UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant ☒ | ||

| Filed by a Party other than the Registrant ☐ | ||

| Check the appropriate box: |

||

| ☐ Preliminary Proxy Statement

☐ Definitive Proxy Statement |

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ Definitive Additional Materials | ||

| ☐ Soliciting Material Pursuant to § 240.14a-12 | ||

BLACKROCK MUNIYIELD PENNSYLVANIA QUALITY FUND

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

On May 22, 2024, representatives of the funds listed below (collectively, the “Funds”) gave a presentation to representatives of Institutional Shareholder Services Inc. regarding the Funds. A copy of this presentation is filed herewith.

BlackRock California Municipal Income Trust

BlackRock New York Municipal Income Trust

BlackRock MuniHoldings New York Quality Fund, Inc.

BlackRock MuniYield Pennsylvania Quality Fund

BlackRock MuniYield New York Quality Fund, Inc.

BlackRock Innovation and Growth Term Trust

BlackRock Health Sciences Term Trust

BlackRock Science and Technology Term Trust

BlackRock Capital Allocation Term Trust

BlackRock ESG Capital Allocation Term Trust

BlackRock Closed-End Funds

Focused on the interests of all shareholders

Contested funds:

BlackRock California Municipal Income Trust (NYSE: BFZ) BlackRock New York Municipal Income Trust (NYSE: BNY)

BlackRock MuniHoldings New York Quality Fund, Inc. (NYSE: MHN) BlackRock MuniYield Pennsylvania Quality Fund (NYSE: MPA) BlackRock MuniYield New York Quality Fund, Inc. (NYSE: MYN)

BlackRock Innovation and Growth Term Trust (NYSE: BIGZ) BlackRock Health Sciences Term Trust (NYSE: BMEZ)

BlackRock Science and Technology Term Trust (NYSE: BSTZ)

BlackRock Capital Allocation Term Trust (NYSE: BCAT) BlackRock ESG Capital Allocation Term Trust (NYSE: ECAT)

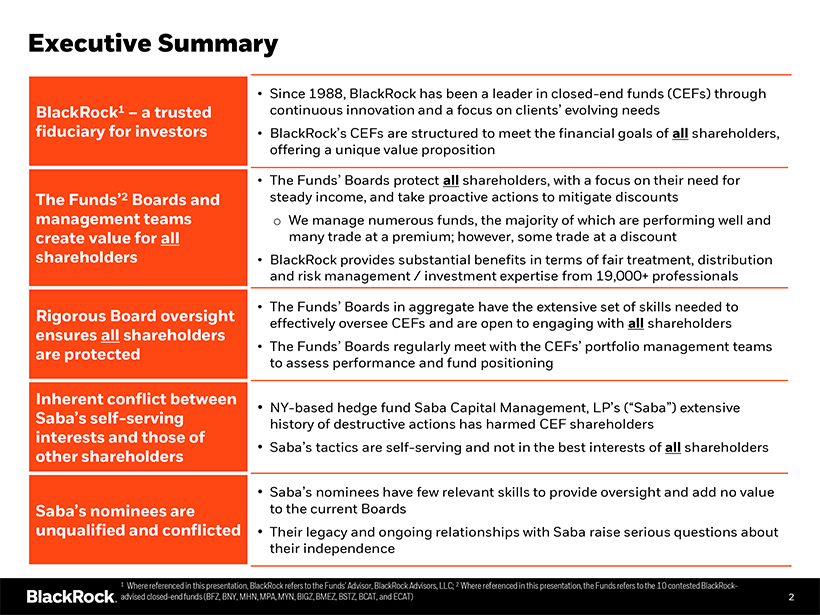

Executive Summary

• Since 1988, BlackRock has

been a leader in closed-end funds (CEFs) through

BlackRock1 – a trusted continuous innovation and a focus on

clients’ evolving needs fiduciary for investors • BlackRock’s CEFs are structured to meet the financial goals of all shareholders, offering a unique value proposition

• The Funds’ Boards protect all shareholders, with a focus on their need for The Funds’2 Boards and steady income, and take proactive actions to mitigate discounts

management teams o We manage numerous funds, the majority of which are performing well and create value for all many trade at a premium; however, some trade at a discount shareholders • BlackRock provides substantial benefits in terms of fair

treatment, distribution and risk management / investment expertise from 19,000+ professionals

• The Funds’ Boards in aggregate have the extensive set of

skills needed to

Rigorous Board oversight effectively oversee CEFs and are open to engaging with all shareholders

ensures all shareholders

are protected • The Funds’ Boards regularly meet with the

CEFs’ portfolio management teams to assess performance and fund positioning

Inherent conflict between

• NY-based hedge fund Saba Capital Management, LP’s (“Saba”) extensive

Saba’s self-serving history of destructive actions has harmed CEF shareholders

interests

and those of

• Saba’s tactics are self-serving and not in the best interests of all shareholders

other shareholders

• Saba’s nominees have few relevant skills to provide oversight

and add no value

Saba’s nominees are to the current Boards unqualified and conflicted • Their legacy and ongoing relationships with Saba raise serious

questions about their independence

1 Where referenced in this presentation, BlackRock refers to the Funds’ Advisor, BlackRock Advisors, LLC; 2 Where

referenced in this presentation, the Funds refers to the 10 contested BlackRock-advised closed-end funds (BFZ, BNY, MHN, MPA, MYN, BIGZ, BMEZ, BSTZ, BCAT, and ECAT) 2

BlackRock – a trusted

fiduciary for investors

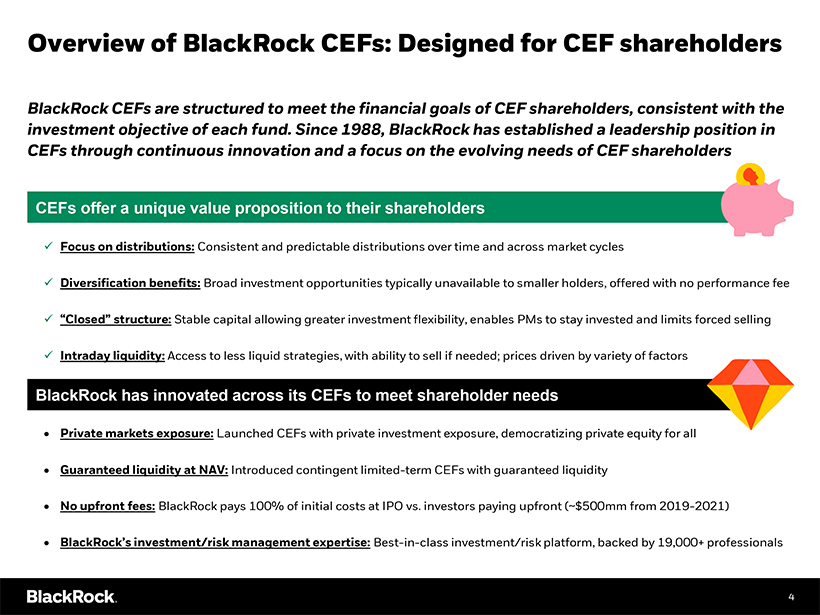

Overview of BlackRock CEFs: Designed for CEF shareholders

BlackRock CEFs are structured to meet the financial goals of CEF shareholders, consistent with the investment objective of each fund. Since 1988, BlackRock has established a

leadership position in CEFs through continuous innovation and a focus on the evolving needs of CEF shareholders

? Focus on distributions: Consistent and

predictable distributions over time and across market cycles

? Diversification benefits: Broad investment opportunities typically unavailable to smaller holders,

offered with no performance fee

? “Closed” structure: Stable capital allowing greater investment flexibility, enables PMs to stay invested and limits

forced selling

? Intraday liquidity: Access to less liquid strategies, with ability to sell if needed; prices driven by variety of factors

• Private markets exposure: Launched CEFs with private investment exposure, democratizing private equity for all

• Guaranteed liquidity at NAV: Introduced contingent limited-term CEFs with guaranteed liquidity

• No upfront fees: BlackRock pays 100% of initial costs at IPO vs. investors paying upfront (~$500mm from 2019-2021)

• BlackRock’s investment/risk management expertise: 4 Best-in-class investment/risk

platform, backed by 19,000+ professionals

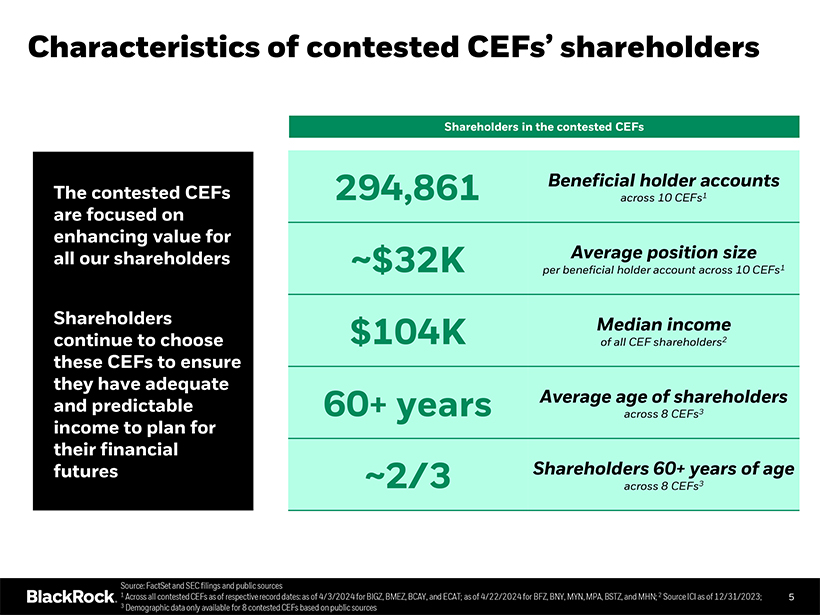

Characteristics of contested CEFs’ shareholders

Beneficial holder accounts

• 294,861 across 10 CEFs1 Average position

size

~$32K per beneficial holder account across 10 CEFs1

• Median income

$104K of all CEF shareholders2

Average age of shareholders 60+ years 3

across 8 CEFs

Shareholders 60+ years of age

~2/3 across 8 CEFs3 5

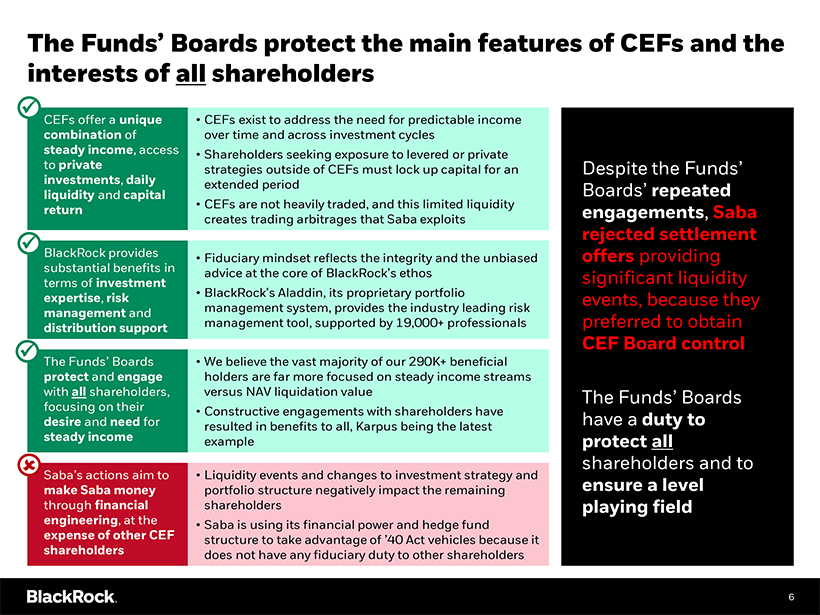

The Funds’ Boards protect the main features of CEFs and the interests of all shareholders

CEFs offer a unique combination of steady income, access to private investments, daily liquidity and capital return

BlackRock provides substantial benefits in terms of investment expertise, risk management and distribution support

The Funds’ Boards protect and engage with all shareholders, focusing on their desire and need for steady income

Saba’s actions aim to make Saba money through financial engineering, at the expense of other CEF shareholders

• CEFs exist to address the need for predictable income over time and across investment cycles

• Shareholders seeking exposure to levered or private strategies outside of CEFs must lock up capital for an extended period

• CEFs are not heavily traded, and this limited liquidity creates trading arbitrages that Saba exploits

• Fiduciary mindset reflects the integrity and the unbiased advice at the core of BlackRock’s ethos

• BlackRock’s Aladdin, its proprietary portfolio management system, provides the industry leading risk management tool, supported by 19,000+ professionals

• We believe the vast majority of our 290K+ beneficial holders are far more focused on steady income streams versus NAV liquidation value

• Constructive engagements with shareholders have resulted in benefits to all, Karpus being the latest example

• Liquidity events and changes to investment strategy and portfolio structure negatively impact the remaining shareholders

• Saba is using its financial power and hedge fund structure to take advantage of ’40 Act vehicles because it does not have any fiduciary duty to other shareholders

Despite the Funds’ Boards’ repeated engagements, Saba rejected settlement offers providing significant liquidity events, because they preferred to obtain

CEF Board control

The Funds’ Boards have a duty to protect all

shareholders and to ensure a level playing field

6

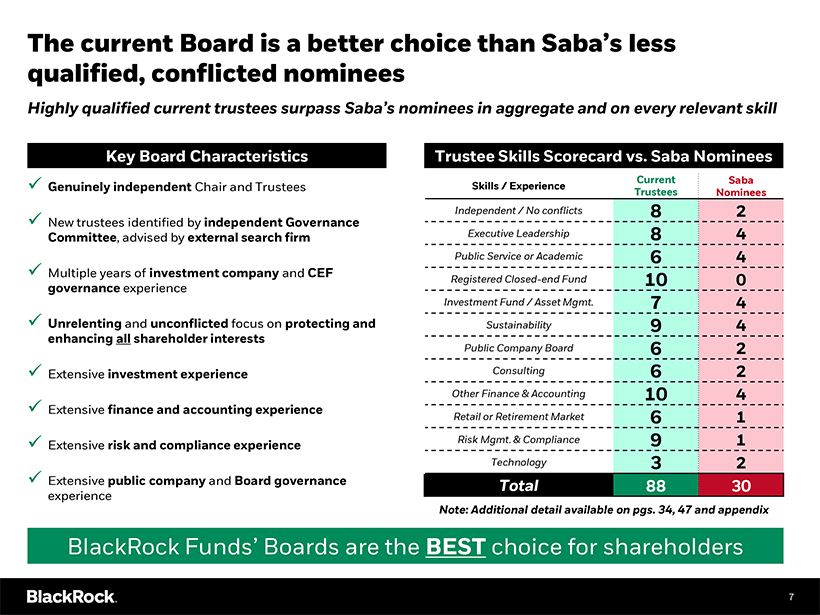

The current Board is a better choice than Saba’s less qualified, conflicted nominees

Highly qualified current trustees surpass Saba’s nominees in aggregate and on every relevant skill

? Genuinely independent Chair and Trustees

? New trustees identified by independent Governance

Committee, advised by external search firm

? Multiple years of investment

company and CEF governance experience

? Unrelenting and unconflicted focus on protecting and enhancing all shareholder interests

? Extensive investment experience

? Extensive finance and accounting experience

? Extensive risk and compliance experience

? Extensive public company and Board governance

experience

Current Saba Skills / Experience Trustees Nominees

Independent /

No conflicts 8 2 Executive Leadership 8 4 Public Service or Academic 6 4 Registered Closed-end Fund 10 0 Investment Fund / Asset Mgmt. 7 4 Sustainability 9 4 Public Company Board 6 2 Consulting 6 2 Other

Finance & Accounting 10 4 Retail or Retirement Market 6 1 Risk Mgmt. & Compliance 9 1 Technology 3 2

Note: Additional detail available on pgs. 34, 47

and appendix 7

The Funds’ Boards and management teams create value for all shareholders

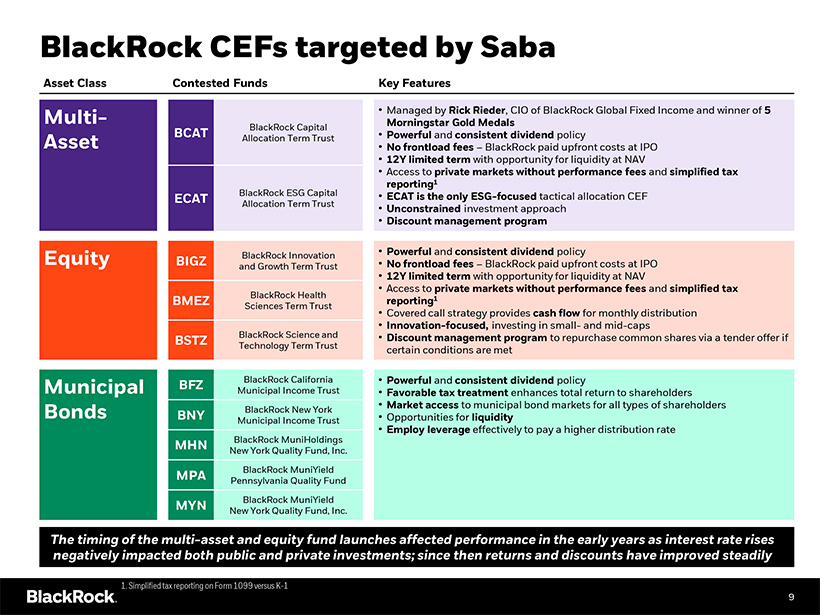

BlackRock CEFs targeted by Saba

Asset

Class Contested Funds Key Features

Multi-Asset

Equity

Municipal Bonds

BCAT

ECAT

BIGZ BMEZ BSTZ

BFZ BNY MHN MPA MYN

BlackRock Capital Allocation Term Trust

BlackRock ESG Capital Allocation Term Trust

BlackRock Innovation and Growth Term Trust

BlackRock Health Sciences Term Trust

BlackRock Science and Technology Term

Trust

BlackRock California Municipal Income Trust BlackRock New York Municipal Income Trust BlackRock MuniHoldings New York Quality Fund, Inc.

BlackRock MuniYield Pennsylvania Quality Fund BlackRock MuniYield New York Quality Fund, Inc.

