FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of July, 2005

Commission File Number: 001-12518

Banco Santander Central Hispano, S.A.

(Translation

of registrant’s name into English)

Plaza de Canalejas, 1

28014 Madrid, Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | X | Form 40-F | _______ |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | _______ | No | X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | _______ | No | X |

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

| Yes | _______ | No | X |

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

Banco Santander Central Hispano, S.A.

TABLE OF CONTENTS

| Item | |||

| 1 | Press release dated July 27, 2005, entitled, “Grupo Santander net attributable income increases 35.2% to EUR 2,551 million in the first half of 2005.” | ||

| 2 | Presentation dated July 27, 2005, entitled, “Activity and Results First half 2005.” | ||

| 3 | Santander Group First Half 2005 Financial Report. | ||

| 4 | Santander Group First Half 2005 Results. | ||

Item 1

![]()

| Press Release |

Grupo Santander net attributable income

increases

35.2% to EUR 2,551 million

in the first half of 2005

The first half was highlighted by the strength of retail business, both in Spain andLatin

America, placing earnings in line with the year-end objective of more

than EUR 5 billion in profit. |

||

| Abbey contributed EUR 321 million to net attributable income, with increased sales, stable revenuesand cost-savings. Without Abbey, profit for the Group increased 18.2%. | ||

| The EUR 717-million extraordinary capital gain from the sale of 2.57% of The Royal Bank of Scotland was offset by a provision that will be allocated in the course of the year and thus had no effect on results. | ||

| Increased profit is based on high business growth, with a 20% increase in lending and a 17% increase in deposits, without Abbey, higher rates than those of the first quarter. | ||

| In continental Europe, net operating income rose 18.1% and net attributable income 40.6% (to EUR 1,554 million) thanks to growth of 17% in lending and 9% in deposits. | ||

| In Latin America, net operating income rose 28.4% and attributable income 21.3% in US dollars (to US$1,156 million), its operating currency, backed by an increase of 20% in lending and of 15% in deposits in local currency. | ||

| Cost control has led to a 0.6 percentage point improvement in the efficiency ratio, to 44.4%. If Abbey is included, the efficiency ratio is 48.4% for the Group. | ||

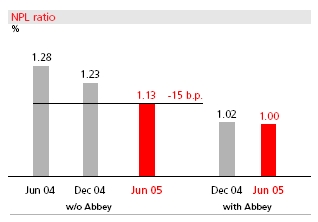

| The NPL ratio, excluding Abbey, fell by 0.15 percentage points, to 1.13%, with coverage increasing 39 points from June 2004 to 219%. The NPL ratio for the Group as a whole is 1.00%, with coverage of 175%. | ||

![]()

Madrid, July 27th, 2005 - Grupo Santander registered net attributable income of EUR 2,551 million in the first half of 2005, an increase of 35.2% from the same period in 2004. In the second quarter of this year the Group registered net attributable income of EUR 1,366 million, 15% more than in the first quarter.

Abbey, consolidated for the first time in the earnings statement (consolidated on the balance sheet at the end of 2004) contributed EUR 321 million in profit during the first half. Without Abbey, Grupo Santander‘s income would have increased 18.2% from the same period last year. During this period, the Group sold a 2.57% stake in The Royal Bank of Scotland, yielding capital gains of EUR 717 million. This capital gain was offset by a provision for contingencies which will be allocated in the course of the year and thus does not affect attributable income. Capital gains of EUR 359 million in the first half of 2004 were assigned to extraordinary write-offs at the end of the year, and thus also do not affect those results.

Grupo Santander has drawn up its 2005 financial statements following the new international financial reporting standards (IFRS) and has restated all the information for 2004 in line with these criteria. The application of these standards involves changes in accounting principles, the presentation of statements and the structure of business areas.

The performance of Grupo Santander in the first half of 2005 was marked by significant growth in business activity - and therefore in revenue - from retail banking in Europe and Latin America. This growth came hand in hand with cost control and a reduction in loan-loss provisions, as the limit for generic provisions had already been reached in some units. This combination of higher revenue with cost control and a reduced need for provisions enabled income to grow by more than 18% without Abbey and more than 35% when Abbey is included.

Grupo Santander results

H1’05

EUR

million

H1’05 w/o |

% change on H1’04 |

H1’05 with Abbey |

% change on H1’04 |

|

Commercial revenue |

6,983 | +8.7 | 8,600 | +33.9 |

Gross

operating income |

7,665 | +8.5 | 9,478 | +34.2 |

Operating

costs |

-3,935 | +6.3 | -5,206 | +40.7 |

Net

operating income |

3,809 | +10.5 | 4,368 | +26.7 |

Loan-loss provisions |

-513 | -32.8 | -672 | -12.1 |

Ordinary

PBT |

2,998 | +19.8 | 3,459 | +38.2 |

Ordinary attributable income |

2,230 | +18.2 | 2,551 | +35.2 |

Earnings

| Comunicación Externa Ciudad Grupo Santander – Edif. Arrecife, 2ª Planta 28660 Boadilla del Monte (Madrid) Telf. 34 91 289 5211 - Fax 34 91 257 1039 |

2

![]()

Growth in business activity helped push net interest income to EUR 5,008 million in the first half of 2005, up 29.7% (6.7% excluding Abbey) from the same period in 2004. The increases in fee income and insurance (+7.8%) and income from equity-accounted holdings (+59%) generated commercial revenue of EUR 8,600 million euros, up 33.9% (8.7% without Abbey). Trading gains rose to EUR 879 million, growth of 36.7% (6% without Abbey), putting net operating revenue at EUR 9,478 million, an increase of 34.2% (8.5% excluding Abbey).

Grupo Santander‘s overall personnel and general expenses account for 48.4% of revenue, whilst for the Group without Abbey the efficiency ratio would be 44.4%, an improvement of 0.6 point from a year earlier. This is due to the fact that operating expenses grew at a rate of 6.3%, whilst revenue increased by 8%, in both cases without Abbey. This enabled net operating income to grow 10.5% without Abbey and 26.7% for the Group as a whole.

Provisions amounted to EUR 693 million, a drop of 17.3% (-36.3% without Abbey). Most of this item (EUR 672 million) stems from loan-loss provisions, which were reduced by 12.1% (-32.8% without Abbey). The drop in these provisions is due to high credit quality, heavy provisions made in previous years in applying the Bank of Spain‘s norms, bringing us back to provisions more in line with the business risk involved, and lower provisions for country risk.

Main units Europe H1’05

EUR Mill. and % on H1’04

| Gross operating income: 4,639; +11.1% |

||

SAN Network |

1,890 |

+8.0% |

Banesto |

885 |

+8.0% |

Santander Consumer |

765 |

+22.8% |

Portugal |

507 |

+11.0% |

Other* |

593 |

+12.4% |

(*) Private Banking, Asset Manegement and Global Wholesale Banking |

||

Net operating income: 2,673; +18.1% |

||

SAN Network |

1,024 |

+15.8% |

Banesto |

557 |

+15.3% |

Santander Consumer |

508 |

+24.8% |

Portugal |

258 |

+22.0% |

Other* |

326 |

+17.1% |

(*)Private Banking, Asset Manegement and Global Wholesale Banking |

||

Attributable income: 1,554; +40.6% |

||

SAN Network |

656 |

+45.9% |

Banesto |

259 |

+15.5% |

Santander Consumer |

237 |

+45.8% |

Portugal |

172 |

+40.0% |

Other* |

230 |

+57.2% |

(*)Private Banking, Asset Manegement and Global Wholesale Banking |

||

| Comunicación Externa Ciudad Grupo Santander – Edif. Arrecife, 2ª Planta 28660 Boadilla del Monte (Madrid) Telf. 34 91 289 5211 - Fax 34 91 257 1039 |

3

![]()

These provisions, together with other losses amounting to EUR 217 million, resulted in income before taxes of EUR 3,459 million, up 38.2% (19.8% excluding Abbey). Under “other income”, a profit of EUR 717 million is included following the sale of 2.57% of The Royal Bank of Scotland and the setting-up of a contingency fund for the same amount. Therefore, this sale has no impact on final earnings.

The Group‘s first half net attributable income after taxes and minority interests was EUR 2,551 million, an increase of 35.2%. Excluding Abbey, income would have been 2,230 million, an increase of 18.2%. Of these earnings, 56% were generated by the Group‘s businesses in Continental Europe, 32% from Latin America and 12% from the U.K. (Abbey). Earnings from continental Europe improved 40.6% and Latin America again registered growth in euros of 15.7%.

Principal countries in Latin America H1’05

US$ Mill. and % on H1’04

Gross operating income: 4,069; +21.8% |

||

Brazil |

1,567 | +25.0% |

Mexico |

937 | +22.8% |

Chile |

647 | +21.2% |

Other countries |

786 | +16.7% |

S. Private Banking |

133 | +13.5% |

Net

operating income: 1,876; +28.4%

|

||

Brazil |

711 |

+24.2% |

Mexico |

393 |

+25.8% |

Chile |

355 |

+42.7% |

Other countries |

342 |

+30.0% |

S. Private Banking |

75 |

+18.0% |

Attributable

income: 1,156; +21.3%

|

||

Brazil |

408 |

+12.8% |

Mexico |

243 |

+23.4% |

Chile |

201 |

+52.8% |

Other countries |

235 |

+12.4% |

S. Private Banking |

69 |

+27.4% |

Business

The volume of funds managed by Grupo Santander amounted to EUR 881,325 million at the close of the first half, growth of 81.2% from a year earlier, which would have been 20.5% without Abbey. Of these overall resources, EUR 729,139 million is on the balance sheet, and the remainder off-balance sheet customer funds such as mutual funds and pensions.

