SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

|

Letter to Shareholders

|

2

|

|

Performance Overview

|

4

|

|

Financial Statements

|

|

|

Schedule of Investments

|

5

|

|

Statement of Assets and Liabilities

|

9

|

|

Statement of Operations

|

10

|

|

Statements of Changes in Net Assets

|

11

|

|

Financial Highlights

|

12

|

|

Notes to the Financial Statements

|

16

|

|

Expense Example

|

23

|

|

Proxy Voting Policy and Proxy Voting Records

|

25

|

|

Availability of Quarterly Portfolio Schedule

|

25

|

|

Federal Tax Distribution Information

|

25

|

|

Important Notice Regarding Delivery of Shareholder Documents

|

25

|

|

Electronic Delivery

|

25

|

|

Board Approval of Investment Advisory Agreement

|

26

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

HENNESSYFUNDS.COM

|

|

LETTER TO SHAREHOLDERS

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Six

|

One

|

Five

|

Ten

|

|

|

Months(1)

|

Year

|

Years

|

Years

|

|

|

Hennessy Cornerstone Growth Fund –

|

||||

|

Investor Class (HFCGX)

|

-22.30%

|

-22.05%

|

-3.32%

|

4.43%

|

|

Hennessy Cornerstone Growth Fund –

|

||||

|

Institutional Class (HICGX)

|

-22.19%

|

-21.79%

|

-3.02%

|

4.76%

|

|

Russell 2000® Index

|

-15.47%

|

-16.39%

|

2.88%

|

7.69%

|

|

S&P 500® Index

|

-3.16%

|

0.86%

|

9.12%

|

11.69%

|

|

(1)

|

Periods of less than one year are not annualized.

|

|

HENNESSYFUNDS.COM

|

|

PERFORMANCE OVERVIEW/SCHEDULE OF INVESTMENTS

|

|

Schedule of Investments as of April 30, 2020 (Unaudited)

|

|

TOP TEN HOLDINGS (EXCLUDING MONEY MARKET FUNDS)

|

% NET ASSETS

|

|

Sportsman’s Warehouse Holdings, Inc.

|

3.16%

|

|

Leidos Holdings, Inc.

|

2.74%

|

|

Sony Corp. – ADR

|

2.51%

|

|

Crown Holdings, Inc.

|

2.49%

|

|

Target Corp.

|

2.48%

|

|

Carvana Co.

|

2.42%

|

|

Teekay Tankers Ltd.

|

2.41%

|

|

Brookfield Asset Management, Inc., Class A

|

2.38%

|

|

Best Buy Co., Inc.

|

2.36%

|

|

Universal Forest Products, Inc.

|

2.34%

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

COMMON STOCKS – 97.88%

|

Number

|

% of

|

||||||||||

|

|

of Shares

|

Value

|

Net Assets

|

|||||||||

|

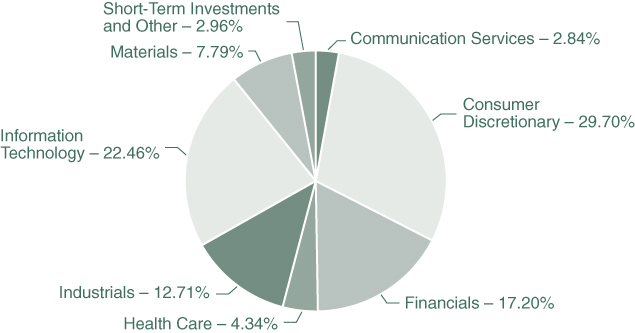

Consumer Discretionary – 33.02%

|

||||||||||||

|

America’s Car-Mart, Inc. (a)

|

25,196

|

$

|

1,661,676

|

1.69

|

%

|

|||||||

|

Best Buy Co., Inc.

|

30,300

|

2,324,919

|

2.36

|

%

|

||||||||

|

Carvana Co. (a)

|

29,800

|

2,387,278

|

2.42

|

%

|

||||||||

|

Dick’s Sporting Goods, Inc.

|

56,100

|

1,648,779

|

1.67

|

%

|

||||||||

|

Installed Building Products, Inc. (a)

|

38,700

|

1,908,297

|

1.94

|

%

|

||||||||

|

KB Home

|

78,300

|

2,054,592

|

2.08

|

%

|

||||||||

|

M/I Homes, Inc. (a)

|

63,400

|

1,614,164

|

1.64

|

%

|

||||||||

|

Rent-A-Center, Inc.

|

92,800

|

1,847,184

|

1.87

|

%

|

||||||||

|

Skechers U.S.A., Inc. (a)

|

65,300

|

1,840,154

|

1.87

|

%

|

||||||||

|

Skyline Champion Corp. (a)

|

79,400

|

1,564,974

|

1.59

|

%

|

||||||||

|

Sony Corp. – ADR (a)(b)

|

38,500

|

2,473,625

|

2.51

|

%

|

||||||||

|

Sportsman’s Warehouse Holdings, Inc. (a)

|

434,800

|

3,113,168

|

3.16

|

%

|

||||||||

|

Target Corp.

|

22,300

|

2,447,202

|

2.48

|

%

|

||||||||

|

The Buckle, Inc.

|

106,300

|

1,627,453

|

1.65

|

%

|

||||||||

|

Williams-Sonoma, Inc.

|

36,600

|

2,263,344

|

2.30

|

%

|

||||||||

|

Zumiez, Inc. (a)

|

83,600

|

1,767,304

|

1.79

|

%

|

||||||||

|

|

32,544,113

|

33.02

|

%

|

|||||||||

|

Energy – 5.69%

|

||||||||||||

|

Cosan Ltd. – Class A (a)(b)

|

120,600

|

1,608,804

|

1.63

|

%

|

||||||||

|

Teekay Tankers Ltd. (a)(b)

|

117,100

|

2,378,301

|

2.41

|

%

|

||||||||

|

World Fuel Services Corp.

|

64,800

|

1,620,000

|

1.65

|

%

|

||||||||

|

|

5,607,105

|

5.69

|

%

|

|||||||||

|

Financials – 10.16%

|

||||||||||||

|

Brookfield Asset Management, Inc., Class A (b)

|

69,400

|

2,347,108

|

2.38

|

%

|

||||||||

|

Equitable Holdings, Inc.

|

105,700

|

1,936,424

|

1.96

|

%

|

||||||||

|

LPL Financial Holdings, Inc.

|

28,000

|

1,686,160

|

1.71

|

%

|

||||||||

|

The Carlyle Group, Inc.

|

87,300

|

2,046,312

|

2.08

|

%

|

||||||||

|

Voya Financial, Inc.

|

44,300

|

2,001,031

|

2.03

|

%

|

||||||||

|

|

10,017,035

|

10.16

|

%

|

|||||||||

|

Health Care – 4.03%

|

||||||||||||

|

R1 RCM, Inc. (a)

|

199,500

|

2,058,840

|

2.09

|

%

|

||||||||

|

RadNet, Inc. (a)

|

135,400

|

1,911,848

|

1.94

|

%

|

||||||||

|

|

3,970,688

|

4.03

|

%

|

|||||||||

|

HENNESSYFUNDS.COM

|

|

SCHEDULE OF INVESTMENTS

|

|

COMMON STOCKS

|

Number

|

% of

|

||||||||||

|

|

of Shares

|

Value

|

Net Assets

|

|||||||||

|

Industrials – 19.12%

|

||||||||||||

|

Alamo Group, Inc.

