TABLE OF CONTENTS

| Page Number | ||||||||

Note 13—Leases | ||||||||

1

Cautionary Statement Regarding Forward-Looking Information

This annual report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The use of words such as “anticipates,” “estimates,” “expects,” “plans” and “believes,” among others, generally identify forward-looking statements. These forward-looking statements include, among others, statements relating to: Match Group’s future financial performance, Match Group’s business prospects and strategy, anticipated trends and prospects in the industries in which Match Group’s businesses operate and other similar matters. These forward-looking statements are based on Match Group management’s current expectations and assumptions about future events as of the date of this annual report, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict.

Actual results could differ materially from those contained in these forward-looking statements for a variety of reasons, including, among others: the risk factors set forth in “Item 1A—Risk Factors.” Other unknown or unpredictable factors that could also adversely affect Match Group’s business, financial condition and results of operations may arise from time to time. In light of these risks and uncertainties, these forward-looking statements discussed in this annual report may not prove to be accurate. Accordingly, you should not place undue reliance on these forward-looking statements, which only reflect the views of Match Group management as of the date of this annual report. Match Group does not undertake to update these forward-looking statements.

2

PART II

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

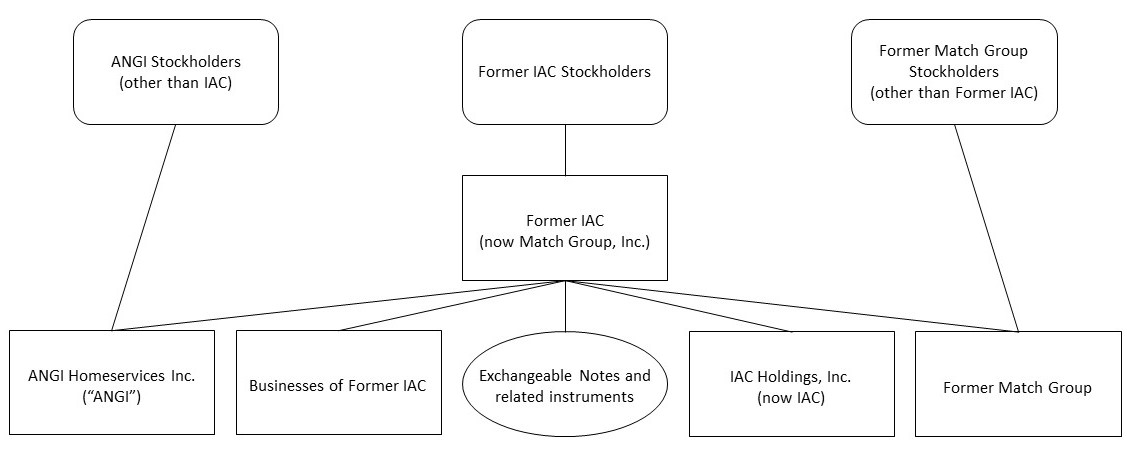

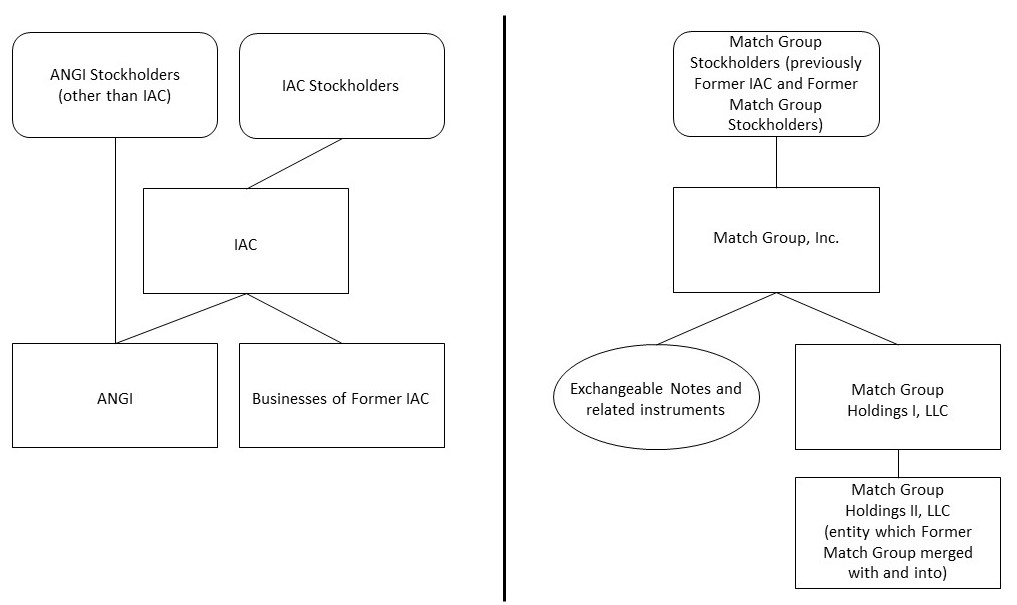

Separation

On June 30, 2020, the companies formerly known as Match Group, Inc. (referred to as “Former Match Group”) and IAC/InterActiveCorp (referred to as “Former IAC”) completed the separation of the Company from IAC through a series of transactions that resulted in two, separate public companies—(1) Match Group, which consists of the businesses of Former Match Group and certain financing subsidiaries previously owned by Former IAC, and (2) IAC, consisting of Former IAC’s businesses other than Match Group (the “Separation”). As part of the Separation, Former Match Group merged with and into Match Group Holdings II, LLC (“MG Holdings II”), an indirect wholly-owned subsidiary of Match Group, with MG Holdings II surviving the merger as an indirect wholly-owned subsidiary of Match Group. As a result of the Separation, the operations of Former IAC businesses other than Match Group are presented as discontinued operations.

For additional information relating to the Separation and the related transactions and agreements, see “Part I—Item 1—Business—Separation of Match Group and IAC” and “Part I—Item 1—Business—Relationship with IAC after the Separation.”

Other 2020 Developments

On February 11, 2020, MG Holdings II completed a private offering of $500 million aggregate principal amount of 4.125% Senior Notes. The proceeds from these notes were used to pay expenses associated with the offering and to fund a portion of the cash consideration of $3.00 per Former Match Group common share in connection with the Separation.

On February 13, 2020, the Credit Facility was amended to, among other things, increase the available borrowing capacity to $750 million, reduce interest rate margins by 0.125%, and extend its maturity to February 13, 2025. Additionally, on February 13, 2020, the Term Loan was amended to reprice the outstanding balance to LIBOR plus 1.75% and extend its maturity to February 13, 2027.

On May 19, 2020, MG Holdings II completed a private offering of $500 million aggregate principal amount of 4.625% Senior Notes. The proceeds from these notes were used to redeem the outstanding 6.375% Senior Notes, for general corporate purposes, and to pay expenses associated with the offering.

In July 2020, in connection with the Separation, the sale of 17.3 million newly issued shares of Match Group common stock was completed by IAC. The proceeds of $1.4 billion, net of associated fees, were transferred directly to IAC pursuant to the terms of the Transaction Agreement.

Key Terms:

Operating metrics:

•North America - consists of the financial results and metrics associated with users located in the United States and Canada.

•International - consists of the financial results and metrics associated with users located outside of the United States and Canada.

•Direct Revenue - is revenue that is received directly from end users of our products and includes both subscription and à la carte revenue.

•Indirect Revenue - is revenue that is not received directly from an end user of our products, substantially all of which is advertising revenue.

•Subscribers - are users who purchase a subscription to one of our products. Users who purchase only à la carte features are not included in Subscribers.

•Average Subscribers - is the number of Subscribers at the end of each day in the relevant measurement period divided by the number of calendar days in that period.

•Average Revenue per Subscriber (“ARPU”) - is Direct Revenue from Subscribers in the relevant measurement period (whether in the form of subscription or à la carte revenue) divided by the

3

Average Subscribers in such period and further divided by the number of calendar days in such period. Direct Revenue from users who are not Subscribers and have purchased only à la carte features is not included in ARPU.

Operating costs and expenses:

•Cost of revenue - consists primarily of the amortization of in-app purchase fees, compensation expense (including stock-based compensation expense) and other employee-related costs for personnel engaged in data center and customer care functions, credit card processing fees, hosting fees, live video costs, and data center rent, energy, and bandwidth costs. In-app purchase fees are monies paid to Apple and Google in connection with the processing of in-app purchases of subscriptions and product features through the in-app payment systems provided by Apple and Google.

