As filed with the Securities and Exchange Commission on July 8, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-07168)

Hennessy Funds Trust

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Teresa M. Nilsen

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Name and address of agent for service)

(Name and address of agent for service)

800-966-4354

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2022

Date of reporting period: April 30, 2022

Item 1. Reports to Stockholders.

|

(a)

|

|

SEMI-ANNUAL REPORT

APRIL 30, 2022

HENNESSY CORNERSTONE GROWTH FUND

Investor Class HFCGX

Institutional Class HICGX

www.hennessyfunds.com | 1-800-966-4354

(This Page Intentionally Left Blank.)

Contents

|

Letter to Shareholders

|

2

|

|

Performance Overview

|

4

|

|

Financial Statements

|

|

|

Schedule of Investments

|

5

|

|

Statement of Assets and Liabilities

|

9

|

|

Statement of Operations

|

10

|

|

Statements of Changes in Net Assets

|

11

|

|

Financial Highlights

|

12

|

|

Notes to the Financial Statements

|

16

|

|

Expense Example

|

24

|

|

Proxy Voting Policy and Proxy Voting Records

|

26

|

|

Availability of Quarterly Portfolio Schedule

|

26

|

|

Important Notice Regarding Delivery of Shareholder Documents

|

26

|

|

Electronic Delivery

|

26

|

|

Board Approval of Investment Advisory Agreement

|

27

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

May 2022

Dear Hennessy Funds Shareholder:

We’d like to start our semi-annual letter with a pause. At the end of 2021, we looked forward to a new year – a potentially calmer year – having come through almost two full years

of the coronavirus pandemic. As people, we were aware our lives had changed, but we hoped for a better 2022; as investors, we were aware that the economy was strong and employment was robust, yet challenges loomed, including inflation, supply chain

disruptions, and tightening monetary policy; as employees, students, and family members, we recognized much was different, but we sought a return to what’s familiar. What we didn’t know was that a world leader who controls one of the largest

militaries on the planet was about to start one of the worst atrocities in Europe since World War II. Our thoughts are with the Ukrainian people, and our hope is for this unjustified, senseless human tragedy to end quickly.

The equity market started 2022 on a high note, with the S&P 500® Index hitting an all-time high on the first trading day of the year. This turned out to be the last hurrah for a market that saw a continuous march higher in 2021, having hit 70 new all-time highs, with a new

all-time high being recorded on average every three and a half days. Concerns in the market then coalesced and overpowered bullish sentiment, and the market has spiraled lower throughout 2022. Factors that drove the market lower include: tightening

monetary policy as the Federal Reserve has begun raising rates and has announced plans for shrinking its $8.5 trillion asset portfolio; inflation, higher energy costs, and their effects on the domestic and global economies; continued supply chain

disruptions; investors’ indiscriminate liquidation of broad-based ETFs and index funds and the detrimental effect on equities; and the near-term and long-term global implications of the Russian invasion of Ukraine.

While markets are adjusting, many positive conditions remain intact. Corporate balance sheets and profits remain strong, GDP growth remains positive, the consumer

continues to show resilience in the face of rising prices, cash is abundant both at the corporate and household levels, unemployment is exceptionally low, and our financial system remains healthy. Markets are also experiencing a change in

leadership, as value stocks have been outperforming growth stocks, and traditionally defensive sectors such as Utilities and Consumer Staples have been outperforming the broader market. Finally, the Energy sector has soared in 2022, as companies

reap the benefits of dramatically higher oil and natural gas prices, and shareholders are rewarded with significantly higher dividends, aggressive buybacks, and higher stock prices after many years of underperformance for the sector.

With history as our guide, we are hopeful that eventually the market may bottom and head higher again. Since the financial crisis of 2008, we have experienced

many corrections and many recoveries to new highs. The Dow Jones Industrial Average has dropped over 10% eight times, including the current drop, for a median decline of 14.00%, and on average, it took 45 trading days to drop from peak to trough

and 127 trading days to return to the previous peak. Since the current drop has taken longer to go from peak to its recent trough, it may take some time for a recovery in prices to truly take hold.

On a positive note, valuations have come in, and many stocks have become more attractive, especially for longer-term investors. We note, however, that the concept

of “historically cheap stocks” does not, on its own, move the market higher. Rather, it is

|

WWW.HENNESSYFUNDS.COM

|

2

|

LETTER TO SHAREHOLDERS

|

overall capitulation and improving fundamentals that could bring buyers back into the market and reverse any bearish trends. Investors need to see improving company earnings, retreating inflationary trends, a measured

pace of interest rate increases globally that does not cause significant economic contraction, hope for a more peaceful and orderly world economic system unconstrained by supply bottlenecks and other hindrances to global trade, and, most

importantly, a subsidence of the deleterious effects of the coronavirus pandemic. While that may seem like a “tall order,” we believe that patient investing, focusing on value, quality, and downside risk mitigation, works well over the longer term.

During this tumultuous period, performance of the majority of the Hennessy Funds has been relatively strong when compared to the overall market as well as to our

benchmarks. During the six months ended April 30, 2022, the Dow Jones Industrial Average, the S&P 500® Index, and the NASDAQ Composite Index dropped

7.05%, 9.65%, and 20.15%, respectively, on a total return basis. During this period when these three major indices saw significant declines, we were pleased that seven of our 16 Funds posted positive total returns, 10 of our 14 domestic Funds

outperformed the S&P 500® Index, and over half of our active funds outperformed their primary benchmarks.

We thank you, our shareholders, for your continued interest in our family of Funds. We are grateful for the trust you put in us, and we will continue to strive to

manage our portfolios for long-term performance, ever mindful of downside risk. While volatility and uncertainty may impact the markets in the short-term, we encourage investors to stay the course, maintain a diversified portfolio, and keep a

long-term perspective. If you have any questions or would like to speak with us, please don’t hesitate to call us directly at (800) 966-4354. In closing, we would also like to thank all of the healthcare and frontline workers that have worked – and

still work – tirelessly throughout the coronavirus pandemic.

Best regards,

|

|

|

|

|

Ryan C. Kelley, CFA

|

|

|

Chief Investment Officer,

|

|

|

Senior Vice President, and Portfolio Manager

|

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible.

Opinions expressed are those of Ryan C. Kelley and are subject to change, are not guaranteed, and should not be considered investment advice.

The Dow Jones Industrial Average and S&P 500® Index are commonly used to measure the performance of U.S. stocks. The NASDAQ Composite

Index comprises all common stocks listed on The NASDAQ Stock Market and is commonly used to measure the performance of technology-related stocks. The indices are used herein for comparative purposes in accordance with SEC regulations. One cannot

invest directly in an index. All returns are shown on a total return basis.

Please refer to the Performance Overview section for more detailed performance information.

|

HENNESSY FUNDS

|

1-800-966-4354

|

3

Performance Overview (Unaudited)

AVERAGE ANNUAL TOTAL RETURN FOR PERIODS ENDED APRIL 30, 2022

|

Six

|

One

|

Five

|

Ten

|

|

|

Months(1)

|

Year

|

Years

|

Years

|

|

|

Hennessy Cornerstone Growth Fund –

|

||||

|

Investor Class (HFCGX)

|

-1.92%

|

-1.39%

|

9.23%

|

10.52%

|

|

Hennessy Cornerstone Growth Fund –

|

||||

|

Institutional Class (HICGX)

|

-1.78%

|

-1.08%

|

9.59%

|

10.86%

|

|

Russell 2000® Index

|

-18.38%

|

-16.87%

|

7.24%

|

10.06%

|

|

S&P 500® Index

|

-9.65%

|

0.21%

|

13.66%

|

13.67%

|

Expense ratios: 1.34% (Investor Class); 1.01% (Institutional Class)

|

(1)

|

Periods of less than one year are not annualized.

|

_______________

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s

shares, when redeemed, may be worth more or less than their original cost. The performance table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the

Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com.

