UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

For the fiscal year ended December 31, 2021

OR

For the transition period from to

Commission File No. 000-49604

(Exact name of registrant as specified in its charter)

__________________________________________

| (State or other jurisdiction of incorporation) | (IRS Employer Identification No.) | ||||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2021 was $2.36 billion (based on the closing price of $86.54 per share on June 30, 2021, as reported by the Nasdaq Global Select Market).

There were the following numbers of shares outstanding of each of the registrant's classes of common stock as of February 23, 2022: ManTech International Corp. Class A Common Stock, $0.01 par value per share, 27,635,206 shares; ManTech International Corp. Class B Common Stock, $0.01 par value per share, 13,176,695 shares.

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

| Page | |||||

PART I

In this document, unless the context indicates otherwise, the terms “Company” and “ManTech” as well as the words “we,” “our,” “ours” and “us” refer to both ManTech International Corporation and its consolidated subsidiaries. The term “registrant” refers only to ManTech International Corporation, a Delaware corporation.

Industry and Market Data

Industry and market data used throughout this Annual Report on Form 10-K were obtained through surveys and studies conducted by third parties, industry and general publications. We have not independently verified any of the market data obtained from these third-party sources, nor have we validated any assumptions underlying such data.

Cautionary Note Regarding Forward-Looking Statements

All statements and assumptions contained in this Annual Report on Form 10-K that do not relate to historical facts constitute "forward-looking statements." These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often include the use of words such as "may," "will," "expect," "intend," "anticipate," "believe," "estimate," "plan" and words and terms of similar substance in connection with discussions of future events, situations or financial performance. While these statements represent our current expectations, no assurance can be given that the results or events described in such statements will be achieved.

Forward-looking statements may include, among other things, statements with respect to our financial condition, results of operations, prospects, business strategies, competitive position, growth opportunities, and plans and objectives of management. Such statements are subject to numerous assumptions, risks, uncertainties and other factors, many of which are outside of our control, and include, without limitations, the risks and uncertainties discussed in Item 1A "Risk Factors" in Part I of this Annual Report on Form 10-K.

Factors or risks that could cause our actual results to differ materially from the results we anticipate include, but are not limited to, the following:

•failure to maintain our relationship with the U.S. government, or the failure to win new contract awards or to retain existing U.S. government contracts;

•disruptions to our business resulting from the COVID-19 pandemic or other similar global health epidemics, pandemics and/or other disease outbreaks;

•adverse changes in U.S. government spending for programs we support, whether due to changing mission priorities, socio-economic policies or federal budget constraints generally;

•inability to recruit and retain a sufficient number of employees with specialized skill sets or necessary security clearances who are in great demand and limited supply;

•failure to compete effectively for awards procured through the competitive bidding process, and the adverse impact of delays resulting from our competitors' protests of new contracts that are awarded to us;

•disruptions to our business or damage to our reputation resulting from cyber attacks and other security threats;

•failure to obtain option awards, task orders or funding under our contracts;

•the government renegotiating, modifying or terminating our contracts;

•failure to comply with, or adverse changes in, complex U.S. government laws and procurement regulations;

•adverse results of U.S. government audits or other investigations of our government contracts;

•failure to successfully integrate acquired companies or businesses into our operations or to realize any accretive or synergistic effects from such acquisitions;

•failure to mitigate risks associated with conducting business internationally; and

•adverse changes in business conditions that may cause our investments in recorded goodwill to become impaired.

We urge you not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. We undertake no obligation to update any forward-looking statement made herein following the date of this Annual Report, whether as a result of new information, subsequent events or circumstances, changes in expectations or otherwise.

3

Item 1.Business

Corporate Overview and Background

We were co-founded by George J. Pedersen in 1968 as a New Jersey corporation, starting with a single U.S. Navy contract. We provide innovative, mission-focused technology solutions and services for U.S. intelligence community, defense and federal civilian agencies. For over 50 years we have successfully developed and delivered solutions that support national and homeland security missions. Our principal areas of expertise include full-spectrum cyber, secure mission and enterprise information technology (IT), advanced data analytics, intelligent systems engineering, software and systems development, and national security mission support. We have differentiated technical capabilities, intimate knowledge of our customers' missions, and extensive experience providing proven, diverse sets of solutions and services, which we use to help our customers solve some of their greatest challenges and most complex problems. We provide services and solutions that support missions of national priority and significance, such as global cyber operations, IT and digital modernization, national security threat intelligence and analytics, and military operational readiness.

Our Solutions and Services

We combine deep domain expertise and technical capability to build upon our strong record of delivering comprehensive IT, systems engineering and other services and solutions, primarily in support of mission-critical programs for the intelligence community, the Department of Defense (DoD) and federal civilian agencies including the diplomatic, homeland security, healthcare and space communities. We integrate our broad capabilities into tailored solutions to meet the evolving requirements of our customers' long-term programs. Our following solution sets are aligned with the long-term needs of our customers:

•Full-Spectrum Cyber;

•Secure Mission & Enterprise IT;

•Advanced Data Analytics;

•Software and Systems Development;

•Intelligent Systems Engineering;

•Intelligence Mission Support; and

•Mission Operations.

Full-Spectrum Cyber

We provide full-spectrum cyber with a focus on cyber network operations, defense, analytics, zero-trust, security orchestration, automation and response (SOAR), hardening and resilience, and range and training. Our professionals tackle some of the most challenging problems facing the nation, including preventing, identifying and neutralizing external cyber-attacks, engineering tailored defensive security solutions and controls, developing robust insider threat detection programs, creating enterprise vulnerability management programs and supporting offensive and exploitation efforts. Additionally, our cyber solutions and services include security operations, threat intelligence, incident response and forensics, boundary defense, security systems engineering, infrastructure security, and computer forensics and exploitation. We are focused on delivering mission continuity in a cyber-contested environment utilizing artificial intelligence (AI) and cognitive methods. Our forensics and incident response capabilities provide our customers with additional insight and evidence for post-attack assessments, assisting with efforts to strengthen their security posture. Through ACRE®, our Advanced Cyber Range Environment, we offer customers enhanced training and visibility into their own IT infrastructures (security design and engineering, vulnerability analysis, software assurance) and arm them with information needed to deny, disrupt and degrade attempts to compromise their business operations and protect their reputation. We also provide extensive, hands-on training and cyber workforce development to help our customers align their resources to the national cyber strategy.

Secure Mission & Enterprise IT

We develop, implement and sustain enterprise information technology systems on a global scale, leveraging technology to improve mission performance, increase security and reduce costs for our customers. We offer a wide range of services and solutions focused on IT and digital modernization, cloud solutions, managed services, IT-as-a-service and integrated service

4

management, edge computing, user engagement and experience and digital workplace transformation. We evaluate our customers' enterprise infrastructure with the goal of enhancing security, increasing efficiency, reducing system footprint and lowering total cost of ownership. We are at the forefront of helping our customers migrate to new, innovative enterprise IT management methodologies, including fully outsourced managed services models.

Advanced Data Analytics

As data volumes continue to grow rapidly, advanced analytics are necessary to drive actionable intelligence. We provide predictive analytics, analytics automation, data science, data collection and management, and data fusion and visualization. Our systems comprise robust ingest engines and data lakes, fault-tolerant databases for unstructured data, programming models for processing large data sets, query engines with instrumentation to support robust hunt missions, and analytics that score and comb output for high-value intelligence. Our systems and services allow all of our customers, across government domains, to make well-informed decisions that benefit the mission and our nation.