•Selling and marketing expense - consists primarily of advertising expenditures and compensation expense (including stock-based compensation expense) and other employee-related costs for personnel engaged in selling and marketing, and sales support functions. Advertising expenditures includes online marketing, including fees paid to search engines and social media sites, offline marketing (which is primarily television advertising), and payments to partners that direct traffic to our brands.

•General and administrative expense - consists primarily of compensation expense (including stock-based compensation expense) and other employee-related costs for personnel engaged in executive management, finance, legal, tax and human resources, acquisition-related contingent consideration fair value adjustments (described below), fees for professional services (including transaction-related costs for acquisitions), and facilities costs.

•Product development expense - consists primarily of compensation expense (including stock-based compensation expense) and other employee-related costs that are not capitalized for personnel engaged in the design, development, testing, and enhancement of product offerings and related technology.

•Acquisition-related contingent consideration fair value adjustments - relate to the portion of the purchase price of certain acquisitions that is contingent upon the financial performance and/or operating metric targets of the acquired company. The fair value of the liability is estimated at the date of acquisition and adjusted each reporting period until the liability is settled. Significant changes in forecasted earnings and/or operating metrics for the acquired company will result in a significantly higher or lower fair value measurement. The changes in the estimated fair value of the contingent consideration arrangements during each reporting period, including the accretion of the discount if the arrangement is longer than one year, are recognized in “General and administrative expense” in the accompanying consolidated statement of operations.

Long-term debt:

•Credit Facility - The revolving credit facility of MG Holdings II. At December 31, 2019, $500 million was available under the Credit Facility. On February 13, 2020, the Credit Facility was amended to, among other things, increase the available borrowing capacity from $500 million to $750 million, reduce interest rate margins by 0.125%, and extend its maturity from December 7, 2023 to February 13, 2025. At December 31, 2020, the Company had letters of credit of $0.2 million outstanding and therefore $749.8 million was available under the Credit Facility.

•Term Loan - MG Holdings II’s term loan. At December 31, 2019, the Term Loan bore interest at LIBOR plus 2.50% and the then applicable rate was 4.44%. On February 13, 2020, the Term Loan was amended to reprice the outstanding balance to LIBOR plus 1.75% and extend its maturity from November 16, 2022 to February 13, 2027. At December 31, 2020, the applicable interest rate was 1.96% and $425 million was outstanding.

•6.375% Senior Notes - MG Holdings II’s 6.375% Senior Notes, which were redeemed on June 11, 2020 with the proceeds from the 4.625% Senior Notes.

4

•5.00% Senior Notes - MG Holdings II’s 5.00% Senior Notes due December 15, 2027, with interest payable each June 15 and December 15, which were issued on December 4, 2017. At December 31, 2020, $450 million aggregate principal amount was outstanding.

•5.625% Senior Notes - MG Holdings II’s 5.625% Senior Notes due February 15, 2029, with interest payable each February 15 and August 15, which were issued on February 15, 2019. At December 31, 2020, $350 million aggregate principal amount was outstanding.

•4.125% Senior Notes - MG Holdings II’s 4.125% Senior Notes due August 1, 2030, with interest payable each February 1 and August 1, which were issued on February 11, 2020. The proceeds were used to pay expenses associated with the offering and fund a portion of the $3.00 per common share of Former Match Group that was payable in connection with the Separation. At December 31, 2020, $500 million aggregate principal amount was outstanding.

•4.625% Senior Notes - MG Holdings II’s 4.625% Senior Notes due June 1, 2028, with interest payable each June 1 and December 1, which were issued on May 19, 2020. The proceeds were used to redeem the outstanding 6.375% Senior Notes, for general corporate purposes, and to pay expenses associated with the offering. At December 31, 2020, $500 million aggregate principal amount was outstanding.

•2022 Exchangeable Notes - During the third quarter of 2017, Match Group FinanceCo, Inc., a subsidiary of the Company, issued $517.5 million aggregate principal amount of 0.875% Exchangeable Senior Notes due October 1, 2022, which are exchangeable into shares of the Company's common stock. Interest is payable each April 1 and October 1. The outstanding balance of the 2022 Exchangeable Notes at December 31, 2020 was $517.5 million.

•2026 Exchangeable Notes - During the second quarter of 2019, Match Group FinanceCo 2, Inc., a subsidiary of the Company, issued $575.0 million aggregate principal amount of 0.875% Exchangeable Senior Notes due June 15, 2026, which are exchangeable into shares of the Company's common stock. Interest is payable each June 15 and December 15. The outstanding balance of the 2026 Exchangeable Notes at December 31, 2020 was $575 million.

•2030 Exchangeable Notes - During the second quarter of 2019, Match Group FinanceCo 3, Inc., a subsidiary of the Company, issued $575.0 million aggregate principal amount of 2.00% Exchangeable Senior Notes due January 15, 2030, which are exchangeable into shares of the Company's common stock. Interest is payable each January 15 and July 15. The outstanding balance of the 2030 Exchangeable Notes at December 31, 2020 was $575 million.

Non-GAAP financial measure:

•Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”) - is a Non-GAAP financial measure. See “Principles of Financial Reporting” for the definition of Adjusted EBITDA and a reconciliation of net earnings attributable to Match Group, Inc. shareholders to operating income and Adjusted EBITDA.

MANAGEMENT OVERVIEW

Match Group, Inc., through its portfolio companies, is a leading provider of dating products available globally. Our portfolio of brands includes Tinder®, Match®, Meetic®, OkCupid®, Hinge®, Pairs™, PlentyOfFish®, and OurTime®, as well as a number of other brands, each designed to increase our users’ likelihood of finding a meaningful connection. Through our portfolio companies and their trusted brands, we provide tailored products to meet the varying preferences of our users. Our products are available in over 40 languages to our users all over the world.

Sources of Revenue

All our products provide the use of certain features for free, and then offer a variety of additional features to Subscribers. Our revenue is primarily derived directly from users in the form of recurring subscription fees.

Subscription revenue is presented net of credits and credit card chargebacks. Subscribers pay in advance, primarily by using a credit card or through mobile app stores, and, subject to certain conditions identified in our terms and conditions, all purchases are final and nonrefundable. Fees collected, or contractually due, in advance

5

for subscriptions are deferred and recognized as revenue using the straight-line method over the term of the applicable subscription period, which primarily ranges from one to six months, and corresponding in-app purchase fees incurred on such transactions, if any, are deferred and expensed over the same period. We also earn revenue from the purchase of à la carte features and from online advertising. Revenue from the purchase of à la carte features is recognized based on usage. Online advertising revenue is recognized every time an ad is displayed.

Trends affecting our business

Over the last several years, we have seen significant changes in our business. Tinder has grown from incubation to the largest contributing brand in our portfolio and in 2020 our other brands also returned to growth in the aggregate. This in turn has allowed us to invest in or acquire brands such as Hinge and Hawaya and incubate new brands such as Chispa, BLK, and Upward, where we see additional growth opportunities. With our evolving portfolio of brands, we have seen a number of significant trends in our business in recent years, including the following:

Lower cost users. All of our brands rely on word-of-mouth, or free, user acquisition to varying degrees. Word-of-mouth acquisition is typically a function of scale (with larger communities driving greater numbers of referrals), youthfulness (with the viral effect being more pronounced in younger populations due, in part, to a significantly higher concentration of single people in any given social circle and the increased adoption of social media and similar platforms among such populations), and monetization rate (with people generally more likely to talk openly about using dating products that are less heavily monetized). Additionally, some, but not all, of our brands spend meaningfully on paid marketing. Accordingly, the average amount we spend to acquire a user differs significantly across brands based in large part on each brand’s mix of paid and free acquisition channels. As our mix has shifted toward younger users, our mix of acquisition channels has shifted toward lower cost channels, driving a decline over the past several years in the average amount we spend to acquire a new user across our portfolio. As a percentage of revenue, our costs of acquiring users have declined.

Changing paid acquisition dynamics. Even as our acquisition of lower cost users increases, paid acquisition of users remains an important driver of our business. The channels through which we market our brands are always evolving, but we are currently in a period of rapid change as TV and video consumption patterns evolve and internet consumption occurs regularly on mobile devices. As we adapt our paid marketing activities to maximize user engagement with our brands, we may increase our use of paid advertising at brands where we traditionally relied on word-of-mouth engagement to leverage these shifts in media consumption patterns and fuel international growth. Other brands in our portfolio may reduce paid marketing activities to reflect the change in audience engagement.