• Managed by Rick Rieder, CIO of BlackRock Global Fixed Income and winner of 5 Morningstar Gold Medals

• Powerful and consistent dividend policy

• No frontload fees – BlackRock paid

upfront costs at IPO

• 12Y limited term with opportunity for liquidity at NAV

• Access to private markets without performance fees and simplified tax reporting1

•

ECAT is the only ESG-focused tactical allocation CEF

• Unconstrained investment approach

• Discount management program

• Powerful and consistent dividend policy

• No frontload fees – BlackRock paid upfront costs at IPO

• 12Y limited term

with opportunity for liquidity at NAV

• Access to private markets without performance fees and simplified tax reporting1

• Covered call strategy provides cash flow for monthly distribution

•

Innovation-focused, investing in small- and mid-caps

• Discount management program to repurchase common shares via a

tender offer if certain conditions are met

• Powerful and consistent dividend policy

• Favorable tax treatment enhances total return to shareholders

• Market access to

municipal bond markets for all types of shareholders

• Opportunities for liquidity

• Employ leverage effectively to pay a higher distribution rate

The timing of the

multi-asset and equity fund launches affected performance in the early years as interest rate rises negatively impacted both public and private investments; since then returns and discounts have improved steadily

1. Simplified tax reporting on Form 1099 versus K-1

9

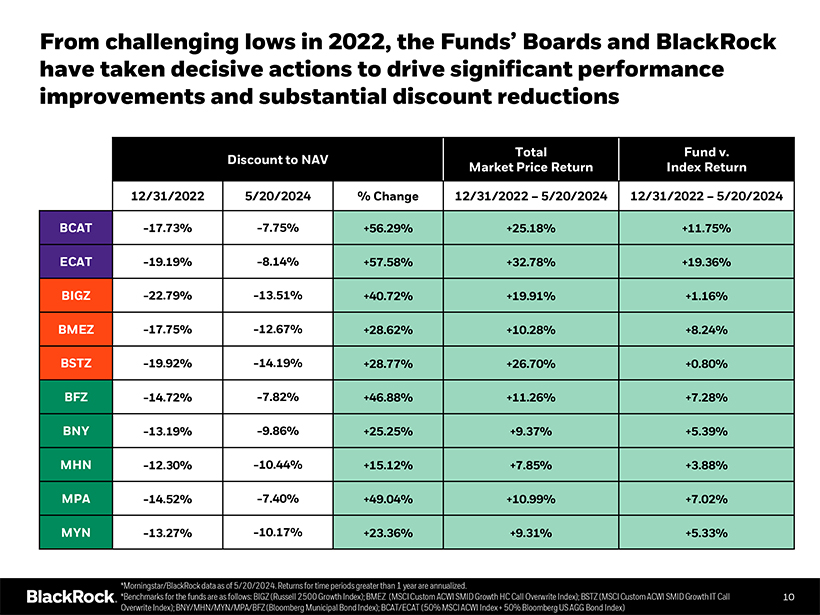

From challenging lows in 2022, the Funds’ Boards and BlackRock have taken decisive actions to drive significant performance

improvements and substantial discount reductions

Total Fund v. Discount to NAV

Market Price Return Index Return 10

12/31/2022 5/20/2024 % Change

12/31/2022 – 5/20/2024 12/31/2022 – 5/20/2024 BCAT -17.73% -7.75% +56.29% +25.18% +11.75% ECAT -19.19% -8.14% +57.58% +32.78% +19.36% BIGZ -22.79% -13.51% +40.72% +19.91% +1.16% BMEZ -17.75% -12.67% +28.62% +10.28% +8.24% BSTZ -19.92% -14.19% +28.77% +26.70% +0.80% BFZ -14.72% -7.82% +46.88% +11.26% +7.28% BNY -13.19% -9.86% +25.25% +9.37% +5.39% MHN -12.30% -10.44% +15.12% +7.85% +3.88% MPA -14.52% -7.40% +49.04% +10.99% +7.02% MYN -13.27% -10.17% +23.36% +9.31% +5.33%

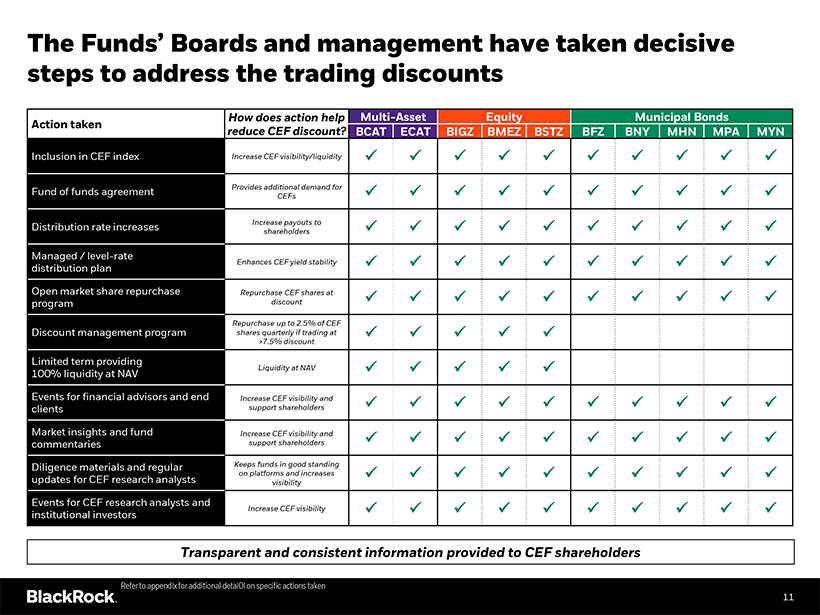

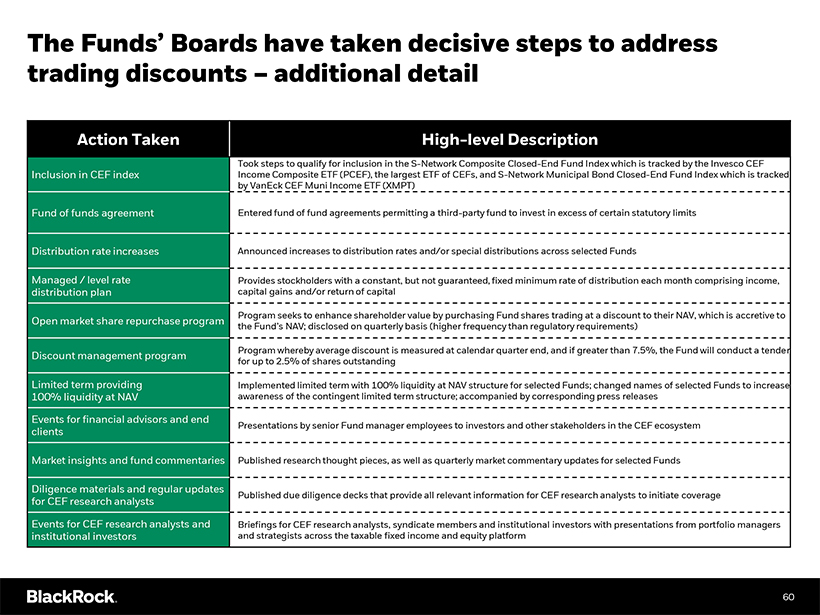

The Funds’ Boards and management have taken decisive steps to address the trading discounts

How does action help Action taken reduce CEF discount?

Increase CEF visibility/liquidity

? ✓

Provides additional demand for ? ✓✓ CEFs

Increase payouts to ? ✓

shareholders

Enhances CEF yield stability ? ✓

Repurchase CEF shares at ?✓

discount

Repurchase up to 2.5% of CEF

shares quarterly if trading at ? ✓

>7.5% discount

Liquidity at NAV ? ✓

Increase CEF visibility and ? ✓

support shareholders

Increase CEF visibility and ? ✓ ✓ support

shareholders

Keeps funds in good standing

on platforms and increases

? ✓ ✓

visibility

Increase CEF visibility

? ✓✓

Transparent and consistent information provided to CEF shareholders

Refer to appendix for additional detai0l on specific actions taken

11

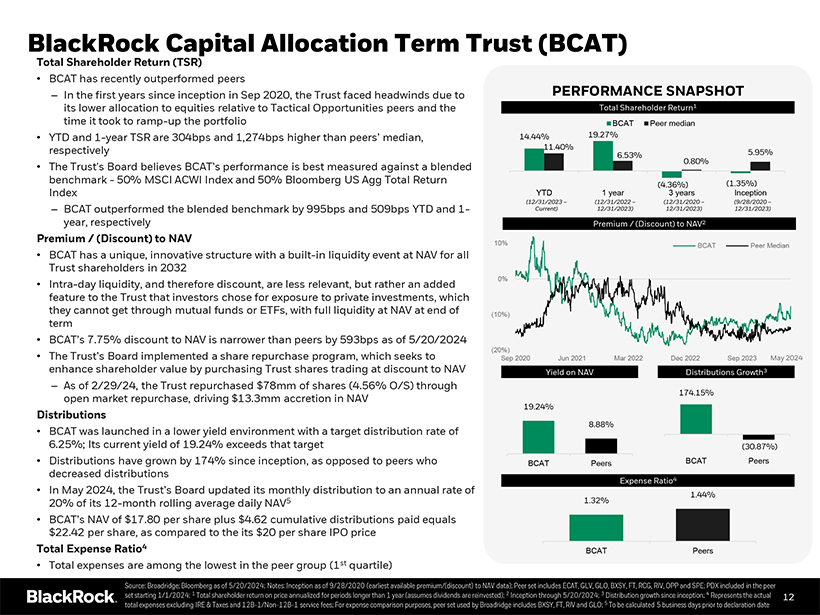

BlackRock Capital Allocation Term Trust (BCAT)

Total Shareholder Return (TSR)

• BCAT has recently outperformed peers

– In the first years since inception in Sep 2020, the Trust faced headwinds due to its lower allocation to equities relative to Tactical Opportunities peers

and the time it took to ramp-up the portfolio

• YTD and 1-year TSR are 304bps

and 1,274bps higher than peers’ median, respectively

• The Trust’s Board believes BCAT’s performance is best measured against a blended

benchmark—50% MSCI ACWI Index and 50% Bloomberg US Agg Total Return Index

– BCAT outperformed the blended benchmark by 995bps and 509bps YTD and 1-year, respectively

Premium / (Discount) to NAV

• BCAT has a unique, innovative structure with a built-in liquidity event at NAV for all Trust shareholders in 2032

• Intra-day liquidity, and therefore discount, are less relevant, but rather an added feature to the Trust that investors chose for

exposure to private investments, which they cannot get through mutual funds or ETFs, with full liquidity at NAV at end of term

• BCAT’s 7.75% discount to

NAV is narrower than peers by 593bps as of 5/20/2024

• The Trust’s Board implemented a share repurchase program, which seeks to enhance shareholder value

by purchasing Trust shares trading at discount to NAV

– As of 2/29/24, the Trust repurchased $78mm of shares (4.56% O/S) through open market repurchase,

driving $13.3mm accretion in NAV

Distributions

• BCAT was launched in a

lower yield environment with a target distribution rate of

6.25%; Its current yield of 19.24% exceeds that target

• Distributions have grown by 174% since inception, as opposed to peers who decreased distributions

• In May 2024, the Trust’s Board updated its monthly distribution to an annual rate of 20% of its 12-month rolling average daily

NAV5

• BCAT’s NAV of $17.80 per share plus $4.62 cumulative distributions paid equals

$22.42 per share, as compared to the its $20 per share IPO price

Total Expense Ratio4

• Total expenses are among the lowest in the peer group (1st quartile)

PERFORMANCE SNAPSHOT

Total Shareholder Return1

BCAT Peer median

14.44% 19.27%

11.40%

6.53% 5.95%

0.80%

(4.36%) (1.35%)

YTD 1 year 3 years Inception

(12/31/2023 – (12/31/2022 – (12/31/2020 –

(9/28/2020 –Current) 12/31/2023) 12/31/2023) 12/31/2023)

Premium / (Discount) to NAV2

10% BCAT Peer Median

0%

(10%)

(20%)

Sep 2020 Jun 2021 Mar 2022 Dec 2022 Sep 2023 May 2024

Yield on NAV Distributions Growth3

174.15%

19.24%

8.88%

(30.87%)

BCAT Peers BCAT Peers

Expense Ratio4

1.44%

1.32%

BCAT Peers

Source: Broadridge; Bloomberg as of 5/20/2024; Notes: Inception as of 9/28/2020

(earliest available premium/(discount) to NAV data); Peer set includes ECAT, GLV, GLO, BXSY, FT, RCG, RIV, OPP and SPE; PDX included in the peer set starting 1/1/2024; 1 Total shareholder return on price annualized for periods longer than 1 year

(assumes dividends are reinvested); 2 Inception through 5/20/2024; 3 Distribution growth since inception; 4 Represents the actual 12 total expenses excluding IRE & Taxes and 12B-1/Non-12B-1 service fees; For expense comparison purposes, peer set used by Broadridge includes BXSY, FT, RIV and GLO; 5 To be calculated 5 business days prior to declaration date 12

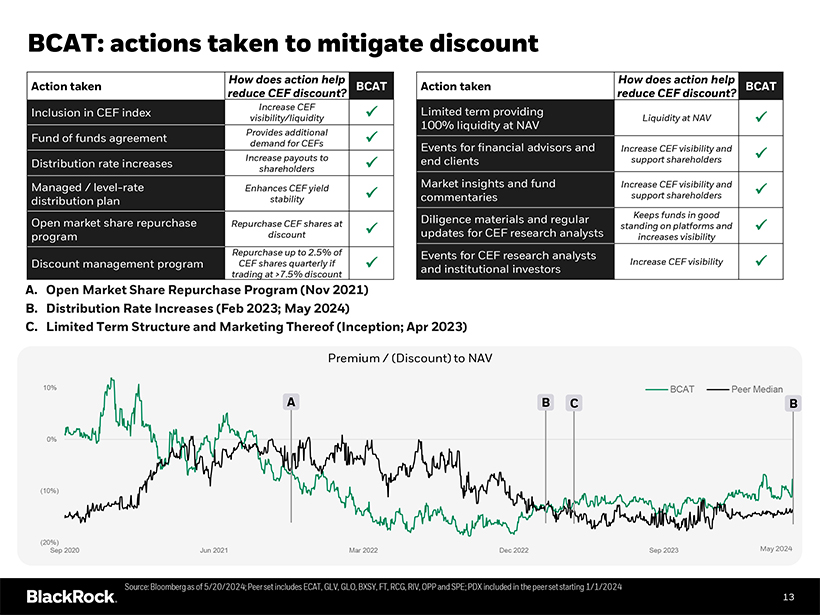

BCAT: actions taken to mitigate discount

How does

action help

Action taken BCAT reduce CEF discount?

Inclusion in CEF index

Increase CEF visibility/liquidity

Fund of funds agreement Provides additional demand for CEFs

Distribution rate increases Increase payouts to shareholders

Managed / level-rate

Enhances CEF yield distribution plan stability Open market share repurchase Repurchase CEF shares at program discount Repurchase up to 2.5% of

Discount

management program CEF shares quarterly if trading at >7.5% discount

How does action help

Action taken BCAT reduce CEF discount?

Limited term providing

Liquidity at NAV

100% liquidity at NAV

Events for financial advisors and Increase CEF visibility and end clients support shareholders

Market insights and fund Increase CEF visibility and commentaries support shareholders

Diligence materials and regular Keeps funds in good standing on platforms and updates for CEF research analysts increases visibility Events for CEF research

analysts

Increase CEF visibility and institutional investors

A. Open

Market Share Repurchase Program (Nov 2021) B. Distribution Rate Increases (Feb 2023; May 2024)

C. Limited Term Structure and Marketing Thereof (Inception; Apr

2023)

Premium / (Discount) to NAV

10% BCAT Peer Median

A B C B

0%

(10%)

(20%) May 2024

Sep 2020 Jun 2021 Mar 2022 Dec 2022 Sep 2023

Source: Bloomberg as of 5/20/2024; Peer set

includes ECAT, GLV, GLO, BXSY, FT, RCG, RIV, OPP and SPE; PDX included in the peer set starting 1/1/2024

13

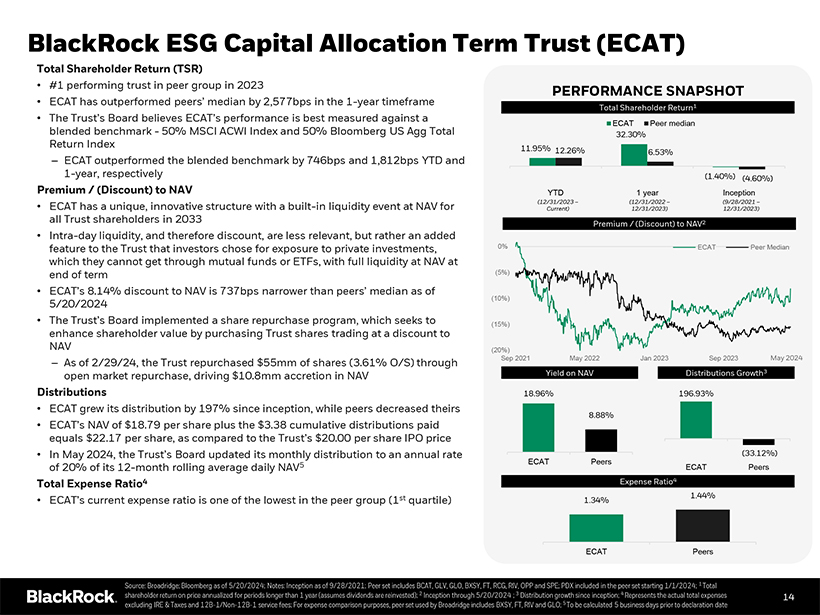

BlackRock ESG Capital Allocation Term Trust (ECAT)

Total Shareholder Return (TSR)

• #1 performing trust in peer group in

2023

• ECAT has outperformed peers’ median by 2,577bps in the 1-year timeframe

• The Trust’s Board believes ECAT’s performance is best measured against a blended benchmark—50% MSCI ACWI Index and 50% Bloomberg US Agg Total Return Index

– ECAT outperformed the blended benchmark by 746bps and 1,812bps YTD and

1-year, respectively

Premium /

(Discount) to NAV

• ECAT has a unique, innovative structure with a built-in liquidity event at NAV for all Trust

shareholders in 2033

• Intra-day liquidity, and therefore discount, are less relevant, but rather an added feature to

the Trust that investors chose for exposure to private investments, which they cannot get through mutual funds or ETFs, with full liquidity at NAV at end of term

• ECAT’s 8.14% discount to NAV is 737bps narrower than peers’ median as of

5/20/2024

• The Trust’s Board implemented a share repurchase program, which seeks to

enhance shareholder value by purchasing Trust shares trading at a discount to NAV

– As of 2/29/24, the Trust repurchased $55mm of shares (3.61% O/S) through

open market repurchase, driving $10.8mm accretion in NAV

Distributions

•

ECAT grew its distribution by 197% since inception, while peers decreased theirs

• ECAT’s NAV of $18.79 per share plus the $3.38 cumulative distributions

paid equals $22.17 per share, as compared to the Trust’s $20.00 per share IPO price

• In May 2024, the Trust’s Board updated its monthly

distribution to an annual rate of 20% of its 12-month rolling average daily NAV5

Total Expense Ratio4

• ECAT’s current expense ratio is one of the lowest in the peer group (1st quartile)

PERFORMANCE SNAPSHOT

Total Shareholder Return1

ECAT Peer median

32.30%

11.95% 12.26% 6.53%

(1.40%) (4.60%)

YTD 1 year Inception

(12/31/2023 – (12/31/2022 – (9/28/2021 –Current)

12/31/2023) 12/31/2023)

Premium / (Discount) to NAV2

0% ECAT Peer Median (5%)

(10%) (15%)

(20%)

Sep 2021 May 2022 Jan 2023 Sep 2023 May 2024

Yield on NAV Distributions Growth3

18.96% 196.93%

8.88%

(33.12%)

ECAT Peers

ECAT Peers

Expense Ratio4

1.44%

1.34%

ECAT Peers 14

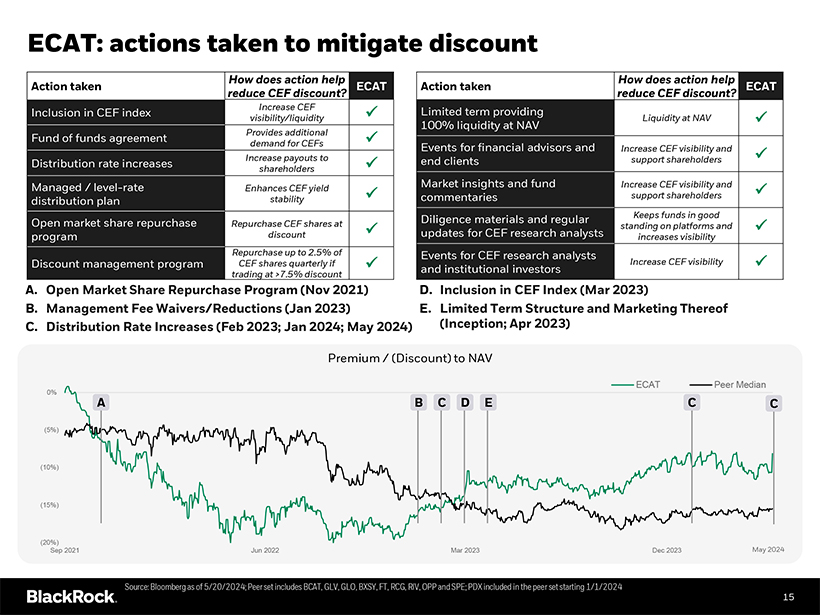

ECAT: actions taken to mitigate discount

How does

action help

Action taken ECAT reduce CEF discount?