The Russell 2000® Index comprises the smallest 2,000 companies in the Russell 3000® Index based on market capitalization, representing approximately 8% of the Russell 3000® Index in terms of total market capitalization.

The S&P 500® Index is a capitalization-weighted index that is designed to represent the broad domestic economy through changes in the aggregate market value of 500

stocks across all major industries. One cannot invest directly in an index. These indices are used for comparative purposes in accordance with Securities and Exchange Commission regulations.

Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell®

is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes or Russell ratings or underlying data and no party may rely on any Russell Indexes or Russell ratings

or underlying data contained in this communication. No further distribution of Russell data is permitted without Russell’s express written consent. Russell does not promote, sponsor, or endorse the content of this communication.

Standard & Poor’s Financial Services is the source and owner of the S&P® and S&P 500® trademarks.

The expense ratios presented are from the most recent prospectus. The expense ratios for the current reporting period are available in the Financial Highlights section of this report.

|

WWW.HENNESSYFUNDS.COM

|

4

|

PERFORMANCE OVERVIEW/SCHEDULE OF INVESTMENTS

|

Financial Statements

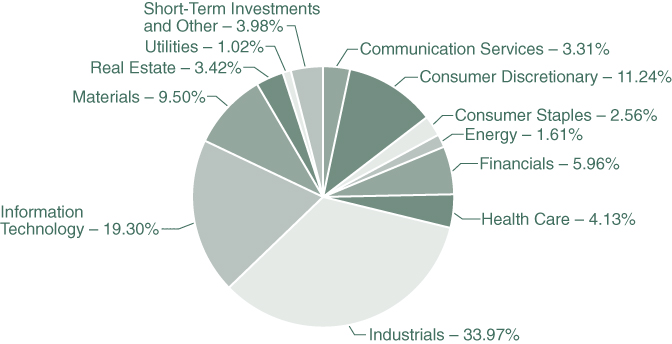

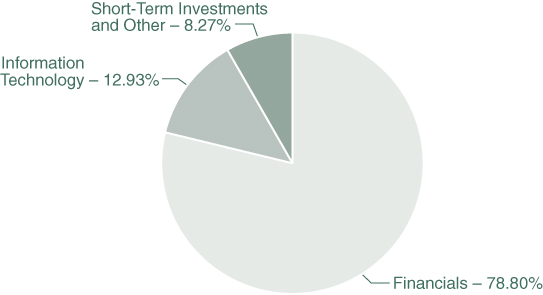

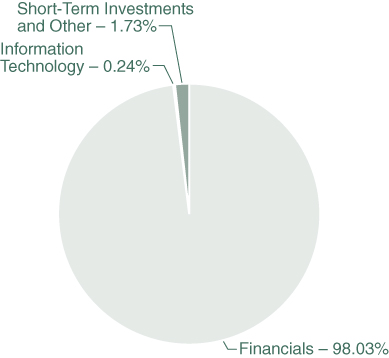

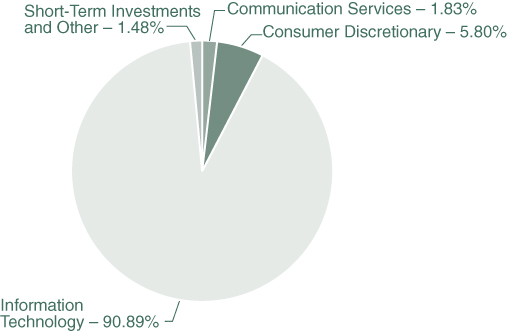

|

Schedule of Investments as of April

30, 2022 (Unaudited)

|

HENNESSY CORNERSTONE GROWTH FUND

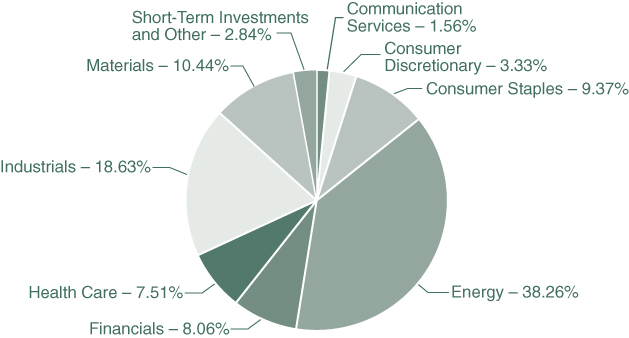

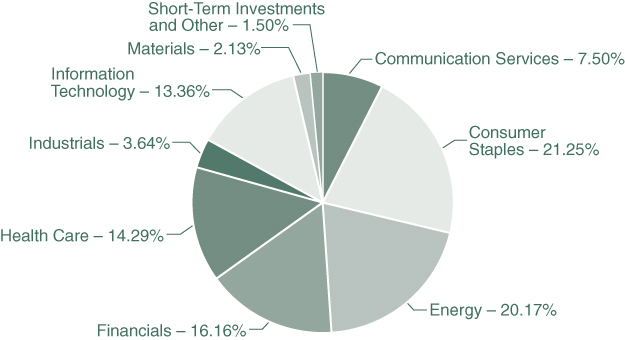

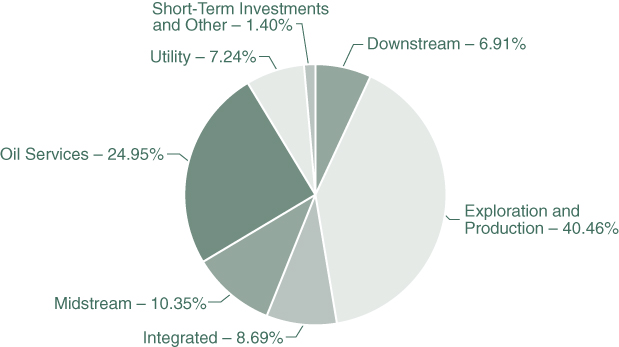

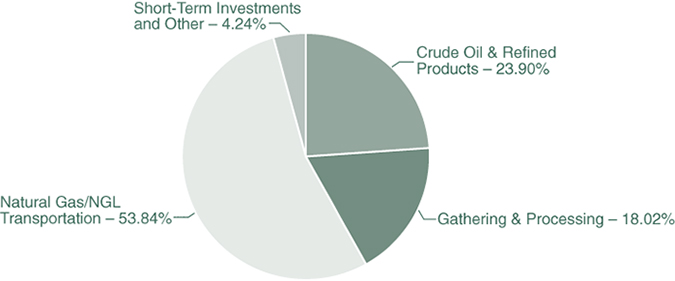

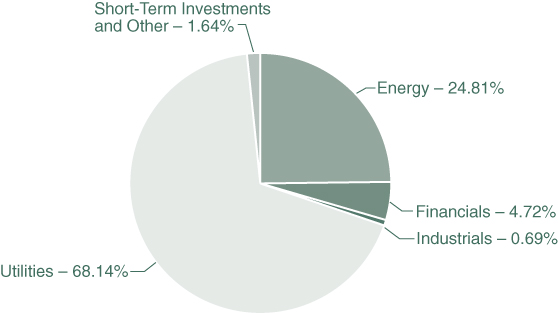

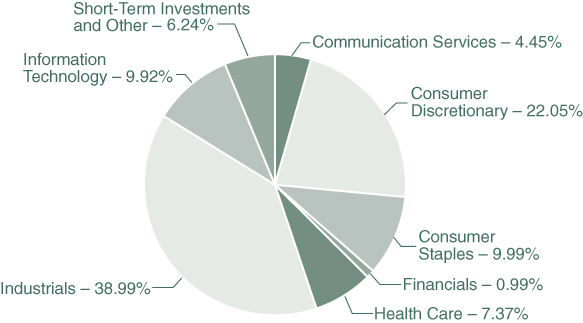

(% of Net Assets)

|

TOP TEN HOLDINGS (EXCLUDING MONEY MARKET FUNDS)

|

% NET ASSETS

|

|

Alpha Metallurgical Resources, Inc.

|

3.16%

|

|

Antero Resources Corp.

|

2.96%

|

|

PBF Energy, Inc.

|

2.94%

|

|

Arch Resources, Inc.

|

2.67%

|

|

Alliance Resource Partners LP

|

2.53%

|

|

Peabody Energy Corp.

|

2.46%

|

|

The Andersons, Inc.

|

2.34%

|

|

Cenovus Energy, Inc.

|

2.27%

|

|

Chesapeake Energy Corp.

|

2.27%

|

|

Titan International, Inc.

|

2.26%

|

Note: For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, as amended, the

Fund uses more specific industry classifications.