In-App Purchase Fees. Purchases made by our customers through mobile applications, as opposed to desktop or mobile web, continue to increase. Purchases processed through the in-app payments systems provided by the Apple App Store and Google Play Store are subject to in-app purchase fees, which are generally 30% of the purchase price. As a result, the percentage of our revenues paid to Apple and Google continues to be a significant expense. In 2019, Tinder began offering subscribers an alternative payment method to Google’s in-app payment system similar to the payment alternatives other brands in our portfolio have historically offered to subscribers through mobile apps on Android. Google has announced that beginning in September 2021, all purchases will be required to be processed through the Google Play Store and subject to in-app purchase fees. To the extent that app stores fee change, or the mix of our revenue generated through app stores shifts, our results, in particular our profit measures, could be impacted.

Increase in acceptance and growth of dating products globally. Over the past decade, there has been meaningful growth in dating product usage in North America and Western Europe, and we see the potential for similar growth in the rest of the world in the years ahead. As more internet-connected singles utilize online dating products and the stigma around dating continues to erode, we believe that there is potential for accelerating growth in the use of dating products globally.

Impacts of the Coronavirus. When the novel coronavirus (“COVID-19”) first hit Western Europe and then certain major metropolitan centers in the U.S. in the Spring of 2020, particularly New York City, engagement (messages sent, daily active users, Swipes® on Tinder) increased significantly, but subscribers who purchase a subscription for the first time (“first-time subscribers”) declined at most of our brands as meeting in person was restricted. Over the summer, as users began to meet outdoors first-time subscribers increased to above pre-

6

COVID-19 levels. Since the end of the summer, the resurgence of COVID-19 lockdowns has once again negatively impacted first-time subscriber trends, though not as severely as in the spring of 2020.

Other factors affecting the comparability of our results

Advertising spend. Our advertising spend, which is included in our selling and marketing expense, has consistently been one of our larger operating expenses. How we deploy our advertising spend varies among brands, with the majority of our advertising spend taking place online, including search engines, social media sites, streaming services and influencers. Additionally, some brands utilize television and out-of-home marketing campaigns, such as on outdoor billboards. For established brands, we seek to optimize for total return on advertising spend by frequently analyzing and adjusting spend to focus on marketing channels and markets that generate returns above our thresholds. Our data-driven approach provides us the flexibility to scale and optimize our advertising spend. We spend advertising dollars against an expected lifetime value of a Subscriber that is realized over a multi-year period; and while this advertising spend is intended to be profitable on that basis, it is nearly always negative during the period in which the expense is incurred. For newer brands that are gaining scale, or existing brands that are expanding into new geographies, we may make incremental advertising investments to establish the brand before optimizing monetization of the brand. In general, our more established brands spend a higher proportion of their revenue on advertising while our newer brands spend a lower proportion and tend to rely more on word of mouth and other viral marketing. Additionally, advertising spend is typically higher during the first quarter of our fiscal year, and lower during the fourth quarter. See “Seasonality” below. We increased our advertising spend as advertising rates declined during the COVID-19 outbreak.

Seasonality. Historically, our business has experienced seasonal fluctuations in quarterly operating results, particularly with respect to our profit measurements. This is driven primarily by a higher concentration of advertising spend in the first quarter, when advertising prices tend to be the lowest and demand for our products tends to be highest, and a lower concentration of advertising spend in the fourth quarter, when advertising costs tend to be highest and demand for our products tends to be lowest. Seasonality is not consistent across our brands, with brands targeted at older users generally showing more seasonality than brands targeted at younger users.

International markets. Our products are available across the world. Our international revenue represented 53% of our total revenue for both of the years ended December 31, 2020 and 2019. We vary our pricing to align with local market conditions and our international businesses typically earn revenue in local currencies. As foreign currency exchange rates change, translation of the statement of operations of our international businesses into U.S. dollars affects year-over-year comparability of operating results.

2020 Consolidated Results

In 2020, revenue, operating income and Adjusted EBITDA grew 17%, 16% and 15%, respectively. Revenue growth was primarily due to strong growth at Tinder and additional contributions from Hinge, Pairs, and PlentyOfFish. The growth in operating income and Adjusted EBITDA was due to the higher revenue and lower selling and marketing expense as a percentage of revenue due to the continued product mix shift toward brands with lower marketing spend as a percentage of revenue. Operating income and Adjusted EBTIDA were also impacted by an increase in cost of revenue expense primarily due to higher in-app purchase fees as a result of growing revenue sourced through mobile app stores, increased web operation costs, and live video costs.

7

Results of Operations for the years ended December 31, 2020, 2019 and 2018

The following discussion should be read in conjunction with “Item 8. Consolidated Financial Statements and Supplementary Data.”

Revenue

| Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||

| 2020 | Change | % Change | 2019 | Change | % Change | 2018 | |||||||||||||||||||||||||||||||||||

| (Amounts in thousands, except ARPU) | |||||||||||||||||||||||||||||||||||||||||

| Direct Revenue: | |||||||||||||||||||||||||||||||||||||||||

| North America | $ | 1,185,307 | $ | 161,146 | 16% | $ | 1,024,161 | $ | 121,683 | 13% | $ | 902,478 | |||||||||||||||||||||||||||||

| International | 1,159,417 | 176,404 | 18% | 983,013 | 208,320 | 27% | 774,693 | ||||||||||||||||||||||||||||||||||

| Total Direct Revenue | 2,344,724 | 337,550 | 17% | 2,007,174 | 330,003 | 20% | 1,677,171 | ||||||||||||||||||||||||||||||||||

| Indirect Revenue | 46,545 | 2,461 | 6% | 44,084 | (8,595) | (16)% | 52,679 | ||||||||||||||||||||||||||||||||||

Total Revenue | $ | 2,391,269 | $ | 340,011 | 17% | $ | 2,051,258 | $ | 321,408 | 19% | $ | 1,729,850 | |||||||||||||||||||||||||||||

| Direct Revenue | |||||||||||||||||||||||||||||||||||||||||

| Tinder | $ | 1,355,400 | $ | 203,355 | 18% | $ | 1,152,045 | $ | 346,729 | 43% | $ | 805,316 | |||||||||||||||||||||||||||||

| Other brands | 989,324 | 134,195 | 16% | 855,129 | (16,726) | (2)% | 871,855 | ||||||||||||||||||||||||||||||||||

| Total Direct Revenue | $ | 2,344,724 | $ | 337,550 | 17% | $ | 2,007,174 | $ | 330,003 | 20% | $ | 1,677,171 | |||||||||||||||||||||||||||||

| Percentage of Total Revenue: | |||||||||||||||||||||||||||||||||||||||||

| Direct Revenue: | |||||||||||||||||||||||||||||||||||||||||

| North America | 50% | 50% | 52% | ||||||||||||||||||||||||||||||||||||||

| International | 48% | 48% | 45% | ||||||||||||||||||||||||||||||||||||||

| Total Direct Revenue | 98% | 98% | 97% | ||||||||||||||||||||||||||||||||||||||

| Indirect Revenue | 2% | 2% | 3% | ||||||||||||||||||||||||||||||||||||||

| Total Revenue | 100% | 100% | 100% | ||||||||||||||||||||||||||||||||||||||

| Average Subscribers: | |||||||||||||||||||||||||||||||||||||||||

| North America | 4,858 | 304 | 7% | 4,554 | 393 | 9% | 4,161 | ||||||||||||||||||||||||||||||||||

| International | 5,572 | 843 | 18% | 4,729 | 1,017 | 27% | 3,712 | ||||||||||||||||||||||||||||||||||

| Total | 10,430 | 1,147 | 12% | 9,283 | 1,410 | 18% | 7,873 | ||||||||||||||||||||||||||||||||||

| (Change calculated using non-rounded numbers) | |||||||||||||||||||||||||||||||||||||||||

| ARPU: | |||||||||||||||||||||||||||||||||||||||||

| North America | $ | 0.65 | 7% | $ | 0.61 | 4% | $ | 0.59 | |||||||||||||||||||||||||||||||||

| International | $ | 0.56 | —% | $ | 0.56 | —% | $ | 0.56 | |||||||||||||||||||||||||||||||||

| Total | $ | 0.60 | $ | 0.02 | 3% | $ | 0.58 | $ | 0.01 | 2% | $ | 0.57 | |||||||||||||||||||||||||||||

For the year ended December 31, 2020 compared to the year ended December 31, 2019

International Direct Revenue grew $176.4 million, or 18%, in 2020 versus 2019, driven by 18% growth in Average Subscribers. North America Direct Revenue grew $161.1 million, or 16%, in 2020 versus 2019, driven by 7% growth in Average Subscribers, a 7% increase in ARPU, and growth of non-subscriber live streaming video revenue at PlentyOfFish.