Inclusion in CEF index

Increase CEF visibility/liquidity

Fund of funds agreement Provides additional demand for CEFs

Distribution rate increases Increase payouts to shareholders

Managed / level-rate

Enhances CEF yield distribution plan stability Open market share repurchase Repurchase CEF shares at program discount Repurchase up to 2.5% of

Discount

management program CEF shares quarterly if trading at >7.5% discount

A. Open Market Share Repurchase Program (Nov 2021) B. Management Fee

Waivers/Reductions (Jan 2023) C. Distribution Rate Increases (Feb 2023; Jan 2024; May 2024)

How does action help

Action taken ECAT reduce CEF discount?

Limited term providing

Liquidity at NAV

100% liquidity at NAV

Events for financial advisors and Increase CEF visibility and end clients support shareholders

Market insights and fund Increase CEF visibility and commentaries support shareholders

Diligence materials and regular Keeps funds in good standing on platforms and updates for CEF research analysts increases visibility Events for CEF research

analysts

Increase CEF visibility and institutional investors

D.

Inclusion in CEF Index (Mar 2023)

E. Limited Term Structure and Marketing Thereof (Inception; Apr 2023)

Premium / (Discount) to NAV

ECAT Peer Median

0% A B C D E C

C

(5%) (10%) (15%)

(20%) May 2024

Sep 2021 Jun 2022 Mar 2023 Dec 2023

Source: Bloomberg as of 5/20/2024; Peer set includes BCAT,

GLV, GLO, BXSY, FT, RCG, RIV, OPP and SPE; PDX included in the peer set starting 1/1/2024

15

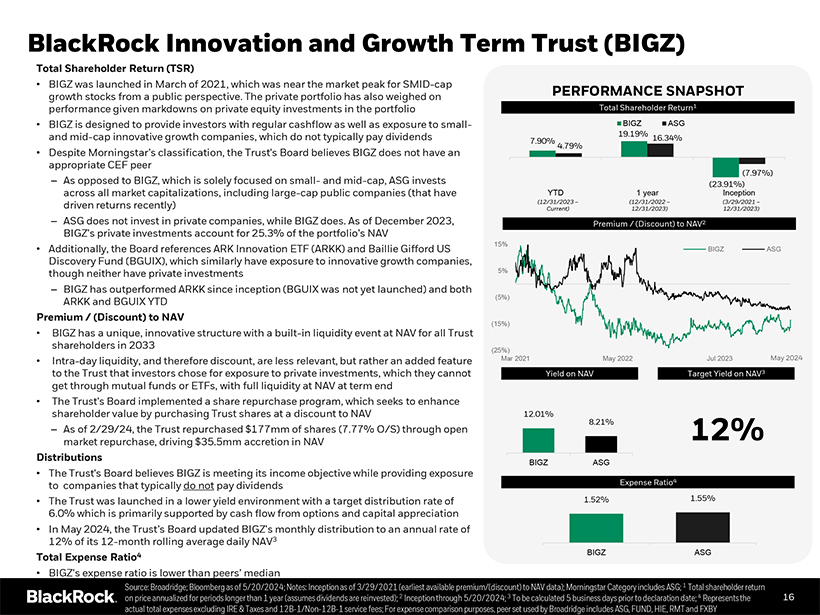

BlackRock Innovation and Growth Term Trust (BIGZ)

Total Shareholder Return (TSR)

• BIGZ was launched in March of 2021,

which was near the market peak for SMID-cap growth stocks from a public perspective. The private portfolio has also weighed on performance given markdowns on private equity investments in the portfolio

• BIGZ is designed to provide investors with regular cashflow as well as exposure to small-and mid-cap innovative growth companies, which do not typically pay dividends

• Despite Morningstar’s classification, the

Trust’s Board believes BIGZ does not have an appropriate CEF peer

– As opposed to BIGZ, which is solely focused on small- and mid-cap, ASG invests across all market capitalizations, including large-cap public companies (that have driven returns recently)

– ASG does not invest in private companies, while BIGZ does. As of December 2023,

BIGZ’s private investments account for 25.3% of the portfolio’s NAV

• Additionally, the Board references ARK Innovation ETF (ARKK) and Baillie Gifford US Discovery Fund (BGUIX), which similarly have exposure to innovative

growth companies, though neither have private investments

– BIGZ has outperformed ARKK since inception (BGUIX was not yet launched) and both ARKK and BGUIX

YTD

Premium / (Discount) to NAV

• BIGZ has a unique, innovative

structure with a built-in liquidity event at NAV for all Trust shareholders in 2033

•

Intra-day liquidity, and therefore discount, are less relevant, but rather an added feature to the Trust that investors chose for exposure to private investments, which they cannot get through mutual funds or

ETFs, with full liquidity at NAV at term end

• The Trust’s Board implemented a share repurchase program, which seeks to enhance shareholder value by

purchasing Trust shares at a discount to NAV

– As of 2/29/24, the Trust repurchased $177mm of shares (7.77% O/S) through open market repurchase, driving

$35.5mm accretion in NAV

Distributions

• The Trust’s Board believes

BIGZ is meeting its income objective while providing exposure to companies that typically do not pay dividends

• The Trust was launched in a lower yield

environment with a target distribution rate of

6.0% which is primarily supported by cash flow from options and capital appreciation

• In May 2024, the Trust’s Board updated BIGZ’s monthly distribution to an annual rate of

12% of its 12-month rolling average daily NAV3

Total

Expense Ratio4

• BIGZ’s expense ratio is lower than peers’ median

PERFORMANCE SNAPSHOT

Total Shareholder Return1

BIGZ ASG

19.19%

7.90% 4.79% 16.34%

(7.97%) (23.91%)

YTD 1 year Inception

(12/31/2023 – (12/31/2022 – (3/29/2021 –Current)

12/31/2023) 12/31/2023)

Premium / (Discount) to NAV2

15%

BIGZ ASG 5% (5%) (15%)

(25%)

Mar 2021 May 2022 Jul 2023 May

Yield on NAV Target Yield on NAV3

12.01% 8.21% 12%

BIGZ ASG

Expense Ratio4

1.52% 1.55%

BIGZ ASG

Source: Broadridge; Bloomberg as of 5/20/2024; Notes: Inception as of 3/29/2021

(earliest available premium/(discount) to NAV data); Morningstar Category includes ASG; 1 Total shareholder return on price annualized for periods longer than 1 year (assumes dividends are reinvested); 2 Inception through 5/20/2024; 3 To be

calculated 5 business days prior to declaration date; 4 Represents the 16 actual total expenses excluding IRE & Taxes and

12B-1/Non-12B-1 service fees; For expense comparison purposes, peer set used by Broadridge includes ASG, FUND, HIE, RMT and FXBY

16

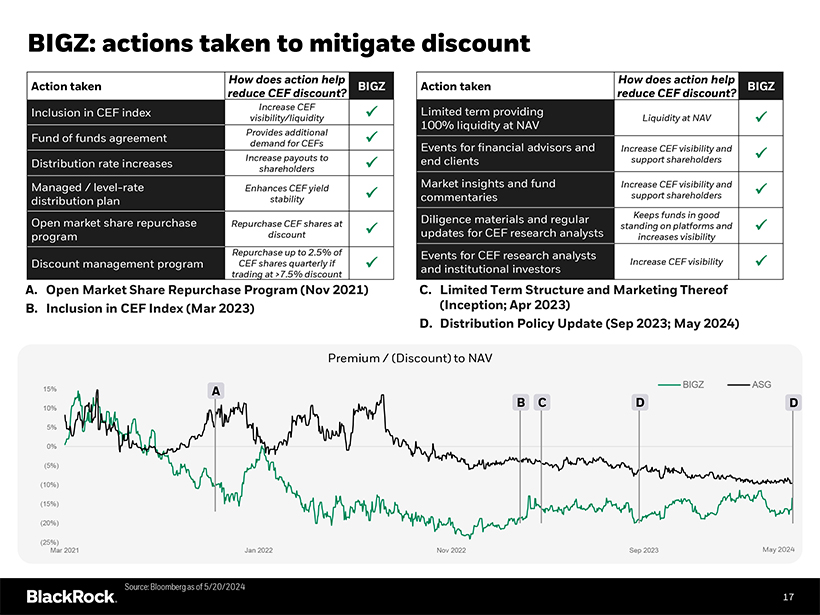

BIGZ: actions taken to mitigate discount

How does

action help

Action taken reduce CEF discount?

Increase CEF ?

visibility/liquidity

Provides additional ? demand for CEFs

Increase payouts

to ? shareholders

Enhances CEF yield ? stability Repurchase CEF shares at ? discount Repurchase up to 2.5% of

CEF shares quarterly if ? trading at >7.5% discount

A. Open Market Share Repurchase Program

(Nov 2021) B. Inclusion in CEF Index (Mar 2023)

How does action help

Action

taken BIGZ reduce CEF discount?

Limited term providing

Liquidity at NAV

100% liquidity at NAV

Events for financial advisors and Increase CEF

visibility and end clients support shareholders

Market insights and fund Increase CEF visibility and commentaries support shareholders

Diligence materials and regular Keeps funds in good standing on platforms and updates for CEF research analysts increases visibility Events for CEF research analysts

Increase CEF visibility and institutional investors

C. Limited Term

Structure and Marketing Thereof (Inception; Apr 2023) D. Distribution Policy Update (Sep 2023; May 2024)

Premium / (Discount) to NAV

BIGZ ASG

15% A

B C D D

10% 5% 0% (5%) (10%) (15%) (20%)

(25%) May 2024

Mar 2021 Jan 2022 Nov 2022 Sep 2023

Source: Bloomberg as of 5/20/2024

17

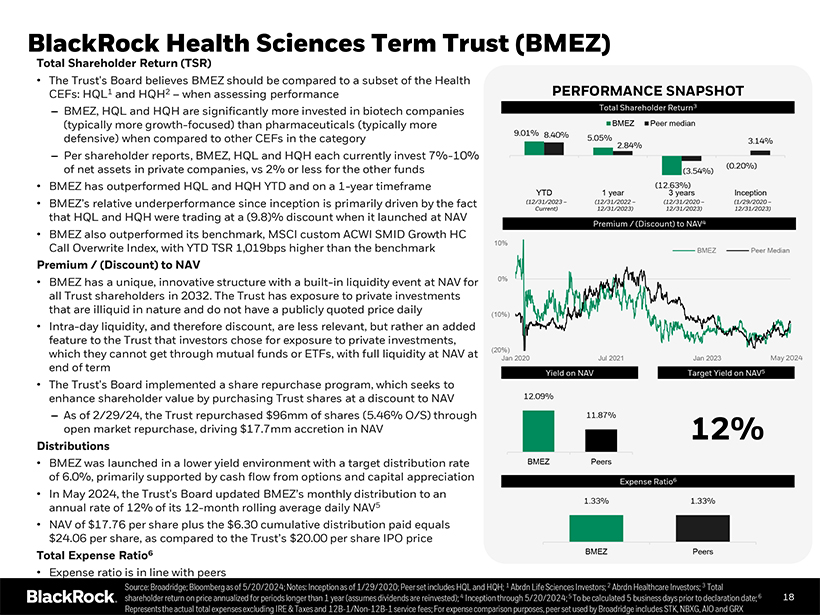

BlackRock Health Sciences Term Trust (BMEZ)

Total

Shareholder Return (TSR)

• The Trust’s Board believes BMEZ should be compared to a subset of the Health CEFs: HQL1 and HQH2 – when assessing

performance

– BMEZ, HQL and HQH are significantly more invested in biotech companies (typically more growth-focused) than pharmaceuticals (typically more

defensive) when compared to other CEFs in the category

– Per shareholder reports, BMEZ, HQL and HQH each currently invest

7%-10% of net assets in private companies, vs 2% or less for the other funds

• BMEZ has outperformed HQL and HQH YTD

and on a 1-year timeframe

• BMEZ’s relative underperformance since inception is primarily driven by the fact that

HQL and HQH were trading at a (9.8)% discount when it launched at NAV

• BMEZ also outperformed its benchmark, MSCI custom ACWI SMID Growth HC Call Overwrite

Index, with YTD TSR 1,019bps higher than the benchmark

Premium / (Discount) to NAV

• BMEZ has a unique, innovative structure with a built-in liquidity event at NAV for all Trust shareholders in 2032. The Trust has

exposure to private investments that are illiquid in nature and do not have a publicly quoted price daily

• Intra-day

liquidity, and therefore discount, are less relevant, but rather an added feature to the Trust that investors chose for exposure to private investments, which they cannot get through mutual funds or ETFs, with full liquidity at NAV at end of term

• The Trust’s Board implemented a share repurchase program, which seeks to enhance shareholder value by purchasing Trust shares at a discount to NAV

– As of 2/29/24, the Trust repurchased $96mm of shares (5.46% O/S) through open market repurchase, driving $17.7mm accretion in NAV

Distributions

• BMEZ was launched in a lower yield environment with a target distribution

rate of 6.0%, primarily supported by cash flow from options and capital appreciation

• In May 2024, the Trust’s Board updated BMEZ’s monthly

distribution to an annual rate of 12% of its 12-month rolling average daily NAV5

• NAV of $17.76 per share plus the

$6.30 cumulative distribution paid equals

$24.06 per share, as compared to the Trust’s $20.00 per share IPO price

Total Expense Ratio6

• Expense ratio is in line with peers

PERFORMANCE SNAPSHOT

Total Shareholder Return3

BMEZ Peer median

9.01% 8.40%

5.05% 2.84% 3.14%

(0.20%)

(3.54%)

YTD 1 year (12.3 63%) years Inception

(12/31/2023 – (12/31/2022 – (12/31/2020 – (1/29/2020 –Current) 12/31/2023) 12/31/2023) 12/31/2023)

Premium / (Discount) to NAV4

10%

BMEZ Peer Median 0% (10%)

(20%)

Jan 2020 Jul 2021 Jan 2023 May 2024

Yield on NAV Target Yield on NAV5

12.09%

11.87% 12%

BMEZ Peers

Expense Ratio6

1.33% 1.33%

BMEZ Peers

Source: Broadridge; Bloomberg as of 5/20/2024; Notes: Inception as of 1/29/2020; Peer set includes HQL and HQH; 1 Abrdn Life Sciences Investors; 2 Abrdn Healthcare Investors; 3

Total shareholder return on price annualized for periods longer than 1 year (assumes dividends are reinvested); 4 Inception through 5/20/2024; 5 To be calculated 5 business days prior to declaration date; 6 18 Represents the actual total expenses

excluding IRE & Taxes and 12B-1/Non-12B-1 service fees; For expense comparison purposes, peer set used by Broadridge

includes STK, NBXG, AIO and GRX 18

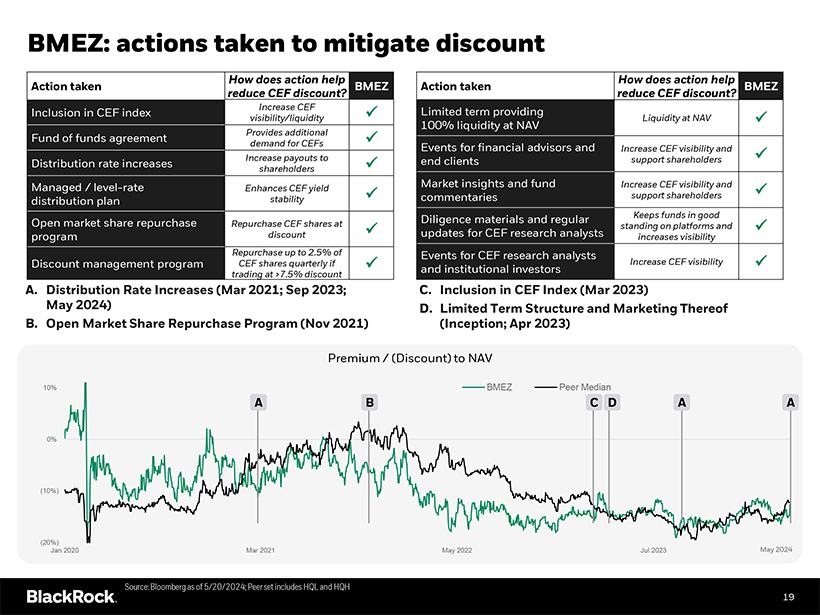

BMEZ: actions taken to mitigate discount

How does

action help How does action help

Action taken BMEZ Action taken BMEZ reduce CEF discount? reduce CEF discount?

