EXHIBIT 99.2

Qumu

corporation

EMPLOYEE Q&A FACT

SHEET

APRIL 24, 2014

* * *

Disc Publishing Employee Q&A

The Proposed Sale

What is happening?

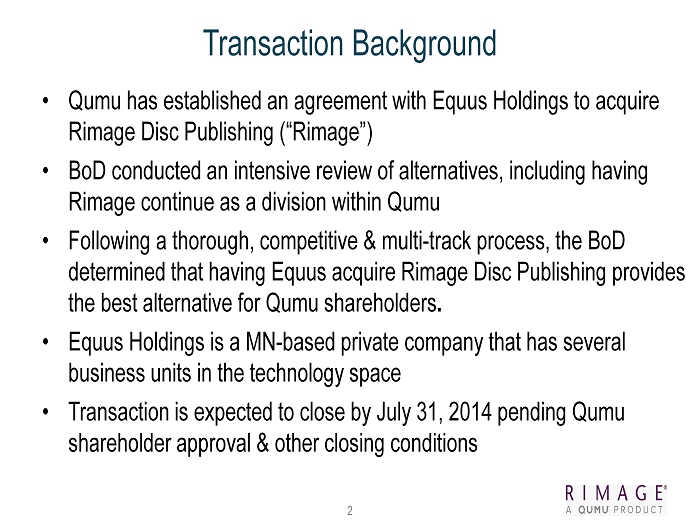

Qumu has entered into a definitive agreement to sell

the Disc Publishing business to Equus Holdings, Inc. (www.equus-holdings.com) and its wholly owned subsidiary, Redwood Acquisition,

Inc., in an all-cash transaction valued at $23 million, subject to certain adjustments. Equus Holdings is a Minneapolis-based company

that has evolved from a custom computer manufacturer to a portfolio of technology companies primarily in the business server and

client computing markets.

Redwood

Acquisition is expected to change its corporate name to include the word “Rimage” at the closing. Throughout

the rest of this document, “RIMAGE” will be used in place of Redwood Acquisition. We have used RIMAGE in place of Redwood

Acquisition to make this document easier to follow.

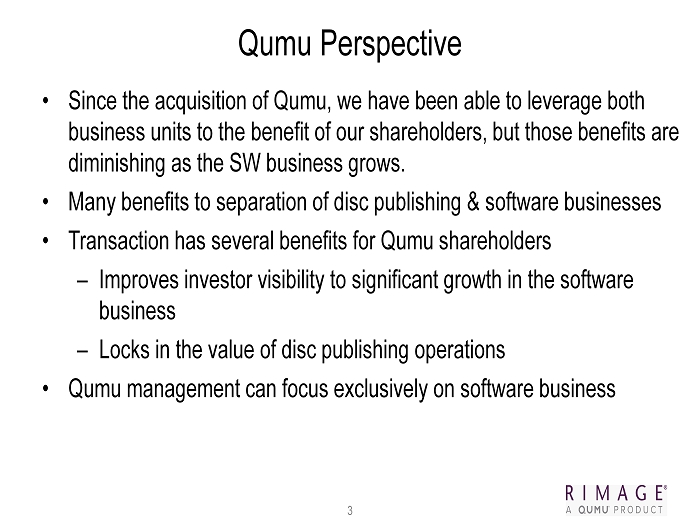

Why is Qumu selling the Disc Publishing business?

After

a thorough analysis of alternatives, Qumu is selling the Disc Publishing business to lock in the value of that business for Qumu

shareholders and focus on its enterprise video content management software business.

What options were considered?

The proposed sale of the Disc Publishing business is

a result of a multi-track competitive process conducted by Qumu with the assistance of its financial advisor, Mooreland Partners

LLC. Mooreland Partners acted as exclusive financial advisor to Qumu in connection with the transaction and delivered a fairness

opinion to Qumu’s Board of Directors.

Following this process, the Board determined that

it is in Qumu’s best interests to sell the Disc Publishing business in this transaction to Equus.

What will happen to the Disc Publishing business

following the sale?