Software and Systems Development

We develop, modify and maintain software solutions and complex systems that link different computing systems and software applications to act as a coordinated whole. This solution set includes a broad array of full lifecycle services, including requirements analysis; planning, design, implementation, integration and enhancement; testing, deployment, maintenance and quality assurance; application migration and modernization; application development; and documentation and configuration management. Our software and systems development activities support all major software development lifecycle methodologies including Agile, DevOps, DevSecOps and other hybrid methodologies. As part of our application development processes, we use cutting-edge techniques, such as microservices architecture to enable continuous deployment of large and complex applications and enhance our ability to migrate and transform legacy applications into modernized platforms. Additionally, our expertise spans the ability to develop natively across a variety of domains including the cloud, mobile and other platforms. We develop software solutions and systems across many domains and mission-specific applications. Our experienced software engineers and developers design, develop, integrate, operate and sustain mission-critical software applications and systems worldwide for our defense, intelligence and federal civilian customers.

Intelligent Systems Engineering

We are recognized across the markets we serve for our operational, engineering and technical expertise across major domains, including land, sea, air, space and cyberspace. We apply intelligent systems engineering across a wide array of large-scale system development and acquisition programs used by government and industry. We provide world-class talent, proven management and technical processes to manage some of the most complex projects throughout their lifecycle, from concept through deployment. The intelligent systems engineering services we provide include platform innovation and modernization, digital and models-based systems engineering, reliability and maintainability, modeling, simulation and analysis, systems lifecycle support, human factors and safety engineering, systems architecture and engineering and test and evaluation. Our test and evaluation services are closely linked with our systems engineering capabilities, and include specific competencies in test engineering, preparation and planning; modeling and simulation; test range operations and management; systems and cyber vulnerability; and independent validation and verification. We use digital representation of systems and the resulting digital artifacts to sustain national defense systems, following the DoD's Digital Engineering Strategy.

Intelligence Mission Support

We provide specialized professional and technical solutions and mission support services for national security missions. Our multi-disciplined intelligence solutions span the intelligence lifecycle and include security, mission assurance and program protection, intelligence analysis, mission operations and management, counterintelligence and media and material exploitation. We focus on data collection and analysis, including providing support to strategic and tactical intelligence systems, networks and facilities; development and integration of collection and analysis systems and techniques; and support to the development and application of analytical techniques to counterintelligence, homeland security operations, human intelligence operations/training and counterterrorist operations. We provide signals intelligence collection, analysis and dissemination, and intelligence analysis. We leverage technology advancements in automation and artificial intelligence to support data-centric approaches to cyber threat intelligence and insider threat support. We develop, integrate and maintain advanced signal

5

processing systems to support classified programs and facilities that collect and process intelligence. We also provide counterterrorism operations support and counterintelligence analytical expertise.

Mission Operations

We have a legacy of providing full-lifecycle mission solutions including C5ISR, training, logistics and supply chain management and sustainment, consulting and mission planning and execution. We are a proven leader in supporting a wide range of federal customers with mission critical solutions. We specialize in the design, development, analysis, implementation and support of all aspects of C5ISR systems and technology. Our experience includes land, sea, air, space and cyber domains, to include command-and-control infrastructure, intelligence, surveillance and reconnaissance platforms and sensors (manned and unmanned), and the communication, dissemination and analysis of data. We also deliver advanced training solutions using a range of environments including live, virtual, constructive, immersive and gaming scenarios. We leverage dedicated subject matter experts, a virtual cyber training range, and our longstanding, acclaimed learning center, ManTech University, in developing customized training solutions for our customers. We also provide supply chain management and logistics services involving the use of sophisticated systems that secure the entire supply chain, from supplies to data.

Human Capital Resources

Our talented people have always been and continue to be our greatest asset. Our ability to deliver enduring value to our customers and their critical missions is enabled by the thoughtful innovation, tireless efforts and steadfast dedication of our people. As of December 31, 2021, we employed approximately 9,800 people, 81% of whom hold security clearances and approximately 45% of whom are veterans. The highly-skilled and cleared nature of our talent base enables us to quickly respond to customer needs and provides us with opportunities to understand and help solve our customers’ most challenging national security problems. Security clearance requirements, and the time and processes required to attain and maintain clearances, serve as a significant barrier to entry in our market.

At ManTech, we believe in the abilities and potential of our people. We invest in attracting, developing, and retaining our talented workforce by providing exciting work assignments and opportunities for skill development and career growth, and we recognize and reward our people for their contributions and accomplishments. In turn, our loyal and career-oriented professionals enjoy great trust and success in helping our customers meet the mission-critical needs of our government.

Training and Development

In recognition of our employees’ interest in career mobility and professional development, we have a robust Career Enablement Initiative. ManTech's Career Enablement Initiative is an employee-initiated, leader supported, and enterprise-wide approach to career growth and development. Since inception, we have seen a rapid adoption of the initiative across the enterprise, as management works to incorporate the initiative into our Company’s culture. In addition, we now offer four career path journeys in the areas of Cyber, IT, Program/Project Management, and P&L Leadership, and have seen an increase in mobility of talent across the organization. Our ManTech University training program, established in 2006, serves as a training platform for the entire company, which we augment with our Skillsoft platform that provides a wide variety of training resources for our employees.

Employee Engagement

We continued to focus on the health, safety, and well-being of our employees during the COVID-19 pandemic. We have supported our employees with the accommodations and support that enable them to continue supporting our customers and their missions despite the difficulties of these unprecedented times. We expanded our dedicated team of engagement specialists, both in reach and in scope, to proactively identify areas of vulnerability and connect with potentially affected employees, identify any trends that relate to employee concern, and build engagement strategies to address systemic issues. Always looking to improve, we surveyed our employees to obtain valuable feedback about their experience and our business culture. We formed a COVID-19 task force to monitor and oversee our response to, and management of, challenges related to the pandemic. We developed and issued health and safety protocols and prepared our leaders to support and respond to the needs of our employees. We prioritized the engagement of our employees, providing our employees with timely and transparent communications, demonstrating strong and visible leadership, and reinforcing of our culture of compassion, which we believe helped us maintain business continuity and led to high levels of retention and employee engagement.

6

Our Customers

We derive the vast majority of our revenues from U.S. government customers. We have successful, long-standing relationships with these customers, having supported many of them for over half a century. Within the U.S. government, our revenues are well-diversified across a number of intelligence, defense and federal civilian agencies.

Backlog

At December 31, 2021, our backlog was $10.6 billion, of which $1.6 billion was funded backlog. At December 31, 2020, our backlog was $10.2 billion, of which $1.2 billion was funded backlog.

We define backlog as our estimate of the remaining future revenue from existing signed contracts, assuming the exercise of all options relating to such contracts and including executed task orders issued under Indefinite Quantity/Indefinite Delivery (ID/IQ) contracts. We also include an estimate of revenue for solutions that we believe we will be asked to provide in the future under the terms of ID/IQ contracts for which there are established patterns of revenues.