Growth in International and North America Average Subscribers was primarily driven by Tinder. Hinge, BLK and Chispa also contributed to North America Average Subscriber growth and Pairs contributed to International Average Subscriber growth. North America ARPU increased primarily due to increases in à la carte purchases at Tinder and PlentyOfFish and optimized subscription pricing at Hinge.

8

Indirect Revenue increased $2.5 million primarily due to higher rates per impression.

For the year ended December 31, 2019 compared to the year ended December 31, 2018

International Direct Revenue grew $208.3 million, or 27%, in 2019 versus 2018, driven by 27% growth in Average Subscribers. North America Direct Revenue grew $121.7 million, or 13%, in 2019 versus 2018, driven by 9% growth in Average Subscribers, and a 4% increase in ARPU.

Growth in International and North America Average Subscribers was primarily driven by Tinder. Hinge and Pairs also contributed to subscriber growth in North America and International, respectively. North America ARPU increased primarily due to increases in ARPU at Tinder as Subscribers purchased premium subscriptions, such as Tinder Gold, as well as additional à la carte features. International ARPU was unfavorably impacted by the strength of the U.S. dollar relative to the Euro, British pound (“GBP”), and certain other currencies.

Indirect Revenue decreased $8.6 million primarily due to lower impressions and a lower price per impression received from an advertising network provider.

Cost of revenue (exclusive of depreciation)

| Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||

| 2020 | $ Change | % Change | 2019 | $ Change | % Change | 2018 | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

| Cost of revenue | $635,833 | $108,649 | 21% | $527,184 | $117,184 | 29% | $410,000 | ||||||||||||||||||||||||||||||||||

| Percentage of revenue | 27% | 26% | 24% | ||||||||||||||||||||||||||||||||||||||

For the year ended December 31, 2020 compared to the year ended December 31, 2019

Cost of revenue increased due to an increase in in-app purchase fees of $50.0 million, as revenue continues to be increasingly sourced through mobile app stores; an increase in hosting fees of $24.0 million; an increase of $17.9 million in partner related costs associated with our live video streaming; and an increase in compensation expense of $11.5 million related to increased headcount and other operating costs in customer care.

For the year ended December 31, 2019 compared to the year ended December 31, 2018

Cost of revenue increased due to an increase in in-app purchase fees of $80.1 million, as revenue continues to be increasingly sourced through mobile app stores; an increase in hosting fees of $21.9 million; and an increase in compensation expense of $11.2 million related to increased headcount and other operating costs in customer care.

Selling and marketing expense

| Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||

| 2020 | $ Change | % Change | 2019 | $ Change | % Change | 2018 | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

Selling and marketing expense | $479,907 | $52,467 | 12% | $427,440 | $7,486 | 2% | $419,954 | ||||||||||||||||||||||||||||||||||

| Percentage of revenue | 20% | 21% | 24% | ||||||||||||||||||||||||||||||||||||||

For the year ended December 31, 2020 compared to the year ended December 31, 2019

Selling and marketing expense increased primarily due to higher marketing spend at multiple brands, and an increase in compensation expense of $5.7 million. Selling and marketing expense continued to decline as a percentage of revenue as we continue to generate revenue growth from brands with relatively lower marketing expense.

For the year ended December 31, 2019 compared to the year ended December 31, 2018

Selling and marketing expense increased primarily due to increases in spending at Tinder, Hinge, and Pairs, partially offset by decreases at Meetic, Match, and PlentyOfFish. Selling and marketing expense declined as a percentage of revenue as we continue to generate revenue growth from brands with relatively lower marketing expense.

9

General and administrative expense

| Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||

| 2020 | $ Change | % Change | 2019 | $ Change | % Change | 2018 | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

General and administrative expense | $311,207 | $55,069 | 21% | $256,138 | $73,886 | 41% | $182,252 | ||||||||||||||||||||||||||||||||||

| Percentage of revenue | 13% | 12% | 11% | ||||||||||||||||||||||||||||||||||||||

For the year ended December 31, 2020 compared to the year ended December 31, 2019

General and administrative expense increased primarily due to an increase in compensation of $39.3 million primarily related to an increase in headcount and an increase in stock-based compensation expense resulting from a modification charge in 2020; an increase of $6.7 million for non-income taxes, primarily digital services taxes; and an increase of $6.4 million in legal expenses.

For the year ended December 31, 2019 compared to the year ended December 31, 2018

General and administrative expense increased primarily due to an increase of $38.1 million in legal fees; an increase in compensation of $19.0 million primarily related to stock-based compensation expense due to new equity awards made since the prior year period, modification charges during 2019, and an increase in headcount; and an increase of $4.7 million for non-income taxes that includes the recently enacted French Digital Services Tax, which was made effective retroactively to January 1, 2019.

Product development expense

| Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||

| 2020 | $ Change | % Change | 2019 | $ Change | % Change | 2018 | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

Product development expense | $169,811 | $17,851 | 12% | $151,960 | $19,930 | 15% | $132,030 | ||||||||||||||||||||||||||||||||||

| Percentage of revenue | 7% | 7% | 8% | ||||||||||||||||||||||||||||||||||||||

For the year ended December 31, 2020 compared to the year ended December 31, 2019

Product development expense increased primarily as a result of an increase of $18.7 million in compensation primarily due to increased headcount at Tinder.

For the year ended December 31, 2019 compared to the year ended December 31, 2018

Product development expense increased primarily as a result of an increase of $18.6 million in compensation, including an increase of $10.3 million in stock-based compensation expense primarily due to the vesting of certain awards for which the market condition was met, and increased headcount at Tinder.

Depreciation

| Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||

| 2020 | $ Change | % Change | 2019 | $ Change | % Change | 2018 | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

| Depreciation | $41,271 | $6,916 | 20% | $34,355 | $(472) | (1)% | $34,827 | ||||||||||||||||||||||||||||||||||

| Percentage of revenue | 2% | 2% | 2% | ||||||||||||||||||||||||||||||||||||||

For the year ended December 31, 2020 compared to the year ended December 31, 2019

Depreciation increased primarily due to an increase in internally developed software being placed in service.

10

For the year ended December 31, 2019 compared to the year ended December 31, 2018

Depreciation decreased primarily due to certain internally developed software becoming fully depreciated, partially offset by increased depreciation related to leasehold improvements.

Operating Income and Adjusted EBITDA

| Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||

| 2020 | $ Change | % Change | 2019 | $ Change | % Change | 2018 | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

| Operating income | $745,715 | $100,261 | 16% | $645,454 | $95,985 | 17% | $549,469 | ||||||||||||||||||||||||||||||||||

| Percentage of revenue | 31% | 31% | 32% | ||||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA | $896,779 | $118,519 | 15% | $778,260 | $126,295 | 19% | $651,965 | ||||||||||||||||||||||||||||||||||

| Percentage of revenue | 38% | 38% | 38% | ||||||||||||||||||||||||||||||||||||||

For a reconciliation of net earnings attributable to Match Group, Inc. shareholders to operating income and Adjusted EBITDA, see “Principles of Financial Reporting.”

For the year ended December 31, 2020 compared to the year ended December 31, 2019

Operating income and Adjusted EBITDA increased 16% to $100.3 million and 15% to $118.5 million, respectively, primarily as a result of the increase in revenue of $340.0 million driven by growth at multiple brands and lower selling and marketing expense as a percentage of revenue, partially offset by an increase in cost of revenue due to higher in-app purchase fees, as revenue is increasingly sourced through mobile app stores, increased web operation costs, and live video costs.

At December 31, 2020, there was $142.5 million of unrecognized compensation cost, net of estimated forfeitures, related to all equity-based awards, which is expected to be recognized over a weighted average period of approximately 2.3 years.

For the year ended December 31, 2019 compared to the year ended December 31, 2018

Operating income and Adjusted EBITDA increased 17% to $96.0 million and 19% to $126.3 million, respectively, primarily as a result of the increase in revenue of $321.4 million and lower selling and marketing expense as a percentage of revenue due to the ongoing product mix shift toward brands with lower marketing spend as a percentage of revenue, partially offset by an increase in cost of revenue due to higher in-app purchase fees and an increase in legal fees. Operating income was also impacted by higher stock-based compensation expense as a percentage of revenue and an increase in amortization due to the impairment of the Match brand in the UK, resulting in decreased growth compared to Adjusted EBITDA.

