SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

|

CONTENTS

|

|

Letter to Shareholders

|

2

|

|

Performance Overview

|

4

|

|

Financial Statements

|

|

|

Schedule of Investments

|

7

|

|

Statement of Assets and Liabilities

|

12

|

|

Statement of Operations

|

13

|

|

Statements of Changes in Net Assets

|

15

|

|

Financial Highlights

|

16

|

|

Notes to the Financial Statements

|

20

|

|

Report of Independent Registered Public Accounting Firm

|

28

|

|

Trustees and Officers of the Fund

|

29

|

|

Expense Example

|

32

|

|

Proxy Voting

|

34

|

|

Quarterly Filings on Form N-Q

|

34

|

|

Householding

|

34

|

|

Privacy Policy

|

35

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

LETTER TO SHAREHOLDERS

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

One

|

Five

|

Ten

|

|

|

Year

|

Years

|

Years

|

|

|

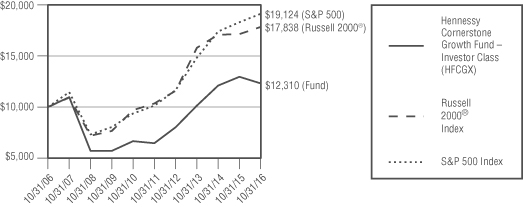

Hennessy Cornerstone Growth Fund –

|

|||

|

Investor Class (HFCGX)

|

-5.00%

|

13.77%

|

2.10%

|

|

Hennessy Cornerstone Growth Fund –

|

|||

|

Institutional Class (HICGX)(1)

|

-4.69%

|

14.10%

|

2.37%

|

|

Russell 2000® Index

|

4.11%

|

11.51%

|

5.96%

|

|

S&P 500 Index

|

4.51%

|

13.57%

|

6.70%

|

|

(1)

|

The inception date of Institutional Class shares is March 3, 2008. Performance shown prior to the inception of Institutional Class shares reflects the performance of Investor Class shares and includes expenses that are not applicable to and are higher than those of Institutional Class shares.

|

|

PERFORMANCE OVERVIEW

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

PERFORMANCE OVERVIEW/SCHEDULE OF INVESTMENTS

|

|

Schedule of Investments as of October 31, 2016

|

|

TOP TEN HOLDINGS (EXCLUDING CASH/CASH EQUIVALENTS)

|

% NET ASSETS

|

|

Insperity, Inc.

|

2.97%

|

|

John Bean Technologies Corp.

|

2.85%

|

|

Itron, Inc.

|

2.54%

|

|

Burlington Stores, Inc.

|

2.51%

|

|

Ingredion, Inc.

|

2.43%

|

|

NeoPhotonics Corp.

|

2.40%

|

|

Astec Industries, Inc.

|

2.39%

|

|

Brady Corp., Class A

|

2.38%

|

|

UGI Corp.

|

2.35%

|

|

Superior Industries International, Inc.

|

2.33%

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

COMMON STOCKS – 97.80%

|

Number

|

% of

|

|||||||||||

|

of Shares

|

Value

|

Net Assets

|

|||||||||||

|

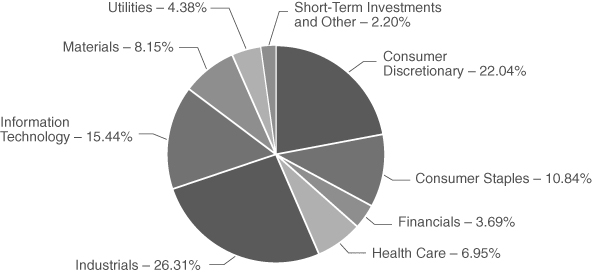

Consumer Discretionary – 22.04%

|

|||||||||||||

|

BJ’s Restaurants, Inc. (a)

|

89,600

|

$

|

3,234,560

|

1.54

|

%

|

||||||||

|

Burlington Stores, Inc. (a)

|

70,400

|

5,275,776

|

2.51

|

%

|

|||||||||

|

Dollar General Corp.

|

53,200

|

3,675,588

|

1.75

|

%

|

|||||||||

|

Genesco, Inc. (a)

|

59,800

|

3,217,240

|

1.53

|

%

|

|||||||||

|

Genuine Parts Co.

|

43,800

|

3,967,842

|

1.89

|

%

|

|||||||||

|

Movado Group, Inc.

|

135,200

|

2,981,160

|

1.42

|

%

|

|||||||||

|

Omnicom Group, Inc.

|

50,700

|

4,046,874

|

1.92

|

%

|

|||||||||

|

Potbelly Corp. (a)

|

314,600

|

4,105,530

|

1.95

|

%

|

|||||||||

|

Superior Industries International, Inc.

|

199,900

|

4,897,550

|

2.33

|

%

|

|||||||||

|

Target Corp.

|

50,300

|

3,457,119

|

1.64

|

%

|

|||||||||

|

The Children’s Place, Inc.

|

57,900

|

4,397,505

|

2.09

|

%

|

|||||||||

|

Vista Outdoor, Inc. (a)

|

80,100

|

3,097,467

|

1.47

|

%

|

|||||||||

|

46,354,211

|

22.04

|

%

|

|||||||||||

|

Consumer Staples – 10.84%

|

|||||||||||||

|

Amira Nature Foods, Ltd. (a)(b)

|

310,100

|

2,431,184

|

1.15

|

%

|

|||||||||

|

Dean Foods Co.

|

204,700

|

3,737,822

|

1.78

|

%

|

|||||||||

|

Ingredion, Inc.

|

39,000

|

5,115,630

|

2.43

|

%

|

|||||||||

|

John B. Sanfilippo & Son, Inc.

|

56,700

|

2,873,556

|

1.37

|

%

|

|||||||||

|

Post Holdings, Inc. (a)

|

56,800

|

4,329,864

|

2.06

|

%

|

|||||||||

|

Tyson Foods, Inc., Class A

|

61,000

|

4,321,850

|

2.05

|

%

|

|||||||||

|

22,809,906

|

10.84

|

%

|

|||||||||||

|

Financials – 3.69%

|

|||||||||||||

|

The Progressive Corp.

|

123,700

|

3,897,787

|

1.85

|

%

|

|||||||||

|

United Fire Group, Inc.

|

97,900

|

3,869,008

|

1.84

|

%

|

|||||||||

|

7,766,795

|

3.69

|

%

|

|||||||||||

|

Health Care – 6.95%

|

|||||||||||||

|

Henry Schein, Inc. (a)

|

23,900

|

3,565,880

|

1.70

|

%

|

|||||||||

|

Owens & Minor, Inc.

|

100,200

|

3,251,490

|

1.55

|

%

|

|||||||||

|

Triple-S Management Corp., Class B (a)(b)

|

150,600

|

3,114,408

|

1.48

|

%

|

|||||||||

|

UnitedHealth Group, Inc.

|

33,100

|

4,678,023

|

2.22

|

%

|

|||||||||

|

14,609,801

|

6.95

|

%

|

|||||||||||

|

SCHEDULE OF INVESTMENTS

|

|

COMMON STOCKS

|

Number

|

% of

|

|||||||||||

|

of Shares

|

Value

|

Net Assets

|

|||||||||||

|

Industrials – 26.31%

|

|||||||||||||

|

Air Transport Services Group, Inc. (a)

|

341,800

|

$

|

4,522,014

|

2.15

|

%

|

||||||||

|

Astec Industries, Inc.