We define funded backlog as the portion of backlog for which funding currently is appropriated and allocated to the contract by the purchasing agency or otherwise authorized for payment by the customer upon completion of a specified portion of work. Our funded backlog does not include the full value of our contracts because Congress often appropriates funds for a particular program or contract on a yearly or quarterly basis, even though the contract may call for performance over a much longer period of time.

A variety of circumstances or events may cause changes in the amount of our backlog and funded backlog, including the execution of new contracts, the extension of existing contracts, the non-renewal or completion of current contracts, the early termination of contracts, and adjustments to estimates for previously included contracts. Changes in the amount of our funded backlog also are affected by the funding cycles of the government.

Seasonality

Our business is not seasonal. However, in order to avoid the loss of unexpended fiscal year funds it is not uncommon for U.S. government agencies to award extra tasks or complete other contract actions in the weeks and days leading up to September 30, which is the end of the government fiscal year. Additionally, our quarterly results are impacted by the number of working days in a given quarter. There are generally fewer working days for our employees to generate revenue in the first and fourth quarters of our fiscal year.

Competitive Landscape

We compete in a market shaped by customer requirements and federal budget priorities and constraints. Our key competitors currently include divisions of large defense contractors, as well as a number of large and mid-size U.S. government contractors with specialized capabilities. Because of the diverse requirements of U.S. government customers and the highly competitive nature of large procurements, we frequently collaborate with these and other companies to compete for large contracts, and we bid against these companies in other situations.

Available Information

Our internet address is www.mantech.com. Through links on the Investor Relations section of our website, we make available, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (SEC). In addition, the SEC maintains a website (www.sec.gov) that contains reports, proxy statements and other information we file electronically with the SEC.

Item 1A.Risk Factors

Set forth below are the risks that we believe are material to our investors. You should carefully consider the following risks, together with the other information contained in or incorporated by reference into this Annual Report on Form 10-K, including our consolidated financial statements and notes thereto. Any of the following risks could materially and adversely affect our business, financial condition, results of operations and prospects, as well as the actual outcome of matters as to which forward-looking statements are made in this Annual Report.

7

The risks described below are not the only risks we face. Additional risks and uncertainties not currently known to us, or those we currently deem to be immaterial, may also materially and adversely affect our business, financial condition or results of operations. This section contains forward-looking statements. You should refer to the explanation of the qualification and limitations of forward-looking statements set forth at the beginning of this Annual Report.

Risks Related to Our Business

We depend on contracts with the U.S. government for substantially all of our revenues. If our relationships with the U.S. government are harmed, our business, future revenues and growth prospects could be adversely affected.

We derive the vast majority of our revenues from U.S. government customers, and we anticipate that U.S. government contracts will be the primary source of our revenues for the foreseeable future. Any issue that compromises our relationship with the U.S. government generally, or any U.S. government agency that we serve, could adversely and materially harm our business, prospects, financial condition or operating results. Among the key factors in maintaining our relationships with U.S. government agencies are our performance on our contracts and task orders, the strength of our professional reputation, compliance with applicable laws and regulations, and the strength of our relationships with our customers and client personnel. To the extent our reputation or relationships with U.S. government agencies is impaired, our revenue and operating profits could materially decline.

Our business could be adversely affected by the COVID-19 pandemic or other similar global health pandemics, epidemics and/or other disease outbreaks.

The COVID-19 pandemic (and any future global health pandemics, epidemics and/or other disease outbreaks), and government responses to mitigate the impact of such crises, could adversely impact our ability to operate our business and therefore have a material adverse effect on our business, financial position, results of operations, liquidity and cash flows. Travel restrictions, social distancing guidelines and other preventative measures put in place by health organizations, federal, state, and local governments have altered the manner in which many of our employees work with our customers, and in response, we have modified our operating schedules and staffing and implemented telework or alternate work arrangements where possible. Notwithstanding our implementation of telework and other means of remote work for our employees that support impacted programs and our internal support organizations, some programs we support, by their nature, cannot accommodate remote work. These programs require shiftwork or the implementation of other mitigation strategies that enable us to maintain our workforce in a “mission ready” state, which has resulted in reduced utilization of that portion of the workforce. The COVID-19 pandemic could also affect our contract performance and could also result in increased costs that may not be fully recoverable, adequately covered by insurance, or addressed by the CARES Act or any subsequent legislative or regulatory measures.

Additionally, the COVID-19 pandemic, along with preventative measures put in place by health organizations and federal, state, and local governments, creates ancillary risks to our business, to include the risk of sustained declines in the capital markets, the risk of a sustained economic downturn or recession and other macroeconomic phenomena that could adversely affect customer demand for our services in the future. Furthermore, our business, financial position, results of operations, liquidity and/or cash flows could be adversely and materially affected if the COVID-19 pandemic worsens, lasts significantly longer than anticipated, and/or manifests in additional multiple waves of infection (whether due to new strains of the virus or vaccines providing less protection than expected). Significant and sustained disruptions at our customers could occur, which could in turn have a material adverse effect on our business, financial position, results of operations, liquidity and/or cash flows.

We may fail to attract and retain skilled and qualified employees with requisite specialized skill sets or security clearances, which could impair our ability to effectively serve our clients, require more subcontracting work than is optimal, impact our profitability and limit our growth prospects.

Our business depends in large part upon our ability to attract and retain sufficient numbers of employees who have advanced IT and technical services skills. Often, these employees must also hold some of the highest security clearances in the United States. Cleared people are in great demand (particularly as it relates to the limited supply of cleared personnel with certain IT and technical service skills), and we compete intensely with other U.S. government contractors, the U.S. government and private industry. The government and industry have recognized that the current process for obtaining security clearances is time-consuming, inefficient and can present a risk to customer mission. While some improvements have been made to the process in the last couple of years, security clearances at the highest levels may still take months or even years to complete. We anticipate that such personnel may remain a limited resource for the foreseeable future. If we are unable to hire a sufficient

8

number of qualified employees or cannot obtain their appropriate security clearances in a timely manner, our ability to serve our clients could be harmed, and we may not be able to grow our business. Additionally, if we cannot hire sufficient qualified employees to staff our contracts, we may be required to engage more contracted personnel, which could reduce our profit margins. Even if we are able to attract the requisite skilled employees, intense competition for such employees may result in attrition in our employee ranks, and we may need to expend additional resources to hire, train and replace such personnel.

U.S. government spending and mission priorities could change in a manner that adversely affects our future revenues and limits our growth prospects.

We depend on continued expenditures by the U.S. government on programs that we support. Spending levels on programs that we support (including those related to intelligence, defense, homeland security, and federal health IT missions) have varied over time, and our customers may reduce expenditures for our services for any number of reasons, to include changing mission priorities, the availability of discretionary spending in light of the country’s growing debt and long-term fiscal challenges, and the implementation of efficiency and cost reduction efforts. A reduction in U.S. government spending levels, or changes in spending priorities, could adversely affect our business and impact our future revenues.

We encounter intense competition to win contracts and most of our contracts are awarded through competitive bidding processes; our revenue and profitability may be adversely impacted if we fail to compete effectively for such awards, or if there are delays as a result of our competitors' protests of contract awards that we receive.

We operate in a highly competitive industry, with contract awards typically subject to competitive bidding processes. We may not be able to continue to win competitively awarded contracts at historic levels. We compete with larger companies who have significant financial resources, as well as smaller, more specialized companies that may be able to concentrate their resources into highly-skilled niche markets. Our competitors may be able to provide our customers with more desirable capabilities or better contract terms than we can provide, including price, technical qualifications, past contract experience, geographic presence and the availability of qualified professional personnel.

