0000891103DEF 14AFALSE00008911032023-01-012023-12-310000891103mtch:AmandaGinsbergMember2017-12-012020-03-310000891103mtch:SharmisthaDubeyMember2020-03-012022-05-310000891103mtch:BernardKimMember2022-05-012023-12-31iso4217:USD0000891103mtch:BernardKimMember2023-01-012023-12-310000891103mtch:SharmisthaDubeyMember2022-01-012022-12-310000891103mtch:BernardKimMember2022-01-012022-12-3100008911032022-01-012022-12-310000891103mtch:SharmisthaDubeyMember2021-01-012021-12-3100008911032021-01-012021-12-310000891103mtch:AmandaGinsbergMember2020-01-012020-12-310000891103mtch:SharmisthaDubeyMember2020-01-012020-12-3100008911032020-01-012020-12-310000891103ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310000891103ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2023-01-012023-12-310000891103ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310000891103ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310000891103ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310000891103ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310000891103ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-01-012023-12-310000891103ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-01-012023-12-310000891103ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-01-012023-12-310000891103ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2023-01-012023-12-310000891103ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310000891103ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310000891103ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2023-01-012023-12-310000891103ecd:NonPeoNeoMemberecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMember2023-01-012023-12-310000891103ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-01-012023-12-310000891103ecd:NonPeoNeoMemberecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMember2023-01-012023-12-31000089110312023-01-012023-12-31000089110322023-01-012023-12-31000089110332023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

| | |

Proxy Statement Pursuant to Section 14(a) of |

| the Securities Exchange Act of 1934 (Amendment No. ) |

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Match Group, Inc.

(Name of registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☑ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

April 29, 2024

Dear Stockholder:

You are invited to attend the Annual Meeting of Stockholders of Match Group, Inc., which will be held on Friday, June 21, 2024, at 8:00 a.m., Eastern Time at the offices of Davis Polk & Wardwell, 450 Lexington Avenue, New York, New York 10017.

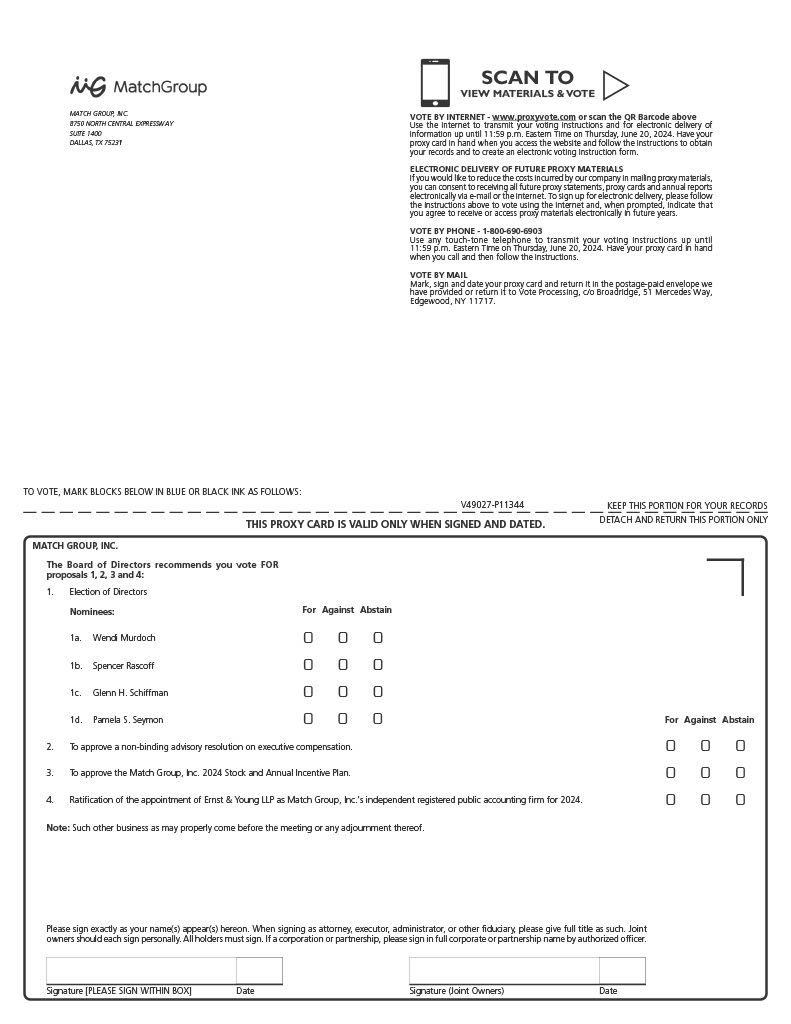

At the Annual Meeting, stockholders will be asked to: (1) elect four directors, (2) approve, on a nonbinding advisory basis, the compensation paid to our named executive officers in 2023, (3) approve the Match Group, Inc. 2024 Stock and Annual Incentive Plan and (4) ratify the appointment of Ernst & Young as Match Group’s independent registered public accounting firm for the 2024 fiscal year. Match Group’s Board of Directors believes that the proposals being submitted for stockholder approval are in the best interests of Match Group and its stockholders. The Board recommends a vote consistent with the Board’s recommendation for each proposal.

It is important that your shares be represented and voted at the Annual Meeting regardless of the size of your holdings. Whether or not you plan to attend the Annual Meeting, please take the time to vote online, by telephone or, if you receive a printed proxy card, by returning a marked, signed and dated proxy card. If you attend the Annual Meeting, you may vote in person if you wish, even if you have previously submitted your vote.

I look forward to greeting those of you who will be able to attend the meeting.

Sincerely,

Bernard Kim ("BK")

Chief Executive Officer

8750 NORTH CENTRAL EXPRESSWAY, SUITE 1400, DALLAS, TEXAS 75231 214.576.9352 www.mtch.com

MATCH GROUP, INC.

8750 North Central Expressway, Suite 1400

Dallas, Texas 75231

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders:

Match Group, Inc. (“Match Group” or the “Company”) is making this proxy statement available to holders of our common stock in connection with the solicitation of proxies by Match Group’s Board of Directors for use at the Annual Meeting of Stockholders to be held on Friday, June 21, 2024, at 8:00 a.m., Eastern Time at the offices of Davis Polk & Wardwell, 450 Lexington Avenue, New York, New York 10017 (the “Annual Meeting”). At the Annual Meeting, stockholders will be asked to:

1. elect four members of our Board of Directors, each to hold office for a three-year term ending on the date of the annual meeting of stockholders in 2027 or until such director’s successor shall have been duly elected and qualified (or, if earlier, such director’s removal or resignation from our Board of Directors);

2. hold an advisory vote on executive compensation;

3. approve the Match Group, Inc. 2024 Stock and Annual Incentive Plan;

4. ratify the appointment of Ernst & Young LLP as Match Group’s independent registered public accounting firm for the 2024 fiscal year; and

5. to transact such other business as may properly come before the meeting and any related adjournments or postponements.

Match Group’s Board of Directors has set April 22, 2024 as the record date for the Annual Meeting. This means that holders of record of our common stock at the close of business on that date are entitled to receive notice of the Annual Meeting and to vote their shares at the Annual Meeting and any related adjournments or postponements.

As permitted by applicable Securities and Exchange Commission rules, on or about April 29, 2024, we first mailed a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Annual Meeting proxy statement and 2023 Annual Report on Form 10-K online, as well as instructions on how to obtain printed copies of these materials by mail.

Only stockholders and persons holding proxies from stockholders may attend the Annual Meeting. Seating is limited, however, and admission to the Annual Meeting will be on a first-come, first-served basis. All attendees will need to bring an admission ticket and other proof of stock ownership as well as a valid photo ID to gain admission to the Annual Meeting. See page 4 for further details.