|

90,900

|

5,032,224

|

2.39

|

%

|

|||||||||

|

Brady Corp., Class A

|

151,100

|

5,001,410

|

2.38

|

%

|

|||||||||

|

Briggs & Stratton Corp.

|

185,600

|

3,455,872

|

1.64

|

%

|

|||||||||

|

C.H. Robinson Worldwide, Inc.

|

56,500

|

3,848,780

|

1.83

|

%

|

|||||||||

|

Hawaiian Holdings, Inc. (a)

|

91,800

|

4,133,295

|

1.97

|

%

|

|||||||||

|

Huntington Ingalls Industries, Inc.

|

30,100

|

4,856,936

|

2.31

|

%

|

|||||||||

|

Insperity, Inc.

|

83,100

|

6,249,120

|

2.97

|

%

|

|||||||||

|

Insteel Industries, Inc.

|

150,800

|

4,056,520

|

1.93

|

%

|

|||||||||

|

John Bean Technologies Corp.

|

75,100

|

5,996,735

|

2.85

|

%

|

|||||||||

|

Kaman Corp.

|

89,900

|

3,925,034

|

1.87

|

%

|

|||||||||

|

Watsco, Inc.

|

31,000

|

4,255,990

|

2.02

|

%

|

|||||||||

|

55,333,930

|

26.31

|

%

|

|||||||||||

|

Information Technology – 15.44%

|

|||||||||||||

|

Arrow Electronics, Inc. (a)

|

69,100

|

4,223,392

|

2.01

|

%

|

|||||||||

|

Convergys Corp.

|

153,100

|

4,470,520

|

2.12

|

%

|

|||||||||

|

Itron, Inc. (a)

|

99,100

|

5,341,490

|

2.54

|

%

|

|||||||||

|

NeoPhotonics Corp. (a)

|

360,200

|

5,042,800

|

2.40

|

%

|

|||||||||

|

Orbotech, Ltd. (a)(b)

|

174,300

|

4,775,820

|

2.27

|

%

|

|||||||||

|

SYNNEX Corp.

|

42,000

|

4,306,680

|

2.05

|

%

|

|||||||||

|

Tech Data Corp. (a)

|

56,100

|

4,320,822

|

2.05

|

%

|

|||||||||

|

32,481,524

|

15.44

|

%

|

|||||||||||

|

Materials – 8.15%

|

|||||||||||||

|

Avery Dennison Corp.

|

60,600

|

4,229,274

|

2.01

|

%

|

|||||||||

|

Bemis Co., Inc.

|

80,500

|

3,921,960

|

1.86

|

%

|

|||||||||

|

Reliance Steel & Aluminum Co.

|

64,800

|

4,456,944

|

2.12

|

%

|

|||||||||

|

Sonoco Products Co.

|

90,300

|

4,541,187

|

2.16

|

%

|

|||||||||

|

17,149,365

|

8.15

|

%

|

|||||||||||

|

Utilities – 4.38%

|

|||||||||||||

|

Exelon Corp.

|

125,400

|

4,272,378

|

2.03

|

%

|

|||||||||

|

UGI Corp.

|

106,800

|

4,943,772

|

2.35

|

%

|

|||||||||

|

9,216,150

|

4.38

|

%

|

|||||||||||

|

Total Common Stocks

|

|||||||||||||

|

(Cost $198,765,034)

|

205,721,682

|

97.80

|

%

|

||||||||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

RIGHTS – 0.00%

|

Number

|

% of

|

|||||||||||

|

of Shares

|

Value

|

Net Assets

|

|||||||||||

|

Health Care – 0.00%

|

|||||||||||||

|

Forest Laboratories, Inc. (a)(c)

|

5,500

|

$

|

275

|

0.00

|

%

|

||||||||

|

Total Rights

|

|||||||||||||

|

(Cost $0)

|

275

|

0.00

|

%

|

||||||||||

|

SHORT-TERM INVESTMENTS – 2.46%

|

|||||||||||||

|

Money Market Funds – 2.46%

|

|||||||||||||

|

Fidelity Government Portfolio,

|

|||||||||||||

|

Institutional Class, 0.27% (d)

|

5,179,813

|

5,179,813

|

2.46

|

%

|

|||||||||

|

Total Short-Term Investments

|

|||||||||||||

|

(Cost $5,179,813)

|

5,179,813

|

2.46

|

%

|

||||||||||

|

Total Investments

|

|||||||||||||

|

(Cost $203,944,847) – 100.26%

|

210,901,770

|

100.26

|

%

|

||||||||||

|

Liabilities in Excess

|

|||||||||||||

|

of Other Assets – (0.26)%

|

(546,091

|

)

|

(0.26

|

)%

|

|||||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

210,355,679

|

100.00

|

%

|

|||||||||

|

(a)

|

Non-income producing security.

|

|

(b)

|

U.S. traded security of a foreign corporation.

|

|

(c)

|

Security is fair valued in good faith.

|

|

(d)

|

The rate listed is the fund’s 7-day yield as of October 31, 2016.

|

|

SCHEDULE OF INVESTMENTS

|

|

Common Stocks

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Consumer Discretionary

|

$

|

46,354,211

|

$

|

—

|

$

|

—

|

$

|

46,354,211

|

||||||||

|

Consumer Staples

|

22,809,906

|

—

|

—

|

22,809,906

|

||||||||||||

|

Financials

|

7,766,795

|

—

|

—

|

7,766,795

|

||||||||||||

|

Health Care

|

14,609,801

|

—

|

—

|

14,609,801

|

||||||||||||

|

Industrials

|

55,333,930

|

—

|

—

|

55,333,930

|

||||||||||||

|

Information Technology

|

32,481,524

|

—

|

—

|

32,481,524

|

||||||||||||

|

Materials

|

17,149,365

|

—

|

—

|

17,149,365

|

||||||||||||

|

Utilities

|

9,216,150

|

—

|

—

|

9,216,150

|

||||||||||||

|

Total Common Stocks

|

$

|

205,721,682

|

$

|

—

|

$

|

—

|

$

|

205,721,682

|

||||||||

|

Rights

|

||||||||||||||||

|

Health Care

|

$

|

—

|

$

|

—

|

$

|

275

|

*

|

$

|

275

|

|||||||

|

Total Rights

|

$

|

—

|

$

|

—

|

$

|

275

|

$

|

275

|

||||||||

|

Short-Term Investments

|

||||||||||||||||

|

Money Market Funds

|

$

|

5,179,813

|

$

|

—

|

$

|

—

|

$

|

5,179,813

|

||||||||

|

Total Short-Term Investments

|

$

|

5,179,813

|

$

|

—

|

$

|

—

|

$

|

5,179,813

|

||||||||

|

Total Investments

|

$

|

210,901,495

|

$

|

—

|

$

|

275

|

$

|

210,901,770

|

||||||||

|

*

|

Acquired as partial consideration in an acquisition of an issuer whose securities were held by the Fund immediately prior to such acquisition.