The consolidation of Abbey caused a quantitative leap in business figures, doubling the amount of loans and increasing customer managed funds by 79.0%. But it was also a qualitative leap, contributing greater geographical diversity in risk, with 47% of loans in continental Europe, 42% in the U.K. and the remaining 11% in Latin America.

| Comunicación Externa Ciudad Grupo Santander – Edif. Arrecife, 2ª Planta 28660 Boadilla del Monte (Madrid) Telf. 34 91 289 5211 - Fax 34 91 257 1039 |

4

![]()

Grupo Santander‘s gross lending amounted to EUR 398,864 million at the close of the first half of 2005, up 103.7%. Without Abbey, lending volume reached EUR 233,642 million, an increase of 19.8%, discounting the effect of securitisations. Lending to other resident sectors rose 18.4%, reflecting business activity in Spain, with 24% growth in mortgage lending. Lending to the non-resident sector grew 22.8%.

Lending rose 17% in continental Europe, across all countries and units. Business in the Santander branch network in Spain increased 16%, in Banesto 24%, in Portugal 8% and in Santander Consumer 36%. In turn, Latin America improved 33% in euros and 20% in local currencies, with strong growth in the main countries in their respective currencies: Brazil (30%), Mexico (25%) and Chile (14%).

Total managed customer funds amounted to EUR 638,772 million at the end of the first half of 2005, an increase of 79.1% compared to last year. Without Abbey, this figure would be EUR 414,184 million (+16.1%). Balance sheet resources, without Abbey, grew 17.6% to EUR 278,298 million, whilst off-balance sheet items (basically mutual funds and pensions) rose 13.2%, to EUR 135,886 million. Between June 2004 and June 2005, mutual funds increased 10.3%, pension plans 22.1% and managed portfolios, 20.4%.

Business growth

Continental Europe |

||

Variation

Jun’05/Jun’04 |

||

(% in euros) |

||

Loans* |

Customer funds** |

|

SAN Network |

+16% |

+8% |

Banesto |

+24% |

+13% |

Santander Consumer |

+36% |

+20% |

Portugal |

+8% |

+10% |

(*) Including securitised loans |

||

(**) Deposits without REPOs, investment funds and pension funds |

||

Latin America |

||

Variation

Jun’05/Jun’04 |

||

(% in local currency) |

||

Loans |

Customer funds* |

|

Brazil |

+30% |

+25% |

Mexico |

+25% |

+19% |

Chile |

+14% |

+22% |

(*) Deposits without REPOs; investment funds and pension funds |

||

| Comunicación Externa Ciudad Grupo Santander – Edif. Arrecife, 2ª Planta 28660 Boadilla del Monte (Madrid) Telf. 34 91 289 5211 - Fax 34 91 257 1039 |

5

![]()

In continental Europe, customer funds under management amounted to EUR 250,444 million, an increase of 9%. In Spain, which accounts for more than 80%, customer funds under management rose by 10% to EUR 204,606 million. The Group remains the leader in mutual funds in Spain, with a market share of around 26%, and is in second place in Portugal, with a market share of 18.3%.

In Latin America, customer funds amounted to EUR 106,931 million, growth of 15% without the exchange rate effect. In deposits less securitisations, all countries registered double-digit growth, especially Brazil (+39%), whilst Mexico and Chile increased by 15% and 30%, respectively. Mutual funds grew 20%, with noteworthy increases in Argentina, Mexico, Colombia and Puerto Rico. In pension plans, overall growth was 17%.

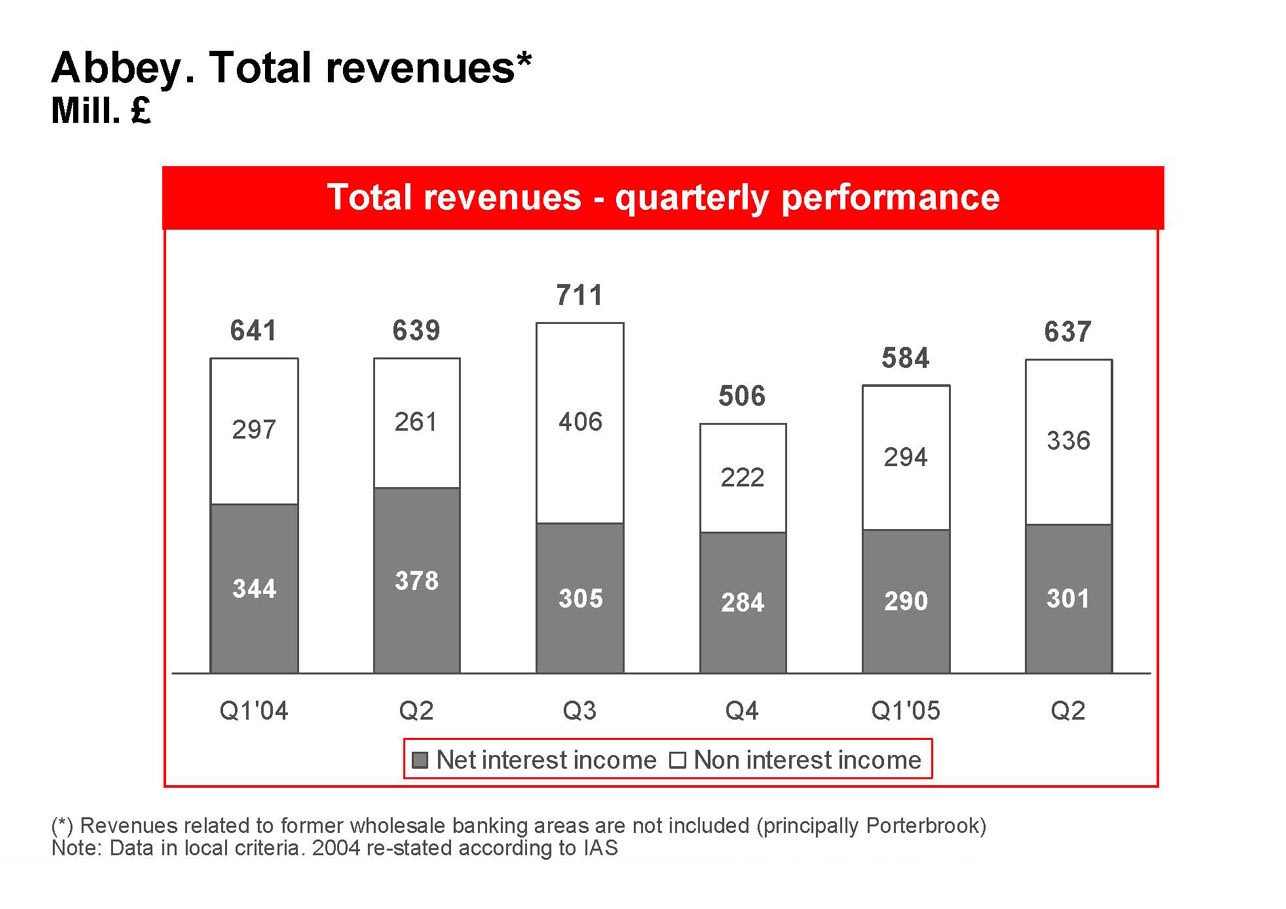

Abbey

The acquisition of Abbey was completed on 12th November 2004, with just its balance sheet consolidated in Grupo Santander at year-end. Abbey‘s earnings have been included in those of Santander since January this year.

In the first months of this year, Abbey is meeting the management priorities set for 2005: increased sales, stable revenues, cost reduction and a continued low risk profile. The new logo was also adopted, in line with the Grupo Santander image.

The plans to improve sales are based on growth in production of Abbey‘s two main products, mortgages and savings, with margins similar to those obtained in recent months. In the second quarter of the year, increases have been registered of 6% in the number of current accounts, 14% in the number of credit cards granted and 11% in the balance of personal loans in comparison with the same period last year.

Abbey‘s market share in gross mortgage business has reached 9.6% versus 8.8% in the previous quarter. This growth in new business has enabled it to absorb the April-June repayments, with an increase in its portfolio balance, curbing the drop in previous quarters. In savings, Abbey has managed to improve its net market share of new deposits versus the first quarter.

Total lending reached EUR 165,223 million and customer funds under management (excluding repos) EUR 259.316 million, both slight increases during the quarter. This increase in business translated into an improving trend in revenues in recent quarters. The most recent quarter represents a 7% increase in pounds on the first quarter of the year.

Cost-reduction is proving better than the initial estimates of a £150 million reduction in the year as a whole. This is the second consecutive quarter in which costs have fallen, after deducting those resulting from restructuring, and are now below £400 million in a quarter for the first time in many years.