|

22,100

|

$

|

2,175,524

|

2.21

|

%

|

|||||||

|

American Woodmark Corp. (a)

|

25,400

|

1,305,814

|

1.32

|

%

|

||||||||

|

Arcosa, Inc.

|

60,200

|

2,243,654

|

2.28

|

%

|

||||||||

|

Atkore International Group, Inc. (a)

|

66,100

|

1,608,874

|

1.63

|

%

|

||||||||

|

BMC Stock Holdings, Inc. (a)

|

91,700

|

1,948,625

|

1.98

|

%

|

||||||||

|

Builders FirstSource, Inc. (a)

|

103,100

|

1,891,885

|

1.92

|

%

|

||||||||

|

Colfax Corp. (a)

|

73,200

|

1,887,828

|

1.91

|

%

|

||||||||

|

Howmet Aerospace, Inc.

|

94,100

|

1,229,887

|

1.25

|

%

|

||||||||

|

JELD-WEN Holding, Inc. (a)

|

111,000

|

1,409,700

|

1.43

|

%

|

||||||||

|

Triumph Group, Inc.

|

119,400

|

840,576

|

0.85

|

%

|

||||||||

|

Universal Forest Products, Inc.

|

56,000

|

2,302,720

|

2.34

|

%

|

||||||||

|

|

18,845,087

|

19.12

|

%

|

|||||||||

|

Information Technology – 19.89%

|

||||||||||||

|

Benchmark Electronics, Inc.

|

77,400

|

1,599,084

|

1.62

|

%

|

||||||||

|

CDW Corp.

|

19,300

|

2,138,440

|

2.17

|

%

|

||||||||

|

Insight Enterprises, Inc. (a)

|

38,500

|

2,090,165

|

2.12

|

%

|

||||||||

|

Itron, Inc. (a)

|

32,400

|

2,262,168

|

2.30

|

%

|

||||||||

|

Jabil, Inc.

|

64,400

|

1,831,536

|

1.86

|

%

|

||||||||

|

JinkoSolar Holding Company Ltd. – ADR (a)(b)

|

119,600

|

1,892,072

|

1.92

|

%

|

||||||||

|

Leidos Holdings, Inc.

|

27,300

|

2,697,513

|

2.74

|

%

|

||||||||

|

Methode Electronics, Inc.

|

70,600

|

2,119,412

|

2.15

|

%

|

||||||||

|

Synnex Corp.

|

18,400

|

1,611,104

|

1.63

|

%

|

||||||||

|

Xerox Holdings Corp.

|

74,500

|

1,362,605

|

1.38

|

%

|

||||||||

|

|

19,604,099

|

19.89

|

%

|

|||||||||

|

Materials – 3.99%

|

||||||||||||

|

Arconic Corp. (a)

|

22,800

|

198,816

|

0.20

|

%

|

||||||||

|

Crown Holdings, Inc. (a)

|

38,100

|

2,454,021

|

2.49

|

%

|

||||||||

|

Koppers Holdings, Inc. (a)

|

81,400

|

1,282,864

|

1.30

|

%

|

||||||||

|

|

3,935,701

|

3.99

|

%

|

|||||||||

|

Real Estate – 1.98%

|

||||||||||||

|

CBRE Group, Inc. (a)

|

45,500

|

1,953,315

|

1.98

|

%

|

||||||||

|

|

||||||||||||

|

Total Common Stocks

|

||||||||||||

|

(Cost $131,272,201)

|

96,477,143

|

97.88

|

%

|

|||||||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

SHORT-TERM INVESTMENTS – 2.31%

|

Number

|

% of

|

||||||||||

|

|

of Shares

|

Value

|

Net Assets

|

|||||||||

|

Money Market Funds – 2.31%

|

||||||||||||

|

First American Government Obligations Fund,

|

||||||||||||

|

Institutional Class, 0.25% (c)

|

2,274,895

|

$

|

2,274,895

|

2.31

|

%

|

|||||||

|

|

||||||||||||

|

Total Short-Term Investments

|

||||||||||||

|

(Cost $2,274,895)

|

2,274,895

|

2.31

|

%

|

|||||||||

|

|

||||||||||||

|

Total Investments

|

||||||||||||

|

(Cost $133,547,096) – 100.19%

|

98,752,038

|

100.19

|

%

|

|||||||||

|

Liabilities in Excess of Other Assets – (0.19)%

|

(185,257

|

)

|

(0.19

|

)%

|

||||||||

|

|

||||||||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

98,566,781

|

100.00

|

%

|

||||||||

|

(a)

|

Non-income-producing security.

|

|

(b)

|

U.S.-traded security of a foreign corporation.

|

|

(c)

|

The rate listed is the fund’s seven-day yield as of April 30, 2020.

|

|

Common Stocks

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Consumer Discretionary

|

$

|

32,544,113

|

$

|

—

|

$

|

—

|

$

|

32,544,113

|

||||||||

|

Energy

|

5,607,105

|

—

|

—

|

5,607,105

|

||||||||||||

|

Financials

|

10,017,035

|

—

|

—

|

10,017,035

|

||||||||||||

|

Health Care

|

3,970,688

|

—

|

—

|

3,970,688

|

||||||||||||

|

Industrials

|

18,845,087

|

—

|

—

|

18,845,087

|

||||||||||||

|

Information Technology

|

19,604,099

|

—

|

—

|

19,604,099

|

||||||||||||

|

Materials

|

3,935,701

|

—

|

—

|

3,935,701

|

||||||||||||

|

Real Estate

|

1,953,315

|

—

|

—

|

1,953,315

|

||||||||||||

|

Total Common Stocks

|

$

|

96,477,143

|

$

|

—

|

$

|

—

|

$

|

96,477,143

|

||||||||

|

Short-Term Investments

|

||||||||||||||||

|

Money Market Funds

|

$

|

2,274,895

|

$

|

—

|

$

|

—

|

$

|

2,274,895

|

||||||||

|

Total Short-Term Investments

|

$

|

2,274,895

|

$

|

—

|

$

|

—

|

$

|

2,274,895

|

||||||||

|

Total Investments

|

$

|

98,752,038

|

$

|

—

|

$

|

—

|

$

|

98,752,038

|

||||||||

|

HENNESSYFUNDS.COM

|

|

SCHEDULE OF INVESTMENTS/STATEMENT OF ASSETS AND LIABILITIES

|

|

Statement of Assets and Liabilities as of April 30, 2020 (Unaudited)

|

|

ASSETS:

|

||||

|

Investments in securities, at value (cost $133,547,096)

|

$

|

98,752,038

|

||

|

Dividends and interest receivable

|

26,083

|

|||

|

Receivable for fund shares sold

|

4,440

|

|||

|

Prepaid expenses and other assets

|

18,823

|

|||

|

Total assets

|

98,801,384

|

|||

|

LIABILITIES:

|

||||

|

Payable for fund shares redeemed

|

27,722

|

|||

|

Payable to advisor

|

54,047

|

|||

|

Payable to administrator

|

16,944

|

|||

|

Payable to auditor

|

11,372

|

|||

|

Accrued distribution fees

|

84,893

|

|||

|

Accrued service fees

|

6,584

|

|||

|

Accrued trustees fees

|

5,581

|

|||

|

Accrued expenses and other payables

|

27,460

|

|||

|

Total liabilities

|

234,603

|

|||

|

NET ASSETS

|

$

|

98,566,781

|

||

|

NET ASSETS CONSISTS OF:

|

||||

|

Capital stock

|

$

|

134,817,851

|

||

|

Accumulated deficit

|

(36,251,070

|

)

|

||

|

Total net assets

|

$

|

98,566,781

|

||

|

NET ASSETS:

|

||||

|

Investor Class

|

||||

|

Shares authorized (no par value)

|

Unlimited

|

|||

|

Net assets applicable to outstanding shares

|

$

|

88,878,741

|

||

|

Shares issued and outstanding

|

5,972,420

|

|||

|

Net asset value, offering price, and redemption price per share

|

$

|

14.88

|

||

|

Institutional Class

|

||||

|

Shares authorized (no par value)

|

Unlimited

|

|||

|

Net assets applicable to outstanding shares

|

$

|

9,688,040

|

||

|

Shares issued and outstanding

|

627,805

|

|||

|

Net asset value, offering price, and redemption price per share

|

$

|

15.43

|

||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Statement of Operations for the six months ended April 30, 2020 (Unaudited)

|

|

INVESTMENT INCOME:

|

||||

|

Dividend income(1)

|

$

|

589,963

|

||

|

Interest income

|

16,198

|

|||

|

Total investment income

|

606,161

|

|||

|

EXPENSES:

|

||||

|

Investment advisory fees (See Note 5)

|

468,599

|

|||

|

Sub-transfer agent expenses – Investor Class (See Note 5)

|

91,203

|

|||

|

Sub-transfer agent expenses – Institutional Class (See Note 5)

|

6,358

|

|||

|

Distribution fees – Investor Class (See Note 5)

|

85,388

|

|||

|

Administration, accounting, custody, and transfer agent fees (See Note 5)

|

69,537

|

|||

|

Service fees – Investor Class (See Note 5)

|

56,925

|

|||

|

Federal and state registration fees

|

18,485

|

|||

|

Compliance expense (See Note 5)

|

13,462

|

|||

|

Audit fees

|

11,375

|

|||

|

Reports to shareholders

|

9,197

|

|||

|

Trustees’ fees and expenses

|

8,921

|

|||

|

Legal fees

|

731

|

|||

|

Other expenses

|

9,380

|

|||

|

Total expenses

|

849,561

|

|||

|

NET INVESTMENT LOSS

|

$

|

(243,400

|

)

|

|

|

REALIZED AND UNREALIZED GAINS (LOSSES):

|

||||

|

Net realized gain on investments

|

$

|

11,594,725

|

||

|

Net change in unrealized appreciation/depreciation on investments

|

(40,617,711

|

)

|

||

|

Net loss on investments

|

(29,022,986

|

)

|

||

|

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

(29,266,386

|

)

|

|

|

(1)

|

Net of foreign taxes withheld of $2,691.

|

|

HENNESSYFUNDS.COM

|

|

STATEMENT OF OPERATIONS/STATEMENTS OF CHANGES IN NET ASSETS

|

|

Statements of Changes in Net Assets

|

|

Six Months Ended

|

||||||||

|

April 30, 2020

|

Year Ended

|

|||||||

|

(Unaudited)

|

October 31, 2019

|

|||||||

|

OPERATIONS:

|

||||||||

|

Net investment loss

|

$

|

(243,400

|

)

|

$

|

(45,248

|

)

|

||

|

Net realized gain (loss) on investments

|

11,594,725

|

(12,686,776

|

)

|

|||||

|

Net change in unrealized

|

||||||||

|

appreciation/depreciation on investments

|

(40,617,711

|

)

|

3,138,849

|

|||||

|

Net decrease in net assets resulting from operations

|

(29,266,386

|

)

|

(9,593,175

|

)

|

||||

|

DISTRIBUTIONS TO SHAREHOLDERS:

|

||||||||

|

Distributable earnings – Investor Class

|

—

|

(12,717,829

|

)

|

|||||

|

Distributable earnings – Institutional Class

|

—

|

(1,655,292

|

)

|

|||||

|

Total distributions

|

—

|

(14,373,121

|

)

|

|||||

|

CAPITAL SHARE TRANSACTIONS:

|

||||||||

|

Proceeds from shares subscribed – Investor Class

|

601,667

|

2,338,416

|

||||||

|

Proceeds from shares subscribed – Institutional Class

|

259,737

|

643,045

|

||||||

|

Dividends reinvested – Investor Class

|

—

|

12,312,126

|

||||||

|

Dividends reinvested – Institutional Class

|

—

|

1,582,859

|

||||||

|

Cost of shares redeemed – Investor Class

|

(10,405,549

|

)

|

(27,329,933

|

)

|

||||

|

Cost of shares redeemed – Institutional Class

|

(2,346,814

|

)

|

(5,351,383

|

)

|

||||

|

Net decrease in net assets derived

|

||||||||

|

from capital share transactions

|

(11,890,959

|

)

|

(15,804,870

|

)

|

||||

|

TOTAL DECREASE IN NET ASSETS

|

(41,157,345

|

)

|

(39,771,166

|

)

|

||||

|

NET ASSETS:

|

||||||||

|

Beginning of period

|

139,724,126

|

179,495,292

|

||||||

|

End of period

|

$

|

98,566,781

|

$

|

139,724,126

|

||||

|

CHANGES IN SHARES OUTSTANDING:

|

||||||||

|

Shares sold – Investor Class

|

36,651

|

125,244

|

||||||

|

Shares sold – Institutional Class

|

14,738

|

32,446

|

||||||

|

Shares issued to holders as reinvestment

|

||||||||

|

of dividends – Investor Class

|

—

|

661,942

|

||||||

|

Shares issued to holders as reinvestment

|

||||||||

|

of dividends – Institutional Class

|

—

|

82,441

|

||||||

|

Shares redeemed – Investor Class

|

(597,965

|

)

|

(1,423,630

|

)

|

||||

|

Shares redeemed – Institutional Class

|

(124,359

|

)

|

(274,093

|

)

|

||||

|

Net decrease in shares outstanding

|

(670,935

|

)

|

(795,650

|

)

|

||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Financial Highlights

|

|

Six Months Ended

|

||||

|

April 30, 2020

|

||||

|

(Unaudited)

|

||||

|

PER SHARE DATA:

|

||||

|

Net asset value, beginning of period

|

$

|

19.15

|

||

|

Income from investment operations:

|

||||

|

Net investment income (loss)

|

(0.04

|

)(1)

|

||

|

Net realized and unrealized gains (losses) on investments

|

(4.23

|

)

|

||

|

Total from investment operations

|

(4.27

|

)

|

||

|

Less distributions:

|

||||

|

Dividends from net investment income

|

—

|

|||

|

Dividends from net realized gains

|

—

|

|||

|

Total distributions

|

—

|

|||

|

Net asset value, end of period

|

$

|

14.88

|

||

|

TOTAL RETURN

|

-22.30

|

%(2)

|

||

|

SUPPLEMENTAL DATA AND RATIOS:

|

||||

|

Net assets, end of period (millions)

|

$

|

88.88

|

||

|

Ratio of expenses to average net assets

|

1.37

|

%(3)

|

||

|

Ratio of net investment income (loss) to average net assets

|

(0.42

|

)%(3)

|

||

|

Portfolio turnover rate(4)

|

96

|

%(2)

|

||

|

(1)

|

Calculated using the average shares outstanding method.