|

|

Rights

|

||||

|

Balance as of October 31, 2015

|

$

|

275

|

||

|

Accrued discounts/premiums

|

—

|

|||

|

Realized gain (loss)

|

—

|

|||

|

Change in unrealized appreciation (depreciation)

|

—

|

|||

|

Purchases

|

—

|

|||

|

(Sales)

|

—

|

|||

|

Transfer in and/or out of Level 3

|

—

|

|||

|

Balance as of October 31, 2016

|

$

|

275

|

||

|

Change in unrealized appreciation/depreciation during the period for

|

||||

|

Level 3 investments held at October 31, 2016

|

$

|

—

|

||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Statement of Assets and Liabilities as of October 31, 2016

|

|

ASSETS:

|

||||

|

Investments in securities, at value (cost $203,944,847)

|

$

|

210,901,770

|

||

|

Dividends and interest receivable

|

622

|

|||

|

Receivable for fund shares sold

|

4,801

|

|||

|

Prepaid expenses and other assets

|

30,672

|

|||

|

Total Assets

|

210,937,865

|

|||

|

LIABILITIES:

|

||||

|

Payable for fund shares redeemed

|

223,869

|

|||

|

Payable to advisor

|

135,746

|

|||

|

Payable to administrator

|

36,812

|

|||

|

Payable to auditor

|

27,579

|

|||

|

Accrued distribution fees

|

71,609

|

|||

|

Accrued service fees

|

16,088

|

|||

|

Accrued trustees fees

|

3,872

|

|||

|

Accrued expenses and other payables

|

66,611

|

|||

|

Total Liabilities

|

582,186

|

|||

|

NET ASSETS

|

$

|

210,355,679

|

||

|

NET ASSETS CONSIST OF:

|

||||

|

Capital stock

|

$

|

310,276,652

|

||

|

Accumulated net investment loss

|

(180,958

|

)

|

||

|

Accumulated net realized loss on investments

|

(106,696,938

|

)

|

||

|

Unrealized net appreciation on investments

|

6,956,923

|

|||

|

Total Net Assets

|

$

|

210,355,679

|

||

|

NET ASSETS

|

||||

|

Investor Class:

|

||||

|

Shares authorized (no par value)

|

Unlimited

|

|||

|

Net assets applicable to outstanding Investor Class shares

|

$

|

184,614,311

|

||

|

Shares issued and outstanding

|

9,725,748

|

|||

|

Net asset value, offering price and redemption price per share

|

$

|

18.98

|

||

|

Institutional Class:

|

||||

|

Shares authorized (no par value)

|

Unlimited

|

|||

|

Net assets applicable to outstanding Institutional Class shares

|

$

|

25,741,368

|

||

|

Shares issued and outstanding

|

1,322,800

|

|||

|

Net asset value, offering price and redemption price per share

|

$

|

19.46

|

||

|

STATEMENT OF ASSETS AND LIABILITIES/STATEMENT OF OPERATIONS

|

|

Statement of Operations for the year ended October 31, 2016

|

|

INVESTMENT INCOME:

|

||||

|

Dividend income

|

$

|

2,803,007

|

||

|

Interest income

|

12,462

|

|||

|

Total investment income

|

2,815,469

|

|||

|

EXPENSES:

|

||||

|

Investment advisory fees (See Note 5)

|

1,839,205

|

|||

|

Sub-transfer agent expenses – Investor Class (See Note 5)

|

363,691

|

|||

|

Sub-transfer agent expenses – Institutional Class (See Note 5)

|

24,712

|

|||

|

Distribution fees – Investor Class (See Note 5)

|

324,967

|

|||

|

Administration, fund accounting, custody and transfer agent fees (See Note 5)

|

242,477

|

|||

|

Service fees – Investor Class (See Note 5)

|

216,645

|

|||

|

Audit fees

|

28,766

|

|||

|

Federal and state registration fees

|

27,330

|

|||

|

Reports to shareholders

|

25,751

|

|||

|

Compliance expense (See Note 5)

|

23,709

|

|||

|

Trustees’ fees and expenses

|

15,948

|

|||

|

Interest expense (See Note 7)

|

5,265

|

|||

|

Legal fees

|

2,743

|

|||

|

Other expenses

|

20,367

|

|||

|

Total expenses

|

3,161,576

|

|||

|

NET INVESTMENT LOSS

|

$

|

(346,107

|

)

|

|

|

REALIZED AND UNREALIZED LOSSES:

|

||||

|

Net realized loss on investments

|

$

|

(8,409,990

|

)

|

|

|

Net change in unrealized appreciation on investments

|

(5,945,754

|

)

|

||

|

Net loss on investments

|

(14,355,744

|

)

|

||

|

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

(14,701,851

|

)

|

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

STATEMENTS OF CHANGES IN NET ASSETS

|

|

Statements of Changes in Net Assets

|

|

Year Ended

|

Year Ended

|

|||||||

|

October 31, 2016

|

October 31, 2015

|

|||||||

|

OPERATIONS:

|

||||||||

|

Net investment income (loss)

|

$

|

(346,107

|

)

|

$

|

926,445

|

|||

|

Net realized gain (loss) on investments

|

(8,409,990

|

)

|

50,172,808

|

|||||

|

Net change in unrealized appreciation on investments

|

(5,945,754

|

)

|

(32,171,870

|

)

|

||||

|

Net increase (decrease) in net

|

||||||||

|

assets resulting from operations

|

(14,701,851

|

)

|

18,927,383

|

|||||

|

DISTRIBUTIONS TO SHAREHOLDERS FROM:

|

||||||||

|

Net investment income

|

||||||||

|

Investor Class

|

(255,352

|

)

|

—

|

|||||

|

Institutional Class

|

(98,941

|

)

|

—

|

|||||

|

Total distributions

|

(354,293

|

)

|

—

|

|||||

|

CAPITAL SHARE TRANSACTIONS:

|

||||||||

|

Proceeds from shares subscribed – Investor Class

|

23,250,634

|

52,930,420

|

||||||

|

Proceeds from shares subscribed – Institutional Class

|

4,485,262

|

31,992,911

|

||||||

|

Dividends reinvested – Investor Class

|

249,654

|

—

|

||||||

|

Dividends reinvested – Institutional Class

|

93,766

|

—

|

||||||

|

Cost of shares redeemed – Investor Class

|

(74,707,125

|

)

|

(48,171,421

|

)

|

||||

|

Cost of shares redeemed – Institutional Class

|

(15,664,076

|

)

|

(21,201,209

|

)

|

||||

|

Net increase (decrease) in net assets derived

|

||||||||

|

from capital share transactions

|

(62,291,885

|

)

|

15,550,701

|

|||||

|

TOTAL INCREASE (DECREASE) IN NET ASSETS

|

(77,348,029

|

)

|

34,478,084

|

|||||

|

NET ASSETS:

|

||||||||

|

Beginning of year

|

287,703,708

|

253,225,624

|

||||||

|

End of year

|

$

|

210,355,679

|

$

|

287,703,708

|

||||

|

Undistributed net investment

|

||||||||

|

income (loss), end of year

|

$

|

(180,958

|

)

|

$

|

354,293

|

|||

|

CHANGES IN SHARES OUTSTANDING:

|

||||||||

|

Shares sold – Investor Class

|

1,215,295

|

2,691,286

|

||||||

|

Shares sold – Institutional Class

|

231,105

|

1,609,045

|

||||||

|

Shares issued to holders as

|

||||||||

|

reinvestment of dividends – Investor Class

|

12,816

|

—

|

||||||

|

Shares issued to holders as reinvestment

|

||||||||

|

of dividends – Institutional Class

|

4,710

|

—

|

||||||

|

Shares redeemed – Investor Class

|

(3,937,410

|

)

|

(2,447,997

|

)

|

||||

|

Shares redeemed – Institutional Class

|

(816,510

|

)

|

(1,044,452

|

)

|

||||

|

Net increase (decrease) in shares outstanding

|

(3,289,994

|

)

|

807,882

|

|||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Financial Highlights

|

|

(1)

|

Portfolio turnover is calculated on the basis of the Fund as a whole.