Inclusion in CEF index Increase CEF Limited term providing visibility/liquidity Liquidity at NAV

100% liquidity at NAV Fund of funds agreement Provides additional demand for CEFs Events for financial advisors and

Increase payouts to Increase CEF visibility and

Distribution rate increases

shareholders end clients support shareholders

Managed / level-rate Enhances CEF yield Market insights and fund Increase CEF visibility and distribution

plan stability commentaries support shareholders

Diligence materials and regular Keeps funds in good

Open market share repurchase Repurchase CEF shares at standing on platforms and program discount updates for CEF research analysts increases visibility Repurchase up to

2.5% of Events for CEF research analysts Increase CEF visibility

Discount management program CEF shares quarterly if and institutional

investors trading at >7.5% discount

A. Distribution Rate Increases (Mar 2021; Sep 2023; C. Inclusion in CEF Index (Mar 2023)

May 2024) D. Limited Term Structure and Marketing Thereof B. Open Market Share Repurchase Program (Nov 2021) (Inception; Apr 2023)

Premium / (Discount) to NAV

10% BMEZ Peer Median

A B C D A A

• 5k 0%

(10%)

(20%) May 2024

Jan 2020 Mar 2021 May 2022 Jul 2023

Source: Bloomberg as of 5/20/2024; Peer set includes HQL

and HQH

19

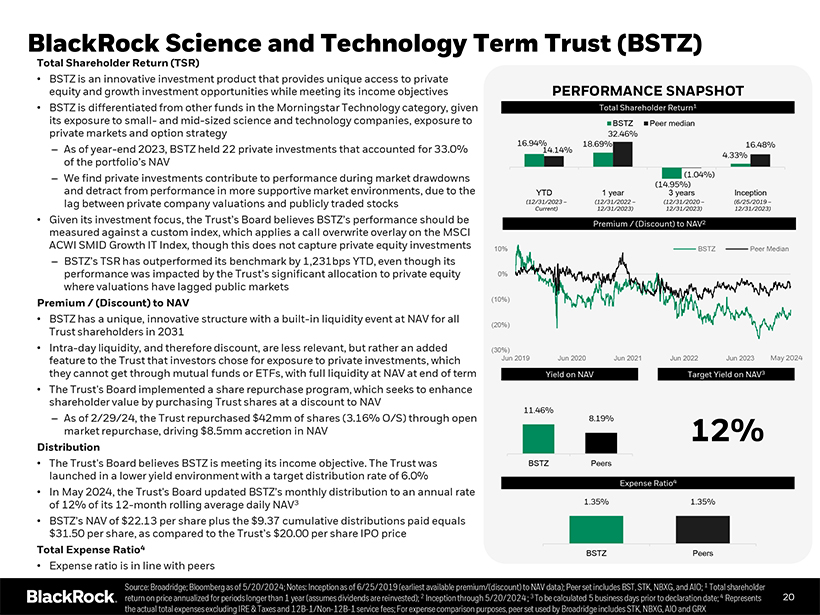

BlackRock Science and Technology Term Trust (BSTZ)

Total Shareholder Return (TSR)

• BSTZ is an innovative investment

product that provides unique access to private equity and growth investment opportunities while meeting its income objectives PERFORMANCE SNAPSHOT

• BSTZ is

differentiated from other funds in the Morningstar Technology category, given Total Shareholder Return1 its exposure to small- and mid-sized science and technology companies, exposure to BSTZ Peer median

private markets and option strategy 32.46%

16.94% 18.69% 16.48%

– As of year-end 2023, BSTZ held 22 private investments that accounted for 33.0% 14.14%

4.33%

of the portfolio’s NAV

– We find private investments contribute to performance

during market drawdowns (1.04%)

(14.95%)

and detract from performance in more

supportive market environments, due to the YTD 1 year 3 years Inception lag between private company valuations and publicly traded stocks (12/31/2023 – (12/31/2022 – (12/31/2020 – (6/25/2019 –

Current) 12/31/2023) 12/31/2023) 12/31/2023)

• Given its investment focus, the

Trust’s Board believes BSTZ’s performance should be Premium / (Discount) to NAV2 measured against a custom index, which applies a call overwrite overlay on the MSCI

ACWI SMID Growth IT Index, though this does not capture private equity investments 10% BSTZ Peer Median

– BSTZ’s TSR has outperformed its benchmark by 1,231bps YTD, even though its performance was impacted by the Trust’s significant allocation to private equity 0%

where valuations have lagged public markets

Premium / (Discount) to NAV (10%)

• BSTZ has a unique, innovative structure with a built-in liquidity event at NAV for all

(20%)

Trust shareholders in 2031

• Intra-day liquidity, and therefore discount, are less relevant, but rather an added (30%) feature to the Trust that investors chose

for exposure to private investments, which Jun 2019 Jun 2020 Jun 2021 Jun 2022 Jun 2023 May 2024 they cannot get through mutual funds or ETFs, with full liquidity at NAV at end of term Yield on NAV Target Yield on NAV3

• The Trust’s Board implemented a share repurchase program, which seeks to enhance shareholder value by purchasing Trust shares at a discount to NAV 11.46%

– As of 2/29/24, the Trust repurchased $42mm of shares (3.16% O/S) through open 8.19% market repurchase, driving $8.5mm accretion in NAV 12%

Distribution

• The Trust’s Board believes BSTZ is meeting its income objective. The

Trust was BSTZ Peers launched in a lower yield environment with a target distribution rate of 6.0%

Expense Ratio4

• In May 2024, the Trust’s Board updated BSTZ’s monthly distribution to an annual rate of 12% of its 12-month rolling average

daily NAV3 1.35% 1.35%

• BSTZ’s NAV of $22.13 per share plus the $9.37 cumulative distributions paid equals

$31.50 per share, as compared to the Trust’s $20.00 per share IPO price

Total Expense

Ratio4

BSTZ Peers

• Expense ratio is in line with peers

Source: Broadridge; Bloomberg as of 5/20/2024; Notes: Inception as of 6/25/2019 (earliest available premium/(discount) to NAV data); Peer set includes BST, STK, NBXG, and AIO; 1

Total shareholder return on price annualized for periods longer than 1 year (assumes dividends are reinvested); 2 Inception through 5/20/2024 ; 3 To be calculated 5 business days prior to declaration date; 4 Represents 20 the actual total expenses

excluding IRE & Taxes and 12B-1/Non-12B-1 service fees; For expense comparison purposes, peer set used by Broadridge

includes STK, NBXG, AIO and GRX 20

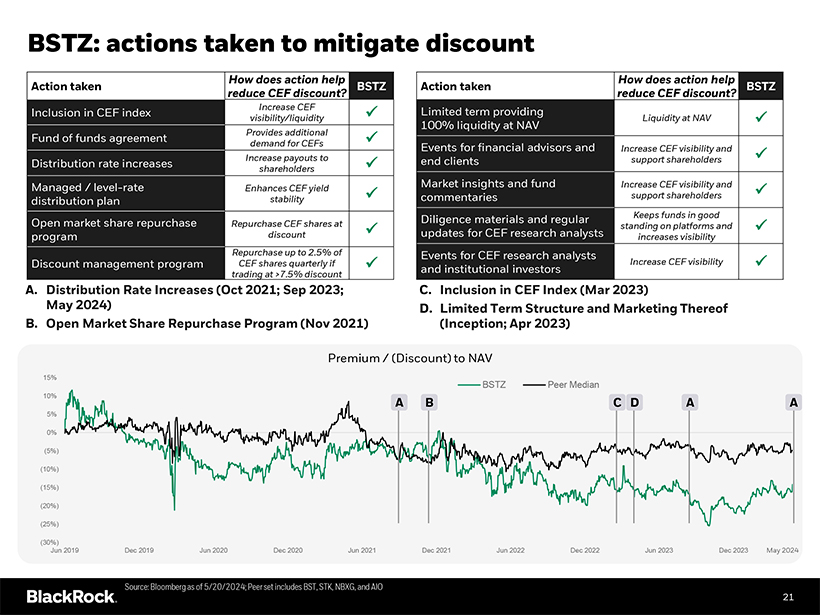

BSTZ: actions taken to mitigate discount

How does

action help How does action help

Action taken BSTZ Action taken BSTZ reduce CEF discount? reduce CEF discount?

Inclusion in CEF index Increase CEF Limited term providing visibility/liquidity Liquidity at NAV

100% liquidity at NAV Fund of funds agreement Provides additional demand for CEFs Events for financial advisors and

Increase payouts to Increase CEF visibility and

Distribution rate increases

shareholders end clients support shareholders

Managed / level-rate Enhances CEF yield Market insights and fund Increase CEF visibility and distribution

plan stability commentaries support shareholders

Diligence materials and regular Keeps funds in good

Open market share repurchase Repurchase CEF shares at standing on platforms and program discount updates for CEF research analysts increases visibility Repurchase up to

2.5% of Events for CEF research analysts Increase CEF visibility

Discount management program CEF shares quarterly if and institutional

investors trading at >7.5% discount

A. Distribution Rate Increases (Oct 2021; Sep 2023; C. Inclusion in CEF Index (Mar 2023)

May 2024) D. Limited Term Structure and Marketing Thereof B. Open Market Share Repurchase Program (Nov 2021) (Inception; Apr 2023)

Premium / (Discount) to NAV

15% BSTZ Peer Median

10% A B C D A A

5% 0% (5%) (10%)

(15%) • c (20%)

(25%)

(30%)

Jun 2019 Dec 2019 Jun 2020 Dec 2020 Jun 2021 Dec 2021 Jun 2022 Dec 2022 Jun 2023 Dec

2023 May 2024

Source: Bloomberg as of 5/20/2024; Peer set includes BST, STK, NBXG, and AIO

21

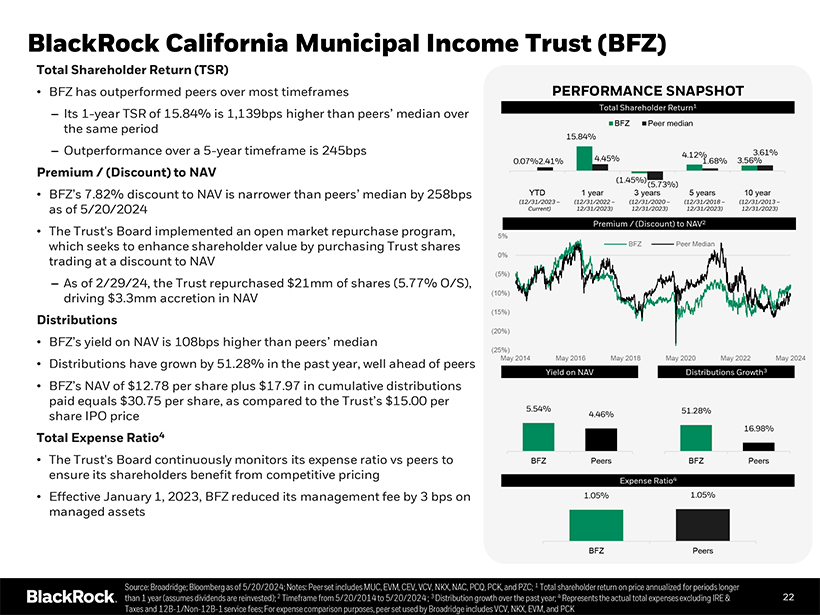

BlackRock California Municipal Income Trust (BFZ)

Total Shareholder Return (TSR)

• BFZ has outperformed peers over most

timeframes PERFORMANCE SNAPSHOT

Total Shareholder Return1

– Its 1-year TSR of 15.84% is 1,139bps higher than peers’ median over

the same period BFZ Peer median

15.84%

– Outperformance over a 5-year timeframe

is 245bps 4.12% 3.61%

0.07%2.41% 4.45% 1.68% 3.56%

Premium / (Discount) to

NAV

(1.45%)

(5.73%)

• BFZ’s 7.82% discount to NAV is narrower than peers’ median by 258bps YTD 1 year 3 years 5 years 10 year

(12/31/2023 – (12/31/2022 – (12/31/2020 – (12/31/2018 – (12/31/2013 –as of 5/20/2024 Current) 12/31/2023) 12/31/2023) 12/31/2023) 12/31/2023)

Premium / (Discount) to NAV2

• The Trust’s Board implemented an open market

repurchase program,

5%

which seeks to enhance shareholder value by purchasing

Trust shares BFZ Peer Median trading at a discount to NAV 0%

(5%)

– As

of 2/29/24, the Trust repurchased $21mm of shares (5.77% O/S), driving $3.3mm accretion in NAV (10%)

(15%)

Distributions

BFZ’s yield (20%) • on NAV is 108bps higher than peers’ median

(25%)

• Distributions have grown by 51.28% in the past year, well ahead of peers May 2014 May 2016 May 2018 May 2020 May 2022 May 2024

Yield on NAV Distributions Growth3

• BFZ’s NAV of $12.78 per share plus $17.97 in

cumulative distributions paid equals $30.75 per share, as compared to the Trust’s $15.00 per

5.54% 51.28%

share IPO price 4.46%

16.98%

Total Expense Ratio4

• The Trust’s Board continuously monitors its expense ratio vs

peers to BFZ Peers BFZ Peers ensure its shareholders benefit from competitive pricing 4

Expense Ratio

• Effective January 1, 2023, BFZ reduced its management fee by 3 bps on 1.05% 1.05% managed assets

BFZ Peers

Source: Broadridge; Bloomberg as of 5/20/2024; Notes: Peer set includes MUC, EVM,

CEV, VCV, NKX, NAC, PCQ, PCK, and PZC; 1 Total shareholder return on price annualized for periods longer than 1 year (assumes dividends are reinvested); 2 Timeframe from 5/20/2014 to 5/20/2024 ; 3 Distribution growth over the past year; 4 Represents

the actual total expenses excluding IRE & 22 Taxes and 12B-1/Non-12B-1 service fees; For expense comparison purposes,

peer set used by Broadridge includes VCV, NKX, EVM, and PCK

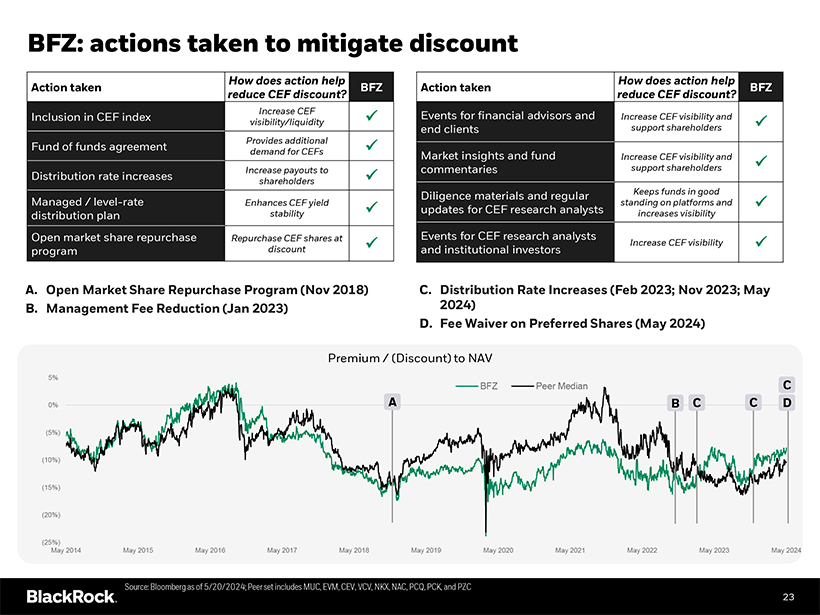

BFZ: actions taken to mitigate discount

How does

action help How does action help

Action taken BFZ Action taken BFZ reduce CEF discount? reduce CEF discount?

Increase CEF Events for financial advisors and

Inclusion in CEF index Increase CEF

visibility and visibility/liquidity end clients support shareholders

Fund of funds agreement Provides additional demand for CEFs Market insights and

fund

Increase CEF visibility and Increase payouts to commentaries support shareholders

Distribution rate increases shareholders

Diligence materials and regular Keeps funds in

good

Managed / level-rate Enhances CEF yield standing on platforms and stability updates for CEF research analysts increases visibility distribution

plan Open market share repurchase Repurchase CEF shares at Events for CEF research analysts

Increase CEF visibility program discount and institutional

investors

A. Open Market Share Repurchase Program (Nov 2018) C. Distribution Rate Increases (Feb 2023; Nov 2023; May B. Management Fee Reduction (Jan 2023) 2024)

D. Fee Waiver on Preferred Shares (May 2024)

Premium / (Discount) to NAV

5%

BFZ Peer Median C

0% A B C C D

(5%) (10%) (15%) (20%)

(25%)

May 2014 May 2015 May 2016 May 2017 May 2018 May 2019 May 2020 May 2021 May 2022 May 2023 May 2024

Source: Bloomberg as of 5/20/2024; Peer set includes MUC, EVM, CEV, VCV, NKX, NAC, PCQ, PCK, and PZC

23

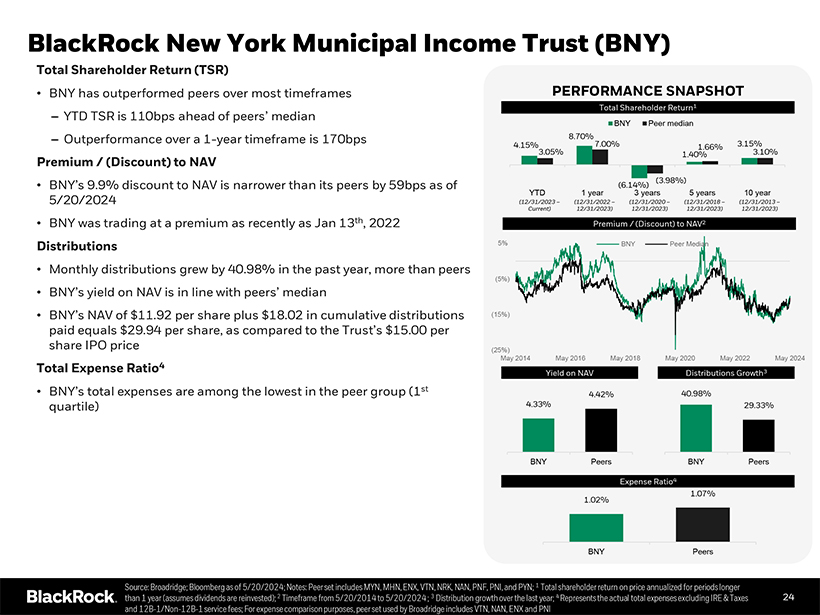

BlackRock New York Municipal Income Trust (BNY)

Total Shareholder Return (TSR)

• BNY has outperformed peers over most

timeframes PERFORMANCE SNAPSHOT

Total Shareholder Return1

– YTD TSR is

110bps ahead of peers’ median

BNY Peer median

– Outperformance over

a 1-year timeframe is 170bps 8.70% 7.00% 3.15%

4.15% 1.66%

3.05% 1.40% 3.10%

Premium / (Discount) to NAV

(3.98%)

• BNY’s 9.9% discount to NAV is narrower than its peers by 59bps as of

(6.14%)

YTD 1 year 3 years 5 years 10 year

5/20/2024 (12/31/2023 –

(12/31/2022 – (12/31/2020 – (12/31/2018 – (12/31/2013 –Current) 12/31/2023) 12/31/2023) 12/31/2023) 12/31/2023)

• BNY was trading at a

premium as recently as Jan 13th, 2022 Premium / (Discount) to NAV2

Distributions 5% BNY Peer Median

• Monthly distributions grew by 40.98% in the past year, more than peers

(5%)

• BNY’s yield on NAV is in line with peers’ median

• BNY’s NAV of

$11.92 per share plus $18.02 in cumulative distributions (15%) paid equals $29.94 per share, as compared to the Trust’s $15.00 per share IPO price (25%)

Total

Expense Ratio4 May 2014 May 2016 May 2018 May 2020 May 2022 May 2024

Yield on NAV Distributions Growth3

• BNY’s total expenses are among the lowest in the peer group (1st

4.42% 40.98%

quartile) 4.33% 29.33%

BNY Peers BNY Peers

Expense Ratio4

1.07%

1.02%

BNY Peers

Source: Broadridge; Bloomberg as of 5/20/2024; Notes: Peer set includes MYN, MHN,

ENX, VTN, NRK, NAN, PNF, PNI, and PYN; 1 Total shareholder return on price annualized for periods longer than 1 year (assumes dividends are reinvested); 2 Timeframe from 5/20/2014 to 5/20/2024 ; 3 Distribution growth over the last year; 4 Represents

the actual total expenses excluding IRE & Taxes 24 and 12B-1/Non-12B-1 service fees; For expense comparison purposes,

peer set used by Broadridge includes VTN, NAN, ENX and PNI

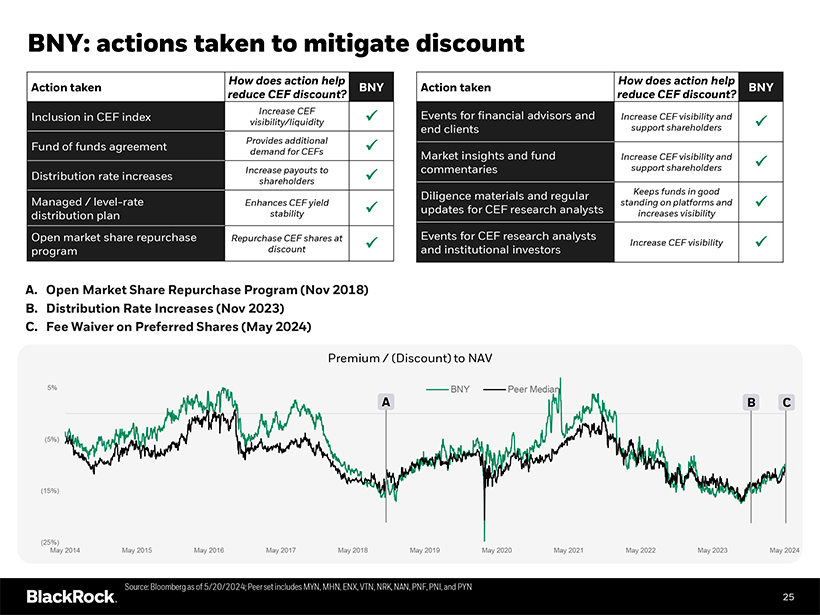

BNY: actions taken to mitigate discount

How does

action help How does action help

Action taken BNY Action taken BNY reduce CEF discount? reduce CEF discount?