The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property and a service mark of MSCI, Inc. and

Standard & Poor’s Financial Services LLC. It has been licensed for use by the Hennessy Funds.

|

HENNESSY FUNDS

|

1-800-966-4354

|

5

|

COMMON STOCKS – 92.62%

|

Number

|

% of

|

||||||||||

|

|

of Shares

|

Value

|

Net Assets

|

|||||||||

|

Communication Services – 1.56%

|

||||||||||||

|

Scholastic Corp.

|

66,000

|

$

|

2,432,100

|

1.56

|

%

|

|||||||

|

Consumer Discretionary – 3.33%

|

||||||||||||

|

Build-A-Bear Workshop, Inc. (a)

|

135,600

|

2,568,264

|

1.65

|

%

|

||||||||

|

Movado Group, Inc.

|

72,600

|

2,611,422

|

1.68

|

%

|

||||||||

|

|

5,179,686

|

3.33

|

%

|

|||||||||

|

Consumer Staples – 9.37%

|

||||||||||||

|

BJ’s Wholesale Club Holdings, Inc. (a)

|

43,100

|

2,773,485

|

1.78

|

%

|

||||||||

|

Coca Cola Consolidated, Inc.

|

4,900

|

2,163,350

|

1.39

|

%

|

||||||||

|

Ingles Markets, Inc.

|

33,600

|

3,128,832

|

2.01

|

%

|

||||||||

|

Tyson Foods, Inc., Class A

|

30,800

|

2,869,328

|

1.85

|

%

|

||||||||

|

The Andersons, Inc.

|

72,500

|

3,641,675

|

2.34

|

%

|

||||||||

|

|

14,576,670

|

9.37

|

%

|

|||||||||

|

Energy – 33.72%

|

||||||||||||

|

Antero Resources Corp. (a)

|

130,900

|

4,607,680

|

2.96

|

%

|

||||||||

|

Arch Resources, Inc.

|

25,000

|

4,159,500

|

2.67

|

%

|

||||||||

|

Cenovus Energy, Inc. (b)

|

191,100

|

3,531,528

|

2.27

|

%

|

||||||||

|

Chesapeake Energy Corp.

|

43,100

|

3,535,062

|

2.27

|

%

|

||||||||

|

EnLink Midstream LLC

|

335,800

|

3,314,346

|

2.13

|

%

|

||||||||

|

Equinor ASA – ADR (b)

|

97,800

|

3,333,024

|

2.14

|

%

|

||||||||

|

Imperial Oil Ltd. (b)

|

65,300

|

3,274,142

|

2.11

|

%

|

||||||||

|

Laredo Petroleum, Inc. (a)

|

41,200

|

2,933,852

|

1.89

|

%

|

||||||||

|

Marathon Petroleum Corp.

|

36,800

|

3,211,168

|

2.07

|

%

|

||||||||

|

Nabors Industries Ltd. (a)(b)

|

22,500

|

3,478,950

|

2.24

|

%

|

||||||||

|

Oceaneering International, Inc. (a)

|

195,300

|

2,212,749

|

1.42

|

%

|

||||||||

|

PBF Energy, Inc. (a)

|

157,500

|

4,576,950

|

2.94

|

%

|

||||||||

|

Peabody Energy Corp. (a)

|

169,100

|

3,828,424

|

2.46

|

%

|

||||||||

|

Ranger Oil Corp. (a)

|

97,300

|

3,099,005

|

1.99

|

%

|

||||||||

|

Targa Resources Corp.

|

45,700

|

3,354,837

|

2.16

|

%

|

||||||||

|

|

52,451,217

|

33.72

|

%

|

|||||||||

|

Financials – 8.06%

|

||||||||||||

|

American International Group, Inc.

|

46,000

|

2,691,460

|

1.73

|

%

|

||||||||

|

Encore Capital Group, Inc. (a)

|

39,600

|

2,289,276

|

1.47

|

%

|

||||||||

|

Mr. Cooper Group, Inc. (a)

|

55,400

|

2,491,338

|

1.60

|

%

|

||||||||

The accompanying notes are an integral part of these financial statements.

|

WWW.HENNESSYFUNDS.COM

|

6

|

SCHEDULE OF INVESTMENTS

|

|

COMMON STOCKS

|

Number

|

% of

|

||||||||||

|

|

of Shares

|

Value

|

Net Assets

|

|||||||||

|

Financials (Continued)

|

||||||||||||

|

Old Republic International Corp.

|

107,800

|

$

|

2,372,678

|

1.52

|

%

|

|||||||

|

Prudential Financial, Inc.

|

24,900

|

2,701,899

|

1.74

|

%

|

||||||||

|

|

12,546,651

|

8.06

|

%

|

|||||||||

|

Health Care – 7.51%

|

||||||||||||

|

Anthem, Inc.

|

6,400

|

3,212,352

|

2.06

|

%

|

||||||||

|

CVS Health Corp.

|

27,800

|

2,672,414

|

1.72

|

%

|

||||||||

|

McKesson Corp.

|

10,500

|

3,250,905

|

2.09

|

%

|

||||||||

|

Tenet Healthcare Corp. (a)

|

35,200

|

2,552,352

|

1.64

|

%

|

||||||||

|

|

11,688,023

|

7.51

|

%

|

|||||||||

|

Industrials – 18.63%

|

||||||||||||

|

BlueLinx Holdings, Inc. (a)

|

33,100

|

2,206,777

|

1.42

|

%

|

||||||||

|

Boise Cascade Co.

|

34,400

|

2,599,952

|

1.67

|

%

|

||||||||

|

Builders FirstSource, Inc. (a)

|

39,600

|

2,438,172

|

1.57

|

%

|

||||||||

|

Daseke, Inc. (a)

|

249,600

|

2,096,640

|

1.35

|

%

|

||||||||

|

Eagle Bulk Shipping, Inc. (b)

|

52,500

|

3,267,600

|

2.10

|

%

|

||||||||

|

Grindrod Shipping Holdings Ltd. (b)

|

126,100

|

3,240,770

|

2.08

|

%

|

||||||||

|

Titan International, Inc. (a)

|

253,600

|

3,514,896

|

2.26

|

%

|

||||||||

|

Triumph Group, Inc. (a)

|

119,000

|

2,682,260

|

1.72

|

%

|

||||||||

|

Univar Solutions, Inc. (a)

|

100,200

|

2,917,824

|

1.88

|

%

|

||||||||

|

USA Truck, Inc. (a)

|

107,000

|

1,755,870

|

1.13

|

%

|

||||||||

|

ZIM Integrated Shipping Services Ltd. (b)

|

40,600

|

2,258,578

|

1.45

|

%

|

||||||||

|

|

28,979,339

|

18.63

|

%

|

|||||||||

|

Materials – 10.44%

|

||||||||||||

|

Alcoa Corp.

|

36,300

|

2,461,140

|

1.58

|

%

|

||||||||

|

Alpha Metallurgical Resources, Inc. (a)

|

31,800

|

4,920,732

|

3.16

|

%

|

||||||||

|

Cabot Corp.

|

38,300

|

2,522,055

|

1.62

|

%

|

||||||||

|

Commercial Metals Co.