|

|

FINANCIAL HIGHLIGHTS — INVESTOR CLASS

|

|

Year Ended October 31,

|

||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

$

|

20.00

|

$

|

18.68

|

$

|

15.65

|

$

|

12.38

|

$

|

9.97

|

|||||||||

|

(0.02

|

)

|

0.06

|

(0.04

|

)

|

(0.11

|

)

|

(0.07

|

)

|

||||||||||

|

(0.98

|

)

|

1.26

|

3.07

|

3.38

|

2.48

|

|||||||||||||

|

(1.00

|

)

|

1.32

|

3.03

|

3.27

|

2.41

|

|||||||||||||

|

(0.02

|

)

|

—

|

—

|

—

|

—

|

|||||||||||||

|

(0.02

|

)

|

—

|

—

|

—

|

—

|

|||||||||||||

|

$

|

18.98

|

$

|

20.00

|

$

|

18.68

|

$

|

15.65

|

$

|

12.38

|

|||||||||

|

(5.00

|

)%

|

7.07

|

%

|

19.36

|

%

|

26.41

|

%

|

24.17

|

%

|

|||||||||

|

$

|

184.61

|

$

|

248.74

|

$

|

227.68

|

$

|

220.83

|

$

|

265.60

|

|||||||||

|

1.32

|

%

|

1.15

|

%

|

1.23

|

%

|

1.29

|

%

|

1.34

|

%

|

|||||||||

|

(0.18

|

)%

|

0.30

|

%

|

(0.17

|

)%

|

(0.26

|

)%

|

(0.66

|

)%

|

|||||||||

|

97

|

%

|

102

|

%

|

84

|

%

|

105

|

%

|

90

|

%

|

|||||||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Financial Highlights

|

|

(1)

|

Portfolio turnover is calculated on the basis of the Fund as a whole.

|

|

FINANCIAL HIGHLIGHTS — INSTITUTIONAL CLASS

|

|

Year Ended October 31,

|

||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

$

|

20.47

|

$

|

19.08

|

$

|

15.94

|

$

|

12.57

|

$

|

10.09

|

|||||||||

|

0.17

|

0.03

|

0.06

|

0.01

|

(0.04

|

)

|

|||||||||||||

|

(1.13

|

)

|

1.36

|

3.08

|

3.36

|

2.52

|

|||||||||||||

|

(0.96

|

)

|

1.39

|

3.14

|

3.37

|

2.48

|

|||||||||||||

|

(0.05

|

)

|

—

|

—

|

—

|

—

|

|||||||||||||

|

(0.05

|

)

|

—

|

—

|

—

|

—

|

|||||||||||||

|

$

|

19.46

|

$

|

20.47

|

$

|

19.08

|

$

|

15.94

|

$

|

12.57

|

|||||||||

|

(4.69

|

)%

|

7.29

|

%

|

19.70

|

%

|

26.81

|

%

|

24.58

|

%

|

|||||||||

|

$

|

25.74

|

$

|

38.96

|

$

|

25.54

|

$

|

26.23

|

$

|

37.11

|

|||||||||

|

0.98

|

%

|

0.99

|

%

|

1.03

|

%

|

1.11

|

%

|

1.11

|

%

|

|||||||||

|

0.98

|

%

|

0.99

|

%

|

0.98

|

%

|

0.98

|

%

|

0.98

|

%

|

|||||||||

|

0.14

|

%

|

0.51

|

%

|

0.03

|

%

|

(0.01

|

)%

|

(0.51

|

)%

|

|||||||||

|

0.14

|

%

|

0.51

|

%

|

0.08

|

%

|

0.12

|

%

|

(0.38

|

)%

|

|||||||||

|

97

|

%

|

102

|

%

|

84

|

%

|

105

|

%

|

90

|

%

|

|||||||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Notes to the Financial Statements October 31, 2016

|

|

a).

|

Investment Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 3.

|

|

b).

|

Federal Income Taxes – No provision for federal income taxes or excise taxes has been made since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all of its taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Net investment income or loss and realized gains and losses for federal income tax purposes may differ from that reported on the financial statements because of temporary book and tax basis differences. Temporary differences are primarily the result of the treatment of wash sales for tax reporting purposes. The Fund recognizes interest and penalties related to income tax benefits, if any, in the statement of operations as an income tax expense. Distributions from net realized gains for book purposes may include short-term capital gains, which are included as ordinary income to shareholders for tax purposes.

|

|

Due to inherent differences in the recognition of income, expenses, and realized gains/losses under GAAP and federal income tax regulations, permanent differences

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

between book and tax basis for reporting for the fiscal year ended October 31, 2016, have been identified and appropriately reclassified on the Statement of Assets and Liabilities. The adjustments are as follows:

|

|

Undistributed

|

Accumulated

|

|||

|

Net Investment

|

Net Realized

|

|||

|

Income/(Loss)

|

Gain/(Loss)

|

Paid-in Capital

|

||

|

$165,149

|

$1,040,214

|

$(1,205,363)

|

|

c).

|

Accounting for Uncertainty in Income Taxes – The Fund has accounting policies regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The tax returns of the Fund for the prior three fiscal years are open for examination. The Fund has reviewed all open tax years in major jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on a tax return. The Fund’s major tax jurisdictions are U.S. federal and Delaware.

|

|

d).

|

Income and Expenses – Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund. Interest income, which includes the amortization of premium and accretion of discount, is recognized on an accrual basis. The Fund is charged for those expenses that are directly attributable to the portfolio, such as advisory, administration, and certain shareholder service fees. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its respective net assets.

|

|

e).

|

Distributions to Shareholders – Dividends from net investment income for the Fund, if any, are declared and paid annually, usually in December. Distributions of net realized capital gains, if any, are declared and paid annually, usually in December.

|

|

f).

|

Security Transactions – Investment and shareholder transactions are recorded on the trade date. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sale proceeds. Discounts and premiums on securities purchased are accreted/amortized over the life of the respective security.

|

|

g).

|

Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported change in net assets during the reporting period. Actual results could differ from those estimates.

|

|

h).

|

Share Valuation – The net asset value (“NAV”) per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on days the New York Stock Exchange is closed for trading. The offering and redemption price per share for the Fund is equal to the Fund’s NAV per share.

|

|

i).

|

Foreign Currency – Values of investments denominated in foreign currencies, if any, are converted into U.S. dollars using the spot market rate of exchange at the time of valuation. Purchases and sales of investments and income are translated into U.S. dollars using the spot market rate of exchange prevailing on the respective dates of such transactions. The Fund does not isolate the portion of the results of operations resulting from

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

fluctuations in foreign exchange rates on investments from fluctuations resulting from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments. Foreign investments present additional risks due to currency fluctuations, economic and political factors, lower liquidity, government regulations, differences in accounting standards, and other factors.