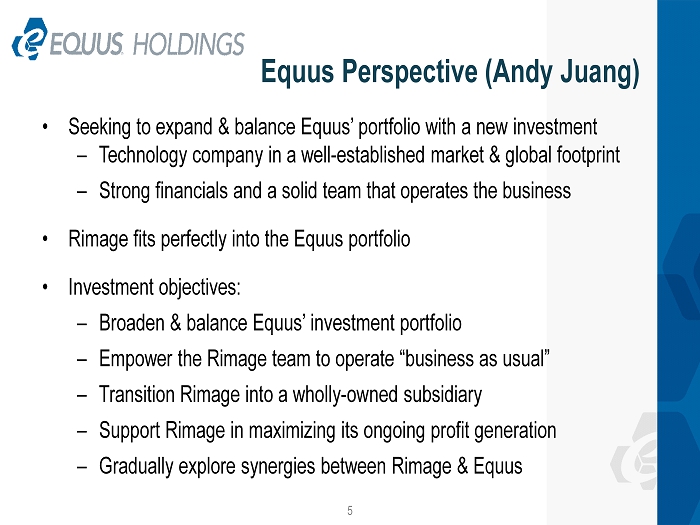

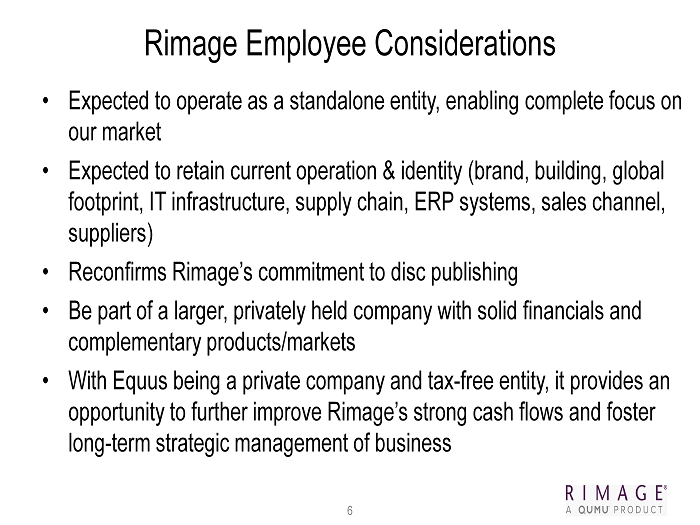

Following the closing of the sale, the Disc Publishing

business will be operated through RIMAGE as a wholly owned subsidiary within the Equus portfolio.

When will the sale be complete?

The sale is expected to be completed by July 31, 2014,

pending shareholder approval and other closing conditions.

How will my employment be affected by the signing

of the purchase agreement between Qumu, Equus Holdings and RIMAGE?

Between now and the closing date, we need all employees

on all teams – both those within disc publishing and software – committed to ensuring there is minimal disruption to

either business. We know that a transaction like this can raise many questions. The information

contained in this Q&A is intended to answer some of the questions on your mind at this point. This is not intended to be an

all-inclusive list of questions or answers. You should also know that there are some matters that legally we cannot discuss until

an appropriate SEC filing is made. We hope that over the next few days and weeks, you will continue to raise questions and send

them to Sonja Grunlan. Sonja will collect all employee questions and ensure information is shared as soon as possible.

All employees should be aware that nothing in this Q&A

changes the employment relationship between Qumu Corporation and any employee. Employees will continue to have an at-will

employment relationship with Qumu and the terms of any employment agreement between the employee and Qumu Corporation will continue

to remain in full force and effect in accordance with their terms.

Disc publishing employees should expect to receive separate

communications from Equus Holdings addressing employment matters.