|

|

(2)

|

Not annualized.

|

|

(3)

|

Annualized.

|

|

(4)

|

Calculated on the basis of the Fund as a whole.

|

|

HENNESSYFUNDS.COM

|

|

FINANCIAL HIGHLIGHTS — INVESTOR CLASS

|

|

Year Ended October 31,

|

||||||||||||||||||

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||

|

$

|

22.17

|

$

|

24.16

|

$

|

18.98

|

$

|

20.00

|

$

|

18.68

|

|||||||||

|

(0.01

|

)(1)

|

(0.17

|

)

|

(0.09

|

)

|

(0.02

|

)

|

0.06

|

||||||||||

|

(1.19

|

)

|

(1.82

|

)

|

5.27

|

(0.98

|

)

|

1.26

|

|||||||||||

|

(1.20

|

)

|

(1.99

|

)

|

5.18

|

(1.00

|

)

|

1.32

|

|||||||||||

|

—

|

—

|

—

|

(0.02

|

)

|

—

|

|||||||||||||

|

(1.82

|

)

|

—

|

—

|

—

|

—

|

|||||||||||||

|

(1.82

|

)

|

—

|

—

|

(0.02

|

)

|

—

|

||||||||||||

|

$

|

19.15

|

$

|

22.17

|

$

|

24.16

|

$

|

18.98

|

$

|

20.00

|

|||||||||

|

-5.19

|

%

|

-8.24

|

%

|

27.29

|

%

|

-5.00

|

%

|

7.07

|

%

|

|||||||||

|

$

|

125.10

|

$

|

158.98

|

$

|

197.22

|

$

|

184.61

|

$

|

248.74

|

|||||||||

|

1.34

|

%

|

1.30

|

%

|

1.30

|

%

|

1.32

|

%

|

1.15

|

%

|

|||||||||

|

(0.07

|

)%

|

(0.56

|

)%

|

(0.33

|

)%

|

(0.18

|

)%

|

0.30

|

%

|

|||||||||

|

95

|

%

|

133

|

%

|

98

|

%

|

97

|

%

|

102

|

%

|

|||||||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Financial Highlights

|

|

Six Months Ended

|

||||

|

April 30, 2020

|

||||

|

(Unaudited)

|

||||

|

PER SHARE DATA:

|

||||

|

Net asset value, beginning of period

|

$

|

19.83

|

||

|

Income from investment operations:

|

||||

|

Net investment income (loss)

|

(0.01

|

)(1)

|

||

|

Net realized and unrealized gains (losses) on investments

|

(4.39

|

)

|

||

|

Total from investment operations

|

(4.40

|

)

|

||

|

Less distributions:

|

||||

|

Dividends from net investment income

|

—

|

|||

|

Dividends from net realized gains

|

—

|

|||

|

Total distributions

|

—

|

|||

|

Net asset value, end of period

|

$

|

15.43

|

||

|

TOTAL RETURN

|

-22.19

|

%(2)

|

||

|

SUPPLEMENTAL DATA AND RATIOS:

|

||||

|

Net assets, end of period (millions)

|

$

|

9.69

|

||

|

Ratio of expenses to average net assets

|

1.06

|

%(3)

|

||

|

Ratio of net investment income (loss) to average net assets

|

(0.10

|

)%(3)

|

||

|

Portfolio turnover rate(4)

|

96

|

%(2)

|

||

|

(1)

|

Calculated using the average shares outstanding method.

|

|

(2)

|

Not annualized.

|

|

(3)

|

Annualized.

|

|

(4)

|

Calculated on the basis of the Fund as a whole.

|

|

HENNESSYFUNDS.COM

|

|

FINANCIAL HIGHLIGHTS — INSTITUTIONAL CLASS

|

|

Year Ended October 31,

|

||||||||||||||||||

|

2019

|

2018

|

2017

|

2016

|

2015

|

||||||||||||||

|

$

|

22.88

|

$

|

24.85

|

$

|

19.46

|

$

|

20.47

|

$

|

19.08

|

|||||||||

|

0.05

|

(1)

|

0.11

|

0.01

|

0.17

|

0.03

|

|||||||||||||

|

(1.22

|

)

|

(2.08

|

)

|

5.38

|

(1.13

|

)

|

1.36

|

|||||||||||

|

(1.17

|

)

|

(1.97

|

)

|

5.39

|

(0.96

|

)

|

1.39

|

|||||||||||

|

—

|

—

|

—

|

(0.05

|

)

|

—

|

|||||||||||||

|

(1.88

|

)

|

—

|

—

|

—

|

—

|

|||||||||||||

|

(1.88

|

)

|

—

|

—

|

(0.05

|

)

|

—

|

||||||||||||

|

$

|

19.83

|

$

|

22.88

|

$

|

24.85

|

$

|

19.46

|

$

|

20.47

|

|||||||||

|

-4.86

|

%

|

-7.93

|

%

|

27.70

|

%

|

-4.69

|

%

|

7.29

|

%

|

|||||||||

|

$

|

14.62

|

$

|

20.52

|

$

|

31.65

|

$

|

25.74

|

$

|

38.96

|

|||||||||

|

1.01

|

%

|

0.96

|

%

|

0.97

|

%

|

0.98

|

%

|

0.99

|

%

|

|||||||||

|

0.27

|

%

|

(0.23

|

)%

|

(0.00

|

)%

|

0.14

|

%

|

0.51

|

%

|

|||||||||

|

95

|

%

|

133

|

%

|

98

|

%

|

97

|

%

|

102

|

%

|

|||||||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Notes to the Financial Statements April 30, 2020 (Unaudited)

|

|

a).

|

Securities Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 3.

|

|

b).

|

Federal Income Taxes – No provision for federal income taxes or excise taxes has been made because the Fund has elected to be taxed as a regulated investment company and intends to distribute substantially all of

its taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Net investment income/loss and realized gains/losses for federal

income tax purposes may differ from those reported in the financial statements because of temporary book and tax basis differences. Temporary differences are primarily the result of the treatment of partnership income and wash sales for tax

reporting purposes. The Fund recognizes interest and penalties related to income tax benefits, if any, in the Statement of Operations as an income tax expense. Distributions from net realized gains for book purposes may include short-term

capital gains, which are included as ordinary income to shareholders for tax purposes. The Fund may utilize equalization accounting for tax purposes and designate earnings and profits, including net realized gains distributed to shareholders

on redemption of shares, as part of the dividends paid deduction for income tax purposes.

|

|

c).

|

Accounting for Uncertainty in Income Taxes – The Fund has accounting policies regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The tax returns of the Fund for the

prior three fiscal years are open for examination. The Fund has reviewed all open tax years in major jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits

relating to uncertain income tax positions taken or expected to be taken on a tax return. The Fund’s major tax jurisdictions are U.S. federal and Delaware.

|

|

HENNESSYFUNDS.COM

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

d).

|

Income and Expenses – Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund. Interest income, which includes the amortization of premium and accretion of discount,

is recognized on an accrual basis. Other non-cash dividends are recognized as investment income at the fair value of the property received. The Fund is charged for those expenses that are directly attributable to its portfolio, such as

advisory, administration, and certain shareholder service fees. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains/losses on investments are allocated to each class of shares based on

such class’s net assets.