By order of the Board of Directors,

Francisco J. Villamar

Secretary

April 29, 2024

PROXY STATEMENT

TABLE OF CONTENTS

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

Q: Why did I receive a Notice of Internet Availability of Proxy Materials?

A: In accordance with rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to deliver this proxy statement and our 2023 Annual Report on Form 10-K to the majority of our stockholders online in lieu of mailing printed copies of these materials to each of our stockholders. If you received a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail, you will not receive printed copies of our proxy materials unless you request them. Instead, the Notice provides instructions on how to access this proxy statement and our 2023 Annual Report on Form 10-K online, as well as how to obtain printed copies of these materials by mail. We believe that this process allows us to provide our stockholders with the information they need in a more timely manner than if we had elected to mail printed materials, while reducing the environmental impact of, and lowering the costs associated with, the printing and distribution of our proxy materials.

The Notice, our proxy materials and our 2023 Annual Report on Form 10-K are being mailed on or about April 29, 2024 to stockholders of record as of the close of business on April 22, 2024. This proxy statement and our 2023 Annual Report on Form 10-K will also be available at www.proxyvote.com beginning on April 29, 2024. If you received a Notice by mail but would rather receive printed copies of our proxy materials, please follow the instructions included in the Notice. You will not receive a Notice if you have previously elected to receive printed copies of our proxy materials.

Q: Can I vote my shares by filling out and returning the Notice?

A: No. However, the Notice provides instructions on how to vote your shares by way of completing and submitting your proxy online or by phone, by requesting and returning a written proxy card by mail or by submitting a ballot in person at the Annual Meeting.

Q: Who is entitled to vote at the Annual Meeting?

A: Holders of common stock of Match Group, Inc. (“Match Group” or the “Company”) as of the close of business on April 22, 2024, the record date for the Annual Meeting established by Match Group’s Board of Directors (the “Board”), are entitled to receive notice of the Annual Meeting and to vote their shares at the Annual Meeting and any related adjournments or postponements.

At the close of business on April 22, 2024, there were 265,598,349 shares of Match Group common stock outstanding and entitled to vote. Holders of Match Group common stock are entitled to one vote per share.

Q: What is the difference between a stockholder of record and a stockholder who holds stock in street name?

A: If your Match Group shares are registered in your name, you are a stockholder of record. If your Match Group shares are held in the name of your broker, bank or other holder of record, your shares are held in street name.

You may examine a list of the stockholders of record at the close of business on April 22, 2024 for any purpose germane to the Annual Meeting during normal business hours during the 10-day period preceding the date of the meeting at our Dallas offices, located at 8750 North Central Expressway, Suite 1400, Dallas, Texas 75231.

Q: What are the quorum requirements for the Annual Meeting?

A: The presence at the Annual Meeting, in person or by proxy, of holders of shares of Match Group common stock representing a majority of the voting power of Match Group common stock entitled to vote at the Annual Meeting constitutes a quorum. Shares of Match Group common stock represented by proxy will be treated as present at the Annual Meeting for purposes of determining whether there is a quorum, without regard to whether the proxy is marked as casting a vote or abstaining.

Q: What matters will Match Group stockholders vote on at the Annual Meeting?

A: Match Group stockholders will vote on the following proposals:

• Proposal 1—to elect four members of Match Group’s Board of Directors, each to hold office for a three-year term ending on the date of the annual meeting of stockholders in 2027 or until such director’s successor shall have been duly elected and qualified (or, if earlier, such director’s removal or resignation from Match Group’s Board of Directors);

• Proposal 2—to hold an advisory vote on executive compensation (the "say on pay proposal");

• Proposal 3—to approve the Match Group, Inc. 2024 Stock and Annual Incentive Plan (the "2024 Stock Plan Proposal");

• Proposal 4—to ratify the appointment of Ernst & Young LLP as Match Group’s independent registered public accounting firm for the 2024 fiscal year; and

• to transact such other business as may properly come before the Annual Meeting and any related adjournments or postponements.

Q: What are my voting choices when voting for director nominees and what votes are required to elect director nominees to Match Group’s Board of Directors?

A: You may vote in favor of a director nominee, against that director nominee or abstain from voting as to the director nominee.

The election of each of our director nominees requires the affirmative vote of a majority of the votes cast with respect to the nominee's election (meaning the number of votes cast "for" each nominee must exceed the number of votes cast "against" such nominee). Our corporate governance guidelines provide that any incumbent nominee who receives a greater number of votes cast against their election than votes cast in favor of their election, shall immediately tender their resignation, and that the Board shall then decide, through a process managed by the Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”), whether to accept the resignation at its next regularly scheduled meeting held not less than 90 days after such election. The Board's explanation of its decision shall be promptly disclosed in a Current Report on Form 8-K.

The Board recommends that our stockholders vote FOR the election of each of the director nominees.

Q: What are my voting choices when voting on the say on pay proposal and what votes are required to approve this proposal?

A: You may vote in favor of the say on pay proposal, against the say on pay proposal or abstain from voting on the say on pay proposal.

The approval, on an advisory basis, of the say on pay proposal requires the affirmative vote of a majority of the voting power of the shares of Match Group common stock present at the Annual Meeting in person or represented by proxy and entitled to vote on the matter.

The Board recommends that our stockholders vote FOR the say on pay proposal.

Q: What are my voting choices when voting on the 2024 Stock Plan Proposal and what votes are required to approve this proposal?

A: You may vote in favor of the 2024 Stock Plan Proposal, against the 2024 Stock Plan Proposal or abstain from voting on the 2024 Stock Plan Proposal.

The approval of the 2024 Stock Plan Proposal requires the affirmative vote of a majority of the voting power of the shares of Match Group common stock present at the Annual Meeting in person or represented by proxy and entitled to vote on the matter.

The Board recommends that our stockholders vote FOR the 2024 Stock Plan Proposal.

Q: What are my voting choices when voting on the ratification of the appointment of Ernst & Young LLP as Match Group’s independent registered public accounting firm for the 2024 fiscal year and what votes are required to ratify this appointment?

A: You may vote in favor of the ratification, against the ratification or abstain from voting on the ratification.

The ratification of the appointment of Ernst & Young LLP as Match Group’s independent registered public accounting firm for the 2024 fiscal year requires the affirmative vote of a majority of the voting power of the shares of Match Group common stock present at the Annual Meeting in person or represented by proxy and entitled to vote on the matter.

The Board recommends that our stockholders vote FOR the ratification of the appointment of Ernst & Young LLP as Match Group’s independent registered public accounting firm for the 2024 fiscal year.

Q: Could other matters be decided at the Annual Meeting?

A: As of the date of this proxy statement, we did not know of any matters to be raised at the Annual Meeting, other than those referred to in this proxy statement.

If any other matters are properly presented at the Annual Meeting for consideration, the three Match Group officers who have been designated as proxies for the Annual Meeting, Philip D. Eigenmann, Jeanette Teckman and Francisco J. Villamar, will have the discretion to vote on those matters for stockholders who have submitted their executed proxy.

Q: What do I need to do now to vote at the Annual Meeting?

A: Match Group’s Board of Directors is soliciting proxies for use at the Annual Meeting. Stockholders may submit proxies to instruct the designated proxies to vote their shares in any of the following three ways:

• Submitting a proxy online: Submit your proxy online at www.proxyvote.com. Online proxy voting is available 24 hours a day and will close at 11:59 p.m., Eastern Time, on Thursday, June 20, 2024;

• Submitting a proxy by telephone: Submit your proxy by telephone by using the toll-free telephone number provided on your proxy card (1.800.690.6903). Telephone proxy voting is available 24 hours a day and will close at 11:59 p.m., Eastern Time, on Thursday, June 20, 2024; or

• Submitting a proxy by mail: If you choose to submit your proxy by mail, simply mark, date and sign your proxy, and return it in the postage-paid envelope provided or to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717.