Our failure to compete effectively in competitive procurements could adversely impact our future revenues. Participating in the competitive bidding process also involves costs, risks and uncertainties, including the cost, time and effort required to prepare bids and proposals for contracts that may not ultimately be awarded to us; the need to expend resources or make financial commitments (such as procuring leased premises) in advance of an award decision, or the need to bid on programs prior to the completion of their design, which may result in execution challenges, cost overruns, or in the case of unsuccessful competitions, the loss of committed costs; and the ability to accurately estimate the resources and costs structure required to service any contract we are awarded. The loss of business to our competitors could adversely impact our revenues and, if we are forced to reduce our prices, adversely impact our profitability.

In recent years, the competitive environment has also resulted in an increase in bid protests from unsuccessful bidders on contract awards. It can take months to resolve protests by one or more of our competitors relating to contracts that are awarded to us. Even where the protest is unsuccessful and the award to us is upheld, the resulting delay in startup and funding of the work under such contracts may adversely impact our revenues and profitability.

Cyber attacks and other security threats could disrupt our business and impair our ability to effectively provide services to our customers; as a leading provider of cyber security services to our customers, any significant cyber incident could damage our reputation and have a material adverse effect on our business and financial results.

We create, implement and maintain IT and engineering systems, and provide services that are often critical to our customers' operations, some of which involve classified or other sensitive information in intelligence, national security and other classified or sensitive customer functions. Our network and systems are subject to continuous exposure to cyber and other security threats, including computer viruses, attacks by individual and state-sponsored computer hackers and physical break-ins. We also face a heightened risk of a security breach or disruption due to our custody of classified and other sensitive information. Like other government contractors, we are regularly the target of cyber incidents, and these attempted cyber intrusions are expected to continue to proliferate.

If we are unable to protect our network and systems from significant cyber attacks, or if we are unable to detect intrusion attempts or other cyber incidents quickly and remediate those incidents successfully, we may experience one or more of the following adverse effects:

•loss of revenue due to adverse customer reaction;

9

•exposure to claims for damages, or the incurrence of significant costs related to upgrading systems, networks and our cyber security program generally;

•loss of revenue due to the redeployment of staff for remediation efforts instead of work on billable contracts;

•damage to our reputation, which could adversely impact our ability to attract or retain customers or market our services that relate to the creation or maintenance of secure IT systems; and

•inability to successfully market services that rely on the creation and maintenance of secure IT systems.

While we maintain cyber risk insurance to provide some coverage for certain risks arising from cybersecurity breaches, there is no assurance that such insurance would cover all or a significant portion of the costs or consequences associated with a cybersecurity breach. In addition to these costs and the adverse effects described in this risk factor, a significant cyber breach could result in one or more of our customers terminating or reducing the scope of our contracts with them.

Security breaches in customer systems could adversely affect our business.

Many of the programs we support and the systems we develop, install and maintain involve managing and protecting information involved in intelligence, national security and other classified or sensitive customer functions. Losses from a security breach in one of these systems could cause serious harm to our business, damage our reputation and impact our eligibility for further work on critical systems for our current customers or for other U.S. government customers generally. Losses could also exceed the policy limits of our errors and omissions and product liability insurance coverage. If our reputation is damaged or our eligibility to compete for additional work is compromised our revenues could be adversely affected.

Our earnings and profitability may vary based on the mix of our contracts, and may be adversely affected if we fail to accurately estimate and manage our costs, time and resources.

We generate revenues under different types of government contracts, including cost-reimbursable, time-and-materials and fixed-price contracts. Our earnings and profitability may vary depending on changes in the amount of revenues we derive from each type of contract, the nature of services or solutions provided, or the level of achievement of performance objectives required to receive award fees. For example, cost-reimbursable contracts generally offer lower margin opportunities than fixed-price contracts, but tend to minimize financial risk. However, to varying degrees, each contract type involves some risk of underestimating the costs and resources necessary to fulfill the contract obligations. Our profitability is adversely impacted when we incur contract costs that we cannot bill to our customers. While fixed-price contracts allow us to benefit from cost savings, these contracts also increase our exposure to the risk of cost overruns. When bidding on proposals involving fixed-price contracts, we rely heavily on our estimates of costs and the time required to complete the associated projects and make assumptions regarding technical issues. Our failure to accurately estimate these costs or the resources and technology necessary to perform these contracts, or to effectively manage and control our costs during performance of work could result, and in some instances has resulted, in reduced profits or in losses. More generally, any increased or unexpected costs or unanticipated delays in connection with performing our contracts (including costs and delays caused by factors outside of our control) could make our contracts less profitable than expected.

We may acquire businesses, and these transactions involve numerous risks and uncertainties that could adversely impact ongoing operations.

As part of our operating strategy, we selectively pursue acquisitions. These transactions pose many risks, including:

•our inability to identify suitable acquisition candidates at prices we consider attractive;

•our inability to compete successfully for an identified acquisition candidate, consummate an acquisition or accurately estimate the financial effect of acquisitions on our business;

•difficulty retaining an acquired company's key employees, customers or contracts;

•difficulty integrating acquired businesses, resulting in unforeseen difficulties and greater expense than anticipated;

•our failure to discover or adequately assess liabilities of a business that we acquire; and

•the need to record write-downs from future impairments of intangible assets, which could reduce our future reported earnings.

Acquired entities may not achieve to the level of profitability or revenue that we anticipate. Additionally, we may not realize anticipated synergies. If our acquisitions perform poorly, our business and financial results could be adversely affected.

10

Congress may fail to approve budgets on a timely basis for the federal agencies we support which could delay procurement of our services and solutions and cause us to lose future revenues.

On an annual basis, Congress must approve budgets that govern spending by the federal agencies that we support. In years when Congress is not able to complete its budget process before the end of the government fiscal year on September 30, Congress typically funds government operations pursuant to a continuing resolution, which allows federal government agencies to operate at the spending levels approved in the previous budget cycle. When the government operates under a continuing resolution, funding we expect to receive from customers for current work may be delayed and new initiatives may be delayed or even canceled. The government's failure to complete its budget process, or to fund government operations pursuant to a continuing resolution, may result in a federal government shutdown. A prolonged delay in Congressional budget approval could delay our customers’ procurement of our services and adversely impact our business and results of operations.

Legal and Regulatory Risks

U.S. government contracts contain provisions giving our customers a variety of rights that are unfavorable to us, including the ability to terminate a contract at any time for convenience.

U.S. government contracts contain provisions and are subject to laws and regulations that provide the government with rights and remedies not typically found in commercial contracts. Among other rights, these contracts give the government the ability to:

•terminate existing contracts for convenience, as well as for default;

•reduce orders under, or otherwise modify, contracts or subcontracts;

•decline to exercise an option to renew multi-year contracts or issue task orders under multiple award contracts;

•suspend or debar us from doing business with the U.S. government or with a government agency;

•terminate our facility security clearances and thereby prevent us from receiving classified contracts;

•claim rights in products and systems produced by us; and

•control or prohibit the export of our products and services.

