,936 | 83,958,038 | 29,387,966 | 15,106,865 | 171,521,312 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net realized and unrealized gain (loss) on investments |

48,090,555 | 116,149,940 | 83,652,353 | 51,587,166 | 188,818,165 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 54,596,029 | $ | 117,588,253 | $ | 84,317,101 | $ | 54,492,845 | $ | 192,631,526 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| † | See Note 1 |

See Notes To Financial Statements

|

| ||

| 15 |

Table of Contents

SUNAMERICA SERIES TRUST

STATEMENT OF CHANGES IN NET ASSETS

| SA American

Funds® Asset Allocation Portfolio†† |

SA American

Funds® Global Growth Portfolio†† |

SA American

Funds® Growth Portfolio†† |

||||||||||||||||||||||

| For the year ended December 31, 2017 |

For the year ended December 31, 2016 |

For the year ended December 31, 2017 |

For the year ended December 31, 2016 |

For the year ended December 31, 2017 |

For the year ended December 31, 2016 |

|||||||||||||||||||

| INCREASE (DECREASE) IN NET ASSETS |

||||||||||||||||||||||||

| OPERATIONS: |

||||||||||||||||||||||||

| Net investment income (loss) |

$ | 6,505,474 | $ | 3,414,898 | $ | 1,438,313 | $ | 2,515,754 | $ | 664,748 | $ | 1,522,081 | ||||||||||||

| Net realized gain (loss) on investments |

17,228,619 | 7,715,548 | 32,191,902 | 44,902,002 | 54,264,387 | 42,276,793 | ||||||||||||||||||

| Net unrealized gain (loss) on investments |

30,861,936 | 8,768,716 | 83,958,038 | (45,414,998 | ) | 29,387,966 | (15,991,735 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) in net assets resulting from operations |

54,596,029 | 19,899,162 | 117,588,253 | 2,002,758 | 84,317,101 | 27,807,139 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM: |

||||||||||||||||||||||||

| Net investment income — Class 1 |

(900 | ) | — | (1,158 | ) | — | (621 | ) | — | |||||||||||||||

| Net investment income — Class 3 |

(3,444,387 | ) | (4,078,481 | ) | (3,932,655 | ) | (7,069,789 | ) | (1,521,460 | ) | (1,016,942 | ) | ||||||||||||

| Net realized gain on securities — Class 1 |

(1,913 | ) | — | (11,538 | ) | — | (13,408 | ) | — | |||||||||||||||

| Net realized gain on securities — Class 3 |

(7,683,246 | ) | (14,909,260 | ) | (41,847,096 | ) | (62,319,507 | ) | (37,409,023 | ) | (83,163,468 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total distributions to shareholders |

(11,130,446 | ) | (18,987,741 | ) | (45,792,447 | ) | (69,389,296 | ) | (38,944,512 | ) | (84,180,410 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) in net assets resulting from capital share transactions (Note 6) |

232,963,007 | 74,651,559 | (44,098,574 | ) | 56,954,103 | (16,304,257 | ) | 67,813,379 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| TOTAL INCREASE (DECREASE) IN NET ASSETS |

276,428,590 | 75,562,980 | 27,697,232 | (10,432,435 | ) | 29,068,332 | 11,440,108 | |||||||||||||||||

| NET ASSETS: |

||||||||||||||||||||||||

| Beginning of period |

272,107,687 | 196,544,707 | 411,842,543 | 422,274,978 | 321,789,920 | 310,349,812 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| End of period† |

$ | 548,536,277 | $ | 272,107,687 | $ | 439,539,775 | $ | 411,842,543 | $ | 350,858,252 | $ | 321,789,920 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

† Includes accumulated undistributed net investment income (loss) |

$ | 6,733,360 | $ | 3,445,287 | $ | 1,438,313 | $ | 3,933,813 | $ | 1,486,855 | $ | 1,522,082 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| †† | See Note 1 |

See Notes to Financial Statements

|

|

||

| 16 |

Table of Contents

SUNAMERICA SERIES TRUST

STATEMENT OF CHANGES IN NET ASSETS

| SA American

Funds® Growth-Income Portfolio†† |

SA American

Funds® VCP Managed Asset Allocation Portfolio†† |

|||||||||||||||

| For the year ended December 31, 2017 |

For the year ended December 31, 2016 |

For the year ended December 31, 2017 |

For the year ended December 31, 2016 |

|||||||||||||

| INCREASE (DECREASE) IN NET ASSETS |

||||||||||||||||

| OPERATIONS: |

||||||||||||||||

| Net investment income (loss) |

$ | 2,905,679 | $ | 2,944,465 | $ | 3,813,361 | $ | 11,201,004 | ||||||||

| Net realized gain (loss) on investments |

36,480,301 | 34,946,693 | 17,296,853 | 30,435,149 | ||||||||||||

| Net unrealized gain (loss) on investments |

15,106,865 | (11,275,491 | ) | 171,521,312 | 29,733,181 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in net assets resulting from operations |