If you were a stockholder of record on April 22, 2024, or if you have a legal proxy from your broker, bank or other holder of record identifying you as a beneficial owner of Match Group shares as of that date, you may vote in person at the Annual Meeting. All attendees will need to bring an admission ticket and other proof of stock ownership as well as a valid photo ID to gain admission to the Annual Meeting. See page 4 for further details.

For Match Group shares held in street name, holders may submit a proxy online or by telephone if their broker, bank or other holder of record makes these methods available. If you submit a proxy online or by telephone, do not request and return a printed proxy card from Match Group or from your broker, bank or other holder of record. If you hold your shares through a broker, bank or other holder of record, follow the voting instructions you receive from your broker, bank or other holder of record.

Q: If I hold my Match Group shares in street name, will my broker, bank or other holder of record vote these shares for me?

A: If you hold your Match Group shares in street name, you must provide your broker, bank or other holder of record with instructions in order to vote these shares. If you do not provide voting instructions, whether your shares can be voted by your broker, bank or other holder of record in their discretion depends on the type of item being considered for a vote.

Non-Discretionary Items. The election of directors, the say on pay proposal and the 2024 Stock Plan Proposal are non-discretionary items and may not be voted on by your broker, bank or other holder of record absent specific voting instructions from you. If your bank, broker or other holder of record does not receive specific voting instructions from you, a “broker non-vote” will occur in the case of your shares of Match Group common stock for these proposals.

Discretionary Items. The ratification of Ernst & Young LLP as Match Group’s independent registered public accounting firm for the 2024 fiscal year is a discretionary item. Generally, brokers, banks and other holders of record that do not receive voting instructions may vote on this proposal in their discretion.

Q: What effect do abstentions and broker non-votes have on quorum requirements and the voting results for each proposal to be voted on at the Annual Meeting?

A: Abstentions and shares represented by broker non-votes are counted as present for purposes of determining a quorum. Abstentions and shares represented by broker non-votes do not count as votes cast and, as a result, have no effect on the outcome of the election of directors, for which the voting standard is a majority of the votes cast. Abstentions are treated as shares present and entitled to vote and, as a result, have the same effect as a vote against any proposal for which the voting standard is based on the voting power present in person or represented by proxy at the Annual Meeting and entitled to vote on the matter, including the say on pay proposal, the 2024 Stock Plan Proposal and the auditor ratification proposal. Shares represented by broker non-votes are not treated as shares

entitled to vote and, as a result, have no effect on the say on pay proposal or the 2024 Stock Plan Proposal. No broker non-votes are expected for the auditor ratification proposal given that it is considered a discretionary item.

Q: Can I change my vote or revoke my proxy?

A: Yes. If you are a stockholder of record, you may change your vote or revoke your proxy at any time before the vote at the Annual Meeting by:

• submitting a later-dated proxy relating to the same shares online, by telephone or by mail prior to the vote at the Annual Meeting. Online and telephone proxy voting are available 24 hours a day and will close at 11:59 p.m., Eastern Time, on Thursday, June 20, 2024;

• delivering a written notice, bearing a date later than your proxy, stating that you revoke the proxy; or

• attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not, by itself, revoke a proxy). All attendees will need to bring an admission ticket or other proof of stock ownership as well as a valid photo ID to gain admission to the Annual Meeting. See the question below for further details.

To change your vote or revoke your proxy, follow the instructions provided on the Notice or the proxy card to do so online or by telephone, or send a written notice or a new proxy card to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717.

If you hold your shares through a broker, bank or other holder of record, follow the instructions that you receive from your broker, bank or other holder of record if you wish to change your vote or revoke your proxy.

Q: Who can attend the Annual Meeting, and what are the rules for admission at the meeting?

A: Only stockholders and persons holding proxies from stockholders may attend the Annual Meeting. Seating is limited, however, and admission to the Annual Meeting will be on a first-come, first-served basis. All attendees will need to bring an admission ticket and other proof of stock ownership as well as a valid photo ID to gain admission to the Annual Meeting. If you are a stockholder of record, you may bring the top half of your proxy card or your Notice to serve as your admission ticket and proof of stock ownership. If you hold your shares in street name, you may bring your Notice or voting instruction form (or a copy thereof) to serve as your admission ticket and you will be required to present proof of ownership to be admitted into the meeting. Acceptable proof of ownership includes a recent brokerage statement or a legal proxy or letter from your broker, bank or other holder of record evidencing your beneficial ownership of Match Group shares as of April 22, 2024.

No cameras, recording equipment, large bags or packages will be permitted at the Annual Meeting. The use of cell phones, smart phones, tablets and other personal communication devices for any reason during the Annual Meeting is strictly prohibited.

Q: What if I do not specify a choice for a matter when returning a proxy?

A: If you do not give specific instructions, proxies that are signed and returned will be voted in accordance with the Board's recommendations, meaning they will be voted FOR the election of all director nominees, FOR the say on pay proposal, FOR the 2024 Stock Plan Proposal and FOR the ratification of the appointment of Ernst & Young LLP as Match Group’s independent registered public accounting firm for the 2024 fiscal year.

Q: How are proxies solicited and who bears the related costs?

A: Match Group bears all expenses incurred in connection with the solicitation of proxies. In addition to solicitations by mail, directors, officers and employees of Match Group may solicit proxies from stockholders by telephone, e-mail, letter, facsimile or in person. Following the initial mailing of the Notice and proxy materials, Match Group will request brokers, banks and other holders of record to forward copies of these materials to persons for whom they hold shares of Match Group common stock and to request authority for the exercise of proxies. In such cases, Match Group, upon the request of these holders, will reimburse these parties for their reasonable expenses.

Q: What should I do if I have questions regarding the Annual Meeting?

A: If you have any questions about the Annual Meeting, the various proposals to be voted at the Annual Meeting, would like to obtain directions to attend the Annual Meeting and vote in person, or would like copies of any of the documents referred to in this proxy statement, contact Match Group Investor Relations at IR@match.com.

PROPOSAL 1—ELECTION OF DIRECTORS

Proposal and Required Vote

The following nominees have been selected by the Nominating Committee and approved by the Board for submission to our stockholders, each to serve a three-year term expiring at the annual meeting of Match Group’s stockholders in 2027 or until such director’s successor shall have been duly elected and qualified (or, if earlier, such director’s removal or resignation from the Board):

• Wendi Murdoch;

• Spencer Rascoff;

• Glenn H. Schiffman; and

• Pamela S. Seymon.

Information concerning the director nominees, all of whom are incumbent directors of Match Group, appears below. Although management does not anticipate that any of these director nominees will be unable or unwilling to stand for election, in the event of such an occurrence, proxies may be voted for a substitute designated by the Board upon recommendation of the Nominating Committee, or the Board may reduce its size.

The election of each of our director nominees requires the affirmative vote of a majority of the votes cast with respect to the nominee's election (meaning the number of votes cast "for" each nominee must exceed the number of votes cast "against" such nominee).

The Board recommends that our stockholders vote FOR the election of all director nominees.

Information Concerning Director Nominees and Other Board Members

Background information about each director nominee and other directors serving unexpired terms is set forth below, including information regarding the specific experiences, characteristics, attributes and skills that the Nominating Committee and the Board considered in determining that each director should serve on the Board, and which the Nominating Committee and the Board believe provide Match Group with the perspective and judgment needed to guide, monitor and execute its strategies.

Nominees for election at the Annual Meeting to a term expiring in 2027:

Wendi Murdoch, age 55, has been a director of Match Group since June 2020. Ms. Murdoch is an entrepreneur and investor. Since 2009, Ms. Murdoch has served as cofounder and board member of Artsy, an online platform for collecting, discovering and selling art that partners with over 4,500 art museums, galleries, art fairs and auction houses. From 2005 to 2012, Ms. Murdoch worked as an advisor for News Corporation’s businesses and investments in China. Throughout her career, Ms. Murdoch has applied her business expertise to advise and invest in technology and other companies in Asia and the United States. Ms. Murdoch is also an award-winning producer and produced the Netflix documentary “Sky Ladder,” which premiered at the 2016 Sundance Film Festival. Ms. Murdoch holds an MBA from Yale University’s School of Management. In determining that Ms. Murdoch should serve as a director, the Nominating Committee and the Board considered her investment and business expertise, including with respect to Asian markets.