Interest expense

| Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||

| 2020 | $ Change | % Change | 2019 | $ Change | % Change | 2018 | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

Interest expense | $130,624 | $19,616 | 18% | $111,008 | $29,554 | 36% | $81,454 | ||||||||||||||||||||||||||||||||||

For the year ended December 31, 2020 compared to the year ended December 31, 2019

Interest expense increased primarily due to the issuance of the 4.125% Senior Notes on February 11, 2020 and the issuance of the 4.625% Senior Notes on May 19, 2020. Additionally, the 2026 and 2030 Senior Exchangeable Notes were outstanding for the entire year. Partially offsetting these increases were decreases due to the redemption of the 6.375% Senior Notes during 2020 and a lower LIBOR rate on the Term Loan.

For the year ended December 31, 2019 compared to the year ended December 31, 2018

Interest expense increased primarily due to the issuance of the 5.625% Senior Notes in February 2019. Additionally, the interest rate on the Term Loan, which is based on LIBOR, was higher in 2019.

11

Other income (expense), net

| Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||

| 2020 | $ Change | % Change | 2019 | $ Change | % Change | 2018 | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

| Other income (expense), net | $15,861 | $17,887 | NM | $(2,026) | $(9,536) | NM | $7,510 | ||||||||||||||||||||||||||||||||||

________________________

NM = not meaningful

Other income, net, in 2020 includes a legal settlement of $35.0 million and interest income of $2.7 million, partially offset by a loss on redemption of bonds of $16.5 million, expense of $3.4 million related to mark-to-market adjustments pertaining to liability classified equity instruments, and $0.6 million in net foreign currency losses in the period.

Other expense, net, in 2019 includes a $4.0 million impairment of an equity investment, expense of $1.7 million related to a mark-to-market adjustment pertaining to a liability classified equity instrument, and $0.9 million in net foreign currency losses in the period, partially offset by interest income of $4.4 million.

Other income, net in 2018 includes $5.3 million in net foreign currency exchange gains due primarily to a strengthening of the U.S. dollar relative to the British Pound in the period and $4.9 million of interest income, partially offset by $2.1 million related to impairments of certain equity investments and $0.7 million related to a mark-to-market adjustment pertaining to a subsidiary denominated equity instrument.

Income tax provision

| Years Ended December 31, | |||||||||||||||||||||||||||||||||||||||||

| 2020 | $ Change | % Change | 2019 | $ Change | % Change | 2018 | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

Income tax provision | $43,273 | $28,193 | 187% | $15,080 | $608 | 4% | $14,472 | ||||||||||||||||||||||||||||||||||

Effective income tax rate | 7% | 3% | 3% | ||||||||||||||||||||||||||||||||||||||

For discussion of income taxes, see “Note 3—Income Taxes” to the consolidated financial statements included in “Item 8—Consolidated Financial Statements and Supplementary Data.”

For the years ended December 31, 2020, 2019, and 2018, the Company recorded an income tax provision of $43.3 million, $15.1 million, and $14.5 million, respectively, representing an effective tax rate of 7%, 3%, and 3%, respectively, which is lower than the U.S. statutory rate of 21% due primarily to excess tax benefits generated by (i) the exercise and vesting of stock-based awards and (ii) research credits. In 2020, these benefits were partially offset by an increase in the valuation allowance for foreign tax credits.

On March 27, 2020, the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”) was enacted to respond to economic challenges due to COVID-19. The CARES Act provided Match Group accelerated depreciation deductions and a relaxation of limitations on interest expense deductions, both of which impact the timing of the realizability of our federal and state net operating loss deferred tax assets. The CARES Act did not have a material impact on our income tax provision for the year ended December 31, 2020, or our ability to recover our deferred tax assets.

Related party transactions

For discussion of related party transactions, see “Note 15—Related Party Transactions” to the consolidated financial statements included in “Item 8—Consolidated Financial Statements and Supplementary Data.”

12

PRINCIPLES OF FINANCIAL REPORTING

Match Group reports Adjusted EBITDA and Revenue excluding foreign exchange effects, both of which are supplemental measures to U.S. generally accepted accounting principles (“GAAP”). Adjusted EBITDA is among the primary metrics by which we evaluate the performance of our business, on which our internal budget is based, and by which management is compensated. Revenue excluding foreign exchange effects provides a comparable framework for assessing how our business performed without the effect of exchange rate differences when compared to prior periods. We believe that investors should have access to the same set of tools that we use in analyzing our results. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. Match Group endeavors to compensate for the limitations of the non-GAAP measures presented by providing the comparable GAAP measure with equal or greater prominence and descriptions of the reconciling items, including quantifying such items, to derive the non-GAAP measure. We encourage investors to examine the reconciling adjustments between the GAAP and non-GAAP measures, which we discuss below.

Adjusted EBITDA

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”) is defined as operating income excluding: (1) stock-based compensation expense; (2) depreciation; and (3) acquisition-related items consisting of (i) amortization of intangible assets and impairments of goodwill and intangible assets, if applicable, and (ii) gains and losses recognized on changes in the fair value of contingent consideration arrangements. We believe this measure is useful for analysts and investors as this measure allows a more meaningful comparison between our performance and that of our competitors. The above items are excluded from our Adjusted EBITDA measure because they are non-cash in nature. Adjusted EBITDA has certain limitations because it excludes the impact of these expenses.

Non-Cash Expenses That Are Excluded From Adjusted EBITDA

Stock-based compensation expense consists principally of expense associated with the grants of stock options, restricted stock units (“RSUs”), performance-based RSUs, and market-based awards. These expenses are not paid in cash, and we include the related shares in our fully diluted shares outstanding using the treasury stock method; however, performance-based RSUs and market-based awards are included only to the extent the applicable performance or market condition(s) have been met (assuming the end of the reporting period is the end of the contingency period). To the extent that stock-based awards are settled on a net basis, we remit the required tax-withholding amounts from our current funds.

Depreciation is a non-cash expense relating to our property and equipment and is computed using the straight-line method to allocate the cost of depreciable assets to operations over their estimated useful lives, or, in the case of leasehold improvements, the lease term, if shorter.

Amortization of intangible assets and impairments of goodwill and intangible assets are non-cash expenses related primarily to acquisitions. At the time of acquisition, the identifiable definite-lived intangible assets of the acquired company, such as customer lists, trade names, and technology, are valued and amortized over their estimated lives. Value is also assigned to (i) acquired indefinite-lived intangible assets, which consist of trade names and trademarks, and (ii) goodwill, which are not subject to amortization. An impairment is recorded when the carrying value of an intangible asset or goodwill exceeds its fair value. We believe that intangible assets represent costs incurred by the acquired company to build value prior to acquisition and the related amortization and impairment charges of intangible assets or goodwill, if applicable, are not ongoing costs of doing business.

Gains and losses recognized on changes in the fair value of contingent consideration arrangements are accounting adjustments to report contingent consideration liabilities at fair value. These adjustments can be highly variable and are excluded from our assessment of performance because they are considered non-operational in nature and, therefore, are not indicative of current or future performance or the ongoing cost of doing business.

13

The following table reconciles net earnings attributable to Match Group, Inc. shareholders to operating income and Adjusted EBITDA:

| Years Ended December 31, | |||||||||||||||||

| 2020 | 2019 | 2018 | |||||||||||||||

| (In thousands) | |||||||||||||||||

| Net earnings attributable to Match Group, Inc. shareholders | $ | 162,329 | $ | 453,838 | $ | 636,910 | |||||||||||

Add back: | |||||||||||||||||

| Net earnings attributable to noncontrolling interests | 59,280 | 112,689 | 130,786 | ||||||||||||||

| Loss (earnings) from discontinued operations, net of tax | 366,070 | (49,187) | (306,643) | ||||||||||||||

| Income tax provision | 43,273 | 15,080 | 14,472 | ||||||||||||||

| Other (income) expense, net | (15,861) | 2,026 | (7,510) | ||||||||||||||

Interest expense | 130,624 | 111,008 | 81,454 | ||||||||||||||

Operating Income | 745,715 | 645,454 | 549,469 | ||||||||||||||

| Stock-based compensation expense | 102,268 | 89,724 | 66,031 | ||||||||||||||

| Depreciation | 41,271 | 34,355 | 34,827 | ||||||||||||||

Amortization of intangibles | 7,525 | 8,727 | 1,318 | ||||||||||||||

Acquisition-related contingent consideration fair value adjustments | — | — | 320 | ||||||||||||||

| Adjusted EBITDA | $ | 896,779 | $ | 778,260 | $ | 651,965 | |||||||||||

Effects of Changes in Foreign Exchange Rates on Revenue

The impact of foreign exchange rates on the Company, due to its global reach, may be an important factor in understanding period over period comparisons if movement in exchange rates is significant. Since our results are reported in U.S. dollars, international revenue is favorably impacted as the U.S. dollar weakens relative to other currencies, and unfavorably impacted as the U.S. dollar strengthens relative to other currencies. We believe the presentation of revenue excluding the effects from foreign exchange, in addition to reported revenue, helps improve the ability to understand the Company’s performance because it excludes the impact of foreign currency volatility that is not indicative of Match Group’s core operating results.