Increase CEF Events for financial advisors and

Inclusion in CEF index Increase CEF

visibility and visibility/liquidity end clients support shareholders

Fund of funds agreement Provides additional demand for CEFs Market insights and

fund

Increase CEF visibility and Increase payouts to commentaries support shareholders

Distribution rate increases shareholders

Managed level-rate Diligence materials and

regular Keeps funds in good

/ Enhances CEF yield standing on platforms and stability updates for CEF research analysts increases visibility

distribution plan Open market share repurchase Repurchase CEF shares at Events for CEF research analysts

Increase CEF visibility program discount and

institutional investors

A. Open Market Share Repurchase Program (Nov 2018) B. Distribution Rate Increases (Nov 2023) C. Fee Waiver on Preferred Shares (May 2024)

Premium / (Discount) to NAV

5% BNY Peer Median

A B C

(5%)

(15%)

(25%)

May 2014 May 2015 May 2016 May 2017 May 2018 May 2019 May 2020 May 2021 May 2022 May 2023 May 2024

Source: Bloomberg as of 5/20/2024; Peer set includes MYN, MHN, ENX, VTN, NRK, NAN, PNF, PNI, and PYN

25

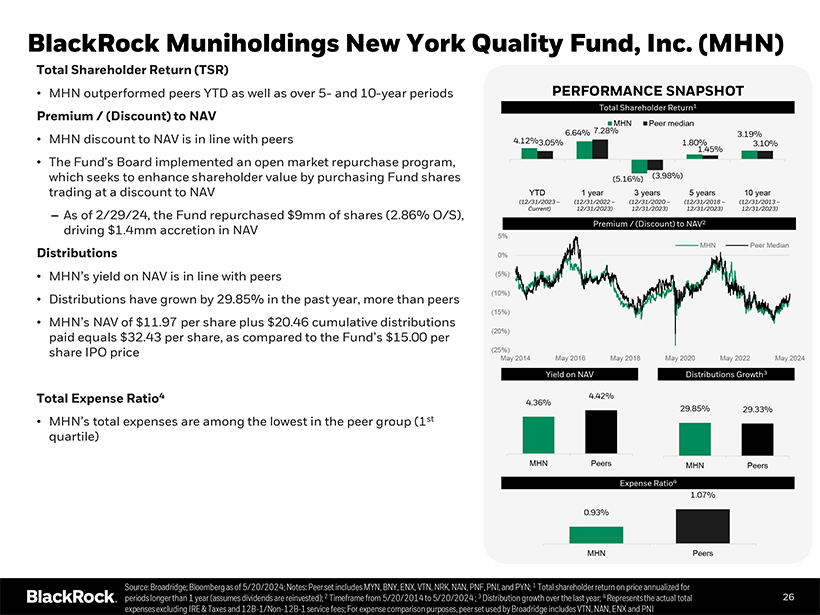

BlackRock Muniholdings New York Quality Fund, Inc. (MHN)

Total Shareholder Return (TSR)

• MHN outperformed peers YTD as well as over 5- and 10-year periods PERFORMANCE SNAPSHOT

Premium / (Discount) to NAV Total Shareholder

Return1

7.28% MHN Peer median

discount is in line 6.64% 3.19%

• MHN to NAV with peers 4.12%3.05% 1.80% 3.10%

1.45%

• The Fund’s Board implemented an open market repurchase program, which seeks to enhance shareholder value by purchasing Fund shares (5.16%) (3.98%) trading at a discount

to NAV YTD 1 year 3 years 5 years 10 year

(12/31/2023 – (12/31/2022 – (12/31/2020 – (12/31/2018 – (12/31/2013 –As of 2/29/24, the Fund

repurchased $ .86% O/S), Current) 12/31/2023) 12/31/2023) 12/31/2023) 12/31/2023)

– 9mm of shares (2 Premium / (Discount) to NAV2

driving $1.4mm accretion in NAV

5%

MHN Peer Median

Distributions 0%

• MHN’s yield on NAV is in line with peers (5%)

• Distributions have grown by

29.85% in the past year, more than peers (10%)

(15%)

• MHN’s NAV of

$11.97 per share plus $20.46 cumulative distributions paid equals $32.43 per share, as compared to the Fund’s $15.00 per (20%) share IPO price (25%)

May 2014

May 2016 May 2018 May 2020 May 2022 May 2024

Yield on NAV Distributions Growth3

Total Expense Ratio4 4.42%

4.36%

29.85% 29.33%

• MHN’s total expenses are among the lowest in the peer group (1st

quartile)

MHN Peers MHN Peers

Expense Ratio4

1.07%

0.93%

MHN Peers

Source: Broadridge; Bloomberg as of 5/20/2024; Notes: Peer set includes MYN, BNY,

ENX, VTN, NRK, NAN, PNF, PNI, and PYN; 1 Total shareholder return on price annualized for periods longer than 1 year (assumes dividends are reinvested); 2 Timeframe from 5/20/2014 to 5/20/2024 ; 3 Distribution growth over the last year; 4 Represents

the actual total 26 expenses excluding IRE & Taxes and 12B-1/Non-12B-1 service fees; For expense comparison purposes,

peer set used by Broadridge includes VTN, NAN, ENX and PNI

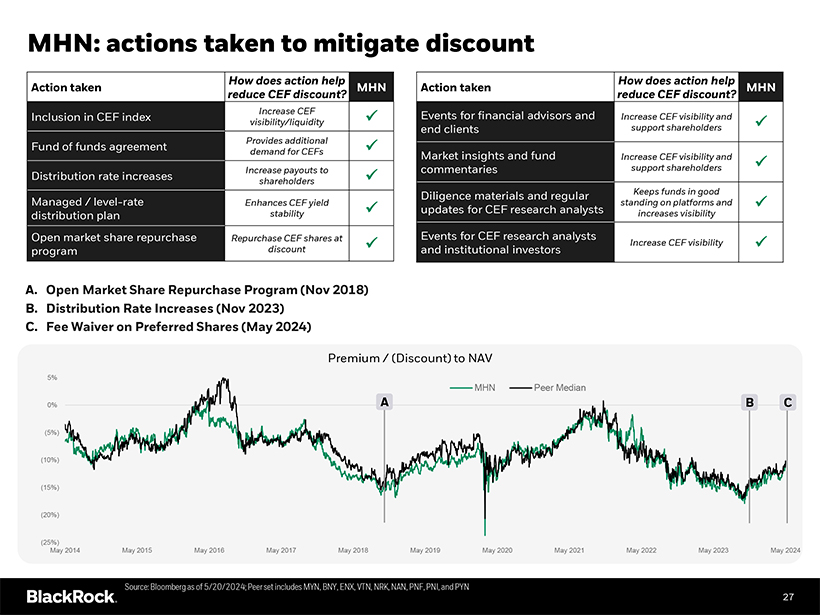

MHN: actions taken to mitigate discount

How does

action help How does action help

Action taken MHN Action taken MHN reduce CEF discount? reduce CEF discount?

Increase CEF Events for financial advisors and

Inclusion in CEF index Increase CEF

visibility and visibility/liquidity end clients support shareholders

Fund of funds agreement Provides additional demand for CEFs Market insights and

fund

Increase CEF visibility and Increase payouts to commentaries support shareholders

Distribution rate increases shareholders

Managed / level-rate Diligence materials and

regular Keeps funds in good

Enhances CEF yield standing on platforms and stability updates for CEF research analysts increases visibility distribution

plan Open market share repurchase Repurchase CEF shares at Events for CEF research analysts

Increase CEF visibility program discount and institutional

investors

A. Open Market Share Repurchase Program (Nov 2018) B. Distribution Rate Increases (Nov 2023) C. Fee Waiver on Preferred Shares (May 2024)

Premium / (Discount) to NAV

5%

MHN Peer Median

0% A B C

(5%) (10%) (15%) (20%)

(25%)

May 2014 May 2015 May 2016 May 2017 May 2018 May 2019 May 2020 May 2021 May 2022 May 2023 May 2024

Source: Bloomberg as of 5/20/2024; Peer set includes MYN, BNY, ENX, VTN, NRK, NAN, PNF, PNI, and PYN

27

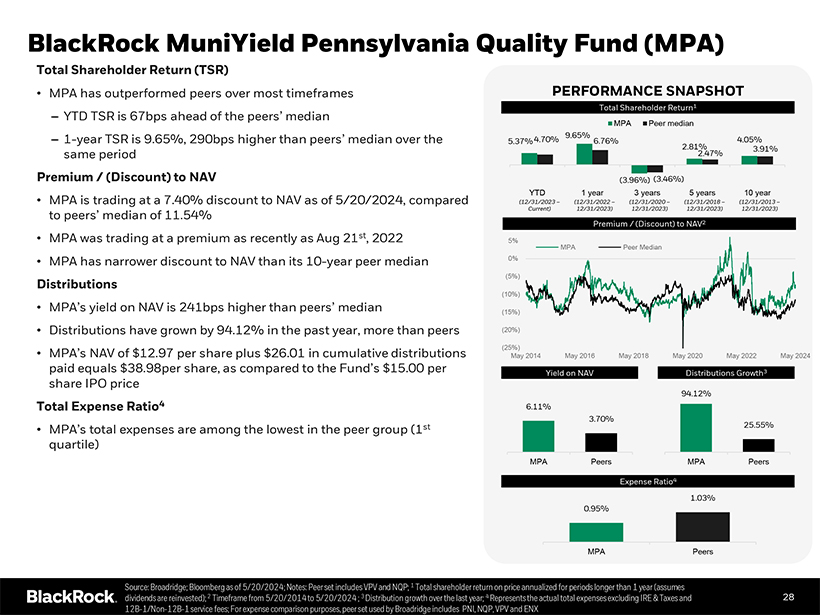

BlackRock MuniYield Pennsylvania Quality Fund (MPA)

Total Shareholder Return (TSR)

• MPA has outperformed peers over most

timeframes PERFORMANCE SNAPSHOT

of the Total Shareholder Return1

– YTD

TSR is 67bps ahead peers’ median

MPA Peer median

9.65%

– 1-year TSR is 9.65%, 290bps higher than peers’ median over the 5.37% 4.70% 6.76% 2.81% 4.05%

3.91%

same period 2.47%

Premium / (Discount) to NAV (3.96%) (3.46%)

YTD 1 year 3 years 5 years 10 year

• MPA is trading at a 7.40% discount to NAV as of 5/20/2024, compared (12/31/2023 – (12/31/2022 – (12/31/2020 – (12/31/2018 – (12/31/2013 –

to peers’ median of 11.54% Current) 12/31/2023) 12/31/2023) 12/31/2023) 12/31/2023)

Premium / (Discount) to NAV2

• MPA was trading at a premium as recently as Aug 21st, 2022

5% MPA Peer Median

• MPA has narrower discount to NAV than its 10-year peer median 0%

(5%)

Distributions

(10%)

• MPA’s yield on NAV is 241bps higher than peers’ median

(15%)

• Distributions have grown by 94.12% in the past year, more than peers (20%)

• MPA’s NAV of $12.97 per share plus $26.01 in cumulative distributions (25%)

May

2014 May 2016 May 2018 May 2020 May 2022 May 2024

paid equals $38.98per share, as compared to the Fund’s $15.00 per Yield on NAV Distributions Growth3 share

IPO price

94.12%

Total Expense Ratio4 6.11%

3.70%

• MPA’s total expenses are among the lowest in the peer group (1st 25.55%

quartile)

MPA Peers MPA Peers

Expense Ratio4

1.03%

0.95%

MPA Peers

Source: Broadridge; Bloomberg as of 5/20/2024; Notes: Peer set includes VPV and NQP;

1 Total shareholder return on price annualized for periods longer than 1 year (assumes dividends are reinvested); 2 Timeframe from 5/20/2014 to 5/20/2024 ; 3 Distribution growth over the last year; 4 Represents the actual total expenses excluding

IRE & Taxes and 28 12B-1/Non-12B-1 service fees; For expense comparison purposes, peer set used by Broadridge includes

PNI, NQP, VPV and ENX

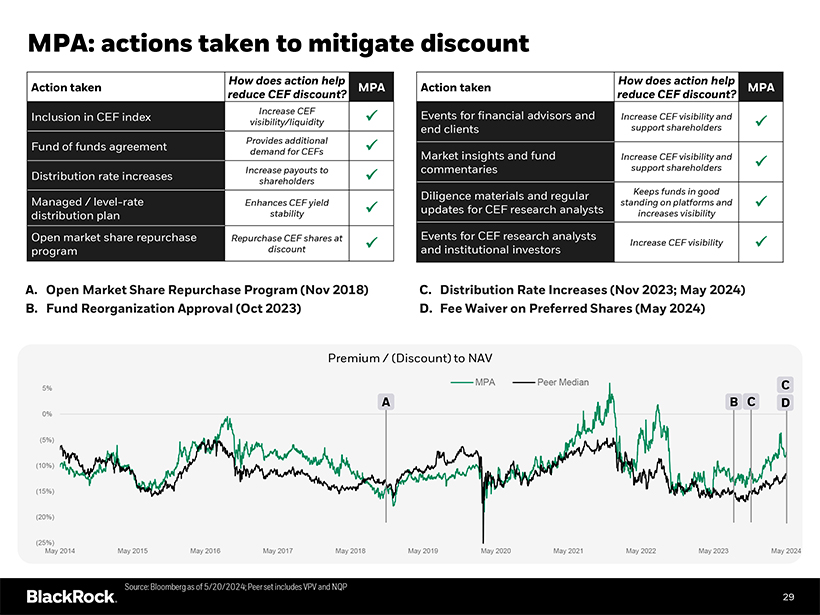

MPA: actions taken to mitigate discount

How does

action help How does action help

Action taken MPA Action taken MPA reduce CEF discount? reduce CEF discount?

Increase CEF Events for financial advisors and

Inclusion in CEF index Increase CEF

visibility and visibility/liquidity end clients support shareholders

Fund of funds agreement Provides additional demand for CEFs Market insights and

fund

Increase CEF visibility and Increase payouts to commentaries support shareholders

Distribution rate increases shareholders

Diligence materials and regular Keeps funds in

good

Managed / level-rate Enhances CEF yield standing on platforms and stability updates for CEF research analysts increases visibility distribution

plan Open market share repurchase Repurchase CEF shares at Events for CEF research analysts

Increase CEF visibility program discount and institutional

investors

A. Open Market Share Repurchase Program (Nov 2018) C. Distribution Rate Increases (Nov 2023; May 2024) B. Fund Reorganization Approval (Oct 2023) D. Fee

Waiver on Preferred Shares (May 2024)

Premium / (Discount) to NAV

MPA Peer

Median C

5%

A B C D

0% (5%) (10%) (15%) (20%)

(25%)

May 2014 May 2015 May 2016 May 2017 May 2018 May 2019 May 2020 May 2021 May 2022 May 2023 May 2024

Source: Bloomberg as of 5/20/2024; Peer set includes VPV and NQP

29

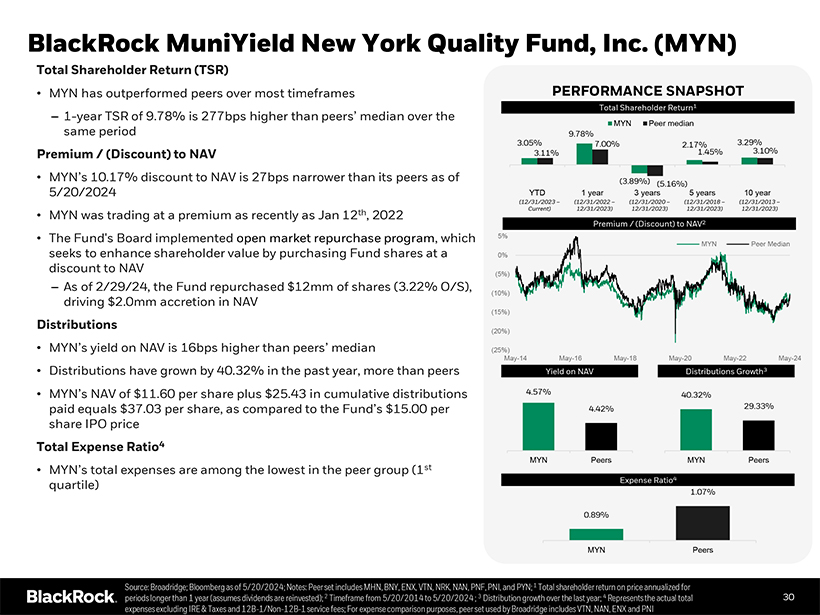

BlackRock MuniYield New York Quality Fund, Inc. (MYN)

Total Shareholder Return (TSR)

• MYN has outperformed peers over most timeframes

PERFORMANCE SNAPSHOT

Total Shareholder Return1

– 1-year TSR of 9.78% is 277bps higher than peers’ median over the

MYN Peer median

same period 9.78%

3.05% 7.00% 2.17% 3.29%

Premium / (Discount) to NAV 3.11% 1.45% 3.10%

• MYN’s 10.17% discount to NAV is

27bps narrower than its peers as of (3.89%)