Spencer Rascoff, age 48, has been a director of Match Group since March 2024. Mr. Rascoff is a co-founder of 75 & Sunny Ventures, a startup studio and venture capital firm, where he has served as CEO since May 2021. Through 75 & Sunny Ventures, Mr. Rascoff is an active angel investor in over 50 companies. Mr. Rascoff is also a co-founder of Pacaso, a marketplace for vacation home ownership, where he has served as Chair since September 2020, as well as founder of several early-stage startups. Mr. Rascoff co-founded Zillow, a technology real estate marketplace company, in 2005 and served as its CEO for 10 years. During Mr. Rascoff's time as CEO, Zillow won dozens of "best places to work" awards as it grew to over 4,500 employees, $3 billion in revenue and $10 billion in market capitalization. Prior to Zillow, Mr. Rascoff co-founded and was VP, Corporate Development of Hotwire, a travel website, which was sold to Expedia in 2003. Mr. Rascoff is also a visiting professor at Harvard where he teaches classes on entrepreneurship and startups. Mr. Rascoff graduated from Harvard University with a Bachelor's degree in Government. Mr. Rascoff previously served as a member of the boards of directors of Zillow Group, Inc. from July 2011 through April 2020, Palantir Technologies Inc. from July 2020 through June 2022, TripAdvisor, Inc. from 2013 through June 2020, Supernova Partners Acquisition Company, Inc. from August 2020 through September 2021, Supernova Partners Acquisition Company II, Ltd. from December 2020 through March 2022, and Supernova Partners Acquisition Company III, Ltd. from March 2021 through April 2023. In determining that Mr. Rascoff should serve as a director, the Nominating Committee and the Board considered his significant experience as an entrepreneur and his proven track record of building and scaling consumer internet businesses.

Glenn H. Schiffman, age 54, has been a director of Match Group since September 2016. Mr. Schiffman has served as Executive Vice President and Chief Financial Officer of Fanatics, Inc., a global digital sports platform, since August 2021. As Chief Financial Officer of Fanatics, Mr. Schiffman is responsible for a broad set of financial and corporate functions across the entire Fanatics global enterprise, including corporate finance, M&A, treasury, financial planning and analysis, investor relations, accounting, information and physical security, real estate, human resources, legal and corporate administration. He drives the financial direction of the company as it expands beyond commerce into new verticals across the sports ecosystem to become a leading global digital sports platform. Prior to Fanatics, Mr. Schiffman served as Executive Vice President and Chief Financial Officer of IAC, Inc. ("IAC") (and its predecessors), a holding company that owns multiple digital products and brands, from April 2016 to August 2021 and as Chief Financial Officer of Angi Inc., a company that connects home service professionals with consumers, from September 2017 to August 2019 and from February 2021 to July 2021. Previously, Mr. Schiffman spent 25 years as an investment banker, holding various leadership and management roles with organizations including Guggenheim Securities, The Raine Group, Nomura, where he ran the Asian and subsequently the North and South America Investment Banking business, and Lehman Brothers, where he ran Asia Investment Banking and previously he ran the Global Media Group. Mr. Schiffman has served on the boards of directors of Angi Inc. and Vimeo, Inc. since June 2017 and May 2021, respectively, including serving as Chairman of the Board of Vimeo, Inc. since March 2023. Mr. Schiffman was named Institutional Investor’s CFO of the Year of the Midcap Internet Sector in 2018 and 2021. In Mr. Schiffman’s philanthropic efforts, he focuses on endowing organizations and funding initiatives with permanent capital to make lasting change. He founded and is Chairman of the Valerie Fund Endowment, which supports children with cancer and blood disorders, created an endowment at the Duke Medical Center to research and hopefully someday cure pediatric cancer, created an endowment at Washington & Lee to support Women’s Athletics, and created an endowment at Duke University to fund scholarships for athletes from underrepresented communities. In determining that Mr. Schiffman should serve as a director, the Nominating Committee and the Board considered the unique knowledge and experience regarding Match Group and its businesses that he gained through his role as Executive Vice President and Chief Financial Officer of IAC, as well as his high level of financial literacy and expertise regarding mergers, acquisitions, investments and other strategic transactions. The Nominating Committee and the Board also considered Mr. Schiffman’s investment banking experience, which the Nominating Committee and the Board believe gives him particular insight into trends in capital markets and the technology and media industries.

Pamela S. Seymon, age 68, has been a director of Match Group since November 2015. Ms. Seymon was a partner at Wachtell, Lipton, Rosen & Katz, a New York law firm (“WLRK”), from January 1989 to January 2011, and prior to that time, was an associate at WLRK from 1982. During her tenure at WLRK, Ms. Seymon specialized in corporate law, mergers and acquisitions, securities and corporate governance, and represented public and private corporations on offense as well as defense, in both friendly and unsolicited transactions. Ms. Seymon is a graduate of Wellesley College, where she was a Wellesley Scholar, and New York University School of Law. In determining that Ms. Seymon should serve as a director, the Nominating Committee and the Board considered her extensive experience representing public and private corporations in connection with a wide array of complex, sophisticated and high profile matters, as well as her high level of expertise generally regarding mergers, acquisitions, investments and other strategic transactions.

Directors whose terms expire in 2025:

Stephen Bailey, age 44, has been a director of Match Group since June 2020. Mr. Bailey has served as Founder and Chief Executive Officer of ExecOnline, Inc., a leading provider of B2B leadership development solutions, since 2011. Prior to that he served as Chief Executive Officer and Chief Product Officer of Frontier Strategy Group, LLC, a software and information services business, from January 2006 to May 2011. Before joining Frontier Strategy Group, Mr. Bailey was an associate in the venture capital and private equity group of WilmerHale. Mr. Bailey has served on the board of directors of Ibotta, Inc. since February 2024. In determining that Mr. Bailey should serve as a director, the Nominating Committee and the Board considered his extensive executive management experience, which the Nominating Committee and the Board believe gives him insight into business strategy, leadership and marketing.

Melissa Brenner, age 49, has been a director of Match Group since June 2020. Since January 2018, Ms. Brenner has served as Executive Vice President, Digital Media for the National Basketball Association ("NBA"), where she leads the development, oversight and implementation of the NBA’s global digital strategy and emerging technology initiatives. Ms. Brenner led the NBA's social media portfolio as the league became one of the largest social media communities in the world. In addition, Ms. Brenner has led the digital products team on the execution of the NBA app and website. Ms. Brenner has held positions of increasing responsibility with the NBA since 1997, including Senior Vice President, Digital Media from February 2014 to December 2017, Senior Vice President, Marketing from February 2013 to January 2014, and Vice President, Marketing from October 2007 to January 2013. In determining that Ms. Brenner should serve as a director, the Nominating Committee and the Board considered her extensive marketing and executive management expertise as well as her experience in social media and digital products.