54,492,845 | 26,615,667 | 192,631,526 | 71,369,334 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM: |

||||||||||||||||

| Net investment income — Class 1 |

(1,915 | ) | — | (877 | ) | — | ||||||||||

| Net investment income — Class 3 |

(4,254,146 | ) | (3,568,907 | ) | (11,200,128 | ) | (7,206,779 | ) | ||||||||

| Net realized gain on securities — Class 1 |

(14,218 | ) | — | (2,230 | ) | — | ||||||||||

| Net realized gain on securities — Class 3 |

(32,846,126 | ) | (44,599,886 | ) | (30,432,919 | ) | (10,153,955 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total distributions to shareholders |

(37,116,405 | ) | (48,168,793 | ) | (41,636,154 | ) | (17,360,734 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in net assets resulting from capital share transactions (Note 6) |

5,166,595 | 33,684,263 | 287,949,004 | 451,230,605 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| TOTAL INCREASE (DECREASE) IN NET ASSETS |

22,543,035 | 12,131,137 | 438,944,376 | 505,239,205 | ||||||||||||

| NET ASSETS: |

||||||||||||||||

| Beginning of period |

258,772,777 | 246,641,640 | 1,215,691,406 | 710,452,201 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| End of period† |

$ | 281,315,812 | $ | 258,772,777 | $ | 1,654,635,782 | $ | 1,215,691,406 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

† Includes accumulated undistributed net investment income (loss) |

$ | 3,124,249 | $ | 4,256,061 | $ | 3,813,360 | $ | 11,201,004 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| †† | See Note 1 |

See Notes to Financial Statements

|

| ||

| 17 |

Table of Contents

SUNAMERICA SERIES TRUST

December 31, 2017

Note 1. Description of Business and Basis of Presentation

SunAmerica Series Trust (the “Trust”), organized as a Massachusetts business trust on September 11, 1992, is an open-end management investment company. The Trust is comprised of fifty-five separate investment series, five of which are included in this report: SA American Funds® Asset Allocation Portfolio, SA American Funds® Global Growth Portfolio, SA American Funds® Growth Portfolio, SA American Funds® Growth-Income Portfolio and SA American Funds® VCP Managed Asset Allocation Portfolio, (collectively, the “Portfolios”). SunAmerica Asset Management, LLC (“SAAMCO” or the “Adviser”), an indirect wholly-owned subsidiary of American International Group, Inc., a Delaware corporation (“AIG”), serves as investment adviser for all Portfolios of the Trust.

Effective October 9, 2017, the names of the American Funds® Asset Allocation SAST Portfolio, American Funds® Global Growth SAST Portfolio, American Funds® Growth SAST Portfolio, American Funds® Growth-Income SAST Portfolio and VCP Managed Asset Allocation SAST Portfolio were changed to SA American Funds® Asset Allocation Portfolio, SA American Funds® Global Growth Portfolio, SA American Funds® Growth Portfolio, SA American Funds® Growth-Income Portfolio and SA American Funds® VCP Managed Asset Allocation Portfolio, respectively.

Shares of the Trust are issued and redeemed only in connection with investments in and payments under variable annuity contracts and variable life policies. Shares of the Portfolios are held by separate accounts of American General Life Insurance Company, a Texas life insurer (“AGL”), The United States Life Insurance Company in The City of New York, a New York life insurer (“USL”) and The Variable Annuity Life Insurance Company, a Texas life insurer (“VALIC”). AGL and USL and VALIC are indirect wholly-owned subsidiaries of AIG. The life insurance companies listed above are collectively referred to as the “Life Companies.” All shares may be purchased or redeemed at net asset value without any sales or redemption charges.

SA American Funds® Asset Allocation Portfolio, SA American Funds® Global Growth Portfolio, SA American Funds® Growth Portfolio, SA American Funds® Growth-Income Portfolio and SA American Funds® VCP Managed Asset Allocation Portfolio operate as “Feeder Funds,” and invest all or substantially all of their assets in shares of an underlying mutual fund (“underlying fund” and/or “Master Fund”).

Class 1 shares of each Portfolio commenced operations effective September 26, 2016. Class 1 shares and Class 3 shares of each Portfolio may be offered only in connection with certain variable contracts. Class 3 shares of a given Portfolio are identical in all respects to Class 1 shares of the same Portfolio, except that (i) each class may bear differing amounts of certain class-specific expenses; (ii) Class 3 shares are subject to service fees while Class 1 shares are not; and (iii) Class 3 shares have voting rights on matters that pertain to the Rule 12b-1 plan adopted with respect to Class 3 shares. Class 3 shares of each Portfolio pay service fees at an annual rate of 0.25% of each class’s average daily net assets. The Board of Trustees may establish additional portfolios or classes in the future.