If the government terminates a contract for convenience, we may recover only our incurred or committed costs, settlement expenses and profit on work completed prior to the termination. If the government terminates a contract for default, we may not even recover those amounts and may be held liable for excess costs incurred by the government in procuring undelivered items and services from another source. If one of our government customers were to unexpectedly terminate, cancel or decline to exercise an option to renew one or more of our significant contracts or programs, our revenues and operating results would be materially harmed.

We are subject to complex laws and regulations, and if we fail to comply with these laws and regulations, we could be subject to severe penalties and sanctions and harm our business.

As a government contractor, we are subject to numerous laws and regulations that govern how we conduct business with our customers. The following are among the more noteworthy laws and regulations:

•the Federal Acquisition Regulation and the Defense Federal Acquisition Regulation Supplement, which comprehensively regulate the formation, administration and performance of U.S. government contracts;

•Truthful Cost or Pricing Data, which requires certification and disclosure of all cost and pricing data in connection with contract negotiations;

•the Cost Accounting Standards and Cost Principles, which impose accounting requirements that govern our right to reimbursement under certain cost-reimbursable U.S. government contracts;

•laws, regulations and executive orders restricting the use and dissemination of information classified for national security purposes and the export of certain products, services and technical data;

•U.S. export controls, which apply when we engage in international work;

•the Foreign Corrupt Practices Act; and

•the False Claims Act, which prohibits the submission of fraudulent claims to the government for payment or approval. Actions under the False Claims Act may be brought by either the government or by individuals on behalf of the government (who may then share a portion of any recovery).

If we fail to comply with these laws and regulations, we may be subject to contractual damages, fines, civil or criminal penalties or administrative sanctions, and could harm our reputation. For more severe misconduct, sanctions and penalties may include the termination of contracts, forfeiture of profits, the triggering of price reduction clauses, suspension of payments,

11

fines and the suspension or debarment from doing business with federal government agencies, any of which could adversely affect our business, financial condition, operating results and future prospects.

Unfavorable results of U.S. government audits or other investigations could adversely affect our profitability, harm our reputation and relationships with our customers or impair our ability to win new contracts.

The Defense Contract Audit Agency (DCAA), Defense Contract Management Agency (DCMA) and other government agencies routinely audit and investigate government contracts and contractor systems. These agencies review our contract performance, cost structure and compliance with applicable laws, regulations and standards. The DCAA and DCMA also review the adequacy of, and compliance with, internal control systems and policies, including accounting, purchasing, estimating, compensation and management information systems. Allegations of impropriety or deficient controls could harm our reputation or influence the award of new contracts. Any costs found to be improperly allocated to a specific contract will not be reimbursed, while such costs already reimbursed must be refunded. If our internal control systems or policies are found to be non-compliant or inadequate, payments may be withheld or suspended, or we may be subject to increased government scrutiny and approval requirements that could delay or adversely affect our ability to invoice and receive timely payment for services we perform on our contracts. Adverse findings by DCAA or DCMA may also impair our ability to compete for and win new contracts with the U.S. government.

We face risks associated with our international business, and our business operations in foreign countries involve considerable risks and hazards.

Our business operations are subject to a variety of risks associated with conducting business internationally, including, changes in or interpretations of foreign laws or policies that may adversely affect the performance of our services; political instability in foreign countries; business practices and customs that are unfamiliar or inconsistent with business practices in the U.S. We also provide services to the U.S. government in foreign countries that may be experiencing political unrest, war or terrorism. In connection with these deployments, we may be exposed to increased risk of incurring liabilities arising from incidents involving our employees or third parties. We may also incur additional costs in connection with such deployments, such as increased insurance costs, the cost of liabilities that are in excess of or not covered by our insurance policies, or the costs of repatriation of our employees or executives for reasons beyond our control.

Changes in tax laws or unanticipated changes in our tax provision could have a material impact on our profitability and/or operating cash flow.

We are subject to income and other taxes in U.S. and foreign jurisdictions. Changes in applicable U.S. (federal, state and local) or foreign tax laws and regulations, or their interpretation and application have affected and could continue to affect our income tax expense and taxes paid or payable. In addition, we are subject to various audits where depending on the final determination could have a material impact on our tax provision. We are currently under examination by several jurisdictions, including U.S. federal tax years 2016-2018 and amounts submitted for research and development credits for those years.

Beginning in 2022, the Tax Cuts and Jobs Act (TCJA) of 2017 eliminates the option to deduct research and development expenditures currently and requires taxpayers to amortize them over five years pursuant to IRC Section 174. Although Congress is considering legislation that would defer or repeal this provision, we have no assurance this will be enacted. If this provision of the TCJA is not repealed or otherwise modified, it will materially reduce our operating cash flows in 2022.

Risks Related to Our Stock

Our quarterly operating results may fluctuate.

Our quarterly revenues and operating results may fluctuate as a result of a number of factors, many of which are outside of our control. For these reasons, comparing our operating results on a period-to-period basis may be of limited significance in some cases. In addition to the risk factors already identified in this section of our Form 10-K, a number of additional factors could cause our revenues, cash flows and operating results to vary from quarter-to-quarter, including:

•fluctuations in revenues earned on fixed-price contracts and contracts with a performance-based fee structure;

•timing of significant bid and proposal costs;

•seasonal or quarterly fluctuations in our workdays and staff utilization rates; and

•changes in the volume of purchase requests from customers for equipment and materials.

12

Because most of our expenses are fixed, cash flows from our operations may vary significantly as a result of changes in the level of services we provide under existing contracts, as well as the number of contracts that are commenced, completed or terminated during any quarter. Depending on the nature of the contract, we may incur significant operating expenses during the start-up and early stages of large contracts and not receive corresponding payments from the customer in that same quarter. We may also incur significant or unanticipated expenses when a contract expires, terminates or is not renewed.

We may change our dividend policy in the future.

We have maintained a regular cash dividend program since 2011. We anticipate continuing to pay quarterly dividends during 2022. However, any future payment of dividends, including the timing and amount of any such dividends, is at the discretion of our Board of Directors and may depend upon our earnings, liquidity, financial condition, alternate capital deployment opportunities or any other factors that our Board of Directors considers relevant. A change in our regular cash dividend program could have an adverse effect on the market price of our common stock.

Mr. Pedersen, Chairman Emeritus, effectively controls us, and his interests may not be aligned with those of other stockholders.

As of December 31, 2021, Mr. Pedersen owned approximately 32% of our total outstanding shares of common stock. Holders of our Class B common stock are entitled to ten votes per share, while holders of our Class A common stock are entitled to only one vote per share. As of December 31, 2021, Mr. Pedersen beneficially owned 13,176,695 shares of Class B common stock and controlled approximately 83% of the combined voting power of our stock. Accordingly, Mr. Pedersen controls the vote on substantially all matters submitted to a vote of our stockholders. As long as Mr. Pedersen beneficially owns a majority of the combined voting power of our common stock, he will have the ability, without the consent of our public stockholders, to elect all members of our Board of Directors and to control our management and affairs. Mr. Pedersen's voting control may have the effect of preventing or discouraging transactions involving an actual or a potential change of control of us, regardless of whether a premium is offered over then-current market prices. Mr. Pedersen will also be able to cause a change of control of us.

Provisions in our charter documents and Delaware law may inhibit potential acquisition bids that our stockholders may consider favorable, and the market price of our Class A common stock may be lower as a result.