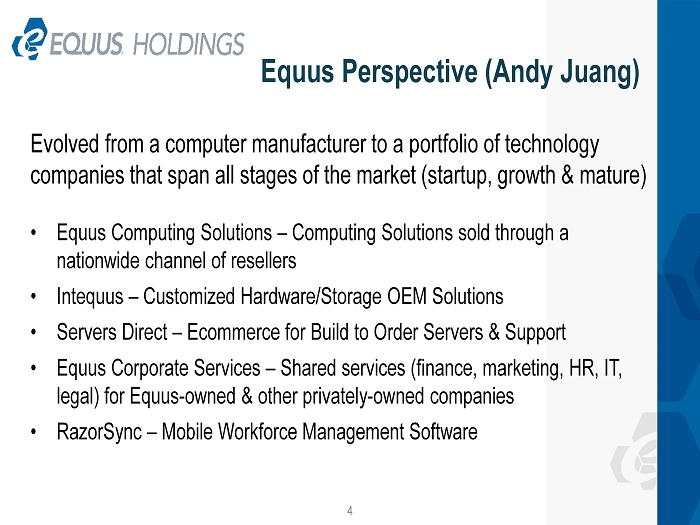

Who is Equus?

Equus Holdings is a Minneapolis-based company that has

evolved from a custom computer manufacturer to a portfolio of technology companies primarily in the business server and client

computing markets. The CEO and founder, Andy Juang, started the business 25 years ago and sold it to the employees seven

years ago. With a breadth of knowledge in managing technology businesses in all stages of the market cycle (startup, growth, and

mature), Equus is well positioned for success and expansion. Here is a listing of Equus’ current business channels and services:

| · | Equus Computing Solutions – Computing Solutions sold through a nationwide channel of resellers. www.equuscs.com |

| · | Intequus – Customized Hardware/Storage OEM Solutions. www.intequus.com |

| · | Servers Direct – Ecommerce store for Build to Order Servers & Support. www.serversdirect.com |

| · | Equus Corporate Services – Shared services (finance, marketing, HR, IT, legal) for all Equus businesses as well as other

privately owned companies like CliqStudios. |

| · | RazorSync – Mobile Workforce Management Software. www.razorsync.com |

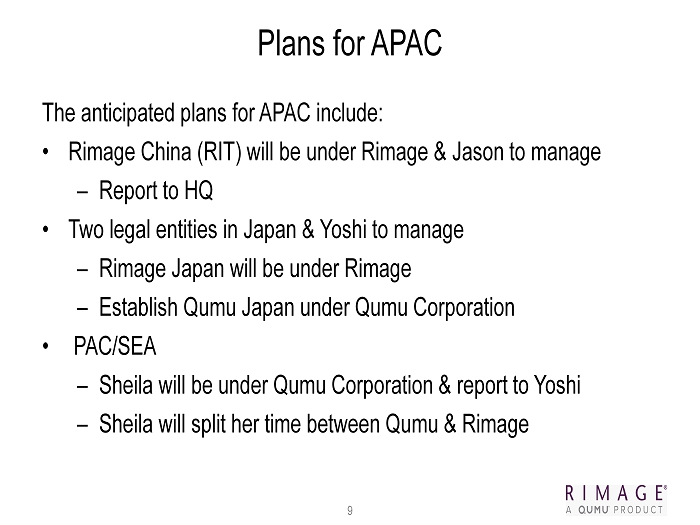

What will happen to our offices outside the U.S.?

Under the asset purchase agreement, Qumu Europe, Rimage

RIT, Rimage Singapore and Rimage Japan will be acquired by RIMAGE at closing. Qumu will retain Qumu UK and Qumu Japan and will

be establishing other legal entities outside of the U.S. as needed. Disc publishing employees should expect to receive separate

communications from Equus Holdings addressing employment matters.

The signing of the asset purchase agreement, the pending

transaction and this Q&A do not change the employment relationship between Qumu and any employee outside the U.S.

What Happens Next

How will the sale affect the employment of current

Disc Publishing employees or employees that do work for Disc Publishing?

The next few months will be highly focused on ironing

out many details. RIMAGE, Qumu and Equus are working closely to define a smooth transition with a partner-centric approach designed

to foster success for everyone.

At closing, RIMAGE and Qumu will enter into a fifteen

month transition services agreement to manage how resources (people, facilities and systems) will be shared between both companies

following closing, both in the U.S. and outside the U.S.

Following the closing, Qumu will lease a portion of

the Minnesota headquarters building from RIMAGE for its software operations, but expects to relocate employees and operations from

this building in the future following the end of the transition.

How does this affect my current work?

During the time between today’s signing and the

closing of this transaction, we will be focused on “business as usual” for both the disc publishing and software businesses

and ensuring a smooth transition post-closing.