Each Master Fund is a portfolio offered by American Funds Insurance Series® (“AFIS” or “American Funds”), a registered open-end management investment company. Each Portfolio’s corresponding Master Fund is listed below:

| Trust Feeder Funds |

American Funds Master Funds | |

| SA American Funds® Asset Allocation Portfolio |

SA American Funds® Asset Allocation Fund | |

| SA American Funds® Global Growth Portfolio |

SA American Funds® Global Growth Fund | |

| SA American Funds® Growth Portfolio |

SA American Funds® Growth Fund | |

| SA American Funds® Growth-Income Portfolio |

SA American Funds® Growth-Income Fund | |

| SA American Funds® VCP Managed Asset Allocation Portfolio |

SA American Funds® Managed Risk Asset Allocation FundSM |

The underlying fund’s accounting policies are outlined in the underlying funds’ financial statements, available at U.S. Securities and Exchange Commission (“SEC”) Internet website at www.sec.gov, and should be read in conjunction with these financial statements.

The investment goals for the Portfolios included in this report are as follows:

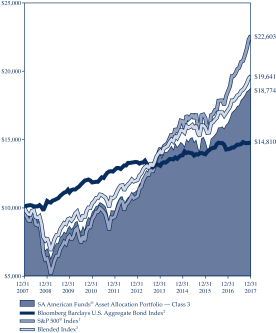

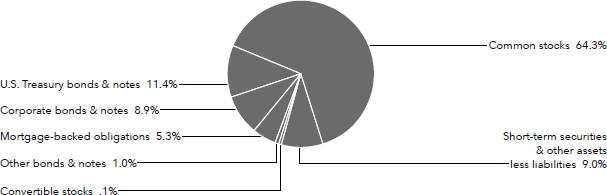

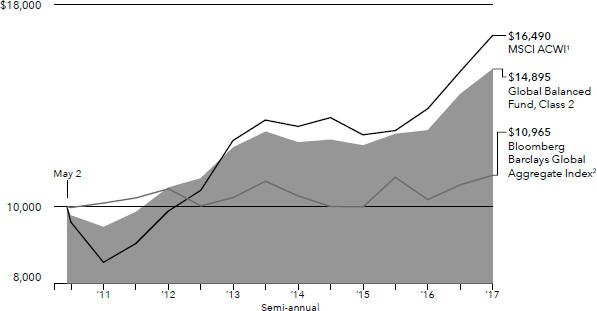

The SA American Funds® Asset Allocation Portfolio seeks high total return (including income and capital gains) consistent with the preservation of capital over the long term. Its strategy is to invest all or substantially all of its assets in Class 1 shares of the Master Fund, the American Funds Insurance Series® Asset Allocation Fund (“the Master Asset Allocation Fund”), a portfolio offered by AFIS, a registered open-end investment company. In turn, the Master Asset Allocation Fund invests in a diversified portfolio of common stocks and other equity securities, bonds and other intermediate and long-term debt securities and money market instruments.

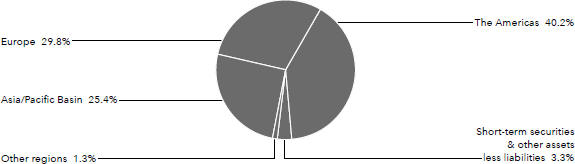

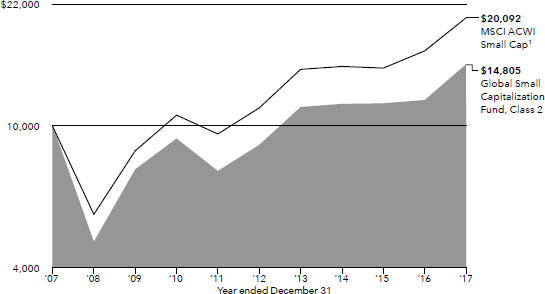

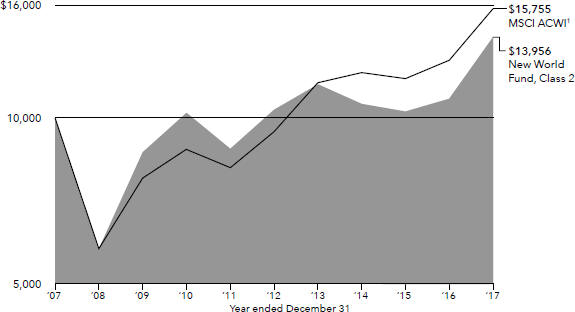

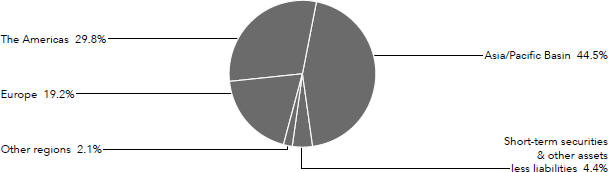

The SA American Funds® Global Growth Portfolio seeks growth. Its strategy is to invest all or substantially all of its assets in Class 1 shares of the Master Fund, the American Funds Insurance Series® Global Growth Fund (“the Master Global Growth Fund”), a portfolio offered by AFIS, a registered open-end investment company. In turn, the Master Global Growth Fund invests primarily in common stocks and other securities of companies around the world that have the potential for growth.