Bernard Kim, age 47, has served as Chief Executive Officer and a director of Match Group since May 2022. Prior to that time, Mr. Kim served as President of Publishing of Zynga Inc., a mobile video game developer, from June 2016 until May 2022, where he oversaw various functions including global marketing, user acquisition, revenue, communications, consumer insights, data science, product management, and mergers and acquisitions. Prior to joining Zynga, Mr. Kim spent nearly 10 years at Electronic Arts Inc. ("EA") as the company's Senior Vice President of Mobile Publishing. In that role, he oversaw EA's mobile distribution, strategy, product management, analytics, network engagement, marketing, revenue demand planning, business development, third-party publishing, and mergers and acquisitions. Before joining EA, Mr. Kim served as Director of Sales and Channel Strategy at The Walt Disney Company, where he led sales and retail for Disney Mobile. Mr. Kim has served on the board of directors of Five Below, Inc. since June 2022. Mr. Kim holds an undergraduate degree in both economics and communications from Boston College. In determining that Mr. Kim should serve as a director, the Nominating Committee and the Board considered his position as Chief Executive Officer of the Company as well as his considerable experience managing operations and strategic planning in the mobile application and interactive entertainment industry.

Alan G. Spoon, age 72, has been a director of Match Group since November 2015. Mr. Spoon served as General Partner and Partner Emeritus of Polaris Partners from 2011 to 2018. He previously served as Managing General Partner of Polaris Partners from 2000 to 2010. Polaris Partners is a private investment firm that provides venture capital and management assistance to development stage information technology and life sciences companies. Mr. Spoon was Chief Operating Officer and a director of The Washington Post Company (now known as Graham Holdings Company) from March 1991 through May 2000 and served as President from September 1993 through May 2000. Prior to his service in these roles, he held a wide variety of positions at The Washington Post Company, including as President of Newsweek from September 1989 to May 1991. Mr. Spoon has served as a member of the boards of directors of IAC since February 2003 and Danaher Corporation since July 1999, and as Chairman of the board of directors of Fortive Corporation since July 2016. Mr. Spoon previously served as a member of the board of directors of Cable One, Inc. from July 2015 through February 2021. In his not-for-profit affiliations, Mr. Spoon was a member of the Board of Regents at the Smithsonian Institution (formerly Vice Chairman) and is a longtime member of the MIT Corporation, where he serves on its Executive Committee and is Chair of its Risk and Audit Committee. He also serves as a member of the board of directors of the AXIM Collaborative Foundation, successor organization to edX.org (a not-for-profit online education platform sponsored by Harvard and the MIT Corporation). In determining that Mr. Spoon should serve as a director, the Nominating Committee and the Board considered his extensive private and public company board experience and public company management experience, all of which the Nominating Committee and the Board believe give him particular insight into business strategy, leadership and marketing in the media industry. The Nominating Committee and the Board also considered Mr. Spoon’s venture capital experience and engagement with the MIT Corporation, which the Nominating Committee and the Board believe give him particular insight into trends in the internet and technology industries, as well as into acquisition strategy and financing.

Directors whose terms expire in 2026:

Sharmistha Dubey, age 53, has been a director of Match Group since September 2019. Ms. Dubey has served as an Operating Partner of Advent International, a global private equity investing firm, since October 2022. Prior to that time, Ms. Dubey served as Chief Executive Officer of Match Group from March 2020 to May 2022. Prior to that, Ms. Dubey served as President of Match Group from January 2018, as Chief Operating Officer of Tinder from February 2017 to January 2018 and as President of Match Group Americas, where she oversaw the product and business operations for North American dating properties, including the Match U.S. brand, Plenty Of Fish, OkCupid and Match Affinity Brands, from December 2015 to January 2018. Prior to that, she served in multiple roles within the Company: Chief Product Officer of The Princeton Review and Tutor.com from July 2014 to December 2015; Executive Vice President of Tutor.com from April 2013 to July 2014; Chief Product Officer of Match.com from January 2013 through April 2013 and Senior Vice President, Match.com and Chemistry.com from September 2008 through December 2012. Ms. Dubey has served on the boards of directors of Fortive Corporation since August 2020, Naspers Limited since April 2022 and Prosus N.V. since August 2022. She holds an undergraduate degree in engineering from the Indian Institute of Technology and a master’s in engineering from Ohio State University. In determining that Ms. Dubey should serve as a director, the Nominating Committee and the Board considered her past position as Chief Executive Officer of the Company as well as her considerable experience managing operations and strategic planning, including in her prior roles within the Company.

Laura Jones, age 42, has been a director of Match Group since March 2024. Ms. Jones has served as Chief Marketing Officer of Instacart, a grocery delivery and pickup service, since July 2022. Prior to that time, Ms. Jones served as Head of Marketing and VP, Brand & Marketing of Instacart from June 2021 to July 2022. Prior to joining Instacart, Ms. Jones served in multiple positions of increasing responsibility with Uber, a multinational transportation company, including leading global marketing for Rides from 2019 to 2021 and various senior marketing roles from 2015 to 2018. At Uber, Ms. Jones built the global product marketing team from the ground up, spanning the entire product portfolio (Rides, Eats, Freight, etc). Prior to

Uber, Ms. Jones served in various senior marketing positions at Google and Visa. Ms. Jones graduated from Dartmouth College with a Bachelor’s degree in Economics and Government and received her Masters in Business Administration from Stanford University. In determining that Ms. Jones should serve as a director, the Nominating Committee and the Board considered her significant expertise in marketing and the consumer internet industry as well as her experience with brand refreshes.

Ann L. McDaniel, age 68, has been a director of Match Group since December 2015. Ms. McDaniel currently serves as a consultant to Graham Holdings Company and previously served as Senior Vice President of Graham Holdings Company (and its predecessor companies) from June 2008 to April 2015. Prior to that time, Ms. McDaniel served as Vice President-Human Resources of Graham Holdings Company from September 2001. Ms. McDaniel also served as Managing Director of Newsweek, Inc., a Graham Holdings Company property, from January 2008 until its sale in September 2010, and prior to that time, held various editorial positions at Newsweek. In determining that Ms. McDaniel should serve as a director, the Nominating Committee and the Board considered her extensive human resources experience, which the Nominating Committee and the Board believe give her particular insight into personnel and compensation matters, as well as her management experience with Newsweek, which the Nominating Committee and the Board believe gives her insight into business strategy, leadership and marketing.

Thomas J. McInerney, age 59, has been Chairman of the Board of Match Group since May 2021 and has served as a director of Match Group since November 2015. Mr. McInerney served as Chief Executive Officer of Altaba Inc., a publicly traded registered investment company and the successor company to Yahoo! Inc., from June 2017 to December 2021. Mr. McInerney previously served as Executive Vice President and Chief Financial Officer of the company formerly known as IAC/InterActiveCorp ("Former IAC") from January 2005 to March 2012. From January 2003 through December 2005, he served as Chief Executive Officer of the retailing division of Former IAC, which included HSN, Inc. and Cornerstone Brands. From May 1999 to January 2003, Mr. McInerney served as Executive Vice President and Chief Financial Officer of Ticketmaster, formerly Ticketmaster Online CitySearch, Inc., a live entertainment ticketing and marketing company. From 1986 to 1988 and from 1990 to 1999, Mr. McInerney worked at Morgan Stanley, a global financial services firm, most recently as Principal. Mr. McInerney has served on the board of directors of Altaba Inc. since June 2017, where he currently serves as the Chairman of the Board since January 2022. In determining that Mr. McInerney should serve as a director, the Nominating Committee and the Board considered his extensive senior leadership experience at Former IAC and his related knowledge and experience regarding Match Group, as well as his high level of financial literacy and expertise regarding restructurings, mergers and acquisitions and operations, and his public company board and committee experience.