(5.16%)

5/20/2024 YTD 1 year 3

years 5 years 10 year

(12/31/2023 – (12/31/2022 – (12/31/2020 – (12/31/2018 – (12/31/2013 –Jan 12th, 2022 Current) 12/31/2023) 12/31/2023)

12/31/2023) 12/31/2023)

• MYN was trading at a premium as recently as Premium / (Discount) to NAV2

• The Fund’s Board implemented open market repurchase program, which 5%

MYN Peer

Median

seeks to enhance shareholder value by purchasing Fund shares at a 0% discount to NAV

(5%)

– As of 2/29/24, the Fund repurchased $12mm of shares (3.22% O/S),

(10%)

driving $2.0mm accretion in NAV

(15%)

Distributions

(20%)

• MYN’s yield on NAV is 16bps higher than peers’ median (25%)

May-14 May-16 May-18

May-20 May-22 May-24

• Distributions

have grown by 40.32% in the past year, more than peers Yield on NAV Distributions Growth3

• MYN’s NAV of $11.60 per share plus $25.43 in cumulative

distributions 4.57% 40.32% paid equals $37.03 per share, as compared to the Fund’s $15.00 per 4.42% 29.33% share IPO price

Total Expense Ratio4

MYN Peers MYN Peers

• MYN’s total expenses are among the lowest in the peer group

(1st

quartile) Expense Ratio4

1.07%

0.89%

MYN Peers

Source: Broadridge; Bloomberg as of 5/20/2024; Notes: Peer set includes MHN, BNY, ENX, VTN, NRK, NAN, PNF, PNI, and PYN; 1 Total shareholder return on price annualized for periods

longer than 1 year (assumes dividends are reinvested); 2 Timeframe from 5/20/2014 to 5/20/2024 ; 3 Distribution growth over the last year; 4 Represents the actual total 30 expenses excluding IRE & Taxes and 12B-1/Non-12B-1 service fees; For expense comparison purposes, peer set used by Broadridge includes VTN, NAN, ENX and PNI

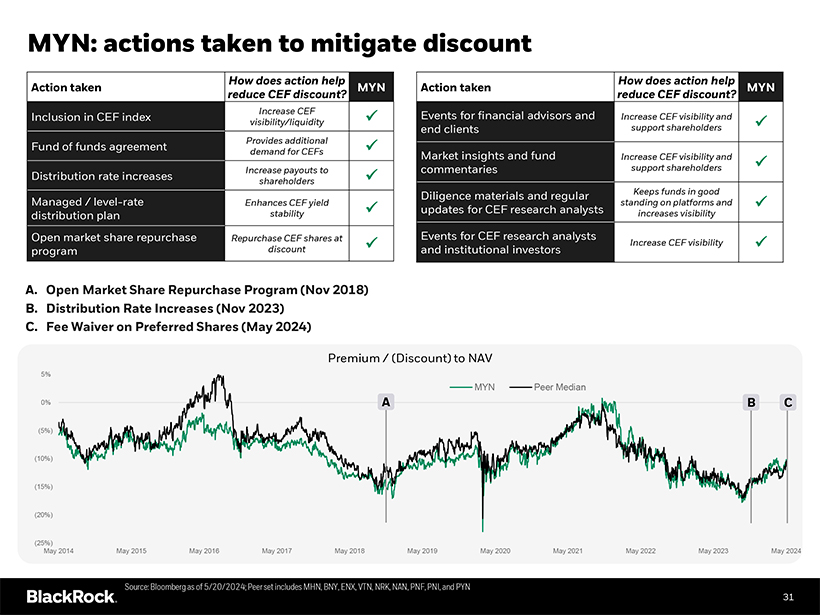

MYN: actions taken to mitigate discount

How does

action help How does action help

Action taken MYN Action taken MYN reduce CEF discount? reduce CEF discount?

Increase CEF Events for financial advisors and

Inclusion in CEF index Increase CEF

visibility and visibility/liquidity end clients support shareholders

Fund of funds agreement Provides additional demand for CEFs Market insights and

fund

Increase CEF visibility and Increase payouts to commentaries support shareholders

Distribution rate increases shareholders

Managed / level-rate Diligence materials and

regular Keeps funds in good

Enhances CEF yield standing on platforms and stability updates for CEF research analysts increases visibility distribution

plan Open market share repurchase Repurchase CEF shares at Events for CEF research analysts

Increase CEF visibility program discount and institutional

investors

A. Open Market Share Repurchase Program (Nov 2018) B. Distribution Rate Increases (Nov 2023) C. Fee Waiver on Preferred Shares (May 2024)

Premium / (Discount) to NAV

5%

MYN Peer Median

0% A B C

(5%) (10%) (15%) (20%)

(25%)

May 2014 May 2015 May 2016 May 2017 May 2018 May 2019 May 2020 May 2021 May 2022 May 2023 May 2024

Source: Bloomberg as of 5/20/2024; Peer set includes MHN, BNY, ENX, VTN, NRK, NAN, PNF, PNI, and PYN

31

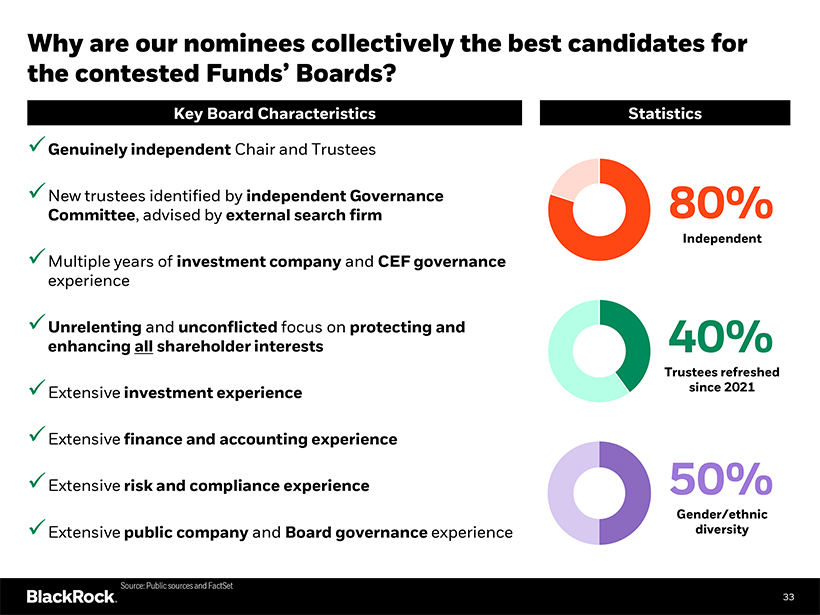

Rigorous Board oversight ensures all shareholders are protected

Why are our nominees collectively the best candidates for the contested Funds’ Boards?

?Genuinely independent Chair and Trustees

?New trustees identified by independent Governance

80%

Committee, advised by external search firm

Independent

?Multiple years of investment company and CEF governance experience

?Unrelenting and

unconflicted focus on protecting and enhancing all shareholder interests 40%

Trustees refreshed

?Extensive investment experience since 2021

?Extensive finance and accounting experience

?Extensive risk and compliance experience 50%

Gender/ethnic

?Extensive public company and Board governance experience diversity 33

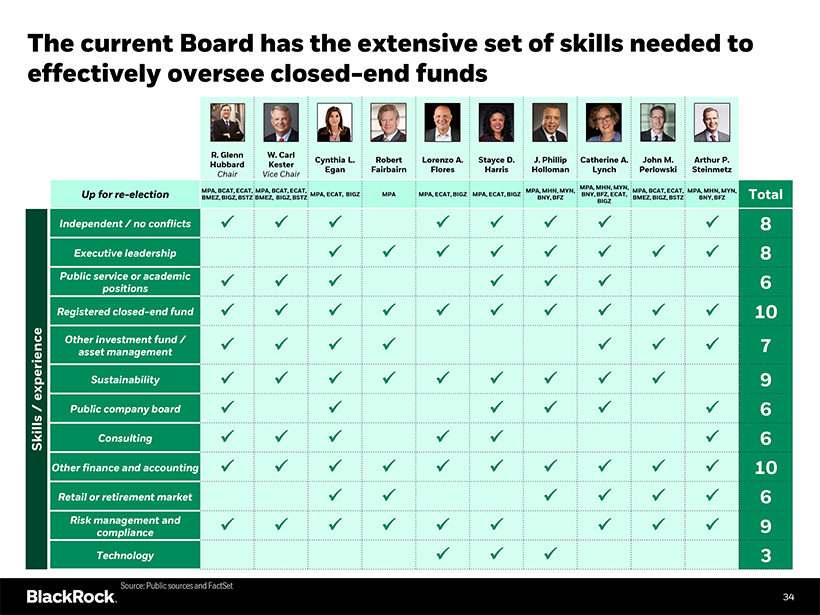

The current Board has the extensive set of skills needed to effectively oversee closed-end funds

R. Glenn W. Carl

Cynthia L. Robert Lorenzo A. Stayce D. J. Phillip Catherine

A. John M. Arthur P. Hubbard Kester Egan Fairbairn Flores Harris Holloman Lynch Perlowski Steinmetz

Chair Vice Chair

MPA, MHN, MYN,

MPA, BCAT, ECAT, MPA, BCAT, ECAT, MPA, MHN, MYN, MPA, BCAT, ECAT, MPA, MHN,

MYN,

Up for re-election MPA, ECAT, BIGZ MPA MPA, ECAT, BIGZ MPA, ECAT, BIGZ BNY, BFZ, ECAT, Total BMEZ, BIGZ, BSTZ BMEZ,

BIGZ, BSTZ BNY, BFZ BMEZ, BIGZ, BSTZ BNY, BFZ

BIGZ

Independent / no

conflicts 8 Executive leadership 8 Public service or academic 6 positions Registered closed-end

fund 10 Other investment fund / 7 asset management experience Sustainability 9

/

Public company board

6

Skills

Consulting 6 Other finance and accounting 10 Retail or retirement market 6 Risk management and 9 compliance

Technology 3

Source: Public sources and FactSet

34

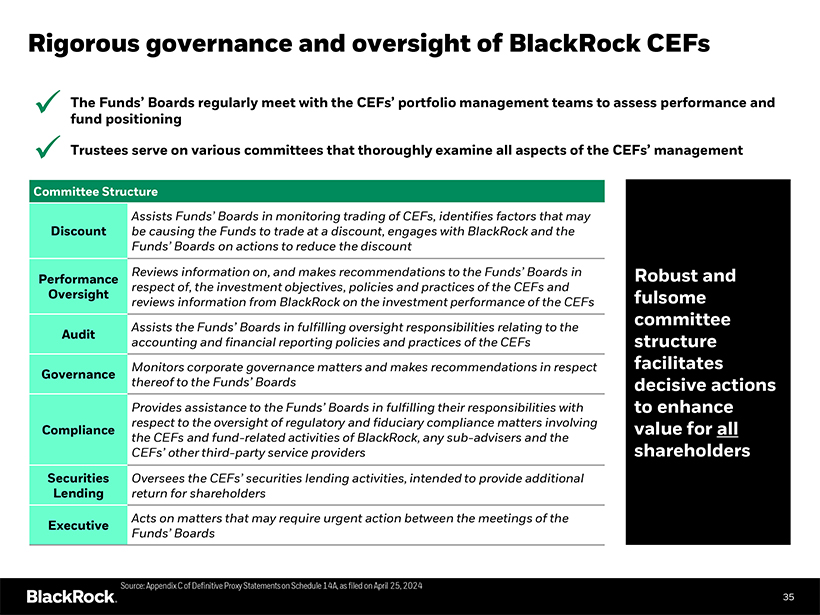

Rigorous governance and oversight of BlackRock CEFs

The Funds’ Boards regularly meet with the CEFs’ portfolio management teams to assess performance and fund positioning

Trustees serve on various committees that thoroughly examine all aspects of the CEFs’ management

Committee Structure

Assists Funds’ Boards in monitoring trading of CEFs, identifies

factors that may

Discount be causing the Funds to trade at a discount, engages with BlackRock and the

Funds’ Boards on actions to reduce the discount

Reviews information on, and makes

recommendations to the Funds’ Boards in Robust and

Performance respect of, the investment objectives, policies and practices of the CEFs and

Oversight fulsome reviews information from BlackRock on the investment performance of the CEFs

Assists the Funds’ Boards in fulfilling oversight responsibilities relating to the committee

Audit accounting and financial reporting policies and practices of the CEFs structure Monitors corporate governance matters and makes recommendations in respect facilitates

Governance thereof to the Funds’ Boards decisive actions Provides assistance to the Funds’ Boards in fulfilling their responsibilities with to enhance

respect to the oversight of regulatory and fiduciary compliance matters involving

Compliance value for all

the CEFs and fund-related activities of BlackRock, any sub-advisers and the

CEFs’ other third-party service providers shareholders

Securities Oversees the CEFs’

securities lending activities, intended to provide additional

Lending return for shareholders

Acts on matters that may require urgent action between the meetings of the

Executive

Funds’ Boards

Source: Appendix C of Definitive Proxy Statements on

Schedule 14A, as filed on April 25, 2024

35

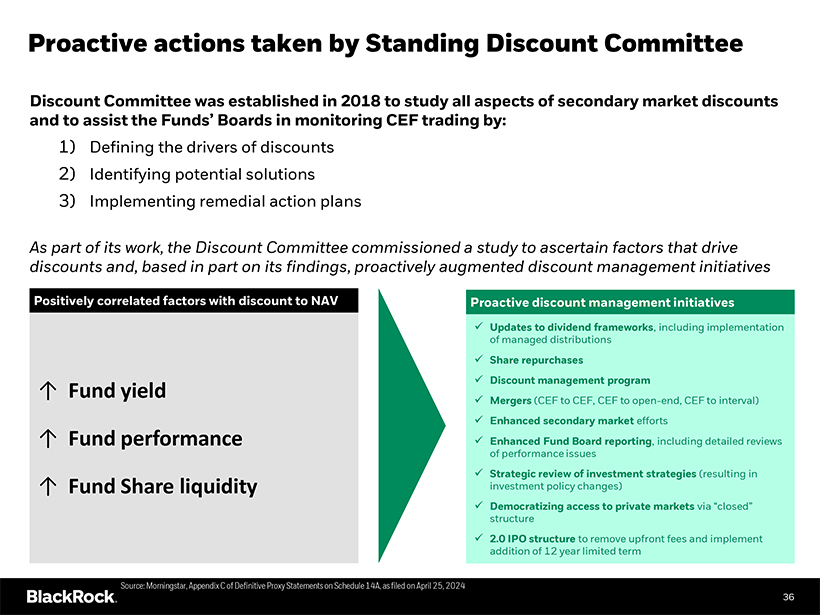

Proactive actions taken by Standing Discount Committee

Discount Committee was established in 2018 to study all aspects of secondary market discounts and to assist the Funds’ Boards in monitoring CEF trading by:

1) Defining the drivers of discounts

2) Identifying potential solutions

3) Implementing remedial action plans

As part of its work, the Discount Committee commissioned

a study to ascertain factors that drive discounts and, based in part on its findings, proactively augmented discount management initiatives

Positively correlated

factors with discount to NAV Proactive discount management initiatives

Updates to dividend frameworks, including implementation of managed distributions

Share repurchases

Discount management program

Fund yield

Mergers (CEF to CEF, CEF to open-end, CEF

to interval)

Enhanced secondary market efforts

Fund

performance Enhanced Fund Board reporting, including detailed reviews of performance issues

Strategic review of investment strategies (resulting in

Fund Share liquidity investment policy changes)

Democratizing access to

private markets via “closed” structure

2.0 IPO structure to remove upfront fees and implement addition of 12 year limited term

Source: Morningstar, Appendix C of Definitive Proxy Statements on Schedule 14A, as filed on April 25, 2024

36

We are open to engaging with all our shareholders

• The Funds’ Boards seek to actively engage with all shareholders

• We approach these engagements with the goal of finding reasonable solutions to address shareholder concerns, including when those concerns are raised by

institutional investors and hedge funds

• The success of our engagement is exemplified by the recently announced settlement with one of our largest CEF

May 3, 2024 shareholders, Karpus Management (Karpus)

• On May 3, 2024, Karpus entered into BlackRock Municipal Income Fund, Inc. (MUI) Announces

Tender agreements to support the Boards at all Offer Contingent Upon Approval of Conversion of MUI to Unlisted Closed-End Interval Fund Structure

BlackRock-advised CEFs that it holds, including the contested CEFs Source: Business Wire

“Our recent engagement with BlackRock was constructive and productive, resulting in fund enhancements that we believe will add to what BlackRock is already

doing to address discounts and enhance the total return to shareholders of these closed-end funds. BlackRock’s management team as well as the funds’ Boards have taken more steps than most other closed-end fund managers to benefit Karpus’ clients as well as all shareholders of these funds.”

-Daniel L. Lippincott,

CFA

President and Chief Investment Officer, Karpus Investment Management 37

Inherent conflict between Saba’s self-serving interests and those of other shareholders

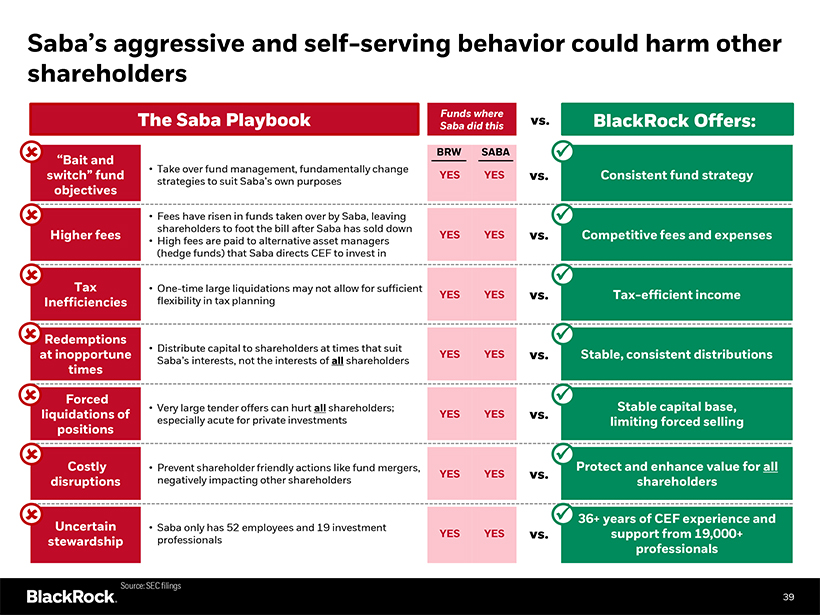

Saba’s aggressive and self-serving behavior could harm other shareholders

The Saba Playbook Funds where vs. BlackRock Offers:

Saba did this

BRW SABA

“Bait and

• Take over fund management, fundamentally change

switch” fund YES YES vs.