Management and capital ratios

| Comunicación Externa Ciudad Grupo Santander – Edif. Arrecife, 2ª Planta 28660 Boadilla del Monte (Madrid) Telf. 34 91 289 5211 - Fax 34 91 257 1039 |

6

![]()

The expansion of the Group’s lending activity came with a drop in the NPL ratio, meaning that the ratios of NPLs and doubtful loans reached an all-time low at the end of the first half of 2005. Grupo Santander’s NPL rate is 1.00%, with 175% coverage. Excluding Abbey, this rate would show a decrease from 1.28%, at June 30th 2004, to the current 1.13%, with coverage increasing by 39 points, to 219%. Abbey‘s NPL ratio is 0.80%, with coverage at 74%, an improvement over the last quarter.

Management ratios

Efficiency ratio(*) |

||

H1’04 |

45.0% |

W/out Abbey |

H1’05 |

44.4%(**) |

W/out Abbey |

H1’05 |

48.4% |

With Abbey |

(*) excluding amortization |

||

(**) -

0.6 p.p. as compared to H1’04

|

||

BIS ratio |

||

Core Cap. |

5.35% |

With Abbey |

Tier I |

7.44% |

With Abbey |

BIS Ratio |

12.81% |

With Abbey |

NPL ratio |

||

Jun

’04 |

1.28% |

W/out Abbey |

Jun

’05 |

1.13%(*) |

W/out Abbey |

Jun

’05 |

1.00% |

With Abbey |

(*) - 0.15

p.p. as compared to Jun’04

|

||

Coverage ratio |

||

Jun ’04 |

180% |

W/out Abbey |

Jun ’05 |

219%(*) |

W/out Abbey |

Jun ’05 |

175% |

With Abbey |

(*) + 39 p.p. as compared to Jun’ 04

|

||

In Spain, the NPL rate is 0.59%, 8 basis points lower than in June 2004, with coverage at 302%, 65 points higher. Consumer finance (Santander Consumer) closed June with a NPL rate of 2.25% and 129% coverage, increases in both items in the quarter. In Latin America, NPLs fell 1.03 points, to 2.17% in the year, whilst coverage increased 37 points, to 181%, in the same period.

The Group‘s eligible capital amounted to EUR 49,238 million at the end of June 2005, with a surplus of EUR 18,484 million over minimum requirements. With this capital base, the BIS ratio is 12.81%, with Tier I at 7.44%.

| Comunicación Externa Ciudad Grupo Santander – Edif. Arrecife, 2ª Planta 28660 Boadilla del Monte (Madrid) Telf. 34 91 289 5211 - Fax 34 91 257 1039 |

7

![]()

The share

Santander shares ended June 2005 at EUR 9.59. In the second half of last year its performance was affected by the takeover offer for Abbey. Between the announcement of the transaction until the end of June, it appreciated by 23%. In the first six months of the year it has appreciated 5%. At the end of June, Santander‘s market capitalisation was EUR 59,979 million, reinforcing its position as the leading bank in the euro zone and ninth in the world.

The Board of Directors has approved the first interim dividend charged to the 2005 earnings, which will be paid on August 1st, amounting to EUR 0.09296, an increase of 12% over the first dividend paid last year on account of the 2004 earnings.

In April, the Bank‘s Board of Directors agreed to appoint Luis Ángel Rojo as an independent external director. Following the death last May of Elías Masaveu, Santander‘s Board comprises 19 members holding 4% of the Bank‘s capital.

Grupo Santander‘s shareholder base increased significantly following the acquisition of Abbey, to 2,528,398 shareholders. 126,500 people work in the Group, serving 63 million customers in 10,099 branches.

| Comunicación Externa Ciudad Grupo Santander – Edif. Arrecife, 2ª Planta 28660 Boadilla del Monte (Madrid) Telf. 34 91 289 5211 - Fax 34 91 257 1039 |

8

![]()

| Income statement | ||||||||||

| Million euros | ||||||||||

| Jan.-Jun. 05 | Jan.-Jun. 04 | Variation (%) | ||||||||

| with Abbey | w/o Abbey | with Abbey | w/o Abbey | |||||||

| Net interest income (w/o dividends) | 4.799 | 3.910 | 3.620 | 32,58 | 8,03 | |||||

| Dividends | 208 | 208 | 242 | (13,86 | ) | (13,93 | ) | |||

| Net interest income | 5.008 | 4.119 | 3.862 | 29,67 | 6,65 | |||||

Income

from companies accounted for by the equity method |

329 | 328 | 207 | 59,15 | 58,46 | |||||

| Net fees | 2.865 | 2.430 | 2.276 | 25,91 | 6,79 | |||||

| Insurance activity | 397 | 107 | 77 | 414,91 | 38,11 | |||||

| Commercial revenue | 8.600 | 6.983 | 6.422 | 33,92 | 8,75 | |||||

| Gains (losses) on financial transactions | 879 | 682 | 643 | 36,66 | 5,97 | |||||

| Gross operating income | 9.478 | 7.665 | 7.065 | 34,17 | 8,50 | |||||

| Income from non-financial services | 223 | 198 | 191 | 16,93 | 4,11 | |||||

| Non-financial expenses | (77 | ) | (69 | ) | (81 | ) | (5,36 | ) | (14,60 | ) |

| Other operating income | (50 | ) | (50 | ) | (27 | ) | 84,15 | 84,15 | ||

| Operating costs | (5.206 | ) | (3.935 | ) | (3.700 | ) | 40,70 | 6,34 | ||

| General administrative expenses | (4.717 | ) | (3.521 | ) | (3.291 | ) | 43,33 | 7,00 | ||

| Personnel | (2.833 | ) | (2.178 | ) | (2.054 | ) | 37,92 | 6,00 | ||

| Other administrative expenses | (1.883 | ) | (1.344 | ) | (1.236 | ) | 52,33 | 8,67 | ||

| Depreciation and amortisation | (489 | ) | (414 | ) | (409 | ) | 19,58 | 1,02 | ||

| Net operating income | 4.368 | 3.809 | 3.447 | 26,73 | 10,52 | |||||

| Impairment loss on assets | (693 | ) | (534 | ) | (838 | ) | (17,35 | ) | (36,29 | ) |

| Loans | (672 | ) | (513 | ) | (765 | ) | (12,07 | ) | (32,84 | ) |

| Goodwill | — | — | (2 | ) | (100,00 | ) | (100,00 | ) | ||

| Other assets | (21 | ) | (21 | ) | (71 | ) | (71,11 | ) | (71,11 | ) |

| Other income | (217 | ) | (277 | ) | (106 | ) | 105,37 | 162,72 | ||

| Income before taxes (ordinary) | 3.459 | 2.998 | 2.503 | 38,18 | 19,77 | |||||

| Corporate income tax | (649 | ) | (509 | ) | (420 | ) | 54,51 | 21,27 | ||

| Net income from ordinary activity | 2.810 | 2.489 | 2.083 | 34,89 | 19,47 | |||||

| Net income from discontinued operations | 1 | 1 | 3 | (75,12 | ) | (75,12 | ) | |||

| Net consolidated income (ordinary) | 2.811 | 2.490 | 2.087 | 34,70 | 19,32 | |||||

| Minority interests | 260 | 260 | 200 | 30,12 | 30,12 | |||||

| Attributable income to the Group (ordinary) | 2.551 | 2.230 | 1.887 | 35,19 | 18,17 | |||||

| Customer loans | ||||||||||

| Million euros | ||||||||||

30.06.05 |

30.06.04 |

Variation (%) |

||||||||

with Abbey |

w/o Abbey |

with Abbey |

w/o Abbey |

|||||||

| Public sector | 3.992 | 3.992 | 6.382 | (37,44 | ) | (37,44 | ) | |||

| Other residents | 137.269 | 137.269 | 114.216 | 20,18 | 20,18 | |||||

| Secured loans | 67.995 | 67.995 | 53.388 | 27,36 | 27,36 | |||||

| Other loans | 69.274 | 69.274 | 60.828 | 13,88 | 13,88 | |||||

| Non-resident sector | 257.603 | 92.380 | 75.232 | 242,41 | 22,79 | |||||

| Secured loans | 161.077 | 23.629 | 20.432 | 688,37 | 15,65 | |||||

| Other loans | 96.526 | 68.751 | 54.801 | 76,14 | 25,46 | |||||

| Gross loans and credits | 398.864 | 233.642 | 195.831 | 103,68 | 19,31 | |||||

| Credit loss allowance | 7.340 | 6.369 | 5.108 | 43,69 | 24,67 | |||||

| Net loans and credits | 391.524 | 227.273 | 190.722 | 105,28 | 19,16 | |||||

| Pro memoria: Doubtful loans | 4.280 | 2.962 | 3.009 | 42,22 | (1,57 | ) | ||||

| Public sector | 1 | 1 | 1 | (43,81 | ) | (43,81 | ) | |||

| Other residents | 973 | 973 | 903 | 7,73 | 7,73 | |||||

| Non-resident sector | 3.306 | 1.988 | 2.105 | 57,07 | (5,54 | ) | ||||

| Comunicación Externa Ciudad Grupo Santander – Edif. Arrecife, 2ª Planta 28660 Boadilla del Monte (Madrid) Telf. 34 91 289 5211 - Fax 34 91 257 1039 |