|

|

|

j).

|

Forward Contracts – The Fund may enter into forward currency contracts to reduce its exposure to changes in foreign currency exchange rates on its foreign holdings and to lock in the U.S. dollar cost of firm purchase and sale commitments for securities denominated in foreign currencies. A forward currency contract is a commitment to purchase or sell a foreign currency at a future date at a negotiated forward rate. The gain or loss arising from the difference between the U.S. dollar cost of the original contract and the value of the foreign currency in U.S. dollars upon closing of such contract is included in net realized gain or loss from foreign currency transactions. During the fiscal year ended October 31, 2016, the Fund did not enter into any forward contracts.

|

|

k).

|

Repurchase Agreements – The Fund may enter into repurchase agreements with member banks or security dealers of the Federal Reserve Board whom the investment advisor deems creditworthy. The repurchase price generally equals the price paid by the Fund plus interest negotiated on the basis of current short-term rates.

|

|

Securities pledged as collateral for repurchase agreements are held by the custodian bank until the respective agreements mature. Provisions of the repurchase agreements ensure that the market value of the collateral, including accrued interest thereon, is sufficient to cover the repurchase amount in the event of default of the counterparty. If the counterparty defaults and the value of the collateral declines or if the counterparty enters an insolvency proceeding, realization of the collateral by the Fund may be delayed or limited. During the fiscal year ended October 31, 2016, the Fund did not enter into any repurchase agreements.

|

|

|

l).

|

New Accounting Pronouncements – In May 2015, the FASB issued ASU No. 2015-07 “Disclosure for Investments in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent).” The amendments in ASU No. 2015-07 remove the requirement to categorize within the fair value hierarchy investments measured at NAV and require the disclosure of sufficient information to reconcile the fair value of the remaining assets categorized within the fair value hierarchy to the financial statements. The amendments in ASU No. 2015-07 are effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. Management has reviewed the requirements and believes the adoption of ASU 2015-07 will not have a material impact on the Fund’s financial statements and related disclosures.

|

|

Level 1 –

|

Unadjusted, quoted prices in active markets for identical instruments that the Fund has the ability to access at the date of measurement.

|

|

|

Level 2 –

|

Other significant observable inputs (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

that are not active for identical or similar instruments, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets (such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data)).

|

||

|

Level 3 –

|

Significant unobservable inputs (including the Fund’s own assumptions about what market participants would use to price the asset or liability based on the best available information) when observable inputs are unavailable.

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

Cost of investments for tax purposes

|

$

|

203,944,847

|

|||

|

Gross tax unrealized appreciation

|

$

|

18,628,329

|

|||

|

Gross tax unrealized depreciation

|

(11,671,406

|

)

|

|||

|

Net tax unrealized appreciation

|

$

|

6,956,923

|

|||

|

Undistributed ordinary income

|

$

|

—

|

|||

|

Undistributed long-term capital gains

|

—

|

||||

|

Total distributable earnings

|

$

|

—

|

|||

|

Other accumulated loss

|

$

|

(106,877,896

|

)

|

||

|

Total accumulated loss

|

$

|

(99,920,973

|

)

|

|

$97,943,326

|

October 31, 2017

|

|

|

$8,753,612

|

Indefinite ST

|

|

Year Ended

|

Year Ended

|

||||||||

|

October 31, 2016

|

October 31, 2015

|

||||||||

|

Ordinary income(1)

|

$

|

354,293

|

$

|

—

|

|||||

|

Long-term capital gain

|

—

|

—

|

|||||||

|

$

|

354,293

|

$

|

—

|

||||||

|

(1) Ordinary income includes short-term gain or loss.

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM/TRUSTEES AND OFFICERS

|

|

Other

|

|||

|

Directorships

|

|||

|

Held Outside

|

|||

|

Name, (Year of Birth),

|

of Fund

|

||

|

and Position Held

|

Start Date

|

Principal Occupation(s)

|

Complex During

|

|

with the Trust

|

of Service

|

During Past Five Years

|

Past Five Years(1)

|

|

Disinterested Trustees and Advisers

|

|||

|

J. Dennis DeSousa

|

January 1996

|

Mr. DeSousa is a real estate investor.

|

None.

|

|

(1936)

|

|||

|

Trustee

|

|||

|

Robert T. Doyle

|

January 1996

|

Mr. Doyle has been the Sheriff of

|

None.

|

|

(1947)

|

Marin County, California since 1996.

|

||

|

Trustee

|

|||

|

Gerald P. Richardson

|

May 2004

|

Mr. Richardson is an independent

|

None.

|

|

(1945)

|

consultant in the securities industry.

|

||

|

Trustee

|

|||

|

Brian Alexander

|

March 2015

|

Mr. Alexander has been employed

|

None.

|

|

(1981)

|

by Sutter Health Novato Community

|

||

|

Adviser to the Board

|

Hospital since 2012, first as an

|

||

|

Assistant Administrator and then,

|

|||

|

beginning in 2013, as the Chief

|

|||

|

Administrative Officer. From 2011

|

|||

|

through 2012, Mr. Alexander was

|

|||

|

employed by Sutter Health West Bay

|

|||

|

Region as the Regional Director of

|

|||

|

Strategic Decision Support. Prior to

|

|||

|

that, in 2011, he served as the

|

|||

|

Director of Managed Care

|

|||

|

Contracting and also the Director of

|

|||

|

Compensation, Benefits, and

|

|||

|

Compliance for the Rehabilitation

|

|||

|

Institute of Chicago.

|

|||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Other

|

|||

|

Directorships

|

|||

|

Held Outside

|

|||

|

Name, (Year of Birth),

|

of Fund

|

||

|

and Position Held

|

Start Date

|

Principal Occupation(s)

|

Complex During

|

|

with the Trust

|

of Service

|

During Past Five Years

|

Past Five Years(1)

|

|

Doug Franklin

|

March 2016

|

Mr. Franklin is a retired insurance

|

None.

|

|

(1964)

|

industry executive. From 1987

|

||

|

Adviser to the Board

|

through 2015, he was employed by

|

||

|

the Allianz-Fireman’s Fund Insurance

|

|||

|

Company in various positions,

|

|||

|

including as its Chief Actuary and

|

|||

|

Chief Risk Officer.

|

|||

|

Claire Knoles

|

December 2015

|

Ms. Knoles is a founder of Kiosk and

|

None.

|

|

(1974)

|

has served as its Chief Operating

|

||

|

Adviser to the Board

|

Officer since 2004. Kiosk is a full

|

||

|

service marketing agency with

|

|||

|

offices in the San Francisco Bay

|

|||

|

Area, Toronto, and Liverpool, UK.

|

|||

|

Interested Trustee(2)

|

|||

|

Neil J. Hennessy

|

January 1996 as

|

Mr. Hennessy has been employed by

|

Hennessy

|

|

(1956)

|

a Trustee and

|

Hennessy Advisors, Inc. since 1989

|

Advisors, Inc.

|

|

Trustee, Chairman of

|

June 2008 as

|

and currently serves as its President,

|

|

|

the Board, Chief

|

an Officer

|

Chairman and Chief Executive Officer.

