SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

|

(a)

|

|

|

Letter to Shareholders

|

2

|

|

|

Performance Overview

|

4

|

|

|

Financial Statements

|

||

|

Schedule of Investments

|

5

|

|

|

Statement of Assets and Liabilities

|

9

|

|

|

Statement of Operations

|

10

|

|

|

Statements of Changes in Net Assets

|

11

|

|

|

Financial Highlights

|

12

|

|

|

Notes to the Financial Statements

|

16

|

|

|

Expense Example

|

24

|

|

|

Proxy Voting Policy and Proxy Voting Records

|

26

|

|

|

Availability of Quarterly Portfolio Schedule

|

26

|

|

|

Federal Tax Distribution Information

|

26

|

|

|

Important Notice Regarding Delivery of Shareholder Documents

|

26

|

|

|

Electronic Delivery

|

26

|

|

|

Board Approval of Investment Advisory Agreement

|

27

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

WWW.HENNESSYFUNDS.COM

|

|

LETTER TO SHAREHOLDERS

|

|

|

|

|

|

Ryan C. Kelley, CFA

|

|

|

Chief Investment Officer,

|

|

|

Senior Vice President, and Portfolio Manager

|

|

1

|

S&P 500® Index monthly total returns: +5.59% in November 2022, -5.76% in December 2022, +6.28% in January 2023, -2.44% in February

2023, +3.67% in March 2023, and +1.56% in April 2023.

|

|

2

|

S&P 500® Financial Sector monthly total return: -9.55% in March 2023. KBW Bank Index monthly total return: -24.87% in March 2023.

S&P 500® Information Technology sector total return: +18.88% for the six months ended April 30, 2023. S&P 500® Communication Services sector total return: +23.15% for the six months ended April 30, 2023.

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Six

|

One

|

Five

|

Ten

|

|

|

Months(1)

|

Year

|

Years

|

Years

|

|

|

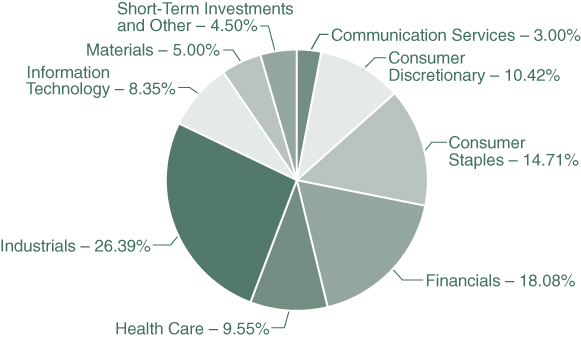

Hennessy Cornerstone Growth Fund –

|

||||

|

Investor Class (HFCGX)

|

-7.67%

|

-3.50%

|

5.69%

|

8.41%

|

|

Hennessy Cornerstone Growth Fund –

|

||||

|

Institutional Class (HICGX)

|

-7.56%

|

-3.21%

|

6.03%

|

8.73%

|

|

Russell 2000® Index

|

-3.45%

|

-3.65%

|

4.15%

|

7.88%

|

|

S&P 500® Index

|

8.63%

|

2.66%

|

11.45%

|

12.20%

|

|

(1)

|

Periods of less than one year are not annualized.

|

|

WWW.HENNESSYFUNDS.COM

|

|

PERFORMANCE OVERVIEW/SCHEDULE OF INVESTMENTS

|

|

Schedule of Investments as of April

30, 2023 (Unaudited)

|

|

TOP TEN HOLDINGS (EXCLUDING MONEY MARKET FUNDS)

|

% NET ASSETS

|

|

Green Brick Partners, Inc.

|

2.43%

|

|

Carpenter Technology Corp.

|

2.37%

|

|

Exxon Mobil Corp.

|

2.30%

|

|

Super Micro Computer, Inc.

|

2.25%

|

|

Clean Harbors, Inc.

|

2.24%

|

|

Academy Sports & Outdoors, Inc.

|

2.21%

|

|

EMCOR Group, Inc.

|

2.19%

|

|

Comfort Systems USA, Inc.

|

2.18%

|

|

Insperity, Inc.

|

2.16%

|

|

O-I Glass, Inc.

|

2.16%

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

COMMON STOCKS – 95.48%

|

Number

|

% of

|

||||||||||

|

|

of Shares

|

Value

|

Net Assets

|

|||||||||

|

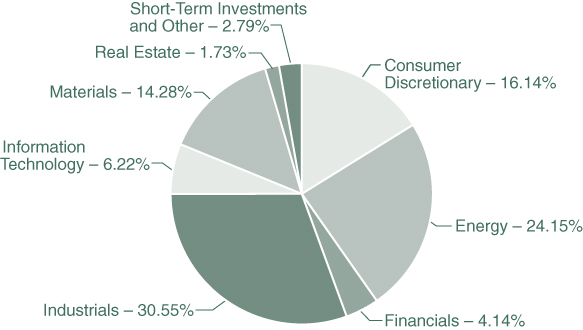

Consumer Discretionary – 16.14%

|

||||||||||||

|

Academy Sports & Outdoors, Inc.

|

51,300

|

$

|

3,258,576

|

2.21

|

%

|

|||||||

|

BorgWarner, Inc.

|

64,000

|

3,080,320

|

2.09

|

%

|

||||||||

|

Dillard’s, Inc.

|

9,200

|

2,745,188

|

1.86

|

%

|

||||||||

|

Green Brick Partners, Inc. (a)

|

96,300

|

3,589,101

|

2.43

|

%

|

||||||||

|

Modine Manufacturing Co. (a)

|

125,300

|

2,620,023

|

1.78

|

%

|

||||||||

|

Oxford Industries, Inc.

|

27,800

|

2,868,682

|

1.95

|

%

|

||||||||

|

Penske Automotive Group, Inc.

|

21,700

|

3,007,186

|

2.04

|

%

|

||||||||

|

Visteon Corp. (a)

|

18,700

|

2,625,293

|

1.78

|

%

|

||||||||

|

|

23,794,369

|

16.14

|

%

|

|||||||||

|

Energy – 24.15%

|

||||||||||||

|

CVR Energy, Inc.

|

99,300

|

2,615,562

|

1.78

|

%

|

||||||||

|

Exxon Mobil Corp.

|

28,600

|

3,384,524

|

2.30

|

%

|

||||||||

|

Marathon Petroleum Corp.

|

24,200

|

2,952,400

|

2.00

|

%

|

||||||||

|

Oceaneering International, Inc. (a)

|

153,200

|

2,716,236

|

1.84

|

%

|

||||||||

|

Oil States International, Inc. (a)

|

337,300

|

2,374,592

|

1.61

|

%

|

||||||||

|

Par Pacific Holdings, Inc. (a)

|

111,300

|

2,607,759

|

1.77

|

%

|

||||||||

|

PBF Energy, Inc., Class A

|

69,800

|

2,433,228

|

1.65

|

%

|

||||||||

|

Teekay Corp. (a)(b)

|

513,700

|

2,902,405

|

1.97

|

%

|

||||||||

|

Tsakos Energy Navigation Ltd. (b)

|

132,400

|

2,271,984

|

1.54

|

%

|

||||||||

|

Valero Energy Corp.