|

|

e).

|

Distributions to Shareholders – Dividends from net investment income for the Fund, if any, are declared and paid annually, usually in December. Distributions of net realized capital gains, if any, are declared and

paid annually, usually in December.

|

|

f).

|

Security Transactions – Investment and shareholder transactions are recorded on the trade date. The Fund determines the realized gain/loss from an investment transaction by comparing the original cost of the

security lot sold with the net sale proceeds. Discounts and premiums on securities purchased are accreted or amortized, respectively, over the life of each such security.

|

|

g).

|

Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of

contingent assets and liabilities at the date of the financial statements and the reported change in net assets during the reporting period. Actual results could differ from those estimates.

|

|

h).

|

Share Valuation – The net asset value (“NAV”) per share of the Fund is calculated by dividing (i) the total value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including

estimated accrued expenses) by (ii) the total number of shares outstanding for the Fund, rounded to the nearest $0.01. The Fund’s shares will not be priced on days the New York Stock Exchange is closed for trading. The offering and redemption

price per share for the Fund is equal to the Fund’s NAV per share.

|

|

Level 1 –

|

Unadjusted, quoted prices in active markets for identical instruments that the Fund has the ability to access at the date of measurement.

|

|

|

Level 2 –

|

Other significant observable inputs (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets that are not active for identical or similar instruments, and

model-derived valuations in which all significant inputs and significant value drivers are observable in active markets, such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data).

|

|

|

Level 3 –

|

Significant unobservable inputs (including the Fund’s own assumptions about what market participants would use to price the asset or liability based on the best available information) when observable inputs are

unavailable.

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Equity Securities – Equity securities, including common stocks, preferred stocks, foreign-issued common stocks, exchange-traded funds, closed-end mutual funds, partnerships,

rights, and real estate investment trusts, that are traded on a securities exchange for which a last-quoted sales price is readily available will generally be valued at the last sales price as reported by the primary exchange on which the

securities are listed. Securities listed on The NASDAQ Stock Market (“NASDAQ”) will generally be valued at the NASDAQ Official Closing Price, which may differ from the last sales price reported. Securities traded on a securities exchange for

which a last-quoted sales price is not readily available will generally be valued at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are classified in

Level 1 of the fair value hierarchy. Securities traded on foreign exchanges generally are not valued at the same time the Fund calculates its NAV because most foreign markets close well before such time. The earlier close of most foreign

markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim. In certain circumstances, it may be determined that a foreign security needs to be fair valued because it appears

that the value of the security might have been materially affected by events occurring after the close of the market in which the security is principally traded, but before the time the Fund calculates its NAV, such as by a development that

affects an entire market or region (e.g., a weather-related event) or a potentially global development (e.g., a terrorist attack that may be expected to have an effect on investor expectations worldwide).

|

|

|

Registered Investment Companies – Investments in open-end registered investment companies, commonly referred to as mutual funds, generally are priced at the ending NAV

provided by the applicable mutual fund’s service agent and will be classified in Level 1 of the fair value hierarchy.

|

|

|

Debt Securities – Debt securities, including corporate bonds, asset-backed securities, mortgage-backed securities, municipal bonds, U.S. Treasuries, and U.S. government

agency issues, are generally valued at market on the basis of valuations furnished by an independent pricing service that utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently

executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. In addition, the model may incorporate observable market data,

such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities are valued primarily using dealer quotations. These securities are generally classified in Level 2 of the fair value

hierarchy.

|

|

|

Short-Term Securities – Short-term equity investments, including money market funds, are valued in the manner specified above. Short-term debt investments with an original

term to maturity of 60 days or less are valued at amortized cost, which approximates fair market value. If the original term to maturity of a short-term debt investment exceeded 60 days, then the values as of the 61st day prior to maturity

are amortized. Amortized cost is not used if its use would be inappropriate due to credit or other impairments of the issuer, in which case the security’s fair value would be determined, as described below. Short-term securities are generally

classified in Level 1 or Level 2 of the fair value hierarchy depending on the inputs used and market activity levels for specific securities.

|

|

HENNESSYFUNDS.COM

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

HENNESSYFUNDS.COM

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

Investments

|

||||

|

Cost of investments for tax purposes

|

$

|

134,392,059

|

||

|

Gross tax unrealized appreciation

|

$

|

15,584,822

|

||

|

Gross tax unrealized depreciation

|

(10,055,455

|

)

|

||

|

Net tax unrealized appreciation/(depreciation)

|

$

|

5,529,367

|

||

|

Undistributed ordinary income

|

$

|

—

|

||

|

Undistributed long-term capital gains

|

—

|

|||

|

Total distributable earnings

|

$

|

—

|

||

|

Other accumulated gain/(loss)

|

$

|

(12,514,051

|

)

|

|

|

Total accumulated gain/(loss)

|

$

|

(6,984,684

|

)

|

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

$12,514,051

|

Unlimited Short-Term

|

|

Six Months Ended

|

Year Ended

|

||||||||

|

April 30, 2020

|

October 31, 2019

|

||||||||

|

Ordinary income(1)

|

$

|

—

|

$

|

—

|

|||||

|

Long-term capital gain

|

—

|

14,373,121

|

|||||||

|

$

|

—

|

$

|

14,373,121

|

||||||

|

(1) Ordinary income includes short-term capital gain.

|

|

HENNESSYFUNDS.COM

|

|

NOTES TO THE FINANCIAL STATEMENTS/EXPENSE EXAMPLE

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Beginning

|

Ending

|

||

|

Account Value

|

Account Value

|

Expenses Paid

|

|

|

November 1, 2019

|

April 30, 2020

|

During Period(1)

|

|

|

Investor Class

|

|||

|

Actual

|

$1,000.00

|

$ 777.00

|

$6.05

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,018.05

|

$6.87

|

|

Institutional Class

|

|||

|

Actual

|

$1,000.00

|

$ 778.10

|

$4.69

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,019.59

|

$5.32

|

|

(1)

|

Expenses are equal to the Fund’s annualized expense ratio of 1.37% for Investor Class shares or 1.06% for Institutional Class shares, as applicable, multiplied by the average account value over the period,

multiplied by 182/366 days (to reflect the half-year period).

|

|

HENNESSYFUNDS.COM

|

|

EXPENSE EXAMPLE — ELECTRONIC DELIVERY

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

(1)

|

A memorandum from outside legal counsel that described the fiduciary duties of the Board with respect to approving the continuation of the advisory agreement and the relevant factors for consideration;

|

|

|

(2)

|

A memorandum from the Advisor that listed the factors relevant to the Board’s approval of the continuation of the advisory agreement and also referenced the documents that had been provided to help the Board assess

each such factor;

|

|

|

(3)

|

An inventory of the services provided by the Advisor;

|

|

|

(4)

|

A written discussion of economies of scale;

|

|

|

(5)

|

A summary of the key terms of the advisory agreement;

|

|

|

(6)

|

A recent Fund fact sheet, which included performance information over various periods;

|

|

|

(7)

|

A peer expense comparison of the net expense ratio and investment advisory fee of the Fund; and

|

|

|

(8)

|

The Advisor’s financial statements from its most recent Form 10-K and Form 10-Q.