The next few months will be highly focused on ironing

out many details. RIMAGE, Qumu and Equus are working closely to define a smooth transition with a partner-centric approach that

will foster success for everyone.

This transaction is structured so that Rimage can continue

without disruption and there are no planned changes to the Rimage products/services, Rimage partner program, or the worldwide commitment

of the Rimage-focused teams.

Continued

execution and focus are required for the business to be successful.The

sale has not closed, and therefore, we need everyone focused on doing what it is you do every day. Your manager will update you

as we get closer to the targeted transition date. During the transition process, employees will be working together on special

projects to help provide a smooth transition, but everyone’s overall roles and responsibilities will remain the same.

Disc Publishing and Qumu share some facilities, equipment

and systems today. How and when will the businesses be separated?

A process is being put in place for a smooth transition

to separate the two businesses once the sale is closed.

At closing, Rimage and Qumu will enter into a fifteen

month transition services agreement to manage how resources (people, facilities and systems) will be shared between the companies

following closing.

Following the closing, Qumu will lease a portion of

the Minnesota headquarters building from RIMAGE for its software operations, but expects to relocate employees and operations from

this building in the future following the end of the transition. Key

to the success of this transition is Equus and Qumu working closely to seamlessly separate the two businesses.

How do I respond to a supplier who asks why Qumu

is selling the disc publishing business?

Chris Heim has sent a letter to Rimage’s suppliers

providing on overview of the acquisition and reassurance to the “business as usual” approach. If suppliers have questions

that are not answered by this letter, please refer them to your manager.

How will this transaction affect

my Qumu stock options and restricted stock?

The sale of Disc Publishing is

not a change of control of Qumu Corporation for the purposes of any outstanding stock option or restricted stock award. Therefore,

under the current terms of these awards, there is no accelerated vesting of stock options or restricted stock. Employees who hold

options are entitled to exercise them for 90 days following termination of employment to the extent those options are vested at

the time of termination. Any unexercised options will terminate at the end of this 90 day period.

For disc publishing employees who

are being transferred to employment with RIMAGE, your employment with Qumu will end and your employment with RIMAGE will begin

either on the closing date or later at the end of an employee transition period. You will be notified in advance of the applicable

termination date.

While the current terms of the

outstanding stock option awards do not provide for acceleration of vesting, our compensation committee and the board of directors

approved the acceleration of vesting in full of the stock options received in the stock option exchange program that would first

vest on September 19, 2014 that are held by disc publishing employees whose employment is transferred to RIMAGE. The acceleration

of vesting is contingent upon closing and effective upon the termination of employment with Qumu on the closing date or if termination

of employment with Qumu occurs at the end of the employee transition period, on the last day of the employee transition period.

Following the applicable acceleration and termination date, disc publishing employees whose employment with Qumu is terminated

and transferred to RIMAGE will have 90 days to exercise the vested portion of their stock options. If your employment terminates

prior to the applicable acceleration and termination date, you will be entitled to exercise your options for 90 days following

termination but only to the extent they are vested at the time of your termination. In either case, the options will terminate

at the end of this 90 day period.

If your options are not subject

to the acceleration described above and your employment with Qumu terminates, you will be entitled to exercise your options for

90 days following termination to the extent they are vested at the time of your termination. The unexercised options will terminate

at the end of this 90 day period.

There were no changes to restricted

stock awards and accordingly, all unvested restricted stock awards will be forfeited at the termination of employment. If your

restricted stock award vests and you are employed by Qumu at the vesting date, you will own those shares without the restrictions

on transfer imposed by the award.

What should I do now?

It is business as usual. Our current work plans and

priorities remain in place. We need everyone to keep moving forward and executing so we can achieve our business goals.

Important Transaction Information

In connection with the proposed sale of disc publishing

assets to Equus Holdings, Inc. and Redwood Acquisition, Inc., Qumu Corporation will file a proxy statement with the SEC. Shareholders

and investors are advised to read the proxy statement when it becomes available because it will contain important information about

the asset sale transaction and the Company. Shareholders and investors may obtain a free copy of the proxy statement (when available)

and other documents filed by Qumu with the SEC at the SEC’s web site at www.sec.gov. Free copies of the proxy statement,

once available, and the Company’s other filings with the SEC, may also be obtained at www.qumu.com by following the

Quick Link for “Investors” and then following the link to “SEC Filings.” Free copies of Qumu’s filings

may be obtained by directing a written request to Qumu Corporation, 7725 Washington Avenue, Minneapolis, Minnesota 55439, Attention:

James R. Stewart or by telephone at 952-683-7900.