|

23,400

|

2,683,278

|

1.82

|

%

|

||||||||

|

Vertex Energy, Inc. (a)

|

322,100

|

2,544,590

|

1.73

|

%

|

||||||||

|

Weatherford International PLC – (a)(b)

|

47,900

|

3,095,777

|

2.10

|

%

|

||||||||

|

YPF SA – ADR (a)(b)

|

270,500

|

3,007,960

|

2.04

|

%

|

||||||||

|

|

35,590,295

|

24.15

|

%

|

|||||||||

|

Financials – 4.14%

|

||||||||||||

|

StoneX Group, Inc. (a)

|

30,500

|

2,991,135

|

2.03

|

%

|

||||||||

|

Unum Group

|

73,600

|

3,105,920

|

2.11

|

%

|

||||||||

|

|

6,097,055

|

4.14

|

%

|

|||||||||

|

Industrials – 30.55%

|

||||||||||||

|

Applied Industrial Technologies, Inc.

|

22,400

|

3,038,784

|

2.06

|

%

|

||||||||

|

CECO Environmental Corp. (a)

|

204,800

|

2,377,728

|

1.61

|

%

|

||||||||

|

Clean Harbors, Inc. (a)

|

22,700

|

3,295,132

|

2.24

|

%

|

||||||||

|

Comfort Systems USA, Inc.

|

21,500

|

3,214,035

|

2.18

|

%

|

||||||||

|

EMCOR Group, Inc.

|

18,900

|

3,231,900

|

2.19

|

%

|

||||||||

|

WWW.HENNESSYFUNDS.COM

|

|

SCHEDULE OF INVESTMENTS

|

|

COMMON STOCKS

|

Number

|

% of

|

||||||||||

|

|

of Shares

|

Value

|

Net Assets

|

|||||||||

|

Industrials (Continued)

|

||||||||||||

|

Encore Wire Corp.

|

16,400

|

$

|

2,563,812

|

1.74

|

%

|

|||||||

|

Fluor Corp. (a)

|

89,500

|

2,600,870

|

1.77

|

%

|

||||||||

|

Granite Construction, Inc.

|

75,000

|

2,859,750

|

1.94

|

%

|

||||||||

|

Insperity, Inc.

|

26,000

|

3,183,960

|

2.16

|

%

|

||||||||

|

Sterling Infrastructure, Inc. (a)

|

76,800

|

2,835,456

|

1.92

|

%

|

||||||||

|

Terex Corp.

|

54,000

|

2,407,860

|

1.63

|

%

|

||||||||

|

The Timken Co.

|

36,100

|

2,774,285

|

1.88

|

%

|

||||||||

|

Titan Machinery, Inc. (a)

|

75,100

|

2,354,385

|

1.60

|

%

|

||||||||

|

United Airlines Holdings, Inc. (a)

|

58,900

|

2,579,820

|

1.75

|

%

|

||||||||

|

Wabash National Corp.

|

117,500

|

3,016,225

|

2.05

|

%

|

||||||||

|

WESCO International, Inc.

|

18,700

|

2,692,800

|

1.83

|

%

|

||||||||

|

|

45,026,802

|

30.55

|

%

|

|||||||||

|

Information Technology – 6.22%

|

||||||||||||

|

Belden, Inc.

|

37,000

|

2,918,930

|

1.98

|

%

|

||||||||

|

Jabil, Inc.

|

37,500

|

2,930,625

|

1.99

|

%

|

||||||||

|

Super Micro Computer, Inc. (a)

|

31,400

|

3,310,502

|

2.25

|

%

|

||||||||

|

|

9,160,057

|

6.22

|

%

|

|||||||||

|

Materials – 14.28%

|

||||||||||||

|

Alpha Metallurgical Resources, Inc.

|

18,000

|

2,638,080

|

1.79

|

%

|

||||||||

|

ATI, Inc. (a)

|

77,200

|

2,981,464

|

2.02

|

%

|

||||||||

|

Carpenter Technology Corp.

|

66,300

|

3,496,662

|

2.37

|

%

|

||||||||

|

Materion Corp.

|

28,400

|

3,076,004

|

2.09

|

%

|

||||||||

|

O-I Glass, Inc. (a)

|

141,900

|

3,188,493

|

2.16

|

%

|

||||||||

|

Reliance Steel & Aluminum Co.

|

12,600

|

3,122,280

|

2.12

|

%

|

||||||||

|

Steel Dynamics, Inc.

|

24,500

|

2,546,775

|

1.73

|

%

|

||||||||

|

|

21,049,758

|

14.28

|

%

|

|||||||||

|

|

||||||||||||

|

Total Common Stocks

|

||||||||||||

|

(Cost $138,088,146)

|

140,718,336

|

95.48

|

%

|

|||||||||

|

|

||||||||||||

|

REITS – 1.73%

|

||||||||||||

|

Real Estate – 1.73%

|

||||||||||||

|

Service Properties Trust

|

290,900

|

2,551,193

|

1.73

|

%

|

||||||||

|

|

||||||||||||

|

Total REITS

|

||||||||||||

|

(Cost $2,849,799)

|

2,551,193

|

1.73

|

%

|

|||||||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

SHORT-TERM INVESTMENTS – 2.83%

|

Number

|

% of

|

||||||||||

|

|

of Shares

|

Value

|

Net Assets

|

|||||||||

|

Money Market Funds – 2.83%

|

||||||||||||

|

First American Government Obligations Fund,

|

||||||||||||

|

Institutional Class, 4.73% (c)

|

4,173,805

|

$

|

4,173,805

|

2.83

|

%

|

|||||||

|

|

||||||||||||

|

Total Short-Term Investments

|

||||||||||||

|

(Cost $4,173,805)

|

4,173,805

|

2.83

|

%

|

|||||||||

|

|

||||||||||||

|

Total Investments

|

||||||||||||

|

(Cost $145,111,750) – 100.04%

|

147,443,334

|

100.04

|

%

|

|||||||||

|

Liabilities in Excess of Other Assets – (0.04)%

|

(65,276

|

)

|

(0.04

|

)%

|

||||||||

|

|

||||||||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

147,378,058

|

100.00

|

%

|

||||||||

|

(a)

|

Non-income-producing security.

|

|

(b)

|

U.S.-traded security of a foreign corporation.

|

|

(c)

|

The rate listed is the fund’s seven-day yield as of April 30, 2023.

|

|

Common Stocks

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Consumer Discretionary

|

$

|

23,794,369

|

$

|

—

|

$

|

—

|

$

|

23,794,369

|

||||||||

|

Energy

|

35,590,295

|

—

|

—

|

35,590,295

|

||||||||||||

|

Financials

|

6,097,055

|

—

|

—

|

6,097,055

|

||||||||||||

|

Industrials

|

45,026,802

|

—

|

—

|

45,026,802

|

||||||||||||

|

Information Technology

|

9,160,057

|

—

|

—

|

9,160,057

|

||||||||||||

|

Materials

|

21,049,758

|

—

|

—

|

21,049,758

|

||||||||||||

|

Total Common Stocks

|

$

|

140,718,336

|

$

|

—

|

$

|

—

|

$

|

140,718,336

|

||||||||

|

REITS

|

||||||||||||||||

|

Real Estate

|

$

|

2,551,193

|

$

|

—

|

$

|

—

|

$

|

2,551,193

|

||||||||

|

Total REITS

|

$

|

2,551,193

|

$

|

—

|

$

|

—

|

$

|

2,551,193

|

||||||||

|

Short-Term Investments

|

||||||||||||||||

|

Money Market Funds

|

$

|

4,173,805

|

$

|

—

|

$

|

—

|

$

|

4,173,805

|

||||||||

|

Total Short-Term Investments

|

$

|

4,173,805

|

$

|

—

|

$

|

—

|

$

|

4,173,805

|

||||||||

|

Total Investments

|

$

|

147,443,334

|

$

|

—

|

$

|

—

|

$

|

147,443,334

|

||||||||

|

WWW.HENNESSYFUNDS.COM

|

|

SCHEDULE OF INVESTMENTS/STATEMENT OF ASSETS AND LIABILITIES

|

|

Statement of Assets and Liabilities as of April 30, 2023 (Unaudited)