There are provisions in our certificate of incorporation and bylaws that make it more difficult for a third party to acquire, or attempt to acquire, control of us, even if a change of control were considered favorable by our stockholders. Among the provisions that could have an anti-takeover effect, are provisions relating to the following: the high vote nature of our Class B common stock; the ability of our Board to issue preferred stock; the inability of stockholders to take action by written consent; and advance notice requirements relating to director nominations or other proposals submitted by our stockholders.

General Risk Factors

Goodwill represents a significant asset on our balance sheet, and changes in future business conditions could cause these investments to become impaired, requiring substantial write-downs that would reduce our operating income.

As of December 31, 2021, our goodwill was $1.5 billion. The amount of our recorded goodwill may substantially increase in the future as a result of any acquisitions that we make. We evaluate the recoverability of recorded goodwill amounts annually, or when evidence of potential impairment exists. Impairment analysis is based on several factors requiring judgment and the use of estimates, which are inherently uncertain and based on assumptions that may prove to be inaccurate. Additionally, material changes in our financial outlook, as well as events outside of our control, such as deteriorating market conditions for companies in our industry, may indicate a potential impairment. When there is an impairment, we are required to write down the recorded amount of goodwill, which is reflected as a charge against operating income.

Item 1B.Unresolved Securities and Exchange Commission Staff Comments

We have not received any written comments from the SEC staff regarding our periodic or current reports under the Exchange Act that remain unresolved.

Item 2.Properties

We do not own any facilities or real estate that are material to our operations.

13

Item 3.Legal Proceedings

We are subject to certain legal proceedings, government audits, investigations, claims and disputes that arise in the ordinary course of our business. Like most large government defense contractors, our contract costs are audited and reviewed on a continual basis by an in-house staff of auditors from the DCAA. In addition to these routine audits, we are subject from time-to-time to audits and investigations by other agencies of the U.S. government. These audits and investigations are conducted to determine if our performance and administration of our government contracts are compliant with contractual requirements and applicable federal statutes and regulations. An audit or investigation may result in a finding that our performance, systems and administration are compliant or, alternatively, may result in the government initiating proceedings against us or our employees, including administrative proceedings seeking repayment of monies, suspension and/or debarment from doing business with the U.S. government or a particular agency or civil or criminal proceedings seeking penalties and/or fines. Audits and investigations conducted by the U.S. government frequently span several years.

Although we cannot predict the outcome of these and other legal proceedings, investigations, claims and disputes, based on the information now available to us, we do not believe the ultimate resolution of these matters, either individually or in the aggregate, will have a material adverse effect on our business, prospects, financial condition or operating results.

Item 4.Mine Safety Disclosures

Not applicable.

14

PART II

Item 5.Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our Class A common stock has been quoted on the Nasdaq Stock Market under the symbol “MANT” since our initial public offering on February 7, 2002. There is no established public market for our Class B common stock. As of February 23, 2022, there were 58 holders of record of our Class A common stock and 3 holders of record of our Class B common stock. The number of holders of record of our Class A common stock is not representative of the number of beneficial holders because many of the shares are held by depositories, brokers or nominees.

Dividend Policy

During fiscal years 2021 and 2020, we declared and paid quarterly dividends, each in the amount of $0.38 and $0.32 per share, respectively, on all issued and outstanding shares of common stock. For 2022, we anticipate we will continue paying quarterly dividends, and on February 22, 2022, the Board of Directors declared a quarterly cash dividend in the amount of $0.41 per share; however any future dividends declared will be at the discretion of our Board of Directors and will depend, among other factors, upon our earnings, liquidity, financial condition, alternate capital allocation opportunities or any other factors our Board of Directors deems relevant.

Recent Sales of Unregistered Securities

We did not issue or sell any securities in fiscal year 2021 that were not registered under the Securities Act of 1933.

Equity Compensation Plan Information

Information regarding our equity compensation plans and the securities authorized for issuance thereunder is incorporated by reference in Item 12 “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.”

Purchase of Equity Securities

We did not purchase equity securities during the year ended December 31, 2021.

15

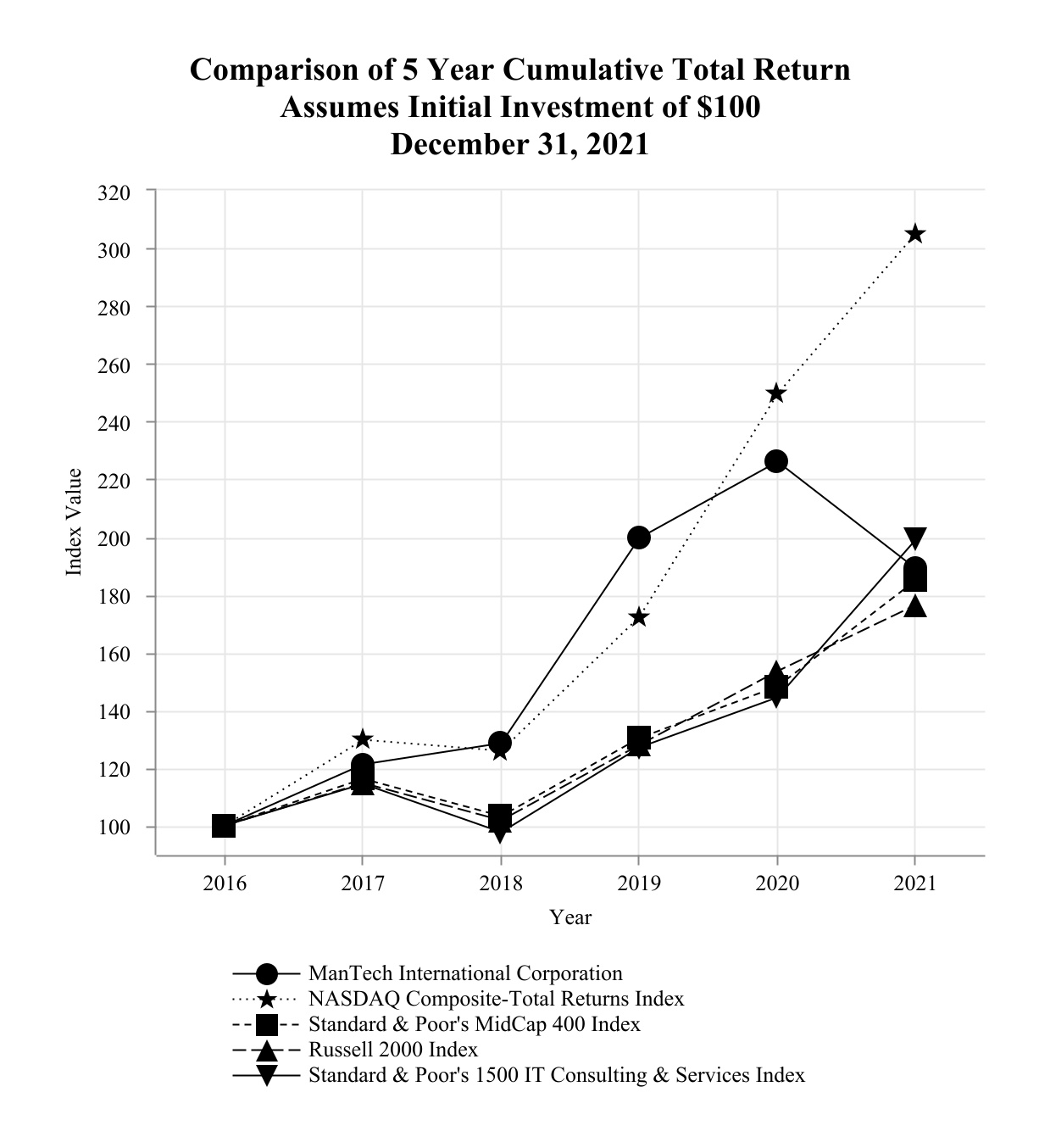

Performance Graph

The stock performance graph compares the cumulative total shareholder return of our common stock to the NASDAQ Composite-Total Returns Index, Standard & Poor's MidCap 400 Index, Russell 2000 Index and Standard & Poor's 1500 IT Consulting & Services Index. The period measured is December 31, 2016 to December 31, 2021. The graph assumes an investment of $100 in our common stock and each of the indices with reinvestment of all dividends.