|

|

|

Investment Officer,

|

|||

|

Portfolio Manager,

|

|||

|

and President

|

|

Name, (Year of Birth),

|

||

|

and Position Held

|

Start Date

|

Principal Occupation(s)

|

|

with the Trust

|

of Service

|

During Past Five Years

|

|

Officers

|

||

|

Teresa M. Nilsen

|

January 1996

|

Ms. Nilsen has been employed by Hennessy Advisors, Inc.

|

|

(1966)

|

since 1989 and currently serves as its Executive Vice President,

|

|

|

Executive Vice President

|

Chief Operations Officer, Chief Financial Officer, and Secretary.

|

|

|

and Treasurer

|

||

|

Daniel B. Steadman

|

March 2000

|

Mr. Steadman has been employed by Hennessy Advisors, Inc.

|

|

(1956)

|

since 2000 and currently serves as its Executive Vice President

|

|

|

Executive Vice President

|

and Chief Compliance Officer.

|

|

|

and Secretary

|

||

|

Jennifer Cheskiewicz

|

June 2013

|

Ms. Cheskiewicz has been employed by Hennessy Advisors, Inc.

|

|

(1977)

|

as its General Counsel since June 2013. She previously served

|

|

|

Senior Vice President and

|

as in-house counsel to Carlson Capital, L.P., an SEC-registered

|

|

|

Chief Compliance Officer

|

investment advisor to several private funds, from

|

|

|

February 2010 to May 2013.

|

||

|

Brian Carlson

|

December 2013

|

Mr. Carlson has been employed by Hennessy Advisors, Inc.

|

|

(1972)

|

since December 2013. Mr. Carlson was previously a co-founder

|

|

|

Senior Vice President and

|

and principal of Trivium Consultants, LLC from February 2011

|

|

|

Head of Distribution

|

through November 2013.

|

|

TRUSTEES AND OFFICERS OF THE FUND

|

|

Name, (Year of Birth),

|

||

|

and Position Held

|

Start Date

|

Principal Occupation(s)

|

|

with the Trust

|

of Service

|

During Past Five Years

|

|

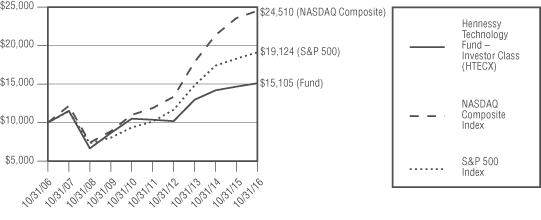

David Ellison

|

October 2012

|

Mr. Ellison has been employed by Hennessy Advisors, Inc. since

|

|

(1958)(3)

|

October 2012. He has served as a Portfolio Manager of the

|

|

|

Senior Vice President and

|

Hennessy Small Cap Financial Fund, the Hennessy Large Cap

|

|

|

Portfolio Manager

|

Financial Fund, and the Hennessy Technology Fund since

|

|

|

inception. Prior to that, Mr. Ellison served as Director, CIO and

|

||

|

President of FBR Fund Advisers, Inc. from December

|

||

|

1999 to October 2012.

|

||

|

Brian Peery

|

March 2003 as

|

Mr. Peery has been employed by Hennessy Advisors, Inc. since

|

|

(1969)

|

an Officer and

|

2002. He has served as a Portfolio Manager of the Hennessy

|

|

Senior Vice President and

|

February 2011

|

Cornerstone Growth Fund, the Hennessy Cornerstone Mid Cap

|

|

Portfolio Manager

|

as a Co-Portfolio

|

30 Fund, the Hennessy Cornerstone Large Growth Fund, the

|

|

Manager or

|

Hennessy Cornerstone Value Fund, the Hennessy Total Return

|

|

|

Portfolio Manager

|

Fund, and the Hennessy Balanced Fund since October 2014.

|

|

|

He served as Co-Portfolio Manager of the same funds from

|

||

|

February 2011 through September 2014. Mr. Peery has also

|

||

|

served as a Portfolio Manager of the Hennessy Gas Utility Fund

|

||

|

since February 2015.

|

||

|

Winsor (Skip) Aylesworth

|

October 2012

|

Mr. Aylesworth has been employed by Hennessy Advisors, Inc.

|

|

(1947)(3)

|

since October 2012. He has served as a Portfolio Manager of

|

|

|

Vice President and

|

the Hennessy Gas Utility Fund since 1998 and as a Portfolio

|

|

|

Portfolio Manager

|

Manager of the Hennessy Technology Fund since inception.

|

|

|

Prior to that, Mr. Aylesworth served as Executive Vice President

|

||

|

of FBR Fund Advisers, Inc. from 1999 to October 2012.

|

||

|

Ryan Kelley

|

March 2013

|

Mr. Kelley has been employed by Hennessy Advisors, Inc. since

|

|

(1972)(4)

|

October 2012. He has served as a Portfolio Manager of the

|

|

|

Vice President and

|

Hennessy Gas Utility Fund, the Hennessy Small Cap Financial

|

|

|

Portfolio Manager

|

Fund, and the Hennessy Large Cap Financial Fund since

|

|

|

October 2014. He served as Co-Portfolio Manager of the same

|

||

|

funds from March 2013 through September 2014, and as a

|

||

|

Portfolio Analyst for the Hennessy Funds from October 2012

|

||

|

through February 2013. Prior to that, Mr. Kelley served as

|

||

|

Portfolio Manager of FBR Fund Advisers, Inc. from

|

||

|

January 2008 to October 2012.

|

|

(1)

|

Messrs. DeSousa, Doyle, Hennessy, and Richardson previously served on the Board of Directors of Hennessy Mutual Funds, Inc. (“HMFI”), The Hennessy Funds, Inc. (“HFI”), and Hennessy SPARX Funds Trust (“HSFT”). Pursuant to an internal reorganization effective as of February 28, 2014, the series of HFMI, HFI, and HSFT were reorganized into corresponding series of Hennessy Funds Trust that mirrored them. Subsequent to the reorganization, HFMI, HFI, and HSFT were dissolved.

|

|

(2)

|

Mr. Hennessy is considered an “interested person,” as defined in the Investment Company Act of 1940, as amended, because he is an officer of the Hennessy Funds.

|

|

(3)

|

The address of these officers is 101 Federal Street, Suite 1900, Boston, MA 02110.

|

|

(4)

|

The address of this officer is 1340 Environ Way, Suite 305, Chapel Hill, NC 27517.

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

EXPENSE EXAMPLE

|

|

Expenses Paid

|

|||

|

Beginning

|

Ending

|

During Period(1)

|

|

|

Account Value

|

Account Value

|

May 1, 2016 –

|

|

|

May 1, 2016

|

October 31, 2016

|

October 31, 2016

|

|

|

Investor Class

|

|||

|

Actual

|

$1,000.00

|

$1,022.10

|

$6.71

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,018.50

|

$6.70

|

|

Institutional Class

|

|||

|

Actual

|

$1,000.00

|

$1,024.20

|

$4.99

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,020.21

|

$4.98

|

|

(1)

|

Expenses are equal to the Fund’s annualized expense ratio of 1.32% for Investor Class shares or 0.98% for Institutional Class shares, as applicable, multiplied by the average account value over the period, multiplied by 184/366 days (to reflect one-half year period).