|

|

ASSETS:

|

||||

|

Investments in securities, at value (cost $145,111,750)

|

$

|

147,443,334

|

||

|

Dividends and interest receivable

|

101,826

|

|||

|

Receivable for fund shares sold

|

306,138

|

|||

|

Prepaid expenses and other assets

|

25,182

|

|||

|

Total assets

|

147,876,480

|

|||

|

LIABILITIES:

|

||||

|

Payable for fund shares redeemed

|

326,322

|

|||

|

Payable to advisor

|

92,177

|

|||

|

Payable to administrator

|

28,038

|

|||

|

Payable to auditor

|

11,226

|

|||

|

Accrued distribution fees

|

18,939

|

|||

|

Accrued service fees

|

11,093

|

|||

|

Accrued interest payable

|

1,652

|

|||

|

Accrued trustees fees

|

4,733

|

|||

|

Accrued expenses and other payables

|

4,242

|

|||

|

Total liabilities

|

498,422

|

|||

|

NET ASSETS

|

$

|

147,378,058

|

||

|

NET ASSETS CONSISTS OF:

|

||||

|

Capital stock

|

$

|

149,882,997

|

||

|

Accumulated deficit

|

(2,504,939

|

)

|

||

|

Total net assets

|

$

|

147,378,058

|

||

|

NET ASSETS:

|

||||

|

Investor Class

|

||||

|

Shares authorized (no par value)

|

Unlimited

|

|||

|

Net assets applicable to outstanding shares

|

$

|

130,580,523

|

||

|

Shares issued and outstanding

|

6,088,633

|

|||

|

Net asset value, offering price, and redemption price per share

|

$

|

21.45

|

||

|

Institutional Class

|

||||

|

Shares authorized (no par value)

|

Unlimited

|

|||

|

Net assets applicable to outstanding shares

|

$

|

16,797,535

|

||

|

Shares issued and outstanding

|

750,158

|

|||

|

Net asset value, offering price, and redemption price per share

|

$

|

22.39

|

||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Statement of Operations for the six months ended April 30, 2023 (Unaudited)

|

|

INVESTMENT INCOME:

|

||||

|

Dividend income(1)

|

$

|

2,781,781

|

||

|

Interest income

|

77,316

|

|||

|

Total investment income

|

2,859,097

|

|||

|

EXPENSES:

|

||||

|

Investment advisory fees (See Note 5)

|

623,300

|

|||

|

Sub-transfer agent expenses – Investor Class (See Note 5)

|

113,041

|

|||

|

Sub-transfer agent expenses – Institutional Class (See Note 5)

|

7,507

|

|||

|

Distribution fees – Investor Class (See Note 5)

|

113,218

|

|||

|

Administration, accounting, custody, and transfer agent fees (See Note 5)

|

84,734

|

|||

|

Service fees – Investor Class (See Note 5)

|

75,479

|

|||

|

Federal and state registration fees

|

18,500

|

|||

|

Compliance expense (See Note 5)

|

11,844

|

|||

|

Audit fees

|

11,227

|

|||

|

Trustees’ fees and expenses

|

10,403

|

|||

|

Reports to shareholders

|

7,576

|

|||

|

Interest expense (See Note 7)

|

1,652

|

|||

|

Legal fees

|

1,484

|

|||

|

Other expenses

|

14,977

|

|||

|

Total expenses

|

1,094,942

|

|||

|

NET INVESTMENT INCOME

|

$

|

1,764,155

|

||

|

REALIZED AND UNREALIZED GAINS (LOSSES):

|

||||

|

Net realized loss on investments

|

$

|

(4,171,171

|

)

|

|

|

Net change in unrealized appreciation/depreciation on investments

|

(10,536,283

|

)

|

||

|

Net loss on investments

|

(14,707,454

|

)

|

||

|

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

(12,943,299

|

)

|

|

|

(1)

|

Net of foreign taxes withheld and issuance fees of $97,491.

|

|

WWW.HENNESSYFUNDS.COM

|

|

STATEMENT OF OPERATIONS/STATEMENTS OF CHANGES IN NET ASSETS

|

|

Statements of Changes in Net Assets

|

|

Six Months Ended

|

||||||||

|

April 30, 2023

|

Year Ended

|

|||||||

|

(Unaudited)

|

October 31, 2022

|

|||||||

|

OPERATIONS:

|

||||||||

|

Net investment income

|

$

|

1,764,155

|

$

|

1,821,004

|

||||

|

Net realized gain (loss) on investments

|

(4,171,171

|

)

|

4,008,127

|

|||||

|

Net change in unrealized

|

||||||||

|

appreciation/depreciation on investments

|

(10,536,283

|

)

|

(4,443,482

|

)

|

||||

|

Net increase (decrease) in net

|

||||||||

|

assets resulting from operations

|

(12,943,299

|

)

|

1,385,649

|

|||||

|

DISTRIBUTIONS TO SHAREHOLDERS:

|

||||||||

|

Distributable earnings – Investor Class

|

(5,391,788

|

)

|

(33,524,164

|

)

|

||||

|

Distributable earnings – Institutional Class

|

(694,551

|

)

|

(3,505,908

|

)

|

||||

|

Total distributions

|

(6,086,339

|

)

|

(37,030,072

|

)

|

||||

|

CAPITAL SHARE TRANSACTIONS:

|

||||||||

|

Proceeds from shares subscribed – Investor Class

|

6,066,479

|

21,825,715

|

||||||

|

Proceeds from shares subscribed – Institutional Class

|

4,293,630

|

21,704,478

|

||||||

|

Dividends reinvested – Investor Class

|

5,220,465

|

32,429,645

|

||||||

|

Dividends reinvested – Institutional Class

|

627,346

|

3,066,398

|

||||||

|

Cost of shares redeemed – Investor Class

|

(17,904,448

|

)

|

(21,756,715

|

)

|

||||

|

Cost of shares redeemed – Institutional Class

|

(4,666,414

|

)

|

(16,595,253

|

)

|

||||

|

Net increase (decrease) in net assets derived

|

||||||||

|

from capital share transactions

|

(6,362,942

|

)

|

40,674,268

|

|||||

|

TOTAL INCREASE (DECREASE) IN NET ASSETS

|

(25,392,580

|

)

|

5,029,845

|

|||||

|

NET ASSETS:

|

||||||||

|

Beginning of period

|

172,770,638

|

167,740,793

|

||||||

|

End of period

|

$

|

147,378,058

|

$

|

172,770,638

|

||||

|

CHANGES IN SHARES OUTSTANDING:

|

||||||||

|

Shares sold – Investor Class

|

252,082

|

919,385

|

||||||

|

Shares sold – Institutional Class

|

179,997

|

849,055

|

||||||

|

Shares issued to holders as reinvestment

|

||||||||

|

of dividends – Investor Class

|

227,645

|

1,319,351

|

||||||

|

Shares issued to holders as reinvestment

|

||||||||

|

of dividends – Institutional Class

|

26,211

|

119,641

|

||||||

|

Shares redeemed – Investor Class

|

(798,483

|

)

|

(925,080

|

)

|

||||

|

Shares redeemed – Institutional Class

|

(191,967

|

)

|

(740,429

|

)

|

||||

|

Net increase (decrease) in shares outstanding

|

(304,515

|

)

|

1,541,923

|

|||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Financial Highlights

|

|

Six Months Ended

|

||||

|

April 30, 2023

|

||||

|

(Unaudited)

|

||||

|

PER SHARE DATA:

|

||||

|

Net asset value, beginning of period

|

$

|

24.07

|

||

|

Income from investment operations:

|

||||

|

Net investment income (loss)

|

0.24

|

(1)

|

||

|

Net realized and unrealized gains (losses) on investments

|

(2.04

|

)

|

||

|

Total from investment operations

|

(1.80

|

)

|

||

|

Less distributions:

|

||||

|

Dividends from net investment income

|

(0.27

|

)

|

||

|

Dividends from net realized gains

|

(0.55

|

)

|

||

|

Total distributions

|

(0.82

|

)

|

||

|

Net asset value, end of period

|

$

|

21.45

|

||

|

TOTAL RETURN

|

-7.67

|

%(2)

|

||

|

SUPPLEMENTAL DATA AND RATIOS:

|

||||

|

Net assets, end of period (millions)

|

$

|

130.58

|

||

|

Ratio of expenses to average net assets

|

1.33

|

%(3)

|

||

|

Ratio of net investment income (loss) to average net assets

|

2.06

|

%(3)

|

||

|

Portfolio turnover rate(4)

|

90

|

%(2)

|

||

|

(1)

|

Calculated using the average shares outstanding method.

|

|

(2)

|

Not annualized.

|

|

(3)

|

Annualized.

|

|

(4)

|

Calculated on the basis of the Fund as a whole.

|

|

WWW.HENNESSYFUNDS.COM

|

|

FINANCIAL HIGHLIGHTS — INVESTOR CLASS

|

|

Year Ended October 31,

|

||||||||||||||||||

|

2022

|

2021

|

2020

|

2019

|

2018

|

||||||||||||||

|

$

|

29.83

|

$

|

19.91

|

$

|

19.15

|

$

|

22.17

|

$

|

24.16

|

|||||||||

|

0.26

|

(1)

|

(0.14

|

)(1)

|

(0.08

|

)(1)

|

(0.01

|

)(1)

|

(0.17

|

)

|

|||||||||

|

0.62

|

10.06

|

0.84

|

(1.19

|

)

|

(1.82

|

)

|

||||||||||||

|

0.88

|

9.92

|

0.76

|

(1.20

|

)

|

(1.99

|

)

|

||||||||||||

|

(6.64

|

)

|

—

|

—

|

(1.82

|

)

|

—

|

||||||||||||

|

(6.64

|

)

|

—

|

—

|

(1.82

|

)

|

—

|

||||||||||||

|

$

|

24.07

|

$

|

29.83

|

$

|

19.91

|

$

|

19.15

|

$

|

22.17

|

|||||||||

|

2.51

|

%

|

49.82

|

%

|

3.97

|

%

|

-5.19

|

%

|

-8.24

|

%

|

|||||||||

|

$

|

154.25

|

$

|

151.96

|

$

|

110.96

|

$

|

125.10

|

$

|

158.98

|

|||||||||

|

1.33

|

%

|

1.34

|

%

|

1.36

|

%

|

1.34

|

%

|

1.30

|

%

|

|||||||||

|

1.10

|

%

|

(0.51

|

)%

|

(0.45

|

)%

|

(0.07

|

)%

|

(0.56

|

)%

|

|||||||||

|

102

|

%

|

98

|

%

|

98

|

%

|

95

|

%

|

133

|

%

|

|||||||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Financial Highlights

|

|

Six Months Ended

|

||||

|

April 30, 2023

|

||||

|

(Unaudited)

|

||||

|

PER SHARE DATA:

|

||||

|

Net asset value, beginning of period

|

$

|

25.17

|

||

|

Income from investment operations:

|

||||

|

Net investment income (loss)

|

0.29

|

(1)

|

||

|

Net realized and unrealized gains (losses) on investments

|

(2.14

|

)

|

||

|

Total from investment operations

|

(1.85

|

)

|

||

|

Less distributions:

|

||||

|

Dividends from net investment income

|

(0.35

|

)

|

||

|

Dividends from net realized gains

|

(0.58

|

)

|

||

|

Total distributions

|

(0.93

|

)

|

||

|

Net asset value, end of period

|

$

|

22.39

|

||

|

TOTAL RETURN

|

-7.56

|

%(2)

|

||

|

SUPPLEMENTAL DATA AND RATIOS:

|

||||

|

Net assets, end of period (millions)

|

$

|

16.80

|

||

|

Ratio of expenses to average net assets:

|

1.02

|

%(3)

|

||

|

Ratio of net investment income (loss) to average net assets:

|

2.43

|

%(3)

|

||

|

Portfolio turnover rate(4)

|

90

|

%(2)

|

||

|

(1)

|

Calculated using the average shares outstanding method.

|

|

(2)

|

Not annualized.

|

|

(3)

|

Annualized.

|

|

(4)

|

Calculated on the basis of the Fund as a whole.

|

|

WWW.HENNESSYFUNDS.COM

|

|

FINANCIAL HIGHLIGHTS — INSTITUTIONAL CLASS

|

|

Year Ended October 31,

|

||||||||||||||||||

|

2022

|

2021

|

2020

|

2019

|

2018

|

||||||||||||||

|

$

|

31.09

|

$

|

20.68

|

$

|

19.83

|

$

|

22.88

|

$

|

24.85

|

|||||||||

|

0.34

|

(1)

|

(0.05

|

)(1)

|

(0.03

|

)(1)

|

0.05

|

(1)

|

0.11

|

||||||||||

|

0.67

|

10.46

|

0.88

|

(1.22

|

)

|

(2.08

|

)

|

||||||||||||

|

1.01

|

10.41

|

0.85

|

(1.17

|

)

|

(1.97

|

)

|

||||||||||||

|

(6.93

|

)

|

—

|

—

|

(1.88

|

)

|

—

|

||||||||||||

|

(6.93

|

)

|

—

|

—

|

(1.88

|

)

|

—

|

||||||||||||

|

$

|

25.17

|

$

|

31.09

|

$

|

20.68

|

$

|

19.83

|

$

|

22.88

|

|||||||||

|

2.84

|

%

|

50.34

|

%

|

4.29

|

%

|

-4.86

|

%

|

-7.93

|

%

|

|||||||||

|

$

|

18.52

|

$

|

15.78

|

$

|

11.65

|

$

|

14.62

|

$

|

20.52

|

|||||||||

|

1.01

|

%

|

1.01

|

%

|

1.05

|

%

|

1.01

|

%

|

0.96

|

%

|

|||||||||

|

1.38

|

%

|

(0.17

|

)%

|

(0.14

|

)%

|

0.27

|

%

|

(0.23

|

)%

|

|||||||||

|

102

|

%

|

98

|

%

|

98

|

%

|

95

|

%

|

133

|

%

|

|||||||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Notes to the Financial Statements April 30, 2023 (Unaudited)

|

|

a).

|

Securities Valuation – All investments in securities are valued in accordance with the Fund’s valuation policies and procedures, as described in Note 3.

|

|

b).

|

Federal Income Taxes – The Fund has elected to be taxed as a regulated investment company and intends to distribute substantially all of its taxable income to its shareholders and otherwise comply with the

provisions of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. As a result, the Fund has made no provision for federal income taxes or excise taxes. Net investment income/loss and realized

gains/losses for federal income tax purposes may differ from those reported in the financial statements because of temporary book-basis and tax-basis differences. Temporary differences are primarily the result of the treatment of partnership

income and wash sales for tax reporting purposes. The Fund recognizes interest and penalties related to income tax benefits, if any, in the Statement of Operations as an income tax expense. Distributions from net realized gains for book

purposes may include short-term capital gains, which are included as ordinary income to shareholders for tax purposes. The Fund may utilize equalization accounting for tax purposes and designate earnings and profits, including net realized

gains distributed to shareholders on redemption of shares, as part of the dividends paid deduction for income tax purposes.