16

Item 6.[Reserved]

Item 7.Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read together with the consolidated financial statements and the notes to those statements included in Item 8 "'Financial Statements and Supplementary Data." This discussion contains forward-looking statements that involve risks and uncertainties. For a description of these forward-looking statements, refer to Part I “Cautionary Note Regarding Forward-Looking Statements.” A description of factors that could cause actual results to differ materially from the results we anticipate include, but are not limited to, those discussed in Item 1A “Risk Factors,” as well as those discussed elsewhere in this Annual Report.

The following discussion is intended to provide the readers of our financial statements with a narrative from management’s perspective regarding our financial condition and results of operations, liquidity, and certain other factors that could affect our future results.

Overview

We provide mission-focused technology solutions and services for U.S. defense, intelligence community and federal civilian agencies. We excel in full-spectrum cyber, secure mission & enterprise IT, advanced data analytics, software and systems development, intelligent systems engineering, intelligence mission support and mission operations.

Approximately 99% of our revenues during the year ended December 31, 2021 were generated from contracts with the U.S. government, or through prime contractors supporting the U.S. government. The U.S. government is the largest consumer of services and solutions in the U.S. In government fiscal year (GFY) 2021, the U.S. government obligated approximately $387 billion on contracted services. Our business is impacted by the overall U.S. government budget and the alignment of our capabilities and offerings with the U.S. government's spending priorities. The Department of Defense (DoD) is the largest purchaser of services and solutions in the U.S. government.

The President’s GFY 2022 budget proposal included $753 billion for national defense programs. Included in the President’s budget proposal is spending for infrastructure, economic stimulus, and education. In November 2021, the President signed into law the Infrastructure, Investment and Jobs Act (IIJA). To date, the GFY 2022 budget appropriations have not been enacted and continue to be debated by Congress. Since the beginning of GFY 2022, the U.S. government has been, and continues to be, funded through a series of Continuing Resolutions (CR). The current CR is set to expire on March 11, 2022. Absent an approval of GFY 2022 appropriations, or other stop gap spending measures, the U.S. government could experience periodic shutdowns which could materially impact our financial results and liquidity.

In 2021, the U.S. government increased the debt ceiling by nearly $3 trillion. The current debt ceiling is expected to allow the U.S. government to operate into 2023. Exiting 2021, inflation has significantly increased. The Federal Reserve has signaled their intent to increase interest rates over the coming year. Increasing interest rates will increase the amount of the federal budget used to satisfy interest payments on the U.S. debt which could impact the amount of funding allocated to programs that support national defense. While we cannot predict the future of the U.S. government’s spending priorities, we believe the geopolitical aggression of adversarial nations as well as cyber threats from state and non-state actors remain prominent and align well to the services and capabilities we provide to our customers.

COVID-19 Pandemic

In March of 2020, the World Health Organization declared COVID-19 a pandemic. Over the past two years, the pandemic has had a significant impact on the global population and economy. In response to the pandemic, the U.S. government enacted legislation in an attempt to mitigate the economic impacts through stimulus spending. In March 2020, the Coronavirus Aid, Relief and Economic Security (CARES) Act was signed into law. The CARES Act contained a provision (3610) under which government contractors could seek reimbursement for employee's salaries when they are prevented from accessing worksites or are subject to reduced work schedules and cannot telecommute. These provisions were extended through September 30, 2021 when the President signed into law the American Rescue Plan (ARP) Act of 2021. Amounts submitted for reimbursement under the CARES Act diminished significantly in our third quarter of 2021 and costs incurred in our fourth quarter of 2021 were no longer covered.

On September 9, 2021, the President issued an Executive Order requiring all federal employees and contractors supporting

17

the federal government be vaccinated (or to have an approved accommodation) by December 8, 2021. The vaccination deadline was subsequently extended to January 18, 2022. On December 7, 2021, a federal district judge suspended the enforcement of this order. This suspension is currently under appeal.

We are continuing to monitor impacts of the global outbreak of the COVID-19 pandemic including new variants of the virus, specific impacts and mitigation protocols enacted in regions in which we operate, and the vaccination status of our employees. In preparation of the vaccine mandate and to promote the well-being of our workforce, we have and continue to encourage our employees to get vaccinated (or seek an approved accommodation). We cannot predict the potential impact of the vaccination mandate or the overall evolution of the pandemic and its further impacts on the economy or our business.

Acquisitions

We continually monitor U.S. government spending and budgetary priorities to align our investments in new capabilities to drive organic growth. We will selectively pursue acquisitions that broaden our domain expertise and service offerings and/or establish relationships with new customers. In 2021, we acquired Gryphon Technologies, Inc. (Gryphon) and Technical and Management Assistance Corporation (TMAC). Gryphon provides a broad array of advanced digital and systems engineering capabilities for Department of Defense agencies. TMAC provides advanced data engineering services and solutions that ensure the delivery of vital information to the U.S. Intelligence Community. Since going public in 2002, we have acquired and integrated 34 businesses into our operations.

Pricing

Our industry remains competitive on price. While there has been a trend away from the lowest-price technically acceptable procurement model for a majority of our customers, contracts continue to be awarded through a competitive bidding process (including indefinite delivery, indefinite quantity and other multi-award contracts), which could increase pricing pressure. To ensure our cost structure remains competitive, we continually evaluate and adjust our levels of indirect spending to stay in line with the expected business opportunities. Our industry also remains competitive with respect to attracting and retaining employees with the necessary skills and security clearances to perform certain services that are a priority for our customers.

We classify indirect expenses either as cost of services or general and administrative in manner consistent with disclosure statements submitted and approved by the Defense Contract Management Agency (DCMA). Effective January 1, 2021, changes in indirect cost allocations reclassified certain expenses from general and administrative to cost of sales (overhead). While this does not impact indirect expenses in total, it does reduce general and administrative as compared to prior periods.

Revenues

Substantially all of our revenues are derived from services and solutions provided to the U.S. government or to prime contractors supporting the U.S. government, including services provided by our employees and our subcontractors, and solutions that include third-party hardware and software that we purchase and integrate as a part of our overall solutions. Customer requirements may vary from period-to-period depending on specific contract and customer requirements.