Board Diversity

The following matrix provides diversity information regarding the Board as of the date indicated, in accordance with the Marketplace Rules of The Nasdaq Stock Market, LLC (the “Marketplace Rules”) and based on the voluntary self-identification of members of the Board.

| | | | | | | | | | | |

Board Diversity Matrix (As of April 29, 2024) Total Number of Directors: 12 |

| Female | | Male |

| Gender Identity: |

| Directors | 6 | | 6 |

| Demographic Background: |

| African American or Black | 0 | | 1 |

| Asian | 2 | | 1 |

| White | 4 | | 4 |

Corporate Governance

Corporate Governance Guidelines, Committee Charters and Code of Business Conduct and Ethics. As part of its ongoing commitment to good corporate governance, the Board has codified its corporate governance practices into a set of Corporate Governance Guidelines and has also adopted written charters for each of the committees of the Board. Match Group has also adopted a Code of Business Conduct and Ethics for directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees. The Corporate Governance Guidelines, Audit Committee Charter, Compensation and Human Resources Committee Charter, Nominating and Corporate

Governance Committee Charter, and Code of Business Conduct and Ethics are available in the Corporate Governance section of our website at http://ir.mtch.com.

Board Leadership Structure. Match Group’s business and affairs are overseen by its Board of Directors, which currently has twelve members. The Nominating and Corporate Governance Committee periodically reviews the size of the Board and may recommend changes to the Board. There is one management representative on the Board and, of the other eleven current directors, ten are independent. The Board has standing Audit, Compensation and Human Resources, and Nominating and Corporate Governance Committees, each comprised solely of independent directors. For more information regarding director independence and our Board Committees, see the discussion below under the headings Director Independence and The Board and Board Committees. All of our directors play an active role in Board matters, are encouraged to communicate among themselves and directly with the Chief Executive Officer and have full access to Match Group management at all times. The Board and each Board Committee conducts an annual evaluation of its performance.

Match Group’s independent directors meet in scheduled executive sessions without management present at least twice a year and may schedule additional meetings as they deem appropriate. These sessions are led by Match Group’s independent Chairman of the Board. The independent membership of the Audit, Compensation and Human Resources, and Nominating and Corporate Governance Committees ensures that directors with no ties to management are charged with oversight for all financial reporting and executive compensation related decisions, as well as for recommending candidates for Board membership and oversight of governance practices and policies. At each regularly scheduled Board meeting, the Chairperson of each of these committees provides the full Board with an update of all significant matters discussed, reviewed, considered and/or approved by the relevant committee since the last regularly scheduled Board meeting.

Mr. McInerney has served as independent Chairman of the Board since May 2021. Our Board currently believes that the roles of Chairperson and Chief Executive Officer should be separated in recognition of the different responsibilities between the two roles. Mr. McInerney, as independent Chairman, leads the Board in its oversight and management role, including with respect to risk oversight, while Mr. Kim, our Chief Executive Officer, focuses on managing the Company’s operations and strategic planning on a day-to-day basis. Mr. McInerney’s other responsibilities include, among others, setting Board meeting agendas, leading Board meetings and executive sessions, and communicating feedback to and advising Mr. Kim.

We believe that it is in the best interests of our stockholders for the Board to review and make a determination regarding the separation or combination of these roles each time it elects a new Chairperson or appoints a Chief Executive Officer.

Risk Oversight. The Board’s role in risk oversight of the Company is consistent with Match Group’s leadership structure, with the Chief Executive Officer and other members of senior management having responsibility for assessing and managing the Company’s risk exposure, and the Board and its committees providing oversight in connection with these efforts. Match Group management, including our Senior Vice President, Internal Audit, and our Risk, Controls and Compliance team, is responsible for assessing and managing Match Group’s exposure to various risks on a day‑to‑day basis, which responsibilities include the conduct of an enterprise risk assessment of short-term, long-term and emerging risks, testing of key controls and procedures, and creation of appropriate risk management programs and policies. Management has developed and implemented guidelines and policies to identify, assess and manage significant risks facing the Company. In developing this framework, Match Group recognizes that leadership and success are impossible without taking risks; however, the imprudent acceptance of risks or the failure to appropriately identify and mitigate risks could adversely impact stockholder value. The Board is responsible for overseeing management in the execution of its responsibilities and for assessing Match Group’s approach to risk management. While the Board’s oversight focuses on all material risks, the Board may focus more frequently on immediate areas of concern that represent significant emerging risks as identified by management. The Board exercises these risk oversight responsibilities periodically as part of its meetings and through discussions with management, as well as through the Board’s committees, with primary risk oversight responsibilities as detailed below:

| | | | | | | | |

| Board of Directors |

•Long-term strategies | •Significant acquisitions and divestitures | •Key risks as monitored by Board committees and reported to full Board |

•Capital structure | •Significant capital expenditures | •Other significant risks as identified and reported by management |

| Audit Committee | Compensation and Human Resources Committee | Nominating and Corporate Governance Committee |

•Integrity of financial statements | •CEO and executive leadership performance, compensation and succession | •Environmental issues and impact |

•Enterprise risk assessment | •Employee compensation policies and practices generally | •Social issues and impact |

•Information security | •Equity compensation | •Governance practices |

•Data privacy | •Human capital | •Director independence |

•Legal and regulatory compliance | •Non-employee director compensation | •Board and committee composition and performance |

•Significant legal and regulatory proceedings | | |

Information Security. Information security is a key component of risk management at Match Group and our Senior Vice President, Security Engineering, briefs the Audit Committee each quarter, and the full Board periodically, on the Company’s information security program and its related priorities and controls. In addition, an overall review of information security risks is inherent in the Board’s consideration of the Company’s long‑term strategies and in the transactions and other matters presented to the Board, including significant capital expenditures and significant acquisitions and divestitures. Our information security teams, led by our Senior Vice President, Security Engineering, are responsible for assessing and managing our exposure to information security risks, including by:

•Implementing and enforcing physical, operational and technical security policies, procedures and controls;

•Conducting, and engaging independent third-party experts to conduct, regular internal and external security assessments and audits, including assessments of the security posture of third-party vendors and partners;

•Collaborating with our development teams to engineer and integrate security throughout the product development lifecycle;

•Implementing scalable and continuous data protection practices; and

•Detecting, monitoring, investigating, and responding to potential security threats and incidents.

We also maintain cyber insurance coverage to mitigate potential costs that may arise from a cybersecurity incident.

Compensation Risk Assessment. We periodically conduct risk assessments of our compensation policies and practices for our employees, including those related to our executive compensation programs. The goal of these assessments is to determine whether the general structure of Match Group’s compensation policies and programs and the administration of these programs pose any material risks to the Company. At the request of the Compensation and Human Resources Committee of the Board, Compensia, Inc. (“Compensia”), the Committee’s independent compensation consultant, assessed the risk profile of Match Group’s executive compensation programs and management assessed the risk profile of Match Group’s other compensation programs. Based on these reviews, management and the Compensation and Human Resources Committee have concluded that Match Group’s compensation policies and practices, taken as a whole, do not encourage excessive or unnecessary risk‑taking and are not reasonably likely to have a material adverse effect on Match Group.

Derivatives Trading and Hedging and Pledging Policies. Match Group’s Securities Trading Policy provides that no director, officer or employee of Match Group and its subsidiaries may engage in transactions in publicly traded options, such as puts, calls, prepaid variable forward contracts, equity swaps or other derivatives that are designed to hedge or speculate on any change in the market value of or relating to Match Group securities, or engage in short sales with respect to Match Group securities. This prohibition extends to any and all forms of hedging or monetization transactions, such as zero-cost collars and forward sale contracts (among others). Match Group’s Securities Trading Policy also provides that no director, officer or employee of Match Group and its businesses may initiate any transactions that involve pledging Match Group securities in any manner, including by purchasing Match Group securities on margin, holding Match Group securities in an account utilizing margin or otherwise pledging Match Group securities as collateral for a loan.

Director Independence. Under the Marketplace Rules, the Board has a responsibility to make an affirmative determination that those members of the Board who serve as independent directors do not have any relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In connection with the independence determinations described below, the Board reviewed information regarding transactions, relationships and arrangements relevant to independence, including those required by the Marketplace Rules. This information is obtained from director responses to questionnaires circulated by management, as well as from Company records and publicly available information. Following these determinations, Match Group management monitors those transactions, relationships and arrangements that were relevant to such determinations, as well as periodically solicits updated information potentially relevant to independence from internal personnel and directors, to determine whether there have been any developments that could potentially have an adverse impact on the Board’s prior independence determinations.