|

|

c).

|

Accounting for Uncertainty in Income Taxes – The Fund has accounting policies regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The tax returns of the Fund for the

prior three fiscal years are open for examination. The Fund has reviewed all open tax years in major tax jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax

benefits relating to uncertain income tax positions taken or expected to be taken on a tax return. The Fund’s major tax jurisdictions are U.S. federal and Delaware.

|

|

WWW.HENNESSYFUNDS.COM

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

d).

|

Income and Expenses – Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund. Interest income, which includes the amortization of premium and accretion of discount,

is recognized on an accrual basis. Market discounts, original issue discounts, and market premiums on debt securities are accreted or amortized to interest income over the life of a security with a corresponding increase or decrease, as

applicable, in the cost basis of such security using the yield-to-maturity method or, where applicable, the first call date of the security. Other non-cash dividends are recognized as investment income at the fair value of the property

received. The Fund is charged for those expenses that are directly attributable to its portfolio, such as advisory, administration, and certain shareholder service fees. Income, expenses (other than expenses attributable to a specific class),

and realized and unrealized gains/losses on investments are allocated to each class of shares based on such class’s net assets.

|

|

e).

|

Distributions to Shareholders – Dividends from net investment income for the Fund, if any, are declared and paid annually, usually in December. Distributions of net realized capital gains, if any, are declared and

paid annually, usually in December.

|

|

f).

|

Security Transactions – Investment and shareholder transactions are recorded on the trade date. The Fund determines the realized gain/loss from an investment transaction by comparing the original cost of the

security lot sold with the net sale proceeds. Discounts and premiums on securities purchased are accreted or amortized, respectively, over the life of each such security.

|

|

g).

|

Use of Estimates – Preparing financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent

assets and liabilities at the date of the financial statements, as well as the reported change in net assets during the reporting period. Actual results could differ from those estimates.

|

|

h).

|

Share Valuation – The net asset value (“NAV”) per share of the Fund is calculated by dividing (i) the total value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including

estimated accrued expenses) by (ii) the total number of Fund shares outstanding, rounded to the nearest $0.01. Fund shares are not priced on days the New York Stock Exchange is closed for trading. The offering and redemption price per share

for the Fund is equal to the Fund’s NAV per share.

|

|

i).

|

REIT Equity Securities – Distributions received from real estate investment trusts (“REITs”) may be classified as dividends, capital gains, or return of capital. Investments in REITs may require the Fund to accrue

and distribute income not yet received. To generate sufficient cash to make any required distributions, the Fund may be required to sell securities in its portfolio (including when it is not advantageous to do so) that it otherwise would have

continued to hold. At other times, investments in a REIT may result in the Fund’s receipt of cash in excess of the REIT’s earnings. If the Fund distributes these amounts, these distributions could constitute a return of capital to Fund

shareholders for U.S. federal income tax purposes. Dividends received by the Fund from a REIT generally do not constitute qualified dividend income and do not qualify for the dividends-received deduction.

|

|

j).

|

Illiquid Securities – Pursuant to Rule 22e-4 under the 1940 Act, the Fund has adopted a Liquidity Risk Management Program (the “Liquidity Program”). The Liquidity Program requires, among other things, that the Fund

limit its illiquid investments to no more than 15% of its net assets. An illiquid investment is any investment that the Fund reasonably expects cannot be sold or disposed of by the Fund in current market conditions in seven calendar days or

less without the sale or disposition significantly changing the market value of the investment.

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

k).

|

Recent Accounting Pronouncements and Regulatory Updates – In October 2020, the Securities and Exchange Commission (the “SEC”) adopted new regulations under the 1940 Act governing the use of derivatives by registered

investment companies (“Rule 18f-4”). Rule 18f-4 imposes limits on the amount of derivatives a fund can enter into, generally eliminates the asset segregation framework used by funds to comply with Section 18 of the 1940 Act, and requires

funds whose use of derivatives is greater than a limited specified amount to establish and maintain a comprehensive derivatives risk management program and appoint a derivatives risk manager. The Fund does not utilize derivatives and

therefore has not adopted a derivatives risk management program.

|

|

In December 2020, the SEC adopted a new rule under the 1940 Act providing a framework for fund valuation practices (“Rule 2a-5”). Rule 2a-5

establishes requirements for determining fair value in good faith for purposes of the 1940 Act. Rule 2a-5 permits fund boards to designate certain parties to perform fair value determinations, subject to board oversight and certain other

conditions. Rule 2a-5 also defines when market quotations are “readily available” for purposes of the 1940 Act and the threshold for determining whether a fund must fair value a security. In connection with Rule 2a-5, the SEC also adopted

related recordkeeping requirements. The Fund has designated Hennessy Advisors, Inc., the Fund’s investment advisor (the “Advisor”), as its valuation designee under Rule 2a-5.

|

|

Level 1 –

|

Unadjusted, quoted prices in active markets for identical instruments that the Fund has the ability to access at the date of measurement.

|

|

|

Level 2 –

|

Other significant observable inputs (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets that are not active for identical or similar instruments, and

model-derived valuations in which all significant inputs and significant value drivers are observable in active markets, such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data).

|

|

|

Level 3 –

|

Significant unobservable inputs (including the Fund’s own assumptions about what market participants would use to price the asset or liability based on the best available information) when observable inputs are

unavailable.

|

|

Equity Securities – Equity securities, including common stocks, preferred stocks, foreign-issued common stocks, exchange-traded funds, closed-end mutual funds, partnerships,

rights, and real estate investment trusts, that are traded on a securities exchange for which a last-quoted sales price is readily available generally are valued at the last sales price as reported by the primary exchange on which the

securities are listed. Securities listed on The Nasdaq Stock Market (“Nasdaq”) generally are valued at the Nasdaq Official Closing Price, which may differ from the last sales price

|

|

WWW.HENNESSYFUNDS.COM

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

reported. Securities traded on a securities exchange for which a last-quoted sales price is not readily available generally are valued at the mean between the bid and ask prices. To the extent these securities are

actively traded and valuation adjustments are not applied, they are classified in Level 1 of the fair value hierarchy. Securities traded on foreign exchanges generally are not valued at the same time the Fund calculates its NAV because most

foreign markets close well before such time. The earlier close of most foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim. In certain circumstances, it may be

determined that a foreign security needs to be fair valued because it appears that the value of the security might have been materially affected by events occurring after the close of the market in which the security is principally traded,

but before the time the Fund calculates its NAV, such as by a development that affects an entire market or region (e.g., a weather-related event) or a potentially global development (e.g., a terrorist attack that may be expected to have an

effect on investor expectations worldwide).

|

|

|

Registered Investment Companies – Investments in open-end registered investment companies, commonly referred to as mutual funds, generally are priced at the ending NAV

provided by the applicable mutual fund’s service agent and are classified in Level 1 of the fair value hierarchy.

|

|

|

Debt Securities – Debt securities, including corporate bonds, asset-backed securities, mortgage-backed securities, municipal bonds, U.S. Treasuries, and U.S. government

agency issues, are generally valued at market on the basis of valuations furnished by an independent pricing service that utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently

executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. In addition, the model may incorporate observable market data,

such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities are valued primarily using dealer quotations. These securities are generally classified in Level 2 of the fair value

hierarchy.

|

|

|

Short-Term Securities – Short-term equity investments, including money market funds, are valued in the manner specified above for equity securities. Short-term debt

investments with an original term to maturity of 60 days or less are valued at amortized cost, which approximates fair market value. If the original term to maturity of a short-term debt investment exceeds 60 days, then the values as of the

61st day prior to maturity are amortized. Amortized cost is not used if its use would be inappropriate due to credit or other impairments of the issuer, in which case the security’s fair value would be determined as described below.