We provide our services and solutions under three types of contracts: cost-reimbursable; time-and-materials; and fixed-price. In general, cost-reimbursable contracts are the least profitable of our government contracts but offer the lowest risk of loss. Under time-and-materials contracts, to the extent that our actual labor costs are higher or lower than the billing rates under the contract, our profit under the contract may either be greater or less than we anticipated or we may suffer a loss under the contract. In general, we realize a higher profit margin on work performed under time-and-materials contracts than cost-reimbursable contracts. Fixed-price contracts generally offer higher profit margin opportunities but can involve greater financial risk because we bear the impact of cost overruns in return for the full benefit of any cost savings.

Cost of Services

Cost of services primarily includes direct costs incurred to provide services and solutions to our customers. The most significant portion of these costs are direct labor costs, including salaries and wages, plus associated fringe benefits of our employees directly serving customers, in addition to the related management, facilities and infrastructure costs. Cost of services also includes other direct costs, such as the costs of subcontractors and outside consultants and third-party materials, including hardware or software that we purchase and provide to the customer as part of an integrated solution.

Changes in the mix of services and equipment provided under our contracts can result in variability in the proportion that cost of services bears to revenues. As we typically earn higher profits on our own labor services, we expect the ratio of cost of

18

services as a percentage of revenues to decline when our labor services mix increases relative to subcontracted labor or third-party materials. Conversely, as subcontracted labor or third-party material purchases for customers increases relative to our own labor services, we expect the ratio of cost of services as a percentage of revenues to increase.

General and Administrative Expenses

General and administrative expenses include the salaries and wages, plus associated fringe benefits of our employees not performing work directly for customers, and associated facilities costs. Among the functions covered by these costs are business development, bid and proposal, contracts administration, finance and accounting, legal, corporate governance and executive and senior management. In addition, we included stock-based compensation, as well as depreciation and amortization expenses related to the general and administrative function. Depreciation and amortization expenses include the depreciation of computers, furniture and other equipment, the amortization of third-party software used internally, leasehold improvements and intangible assets. Intangible assets include customer relationships and contract backlogs acquired in business combinations, which are amortized over their estimated useful lives.

Interest Expense

Interest expense is primarily related to interest expense incurred or accrued under our outstanding borrowings on our debt and deferred financing charges.

Interest Income

Interest income is primarily from cash on hand and late invoice payments by the government.

19

Results of Operations

Year Ended December 31, 2021 Compared to Year Ended December 31, 2020

The following table sets forth certain items from our consolidated statements of income and the relative percentages that certain items of expense and earnings bear to revenues as well as the year-over-year change from December 31, 2020 to December 31, 2021.

| Year Ended December 31, | Year-to-Year Change | ||||||||||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | 2020 to 2021 | |||||||||||||||||||||||||||||||

| Dollars | Percentages | Dollars | Percent | ||||||||||||||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||||||||||||||||

| REVENUES | $ | 2,553,956 | $ | 2,518,384 | 100.0 | % | 100.0 | % | $ | 35,572 | 1.4 | % | |||||||||||||||||||||||

| Cost of services | 2,174,545 | 2,138,791 | 85.1 | % | 84.9 | % | 35,754 | 1.7 | % | ||||||||||||||||||||||||||

| General and administrative expenses | 192,595 | 221,544 | 7.6 | % | 8.8 | % | (28,949) | (13.1) | % | ||||||||||||||||||||||||||

| OPERATING INCOME | 186,816 | 158,049 | 7.3 | % | 6.3 | % | 28,767 | 18.2 | % | ||||||||||||||||||||||||||

| Interest expense | (2,389) | (1,900) | 0.1 | % | 0.1 | % | 489 | 25.7 | % | ||||||||||||||||||||||||||

| Interest income | 128 | 247 | — | % | — | % | (119) | (48.2) | % | ||||||||||||||||||||||||||

| Other income (expense), net | (277) | 1 | — | % | — | % | (278) | (27,800.0) | % | ||||||||||||||||||||||||||

| INCOME FROM OPERATIONS BEFORE INCOME TAXES AND EQUITY METHOD INVESTMENTS | 184,278 | 156,397 | 7.2 | % | 6.2 | % | 27,881 | 17.8 | % | ||||||||||||||||||||||||||

| Provision for income taxes | (47,541) | (35,865) | 1.8 | % | 1.4 | % | 11,676 | 32.6 | % | ||||||||||||||||||||||||||

| Equity in earnings (losses) of unconsolidated subsidiaries | 280 | (2) | — | % | — | % | 282 | 14,100.0 | % | ||||||||||||||||||||||||||

| NET INCOME | $ | 137,017 | $ | 120,530 | 5.4 | % | 4.8 | % | $ | 16,487 | 13.7 | % | |||||||||||||||||||||||

Revenues

The primary drivers of the increase in our revenues are revenues from new contract awards, growth on existing contracts and the acquisitions we completed in the prior year. These increases were offset by contracts and tasks that ended during the year and reduced scope of work on some contracts including contracts with variable material purchase requirements. We expect revenues to increase in 2022 due to our recent acquisitions, growth on existing programs and new contracts.

Cost of services

The increase in cost of services was primarily due to increases in revenues. As a percentage of revenues, direct labor costs were 50% and 49% for the years ended December 31, 2021 and 2020, respectively. As a percentage of revenues, other direct costs, which include subcontractors and third party equipment and materials used in the performance of our contracts, were 36% for both the years ended December 31, 2021 and 2020. With COVID-19 mitigation protocols being reduced or lifted, direct labor has been impacted as employees have begun utilizing paid time off at a normalized level. Profitability has increased due to higher program profits including improved award fees as compared to the prior period.

General and administrative expenses

The decrease in general and administrative expenses was primarily the result of changes in the classification of certain indirect cost allocations of approximately $30.1 million. These decreases were partially offset by a return to more normalized indirect spending compared to 2020, which experienced reduced travel, conference expenses and other indirect expenses due to the impacts of COVID-19. As a percentage of revenues, general and administrative expenses decreased for the year ended December 31, 2021 as compared to the same period in 2020. We expect general and administrative expenses as a percentage of revenue to increase slightly in 2022, due to higher amortization expenses and continued return to normalized indirect spending.

20

Provision for income taxes

Our effective tax rate is affected by recurring items, such as the relative amount of income we earn in various taxing jurisdictions and their tax rates. It is also affected by discrete items that may occur in any given year, but are not consistent from year-to-year. Our effective income tax rate was 26% and 23% for the years ended December 31, 2021 and 2020, respectively. The increase in our effective tax rate is primarily due to an increase in nondeductible executive equity compensation and a reduced research and development credit. For additional information concerning the research and development tax credit, see Note 13 to our consolidated financial statements in Item 8.

Year Ended December 31, 2020 Compared to Year Ended December 31, 2019

To review the comparison of our results of operations for the fiscal year ended December 31, 2020 with our results of operations for the fiscal year ended December 31, 2019, please refer to the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

Backlog

For the years ended December 31, 2021 and 2020 our backlog was $10.6 billion and $10.2 billion, respectively, of which $1.6 billion and $1.2 billion, respectively, was funded backlog. The increase in our backlog is due to contract awards and acquisitions during the year. We believe our backlog, together with new contract awards, will support continued growth in our business. Backlog represents estimates that we calculate on a consistent basis. For additional information on how we compute backlog, see “Backlog” in Item 1 “Business.”

Liquidity and Capital Resources