|

|

||

| 18 |

Table of Contents

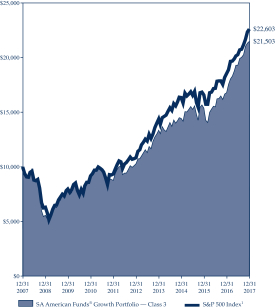

The SA American Funds® Growth Portfolio seeks growth. Its strategy is to invest all or substantially all of its assets in Class 1 shares of the Master Fund, the American Funds Insurance Series® Growth Fund (“the Master Growth Fund”), a portfolio offered by AFIS, a registered open-end investment company. In turn, the Master Growth Fund invests primarily in common stocks of companies that appear to offer superior opportunities for growth of capital.

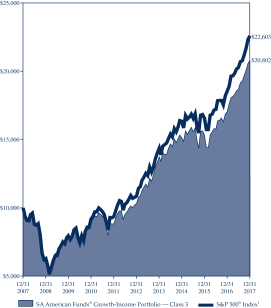

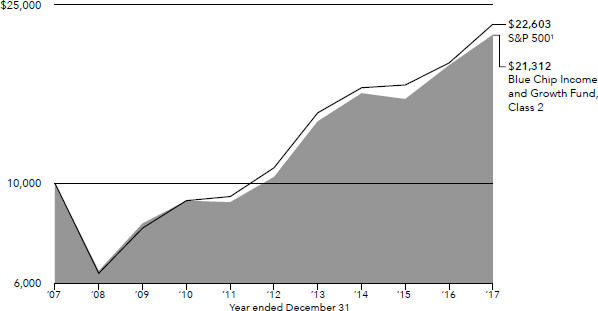

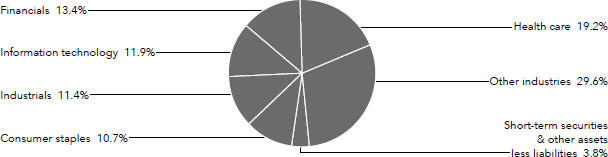

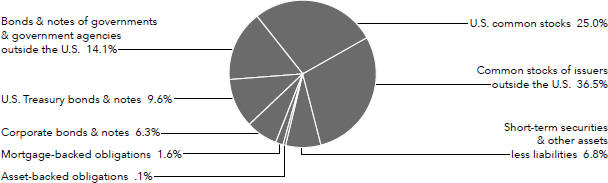

The SA American Funds® Growth-Income Portfolio seeks growth and income. Its strategy is to invest all or substantially all of its assets in Class 1 shares of the Master Fund, the American Funds Insurance Series® Growth-Income Fund (“the Master Growth-Income Fund”), a portfolio offered by AFIS, a registered open-end investment company. In turn, the Master Growth-Income Fund invests primarily in common stocks or other securities that demonstrate the potential for appreciation and/or dividends.

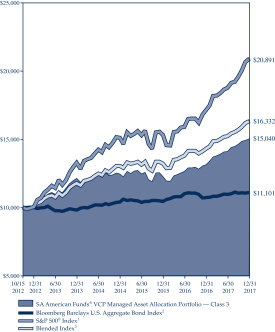

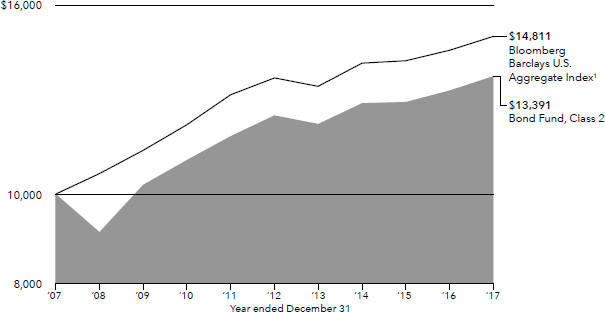

The SA American Funds® VCP Managed Asset Allocation Portfolio seeks high total return (including income and capital gains) consistent with the preservation of capital over the long term while seeking to manage volatility and provide downside protection by investing all or substantially all of its assets in Class P1 shares of the Master Fund, the American Funds Insurance Series® Managed Risk Asset Allocation FundSM (“the Master Managed Risk Allocation Fund”), a portfolio offered by AFIS, a registered open-end investment company. In turn, the Master Managed Risk Allocation Fund invests in the shares of an underlying fund, the American Funds Asset Allocation Fund (the “Underlying Fund”). The Underlying Fund invests in a diversified portfolio of common stocks and other equity securities, bonds and other intermediate and long term debt securities and money market instruments.

Indemnifications: The Trust’s organizational documents provide current and former officers and trustees with a limited indemnification against liabilities arising out of the performance of their duties to the Trust. In addition, pursuant to Indemnification Agreements between the Trust and each of the current (and certain former) trustees who is not an “interested person,” as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), of the Trust (collectively, the “Disinterested Trustees”), the Trust provides the Disinterested Trustees with a limited indemnification against liabilities arising out of the performance of their duties to the Trust, whether such liabilities are asserted during or after their service as trustees. In addition, in the normal course of business the Trust enters into contracts that contain the obligation to indemnify others. The Trust’s maximum exposure under these arrangements is unknown. Currently, however, the Trust expects the risk of loss to be remote.