Participants in the Solicitation

Qumu Corporation and its directors, executive officers

and other members of its management may be deemed to be soliciting proxies from the Company’s shareholders in favor of the

asset sale transaction with Equus Holdings, Inc. and Redwood Acquisition, Inc. Investors and shareholders may obtain more detailed

information regarding the direct and indirect interests in the transaction of persons who may, under the rules of the SEC, be considered

participants in the solicitation of Qumu’s shareholders in connection with the transaction by reading the preliminary and

definitive proxy statements regarding the transaction, which will be filed with the SEC. Information about the Company’s

directors and executive officers may be found in the Company’s definitive proxy statement for its 2014 Annual Meeting of

Shareholders filed with the SEC on April 15, 2014. These documents are available free of charge once available at the SEC’s

web site at www.sec.gov or by directing a request to the Company as described above.

Qumu Software Employee Q&A

The Proposed Sale

What is happening?

Qumu has entered into a definitive agreement to sell

the Disc Publishing business to Equus Holdings, Inc. (www.equus-holdings.com) in an all-cash transaction valued at $23 million,

subject to certain adjustments. Equus Holdings is a Minneapolis-based company that has evolved from a custom computer manufacturer

to a portfolio of technology companies primarily in the business server and client computing markets.

Why is Qumu selling the Disc Publishing business?

After

a thorough analysis of alternatives, Qumu is selling the Disc Publishing business to lock in the value of that business for Qumu

shareholders and focus on its enterprise video content management software business.

What options were considered?

The proposed sale of the Disc Publishing business is

a result of a multi-track competitive process conducted by Qumu with the assistance of its financial advisor, Mooreland Partners

LLC. Mooreland Partners acted as exclusive financial advisor to Qumu in connection with the transaction and delivered a fairness

opinion to Qumu’s Board of Directors.

Following this process, the Board determined that

it is in Qumu’s best interests to sell the Disc Publishing business in this transaction to Equus.

What will happen to the Disc Publishing business

following the sale?

Following

the closing of the sale, the Disc Publishing business will be operated through Redwood Acquisition as a wholly owned subsidiary

within the Equus portfolio. Redwood Acquisition is expected to change its corporate name to include the word “Rimage”

at the closing. Throughout the rest of this document, all references to “RIMAGE” will be used in place of

Redwood Acquisition. We have used RIMAGE in place of Redwood Acquisition to make this document easier to follow.

When will the sale be complete?

The sale is expected to be completed by July 31, 2014,

pending shareholder approval and other closing conditions.

What are the benefits to the Qumu software business?

The sale frees Qumu to focus on its fast-growing

software business. It positions Qumu even better to support the growth of its business by adding additional cash. Qumu retains

its global footprint and experienced software-focused global team.

How will my employment be affected by the signing

of the purchase agreement between Qumu and Equus Holdings and RIMAGE?

For the vast majority of software employees working

outside of the Minnesota office, you will feel little to no change in daily operations, job functions or reporting relationships.

Software Employees, specifically those located in our Minnesota office who assist with the Rimage business, will be asked to provide

additional support as we work through the transition.

Employees should be aware that nothing in this Q&A

or with the acquisition of Rimage changes the employment relationship between Qumu Corporation and any employee. U.S. employees

will continue to have an at-will employment relationship with Qumu. For those employees outside of the U.S. or U.S. employees with

agreements with Qumu, their employment agreements will continue to remain in full force and effect in accordance with their terms.