Short-term securities are generally classified in Level 1 or Level 2 of the fair value hierarchy depending on the inputs used and market activity levels for specific securities.

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

WWW.HENNESSYFUNDS.COM

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Investments

|

|||||

|

Cost of investments for tax purposes

|

$

|

161,148,951

|

|||

|

Gross tax unrealized appreciation

|

$

|

28,530,051

|

|||

|

Gross tax unrealized depreciation

|

(16,847,697

|

)

|

|||

|

Net tax unrealized appreciation/(depreciation)

|

$

|

11,682,354

|

|||

|

Undistributed ordinary income

|

$

|

829,382

|

|||

|

Undistributed long-term capital gains

|

4,012,963

|

||||

|

Total distributable earnings

|

$

|

4,842,345

|

|||

|

Other accumulated gain/(loss)

|

$

|

—

|

|||

|

Total accumulated gain/(loss)

|

$

|

16,524,699

|

|||

|

WWW.HENNESSYFUNDS.COM

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

Six Months Ended

|

Year Ended

|

||||||||

|

April 30, 2023

|

October 31, 2022

|

||||||||

|

Ordinary income(1)

|

$

|

2,073,342

|

$

|

—

|

|||||

|

Long-term capital gains

|

4,012,997

|

37,030,072

|

|||||||

|

Total distributions

|

$

|

6,086,339

|

$

|

37,030,072

|

|||||

|

(1) Ordinary income includes short-term capital gains.

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

WWW.HENNESSYFUNDS.COM

|

|

EXPENSE EXAMPLE

|

|

Expenses Paid

|

|||

|

Beginning

|

Ending

|

During Period(1)

|

|

|

Account Value

|

Account Value

|

November 1, 2022 –

|

|

|

November 1, 2022

|

April 30, 2023

|

April 30, 2023

|

|

|

Investor Class

|

|||

|

Actual

|

$1,000.00

|

$ 923.30

|

$12.79

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,036.70

|

$13.54

|

|

Institutional Class

|

|||

|

Actual

|

$1,000.00

|

$ 924.40

|

$ 9.81

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,039.80

|

$10.40

|

|

(1)

|

Expenses are equal to the Fund’s annualized expense ratio of 1.33% for Investor Class shares or 1.02% for Institutional Class shares, as applicable, multiplied by the average account value over the period,

multiplied by 181/365 days (to reflect the half-year period).

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

|

|

|

|

WWW.HENNESSYFUNDS.COM

|

|

PROXY VOTING — BOARD APPROVAL OF INVESTMENT ADVISORY AGREEMENT

|

|

(1)

|

A memorandum from outside legal counsel that described the fiduciary duties of the Board with respect to approving the continuation of the advisory agreement and the relevant factors for consideration;

|

|

|

(2)

|

A memorandum from the Advisor that listed the factors relevant to the Board’s approval of the continuation of the advisory agreement and also referenced the documents that had been provided to help the Board assess

each such factor;

|

|

|

(3)

|

The Advisor’s financial statements from its most recent Form 10-K and Form 10-Q;

|

|

|

(4)

|

A summary of the advisory agreement;

|

|

|

(5)

|

A recent Fund fact sheet, which included, among other things, Fund performance over various periods;

|

|

|

(6)

|

A description of the range of services provided by the Advisor and the distinction between the Advisor-provided services and the Sub-Advisor-provided services;

|

|

|

(7)

|

A peer expense comparison of the net expense ratio and investment advisory fee of the Fund; and

|

|

|

(8)

|

A memorandum from the Advisor regarding economies of scale.

|

|

(1)

|

The nature and quality of the advisory services provided by the Advisor;

|

|

|

(2)

|

A comparison of the fees and expenses of the Fund to other similar funds;

|

|

|

(3)

|

Whether economies of scale are recognized by the Fund;

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

(4)

|

The costs and profitability of the Fund to the Advisor;

|

|

|

(5)

|

The performance of the Fund; and

|

|

|

(6)

|

Any benefits to the Advisor from serving as an investment advisor to the Fund (other than the advisory fee).

|

|

(1)

|

The Trustees considered the services identified below that are provided by the Advisor. Based on this review and an assessment of the Advisor’s performance, the Trustees concluded that the Advisor provides

high-quality services to the Fund, and they noted that their overall confidence in the Advisor was high. The Trustees also concluded that they were satisfied with the nature, extent, and quality of the advisory services provided to the Fund

by the Advisor and that the nature and extent of the services provided by the Advisor were appropriate to assure that the Fund’s operations are conducted in compliance with applicable laws, rules, and regulations.

|

|

(a)

|

The Advisor acts as the portfolio manager for the Fund. In this capacity, the Advisor does the following:

|

|

(i)

|

manages the composition of the Fund’s portfolio, including the purchase, retention, and disposition of portfolio securities in accordance with the Fund’s investment objectives, policies, and restrictions;

|

|||

|

(ii)

|

seeks best execution for the Fund’s portfolio;

|

|||

|

(iii)

|

manages the use of soft dollars for the Fund; and

|

|||

|

(iv)

|

manages proxy voting for the Fund.

|

|

(b)

|

The Advisor performs a daily reconciliation of portfolio positions and cash for the Fund.

|

||

|

(c)

|

The Advisor monitors the liquidity of each Fund.

|

||

|

(d)

|

The Advisor monitors the Fund’s compliance with its investment objectives and restrictions and federal securities laws.

|

||

|

(e)

|

The Advisor maintains a compliance program (including a code of ethics), conducts ongoing reviews of the compliance programs of the Fund’s service providers (including their codes of ethics, as appropriate),

conducts on-site visits to the Fund’s service providers, as feasible, monitors incidents of abusive trading practices, reviews Fund expense accruals, payments, and fixed expense ratios, evaluates insurance providers for fidelity bond,

D&O/E&O insurance, and cybersecurity insurance coverage, manages regulatory examination compliance and responses, conducts employee compliance training, reviews reports provided by service providers, and maintains books and records.

|

||

|

(f)

|

The Advisor oversees service providers that provide accounting, administration, distribution, transfer agency, custodial, sales, marketing, public relations, audit, information technology, and legal services to the

Fund.

|

||

|

(g)

|

The Advisor maintains in-house marketing and distribution departments on behalf of the Fund.

|

|

WWW.HENNESSYFUNDS.COM

|

|

BOARD APPROVAL OF INVESTMENT ADVISORY AGREEMENT

|

|

(h)

|

The Advisor prepares or directs the preparation of all regulatory filings for the Fund, including writing and annually updating the Fund’s prospectus and related documents.

|

||

|

(i)

|

For each annual report of the Fund, the Advisor prepares a written summary of the Fund’s performance during the most recent 12-month period.

|

||

|

(j)

|

The Advisor oversees distribution of the Fund through third-party broker/dealers and independent financial institutions such as Charles Schwab, Inc., Fidelity, TD Ameritrade, and Pershing. The Advisor participates

in “no transaction fee” (“NTF”) programs with these companies on behalf of the Fund, which allow customers to purchase the Fund through third-party distribution channels without paying a transaction fee. The Advisor compensates, in part, a

number of these third-party providers of NTF programs out of its own revenues.

|

||

|

(k)

|

The Advisor pays the incentive compensation of the Fund’s compliance officer and employs other staff, such as legal, marketing, national accounts, distribution, sales, administrative, and trading oversight

personnel, as well as management executives.

|

||

|

(l)

|

The Advisor provides a quarterly compliance certification to the Board.

|

||

|

(m)

|

The Advisor prepares or reviews all Board materials, presents to and leads discussions with the Board, prepares or reviews all meeting minutes, and arranges for Board training and education.

|

|

(2)

|

The Trustees compared the performance of the Fund to benchmark indices over various periods and noted that the Trustees review and discuss reports comparing the investment performance of the Fund to various indices

at each quarterly Board meeting. Based on such information, the Trustees determined that the Advisor manages the Fund in a manner materially consistent with its stated investment objective and style. The Trustees concluded that the

performance of the Fund over various periods warranted the continuation of the advisory agreement.

|

|

|

(3)

|

The Trustees reviewed the advisory fees and overall expense ratios of the Fund compared to other funds similar in asset size and investment objective to the Fund using data from Morningstar. As part of the

discussion with management, the Trustees ensured that they understood and were comfortable with the criteria used to determine the mutual funds included in the Morningstar categories for purposes of the materials considered at the meeting.