Consistent fund strategy

strategies to suit Saba’s own purposes

objectives

• Fees have risen in funds taken over by Saba,

leaving shareholders to foot the bill after Saba has sold down

Higher fees YES YES vs. Competitive fees and expenses

• High fees are paid to alternative asset managers (hedge funds) that Saba directs CEF to invest in

Tax • One-time large liquidations may not allow for sufficient

YES YES vs. Tax-efficient income

Inefficiencies

flexibility in tax planning

Redemptions Distribute capital at times suit • to shareholders that

at inopportune YES YES vs. Stable, consistent distributions

Saba’s interests, not the

interests of all shareholders

times

Forced

• Very large tender offers can hurt all shareholders; Stable capital base,

liquidations

of YES YES vs.

especially acute for private investments limiting forced selling

positions

Costly • Prevent shareholder friendly actions like fund

mergers, Protect and enhance value for all

YES YES vs. disruptions negatively impacting other shareholders shareholders

36+ years of CEF experience and

Uncertain • Saba only has 52 employees and 19 investment

YES YES vs. support from 19,000+

stewardship professionals

professionals

Source: SEC filings

39

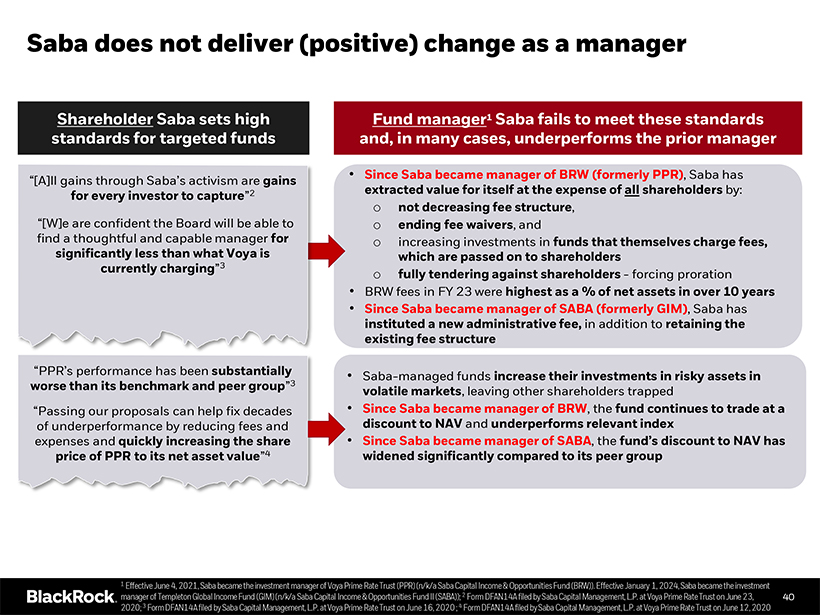

Saba does not deliver (positive) change as a manager

Shareholder Saba sets high Fund manager1 Saba fails to meet these standards standards for targeted funds and, in many cases, underperforms the prior manager

“[A]ll gains through Saba’s activism are gains • Since Saba became manager of BRW (formerly PPR), Saba has for every investor to capture”2

extracted value for itself at the expense of all shareholders by: o not decreasing fee structure,

“[W]e are confident the Board will be able to o ending fee

waivers, and find a thoughtful and capable manager for o increasing investments in funds that themselves charge fees, significantly less than what Voya is which are passed on to shareholders currently charging”3 o fully tendering against

shareholders—forcing proration

• BRW fees in FY 23 were highest as a % of net assets in over 10 years

• Since Saba became manager of SABA (formerly GIM), Saba has instituted a new administrative fee, in addition to retaining the existing fee structure

“PPR’s performance has been substantially • Saba-managed funds increase their investments in risky assets in worse than its benchmark and peer group”3 volatile

markets, leaving other shareholders trapped

“Passing our proposals can help fix decades • Since Saba became manager of BRW, the fund continues to trade

at a of underperformance by reducing fees and discount to NAV and underperforms relevant index expenses and quickly increasing the share • Since Saba became manager of SABA, the fund’s discount to NAV has price of PPR to its net asset

value”4 widened significantly compared to its peer group

1 Effective June 4, 2021, Saba became the investment manager of Voya Prime Rate Trust (PPR)

(n/k/a Saba Capital Income & Opportunities Fund (BRW)). Effective January 1, 2024, Saba became the investment manager of Templeton Global Income Fund (GIM) (n/k/a Saba Capital Income & Opportunities Fund II (SABA)); 2 Form

DFAN14A filed by Saba Capital Management, L.P. at Voya Prime Rate Trust on June 23, 40 2020; 3 Form DFAN14A filed by Saba Capital Management, L.P. at Voya Prime Rate Trust on June 16, 2020 ; 4 Form DFAN14A filed by Saba Capital Management,

L.P. at Voya Prime Rate Trust on June 12, 2020

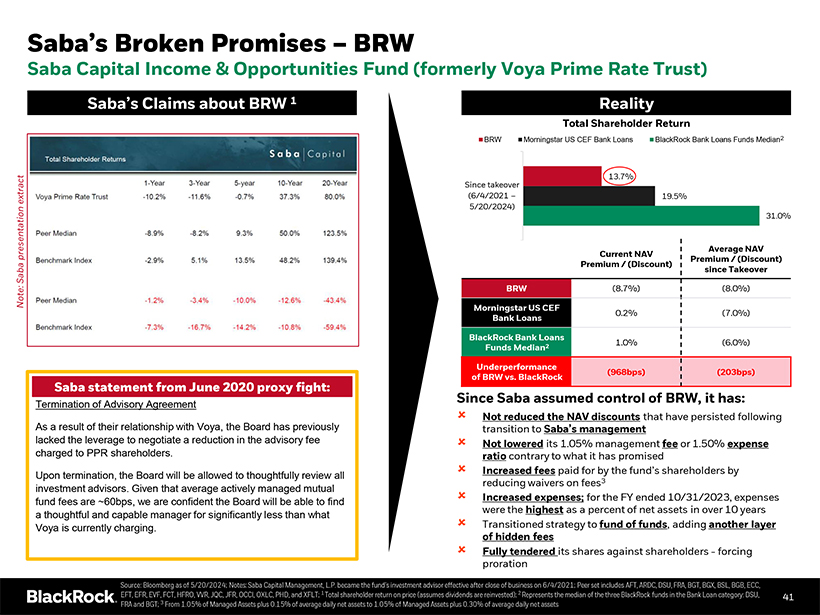

Saba’s Broken Promises – BRW

Saba

Capital Income & Opportunities Fund (formerly Voya Prime Rate Trust)

Saba’s Claims about BRW 1 Reality

Total Shareholder Return

BRW Morningstar US CEF Bank Loans BlackRock Bank Loans Funds Median2

13.7% Since takeover extract (6/4/2021 – 19.5% 5/20/2024)

31.0%

Average NAV presentation Current NAV

Premium / (Discount) Premium /

(Discount) Saba since Takeover

Note: BRW (8.7%) (8.0%)

Morningstar US CEF

0.2% (7.0%)

Bank Loans

BlackRock Bank Loans

1.0% (6.0%)

Funds Median2

Underperformance

(968bps) (203bps) of BRW vs. BlackRock

Saba statement from June 2020 proxy fight:

Since Saba assumed control of BRW, it has:

Termination of Advisory Agreement

Not reduced the NAV discounts that have persisted following

As a result of their relationship

with Voya, the Board has previously transition to Saba’s management lacked the leverage to negotiate a reduction in the advisory fee Not lowered its 1.05% management fee or 1.50% expense charged to PPR shareholders. ratio contrary to what

it has promised

Increased fees paid for by the fund’s shareholders by

Upon termination, the Board will be allowed to thoughtfully review all investment advisors. Given that average actively managed mutual reducing waivers on fees3

fund fees are ~60bps, we are confident the Board will be able to find Increased expenses; for the FY ended 10/31/2023, expenses were the highest as a percent of net assets in over 10 years a thoughtful and capable manager for significantly

less than what funds, adding another layer Voya is currently charging. Transitioned strategy to fund of of hidden fees

Fully tendered its shares against

shareholders—forcing proration

Source: Bloomberg as of 5/20/2024; Notes: Saba Capital Management, L.P. became the fund’s investment advisor effective

after close of business on 6/4/2021; Peer set includes AFT, ARDC, DSU, FRA, BGT, BGX, BSL, BGB, ECC,

EFT, EFR, EVF, FCT, HFRO, VVR, JQC, JFR, OCCI, OXLC, PHD, and

XFLT; 1 Total shareholder return on price (assumes dividends are reinvested); 2 Represents the median of the three BlackRock funds in the Bank Loan category: DSU, 41 FRA and BGT; 3 From 1.05% of Managed Assets plus 0.15% of average daily net assets

to 1.05% of Managed Assets plus 0.30% of average daily net assets

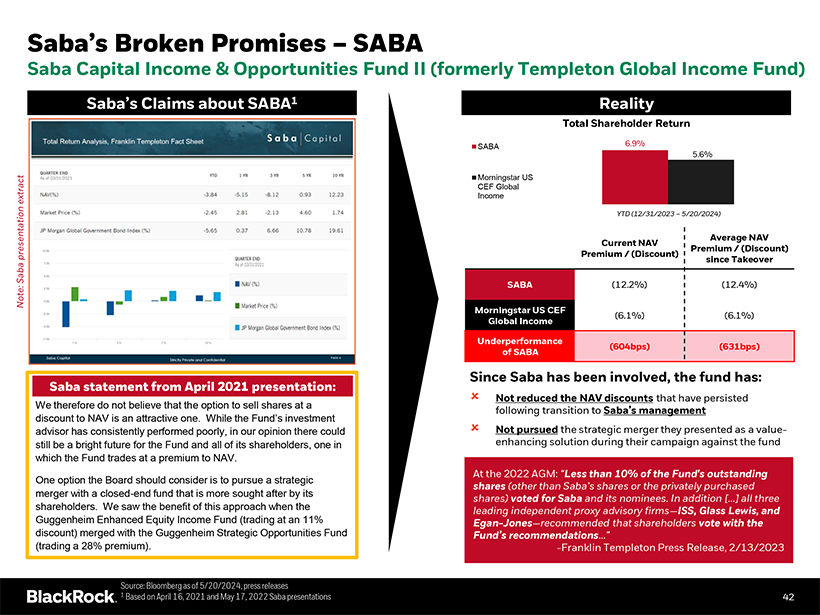

Saba’s Broken Promises – SABA

Saba

Capital Income & Opportunities Fund II (formerly Templeton Global Income Fund)

Saba’s Claims about SABA1 Reality

Total Shareholder Return

SABA 6.9%

5.6%

Morningstar US CEF Global extract Income

YTD (12/31/2023 – 5/20/2024)

Average NAV Current NAV

Premium / (Discount) presentation Premium / (Discount) Saba since Takeover

Note: SABA (12.2%)

(12.4%)

Morningstar US CEF

(6.1%) (6.1%)

Global Income Underperformance

(604bps) (631bps) of SABA

Since Saba has been involved, the fund has:

Saba statement from April 2021 presentation:

Not reduced the NAV discounts that have persisted

We therefore do not believe

that the option to sell shares at a following transition to Saba’s management discount to NAV is an attractive one. While the Fund’s investment advisor has consistently performed poorly, in our opinion there could Not pursued the

strategic merger they presented as a value-still be a bright future for the Fund and all of its shareholders, one in enhancing solution during their campaign against the fund which the Fund trades at a premium to NAV.

At the 2022 AGM: “Less than 10% of the Fund’s outstanding

One option the Board

should consider is to pursue a strategic shares (other than Saba’s shares or the privately purchased merger with a closed-end fund that is more sought after by its shares) voted for Saba and its nominees.

In addition […] all three shareholders. We saw the benefit of this approach when the leading independent proxy advisory firms—ISS, Glass Lewis, and Guggenheim Enhanced Equity Income Fund (trading at an 11% Egan-Jones—recommended that

shareholders vote with the discount) merged with the Guggenheim Strategic Opportunities Fund Fund’s recommendations…”

(trading a 28% premium).

-Franklin Templeton Press Release, 2/13/2023

Source: Bloomberg as of 5/20/2024, press releases

1 Based on April 16, 2021 and May 17, 2022 Saba presentations 42

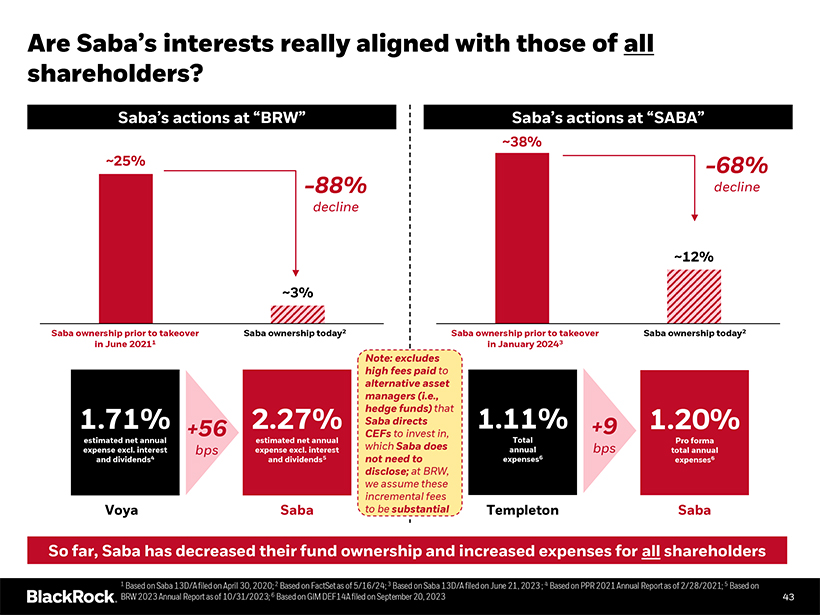

Are Saba’s interests really aligned with those of all shareholders?

Saba’s actions at “BRW” Saba’s actions at “SABA”

~38%

~25% -68% -88% decline decline

~12%

~3%

Saba ownership prior to takeover Saba ownership today2 Saba ownership prior to takeover Saba ownership today2 in June Before 20211 After in January Before 20243

After

Note: excludes high fees paid to alternative asset managers (i.e., hedge funds) that

1.71% +56 2.27% Saba directs 1.11% +9 1.20%

CEFs to invest in,

estimated net annual estimated net annual Total Pro forma expense excl. interest bps expense excl. interest which Saba does annual bps total annual and dividends4 and dividends5

not need to expenses6 expenses6

disclose; at BRW, we assume these incremental fees

Voya Saba to be substantial Templeton Saba

So far, Saba has decreased their fund ownership and

increased expenses for all shareholders

1 Based on Saba 13D/A filed on April 30, 2020; 2 Based on FactSet as of 5/16/24; 3 Based on Saba 13D/A filed on

June 21, 2023 ; 4 Based on PPR 2021 Annual Report as of 2/28/2021; 5 Based on

BRW 2023 Annual Report as of 10/31/2023; 6 Based on GIM DEF14A filed on

September 20, 2023 43

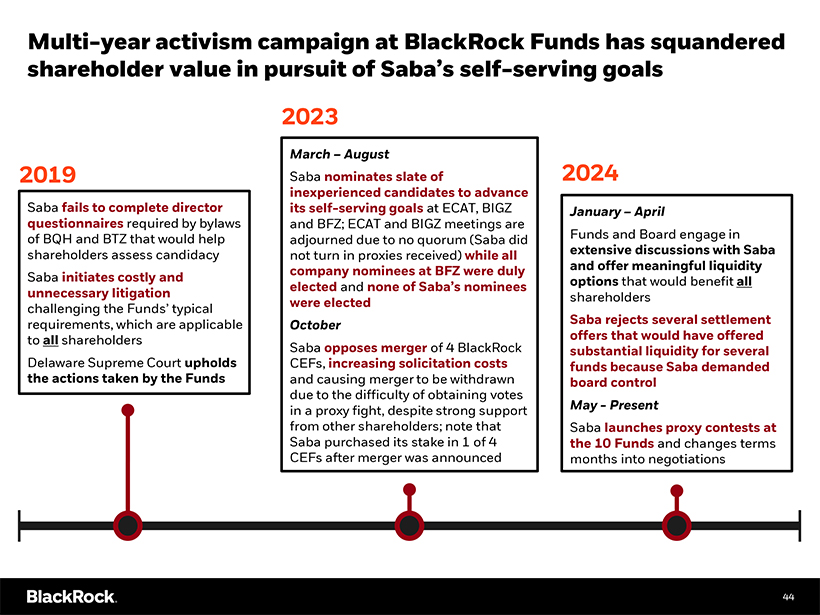

Multi-year activism campaign at BlackRock Funds has squandered shareholder value in pursuit of Saba’s self-serving goals

2023

March – August 2024 2019 Saba nominates slate of inexperienced

candidates to advance Saba fails to complete director its self-serving goals at ECAT, BIGZ January – April questionnaires required by bylaws and BFZ; ECAT and BIGZ meetings are of BQH and BTZ that would help adjourned due to no quorum (Saba did

Funds and Board engage in shareholders assess candidacy not turn in proxies received) while all extensive discussions with Saba company nominees at BFZ were duly and offer meaningful liquidity Saba initiates costly and options that would benefit all

unnecessary litigation elected and none of Saba’s nominees were elected shareholders challenging the Funds’ typical requirements, which are applicable October Saba rejects several settlement to all shareholders Saba opposes merger of 4

BlackRock offers that would have offered substantial liquidity for several Delaware Supreme Court upholds CEFs, increasing solicitation costs funds because Saba demanded the actions taken by the Funds and causing merger to be withdrawn board control

due to the difficulty of obtaining votes in a proxy fight, despite strong support May—Present from other shareholders; note that Saba launches proxy contests at Saba purchased its stake in 1 of 4 the 10 Funds and changes terms CEFs after merger

was announced months into negotiations 44

Saba’s nominees are unqualified and conflicted

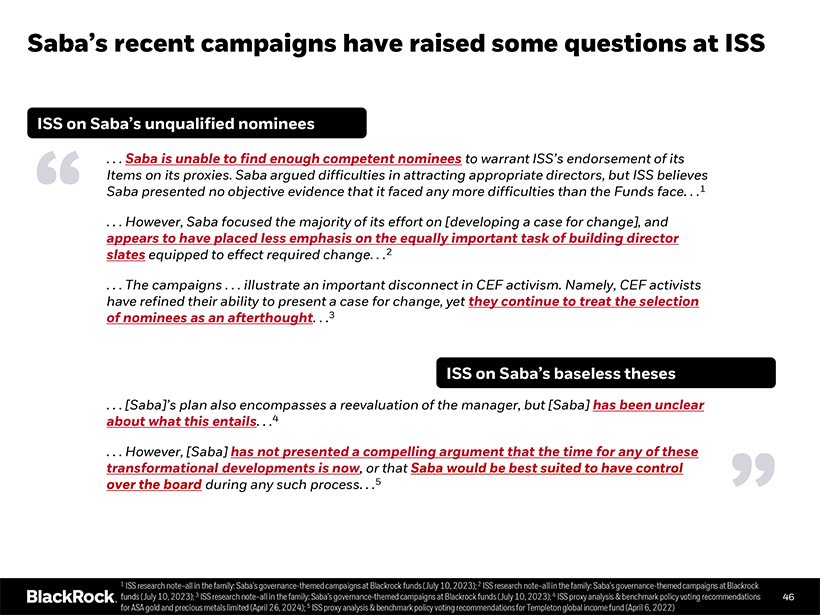

Saba’s recent campaigns have raised some questions at ISS

ISS on Saba’s unqualified nominees

. . . Saba is unable to find enough competent nominees

to warrant ISS’s endorsement of its

Items on its proxies. Saba argued difficulties in attracting appropriate directors, but ISS believes Saba presented no

objective evidence that it faced any more difficulties than the Funds face. . .1

“ . . . However, Saba focused the majority of its effort on [developing a

case for change], and appears to have placed less emphasis on the equally important task of building director slates equipped to effect required change. . .2

. . .