9

![]()

| Customer funds under management | |||||||||||

| Million euros | |||||||||||

| 30.06.05 | 30.06.04 | Variation (%) | |||||||||

| with Abbey | w/o Abbey | with Abbey | w/o Abbey | ||||||||

| Public sector | 14.555 | 14.555 | 10.504 | 38,57 | 38,57 | ||||||

| Other residents | 81.827 | 81.827 | 84.631 | (3,31 | ) | (3,31 | ) | ||||

| Demand deposits | 48.454 | 48.454 | 44.753 | 8,27 | 8,27 | ||||||

| Time deposits | 18.436 | 18.436 | 21.597 | (14,64 | ) | (14,64 | ) | ||||

| REPOs | 14.938 | 14.938 | 18.281 | (18,29 | ) | (18,29 | ) | ||||

| Non-resident sector | 201.996 | 92.617 | 75.402 | 167,89 | 22,83 | ||||||

| Demand deposits | 111.965 | 33.698 | 28.092 | 298,56 | 19,95 | ||||||

| Time deposits | 74.746 | 46.736 | 37.349 | 100,13 | 25,13 | ||||||

| REPOs | 11.613 | 8.563 | 7.424 | 56,43 | 15,34 | ||||||

| Public Sector | 3.672 | 3.620 | 2.536 | 44,76 | 42,72 | ||||||

| Customer deposits | 298.379 | 189.000 | 170.538 | 74,96 | 10,83 | ||||||

| Debt securities | 119.513 | 68.437 | 48.196 | 147,97 | 42,00 | ||||||

| Subordinated debt | 22.915 | 12.861 | 12.220 | 87,52 | 5,24 | ||||||

| Insurance liabilities | 45.779 | 8.000 | 5.658 | 709,04 | 41,38 | ||||||

| On-balance-sheet customer funds | 486.586 | 278.298 | 236.613 | 105,65 | 17,62 | ||||||

| Mutual funds | 100.642 | 99.040 | 89.773 | 12,11 | 10,32 | ||||||

| Pension plans | 39.495 | 24.797 | 20.316 | 94,40 | 22,05 | ||||||

| Managed portfolios | 12.049 | 12.049 | 10.005 | 20,43 | 20,43 | ||||||

| Off-balance-sheet customer funds | 152.186 | 135.886 | 120.094 | 26,72 | 13,15 | ||||||

| Customer funds under management | 638.772 | 414.184 | 356.708 | 79,07 | 16,11 | ||||||

| Shareholders’ equity and capital ratios | |||||||||||

| Million euros | |||||||||||

Variation |

|||||||||||

30.06.05 |

30.06.04 |

Amount |

% |

31.12.04 |

|||||||

| Capital stock | 3.127 | 2.384 | 743 | 31,16 | 3.127 | ||||||

| Additional paid-in surplus | 20.370 | 8.721 | 11.649 | 133,58 | 20.370 | ||||||

| Reserves | 8.619 | 6.748 | 1.871 | 27,73 | 6.949 | ||||||

| Treasury stock | (0 | ) | (21 | ) | 20 | (97,89 | ) | (104 | ) | ||

| On-balance-sheet shareholders’ equity | 32.116 | 17.832 | 14.284 | 80,10 | 30.342 | ||||||

| Net attributable income | 2.551 | 2.246 | 305 | 13,58 | 3.606 | ||||||

| Interim dividend distributed | — | — | — | — | (792 | ) | |||||

| Shareholders’ equity at period-end | 34.667 | 20.079 | 14.589 | 72,66 | 33.156 | ||||||

| Interim dividend not distributed | (581 | ) | — | (581 | ) | — | (1.046 | ) | |||

| Shareholders’ equity | 34.086 | 20.079 | 14.007 | 69,76 | 32.111 | ||||||

| Valuation adjustments | 3.004 | 1.517 | 1.487 | 97,99 | 1.778 | ||||||

| Minority interests | 2.462 | 1.993 | 469 | 23,50 | 2.085 | ||||||

| Preferred securities | 8.555 | 3.917 | 4.638 | 118,41 | 7.623 | ||||||

| Shareholders’ equity and minority interests | 48.107 | 27.506 | 20.601 | 74,90 | 43.596 | ||||||

| Basic capital | 28.609 | 17.636 | 10.973 | 62,22 | 24.419 | ||||||

| Supplementary capital | 20.628 | 8.582 | 12.046 | 140,36 | 19.941 | ||||||

| Computable capital (BIS criteria) | 49.238 | 26.218 | 23.020 | 87,80 | 44.360 | ||||||

| Risk-weighted assets (BIS criteria) | 384.428 | 217.111 | 167.317 | 77,07 | 340.946 | ||||||

| BIS ratio | 12,81 | 12,08 | 0,73 | 13,01 | |||||||

|

|

|

||||||||||

| Tier 1 | 7,44 | 8,12 | (0,68 | ) | 7,16 | ||||||

| Cushion (BIS ratio) | 18.484 | 8.849 | 9.634 | 108,87 | 17.084 | ||||||

| Comunicación Externa Ciudad Grupo Santander – Edif. Arrecife, 2ª Planta 28660 Boadilla del Monte (Madrid) Telf. 34 91 289 5211 - Fax 34 91 257 1039 |

10

|

|

Item 2

|

|

|

|

|

|

|

|

|

ACTIVITY AND

RESULTS |

|

|

|

|

|

|

|

|

First Half 2005

|

|

|

|

|

|

July 27, 2005

|

|

|

|

|

|

|

|

•

|

Grupo Santander’s performance H1’05

|

|

|

|

|

•

|

Business areas’ performance H1’05

|

|

|

|

|

•

|

Conclusions

|

|

|

|

|

|

|

EUR million

|

|

|

Change H1’05

o/ H1’04 |

|

|

|

|

|

|

|

|

|

Trading gains

|

|

|

-279

|

|

|

Other revenues and costs

|

|

|

-37

|

|

|

Net operating income

|

|

|

-316

|

|

|

Attributable income

|

|

|

-228

|

|

EUR Mill.

|

|

|

|

H1’05

w/o Abbey |

|

% change

o/ H1’04 |

|

H1’05

with Abbey |

|

% change

o/ H1’04 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial revenue

|

|

|

6,983

|

|

|

+8.7

|

|

|

8,600

|

|

|

+33.9

|

|

|

Gross operating income

|

|

|

7,665

|

|

|

+8.5

|

|

|

9,478

|

|

|

+34.2

|

|

|

Operating costs

|

|

|

-3,935

|

|

|

+6.3

|

|

|

-5,206

|

|

|

+40.7

|

|

|

Net operating income

|

|

|

3,809

|

|

|

+10.5

|

|

|

4,368

|

|

|

+26.7

|

|

|

Loan-loss provisions

|

|

|

-513

|

|

|

-32.8

|

|

|

-672

|

|

|

-12.1

|

|

|

Ordinary PBT

|

|

|

2,998

|

|

|

+19.8

|

|

|

3,459

|

|

|

+38.2

|

|

|

Ordinary attributable inc.

|

|

|

2,230

|

|

|

+18.2

|

|

|

2,551

|

|

|

+35.2

|

|

|

|

|

|

|

|

|

•

|

Grupo Santander’s performance H1’05

|

|

|

|

|

|

|

|

|

•

|

Business areas’ performance H1’05

|

|

|

|

|

|

|

|

|

|

–

|

Continental Europe

|

|

|

|

|

|

|

|

|

–

|

Latin America

|

|

|

|

|

|

|

|

|

–

|

Global Businesses

|

|

|

|

|

|

|

|

|

–

|

United Kingdom - Abbey

|

|

|

|

|

|

|

|

•

|

Conclusions

|

|

|

|

•

|

Grupo Santander’s performance H1’05

|

|

|

|

|

|

|

|

|

•

|

Business areas’ performance H1’05

|

|

|

|

|

|

|

|

|

|

–

|

Continental Europe

|

|

|

|

|

|

|

|

|

–

|

Latin America

|

|

|

|

|

|

|

|

|

–

|

Global Businesses

|

|

|

|

|

|

|

|

|

–

|

United Kingdom - Abbey

|

|

|

|

|

|

|

|

•

|

Conclusions

|

|

|

|

•

|

Grupo Santander’s performance H1’05 | |

| |

|

|

|

|

|

•

|

Business areas’ performance H1’05 | |

| |

|

|

|

|

|

|

–

|

Continental Europe

|

|

|

|

|

|

|

|

|

–

|

Latin America

|

|

|

|

|

|

|

|

|

–

|

Global Businesses

|

|

|

|

|

|

|

|

|

–

|

United Kingdom - Abbey

|

|

|

|

|

|

|

|

•

|

Conclusions

|

|

|

|

•

|

Grupo Santander’s performance H1’05

|

|

|

|

|

|

|

|

|

•

|

Business areas’ performance H1’05

|

|

|

|

|

|

|

|

|

|

–

|

Continental Europe

|

|

|

|

|

|

|

|

|

–

|

Latin America

|

|

|

|

|

|

|

|

|

–

|

Global Businesses

|

|

|

|

|

|

|

|

|

–

|

United Kingdom - Abbey

|

|

|

|

|

|

|

|

•

|

Conclusions

|

|

|

•

|

Abbey: delivering on our priorities for 2005

|

|

|

|

|

|

|

•

|

Sales productivity and performance is starting to improve

|

|

|

|

|

|

|

•

|

Stabilising underlying revenues after several periods of slowdown

|

|

|

|

|

|

|

|

–

|

Slowing the decline of spreads and increasing revenues via fees and commissions

|

|

|

|

|

|

•

|

Reducing costs - ahead of target

|

|

|

|

|

|

|

•

|

Credit quality remains strong. Second quarter provisions increase due to generic ones