|

77,200

|

3,165,200

|

2.04

|

%

|

||||||||

|

Sasol Ltd – ADR (a)(b)

|

130,500

|

3,165,930

|

2.04

|

%

|

||||||||

|

|

16,235,057

|

10.44

|

%

|

|||||||||

|

|

||||||||||||

|

Total Common Stocks

|

||||||||||||

|

(Cost $136,898,574)

|

144,088,743

|

92.62

|

%

|

|||||||||

The accompanying notes are an integral part of these financial statements.

|

HENNESSY FUNDS

|

1-800-966-4354

|

7

|

PARTNERSHIPS & TRUSTS – 4.54%

|

Number

|

% of

|

||||||||||

|

|

of Shares

|

Value

|

Net Assets

|

|||||||||

|

Energy – 4.54%

|

||||||||||||

|

Alliance Resource Partners LP

|

220,000

|

$

|

3,940,200

|

2.53

|

%

|

|||||||

|

Energy Transfer Equity LP

|

282,300

|

3,127,884

|

2.01

|

%

|

||||||||

|

|

||||||||||||

|

Total Partnerships & Trusts

|

||||||||||||

|

(Cost $5,895,832)

|

7,068,084

|

4.54

|

%

|

|||||||||

|

|

||||||||||||

|

SHORT-TERM INVESTMENTS – 2.87%

|

||||||||||||

|

Money Market Funds – 2.87%

|

||||||||||||

|

First American Government Obligations Fund,

|

||||||||||||

|

Institutional Class, 0.22% (c)

|

4,472,378

|

4,472,378

|

2.87

|

%

|

||||||||

|

|

||||||||||||

|

Total Short-Term Investments

|

||||||||||||

|

(Cost $4,472,378)

|

4,472,378

|

2.87

|

%

|

|||||||||

|

|

||||||||||||

|

Total Investments

|

||||||||||||

|

(Cost $147,266,784) – 100.03%

|

155,629,205

|

100.03

|

%

|

|||||||||

|

Liabilities in Excess of Other Assets – (0.03)%

|

(45,034

|

)

|

(0.03

|

)%

|

||||||||

|

|

||||||||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

155,584,171

|

100.00

|

%

|

||||||||

Percentages are stated as a percent of net assets.

ADR – American Depository Receipt

|

(a)

|

Non-income-producing security.

|

|

(b)

|

U.S.-traded security of a foreign corporation.

|

|

(c)

|

The rate listed is the fund’s seven-day yield as of April 30, 2022.

|

Summary of Fair Value Exposure as of April 30, 2022

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2022 (see Note 3 in the accompanying Notes to the Financial Statements):

|

Common Stocks

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Communication Services

|

$

|

2,432,100

|

$

|

—

|

$

|

—

|

$

|

2,432,100

|

||||||||

|

Consumer Discretionary

|

5,179,686

|

—

|

—

|

5,179,686

|

||||||||||||

|

Consumer Staples

|

14,576,670

|

—

|

—

|

14,576,670

|

||||||||||||

|

Energy

|

52,451,217

|

—

|

—

|

52,451,217

|

||||||||||||

|

Financials

|

12,546,651

|

—

|

—

|

12,546,651

|

||||||||||||

|

Health Care

|

11,688,023

|

—

|

—

|

11,688,023

|

||||||||||||

|

Industrials

|

28,979,339

|

—

|

—

|

28,979,339

|

||||||||||||

|

Materials

|

16,235,057

|

—

|

—

|

16,235,057

|

||||||||||||

|

Total Common Stocks

|

$

|

144,088,743

|

$

|

—

|

$

|

—

|

$

|

144,088,743

|

||||||||

|

Partnerships & Trusts

|

||||||||||||||||

|

Energy

|

$

|

7,068,084

|

$

|

—

|

$

|

—

|

$

|

7,068,084

|

||||||||

|

Total Partnerships & Trusts

|

$

|

7,068,084

|

$

|

—

|

$

|

—

|

$

|

7,068,084

|

||||||||

|

Short-Term Investments

|

||||||||||||||||

|

Money Market Funds

|

$

|

4,472,378

|

$

|

—

|

$

|

—

|

$

|

4,472,378

|

||||||||

|

Total Short-Term Investments

|

$

|

4,472,378

|

$

|

—

|

$

|

—

|

$

|

4,472,378

|

||||||||

|

Total Investments

|

$

|

155,629,205

|

$

|

—

|

$

|

—

|

$

|

155,629,205

|

||||||||

The accompanying notes are an integral part of these financial statements.

|

WWW.HENNESSYFUNDS.COM

|

8

|

SCHEDULE OF INVESTMENTS/STATEMENT OF ASSETS AND LIABILITIES

|

Financial Statements

|

Statement of Assets and Liabilities as of April 30, 2022 (Unaudited)

|

|

ASSETS:

|

||||

|

Investments in securities, at value (cost $147,266,784)

|

$

|

155,629,205

|

||

|

Dividends and interest receivable

|

28,141

|

|||

|

Receivable for fund shares sold

|

71,838

|

|||

|

Return of capital receivable

|

53,773

|

|||

|

Prepaid expenses and other assets

|

20,945

|

|||

|

Total assets

|

155,803,902

|

|||

|

LIABILITIES:

|

||||

|

Payable for fund shares redeemed

|

24,416

|

|||

|

Payable to advisor

|

97,409

|

|||

|

Payable to administrator

|

29,644

|

|||

|

Payable to auditor

|

11,228

|

|||

|

Accrued distribution fees

|

19,381

|

|||

|

Accrued service fees

|

11,921

|

|||

|

Accrued trustees fees

|

5,258

|

|||

|

Accrued expenses and other payables

|

20,474

|

|||

|

Total liabilities

|

219,731

|

|||

|

NET ASSETS

|

$

|

155,584,171

|

||

|

NET ASSETS CONSISTS OF:

|

||||

|

Capital stock

|

$

|

142,272,563

|

||

|

Total distributable earnings

|

13,311,608

|

|||

|

Total net assets

|

$

|

155,584,171

|

||

|

NET ASSETS:

|

||||

|

Investor Class

|

||||

|

Shares authorized (no par value)

|

Unlimited

|

|||

|

Net assets applicable to outstanding shares

|

$

|

140,812,096

|

||

|

Shares issued and outstanding

|

6,115,206

|

|||

|

Net asset value, offering price, and redemption price per share

|

$

|

23.03

|

||

|

Institutional Class

|

||||

|

Shares authorized (no par value)

|

Unlimited

|

|||

|

Net assets applicable to outstanding shares

|

$

|

14,772,075

|

||

|

Shares issued and outstanding

|

614,604

|

|||

|

Net asset value, offering price, and redemption price per share

|

$

|

24.04

|

||

The accompanying notes are an integral part of these financial statements.

|

HENNESSY FUNDS

|

1-800-966-4354

|

9

Financial Statements

|

Statement of Operations for the six months ended April 30, 2022 (Unaudited)

|

|

INVESTMENT INCOME:

|

||||

|

Dividend income(1)

|

$

|

1,751,703

|

||

|

Interest income

|

1,287

|

|||

|

Total investment income

|

1,752,990

|

|||

|

EXPENSES:

|

||||

|

Investment advisory fees (See Note 5)

|

600,313

|

|||

|

Distribution fees – Investor Class (See Note 5)

|

110,256

|

|||

|

Sub-transfer agent expenses – Investor Class (See Note 5)

|

99,028

|

|||

|

Sub-transfer agent expenses – Institutional Class (See Note 5)

|

4,560

|

|||

|

Administration, accounting, custody, and transfer agent fees (See Note 5)

|

93,799

|

|||

|

Service fees – Investor Class (See Note 5)

|

73,504

|

|||

|

Federal and state registration fees

|

15,463

|

|||

|

Compliance expense (See Note 5)

|

15,156

|

|||

|

Audit fees

|

11,222

|

|||

|

Trustees’ fees and expenses

|

9,779

|

|||

|

Reports to shareholders

|

6,785

|

|||

|

Legal fees

|

1,169

|

|||

|

Interest expense (See Note 7)

|

678

|

|||

|

Other expenses

|

13,409

|

|||

|

Total expenses

|

1,055,121

|

|||

|

NET INVESTMENT INCOME

|

$

|

697,869

|

||

|

REALIZED AND UNREALIZED GAINS (LOSSES):

|

||||

|

Net realized gain on investments

|

$

|

5,241,966

|

||

|

Net change in unrealized appreciation/depreciation on investments

|

(8,948,928

|

)

|

||

|

Net loss on investments

|

(3,706,962

|

)

|

||

|

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

(3,009,093

|

)

|

|

|

(1)

|

Net of foreign taxes withheld and issuance fees of $177,645.