Between now and the closing date, we need all employees

on all teams – both those within disc publishing and software – committed to ensuring there is minimal disruption to

either business. We know that a transaction like this can raise many questions. The information

contained in this Q&A is intended to answer some of the questions on your mind at this point. This is not intended to be an

all-inclusive list of questions or answers. You should also know that there are some matters that legally we cannot discuss until

an appropriate SEC filing is made. As you’ll see, there are several questions that we cannot yet answer at this time. We

hope that over the next few days and weeks, you will continue to raise questions and send them to Sonja Grunlan. Sonja will collect

all employee questions and ensure information is shared as soon as possible.

What positions will remain in Minnesota and what

about the Minnesota office?

A process is being put in place for a smooth transition

to separate the two businesses once the sale is closed.

At closing, RIMAGE and Qumu will enter into a fifteen

month transition services agreement to manage how resources (people, facilities and systems) will be shared between the companies

following closing, both in the U.S. and outside the U.S. Some Qumu

software employees who do work for the Disc Publishing business will continue to provide their services to the Disc Publishing

business following closing under the transition services agreement. Additional information about how the transition

services agreement will affect the work of Qumu employees following closing will be available at a later date.

Following the closing, Qumu will lease a portion of

the Minnesota headquarters building from RIMAGE for its software operations, but expects to relocate employees and operations from

this building to other local office space in the future following the end of the transition.

Qumu Minnesota will continue to provide Marketing, HR,

IT, Finance, Supply Chain and other supporting functions. However, we are a global company and will continue to hire where we find

the best talent and expand functions and/or people where needed.

Will I need to relocate to the San Bruno office in

California?

There

are no current plans to relocate people or functions due to the transaction. Following the closing, Qumu will lease

a portion of the Minnesota headquarters building from RIMAGE for its software operations, but expects to relocate employees and

operations from this building to other local office space in the future following the end of the transition.

How does this affect my current work?

For

those solely focused on Software, the activities associated with the sale of Rimage has little effect on your day to day duties.

For those individuals supporting both business, managers will work with you on transition needs. Overall, we are focused on business

as usual. Continued execution and focus are required for the business to be successful both now and after we close.

Your manager will update you with information you need to know as

we get closer to the targeted closing and transition date.

Will the sale of Disc Publishing limit the funds

that we have to invest in the Software business?

Cash deployment is a regular part of our board’s

strategic planning process. The board will continue to evaluate how best to grow shareholder value and how best to deploy our cash

to support our Software business and to achieve our future goals. The sale of Disc Publishing provides the cash at the time of

closing as opposed to the cash being delivered over time.

What should I do now?

It is business as usual. Our current work plans and

priorities remain in place. We need everyone to keep moving forward and executing so we can achieve our business goals.

Important Transaction Information

In connection with the proposed sale of disc publishing

assets to Equus Holdings, Inc. and Redwood Acquisition, Inc., Qumu Corporation will file a proxy statement with the SEC. Shareholders

and investors are advised to read the proxy statement when it becomes available because it will contain important information about

the asset sale transaction and the Company. Shareholders and investors may obtain a free copy of the proxy statement (when available)

and other documents filed by Qumu with the SEC at the SEC’s web site at www.sec.gov. Free copies of the proxy statement,

once available, and the Company’s other filings with the SEC, may also be obtained at www.qumu.com by following the

Quick Link for “Investors” and then following the link to “SEC Filings.” Free copies of Qumu’s filings

may be obtained by directing a written request to Qumu Corporation, 7725 Washington Avenue, Minneapolis, Minnesota 55439, Attention:

James R. Stewart or by telephone at 952-683-7900.

Participants in the Solicitation

Qumu Corporation and its directors, executive officers

and other members of its management may be deemed to be soliciting proxies from the Company’s shareholders in favor of the

asset sale transaction with Equus Holdings, Inc. and Redwood Acquisition, Inc. Investors and shareholders may obtain more detailed

information regarding the direct and indirect interests in the transaction of persons who may, under the rules of the SEC, be considered

participants in the solicitation of Qumu’s shareholders in connection with the transaction by reading the preliminary and

definitive proxy statements regarding the transaction, which will be filed with the SEC. Information about the Company’s

directors and executive officers may be found in the Company’s definitive proxy statement for its 2014 Annual Meeting of

Shareholders filed with the SEC on April 15, 2014. These documents are available free of charge once available at the SEC’s

web site at www.sec.gov or by directing a request to the Company as described above.