|

|

|

|

|

|

|

•

|

Taking decisive action to reverse trends - scope for growth

|

|

|

Increasing new business volumes

|

|

Abbey. Measures taken for continued growth

|

||

|

|

|

|

|

Investing in our commercial capacity

|

||

|

|

|

|

|

•

|

Redefinition in-branch roles

|

|

|

|

|

|

|

|

–

|

Re-skill people so as to enable renewed sales focus

|

|

|

|

|

|

|

–

|

Introducing redefined Personal Banking Advisor (PBA) role

|

|

|

|

|

|

|

–

|

Enhancing sales profile of branch managers to focus on selling and coaching

|

|

|

|

|

|

•

|

Intensive training program to increase authorisations, sales and service skills. Increases over January 2005

|

|

|

|

|

|

|

|

–

|

Sales authorisations: 23,800 (+7%)

|

|

|

|

|

|

|

–

|

Fully authorised branch staff: 2,485 (+15%)

|

|

|

|

|

|

|

–

|

PBAs able to give mortgage illustrations and decisions: 1,200 (+70%)

|

|

|

|

|

|

•

|

Value alignment: Increased incentive pay linked to results delivery

|

|

|

Abbey. Measures taken for continued growth

|

|

|

|

Investing in our branches

|

|

|

|

Reinvigorating our franchise with the new corporate identity

|

|

|

|

|

|

|

|

|

|

||

|

|

•

|

Re-branding the network

|

||

|

|

|

|

|

|

|

|

|

–

|

Work already on way; external signage due to complete in September

|

|

|

|

|

|

|

|

|

|

•

|

Internal refurbishment

|

||

|

|

|

|

|

|

|

|

|

–

|

125 refurbished branches by end 2005 focusing on London and other high visibility locations

|

|

|

|

|

|

|

|

|

|

•

|

New merchandising and product literature

|

||

|

|

|

|

|

|

|

|

|

–

|

improved customer communication to increase sales and cross sale

|

|

|

Revenue stablilisation

|

|

Cost reduction

|

|

Low credit risk

|

|

In summary …

|

|

•

|

Grupo Santander’s performance H1’05

|

|

|

|

|

•

|

Business areas’ performance H1’05

|

|

|

|

|

•

|

Conclusions

|

|

Conclusions

|

|

|

|

|

|

A good first half for Grupo Santander …

|

|

|

|

|

|

•

|

Strength in our principal growth driver, retail banking business

|

|

|

|

|

•

|

Positive evolution in Abbey, with clear signals of the turn-around in sales, revenues and costs

|

|

|

|

|

•

|

Global areas stepping up in their contribution of customer generated business

|

|

|

|

|

•

|

Generalised improvement in efficiency and high credit quality

|

|

|

|

|

… which places us in line to attain our

annual earnings objective |

|

|

Investor Relations

|

|

Ciudad Grupo Santander

|

|

Edificio Pereda, 1st floor

|

|

Avda de Cantabria, s/n

|

|

28660 Boadilla del Monte

|

|

Madrid (Spain)

|

|

Tel.: 34 91 259 65 20 – 34 91 259 65 15 –

|

|

34 91 259 65 17 – 34 91 259 65 18

|

|

Fax: 34 91 257 02 45

|

|

e-mail: investor@gruposantander.com

|

|

www.gruposantander.com

|

| Item 3 | |

| Financial

Report 2005 January - June |

|

|

|

|

|

| January – June 2005 | |||

| 2 | |||

| Key consolidated data |

| Jan-Jun 05 | Jan-Jun 04 | Variation (%) | ||||||||||

| with Abbey | w/o Abbey | with Abbey | w/o Abbey | 2004 | ||||||||

| Balance sheet (Million euros) | ||||||||||||

| Total assets | 729,139 | 450,340 | 366,269 | 99.07 | 22.95 | 661,113 | ||||||

| Customer loans | 391,524 | 227,273 | 190,722 | 105.28 | 19.16 | 358,524 | ||||||

| Customer funds under management | 638,772 | 414,184 | 356,708 | 79.07 | 16.11 | 600,830 | ||||||

| On-balance sheet | 486,586 | 278,298 | 236,613 | 105.65 | 17.62 | 460,835 | ||||||

| Off-balance sheet | 152,186 | 135,886 | 120,094 | 26.72 | 13.15 | 139,995 | ||||||

| Shareholders’ equity | 34,086 | 20,079 | 69.76 | 32,111 | ||||||||

| Total managed funds | 881,325 | 586,226 | 486,364 | 81.21 | 20.53 | 801,108 | ||||||

| Capital and NPL ratios (%) | ||||||||||||

| BIS ratio | 12.81 | 12.08 | 13.01 | |||||||||

| Tier I | 7.44 | 8.12 | 7.16 | |||||||||

| NPL ratio | 1.00 | 1.13 | 1.28 | 1.02 | ||||||||

| NPL coverage | 174.92 | 219.36 | 180.70 | 166.14 | ||||||||

| Income statement (Million euros)* | ||||||||||||

| Net interest income (w/o dividends) | 4,799 | 3,910 | 3,620 | 32.58 | 8.03 | 7,372 | ||||||

| Commercial revenue | 8,600 | 6,983 | 6,422 | 33.92 | 8.75 | 12,955 | ||||||

| Gross operating income | 9,478 | 7,665 | 7,065 | 34.17 | 8.50 | 14,055 | ||||||

| Net operating income | 4,368 | 3,809 | 3,447 | 26.73 | 10.52 | 6,662 | ||||||

| Net consolidated income (ordinary) | 2,811 | 2,490 | 2,087 | 34.70 | 19.32 | 3,996 | ||||||

| Attributable income to the Group (ordinary) | 2,551 | 2,230 | 1,887 | 35.19 | 18.17 | 3,606 | ||||||

| (*).- The extraordinary capital gains generated in the first half of 2004 (assigned to extraordinary allowances at the end of the year) and those in the first half of 2005 (used to constitute a provision of the same amount to cover possible contingencies) have no impact on these income statements. | ||||||||||||

| Profitability and efficiency (%) | ||||||||||||

| ROA | 0.80 | 1.14 | 1.02 | |||||||||

| Ordinary ROE | 15.92 | 21.84 | 19.70 | |||||||||

| Efficiency ratio (1) | 48.41 | 44.44 | 45.03 | 46.12 | ||||||||

| Efficiency ratio with depreciation and amortization (2) | 53.49 | 49.74 | 50.74 | 52.00 | ||||||||

| Market capitalisation and shares | ||||||||||||

| Shares outstanding (millions at period-end) | 6,254 | 4,768 | 6,254 | |||||||||

| Share price (euros) | 9.59 | 8.53 | 9.13 | |||||||||

| Market capitalisation (million euros) | 59,979 | 40,674 | 57,102 | |||||||||

| EPS ordinary (euro) | 0.4088 | 0.3975 | 0.7289 | |||||||||

| Diluted EPS ordinary (euro) | 0.4080 | 0.3973 | 0.7276 | |||||||||

| P/E ratio (share price / annualized EPS) | 11.73 | 10.73 | 12.53 | |||||||||

| Other data | ||||||||||||

| Shareholders (number) | 2,528,398 | 1,100,827 | 2,685,317 | |||||||||

| Number of employees | 126,500 | 105,277 | 129,663 | |||||||||

| Continental Europe | 42,824 | 44,311 | 43,366 | |||||||||

| United Kingdom (Abbey) | 21,778 | — | 24,361 | |||||||||

| Latin America | 60,263 | 59,560 | 60,504 | |||||||||

| Financial management and equity stakes | 1,635 | 1,406 | 1,432 | |||||||||

| Number of branches | 10,099 | 9,219 | 9,973 | |||||||||

| Continental Europe | 5,270 | 5,163 | 5,233 | |||||||||

| United Kingdom (Abbey) | 716 | — | 730 | |||||||||

| Latin America | 4,113 | 4,056 | 4,010 | |||||||||

| (1).- | (general administrative expenses - compensating fees / gross operating income + income from non-financial services (net)) |

| (2).- | (general administrative expenses - compensating fees + depreciation and amortisation / gross operating income + income from non-financial services (net)) |

| Note: This information has not been audited. It was prepared in accordance with International Financial Reporting Standards (IFRS). | |

| January – June 2005 | |||

| 3 | |||

Contents

Highlights of the first half

| • | Grupo Santander’s financial statements have been drawn up in line with the International Financial Reporting Standards (IFRS). All the information for 2004 was drawn up again in accordance with the new criteria. |

| • | Of note in the first half was the strength of retail business in both Europe and Latin America, and the progress made at Abbey (greater sales, stabilisation of revenues and cost savings), putting the Group on track to meet its targets for 2005. |

| • | The Group generated attributable income of EUR 2,551 million, 35.2% more than the ordinary attributable income of the same period of 2004. Excluding Abbey (which contributed EUR 321 million), growth was 18.2%. Second quarter attributable income of EUR 1,366 million was 15% higher than that of the first quarter. |

| • | Extraordinary income played no part in this growth: EUR 359 million in the first half of 2004 (assigned at the end of the year for extraordinary allowances) and EUR 717 million in 2005 (assigned to a provision of the same amount to cover possible contingencies). |