|

The accompanying notes are an integral part of these financial statements.

|

WWW.HENNESSYFUNDS.COM

|

10

|

STATEMENT OF OPERATIONS/STATEMENTS OF CHANGES IN NET ASSETS

|

Financial Statements

|

Statements of Changes in Net Assets

|

|

Six Months Ended

|

||||||||

|

April 30, 2022

|

Year Ended

|

|||||||

|

(Unaudited)

|

October 31, 2021

|

|||||||

|

OPERATIONS:

|

||||||||

|

Net investment income (loss)

|

$

|

697,869

|

$

|

(785,532

|

)

|

|||

|

Net realized gain on investments

|

5,241,966

|

41,914,519

|

||||||

|

Net change in unrealized

|

||||||||

|

appreciation/depreciation on investments

|

(8,948,928

|

)

|

18,604,616

|

|||||

|

Net increase (decrease) in net

|

||||||||

|

assets resulting from operations

|

(3,009,093

|

)

|

59,733,603

|

|||||

|

DISTRIBUTIONS TO SHAREHOLDERS:

|

||||||||

|

Distributable earnings – Investor Class

|

(33,524,165

|

)

|

—

|

|||||

|

Distributable earnings – Institutional Class

|

(3,505,908

|

)

|

—

|

|||||

|

Total distributions

|

(37,030,073

|

)

|

—

|

|||||

|

CAPITAL SHARE TRANSACTIONS:

|

||||||||

|

Proceeds from shares subscribed – Investor Class

|

5,666,528

|

7,853,848

|

||||||

|

Proceeds from shares subscribed – Institutional Class

|

1,153,176

|

1,438,342

|

||||||

|

Dividends reinvested – Investor Class

|

32,429,645

|

—

|

||||||

|

Dividends reinvested – Institutional Class

|

3,066,399

|

—

|

||||||

|

Cost of shares redeemed – Investor Class

|

(12,958,096

|

)

|

(20,954,269

|

)

|

||||

|

Cost of shares redeemed – Institutional Class

|

(1,475,108

|

)

|

(2,945,640

|

)

|

||||

|

Net increase (decrease) in net assets derived

|

||||||||

|

from capital share transactions

|

27,882,544

|

(14,607,719

|

)

|

|||||

|

TOTAL INCREASE (DECREASE) IN NET ASSETS

|

(12,156,622

|

)

|

45,125,884

|

|||||

|

NET ASSETS:

|

||||||||

|

Beginning of period

|

167,740,793

|

122,614,909

|

||||||

|

End of period

|

$

|

155,584,171

|

$

|

167,740,793

|

||||

|

CHANGES IN SHARES OUTSTANDING:

|

||||||||

|

Shares sold – Investor Class

|

227,406

|

276,838

|

||||||

|

Shares sold – Institutional Class

|

43,548

|

49,401

|

||||||

|

Shares issued to holders as reinvestment

|

||||||||

|

of dividends – Investor Class

|

1,319,351

|

—

|

||||||

|

Shares issued to holders as reinvestment

|

||||||||

|

of dividends – Institutional Class

|

119,641

|

—

|

||||||

|

Shares redeemed – Investor Class

|

(525,284

|

)

|

(755,784

|

)

|

||||

|

Shares redeemed – Institutional Class

|

(56,235

|

)

|

(105,327

|

)

|

||||

|

Net increase (decrease) in shares outstanding

|

1,128,427

|

(534,872

|

)

|

|||||

The accompanying notes are an integral part of these financial statements.

|

HENNESSY FUNDS

|

1-800-966-4354

|

11

Financial Statements

|

Financial Highlights

|

For an Investor Class share outstanding throughout each period

|

Six Months Ended

|

||||

|

April 30, 2022

|

||||

|

(Unaudited)

|

||||

|

PER SHARE DATA:

|

||||

|

Net asset value, beginning of period

|

$

|

29.83

|

||

|

Income from investment operations:

|

||||

|

Net investment income (loss)

|

0.10

|

(1)

|

||

|

Net realized and unrealized gains (losses) on investments

|

(0.26

|

)

|

||

|

Total from investment operations

|

(0.16

|

)

|

||

|

Less distributions:

|

||||

|

Dividends from net realized gains

|

(6.64

|

)

|

||

|

Total distributions

|

(6.64

|

)

|

||

|

Net asset value, end of period

|

$

|

23.03

|

||

|

TOTAL RETURN

|

-1.92

|

%(2)

|

||

|

SUPPLEMENTAL DATA AND RATIOS:

|

||||

|

Net assets, end of period (millions)

|

$

|

140.81

|

||

|

Ratio of expenses to average net assets

|

1.33

|

%(3)

|

||

|

Ratio of net investment income (loss) to average net assets

|

0.83

|

%(3)

|

||

|

Portfolio turnover rate(4)

|

88

|

%(2)

|

||

|

(1)

|

Calculated using the average shares outstanding method.

|

|

(2)

|

Not annualized.

|

|

(3)

|

Annualized.

|

|

(4)

|

Calculated on the basis of the Fund as a whole.

|

The accompanying notes are an integral part of these financial statements.

|

WWW.HENNESSYFUNDS.COM

|

12

|

FINANCIAL HIGHLIGHTS — INVESTOR CLASS

|

|

Year Ended October 31,

|

||||||||||||||||||

|

2021

|

2020

|

2019

|

2018

|

2017

|

||||||||||||||

|

$

|

19.91

|

$

|

19.15

|

$

|

22.17

|

$

|

24.16

|

$

|

18.98

|

|||||||||

|

(0.14

|

)(1)

|

(0.08

|

)(1)

|

(0.01

|

)(1)

|

(0.17

|

)

|

(0.09

|

)

|

|||||||||

|

10.06

|

0.84

|

(1.19

|

)

|

(1.82

|

)

|

5.27

|

||||||||||||

|

9.92

|

0.76

|

(1.20

|

)

|

(1.99

|

)

|

5.18

|

||||||||||||

|

—

|

—

|

(1.82

|

)

|

—

|

—

|

|||||||||||||

|

—

|

—

|

(1.82

|

)

|

—

|

—

|

|||||||||||||

|

$

|

29.83

|

$

|

19.91

|

$

|

19.15

|

$

|

22.17

|

$

|

24.16

|

|||||||||

|

49.82

|

%

|

3.97

|

%

|

-5.19

|

%

|

-8.24

|

%

|

27.29

|

%

|

|||||||||

|

$

|

151.96

|

$

|

110.96

|

$

|

125.10

|

$

|

158.98

|

$

|

197.22

|

|||||||||

|

1.34

|

%

|

1.36

|

%

|

1.34

|

%

|

1.30

|

%

|

1.30

|

%

|

|||||||||

|

(0.51

|

)%

|

(0.45

|

)%

|

(0.07

|

)%

|

(0.56

|

)%

|

(0.33

|

)%

|

|||||||||

|

98

|

%

|

98

|

%

|

95

|

%

|

133

|

%

|

98

|

%

|

|||||||||

The accompanying notes are an integral part of these financial statements.