The Trustees determined that the advisory fee and overall expense ratio of the Fund falls within a reasonable range of the advisory fees and overall expense ratios of other comparable funds and concluded that they are reasonable and warranted

continuation of the advisory agreement.

|

|

|

(4)

|

The Trustees also considered whether the Advisor was realizing economies of scale that should be shared with the Fund’s shareholders. The Trustees noted that many of the expenses incurred to manage the Fund were

variable asset-based fees, so the Advisor would not realize material economies of scale relating to these expenses as the assets of the Fund increased. For example, third-party platform fees increase as the Fund’s assets grow.

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

(5)

|

The Trustees considered the profitability of the Advisor, including the impact of mutual fund platform fees on the Advisor’s profitability, and also considered the resources and revenues that the Advisor has put

into managing and distributing the Fund. The Trustees then concluded that the profits of the Advisor are reasonable and not excessive when compared to profitability guidelines set forth in relevant court cases.

|

|

|

(6)

|

The Trustees considered the high level of professionalism and knowledge of the Advisor’s employees and concluded that this was beneficial to the Fund and its shareholders.

|

|

|

(7)

|

The Trustees considered any benefits to the Advisor from serving as an advisor to the Fund (other than the advisory fee). The Trustees noted that the Advisor may derive ancillary benefits from, by way of example,

its association with the Fund in the form of proprietary and third-party research products and services received from broker-dealers that execute portfolio trades for the Fund. The Trustees determined that any such products and services have

been used for legitimate purposes relating to the Fund by providing assistance in the investment decision-making process. The Trustees concluded that any additional benefits realized by the Advisor from its relationship with the Fund were

reasonable, which was based on, among other things, the Trustees’ finding that the research, analytical, statistical, and other information and services provided by brokers are merely supplemental to the Advisor’s own efforts in the

performance of its duties under the advisory agreement.

|

|

WWW.HENNESSYFUNDS.COM

|

|

BOARD APPROVAL OF INVESTMENT ADVISORY AGREEMENT

|

|

Letter to Shareholders

|

2

|

|

|

Performance Overview

|

4

|

|

|

Financial Statements

|

||

|

Schedule of Investments

|

5

|

|

|

Statement of Assets and Liabilities

|

9

|

|

|

Statement of Operations

|

10

|

|

|

Statements of Changes in Net Assets

|

11

|

|

|

Financial Highlights

|

12

|

|

|

Notes to the Financial Statements

|

16

|

|

|

Expense Example

|

24

|

|

|

Proxy Voting Policy and Proxy Voting Records

|

26

|

|

|

Availability of Quarterly Portfolio Schedule

|

26

|

|

|

Federal Tax Distribution Information

|

26

|

|

|

Important Notice Regarding Delivery of Shareholder Documents

|

26

|

|

|

Electronic Delivery

|

26

|

|

|

Board Approval of Investment Advisory Agreements

|

27

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

WWW.HENNESSYFUNDS.COM

|

|

LETTER TO SHAREHOLDERS

|

|

|

|

|

|

Ryan C. Kelley, CFA

|

|

|

Chief Investment Officer,

|

|

|

Senior Vice President, and Portfolio Manager

|

|

1

|

S&P 500® Index monthly total returns: +5.59% in November 2022, -5.76% in December 2022, +6.28% in January 2023, -2.44% in February

2023, +3.67% in March 2023, and +1.56% in April 2023.

|

|

2

|

S&P 500® Financial Sector monthly total return: -9.55% in March 2023. KBW Bank Index monthly total return: -24.87% in March 2023.

S&P 500® Information Technology sector total return: +18.88% for the six months ended April 30, 2023. S&P 500® Communication Services sector total return: +23.15% for the six months ended April 30, 2023.

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Six

|

One

|

Five

|

Ten

|

|

|

Months(1)

|

Year

|

Years

|

Years

|

|

|

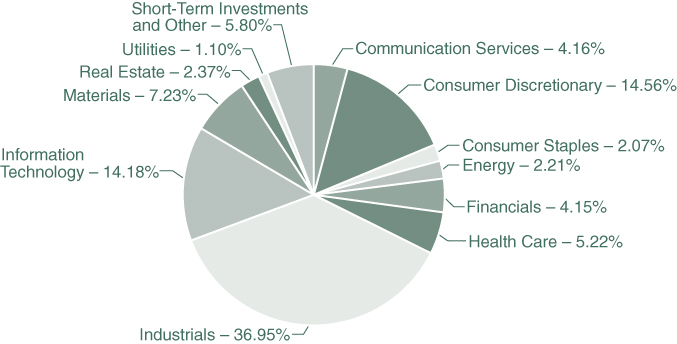

Hennessy Focus Fund –

|

||||

|

Investor Class (HFCSX)

|

7.67%

|

-3.37%

|

6.50%

|

8.68%

|

|

Hennessy Focus Fund –

|

||||

|

Institutional Class (HFCIX)

|

7.85%

|

-3.04%

|

6.89%

|

9.07%

|

|

Russell 3000® Index

|

7.30%

|

1.50%

|

10.60%

|

11.67%

|

|

Russell Midcap® Growth Index

|

6.60%

|

1.60%

|

8.96%

|

10.84%

|

|

(1)

|

Periods of less than one year are not annualized.

|

|

WWW.HENNESSYFUNDS.COM

|

|

PERFORMANCE OVERVIEW/SCHEDULE OF INVESTMENTS

|

|

Schedule of Investments as of April 30, 2023 (Unaudited)

|

|

TOP TEN HOLDINGS (EXCLUDING MONEY MARKET FUNDS)

|

% NET ASSETS

|

|

Markel Corp.

|

8.23%

|

|

CarMax, Inc.

|

8.12%

|

|

Encore Capital Group, Inc.

|

8.05%

|

|

Aon PLC

|

7.98%

|

|

American Tower Corp., Class A

|

7.90%

|

|

O’Reilly Automotive, Inc.

|

7.57%

|

|

Brookfield Corp.

|

7.31%

|

|

Ashtead Group PLC

|

7.17%

|

|

SS&C Technologies Holdings, Inc.

|

5.16%

|

|

Restoration Hardware Holdings, Inc.