| • | Lending increased 5% in the second quarter and customer funds rose 7% excluding REPOs. The growth in the year to June 2005 was 20% in loans and 17% in funds (both excluding Abbey). This produced strong revenue growth and, above all, in the net operating income of the retail segments (Continental Europe Retail Banking; +18.5%; Latin America Retail Banking; +23.8% in euros; Asset Management and Insurance; +38.5% excluding Abbey). |

| • | The efficiency ratio at June was 44.4% (excluding Abbey for a like-for-like comparison). Including depreciation and amortisation costs it was 49.7%, 1.0 p.p. better than the first half of 2004. Including Abbey, the ratios were 48.4% and 53.5% respectively. |

| • | Credit risk quality remained excellent improving again during the second quarter. Including Abbey the ratio of non-performing loans was 1.00% and coverage was 175%. Excluding Abbey, in order to make like-for-like comparisons with June 2004, the ratio was 15 b.p. better and coverage increased by 39 percentage points. |

| • | The first interim dividend charged to 2005 earnings was EUR 0.09296 per share, 12% more than the same one in 2004. |

| • | Santander became the first Spanish bank to be awarded the “World’s Best Bank” by Euromoney. |

| January – June 2005 | |||

| 4 | Performance during the first half | ||

General background

Grupo Santander conducted its business against a background of a continued upswing in the global economy, with satisfactory growth (around 4%) but slightly weaker because of the surge in oil prices over the last two years. The United States and emerging Asia continued to be the main engines of growth. Latin America and Eastern Europe consolidated their expansion. Japan continued to recover, while the Euro zone remained sluggish.

The US economy grew at between 3.5% and 4%, above its potential rate, spurred by a solid base which points to a similar dynamic for the rest of the year. Inflation was under control although with some upward risks, enabling the Fed to continue to gradually increase its funds rate to 3.25% at the end of June. Latin American countries maintained growth rates of around 4% and the main macroeconomic fundamentals performed well. This was also the case of inflation, which in Brazil and Mexico had risen and is now beginning to fall.

The Euro zone’s growth remained weak (slowing to 1.3% in the first quarter of 2005) because of higher oil prices, the easing of the cycle of global growth and the euro’s previous strengthening. Inflation was virtually unchanged at around 2% because of the rise in oil prices and the underlying rate of inflation was 1.6%. The ECB held its repo rate at 2%.

Unlike the Euro zone as a whole, the pace of Spain’s growth continued to accelerate a little (3.3% in the first quarter), thanks to buoyant domestic demand. The UK authorities seem to have engineered a soft landing of the economy which is growing at around 2% and with stable inflation. The base rate is still at 4.75%, although a cut is expected.

Summary of the Group’s performance and businesses

In this environment, Grupo Santander maintained its organic growth strategy in its traditional markets through a drive in retail business with customers, based on greater diversification and improved commercial and operating efficiency. In Europe the Group performed solidly; Abbey is making progress in its management priorities for 2005 and business growth remains strong in Latin America.

Reflecting the Group’s strategy and performance, the magazine Euromoney awarded Grupo Santander its “World’s Best Bank” prize for 2005. We were also recognised as the best bank in Spain (for the fourth time in the last five years), best bank in Portugal (fourth straight

year), best bank in Chile (sixth year running), best equities house in Spain and best treasury in Latin America.

All these awards were made in recognition of the leadership shown in the acquisition of Abbey, the notable growth over the past 20 years, the leadership in Spain and the excellence of the franchise in Latin America.

The 2005 financial statements were drawn up on the basis of the new International Financial Reporting Standards (IFRS). In addition, and in accordance with the Bank of Spain’s rules, the statements for the first half were adapted to the new General Accounting Plan, which meant restructuring some balance sheet items.

In order to provide like-for-like comparisons, the 2004 statements were drawn up again in accordance with the new regulations. These statements are not audited. The notes explaining the main concepts affected by the changes are on pages 10 and 11 of this Report.

Grupo Santander’s attributable income in the first half was EUR 2,551 million, 35.2% more than the ordinary attributable income in the same period of 2004. Both the 2005 and 2004 figures were calculated on the basis of the new regulations. The higher earnings reflect the impact of the incorporation of EUR 321 million of attributable income from Abbey. Excluding this contribution, growth would have been 18.2%.

Attributable income per share was EUR 0.4088, 2.9% more than the ordinary attributable income per share in the first half of 2004, and the diluted earnings per share were EUR 0.4080. ROE was 15.9% at the end of the first half (21.8% a year earlier). The lower return is the result of the capital increase for the acquisition of Abbey, which has not yet reached its full potential in results.

The efficiency ratio was 48.4% (excluding Abbey, it was 44.4%). Including depreciation and amortisations, the ratio was 53.5% for the whole Group and 49.7% without Abbey (one percentage point better).

The ratio of non-performing loans, also excluding Abbey in order to provide a like-for-like comparison, was 0.15 points lower and NPL coverage was 39 points higher than in June 2004.

This Report presents the Group’s balance sheet and income statement figures, as well as their details, with and without Abbey. The year-on-year comparisons with 2004 and the comments are made on figures excluding Abbey.

| January – June 2005 | |||

| Performance during the first half | 5 | ||

As these figures are comparatively homogenous, they provide a truer picture of the Group’s performance between the two periods.

The Group’s results excluding Abbey show:

| • | A 8.7% rise in commercial revenue (basic revenue plus insurance activity), with more balanced growth by components, |

| • | Lower growth (+6.3%) in operating costs than in revenues. |

| • | Strong reduction in loan-loss provisions (-32.8%), due to the high quality of credit risk and the coverage levels reached, in many cases already at the maximum limit set by the Bank of Spain for the generic provision. |

| • | Ordinary income before taxes (excluding Abbey) was 19.8% higher than in the first half of 2004, in line with growth of attributable income (+18.2%). |

This performance, unlike in previous periods, was hardly affected by exchange rate variations.

The growth was due to ordinary income and was not inflated by the extraordinary income generated in the first half of 2004 (EUR 359 million, assigned at the end of the year to extraordinary provisions) nor by that in the first half of 2005 (EUR 717 million from the sale of a stake in The Royal Bank of Scotland (the same amount was used to constitute a provision to cover possible contingencies)).

As a result, the notable growth in the Group’s earnings came from the operating areas in both Europe and Latin America, and especially those most related to retail banking. For example, commercial revenue, excluding Abbey, rose 10.9%, net operating income increased 20.0% and income before taxes was up 33.8%. Financial Management and Equity Stakes, on the other hand, reflect lower results because of lower revenues generated in the Assets and Liabilities portfolio of the parent bank (ALCO) and a negative impact from the structural position of exchange rates.

The principal level of segmentation (geographic) has four segments: three operating areas plus Financial Management and Equity Stakes. The operating areas cover all the businesses that the Group develops in them, and they are: Continental Europe, United Kingdom (Abbey) and Latin America. Aside from the business in the United Kingdom from Abbey, which was only integrated in 2005, the other two large segments registered growth in euros in revenues, net operating income and attributable income.

Continental Europe, which generates 56% of the attributable income of the operating areas, registered significant growth in revenues thanks to higher net interest income, almost flat costs and reduced needs for provisions because of the high credit risk quality arising from implementation of the IFRS. Attributable income amounted to EUR 1,554 million, 40.6% more than in the first half of 2004. All Retail Banking units (Santander Central Hispano Network, Banesto, Santander Consumer, Portugal and Banif), as well as Asset Management and Wholesale Banking, grew.

| • | In the Santander Central Hispano Network, and confirming the trend indicated in the first quarter, greater business with customers is feeding through more to net interest income (+7.3%). This increase, together with another good quarter in terms of cost control, pushed up net operating income by 15.8%. As a result of the reduced need for loan-loss provisions, attributable income in the first half was 45.9% higher than in the same period of 2004. |

| • | The main developments at Banesto were an increase of 8.0% in gross operating income, controlled costs and moderately rising net provisions, which produced a further improvement in the efficiency ratio and a rise of 15.3% in net operating income. Attributable income was 15.5% higher. |

| • | Santander Consumer maintained its trend of strong growth in business and revenues, reflected in an increase of 24.8% in net operating income (+18.7% overall on a like-for-like basis). Lower loan-loss provisions produced attributable income that was 45.8% more than in the first half 2004 (+37.2% on a like-for-like basis). |

| Santander Consumer completed in the second quarter the purchase of the Norwegian bank Bankia, which specialises in revolving loans through credit cards. Its merger with Elcon, scheduled before the end of 2005, would make Santander Consumer Norway’s consumer finance leader. | |

| • | In Portugal gross operating income rose 11.0%, backed by net interest income and, above all, net fees, which combined with flat costs lifted net operating income by 22.0% and attributable income by 40.0%. Lending was strong, particularly mortgages and to companies. |

United Kingdom (Abbey) generated attributable income of EUR 321 million (£220 million) in the first half, 12% of that of all the operating areas. Revenues, net operating income and attributable income were higher in the second quarter than in the first.

| January – June 2005 | |||

| 6 | Performance during the first half | ||

The management team was strengthened and it has focused on boosting sales and implementing the cost-cutting programme. This is producing progress in meeting the year’s management priorities: stabilising recurrent revenues, improving productivity in sales and cutting costs.