|

HENNESSY FUNDS

|

1-800-966-4354

|

13

Financial Statements

|

Financial Highlights

|

For an Institutional Class share outstanding throughout each period

|

Six Months Ended

|

||||

|

April 30, 2022

|

||||

|

(Unaudited)

|

||||

|

PER SHARE DATA:

|

||||

|

Net asset value, beginning of period

|

$

|

31.09

|

||

|

Income from investment operations:

|

||||

|

Net investment income (loss)

|

0.15

|

(1)

|

||

|

Net realized and unrealized gains (losses) on investments

|

(0.27

|

)

|

||

|

Total from investment operations

|

(0.12

|

)

|

||

|

Less distributions:

|

||||

|

Dividends from net realized gains

|

(6.93

|

)

|

||

|

Total distributions

|

(6.93

|

)

|

||

|

Net asset value, end of period

|

$

|

24.04

|

||

|

TOTAL RETURN

|

-1.78

|

%(2)

|

||

|

SUPPLEMENTAL DATA AND RATIOS:

|

||||

|

Net assets, end of period (millions)

|

$

|

14.77

|

||

|

Ratio of expenses to average net assets

|

1.01

|

%(3)

|

||

|

Ratio of net investment income (loss) to average net assets

|

1.18

|

%(3)

|

||

|

Portfolio turnover rate(4)

|

88

|

%(2)

|

||

|

(1)

|

Calculated using the average shares outstanding method.

|

|

(2)

|

Not annualized.

|

|

(3)

|

Annualized.

|

|

(4)

|

Calculated on the basis of the Fund as a whole.

|

The accompanying notes are an integral part of these financial statements.

|

WWW.HENNESSYFUNDS.COM

|

14

|

FINANCIAL HIGHLIGHTS — INSTITUTIONAL CLASS

|

|

Year Ended October 31,

|

||||||||||||||||||

|

2021

|

2020

|

2019

|

2018

|

2017

|

||||||||||||||

|

$

|

20.68

|

$

|

19.83

|

$

|

22.88

|

$

|

24.85

|

$

|

19.46

|

|||||||||

|

(0.05

|

)(1)

|

(0.03

|

)(1)

|

0.05

|

(1)

|

0.11

|

0.01

|

|||||||||||

|

10.46

|

0.88

|

(1.22

|

)

|

(2.08

|

)

|

5.38

|

||||||||||||

|

10.41

|

0.85

|

(1.17

|

)

|

(1.97

|

)

|

5.39

|

||||||||||||

|

—

|

—

|

(1.88

|

)

|

—

|

—

|

|||||||||||||

|

—

|

—

|

(1.88

|

)

|

—

|

—

|

|||||||||||||

|

$

|

31.09

|

$

|

20.68

|

$

|

19.83

|

$

|

22.88

|

$

|

24.85

|

|||||||||

|

50.34

|

%

|

4.29

|

%

|

-4.86

|

%

|

-7.93

|

%

|

27.70

|

%

|

|||||||||

|

$

|

15.78

|

$

|

11.65

|

$

|

14.62

|

$

|

20.52

|

$

|

31.65

|

|||||||||

|

1.01

|

%

|

1.05

|

%

|

1.01

|

%

|

0.96

|

%

|

0.97

|

%

|

|||||||||

|

(0.17

|

)%

|

(0.14

|

)%

|

0.27

|

%

|

(0.23

|

)%

|

(0.00

|

)%

|

|||||||||

|

98

|

%

|

98

|

%

|

95

|

%

|

133

|

%

|

98

|

%

|

|||||||||

The accompanying notes are an integral part of these financial statements.

|

HENNESSY FUNDS

|

1-800-966-4354

|

15

Financial Statements

|

Notes to the Financial Statements April 30, 2022 (Unaudited)

|

1). ORGANIZATION

The Hennessy Cornerstone Growth Fund (the “Fund”) is a series of Hennessy Funds Trust (the “Trust”), which was organized as a Delaware statutory trust on September 17, 1992. The Fund is an open-end management investment

company registered under the Investment Company Act of 1940, as amended. The investment objective of the Fund is long-term growth of capital. The Fund is a diversified fund.

The Fund offers Investor Class and Institutional Class shares. Each class of shares differs principally in its respective 12b-1 distribution and service, shareholder servicing, and sub-transfer agent

expenses. There are no sales charges. Each class has identical rights to earnings, assets, and voting privileges, except for class-specific expenses and exclusive rights to vote on matters affecting only one class.

As an investment company, the Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946

“Financial Services—Investment Companies.”

2). SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies conform to U.S. generally accepted accounting principles

(“GAAP”).

|

a).

|

Securities Valuation – All investments in securities are valued in accordance with the Fund’s valuation policies and procedures, as described in Note 3.

|

|

b).

|

Federal Income Taxes – The Fund has elected to be taxed as a regulated investment company and intends to distribute substantially all of its taxable income to its shareholders and otherwise comply with the

provisions of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. As a result, the Fund has made no provision for federal income taxes or excise taxes. Net investment income/loss and realized

gains/losses for federal income tax purposes may differ from those reported in the financial statements because of temporary book-basis and tax-basis differences. Temporary differences are primarily the result of the treatment of

partnership income and wash sales for tax reporting purposes. The Fund recognizes interest and penalties related to income tax benefits, if any, in the Statement of Operations as an income tax expense. Distributions from net realized gains

for book purposes may include short-term capital gains, which are included as ordinary income to shareholders for tax purposes. The Fund may utilize equalization accounting for tax purposes and designate earnings and profits, including net

realized gains distributed to shareholders on redemption of shares, as part of the dividends paid deduction for income tax purposes.

|

|

c).

|

Accounting for Uncertainty in Income Taxes – The Fund has accounting policies regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The tax returns of the Fund for

the prior three fiscal years are open for examination. The Fund has reviewed all open tax years in major tax jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax

benefits relating to uncertain income tax positions taken or expected to be taken on a tax return. The Fund’s major tax jurisdictions are U.S. federal and Delaware.

|

|

WWW.HENNESSYFUNDS.COM

|

16

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

d).

|

Income and Expenses – Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund. Interest income, which includes the amortization of premium and accretion of

discount, is recognized on an accrual basis. Market discounts, original issue discounts, and market premiums on debt securities are accreted or amortized to interest income over the life of a security with a corresponding increase or

decrease, as applicable, in the cost basis of such security using the yield-to-maturity method or, where applicable, the first call date of the security. Other non-cash dividends are recognized as investment income at the fair value of the

property received. The Fund is charged for those expenses that are directly attributable to its portfolio, such as advisory, administration, and certain shareholder service fees. Income, expenses (other than expenses attributable to a

specific class), and realized and unrealized gains/losses on investments are allocated to each class of shares based on such class’s net assets. Distributions received from the Fund’s investments in master limited partnerships (“MLPs”)

generally consist of ordinary income, capital gains, and return of capital. The Fund records investment income on the ex-date of the distributions. For financial statement purposes, the Fund uses return of capital and income estimates to

allocate the dividend income received. Such estimates are based on historical information available from the MLPs and other industry sources. These estimates may subsequently be revised based on information received from the MLPs after

their tax reporting periods are concluded, as the actual character of these distributions is not known until after the fiscal year end of the Fund.

|

|

e).

|

Distributions to Shareholders – Dividends from net investment income for the Fund, if any, are declared and paid annually, usually in December. Distributions of net realized capital gains, if any, are declared and

paid annually, usually in December.

|

|

f).

|

Security Transactions – Investment and shareholder transactions are recorded on the trade date. The Fund determines the realized gain/loss from an investment transaction by comparing the original cost of the

security lot sold with the net sale proceeds. Discounts and premiums on securities purchased are accreted or amortized, respectively, over the life of each such security.

|

|

g).

|

Use of Estimates – Preparing financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial statements, as well as the reported change in net assets during the reporting period. Actual results could differ from those estimates.

|

|

h).