Revenue excluding foreign exchange effects compares results between periods as if exchange rates had remained constant period over period. Revenue excluding foreign exchange effects is calculated by translating current period revenue using prior period exchange rates. The percentage change in revenue excluding foreign exchange effects is calculated by determining the change in current period revenue over prior period revenue where current period revenue is translated using prior period exchange rates.

14

The following tables presents the impact of foreign exchange on total revenue, ARPU, and International ARPU for the year ended December 31, 2020 compared to the year ended December 31, 2019 and the year ended December 31, 2019 compared to the year ended December 31, 2018:

| Years Ended December 31, | |||||||||||||||||||||||

| 2020 | $ Change | % Change | 2019 | ||||||||||||||||||||

| (Dollars in thousands, except ARPU) | |||||||||||||||||||||||

| Revenue, as reported | $ | 2,391,269 | $ | 340,011 | 17% | $ | 2,051,258 | ||||||||||||||||

| Foreign exchange effects | 6,412 | ||||||||||||||||||||||

| Revenue excluding foreign exchange effects | $ | 2,397,681 | $ | 346,423 | 17% | $ | 2,051,258 | ||||||||||||||||

| (Percentage change calculated using non-rounded numbers) | |||||||||||||||||||||||

| ARPU, as reported | $ | 0.60 | 3% | $ | 0.58 | ||||||||||||||||||

| Foreign exchange effects | 0.00 | ||||||||||||||||||||||

| ARPU, excluding foreign exchange effects | $ | 0.60 | 3% | $ | 0.58 | ||||||||||||||||||

| International ARPU, as reported | $ | 0.56 | 0% | $ | 0.56 | ||||||||||||||||||

| Foreign exchange effects | 0.00 | ||||||||||||||||||||||

| International ARPU, excluding foreign exchange effects | $ | 0.56 | 0% | $ | 0.56 | ||||||||||||||||||

| Years Ended December 31, | |||||||||||||||||||||||

| 2019 | $ Change | % Change | 2018 | ||||||||||||||||||||

| (Dollars in thousands, except ARPU) | |||||||||||||||||||||||

| Revenue, as reported | $ | 2,051,258 | $ | 321,408 | 19% | $ | 1,729,850 | ||||||||||||||||

| Foreign exchange effects | 47,459 | ||||||||||||||||||||||

| Revenue excluding foreign exchange effects | $ | 2,098,717 | $ | 368,867 | 21% | $ | 1,729,850 | ||||||||||||||||

| (Percentage change calculated using non-rounded numbers) | |||||||||||||||||||||||

| ARPU, as reported | $ | 0.58 | 2% | $ | 0.57 | ||||||||||||||||||

| Foreign exchange effects | 0.02 | ||||||||||||||||||||||

| ARPU, excluding foreign exchange effects | $ | 0.60 | 4% | $ | 0.57 | ||||||||||||||||||

| International ARPU, as reported | $ | 0.56 | —% | $ | 0.56 | ||||||||||||||||||

| Foreign exchange effects | 0.03 | ||||||||||||||||||||||

| International ARPU, excluding foreign exchange effects | $ | 0.59 | 5% | $ | 0.56 | ||||||||||||||||||

15

FINANCIAL POSITION, LIQUIDITY AND CAPITAL RESOURCES

Financial Position

| December 31, 2020 | December 31, 2019 | ||||||||||

| (In thousands) | |||||||||||

| Cash and cash equivalents: | |||||||||||

United States | $ | 581,038 | $ | 322,267 | |||||||

All other countries | 158,126 | 143,409 | |||||||||

| Total cash and cash equivalents | $ | 739,164 | $ | 465,676 | |||||||

| Long-term debt, net: | |||||||||||

| Credit Facility due February 13, 2025 | $ | — | $ | — | |||||||

| Term Loan due February 13, 2027 | 425,000 | 425,000 | |||||||||

| 6.375% Senior Notes | — | 400,000 | |||||||||

5.00% Senior Notes due December 15, 2027 | 450,000 | 450,000 | |||||||||

| 4.625% Senior Notes due June 1, 2028 | 500,000 | — | |||||||||

| 5.625% Senior Notes due February 15, 2029 | 350,000 | 350,000 | |||||||||

| 4.125% Senior Notes due August 1, 2030 | 500,000 | — | |||||||||

| 2022 Exchangeable Notes | 517,500 | 517,500 | |||||||||

| 2026 Exchangeable Notes | 575,000 | 575,000 | |||||||||

| 2030 Exchangeable Notes | 575,000 | 575,000 | |||||||||

| Total long-term debt | 3,892,500 | 3,292,500 | |||||||||

Less: unamortized original issue discount | 6,029 | 6,283 | |||||||||

| Less: unamortized debt issuance costs | 45,541 | 46,201 | |||||||||

| Total long-term debt, net | $ | 3,840,930 | $ | 3,240,016 | |||||||

Long-term Debt

For a detailed description of long-term debt, see “Note 7—Long-term Debt, net” to the consolidated financial statements included in “Item 8. Consolidated Financial Statements and Supplementary Data.”

Cash Flow Information

In summary, the Company’s cash flows are as follows:

| Years ended December 31, | |||||||||||||||||

| 2020 | 2019 | 2018 | |||||||||||||||

| (In thousands) | |||||||||||||||||

Net cash provided by operating activities attributable to continuing operations | $ | 788,552 | $ | 647,989 | $ | 611,455 | |||||||||||

Net cash used in investing activities attributable to continuing operations | (3,922,131) | (41,730) | (38,204) | ||||||||||||||

Net cash provided by (used in) financing activities attributable to continuing operations | 1,787,846 | 654,024 | (198,768) | ||||||||||||||

2020

Net cash provided by operating activities attributable to continuing operations in 2020 includes adjustments to earnings consisting primarily of $102.3 million of stock-based compensation expense; $41.3 million of depreciation; $7.5 million of amortization of intangibles; other adjustments of $27.3 million, which includes a loss on bond redemption of $16.5 million; and deferred income tax of $15.4 million. The increase in cash from changes in working capital primarily consists of an increase from income taxes payable and receivable

16

of $16.9 million due primarily to the timing of tax payments and refunds; an increase in accounts payable and accrued expenses and other current liabilities of $24.2 million due mainly to the timing of payments, including interest payments; and an increase in deferred revenue of $23.5 million, due mainly to growth in subscription sales. These increases in cash were partially offset by a decrease related to an increase in other assets of $33.2 million primarily related to an increase in prepaid hosting services and an increase in accounts receivable of $24.2 million primarily related to an increase in revenue.

Net cash used in investing activities attributable to continuing operations in 2020 consists primarily of the $3.9 billion of net cash distributed to IAC related to the Separation, which was partially funded by $1.4 billion of net proceeds from the stock issuance in connection with the Separation as noted below, and capital expenditures of $42.4 million that are primarily related to internal development of software and computer hardware to support our products and services.

Net cash provided by financing activities attributable to continuing operations in 2020 is primarily due to proceeds of $1.4 billion from the stock offering in connection with the Separation, which were subsequently transferred to IAC as noted above, proceeds of $1.0 billion from the issuance of the 4.125% and 4.625% Senior Notes, partially offset by the redemption of the $400.0 million 6.375% Senior Notes, payments of $212.0 million for withholding taxes paid on behalf of employees for net settled equity awards of both Former Match Group and Match Group, and purchases of treasury stock of Former Match Group of $132.9 million.