Of note in the second quarter were improved sales of the two main products (mortgages and deposits), together with accounts, cards and investment products, all of which helped to generate revenues that were more stable than in the second half of 2004. Costs, in local criteria, excluding ones related to restructuring were EUR 118 million lower than in the first half of 2004.

Latin America generated EUR 900 million, 32% of the attributable income of operating business areas (+15.7% over H1’04 and 29.9% over H2’04). The main points were a strong rise in activity and in revenues from customer business, well above that of costs, and lower loan-loss provisions because of the IFRS. In dollars, the currency used to manage the area, attributable income was $1,156 million (+21.3%).

| • | Brazil kept up its strong growth in the first half (+30% in loans; +25% in deposits plus mutual funds), which produced a good performance of retail business. On the other hand, the weak performance of financial business affected by higher interest rates and the negative yield slope was offset by portfolio and equity stakes sales. Revenues increased 19.3% in euros, in line with the rise in net operating income (+18.5%). Total attributable income was 7.7% higher at EUR 317 million ($408 million, +12.8%). |

| • | Under its strategic plan focused on profitable growth, Mexico maintained in the first half of 2005 the strong pace of growth of 2004. This produced further market share gains in loans (mainly consumer) and managed funds, basically mutual funds. |

| Underscoring the greater activity with customers and higher spreads, revenue growth gained in quality and diversification. Commercial revenue rose 14.2% in euros, outpacing that of costs (+12.8%) and reflecting the rise in increased business infrastructure and greater commercial needs. Net operating income was 20.1% higher in euros, with attributable income growing at 17.8% to EUR 189 million (+23.4% in dollars to $243 million). | |

| • | Chile’s strategy continued to focus on profitable growth in customer banking businesses, particularly retail segments, and on increasing the number of customers and the products they have. This produced strong growth in loans and deposits plus mutual funds. |

| The stronger activity was underscored by growth in all revenue lines, notably commercial revenues (+16.3% in |

| euros). The small nominal reduction in costs and total allowances similar to 2004 pushed up net operating income by 36.2% and attributable income by 45.8% to EUR 157 million (in dollars +52.8% to $201 million). |

Argentina continued to improve, and of note among other countries was the 9.8% increase in Puerto Rico’s attributable income to EUR 27 million and Colombia’s to EUR 22 million (+69.4%).

The secondary level (by businesses) distinguishes between Retail Banking, Asset Management and Insurance and Global Wholesale Banking (the sum of the three geographic areas of the principal level).

Retail Banking, which generates 83% of the total revenues of the operating business areas and 75% of income before taxes, performed well. Excluding the contribution of Abbey’s retail business, the rest of the Group’s retail banking registered a rise of 20.0% in net operating income and 33.8% in income before taxes over the first half of 2004. Continental Europe’s net operating income increased 18.5% and its income before taxes grew 37.7%. The respective growth rates in Latin America were 23.8% and 24.9%, spurred by the take-off in customer business in the main markets.

Asset Management and Insurance continued to be consolidated as a global business. The commercial brand of the fund management entities in all countries and markets was unified and is now called Santander Asset Management, and the Global Insurance Unit was created which integrates business in Spain and Latin America.

Income before taxes, excluding Abbey, amounted to EUR 379 million, 9% of that of all operating areas and 44.2% higher than in the first half of 2004.

Total revenue generated by all the products managed in this segment (mutual and pension funds and insurance) was EUR 1,770 million, 63.0% more than in the first half of 2004. Growth, excluding Abbey, was 16.7%, underscoring the Group’s innovation capacity and management in this business, as well as the distribution power of our networks.

Global Wholesale Banking, which generates 16% of income before taxes of the operating business areas, increased this line by 29.5% year-on-year to EUR 638 million. This was due to revenue growth in line with the increase in costs, which enabled net operating income to grow by 11.7%, and lower needs for loan-loss provisions.

When compared to the first half of 2004 the revenue performance is positively affected by higher client activity and

| January – June 2005 | |||

| Performance during the first half | 7 | ||

capital gains, and negatively by lower revenues from own account trading in Latin American treasuries.

In short, this analysis underlines the Group’s effort to boost business volumes and increase revenues through strengthening customer activity in all geographic and business areas, while controlling costs and maintaining excellent credit risk quality.

Grupo Santander results

Net interest income was EUR 5,008 million. Excluding Abbey, it was EUR 4,119 million, 6.7% more than in the first half of 2004. The increased business volumes fed through more to revenues of the retail areas. The net interest income of Continental Europe and Latin America (without Abbey for like-to-like comparisons) increased 10.0%.

In accordance with the new IFRS, the cost of preferred shares is now recorded in net interest income. The cost in the first half for the whole Group was EUR 169 million, 12.0% lower than in the same period of 2004 (excluding Abbey).

Total net fees and insurance activity, excluding Abbey, were 7.8% higher than in the first half of 2004, with a moderate rise in Europe and a significant one (+14.3%) in Latin America, which shows a good quarterly evolution. Of note by products were the revenues from mutual and pension funds (+10.7%), insurance (+31.2%) and a pick-up in those from securities (+5.7%).

Income from companies accounted for by the equity method increased 58.5% (excluding Abbey), mainly because of Cepsa’s larger contribution.

The Group’s commercial revenue (excluding Abbey) was 8.7% higher year-on-year at EUR 6,983 million. This growth was almost the same in gross operating income (+8.5%), as the negative impact on trading gains of the lower value of some Latin American portfolios and the reduced revenues from management of the parent bank’s structural risk were largely offset by higher trading gains from customers and the positive effect of applying the IFRS to the valuation of derivatives.

The net figure of revenues less the costs of non-financial services, excluding Abbey, was 18.0% higher than in the first half of 2004 at EUR 129 million. This includes the results from non-financial consolidated companies, such as real estate and renting companies.

General administrative expenses increased 6.3% excluding Abbey, due to the commercial efforts and the increased infrastructure in some countries (Brazil and Mexico) and the perimeter effect of Santander Consumer’s acquisitions.

The growth in costs, lower than that of revenues, produced an improvement of 0.6 points in the efficiency ratio to 44.4% (excluding Abbey). Including depreciation and amortisation, the ratio stood at 49.7% (1.0 p.p. better than in the first half of 2004).

Net operating income (excluding Abbey) grew 10.5%. This growth was based on all operating areas, which increased 19.6% (Financial Management and Equity Stakes contributed less than in 2004 because of the reduced revenues from the ALCO portfolios and the smaller contribution of the centralised exchange rate position). Including Abbey, net operating income was EUR 4,368 million, 26.7% more than in the first half of 2004.

The impairment loss on the Group’s assets amounted to EUR 693 million, most of which were net loan loss provisions (EUR 672 million) which, excluding Abbey, were 32.8% lower than in the first half of 2004. This was due to the high credit risk quality, applying the IFRS and lower country-risk provisions.

Other income was EUR 217 million negative in the first half of 2005 (EUR 106 million negative in the same period of 2004).

Attributable income, excluding Abbey, amounted to EUR 2,230 million, 18.2% more than the ordinary attributable income in the first half of 2004. Including Abbey’s contribution of EUR 321 million, total attributable income was 35.2% higher than in the first half of 2004 at EUR 2,551 million (+EUR 664 million).

Grupo Santander balance sheet

Assets at the end of June amounted to EUR 729,139 million and including off-balance sheet customer funds they totalled EUR 881,325 million.

Loans and managed funds (customer activity) amounted to EUR 398,864 million and EUR 638,772 million, respectively. A large part of this growth (+103.7% and +79.1% y-o-y) was due to Abbey’s incorporation in December 2004 and the greater geographic diversification of businesses. Continental Europe accounted for 47% of the Group’s total lending, the United Kingdom 42% and Latin America 11%. The respective figures for managed customer funds are 45%, 36% and 19%.

Business volumes remained high in the second quarter, with loans growing 5% and customer funds without REPOs 7%.

In order to provide like-for-like comparisons, the Group’s performance over the last 12 months is analysed without including Abbey.

| January – June 2005 | |||

| 8 | Performance during the first half | ||

Gross lending increased by 19.3% over June 2004 to EUR 233,642 million (+19.8% excluding securitisations). Year-on-year growth in loans to other resident sectors was 18.4% and particularly noteworthy was the 24.0% rise in secured loans (both excluding securitisations). Loans to the non-resident sector increased 22.8%.

As regards the geographic distribution (principal segments), Continental Europe’s lending grew 17%. In Spain the Santander Central Hispano Network’s lending increased 16% and Banesto’s 24%, while Portugal’s rose 8% and Santander Consumer’s 36% (all excluding securitisations).

Latin America’s registered growth in loans of 33% in euros (+20% in local currency), with increases in all large countries: Brazil (+30%), Mexico (+25%), excluding the Fobaproa paper, and Chile (+14%).

On-balance sheet customer funds excluding Abbey amounted to EUR 278,298 million, 17.6% more than in the first half of 2004. Deposits excluding REPOs increased 12.5%, marketable debt securities 42.0% and subordinated debt 5.2%, while insurance liabilities rose 41.4%.

Mutual funds rose by 10.3% year-on-year and pension plans 22.1%.

Total managed funds (on-and off-balance sheet), excluding Abbey, amounted to EUR 414,184 million at the end of June, 16.1% more than a year earlier (+13.3% excluding the exchange rate impact).