|

|

(1)

|

The nature and quality of the advisory services provided by the Advisor;

|

|

|

(2)

|

A comparison of the fees and expenses of the Fund to other similar funds;

|

|

|

(3)

|

Whether economies of scale are recognized by the Fund;

|

|

HENNESSYFUNDS.COM

|

|

BOARD APPROVAL OF INVESTMENT ADVISORY AGREEMENT

|

|

(4)

|

The costs and profitability of the Fund to the Advisor;

|

|

|

(5)

|

The performance of the Fund; and

|

|

|

(6)

|

Any benefits to the Advisor from serving as an investment advisor to the Fund (other than the advisory fee).

|

|

(1)

|

The Trustees considered the services identified below that are provided by the Advisor. Based on this review, the Trustees concluded that the Advisor provides high-quality services to the Fund and noted that their

overall confidence in the Advisor was high. The Trustees also concluded that they were satisfied with the nature, extent, and quality of the advisory services provided to the Fund by the Advisor and that the nature and extent of the services

provided by the Advisor were appropriate to assure that the Fund’s operations are conducted in compliance with applicable laws, rules, and regulations.

|

|

(a)

|

The Advisor acts as the portfolio manager for the Fund. In this capacity, the Advisor does the following:

|

|

(i)

|

manages the composition of the Fund’s portfolio, including the purchase, retention, and disposition of portfolio securities in accordance with the Fund’s investment objectives, policies, and restrictions;

|

|||

|

(ii)

|

seeks best execution for the Fund’s portfolio;

|

|||

|

(iii)

|

manages the use of soft dollars for the Fund; and

|

|||

|

(iv)

|

manages proxy voting for the Fund.

|

|

(b)

|

The Advisor performs a daily reconciliation of portfolio positions and cash for the Fund.

|

||

|

(c)

|

The Advisor monitors the liquidity of each Fund.

|

||

|

(d)

|

The Advisor monitors the Fund’s compliance with its investment objectives and restrictions.

|

||

|

(e)

|

The Advisor monitors compliance with federal securities laws, maintains a compliance program (including a code of ethics), conducts ongoing reviews of the compliance programs of the Fund’s service providers, as

feasible, conducts on-site visits to the Fund’s service providers, monitors incidents of abusive trading practices, reviews Fund expense accruals, payments, and fixed expense ratios, evaluates insurance providers for fidelity bond,

D&O/E&O insurance, and cybersecurity insurance coverage, manages regulatory examination compliance and responses, conducts employee compliance training, reviews reports provided by service providers, and maintains books and records.

|

||

|

(f)

|

The Advisor oversees service providers that provide accounting, administration, distribution, transfer agency, custodial, sales, marketing, public relations, audit, information technology, and legal services to the

Fund.

|

||

|

(g)

|

The Advisor maintains in-house marketing and distribution departments on behalf of the Fund.

|

||

|

(h)

|

The Advisor is actively involved with preparing regulatory filings for the Fund, including writing and annually updating the Fund’s prospectus and related documents.

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

(i)

|

For each annual report of the Fund, the Advisor prepares a written summary of the Fund’s performance during the most recent 12-month period.

|

||

|

(j)

|

The Advisor oversees distribution of the Fund through third-party broker/dealers and independent financial institutions such as Charles Schwab, Inc., Fidelity, TD Ameritrade, and Pershing. The Advisor participates

in “no transaction fee” (“NTF”) programs with these companies on behalf of the Fund, which allow customers to purchase the Fund through third-party distribution channels without paying a transaction fee. The Advisor compensates, in part, a

number of these third-party providers of NTF programs out of its own revenues.

|

||

|

(k)

|

The Advisor pays the incentive compensation of the Fund’s compliance officers and employs other staff, such as legal, marketing, national accounts, distribution, sales, administrative, and trading oversight

personnel, as well as management executives.

|

||

|

(l)

|

The Advisor provides a quarterly compliance certification to the Board.

|

||

|

(m)

|

The Advisor prepares or reviews all Board materials, frequently presents to the Board and leads Board discussions, prepares or reviews all meeting minutes, and arranges for Board training and education.

|

|

(2)

|

The Trustees compared the performance of the Fund to benchmark indices over various periods and also noted that the Trustees review and discuss reports comparing the investment performance of the Fund to various

indices at each quarterly Board meeting. Based on such information, the Trustees determined that the Advisor manages the Fund in a manner materially consistent with its stated investment objective and style. The Trustees concluded that the

performance of the Fund over various periods warranted continuation of the advisory agreement.

|

|

|

(3)

|

The Trustees reviewed the advisory fees and overall expense ratios of the Fund compared to other funds similar in asset size and investment objective to the Fund using data from Morningstar. As part of the

discussion with management, the Trustees ensured that they understood and were comfortable with the criteria used to determine the mutual funds included in the Morningstar categories for purposes of the materials considered at the meeting.

The Trustees determined that the advisory fee and overall expense ratio of the Fund falls within the range of the advisory fees and overall expense ratios of other comparable funds and concluded that they are reasonable and warranted

continuation of the advisory agreement.

|

|

|

(4)

|

The Trustees also considered whether the Advisor was realizing economies of scale that it should share with the Fund’s shareholders. The Trustees noted that the assets of the Fund had declined over the prior year.

In addition, the Trustees noted that many of the expenses incurred to manage the Fund are asset-based fees, so the Advisor does not realize material economies of scale relating to those expenses as the assets of the Fund increase. For

example, mutual fund platform fees increase as the Fund’s assets grow. The Trustees also considered the Advisor’s efforts to contain expenses through actions such as renegotiating service contracts, the Advisor’s significant marketing efforts

to promote the Funds, the Advisor’s investments in personnel to manage the Funds, and the Advisor’s agreement to waive fees or lower its management fees in certain

|

|

HENNESSYFUNDS.COM

|

|

BOARD APPROVAL OF INVESTMENT ADVISORY AGREEMENT

|

|

circumstances. The Trustees noted that it did not appear that the Advisor was realizing economies of scale at current asset levels and concluded that it would continue to monitor economies of scale in the future as

circumstances changed.

|

||

|

(5)

|

The Trustees considered the profitability of the Advisor, including the impact of mutual fund platform fees on the Advisor’s profitability, and also considered the resources and revenues that the Advisor has put

into managing and distributing the Fund. The Trustees then concluded that the profits of the Advisor are reasonable and not excessive when compared to profitability guidelines set forth in relevant court cases.

|

|

|

(6)

|

The Trustees considered the high level of professionalism and knowledge of the Advisor’s employees, along with a very low level of turnover, and concluded that this was beneficial to the Fund and its shareholders.

|

|

|

(7)

|

The Trustees considered any benefits to the Advisor from serving as an advisor to the Fund (other than the advisory fee). The Trustees noted that the Advisor may derive ancillary benefits from, by way of example,

its association with the Fund in the form of proprietary and third-party research products and services received from broker-dealers that execute portfolio trades for the Fund. The Trustees determined that any such products and services have

been used for legitimate purposes relating to the Fund by providing assistance in the investment decision-making process. The Trustees concluded that any additional benefits realized by the Advisor from its relationship with the Fund were

reasonable, which was based on, among other things, the Trustees’ finding that the research, analytical, statistical, and other information and services provided by brokers are merely supplemental to the Advisor’s own efforts in the

performance of its duties under the advisory agreement.