In 2024, the Board determined that each of Mses. Brenner, Jones, McDaniel, Murdoch and Seymon and Messrs. Bailey, McInerney, Rascoff, Schiffman and Spoon is independent. In connection with these determinations, the Board considered that in some cases in the ordinary course of business, Match Group and its businesses purchase products and services from companies at which certain directors are employed or serve as directors, or over which certain directors otherwise exert control. Furthermore, the Board considered whether there were any payments made to (or received from) such entities by Match Group and its businesses. No relationships or payments considered were determined to be of the type that would (i) preclude a finding of director independence under the Marketplace Rules or (ii) otherwise interfere with the exercise of independent judgment in carrying out the responsibilities of the director.

In addition to the satisfaction of the director independence requirements set forth in the Marketplace Rules, members of the Audit and Compensation and Human Resources Committees have also satisfied separate independence requirements under the current standards imposed by the SEC and the Marketplace Rules for audit committee and compensation committee members.

Director Nominations. The Nominating Committee identifies and evaluates individuals qualified to become members of the Match Group Board. The Nominating Committee receives candidate recommendations from stockholders, directors and management and, from time to time, has been assisted by a third-party advisor in identifying qualified candidates. In assessing the candidates for recommendation to the Board as director nominees (regardless of how the candidate was identified or recommended), the Nominating Committee will evaluate such candidates against the standards and qualifications set out its charter, including:

•Personal and professional integrity and character

•Prominence and reputation in the candidate’s profession

•Skills, knowledge, diversity of background and experience, and expertise (including business or other relevant experience) useful and appropriate to the effective oversight of our business

•The capacity and desire to represent the interests of the stockholders as a whole

•The extent to which the interplay of the candidate’s skills, knowledge, expertise, diversity of background and experience with that of the other Board members will help build a Board that is effective in collectively meeting our strategic needs and serving the long-term interests of the various stakeholders

•Availability to devote sufficient time to the affairs of Match Group

The Nominating Committee considers not only an individual’s qualities, performance and professional responsibilities, but also the then composition of the Board and the challenges and needs of the Board at that time. While the Board does not have a formal diversity policy, the Nominating Committee also considers the overall diversity of the experiences, characteristics, attributes, skills and backgrounds of candidates relative to those of other Board members and those represented by the Board as a whole to ensure that the Board has the right mix of skills, expertise and background.

The Board does not have a formal policy regarding the consideration of director nominees recommended by stockholders as the Board and the Nominating Committee assess all candidates in the same manner regardless of how the candidate was identified or recommended. Stockholders who wish to make such a recommendation should send the recommendation to Match Group, 8750 North Central Expressway, Suite 1400, Dallas, Texas 75231, Attention: Corporate Secretary. The envelope must contain a clear notation that the enclosed letter is a “Director Nominee Recommendation.” The letter must identify the author as a stockholder, provide a brief summary of the candidate’s qualifications and history, together with an indication that the recommended individual would be willing to serve (if elected), and must be

accompanied by evidence of the sender’s stock ownership. Any nominations for directors must comply with the requirements set forth in our bylaws.

Director Time Commitments and Service on Other Public Company Boards. Serving on Match Group's Board requires significant time and attention. Directors are expected to spend the time needed and meet as often as necessary to discharge their responsibilities. In considering each director’s ability to properly discharge their duties, the Nominating Committee will annually review each director’s professional time commitments. This may include, without limitation, the director’s principal occupation, service on other public company boards, including any leadership positions held and service on such board’s committees, as well as service on private company boards and boards of non-profit organizations. If at any time the principal occupation of any director changes, the Nominating Committee will review the continued appropriateness of such director’s service on the Board. Directors should not serve on more than four public company boards (including Match Group's Board), other than a director who serves as Match Group's Chief Executive Officer, who should not serve on more than three public company boards (including Match Group's Board). Service on boards of other organizations should follow the Company’s conflict of interest policies.

Director Orientation and Education. All new members of the Board are required to participate in Match Group’s orientation program for directors. The orientation program includes discussions with and presentations by senior management and provides new directors with a review of Match Group’s financial position, an overview of the industry in which we operate and compete and the regulatory and legal environment that affects our business, as well as governs directors’ fiduciary duties. All directors are offered the opportunity, and are encouraged, to participate in continuing education programs with reimbursement by us of any associated expenses.

Communications with the Match Group Board. Stockholders who wish to communicate with the Board or a particular director may send any such communication to MatchGroupCorporateSecretary@match.com or Match Group, 8750 North Central Expressway, Suite 1400, Dallas, Texas, 75231, Attention: Corporate Secretary. If sent by mail, the mailing envelope must contain a clear notation indicating that the enclosed letter is a “Stockholder—Board Communication” or “Stockholder—Director Communication.” All correspondence must identify the author as a stockholder, provide evidence of the sender’s stock ownership and clearly state whether the intended recipients are all members of the Board or a particular director or directors. Match Group’s Corporate Secretary will then review such correspondence and forward it to the Board, or to the specified director(s), if appropriate. Items unrelated to directors’ duties and responsibilities may be excluded, including solicitations and advertisements.

The Board and Board Committees

The Board. The Board acts as the ultimate decision-making body of the Company and advises and oversees management, who are responsible for the day-to-day operations and management of the Company. The Board met five times during 2023. During 2023, all then incumbent directors attended at least 75% of the meetings of the Board and the Board committees on which they served, other than Ms. Murdoch. Directors are not required to attend annual meetings of Match Group stockholders. Three directors attended Match Group’s annual meeting of stockholders in 2023.

The Board currently has three standing committees: the Audit Committee, the Compensation and Human Resources Committee, and the Nominating and Corporate Governance Committee.

Audit Committee. The members of Match Group’s Audit Committee, all of whom are independent directors, are Messrs. Bailey, McInerney and Spoon (Chairperson). The Audit Committee met nine times during 2023. The Audit Committee is appointed by the Board to assist the Board with a variety of matters described in its charter, which include monitoring: (i) the integrity of Match Group’s financial statements, (ii) the effectiveness of Match Group’s internal control over financial reporting, (iii) the qualifications, performance and independence of Match Group’s independent registered public accounting firm, (iv) the performance of Match Group’s internal audit function, (v) Match Group’s risk assessment and risk management policies as they relate to financial, information security and other risk exposures and (vi) Match Group’s compliance with legal and regulatory requirements. In fulfilling its purpose, the Audit Committee maintains free and open communication among its members, Match Group’s independent registered public accounting firm, Match Group’s internal audit function and Match Group management. The formal report of the Audit Committee is set forth under Audit Committee Matters—Audit Committee Report.

The Board has concluded that Mr. Spoon is an “audit committee financial expert,” as such term is defined in applicable SEC rules, as well as the Marketplace Rules.

Compensation and Human Resources Committee. The members of Match Group’s Compensation and Human Resources Committee, all of whom are independent directors, are Mses. Brenner, McDaniel (Chairperson) and Seymon. The Compensation and Human Resources Committee met ten times during 2023. The Compensation and Human Resources

Committee is appointed by the Board to assist the Board with all matters relating to the compensation of Match Group’s executive officers and non-employee directors and has overall responsibility for approving and evaluating all compensation plans, policies and programs of Match Group as they affect Match Group’s executive officers and non-employee directors. The Compensation and Human Resources Committee also evaluates the performance of Match Group’s senior management and presents its findings and recommendations to the full Board. The Compensation and Human Resources Committee may form and delegate authority to subcommittees and may delegate authority to one or more of its members. The Compensation and Human Resources Committee may also delegate to one or more of Match Group’s officers the authority to make grants of equity‑based compensation to eligible individuals (other than directors or executive officers) to the extent allowed under applicable law. For additional information on Match Group’s processes and procedures for the consideration and determination of executive compensation and the related roles of the Compensation and Human Resources Committee, Match Group management and consultants, see the discussion under Compensation Discussion and Analysis. The formal report of the Compensation and Human Resources Committee is set forth under Compensation Committee Report.