Note 2. Significant Accounting Policies

The preparation of financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates and those differences could be significant. The following is a summary of significant accounting policies consistently followed by the Trust and the Master Funds, in the preparation of their respective financial statements:

Security Valuation

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the Portfolios disclose the fair value of their investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. In accordance with GAAP, fair value is defined as the price that the Portfolios would receive upon selling an asset or transferring a liability in a timely transaction to an independent third party in the principal or most advantageous market. GAAP establishes a three-tier hierarchy to provide more transparency around the inputs used to measure fair value and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The three-tiers are as follows:

Level 1 — Unadjusted quoted prices in active markets for identical securities

Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, referenced indices, quoted prices in inactive markets, adjusted quoted prices in active markets, adjusted quoted prices on foreign equity securities that were adjusted in accordance with pricing procedures approved by the Board of Trustees (the “Board”), etc.)

Level 3 — Significant unobservable inputs (includes inputs that reflect the Portfolios’ own assumptions about the assumptions market participants would use in pricing the security, developed based on the best information available under the circumstances)

Changes in valuation techniques may result in transfers in or out of an investment’s assigned Level within the hierarchy. The methodology used for valuing investments is not necessarily an indication of the risk associated with investing in those investments and the determination of the significance of a particular input to the fair value measurement in its entirety requires judgment and consideration of factors specific to each security.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is recently issued and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

|

| ||

| 19 |

Table of Contents

The summary of the Portfolios’ assets and liabilities classified in the fair value hierarchy as of December 31, 2017, is reported on a schedule following the portfolio of investments.

The net asset value (“NAV”) of each Portfolio is determined based upon the NAV of its corresponding Master Fund.

Master Funds

Each Master Fund is a series of AFIS. All portfolio securities of funds managed by Capital Research and Management Company (“Capital Research”) are valued, and the NAV per share for each share class are determined, as follows:

The AFIS investment adviser values the AFIS investments at fair value as defined by U.S. GAAP. The net asset value of each share class of each AFIS fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Methods and inputs — The AFIS investment adviser uses the following methods and inputs to establish the fair value of each fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market in which the security trades. The value of an underlying fund is based on its reported net asset value.

Fixed-income securities, including short-term securities, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the funds are authorized to invest. However, these classifications are not exclusive and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | Examples of standard inputs | |

| All | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) | |

| Corporate bonds & notes; convertible securities | Standard inputs and underlying equity of the issuer | |

| Bonds & notes of governments & government agencies | Standard inputs and interest rate volatilities | |

| Mortgage-backed; asset-backed obligations | Standard inputs and cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements and specific deal information | |

| Municipal securities | Standard inputs and, for certain distressed securities, cash flows or liquidation values using a net present value calculation based on inputs that include, but are not limited to, financial statements and debt contracts | |

When the AFIS investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or not deemed to be representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are generally valued in the manner described for either equity or fixed-income securities, depending on which method is deemed most appropriate by the AFIS investment adviser. The Government Cash Management Fund held by the managed risk funds is managed to maintain a $1.00 net asset value per share. The net asset value of each share class of each managed risk fund is calculated based on the reported net asset values of the underlying funds in which each fund invests.

Exchange-traded futures are generally valued at the official settlement price of, or the last reported sale price on, the exchange or market on which such instruments are traded, as of the close of business on the day the futures are being valued or, lacking any sales, at the last available bid price. Prices for each future are taken from the exchange or market on which the security trades. Forward currency contracts are valued at the mean of representative quoted bid and ask prices, generally based on prices supplied by one or more pricing vendors. Interest rate swaps and credit default swaps are generally valued by pricing vendors based on market inputs that include the index and term of index, reset frequency, payer/receiver, currency and pay frequency.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the AFIS investment adviser are fair valued as determined in good faith under fair value guidelines adopted by authority of the AFIS

|

|

||

| 20 |

Table of Contents

board of trustees as further described. The AFIS investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The AFIS investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities and futures that trade in markets outside U.S. time zones may be adjusted to reflect significant events that occur after the close of local trading but before the net asset value of each share class of each fund is determined. Fair valuations and valuations of investments and futures that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The AFIS board of trustees has delegated authority to the AFIS investment adviser to make fair value determinations, subject to board oversight. The AFIS investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the AFIS investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees with supplemental information to support the changes. The AFIS board and audit committee also regularly review reports that describe fair value determinations and methods.

The AFIS investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Securities Transactions, Investment Income, Expenses, Dividends and Distributions to Shareholders: Security transactions are recorded on a trade date basis. Interest income is accrued daily from settlement date except when collection is not expected. Realized gains and losses on the sale of investments are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date.