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Letter to Shareholders

|

2

|

|

Performance Overview

|

4

|

|

Financial Statements

|

|

|

Schedule of Investments

|

5

|

|

Statement of Assets and Liabilities

|

9

|

|

Statement of Operations

|

10

|

|

Statements of Changes in Net Assets

|

11

|

|

Financial Highlights

|

12

|

|

Notes to the Financial Statements

|

16

|

|

Expense Example

|

24

|

|

Proxy Voting Policy and Proxy Voting Records

|

26

|

|

Availability of Quarterly Portfolio Schedule

|

26

|

|

Federal Tax Distribution Information

|

26

|

|

Important Notice Regarding Delivery of Shareholder Documents

|

26

|

|

Electronic Delivery

|

26

|

|

Board Approval of Investment Advisory Agreements

|

27

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

HENNESSYFUNDS.COM

|

|

LETTER TO SHAREHOLDERS

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Six

|

One

|

Five

|

Ten

|

|

|

Months(1)

|

Year

|

Years

|

Years

|

|

|

Hennessy Focus Fund –

|

||||

|

Investor Class (HFCSX)

|

-17.53%

|

-10.23%

|

4.01%

|

9.77%

|

|

Hennessy Focus Fund –

|

||||

|

Institutional Class (HFCIX)

|

-17.40%

|

-9.94%

|

4.39%

|

10.12%

|

|

Russell 3000® Index

|

-4.33%

|

-1.04%

|

8.33%

|

11.29%

|

|

Russell Midcap® Growth Index

|

-1.78%

|

0.23%

|

8.88%

|

12.19%

|

|

(1)

|

Periods of less than one year are not annualized.

|

|

HENNESSYFUNDS.COM

|

|

PERFORMANCE OVERVIEW/SCHEDULE OF INVESTMENTS

|

|

Schedule of Investments as of April 30, 2020 (Unaudited)

|

|

TOP TEN HOLDINGS (EXCLUDING MONEY MARKET FUNDS)

|

% NET ASSETS

|

|

Brookfield Asset Management, Inc., Class A

|

10.32%

|

|

CarMax, Inc.

|

10.19%

|

|

O’Reilly Automotive, Inc.

|

9.85%

|

|

American Tower Corp., Class A

|

9.37%

|

|

Markel Corp.

|

8.67%

|

|

Aon PLC

|

7.92%

|

|

Encore Capital Group, Inc.

|

7.07%

|

|

American Woodmark Corp.

|

6.05%

|

|

NVR, Inc.

|

5.77%

|

|

Ashtead Group PLC

|

5.58%

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

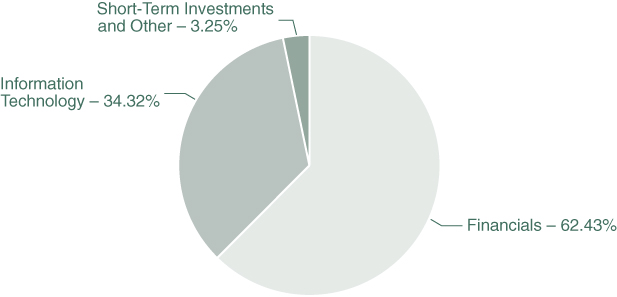

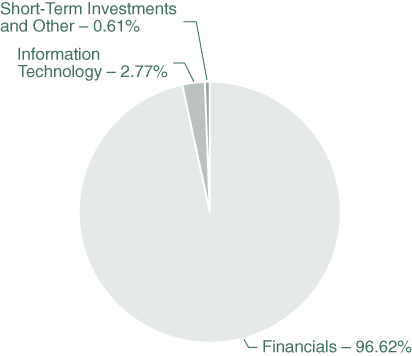

COMMON STOCKS – 89.09%

|

Number

|

% of

|

||||||||||

|

|

of Shares

|

Value

|

Net Assets

|

|||||||||

|

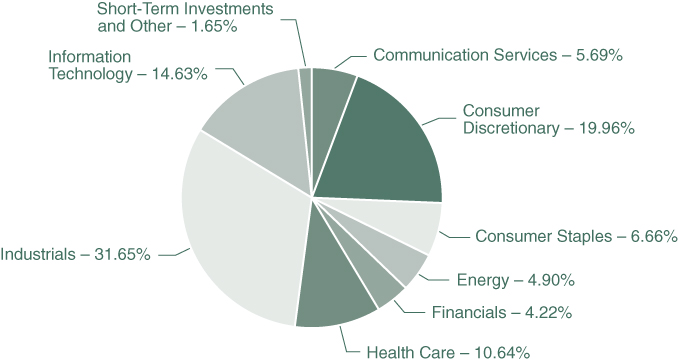

Consumer Discretionary – 27.14%

|

||||||||||||

|

CarMax, Inc. (a)

|

1,559,717

|

$

|

114,873,157

|

10.19

|

%

|

|||||||

|

NVR, Inc. (a)

|

20,984

|

65,050,400

|

5.77

|

%

|

||||||||

|

O’Reilly Automotive, Inc. (a)

|

287,218

|

110,963,802

|

9.85

|

%

|

||||||||

|

Restoration Hardware Holdings, Inc. (a)

|

104,116

|

14,969,799

|

1.33

|

%

|

||||||||

|

|

305,857,158

|

27.14

|

%

|

|||||||||

|

Financials – 38.86%

|

||||||||||||

|

Aon PLC (b)

|

516,581

|

89,198,041

|

7.92

|

%

|

||||||||

|

Brookfield Asset Management, Inc., Class A (b)

|

3,439,047

|

116,308,586

|

10.32

|

%

|

||||||||

|

Encore Capital Group, Inc. (a)(d)

|

3,067,416

|

79,691,468

|

7.07

|

%

|

||||||||

|

Markel Corp. (a)

|

112,831

|

97,693,593

|

8.67

|

%

|

||||||||

|

Marlin Business Services Corp. (d)

|

1,010,273

|

10,749,305

|

0.95

|

%

|

||||||||

|

The Charles Schwab Corp.

|

1,175,168

|

44,327,337

|

3.93

|

%

|

||||||||

|

|

437,968,330

|

38.86

|

%

|

|||||||||

|

Industrials – 17.87%

|

||||||||||||

|

American Woodmark Corp. (a)(d)

|

1,325,021

|

68,119,330

|

6.05

|

%

|

||||||||

|

Ametek, Inc.

|

316,322

|

26,529,926

|

2.35

|

%

|

||||||||

|

Ashtead Group PLC (b)

|

2,293,317

|

62,823,085

|

5.58

|

%

|

||||||||

|

Hexcel Corp.

|

1,134,608

|

39,246,091

|

3.48

|

%

|

||||||||

|

Mistras Group, Inc. (a)

|

971,558

|

4,614,900

|

0.41

|

%

|

||||||||

|

|

201,333,332

|

17.87

|

%

|

|||||||||

|

Information Technology – 5.22%

|

||||||||||||

|

SS&C Technologies Holdings, Inc.