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

PROXY VOTING — PRIVACY POLICY

|

|

•

|

information we receive from you on or in applications or other forms, correspondence, or conversations, including, but not limited to, your name, address, phone number, social security number, assets, income, and date of birth; and

|

|

|

•

|

information about your transactions with us, our affiliates, or others, including, but not limited to, your account number and balance, payment history, parties to transactions, cost basis information, and other financial information.

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

hennessyfunds.com|1-800-966-4354

|

CONTENTS

|

|

Letter to Shareholders

|

2

|

||

|

Performance Overview

|

4

|

||

|

Financial Statements

|

|||

|

Schedule of Investments

|

9

|

||

|

Statement of Assets and Liabilities

|

13

|

||

|

Statement of Operations

|

14

|

||

|

Statements of Changes in Net Assets

|

15

|

||

|

Financial Highlights

|

16

|

||

|

Notes to the Financial Statements

|

20

|

||

|

Report of Independent Registered Public Accounting Firm

|

28

|

||

|

Trustees and Officers of the Fund

|

29

|

||

|

Expense Example

|

32

|

||

|

Proxy Voting

|

34

|

||

|

Quarterly Filings on Form N-Q

|

34

|

||

|

Federal Tax Distribution Information

|

34

|

||

|

Householding

|

34

|

||

|

Privacy Policy

|

35

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

LETTER TO SHAREHOLDERS

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

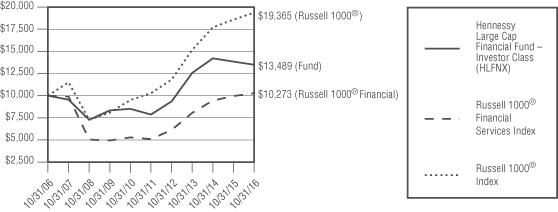

One

|

Five

|

Ten

|

|

|

Year

|

Years

|

Years

|

|

|

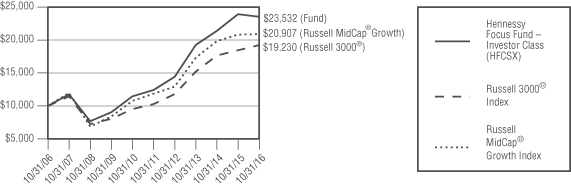

Hennessy Focus Fund –

|

|||

|

Investor Class (HFCSX)

|

-1.63%

|

13.64%

|

8.93%

|

|

Hennessy Focus Fund –

|

|||

|

Institutional Class (HFCIX)(1)

|

-1.27%

|

14.01%

|

9.24%

|

|

Russell 3000® Index

|

4.24%

|

13.35%

|

6.76%

|

|

Russell Mid Cap® Growth Index

|

0.40%

|

12.02%

|

7.65%

|

|

(1)

|

The inception date of Institutional Class shares is May 30, 2008. Performance shown prior to the inception of Institutional Class shares reflects the performance of Investor Class shares and includes expenses that are not applicable to and are higher than those of Institutional Class shares.

|

|

PERFORMANCE OVERVIEW

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

PERFORMANCE OVERVIEW

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

PERFORMANCE OVERVIEW/SCHEDULE OF INVESTMENTS

|

|

Schedule of Investments as of October 31, 2016

|

|

TOP TEN HOLDINGS (EXCLUDING CASH/CASH EQUIVALENTS)

|

% NET ASSETS

|

|

American Tower Corp., Class A

|

10.50%

|

|

O’Reilly Automotive, Inc.

|

9.32%

|

|

Markel Corp.

|

7.91%

|

|

Brookfield Asset Management, Inc.

|

6.65%

|

|

CarMax, Inc.

|

6.18%

|

|

Aon PLC

|

5.46%

|

|

The Charles Schwab Corp.

|

5.34%

|

|

Hexcel Corp.

|

4.93%

|

|

Gaming and Leisure Properties, Inc.

|

4.28%

|

|

Twenty First Century Fox, Inc.

|

4.21%

|

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

COMMON STOCKS – 63.59%

|

Number

|

% of

|

|||||||||||

|

of Shares

|

Value

|

Net Assets

|

|||||||||||

|

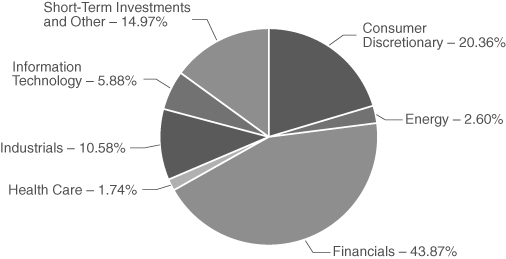

Consumer Discretionary – 20.36%

|

|||||||||||||

|

CarMax, Inc. (a)

|

2,962,712

|

$

|

147,957,837

|

6.18

|

%

|

||||||||

|

O’Reilly Automotive, Inc. (a)

|

842,815

|

222,873,999

|

9.32

|

%

|

|||||||||

|

Penn National Gaming, Inc. (a)

|

1,197,772

|

15,487,192

|

0.65

|

%

|

|||||||||

|

Twenty First Century Fox, Inc.

|

3,837,592

|

100,813,542

|

4.21

|

%

|

|||||||||

|

487,132,570

|

20.36

|

%

|

|||||||||||

|

Energy – 2.60%

|

|||||||||||||

|

World Fuel Services Corp.

|

1,547,585

|

62,290,296

|

2.60

|

%

|

|||||||||

|

|

|||||||||||||

|

Financials – 22.43%

|

|||||||||||||

|

Aon PLC (b)

|

1,179,036

|

130,672,560

|

5.46

|

%

|

|||||||||

|

Diamond Hill Investment Group, Inc.

|

145,893

|

26,553,985

|

1.11

|

%

|

|||||||||

|

Encore Capital Group, Inc. (a) (d)

|

2,258,784

|

44,836,862

|

1.87

|

%

|

|||||||||

|

Markel Corp. (a)

|

215,672

|

189,237,083

|

7.91

|

%

|

|||||||||

|

Marlin Business Services Corp. (d)

|

1,010,273

|

17,679,777

|

0.74

|

%

|

|||||||||

|

The Charles Schwab Corp.

|

4,029,065

|

127,721,361

|

5.34

|

%

|

|||||||||

|

|

536,701,628

|

22.43

|

%

|

||||||||||

|

|

|||||||||||||

|

Health Care – 1.74%

|

|||||||||||||

|

Henry Schein, Inc. (a)

|

279,398

|

41,686,181

|

1.74

|

%

|

|||||||||

|

|

|||||||||||||

|

Industrials – 10.58%

|

|||||||||||||

|

American Woodmark Corp. (a) (d)

|

1,209,780

|

90,370,566

|

3.78

|

%

|

|||||||||

|

Ametek, Inc.

|

459,822

|

20,278,150

|

0.85

|

%

|

|||||||||

|

Hexcel Corp.