The Portfolios invest in Master Fund portfolios offered by American Funds including funds investing in fixed income securities. Distributions from income from the Master Funds, if any, are recorded to income on ex-dividend date. Distributions from net realized capital gains from the Master Funds, if any are recorded to realized gains on ex-dividend date.

Expenses common to all Portfolios, not directly related to individual Portfolios are allocated among the Portfolios based upon relative net assets or other appropriate allocation methods. In all other respects, expenses are charged to each Portfolio as incurred on a specific identification basis.

The expenses included in the accompanying financial statements reflect the expenses of the Portfolios and do not include indirect expenses borne by each underlying Portfolio in connection with its investment in the underlying Portfolio.

Dividends from net investment income and capital gain distributions, if any, are paid annually. The Portfolios record dividends and distributions to their shareholders on the ex-dividend date.

The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts at fiscal year end based on their federal tax-basis treatment; temporary differences do not require reclassification. Net assets are not affected by these reclassifications.

Each Portfolio is considered a separate entity for tax purposes and intends to comply with the requirements of the Internal Revenue Code, as amended, applicable to regulated investment companies and distribute all of its taxable income, including any net capital gains on investments, to its shareholders. Each Portfolio also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. Therefore, no federal income tax or excise tax provision is required.

The Portfolios recognize the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained, assuming examination by tax authorities. Management has analyzed each Portfolio’s tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years 2014 – 2016 or expected to be taken in each Portfolio’s 2017 tax return. The Portfolios are not aware of any tax provisions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Portfolios file U.S. federal and certain state income tax returns. With few exceptions, the Portfolios are no longer subject to U.S. federal and state tax examinations by tax authorities for tax returns ending before 2014.

New Accounting Pronouncement: In October 2016, the SEC adopted amendments to rules under the 1940 Act (“final rules”) intended to modernize the reporting and disclosure of information by registered investment companies. The final rules amend

|

| ||

| 21 |

Table of Contents

Regulation S-X and require funds to provide standardized, enhanced derivative disclosure in fund financial statements in a format designed for individual investors. The amendments to Regulation S-X also update the disclosures for other investments and investments in and advances to affiliates and amend the rules regarding the general form and content of fund financial statements. The compliance date for the amendments to Regulation S-X was August 1, 2017. All required changes have been made in accordance with Regulation S-X.

Note 3. Federal Income Taxes

The following details the tax basis of distributions as well as the components of distributable earnings. The tax basis components of distributable earnings differ from the amounts reflected in the Statement of Assets and Liabilities by temporary book/tax differences primarily arising from wash sales.

| For the year ended December 31, 2017 | ||||||||||||||||||||

| Distributable Earnings | Tax Distributions | |||||||||||||||||||

| Portfolio |

Ordinary Income |

Long-term Gains/ Capital and Other Losses |

Unrealized Appreciation (Depreciation) |

Ordinary Income |

Long-Term Capital Gains |

|||||||||||||||

| SA American Funds® Asset Allocation |

$ | 6,733,360 | $ | 16,979,586 | $ | 53,007,814 | $ | 3,445,287 | $ | 7,685,159 | ||||||||||

| SA American Funds® Global Growth |

1,438,313 | 32,175,734 | 93,118,968 | 3,933,813 | 41,858,634 | |||||||||||||||

| SA American Funds® Growth |

1,486,854 | 48,632,217 | 53,885,890 | 1,522,081 | 37,422,431 | |||||||||||||||

| SA American Funds® Growth-Income |

3,124,249 | 33,182,546 | 41,200,529 | 4,256,061 | 32,860,344 | |||||||||||||||

| SA American Funds® VCP Managed Asset Allocation |

3,813,360 | 17,296,853 | 187,604,422 | 11,201,005 | 30,435,149 | |||||||||||||||

| For the year ended December 31, 2016 |

||||||||

| Tax Distributions | ||||||||

| Ordinary Income |

Long-Term Capital Gains |

|||||||

| SA American Funds® Asset Allocation |

$ | 4,078,481 | $ | 14,909,260 | ||||

| SA American Funds® Global Growth |

7,069,789 | 62,319,507 | ||||||

| SA American Funds® Growth |

1,016,942 | 83,163,468 | ||||||

| SA American Funds® Growth-Income |

3,568,907 | 44,599,886 | ||||||

| SA American Funds® VCP Managed Asset Allocation |

7,206,779 | 10,153,955 | ||||||

For the year ended December 31, 2017, the reclassifications arising from book/tax differences resulted in increases (decreases) that were primarily due to short-term capital gain distributions from underlying funds were as follows:

| Portfolio |

Accumulated Undistributed Net Investment Income (Loss) |

Accumulated Undistributed Net Realized Gain (Loss) |

Capital Paid-in |

|||||||||

| SA American Funds® Asset Allocation |

$ | 227,886 | $ | (227,886 | ) | $ | — | |||||

| SA American Funds® Global Growth |

— | — | — | |||||||||

| SA American Funds® Growth |

822,106 | (822,106 | ) | — | ||||||||

| SA American Funds® Growth-Income |

218,570 | (218,570 | ) | — | ||||||||

| SA American Funds® VCP Managed Asset Allocation |

— | — | — | |||||||||

The amounts of aggregate unrealized gain (loss) and the cost of investment securities for Federal tax purposes, including short-term securities and repurchase agreements, were as follows:

| Portfolio |

Aggregate Unrealized Gain |

Aggregate Unrealized Loss |

Net Unrealized Gain / (Loss) |

Cost of Investments |

||||||||||||

| SA American Funds® Asset Allocation |

$ | 54,575,768 | $ | (1,567,954 | ) | $ | 53,007,814 | $ | 495,820,758 | |||||||

| SA American Funds® Global Growth |

95,097,967 | (1,978,999 | ) | 93,118,968 | 346,679,110 | |||||||||||

| SA American Funds® Growth |

58,717,104 | (4,831,214 | ) | 53,885,890 | 297,190,478 | |||||||||||

| SA American Funds® Growth-Income |

51,315,322 | (10,114,793 | ) | 41,200,529 | 240,294,524 | |||||||||||

| SA American Funds® VCP Managed Asset Allocation |

187,604,422 | — | 187,604,422 | 1,467,846,799 | ||||||||||||

On December 22, 2017, the Tax Cuts and Jobs Act (the “Act”) was signed into law. Certain provisions of the Act were effective upon enactment with the remainder becoming effective for tax years beginning after December 31, 2017. Management is currently evaluating the impact, if any, on the financial statements and the accompanying notes to financial statements.

Note 4. Investment Advisory and Management Agreement, and Service Plan (12b-1 Plan)

Capital Research serves as investment adviser to the Master Funds. Capital Research, a wholly owned subsidiary of The Capital Group Companies, Inc., manages the investment fund and business affairs of the Master Funds. The Trust, on behalf of each Portfolio, entered into an Investment Advisory and Management Agreement (the “Agreement”) with SAAMCo to handle the Trust’s day-to-day affairs. The Agreement provides that SAAMCo shall manage the Trust’s investments and administer its business affairs; furnish offices, necessary facilities and equipment; provide clerical, bookkeeping and administrative services; and permit any of its officers or employees to serve, without compensation, as trustees or officers of the Trust, if duly elected to such positions. SAAMCo performs all investment advisory services for these Portfolios with the exception of portfolio management. The term “Assets,” as used in the following table, means the average daily net assets of the Portfolios.

|

|

||

| 22 |

Table of Contents

The Trust pays SAAMCo a monthly fee calculated daily at the following annual percentages of each Portfolio’s Assets:

| Portfolio |

Management Fees |

|||

| SA American Funds® Asset Allocation |

0.85 | % | ||

| SA American Funds® Global Growth |

0.95 | % | ||

| SA American Funds® Growth |

0.85 | % | ||

| SA American Funds® Growth-Income |

0.85 | % | ||

| SA American Funds® VCP Managed Asset Allocation |

0.95 | % | ||

The Trust has entered into a contractual agreement with SAAMCo under which SAAMCo will waive 0.60%, 0.70%, 0.60%, 0.60%, and 0.70% for SA American Funds® Asset Allocation Portfolio, SA American Funds® Global Growth Portfolio, SA American Funds® Growth Portfolio, SA American Funds® Growth-Income Portfolio and SA American Funds® VCP Managed Asset Allocation Portfolio, respectively, of its advisory fee for such time as the Portfolios are operated as feeder funds, because during that time it will not be providing the portfolio management portion of the advisory and management services to be provided under its investment advisory and management agreement with the Trust. This fee waiver will continue as long as the Portfolios are part of a master-feeder fund structure unless the Board approves a change in or elimination of the waiver.

For the year ended December 31, 2017, SAAMCo has agreed to waive advisory fees as follows:

| Portfolio |

Amount | |||

| SA American Funds® Asset Allocation |

$ | 2,316,150 | ||

| SA American Funds® Global Growth |

3,060,532 | |||

| SA American Funds® Growth |

2,068,673 | |||

| SA American Funds® Growth-Income |

1,647,637 | |||

| SA American Funds® VCP Managed Asset Allocation |

10,188,694 | |||

SAAMCo has contractually agreed to waive fees and/or reimburse expenses of the following Portfolio until April 30, 2018; so that the annual operating expenses do not exceed the following percentage of the Portfolio’s average net assets. For purposes of the waived fees and/or reimbursed expense calculations, annual operating expenses shall not include extraordinary expenses (i.e. expenses that are unusual in nature and/or infrequent in occurrence such as litigation), or acquired fund fees and expenses, brokerage commissions and other transactional expenses relating to the purchase and sale of portfolio securities, interest, taxes and governmental fees, and other expenses not incurred in the ordinary course of the Portfolio’s business. This agreement may be modified or discontinued prior to April 30, 2018 only with the approval of the Board of Trustees of the Portfolio, including a majority of the Independent Trustees. This agreement will be renewed in terms of one year only if the Adviser agrees to extend the expense limitation.