|

1,067,191

|

58,866,255

|

5.22

|

%

|

||||||||

|

|

||||||||||||

|

Total Common Stocks

|

||||||||||||

|

(Cost $595,132,355)

|

1,004,025,075

|

89.09

|

%

|

|||||||||

|

|

||||||||||||

|

REITS – 9.37%

|

||||||||||||

|

Financials – 9.37%

|

||||||||||||

|

American Tower Corp., Class A

|

443,706

|

105,602,028

|

9.37

|

%

|

||||||||

|

|

||||||||||||

|

Total REITS

|

||||||||||||

|

(Cost $871,527)

|

105,602,028

|

9.37

|

%

|

|||||||||

|

HENNESSYFUNDS.COM

|

|

SCHEDULE OF INVESTMENTS

|

|

SHORT-TERM INVESTMENTS – 1.72%

|

Number

|

% of

|

||||||||||

|

|

of Shares

|

Value

|

Net Assets

|

|||||||||

|

Money Market Funds – 1.72%

|

||||||||||||

|

First American Government Obligations Fund,

|

||||||||||||

|

Institutional Class, 0.25% (c)

|

19,440,273

|

$

|

19,440,273

|

1.72

|

%

|

|||||||

|

|

||||||||||||

|

Total Short-Term Investments

|

||||||||||||

|

(Cost $19,440,273)

|

19,440,273

|

1.72

|

%

|

|||||||||

|

|

||||||||||||

|

Total Investments

|

||||||||||||

|

(Cost $615,444,155) – 100.18%

|

1,129,067,376

|

100.18

|

%

|

|||||||||

|

Liabilities in Excess of Other Assets – (0.18)%

|

(2,058,696

|

)

|

(0.18

|

)%

|

||||||||

|

|

||||||||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

1,127,008,680

|

100.00

|

%

|

||||||||

|

(a)

|

Non-income-producing security.

|

|

(b)

|

U.S.-traded security of a foreign corporation.

|

|

(c)

|

The rate listed is the fund’s seven-day yield as of April 30, 2020.

|

|

(d)

|

Investment in affiliated security. Investment represents five percent or more of the outstanding voting securities of the issuer, making the issuer an affiliate of the Fund, as defined in the Investment Company

Act of 1940, as amended, for the six months ended April 30, 2020. Details of transactions with affiliated companies for the six months ended April 30, 2020, are as follows:

|

|

Common Stocks

|

|||||||||||||||||

|

American

|

Encore

|

Marlin

|

|||||||||||||||

|

Woodmark

|

Capital

|

Business

|

|||||||||||||||

|

Corp.

|

Group, Inc.

|

Services Corp.

|

Total

|

||||||||||||||

|

Beginning Cost – November 1, 2019

|

$

|

63,553,435

|

$

|

104,853,067

|

$

|

15,865,289

|

$

|

184,271,791

|

|||||||||

|

Purchase Cost

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

|||||||||

|

Sales Cost

|

$

|

(2,365,758

|

)

|

$

|

(733,287

|

)

|

$

|

—

|

$

|

(3,099,045

|

)

|

||||||

|

Ending Cost – April 30, 2020

|

$

|

61,187,677

|

$

|

104,119,780

|

$

|

15,865,289

|

$

|

181,172,746

|

|||||||||

|

Dividend Income

|

$

|

—

|

$

|

—

|

$

|

282,876

|

$

|

282,876

|

|||||||||

|

Net Change in Unrealized

|

|||||||||||||||||

|

Appreciation/Depreciation

|

$

|

(63,726,485

|

)

|

$

|

(21,880,632

|

)

|

$

|

(13,234,576

|

)

|

$

|

(98,841,693

|

)

|

|||||

|

Realized Gain/Loss

|

$

|

750,628

|

$

|

(182,630

|

)

|

$

|

—

|

$

|

567,998

|

||||||||

|

Shares

|

1,325,021

|

3,067,416

|

1,010,273

|

5,402,710

|

|||||||||||||

|

Market Value – April 30, 2020

|

$

|

68,119,330

|

$

|

79,691,468

|

$

|

10,749,305

|

$

|

158,560,103

|

|||||||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Common Stocks

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Consumer Discretionary

|

$

|

305,857,158

|

$

|

—

|

$

|

—

|

$

|

305,857,158

|

||||||||

|

Financials

|

437,968,330

|

—

|

—

|

437,968,330

|

||||||||||||

|

Industrials

|

201,333,332

|

—

|

—

|

201,333,332

|

||||||||||||

|

Information Technology

|

58,866,255

|

—

|

—

|

58,866,255

|

||||||||||||

|

Total Common Stocks

|

$

|

1,004,025,075

|

$

|

—

|

$

|

—

|

$

|

1,004,025,075

|

||||||||

|

REITS

|

||||||||||||||||

|

Financials

|

$

|

105,602,028

|

$

|

—

|

$

|

—

|

$

|

105,602,028

|

||||||||

|

Total REITS

|

$

|

105,602,028

|

$

|

—

|

$

|

—

|

$

|

105,602,028

|

||||||||

|

Short-Term Investments

|

||||||||||||||||

|

Money Market Funds

|

$

|

19,440,273

|

$

|

—

|

$

|

—

|

$

|

19,440,273

|

||||||||

|

Total Short-Term Investments

|

$

|

19,440,273

|

$

|

—

|

$

|

—

|

$

|

19,440,273

|

||||||||

|

Total Investments

|

$

|

1,129,067,376

|

$

|

—

|

$

|

—

|

$

|

1,129,067,376

|

||||||||

|

HENNESSYFUNDS.COM

|

|

SCHEDULE OF INVESTMENTS/STATEMENT OF ASSETS AND LIABILITIES

|

|

Statement of Assets and Liabilities as of April 30, 2020 (Unaudited)

|

|

ASSETS:

|

||||

|

Investments in unaffiliated securities, at value (cost $434,271,409)

|

$

|

970,507,273

|

||

|

Investments in affiliated securities, at value (cost $181,172,746)

|

158,560,103

|

|||

|

Total investments in securities, at value (cost $615,444,155)

|

1,129,067,376

|

|||

|

Dividends and interest receivable

|

230,604

|

|||

|

Receivable for fund shares sold

|

771,727

|

|||

|

Receivable for securities sold

|

1,376,981

|

|||

|

Prepaid expenses and other assets

|

52,645

|

|||

|

Total assets

|

1,131,499,333

|

|||

|

LIABILITIES:

|

||||

|

Payable for fund shares redeemed

|

3,077,192

|

|||

|

Payable to advisor

|

811,578

|

|||

|

Payable to administrator

|

191,372

|

|||

|

Payable to auditor

|

11,373

|

|||

|

Accrued distribution fees

|

110,426

|

|||

|

Accrued service fees

|

58,014

|

|||

|

Accrued expenses and other payables

|

230,698

|

|||

|

Total liabilities

|

4,490,653

|

|||

|

NET ASSETS

|

$

|

1,127,008,680

|

||

|

NET ASSETS CONSISTS OF:

|

||||

|

Capital stock

|

$

|

355,862,305

|

||

|

Total distributable earnings

|

771,146,375

|

|||

|

Total net assets

|

$

|

1,127,008,680

|

||

|

NET ASSETS:

|

||||

|

Investor Class

|

||||

|

Shares authorized (no par value)

|

Unlimited

|

|||

|

Net assets applicable to outstanding shares

|

$

|

717,212,003

|

||

|

Shares issued and outstanding

|

11,308,379

|

|||

|

Net asset value, offering price, and redemption price per share

|

$

|

63.42

|

||

|

Institutional Class

|

||||

|

Shares authorized (no par value)

|