The campaigns . . . illustrate an important disconnect in CEF activism. Namely, CEF activists have refined their ability to present a case for change, yet they continue to treat the selection of nominees as an afterthought. . .3

ISS on Saba’s baseless theses

. . . [Saba]’s plan also encompasses a reevaluation of

the manager, but [Saba] has been unclear about what this entails. . .4

. . . However, [Saba] has not presented a compelling argument that the time for any of these

transformational developments is now, or that Saba would be best suited to have control over the board during any such process. . .5 ”

1 ISS research

note–all in the family: Saba’s governance-themed campaigns at Blackrock funds (July 10, 2023); 2 ISS research note–all in the family: Saba’s governance-themed campaigns at Blackrock funds (July 10, 2023); 3 ISS research

note–all in the family: Saba’s governance-themed campaigns at Blackrock funds (July 10, 2023); 4 ISS proxy analysis & benchmark policy voting recommendations 46 for ASA gold and precious metals limited (April 26, 2024); 5 ISS

proxy analysis & benchmark policy voting recommendations for Templeton global income fund (April 6, 2022)

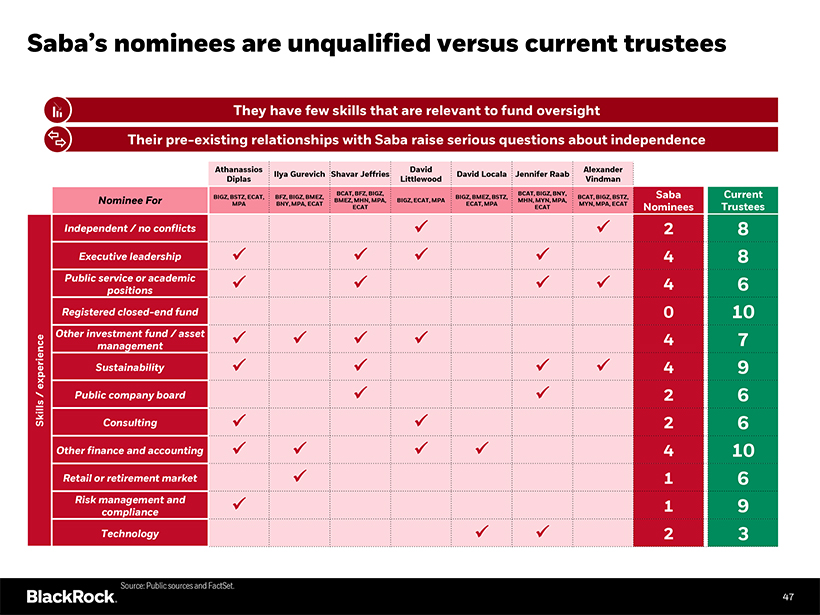

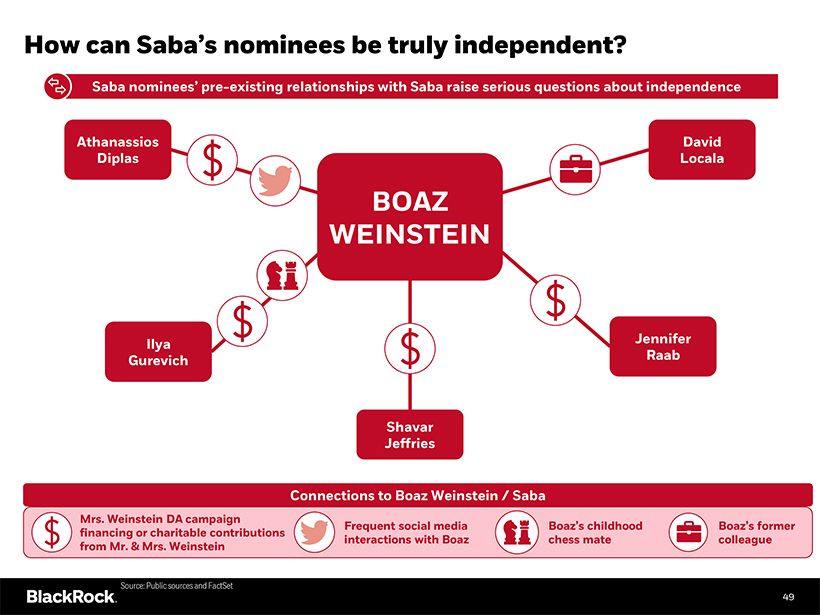

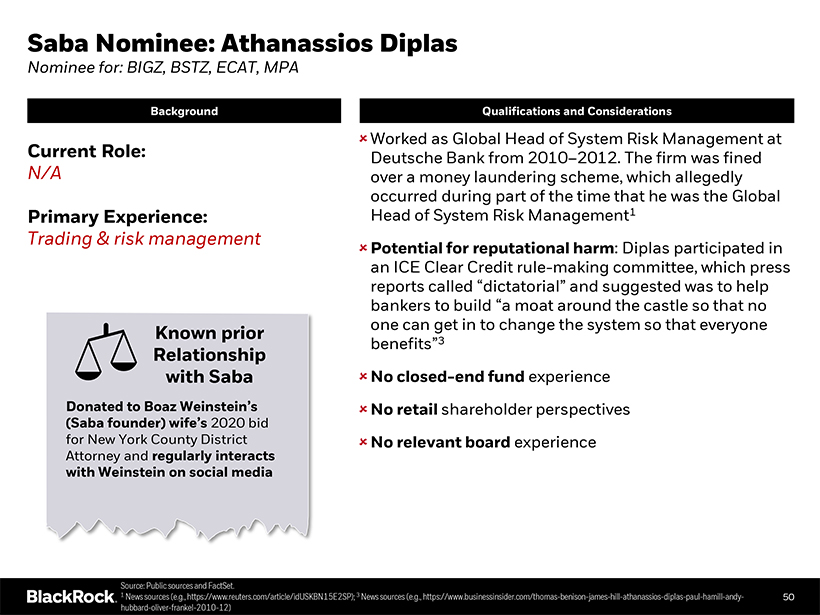

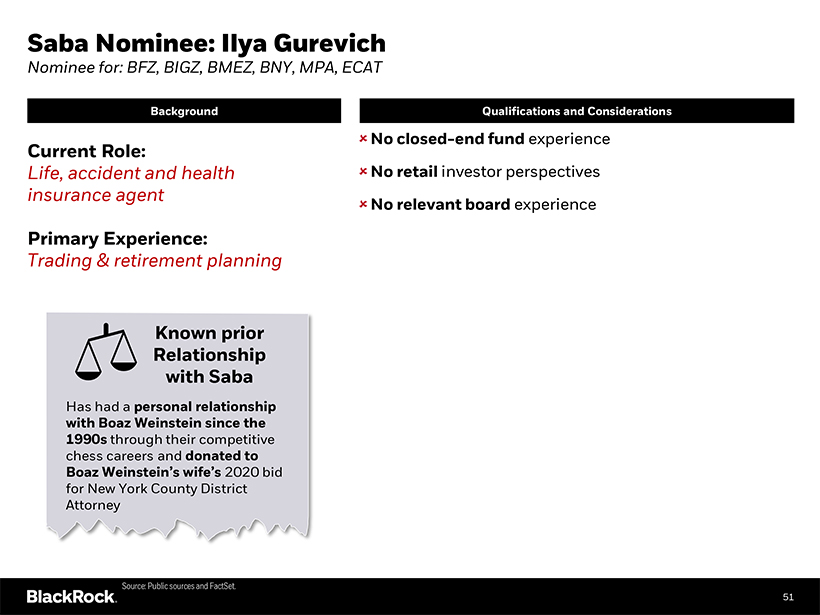

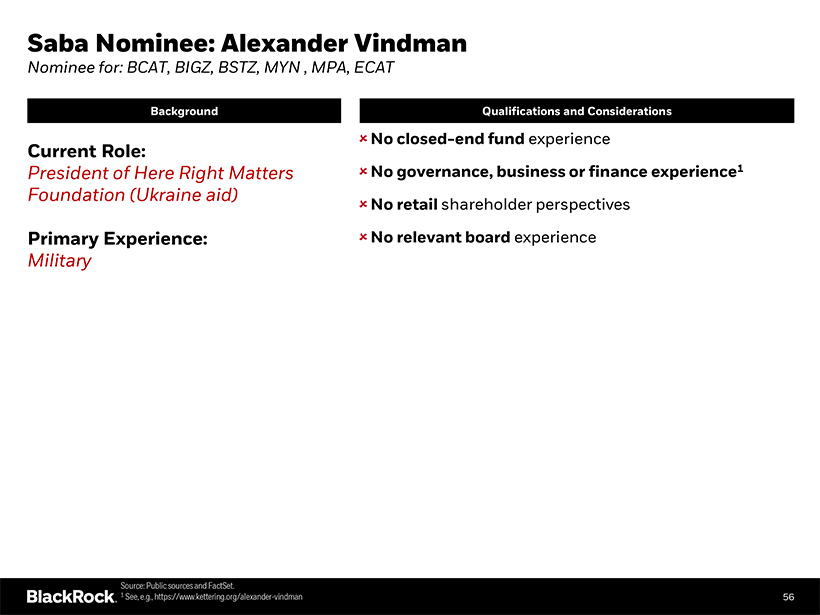

Saba’s nominees are unqualified versus current trustees

They have few skills that are relevant to fund oversight

Their

pre-existing relationships with Saba raise serious questions about independence

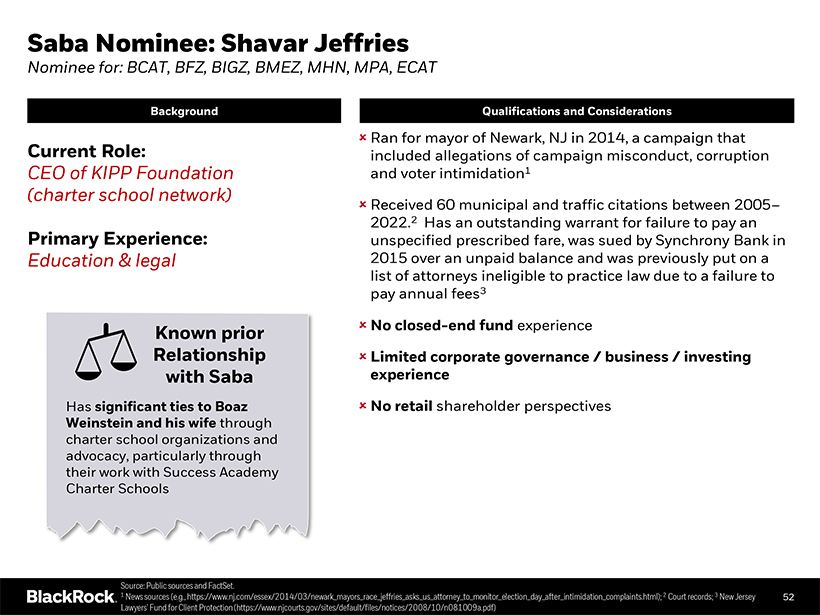

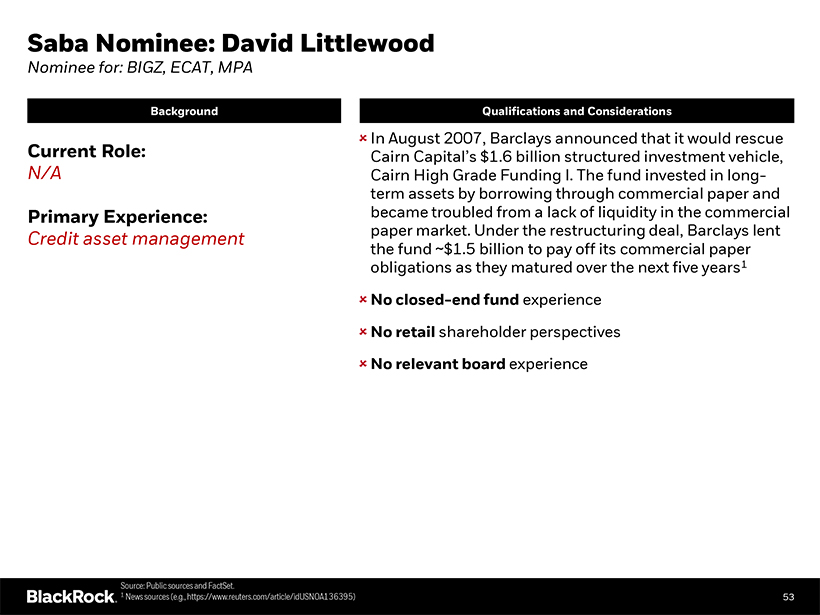

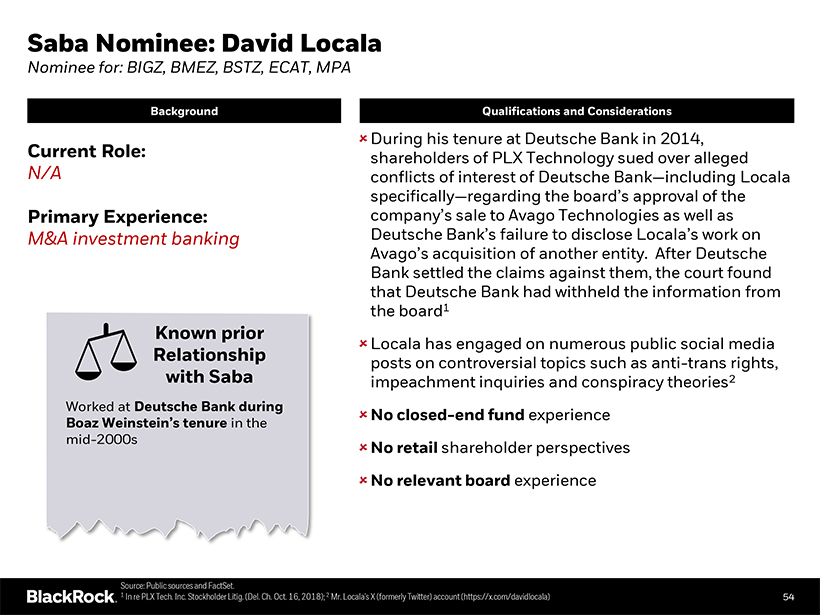

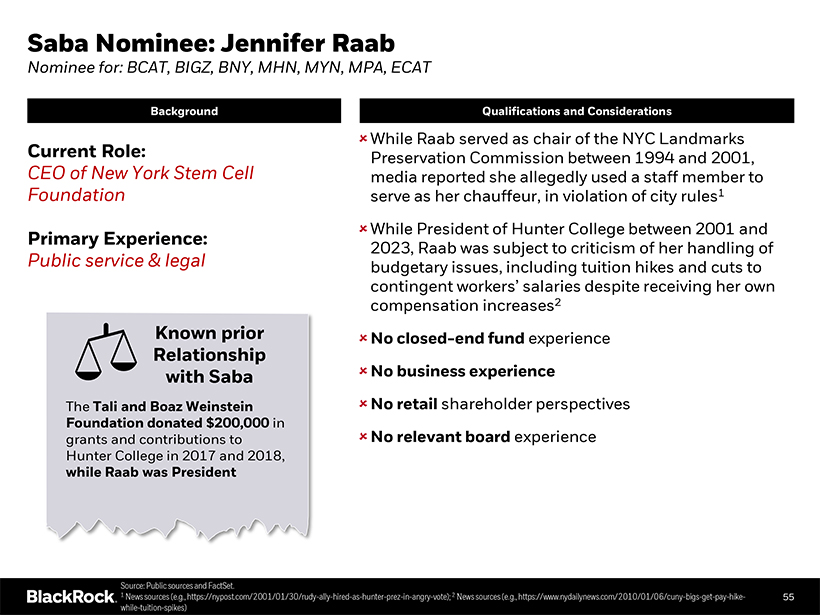

Athanassios David Alexander Ilya Gurevich

Shavar Jeffries David Locala Jennifer Raab Diplas Littlewood Vindman

BCAT, BFZ, BIGZ, BCAT, BIGZ, BNY, Saba Current BIGZ, BSTZ, ECAT, BFZ, BIGZ, BMEZ, BIGZ, BMEZ,

BSTZ, BCAT, BIGZ, BSTZ, Nominee For BMEZ, MHN, MPA, BIGZ, ECAT, MPA MHN, MYN, MPA, MPA BNY, MPA, ECAT ECAT, MPA MYN, MPA, ECAT

ECAT ECAT Nominees Trustees

Independent / no conflicts 2 8 Executive leadership 4 8 Public service or academic 4 6 positions

Registered closed-end fund 0 10 Other investment fund / asset 4 7 management experience Sustainability 4 9

/ Public company board

2 6

Skills Consulting 2 6 Other finance and accounting 4 10 Retail or retirement market 1 6 Risk management and 1 9 compliance

Technology 2 3

Source: Public sources and FactSet.

47

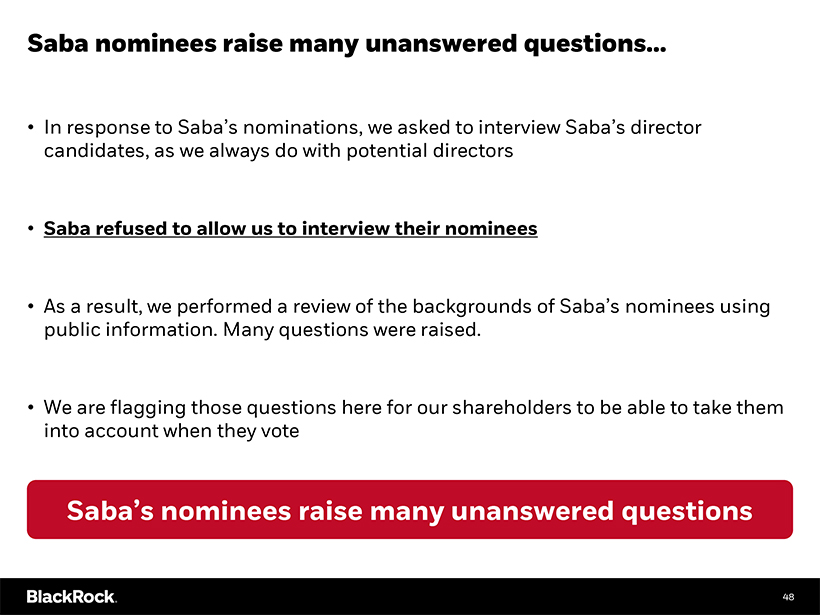

Saba nominees raise many unanswered questions…

• In response to Saba’s nominations, we asked to interview Saba’s director candidates, as we always do with potential directors

• Saba refused to allow us to interview their nominees

• As a result, we performed a

review of the backgrounds of Saba’s nominees using public information. Many questions were raised.