2019

Net cash provided by operating activities attributable to continuing operations in 2019 includes adjustments to earnings consisting primarily of $89.7 million of stock-based compensation expense, $34.4 million of depreciation, and $8.7 million of amortization of intangibles. Partially offsetting these adjustments was deferred income tax of $12.8 million primarily related to net operating loss created by settlement of stock-based awards. The decrease in cash from changes in working capital primarily consists of an increase in other assets of $24.2 million primarily related to an increase in prepaid hosting services, an increase in accounts receivable of $17.9 million primarily related to an increase in revenue, and a decrease from income taxes payable and receivable of $4.2 million due primarily to the timing of tax payments. These decreases in cash were partially offset by an increase in accounts payable and accrued expenses and other current liabilities of $33.7 million due mainly to the timing of payments, including interest payments; and an increase in deferred revenue of $9.5 million, due mainly to growth in subscription sales.

Net cash used in investing activities attributable to continuing operations in 2019 consists primarily of capital expenditures of $39.0 million that are primarily related to internal development of software and computer hardware to support our products and services.

Net cash provided by financing activities attributable to continuing operations in 2019 is primarily due to $1.2 billion from the issuance of the 2026 and 2030 Exchangeable Notes; proceeds of $350.0 million from the issuance of the 5.625% Senior Notes and proceeds of $40.0 million from borrowings under the Credit Facility. Partially offsetting these proceeds were cash payments of $300.0 million for the repayment of borrowings under the Credit Facility, purchases of treasury stock of $216.4 million, $203.2 million for withholding taxes paid on behalf of employees for net settled equity awards, and $136.9 million used to pay the net premium on the 2026 and 2030 Exchangeable Notes hedge and warrant transactions.

2018

Net cash provided by operating activities attributable to continuing operations in 2018 includes adjustments to earnings consisting primarily of $66.0 million of stock-based compensation expense, $34.8 million of depreciation, and $1.3 million of amortization of intangibles. Partially offsetting these adjustments was deferred income tax of $19.8 million primarily related to an increase in tax credit carryforwards, partially offset by the utilization of net operating losses. The increase in cash from changes in working capital primarily consists of an increase in accounts payable and accrued expenses and other current liabilities of $21.4 million due to the timing of payments; a decrease in accounts receivable of $17.3 million primarily related to an accelerated cash receipt from a mobile app store provider; an increase in deferred revenue of $13.1 million, due mainly to growth in subscription sales; and an increase from income taxes payable and receivable of $26.9 million due primarily to

17

the timing of tax payments. These increases in cash were partially offset by an increase in other assets of $14.6 million primarily related to an increase in capitalized mobile app fees.

Net cash used in investing activities attributable to continuing operations in 2018 consists primarily of capital expenditures of $31.4 million that are primarily related to computer hardware and internal development of software to support our products and services and purchases of investments of $3.8 million, partially offset by net cash acquired in a business combination of $1.1 million.

Net cash used in financing activities attributable to continuing operations in 2018 is primarily due to withholding taxes paid on behalf of employees for net settled stock awards of $207.7 million, purchases of treasury stock of $133.5 million, a cash dividend of $105.1 million, purchases of non-controlling interests of $10.0 million, and debt issuance costs of $1.7 million. Partially offsetting these payments were proceeds of $260.0 million from a draw on the Credit Facility.

Liquidity and Capital Resources

The Company’s principal sources of liquidity are its cash flows generated from operations as well as cash and cash equivalents. At December 31, 2020, $749.8 million was available under the Credit Facility that expires on February 13, 2025.

The Company anticipates that it will need to make capital and other expenditures in connection with the development and expansion of its operations. The Company expects that 2021 cash capital expenditures will be between $80 million and $90 million, an increase from 2020 cash capital expenditures primarily related to leasehold improvements in our new leased New York office space, and building improvements at our company owned buildings in Los Angeles.

On June 17, 2021, the Company completed the acquisition of Hyperconnect. The purchase price of $1.75 billion was paid in the form of $884 million of cash, utilizing cash on hand; the issuance of 5.9 million shares of Match Group common stock (determined based on a deemed issue price of $141.73); and a $23 million of withholding taxes to be paid on behalf of the sellers in the third quarter of 2021. 2.4 million shares issued in the transaction are subject to restrictions on transfer set forth in the definitive Share Purchase Agreement.

At December 31, 2020, all of the Company’s international cash can be repatriated without significant tax consequences.

Our indebtedness could limit our ability to: (i) obtain additional financing to fund working capital needs, acquisitions, capital expenditures, debt service, or other requirements; and (ii) use operating cash flow to pursue acquisitions or invest in other areas, such as developing properties and exploiting business opportunities. The Company may need to raise additional capital through future debt or equity financing to make additional acquisitions and investments or to provide for greater financial flexibility. Additional financing may not be available on terms favorable to the Company or at all.

18

CONTRACTUAL OBLIGATIONS AND COMMERCIAL COMMITMENTS

| Payments Due by Period | |||||||||||||||||||||||||||||

Contractual Obligations(a) | Less Than 1 Year | 1–3 Years | 3–5 Years | More Than 5 Years | Total | ||||||||||||||||||||||||

| (In thousands) | |||||||||||||||||||||||||||||

Long-term debt(b) | $ | 115,581 | $ | 744,102 | $ | 222,097 | $ | 3,714,837 | $ | 4,796,617 | |||||||||||||||||||

Operating leases(c) | 14,806 | 22,813 | 18,172 | 62,458 | 118,249 | ||||||||||||||||||||||||

Purchase obligation(d) | 54,000 | 9,000 | 12,000 | — | 75,000 | ||||||||||||||||||||||||

| Total contractual obligations | $ | 184,387 | $ | 775,915 | $ | 252,269 | $ | 3,777,295 | $ | 4,989,866 | |||||||||||||||||||

_______________________________________________________________________________

(a)The Company has excluded $41.8 million in unrecognized tax benefits and related interest from the table above as we are unable to make a reasonably reliable estimate of the period in which these liabilities might be paid. For additional information on income taxes, see “Note 3—Income Taxes” to the consolidated financial statements included in “Item 8—Consolidated Financial Statements and Supplementary Data.”

(b)Represents contractual amounts due including interest on both fixed and variable rate instruments. Long-term debt at December 31, 2020 consists of the 5.00%, 5.625%, 4.125%, and 4.625% Senior Notes of $450 million, $350 million, $500 million, and $500 million, respectively, which bear interest at fixed rates; the 2022, 2026, and 2030 Exchangeable Notes of $518 million, $575 million, and $575 million, respectively, which bear interest at fixed rates; and the Term Loan balance of $425 million, which bears interest at a variable rate. The Term Loan bears interest at LIBOR plus 1.75%, or 1.96%, at December 31, 2020. The amount of interest ultimately paid on the Term Loan may differ based on changes in interest rates and outstanding balances. For additional information on long-term debt, see “Note 7—Long-term Debt, net” to the consolidated financial statements included in “Item 8—Consolidated Financial Statements and Supplementary Data.”

(c)The Company leases office space, data center facilities and equipment used in connection with its operations under various operating leases, many of which contain escalation clauses. The Company is also committed to pay a portion of the related operating expenses under certain lease agreements. These operating expenses are not included in the table above. For additional information on operating leases, see “Note 13—Leases” to the consolidated financial statements included in “Item 8—Consolidated Financial Statements and Supplementary Data.”

(d)The purchase obligations consist primarily of a web hosting commitment.

We also had $0.2 million of letters of credit and surety bonds outstanding at December 31, 2020 that could potentially require performance by the Company in the event of demands by third parties or other contingent events.

Off-Balance Sheet Arrangements

Other than the items described above, the Company did not have any off-balance sheet arrangements at December 31, 2020.

19

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The following disclosure is provided to supplement the descriptions of Match Group’s accounting policies contained in “Note 2—Summary of Significant Accounting Policies” to the consolidated financial statements included in “Item 8—Consolidated Financial Statements and Supplementary Data” in regard to significant areas of judgment. Management of the Company is required to make certain estimates, judgments and assumptions during the preparation of its consolidated financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”). These estimates, judgments and assumptions impact the reported amount of assets, liabilities, revenue and expenses and the related disclosure of contingent assets and liabilities. Actual results could differ from these estimates. Because of the size of the financial statement elements to which they relate, some of our accounting policies and estimates have a more significant impact on our consolidated financial statements than others. What follows is a discussion of some of our more significant accounting policies and estimates.