Nominating and Corporate Governance Committee. The members of Match Group’s Nominating and Corporate Governance Committee, all of whom are independent directors, are Mses. McDaniel and Murdoch (Chairperson) and Mr. Spoon. The Nominating Committee met four times during 2023. The Nominating and Corporate Governance Committee is appointed by the Board to (i) identify and evaluate individuals qualified to become Board members consistent with such criteria as are deemed appropriate by the Nominating Committee or the Board, including the consideration of nominees submitted by stockholders, and to recommend to the Board director nominees for the next annual meeting of stockholders or special meeting of stockholders at which directors are to be elected (and nominees to fill vacancies on the Board as necessary); (ii) periodically review Board committee composition and recommend changes as needed, (iii) oversee periodic evaluations of the Board and its committees, (iv) develop and periodically review corporate governance guidelines, (v) review director and director nominee independence, (vi) review and make recommendations regarding responses to stockholder proposals, (vii) oversee social and environmental policies and initiatives, (viii) oversee political contributions and expenditures and (ix) oversee corporate governance practices and identify best practices for potential adoption.

PROPOSAL 2—ADVISORY VOTE ON EXECUTIVE COMPENSATION

As required pursuant to Section 14A of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”), we are seeking a non-binding advisory vote from our stockholders to approve the compensation of our named executive officers for 2023. This proposal, which we refer to as the “say on pay proposal,” is not intended to address any specific item of compensation, but rather our overall compensation program and policies relating to our named executive officers.

As described in detail in the Compensation Discussion and Analysis section of this proxy statement, our executive officer compensation program is designed to increase long term stockholder value by attracting, retaining, motivating and rewarding leaders with the competence, character, experience and ambition necessary to enable Match Group to meet its growth objectives.

We believe that our executive officer compensation program, with its balance of short-term and long-term incentives, rewards sustained performance that is aligned with long-term stockholder interests. Accordingly, we believe that the compensation paid to our named executive officers in 2023 pursuant to our executive officer compensation program was fair and appropriate and are asking our stockholders to vote FOR the adoption of the following resolution:

“RESOLVED, that the stockholders of Match Group, Inc. (the “Company”) approve, on an advisory basis, the compensation of the Company’s named executive officers for 2023, as disclosed in the Company’s Proxy Statement for the 2024 Annual Meeting of Stockholders pursuant to the U.S. Securities and Exchange Commission’s compensation disclosure rules, including the Compensation Discussion and Analysis, the Executive Compensation tables and the related narrative discussion.”

The approval, on an advisory basis, of the say on pay proposal requires the affirmative vote of a majority of the voting power of the shares of Match Group common stock present at the Annual Meeting in person or represented by proxy and entitled to vote on the matter. The vote is advisory in nature and therefore not binding on us or our Board. However, our Board and Compensation and Human Resources Committee value the opinions of all of our stockholders and will consider the outcome of this vote when making future compensation decisions for our named executive officers.

The Company last sought a say on pay vote at its 2023 Annual Meeting of Stockholders and last sought a non-binding advisory vote from its stockholders on the frequency of seeking the say on pay vote (required by applicable law every six years) at its 2022 Annual Meeting of Stockholders. Based on voting results from the 2022 Annual Meeting of Stockholders, and consistent with the Company’s recommendation, say on pay votes currently occur every year. Accordingly, the next say on pay vote is currently scheduled to be held at the Company’s 2025 Annual Meeting of Stockholders.

The Board recommends that our stockholders vote FOR the advisory vote on executive compensation.

PROPOSAL 3—APPROVAL OF THE 2024 STOCK AND ANNUAL INCENTIVE PLAN

Proposal and Required Vote

On April 25, 2024, upon the recommendation of the Compensation and Human Resources Committee, our Board approved and adopted the Match Group, Inc. 2024 Stock and Annual Incentive Plan (the “2024 Plan”), subject to approval by our stockholders.

In connection with the design and adoption of the 2024 Plan, our Board and the Compensation and Human Resources Committee carefully considered our anticipated future equity needs and our historical equity compensation practices.

The aggregate number of shares being requested for authorization under the 2024 Plan is:

•6 million shares of common stock, plus:

•the number of shares remaining available for future grant under the Company’s Amended and Restated 2017 Stock and Annual Incentive Plan (the “2017 Plan”) as of the date of stockholder approval of the 2024 Plan, plus:

•any shares subject to any outstanding award under the 2017 Plan that, after the date of stockholder approval of the 2024 Plan, is forfeited, is terminated, expires or lapses for any reason without delivery of the shares underlying such award.

Based on the above, the shares available for issuance under the 2024 Plan would represent approximately 6.3% of our outstanding shares as of April 22, 2024, the record date for the Annual Meeting. The Board believes the number of shares reserved for issuance under the 2024 Plan represents a reasonable amount of potential additional equity dilution, especially in light of the benefits afforded to us by our equity compensation program, as further described below.

If the 2024 Plan is approved by our stockholders, it will replace the 2017 Plan, and we will cease granting any new awards under the 2017 Plan. If the 2024 Plan is not approved by our stockholders, the 2017 Plan will remain in effect in its current form, and we will continue to be able to grant equity incentive awards under the 2017 Plan until the earlier of its expiration or the date on which the maximum number of shares authorized under the 2017 Plan has been issued. Regardless of whether the 2024 Plan is approved by our stockholders, we will be able to continue to grant awards under the Match Group, Inc. 2015 Stock and Annual Incentive Plan (the “2015 Plan”), which expires in November 2025. We will also continue to maintain the Match Group, Inc. 2020 Stock and Annual Incentive Plan (the “2020 Plan”); however, we are not able to make further grants under the 2020 Plan. The following table reflects the number of shares subject to awards outstanding, and the number of shares remaining available for issuance, under the 2015 and 2020 Plans as of April 2, 2024, the most recent practicable date prior to the filing of our proxy statement.

| | | | | | | | |

| 2015 Plan(1) | 2020 Plan |

| Shares currently available for future awards | 2,263,552 | — |

| Shares subject to currently outstanding full value awards | 7,677,601 | — |

Shares subject to currently outstanding stock options(2) | 892,131 | 1,543,298 |

(1)2015 Plan amounts reflect (i) the maximum number of PSUs that would vest if the highest level of performance condition is achieved and (ii) 610,247 shares reserved under the 2015 Plan to settle equity awards denominated in the equity of certain of our subsidiaries (the "Subsidiary Equity Awards"). For a description of Subsidiary Equity Awards, see Note 11—Stock-based compensation—Equity Instruments Denominated in Shares of Certain Subsidiaries to the consolidated financial statement in Item 8 of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

(2)Stock options outstanding under the 2015, 2017 and 2020 Plans have a weighted average exercise price of $21.01 and a weighted-average remaining term of 2.58 years.

We estimate that, with the shares authorized under the 2024 Plan, we will have a sufficient number of shares of our common stock to cover issuances under the 2015 Plan and 2024 Plan for at least the next year.

The approval of the 2024 Stock Plan Proposal requires the affirmative vote of a majority of the voting power of the shares of Match Group common stock present at the Annual Meeting in person or represented by proxy and entitled to vote on the matter. The Board has determined that it is in the best interests of the Company and its stockholders to approve this proposal. The Board recommends that our stockholders vote FOR the 2024 Stock Plan Proposal.

Considerations for the Approval the 2024 Plan

Incentive Compensation is a Critical Part of Match Group’s Ability to Effectively Compete for Talent