|

4.61%

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

COMMON STOCKS – 90.34%

|

Number

|

% of

|

||||||||||

|

|

of Shares

|

Value

|

Net Assets

|

|||||||||

|

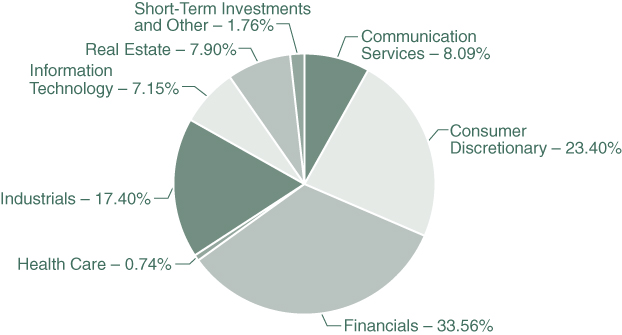

Communication Services – 8.09%

|

||||||||||||

|

AST SpaceMobile, Inc. (a)

|

1,997,902

|

$

|

10,608,860

|

1.60

|

%

|

|||||||

|

Cogent Communications Holdings, Inc.

|

308,047

|

21,267,565

|

3.22

|

%

|

||||||||

|

Shenandoah Telecommunications Co.

|

796,737

|

16,580,097

|

2.51

|

%

|

||||||||

|

Warner Music Group Corp.

|

165,601

|

5,045,862

|

0.76

|

%

|

||||||||

|

|

53,502,384

|

8.09

|

%

|

|||||||||

|

Consumer Discretionary – 23.40%

|

||||||||||||

|

CarMax, Inc. (a)

|

766,122

|

53,651,524

|

8.12

|

%

|

||||||||

|

Hilton Worldwide Holdings, Inc.

|

39,481

|

5,686,054

|

0.86

|

%

|

||||||||

|

NVR, Inc. (a)

|

2,537

|

14,816,080

|

2.24

|

%

|

||||||||

|

O’Reilly Automotive, Inc. (a)

|

54,531

|

50,021,831

|

7.57

|

%

|

||||||||

|

Restoration Hardware Holdings, Inc. (a)

|

119,446

|

30,474,258

|

4.61

|

%

|

||||||||

|

|

154,649,747

|

23.40

|

%

|

|||||||||

|

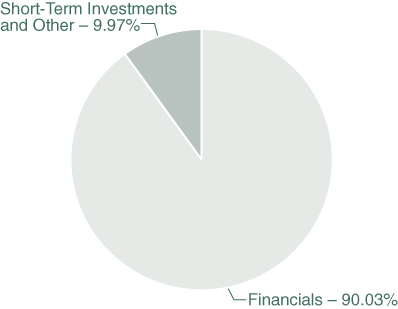

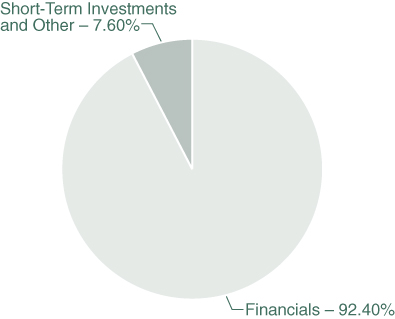

Financials – 33.56%

|

||||||||||||

|

Aon PLC (b)

|

162,177

|

52,736,717

|

7.98

|

%

|

||||||||

|

Brookfield Asset Management Ltd. (b)

|

376,240

|

12,622,852

|

1.91

|

%

|

||||||||

|

Brookfield Corp. (b)

|

1,489,242

|

48,340,795

|

7.31

|

%

|

||||||||

|

Brookfield Reinsurance Ltd. (b)

|

15,721

|

510,933

|

0.08

|

%

|

||||||||

|

Encore Capital Group, Inc. (a)(d)

|

1,035,743

|

53,216,475

|

8.05

|

%

|

||||||||

|

Markel Corp. (a)

|

39,760

|

54,412,753

|

8.23

|

%

|

||||||||

|

|

221,840,525

|

33.56

|

%

|

|||||||||

|

Health Care – 0.74%

|

||||||||||||

|

Danaher Corp.

|

20,677

|

4,898,588

|

0.74

|

%

|

||||||||

|

Industrials – 17.40%

|

||||||||||||

|

American Woodmark Corp. (a)

|

524,614

|

26,503,500

|

4.01

|

%

|

||||||||

|

Ashtead Group PLC (b)

|

824,513

|

47,427,372

|

7.17

|

%

|

||||||||

|

Mistras Group, Inc. (a)

|

21,401

|

173,776

|

0.03

|

%

|

||||||||

|

SS&C Technologies Holdings, Inc.

|

582,330

|

34,089,598

|

5.16

|

%

|

||||||||

|

TransDigm Group, Inc.

|

8,873

|

6,787,845

|

1.03

|

%

|

||||||||

|

|

114,982,091

|

17.40

|

%

|

|||||||||

|

Information Technology – 7.15%

|

||||||||||||

|

Applied Materials, Inc.

|

166,465

|

18,815,539

|

2.85

|

%

|

||||||||

|

CDW Corp.

|

167,589

|

28,421,418

|

4.30

|

%

|

||||||||

|

|

47,236,957

|

7.15

|

%

|

|||||||||

|

|

||||||||||||

|

Total Common Stocks

|

||||||||||||

|

(Cost $271,530,612)

|

597,110,292

|

90.34

|

%

|

|||||||||

|

WWW.HENNESSYFUNDS.COM

|

|

SCHEDULE OF INVESTMENTS

|

|

REITS – 7.90%

|

Number

|

% of

|

||||||||||

|

|

of Shares

|

Value

|

Net Assets

|

|||||||||

|

Real Estate – 7.90%

|

||||||||||||

|

American Tower Corp., Class A

|

255,468

|

$

|

52,215,105

|

7.90

|

%

|

|||||||

|

|

||||||||||||

|

Total REITS

|

||||||||||||

|

(Cost $196,711)

|

52,215,105

|

7.90

|

%

|

|||||||||

|

|

||||||||||||

|

SHORT-TERM INVESTMENTS – 1.64%

|

||||||||||||

|

Money Market Funds – 1.64%

|

||||||||||||

|

First American Government Obligations Fund,

|

||||||||||||

|

Institutional Class, 4.73% (c)

|

10,854,925

|

10,854,925

|

1.64

|

%

|

||||||||

|

|

||||||||||||

|

Total Short-Term Investments

|

||||||||||||

|

(Cost $10,854,925)

|

10,854,925

|

1.64

|

%

|

|||||||||

|

|

||||||||||||

|

Total Investments

|

||||||||||||

|

(Cost $282,582,248) – 99.88%

|

660,180,322

|

99.88

|

%

|

|||||||||

|

Other Assets in Excess of Liabilities – 0.12%

|

781,490

|

0.12

|

%

|

|||||||||

|

|

||||||||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

660,961,812

|

100.00

|

%

|

||||||||

|

(a)

|

Non-income-producing security.

|

|

(b)

|

U.S.-traded security of a foreign corporation.

|

|

(c)

|

The rate listed is the fund’s seven-day yield as of April 30, 2023.

|

|

(d)

|

Investment in affiliated security. Investment represents five percent or more of the outstanding voting securities of the issuer, making the issuer an affiliate of the Fund, as defined in the Investment Company Act

of 1940, as amended. Details of transactions with affiliated companies for the six months ended April 30, 2023, are as follows:

|

|

Value at

|

Sales

|

Realized

|

|||||||||||||||

|

Common Stocks

|

November 1, 2022

|

Purchases

|

Proceeds

|

Gain/Loss

|

|||||||||||||

|

Encore Capital Group, Inc.(1)(2)

|

$

|

74,084,017

|

$

|

—

|

$

|

(21,351,134

|

)

|

$

|

5,553,024

|

||||||||

|

$

|

74,084,017

|

$

|

—

|

$

|

(21,351,134

|

)

|

$

|

5,553,024

|

|||||||||

|

Net Change

|

|||||||||||||||||

|

in Unrealized