Business Combinations and Contingent Consideration Arrangements

Acquisitions have been, and will continue to be, an important part of the Company’s growth strategy. The purchase price of each acquisition is attributed to the assets acquired and liabilities assumed based on their fair values at the date of acquisition, including identifiable intangible assets that either arise from a contractual or legal right or are separable from goodwill. The fair value of these intangible assets is based on valuations that use information and assumptions provided by management. The excess purchase price over the net tangible and identifiable intangible assets is recorded as goodwill and is assigned to the reporting unit that is expected to benefit from the combination as of the acquisition date.

In connection with certain business combinations in the past, the Company has entered into contingent consideration arrangements that are determined to be part of the purchase price. Each of these arrangements is initially recorded at its fair value at the time of the acquisition and reflected at current fair value for each subsequent reporting period thereafter until settled. The contingent consideration arrangements are generally based upon earnings performance and/or operating metrics. The Company determines the fair value of the contingent consideration arrangements by using probability-weighted analyses to determine the amounts of the gross liability, and, if the arrangement is long-term in nature, applying a discount rate that appropriately captures the risk associated with the obligation to determine the net amount reflected in the consolidated financial statements. Significant changes in forecasted earnings or operating metrics would result in a significantly higher or lower fair value measurement. The changes in the remeasured fair value of the contingent consideration arrangements during each reporting period, including the accretion of the discount, if applicable, are recognized in “General and administrative expense” in the accompanying consolidated statement of operations.

Recoverability of Goodwill and Indefinite-Lived Intangible Assets

Goodwill is the Company’s largest asset with a carrying value of $1.3 billion and $1.2 billion at December 31, 2020 and 2019, representing 42% and 15%, respectively, of the Company’s total assets. Indefinite-lived intangible assets, which consist of the Company’s acquired trade names and trademarks, have a carrying value of $226.6 million and $221.2 million at December 31, 2020 and 2019, respectively.

Goodwill and indefinite-lived intangible assets are assessed annually for impairment as of October 1, or more frequently if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit or the fair value of an indefinite-lived intangible asset below its carrying value.

In performing its annual goodwill impairment assessment, the Company has the option under GAAP to qualitatively assess whether it is more likely than not that the fair value of a reporting unit is less than its carrying value; if the conclusion of the qualitative assessment is that there are no indicators of impairment, the Company does not perform a quantitative test, which would require a valuation of the reporting unit, as of October 1. If needed, the annual or interim quantitative test of the recovery of goodwill involves a comparison of the estimated fair value of each reporting unit to its carrying value, including goodwill. If the estimated fair value of the reporting unit exceeds its carrying value, goodwill of the reporting unit is not impaired. If the carrying value of the reporting unit exceeds its estimated fair value, an impairment loss equal to the excess is recorded. The 2020 and 2019 annual assessments did not identify any impairments.

20

As a result of the Separation, the Company had a negative carrying value for the Company’s annual goodwill test at October 1, 2020. Additionally, an impairment test of goodwill was not necessary because there were no factors identified that would indicate an impairment loss. The Company continued to have a negative carrying value at December 31, 2020.

While the Company has the option to qualitatively assess whether it is more likely than not that the fair values of its indefinite-lived intangible assets are less than their carrying values, the Company’s policy is to determine the fair value of each of its indefinite-lived intangible assets annually as of October 1, in part, because the level of effort required to perform the quantitative and qualitative assessments is essentially equivalent. The Company determines the fair value of its indefinite-lived intangible assets using an avoided royalty DCF valuation analysis. Significant judgments inherent in this analysis include the selection of appropriate royalty and discount rates and estimating the amount and timing of expected future cash flows. The discount rates used in the DCF analyses are intended to reflect the risks inherent in the expected future cash flows generated by the respective intangible assets. The royalty rates used in the DCF analyses are based upon an estimate of the royalty rates that a market participant would pay to license the Company’s trade names and trademarks. The future cash flows are based on the Company’s most recent forecast and budget and, for years beyond the budget, the Company’s estimates, which are based, in part, on forecasted growth rates. Assumptions used in the avoided royalty DCF analyses, including the discount rate and royalty rate, are assessed annually based on the actual and projected cash flows related to the asset, as well as macroeconomic and industry specific factors. The discount rates used in the Company’s annual indefinite-lived impairment assessment ranged from 10% to 23% in 2020 and 11% to 26% in 2019, and the royalty rates used ranged from 5% to 8% in 2020 and 3% to 8% in 2019.

If the carrying value of an indefinite-lived intangible asset exceeds its estimated fair value, an impairment equal to the excess is recorded. During the year ended December 31, 2020, the Company recognized an impairment charge related to the Match brand in the UK and the Meetic brand in Europe of $4.6 million. During the year ended December 31, 2019, the Company recognized an impairment charge on the Match brand in the UK of $6.6 million. At December 31, 2019, the aggregate indefinite-lived intangible asset balance for which the estimate of fair value at that time was less than 110% of their carrying values was approximately $92.3 million. At December 31, 2020, no indefinite-lived intangible asset balance had an estimated fair value less than 110% of carrying value.

Recoverability and Estimated Useful Lives of Long-Lived Assets

We review the carrying value of all long-lived assets, consisting of property and equipment and definite-lived intangible assets, for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. The carrying value of a long-lived asset is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. If the carrying value is deemed not to be recoverable, an impairment loss is recorded equal to the amount by which the carrying value of the long-lived asset exceeds its fair value. In addition, the Company reviews the useful lives of its long-lived assets whenever events or changes in circumstances indicate that these lives may be changed. The carrying value of property and equipment and definite-lived intangible assets was $112.1 million and $108.2 million, at December 31, 2020 and 2019, respectively.

Income Taxes

Match Group is subject to income taxes in the United States and numerous foreign jurisdictions. Significant judgment is required in determining our provision for income taxes and income tax assets and liabilities, including evaluating uncertainties in the application of accounting principles and complex tax laws.

We record a provision for income taxes for the anticipated tax consequences of our reported results of operations using the asset and liability method. Under this method, we recognize deferred income tax assets and liabilities for the future tax consequences of temporary differences between the financial reporting and tax bases of asset and liabilities, as well as for net operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates in effect for the year in which those temporary differences are expected to be realized or settled. We recognize the deferred income tax effects of a change in tax rates in the period of enactment.

A valuation allowance is provided on deferred tax assets if it is determined that it is more likely than not that the deferred tax asset will not be realized. We consider all available evidence, both positive and negative,

21

including historical levels of income, expectations and risks associated with estimates of future taxable income, and tax planning strategies in assessing the need for a valuation allowance.

We recognize tax benefits from uncertain tax positions only if we believe that it is more likely than not that the tax position will be sustained based on the technical merits of the position. Such tax benefits are measured based on the largest benefit that has a greater than 50% likelihood of being realized upon settlement. This measurement step is inherently difficult and requires subjective estimations of such amounts to determine the probability of various possible outcomes. We consider many factors when evaluating and estimating our tax positions and tax benefits, which may require periodic adjustment. We make adjustments to our unrecognized tax benefits when facts and circumstances change, such as the closing of a tax audit or the refinement of an estimate. Although we believe that we have adequately reserved for our uncertain tax positions, the final outcome of these matters may vary significantly from our estimates. To the extent that the final outcome of these matters is different from the amounts recorded, such differences will affect the income tax provision in the period in which such determination is made, and could have a material impact on our financial condition and operating results.

As of December 31, 2020, $158.1 million in cash and cash equivalents was held by our foreign subsidiaries. Generally, our ability to distribute cash from these subsidiaries is limited to that subsidiary’s distributable reserves and after considering other corporate legal restrictions. As a result of the Tax Cuts and Jobs Act enacted in the U.S. in 2017, earnings in our foreign jurisdictions are generally available for distribution to the U.S. without significant tax consequences.

Stock-Based Compensation

The Company recorded stock-based compensation expense of $102.3 million and $89.7 million for the years ended December 31, 2020 and 2019, respectively.

Stock-based compensation at the Company is complex due to our desire to attract, retain, and reward employees at many of our brands by allowing them to benefit from the value they help to create. We also utilize equity awards as part of our acquisition strategy. We accomplish these objectives, in part, by issuing equity awards denominated in the equity of our non-public subsidiaries as well as in Match Group, Inc. We further refine this approach by tailoring the terms of equity awards as appropriate. For example, we issue certain equity awards with vesting conditioned on the achievement of specified performance targets such as revenue or profits; these awards are referred to as performance awards. In other cases, we condition the vesting of equity awards to the achievement of value targets for a specific subsidiary or the Company’s stock price; these awards are referred to as market-based awards.