| Portfolio |

Class 1 | Class 3 | ||||||

| SA American Funds® VCP Managed Asset Allocation |

0.28 | % | 0.53 | % | ||||

Further, SAAMCo has voluntarily agreed to waive fees and/or reimburse expenses, if necessary, to keep annual operating expenses at or below the following percentages of each of the following Portfolios’ Class 3 shares’ average daily net assets. For purposes of the waived fees and/or reimbursed expense calculations, annual operating expenses shall not include extraordinary expenses (i.e. expenses that are unusual in nature and/or infrequent in occurrence such as litigation), or acquired fund fees and expenses, brokerage commissions and other transactional expenses relating to the purchase and sale of portfolio securities, interest, taxes and governmental fees, and other expenses not incurred in the ordinary course of the Portfolio’s business. The Adviser also may voluntarily reimburse additional amounts to increase the investment return to a Portfolio’s investors. The Adviser may terminate voluntary waivers and/or reimbursements at any time.

| Portfolio |

Class 3 | |||

| SA American Funds® Asset Allocation |

0.70 | % | ||

| SA American Funds® Global Growth |

0.70 | % | ||

| SA American Funds® Growth |

0.70 | % | ||

| SA American Funds® Growth-Income |

0.70 | % | ||

For the year ended December 31, 2017, pursuant to the voluntary and contractual expense referred to above, SAAMCo has waived or reimbursed expenses as follows:

| Portfolio |

Amount | |||

| SA American Funds® VCP Managed Asset Allocation |

$ | 7,618 | ||

Both voluntary and contractual waivers or reimbursements, with the exception of advisory fee waivers, made by the Adviser are subject to recoupment from that Portfolio within the following two years after the occurrence of the waivers and/or reimbursements provided that the Portfolio is able to effect such payment to the Adviser and remain in compliance with the expense limitations in effect at the time the waivers and/or reimbursements were made.

For the year ended December 31, 2017, the amounts repaid to the Adviser, which are included in the Statement of Operations, along with the remaining balance subject to recoupment are as follows:

| Amount Recouped | Balance Subject to Recoupment | |||||||||||

| Portfolio |

December 31, 2017 | December 31, 2018 | December 31, 2019 | |||||||||

| SA American Funds® VCP Managed Asset Allocation |

$ | 60,861 | $ | — | $ | — | ||||||

|

| ||

| 23 |

Table of Contents

The Trust has entered into a master Transfer Agency and Service Agreement with VALIC Retirement Services Company (VRSCO), a wholly-owned subsidiary of VALIC, which is an affiliate of the Adviser. Under the agreement, VRSCO provides services, which include the issuance and redemption of shares, payment of dividends between the Trust and their “institutional” shareholders and certain shareholder reporting services including confirmation of transactions, statements of account and tax reporting. The Trust, and certain other mutual funds advised by SAAMCo pay VRSCO on an annual basis, a fee in the aggregate amount of $150,000 for transfer agency services provided, pursuant to the agreement. Accordingly, for the year ended December 31, 2017, transfer agent fees were paid (see Statement of Operations) based on the aforementioned agreement.

Class 3 shares of each Portfolio are subject to Rule 12b-1 plans that provide for service fees payable at the annual rate 0.25% of the average daily net assets of Class 3 shares. The service fees are used to compensate the Life Companies for costs associated with the servicing of Class 3 shares, including the cost of reimbursing the Life Companies for expenditures made to financial intermediaries for providing services to contract holders who are the indirect beneficial owners of the Portfolios’ Class 3 shares. Accordingly, for the year ended December 31, 2017, service fees were paid (see Statement of Operations) based on the aforementioned rate.

Note 5. Purchases and Sales of Investment Securities

The cost of purchases and proceeds from sales and maturities of long-term investments during the year ended December 31, 2017 were as follows:

| Portfolio |

Purchases of Portfolio Securities (excluding U.S. Government Securities) |

Sales of

Portfolio Securities (excluding U.S. Government Securities) |

Purchases of U.S. Government Securities |

Sales of U.S. Government Securities |

||||||||||||

| SA American Funds® Asset Allocation |

$ | 223,362,020 | $ | 3,324,223 | $ | — | $ | — | ||||||||

| SA American Funds® Global Growth |

4,182,747 | 96,135,981 | — | — | ||||||||||||

| SA American Funds® Growth |

4,035,502 | 60,949,350 | — | — | ||||||||||||

| SA American Funds® Growth-Income |

5,418,124 | 38,702,675 | — | — | ||||||||||||

| SA American Funds® VCP Managed Asset Allocation |

263,798,295 | 24,262,384 | — | — | ||||||||||||

Note 6. Capital Share Transactions

Transactions in capital shares of each class of each Portfolio were as follows:

| SA American Funds® Asset Allocation Portfolio | ||||||||||||||||||||||||||||||||