|

2,592,037

|

117,911,763

|

4.93

|

%

|

|||||||||

|

Mistras Group, Inc. (a)

|

1,171,870

|

24,538,958

|

1.02

|

%

|

|||||||||

|

|

253,099,437

|

10.58

|

%

|

||||||||||

|

|

|||||||||||||

|

Information Technology – 5.88%

|

|||||||||||||

|

Alphabet, Inc., Class A (a)

|

68,984

|

55,870,142

|

2.34

|

%

|

|||||||||

|

Alphabet, Inc., Class C (a)

|

108,017

|

84,743,657

|

3.54

|

%

|

|||||||||

|

|

140,613,799

|

5.88

|

%

|

||||||||||

|

|

|||||||||||||

|

Total Common Stocks

|

|||||||||||||

|

(Cost $904,303,452)

|

1,521,523,911

|

63.59

|

%

|

||||||||||

|

SCHEDULE OF INVESTMENTS

|

|

REITS – 21.44%

|

Number

|

% of

|

|||||||||||

|

of Shares

|

Value

|

Net Assets

|

|||||||||||

|

Financials – 21.44%

|

|||||||||||||

|

American Tower Corp., Class A

|

2,145,080

|

$

|

251,381,925

|

10.51

|

%

|

||||||||

|

Brookfield Asset Management, Inc. (b)

|

4,543,328

|

159,107,347

|

6.65

|

%

|

|||||||||

|

Gaming and Leisure Properties, Inc.

|

3,122,341

|

102,506,455

|

4.28

|

%

|

|||||||||

|

512,995,727

|

21.44

|

%

|

|||||||||||

|

Total REITS

|

|||||||||||||

|

(Cost $324,420,323)

|

512,995,727

|

21.44

|

%

|

||||||||||

|

SHORT-TERM INVESTMENTS – 15.11%

|

|||||||||||||

|

Money Market Funds – 15.11%

|

|||||||||||||

|

Fidelity Government Portfolio, Institutional Class, 0.27% (c)

|

119,705,000

|

119,705,000

|

5.01

|

%

|

|||||||||

|

First American Government Obligations Fund, 0.24% (c)

|

2,339,306

|

2,339,306

|

0.10

|

%

|

|||||||||

|

The Government & Agency Portfolio, Institutional Class, 0.29% (c)

|

119,705,000

|

119,705,000

|

5.00

|

%

|

|||||||||

|

Morgan Stanley Institutional Liquidity Fund –

|

|||||||||||||

|

Government Portfolio, 0.30% (c)

|

119,705,000

|

119,705,000

|

5.00

|

%

|

|||||||||

|

361,454,306

|

15.11

|

%

|

|||||||||||

|

Total Short-Term Investments

|

|||||||||||||

|

(Cost $361,454,306)

|

361,454,306

|

15.11

|

%

|

||||||||||

|

Total Investments

|

|||||||||||||

|

(Cost $1,590,178,081) – 100.14%

|

2,395,973,944

|

100.14

|

%

|

||||||||||

|

Liabilities in Excess of Other Assets – (0.14)%

|

(3,442,456

|

)

|

(0.14

|

)%

|

|||||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

2,392,531,488

|

100.00

|

%

|

|||||||||

|

(a)

|

Non-income producing security.

|

|

(b)

|

U.S. traded security of a foreign corporation.

|

|

(c)

|

The rate listed is the fund’s 7-day yield as of October 31, 2016.

|

|

(d)

|

Investment represents five percent or more of the outstanding voting securities of the issuer, and is or was an affiliate of the Hennessy Focus Fund, as defined in the Investment Company Act of 1940, as amended, at or during the year ended October 31, 2016. Details of transactions with these affiliated companies for the year ended October 31, 2016, are as follows:

|

|

American

|

Encore Capital

|

Marlin Business

|

|||||||||||

|

Issuer

|

Woodmark Corp.

|

Group, Inc.

|

Services Corp.

|

||||||||||

|

Beginning Cost

|

$

|

32,425,960

|

$

|

72,792,945

|

$

|

15,865,289

|

|||||||

|

Purchase Cost

|

$

|

19,466,818

|

$

|

732,458

|

—

|

||||||||

|

Sales Cost

|

—

|

—

|

—

|

||||||||||

|

Ending Cost

|

$

|

51,892,778

|

$

|

73,525,403

|

$

|

15,865,289

|

|||||||

|

Dividend Income

|

—

|

—

|

$

|

565,753

|

|||||||||

|

Shares

|

1,209,780

|

2,258,784

|

1,010,273

|

||||||||||

|

Market Value

|

$

|

90,370,566

|

$

|

44,836,862

|

$

|

17,679,777

|

|||||||

|

HENNESSY FUNDS

|

1-800-966-4354

|

|

Common Stocks

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Consumer Discretionary

|

$

|

487,132,570

|

$

|

—

|

$

|

—

|

$

|

487,132,570

|

||||||||

|

Energy

|

62,290,296

|

—

|

—

|

62,290,296

|

||||||||||||

|

Financials

|

536,701,628

|

—

|

—

|

536,701,628

|

||||||||||||

|

Health Care

|

41,686,181

|

—

|

—

|

41,686,181

|

||||||||||||

|

Industrials

|

253,099,437

|

—

|

—

|

253,099,437

|

||||||||||||

|

Information Technology

|

140,613,799

|

—

|

—

|

140,613,799

|

||||||||||||

|

Total Common Stocks

|

$

|

1,521,523,911

|

$

|

—

|

$

|

—

|

$

|

1,521,523,911

|

||||||||

|

REITS

|

||||||||||||||||

|

Financials

|

$

|

512,995,727

|

$

|

—

|

$

|

—

|

$

|

512,995,727

|

||||||||

|

Total REITS

|

$

|

512,995,727

|

$

|

—

|

$

|

—

|

$

|

512,995,727

|

||||||||

|

Short-Term Investments

|

||||||||||||||||

|

Money Market Funds

|

$

|

361,454,306

|

$

|

—

|

$

|

—

|

$

|

361,454,306

|

||||||||

|

Total Short-Term Investments

|

$

|

361,454,306

|

$

|

—

|

$

|

—

|

$

|

361,454,306

|

||||||||

|

Total Investments

|

$

|

2,395,973,944

|

$

|

—

|

$

|

—

|

$

|

2,395,973,944

|

||||||||

|

SCHEDULE OF INVESTMENTS/STATEMENT OF ASSETS AND LIABILITIES

|

|

Statement of Assets and Liabilities as of October 31, 2016

|

|

ASSETS:

|

||||

|

Investments in securities, at value (cost $1,448,894,611)

|

$

|

2,243,086,739

|

||

|

Investments in affiliated securities, at value (cost $141,283,470)

|

152,887,205

|

|||

|

Total Investments in securities, at value (cost $1,590,178,081)

|

2,395,973,944

|

|||

|

Dividends and interest receivable

|

763,395

|

|||

|

Receivable for fund shares sold

|

2,747,797

|

|||

|

Prepaid expenses and other assets

|

89,921

|

|||

|

Total Assets

|

2,399,575,057

|

|||

|

LIABILITIES:

|

||||

|

Payable for fund shares redeemed

|

3,900,537

|

|||

|

Payable to advisor

|

1,853,205

|

|||

|

Payable to administrator

|

398,595

|

|||

|

Payable to auditor

|

20,699

|

|||

|

Accrued distribution fees

|

305,646

|

|||

|

Accrued service fees

|

140,290

|

|||

|

Accrued trustees fees

|

3,896

|

|||

|

Accrued expenses and other payables

|

420,701

|

|||

|

Total Liabilities

|

7,043,569

|

|||

|

NET ASSETS

|

$

|

2,392,531,488

|

||

|

NET ASSETS CONSIST OF:

|

||||

|

Capital stock

|

$

|

1,602,944,656

|

||

|

Accumulated net investment loss

|

(10,118,034

|

)

|

||

|