Continental Europe’s total managed customer funds increased 9%. In Spain, which accounts for more than 80% of Continental Europe’s total balances, on-balance sheet funds increased 12% and off-balance sheet ones 6%. The Group continued to be the leader in Spain in mutual funds with a market share of around 26%. In Portugal the Group is ranked second in mutual funds with a market share of 18.3%.

Latin America’s on- and off-balance sheet funds increased 29% in euros (+15% excluding the exchange rate impact). All countries’ funds grew in local currency terms and in deposits, excluding REPOs, they all registered double digit growth, notably Venezuela (+62%), Brazil, Colombia and Puerto Rico, with growth of around 39%, while Chile and Mexico grew at 30% and 15%, respectively. The region’s total mutual funds rose 20% (excluding the exchange rate impact), notably Argentina, Puerto Rico, Mexico and Colombia. In pension plans all countries grew (+17% overall growth, excluding the exchange rate impact).

In addition, and as part of its global financing strategy, the

Group issued in the first half EUR 7,000 million of covered bonds of between 7 and 15 years, as well as senior debt issues amounting to EUR 11,263 million and subordinated debt for EUR 800 million. It also placed EUR 1,000 million of preferred shares.

In the first half of 2005 EUR 4,667 million of senior debt issues and one of covered bonds (EUR 226 million) matured and two issues of preferred shares (EUR 506 million) and issues of subordinated debt (EUR 1,991 million) were amortised ahead of schedule.

Goodwill pending amortisation, including Abbey, stood at EUR 15,871 million at the end of June.

Shareholders Equity totalled EUR 49,238 million, according to the Bank for International Settlements (BIS) criteria, with a surplus of EUR 18,484 million. The BIS ratio stands at 12.81%, Tier I at 7.44% and core capital at 5.35%.

Standard & Poor’s confirmed its ratings in July and improved from stable to positive the outlook of Banco Santander Central Hispano and its main subsidiaries in Europe. This positive outlook reflects the favourable potential impact of Abbey’s restructuring on the Group’s results, the good performance of other business units, the recovery of capital ratios and the continued high quality of assets.

Risk management

The Group’s ratio of non-performing loans (NPLs) was 1.00% at the end of the first half of 2005 and NPL coverage was 175%. Abbey’s NPL ratio was 0.80% and coverage 74%, both better than the first quarter figures of 0.84% and 72%, respectively.

Excluding Abbey, the NPL ratio was 1.13%, 8 b.p. better than the first quarter of 2005 and 15 b.p. below that of the first half of 2004. Coverage was 219%, 17 p.p. better than the first quarter and 39 points higher than in June 2004.

Loan loss provisions net of recoveries (excluding Abbey in order to make a like-for-like comparison with 2004) amounted to EUR 513 million in the first half, 32.8% less than in the same period of 2004. Specific provisions, net of the recovery of written-off assets, totalled EUR 270 million, 29.8% more than in the first half of 2004, because of higher provisions in Latin America, mainly due to the exchange rate effect, Santander Consumer and the growth in lending. The annualised cost of lending remained at 0.23% (0.21% in H1’04).

The NPL ratio in Spain remained at an all time low of 0.59%, (-8 b.p. over June 2004). NPL coverage was over 300% (+65 p.p. year-on-year).

| January – June 2005 | |||

| Performance during the first half | 9 | ||

The NPL ratio in Portugal, in a still weak economic environment, was 1.38% (-30 b.p. during the second quarter and almost in line with the 1.30% of June 2004). NPL coverage was 217%, 35 points higher than in March 2005 and 44 points more than in June 2004.

Santander Consumer’s NPL ratio dropped 19 b.p. in the second quarter to 2.25%. Coverage stands at 129%.

In Latin America the NPL ratio was 2.17%, 56 b.p. lower than in the second quarter, largely due to lower non-performing loans in Argentina. Year on year the NPL ratio was 103 b.p lower. NPL coverage was 181%, a rise of 21 percentage points during the second quarter and 37 year-on-year.

As regards market risk management, the trading risk,

measured in terms of daily value at risk (DVaR), remained stable with an average DVaR of EUR 18.7 million. At the end of May positions in long bonds in Mexico increased and the maximum DVaR for the quarter of EUR 20.4 million was reached. The minimum was reached at the end of June (EUR 17.6 million), as a result of reducing risk in Brazil.

Dividends

On May 1, Santander Central Hispano paid the fourth interim dividend charged to 2004 earnings of EUR 0.0842 per share. This brought the total for 2004 to EUR 0.332 per share, 10% more than in 2003.

The first interim dividend charged to 2005 earnings of EUR 0.09296 will be paid as of August 1, 12% more than the same one in 2004.

| Exchange rates: 1 euro / currency parity | ||||||||||

| Average (Income statement) | Period-end (Balance sheet) | |||||||||

| Jan-Jun 05 | Jan-Jun 04 | 30.06.05 | 31.12.04 | 30.06.04 | ||||||

| US$ | 1.2848 | 1.2263 | 1.2092 | 1.3621 | 1.2155 | |||||

| Pound sterling | 0.6859 | 0.6732 | 0.6742 | 0.7050 | 0.6708 | |||||

| Brazilian real | 3.2929 | 3.6410 | 2.8351 | 3.6177 | 3.7851 | |||||

| New Mexican peso | 14.2189 | 13.7244 | 13.0152 | 15.2279 | 14.0706 | |||||

| Chilean peso | 744.8512 | 746.1072 | 700.7314 | 759.7110 | 771.2360 | |||||

| Venezuelan bolivar | 2,659.4330 | 2,267.4194 | 2,596.5152 | 2,611.9630 | 2,330.8428 | |||||

| Argentine peso | 3.7455 | 3.5723 | 3.4931 | 4.0488 | 3.6040 | |||||

| January – June 2005 | |||

| 10 | Explanatory notes to the financial statements | ||

Explanatory notes to the financial statements

| The International Financial Reporting Standards (IFRS) came into force in Spain on January 1, 2005 and must be applied by the groups of listed companies. | |

| As a result, in order to interpret appropriately the financial statements presented below, the accounting principles described in Note 1 of the latest annual statements drawn up by Grupo Santander must be taken into account, and the changes which are now indicated. The figures for 2004 have been drawn up retroactively using the new criteria, but have not yet been audited. | |

| a) | Financial commissions. Commissions for the opening of credits and loans, which are not directly incurred by the formalisation of operations, must be accrued over the life of the operation, as one more component of the effective return of a credit or loan, although limited amounts are recorded in other operating income at the time they are charged. Until now, these commissions were fully reflected in the income statement once the operation was approved. |

| b) | Derivatives. Under the IFRS, all derivative products have to be valued on the basis of their fair value which, whenever possible, should be their market value, recording, as a general rule, the changes in the income statement. Previously, all that could be recorded were the changes in value if they were derivatives contracted in |

| organised markets. Otherwise, if the valuation showed potential losses, they were reflected in results and if they were potential profits they could not be recorded until their effective materialisation or be offset with capital losses in instruments of the same currency. | |

| c) | Financial assets available for sale. The new rules create a portfolio that is very similar to the previous portfolio of ordinary investment. The basic difference is that the changes in the fair value of assets classified in this portfolio must be registered, both negative and positive ones, in the company’s capital. When these changes in value occur, they are recorded in the income statement. The previous rules were similar but only in the allowance for capital losses. |

| d) | Net loan-loss provisions. The new rules establish an impairment test for all assets. The Bank of Spain introduces a new provision for inherent losses, which are those that all risk operations contracted by the entity have from the time they are granted. The new provision replaces the previous generic and statistical provisions. There are also maximum and minimum provision limits and a mechanism for annual allocation which takes into account, on the one hand, the change in the credit during the year and, on the other, the specific provisions made during the year for specific doubtful loans. |

| January – June 2005 | |||

| Explanatory notes to the financial statements | 11 | ||

| e) | Pension funds. The new rules mean the so-called “focus of the fluctuation band” can be applied to actuarial gains and losses, deferring the recording in results of the differences that exceed 10% of the commitments over a period of up to five years. This focus is also applied to the deficit that arose in 2000 as a result of implementing the regulations issued in 1999 and which had to be amortised in 10 years, as long as this deficit is within the 10% fluctuation band. |

| f) | Goodwill. Until now, goodwill had to be amortised systematically over a period which could last 20 years. Under the new rules goodwill stops being amortised and must be submitted, at least annually, to an impairment test to determine if it continues to maintain its value, or whether the eventual deterioration should be recorded against the income statement. |

| g) | Operations with treasury stock instruments. Under the IFRS the results from the trading of treasury stock are recorded as changes in capital and their value remains fixed at acquisition cost. Under the previous rules the results were recorded in the income statement. |

| h) | Capital with the nature of financial liabilities. The cost of some capital instruments, such as preferred stock, which have a regular contractual remuneration, is now recorded as a financial cost. Previously, this cost was attributed to minority interests. |

| i) | Sphere of consolidation. Until now, in the consolidated financial statements of groups of credit entities only financial entities and companies that conducted banking activity or were mere investment companies consolidated by the global integration method. In addition, insurance companies and others whose activity had nothing to do with financial activity, such as industrial, commercial or real estate firms, consolidated by the equity method. |