|

Share Valuation – The net asset value (“NAV”) per share of the Fund is calculated by dividing (i) the total value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including

estimated accrued expenses) by (ii) the total number of Fund shares outstanding, rounded to the nearest $0.01. Fund shares are not priced on days the New York Stock Exchange is closed for trading. The offering and redemption price per share

for the Fund is equal to the Fund’s NAV per share.

|

|

i).

|

Recent Accounting Pronouncements and Regulatory Updates – In October 2020, the Securities and Exchange Commission (“SEC”) adopted new regulations governing the use of derivatives by registered investment companies

(“Rule 18f-4”). Rule 18f-4 imposes limits on the amount of derivatives a fund can enter into, eliminates the asset segregation framework currently used by funds to comply with Section 18 of the 1940 Act, and requires funds whose use of

derivatives is greater than a limited specified amount to establish and maintain a comprehensive derivatives risk management program and appoint a derivatives risk manager. Funds are required to

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

17

|

comply with Rule 18f-4 by August 19, 2022. The impact, if any, that Rule 18f-4 will have on the availability, liquidity, and performance of derivatives is unclear. Management is currently evaluating the potential

impact of Rule 18f-4 on the Fund. When fully implemented, Rule 18f-4 may require changes in how the Fund uses derivatives, adversely affect the Fund’s performance, and increase costs related to the Fund’s use of derivatives.

|

|

|

In December 2020, the SEC adopted a new rule providing a framework for fund valuation practices (“Rule 2a-5”). Rule 2a-5 establishes

requirements for determining fair value in good faith for purposes of the 1940 Act. Rule 2a-5 permits fund boards to designate certain parties to perform fair value determinations, subject to board oversight and certain other conditions.

Rule 2a-5 also defines when market quotations are “readily available” for purposes of the 1940 Act and the threshold for determining whether a fund must fair value a security. In connection with Rule 2a-5, the SEC also adopted related

recordkeeping requirements and is rescinding previously issued guidance, including with respect to the role of a board in determining fair value and the accounting and auditing of fund investments. Funds must comply with the rules by

September 8, 2022. Management is currently assessing the potential impact of the new rules on the Fund’s financial statements.

|

3). SECURITIES VALUATION

The Fund follows its valuation policies and procedures in determining its net asset value and, in preparing these financial statements, the fair value accounting standards that establish an authoritative definition of

fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation

techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

|

Level 1 –

|

Unadjusted, quoted prices in active markets for identical instruments that the Fund has the ability to access at the date of measurement.

|

|

|

Level 2 –

|

Other significant observable inputs (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets that are not active for identical or similar instruments, and

model-derived valuations in which all significant inputs and significant value drivers are observable in active markets, such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data).

|

|

|

Level 3 –

|

Significant unobservable inputs (including the Fund’s own assumptions about what market participants would use to price the asset or liability based on the best available information) when observable inputs are

unavailable.

|

The following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities on a recurring basis:

|

Equity Securities – Equity securities, including common stocks, preferred stocks, foreign-issued common stocks, exchange-traded funds, closed-end mutual funds,

partnerships, rights, MLPs, and real estate investment trusts, that are traded on a securities exchange for which a last-quoted sales price is readily available generally are valued at the last sales price as reported by the primary

exchange on which the securities are listed. Securities listed on The Nasdaq Stock Market (“Nasdaq”) generally are valued at the Nasdaq Official Closing Price, which may differ from the last sales price reported. Securities traded on a

securities exchange for which a last-quoted sales price is not readily available generally are valued at the mean between

|

|

WWW.HENNESSYFUNDS.COM

|

18

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are classified in Level 1 of the fair value hierarchy. Securities traded on foreign

exchanges generally are not valued at the same time the Fund calculates its NAV because most foreign markets close well before such time. The earlier close of most foreign markets gives rise to the possibility that significant events,

including broad market moves, may have occurred in the interim. In certain circumstances, it may be determined that a foreign security needs to be fair valued because it appears that the value of the security might have been materially

affected by events occurring after the close of the market in which the security is principally traded, but before the time the Fund calculates its NAV, such as by a development that affects an entire market or region (e.g., a

weather-related event) or a potentially global development (e.g., a terrorist attack that may be expected to have an effect on investor expectations worldwide).

|

|

|

Registered Investment Companies – Investments in open-end registered investment companies, commonly referred to as mutual funds, generally are priced at the ending NAV

provided by the applicable mutual fund’s service agent and are classified in Level 1 of the fair value hierarchy.

|

|

|

Debt Securities – Debt securities, including corporate bonds, asset-backed securities, mortgage-backed securities, municipal bonds, U.S. Treasuries, and U.S. government

agency issues, are generally valued at market on the basis of valuations furnished by an independent pricing service that utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently

executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. In addition, the model may incorporate observable market data,

such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities are valued primarily using dealer quotations. These securities are generally classified in Level 2 of the fair value

hierarchy.

|

|

|

Short-Term Securities – Short-term equity investments, including money market funds, are valued in the manner specified above for equity securities. Short-term debt

investments with an original term to maturity of 60 days or less are valued at amortized cost, which approximates fair market value. If the original term to maturity of a short-term debt investment exceeds 60 days, then the values as of the

61st day prior to maturity are amortized. Amortized cost is not used if its use would be inappropriate due to credit or other impairments of the issuer, in which case the security’s fair value would be determined as described below.

Short-term securities are generally classified in Level 1 or Level 2 of the fair value hierarchy depending on the inputs used and market activity levels for specific securities.

|

The Board of Trustees of the Fund (the “Board”) has adopted fair value pricing procedures that are followed when a price for a security is not readily available or if a significant event has occurred

that indicates the closing price of a security no longer represents the true value of that security. Fair value pricing determinations are made in good faith in accordance with these procedures. There are numerous criteria considered in determining

a fair value of a security, such as the trading volume of a security and markets, the values of other similar securities, and news events with direct bearing on a security or markets. Fair value pricing results in an estimated price for a security

that reflects the amount the Fund might reasonably expect to receive in a current sale. Depending on the relative significance of the valuation inputs, these securities may be classified in either Level 2 or Level 3 of the fair value hierarchy.

|

HENNESSY FUNDS

|

1-800-966-4354

|

19

The fair value of foreign securities may be determined with the assistance of a pricing service using correlations between the movement of prices of such securities and indices of domestic securities

and other appropriate indicators, such as closing market prices of relevant American Depositary Receipts or futures contracts. Using fair value pricing means that the Fund’s NAV reflects the affected portfolio securities’ values as determined by

the Board or its designee, pursuant to the fair value pricing procedures adopted by the Board, instead of being determined by the market. Using a fair value pricing methodology to price a foreign security may result in a value that is different

from such foreign security’s most recent closing price and from the value used by other investment companies to calculate their NAVs. Such securities are generally classified in Level 2 of the fair value hierarchy. Because the Fund may invest in

foreign securities, the value of the Fund’s portfolio securities may change on days when a shareholder is unable to purchase or redeem Fund shares.

The Board has delegated day-to-day valuation matters to the Valuation and Liquidity Committee comprising representatives from Hennessy Advisors, Inc., the Fund’s investment advisor (the “Advisor”). The

function of the Valuation and Liquidity Committee, among other things, is to value securities where current and reliable market quotations are not readily available. All actions taken by the Valuation and Liquidity Committee are reviewed by the

Board.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determinations. Various inputs are used to determine the

value of the Fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Details related to the fair value hierarchy of the Fund’s securities

as of April 30, 2022, are included in the Schedule of Investments.

4). INVESTMENT TRANSACTIONS

Purchases and sales of investment securities (excluding government and short-term investments) for the Fund during the six months ended April 30, 2022, were $139,671,060 and $150,767,713, respectively.

There were no purchases or sales/maturities of long-term U.S. government securities for the Fund during the six months ended April 30, 2022.

5). INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

The Advisor provides the Fund with investment advisory services under an Investment Advisory Agreement. The Advisor furnishes all investment advice, office space, and facilities and most of the personnel needed by the

Fund. As compensation for its services, the Advisor is entitled to a monthly fee from the Fund. The fee is based on the average daily net assets of the Fund at an annual rate of 0.74%. The net investment advisory fees expensed by the Fund during

the six months ended April 30, 2022, are included in the Statement of Operations.

The Board has approved a Shareholder Servicing Agreement for Investor Class shares of the Fund, which compensates the Advisor for the non-investment advisory services it provides to the Fund. The

Shareholder Servicing Agreement provides for a monthly fee paid to the Advisor at an annual rate of 0.10% of the average daily net assets of the Fund attributable to Investor Class shares. The shareholder service fees expensed by the Fund during

the six months ended April 30, 2022, are included in the Statement of Operations.

The Fund has adopted a plan pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended, that authorizes payments in connection with the

|

WWW.HENNESSYFUNDS.COM

|

20

|

NOTES TO THE FINANCIAL STATEMENTS

|

distribution of Fund shares at an annual rate of up to 0.25% of the Fund’s average daily net assets attributable to Investor Class shares. Even though the authorized rate is up to 0.25%, the Fund is currently only using

up to 0.15% of its average daily net assets attributable to Investor Class shares for such purpose. Amounts paid under the plan may be spent on any activities or expenses primarily intended to result in the sale of shares, including, but not

limited to, advertising, shareholder account servicing, printing and mailing of prospectuses to other than current shareholders, printing and mailing of sales literature, and compensation for sales and marketing activities or to financial

institutions and others, such as dealers and distributors. The distribution fees expensed by the Fund during the six months ended April 30, 2022, are included in the Statement of Operations.

The Fund has entered into agreements with various brokers, dealers, and financial intermediaries in connection with the sale of Fund shares. The agreements provide for periodic payments of sub-transfer

agent expenses by the Fund to the brokers, dealers, and financial intermediaries for providing certain shareholder maintenance services. These shareholder services include the pre-processing and quality control of new accounts, shareholder

correspondence, answering customer inquiries regarding account status, and facilitating shareholder telephone transactions. The sub-transfer agent fees expensed by the Fund during the six months ended April 30, 2022, are included in the Statement

of Operations.

U.S. Bancorp Fund Services, LLC, d/b/a U.S. Bank Global Fund Services (“Fund Services”) provides the Fund with administrative, accounting, and transfer agent services. As administrator, Fund Services is

responsible for activities such as (i) preparing various federal and state regulatory filings, reports, and returns for the Fund, (ii) preparing reports and materials to be supplied to the Board, (iii) monitoring the activities of the Fund’s

custodian, transfer agent, and accountants, and (iv) coordinating the preparation and payment of the Fund’s expenses and reviewing the Fund’s expense accruals. U.S. Bank N.A., an affiliate of Fund Services, serves as the Fund’s custodian. The

servicing agreements between the Trust, Fund Services, and U.S. Bank N.A. contain a fee schedule that is inclusive of administrative, accounting, custody, and transfer agent fees. The administrative, accounting, custody, and transfer agent fees

expensed by the Fund during the six months ended April 30, 2022, are included in the Statement of Operations.

Quasar Distributors, LLC (“Quasar”), a wholly owned broker-dealer subsidiary of Foreside Financial Group, LLC, acts as the Fund’s principal underwriter in a continuous public offering of Fund shares.

The officers of the Fund are affiliated with the Advisor. With the exception of the Chief Compliance Officer and the Senior Compliance Officer, such officers receive no compensation from the Fund for

serving in their respective roles. The Fund, along with the other funds in the Hennessy Funds family (collectively, the “Hennessy Funds”), makes reimbursement payments on an equal basis to the Advisor for a portion of the salary and benefits

associated with the office of the Chief Compliance Officer and for all of the salary and benefits associated with the office of the Senior Compliance Officer. The compliance fees expensed by the Fund during the six months ended April 30, 2022, are

included in the Statement of Operations.

6). GUARANTEES AND INDEMNIFICATIONS

Under the Hennessy Funds’ organizational documents, their officers and trustees are indemnified by the Hennessy Funds against certain liabilities arising out of the performance of their duties to the Hennessy Funds.

Additionally, in the normal course of business, the Hennessy Funds enter into contracts with service providers that contain

|

HENNESSY FUNDS

|

1-800-966-4354

|

21

general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund

expects the risk of loss to be remote.

7). LINE OF CREDIT

The Fund has an uncommitted line of credit with the other Hennessy Funds in the amount of the lesser of (i) $100,000,000 or (ii) 33.33% of each Hennessy Fund’s net assets, or 30% for the Hennessy Gas Utility Fund and 10%

for the Hennessy Balanced Fund. The line of credit is intended to provide any necessary short-term financing in connection with shareholder redemptions, subject to certain restrictions. The credit facility is with the Hennessy Funds’ custodian

bank, U.S. Bank N.A. Borrowings under this arrangement bear interest at the bank’s prime rate and are secured by all of the Fund’s assets (as to its own borrowings only). During the six months ended April 30, 2022, the Fund had an outstanding

average daily balance and a weighted average interest rate of $41,497 and 3.25%, respectively. The interest expensed by the Fund during the six months ended April 30, 2022, is included in the Statement of Operations. The maximum amount outstanding

for the Fund during the period was $3,039,000. As of April 30, 2022, the Fund did not have any borrowings outstanding under the line of credit.

8). FEDERAL TAX INFORMATION

As of October 31, 2021, the Fund’s most recent fiscal year end, the components of accumulated earnings (losses) for income tax purposes were as follows:

|

Investments

|

|||||

|

Cost of investments for tax purposes

|

$

|

150,726,712

|

|||

|

Gross tax unrealized appreciation

|

$

|

36,563,930

|

|||

|

Gross tax unrealized depreciation

|

(19,252,581

|

)

|

|||

|

Net tax unrealized appreciation/(depreciation)

|

$

|

17,311,349

|

|||

|

Undistributed ordinary income

|

$

|

—

|

|||

|

Undistributed long-term capital gains

|

37,030,068

|

||||

|

Total distributable earnings

|

$

|

37,030,068

|

|||

|

Other accumulated gain/(loss)

|

$

|

(990,643

|

)

|

||

|

Total accumulated gain/(loss)

|

$

|

53,350,774

|

|||

As of October 31, 2021, the Fund had no tax-basis capital losses to offset future capital gains. During fiscal year 2021, the capital losses utilized by the Fund were $1,916,363.

Capital losses sustained in or after fiscal year 2012 can be carried forward indefinitely, but any such loss retains the character of the original loss and must be utilized prior to any loss incurred

before fiscal year 2012. As a result of this ordering rule, capital loss carryforwards incurred prior to fiscal year 2012 may be more likely to expire unused. Capital losses sustained prior to fiscal year 2012 can be carried forward for eight years

and can be carried forward as short-term capital losses regardless of the character of the original loss.

As of October 31, 2021, the Fund deferred, on a tax basis, a late-year ordinary loss of $990,643. Late-year ordinary losses are net ordinary losses incurred after December 31, 2020, but within the

taxable year, that are deemed to arise on the first day of the Fund’s next taxable year.

|

WWW.HENNESSYFUNDS.COM

|

22

|

NOTES TO THE FINANCIAL STATEMENTS

|

During fiscal year 2022 (year to date) and fiscal year 2021, the tax character of distributions paid by the Fund was as follows:

|

Six Months Ended

|

Year Ended

|

||||||||

|

April 30, 2022

|

October 31, 2021

|

||||||||

|

Ordinary income(1)

|

$

|

—

|

$

|

—

|

|||||

|

Long-term capital gains

|

37,030,073

|

—

|

|||||||

|

Total distributions

|

$

|

37,030,073

|

$

|

—

|

|||||

|